The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

During the first season of Gilligan’s Island, the end of the original, stripped-down theme song went like this:

The ship set ground on the shore of this uncharted desert isle

With Gilligan, The Skipper too,

A millionaire and his wife,

The movie star, and the rest,

Here on Gilligan’s Isle.

As part of an unofficial three-part series, this post is the document version of “and the rest.”

Two weeks ago, in How to Replace and Organize 7 Essential Government Documents, we covered how to replace a missing birth certificate, Social Security Card, marriage license and certificate, divorce decree, military separation papers, death certificate, and passport. We also discussed the circumstances under which you’d need each, and how and where to store these documents safely.

Last week, in How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents, we continued by looking at important documents you should create and safeguard for your family’s security and your own peace of mind. These included Durable Powers of Attorney for finances and healthcare, a living will or advanced healthcare directive, a will, and a digital will.

All of those documents are “official” documents, paperwork you either obtain from the government or create (generally) with the help of a legal expert. But these aren’t the only papers that will help you create an easier life. Today, we’re going to talk about the other important documents I encourage you to create and maintain.

FINANCIAL DOCUMENTS

Last week, in the sections on Durable Power of Attorney for Finances and wills, we talked about the handling of your finances, either during a temporary absence or incapacitation or, in the case of a will, a more permanent absence. The only way someone can oversee the management and disbursement of your assets is to know what your assets entail. When it comes to organizing, you can’t be listless. So, make a list! Or a few!

Photo by Sharon McCutcheon on Unsplash

1) List of Assets and Accounts

For each of the following, you need to create a list or chart that indicates the following:

-

- the asset by name and type

- the financial institution (bank, brokerage house, transfer agent, etc.)

- the contact person and information, if appropriate (such as your personal banker, retirement officer in Human Resources, your Certified Financial Planner, etc.)

- the physical location of any tangible paperwork (safe, financial file drawer, etc.)

- and the log-in information for any digital account related to the asset.

Depending on where you keep this list and the level of security needed, you may wish to list only the URL and account user name. Then, you might keep all passwords in a digital password manager like 1Password, Dashlane, or LastPass, and only give the master password to the person holding your Power of Attorney for Finances. Alternatively, a digital password manager will generally allow you to share access for specific accounts with the email address(es) of your choice, such as for a family member or the holder of your Power of Attorney.

So, what goes on your lists? Review the options below, and then go through your files, your tax folders, and your memory to try to come up with everything you can recall. You may miss a few; as life goes on, when you encounter a document reminding you of an account, be sure to add it to the list.

List of financial assets:

- checking accounts

- savings accounts

- money markets accounts

- certificates of deposit (CDs)

- stocks, held individually

- bonds, held individually

- mutual funds

- Individual Retirement Accounts (IRAs)

- 401(k)

- 403(b)

- pension

- Social Security account

- insurance policies (with a cash value, such as life insurance)

- annuities

- cash on hand (such as in your safe or safety deposit box)

- treasury notes

- government bonds

List of tangible assets:

- real estate

- vehicles (automobiles, boats, all terrain vehicles, snowmobiles, etc.)

- jewelry

- artwork

- antiques

- collections

List of intangible assets:

- intellectual property rights (patents, copyrights, trademarks, royalty agreements)

- partnership agreements in businesses

How to Organize Your Lists

While any kind of list is better than leaving it to your memory, I don’t recommend using a plain text document or something like Word or Google Docs because those are harder to format for multiple columns and more difficult to adjust as circumstances change.

A spreadsheet, using something like Excel or Google Sheets, is the simplest method for keeping these lists. With a spreadsheet, you can sort alphabetically, by institution name, or other characteristic, and you can easily add or delete lines as necessary. You can also add additional fields, or make simple changes, such as updating beneficiaries, contact information, etc.

A more detailed solution would be to use Airtable. If you’ve never used it, consider it a database that works like a spreadsheet, but you can add pictures and documents into the field. It’s ideal for maintaining all of the text information related to your tangible assets while allowing you to insert photos into specific fields.

Finally, you may want to consider doing a complete home inventory for your tangible property. A popular home inventory solution about professional organizers is HomeZada, a suite of apps for managing all aspects of your home records, from inventory to remodeling to maintenance projects.

Whatever you use, the key is to write down every asset and to update the lists as you add, eliminate, or change your assets.

2) List of Debts and Accounts

Just as you created your list of assets, go through your monthly payables and paperwork to identify any debts you owe. These may include the following (but can include many others):

- mortgages

- auto loans

- college/education loans

- personal loans

- credit card debt

- home equity debt

- medical debt

- payday loans

A basic spreadsheet with all of the columns indicated at the start of the asset section should suffice.

3) Copy of the Contents of Your Wallet

The main reasons to keep a copy of the contents of your wallet is for recovery of control and for replacement of contents in case it’s ever lost or stolen. The copy provides you with all of the information you need: the exact way your name is listed on your card (with or without an a middle initial), the card number, any security code, and any toll-free numbers associated with reporting the loss and getting a replacement.

Image by Steve Buissinne from Pixabay

This is the easiest of your financial projects, particularly if you have a home scanner or printer, because you’re focused on everything in your wallet, the cards that most often leave your home.

- Take everything out of your wallet.

- Lay the cards face (logo) down in two neat columns, and scan the front.

- Leaving each card roughly in place, flip them all over so the reverse (signature) side of the card faces down, and scan that side. This way, each card is in the same position on both scans.

- If necessary, create a second set of scans. (If you need more than two sets of scans, you’re probably carrying too much in your wallet.)

The key is to scan the front and reverse of everything you carry in your wallet, including your driver’s license, health and auto insurance cards, credit and debit cards, AAA or auto club card, library card, etc.

If you carry cards related to implanted medical devices, make sure to copy those as well, but you may prefer to keep the originals in your medical files at home, and carry a photocopy when necessary, such as when you’re having medical treatment or going through a metal detector or scanner.

It’s up to you whether you want to copy retail loyalty cards, as you’re not generally in danger if those are lost or stolen.

For more about good “wallet hygiene,” check out these classic Paper Doll posts:

What’s In Your Wallet (That Shouldn’t Be)?

What’s In Your Wallet (That SHOULD Be)?

What’s In Your Wallet? (Part 3): A Little Insurance Policy

Lost and Found: GONE in 6 seconds: Your Wallet!

MEDICAL DOCUMENTS

The person to whom you give your Power of Attorney for Healthcare (also known as your healthcare proxy) may need to know things about your medical history. But that’s not the only reason to maintain the following documents. Creating both of these, in advance, and updating them as necessary, will save you time and effort when visiting new physicians, answering questions from medical practitioners, assisting first responders, and providing medical history information to your children and other relatives.

Image by StockSnap from Pixabay

4) Medical History

Every time you go to a new physician, you are likely asked to fill out a form regarding your medical history, including past illnesses and injuries, surgeries, current (and sometimes past) medications, and more.

Do you know what year you had your tonsils out? What about the name of the doctor who diagnosed you with that thing that you can’t spell or pronounce? (You don’t want to tell your new ophthalmologist, “I once had a thing that sounds like a penguin.” She may know what you mean, but you’ll feel like an idiot.)

Sometimes, a physician’s record will show that it’s been many years since you’ve had a particular test, like an MRI or CT scan, but you know of a more recent test than he does; being able to consult your record can save time and money.

Sit down with your medical records, EOBs, and maybe your parents or spouse, and create a detailed list of the following:

- health insurance policy and group number (and the address from the reverse of the card)

- your blood type, including Rh factor (that’s the plus or minus after the letter)

- immunization record (If you’re beyond a certain age, your pediatrician has probably long since retired. The last time you probably needed to provide this record was when you started college, so your parents may still have it stored with your baby records. If you served in the military, that’s another good place to check.)

- allergies (including to any foods, medications, and environmental situations, as well as a notation of if you use an Epi-Pen and locations of where you keep them)

- medical conditions – include any ongoing health concerns, whether they would be considered symptoms (like high blood pressure) or diseases, like diabetes or MS. Note the names and contact information of any specialist you’ve seen and the dates of any tests you’ve had.

- records of any surgeries, including the type of surgery type, date, physician (with contact number), hospital (and location)

- records of any procedures that may not quite be considered surgeries, including the type of procedure, date, and physician (with contact number)

- existence of any implanted devices (pacemakers, lenses placed during cataract surgery, etc.), their serial numbers, and the location of the device card for each)

- eyeglass or contact lens prescriptions (in case of head trauma, it will help medical providers determine if you have a likely concussion or if you’ve just lost your glasses)

- family medical history (including any major illnesses, including cancers, among your siblings, parents, aunts, uncles, or grandparents and the approximate age of onset)

- a running record of medical appointments and tests (this will help you determine if you are overdue for scheduling any visits)

Again, you can create a personal medical record on your own, using a simple spreadsheet workbook with columns for each piece of information. A workbook has separate worksheet pages, so you might keep one sheet for immunizations, one for allergies, one for records of surgeries and procedures, one for family history, and so on.

Alternatively, you can use your favorite search engine to locate medical history templates. For example, Microsoft 365 has a personal health record template, which you can download or edit from your browser.

5) Medication Record

Photo by freestocks.org on Unsplash

What prescriptions do you currently take? If you’re in your twenties or thirties, it might be very easy for you to provide a physician with your current medication regimen, but the older we get, or the more conditions we have, the more meds we take. It can be hard to remember the exact names of medications, especially during a medical crisis. Create a list that indicates:

- every prescription medication you take

- medication name (brand and generic name)

- purpose of prescription (especially if you are prescribed for an off-label purpose)

- dosage (this is usually indicated in milligrams; if you take one drug that combines two types of medications, it will be indicated in combined format, like Janumet 50/500, which means each pill contains 50 mg of Januvia and 500 mg of Metformin)

- frequency and instructions (as needed for pain? twice daily with meals? thirty minutes before sitting/standing?)

- prescribing physician’s name and contact information

- date prescribed*

- any adverse reactions, if applicable

- pharmacy name and contact number

- any non-prescription supplements or meds you take on a regular basis (as vitamins, minerals, low-dose aspirin, etc.) – In a high-stress situation, it might not occur to you to mention that you take fish oil capsules or a low-dose (“baby”) aspirin, but that could be vital information to a health professional.

*You may not be able to remember medications you previously took, but it might be to your advantage keep meds on your list after you stop taking them. You can indicate that medication’s line with a strikethrough, or you could have a separate column, next to the date the medication was prescribed, noting when you were taken off that particular drug. Spreadsheets let you sort by any field, so you could keep non-current medications at the bottom of the list or hide those rows.

Print copies of your medical history and medication record to take with you to appointments and to periodically update anyone involved with your medical care. Keep a current copy of each in the cloud, such as in Dropbox or Evernote, so it is always accessible.

Be sure to review additional resources from the Paper Doll vault:

Organize to Help First Responders: The Vial Of Life

Paper Doll on the Smead Podcast: How To Get Organized When You Have a Chronic Illness

PERSONAL/LIFE DOCUMENTS

The financial and medical lists, above, will help you help yourself…and others. There’s still one category of documents you should consider creating and keeping up-to-date: the documents that keep a record of your life.

6) Resume/CV

At some point in your life, you likely had a resume. But if you’ve worked in the same place for a quite a while, or if you own your own business, your resume might be a little – or a lot – out of date. And resumes are a lot more complex and varied than they were a few decades ago, when the most common format was a one-page, one-column, reverse-chronological list of your previously held positions, skills, and achievements, with perhaps a brief reference to your education.

[A CV, or curriculum vitae, is a fancy-pants resume for people in the academic and scientific realms, and it can be long…like anywhere from a couple to ten pages, depending on how many achievements, honors, publications and positions you’ve racked up.]

We are never returning to the kind of mid-20th-century economy where employees work for one company for their entire careers. Whether you’ve got a so-so-, good, or great job, there’s no harm in learning about the various formats of resumes popular these days and the information desired by employers. Even if all you do is refresh your resume, it’ll remind you of your achievements and put you in a great mood for the day.

I’m a professional organizer, not a career counselor, so I’m not going to tell you how to create a resume, but you can find online resources like Zety or ResumeNerd with a quick search.

7) Final Wishes

This topic harkens back to our discussion of wills. While nobody likes to think or talk about these things, if you have a strong preference for your final resting place, the song you want played at your memorial service, or whether you’d like to ask for charitable donations in lieu of flowers to mark your passing, you’re going to need to tell someone what you want.

Cake, the most cheerful end-of-life site of its kind, has a piece called How to Organize and Share Your Final Wishes for Free, which is the perfect place to start compiling your wishes.

8) Biographical Record

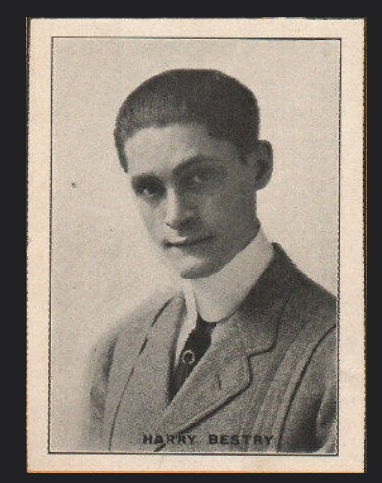

Paper Doll‘s Great-Uncle Mike “Harry” Bestry, the Vaudeville Star & Agent

Have you ever read a stranger’s obituary and been amazed at how a few paragraphs can give you a sense of a person and make you wish you’d known them? A friend of friend on Twitter posted Tom Meyer’s obituary. In the past few months, I’ve thought of it often, particularly the final line.

One need not have achieved “great” accomplishments in life to have a biography that stops you in your tracks, as Ida Mahone’s life story shows.

Try not to think of this as writing your own obituary. Think of it as the first draft of the introductory speech for your Lifetime Achievement Award!

Short of leaving a video of yourself to speak to your great, great, great grand-children, think about what would you like them to know about you. Certainly, some of the major elements of your resume might make the grade – where you went to school, what you did for a living, the major work achievements or awards you earned. But what else would you want future generations to know about you? How about making it easier for the genealogy organizers?

Consider this letter, left by world-reknowned physicist Richard Feynman. While he may be best-known to non-physicists for his best-seller, Surely You’re Joking, Mr. Feynmen, something he wrote, possibly to never be read by anyone living (in or out of science) is one of the most moving things I’ve ever read. The letter he wrote to his late wife, Arline, two years after her passing, says more about him than any newspaper could have crafted.

Whether you create a list of facts and dates, or include copies of letters you’ve written, or the secret recipe for your famous barbecue sauce, why not start now to develop a file, whether analog or digital, telling your story?

In the end, the Professor and Maryann got the credit they were due. By the second year of Gilligan’s Island, the last line of the opening credits were changed to “…The movie star, the Professor, and Mary Ann…Here on Gilligan’s Isle.”

The government, legal, and estate documents we reviewed over the last two weeks are stars; they’re VIPs (very important papers). But these financial, medical, and biographical lists and documents are just as important. They deserve their due.

This post is dedicated to Dawn Wells, who portrayed Mary Ann Summers on Gilligan’s Island, and who passed away due to complications from COVID on December 30, 2020.

Poor Maryann.. she always got the short end of the stick! That show seems so funny when viewed through the modern lens, doesn’t it? Anyway, I love all the care you took to compile this thorough series, including this installment. Thinking these through can save hours and stress. Plus, it just gives you peace of mind!!

Seana, seriously! MaryAnn was the only one among them who (usually) had common sense, and they’d all have starved if she hadn’t known how to grow food and cook. She was organized, brought suitable clothes, and did not deserve to be overlooked. (Also, I always thought she and the professor would have made a cute couple; her organizing skills would have balanced his befuddlement.) Thanks for reading the series. 😉

Thank you for sharing this! I love that you included the other important documents. I am definitely going to share this with my family, friends, and followers.

Thanks, Sabrina. I feel like people are really good at getting those essential government documents, then they wait until they’re married with kids before they start working on creating the estate documents, but then nobody ever tells them about these “and the rest” items, which make everything else so much easier to handle. I appreciate you reading!

Wow, Julie! Another stellar post and wealth (no pun intended) of information about important documents to keep and how to organize them. It’s a lot. A lot to think about and a lot to compile. I remember gathering most of this information for my parents, which was so useful. I’ve gathered some (not all) of this for my husband and me, but we have more to do. And I’ve helped numerous clients work on their lists. It’s involved, but so worth the peace of mind for yourself and your loved ones.

Thanks, Linda. I think it helps to realize that we really do have all this information fairly close at hand; it takes less time to compile than we expect, but it’s so much better to do it before we need it!

This is a very good article. I have tried to do this many times and keeping it up to date is my downfall. One thing I think can be helpful is for people to pick up a business card. It can be stapled to paper or information written on the back and they file it in a system they like. It gives all the addresses and phone numbers of the institution and business. Even if the person they deal with at the institution changes it does have other helpful information. I was using business card sheets to hold the business card and then across from the card use a piece of paper to describe what accounts and policies were held there.

Thank you, Julie. I know some of the information in the first two posts may not have been applicable for you in Canada, but at least these “and the rest” items are useful for you and your clients.

Yes, keeping business cards can be helpful, though I’ll admit I haven’t done this kind of business (banking, insurance, etc.) with an actual human in-person in over twenty years. I wouldn’t recognize my insurance agent, whom I’ve had ten years and with whom I’ve only ever emailed or talked on the phone, if she passed me on the street, so I don’t have an insurance card. And I don’t think I’ve ever gotten a card from a physician, and here in the US, progressively more medical records are electronic only, available through a log-in portal. However, if you’re getting cards and paper, having all of those cards in a business card sheet protector would make it really easy to gather that information, and you could scan them all at once to digitize!

As far as keeping it up-to-date, I think the only way to ensure that is to schedule it. Here in the US, we pay our taxes on April 15th, and some of us pay quarterly taxes on April, June, September, and January 15th. So, the other months’ 15ths could be used as trigger dates.

This has been a very comprehensive series. So much to maintain! But thanks to this series, one can work on one category at a time to get it all sorted away!

Thanks, Phaedra. I think sometimes I write posts like these to make sure I get my own records in order and up-to-date. Whatever gets us what we need, right? 😉

Such great information. You got it all together. Everyone needs to have this information available because when it’s needed is not the time to start looking for it.

Exactly! You get it, Janet! I think the idea of doing it is daunting for people, but it’s so much easier to work on it a little at a time than to be caught without. Thanks for reading.