- Consider Designating Backup Agents

It’s a good idea to have a backup person, or a secondary agent, in case your primary agent cannot accept the responsibility. For example, if you give PoA authorization to a spouse, and you are both stuck on a mountain pass in the Andes on a vacation (that you never even wanted to go on in the first place, thankyouverymuch!), that’s not good. It’ll be better to have named a secondary agent who can release funds to pay for a helicopter and a search party.

Be sure to have your durable PoA witnessed and notarized, and follow all instructions as required by your state.

- Safeguard Your Power of Attorney Documents

Make multiple copies of your signed, notarized Power of Attorney documents. Give one to the person you’ve named as your agent; if you have a secondary agent, give a copy to that person. Keep the original in your fireproof safe, and scan a copy to the cloud (like in Dropbox) so that you can access it from anywhere.

3) Living Will (also called an Advanced Medical Directive)

A living will is a document that exists to provide guidance to physicians regarding what types of treatments you’re willing to undergo, what pain management techniques are acceptable to you, etc., and usually relates to end-of-life situations.

- Why Do You Need a Living Will?

Some people wonder why, if they have a living will, they would also need a durable Power of Attorney for health care. Isn’t one enough? Excellent question!

Only someone authorized by a durable Power of Attorney can make decisions about if, and under what circumstances, life support might be withdrawn. The assumption is that if you’re incapacitated but have not authorized someone to make your medical decisions, then your doctor will, de facto, be in charge. If you’ve watched Grey’s Anatomy, you know this isn’t the case.

The authority to make your health care decisions shifts from the doctor (who makes emergency decisions, like in surgery), to whomever you’ve authorized (via your signed, witnessed durable Power of Attorney for health care document) once the doctor makes the medical determination that you’ve been incapacitated—if you’re “altered,” delirious, comatose, etc.

A living will or advanced medical directive can’t foresee all future circumstances; the person authorized by a durable Power of Attorney for healthcare can make sure your most recent wishes are followed. Perhaps, when you were 25, you believed that you should be kept alive no matter what, even if you were just a head in a jar, like Nixon in Futurama. But at 95, you might not feel the same way.

Of course, you’ll want to tell the person whom you’ve authorized what your wishes are. For example, you might wish to be kept on life support no matter the circumstances. My mother calls this the “I want to be a burden to my children” option, and it’s my preference. Or, you might wish to be receive life-sustaining treatment unless a certain circumstance arises, such as a prolonged vegetative state. Or, you might want all life support to be withdrawn unless there’s hope for full (or vastly increased) restoration of mental and physical health.

It’s your choice, but it’s only your choice if you make your preferences known!

[Editor’s note: Friend of the blog Carol Kaufman of Pinventory has wisely raised a point that I should reiterate here: for the same reasons your adult children (including college students) should have a designated Power of Attorney for healthcare, they should also have their own signed, notarized living wills and HIPAA release forms. Thanks, Carol!]

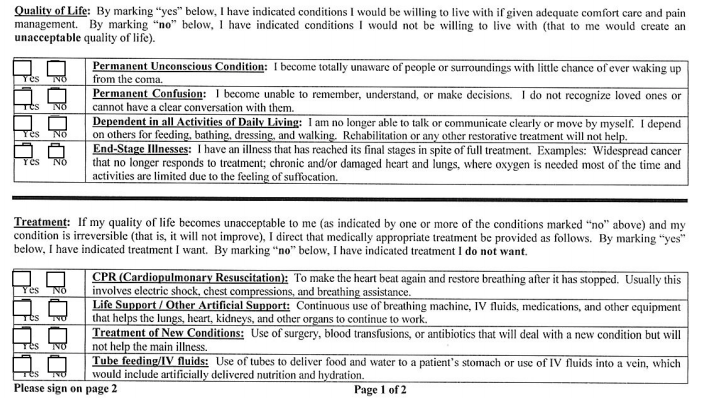

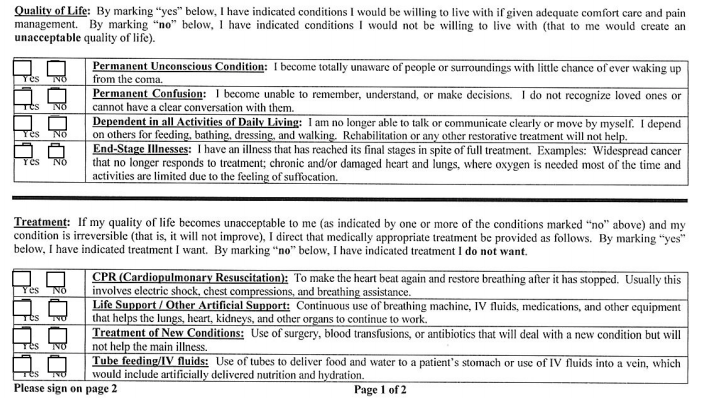

Unlike completing Power of Attorney documents, which you can do in a matter of minutes, completing your living will or advanced healthcare directive requires answering some pretty difficult questions, like:

-

- Would you want to be put on a ventilator if you could no longer breathe on your own?

- Would you want CPR or other resuscitation if your heart were to stop beating?

- Would you wish to have tube or needle feeding if you lost the ability to swallow?

- If you had progressive dementia, what health treatments would you want?

- Would you want to be an organ donor?

In Tennessee, my form asked the following questions about quality of life and treatment. Both gave me pause, and it took weeks before I felt prepared to put my decisions in writing.

In non-COVID times, you can easily pick up a blank living will or advanced health care directive form at most hospitals. These days, just download a form designated for your state, such as those at the following sites:

eForms (Advanced Medical Directive)

Rocket Lawyer (Living Will)

Cake (Advanced Directives)

Or, plug the terms “advanced medical directive” or “living will” along with the name of your state into your preferred search engine.

- Safeguard Your Living Will (Advanced Healthcare Directive)

Make multiple copies of your signed, notarized living will.

Give one to the person you’ve named as your agent for healthcare decisions; if you have a secondary agent, give a copy to that person, too.

Keep the original in your fireproof safe, and scan a copy to the cloud (like in Dropbox) so that you can access it from anywhere. It’s also helpful to keep one copy clipped to the interior front your Medical folder in your Family Files, as well, so that as you file paperwork regarding your health and wellness, you are reminded to keep your wishes up to date.

4) Will (also known as a Last Will and Testament)

You may assume that if you die intestate (that means, “without a will”) that your money and stuff will automatically go wherever you told everyone you wanted it to go. But that’s not how it works. If you die without a will, depending on the state in which you lived/died, those state’s intestacy laws determine who gets what, and it’s often not very pretty…and not what you would have wanted.

For example, if you are single and have no children when you die, everything you own would likely automatically go to your parent(s)—even if you were estranged; or, if they are no longer living, to your siblings (even if you didn’t like them), then to random relatives of ever-increasing relational distance, even if you’d wanted your Star Wars memorabilia, Beyoncé CDs, and Bitcoins to go to your best friend. If you are not married but in a romantic or domestic partnership and die intestate, your partner generally cannot inherit. And the state rules for married people can be equally frustrating.

Unless you want the state deciding who gets what, you need a will!

- What Do You Need to Mention in My Will?

The short answer is, ask your attorney! Seriously.

At the very least, you’re going to need to create a list of all of your assets and debts (something we’ll be discussing in an upcoming post). This will include traditional assets like bank accounts and investments, but you’ll also need to consider all of your tangible property. Will your executor sell your car and add the revenue to your overall assets, or would you like your great-niece to have a more dependable ride? Will you donate your library of books to charity or sell them or have someone create the Biggest Memorial Little Free Library in your name?

If you have any minor children, your will should spell out whom you wish to name as a guardian. (If you have pets, while it’s less of a legal issue, ethically you want to make sure you provide for Fluffy or Mr. Barker.)

And while you can create your wishes regarding funeral arrangements as part of your will, that’s not the only place they should be listed, and we’ll be covering that in a future post.

The reading of the will in Monseiur Verdoux (1947), in the public domain

Without turning this into a law school class, there are three types of wills (notwithstanding a living will, explained above):

A simple will lets you specify who will get your assets. If you have minor children, this is where you name who will be their guardian. Depending on the rest of your financial and legal situation, you can create a simple will fairly easily, even without an attorney. LegalZoom has a good piece on the starting point for gathering the essential information, writing your will, and making sure it’s kosher.

A testamentary trust will lets you place some of your assets into a trust. If your eyes glaze over at the sight of “wills and trusts,” just know that this a way to make things easier for your beneficiaries and all of your assets (investments, accounts, etc.) live inside the trust. This is advantageous in a few different ways.

First, if you have minor children (or beneficiaries who sometimes act like children) this is a safe way to put conditions on how and when they can access their inheritances. Second, while a will only takes effect after someone dies, a trust becomes active as soon as you create it, and you can spell out the distribution of your assets prior to your death. There are also sub-categories, like living trusts, which you can change, and irrevocable trusts, which can’t be altered after they’re put in place.

A joint will is basically a will where two spouses each have wills that mirror one another’s, and each leaves everything to the other. These are prickly, because the terms of a joint will can’t be changed, even after one of the spouses dies.

- How Do You Create a Will?

If your life is fairly simple — if you’re single and you have relatively few assets, even if you have a spouse and/or a child, you can probably use the internet to create a will at a fairly low cost. Check out sites like:

Trust and Will

Willing

Free Will

Legal Zoom Last Will and Testament

To help you in this process, Cake has a detailed piece comparing 13 different online will-making sites.

That said, no matter how simple your life, and how likely you are to select a simple will (vs. a testamentary trust will), I VERY strongly encourage you to at least sit down with an attorney to make sure that you have covered all of your bases and considered all of the issues. Doing so will help you sleep better at night.

An attorney can help you recall assets you may not have remembered, help you fine-tune the decision-making process regarding beneficiaries, guide you with regard to selecting an executor and choosing guardians for minor children, and more.

- What about a Holographic Will?

You may have heard about a holographic will, and no, it has nothing to do with the holodeck on the USS Enterprise. A holographic will is a handwritten and signed document that you can create without a lawyer, and it doesn’t require notaries or witnesses. Sounds great, right?

Nope!

First, some states don’t recognize holographic wills at all. Others have very strict requirements to prove that you (the “testator”) wrote the will and that you are of “sound mind and body” (as they say in the movies), and in the 21st century, if you’re hand-writing your will, somebody is going to question that soundness! A holographic will also has to include your wish to disburse your personal property to your beneficiaries. Nine states will only accept a holographic will from out of state, treating it as a foreign will, and two states (New York and Maryland) only accept holographic wills from members of the military, and only under narrow circumstances.

So, even if you have the best penmanship and can prove that you are “all there up there,” Paper Doll is going to discourage you from creating a holographic will. Come on, if you are reading this post on the web, you can, I’m sure, create your simple will on the web.

Once you have written your will, made sure it is legal for your state, signed it and had it notarized, then you need to keep it safe. Make multiple copies.

Store both the original and one copy in your fireproof safe or lockbox, and one in your Family File system. If an attorney helped you prepare your will, he or she will likely maintain a copy at the law firm.

At the very least, let your significant other and close family members know where the documents are and how to find them.

Do NOT keep your only copy of the will in your bank safe deposit box, because if you are the sole key-holder, access to your box will be shut down upon your death.

5) Digital Will

Digital wills are a relatively new concept. However, as more and more of our assets and accounts can best be accessed digitally (like bank and investment accounts) and exist solely digitally (in terms of intellectual property, web sites, social media accounts, etc.), a digital will is now just as important as a traditional last will and testament.

Your traditional will covers your tangible possessions and financial assets, and creates an executor to handle disbursement of assets to your beneficiaries. Your digital will is your opportunity to create a digital executor to handle digital issues, and spells out what you want done.

First, all of your financial assets will need to be accessed, so you’ll need to create a list of all such accounts and passwords to pass along to your digital executor (or, if you use password software, you’ll need to provide your master password to your trusted executor).

But what about all of your other online property? Do you want to leave accounts open, shut them down, or turn them into memorials to your memory? Each web site has its own very complicated set of guidelines regarding who can access online accounts and how.

Until we cover this in a future post, I strongly urge you to check out Creating Your Digital Estate Plan (Second Edition) by the professional organizing industry rock star, Judith Kolberg. She specializes in this field and has deeply researched the best approaches.

Finally, if the idea of thinking about all of these estate and end-of-life documents trouble you, I encourage you to read Chanel Reynold’s What Matters Most: The Get Your Sh** Together Guide to Wills, Money, Insurance, and Life’s What-Ifs.

Next week, we will finish this series by discussing a variety of non-governmental, non-estate documents that you should create and organize to make your life, and the lives of your loved ones, run more smoothly. In the meantime, I urge you to consider which of these documents you have, which you need, and which you should update.

Wow, Julie this is a post to print and keep because it explains so clearly the reasons to create certain documents. My brother and I shared many of these responsibilities for our mother as she was under-going treatments for Leukemia. I was thankful not only that she did not have the burden of paying her bills but also that I had someone with whom to confer. You never know when you are going to need one of these documents. Get them in place before you need them so you are protected. Valuable advice, Julie!

Thanks so much, Diane. Until a few years ago, nobody in our family had any of these documents…we all had put them off. I’m still working on a couple of them, but I already feel more relieved.

Another detailed post for the books, Julie! These are essential documents that often we postpone putting into place. Why is that? Because they make us face our mortality, which most of us don’t like to do. But by getting our affairs in order, it’s a gift to our loved ones.

After my dad died, my mom and I went to her attorney to update all of her legal documents, like those you included in this article. Thank goodness she did that because a year later, she was diagnosed with vascular dementia. Over the next years, I handled all her affairs and made medical decisions for her as she was no longer capable of doing that herself. But the positive part was that because she took the time to discuss her wishes with me AND put them on paper (legally,) I’ve been able to use that as a guide with all the decisions. What a gift that has been during this challenging time.

It’s funny, Linda; some of these, it’s about facing mortality, but we tend to put off all sorts of things for which there’s not an immediate and obvious payoff. As I’ll talk about in future posts, the byproduct of creating some of these documents is making all sorts of aspects of our lives easier.

For example, to help the person we make our healthcare proxy, creating a medical history document and a list of current medicines also helps US when we see new physicians. Creating a digital will means the labor of clarifying which accounts we own and verifying we can still get into them, and it gives us impetus to delete accounts we don’t use and which could serve as portals for identity theft.

I’m so glad you and your mom had that window of time to prepare; it really was a gift! Thank you for sharing.

Great post! This information is so important for everyone to know. Thanks for sharing, Julie.

I love the digital will idea. I know I do not have one of those. I share all my accounts for my business with my husband, but it probably should be in writing. Thanks for the idea. =)

Thanks, Sabrina. I’ll be talking a lot more about the details of that in the future. Judith was the first person I’d ever heard discuss the importance of a digital will, and reading her book really opened my eyes to how much more to it there could be than just memorializing your Facebook page and accessing financial accounts. I think it’ll be an organizing and legal specialty for a long time to come.

I’ve been through all of this planning with my husband and a lawyer, but honestly it has been so long I’m not sure if I covered everything. I’m going to pin this so I can schedule a meeting to review with my spouse. I like the idea of a secondary person, just in case. As always, your whimsical writing style makes reading about this topic fun instead of scary!

Thanks, Seana, and I always love that you consider my approach as one of whimsy. I feel like these topics are difficult – as Linda noted, it reminds people of their mortality. But I think it also reminds people of their loved ones’ mortality, and that’s why so many fail to have these discussions with their family.

I think we should all probably revisit these documents every 5 years, just to make sure they’re up to snuff. So many medical and financial situations change, and it’s easier to make small updates than massive ones.

This is incredibly thorough, Julie. ( That’s not a surprise.) I’m so glad that I was able to read it and I’m going to make a copy so I can check off each must-do. ( Some of which are done.)

I admit that my parents did not have a living will, wills, agent or anything that you mentioned above. Luckily, my siblings and I are close and we were able to handle all the details, responsibly, and without angst.

Your humor definitely makes this easier to read and qualify for “do it anyway!” I’m still rooting for you to create a handbook or a guide or the Bible of How-tos!!

Good for you, Ronni (and thanks)! I’m not finished, either. I’m still working on my actual will and my digital will, but I’m getting there.

You’re lucky that everything worked well for your families, but the medical world has a lot of rules, and going forward, we all need to be both cautious and lucky!

And thank you SO MUCH for getting my humor. Sometimes, I call Paper Mommy, read her a passage-in-progress, and ask, “Is this funny, or is it just funny to me?” A bible of paper how-to’s may very well be in the offing. I appreciate the motivation!

If people do nothing else, they should follow your advice. These 5 essential documents are often tucked into a file cabinet and not easy to find – if available at all.

Thanks, Janet. I’m less afraid of the tucked-in-the-cabinet situations than the man-I-should-have-created-one-of-those situations. So many people have told me, after they read the post, that they had been meaning to create these documents, and that was totally me until a few years ago.

Wow! What a great and detailed list of essential documents, Julie! Thank you for the insights of all that we need to have. These are so very important and while I already have most of these, I’m going to share your post with my adult daughter who is in the process of working on her essential documents now! You’ve really outdone yourself 🙂

Side note: I was hoping the holographic will could be a hologram of me reading my will once I was gone!! Oh well….

I know, right? I’d love to feel like a cross between Princess Leia and Will.I.Am reading my last will and testament sitting in the palm of someone’s hand or on the top of the attorney’s desk. It would be too cool for school!