Lost & Found: Recover Unclaimed Money, Property, and Savings Bonds

Treasure Chest by Immo Wegmann on Unsplash

Treasure Chest by Immo Wegmann on Unsplash

There are many reasons to keep your paperwork organized, but I think the most compelling one is that many VIPs (very important papers) are the equivalent of money.

Your Social Security card, for example, is key to proving who you are, and if someone gets his or her hands on your card (or even just the number) and a little bit of other information, you may suffer from years of financial strife due to identity theft.

A lost last will and testament means that a family could have to spend months or years lacking access to resources promised to them because of the difficulty of proving the deceased’s intentions for funds and possessions.

If you lose your birth certificate, you may not be able to replace other essential documents if they go missing or get destroyed in a fire or natural disaster.

Lose your passport without enough time before an international trip, and your vacation or work plans could be scuttled, leaving aside the potential for identity theft of a more-than-financial nature.

Paper Doll has covered a wide variety of topics over the years on accessing lost documents, creating essential ones you lack, and keeping them all safe so they are not lost in the future. These posts include:

Ask Paper Doll: Do I Really Need A Safe Deposit Box?

How to Replace and Organize 7 Essential Government Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Protect and Organize Your COVID Vaccination Card

A New VIP: A Form You Didn’t Know You Needed

Today, we’re going consider options for recovering lost property. Consider it a treasure hunt!

RECLAIM LOST “PROPERTY”

When I say “property,” what do you think of? Perhaps real estate?

Maybe that reality show Property Brothers with Canadian twins Drew and Jonathan Scott?

When you hear “lost property,” it’s possible you think of the boilerplate language on one of those claim tickets you get when you leave your coat at the fancy coat check room at a swanky venue.

So What Is Unclaimed Property?

The term unclaimed property is what you’ll hear most often when searching for lost money in various types of accounts. Unclaimed property usually refers to funds that a government (federal, state, or local) or business owes you because you’ve, quite literally, left it unclaimed.

It’s possible that you’re so organized with your paperwork that you feel affronted that I’ve implied you might have just haphazardly left money sitting around. But I’m not saying you’re absent-mindedly leaving piles of cash wrapped in newspapers like Uncle Billy in It’s a Wonderful Life. (By the way, that $8000 deposit that ended up in Mr. Potter’s hands would be work $121,762 in 2023! Maybe Uncle Billy should have tied the money to one of those strings around his fingers.)

Thomas Mitchell as Uncle Billy, searching the bank’s trash cans for the lost Savings & Loan deposit.

There are all sorts of reasons money may get separated from its rightful owner.

Perhaps you put a security deposit down on an apartment when you were in college, but after graduation you were heading across the country to start your first job. Your roommate returned the keys to the landlords, got the OK that you hadn’t left the place in a horrifying state, and similarly disappeared into the adult world, leaving no forwarding address for either of you.

In many cases, by law, your security deposit was placed in an account (perhaps interest-bearing, perhaps not) and should have been returned to you when your lease ended. If your landlords were playing by the rules, rather than deciding to take the money and run, they should have turned it over to the state.

Similarly, it’s common to have to pay a deposit when opening an account for certain utilities. While some utilities keep these deposits until you move and close your account, others have (little-advertised) rules stating you can request your deposit be returned after a set period of good payment history. Sometimes, however, if you don’t actually request your deposit back, it just sits there, eventually going unclaimed, and being sent to the state.

When I helped one of my clients, a gentleman in his 60s, search for unclaimed property in his name, we found a life insurance policy that his parents took out in his name when he was an infant. It had long since stopped increasing in value, so he claimed it and cashed out.

Or maybe your Great Uncle Horace left you oodles of money in his will, but his last valid address for you was three states and 22 years ago? (My condolences on Horace. We always heard good things about him.)

Unclaimed property can be in the form of cash, uncashed checks (including stock dividends), insurance policies, abandoned bank accounts, forgotten security deposits, or even tangible property in the case of safe deposit boxes.

Life gets busy. It’s OK. Don’t play the blame game. Instead, play finders keepers and locate your missing money!

Where Can You Find Your Unclaimed Funds?

Unfortunately, there’s no central repository for all unclaimed property. Instead, you can search in each applicable state’s unclaimed property office.

Start with Unclaimed.org, the website of the National Association of Unclaimed Property Administrators.

Once there, scroll down and select your state by clicking on the location on the map. If you are from a United States territory like Puerto Rico or the U.S. Virgin Islands, or from one of several Canadian provinces (Alberta, British Columbia, New Brunswick, or Quebec), click on the appropriate link below the map, or use the yellow “Select Your State or Province” button. This will take you to a specific unclaimed property office, like the Office of New York State Comptroller’s Search for Lost Money page or Tennessee’s unclaimed property search (with a snazzy alternative address of ClaimItTN.gov).

To begin your search at any of these state sites, provide whatever information you have available, but at least a first and last name (or, if you’re searching money owed to a company or non-profit, the entity’s legal name). Some state search sites will also ask for a city in order to narrow the parameters.

If you want to search for multiple states simultaneously (let’s say you have lived in many locations, or you’re searching for abandoned accounts for a relative who has passed away and are unsure where they might have had lived), visit MissingMoney.com.

MissingMoney.com allows you to just type a first and last name, and all possibilities for that name, across all state databases, will come up.

Whether you use a state search or a multi-state search, the resulting page should provide a series of options. If you find a listing for yourself (or a relative), you’ll likely see some combination of the following information:

- the name of the owner of the unclaimed property

- any co-owner’s name, if applicable

- the last known address of the owner (possibly including the street address, city, state, and/or zip code, though some states hide some of the information)

- the state in which the unclaimed property is held (if you’re doing a multi-state search)

- the amount or value of money being held (which may be listed as an exact dollar amount, a range (like $50-$100, or >$500), or “undisclosed); if the property is tangible rather than monetary, you may or may not get a clue to what it might be.

How Do You Claim Your Funds?

If you find a match for unclaimed property on your state’s page or through MissingMoney.com, you’ll need to file a claim to prove that you own the account or property. Similarly, if you are claiming it on behalf of a relative who cannot act on their own behalf or a person who has passed away, you must prove their connection to the property as well as show that you are the party authorized to file a claim.

Whatever search method you choose, as long as you go through a government web site, know that searching for the unclaimed property is free, as is filing your claim. (Please don’t get scammed by a site promising to funds that are due to you anyway. While some services are valid and may relieve you of labor searching for large 5- and 6-digit recoveries, I encourage you to exhaust all free options first.)

Each state or province will have its own rules regarding claim submission. While most prefer you to submit your claim online, some still let you submit by mail. Answer all of the questions to the best of your ability, and assuming you are able to substantiate that you have a right to the funds, the account will be processed in due time and sent to you.

For individuals, businesses, and non-profits, you will have to submit proof of identity, address, and ownership. For individuals, your identity can usually be proven by a scan/copy of your driver’s license, passport, or Social Security number; please be cautious about transmitting your Social Security number through the mail and be sure you are using secure web sites marked HTTPS.

Proof of ownership of property will vary. Options might include your Social Security number, employment pay stubs, W2s or 1099s, or utility bills.

If you’re making a claim on behalf of someone who is living, you will need to provide the appropriate documentation, which might included a copy of a child’s birth certificate or legal adoption order (if the money is due to someone under 18), proof of a claimant’s age, and a court document or other signed legal documents proving you have the authority to act on the actual owner’s behalf. These could include letters of guardianship or conservatorship, a trust agreement, or a Power of Attorney document.

If you are making a claim on behalf of someone who has passed away, you’ll have to submit a death certificate as well as a will or other court documents, like a Small Estate Affidavit and a Table of Heirs. (These are state-specific.)

What To Do Once You Get Your Now-Claimed Funds?

After you submit your claim, if you are able to sufficiently able to prove your right to the funds, you will eventually be sent a check. Verifying your identity and rights to the funds can take a while, though many states try to complete the processing within thirty days.

Once you receive your money, usually by check, deposit the funds as soon as possible. Do not run the risk of losing the check and starting the whole process over!

Depending on the source of the funds, you may have to pay state and/or federal tax on the claimed money.

For example, if this is a deposit returned to you, you would not owe tax on the amount of your deposit, but tax might be due on any interest the account earned. The same is true regarding funds from abandoned bank accounts; the principal would not be income, but interest would likely be taxable. Of course, if the money would initially have been taxable had you received it on time (such as with stock dividends), it will still be taxable, but as income in the tax year in which you are receiving it.

What About Unclaimed Money in Other Countries?

Are you a fancy-schmancy world traveler? Maybe someone in your family lived abroad?

Unfortunately, there’s no central repository for tracking money left behind in your Tunisian bank account or a security deposit your mom paid during her semester abroad in Paris. (You may find some solace in the links collected by the Global Payroll Management Institute.)

However, the US government’s Foreign Claims Settlement Commission does oversee unpaid foreign claims for covered losses. That’s government-speak for money you are owed for lost funds or real property in the following circumstances:

- a foreign government “nationalizes” your property (whether that’s the money in your account or the house you owned)

- damage to property you owned that was caused by military operations

- injury to civilian and military personnel

If any of these apply to you, review the Unpaid Foreign Claims page and fill out a certification form (linked on that page). There’s also a link for Standard Form 1055, if you’re filing on behalf of someone who has died.

LOST SAVINGS BONDS

Once upon a time, it was popular to give United States savings bonds as gifts when people got married, had babies, graduated from college, got confirmed or Bar or Bat Mitzvahed, or otherwise had a rite of passage.

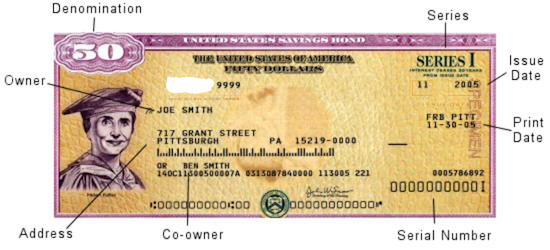

In ye olden days, you’d go to your bank to buy a savings bond, and get a receipt for your purchase as well as a paper certificate to give to the recipient. With the old EE savings bonds, you could purchase a bond at half the face value, and then a few decades later, your investment would double to the face value. If you waited a little longer, the bond would keep earning interest, at least for a while. (If your bonds are more than 30 years old, they have likely stopped earning interest.)

Nowadays, savings bonds are registered electronically, which makes everything much easier. However, with the old bonds, without the certificates in hand, the process gets complicated.

The problem was that these called SAVINGS bonds — but people often treated them as if they were called “throwing-them-in-a-box-hidden-under-the-bed” bonds. That’s fine for a while, but once your bond stops earning interest, it would make sense to cash it in and find another wise investment option. That’s hard to do if you don’t have the bond.

What Should You Do If You Can’t Find Your Savings Bonds?

If you’re sure you have savings bonds, but can’t find your paperwork, you have a few alternatives:

- Check your safe deposit box or fireproof safe — Free, except for the value of your time.

- Search through those boxes of stuff your parents or guardians gave you when they retired to Boca or Shadytime Retirement Village. Again, free except for the value of your time.

- Ask your family members to check their safe deposit box(es) and/or fireproof safe(s) and send you (via secure shipping) your bond certificates — Depending on whether you live across the street or across the country from your loved ones, this will come at variable cost in terms of their time, delivery service fees, and you getting roped into providing IT support for your parents now that they’ve got you on the phone.

- Contact the Feds — If you can’t find your bonds, or know they were definitely lost, stolen, or damaged, this may be your only alternative.

If you’ve lost your original savings bond’s nifty tangible certificate, you have two options:

- replace your original bond with a digital* bond (held in your Treasury Direct account); or

- cash in your bond (possibly losing value if you decide to cash it in before it has reached maturity)

*Note: If your lost bond is a now-defunct HH bond, you can get a substitute paper bond. For EE or I-series, they must be digital

If you’re really lucky, even if you’ve lost the actual bond, someone in your family may have kept track of the serial number of the bond. If not, you’ll have to help the government perform a search. Go to the U.S. Treasury’s website at www.TreasuryDirect.com and fill out Form 1048 to locate savings bonds registered all the way back to 1935.

Random Treasury Trivia

EE savings bonds took the place of World War II-era E-series or “Liberty bonds,” which date back to WWI!

HH-series bonds, popular as gifts for GenXers and Millennials, only came in the paper format and existed from 1980 through 2004, and they stop earning interest in 2024. That’s next year. Yes, really. So it’s a good time to start looking for your HH bonds! I-series bonds were introduced in 1998.

Interested in buying bonds but not sure how they work? Treasury Direct has a whole page comparing EE and I-series bonds. Be sure to check out the rules and options for buying savings bonds.)

On Form 1048, you’ll be asked to provide as much information as possible, including the:

- Issue date (or a range of dates, if you are uncertain)

- Bond certificate serial numbers (if you have them)

- Inscription information on the bonds, including names, addresses as Social Security numbers.

- Whether the bonds were lost, stolen or destroyed. If the bonds were stolen and a police report was made, you will need to append that, as well. The government wants to know all the gory details, so if your Great-Aunt Gertrude started a food fight at Thanksgiving and your savings bonds were drowned in gravy, explain. Or, y’know, explain if your town had a flood. Whatever.

- If you are not the named party on the bond certificate, you will have to explain your right to access the bonds; for example, are you the parent or guardian of a minor, the conservator or legal representative of another adult, or the executor of the will of a now-deceased party? (Note: if the person named on the bond is deceased, you will also need to include a certified copy of the death certificate.)

- Then, you’ll have to state whether you want substitute (digitally-held) bonds or payment in return for cashing in your bond.

You will need the form to be certified by a Notary Public. Review Paper Doll’s Ultimate Guide to Getting a Document Notarized for your options.

Finally, mail the form to:

Treasury Retail Securities Services

P.O. Box 9150

Minneapolis, MN 55480-9150

What If You’re Not Even Sure If There Were Savings Bonds?

All of the above tells you what to do if you know you received the bonds, but they’ve since been lost, stolen, or destroyed (as in irretrievably folded, spindled, or mutilated…or drowned in gravy).

But maybe you’re not sure if your hazily-recalled bonds ever existed? Maybe you (or someone on your behalf) purchased bonds but they never arrived. Maybe you got hit on the head with a falling anvil and can’t remember if you ever had a bond, or maybe you think a deceased loved one owned savings bonds but you can’t find them?

If any of the above situations apply, visit the Department of the Treasury’s Treasury Hunt link. Enter your (or your loved one’s) Social Security number and state, and if there’s a match, the site will let you know what to do next to locate matured savings bonds, those that are uncashed but no longer earning interest.

This just scratches the surface of the unclaimed funds, property, and financial instruments that can be recovered with a little bit of effort. Invest a few moments to let your fingers do the walking and see if you can recover what’s been lost.

If you DO find money owed to you, please come back and share the story (but not confidential information) in the comments.

I seem to remember leaving a small sum (less than $5) in a bank account when I moved over 30 years ago, but I can’t imagine there’s anything else waiting for me to find it.

On the other hand, I knew someone who never applied for his pension from a former employer because he didn’t think he’d worked there long enough for it to amount to anything. Eventually they contacted him and set the wheels in motion – I will only say it was a VERY pleasant surprise!

Oooh, pensions! That’s one of the categories I have for a follow-up post. This post hit the major categories, but there are some specialized searches. Of course, this post was already long, so the specialized types of unclaimed property will have to wait for a future post. I’m glad your friend got his surprise pension money!

The way I look at it, if you’d go back to a restaurant to get an umbrella left behind (I would!) or if you’d bend over to pick up money off the ground (even pennies! I do it it!) then it’s always worth checking.

When clearing out my parent’s house, I searched for unclaimed funds. I had found several papers which indicated there might be some outstanding, unclaimed items somewhere. I got frustrated with the process and stopped pursuing it.

In reading your terrific post, I can see why. It requires quite a lot of sleuthing, following up, and patience. And at that time, I was short on all of those. Maybe at some point, I’ll try again. And if I do, I will DEFINITELY use your fantastic post to help.

I understand the frustration. I once had a client with whom I spent many sessions calling insurance companies and banks that had been taken over by larger companies, over and over, to determine what policies might still be in existence and what unclaimed money there might be. This was before the internet was so robust — it’s a lot easier now.

For your parents’ situation, another thing to consider is that it sometimes takes years before an account is considered abandoned. You might find that many of those accounts that took calls and paperwork sleuthing have now been put into state control, making them easier to access. Good luck!

I’ll have to take a look. My name is unique enough that it should pop up quickly if I’m due anything.

Here is a funny story, though. My husband somehow came across an award that my daughter had received which had a financial component. She had never been notified that she had been given this award, and therefore didn’t know to claim it. Once he stumbled upon it, he let her know and she was able to follow up and get the money. It wasn’t a lot, but hey, it was hers!

That’s fabulous that your husband found the money, but I’m left wondering how it was that your daughter was never notified in the first place!

Professionally, there is nothing I love more than found money. When I unearth checks, cash, gift cards, etc., when helping client’s declutter and downsize, it’s like a treasure hunt. I hope you find something great!

Thank you for this article. It can be fairly easy to have lost property if you move around a lot and open bank accounts in different locations. Sometimes a credit card or bank will offer you a small life insurance policy ($2000)for opening an account and as time passes you forget all about it. I am sure during Covid there were documents that people didn’t use for a couple of years and now can’t find them. Having a system to keep track of where your money and policies are is very important.

You’re so right about systems. Years ago, when I first wrote about savings bonds, I spelled out the entire process for tracking the serial numbers and safekeeping the certificates. Now it’s all digital and far less work…as long as you remember that you own them!

Jackpot! Well…..I had done unclaimed.org before, when I first moved here to NM, so was pretty sure there wasn’t anything lingering in other states. But this time I found $25.58 in NM. I didn’t recognize the source of the funds, but I claimed it, and if I get a check in the mail, great! I also checked some states for relatives. When I checked missingmoney.com (which covers lots of states) I found a ton of Hazel Thornton listings. I can’t imagine any of them actually belong to me, though. So there are either lots more Hazel Thorntons out there than I’d ever imagined, or there’s one disorganized Hazel Thornton that moves around a lot!

Yay! Every bit of found money is great!

As for the other Hazel, she may not be disorganized. Sometimes, people have accounts in lots of places and then die intestate and it’s not worth it to the family to get a Small Estate certificate — because they don’t know those accounts are out there! (That said, if ANY are in states where you lived or did business, like an insurance company out of the another state, I suppose it could be yours.)

Oooh, and one of your namesakes is Senior Programme Officer, Nature Restored, United Nations Environment Programme World Conservation Monitoring Centre (UNEP-WCMC). Fancy that! Maybe she’ll Google herself and find this page!

This is great information, Julie.

Organizing paperwork is a huge part of what I do for my clients. I often find money (as in unclaimed checks) hidden in the piles. I’ve also found passports, birth certificates, and other VIPs. Keeping these things well-labeled is important for the individual and for their families. I will hold onto this post in case I come across something I need to investigate.

I think that’s the best (or at least most fun) part of our profession — finding things that clients either didn’t know was missing, didn’t know they had, or wished they could find. It’s like magic!

Thanks for reading!

Well, you had me at Uncle Billy.

I can’t tell you how many times I’ve worked with clients on paperwork and we’ve uncovered everything from unexercised stock options (that they had no clue had value) to cold hard cash. Even a large amount (think four zeroes) in the recesses of a pantry once! But I hadn’t stopped to consider the unclaimed money that isn’t directly tangible. Such great information here, as always Julie!

p.s. I couldn’t resist searching on that Tennessee site – tried both my names, but came up empty! Ah well…

LOL. Uncle Billy resonates with our clients, eh?

There are so many ways that money is hiding in plain sight; what a joy it is to find it for our clients…or for ourselves! I’m sorry you didn’t find any in TN, but be sure to check the other places you’ve lived!