Archive for ‘Financial’ Category

Paper Doll Organizes Your Space, Money, and Well-Being While Traveling

The year is now officially half over. Have you used many of your paid vacation days? Have you used any of your vacation days?

One of the signs of toxic productivity is the sense that there’s always more work to do, more things to accomplish, and that vacation time will always be there. But the human mind needs rest just as much as the body, and going without both rest and recreation is a recipe for disaster.

Going without time off is called vacation deprivation, and according to Expedia’s 2023 Global Deprivation Report, Americans take 8-1/2 fewer vacation days than our global cousins, and nearly half (45%) of Americans left vacation days untaken last year. And that’s on top of the fact that we already receive fewer paid vacation days than most of the industrialized world.

Of course, even those who have vacation days and value the time off have been squeamish about traveling. (I’ll admit, I’m one of them.) COVID is still out there, and inflation means our hard-earned pennies don’t go as far.

Still, a staycation often doesn’t feel like a vacation, and getting out of Dodge for a while is a great opportunity to reset your perspective. So, let’s at least look at some options for saving time time and money and making the travel experience less stressful.

Of course, Paper Doll has covered travel-related topics before. Back in 2018, I wrote Paper Doll’s 5 Essential Lists For Planning an International Vacation.

For what it’s worth, it’s almost entirely applicable to domestic travel, too, and covers lists of:

- What to acquire for your trip

- What clothing and accessories to pack

- What other essentials to pack

- What to do before you leave

- Important phrases (admittedly, the most “international” of the lists)

For those who prefer to listen rather than read, much of the material covered was included in two interviews I did on the (much-missed) Smead podcast, embedded in Paper Doll on the Smead Podcast: Essential Lists For Organized Travel.

Today’s post is more along the lines of “travel tidbits,” a collection of nifty options for making travel situations more organized so you can focus your attention on relaxation.

GET SOME ELBOW ROOM AT THE AIRPORT

Let’s start with stuff. As you prepare to travel, you gather a lot of stuff to keep handy — to watch, to use, to eat. But it’s not always convenient to access it.

goDesk

Have you ever tried to set up an iPad so you and your traveling companion (or your tussling tiny humans) can watch a movie?

Have you ever tried to eat a meal balanced on your lap in the boarding area because there were no tables near the restaurants, but there were also no tables at your gate?

Do you know what’s is like to struggle to find something in your bag but there’s no place to put the items as you take out and sort through them?

Wouldn’t it be nice to have a desktop space when you’re traveling? But obviously, you don’t want to schlep around an actual desk when flying, and those beanbag-bottom laptop desk surfaces designed for when you’re sitting on your couch aren’t really workable in those teeny airport chairs. But I’ve recently found what seems like a nifty solution.

The goDesk lets you transform your rolling bag into a desk/entertainment center.

Taking advantage of the fact that almost all modern luggage pieces, particularly carry-ons, have those collapsible/telescoping handles, the goDesk can attach to your bags telescoping handle in seconds. It gives you enough desk space to securely hold a full-sized laptop, your airport meal, your child’s tablet, or the contents of your tumbled purse.

Later, when you’re ready to board, use the on/off release knob, and goDesk detaches in seconds. It’s got a slim profile, so you can just slide it in your outer luggage pocket.

The goDesk’s unique lock/latch system makes it compatible with most 4-wheel carry-on roller luggage, and it supports up to 12 pounds. The whole unit measures 11 1/2″ wide x 10″deep x 7/8″ high (with a 10″ x 10″ desktop surface) and ways only one pound.

There’s a flip-up media stand to use with iPads and other tablets, smart phones, or small books/notebooks, and a slide-out cup holder so you don’t have to worry about your beverage wobbling and spilling on the desktop surface (or your pricey devices).

The goDesk is made in the USA with TSA-approved materials and comes with a one-year warranty. It’s available from the goDesk website for $39.95 and ships with 2-3 day delivery.

AVOID EXCESS FEES WHILE TRAVELING

The first time I ever did any significant traveling without my family was when I was in college. I was going to be working on a special school-sponsored project in San Francisco. Although I had a debit card and a credit card, Paper Mommy took me to AAA to get American Express-backed travelers checks, where I dutifully filled out forms and signed the checks and registered them. I was told I would then countersign them when I used them to purchase anything, and if they were lost, I could easily get them replaced, just as Karl Malden promised in all those commercials.

I don’t know anyone who uses travelers checks anymore. Most of the time, you’re going to use a credit or debit card, or something like ApplePay from the wallet in your smart phone using magic technology. But sometimes, you want to have cash on hand, whether to tip a bellhop or give money to a talented busker or just pay in local currency.

The problem? When you aren’t getting cash from your own bank’s ATM, you’re likely to have to deal with an ATM surcharge fee. However, there are a few ways around that problem.

ATM Fees/Surcharges

In the US, different ATM machines (whether they are associated with banks or not) are affiliated with ATM networks. If you look on the back of your ATM card, you’ll see the network in which it participates, and there should not be a fee if you use an ATM that is also part of that network. So, if your bank uses STAR, or PULSE, or PLUS and you find an ATM in that network, there shouldn’t be a fee. However, it’s going to take some digging to get that information and locate the right ATM, and that will add frustration and take time out of your precious vacation.

ATM Keypad Photo by Eduardo Soares on Unsplash

Luckily, there are a few options to quickly identify which ATMs do not have surcharge fees.

The Allpoint Network has more than 55,000 fee-free ATMs. Download the app or use the website. Enter your zip code, and the Allpoint search will identify which ATMs in your vicinity do not charge a fee. Scroll through the map or list to find an ATM near your current location or in the neighborhood of where you’re planning to be. (Note: the app has a geolocator function, so you don’t have to type in your zip code, which is convenient when you’re traveling in a strange city and don’t necessarily know the zip code.)

Similarly, you can use the ATM locator on the MoneyPass website. Type in your zip code and then click on the “Search options” button. From the drop-down, make sure “All Surcharge-Free ATMs” is checked. (Other options include deposit-taking ATMs, handicapped-accessible ATMs, and 24-hour ATMs.) You’ll be able to see your options on a map and in a list.

If you’re traveling abroad and want cash, it can be especially frustrating, as surcharges may vary from non-existent to upwards of $8. (If you have to pay a flat fee rather than a percentage, consider taking out more money but less often so you won’t be drained by excess fees.)

For foreign ATM withdrawals, try ATM Fee Saver, available in 40 countries in North, South, and Central America, Europe, Africa and the Middle East, Asia, and Australia. ATM Fee Saver’s app is available for iOS and Android. The site also has a great blog with travel-related financial advice, like this one on the 9 best ways to save foreign ATM fees.

FIND A LITTLE EXTRA HELP IF YOU NEED IT

Traveling with a disability can up-end all kinds of travel plans. Whether you’re traveling with service animals, need alternative security measures (for example, if you have an implanted or attached medical advice), or will need a wheelchair or other accommodations at your destination, you’ll need to plan ahead.

To ensure that you’re getting all the right information you need, be sure to review the following resources:

Traveling with a Disability (Centers for Disease Control and Prevention) — This covers a wide variety of tasks, like contacting your physician in advance of your travel to ensure you have destination-specific care, acquiring MedicAlert jewelry or other notification-bearing items, to specialized considerations for air and cruise travel.

Traveling with a Disability (U.S. Department of Transportation) — This includes the Airline Passengers with Disabilities Bill of Rights and other helpful information.

Travel: Tips for People with Disabilities (DisabilityInfo.org)

10 Tips for Traveling With Physical Disabilities (Travel Channel)

Traveling abroad with disabilities: Here’s a post-pandemic guide (USA Today)

How to Travel with Invisible Disabilities (AARP)

6 Tour Companies Dedicated to Travelers with Disabilities (Condé Nast Traveler)

Speaking of disabilities, it’s been really gratifying to learn that great strides are being made in helping travelers living with invisible disabilities.

In case you’re unfamiliar with the term, invisible or hidden disabilities can refer to any type of disability that is not obvious. If you see a person in a wheelchair, using crutches, or walking with a white cane, that’s a visible disability. Invisible disabilities may relate to physical concerns that are not immediately apparent (anything from deafness to asthma, heart conditions to diabetes). But they may not be primarily physical in nature — consider Alzheimer’s, aphasia, dyslexia, autism, etc. Any of these can make traveling problematic.

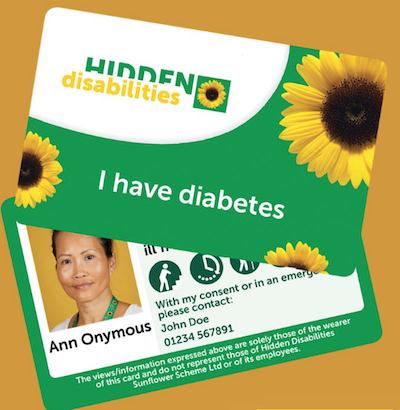

Hidden Disabilities Sunflower Program

Recently, I was fascinated to learn about the Hidden Disabilities Sunflower program. This program provides lanyards with yellow sunflowers on green backgrounds to alert airport and airline workers that the person wearing one might need some extra time or assistance. Imagine how much easier it would be to have people trained to look for the lanyard rather than always having to jockey in line to request assistance for yourself or someone with whom you’re traveling!

The key is that you don’t need to disclose your specific disability to get a lanyard, nor does the lanyard say why you need help, because “why?” is beside the point. Instead, workers are trained to recognize that individiuals wearing the lanyards may need help, support, or additional time, and should ask, “How may I help?”

That said, individuals can personalize the card (for purchase at a small fee) for their lanyard with up to five different icons (of 25 available) to help identify the kind of assistance they may need. For example:

![]() Hidden Disabilities Sunflower initially launched at the UK’s Gatwick Airport in 2016. The program has now grown to include about 216 airports worldwide in 30 nations, including 93 here in the United States (of which 19 will be launching the program soon). British Airways, Air France, and ten other airlines, along with many other businesses, have also signed on to participate in the program.

Hidden Disabilities Sunflower initially launched at the UK’s Gatwick Airport in 2016. The program has now grown to include about 216 airports worldwide in 30 nations, including 93 here in the United States (of which 19 will be launching the program soon). British Airways, Air France, and ten other airlines, along with many other businesses, have also signed on to participate in the program.

In addition to prioritizing assistance, airports and shopping venues are developing Sunflower programs. At the Pittsburgh airport, to help individuals with sensory issues, they’ve developed a room with tunnels, wall displays, rocking chairs and special lighting to create a soothing environment. The Seattle airport has a similar Sensory Room and Interfaith Prayer area.

Learning about this reminded me of the large tunnel between concourses at the Detroit airport with psychedelic lighting, which I originally saw in 2016. On each side of the tunnel, there’s a button to push so that people with epilepsy or other sensory issues for which the tunnel would create difficulties can stop the effects. Push the button and the strobe and lighting effects cease for the period it takes to cross to the other side, then start again soon after.

So far, the Hidden Disabilities Sunflower index includes more than 900 disabilities, and there’s a form to list any that have been missed.

The Sunflower lanyards are free.

Find an airport or business participating in the Hidden Disabilities Sunflower program here.

If you do travel in the coming months, I hope you have a safe, serene, and organized journey.

Lost & Found: Recover Unclaimed Money, Property, and Savings Bonds

Treasure Chest by Immo Wegmann on Unsplash

Treasure Chest by Immo Wegmann on Unsplash

There are many reasons to keep your paperwork organized, but I think the most compelling one is that many VIPs (very important papers) are the equivalent of money.

Your Social Security card, for example, is key to proving who you are, and if someone gets his or her hands on your card (or even just the number) and a little bit of other information, you may suffer from years of financial strife due to identity theft.

A lost last will and testament means that a family could have to spend months or years lacking access to resources promised to them because of the difficulty of proving the deceased’s intentions for funds and possessions.

If you lose your birth certificate, you may not be able to replace other essential documents if they go missing or get destroyed in a fire or natural disaster.

Lose your passport without enough time before an international trip, and your vacation or work plans could be scuttled, leaving aside the potential for identity theft of a more-than-financial nature.

Paper Doll has covered a wide variety of topics over the years on accessing lost documents, creating essential ones you lack, and keeping them all safe so they are not lost in the future. These posts include:

Ask Paper Doll: Do I Really Need A Safe Deposit Box?

How to Replace and Organize 7 Essential Government Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Protect and Organize Your COVID Vaccination Card

A New VIP: A Form You Didn’t Know You Needed

Today, we’re going consider options for recovering lost property. Consider it a treasure hunt!

RECLAIM LOST “PROPERTY”

When I say “property,” what do you think of? Perhaps real estate?

Maybe that reality show Property Brothers with Canadian twins Drew and Jonathan Scott?

When you hear “lost property,” it’s possible you think of the boilerplate language on one of those claim tickets you get when you leave your coat at the fancy coat check room at a swanky venue.

So What Is Unclaimed Property?

The term unclaimed property is what you’ll hear most often when searching for lost money in various types of accounts. Unclaimed property usually refers to funds that a government (federal, state, or local) or business owes you because you’ve, quite literally, left it unclaimed.

It’s possible that you’re so organized with your paperwork that you feel affronted that I’ve implied you might have just haphazardly left money sitting around. But I’m not saying you’re absent-mindedly leaving piles of cash wrapped in newspapers like Uncle Billy in It’s a Wonderful Life. (By the way, that $8000 deposit that ended up in Mr. Potter’s hands would be work $121,762 in 2023! Maybe Uncle Billy should have tied the money to one of those strings around his fingers.)

Thomas Mitchell as Uncle Billy, searching the bank’s trash cans for the lost Savings & Loan deposit.

There are all sorts of reasons money may get separated from its rightful owner.

Perhaps you put a security deposit down on an apartment when you were in college, but after graduation you were heading across the country to start your first job. Your roommate returned the keys to the landlords, got the OK that you hadn’t left the place in a horrifying state, and similarly disappeared into the adult world, leaving no forwarding address for either of you.

In many cases, by law, your security deposit was placed in an account (perhaps interest-bearing, perhaps not) and should have been returned to you when your lease ended. If your landlords were playing by the rules, rather than deciding to take the money and run, they should have turned it over to the state.

Similarly, it’s common to have to pay a deposit when opening an account for certain utilities. While some utilities keep these deposits until you move and close your account, others have (little-advertised) rules stating you can request your deposit be returned after a set period of good payment history. Sometimes, however, if you don’t actually request your deposit back, it just sits there, eventually going unclaimed, and being sent to the state.

When I helped one of my clients, a gentleman in his 60s, search for unclaimed property in his name, we found a life insurance policy that his parents took out in his name when he was an infant. It had long since stopped increasing in value, so he claimed it and cashed out.

Or maybe your Great Uncle Horace left you oodles of money in his will, but his last valid address for you was three states and 22 years ago? (My condolences on Horace. We always heard good things about him.)

Unclaimed property can be in the form of cash, uncashed checks (including stock dividends), insurance policies, abandoned bank accounts, forgotten security deposits, or even tangible property in the case of safe deposit boxes.

Life gets busy. It’s OK. Don’t play the blame game. Instead, play finders keepers and locate your missing money!

Where Can You Find Your Unclaimed Funds?

Unfortunately, there’s no central repository for all unclaimed property. Instead, you can search in each applicable state’s unclaimed property office.

Start with Unclaimed.org, the website of the National Association of Unclaimed Property Administrators.

Once there, scroll down and select your state by clicking on the location on the map. If you are from a United States territory like Puerto Rico or the U.S. Virgin Islands, or from one of several Canadian provinces (Alberta, British Columbia, New Brunswick, or Quebec), click on the appropriate link below the map, or use the yellow “Select Your State or Province” button. This will take you to a specific unclaimed property office, like the Office of New York State Comptroller’s Search for Lost Money page or Tennessee’s unclaimed property search (with a snazzy alternative address of ClaimItTN.gov).

To begin your search at any of these state sites, provide whatever information you have available, but at least a first and last name (or, if you’re searching money owed to a company or non-profit, the entity’s legal name). Some state search sites will also ask for a city in order to narrow the parameters.

If you want to search for multiple states simultaneously (let’s say you have lived in many locations, or you’re searching for abandoned accounts for a relative who has passed away and are unsure where they might have had lived), visit MissingMoney.com.

MissingMoney.com allows you to just type a first and last name, and all possibilities for that name, across all state databases, will come up.

Whether you use a state search or a multi-state search, the resulting page should provide a series of options. If you find a listing for yourself (or a relative), you’ll likely see some combination of the following information:

- the name of the owner of the unclaimed property

- any co-owner’s name, if applicable

- the last known address of the owner (possibly including the street address, city, state, and/or zip code, though some states hide some of the information)

- the state in which the unclaimed property is held (if you’re doing a multi-state search)

- the amount or value of money being held (which may be listed as an exact dollar amount, a range (like $50-$100, or >$500), or “undisclosed); if the property is tangible rather than monetary, you may or may not get a clue to what it might be.

How Do You Claim Your Funds?

If you find a match for unclaimed property on your state’s page or through MissingMoney.com, you’ll need to file a claim to prove that you own the account or property. Similarly, if you are claiming it on behalf of a relative who cannot act on their own behalf or a person who has passed away, you must prove their connection to the property as well as show that you are the party authorized to file a claim.

Whatever search method you choose, as long as you go through a government web site, know that searching for the unclaimed property is free, as is filing your claim. (Please don’t get scammed by a site promising to funds that are due to you anyway. While some services are valid and may relieve you of labor searching for large 5- and 6-digit recoveries, I encourage you to exhaust all free options first.)

Each state or province will have its own rules regarding claim submission. While most prefer you to submit your claim online, some still let you submit by mail. Answer all of the questions to the best of your ability, and assuming you are able to substantiate that you have a right to the funds, the account will be processed in due time and sent to you.

For individuals, businesses, and non-profits, you will have to submit proof of identity, address, and ownership. For individuals, your identity can usually be proven by a scan/copy of your driver’s license, passport, or Social Security number; please be cautious about transmitting your Social Security number through the mail and be sure you are using secure web sites marked HTTPS.

Proof of ownership of property will vary. Options might include your Social Security number, employment pay stubs, W2s or 1099s, or utility bills.

If you’re making a claim on behalf of someone who is living, you will need to provide the appropriate documentation, which might included a copy of a child’s birth certificate or legal adoption order (if the money is due to someone under 18), proof of a claimant’s age, and a court document or other signed legal documents proving you have the authority to act on the actual owner’s behalf. These could include letters of guardianship or conservatorship, a trust agreement, or a Power of Attorney document.

If you are making a claim on behalf of someone who has passed away, you’ll have to submit a death certificate as well as a will or other court documents, like a Small Estate Affidavit and a Table of Heirs. (These are state-specific.)

What To Do Once You Get Your Now-Claimed Funds?

After you submit your claim, if you are able to sufficiently able to prove your right to the funds, you will eventually be sent a check. Verifying your identity and rights to the funds can take a while, though many states try to complete the processing within thirty days.

Once you receive your money, usually by check, deposit the funds as soon as possible. Do not run the risk of losing the check and starting the whole process over!

Depending on the source of the funds, you may have to pay state and/or federal tax on the claimed money.

For example, if this is a deposit returned to you, you would not owe tax on the amount of your deposit, but tax might be due on any interest the account earned. The same is true regarding funds from abandoned bank accounts; the principal would not be income, but interest would likely be taxable. Of course, if the money would initially have been taxable had you received it on time (such as with stock dividends), it will still be taxable, but as income in the tax year in which you are receiving it.

What About Unclaimed Money in Other Countries?

Are you a fancy-schmancy world traveler? Maybe someone in your family lived abroad?

Unfortunately, there’s no central repository for tracking money left behind in your Tunisian bank account or a security deposit your mom paid during her semester abroad in Paris. (You may find some solace in the links collected by the Global Payroll Management Institute.)

However, the US government’s Foreign Claims Settlement Commission does oversee unpaid foreign claims for covered losses. That’s government-speak for money you are owed for lost funds or real property in the following circumstances:

- a foreign government “nationalizes” your property (whether that’s the money in your account or the house you owned)

- damage to property you owned that was caused by military operations

- injury to civilian and military personnel

If any of these apply to you, review the Unpaid Foreign Claims page and fill out a certification form (linked on that page). There’s also a link for Standard Form 1055, if you’re filing on behalf of someone who has died.

LOST SAVINGS BONDS

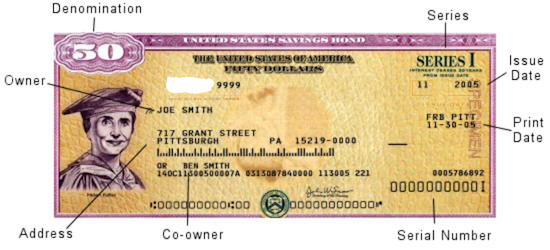

Once upon a time, it was popular to give United States savings bonds as gifts when people got married, had babies, graduated from college, got confirmed or Bar or Bat Mitzvahed, or otherwise had a rite of passage.

In ye olden days, you’d go to your bank to buy a savings bond, and get a receipt for your purchase as well as a paper certificate to give to the recipient. With the old EE savings bonds, you could purchase a bond at half the face value, and then a few decades later, your investment would double to the face value. If you waited a little longer, the bond would keep earning interest, at least for a while. (If your bonds are more than 30 years old, they have likely stopped earning interest.)

Nowadays, savings bonds are registered electronically, which makes everything much easier. However, with the old bonds, without the certificates in hand, the process gets complicated.

The problem was that these called SAVINGS bonds — but people often treated them as if they were called “throwing-them-in-a-box-hidden-under-the-bed” bonds. That’s fine for a while, but once your bond stops earning interest, it would make sense to cash it in and find another wise investment option. That’s hard to do if you don’t have the bond.

What Should You Do If You Can’t Find Your Savings Bonds?

If you’re sure you have savings bonds, but can’t find your paperwork, you have a few alternatives:

- Check your safe deposit box or fireproof safe — Free, except for the value of your time.

- Search through those boxes of stuff your parents or guardians gave you when they retired to Boca or Shadytime Retirement Village. Again, free except for the value of your time.

- Ask your family members to check their safe deposit box(es) and/or fireproof safe(s) and send you (via secure shipping) your bond certificates — Depending on whether you live across the street or across the country from your loved ones, this will come at variable cost in terms of their time, delivery service fees, and you getting roped into providing IT support for your parents now that they’ve got you on the phone.

- Contact the Feds — If you can’t find your bonds, or know they were definitely lost, stolen, or damaged, this may be your only alternative.

If you’ve lost your original savings bond’s nifty tangible certificate, you have two options:

- replace your original bond with a digital* bond (held in your Treasury Direct account); or

- cash in your bond (possibly losing value if you decide to cash it in before it has reached maturity)

*Note: If your lost bond is a now-defunct HH bond, you can get a substitute paper bond. For EE or I-series, they must be digital

If you’re really lucky, even if you’ve lost the actual bond, someone in your family may have kept track of the serial number of the bond. If not, you’ll have to help the government perform a search. Go to the U.S. Treasury’s website at www.TreasuryDirect.com and fill out Form 1048 to locate savings bonds registered all the way back to 1935.

Random Treasury Trivia

EE savings bonds took the place of World War II-era E-series or “Liberty bonds,” which date back to WWI!

HH-series bonds, popular as gifts for GenXers and Millennials, only came in the paper format and existed from 1980 through 2004, and they stop earning interest in 2024. That’s next year. Yes, really. So it’s a good time to start looking for your HH bonds! I-series bonds were introduced in 1998.

Interested in buying bonds but not sure how they work? Treasury Direct has a whole page comparing EE and I-series bonds. Be sure to check out the rules and options for buying savings bonds.)

On Form 1048, you’ll be asked to provide as much information as possible, including the:

- Issue date (or a range of dates, if you are uncertain)

- Bond certificate serial numbers (if you have them)

- Inscription information on the bonds, including names, addresses as Social Security numbers.

- Whether the bonds were lost, stolen or destroyed. If the bonds were stolen and a police report was made, you will need to append that, as well. The government wants to know all the gory details, so if your Great-Aunt Gertrude started a food fight at Thanksgiving and your savings bonds were drowned in gravy, explain. Or, y’know, explain if your town had a flood. Whatever.

- If you are not the named party on the bond certificate, you will have to explain your right to access the bonds; for example, are you the parent or guardian of a minor, the conservator or legal representative of another adult, or the executor of the will of a now-deceased party? (Note: if the person named on the bond is deceased, you will also need to include a certified copy of the death certificate.)

- Then, you’ll have to state whether you want substitute (digitally-held) bonds or payment in return for cashing in your bond.

You will need the form to be certified by a Notary Public. Review Paper Doll’s Ultimate Guide to Getting a Document Notarized for your options.

Finally, mail the form to:

Treasury Retail Securities Services

P.O. Box 9150

Minneapolis, MN 55480-9150

What If You’re Not Even Sure If There Were Savings Bonds?

All of the above tells you what to do if you know you received the bonds, but they’ve since been lost, stolen, or destroyed (as in irretrievably folded, spindled, or mutilated…or drowned in gravy).

But maybe you’re not sure if your hazily-recalled bonds ever existed? Maybe you (or someone on your behalf) purchased bonds but they never arrived. Maybe you got hit on the head with a falling anvil and can’t remember if you ever had a bond, or maybe you think a deceased loved one owned savings bonds but you can’t find them?

If any of the above situations apply, visit the Department of the Treasury’s Treasury Hunt link. Enter your (or your loved one’s) Social Security number and state, and if there’s a match, the site will let you know what to do next to locate matured savings bonds, those that are uncashed but no longer earning interest.

This just scratches the surface of the unclaimed funds, property, and financial instruments that can be recovered with a little bit of effort. Invest a few moments to let your fingers do the walking and see if you can recover what’s been lost.

If you DO find money owed to you, please come back and share the story (but not confidential information) in the comments.

Organize for an Accident: Don’t Crash Your Car Insurance Paperwork [UPDATED]

[Editor’s note: This post originally appeared on Paper Doll on 1/23/2020 and has been revised and updated as of 8/8/2022. As many college students are headed off or back to their universities with cars, this is an ideal time to discuss the finer points of auto insurance.]

(Image by Andrea Closier on Pixabay)

What happens when an unstoppable force meets an immovable object?

In January 2020, Paper Doll was sitting at a traffic light, preparing to make a turn, when the car behind me answered that physics question. Luckily, it was more of a THUD or a BAM than a CRUNCH. However, even the most minor of fender benders can be scary and overwhelming. It’s definitely not the time to wish you’d been more organized with your car insurance paperwork.

Even the most minor of fender benders can be scary and overwhelming. It's definitely not the time to wish you'd been more organized with your car insurance paperwork. Click To TweetToday, we’re going to look at the different kinds of paperwork you need, and how to organize it, to make sure you are protected and confident regarding your car insurance.

APPLYING FOR CAR INSURANCE

Whether you’re new to driving, are changing insurance companies, or are insuring a new car in your household, there are certain documents you’re going to need when you apply. Having everything in order ahead of time will make the process move more smoothly. You will need information about yourself, any other drivers covered on the policy, and the vehicle, such as:

Social Security Number(s) — You will need the SSN of anyone who is to be covered on your policy.

Your Driver’s License — Some insurance companies will only need the license number; more old-school agents may want a photocopy of your license. If, like me, you don’t like letting your license out of your hands, make a few photocopies of your license and you’ll have them when you need them.

Your insurance company isn’t just verifying that you are licensed to drive. They’re going to check your driving record — also called a Motor Vehicle Report (MVR) in some areas — to verify that your license hasn’t expired or been suspended, and to see whether you’ve had any accidents, convictions, or traffic violations. Most states look at your driving record for the last three years; however, there are exceptions. Kansas and New Jersey reports go back five years; Colorado, Indiana, and West Virginia look back seven years.

WalletHub has a state-by-state guide to getting a copy of your MVR, with links, in case you want to check it for accuracy before seeking insurance. In my state, I can get a copy for $5 in person or or online; nationwide, costs range from $2 to $25 (sometimes plus processing fees to use debit/credit cards) per report. Be prepared to use an authentication app, like Google Authenticator, or receive a text or email or verify your identity.

Do not be scammed into using a non-governmental service that promises to get your MVR online for you; they up-charge a significant amount and are usually not any faster than going through your state’s website.

Financial History — Insurance companies do standard credit checks, so it’s a good idea to check your credit history at AnnualCreditReport.com (and not one of the shady copycats), as well as your credit score, to make sure there are no mistakes.

Your Current Insurance Declarations Page – You know that long page (or set of pages) in your policy with big numbers like $300,000/$500,000? (More on that, below.) Having that page will allow your new insurer to provide you with an apples-to-apples quote.

Vehicle Information Number (VIN) — This 17-character identifier is unique to your car and is built into your dashboard or imprinted in your driver’s side door frame. Your insurer uses this to verify that the car is not stolen and doesn’t have any problematic history.

Discount-Related Paperwork — There are a variety of ways to get a discount on car insurance. Your driving record (MVR) will verify if you qualify for a “good driver” discount, and you (or your teenager or college student) may be able to submit a current report card to qualify for a “good student” discount. To get the discount, students usually need to be under 25 and have no at-fault or moving violations on their MVR. A GPA of 3.0 (on a 4.0 scale) or Honor Roll/Dean’s List status is generally required.

You can also get multi-car discounts if you and your spouse both have cars, or multi-policy discounts if you carry homeowners’ or renters’ insurance with the same company.

If you’re over a certain age, you may be able to take a safe driver course, like one offered by AARP, to lower your rates.

You might be eligible for affinity discounts if you are a member of certain clubs, organizations, alumni associations, or sororities/fraternities. There are also often occupational discounts for members of certain professions, including first responders and medical professionals, educators, and government employees, so it’s worth asking your agent what discounts exist before you get too far in the application process.

ORGANIZING YOUR INSURANCE PAPERWORK

Once you have an auto insurance policy in place, you’re going to have paperwork. The more organized you can be, up-front, the less stress you’ll have to deal with in case of an accident or other issue.

Policy

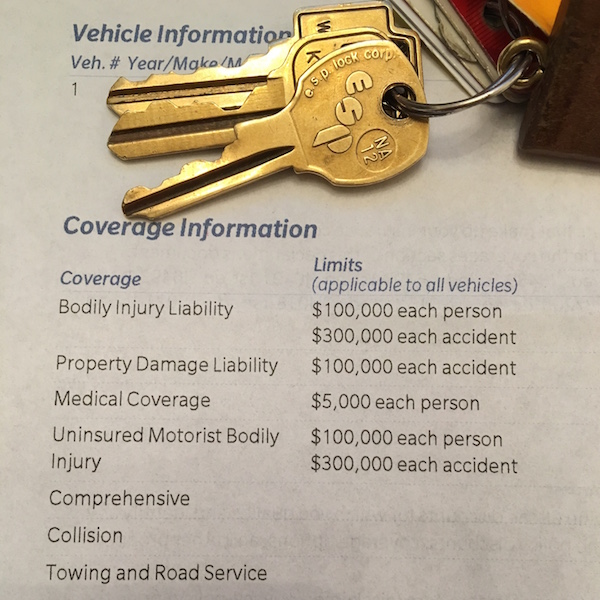

This is the multi-page legal document that tells you everything about your coverage. It can be overwhelming. Make sure you go over it with your insurance agent so that you know and understand the essential elements of your policy, particularly the items on your declarations page, which spells out your coverage:

- Liability (also called Bodily Injury Liability) — These are the limits on your policy per person per accident. You may see $100,000/$300,000, which means you’re covered for any medical expenses and/or lost wages for anyone (including other drivers, passengers, and even bystanders) injured in an accident you cause, up to that amount.

- Property Damage — This pays to repair or replace things that get damaged (in an accident you cause), like other people’s cars, items in their cars that get damaged, actual property (like someone’s garage or mailbox). The dollar limit is quoted per accident. Be sure you understand the difference between collision and comprehensive. Collision covers damage to your car when it collides with another car, or a tree, or a Bob’s Big Boy. Comprehensive covers damage to your car caused by things like vandalism or theft by hooligans, or “natural” disasters (hail, tornadoes), a tree toppling onto your car, or Bambi taking a running leap at your hood.

Your policy may combine liability and property damage into one category, so you might see it listed with three numbers, like “100/300/50” which means $100,000 for injuries per person, $300,000 for total injuries per accident, $50,000 for damages to property.

Depending on your state, your policy may also have (or even require) special types of insurance options, like:

- Uninsured and underinsured motorist coverage — If someone hits you but doesn’t have enough (or any!) insurance, it will cover injuries if you or your passengers get hurt. Basically, you’re insuring yourself against people who aren’t responsible enough to have (enough) insurance. There’s also a line item for uninsured motorist property damage; as you may have guessed, it covers your car if the person who hits you doesn’t have insurance.

- Personal injury protection insurance (PIP) — If you live in a “no-fault” state, this pays out for medical expenses for minor injuries or lost wages for you or your passengers. (Liability coverage is only invoked if the costs go beyond what PIP covers.)

- Medical payment coverage — Like PIP, this covers you or your passengers’ accident-related injuries, no matter which driver is at fault. It doesn’t cover lost wages, and the limits tend to be $5,000-10,000.

Your policy may also cover things like glass replacement damage, towing and road service, accident forgiveness (to keep your rates from going up after an accident claim) and loss of use (for a car rental while a vehicle is being repaired).

I encourage clients to make a file folder for each insurance policy they own (auto insurance, homeowners, etc.) and keep it in the Legal section of your Family File System.

The declarations page is a good cheat sheet for all of your coverage. You may want to make a photocopy and keep it in your glove compartment, or take a photo/scan to save in Evernote, Dropbox, or a similar app accessible on your phone.

Notes for Canadian Readers

Please note that all of the above refers to purchasing auto insurance in the United States. In Canada, different language is used. For example, in addition to provincial and territorial mandatory coverage, there are optional policies including “collision, specified perils, comprehensive, and all perils.” If you are seeking information regarding auto insurance (and organizing insurance paperwork) in Canada, please confer with an insurance professional (or a member of Professional Organizers in Canada).

Bills for Premiums

Insurance companies usually give you the option of paying annually, twice per year, or monthly. The less often they have to invoice you, the more likely you are to get a discount, so paying every six months can save you a bit over monthly bills.

If you receive paper bills, mark the payment date, amount, method of payment (and confirmation number, if applicable) on the invoice and file it in the Financial section of your Family File System.

If you tend to go paperless, print a PDF or take a screen shot of the confirmation screen and keep it in a “paid invoices” folder on your computer, and be sure to able it clearly, like “2022-May Ins-Car.”

Re-shopping Insurance Policies

In April 2022, I made a few calls to investigate the rates of competitive auto and rental insurance policies. When I found an auto policy that was significantly lower than what I’d been paying (while not increasing my associated renter’s policy) for an equivalent policy with an equally reputable insurance company, I contacted my agent.

I was surprised, delighted, and then admittedly annoyed when my agent “magically” found me an even more competitive rate. (A reminder: companies generally do not go looking for ways to reduce consumer costs!) However, even though I was staying with my same insurance company where I’d been for 24+ years, my policy was technically with a new sub-company, and my “accident forgiveness” guarantee went away, as if I were a new policy holder. However, I was able to retain that status with a $20 one-time fee. Caveat emptor!

So, do consider shopping for better rates/discounts at least every couple of years. It’s not fun, but it’s not as inconvenient as you might imagine. If you like your current insurance agent/company, give them the opportunity to surprise, delight, and slightly annoy you by magically finding better rates.

Proof of Insurance Cards

This little card has your name and address, your car’s VIN, make, and model, your insurance company’s name and contact information, and your policy number. It is the only document that verifies the coverage on each of your cars, so keep your proof of insurance somewhere safe in case you need to present it to a police officer or someone with whom you’ve had a driving “misadventure,” or to have information handy if you need to file a claim or report damage to your insurer.

Most insurance companies provide two proof of insurance cards on one piece of paper with your policy renewal. Consider putting one in your wallet and one in your glove compartment. If your glove box is not always tidy, you may want to consider something that keeps important documents front and center, like this car insurance and registration card holder in a bright color.

Organize Back-to-School Savings: Tax-Free Holidays & Discount Codes

Photo by Kelli Tungay on Unsplash

Finances are tight these days. (Let’s be real — when aren’t they?) Inflation is frustrating our bank balances, and corporations are reaping record profits, frustrating our sense of fairness and propriety. Energy costs are surging just as it’s ridiculously hot in most of North America (and elsewhere). And while gas prices have dropped 40-straight-days as of the writing of this post, it’s not like that makes it any more delightful to pay at the pump.

And now, shockingly, it’s time to start thinking about organizing for back-to-school shopping.

Depending on where you live, you’re either nodding or looking shocked; if it’s the latter, it’s because you live, like I did when I grew up in Buffalo, New York, where kids don’t go back to school until after Labor Day. So for you, talking about back-to-school in July is like putting up Christmas decorations right after Halloween. (Oy. Never mind.)

The point is, there’s something going on right about now that can help you organize your financial resources for the back-to-school period.

ORGANIZE YOUR FINANCES WITH TAX-FREE HOLIDAYS

Throughout the year, many states have tax-free holiday weekends or weeks, and they are usually clustered in these mid-summer weeks to coincide with the back-to-school season for the southern states, where students return to school in early August, rather than post-Labor Day.

These states generally allow retailers to sell clothing and footwear, school supplies, computers, and sometimes backpacks, books, and other “tangible personal property” without charging sales tax. In my state, that’s a savings of 9.25%. Combine that with various 10%-off to 40%-off sales, and that’s a great opportunity to stock up on necessities.

Seventeen states scheduled back-to-school tax-free holiday weekends or weeks in 2022. If your state is not listed below, consider clicking on the name of your nearest state to be directed to that state’s official tax-free holiday page.

Note: Alabama’s tax-free holiday period has already occurred (July 15-17, 2022, and generally starts on the third Friday in July and ends at midnight on the following Sunday); watch the Alabama Department of Revenue website for 2023’s schedule.

Arkansas (August 6-7, 2022)

Tax-free: Clothing and footwear (up to $100); clothing accessories and equipment (up to $50); school and academic art supplies; scholastic instructional materials (including, but not limited to books) (no dollar limit)

Connecticut (August 21-27, 2022)

Tax-free: Clothing and footwear (up to $100)

Florida (various tax-free dates — see below)

May 14-August 14, 2022: children’s books

July 25-August 7, 2022: Clothing, footwear, and accessories (up to $100); school supplies (up to $50); learning aids and jigsaw puzzles (up to $30); computers and accessories for personal/non-commercial use (up to $1500).

Note: this overlaps with a year-long tax-free Florida holiday on baby/children’s clothing, shoes, and diapers, from July 1, 2022-June 30, 2023.

Illinois (August 5-14, 2022)

Reduced tax rate to 1.25%: Clothing and school supplies (up to $125)

Iowa (August 5-6, 2022)

Tax-free: Clothing and footwear (up to $100)

Maryland (August 14-20, 2022)

Tax-free: Clothing & footwear (up to $100)

Mississippi (July 29-30, 2022)

Tax-free: Clothing & footwear (up to $100)

Missouri (August 5-7, 2022)

Tax-free: Clothing (up to $100); computers/peripherals (up to $1,500); software (up to $350); graphing calculators (up to $150); school supplies (up to $50)

New Mexico (August 5-7, 2022)

Tax-free: Clothing and footwear (up to $100); desktop or laptop computers, tablets or notebooks (up to $1,000); computer peripherals/hardware (up to $500); school supplies (up to $30)

Ohio (August 5-7, 2022)

Tax-free: Clothing (up to $75); school supplies (up to $20)

Oklahoma (August 5-7, 2022)

Tax-free: Clothing and footwear (up to $100)

South Carolina (August 5-7, 2022)

Tax-free: Clothing and shoes (no limit); school supplies (no limit); backpacks (no limit); computers, printers, peripherals, and software (no limit)

Tennessee (July 29-31, 2022)

Tax-free: Clothing (up to $100); school and art supplies (up to $100); desktop, laptop, and tablet computers (up to $1,500)

Texas (August 5-7, 2022)

Tax-free: Clothing and accessories; footwear; school supplies; and backpacks (each up to $100)

Virginia (August 5-7, 2022)

Tax-free: Clothing, accessories, and footwear (up to $100); school supplies (up to $20)

West Virginia (August 5-8, 2022)

Tax-free: Clothing (up to $125 limit); accessories, and footwear (up to $100); school supplies (up to $20)

In most cases, retailers should abide by the discounts or tax-free status whether the purchases are made at brick & mortar stores, online, or by phone.

However, so that you don’t experience any surprises, be sure to double-check that the online/phone venues from which you order understand your state’s tax holiday regulations. (In case you’re wondering, yes, Amazon participates in state sales tax holidays as long as you purchase the products exempted during your state’s tax holiday. And no, I have no idea how Amazon’s computers work that magic. I still haven’t figured out how Kohl’s magically makes my receipt so much less than I’m always expecting!)

Tax-free holiday tips:

- The price limits above generally refer to the price-per-item cost, not your entire purchase. If the per-item limit is $100 and your entire bill for clothing comes to $250, but no one item is more than $100, you’re golden.

- Make a list of what each family member needs before you get to the store. (Check with your school to see if a grade-appropriate supply list has been posted online. If your school does not provide a list prior to the start of the school year, consider an online supply list organized by grade level.) It’s tempting to buy anything that seems like a bargain, but acquiring what you don’t need just because it’s a “deal” is the fast track to clutter.

- Set a budget for each shopping category so that you’re not tempted to go hog-wild, and consider what each of your students might need vs. what you can keep in a central home school supply area for all to share.

- Shopping with smaller children may stress you (and your kids) out, so consider trading shopping and babysitting time with a friend or split babysitter costs while you and your friend hunt for bargains together.

- Let older children participate — use it as an opportunity to practice math skills (“How much is this shirt if it’s marked as 15% off?”) and encourage them in finding good deals on high-quality products. The more responsible they are, perhaps reward them with the amount by which they came in under budget to apply toward something fun.

- Remember to keep your receipts in case you need to return something; note each retailer’s return policy. Again, this is a great opportunity to teach financial and organizing skills. Show them how you calculated your budget and checked the purchases against the bottom line. Have tweens and teens help you take note of return policy dates and file receipts pending any possible returns.

- Remember that tax-free holidays aren’t just for kids! In most cases, there’s a $100 limit on clothing and shoes for any age person. After all, a shirt a 15-year-old can wear might just as easily be worn by a 30-year-old, and there’s very little way to differentiate school supplies from office supplies. (What do you mean grownups aren’t supposed to use unicorn stickers and fuzzy troll pencil toppers?)

- I’m going to say this a second time — set a budget. And stick to it. The point of saving money is to have more of it, not to buy more of what you don’t necessarily need. Focus on needs, then surprise and delight yourself and your kids with a few wants, as well.

And as long as we’re talking about saving money, here are a few discounts of which you might want to take advantage, as long as you’re doing the back-to-school thing.

Bixbee

Nobody likes sales emails, but I have to admit it. Once I learned of Bixbee a few years ago, I became obsessed with their cool kid products, which include backbacks, lunchboxes, sleeping bags, and kids’ accessories.

Bixbee, maker of ergonomically-smart backpacks built with the anatomy of tiny humans in mind, has some products that will charm your kids (and their spines) and keep clutter at bay.

Also, if your kids’ backpacks or lunchboxes are super-cool and fun, they’re less likely to leave them on the bus, or in their gym lockers, or just lose them altogether, which means you won’t have to make duplicate purchases…which means you save money. Whoohoo!

Bixbee also has delightful luggage and duffels for ease of traveling, rain boots and T-shirts, water bottles and just a whole bunch of kid-friendly goofiness.

You didn’t ask me, but of course I have favorites, like the Sparkalicious Ruby Raspberry Butterflyer Backpack

and the Monkey Backpack and the matching Monkey Lunchbox:

Bixbee is having a back-to-school sale. Get 25% off any purchase with the code BACK2SCHOOL but hurry, because this discount code expires on Wednesday, July 27, 2022!

Bixbee is also offering free Standard Shipping (for US customers only) on all orders over $60.00 and a FREE folder and stickers with every backpack order! (Who doesn’t love stickers?)

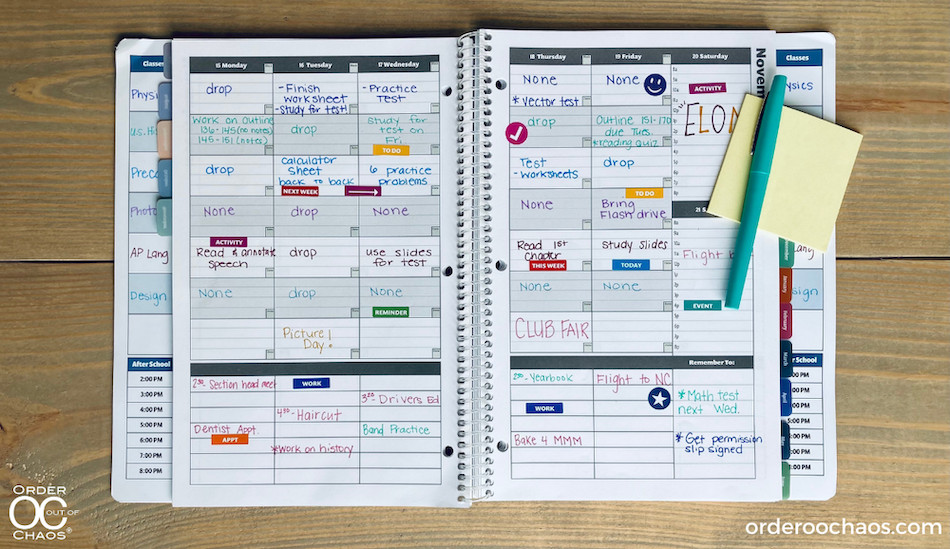

Academic Planner: A Tool for Time Management®

If you’ve been a reader of the Paper Doll blog for a while, then you know that professional organizer Leslie Josel of Order Out of Chaos, is a colleague, friend, and fellow Cornell University alum. And I love every darned thing this smarty-skirt does!

(For more about Leslie, you can read Paper Doll Peeks Behind the Curtain with Superstar Coach, Author & Speaker Leslie Josel. Go. Read. Come back. We’ll wait.)

Paper Doll with Leslie Josel, © 2017 Best Results Organizing

I’ve written many, many times about Leslie’s Academic Planner: A Tool for Time Management®. The central concept behind the planner is the need to better enable students to “see” time and all of the related obligations. If you’re brand new to the Academic Planner, you can start here:

The Academic Planner has even won the 2018, 2020, and 2022 Family Choice Award!

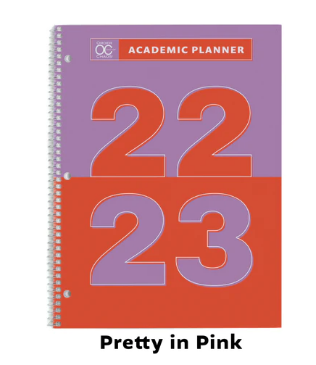

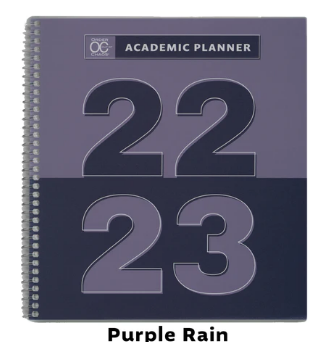

The spiral-bound 2022-2023 Academic Planner comes in two sizes: letter-sized planner with after-school planning (8 1/2″ x 11″) and smaller personal-sized with all-day planning (8 1/4″ x 8 1/2″), both for $19.99. Based on an academic year calendar, the planners run July through June.

The spiral-bound 2022-2023 Academic Planner comes in two sizes: letter-sized planner with after-school planning (8 1/2″ x 11″) and smaller personal-sized with all-day planning (8 1/4″ x 8 1/2″), both for $19.99. Based on an academic year calendar, the planners run July through June.

Four styles of planners in each size

The letter-sized planners with after-school planning come in LimeLight, Pretty In Pink, Blues Brothers, and WhiteOut. The interior pages measure 7” x 11”, offering up more than the typical space for writing down assignments and activities. It has 7 subject boxes and after-school planning capabilities starting at 2p.m., and is ideal for elementary, middle, and high school students and those that are virtual learning or homeschooled.

The smaller, personal-sized planner with all-day planning come in Men in Black, Purple Rain, Yellow Submarine, and AquaMan. They have 6 subject boxes and all-day planning capabilities, starting at 8:00am. These work well for high school, college, and homeschool students and even adults!

Introductory Pages

The front pages, measuring the same size as the front and rear cover of the planner, include:

- a contact information section so a lost planner can be easily returned

- a class schedule (subject, period, instructor, room #, days) to quickly acclimate students for the new year (and give a fellow student, armed with the contact info, an easy way to find the owner at the right classroom and return a lost planner)

- a Welcome Letter from Leslie to parents

- a detailed set of Planner Pointers, providing excellent guiding tips for making smart use of the planner. (My favorite? Writing “No Homework” if none was assigned so the student never has to wonder if he or she just forgot to write something down.)

- a two-page Planner Use Guide, showing the planner in action — noting assignments, reminders (“Get permission slips signed!”), after-school activities and previews for the next week

- a Study Planning Guide to help prepare for tests and quizzes

- a sample Project Planning Guide to help plan long-term assignments

- a two-page School Year at a Glance

Planner Pages

On the first and last (extra-sturdy) full-sized, the Academic Planner has a vertical index page that peeks out from behind (and to the left and right) of the actual planner pages. This index page means that students record their class subjects only once. Then everything on the upper calendar sections of the planner pages lines up with the appropriate class subjects, course by course, horizontally (with days of the week arrayed, vertically) across a two-page layout.

The next row in the smaller planner is for To-Do items by day. In the letter-sized planners, the left and right front pages provide hourly slots from 2 p.m. until 8 p.m. for students to log after school activities and obligations, like clubs, athletic practice, rehearsals, and jobs.

Other Features

- At the start of each month, there’s a left-side full-page monthly calendar with space to note major events, holidays, and vacations, and adequately plan longer-term projects.

- The right-side Notes page facing the calendar offers up ample room for planning, notes, and the kinds of serious thoughts only people between 12 and 18 can understand.

- There’s a clear poly pocket at the rear of the planner for safely keeping notes, permission slips, and other documents too small for a student’s binder.

- There are oodles of extras, like a library of printouts, downloads, videos, and “how-tos”, as well as downloadable resources like Project and Study Planning Guides, Time Trackers, Homework Checklists, Planner Pointers, Study Skills Videos.

- A bonus Academic Planner Accessories Pack (sold separately, for $10.99) includes a plastic page marker that clips into the spiral binding, so it’s easy to find the current week in the planner, a set of monthly tabs, and a really bright, sunny set of useful stickers.

Whew! That was a lot. To really do justice to the 2022-2023 Academic Planner: A Tool for Time Management®, take a detailed walk-through with Leslie herself. It’s like having a private coaching session!

Whew! That was a lot. To really do justice to the 2022-2023 Academic Planner: A Tool for Time Management®, take a detailed walk-through with Leslie herself. It’s like having a private coaching session!

And since this post is about saving money for back-to-school, use the promo code PLANNER20 at checkout to get 20% off any academic planners you purchase directly from the Order Out of Chaos website. This promo code expires September 30, 2022.

(If you prefer to order through Amazon, the 8 1/2″ x11″ planner and 8 1/2″ x 8 1/4″ planner sell for the same price.)

Enjoy your summer, but remember that a little planning and organizing now can make back-to-school shopping less costly, less stressful, and a bit more sunny!

And, just a reminder if you missed my last post, Paper Doll on Planning & Prioritizing for Leadership, we’re only one week into the free, 3-week, The Leader’s Asset interview series. You can still register and catch my interview this Wednesday, July 27, 2022.

Disclosure: Some of the links above are affiliate links, and I may get a small remuneration (at no additional cost to you) if you make a purchase after clicking through to the resulting pages. The opinions, as always, are my own. (Seriously, who else would claim them?)

Paper Doll’s 10-Minute Tasks to Make Difficult Moments Easier

Lately, I’ve been considering that it’s a bit ironic that February, the shortest month of the year, is National Time Management Month. We collectively assign the month with the fewest days to figure out how to achieve goals that would solve so many frustrations.

Wouldn’t a 31-day month be better for that?

A Necessary Caveat About “Time Management”

Time management, obviously, is a misnomer. We don’t really manage time, which is fixed. Every person gets the same 60 seconds every minute, the same 60 minutes every hour, the same 24 hours every day, and of course, 525,600 minutes in a year.

(With apologies to all of you who’d rather watch the Broadway version, linked above, than Glee‘s, but YouTube is really cracking down on music videos being played anywhere but their own platform.)

Rather, we must try to manage our attention, our energy, and our labor. Though we have the same amount of time, none of us has the exact same quality of our time, nor the same obligations.

The single, healthy, unencumbered twenty-something with a salaried office job has more (financial, as well as temporal) resources than the mom of two working multiple retail jobs, or the person going to school while taking care of an elderly parent, or the individual struggling to make it through these crazy times with a chronic illness, visible or invisible.

Often, when the media has articles on time-saving tasks, they fail to acknowledge the complexities of life. If you are beyond the juggling and are full-on struggling, we professional organizers and productivity consultants see you. And we know that when the you-know-what hits the fan, you’ve got limited energy and time to deal.

So, today’s post has ten-minute tasks (or projects that can be handled as a series of ten-minute tasks) that will make things easier for you and your family when things get “ouchie.”

Check and Update Your Beneficiaries

You don’t even have to do these all at once, though if your paperwork is already organized, it should only take you a couple minutes for each. Though the time investment is small, the ease of mind it will bring (both now, and in the future) is tremendous.

And yes, you can even consider these two separate tasks (the checking and the updating) so you can make two different checkmarks on your task list.

Pull out the file folders or head to your online accounts and check to see who you previously listed as your primary and secondary beneficiaries for any of the following you may have:

- life insurance policies

- annuities

- pension accounts

- Individual Retirement Accounts (IRAs)

- 401(k)s, 403(b)s, and other retirement accounts

- profit-sharing plans

- brokerage/investment accounts

Obviously, a beneficiary is someone who gets a benefit. When we’re looking at financial documents, beneficiaries are the people (or sometimes entities) that the account holder designates as the recipient of any assets in that account when the account holder eventually shuffles off this mortal coil. (I know, nobody likes to use the world “death” or think about it, but that’s why we have life insurance policies, wills, and similar accounts and documents — to make things easier when someone has passed away.)

“The Reading of the Will” — central to any good murder mystery

In most cases, setting a beneficiary (and usually both a primary and secondary beneficiary) is part of the required paperwork. Some states (usually “community property states”) require you to list your spouse (if you have one) as your primary beneficiary for retirement and other accounts.

You may be wondering, if you have a will, why do you need to name beneficiaries? That’s a darned good question.

The main reason is that when a person dies, a will goes through “probate,” a legal process where the court in your jurisdiction supervises all the assets in your estate getting distributed hither and yon. Depending on the situation, it can be murky and complicated, and take a long time, which is pretty miserable if your people need those funds.

However, whenever you have a beneficiary set in your insurance policies and various financial accounts, that money can go straight to your intended recipient as soon as the insurance or financial institution gets proof that you are no longer among us. That usually just amounts to a certified copy of the death certificate and some proper ID.

If you set your beneficiaries for any of these accounts several years ago, you may have picked someone no longer appropriate — parents who are no longer living (or not able to manage their own finances), former spouses or significant others, or even friends who are not part of your active life anymore.

I went through the “check the beneficiaries” process with one client who was shocked to realize that she’d never gone back to revise the beneficiary on a small 401(k) plan she’d never bothered to roll over from a job decades earlier. (Note to readers: don’t do that. Roll over your retirement accounts so you don’t have to hope your former employers have stayed solvent and managed your funds properly.)

Imagine my client’s shock when she realized that her [expletive deleted], [expletive deleted]ing [expletive] of a [expletive deleting] ex-[expletive deleted] husband was still her beneficiary! Be assured it did not take her ten full seconds, let alone minutes, to get cracking on changing that beneficiary!

Imagine my client's shock when she realized that her *expletive deleted*, *expletive deleted*ing *expletive* of a *expletive deleted*ing ex-*expletive deleted* husband was still her beneficiary! Click To TweetIf you never set your beneficiaries before or your want or need to change them, you’ll need a few pieces of information, like their Social Security numbers, birth dates, and contact information (like phone numbers, email addresses, and mailing addresses).

EXTRA CREDIT: Here’s a time-saver so you don’t have to go through this entire process in the future:

- Create a spreadsheet (or even a handwritten note) with the first column listing all of your account names.

- Create a column and list all of the beneficiaries as they stand now.

- Create a column entitled “as of” and list today’s date.

- Any time you acquire a new policy, add a line to this list. Any time you revise a beneficiary, revise the spreadsheet.

This way, whenever you’re not sure whether you’ve updated your beneficiary, you’ll only have to look in one place.

EXTRA, EXTRA CREDIT: Checking your beneficiaries is easy and quick. Changing/updating them should be easy, but how quickly you can accomplish it depends on whether your insurance or financial institution will let you do this all online. But making this list is definitely easy and quick.

However, to take it a step further, fancy-up this spreadsheet with another ten-minute (or so) task.

Add columns for your account number, and the name, email address, and phone number of your insurance agents and financial brokers associated with each policy or account. Create a column to explain what kind of policy or account it is. And then make sure that someone you trust, like the person who has your Power of Attorney, has a copy or can access it when/if necessary.

Put Your Emergency Contacts On Ice

“Downtown Hospital Ambulance” by sponki25 is licensed under CC BY 2.0

In the early 2000s, first responders in the UK started suggesting that people list their “In Case of Emergency” contacts as “ICE” on their cell phones to make those contacts easy to locate. The idea quickly took hold in North America.

While first responders, themselves, generally don’t have the time (or authorization) to contact someone for you, nurses and hospital staff often do need to obtain important medical information when you are not able to provide it. That’s where your contacts come in.

As cell phones got fancier, the lock screens made accessing ICE contacts more difficult, but now, even if you are not able to respond, medical personnel may be able to use your thumb print access or facial recognition to get your emergency contact info.

But there’s something else you can quickly do to make sure your emergency contacts can, um, get contacted. Add your emergency contacts to your cell phone’s lock screen.

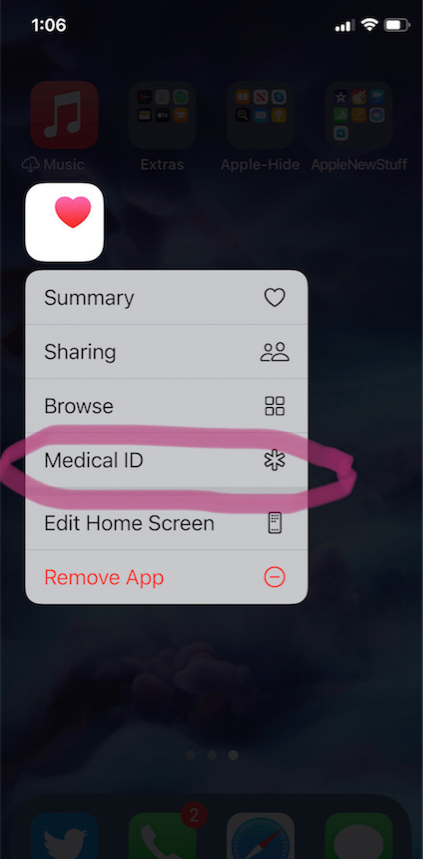

On an iPhone:

1) Go to the Medical ID screen. You can get there one of three ways:

- Long-press on the Health app icon. That will bring up a screen that looks like this:

- You can also manually open the Health App by tapping on it, then on your profile image, and then selecting Medical ID.

- Or go to Settings, then Health, then Medical ID.

2) Tap Edit.

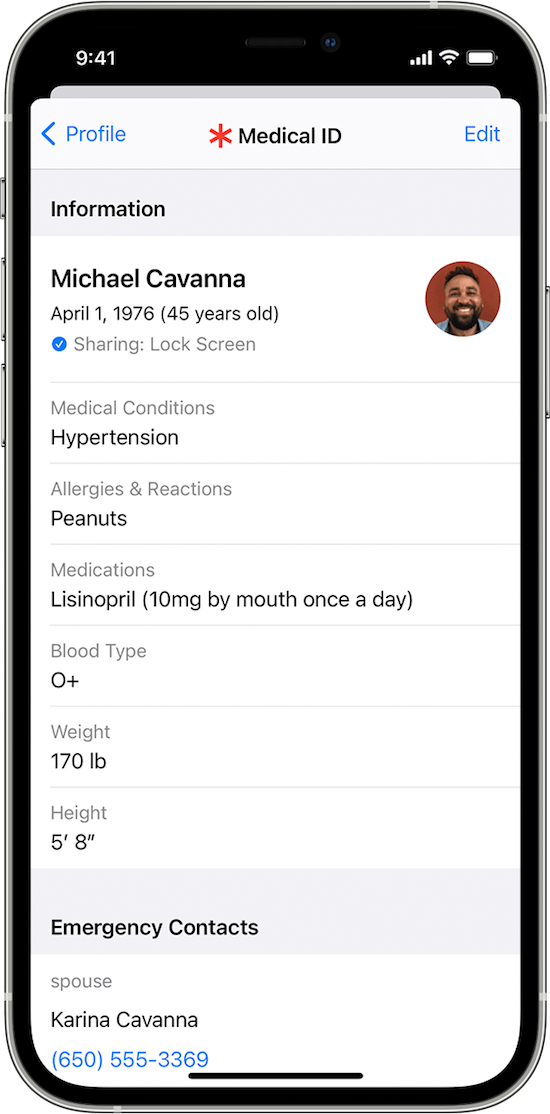

3) Fill in all the fields that you want, but if there’s nothing significant, it’s better to type “none” than to leave it blank (so that you’re not leaving anything open to interpretation). There are fields for medical conditions, allergies, medications, blood type, weight, height, and emergency contacts. (Bingo!)

At the top, there’s an option to put in your photo. Do that; it ensures that an emergency responder can verify this is your phone.

4) Choose a name and phone number (or two names and numbers) for your Emergency Contact(s). Be sure you select names/numbers that already exist in your contacts list.

5) Scroll down to the section for Emergency Access.

6) Enable “Show When Locked” and “Share During Emergency Call.”

7) Tap “Done” at the top right corner to save your info.

Now, go look at your lock screen. You should see the word “Emergency” in the lower left corner of your iPhone. If your phone is locked and someone taps that, they can see your emergency information but nothing else.

If you don’t see the word “Emergency” there, hold down your power button (or power and volume-down buttons) as if you were going to turn off your phone and you’ll see the Medical ID access. (I guess it all depends on which version of iOS you’re using.)

For more information about the iOS Medical ID, Apple has a detailed page of instructions and explanations.

Assuming you have a photo somewhere on your phone to add in the photo field, this can usually be completed in well under 10 minutes. (The only sticking point is if someone has many medications or allergies they have to list.)

On an Android Phone

Although Android phones do not have one default health-related app, you can easily show your emergency contacts on your lock screen in one of two ways.

Method #1

- Open your Settings app.

- Tap “User & Accounts” and then select “Emergency Information.”

- Tap “Info” and then “Edit information” to enter any medical information you want to store.

- Tap “Add Contact” to add a person from your contacts list. Note, you might have to click on “Contacts” first to be presented with the list

Method #2

Android phones will let owners put any message directly on the lock screen.

- Open your Settings app.

- Tap “Security & Location.”

- Tap “Settings” next to “Screen lock.”

- Tap “Lock screen message.”

- Type your primary emergency contact (and, if applicable, any medical conditions). You could type, “In Emergency, call Lin-Manuel Miranda” and his number. What? Can you think of someone more comforting to have around in an emergency? OK, maybe Stanley Tucci. Or Paper Mommy.

- Tap “Save.”

After you’ve set this up, your ICE information can be found by swiping upward on the lock screen and tapping EMERGENCY and then “Emergency information.”

Do An Inventory of Your Essential Documents

An emergency is the worst time to realize you have no idea where your important documents are. Do you know which of these documents you have and where you can find them?

- Birth Certificate

- Social Security card

- Marriage License and Certificate

- Divorce Degree

- Military Separation Papers

- Death Certificate

- Passport

- Durable Power of Attorney for Finances

- Healthcare Proxy or Durable Power of Attorney for Healthcare

- Living Will or Advanced Medical Directive

- Last Will and Testament

- Digital Will

- Driver’s License

- Voter Registration card

- Vaccination Record

- COVID Vaccinate Card

- Professional license(s)

- Other licenses

As with the beneficiaries section above, a great way to save time is to make a list (think of it as a treasure map) of where each of these documents are located. Use Excel or a Google spreadsheet and take note of what the document is and where it’s located (e.g., your family filing system, fireproof safe, safe deposit box, wallet, etc.).

EXTRA CREDIT: For good measure, for your passport, driver’s license, and any other licenses, take note of the expiration date.

And then for really good measure, put a reminder task in your phone to alert you one month before your any of these items expire to make sure you address renewals. (Give yourself a longer lead-time to renew your passport; also, as you’ve probably not been traveling out of the country in the last two years, you should check to make sure your passport hasn’t already expired.)

If you have a lot of documents, just do a few every day and you’ll be amazed at what a few ten-minute tasks can do to put your mind at ease.

EXTRA, EXTRA CREDIT: The Paper Doll archive has extensive information about what documents you should have and what to do if they’re missing. These posts are a great place to start.

How to Replace and Organize 7 Essential Government Documents

How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Protect and Organize Your COVID Vaccination Card

Paper Doll acknowledges that I write longer-than-typical blog posts. Feel free to consider reading each one to be a 10-minute task. But the knowledge you gain will contribute to your ability to use your time more efficiently. Because, the more you know, the better prepared you are for any eventuality.

Snap Some Photos to Take Key Information With You

Unlike the vital documents listed in the prior section, there are some pieces of information you are more likely to lack at the most inconvenient times.

Toy car accident image by Andrea Closier on Pixabay

For example, if you have an auto accident and the police or first responders won’t let you get back into your car for safety reasons, you wouldn’t be able to get your auto registration and car insurance paperwork out of your car. Yes, you’d have it at home, but that would slow everything down.

Or perhaps you need to fill a prescription at a different pharmacy from usual, perhaps when you’re on vacation, and they don’t already have your pharmaceutical company discount card on record.

Or maybe you’re unexpectedly with your spouse or child or senior parent in the emergency room, and the physicians want to know what medications, at what dosages, prescribed by what healthcare providers, the patient is taking. If that information is pinned to the fridge at home, but you came directly to the ER from somewhere else, that’s frustrating.

This is where the magic of modern cell phones (which we usually bemoan for the time they steal from us) comes in handy. Consider any of the following:

- auto registration form

- auto insurance card

- health insurance card

- homeowner’s insurance card

- pharmaceutical company discount cards

- handwritten instructions of how to get to a room or office you visit infrequently

- a list of the size/type of batteries and light bulbs you use for which items in your home so that you never again have to unscrew a light bulb just to know what voltage and whether you want a skinny-base or a fat-base bulb)

- etc., for whatever is important in your life.

You could snap all of these as photographs and store them in a photo album in your phone’s photo section. Name it “Remember” or “Vital” or whatever will catch your eye.

If you want to go to the effort of scanning the document and sending it to your phone, that’s fine, but iOS has created an easy option using the Notes app.

- Open a new or existing note.

- Tap the cute little camera icon.

- Tap “Scan Documents.”

- Focus your document, card, medicine label or whatever within your camera’s viewing area.

- Then you have two options:

- Let the auto-capture work its magic as the item comes into the viewfinder and auto-focuses, or

- Click the shutter button (or one of the volume buttons) to capture the scan

- Drag the corners of the scan to do any necessary adjustments.

- Tap “Keep Scan.”

- Scan more fiddly stuff to keep it handy or tape Save if you’re done.

From here, you can save the scan in your Notes or Files app in your phone itself, or upload it to a synced app, like Dropbox or Evernote:

As an all-Apple user, I don’t have an Android-specific scanning suggestion; if you do, please add your voice in the comments.

The next time a new insurance card or other piece of important information comes your way, take a snapshot or scan to ensure you’ll have whatever you might need when you are out and about.

As I often say, organizing can’t prevent all catastrophes, but it can make many of them less catastrophic. I hope these various ten(ish)-minute tasks will help ease many of the ickier moments in life for you.

Photo by

Photo by

Follow Me