Paper Doll Explains Your Health Insurance Explanation of Benefits

In more than two decades as a professional organizer, I’ve found that people have disorganized papers because they don’t create and maintain working systems for organizing what they need and letting go of what they don’t. Eight years ago, I talked about how fear plays a huge role in what people decide to keep (or fail to decide, and thus end up keeping).

If I ask someone, “Why do you have this?” whether “this” is a document or a never-worn article of clothing or a piece of broken furniture, the answer often betrays an unspoken fear. Sometimes, that fear may be related to anticipation of an unpleasant emotion — if you give away the itchy sweater (in a color that makes you look like you have the flu) that Aunt Gertrude gave you, will you eventually feel you are betraying late Aunt Gertrude?

Other times, particularly with papers, people hold onto documents long after they’ve served any useful purpose out of fear of what might happen if they need, but don’t have, that paper. This is why I developed Do I Have To Keep This Piece Of Paper?

I can tell you that that the item I see clients keep the most of, and the most often, and the longest after they’ve ceased being necessary, are health insurance Explanation of Benefits documents.

Sometimes, organizing clients ask, “How long do I need to keep these?” but more often, they don’t ask at all. Explanation of Benefits can often seem mysterious or scary. People know they aren’t medical bills, per se, but they don’t know what they are, or what they’re supposed to do with them. Understandably, if you don’t know why you have something, you’re going to be afraid to let it go. But that way, madness lies.

EXPLAIN THE EXPLANATION OF BENEFITS

First, I should clarify that while many insurance companies call these pieces of mystery mail “Explanation of Benefits” (EOBs for short), they go by other names. Depending on your insurance provider and your region of the country, the title of the document may be any of the following:

- Explanation of Payment (EOP) — Used interchangeably with EOB — a document explaining the payment or coverage details for a healthcare claim.

- Explanation of Review (EOR) — This serves the same purpose as an EOB or EOP.

- Benefits Statement or Statement of Benefits — Either term emphasizes the benefits of one’s health insurance policy re: covering (or not covering) a specific healthcare claim.

- Claim Summary or Claim Explanation — Some insurance providers use these terms to describe how a medical claim was processed, including the payment details and any patient responsibilities.

You might also see payment summary, healthcare summary, coverage explanation or remittance advice. Whatever they’re called, the purpose is to inform you about how a medical claim has been processed, including what portion of the claim is covered by insurance and what you (may) owe.

It’s a summary of the whole process from what the provider charged to what each responsible party owes, and it’s supposed to make it easier for you to understand what has happened. The problem? EOBs are often designed to be as clear as mud.

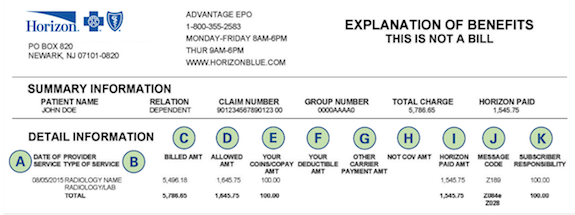

What does an EOB show?

These documents are designed to convey the following:

- Who received treatment or service — This could be you or anyone included on your policy, like a spouse or child.

- The date of a medical service or procedure — Your child may have had a well-child visit, or perhaps you had the yuckies and needed a full workup and blood tests. If you had an appendectomy, not only will your surgeon actions be listed, but so will the services of the anesthesiologist and other specialists in attendance, plus medications, tests, and your hospital stay.

- The name of the physician, lab, clinic, etc. — You may not recognize the name listed if your medical provider sends blood or tissue to a lab for analysis, or an X-ray, CT scan, or MRI requires review.

- Non-covered codes — Not everything done for your health is covered by your insurance policy. In a perfect world, whatever your provider felt was necessary would be covered, but (sigh) that’s not how it works. There may be random letters or numbers indicating why something wasn’t covered due to a wide variety of circumstances, including

- a provider, clinic, or hospital is not in-network for you (meaning, not on a list of pre-approved providers)

- a procedure or treatment not included among the items covered by your policy

- a procedure or treatment requires pre-approval but you didn’t get it pre-approved — This may not be covered even though, if you had ask for it to be pre-approved, they would have approved it and covered it (that is, paid for it).

- a procedure or treatment is allowed, but only so often in a given time frame — For example, mental health appointments or physical therapy sessions may be limited to (for example) 10 sessions in a calendar year.

Also, while some appointments may be allowed at any time in a given year, others must be scheduled 365+ days apart.

The A1C blood test allows physicians to track blood glucose levels over a rolling period of time; most insurance companies require 90+ days in between tests. Sometimes, medical offices are good about making sure your appointments aren’t scheduled closer than 90 days apart so that you can actually get your A1C test done (and covered), but as a patient, it’s in your best interest to know what your policy covers, and how often, so you don’t pay extra.

- The total charged by the physician, clinic, lab, hospital, or pharmacy.

- The network savings — OK, I get it your eyes have glazed over at this point. If you’ve never had much reason to see lots of doctors, go to the hospital, have a baby, or just use much of your medical insurance, this may be one of the mysteries that causes you to toss your EOBs on top of the microwave or stuff them in a drawer. I promise you a sidebar in a minute to answer all of your questions!

- The amount the insurance company paid your provider — This is self-explanatory, or it should be. If there are no codes in the “Non-covered codes” section, then you should be able to eventually match up all of your numbers to see why your insurer paid your provider as it did. We’ll get back to that.

- Your co-pay — Your policy might require you to pay a specific amount for each medical visit or pharmacy purchase. It’s common for there to be one level of charge (say, $20) for your primary care physician and another (perhaps $60) for specialists; similarly, you may have different levels of co-pays for generic, preferred, and non-preferred prescriptions.

- Your co-insurance — Co-insurance is the percentage of your medical healthcare costs you share with your insurance company, usually after meeting your deductible. For example, if you have an 80/20 co-insurance, once you hit your deductible, your insurance company will pay 80% of covered (that is, allowed) costs, and you’ll pay the remaining 20%…until you hit your out-of-pocket maximum.

- Other insurance — Depending on your stage in life, you might only be familiar with having one kind of health insurance at a time. However, if you have (for example) Medicare, you might also have a secondary health insurance policy that covers a percentage of what’s left over after your primary policy (or Medicare) pays.

- “You owed provider” — This is usually the bottom line, and it tells you what, all-told, you should have to pay your doctor, the pharmacy, the clinic, the lab, or whomever. In a perfect world, the bill you get matches that amount, it’s what you expect, and everyone’s happy.

Still with me? Health insurance in the United States can be confusing, though many insurers try to make it more comprehensible.

But how does it all work?

Here’s how you imagine it works. You have a tiny booboo and you have insurance. You go to your doctor and she fixes your booboo. You pay the doctor your co-pay of $20 and you leave. After you walk out the door, someone who works for your doctor does the typey-typey thing on a computer, relaying codes for the procedure you had done, and the insurance company pays the doctor the rest of what the doctor charges, and everyone’s happy. Right?

Well…not necessarily. Things may be more complicated, and you may find yourself lost:

- If the typey-typey person types the wrong code, perhaps for something your insurance doesn’t cover, then you may get an EOB full of “Nuh-uh, we’re not going to pay for this!” codes and then you’ll get a bill from the doctor for hundreds or thousands of dollars you weren’t expecting.

- The typey-typey person may not get around to billing the insurance company, or the insurance company may be pokey and not pay them as fast as they want, and you might get a bill for the whole amount. This is why, when you get a bill you aren’t expecting, you must always:

- Look at the bill to see if it lists the insurance company’s paid portion

- Look at the EOB to see if the insurance company is saying they paid something that the administrative office (the typey-typey folks) haven’t yet processed.

- The numbers don’t add up. Before you get stressed about this, it helps to know how insurance works. Too often, I hear clients say, “I hit my deductible already this year, so I don’t know why the doctor is sending me a bill” or “The amount the insurance company paid the provider plus the amount I paid doesn’t add up to what it says the doctor is charging.” Both of these are easy to explain, but because they don’t teach any of this in school, most people don’t learn it until or unless they experience serious medical situations.

Why am I still getting billed if I’ve already hit my deductible?

The deductible issue often confuses people. First, you pay a monthly premium (think of it like a subscription) to have insurance. Along with that premium, you get may get certain things for which you don’t have to pay extra, like a flu shot or an annual exam. For lots of other things, like doctors’ appointments and procedures, you may have a copay or co-insurance, as we discussed above. And all of this adds up until you hit your deductible.

Your deductible is the amount you must pay out of pocket for covered healthcare services before your insurance plan starts to pay. Once you’ve met your deductible, then your insurance plan will usually cover a percentage of the remaining costs as defined by your plan.

Then, if you keep racking up medical expenses, there’s a point at which you may hit your out-of-pocket maximum. As you may have guessed, that’s the maximum you’ll have to pay out of your own pocket, after which (not counting your monthly premiums), the insurance company pays for everything…until you hit the end of the year. And then on January 1st, everything re-sets to zero.

Happy New Year by Sincerely Media on Unsplash

Let’s say your deductible is $1000 and your out-of-pocket maximum is $5000. That means that until you hit your deductible (and paid $1000) you will pay providers whatever your insurance policy says you must pay up to that amount. That includes co-pays and co-insurance for doctors, pharmacies, and everyone else.

Once you’ve paid $1000 (either in one lump sum or in a bunch payments), your insurance kicks in, and from the next dollar of medical expenses (so, $1001) up to $5000 (your out-of-pocket maximum), your insurance company will pay a percentage (often 80%) and you’ll only be responsible for the remaining (usually 20%) until you reach your out-of-pocket maximum.

But why don’t the numbers add up?

Remember those “network savings?” Insurance companies and the providers in their networks have a deal. Their contractual agreements say that if their policyholders are serviced by these doctors (or hospitals or pharmacies), there’s a limit on how much they can charge.

If you have no insurance: Your doctor fixes your booboo and charges you $1000. You pay your doctor $1000. No coupons, no discounts. No paperwork.

If you have insurance, but haven’t hit your deductible for the year: Your doctor fixes your booboo and charges $1000. The insurance company immediately says, “Hey, Doc, we’ve got a deal. You aren’t allowed to charge our policyholders $1000. You can only charge $400!” The doctor grumbles.

The insurance company pays nothing (because you haven’t hit your deductible) but you get the benefit of a discounted total cost that is much lower than what the doctor wanted to charge. And everything you pay, including this $400, adds up until you hit your deductible.

If you have insurance, have hit your deductible, but haven’t hit your out-of-pocket maximum: Now, the insurance company pays a big chunk (like 80%) of covered costs and you pay the rest. Everything you’ve paid toward your deductible, plus everything you pay now, piles up as you head toward your out-of-pocket maximum.

If you have insurance, have hit your deductible, and have hit your out-of-pocket maximum: This is that weird circumstance where you’ve had so many medical expenses in a year (boo!) that you finally end up not having to pay for anything (yay!). So, fixed booboos and tonsils removed and whatnot later, all of your out-of-pocket expenses reach your maximum, $5000. As of the next dollar of medical expenses, $5001, insurance pays for everything, and you shouldn’t even have to peek at the paperwork beyond eyeballing those great “You owe provider $0.00” lines.

WHY DO YOU NEED AN EOB?

So, now that you know what an EOB says and why the numbers are sometimes wacky, you may be wondering why you need them, and perhaps more importantly, how long you have to keep them. This is why, when my clients ask me, “Do I have to keep these EOBs?” or “How long do I have to keep these EOBs?” the answer is, it depends.

As much as you don’t want to do it, as a policyholder, it’s really important to review your EOBs carefully to ensure accuracy so you understand your financial obligations related to healthcare services.

If you pay every bill the doctor sends, without checking it against your EOBs, you might be overpaying by either duplicating what insurance has already paid (or is in the process of paying) or paying more than the discounted rate you’re due because of network savings.

EOBs exist so that:

- You can understand real healthcare costs. Your EOB breaks down what the doctor charged, what the insurance company actually “lets” them charge, and what (if anything) the insurance company paid on your behalf. When you see all the actual numbers, you may get a sense of whether you’re overpaying for health insurance (vs. the coverage you’re getting for your needs), and you’ll definitely have a better sense of how U.S. healthcare finances work. Sorry.

There’s transparency so the process doesn’t seem so opaque. Yes, unless you take delight in checking the math, just seeing the billed charges, allowed amounts, network savings/contractual adjustments, and your responsibility (including deductibles, copayments, and/or coinsurance) gives you the opportunity (whether or not you take it) to get a handle on what the real costs of your health issues are.

- You can verify how a claim was processed — I’m sure most administrative offices for medical practitioners and hospitals are stellar professionals. But people make mistakes, and computers make it easy to make mistakes, and those mistakes can have real consequences for you as a healthcare consumer. If you get a bill that doesn’t match your EOBs, it gives you the opportunity to call attention to the discrepancy. EOBs help you verify that your insurance claims were processed correctly and that your insurance benefits (for which you pay!) get applied accurately.

Gavel: Creative Commons/U.S. Air Force photo by Airman 1st Class Aspen Reid/af.milvv

Gavel: Creative Commons/U.S. Air Force photo by Airman 1st Class Aspen Reid/af.milvv

- You have documentation to help with disputes and appeals — Again, the EOB lays out the process by which a claim was handled. When you see in black-and-white that a procedure or treatment wasn’t covered due to a “non-covered code” that you don’t think is applicable, you can chase down the error to dispute it or work with your medical provider to appeal.

- You get documentation for your medical and financial records. — You don’t need to keep your EOBs for tax purposes, per se. The IRS doesn’t consider your EOBs as proof of your medical costs; that’s because EOBs don’t say what you paid, but what the insurance company paid. Yes, an EOB indicates what the insurance company believes you owed the doctor, pharmacy, or hospital, but is not proof that you actually paid for those expenses.

EOBs document what healthcare services you received and the associated costs. As such, they can help you track information to accurately prepare your taxes with regard to healthcare-related tax deductions and remember what reimbursement you want to seek from health savings accounts (HSAs) or flexible spending accounts (FSAs).

- You can use EOBs to help you plan your future healthcare expenses. Eyeballing your EOBs will help you estimate the out-of-pocket costs you and your family generally use. This might help you plan how you budget for anticipated medical expenses (especially early in each calendar year, before you’ve hit your deductible).

HOW LONG DO I NEED TO KEEP MY EOBs?

I find that almost everyone saves EOBs much longer than necessary.

If your medical history is uncomplicated and your insurance company allows you to access your EOBs online in your health insurance portal, especially if the EOBs are accessible for at least one year, you may want to request that they cease sending you paper copies. If, in a typical year, you get one EOB after your annual checkup and another after you get a mammogram, and that’s about it, just check your EOBs online. If you like to keep your own records, download the digital version as a PDF you can keep in your own digital records. As always, keep your digital records backed up!

For most people, I recommend keeping your EOBs for about one year, or at least until you do your taxes for the prior calendar year. This way, you can track your healthcare expenses, compare them with any medical bills you receive, and ensure that insurance claims have been processed correctly. Most of my clients will actually compare and contrast numbers when paper documents are set side-by-side; highlight, circle, or otherwise note important figures. Start the year with one folder, like “EOBs 2024.” If you tend to have a lot of medical bills, make a folder for each calendar quarter.

If you get involved in a dispute or lawsuit with either a medical provider or your insurance company, keep all of the relevant bills, EOBs, correspondence, and contemporaneous notes you take during phone calls or meetings until the dispute is resolved or the lawsuit is settled or adjudicated.

If you’ve got complicated or chronic long-term conditions, EOBs may help you track the history of your illness, the dates of important procedures, and the physicians you have seen. However, I encourage clients to either scan older EOBs or use them to develop a log of the timeline and essential information in a spreadsheet before discarding the actual paperwork. Reduce the paperwork and streamline the data!

No matter what, be sure to protect your privacy and your personal information. Shred EOBs to prevent identity theft or unauthorized access to your health information.

I was an executor of the estate for both my parents and found that these EOPs were helpful for end-of-life services to know if I would be receiving a bill from the doctor, hospital, and emergency services. Our insurance is allowed to bill up to 14 months after the person has passed.

For personal, I have changed these to digital, and they are stored on my insurance company account. No papers to keep, yay!

Great information! Thanks for the thorough post, Julie!

14 months! So much for timely billing! You make a good point, and 14 months would just about fall into that “prior year and until you submit your taxes” rubric. I’m shocked that your state allows your insurance company to take more than a year to complete claim processing, though I suppose nothing about the US healthcare industrial complex should shock me anymore.

Thanks for reading!

Great explanations! I have had that fight many years ago with a wrong code being keyed in. It took me over a year to get that straightened out.

I always suggest that my clients keep the EOBs until the end of the tax year. While the expenses might not seem to warrant it now, you never know what illness or disaster can loom ahead. When you hit that new year restart button, it’s usually safe to let them go.

We’re definitely in agreement there, and for most people, that calendar year + time to submit your taxes is the right window, but there are always those outliers I described. And those codes just make it all easier for mistakes to go un-found for longer.

Thanks for reading!

Julie- What a great explanation of EOBs! This morning, my husband showed me a medical bill and wondered why he had to pay something. I asked if he received the EOB, which he had. We looked at it together and determined that the billed amount was correct.

Your article supports the conclusions we arrived at and goes beyond that. So, thank you, Julie, for your timely post. I love how you go deep.

Thank you for the validation, and while I’m sorry you have to pay the bill, I’m glad you were able to use the EOB for verification.

Thank you for your kind words and for reading!

Fortunately, it isn’t a ‘break-the-bank’ medical bill. Phew!

This is highly informative. I appreciate the explanation of what information the EOBs have and how one can use them. This gives a lot of context that empowers the reader to decide for themselves about whether to keep these documents and for how long. Thanks for sharing your knowledge!

EOBs are just such mysterious administrivia for people, and though I was sure I’d written about them before, a thorough search shows all I’ve done is casually mention them. I’m hopeful that this will give readers (particularly younger ones who’ve had less experience with the paperwork of healthcare) a leg up on dealing with these things.

Thanks for reading and for your kind words!

Most of the dealings I have with EOBs is with my ‘senior’ clients. One of my long-time clients is a cancer survivor–I’m always filing her EOB’s for her. I have recommended she keep them to track her past, present, and future health journey. We’ve been clipping them together by year and keeping them for reference. And once in a while, we have had to reference a few of them!

I hope I never need this information but I sure am glad you wrote about it. You’ve handed your readers so much knowledge on the topic of EOBs.

And–you always have the best videos in your posts to support the topic you’ve written about!

Thanks for sharing your expansive knowledge of EOBs!

I get it — your client is the kinds of special situation I was referring to with regard to complicated or long-term illnesses. And while I’d still encourage “decanting” that information to a log, a tightened-up filing system by year definitely assures finding what she needs in the future.

And thanks for your comment about the videos. I know that not everyone can sort through a wall of text, and a little levity goes a long way. Plus, Dr. Glaucomflecken is one of my favorites on TikTok. He’s a real physician (an ophthalmologist) with no mercy for the insurance industry!

Thanks for reading!

This is great information and really important. I love the explanation, it helps a lot for the ones that are not sure why they’re being billed again.

The video is very informative and also worth sharing with family and our kids that will soon be learning how to handle insurance themselves.

Thanks for your blog

Thanks for reading. I wish these financial/medical concepts were taught in school, starting in middle school or at least high school. So many post-college young adults find this all mystifying, and the first time they see these documents shouldn’t be in their 20s!