Organize for an Accident: Don’t Crash Your Car Insurance Paperwork [UPDATED]

[Editor’s note: This post originally appeared on Paper Doll on 1/23/2020 and has been revised and updated as of 8/8/2022. As many college students are headed off or back to their universities with cars, this is an ideal time to discuss the finer points of auto insurance.]

(Image by Andrea Closier on Pixabay)

What happens when an unstoppable force meets an immovable object?

In January 2020, Paper Doll was sitting at a traffic light, preparing to make a turn, when the car behind me answered that physics question. Luckily, it was more of a THUD or a BAM than a CRUNCH. However, even the most minor of fender benders can be scary and overwhelming. It’s definitely not the time to wish you’d been more organized with your car insurance paperwork.

Even the most minor of fender benders can be scary and overwhelming. It's definitely not the time to wish you'd been more organized with your car insurance paperwork. Click To TweetToday, we’re going to look at the different kinds of paperwork you need, and how to organize it, to make sure you are protected and confident regarding your car insurance.

APPLYING FOR CAR INSURANCE

Whether you’re new to driving, are changing insurance companies, or are insuring a new car in your household, there are certain documents you’re going to need when you apply. Having everything in order ahead of time will make the process move more smoothly. You will need information about yourself, any other drivers covered on the policy, and the vehicle, such as:

Social Security Number(s) — You will need the SSN of anyone who is to be covered on your policy.

Your Driver’s License — Some insurance companies will only need the license number; more old-school agents may want a photocopy of your license. If, like me, you don’t like letting your license out of your hands, make a few photocopies of your license and you’ll have them when you need them.

Your insurance company isn’t just verifying that you are licensed to drive. They’re going to check your driving record — also called a Motor Vehicle Report (MVR) in some areas — to verify that your license hasn’t expired or been suspended, and to see whether you’ve had any accidents, convictions, or traffic violations. Most states look at your driving record for the last three years; however, there are exceptions. Kansas and New Jersey reports go back five years; Colorado, Indiana, and West Virginia look back seven years.

WalletHub has a state-by-state guide to getting a copy of your MVR, with links, in case you want to check it for accuracy before seeking insurance. In my state, I can get a copy for $5 in person or or online; nationwide, costs range from $2 to $25 (sometimes plus processing fees to use debit/credit cards) per report. Be prepared to use an authentication app, like Google Authenticator, or receive a text or email or verify your identity.

Do not be scammed into using a non-governmental service that promises to get your MVR online for you; they up-charge a significant amount and are usually not any faster than going through your state’s website.

Financial History — Insurance companies do standard credit checks, so it’s a good idea to check your credit history at AnnualCreditReport.com (and not one of the shady copycats), as well as your credit score, to make sure there are no mistakes.

Your Current Insurance Declarations Page – You know that long page (or set of pages) in your policy with big numbers like $300,000/$500,000? (More on that, below.) Having that page will allow your new insurer to provide you with an apples-to-apples quote.

Vehicle Information Number (VIN) — This 17-character identifier is unique to your car and is built into your dashboard or imprinted in your driver’s side door frame. Your insurer uses this to verify that the car is not stolen and doesn’t have any problematic history.

Discount-Related Paperwork — There are a variety of ways to get a discount on car insurance. Your driving record (MVR) will verify if you qualify for a “good driver” discount, and you (or your teenager or college student) may be able to submit a current report card to qualify for a “good student” discount. To get the discount, students usually need to be under 25 and have no at-fault or moving violations on their MVR. A GPA of 3.0 (on a 4.0 scale) or Honor Roll/Dean’s List status is generally required.

You can also get multi-car discounts if you and your spouse both have cars, or multi-policy discounts if you carry homeowners’ or renters’ insurance with the same company.

If you’re over a certain age, you may be able to take a safe driver course, like one offered by AARP, to lower your rates.

You might be eligible for affinity discounts if you are a member of certain clubs, organizations, alumni associations, or sororities/fraternities. There are also often occupational discounts for members of certain professions, including first responders and medical professionals, educators, and government employees, so it’s worth asking your agent what discounts exist before you get too far in the application process.

ORGANIZING YOUR INSURANCE PAPERWORK

Once you have an auto insurance policy in place, you’re going to have paperwork. The more organized you can be, up-front, the less stress you’ll have to deal with in case of an accident or other issue.

Policy

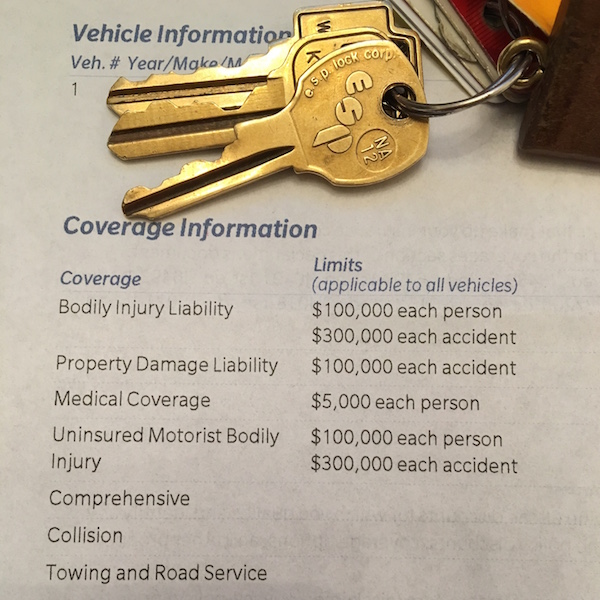

This is the multi-page legal document that tells you everything about your coverage. It can be overwhelming. Make sure you go over it with your insurance agent so that you know and understand the essential elements of your policy, particularly the items on your declarations page, which spells out your coverage:

- Liability (also called Bodily Injury Liability) — These are the limits on your policy per person per accident. You may see $100,000/$300,000, which means you’re covered for any medical expenses and/or lost wages for anyone (including other drivers, passengers, and even bystanders) injured in an accident you cause, up to that amount.

- Property Damage — This pays to repair or replace things that get damaged (in an accident you cause), like other people’s cars, items in their cars that get damaged, actual property (like someone’s garage or mailbox). The dollar limit is quoted per accident. Be sure you understand the difference between collision and comprehensive. Collision covers damage to your car when it collides with another car, or a tree, or a Bob’s Big Boy. Comprehensive covers damage to your car caused by things like vandalism or theft by hooligans, or “natural” disasters (hail, tornadoes), a tree toppling onto your car, or Bambi taking a running leap at your hood.

Your policy may combine liability and property damage into one category, so you might see it listed with three numbers, like “100/300/50” which means $100,000 for injuries per person, $300,000 for total injuries per accident, $50,000 for damages to property.

Depending on your state, your policy may also have (or even require) special types of insurance options, like:

- Uninsured and underinsured motorist coverage — If someone hits you but doesn’t have enough (or any!) insurance, it will cover injuries if you or your passengers get hurt. Basically, you’re insuring yourself against people who aren’t responsible enough to have (enough) insurance. There’s also a line item for uninsured motorist property damage; as you may have guessed, it covers your car if the person who hits you doesn’t have insurance.

- Personal injury protection insurance (PIP) — If you live in a “no-fault” state, this pays out for medical expenses for minor injuries or lost wages for you or your passengers. (Liability coverage is only invoked if the costs go beyond what PIP covers.)

- Medical payment coverage — Like PIP, this covers you or your passengers’ accident-related injuries, no matter which driver is at fault. It doesn’t cover lost wages, and the limits tend to be $5,000-10,000.

Your policy may also cover things like glass replacement damage, towing and road service, accident forgiveness (to keep your rates from going up after an accident claim) and loss of use (for a car rental while a vehicle is being repaired).

I encourage clients to make a file folder for each insurance policy they own (auto insurance, homeowners, etc.) and keep it in the Legal section of your Family File System.

The declarations page is a good cheat sheet for all of your coverage. You may want to make a photocopy and keep it in your glove compartment, or take a photo/scan to save in Evernote, Dropbox, or a similar app accessible on your phone.

Notes for Canadian Readers

Please note that all of the above refers to purchasing auto insurance in the United States. In Canada, different language is used. For example, in addition to provincial and territorial mandatory coverage, there are optional policies including “collision, specified perils, comprehensive, and all perils.” If you are seeking information regarding auto insurance (and organizing insurance paperwork) in Canada, please confer with an insurance professional (or a member of Professional Organizers in Canada).

Bills for Premiums

Insurance companies usually give you the option of paying annually, twice per year, or monthly. The less often they have to invoice you, the more likely you are to get a discount, so paying every six months can save you a bit over monthly bills.

If you receive paper bills, mark the payment date, amount, method of payment (and confirmation number, if applicable) on the invoice and file it in the Financial section of your Family File System.

If you tend to go paperless, print a PDF or take a screen shot of the confirmation screen and keep it in a “paid invoices” folder on your computer, and be sure to able it clearly, like “2022-May Ins-Car.”

Re-shopping Insurance Policies

In April 2022, I made a few calls to investigate the rates of competitive auto and rental insurance policies. When I found an auto policy that was significantly lower than what I’d been paying (while not increasing my associated renter’s policy) for an equivalent policy with an equally reputable insurance company, I contacted my agent.

I was surprised, delighted, and then admittedly annoyed when my agent “magically” found me an even more competitive rate. (A reminder: companies generally do not go looking for ways to reduce consumer costs!) However, even though I was staying with my same insurance company where I’d been for 24+ years, my policy was technically with a new sub-company, and my “accident forgiveness” guarantee went away, as if I were a new policy holder. However, I was able to retain that status with a $20 one-time fee. Caveat emptor!

So, do consider shopping for better rates/discounts at least every couple of years. It’s not fun, but it’s not as inconvenient as you might imagine. If you like your current insurance agent/company, give them the opportunity to surprise, delight, and slightly annoy you by magically finding better rates.

Proof of Insurance Cards

This little card has your name and address, your car’s VIN, make, and model, your insurance company’s name and contact information, and your policy number. It is the only document that verifies the coverage on each of your cars, so keep your proof of insurance somewhere safe in case you need to present it to a police officer or someone with whom you’ve had a driving “misadventure,” or to have information handy if you need to file a claim or report damage to your insurer.

Most insurance companies provide two proof of insurance cards on one piece of paper with your policy renewal. Consider putting one in your wallet and one in your glove compartment. If your glove box is not always tidy, you may want to consider something that keeps important documents front and center, like this car insurance and registration card holder in a bright color.

Photo by

Photo by

Wow. This is the best, least intimidating, overview of car insurance I’ve ever read. I plan to save this article for my daughter when she needs to buy her own insurance. Cue happy dance…

Thank you so much, Melissa. I think we all know what we should do until we have to do it, so I’m glad she’ll have this backup!

First of all, even though you said you had a small fender bender, I hope you and your car are doing OK. What a great list of things to do and know about when it comes to car insurance, accidents, and being prepared.

One other thing that would be good to add to the list is making sure your cell phone is charged when you’re driving. Or at least have a cord to recharge it in your car. That way IF you get into a compromising or dangerous situation, you will be able to dial 911, the insurance company, the towing company, and a family or friend to be a supportive calming force in the midst of a crisis.

Thanks, Linda. Sometimes our own lives really do inspire blog post teachings. And yes, the damage to the car was minor, but ridiculously expensive (and thankfully, handled by the insurance company of the person who hit me).

And yes, one’s phone should ALWAYS be charged!

So great to read this post again. A few other things stood out.

It’s well worth taking the safe driver course (every 3 years.) It saves you a substantial amount on your insurance rates. And if you have two drivers on your policy (like I do,) and you both take the course, you save even more.

Another thing worth mentioning, which you alluded to, is when you purchase all of your insurance policies (auto, home, liability, etc.) through one company, they will often give you additional discounts for having multiple policies.

Lastly, thank you for the reminder to check rates every few years. It’s natural for things to increase, but it’s worth seeing if other companies can offer better rates. With that said, if your insurance company has been great and has helped you easily in various situations, it might be worth staying with them even if another company has lower rates. Good customer service around claims is worth a lot.

I haven’t taken the AARP course yet; the last time I looked, I wasn’t old enough (although I am an AARP member). I’m glad to get your stamp of approval, though!

And you’re right, though I did say you could get “multi-policy discounts if you carry homeowners’ or renters’ insurance with the same company” I didn’t go into as much detail as I could have. (LOL, I could have written an entire post about it!)

Luckily, in 25 years, I’ve only had two claims against my own insurance. Once, someone hit-and-ran my car in a grocery store parking lot; the other time, I just needed a window replacement due to a rock bouncing off a truck on the highway. Both times, the first thing the claims agent asked was, “Are you OK?” I like that!

Wow, so sorry to hear about the accident, Julie! That is never any fun. Reading this reminds me of how complicated life can be, and how unprepared we often are for the unexpected. I’m so glad you made it clear to call the police. You have one chance to do this, and even though it may feel tempting to simply exchange phone numbers and carry on, it is always wise to get a police report.

Thanks, Seana, and yes, it’s tempting to not involve the police, but a police report really protects everyone involved.

After reading this, I checked and discovered that I don’t have the police phone number in my contacts, so I looked it up and discovered that here you have to go to the Collision Reporting Centre and complete a form. I may have known that at one time, but it’s been so long (thankfully) since I needed the information that I’d forgotten. Thanks for making me think about this not so pleasant topic!

That’s me, Janet, forcing people to think of unpleasant things in the most charming way I can muster! 😉

I’m glad you’re more prepared now, but I hope you never need to avail yourself of any of it.

This is such an important topic. There have been occasions where I’ve had to sort through papers for clients who are in the middle of big insurance claims and it’s a headache.

I’m lucky that my husband has an insurance company and knows just what to do. It has saved me so much time. Except this one time when I needed help and he was in the gym and didn’t have his phone on him. Someone at the front desk finally found him on the treadmill -lol.

Just a few years ago, My car wouldn’t start. I had a problem with the engine. ( I now have a new car!) Luckily, I kept the emergency numbers on my phone and in the glove department. My phone had a flashlight so I was able to find what I was looking for as there was no light in the car.

It was in the middle of winter so it’s also helpful to keep a blanket in the car and bottles of water. If you’re in an accident you never know how long it will take to get help.

So true, Ronni. Yet another reason people shouldn’t put their coats on over their PJs to go out of milk or coffee or diapers at midnight. You never know!

Increasing your Excess or Payout amount can also decrease your premium. Depending on the age of your vehicle you may not always want to claim to get the damaged repaired (particularly if its a minor dent or scratch ie bumper bar.

Hi, Arthur. Thank you for sharing. For American readers, the Australian concept you refer to as “excess” is what we refer to as a deductible, and yes, we also adjust deductibles and coverage amounts (what you are referring to as payout amounts) as cars age. To your other point, while repair purely aesthetic damage can be debatable, most laymen can’t judge that by viewing. I was certain that the minor damage done by the person who hit me was purely aesthetic because the paint was merely scratched, but it turned out that an unseen reinforcement/stabilizing element had been damaged. This was covered by the other party’s insurance, and I was glad that I’d had it handled. Thanks again for writing!

Great information! We did the same thing, we found a better rate and went back to our agent, and he was able to adjust our rate. It is frustrating that they don’t offer new discounts to existing customers. Insurance agents have to feel like the customer is going to leave before they will do anything about it.

Sigh, it’s so true. It seems that too many companies, from insurance to cable to the phone service are more invested in gaining customers than keeping them loyal. It’s definitely to people’s advantage to shop for better pricing!

Thanks for reading.

Great job with this one, Julie! Clear, concise, and the bit about Bambi made me do a little snortle.

Heh, thanks, I aim to make my readers snortle! 😉