A New VIP: A Form You Didn’t Know You Needed

Brown Plush Bear Patient Photo by Kristine Wook on Unsplash

As a professional organizer for 20 years, I am rarely stumped by organizing-related questions, especially those having to do with vital documents or what I call VIPs (very important papers). However, a client recently presented me with an article making a recommendation for a particular document, and it sent me down a rabbit hole of research.

THE USUAL SUSPECTS: VIPS AND HOW TO MAINTAIN THEM

Over the past years, we’ve discussed (at length) the essential documents everyone should have and how to organize and keep them safe. Posts covering these topics have included:

How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Ask Paper Doll: Do I Really Need A Safe Deposit Box?

Paper Doll’s Ultimate Guide to Getting a Document Notarized

Over the years, we’ve looked at documents granted by a government entity, like birth and marriage certificates, divorce decrees and custody documents, citizenship and military separation papers, passports, and Social Security cards.

We’ve also reviewed essential documents you must create for yourself (or with assistance), including home inventories, insurance policies, estate planning documents (like wills and trusts, pre- and post-nuptial agreements), and living wills (also known as advanced medical directives).

And, for ensuring that your loved ones can take care of you (and you can take care of them) in the event of incapacitation, we have always accented the importance of having both a Durable Power of Attorney for finances and Durable Power of Attorney for healthcare (known in some states as a healthcare proxy).

BEHOLD: THE POWER OF ATTORNEY

A Durable Power of Attorney for financial decisions is necessary if you are unable to make financial decisions or take financial actions on your own. This might occur if you are ill and lack the cognitive capacity to make your own decisions (such as if you’re comatose, heavily medicated, or experiencing some sort of dementia), but it might also come in handy in other circumstances.

Imagine that you are taking an around-the-world cruise or hiking in the Himalayas. In such cases, communication may be spotty or impossible. If the stock market were tanking or a financial opportunity of great importance occurred, or if your return were delayed and you needed to make sure your child’s college tuition was paid or some other financial arrangement was secured, knowing that someone with your Power of Attorney for financial concerns was handling everything would certainly put your mind at ease.

A Durable Power of Attorney for healthcare, or a healthcare proxy, is similarly important if you are unable to make your own healthcare decisions, pretty much for the same reasons initially outlined. If you are physically or cognitively incapacitated and need someone to make decisions on your care, it’s essential to have that paperwork in place.

And, as a periodic reminder to all parents who’ve recently sent their kids off to college, without a Power of Attorney for healthcare or healthcare proxy in place, if your away-at-school adult child were ill and had not granted you PoA for healthcare, the college’s health center or local hospital would not be allowed to provide you with any information about your child’s condition or care.

So, Power of Attorney documents are pretty darned important. You want them in place so that your spouse, partner, adult child, or trusted friend or advisor can be kept informed of your situation and can, if necessary, make decisions and take actions on your behalf.

This is the be-all and end-all of advice we paper specialists generally need to give. But guess what? We’ve been missing a pretty important document related to older adults!

BEYOND THE POA: THE DOCUMENT YOU DIDN’T KNOW YOU NEEDED

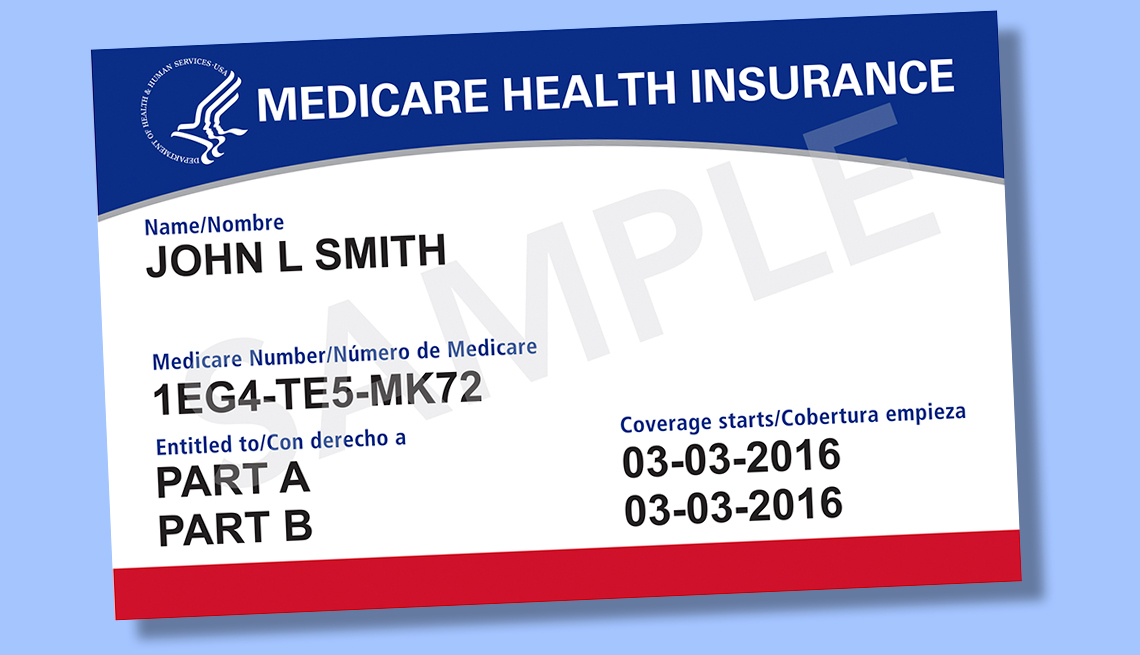

Let’s imagine your spouse is 65 or older. Or perhaps we’re talking about your parent, or another slightly older loved one. (I say slightly older, as now that Paper Doll has reached 55, the age of 65, when you can get Medicare coverage, doesn’t seem that far off.) Or perhaps you’re the one with Medicare.

You’d assume that as long as Powers of Attorney had been executed with regard to financial and medical decisions, then everything would be A-OK. Right?

Mostly. But not entirely.

It turns out that, by law, if you want someone (your spouse or significant other, your adult child, your caregiver, etc.) to speak to Medicare on your behalf, having a both a Durable Power of Attorney for financial issues and one for medical issues is not enough.

Perhaps because each state has a different variation on PoA forms, or perhaps because the government just likes to be wackadoodle, Medicare requires you grant prior authorization via a surprisingly under-mentioned form called the 1-800-MEDICARE Authorization to Disclose Personal Health Information Form or CMS-10106. (Doesn’t that just roll trippingly off the tongue?)

You must fill out the CMS-10106 well in advance if you want someone to potentially be able to discuss any of the following with Medicare:

- Medicare eligibility

- Medicare claims

- Plan enrollment (including part D or other drug plans)

- Payment of premiums

- Other information, including payments to beneficiaries

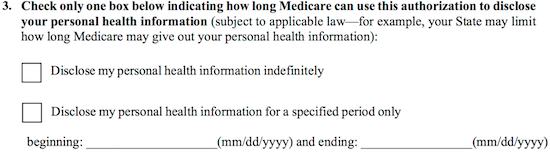

So, if you have Medicare, are you thinking “Whoops!” and wondering what happens if you have secured your financial and healthcare PoAs but haven’t ever filled out this authorization?

It turns out there’s a quirky loophole. If a person HAS done both of their PoA forms but hasn’t actually filled out this authorization form, it’s entirely not a catastrophe. That’s because the person who fills out the form has to be either one of the following:

- the beneficiary (that is, the person on Medicare)

OR

- the personal representative of the person on Medicare (that is, the person who has the Powers of Attorney, or otherwise has been granted authorization over your information).

So, yes, if you’re the person with the Power of Attorney for a Medicare beneficiary, you can authorize yourself to let Medicare talk to you about someone’s health and payment information. And if that seems a little weird to you, well, you’re not the only one.

The problem is that if someone hasn’t ever filled out the CMS-10106 in advance and their personal representative has to do it, it’ll take time to process because you have to MAIL it to Medicare.

That’s right — you can’t submit the authorization form online or even by fax. You have to mail it, like it’s 20th century, to a post office box in Lawrence, Kansas!

Julie- This is fantastic! As my husband and I are ’rounding the corner’ to 65, this is a form I will definitely need to fill out. I wonder how long it’s been in place. I was the POA for my mom and don’t recall having this form filled out. I’m sure she didn’t know about it. But I never had an issue talking with Medicare on her behalf as the POA. Perhaps the rules have changed in the past few years, or maybe things are different in New York.

But the bottomline is, why take a chance and make things difficult on the people who are ‘caring’ for you when you can’t. I’ll make a note in my calendar to fill out form CMS-10106 when the time comes.

Thank you, thank you for your great research and complete explanation. You are amazing, Julie!!!

Thank you! When my client mentioned this document, I anticipated that it would only be useful for people who hadn’t already set up their Power of Attorney documents, but as I got deeper, I realized this is one of those secrets that is too closely kept! I know it’s been in effect since at least early 2019, because that’s the last revision date of the form.

I figured that if I didn’t know about this form, there must be many other people who aren’t aware that it exists. Knowing now, and getting it set up, will prevent many headaches.

Wow! Who knew? Thanks for this important information. It is now added to my to do list.

I’m amazed that this is kept such a secret. “Essential life documents” should be a class taught in high school or college!

Wow, Julie. I never heard of this form for medicare. I do know of clients that had parents that were Medicare patients. I will share this information with them.

I hadn’t heard of it either until my client raised the question. I started asking other organizers and DMMs, and except for the daily money managers who specialize in elder finances, this is a truly under-the-radar document.

I’m glad you’ll be spreading the word!

Just when I thought I’d finished jumping through all the Medicare hoops. Sheesh! Thanks, Julie!

It’s definitely been kept a secret as far as I can tell. You’d think this would be part of the initial paperwork included in signing up!

If you ever hear me talk about hiking in the Himalayas, feel free to slap me LOL! But you make a good point. Being prepared with a PoA is a good idea for everyone.

No one I know is yet on Medicare, although I am getting closer. It’s all so crazy. Seems like forms and questions upon forms and questions.

As you point out, this is important to get nailed down long before there is an emergency. Who would have thought it had to be handled via snail mail? As if, in a medical emergency, there is time for that? Crazy…

OK, so maybe you’ll be on a soothing cruise, like the kind that sponsors the cozy mysteries on Masterpiece Theatre?

My suspicion is that Medicare assumes that most people currently over 65 wouldn’t know how to digitally sign a fillable PDF with Adobe or Preview, but who knows why it has to be mailed?

Thank you for writing this article. It is so important to consider all these things before a crisis happens. If you can help prepare your family or clients it is so helpful.

Thanks, Julie. I know that you have completely different forms and organizations in Canada, so I appreciate you reading this.

Wow, great resource. Thank you for doing this researching and sharing it with all of us.

This was definitely an unexpected topic, and I was so glad my client brought it up. Thanks for reading!

Julie, like the others, I was completely unaware of this important document. Thank you very much for this great information. I have added it to my list to do sooner rather than later.

It was so new to me that I was dubious when my client first mentioned it — how could there be such an important document that nobody had ever seemed to mention it? I wonder what other sneaky secrets exist in the red tape out there?

Thanks for reading!

Wow! This is the first time that I have heard of this document so thanks, Julie. I did know that once a person passes away, the POA/POF ceases and I have heard of the difficulty this can cause (For example, planning on using the deceased funds to pay funeral fees and other related fees but suddenly not having access to said funds). I will be sharing this information.

This is definitely an under-the-radar document, and I can’t figure out why it’s not part of the initial enrollment documents. Thanks for reading and sharing!