Archive for ‘Financial’ Category

Paper Doll’s Ultimate Guide to Tax-Smart Organizing: 2024

Every few years, I share a series of tax-related organizing tips for readers. Recently I’ve received inquiries from first-time filers asking for how to even begin the process. So, today’s post mixes tax-related news with a larger baseline of how to accomplish preparing and submitting your 2023 tax return.

Note: I’m neither an accountant nor a tax preparer. I don’t even play one on television. But I do help my clients find, organize, and make sense of the documents they need in order to prepare their tax returns.

ESSENTIAL TAX INFO TO KEEP ORGANIZED

Tax Deadlines

The federal Tax Day is April 15, 2024 (unless you live in Maine or Massachusetts, where it’s April 17, 2024).

If you file a (valid) extension request, you must file your tax return by October 15, 2024. Note, you still have to PAY what you (estimate that you) owe by April 15th to avoid a fine. However, if you strongly believe you’re not going to owe anything, you may file late (without filing for an extension) and there’s no penalty fee. But then you’ll also be delaying getting a refund if you’re owed one, so Paper Doll advises against procrastinating.

How To Prepare and File Your Taxes

You have a variety of options for how you prepare and file your federal taxes:

- Prepare your taxes yourself on paper forms. Like a caveman. And you’ll have to do your own math.

- Hire an accountant or CPA firm. You still have to gather all of your forms and your receipts and tell your tax preparer all the wiggly little oddities in your life last year, but you won’t have to do math. The complexity of your return (and how well you organized your supporting document) will determine the cost of the service.

- Visit a tax preparation service like H&R Block or Jackson Hewitt. Find them in independent storefronts or at desks inside big box stores, like Walmart. However, you may want to reconsider this option.

Color Of Change, in collaboration with Better IRS, just released a report called Preying Preparers: How Storefront Tax Preparation Companies Target Low-Income Black and Brown Communities. In it, they cite that many of these companies are unqualified, hiring non-accountant “unenrolled tax preparers,” who are neither credentialed nor certified in tax policy and regulations, and who do not adhere to continuing education requirements — and in 43 states aren’t even obliged to meet basic standards!

As such, many of these unenrolled preparers have been found to have made excessive errors; indeed, one study by the U.S. Government Accountability Office (GAO) found that only 10% of preparers at large tax prep chains calculated tax refunds correctly! Additionally, many of these companies are preying on low-income and minority taxpayers by charging for advances on refund checks, and promoting unnecessary tax products and high-interest refund anticipation loans.

- Use online tax preparation software, like TurboTax, H&R Block Online, TaxAct, Cash App Taxes, and Free Tax USA. They’ll hold your hand through prompting questions and you won’t have to do the math, but you’re ultimately responsible if you misunderstand a question or make an error. And it can be pricey!

The IRS already receives copies of our income information directly from employers, banks, investment companies, etc., so why do we have to do all of this? And why is it so expensive, especially for those who don’t even owe? Because these companies lobby and bribe — ahem, sorry, contribute — to congressional representatives’ election campaigns to prevent the federal government from creating a free option for all!

More Affordable Filing Options

The IRS estimates that Americans spend an average of $250 to prepare and file their taxes, but there are options for lessening that burden.

- If you are age 60 or older, make $64,000/year or less, are disabled, or need language support, you can get free help from IRS-certified volunteers in the Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs.

-

-

- Find VITA and TCE program locations at the IRS locator page.

- Seek related help from the AARP Tax-Aide Service.

- The United Way can connect you to preparation and filing assistance via MyFreeTaxes.

-

- If you’re a member of the military (or a military family), you can prepare and file a federal return and up to three state returns, for free, through MilTax. Eligibility requires that you are:

-

- An active-duty service member, and/or their spouse and dependent child(ren).

- A member of the National Guard and National Guard Reserve (no matter your activation status).

- Survivors of deceased active-duty service members, National Guard, or National Guard Reserve members (without regard to activation status or conflict).

- Honorably discharged, retired service members from all branches, including the Coast Guard, if you’ve been discharged within the past 365 days.

- Designated family members of service personnel who’ve been authorized to manage the eligible member’s financial affairs during deployment. Similarly, any designated family member of a service member deemed “severely injured” and not capable of handing their own financial affairs.

-

- If your 2023 adjusted gross income (AGI) was $79,000 or less in 2023, you can use the government’s Free File program. Here, the IRS partners with online tax preparers each year and eligible users (for 2023 filing, that means those with an adjusted gross income (AGI) of $79,000 or less) can file federal taxes with no fee. (State tax costs vary.)

However, the contracted companies change year-to-year, so if you prefer to maintain your data in your account, making it easier to do year-to-year comparisons and be prompted to recall charitable recipients and sources of W2s, 1099s, etc., next year you may have to decide between switching to a new program partner or paying for what was once free.

Some past participating partners in the Free File program have been problematic. The Federal Trade Commission (FTC) found that TurboTax engaged in deceptive advertising (forcing up-selling), and investigated H&R Block for improperly handling and deleting customer data (as well as for deceptive advertising).

Unsurprisingly, both companies have supported legislation to ban the IRS from offering free tax filing services.

- If you qualify, try the US government’s new Direct File trial program. Only 12 states (Arizona, California, Florida, New Hampshire, New York, Nevada, Massachusetts, South Dakota, Tennessee, Texas, Washington, and Wyoming) are participating in this trial effort.

Direct File eligibility is limited to those with income from employment (reported via W2), unemployment compensation, or from Social Security, so self-employed individuals, gig workers, and those with pensions can’t use it. To try Direct File, you have to take the Standard Deduction and can’t itemize. (You can have up to $1500 in interest or savings bond income, but not earnings through payment apps, rent, or prizes. Wages are limited to $200,000, or $125,000 if you are filing Married Filing Separately.)

Unfortunately, Direct File’s future is uncertain. The Biden administration allocated $15 million from the Inflation Reduction Act for IRS to evaluate the viability of a a free online tax preparation and filing service, with $80 billion apportioned for over the next decade. However, Congress’ debt ceiling agreement “clawed back” some of those funds.

Special K: It’s Not Just for Breakfast Anymore

Do you have an online platform on Etsy or eBay, or use a payment platform to sell through your website? Then you may have heard rumblings about the 1099-K form finally getting the $600 rule up and running. Well, it’s been delayed again.

The rule is designed so that anyone who receives money from a third-party network like Venmo, Cash App, PayPal, Square, or Stripe for having made $600 or more in sales for either goods or services would receive a Form 1099-K by late January or early February (when we’re supposed to get all of our 1099s). But the IRS has repeatedly delayed implementing the rule, so some people have received 1099-Ks and others haven’t, causing confusion.

So, if you got a 1099-K, check to make sure the numbers match the income you believe you received. (If there’s a mismatch between your records and the form, contact your financial network and correct it before you file your return.)

If you didn’t get a 1099-K, that doesn’t mean that you can fib to the IRS! You must report all taxable income, even if someone who was supposed to send you a form didn’t do their job.

Photo courtesy of Chris Potter/CCPix at www.ccPixs.com under CC 2.0

START THE TREASURE HUNT

Know What You Spent

Start by gathering expense information, like:

- receipts for tax-deductible purchases — check paper receipts as well as email confirmations of purchases

- statements or summaries from ongoing accounts. (On Amazon, select the year from the drop-down under Your Orders in your account. Don’t forget to check the tab for digital orders, too!)

- online financial dashboards — Mint closed in March, so plan to find a new dashboard like Quicken Simplifi, Empower, or YNAB.

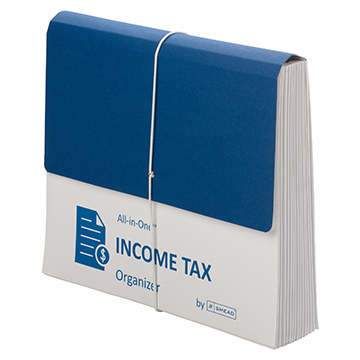

Gather tangible information in a folder labeled Tax Prep 2023, or use something like the Smead All-In-One Income Tax Organizer. Just having it all together will be the first step toward tabulating the correct amounts.

Gather Ye Forms

Most of the essential data you’ll enter into your tax return will come as supporting documents called information returns. These are sent to you by others — employers, banks, brokerage houses, schools, casinos, etc. — and they’re required to mail them by January 31st! That scary-but-official mail you threw on top of the microwave the week before Valentine’s Day? Move the oven mitts and get looking!

The rest of this post is an update of past year’s posts, laying out the different kinds of forms you might need.

MONEY YOU RECEIVED

W-2 (Wage and Tax Statement)

If you were an employee at any point in 2023, your employer should have sent one W2 copy to you and one to the IRS, reporting how much you were paid (in wages, salaries, and/or tips). If applicable, it should also indicate how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state, and local taxes, FICA, unemployment insurance, and a few other withholdings are considered statutory payroll tax deductions. Statutes (that is, laws) require them, so your employer can’t just blow off withholding this money and sending it to the right agencies.

Sometimes, a court might rule that an an employee’s wages may be garnished, but this has nothing to do with sprigs of parsley. People behind on child support payments or who owe money in lawsuits may have money removed from their earnings, before it ever gets to their paychecks, to ensure it goes directly to whomever is owed.

Your W-2 may also report voluntary payroll deductions. These are amounts withheld from your paycheck because you’ve granted permission. These may include your portion of health and life insurance premiums, contributions to your 401(k) or other retirement fund, employee stock purchasing plans, one-time or ongoing donations to the United Way, union dues, etc.

Photo by The New York Public Library on Unsplash

Did you get multiple copies of the same W-2? Employers submit copy A directly to the Social Security Administration for FICA and keep copy D for their own records. Copies B and C are for you (the employee) – you send one to the IRS with your federal tax return and keep one for your own records. Then, they provide copies 1 and 2 to file with applicable state or local tax authorities. (I’ve never figured out why W-2 copies 1 and 2 aren’t called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, FF, and G, skipping E entirely?)

I've never figured out why W-2 copies 1 and 2 aren't called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, and G, skipping E entirely? Click To TweetIn theory, a W-2 should be mailed to the address listed on your W-4. (Don’t be confused. The W-4, is the form that tells your boss how much to withhold based on your number of dependents you have.)

Smaller companies may just hand you your W-2 instead of mailing it, but if your W2 is missing, consider:

- Did you change employers last year? You should have received W-2s from each employer. (If you changed jobs at the same company, you’ll receive one W-2 from each employer, not one per position. If you changed companies within a larger corporation, though, you may get one for each.)

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down to give you your W-2. Keep the Madge in HR updated!

Don’t assume that if you don’t have your W-2, then nobody knows what you made. Remember, the IRS got Copy A. The IRS knows what you made, so be sure you do, too! (If your former company went out of business or is otherwise not returning your calls, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

Examine your W-2 it carefully. Do the numbers seem right? Compare them to the final pay stub you got for last year. Calendar years may end mid-week (or even mid-pay period), so the numbers won’t correspond perfectly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return.

W-2G (Certain Gambling Winnings)

Gambling Photo by Aidan Howe on Unsplash

The W2G is the freewheeling cousin of the W-2. While a W-2 is for money you make while working, the W-2G is what you get while playing. If you win more than $600 in any gambling session at a casino – whoohoo! – the “house” should request your Tax ID (generally your Social Security number) and either prepare a W-2G on the spot or send it to you in January.

Casinos aren’t interested in keeping up with your losses, just your winnings, so they only tell the IRS about what they paid you. If you gamble and want to deduct losses, the IRS requires you have provide receipts, tickets, statements, or other records to support both your winnings and losses.

1099s (Income)

A 1099 is a form that basically says, “Hey, we paid you some money for something, but you weren’t an employee.” You get a copy; the IRS gets a copy. Easy-peasy.

There’s not just one type of 1099; actually, there are 22 different kinds of 1099s. Some of the more common are:

This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account.

Internet-only banks may require you to log into your account to get your 1099-INT, so don’t count on it coming by mail. If you received less than $10 in interest, your bank may not send a 1099-INT.

Do you own stock or other taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equal; ask your tax professional if you have any that seem unusual or complicated. Whether you receive dividend checks or your dividends are held in a DRIP (a direct re-investment plan), if you didn’t earn at least $10 in dividends, you are unlikely to receive a 1099-DIV.

This random form is subtitled “Certain Government Payments” and can cover everything from state unemployment compensation to tax refunds, credits, and offsets at the state and local level. It can also be used to report payment of taxable grants, agricultural payments, and other nifty things where a state or local government gives you money.

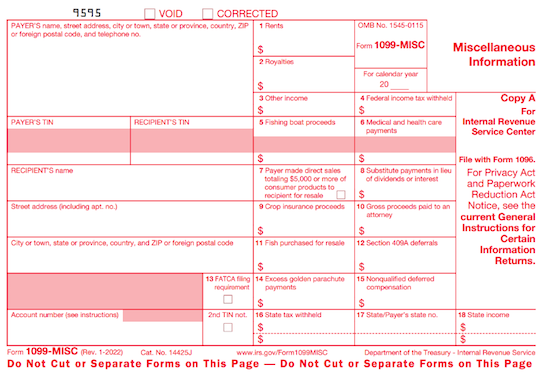

This new(ish) form replaces some uses of the 1099-MISC. If you’re self-employed (a freelancer, an independent contractor, etc.), you should get a 1099-NEC. However, 1099-NEC just started in 2021, so people unfamiliar with it may send you a 1099-MISC by mistake.

Another problem is that even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-NEC. So, if you are self-employed or irregularly employed, it’s essential to keep track of your own incoming revenue. Otherwise, if the person who paid you ever gets audited, it could trigger some messy situations for you, too.

Now that this form no longer covers income for freelances and independent contractors, it’s truly more “miscellaneous.” Seriously, it’s the junk drawer of tax forms!

It’s used to report payment of royalties, broker payments, certain rents, prizes and awards, fishing boat proceeds (yes, really!), crop insurance proceeds, and some payments to attorneys that wouldn’t be reported on a 1099-NEC, like if you received a settlement and had to pay an attorney a portion of it. In general, once people get used to the 1099-NEC, you’ll only get this miscellaneous form to report truly miscellaneous payments.

SSA-1099 (Nobody knows why the numbers and letters are reversed on this one form! It must be done by the same people who label the copies of W-2s and bra sizes!)

If you receive Social Security benefits, you should receive an SSA-1099. (Non-citizens living outside the US, like widows/widowers receiving spousal Social Security benefits, may get a SSA-1042.) The 1099-SSA tends to come on a long form, folded and sealed such that it makes its own envelope. It may look like junk mail, so watch out and replace it, if necessary!

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that someone forgave a debt, like a mortgage or a credit card balance. You may owe tax on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, and got to keep it in your pocket, it’s as if you received money.

1099s sometimes hide in plain sight. Sometimes, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope — sometimes perforated at the bottom of a quarterly or end-of-year financial statement. Be sure to check all that boring-looking official mail. Brokerage houses often sent multiple forms as a “combined 1099,” scrolling across multiple pages. Check the reverse sides of forms, in case you’re missing one.

MONEY YOU PAID

1098 (Mortgage Interest)

A 1098 is not a 1099 with low-self-esteem. The vanilla, no-frills 1098 reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. Renters don’t get 1098s; neither do homeowners who’ve paid off their mortgages.

There are also sub-types of 1098s for things other than interest on property loans:

- 1098-T indicates tuition you paid; you’ll get this from a college or training school.

- 1098-E shows you’ve paid interest on a student loan and will come from your lender.

- 1098-C indicates the donation value of a car, boat or airplane by fancy-pants, monocle-wearing Mr. and Mrs. Thurston Howell.

Photo by Diego F. Parra from Pexels

1095-A (Health Insurance Statement)

The 1095-A is also called the Health Insurance Marketplace Statement. If you purchased coverage through a state or federal exchange, this helps you determine whether you are able to receive an additional premium tax credit or have to pay some back.

Related forms include the 1095-B (supplied by companies with fewer than 50 employees), detailing the the type of coverage you had, the period of coverage, and your number of dependents, so you can prove you had the Minimum Essential Coverage (MEC) required by law. A 1095-C is similar, but for employers with more than 50 employees.

SPECIAL 1040 FORM FOR SENIORS

Are you a senior? If you are over 65, instead of filing the standard 1040 form, you can file the 1040-SR. The main benefit is that this form, when printed, uses a larger font and provides easier readability.

FINAL THOUGHTS

If you receive a mysterious form, or have questions about how to use a form, the IRS has a surprisingly easy Forms, Instructions and Publications Search. Again, I am a Certified Professional Organizer, not an accountant, so please address any concerns to a tax specialist.

Making sure you have all of the necessary forms in hand will make it much easier to prepare your tax return. Once you file your taxes, make a list of all the forms you received this year, and tuck that list into your tickler file for next January. Check off each form as it arrives, and you’ll have a better sense of when you’ll be ready to start working on your 2024 taxes in 2025.

Slam the Scam! Organize to Protect Against Scams

Being organized and productive depends on having systems in place. The problem is that sometimes things happen that throw all of our carefully curated systems out the window. Things like getting the flu, having your car break down (or get stolen), your computer crashing — or getting scammed.

It’s shockingly easy to fall for a scam, and frustratingly difficult to recover financially and legally after being a victim. It may require time, money, the services of specialists (like attorneys) and more. The best thing you can do is to organize yourself to protect against being victimized.

SCAMMERS PREY ON EVERYONE

You may have heard about a recent viral article in The Cut by Charlotte Cowles, the online magazine’s financial advice columnist. You wouldn’t have expected someone with that professional identity to write a column entitled, The Day I Put $50,000 in a Shoe Box and Handed It to a Stranger. But she fell for a scam, and she fell hard. And now, risking public and professional embarrassment, she has spoken out.

For weeks, there’s been debate online regarding what happened to Cowles. Many people can’t imagine that a grown woman with a professional background in financial writing could have been fooled by the ring of scammers who convinced Cowles that they were representatives of Amazon, of the Federal Trade Commission, and of the CIA.

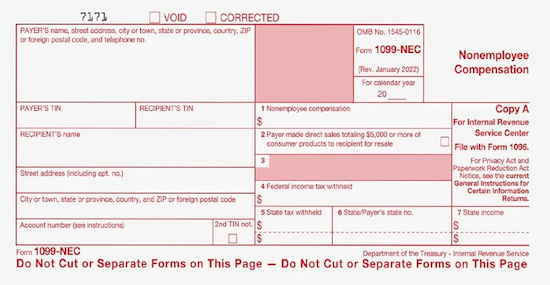

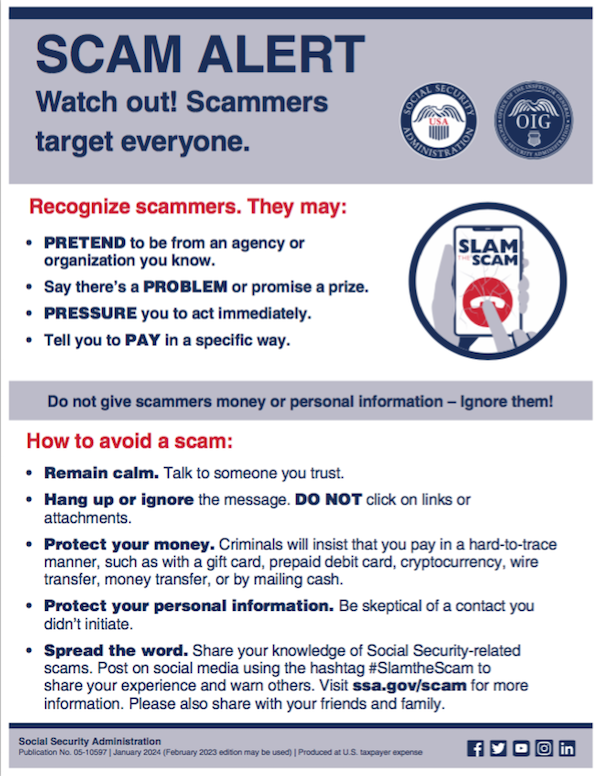

But scams are real, they are everywhere, and we need to organize ourselves (and warn our loved ones) to be vigilant. Gallup found that 15% of American households were victims of financial scams just last year.

Graph provided by Gallup

And, while we tend to think of victims as being older, every demographic group is at risk. In fact, younger adults (like Gen Z and the youngest Millennials) are overrepresented as victims of scamming (at 22%); meanwhile Gen Xers like Paper Doll and Baby Boomers are somewhat less likely to be scammed, at 9% and 14%, respectively.

The rate of victimization is lower among adults without a college education and with lower incomes than those who have college educations and who earn at least $50,000 per year. One might surmise that both of the latter groups have more opportunity to be warned and prepared to identify elements of scams.

But people with education, experience, savvy, and money can also be scammed. Last month, author Cory Doctorow wrote How I Got Scammed, explaining how a Christmas holiday travel week, a failed ATM transaction, and the post Alaska Air 737 Max door-plug disaster created a perfect storm for him being taken advantage by a phone-phishing fraudster pretending to be from his credit union.

Sometimes, a scam is obvious. Out of nowhere, you’ll be cooking or watching TV and the phone will ring. A mysterious and heavily accented speaker will say that there is “something seriously wrong with your Microsoft computer.” It doesn’t matter if you actually have a Mac, or if you don’t even have a computer. They’ll use that wearily patient voice so identifiable as IT customer support.

You immediately know it’s fake; but would your grandparents? Would your teenager?

Other scams are less obvious because they come wrapped in the kind of tech-related language we see every day. In just the 24 hours prior to writing this post, Paper Doll and Paper Mommy experience attempted scams.

I received an email claiming that I’d purchased $500+ in services, and if had not made those purchases, I should immediately click to be connected with the company’s fraud department. Of course, merely hovering my cursor over the return email address (displayed as the company’s name) showed it was actually sent by gibberishletters@Yahoo.com. Real companies don’t use Yahoo addresses; in theory, they shouldn’t even use Gmail addresses. Dependable companies have their own domains.

Meanwhile, Paper Mommy got the all-too-common email advising her to click because her iCloud was full. [Be assured, her iCloud was not full. It has a backup of her iPad and probably a few dozen photos and not much more.] Paper Mommy may be 87, but she is one smart cookie, and even if she hadn’t received one of these same phishing attempts previously, she knows enough to verify such things.

However, it’s common enough to get random notification texts, popups, and emails claiming that something is awry. One of the immediate clues is bad spelling, grammar, or punctuation, something that older generations are more likely to take seriously; a 50- or 70-year-old is more likely to immediately realize that a poor command of English (in an email sent, ostensibly, by an American company to an American customer) is a sign of a scam. Thus, given the propensity of younger people for text-speak and a lesser reliance on standard usage, younger adults might be more easily tripped up.

Still other scams prey on the inclination of individuals to be good natured. One popular scam comes in the guise of a text regarding a sick or injured dog. The sender addresses you by the wrong name and says that they’re at the vet; their dog won’t eat and is whimpering, and they’re waiting for assistance. I “fell” for such a scam a few months ago, in that I replied and said, “Sorry, you have the wrong person. I hope everything turns out OK for you and the dog.”

Sad Doggie Photo by Bruno Cervera at Pexels

I thought nothing more of it until the person kept texting and trying to inveigle me in conversation, asserting that I must be a dog lover, too. (Readers, while I’d hate for you to think I’m a Disney villainess, I’m not fond of animals in person, though I do love monkeys, puppies, kittens, and penguins, as long as they’re on my device screens and nowhere near me.)

I Googled, and immediately found that this is a long-running scam to convince text recipients to get emotionally enmeshed in the condition of the dog, and end up giving money. One can understand how Congressman George Santos managed to set up fake Go Fund Me accounts for animal care and steal the proceeds. People are softies and want to be kind.

We’re also inclined to be law-abiding. There have been a number of jury duty scams where recipients get calls or texts saying that there’s a bench warrant for them to be arrested because they have not shown up for jury duty. Sometimes, recipients are warned that deputies are on the way to arrest them unless they pay a fee over the phone, or buy gift cards and send them to the caller.

Government agencies don’t text you out of the blue. In most cases, none but teeny, hyper-local government offices will even email. They certainly don’t take payment in gift cards.

Scams are designed to prey on your lack of experience or information, your good nature, and your fear of getting in trouble (as with Cowles’ example). Do not let scammers waste your time, ruin your productivity, or take advantage of your goodwill.

SOCIAL SECURITY: SLAM THE SCAM DAY

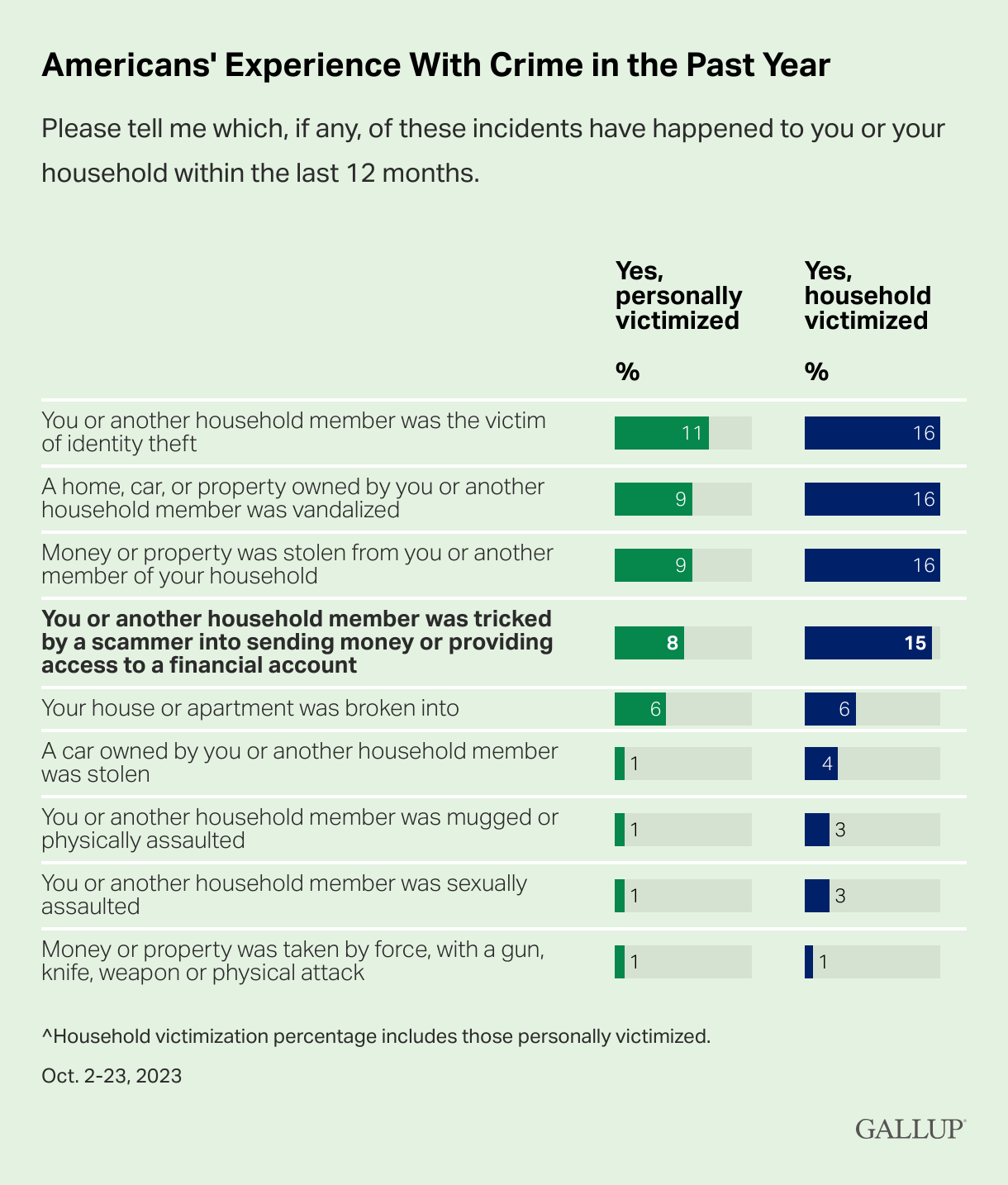

The Social Security Administration has declared this Thursday, March 7, 2024 Slam the Scam Day!

On National Slam the Scam Day and throughout the year, the SSA provides tools to help seniors and others recognize scams related to Social Security and prevent scammers from stealing both funds and personal information.

Social Security and Paper Doll want you to protect yourself, your loved ones, and people in your community this Slam the Scam Day by educating everyone about government imposter scams. Discuss the issue and let people in your life know they shouldn’t be embarrassed to report if they shared personal information or suffered a financial loss. It’s important to report scams as quickly as possible, both to aid recovery and identify the culprits.

The Social Security Administration encourages us to share their Scam Alert fact sheet to help educate others about how to protect themselves. Report Social Security-related scams to the Social Security Office of the Inspector General (OIG).

If you do encounter scammers in any way related to Social Security, report the scam online with as much information as you have regarding the characteristics of their claims.

Social Security encourages you to visit www.ssa.gov/scam for more information and follow the SSA OIG accounts on Facebook, Twitter, and LinkedIn. Those accounts aren’t going to share the newest viral dances or memes, but will keep you informed of the latest nasty tactics. Please consider sharing this post with the #SlamtheScam hashtag on your social media platforms.

OTHER SCAMS TARGETING SENIORS

Scams targeting seniors aren’t limited to those involving Social Security.

The “Grandma, I’m in Jail!” scam has been prevalent for more than a decade. Your phone rings and you hear a young person’s distraught voice begging for help. The caller, ostensibly your grandchild, has somehow accidentally run afoul of the law and is in jail. “Please send bail money but don’t tell Mom and Dad,” the caller begs, providing a phone number and case number; you call as directed and the faux police officer verifies the case number and takes your money. These scams assume Grandma doesn’t hear your voice often enough to recognize it on the phone.

Help your grandparents not fall for such scams by 1) explaining how they work and 2) calling them more often so that they recognize your voice!

Photo by RepentAndSeekChristJesus on Unsplash

Elders are often the victims of medical scams designed to impersonate legitimate agencies related to Medicare, diabetes supplies, medical equipment, hospice, and more. Romance scams, which prey on lonely people of all ages, but especially tender-hearted seniors, are also on the rise.

The American Association of Retired Persons (AARP) is great resource for keeping on top of scams targeting the elderly. Bookmark AARP’s Scams and Fraud page to learn about new schemes as they become known.

KNOW THE SCAMMERS’ TRICKS

Similar to “Grandma, I’m in Jail” is “Dad, I’ve had a car accident!” There’s loud traffic noise (and perhaps sirens) in the background and the faux-distraught caller is saying that they’ve caused an accident and that the police say they need to pay a fine right away. Don’t fall for it.

Remember how I said that government agencies won’t ask for payment in gift cards? Neither will your boss. The Do Me a Favor scam shows up via email or text, when your boss (or maybe the CEO of your company) sends a message asking you to purchase gift cards for a work-related charity promotion, promising to pay you back after he receives them.

Yeah, no. The email or text may look like it’s coming from your work contact, your church leader, or your Facebook friend, but it’s almost certainly not.

Similarly, your friends aren’t going to be at the Paris Olympics and lose their wallets and ask you to send them money via Facebook.

The best way to organize yourself against scams is to stay informed of what scams are popular. When you know what to expect, it’s easier to identify scammers and avoid engaging.

- 5 Financial Scams To Avoid in 2024 as Expert Warns Fraud Has Reached ‘Crisis Level’ (NASDAQ)

- 6 Top Scams to Watch Out for in 2024 (AARP)

- 10 Scams You Should Know About in 2024 (Express VPN)

- 17 Facebook Marketplace scams to avoid in 2024 (Lifelock)

- Credit Card Scams to Know in 2024 (and How to Avoid Them) (Time Magazine)

- Five Biggest Frauds To Watch Out for in 2024 (Kiplinger)

- The Latest Scams You Need to Be Aware of in 2024 (Experian)

- No Love for Romance Scammers in 2024 (IRS)

DON’Ts AND DOs TO KEEP YOURSELF SAFE FROM SCAMMERS

DON’T CLICK — If you receive an email or text with links to your bank or other financial account, go instead to the official website and log in from there. If you don’t know the URL, look it up on the back of your bank or credit card or on your statements. And, as you’ve been told since the dawn of email, do not click on attachments from somebody you don’t know.

DON’T TRUST — The Caller ID may say that the inbound call is coming from your bank or the IRS, but it’s ridiculously easy to “spoof” (that is, fake) the identity of a caller. Consider not answering; scammers rarely leave voicemail.

Don’t assume that the caller having the last four digits of your Social Security number or even all of the digits of your account number is on the up-and-up; there’s just too much of our private information on the dark web. Instead, hang up and call the official number for your financial institution and request to be connected to the fraud department.

DON’T DIVULGE — If a stranger claiming to be from your bank or credit card’s fraud department contacts you, ask for a case number. Do not give out your personal information. Do not give out your PIN.

DON’T SAY YES — Do not answer questions in the affirmative. That is, if they ask, “Is this Jane Smith?” don’t say yes; if you must say something, reply, “What is this regarding?” Your voice could be recorded and cloned for AI-related scams. The less you say, the better.

DON’T RUSH (OR BE RUSHED) — It’s the nature of scammers, like the stereotypical used car salesman, to use the pressure of time to get you act against your best interest. Don’t be fooled into making a decision or taking action quickly. Check with advisors, whether more technologically savvy friends or relatives, your accountant or financial advisor, your attorney, or the police.

DO READ UP — The American Bankers Association has a nifty website called BankersNeverAskThat.com. The site explains what to watch out for in terms of email, text, phone, and payment app scams, and also has a great eight-question quiz where you can walk through the situations (on your own, or as part of coaching with a loved one) to identify whether something is a scam or legitimate.

For reference, I did pretty well, but I dithered on the question regarding payment app alerts; if you’ve only recently begun using apps like Zelle, Venmo, or other peer-to-peer payment services, you might find the example sneaky, too, so read (and share) AARP’s How to Avoid Scams on Zelle, Venmo and Other P2P Apps.

The site offers a goofy “retro” scam-themed video game and a series of lighthearted videos to drive the point home.

DO HAVE FAMILY PASSWORDS — Schools have security that was non-existent when I was a kid; there are lists of who is allowed to pick up little Johnny or Janey from school to ensure not only that there’s no Stranger Danger but that wackadoodle exes and pushy in-laws don’t insert themselves between you and your kids. Modern parenting includes having family passwords so that if someone says, “Hi, your mommy told me to come pick you up from soccer practice today,” even if the child recognizes Mommy’s best friend as Auntie Karen, the kids know to wait for the official password.

This concept should be applied to families at all ages. Have a communication password designed so that if Grandma or Dad or College Kid gets a call purporting to be from one of the others and is in in need of emergency funds, there’s a level of security involved. (But, y’know, if Grandma calls from jail too often, maybe let her think about the consequences of her actions for a little while.)

DO TELL THE AUTHORITIES — No matter how embarrassing it is to have been scammed, it’s important to report suspected and actual scams.

- Notify your bank, credit card company, brokerage, or other financial institution immediately. If scammers have actually taken your money via credit card, the company should be able to flag the transaction as fraud and reverse it immediately; other financial institutions may also be able to freeze the transaction and save your money. Take screenshots of texts or emails, and don’t delete the original messages in case law enforcement wants to dig more deeply into the source code.

- Contact the police, and file a police report. Do not be dissuaded if the police officer seems blasé about the crime.

My credit card company once notified me that someone had used my card number to buy an inordinate amount of mail order men’s underwear and stereo equipment. Algorithms had already flagged the purchases as fraud, but they asked me to file a police report. The police officer who took the report at my workplace could not have looked more bored if I’d asked him to watch paint dry. It doesn’t matter. Report!

- File reports with applicable state and federal agencies. Whether the case involves the Social Security Administration, Medicare, or other federal crimes, report scams to the applicable agencies. The Federal Bureau of Investigation (FBI) and the Federal Trade Commission (FTC), as well as your state’s bureau of investigation all have fraud departments. Learn more at the FTC’s Reportfraud.ftc.gov and the FBI’s Internet Crime Complaint Center at IC3.gov.

THE FUTURE OF SCAMS

Scams — and scammers — aren’t going away. There will always be scammers who take advantage of anyone more easily duped because they have less information, less experience, and fewer people watching out for them. But, as I alluded to earlier, there are higher tech scams on the horizon.

Artificial intelligence is scary. I bet you’ve heard about deepfakes, video imitations made to sound and look like a real person is saying something they never actually said.

Voiceprints and voice cloning constitute the audio version of deepfakes. A scammer can record you — or take your teenager’s Instagram or TikTok video — and create a completely new message using words and expressions that were never actually said, and then create an “emergency” where it’s believable that money or your Social Security number or other private information is requested. If your college-age kid still hasn’t memorized his Social Security number, you might be tempted to believe it if “he” calls from a spoofed number that looked like his and says he’s filling out a form at school and needed his (or your) digits.

Voice cloning is already being used. Scammy deepfake videos could just as easily be to sent via Facetime or text video. Be careful.

FUNNY THINGS (NOT) TO DO TO SCAMMERS

You shouldn’t engage with scammers, so don’t emulate Paper Mommy or her friend in the stories below. Still, it’s fun to imagine retribution against bad guys.

When I was a teen, my mother was visiting a friend, a suburban woman of (shall we say) means. A phone scammer interrupted their visit and was urgently pushing some sort of financial scheme. Mom’s friend told the caller that she was sorry, but he’d have to wait, that her husband busy shoveling the cow s***.

Later, my mother spoke of her friend’s response with a twinkle in her eye.

Paper Mommy, as longtime readers know, is a hoot. After a friend briefly fell prey to the “Grandma, I’m in jail!” scam (until she learned that her teen grandson was fast asleep in his own bed), Paper Mommy began plotting her revenge on scammers. A few years ago, she called me with delight to report that the day she’d been anticipating had finally arrived.

“Grandma, I need your help!” the voice implored. The scammer had already made a tactical error; much to Paper Mommy‘s chagrin, neither my sister nor I have made her a grandmother. My mom tut-tutted as the scammer wove his tale, offering periodic, “Oh, no, darling! … Oh, you poor thing? … You need me to send you money?”

She kept him on the line for eons, repeatedly leading the evil-doer to believe she was prepared to turn over her credit card number to secure grandson’s release. Oh, she just had to find her purse. Oh, fiddlesticks, where was her wallet? Just when his frustration led him to almost crack and he implored, “Grandma, aren’t you going to help me?” my mom uttered her Oscar-worthy line:

“No, Sweetheart. I never really liked you that much.” Click.

#SlamTheScam

Reference Files Master Class (Part 2) — Financial and Legal Papers

As we move through Get Organized & Be Productive (GO) Month, the annual initiative sponsored by the National Association of Productivity & Organizing Professionals (NAPO), it’s the perfect time to revisit classic posts and essential concepts in paper organizing.

Two weeks ago, we looked at Paper Doll Shares 12 Kinds of Paper To Declutter Now, and while the items listed there aren’t the only papers you can purge, they’re a great start for lessening the clutter so you can see what you own, need, and must organize.

Last week, we began our modern refresh of the basics with Reference Files Master Class (Part 1) — The Essentials of Paper Filing. You can sort and purge papers without those filing resources, but having them allows you to create a system that can grow and expand as your needs change. Even somewhat orderly stacks and piles are better than disarray, but a good filing system assures you that everything won’t be sent into chaos when the kids and pets (or spouses behaving like kids and pets) chase one another through the house.

As I’ve been teaching my professional organizing clients for 22 years, all reference papers can fall into one of five categories. Today, we’ll be reviewing the first two:

- Financial

- Legal

- Medical

- Household

- Personal

FINANCIAL FILES

In almost any household, whether you’re a family of one or 10 (and I mean, geez, even the Brady Bunch, with Alice, only had nine!), financial paperwork makes up the bulk of almost any personal or family filing system.

It’s the nature of living in a Western, capitalist society in the 21st-century — everything centers around whatever represents having or owing little green pieces of paper. At least our Canadian readers have much more colorful currency.

Canadian Frontier Banknotes @2006 Bank of Canada

Your financial files keep track of money coming in (in Yoda-speak, quite literally, in-come), money going out for expenses, money we are investing and (hopefully) growing for future use, and everything related to money we give governments to run things. (If we don’t have the focus and energy to organize our financial paperwork, how would we ever deal with having to raise our own armies and fill our own potholes?!)

Let’s look at each of these categories, in turn.

Transitional Money

Most of your files will relate to money that’s coming to you or paid (or at least owed) by you. But all that money tends to funnel through a few central locations that serve as receiving and funding sources. Generally, these are bank (or credit union) accounts and brokerage accounts.

Bank/credit union statements reflect the monthly status of checking, savings, and trust accounts. These represent collections of funds that are in transition, basically at a weigh-station until you determine where the money is going. Accounts may accrue interest or have fees associated with them, and some (like certificates of deposit) act like investment accounts, but are still basically interest-bearing accounts. Take time each month to make sure these accounts reflect what you think they should.

Brokerage statements reflect investments. Separate these by investment type, like retirement, college savings, goal-related (vacation funds, Christmas Club accounts, etc.), first, and then sub-categorize (and alphabetize) by company. So, in the Retirement hanging folder, you might have interior folders for your 401(k), an old 403(b), IRAs with Fidelity and Vanguard, and so on. Each account should have its own folder.

Clearly label folders with the financial body (bank, brokerage, etc.) and account type; if you have more than one account of the same type at the same institution, put the last four digits of the account number on the file label.

Income

However many people in your household have a job (or jobs), income is likely reflected by pay stubs from employment. In ye olden days, they were truly stubs from checks received from employers. Nowadays, almost everyone gets paid electronically by direct deposit, but often receives printed pay “stubs” showing not merely what was earned, but any deductions from the paycheck. Common deductions include:

- FICA (payroll tax, which goes to Social Security and Medicare)

- Other income tax (federal/state/local)

- Insurance premiums for health, life, and disability coverage

- Retirement contributions (which may or may not be matched by employer contributions)

- Charitable contributions (also called payroll giving) like United Way

- Wage garnishments for child support or other

- Union dues

(If your income is derived from your own business, keep business files separated from personal files.)

While employment is the main category, it’s not the only type of income. You may also receive paperwork reflecting receipt of alimony or child support, Social Security income, disability payments, IRA disbursements, personal loans repaid to you, stock-dividends (outside of a dividend reimbursement plan) and lottery or gambling winnings.

This leaves aside illegal proceeds; Tony Soprano isn’t likely to give you a 1099 for the bribe he paid you. (Tony Soprano also didn’t give me a lot of options for clean language, even when I found a really applicable filing-related, if potty-mouthed, clip.)

Whether you regularly receive money or get a one-time lump sum, keep records for tax and other legal reasons (like divorce and child support proceedings, Medicaid evaluations, etc.)

Maintain an interior folder for each type of income you usually receive to make it easy to check your 1099s against when preparing your taxes. If you have multiple sources of income within one type (and get lots of paperwork for each), label a folder with the name of each high-volume payer.

Outgoing Money (Expenses)

In business, they’re called Accounts Payable. These are your regular (monthly, quarterly, annual, etc.) plus occasional (unexpected) lump-sum payments, reflected by bills or statements, like:

- Monthly/periodic personal/household bills — rent or mortgage, utilities, auto or health insurance, etc.

- Credit cards statements

- Loans — personal, auto, college, home equity, etc.

- Medical bills — these may be one-time or part of an ongoing payment plan

- Tuition —

- Miscellaneous invoices or payment records reflecting anything for or which you wish to keep careful records, like tutoring, music lessons, tuition, professional organizer, fitness trainer, etc.

If your bills are paid by automatic withdrawal, verify that the proper amount was removed from your bank account or charged to your credit card, and then file the papers away. (For now, we’re assuming paper files; we’ll cover scanning and digital filing in the future.)

You may not enjoy the paperwork, but ignoring money issues won’t make them go away. If you struggle with keeping track of finances, learning to manage them in paper form makes money feel tangible, builds financial management skills, and increases financial awareness.

Ignoring money issues won't make them go away. If you struggle with keeping track of finances, managing them in paper form makes money feel tangible and 'real,' builds financial management skills, and increases financial awareness. Click To TweetIf you receive paper bills but pay each individually online, write the confirmation number and date of payment on the statement. If you still pay by check, tear off the stub to mail back with your payment (assuming you’re not doing online bill-pay), note the check number and date of payment on the larger, non-stub portion of the statement.

Create an interior (manila) folder for each account you hold. It doesn’t matter if you use generic terms (cable, power, water) or company-specific (Spectrum, ConEdison, Springfield Water). The key is to create labels that reflect the way you think. Keep it simple — the more complicated the system, the more friction will prevent you from filing things away.

If you have multiple accounts for the same company — for example, one water bill for your city penthouse and one for your summer cottage (or more likely, one bill for each of several student loans), label folders to differentiate between the two. (So: “Water — Park Avenue” vs. “Water — Park Avenue”; “College Loan — 1st National” vs. “College Loan — Fred’s Bank.”)

For credit cards, if you have more than one card from any one issuing lender, put the last four digits of the card number on the label (AmEx – 4321, AmEx – 9876) to help you file or access papers quickly.

Label a hanging folder for each sub-category. If you have more than one hanging folder’s worth of interior folders, just label the first in the sequence. It will be obvious from the interior labels that you’re still in that same sub-category.

Taxes

Create at least one tax-prep folder, or have one for medical expense records, one for charitable donation records and a third for “other” tax issues. Each January, when you start receiving W-2s and 1099s, pop them in your Tax Prep [Year] file folders. Once your taxes are completed, create an interior folder for a copy of your filed return and all supporting documentation.

As an alternative to collecting active tax filing year documents in file folders, you may want to sequester them in a portable tax according file, whether pre-made like the Smead All-in-One Income Tax Organizer.

Reference Files Master Class (Part 1) — The Essentials of Paper Filing

COPING WITH PAPER OVERWHELM

After last week’s post, Paper Doll Shares 12 Kinds of Paper To Declutter Now, I had a number of readers mention to me that while knowing what to get rid of helps them deal with their paper piles, they were still sometimes at a loss as to what to do with the rest.

Some fear they should be scanning everything to keep it digital, but don’t even own scanners. Others feel frustrated because even when they’ve arranged to get (and pay) their bills digitally, they still have paper coming to them. Many people feel at odds with the 21st-century pressure to have digital records, and don’t particularly feel adept with handling papers digitally. (They forget to look at email until it’s too late, or they never get around to scanning, or information just doesn’t seem “real” to them if it’s not in tangible form).

Over the 16+ years that I’ve been blogging as Paper Doll, I’ve tried to get across that whether you use analog or digital techniques — whether for paying bills, or keeping track of your appointments and tasks, or filing or archiving your information — doesn’t matter. That is, the method doesn’t matter; the commitment to a system is what is most important.

But 16 years is a long time. Babies born during the launch of my first Paper Doll posts are old enough to drive! To give you a sense of how long ago that was, Desperate Housewives was still a top-10 TV show (and people were still watching broadcast television). The top song was Crank That (Soulja Boy) and we were all trying (and mostly failing) to do the dance.

I originally wrote about the elements of a reference filing system in the first month of Paper Doll posts, back in 2007. It’s time to revisit the topic, see how digital solutions do (and don’t) help with the paper overwhelm, and introduce new readers to the best ways to manage paper.

Over the next several weeks, we’ll be taking a fresh look at how eliminate the frustration of paper files.

The Ice Cream Rule

The key to making any system work is just that — a system. That means having a location where something belongs and behavioral rules to get them there. I often refer to this as the Ice Cream Rule. If you come home from the store with two bags, one holding a half gallon of cream and one with a package of toilet paper, which one will you put away first? And where would you put them?

Even people who insist that they’re terrible with systems laugh and admit that they automatically know to put the ice cream away first; they recognize that they’ll end up with a melted mess if they do not.

They also have no worries that they’ll put the ice cream where they won’t be able to find it again — in the cupboard or the pantry — because their system not only includes behavioral cues (ice cream before toilet paper), but a geographic location (that is, the freezer) where the ice cream belongs.

Yes, people may drop the bag with the toilet paper on the kitchen floor, or hang it on the linen closet door, or actually put away the toilet paper in the bathroom right after getting the ice cream in the freezer.

Admittedly, the behavioral part of putting away non-urgent items isn’t perfect. The squeaky wheel gets the oil, and when it comes to putting things away properly, ice cream’s urgency is squeakier than toilet paper. (That said, the retrieval of ice cream is likely to be less urgent.)

A HOME FOR YOUR REFERENCE FILING SYSTEM

The point, and I do have one, is that to create order with the paper in our lives, we must ensure that we know exactly where everything goes. How? Filing papers is easy once each item is assigned a place to live. All of your reference papers need to have a home.

Keep in mind, that home does not have to be a palace. You certainly can invest in filing cabinets. These range from bargain 2-drawer metal filing cabinets to office-style 4-drawer tower-style cabinets.

If you prefer lateral filing cabinets (where you stand to the side of the open drawer, rather than in front of it), there are a variety of styles and materials from which to choose.

Recapping Paper Doll’s 2023 Posts — Which Were Your Favorites?

With one week left in 2023, have you taken time yet to review your year?

For the December Productivity and Organizing Blog Carnival, Janet Barclay asked us to identify our best blog posts of 2023, and I had a tough time.

“Best” is subjective, and Janet let us have free reign as to which post fit. Some bloggers chose their most popular posts in terms of readership; others, the ones that garnered the most comments. Some of my blogging colleagues picked their most personal posts, while others selected what they felt would have the most impact on people’s lives.

The problem is that picking just one means leaving the others behind, and I wrote forty-two posts this year! Eventually, I narrowed the selection to half a dozen posts, and then turned to colleagues and friends who were almost evenly split, bringing me no closer to a solution. In the end, I picked Paper Doll On Understanding and Conquering Procrastination because it served as the foundation for so many other posts, but also because I’d been lucky enough to find some great visuals, like this one from Poorly Drawn Lines:

so much to do pic.twitter.com/fiSm7Y2Erg

— poorly drawn lines (@PDLComics) December 21, 2022

Beauty, like clutter, is in the eye of the beholder. To that end, here’s a recap of everything we’ve discussed in 2023, with a few updates and tweaks along the way. My personal favorites are in bold, but I’d love to know which ones resonated the most with you during the year!

ORGANIZE YOUR INSPIRATION

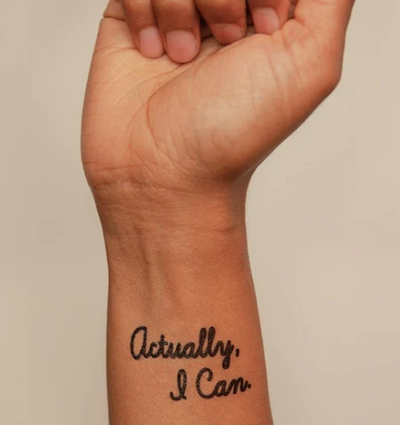

After uploading last week’s post, Toss Old Socks, Pack Away 2023, and Adjust Your Attitude for 2024, I got to thinking about all the different ways we can take our word, phrase, or song of the year and keep it in the forefront of our minds.

I’d reviewed the traditional methods (vision boards, posted signs, turning the song into your wakeup alarm), but felt like there needed to be something that stayed with you, independent of your location. Only being reminded of your goal to be a leader when you’re standing in front of your fridge doesn’t really help you in your 1-to-1 meetings at work. (I mean, unless you’re the Queen of the Condiments or King of the Crisper Drawer.)

Only being reminded of your goal to be a leader when you're standing in front of your fridge doesn't really help you in your 1-to-1 meetings at work. (I mean, unless you're the Queen of the Condiments or King of the Crisper Drawer.) Click To TweetSerendipitously, within minutes of thinking about this, an ad came across one of my social media pages. (Normally, I ignore ads, but this one had me thinking maybe “serendipity” would be a good theme word for some year!) The ad was for Conscious Ink, an online temporary tattoo retailer specifically for creating body art to help you mindfully connect with your themes and messages to yourself, disrupt negative self-talk, and promote the healthy habits you’re trying to embrace!

As Conscious Ink’s About page explains, if you want to keep something top of the mind, why not try something that keeps it “top of the body?” Whether body art is your thing or you haven’t experimented since your Minnie Mouse temporary tattoo at summer camp <mumble mumble> years ago, this is a neat trick!

There’s even research as to how a temporary tattoo can support permanent emotional and cognitive transformation and improve mindfulness and focus on things that uplift one’s higher self. And that’s the point of a theme word, phrase, or song, to keep you focused on what you want rather than what you allow to drag you down! Manifest what you want your life to be.

Conscious Ink’s temporary tattoos use non-toxic, cosmetic-grade, FDA-certified, vegan inks. Each one lasts 3-7 days, depending on where you apply it, your skin type and activity level, and (I suspect) how many life-affirming, stress-reducing bubble baths you take. Categories include mindset, health and wellness, spiritual/nature, relationships, parenting, celebratory, and those related to social causes. Prices seem to hover at around $10 for a three-pack and $25 for a 10-pack. There’s even a Good Karma Guarantee to make sure you’re satisfied.

Whether you go with Conscious Ink (which is designed for this uplifting purpose) or seek an alternative or custom-designed temporary tattoo (through vendors like Momentary Ink or independent Etsy shops), it only makes sense if you place it somewhere you can see it often.

After all, if you place a temporary tattoo reminder to stand up for yourself on your tushy, it probably won’t remind you of much. For most of us of a certain age, putting it at our wrists, covered (when we prefer) by our cuffs, will give us the most serene “om” for our buck.

If you place a temporary tattoo reminder to stand up for yourself on your tushy, it probably won't remind you of much. Click To TweetAlong the same lines as my advice on adjusting your attitude for 2024, you may want to consult Gretchen Rubin’s Tips for Your “24 for 2024” List. Rubin and her sister/podcast co-host always have an inspring Happier Trifecta: a year-numbered theme, along with with a challenge and a list.

PRODUCTIVITY AND TIME MANAGEMENT

This was a big year for productivity discussion. I’m a firm believer that keeping your space and resources organized is key to being productive. However, it’s hard to keep the world around you organized when outside influences prevent you from being efficient (doing things well) and effective (doing the right things).

We continue to see the value of body doubling, whether through friendly hang-outs, co-working (virtually or in person), or professional organizing services, whether you want to conquer garden-variety procrastination or get special support for ADHD.

Partnering for Success

Paper Doll Sees Double: Body Doubling for Productivity (I almost submitted this post to the carnival. Accountability and motivation for the win!)

Paper Doll Shares 8 Virtual Co-Working Sites to AmpUp Your Productivity

If you’d like to explore the body doubling or co-working experience, friend-of-the-blog Deb Lee of D. Allison Lee is offering a no-cost, two-hour Action Day event on Tuesday, January 9, 2024, from 10 a.m. to 12 p.m.

This event is designed for her clients and subscribers, but after a cheery holiday conversation, Deb said it was OK to let my readers know about the opportunity.

Deb describes an Action Day as “personal training for your productivity muscles!”

An Action Day (especially as Deb runs them) is a stellar way to narrow your focus and start taking action on your goals. (And what better time than at the start of the new year?) You’ll get to connect with others who are also working on goals and habits with the support of Deb, a productivity coach I admire and adore.

Just bring your top two or three priorities, and you can conquer anything, like:

- organize your workspace

- write your book outline

- clean up your digital files

- test a new productivity app

- send out client proposals

- anything!

You’ll videoconference with a small, select group via Zoom. Share your goal and tasks, work for the bulk of the two hours, and then take time to debrief and share your successes!

Moving Yourself Forward

Getting anything done involves figuring out what you have to do, knowing what’s kept you from getting started, making it easy for you to begin, and celebrating even the smallest wins. These next three posts were where the magic happened this year!

Paper Doll On Understanding and Conquering Procrastination (This is the post I submitted to the Productivity & Organizing Carnival.)

Frogs, Tomatoes, and Bees: Time Techniques to Get Things Done

Use the Rule of 3 to Improve Your Productivity

Dealing with the Pokey Times

If you’re overwhelmed by all you’ve got going on during late December and early January, you can skip onward. However, if your workplace closes down during the holidays, or your professional and personal lives just feel like they’re kind of in a slump right now, you may find some inspiration in two pieces I wrote for the summer slowdown.

The weather outside may be frightful (unless you’re reading from Australia), but if you are looking for ideas to pump you up when everyone is in a post-shopping/meal/travel haze, these posts may stir your motivation:

Organize Your Summer So It Doesn’t Disappear So Quickly

Use Your Heart, Head, and Hands to Organize During the Slow Times

Try To Do It All (And Knowing When to Step Away)

Maybe you did your annual review and found that you’re feeling burned out. If so, you are not alone. It’s easy for your groove to turn into a rut, and for all of your drive to accomplish come crashing down because you never take your foot off the gas all year!

If you missed these posts earlier need a second shot at embracing the importance of variety, small breaks, and actual vacations, here’s your chance to read some of my absolute favorite posts of the year:

Paper Doll Says: Don’t Get Stuck in a Rut — Take Big Leaps (Be sure to watch the diving board video!)

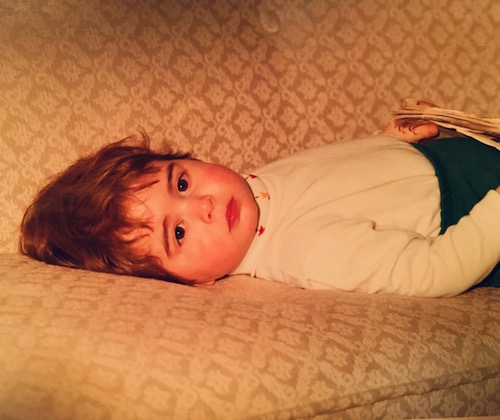

Was baby Paper Doll burned out? In a rut? Just pooped?

Take a Break — How Breaks Improve Health and Productivity

Take a Break for Productivity — The International Perspective (This is the post that introduced the Swedish convivial snack break, fika!)

If you had any doubts about what I said about the importance of taking breaks in your day to refresh your body, your brain, or your spirit, a new report just a few weeks ago confirms that we need that late afternoon break if we don’t want our productivity to turn to mush! And the more we push ourselves beyond work hours, the greater our decrease in productivity!

If you’re desperately in need of a full break, but are suffering from decision fatigue and don’t have the energy to begin planning a whole vacation, there are options to make it easier for you. In the BBC’s piece, Why 2024 May Be the Year of Surprise Travel, you may find some rousing options.

Need a little inspiration to spend your holiday gift money on experiences rather than tzotchkes? Check out Time Out’s 24 Best Things to Do in the World in 2024 to envision where you could take long breaks to refresh yourself. Those vintage trains in Italy are calling to me, but perhaps you’d prefer the immersive “Dream Circus” in Sydney, Australia, or Montréal en Lumière’s 25th anniversary?

(Never mind, I know. Everyone wants to go on the Taylor Swift cruise from Miami to the Bahamas. Just come back with good stories instead of memento clutter, OK?)

TOOLS AND IDEAS FOR GREATER PRODUCTIVITY

Sometimes, rereading my own posts reminds me how many nifty things there are to share with you, and how many are still to be discovered.

Paper Doll Helps You Find Your Ideal Analog Habit Tracker — So many people have requested a follow-up covering digital habit trackers, so watch for that in 2024.

Paper Doll Presents 4 Stellar Organizing & Productivity Resources

Paper Doll Shares Presidential Wisdom on Productivity — From the Eisenhower Matrix to Jefferson’s design for the swivel chair, from limiting wardrobe options to understanding the difference between being busy and being productive, we’ve had presidents who have known how to get more (of the right things) done. With an election year in 2024, I’d love a debate question on the candidate’s best tips for staying organized and productive!

Surprising Productivity Advice & the 2023 Task Management & Time Blocking Summit

Highlights from the 2023 Task Management & Time Blocking Summit

3 Simple But Powerful Productivity Resources — Right in Your Browser Tab — The offering that got the most attention this year was definitely Goblin.Tools. I’m sure that as we head into 2024 and beyond, I’ll be sharing more resources that make use of artificial intelligence.

Let’s just remember that we always need to give precedence to our own intelligence, in the same way we can’t follow GPS to the letter if it directs us to drive in to a lake. In fact, like all organizing and productivity guidance, remember what I said way back in 2020 in The Truth About Celebrity Organizers, Magic Wands, and the Reality of Professional Organizing: there is no magic wand.

AI and other solutions, tangible or digital, and even professional organizers, can make things easier, but the only way to get the life you want is to embrace making positive behavioral changes.

RESOURCES FOR ORGANIZING YOUR WORK AND TRAVEL SPACE

Privacy in Your Home Office: From Reality to Fantasy — It’s interesting to see that privacy, and not just in home offices but in communal workspaces, has become a priority again. Check out this recent New York Times piece, As Offices Workers Make Their Return, So Does the Lowly Cubicle.

Paper Doll Refreshes Your Paper Organizing Solutions

Paper Doll Organizes Temporary Papers and Explores Third Spaces — Do you have systems for dealing with your “temporary papers,” the ones that you don’t need to file away but aren’t triggering an immediate action?

Paper Doll Organizes Your Space, Money, and Well-Being While Traveling

Paper Doll is Clearly Organized — Translucent Tools for Getting it Together

Paper Doll Explores New & Nifty Office and School Supplies

Organize Your Desktop with Your Perfect Desk Pad

No matter where I go in 2024, be assured that I will be keeping my eyes open for solutions for keeping your paper and work supplies organized.

My Thanksgiving weekend shopping trips brought me a variety of intriguing options. At Kohl’s, I saw 30 Watt‘s Face Plant, a way to keep your eyeglasses handy while refreshing the air around you (and keeping you perky) with greenery. The 5.5″ x 6″ x 5.25″ ceramic planter holds a plant, gives you a place to rest your glasses (so you won’t misplace them under piles of paper on your desk), and is dry erase marker-friendly! (It’s currently on sale for under $14.)

A stop at IKEA in Atlanta was so productive for organizing tools that you’ll be seeing posts with nifty names like Övning (for tidying a child’s desk accessories and creating privacy), Kugsfors (wall-mounted shelves with tablet stands for keeping books and iPads visible while working), Bekant (sit/stand desks) and more.

ORGANIZING YOUR FINANCIAL & LEGAL LIFE

Not everything in the organizing and productivity world is fun to look at, and that’s especially true of all the financial and legal documents that help you sleep soundly at night. Still, Paper Doll kept you aware of how to understand and protect your money, your identity, and your legacy.

Speaking of which, if you haven’t created your Apple Legacy Contact and your Google Inactive Account Manager, why the heck not? Use the power of body doubling up above, grab a partner, and get your digital life in order!

Lost & Found: Recover Unclaimed Money, Property, and Savings Bonds

Paper Doll’s Ultimate Guide to Legally Changing Your Name

Paper Doll Explains Digital Social Legacy Account Management

How to Create Your Apple & Google Legacy Contacts

Paper Doll Explains Your Health Insurance Explanation of Benefits

DEALING WITH EMERGENCIES AND STRESSFUL SITUATIONS

Sometimes, I write a post I wish I’d been able to read earlier (like the one on preventing and recovering from a car theft). Other times, like when a friend had a health emergency, or when Paper Mommy had her fall in November, I’m glad the posts already exist. If you missed these the first time around, please be sure to read, share, and bookmark them; think of them as an insurance policy, and let’s hope you won’t need them.

How to Organize Support for Patients and Families in Need

Organize to Prevent (or Recover From) a Car Theft

Paper Doll Organizes You To Prepare for an Emergency

GRAB BACK OF INTERVIEWS, UPDATES, AND PHILOSOPHY

Paper Doll Interviews Motivational Wordsmith Kara Cutruzzula

You already know how beloved my friend Kara Cutruzzula‘s Brass Ring Daily newsletter and Do It Today podcast are at Paper Doll HQ.

After having read and enjoyed Kara’s Do It For Yourself — A Motivational Journal and her follow-up, Do It Today — A Motivational Journal (Start Before Your Ready), I had no doubt that I’d be jumping on her third when it was released in September.

If you haven’t already picked up Do It Or Don’t — A Boundary-Creating Journal, use that Amazon money you almost certainly got this holiday season!

One of the Paper Doll themes for 2024 will focus on setting (and maintaining) better boundaries to accomplish more of what’s meaningful, and I’ve got multi-color tape flags sticking out of Kara’s book from all the chapters to share her bounty with you.

One of the Paper Doll themes for 2024 will focus on setting (and maintaining) better boundaries to accomplish more of what’s meaningful, and I’ve got multi-color tape flags sticking out of Kara’s book from all the chapters to share her bounty with you.

What’s in a Name? “Addressing” Organizing and Productivity

Paper Doll Suggests What to Watch to Get More Organized and Productive — As we head into the new year, I’ll be keeping my eyes open for podcasts, webinars, and TV shows to help you keep your space organized, your time productive, your finances orderly, and your life joyous. Readers have been sending in YouTube and TikTok videos that inspire them, so please feel free to share programming that you’d like to see profiled on Paper Doll‘s pages.

Paper Doll on How to Celebrate Organizing and Productivity with Friends

Paper Doll and Friends Cross an Ocean for Fine Productivity Conversations

From in-person get togethers with frolleagues (what my accountability partner Dr. Melissa Gratias calls those special folks who are both friends and colleagues) to Friday night professional organizer Zooms, accountability calls, and Mastermind group collaborations, this has been a great year for staying connected and sharing the benefits of those conversations with you.

I also loved guesting on so many fun podcasts related to organizing, productivity, technology, and more. If there’s someone you’d like to hear me debate or banter with, let me know!

SEASONAL POSTS

Spooky Clutter: Fears that Keep You from Getting Organized

Paper Doll’s Thanksgiving Week Organizing and Productivity Buffet

Paper Doll De-Stresses Your December

Paper Doll on Clutter-Free Gifts and How to Make Gift Cards Make Sense

Are you stressed out because you haven’t gotten someone a gift yet? Maybe a good start would be to help an overwhelmed special someone take my advice about going on a travel break. Consider gift certificates for something like Get Your Guide, with opportunities to get guided tours of locally-vetted, expertly-curated sporting, nature, cultural, and food experiences. With 118,000 experiences in 150 countries, pick a multiple of $50 or set your own amount, and your recipient can pick the domestic or international travel experience that fits best.

If you know your recipient will be traveling by rail, consider a gift card for Amtrak or ViaRail in North America. Eurail doesn’t sell gift cards, but you can pay for a pass, or buy a gift card for a rail pass for more than a dozen specific European train lines. And if you’d like to help someone organize vacation serenity and secure a bundle of travel attractions for a given city, try TurboPass in Europe or City Pass and The Sightseeing Pass in North America.

HERE’S TO A MORE ORGANIZED AND PRODUCTIVE 2024

Whether you’ll be spending the next few days reading, traveling, or doing your annual review, I hope this last week of 2023 is a happy and healthy one.

To send you off for a cozy week, I’d like to share a Whamagaddon– and Mariah–free, retro 100-minute holiday playlist from the late 1930s through the early 1960s. It’s somehow easier to dismantle the tree and write thank-you notes to Guy Lombardo. (My favorite clocks in at 52:42 with “What Are You Doing New Year’s Eve?”)

Please let me know your favorite Paper Doll posts from this year, and I’ll meet you back here in 2024!

Follow Me