Archive for ‘Financial’ Category

Reference Files Master Class (Part 1) — The Essentials of Paper Filing

COPING WITH PAPER OVERWHELM

After last week’s post, Paper Doll Shares 12 Kinds of Paper To Declutter Now, I had a number of readers mention to me that while knowing what to get rid of helps them deal with their paper piles, they were still sometimes at a loss as to what to do with the rest.

Some fear they should be scanning everything to keep it digital, but don’t even own scanners. Others feel frustrated because even when they’ve arranged to get (and pay) their bills digitally, they still have paper coming to them. Many people feel at odds with the 21st-century pressure to have digital records, and don’t particularly feel adept with handling papers digitally. (They forget to look at email until it’s too late, or they never get around to scanning, or information just doesn’t seem “real” to them if it’s not in tangible form).

Over the 16+ years that I’ve been blogging as Paper Doll, I’ve tried to get across that whether you use analog or digital techniques — whether for paying bills, or keeping track of your appointments and tasks, or filing or archiving your information — doesn’t matter. That is, the method doesn’t matter; the commitment to a system is what is most important.

But 16 years is a long time. Babies born during the launch of my first Paper Doll posts are old enough to drive! To give you a sense of how long ago that was, Desperate Housewives was still a top-10 TV show (and people were still watching broadcast television). The top song was Crank That (Soulja Boy) and we were all trying (and mostly failing) to do the dance.

I originally wrote about the elements of a reference filing system in the first month of Paper Doll posts, back in 2007. It’s time to revisit the topic, see how digital solutions do (and don’t) help with the paper overwhelm, and introduce new readers to the best ways to manage paper.

Over the next several weeks, we’ll be taking a fresh look at how eliminate the frustration of paper files.

The Ice Cream Rule

The key to making any system work is just that — a system. That means having a location where something belongs and behavioral rules to get them there. I often refer to this as the Ice Cream Rule. If you come home from the store with two bags, one holding a half gallon of cream and one with a package of toilet paper, which one will you put away first? And where would you put them?

Even people who insist that they’re terrible with systems laugh and admit that they automatically know to put the ice cream away first; they recognize that they’ll end up with a melted mess if they do not.

They also have no worries that they’ll put the ice cream where they won’t be able to find it again — in the cupboard or the pantry — because their system not only includes behavioral cues (ice cream before toilet paper), but a geographic location (that is, the freezer) where the ice cream belongs.

Yes, people may drop the bag with the toilet paper on the kitchen floor, or hang it on the linen closet door, or actually put away the toilet paper in the bathroom right after getting the ice cream in the freezer.

Admittedly, the behavioral part of putting away non-urgent items isn’t perfect. The squeaky wheel gets the oil, and when it comes to putting things away properly, ice cream’s urgency is squeakier than toilet paper. (That said, the retrieval of ice cream is likely to be less urgent.)

A HOME FOR YOUR REFERENCE FILING SYSTEM

The point, and I do have one, is that to create order with the paper in our lives, we must ensure that we know exactly where everything goes. How? Filing papers is easy once each item is assigned a place to live. All of your reference papers need to have a home.

Keep in mind, that home does not have to be a palace. You certainly can invest in filing cabinets. These range from bargain 2-drawer metal filing cabinets to office-style 4-drawer tower-style cabinets.

If you prefer lateral filing cabinets (where you stand to the side of the open drawer, rather than in front of it), there are a variety of styles and materials from which to choose.

Recapping Paper Doll’s 2023 Posts — Which Were Your Favorites?

With one week left in 2023, have you taken time yet to review your year?

For the December Productivity and Organizing Blog Carnival, Janet Barclay asked us to identify our best blog posts of 2023, and I had a tough time.

“Best” is subjective, and Janet let us have free reign as to which post fit. Some bloggers chose their most popular posts in terms of readership; others, the ones that garnered the most comments. Some of my blogging colleagues picked their most personal posts, while others selected what they felt would have the most impact on people’s lives.

The problem is that picking just one means leaving the others behind, and I wrote forty-two posts this year! Eventually, I narrowed the selection to half a dozen posts, and then turned to colleagues and friends who were almost evenly split, bringing me no closer to a solution. In the end, I picked Paper Doll On Understanding and Conquering Procrastination because it served as the foundation for so many other posts, but also because I’d been lucky enough to find some great visuals, like this one from Poorly Drawn Lines:

so much to do pic.twitter.com/fiSm7Y2Erg

— poorly drawn lines (@PDLComics) December 21, 2022

Beauty, like clutter, is in the eye of the beholder. To that end, here’s a recap of everything we’ve discussed in 2023, with a few updates and tweaks along the way. My personal favorites are in bold, but I’d love to know which ones resonated the most with you during the year!

ORGANIZE YOUR INSPIRATION

After uploading last week’s post, Toss Old Socks, Pack Away 2023, and Adjust Your Attitude for 2024, I got to thinking about all the different ways we can take our word, phrase, or song of the year and keep it in the forefront of our minds.

I’d reviewed the traditional methods (vision boards, posted signs, turning the song into your wakeup alarm), but felt like there needed to be something that stayed with you, independent of your location. Only being reminded of your goal to be a leader when you’re standing in front of your fridge doesn’t really help you in your 1-to-1 meetings at work. (I mean, unless you’re the Queen of the Condiments or King of the Crisper Drawer.)

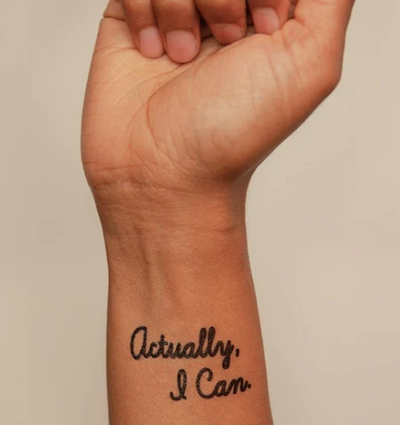

Only being reminded of your goal to be a leader when you're standing in front of your fridge doesn't really help you in your 1-to-1 meetings at work. (I mean, unless you're the Queen of the Condiments or King of the Crisper Drawer.) Share on XSerendipitously, within minutes of thinking about this, an ad came across one of my social media pages. (Normally, I ignore ads, but this one had me thinking maybe “serendipity” would be a good theme word for some year!) The ad was for Conscious Ink, an online temporary tattoo retailer specifically for creating body art to help you mindfully connect with your themes and messages to yourself, disrupt negative self-talk, and promote the healthy habits you’re trying to embrace!

As Conscious Ink’s About page explains, if you want to keep something top of the mind, why not try something that keeps it “top of the body?” Whether body art is your thing or you haven’t experimented since your Minnie Mouse temporary tattoo at summer camp <mumble mumble> years ago, this is a neat trick!

There’s even research as to how a temporary tattoo can support permanent emotional and cognitive transformation and improve mindfulness and focus on things that uplift one’s higher self. And that’s the point of a theme word, phrase, or song, to keep you focused on what you want rather than what you allow to drag you down! Manifest what you want your life to be.

Conscious Ink’s temporary tattoos use non-toxic, cosmetic-grade, FDA-certified, vegan inks. Each one lasts 3-7 days, depending on where you apply it, your skin type and activity level, and (I suspect) how many life-affirming, stress-reducing bubble baths you take. Categories include mindset, health and wellness, spiritual/nature, relationships, parenting, celebratory, and those related to social causes. Prices seem to hover at around $10 for a three-pack and $25 for a 10-pack. There’s even a Good Karma Guarantee to make sure you’re satisfied.

Whether you go with Conscious Ink (which is designed for this uplifting purpose) or seek an alternative or custom-designed temporary tattoo (through vendors like Momentary Ink or independent Etsy shops), it only makes sense if you place it somewhere you can see it often.

After all, if you place a temporary tattoo reminder to stand up for yourself on your tushy, it probably won’t remind you of much. For most of us of a certain age, putting it at our wrists, covered (when we prefer) by our cuffs, will give us the most serene “om” for our buck.

If you place a temporary tattoo reminder to stand up for yourself on your tushy, it probably won't remind you of much. Share on XAlong the same lines as my advice on adjusting your attitude for 2024, you may want to consult Gretchen Rubin’s Tips for Your “24 for 2024” List. Rubin and her sister/podcast co-host always have an inspring Happier Trifecta: a year-numbered theme, along with with a challenge and a list.

PRODUCTIVITY AND TIME MANAGEMENT

This was a big year for productivity discussion. I’m a firm believer that keeping your space and resources organized is key to being productive. However, it’s hard to keep the world around you organized when outside influences prevent you from being efficient (doing things well) and effective (doing the right things).

We continue to see the value of body doubling, whether through friendly hang-outs, co-working (virtually or in person), or professional organizing services, whether you want to conquer garden-variety procrastination or get special support for ADHD.

Partnering for Success

Paper Doll Sees Double: Body Doubling for Productivity (I almost submitted this post to the carnival. Accountability and motivation for the win!)

Paper Doll Shares 8 Virtual Co-Working Sites to AmpUp Your Productivity

If you’d like to explore the body doubling or co-working experience, friend-of-the-blog Deb Lee of D. Allison Lee is offering a no-cost, two-hour Action Day event on Tuesday, January 9, 2024, from 10 a.m. to 12 p.m.

This event is designed for her clients and subscribers, but after a cheery holiday conversation, Deb said it was OK to let my readers know about the opportunity.

Deb describes an Action Day as “personal training for your productivity muscles!”

An Action Day (especially as Deb runs them) is a stellar way to narrow your focus and start taking action on your goals. (And what better time than at the start of the new year?) You’ll get to connect with others who are also working on goals and habits with the support of Deb, a productivity coach I admire and adore.

Just bring your top two or three priorities, and you can conquer anything, like:

- organize your workspace

- write your book outline

- clean up your digital files

- test a new productivity app

- send out client proposals

- anything!

You’ll videoconference with a small, select group via Zoom. Share your goal and tasks, work for the bulk of the two hours, and then take time to debrief and share your successes!

Moving Yourself Forward

Getting anything done involves figuring out what you have to do, knowing what’s kept you from getting started, making it easy for you to begin, and celebrating even the smallest wins. These next three posts were where the magic happened this year!

Paper Doll On Understanding and Conquering Procrastination (This is the post I submitted to the Productivity & Organizing Carnival.)

Frogs, Tomatoes, and Bees: Time Techniques to Get Things Done

Use the Rule of 3 to Improve Your Productivity

Dealing with the Pokey Times

If you’re overwhelmed by all you’ve got going on during late December and early January, you can skip onward. However, if your workplace closes down during the holidays, or your professional and personal lives just feel like they’re kind of in a slump right now, you may find some inspiration in two pieces I wrote for the summer slowdown.

The weather outside may be frightful (unless you’re reading from Australia), but if you are looking for ideas to pump you up when everyone is in a post-shopping/meal/travel haze, these posts may stir your motivation:

Organize Your Summer So It Doesn’t Disappear So Quickly

Use Your Heart, Head, and Hands to Organize During the Slow Times

Try To Do It All (And Knowing When to Step Away)

Maybe you did your annual review and found that you’re feeling burned out. If so, you are not alone. It’s easy for your groove to turn into a rut, and for all of your drive to accomplish come crashing down because you never take your foot off the gas all year!

If you missed these posts earlier need a second shot at embracing the importance of variety, small breaks, and actual vacations, here’s your chance to read some of my absolute favorite posts of the year:

Paper Doll Says: Don’t Get Stuck in a Rut — Take Big Leaps (Be sure to watch the diving board video!)

Was baby Paper Doll burned out? In a rut? Just pooped?

Take a Break — How Breaks Improve Health and Productivity

Take a Break for Productivity — The International Perspective (This is the post that introduced the Swedish convivial snack break, fika!)

If you had any doubts about what I said about the importance of taking breaks in your day to refresh your body, your brain, or your spirit, a new report just a few weeks ago confirms that we need that late afternoon break if we don’t want our productivity to turn to mush! And the more we push ourselves beyond work hours, the greater our decrease in productivity!

If you’re desperately in need of a full break, but are suffering from decision fatigue and don’t have the energy to begin planning a whole vacation, there are options to make it easier for you. In the BBC’s piece, Why 2024 May Be the Year of Surprise Travel, you may find some rousing options.

Need a little inspiration to spend your holiday gift money on experiences rather than tzotchkes? Check out Time Out’s 24 Best Things to Do in the World in 2024 to envision where you could take long breaks to refresh yourself. Those vintage trains in Italy are calling to me, but perhaps you’d prefer the immersive “Dream Circus” in Sydney, Australia, or Montréal en Lumière’s 25th anniversary?

(Never mind, I know. Everyone wants to go on the Taylor Swift cruise from Miami to the Bahamas. Just come back with good stories instead of memento clutter, OK?)

TOOLS AND IDEAS FOR GREATER PRODUCTIVITY

Sometimes, rereading my own posts reminds me how many nifty things there are to share with you, and how many are still to be discovered.

Paper Doll Helps You Find Your Ideal Analog Habit Tracker — So many people have requested a follow-up covering digital habit trackers, so watch for that in 2024.

Paper Doll Presents 4 Stellar Organizing & Productivity Resources

Paper Doll Shares Presidential Wisdom on Productivity — From the Eisenhower Matrix to Jefferson’s design for the swivel chair, from limiting wardrobe options to understanding the difference between being busy and being productive, we’ve had presidents who have known how to get more (of the right things) done. With an election year in 2024, I’d love a debate question on the candidate’s best tips for staying organized and productive!

Surprising Productivity Advice & the 2023 Task Management & Time Blocking Summit

Highlights from the 2023 Task Management & Time Blocking Summit

3 Simple But Powerful Productivity Resources — Right in Your Browser Tab — The offering that got the most attention this year was definitely Goblin.Tools. I’m sure that as we head into 2024 and beyond, I’ll be sharing more resources that make use of artificial intelligence.

Let’s just remember that we always need to give precedence to our own intelligence, in the same way we can’t follow GPS to the letter if it directs us to drive in to a lake. In fact, like all organizing and productivity guidance, remember what I said way back in 2020 in The Truth About Celebrity Organizers, Magic Wands, and the Reality of Professional Organizing: there is no magic wand.

AI and other solutions, tangible or digital, and even professional organizers, can make things easier, but the only way to get the life you want is to embrace making positive behavioral changes.

RESOURCES FOR ORGANIZING YOUR WORK AND TRAVEL SPACE

Privacy in Your Home Office: From Reality to Fantasy — It’s interesting to see that privacy, and not just in home offices but in communal workspaces, has become a priority again. Check out this recent New York Times piece, As Offices Workers Make Their Return, So Does the Lowly Cubicle.

Paper Doll Refreshes Your Paper Organizing Solutions

Paper Doll Organizes Temporary Papers and Explores Third Spaces — Do you have systems for dealing with your “temporary papers,” the ones that you don’t need to file away but aren’t triggering an immediate action?

Paper Doll Organizes Your Space, Money, and Well-Being While Traveling

Paper Doll is Clearly Organized — Translucent Tools for Getting it Together

Paper Doll Explores New & Nifty Office and School Supplies

Organize Your Desktop with Your Perfect Desk Pad

No matter where I go in 2024, be assured that I will be keeping my eyes open for solutions for keeping your paper and work supplies organized.

My Thanksgiving weekend shopping trips brought me a variety of intriguing options. At Kohl’s, I saw 30 Watt‘s Face Plant, a way to keep your eyeglasses handy while refreshing the air around you (and keeping you perky) with greenery. The 5.5″ x 6″ x 5.25″ ceramic planter holds a plant, gives you a place to rest your glasses (so you won’t misplace them under piles of paper on your desk), and is dry erase marker-friendly! (It’s currently on sale for under $14.)

A stop at IKEA in Atlanta was so productive for organizing tools that you’ll be seeing posts with nifty names like Övning (for tidying a child’s desk accessories and creating privacy), Kugsfors (wall-mounted shelves with tablet stands for keeping books and iPads visible while working), Bekant (sit/stand desks) and more.

ORGANIZING YOUR FINANCIAL & LEGAL LIFE

Not everything in the organizing and productivity world is fun to look at, and that’s especially true of all the financial and legal documents that help you sleep soundly at night. Still, Paper Doll kept you aware of how to understand and protect your money, your identity, and your legacy.

Speaking of which, if you haven’t created your Apple Legacy Contact and your Google Inactive Account Manager, why the heck not? Use the power of body doubling up above, grab a partner, and get your digital life in order!

Lost & Found: Recover Unclaimed Money, Property, and Savings Bonds

Paper Doll’s Ultimate Guide to Legally Changing Your Name

Paper Doll Explains Digital Social Legacy Account Management

How to Create Your Apple & Google Legacy Contacts

Paper Doll Explains Your Health Insurance Explanation of Benefits

DEALING WITH EMERGENCIES AND STRESSFUL SITUATIONS

Sometimes, I write a post I wish I’d been able to read earlier (like the one on preventing and recovering from a car theft). Other times, like when a friend had a health emergency, or when Paper Mommy had her fall in November, I’m glad the posts already exist. If you missed these the first time around, please be sure to read, share, and bookmark them; think of them as an insurance policy, and let’s hope you won’t need them.

How to Organize Support for Patients and Families in Need

Organize to Prevent (or Recover From) a Car Theft

Paper Doll Organizes You To Prepare for an Emergency

GRAB BACK OF INTERVIEWS, UPDATES, AND PHILOSOPHY

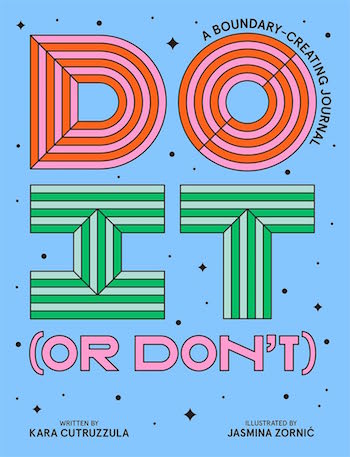

Paper Doll Interviews Motivational Wordsmith Kara Cutruzzula

You already know how beloved my friend Kara Cutruzzula‘s Brass Ring Daily newsletter and Do It Today podcast are at Paper Doll HQ.

After having read and enjoyed Kara’s Do It For Yourself — A Motivational Journal and her follow-up, Do It Today — A Motivational Journal (Start Before Your Ready), I had no doubt that I’d be jumping on her third when it was released in September.

If you haven’t already picked up Do It Or Don’t — A Boundary-Creating Journal, use that Amazon money you almost certainly got this holiday season!

One of the Paper Doll themes for 2024 will focus on setting (and maintaining) better boundaries to accomplish more of what’s meaningful, and I’ve got multi-color tape flags sticking out of Kara’s book from all the chapters to share her bounty with you.

One of the Paper Doll themes for 2024 will focus on setting (and maintaining) better boundaries to accomplish more of what’s meaningful, and I’ve got multi-color tape flags sticking out of Kara’s book from all the chapters to share her bounty with you.

What’s in a Name? “Addressing” Organizing and Productivity

Paper Doll Suggests What to Watch to Get More Organized and Productive — As we head into the new year, I’ll be keeping my eyes open for podcasts, webinars, and TV shows to help you keep your space organized, your time productive, your finances orderly, and your life joyous. Readers have been sending in YouTube and TikTok videos that inspire them, so please feel free to share programming that you’d like to see profiled on Paper Doll‘s pages.

Paper Doll on How to Celebrate Organizing and Productivity with Friends

Paper Doll and Friends Cross an Ocean for Fine Productivity Conversations

From in-person get togethers with frolleagues (what my accountability partner Dr. Melissa Gratias calls those special folks who are both friends and colleagues) to Friday night professional organizer Zooms, accountability calls, and Mastermind group collaborations, this has been a great year for staying connected and sharing the benefits of those conversations with you.

I also loved guesting on so many fun podcasts related to organizing, productivity, technology, and more. If there’s someone you’d like to hear me debate or banter with, let me know!

SEASONAL POSTS

Spooky Clutter: Fears that Keep You from Getting Organized

Paper Doll’s Thanksgiving Week Organizing and Productivity Buffet

Paper Doll De-Stresses Your December

Paper Doll on Clutter-Free Gifts and How to Make Gift Cards Make Sense

Are you stressed out because you haven’t gotten someone a gift yet? Maybe a good start would be to help an overwhelmed special someone take my advice about going on a travel break. Consider gift certificates for something like Get Your Guide, with opportunities to get guided tours of locally-vetted, expertly-curated sporting, nature, cultural, and food experiences. With 118,000 experiences in 150 countries, pick a multiple of $50 or set your own amount, and your recipient can pick the domestic or international travel experience that fits best.

If you know your recipient will be traveling by rail, consider a gift card for Amtrak or ViaRail in North America. Eurail doesn’t sell gift cards, but you can pay for a pass, or buy a gift card for a rail pass for more than a dozen specific European train lines. And if you’d like to help someone organize vacation serenity and secure a bundle of travel attractions for a given city, try TurboPass in Europe or City Pass and The Sightseeing Pass in North America.

HERE’S TO A MORE ORGANIZED AND PRODUCTIVE 2024

Whether you’ll be spending the next few days reading, traveling, or doing your annual review, I hope this last week of 2023 is a happy and healthy one.

To send you off for a cozy week, I’d like to share a Whamagaddon– and Mariah–free, retro 100-minute holiday playlist from the late 1930s through the early 1960s. It’s somehow easier to dismantle the tree and write thank-you notes to Guy Lombardo. (My favorite clocks in at 52:42 with “What Are You Doing New Year’s Eve?”)

Please let me know your favorite Paper Doll posts from this year, and I’ll meet you back here in 2024!

Paper Doll Organizes Your Space, Money, and Well-Being While Traveling

The year is now officially half over. Have you used many of your paid vacation days? Have you used any of your vacation days?

One of the signs of toxic productivity is the sense that there’s always more work to do, more things to accomplish, and that vacation time will always be there. But the human mind needs rest just as much as the body, and going without both rest and recreation is a recipe for disaster.

Going without time off is called vacation deprivation, and according to Expedia’s 2023 Global Deprivation Report, Americans take 8-1/2 fewer vacation days than our global cousins, and nearly half (45%) of Americans left vacation days untaken last year. And that’s on top of the fact that we already receive fewer paid vacation days than most of the industrialized world.

Of course, even those who have vacation days and value the time off have been squeamish about traveling. (I’ll admit, I’m one of them.) COVID is still out there, and inflation means our hard-earned pennies don’t go as far.

Still, a staycation often doesn’t feel like a vacation, and getting out of Dodge for a while is a great opportunity to reset your perspective. So, let’s at least look at some options for saving time time and money and making the travel experience less stressful.

Of course, Paper Doll has covered travel-related topics before. Back in 2018, I wrote Paper Doll’s 5 Essential Lists For Planning an International Vacation.

For what it’s worth, it’s almost entirely applicable to domestic travel, too, and covers lists of:

- What to acquire for your trip

- What clothing and accessories to pack

- What other essentials to pack

- What to do before you leave

- Important phrases (admittedly, the most “international” of the lists)

For those who prefer to listen rather than read, much of the material covered was included in two interviews I did on the (much-missed) Smead podcast, embedded in Paper Doll on the Smead Podcast: Essential Lists For Organized Travel.

Today’s post is more along the lines of “travel tidbits,” a collection of nifty options for making travel situations more organized so you can focus your attention on relaxation.

GET SOME ELBOW ROOM AT THE AIRPORT

Let’s start with stuff. As you prepare to travel, you gather a lot of stuff to keep handy — to watch, to use, to eat. But it’s not always convenient to access it.

goDesk

Have you ever tried to set up an iPad so you and your traveling companion (or your tussling tiny humans) can watch a movie?

Have you ever tried to eat a meal balanced on your lap in the boarding area because there were no tables near the restaurants, but there were also no tables at your gate?

Do you know what’s is like to struggle to find something in your bag but there’s no place to put the items as you take out and sort through them?

Wouldn’t it be nice to have a desktop space when you’re traveling? But obviously, you don’t want to schlep around an actual desk when flying, and those beanbag-bottom laptop desk surfaces designed for when you’re sitting on your couch aren’t really workable in those teeny airport chairs. But I’ve recently found what seems like a nifty solution.

The goDesk lets you transform your rolling bag into a desk/entertainment center.

Taking advantage of the fact that almost all modern luggage pieces, particularly carry-ons, have those collapsible/telescoping handles, the goDesk can attach to your bags telescoping handle in seconds. It gives you enough desk space to securely hold a full-sized laptop, your airport meal, your child’s tablet, or the contents of your tumbled purse.

Later, when you’re ready to board, use the on/off release knob, and goDesk detaches in seconds. It’s got a slim profile, so you can just slide it in your outer luggage pocket.

The goDesk’s unique lock/latch system makes it compatible with most 4-wheel carry-on roller luggage, and it supports up to 12 pounds. The whole unit measures 11 1/2″ wide x 10″deep x 7/8″ high (with a 10″ x 10″ desktop surface) and ways only one pound.

There’s a flip-up media stand to use with iPads and other tablets, smart phones, or small books/notebooks, and a slide-out cup holder so you don’t have to worry about your beverage wobbling and spilling on the desktop surface (or your pricey devices).

The goDesk is made in the USA with TSA-approved materials and comes with a one-year warranty. It’s available from the goDesk website for $39.95 and ships with 2-3 day delivery.

AVOID EXCESS FEES WHILE TRAVELING

The first time I ever did any significant traveling without my family was when I was in college. I was going to be working on a special school-sponsored project in San Francisco. Although I had a debit card and a credit card, Paper Mommy took me to AAA to get American Express-backed travelers checks, where I dutifully filled out forms and signed the checks and registered them. I was told I would then countersign them when I used them to purchase anything, and if they were lost, I could easily get them replaced, just as Karl Malden promised in all those commercials.

I don’t know anyone who uses travelers checks anymore. Most of the time, you’re going to use a credit or debit card, or something like ApplePay from the wallet in your smart phone using magic technology. But sometimes, you want to have cash on hand, whether to tip a bellhop or give money to a talented busker or just pay in local currency.

The problem? When you aren’t getting cash from your own bank’s ATM, you’re likely to have to deal with an ATM surcharge fee. However, there are a few ways around that problem.

ATM Fees/Surcharges

In the US, different ATM machines (whether they are associated with banks or not) are affiliated with ATM networks. If you look on the back of your ATM card, you’ll see the network in which it participates, and there should not be a fee if you use an ATM that is also part of that network. So, if your bank uses STAR, or PULSE, or PLUS and you find an ATM in that network, there shouldn’t be a fee. However, it’s going to take some digging to get that information and locate the right ATM, and that will add frustration and take time out of your precious vacation.

ATM Keypad Photo by Eduardo Soares on Unsplash

Luckily, there are a few options to quickly identify which ATMs do not have surcharge fees.

The Allpoint Network has more than 55,000 fee-free ATMs. Download the app or use the website. Enter your zip code, and the Allpoint search will identify which ATMs in your vicinity do not charge a fee. Scroll through the map or list to find an ATM near your current location or in the neighborhood of where you’re planning to be. (Note: the app has a geolocator function, so you don’t have to type in your zip code, which is convenient when you’re traveling in a strange city and don’t necessarily know the zip code.)

Similarly, you can use the ATM locator on the MoneyPass website. Type in your zip code and then click on the “Search options” button. From the drop-down, make sure “All Surcharge-Free ATMs” is checked. (Other options include deposit-taking ATMs, handicapped-accessible ATMs, and 24-hour ATMs.) You’ll be able to see your options on a map and in a list.

If you’re traveling abroad and want cash, it can be especially frustrating, as surcharges may vary from non-existent to upwards of $8. (If you have to pay a flat fee rather than a percentage, consider taking out more money but less often so you won’t be drained by excess fees.)

For foreign ATM withdrawals, try ATM Fee Saver, available in 40 countries in North, South, and Central America, Europe, Africa and the Middle East, Asia, and Australia. ATM Fee Saver’s app is available for iOS and Android. The site also has a great blog with travel-related financial advice, like this one on the 9 best ways to save foreign ATM fees.

FIND A LITTLE EXTRA HELP IF YOU NEED IT

Traveling with a disability can up-end all kinds of travel plans. Whether you’re traveling with service animals, need alternative security measures (for example, if you have an implanted or attached medical advice), or will need a wheelchair or other accommodations at your destination, you’ll need to plan ahead.

To ensure that you’re getting all the right information you need, be sure to review the following resources:

Traveling with a Disability (Centers for Disease Control and Prevention) — This covers a wide variety of tasks, like contacting your physician in advance of your travel to ensure you have destination-specific care, acquiring MedicAlert jewelry or other notification-bearing items, to specialized considerations for air and cruise travel.

Traveling with a Disability (U.S. Department of Transportation) — This includes the Airline Passengers with Disabilities Bill of Rights and other helpful information.

Travel: Tips for People with Disabilities (DisabilityInfo.org)

10 Tips for Traveling With Physical Disabilities (Travel Channel)

Traveling abroad with disabilities: Here’s a post-pandemic guide (USA Today)

How to Travel with Invisible Disabilities (AARP)

6 Tour Companies Dedicated to Travelers with Disabilities (Condé Nast Traveler)

Speaking of disabilities, it’s been really gratifying to learn that great strides are being made in helping travelers living with invisible disabilities.

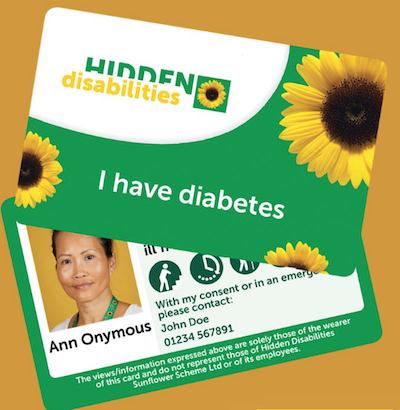

In case you’re unfamiliar with the term, invisible or hidden disabilities can refer to any type of disability that is not obvious. If you see a person in a wheelchair, using crutches, or walking with a white cane, that’s a visible disability. Invisible disabilities may relate to physical concerns that are not immediately apparent (anything from deafness to asthma, heart conditions to diabetes). But they may not be primarily physical in nature — consider Alzheimer’s, aphasia, dyslexia, autism, etc. Any of these can make traveling problematic.

Hidden Disabilities Sunflower Program

Recently, I was fascinated to learn about the Hidden Disabilities Sunflower program. This program provides lanyards with yellow sunflowers on green backgrounds to alert airport and airline workers that the person wearing one might need some extra time or assistance. Imagine how much easier it would be to have people trained to look for the lanyard rather than always having to jockey in line to request assistance for yourself or someone with whom you’re traveling!

The key is that you don’t need to disclose your specific disability to get a lanyard, nor does the lanyard say why you need help, because “why?” is beside the point. Instead, workers are trained to recognize that individiuals wearing the lanyards may need help, support, or additional time, and should ask, “How may I help?”

That said, individuals can personalize the card (for purchase at a small fee) for their lanyard with up to five different icons (of 25 available) to help identify the kind of assistance they may need. For example:

![]() Hidden Disabilities Sunflower initially launched at the UK’s Gatwick Airport in 2016. The program has now grown to include about 216 airports worldwide in 30 nations, including 93 here in the United States (of which 19 will be launching the program soon). British Airways, Air France, and ten other airlines, along with many other businesses, have also signed on to participate in the program.

Hidden Disabilities Sunflower initially launched at the UK’s Gatwick Airport in 2016. The program has now grown to include about 216 airports worldwide in 30 nations, including 93 here in the United States (of which 19 will be launching the program soon). British Airways, Air France, and ten other airlines, along with many other businesses, have also signed on to participate in the program.

In addition to prioritizing assistance, airports and shopping venues are developing Sunflower programs. At the Pittsburgh airport, to help individuals with sensory issues, they’ve developed a room with tunnels, wall displays, rocking chairs and special lighting to create a soothing environment. The Seattle airport has a similar Sensory Room and Interfaith Prayer area.

Learning about this reminded me of the large tunnel between concourses at the Detroit airport with psychedelic lighting, which I originally saw in 2016. On each side of the tunnel, there’s a button to push so that people with epilepsy or other sensory issues for which the tunnel would create difficulties can stop the effects. Push the button and the strobe and lighting effects cease for the period it takes to cross to the other side, then start again soon after.

So far, the Hidden Disabilities Sunflower index includes more than 900 disabilities, and there’s a form to list any that have been missed.

The Sunflower lanyards are free.

Find an airport or business participating in the Hidden Disabilities Sunflower program here.

If you do travel in the coming months, I hope you have a safe, serene, and organized journey.

Lost & Found: Recover Unclaimed Money, Property, and Savings Bonds

Treasure Chest by Immo Wegmann on Unsplash

Treasure Chest by Immo Wegmann on Unsplash

There are many reasons to keep your paperwork organized, but I think the most compelling one is that many VIPs (very important papers) are the equivalent of money.

Your Social Security card, for example, is key to proving who you are, and if someone gets his or her hands on your card (or even just the number) and a little bit of other information, you may suffer from years of financial strife due to identity theft.

A lost last will and testament means that a family could have to spend months or years lacking access to resources promised to them because of the difficulty of proving the deceased’s intentions for funds and possessions.

If you lose your birth certificate, you may not be able to replace other essential documents if they go missing or get destroyed in a fire or natural disaster.

Lose your passport without enough time before an international trip, and your vacation or work plans could be scuttled, leaving aside the potential for identity theft of a more-than-financial nature.

Paper Doll has covered a wide variety of topics over the years on accessing lost documents, creating essential ones you lack, and keeping them all safe so they are not lost in the future. These posts include:

Ask Paper Doll: Do I Really Need A Safe Deposit Box?

How to Replace and Organize 7 Essential Government Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Protect and Organize Your COVID Vaccination Card

A New VIP: A Form You Didn’t Know You Needed

Today, we’re going consider options for recovering lost property. Consider it a treasure hunt!

RECLAIM LOST “PROPERTY”

When I say “property,” what do you think of? Perhaps real estate?

Maybe that reality show Property Brothers with Canadian twins Drew and Jonathan Scott?

When you hear “lost property,” it’s possible you think of the boilerplate language on one of those claim tickets you get when you leave your coat at the fancy coat check room at a swanky venue.

So What Is Unclaimed Property?

The term unclaimed property is what you’ll hear most often when searching for lost money in various types of accounts. Unclaimed property usually refers to funds that a government (federal, state, or local) or business owes you because you’ve, quite literally, left it unclaimed.

It’s possible that you’re so organized with your paperwork that you feel affronted that I’ve implied you might have just haphazardly left money sitting around. But I’m not saying you’re absent-mindedly leaving piles of cash wrapped in newspapers like Uncle Billy in It’s a Wonderful Life. (By the way, that $8000 deposit that ended up in Mr. Potter’s hands would be work $121,762 in 2023! Maybe Uncle Billy should have tied the money to one of those strings around his fingers.)

Thomas Mitchell as Uncle Billy, searching the bank’s trash cans for the lost Savings & Loan deposit.

There are all sorts of reasons money may get separated from its rightful owner.

Perhaps you put a security deposit down on an apartment when you were in college, but after graduation you were heading across the country to start your first job. Your roommate returned the keys to the landlords, got the OK that you hadn’t left the place in a horrifying state, and similarly disappeared into the adult world, leaving no forwarding address for either of you.

In many cases, by law, your security deposit was placed in an account (perhaps interest-bearing, perhaps not) and should have been returned to you when your lease ended. If your landlords were playing by the rules, rather than deciding to take the money and run, they should have turned it over to the state.

Similarly, it’s common to have to pay a deposit when opening an account for certain utilities. While some utilities keep these deposits until you move and close your account, others have (little-advertised) rules stating you can request your deposit be returned after a set period of good payment history. Sometimes, however, if you don’t actually request your deposit back, it just sits there, eventually going unclaimed, and being sent to the state.

When I helped one of my clients, a gentleman in his 60s, search for unclaimed property in his name, we found a life insurance policy that his parents took out in his name when he was an infant. It had long since stopped increasing in value, so he claimed it and cashed out.

Or maybe your Great Uncle Horace left you oodles of money in his will, but his last valid address for you was three states and 22 years ago? (My condolences on Horace. We always heard good things about him.)

Unclaimed property can be in the form of cash, uncashed checks (including stock dividends), insurance policies, abandoned bank accounts, forgotten security deposits, or even tangible property in the case of safe deposit boxes.

Life gets busy. It’s OK. Don’t play the blame game. Instead, play finders keepers and locate your missing money!

Where Can You Find Your Unclaimed Funds?

Unfortunately, there’s no central repository for all unclaimed property. Instead, you can search in each applicable state’s unclaimed property office.

Start with Unclaimed.org, the website of the National Association of Unclaimed Property Administrators.

Once there, scroll down and select your state by clicking on the location on the map. If you are from a United States territory like Puerto Rico or the U.S. Virgin Islands, or from one of several Canadian provinces (Alberta, British Columbia, New Brunswick, or Quebec), click on the appropriate link below the map, or use the yellow “Select Your State or Province” button. This will take you to a specific unclaimed property office, like the Office of New York State Comptroller’s Search for Lost Money page or Tennessee’s unclaimed property search (with a snazzy alternative address of ClaimItTN.gov).

To begin your search at any of these state sites, provide whatever information you have available, but at least a first and last name (or, if you’re searching money owed to a company or non-profit, the entity’s legal name). Some state search sites will also ask for a city in order to narrow the parameters.

If you want to search for multiple states simultaneously (let’s say you have lived in many locations, or you’re searching for abandoned accounts for a relative who has passed away and are unsure where they might have had lived), visit MissingMoney.com.

MissingMoney.com allows you to just type a first and last name, and all possibilities for that name, across all state databases, will come up.

Whether you use a state search or a multi-state search, the resulting page should provide a series of options. If you find a listing for yourself (or a relative), you’ll likely see some combination of the following information:

- the name of the owner of the unclaimed property

- any co-owner’s name, if applicable

- the last known address of the owner (possibly including the street address, city, state, and/or zip code, though some states hide some of the information)

- the state in which the unclaimed property is held (if you’re doing a multi-state search)

- the amount or value of money being held (which may be listed as an exact dollar amount, a range (like $50-$100, or >$500), or “undisclosed); if the property is tangible rather than monetary, you may or may not get a clue to what it might be.

How Do You Claim Your Funds?

If you find a match for unclaimed property on your state’s page or through MissingMoney.com, you’ll need to file a claim to prove that you own the account or property. Similarly, if you are claiming it on behalf of a relative who cannot act on their own behalf or a person who has passed away, you must prove their connection to the property as well as show that you are the party authorized to file a claim.

Whatever search method you choose, as long as you go through a government web site, know that searching for the unclaimed property is free, as is filing your claim. (Please don’t get scammed by a site promising to funds that are due to you anyway. While some services are valid and may relieve you of labor searching for large 5- and 6-digit recoveries, I encourage you to exhaust all free options first.)

Each state or province will have its own rules regarding claim submission. While most prefer you to submit your claim online, some still let you submit by mail. Answer all of the questions to the best of your ability, and assuming you are able to substantiate that you have a right to the funds, the account will be processed in due time and sent to you.

For individuals, businesses, and non-profits, you will have to submit proof of identity, address, and ownership. For individuals, your identity can usually be proven by a scan/copy of your driver’s license, passport, or Social Security number; please be cautious about transmitting your Social Security number through the mail and be sure you are using secure web sites marked HTTPS.

Proof of ownership of property will vary. Options might include your Social Security number, employment pay stubs, W2s or 1099s, or utility bills.

If you’re making a claim on behalf of someone who is living, you will need to provide the appropriate documentation, which might included a copy of a child’s birth certificate or legal adoption order (if the money is due to someone under 18), proof of a claimant’s age, and a court document or other signed legal documents proving you have the authority to act on the actual owner’s behalf. These could include letters of guardianship or conservatorship, a trust agreement, or a Power of Attorney document.

If you are making a claim on behalf of someone who has passed away, you’ll have to submit a death certificate as well as a will or other court documents, like a Small Estate Affidavit and a Table of Heirs. (These are state-specific.)

What To Do Once You Get Your Now-Claimed Funds?

After you submit your claim, if you are able to sufficiently able to prove your right to the funds, you will eventually be sent a check. Verifying your identity and rights to the funds can take a while, though many states try to complete the processing within thirty days.

Once you receive your money, usually by check, deposit the funds as soon as possible. Do not run the risk of losing the check and starting the whole process over!

Depending on the source of the funds, you may have to pay state and/or federal tax on the claimed money.

For example, if this is a deposit returned to you, you would not owe tax on the amount of your deposit, but tax might be due on any interest the account earned. The same is true regarding funds from abandoned bank accounts; the principal would not be income, but interest would likely be taxable. Of course, if the money would initially have been taxable had you received it on time (such as with stock dividends), it will still be taxable, but as income in the tax year in which you are receiving it.

What About Unclaimed Money in Other Countries?

Are you a fancy-schmancy world traveler? Maybe someone in your family lived abroad?

Unfortunately, there’s no central repository for tracking money left behind in your Tunisian bank account or a security deposit your mom paid during her semester abroad in Paris. (You may find some solace in the links collected by the Global Payroll Management Institute.)

However, the US government’s Foreign Claims Settlement Commission does oversee unpaid foreign claims for covered losses. That’s government-speak for money you are owed for lost funds or real property in the following circumstances:

- a foreign government “nationalizes” your property (whether that’s the money in your account or the house you owned)

- damage to property you owned that was caused by military operations

- injury to civilian and military personnel

If any of these apply to you, review the Unpaid Foreign Claims page and fill out a certification form (linked on that page). There’s also a link for Standard Form 1055, if you’re filing on behalf of someone who has died.

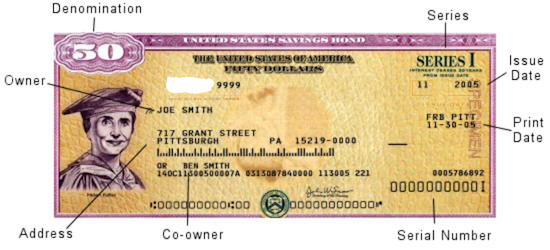

LOST SAVINGS BONDS

Once upon a time, it was popular to give United States savings bonds as gifts when people got married, had babies, graduated from college, got confirmed or Bar or Bat Mitzvahed, or otherwise had a rite of passage.

In ye olden days, you’d go to your bank to buy a savings bond, and get a receipt for your purchase as well as a paper certificate to give to the recipient. With the old EE savings bonds, you could purchase a bond at half the face value, and then a few decades later, your investment would double to the face value. If you waited a little longer, the bond would keep earning interest, at least for a while. (If your bonds are more than 30 years old, they have likely stopped earning interest.)

Nowadays, savings bonds are registered electronically, which makes everything much easier. However, with the old bonds, without the certificates in hand, the process gets complicated.

The problem was that these called SAVINGS bonds — but people often treated them as if they were called “throwing-them-in-a-box-hidden-under-the-bed” bonds. That’s fine for a while, but once your bond stops earning interest, it would make sense to cash it in and find another wise investment option. That’s hard to do if you don’t have the bond.

What Should You Do If You Can’t Find Your Savings Bonds?

If you’re sure you have savings bonds, but can’t find your paperwork, you have a few alternatives:

- Check your safe deposit box or fireproof safe — Free, except for the value of your time.

- Search through those boxes of stuff your parents or guardians gave you when they retired to Boca or Shadytime Retirement Village. Again, free except for the value of your time.

- Ask your family members to check their safe deposit box(es) and/or fireproof safe(s) and send you (via secure shipping) your bond certificates — Depending on whether you live across the street or across the country from your loved ones, this will come at variable cost in terms of their time, delivery service fees, and you getting roped into providing IT support for your parents now that they’ve got you on the phone.

- Contact the Feds — If you can’t find your bonds, or know they were definitely lost, stolen, or damaged, this may be your only alternative.

If you’ve lost your original savings bond’s nifty tangible certificate, you have two options:

- replace your original bond with a digital* bond (held in your Treasury Direct account); or

- cash in your bond (possibly losing value if you decide to cash it in before it has reached maturity)

*Note: If your lost bond is a now-defunct HH bond, you can get a substitute paper bond. For EE or I-series, they must be digital

If you’re really lucky, even if you’ve lost the actual bond, someone in your family may have kept track of the serial number of the bond. If not, you’ll have to help the government perform a search. Go to the U.S. Treasury’s website at www.TreasuryDirect.com and fill out Form 1048 to locate savings bonds registered all the way back to 1935.

Random Treasury Trivia

EE savings bonds took the place of World War II-era E-series or “Liberty bonds,” which date back to WWI!

HH-series bonds, popular as gifts for GenXers and Millennials, only came in the paper format and existed from 1980 through 2004, and they stop earning interest in 2024. That’s next year. Yes, really. So it’s a good time to start looking for your HH bonds! I-series bonds were introduced in 1998.

Interested in buying bonds but not sure how they work? Treasury Direct has a whole page comparing EE and I-series bonds. Be sure to check out the rules and options for buying savings bonds.)

On Form 1048, you’ll be asked to provide as much information as possible, including the:

- Issue date (or a range of dates, if you are uncertain)

- Bond certificate serial numbers (if you have them)

- Inscription information on the bonds, including names, addresses as Social Security numbers.

- Whether the bonds were lost, stolen or destroyed. If the bonds were stolen and a police report was made, you will need to append that, as well. The government wants to know all the gory details, so if your Great-Aunt Gertrude started a food fight at Thanksgiving and your savings bonds were drowned in gravy, explain. Or, y’know, explain if your town had a flood. Whatever.

- If you are not the named party on the bond certificate, you will have to explain your right to access the bonds; for example, are you the parent or guardian of a minor, the conservator or legal representative of another adult, or the executor of the will of a now-deceased party? (Note: if the person named on the bond is deceased, you will also need to include a certified copy of the death certificate.)

- Then, you’ll have to state whether you want substitute (digitally-held) bonds or payment in return for cashing in your bond.

You will need the form to be certified by a Notary Public. Review Paper Doll’s Ultimate Guide to Getting a Document Notarized for your options.

Finally, mail the form to:

Treasury Retail Securities Services

P.O. Box 9150

Minneapolis, MN 55480-9150

What If You’re Not Even Sure If There Were Savings Bonds?

All of the above tells you what to do if you know you received the bonds, but they’ve since been lost, stolen, or destroyed (as in irretrievably folded, spindled, or mutilated…or drowned in gravy).

But maybe you’re not sure if your hazily-recalled bonds ever existed? Maybe you (or someone on your behalf) purchased bonds but they never arrived. Maybe you got hit on the head with a falling anvil and can’t remember if you ever had a bond, or maybe you think a deceased loved one owned savings bonds but you can’t find them?

If any of the above situations apply, visit the Department of the Treasury’s Treasury Hunt link. Enter your (or your loved one’s) Social Security number and state, and if there’s a match, the site will let you know what to do next to locate matured savings bonds, those that are uncashed but no longer earning interest.

This just scratches the surface of the unclaimed funds, property, and financial instruments that can be recovered with a little bit of effort. Invest a few moments to let your fingers do the walking and see if you can recover what’s been lost.

If you DO find money owed to you, please come back and share the story (but not confidential information) in the comments.

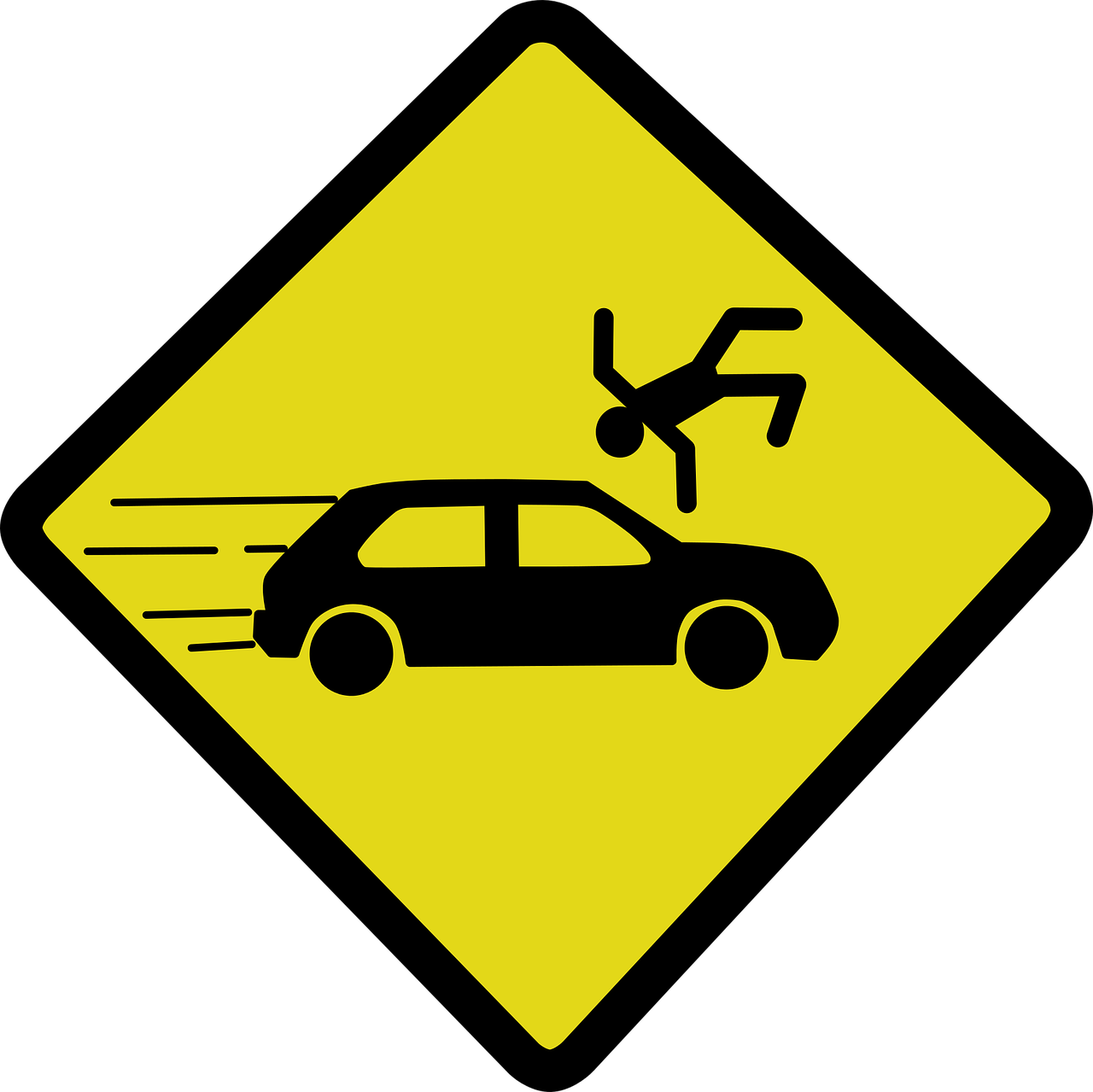

Organize for an Accident: Don’t Crash Your Car Insurance Paperwork [UPDATED]

[Editor’s note: This post originally appeared on Paper Doll on 1/23/2020 and has been revised and updated as of 8/8/2022. As many college students are headed off or back to their universities with cars, this is an ideal time to discuss the finer points of auto insurance.]

(Image by Andrea Closier on Pixabay)

What happens when an unstoppable force meets an immovable object?

In January 2020, Paper Doll was sitting at a traffic light, preparing to make a turn, when the car behind me answered that physics question. Luckily, it was more of a THUD or a BAM than a CRUNCH. However, even the most minor of fender benders can be scary and overwhelming. It’s definitely not the time to wish you’d been more organized with your car insurance paperwork.

Even the most minor of fender benders can be scary and overwhelming. It's definitely not the time to wish you'd been more organized with your car insurance paperwork. Share on XToday, we’re going to look at the different kinds of paperwork you need, and how to organize it, to make sure you are protected and confident regarding your car insurance.

APPLYING FOR CAR INSURANCE

Whether you’re new to driving, are changing insurance companies, or are insuring a new car in your household, there are certain documents you’re going to need when you apply. Having everything in order ahead of time will make the process move more smoothly. You will need information about yourself, any other drivers covered on the policy, and the vehicle, such as:

Social Security Number(s) — You will need the SSN of anyone who is to be covered on your policy.

Your Driver’s License — Some insurance companies will only need the license number; more old-school agents may want a photocopy of your license. If, like me, you don’t like letting your license out of your hands, make a few photocopies of your license and you’ll have them when you need them.

Your insurance company isn’t just verifying that you are licensed to drive. They’re going to check your driving record — also called a Motor Vehicle Report (MVR) in some areas — to verify that your license hasn’t expired or been suspended, and to see whether you’ve had any accidents, convictions, or traffic violations. Most states look at your driving record for the last three years; however, there are exceptions. Kansas and New Jersey reports go back five years; Colorado, Indiana, and West Virginia look back seven years.

WalletHub has a state-by-state guide to getting a copy of your MVR, with links, in case you want to check it for accuracy before seeking insurance. In my state, I can get a copy for $5 in person or or online; nationwide, costs range from $2 to $25 (sometimes plus processing fees to use debit/credit cards) per report. Be prepared to use an authentication app, like Google Authenticator, or receive a text or email or verify your identity.

Do not be scammed into using a non-governmental service that promises to get your MVR online for you; they up-charge a significant amount and are usually not any faster than going through your state’s website.

Financial History — Insurance companies do standard credit checks, so it’s a good idea to check your credit history at AnnualCreditReport.com (and not one of the shady copycats), as well as your credit score, to make sure there are no mistakes.

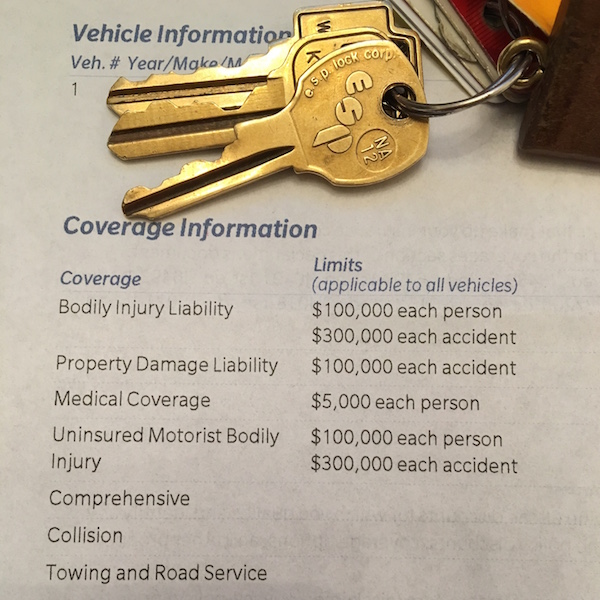

Your Current Insurance Declarations Page – You know that long page (or set of pages) in your policy with big numbers like $300,000/$500,000? (More on that, below.) Having that page will allow your new insurer to provide you with an apples-to-apples quote.

Vehicle Information Number (VIN) — This 17-character identifier is unique to your car and is built into your dashboard or imprinted in your driver’s side door frame. Your insurer uses this to verify that the car is not stolen and doesn’t have any problematic history.

Discount-Related Paperwork — There are a variety of ways to get a discount on car insurance. Your driving record (MVR) will verify if you qualify for a “good driver” discount, and you (or your teenager or college student) may be able to submit a current report card to qualify for a “good student” discount. To get the discount, students usually need to be under 25 and have no at-fault or moving violations on their MVR. A GPA of 3.0 (on a 4.0 scale) or Honor Roll/Dean’s List status is generally required.

You can also get multi-car discounts if you and your spouse both have cars, or multi-policy discounts if you carry homeowners’ or renters’ insurance with the same company.

If you’re over a certain age, you may be able to take a safe driver course, like one offered by AARP, to lower your rates.

You might be eligible for affinity discounts if you are a member of certain clubs, organizations, alumni associations, or sororities/fraternities. There are also often occupational discounts for members of certain professions, including first responders and medical professionals, educators, and government employees, so it’s worth asking your agent what discounts exist before you get too far in the application process.

ORGANIZING YOUR INSURANCE PAPERWORK

Once you have an auto insurance policy in place, you’re going to have paperwork. The more organized you can be, up-front, the less stress you’ll have to deal with in case of an accident or other issue.

Policy

This is the multi-page legal document that tells you everything about your coverage. It can be overwhelming. Make sure you go over it with your insurance agent so that you know and understand the essential elements of your policy, particularly the items on your declarations page, which spells out your coverage:

- Liability (also called Bodily Injury Liability) — These are the limits on your policy per person per accident. You may see $100,000/$300,000, which means you’re covered for any medical expenses and/or lost wages for anyone (including other drivers, passengers, and even bystanders) injured in an accident you cause, up to that amount.

- Property Damage — This pays to repair or replace things that get damaged (in an accident you cause), like other people’s cars, items in their cars that get damaged, actual property (like someone’s garage or mailbox). The dollar limit is quoted per accident. Be sure you understand the difference between collision and comprehensive. Collision covers damage to your car when it collides with another car, or a tree, or a Bob’s Big Boy. Comprehensive covers damage to your car caused by things like vandalism or theft by hooligans, or “natural” disasters (hail, tornadoes), a tree toppling onto your car, or Bambi taking a running leap at your hood.

Your policy may combine liability and property damage into one category, so you might see it listed with three numbers, like “100/300/50” which means $100,000 for injuries per person, $300,000 for total injuries per accident, $50,000 for damages to property.

Depending on your state, your policy may also have (or even require) special types of insurance options, like:

- Uninsured and underinsured motorist coverage — If someone hits you but doesn’t have enough (or any!) insurance, it will cover injuries if you or your passengers get hurt. Basically, you’re insuring yourself against people who aren’t responsible enough to have (enough) insurance. There’s also a line item for uninsured motorist property damage; as you may have guessed, it covers your car if the person who hits you doesn’t have insurance.

- Personal injury protection insurance (PIP) — If you live in a “no-fault” state, this pays out for medical expenses for minor injuries or lost wages for you or your passengers. (Liability coverage is only invoked if the costs go beyond what PIP covers.)

- Medical payment coverage — Like PIP, this covers you or your passengers’ accident-related injuries, no matter which driver is at fault. It doesn’t cover lost wages, and the limits tend to be $5,000-10,000.

Your policy may also cover things like glass replacement damage, towing and road service, accident forgiveness (to keep your rates from going up after an accident claim) and loss of use (for a car rental while a vehicle is being repaired).

I encourage clients to make a file folder for each insurance policy they own (auto insurance, homeowners, etc.) and keep it in the Legal section of your Family File System.

The declarations page is a good cheat sheet for all of your coverage. You may want to make a photocopy and keep it in your glove compartment, or take a photo/scan to save in Evernote, Dropbox, or a similar app accessible on your phone.

Notes for Canadian Readers

Please note that all of the above refers to purchasing auto insurance in the United States. In Canada, different language is used. For example, in addition to provincial and territorial mandatory coverage, there are optional policies including “collision, specified perils, comprehensive, and all perils.” If you are seeking information regarding auto insurance (and organizing insurance paperwork) in Canada, please confer with an insurance professional (or a member of Professional Organizers in Canada).

Bills for Premiums

Insurance companies usually give you the option of paying annually, twice per year, or monthly. The less often they have to invoice you, the more likely you are to get a discount, so paying every six months can save you a bit over monthly bills.

If you receive paper bills, mark the payment date, amount, method of payment (and confirmation number, if applicable) on the invoice and file it in the Financial section of your Family File System.

If you tend to go paperless, print a PDF or take a screen shot of the confirmation screen and keep it in a “paid invoices” folder on your computer, and be sure to able it clearly, like “2022-May Ins-Car.”

Re-shopping Insurance Policies

In April 2022, I made a few calls to investigate the rates of competitive auto and rental insurance policies. When I found an auto policy that was significantly lower than what I’d been paying (while not increasing my associated renter’s policy) for an equivalent policy with an equally reputable insurance company, I contacted my agent.

I was surprised, delighted, and then admittedly annoyed when my agent “magically” found me an even more competitive rate. (A reminder: companies generally do not go looking for ways to reduce consumer costs!) However, even though I was staying with my same insurance company where I’d been for 24+ years, my policy was technically with a new sub-company, and my “accident forgiveness” guarantee went away, as if I were a new policy holder. However, I was able to retain that status with a $20 one-time fee. Caveat emptor!

So, do consider shopping for better rates/discounts at least every couple of years. It’s not fun, but it’s not as inconvenient as you might imagine. If you like your current insurance agent/company, give them the opportunity to surprise, delight, and slightly annoy you by magically finding better rates.

Proof of Insurance Cards

This little card has your name and address, your car’s VIN, make, and model, your insurance company’s name and contact information, and your policy number. It is the only document that verifies the coverage on each of your cars, so keep your proof of insurance somewhere safe in case you need to present it to a police officer or someone with whom you’ve had a driving “misadventure,” or to have information handy if you need to file a claim or report damage to your insurer.

Most insurance companies provide two proof of insurance cards on one piece of paper with your policy renewal. Consider putting one in your wallet and one in your glove compartment. If your glove box is not always tidy, you may want to consider something that keeps important documents front and center, like this car insurance and registration card holder in a bright color.

Photo by

Photo by

Follow Me