Archive for ‘Financial’ Category

Organize To Pay Your Bills On Time

Photo by Leone Venter on Unsplash

After I wrote Ask Paper Doll: Should I Organize My Space and Time with Color? last week, I got to thinking about how color relates to finance, at least in terms of expressions.

Even though black usually signifies something dire, if you’re “in the black,” it means that you’ve got a net positive income, while finances that are “in the red” are considered bleak, signifying debt greater than revenue.

When you’re “in the pink” you’re in good health, financially or otherwise. And, although it would seem to make more sense that being “in the green” would mean you were flush with money, English lacks that expression. And I’ve learned that in Italian, “Sono al verde,” which literally translates as “I am at the green” means “I’m broke.” Language is funny.

You know what’s not funny? Late payments. Fines for late payments. Increased interest rates because of late payments. Lower FICO scores because of a history of late payments!

During consultations with new organizing clients, people often express frustration over difficulty paying their bills on time. Generally, it’s not that they lack the funds, but that their bill-paying systems get out of whack and fail to fit into their already overstuffed, overburdened schedules. Today, we’re going to look at strategies to get bills paid on time.

BEYOND THE BUDGET: KNOW THE WHO, WHAT, WHEN, WHERE, AND WHY

You might expect that I’d bring up the topic of a budget. Certainly, knowing all of your financial obligations is important to a smoothly-run financial life. As Charles Dickens said,

Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.

Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery. ~ Charles Dickens Click To TweetIn order to pay your bills on time, it’s essential to know when they are due, and (if applicable) how that relates to when your income will arrive.

Make a chart of all of your creditors and bills. It’s best to do this on a spreadsheet, like Excel or Google Sheets so you can update the chart over time.

- Note when bills are due. Usually, you have three kinds of bills:

- Bills that are due on or around the same date every month (like rent/mortgage, health insurance, utility/cable/internet bills, credit card bills, etc.)

- Bills that are due on a regular cycle but not every month. They may arrive quarterly, like water bills, auto, renter’s, or homeowner’s insurance premiums, or tuition bills, or annually, like professional dues, memberships, or auto registration renewals.

- Bills that a have no regular cycle. These may be one-off bills, like occasional department store credit card purchases or service providers who bill at their convenience, sometimes after you’ve long forgotten about the expense.

- List the amounts or ranges of your regular bills.

- Some of your bills will have the same dollar amount every month, like health insurance or your cell phone bill, because they are regulated by a contract. (These are the ones that for which it is easiest to set up automated payments.)

- Other bills will vary by month due to different usage or consumption, like electric bills or credit card statements.

- List the amounts or ranges of your regular bills.

- Learn and list the penalty of paying late! — My office landline (yes, I said land line!) payment is due on the 28th of the month, but there’s a grace period until the 8th of the following month, at which point the extra fee is about $3. No biggie. However, the average late fee for U.S. credit cards is $36, and that doesn’t take into account that late payments can trigger higher interest rates. If your credit card balance includes a 0% balance transfer, you could lose that rate if you make even one late payment. Oh, and late payments can also wreck your FICO score.

Photo credit: Simon Cunningham under Creative Commons CC By 4.0 Deed

- Make a column for each month of the year so you can mark when you’ve made a payment. This way, you’ll regularly see your progress and recognize when a payment hasn’t been made.

Yes, this sounds like homework, and you may be thinking that if you had the time to do homework in the first place, you’d be able to pay your bills on time.

However, having a sense of how many bills you have, in what amounts, due when, and with what penalty for paying late, can make all the difference in getting your finances in order.

PICK YOUR BILL-PAYING STYLE

No one bill-paying system is necessarily better than the others, but picking a method that works for you will help you stay committed to the process.

Pay Bills the Day They “Arrive”

This simple strategy requires the least amount of advanced planning and you’ll never have to worry that procrastination will lead to late fees.

If you get your bills by mail:

Bring in the mail every day, open the envelopes, toss out extraneous junk and “shiny” advertising material, and pay your bills immediately. Done! (Now log that you’ve paid it on the chart.) People rarely have more than a few bills each day, and if you get in the habit of doing this diligently, it’ll take only a few minutes out of your daily schedule.

Photo by Abstrakt Xxcellence Studios from Pexels

If you have opted out of paper bills:

Open your email every day, log in (to either your bank’s bill-pay site/app, or the account’s website), pay your bill, and log that you’ve done it. Bing, bang, boom!

Paying bills the day they arrive saves time (because it’s easy to complete quickly), eliminates anxiety regarding whether you may forget to pay, and helps you stick to your budget. If you pay for all of the things for which you have already obligated yourself, you’re less likely to spend on wants before needs.

This is the easiest system, but it’s also the least-often used.

Some people avoid this option because they lack the funds to pay each bill on the day it arrives. If our two biggest bills (for example, mortgage and insurance) arrived on the same day, it might wipe out (or even exceed) our checking account balances. So, there may be a practical reason to skip this method.

But there are far more common reasons why people don’t pay their bills as they arrive.

For some, there are psychological or philosophical obstacles to using this strategy. They may think, for example:

“I’m not going to pay this bill until right before it’s due. They don’t deserve my money one minute earlier than necessary!” [Insert your own “harrumph” as necessary.]

We see this most often when someone wants to avoid paying a credit card bill before the due date. People are fine paying for their electricity or health insurance, because they see that they’re getting the benefit already, so payment feels “fair.” But with credit cards, it’s common to forget that payment was actually due upon purchase; the cards simply shifted the time frame. People forget that a credit card bill is actually an IOU, the debt having been incurred in the past.

If you struggle with this philosophy, there’s still a way to pay bills as they arrive to prevent late payments.

If you pay bills online, log in now but schedule each payment for a day or two before it’s due. (Waiting until the day it’s due can cause holiday/weekend kerfuffles.)

If you pay by check, write out the checks, but put them in your tickler file (see below) or clip them to the calendar page of the date when you’re comfortable mailing them so only that final step remains.

“I don’t like paying my bills in dribs and drabs. I want to pay them all at once.”

This is similar to not wanting to hang up one shirt, or not wanting to file each piece of paper as you finish with it, or not wanting to wash each dish (or put it in the dishwasher) when done eating. It makes sense…until you find yourself with a backlog.

Sure, there’s something to be said for flow, doing a large project once and pushing through it to give your the satisfaction of completing a major task. However, the more we let our clothes pile up on the exercise machine, the more we let our filing pile up in the office, and the more we let the dishes pile up in the sink, the more of a behemoth the task seems, and the more likely we are to procrastinate altogether.

The downside of procrastinating on those tasks are wrinkled clothes, messy offices, and dried-on kitchen yuckiness. The downside of procrastinating on bill-paying? Late fees, increased interest rates, and lowered FICO scores.

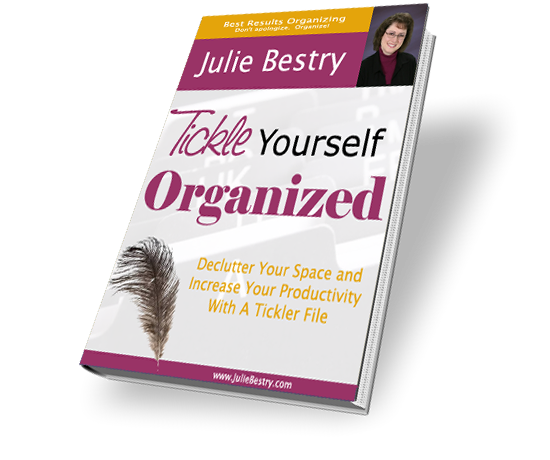

Tickle Yourself Organized

If you don’t do something immediately, you have to do it later. Sadly, that’s just one of the laws of physics, that we can’t go back in time. (That said, if you find yourself with a time machine or TARDIS, please let Paper Doll know. I have some experiments I’d like to try.)

Later requires a system, and a system requires both geographic and behavioral changes from what you’ve been doing thus far.

Photo by Nataliya Vaitkevich from Pexels

Geographically, you need a bill-paying center with the following tools:

- Tickler file, or at least a bill-paying folder

- Letter opener (to avoid paper cuts and add pizzazz to opening envelopes)

- Calculator or calculator app

- Pencil and scrap paper (if you have an untenable relationship with calculators)

- Envelopes

- Stamps

- Return address labels

- Non-washable gel-ink pens (to deter identity theft and fraud) to write out checks OR a printer if you prefer computer-generated checks

This assumes you’re getting your bills in the mail and paying them by check. If you’re paying them digitally, you can skip the envelopes, stamps, and return address labels.

The behavioral process is similar to the pay-upon-arrival system. Show up for mail call. (Seriously, I want you to open your mail every day. But if you absolutely won’t, at least put all of your mail in one spot, near your bill-paying area, and commit to opening ALL the mail at least once per a week.)

Open the envelopes, toss out the glossy advertising inserts, and if you pay online, toss the envelopes, too. Even if you’re not going to pay right away, process each bill immediately to keep it from ending up on top of the microwave or mixed in with your third grader’s math homework.

Eyeball each statement to review the charges, note any unexplained fees, and check for new policies and/or errors. (The sooner you catch a billing error or a policy change you don’t like, the easier it is to address.)

Circle or highlight the payment due date. Then figure out how far ahead you want to pay the bill. Take a glance at the calendar to make sure there are no weekends or federal holidays that might cause delivery obstacles.

If the due date is consistently inconvenient (because of when you get paid, or when lots of other bills are due), ask the vendor to change the date to a more convenient one. Many credit cards let you change your due date from inside the account profile.

Once you’ve opened each bill and figured out when you want to pay it, arrange them in chronological order by due date with the one due soonest on top. You can stop here and just tuck the stack in a folder, but longtime readers know that I encourage you to use a tickler file.

I used to tell folks to put the bills in slots at least 7 days in advance of when they’re due, but with the change in postal service delivery speeds, I encourage mailing at least ten days in advance or paying online. Or, make it even easier on yourself and only pay bills one day per week (like Tuesdays), and then just pick a pay date that’s two Tuesdays (or whichever) prior to the due date.

6 Steps to Ease Your Way Into Organizing the New Year

Happy New Year! Paper Doll knows that the first week of any new year (let alone after the year we’ve just escaped), can be daunting. Instead of weighing you down with homework, how about we set you up for success with some simple strategies that will ease you into a more organized approach to this year? Deal?

START WITH BABY STEPS

When it comes to clutter, it’s not the space it takes up in your house, it’s the dent it puts in your life!

When it comes to clutter, it's not the space it takes up in your house, it's the dent it puts in your life! Click To TweetIf you’re late every day because you can’t find your keys or your kids can’t find their homework, that’s a much bigger deal than a cluttered guest room closet or piles of old birthday party photos that haven’t been scrapbooked. (Need I explain to younger readers that photos used to be on paper?)

Focus on your biggest daily stressors, break them down into small, actionable steps, and solve those first.

For example, each night after dinner, sort through and declutter one kitchen drawer. When you change for bed, flip through five hangers to see what’s ready to depart. Put a table near the door for the daily launch pad of essential items you need to take with you. Hang a key hook and charging station there and make it a nighttime ritual with your kids to check that everything you’ll need the next day is there.

Don’t even know where to start? Try some of these easy options to organize your finances, your health, and your life – no heavy lifting required:

- Make a tax prep folder. Just grab a folder, label it Tax Prep 2020, and as documents start trickling in this month, you’ll at least have some place to stow them. (Don’t know what to watch for? Read last year’s Paper Doll Says the Tax Man Cometh: Organize Your Tax Forms to get a head start.)

If you want to get a little more advanced, consider Smead’s All-in-One Income Tax Organizer.

- Flip through your new 2021 planner or your digital calendar to see what medical appointments are already scheduled. Make a list of all the doctor’s appointments that you need — family doctor/GP, pediatrician, dentist and orthodontist, ophthalmologist and/or optometrist, OB/GYN, and any specialists, as appropriate.

Check all those appointment cards at the bottom of your bag or thrown in the junk drawer to make sure you’ve scheduled them on your calendar. Then pick up the phone and make all the other appointments now. (Going forward, always schedule your next appointment before you leave their offices. See if you can make one day a week, like Mondays, your “appointment” day so that you’ll get it out of the way early in any week.

- Look through your wallet and VIP files to see what needs to be renewed — driver’s license, car registration, passport, etc. Instead of marking just the expiration date, make notations on your calendar to handle renewals enough in advance so nothing falls through the cracks.

GIVE UP TOLERATING WHAT BRINGS YOU DOWN

Last summer, in Organize Away Frustration: Practice the Only Good Kind of Intolerance, we talked about this at length. Take notice of the things that annoy you, whether it’s a closet too cluttered that you can’t close the door, a light fixture that keeps flickering, or a cable bill that should be renegotiated with a gentle threat to cut the cord. If something doesn’t bring you closer to the life you want to be living, make this the year you let it go. Don’t tolerate what doesn’t delight you.

Do a brain dump. Think of a brain dump as mental hygiene, like the cognitive equivalent of brushing your teeth. Ever have the taste of garlic or fish in your mouth after dinner, such that you couldn’t really enjoy your dessert? A brain dump, where you get everything out of your head and onto paper, let’s you stop thinking of things and start thinking about them, in context. Taste your life!

Try to make a list of everything that you know you have to do in order to stop being frustrated. Go room to room and write down what you need to address. (If you’re the kind of person who really needs categories, you can create columns for things that are free or only require your own effort vs. things that require payment.)

Once you have the list, you can start working through what are immediate priorities, what’s worth scheduling, and what can go on the “I’ll do it if I’m so bored it’s between doing this task or watching paint try” list.

Feel free to tackle the tasks in any order you choose, but come up with a plan. Easiest-to-hardest helps you gain confidence; hardest-to-easiest makes everything less stressful because you’ve tackled the most difficult item first. Doing the free tasks first gives you time to budget for the more costly ones, but if you can purchase freedom from a frustration, it’ll release mental energy for other tasks.

STOP USING CLUTTER AS A TO-DO LIST

- Are you keeping a holiday gift on the dining table so you’ll remember to write a thank you note?

- Do you have boxes of donations in the middle of the hall to prompt you deliver them?

- Are you keeping a receipt to remind you to get someone to pay you back for their half of a gift (or to remind yourself to pay them back)?

- Is your unopened electric bill sitting out to remind you to pay it?

- Do you have months’ old email in your inbox hoping that keeping it there will push you to reply?

How’s that working for you? Instead, follow these steps.

- Clear your desk or a space at your kitchen or dining room table to give yourself work space.

- Take five minutes and look around the room you’re in. What do you see that’s out of place because you’re (intentionally or otherwise) using it to prompt you to do something?

- Grab a notebook and for each thing that’s in the wrong place, write down what you should be doing, instead. Yes, this gives you a To Do list that will stare you in the face (but we’ll get to that).

- Put the item away so that it’s no longer clutter.

- DO THE THING!

©2010 Allie Brosh, Hyperbole and a Half, via MemeGenerator

Let’s see how this works. Unpack and put away the holiday gift and go grab a notecard, envelope, return address label and stamp. Put it down on your cleared desk space.

Now, here’s the first tricky part. You can either write out the thank you note right now (check out my Gratitude, Mr. Rogers, and How To Organize A Thank You Note for guidance) and then you won’t use all your mental energy procrastinating about it, or you can put it on your To Do list. If you write the note now, you can put it on your To Do list and check it off your list, all at once, giving you an immediate sense of accomplishment! Whoohoo!

Repeat the process. Carry the donation boxes to your car, then eyeball your calendar to figure out when you can deliver the donations. Schedule the task, delegate it to a family member, or use GiveBackBox to schedule a free pickup.

And again! Use your favorite app, like Zelle, CashApp, Paypal (or ugh, fine, Venmo) to pay or request money and either file or shred the receipt as necessary. Pay the electric bill. Reply to the email or declare bankruptcy on it.

FOLLOW THE ICE CREAM RULE

So maybe your clutter is there because you don’t know where else to put it.

I tell my clients, “Don’t put things down, put them away.” By “away,” we assume you’ve already got a location in mind. Good organizing systems have two parts: the where & the how. If you bring home a bag with three items, ice cream, toilet paper, and breakfast cereal, I’m pretty sure you’re going to put the ice cream away in the freezer first (and immediately) to keep from having a melted, sticky mess. The freezer is the “where” but putting the ice cream away first is the “how.” It’s so innate, you don’t even think about.

Clutter comes from deferring that decision making. With ice cream, you don’t even have to stop and think; it’s instinct built from life-long experience. With everything else entering your home (whether a purchase, a gift, or a freebie), decide on a home before you buy or bring it in. Once it’s in your space, build time into your calendar for how/when you’ll deal with maintaining it or getting it back to where it lives.

Do you bristle at the idea of planning when you’ll do things? Maybe you feel like scheduling things belongs in the category of “budgets” and “diets” — it’s about The Man trying to keep you down!

The thing is, if you’re organized, you probably already have a system and your system feels like a safety net rather than a suffocating obligation. If you’re NOT organized, you’ll just have to trust that a system – a plan, if you will – makes life more organized so you don’t have to keep thinking about these things.

What are the triggers in your system? When will you do laundry: when the laundry basket is full or when it’s Tuesday morning after breakfast? When will you file financial papers? When your in-box is overflowing, or when your computer dings to tell you it’s 11:45a on Wednesday?

Remember: “Someday” is not a day on the calendar. Until something is innate, having an auditory or visual trigger (or both) will help remind you where and when to put things away.

REMEMBER THAT EVERYTHING SHOULD HAVE A HOME…BUT NOT EVERYTHING HAS TO LIVE WITH YOU

Systems are important, but don’t forget a universal truth: not everything you own needs to stay in your orbit forever.

Give what is no longer age-, size-, or lifestyle-appropriate new life via charity or consignment. Let it be a blessing to someone else.

Give what is no longer age-, size-, or lifestyle-appropriate new life via charity or consignment. Let it be a blessing to someone else. Click To TweetIf it’s broken and you’re not willing to spend the time or money to repair it, let it go. If you have an emotional attachment to something that’s broken, outdated, or takes up too much space to keep, take a photo of you holding it or wearing it. Then set it free!

Setting up a donation station in your home is as easy as putting a box or plastic tub in your utility room, mudroom, or garage. When you’re doing laundry or sorting through toys in the playroom, if it doesn’t fit your life, take it to the donation box right away. When the box is full, log the contents (if you’ll be taking a deduction), and send it to your favorite non-profit. Don’t wait until you have lots of boxes – one box of useful items or clothes, sent on its way, is more useful to others than mountains of boxes that never make it out of your home.

Are your file folders bulging? Do I Have To Keep This Piece of Paper? gives you a clear idea of what you need to keep and for how long. The rest? Shred and send on its way! Buh-bye!

FOLLOW THE BUDDY SYSTEM

Getting your space, time, and priorities in order can be overwhelming, but you don’t have to go it alone. For accountability and support in reaching your organizing goals, buddy up with:

- Your spouse – Trade the chore you hate (unloading the dishwasher) for the one that annoys your spouse (folding laundry) and you’re each less likely to procrastinate.

- Your kids – Make organizing a game – play Beat the Clock with your kids to see who can collect the most things that don’t belong in the living room before the song ends, and then work together to put the items away.

- Friends – Make organizing social, even when you can’t get together. Text “fashion show” photos or do a Zoom call as you organize your closets. (Friend-of-the-blog Nancy Haworth of OnTask Organizing and I did this last week! I got rid of big-shoulder-pad 80s-style blazers and she jettisoned clothes that pre-dated her strong, lithe, “certified exercise instructor” shoulders!)

- A professional organizer – As a Certified Professional Organizer®, I know how much my clients get out of having someone who knows the ropes guide them in making solid decisions and developing systems to surmount those challenging obstacles. Find a professional organizer near you by using the search function for the National Association of Productivity and Organizing Professionals (NAPO).

Speaking of which, it’s January, so that means it’s GO (Get Organized and Be Productive) Month! It’s the perfect time to focus on making your life run the way you want it to. Happy New Year, Happy GO Month, and just plain…be happy!

Back-to-School Organizing News You Can Use: 3 Solutions to Save Time, Money, and Serenity

Wait, it was just Independence Day! Why are we talking about back-to-school organizing? In ye olden days, when I grew up in Buffalo, New York, where kids still don’t go back to school until after Labor Day, talking about back-to-school so soon after the 4th of July would be like stores putting up Christmas decorations right after Halloween. (Oh…right.)

But there’s a method to the madness. In many parts of the country, students go back to school in the middle of the summer. In my county in Tennessee, the public schools start on August 3rd, and mere miles from me in Georgia, students go back on the first of August. But even for kids going back to school in September, that’s only about eight weeks from now. Instead of rushing to get everything done, here’s a roundup of ways to organize your approach to the back-to-school season.

ORGANIZE YOUR ADHD STUDENT – FREE WEBINAR

Paper Doll‘s colleagues (and longtime friends), Michelle Cooper and Michelle Grey of Student Organizers of Atlanta will be presenting a free, live webinar entitled Practical Organization and Time Management Strategies for Middle and High Schoolers with ADHD on July 20, 2017, at 1 p.m. ET.

Presented as part of ADDitude Magazine‘s ongoing webinar series, the webinar will provide strategies for:

- Managing the day-to-day organizational challenges facing students both inside and outside of the classroom

- Understanding your child’s “thinking style” and finding organizing methods and tools that fit his or her style

- Using organizational systems that will improve his or her chances of academic success

- Collaborating with your child and the teachers to support his or her efforts at organization

- Using products, books, and websites to ease the process of organization for your student

Register for the webinar and take it live, or you can use the replay link to watch (or rewatch) the webinar for free, any time up through next January 20, 2018.

Learn more about ADDitude and check out the other webinars in the series. If your child is heading to college, both of you might want to watch the webinar on July 11, 2017, entitled The College Transition Guide for Teens with ADHD.

ORGANIZE YOUR FINANCES – TAX-FREE HOLIDAYS

Over the four weekends from July 21 through August 13, sixteen states will be having tax-free holiday weekends. In general, these states allow retailers to sell clothing and footwear, school supplies, computers, and sometimes backpacks, books, and other “tangible personal property” without charging sales tax. In my state, that’s a savings of 9.25%. Combine that with various 10%-25%-off sales, and that’s a great opportunity to stock up on necessities.

Note: Some states, such as Georgia, have discontinued their tax-free holidays, so be sure to check out states adjacent to yours.

Click on the name of your nearest state to be directed to that state’s official tax-free holiday page.

Alabama (July 21-23, 2017)

Tax-free: Clothing (up to $100), Computers (up to $750), School supplies (up to $50), Books (up to $30)

Arkansas (August 5-6, 2017)

Tax-free: Clothing and footwear (up to $100), Clothing accessories and equipment (up to $50), School and academic art supplies (no dollar limit)

Connecticut (August 20-26, 2017)

Tax-free: Clothing and footwear (up to $100)

Florida (August 4-6, 2017)

Tax-free: Clothing, footwear, wallets, and bags (up to $60), School supplies (up to $15/item), Computers (up to $750)

Iowa (August 4-5, 2017)

Tax-free: Clothing and footwear (up to $100)

Louisiana (August 4-5, 2017)

Tax-free: Tangible Personal Property (3% tax rate up to $2,500; a 2% state sales tax exemption applies, so qualified purchases are subject to only 3% state sales tax)

Maryland (August 13-19, 2017)

Tax-free: Clothing & footwear (up to $100)

Mississippi (July 28-29, 2017)

Tax-free: Clothing & footwear (up to $100)

Missouri (August 4-6, 2017)

Tax-free: Clothing (up to $100), Computers/peripherals (up to $1,500), Software (up to $350), Graphing calculators (up to $150), School supplies (up to $50)

New Mexico (August 4-6, 2017)

Tax-free: Clothing and footwear (up to $100), Computers, tablets, and e-readers (up to $1,000), Computer equipment (up to $500), Book bags and backpacks (up to $100 per item), maps and globes (up to $100 per item), Calculators (up to $200), School supplies (up to $30)

Ohio (August 4-6, 2017)

Tax-free: Clothing (up to $75), School supplies (up to $20)

Oklahoma (August 4-6, 2017)

Tax-free: Clothing and footwear (up to $100)

South Carolina (August 4-6, 2017)

Tax-free: Clothing (no limit) School supplies (no limit), Computers, printers, peripherals, and software (no limit)

Tennessee (July 28-30, 2017)

Tax-free: Clothing (up to $100), School and art supplies (up to $100), Computers (up to $1,500)

Texas (August 11-13, 2017)

Tax-free: Clothing, backpacks and school supplies (up to $100)

Virginia (August 4-6, 2017)

Tax-free: Clothing (up to $100), School supplies (up to $20), Energy Star products (up to $2,500) and a variety of hurricane-preparedness items.

Tax-free holiday tips:

- The price limits generally refer to the price-per-item cost, not your entire purchase. However, if a store is placing limits on entire purchases and you have a large family, you might want to have your older, more responsible children stand in line and pay with cash.

- Make a list of what each child needs before you get to the store. (Check with your school to see if a grade-appropriate list has been posted online.) It’s tempting to buy anything that seems like a bargain, but acquiring what you don’t need just because it’s a “deal” is the fast track to clutter.

- Set a budget for each shopping category.

- Shopping with smaller children will stress you (and your kids) out, so consider trading shopping and babysitting time with a friend or split babysitter costs while you and your friend hunt for bargains together. Let older children participate – use it as an opportunity to practice math skills (“How much is this shirt if it’s marked as 15% off?”) and encourage them in finding good deals on high-quality products. The more responsible they are, consider rewarding them with the amount by which they came in under budget to apply toward something fun.

- Remember to keep your receipts in case you find that you need to return something; note each retailer’s return policy.

ORGANIZE YOUR STUDENT’S SCHEDULE – A NEW KIND OF PLANNER

As mentioned a few weeks back when I was talking about Time Timer, many people, especially students, can have trouble mastering the concept of the passing of time, which makes it difficult to properly plan academic and life tasks. When I was in middle and high school, almost nobody used a planner or a calendar. These were the days when Trapper Keepers were the height of organizational technology and pocket-sized assignment notebooks yielded the best option for academic time management. Somewhere during the <mumble mumble> intervening decades, schools started providing and/or requiring student planners to help keep up with homework assignments, projects, and tests.

These planners give students the opportunity to mark down what they must do. It’s not clear, however, that students get the time management skills and system-training they need to master the intricacies of juggling academics, extracurriculars, part-time jobs, and familial obligations, or learn when to complete it all. That’s where Leslie Josel comes in.

Professional organizer Leslie Josel of Order Out of Chaos, is not just a colleague and friend; she’s also a fellow Cornell University alum, so when I first heard about her product line for students, I paid particular attention.

Paper Doll with Leslie Josel, © 2017 Best Results Organizing

At first, Leslie’s organizing practice concentrated on working with chronically disorganized clients, people with ADHD, students with learning challenges, and clients with hoarding behaviors. Eventually, (like Michelle and Michelle, above), she expanded her offerings to include coaching services for both students and parents. In 2016, Leslie expanded her company’s product division and officially launched Products Designed With Students in Mind.

Leslie’s big idea was the Academic Planner: A Tool for Time Management®. The 2017-2018 Academic Planner comes in two sizes: letter-sized (8 1/2″ x 11″) and personal-sized (8 1/4″ x 8 1/2″), both for $18.99. Based on an academic year calendar, the planners run July through June. They’re spiral bound, but also three-hole punched to allow students to pop them right into their binders.

Each size is available in four styles of planners: Jamie (black), Riley (orange/blue), Taylor (white) and Paper Doll‘s personal favorite, Violet (pink/purple). The interior pages measure 7” x 11”, offering up more than the typical space for writing down assignments and activities.

Introductory Pages

The front pages, measuring the same size as the front and rear cover of the planner, include:

- a contact information section so a lost planner can be easily returned

- a class schedule (subject, period, instructor, room #, days) to quickly acclimate students for the new year (and give a fellow student, armed with the contact info, an easy way to find the owner at the right classroom and return a lost planner)

- a Welcome Letter from Leslie to parents

- a detailed set of Planner Pointers, providing excellent guiding tips for making smart use of the planner. (My favorite? Writing “No Homework” if none was assigned so the student never has to wonder if he or she just forgot to write something down.)

- a two-page Planner Use Guide, showing the planner in action — noting assignments, reminders (“Get permission slips signed!”), after-school activities and previews for the next week

- Homework Helpers, tips that could only come from a professional organizer experienced with helping students gain control of their work.

- a sample Project Planning Guide to help plan long-term assignments (Students can download more guides for future projects.)

- a two-page School Year at a Glance

Planner Pages

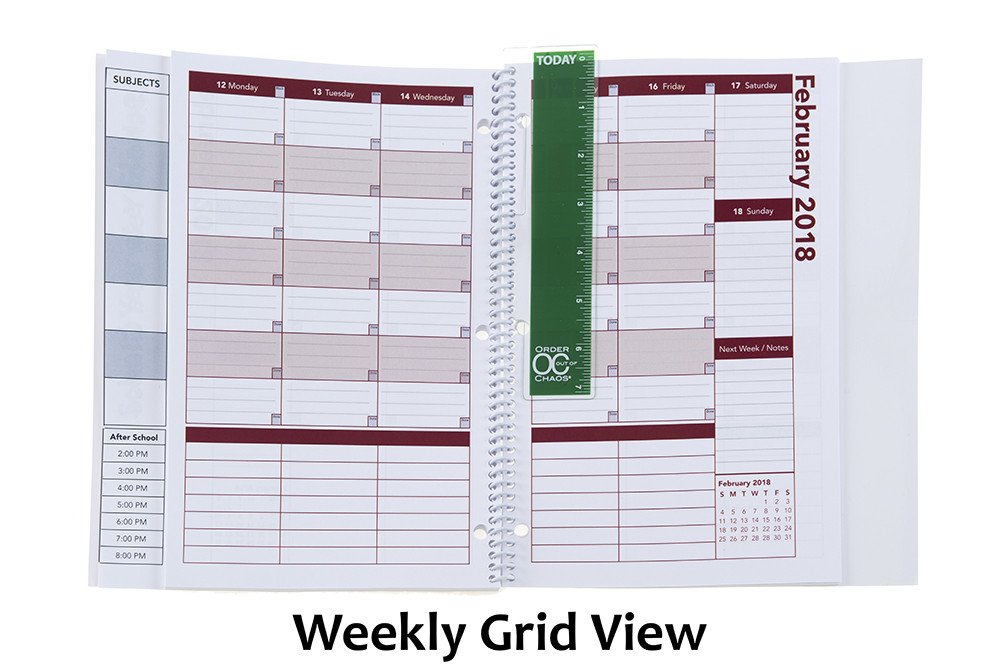

On the last (extra-sturdy) full-sized front page, the Academic Planner has a vertical index page that peeks out from behind (and to the left) of the actual planner pages. This index page means that students record their class subjects (in up to 7 subject boxes) only once. Then everything on the upper calendar sections of the planner pages lines up with the appropriate class subjects, course by course, horizontally (with days of the week arrayed, vertically) across a two-page layout. (You can download a sample planner page.)

The next row (in the personal-sized planner, only) is for To Do items.

Below that, there’s an hour-by-hour schedule from 8 a.m. until 8 p.m. Typical student planners only cover the academic day and don’t take into account post-school activities, like doctor’s appointments, tutoring, clubs, rehearsals, sports, and jobs. This planner provides oodles of space for all of those activities and recognizing conflicts (just like in the best calendar planners for adults). This really helps students see the forest and the trees of weekly time management.

Other Features

- At the start of each month, there’s a left-side full-page monthly calendar with space to note major events, holidays, and vacations, and adequately plan longer-term projects.

- The right-side Notes page facing the calendar offers up ample room for planning, notes, and the kinds of serious thoughts only people between 12 and 18 can understand.

- There’s a clear poly pocket at the rear of the planner for safely keeping notes, permission slips, and other documents too small for a student’s binder.

- A bonus Academic Planner Accessories Pack (sold separately, for $8.97) includes a plastic page marker that clips into the spiral binding, so it’s easy to find the current week in the planner, a set of monthly tabs, and a really bright, sunny set of useful stickers.

But of course, measurements, styles, and features don’t give credit to what the 2017-2018 Academic Planner: A Tool for Time Management® can actually do to help students. For that, let’s go to the video!

Enjoy your summer, but remember that a little organizing now can make back-to-school the most wonderful time of the year!

Disclosure: Some of the links above are affiliate links, and I may get a small remuneration (at no additional cost to you) if you make a purchase after clicking through to the resulting pages. The opinions, as always, are my own. (Seriously, who else would claim them?)

Paper Doll’s 16 Ways To Organize Your Money In 2016 — Part 3

Whether it’s that shiny nickel that burns a hole in your Garanimals pocket at age 5 or the wallet overflowing with wrinkled receipts or a hot mess of old abandoned 401(k)s that have never been rebalanced or rolled over, money can be a source of pleasure or pain. This series on organizing your finances is designed to give you some actionable ideas for gaining more control over your money in 2016. Review the first nine strategies in Part 1 and Part 2, and continue with today’s money-organizing tips.

10) Organize yourself out of debt.

“Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.” ~ Charles Dickens, David Copperfield

It might seem as though getting out of debt would have little to do with organizing — perhaps you think it’s solely a matter of making more money or spending less. In theory, both of those things should help you get out of debt; in reality, humans are irrational. To get ahead on your debt repayment, you’ll need to add a little rationality to your approach:

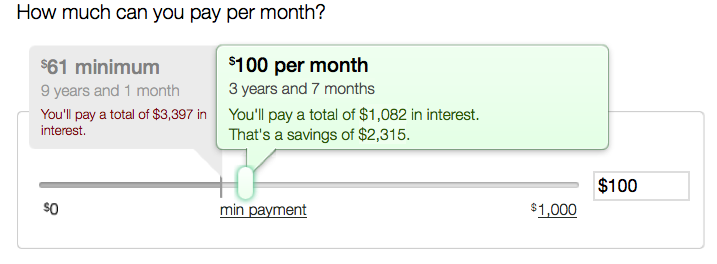

- Stop paying only the minimums — Recognize that just because your bill tells you that $34 is the minimum you have to pay doesn’t mean that’s what you should pay. The less you pay each month, the more interest you’ll pay over time, and the longer it will take you to pay off your debt. It’s in each lender’s interest for you to pay as little as possible beyond the minimum, because it keeps you indebted (and them in business), and because the minimums are so small, they seem inconsequential, leading you to take on more debt. Obviously, your goal is to pay off all unsecured, revolving debt each month; if you can’t, at least throw as much money at your debt as possible.

- Let your right hand know what the left hand is doing — If you have money in savings or investments earning low interest, but credit card or other debt at high interest, consider applying the former to the latter. If you’re earning less than 1% on $1000 but racking up interest at 13% on $1000 in credit card debt, you are losing money. Of course it’s always important to have a liquid (that is, accessible) financial cushion for emergencies, but letting debt pile up each month while low-earning funds wallow, you may be penny wise but pound foolish. Make sure your savings/investing brain is talking to your debt-payment brain by getting a reality check; use the National Foundation for Credit Counseling “Debt or Invest” calculator to see where your money will best serve you.

- Make sure your head and heart converse — Being rational is important, but if you’re in a constant struggle against your instincts, it will be hard to stick to a repayment plan. Pull up your most recent statement for every credit card and take note of the interest rates. If you have three credit cards, for example, you might have three different amounts at three different rates. Now that you’re not paying merely the minimum, you might be tempted to take the total amount you’ve earmarked to pay off debt and divide it equally among those three credit cards every month. Not so fast! There are better methods that work, either logically or psychologically, and both have advantages and disadvantages.

The Snowball Method — With this strategy, you pay the minimum on all debts except the smallest, and throw all the rest of your budgeted debt-reduction funds toward paying off that smallest debt. Armed with this bit of success, you’ll rebalance your efforts and take all the money you’d been putting against the smallest balance, and now apply it (plus what you were already applying) to the next-lowest balance, and so on. This method has a psychological reward — by focusing on the smallest debt owed, you’ve got something in your “win” column to motivate you to stay committed to the plan. But it’s not particularly logical — by focusing on balances rather than interest rates, your total debt keeps growing.

The Debt Avalanche Method — Line up your debts by interest rate, pay the minimum toward all but the highest-rate debt, and put all of your available money (salary, birthday money, funds raised from selling your books or your plasma, etc.) toward the highest rate debt. This method is logical, but it lacks the immediate sense of victory of the Snowball Method.

Still not sure how much to put toward your individual debts? There are some great no-cost debt calculators available to help you, including:

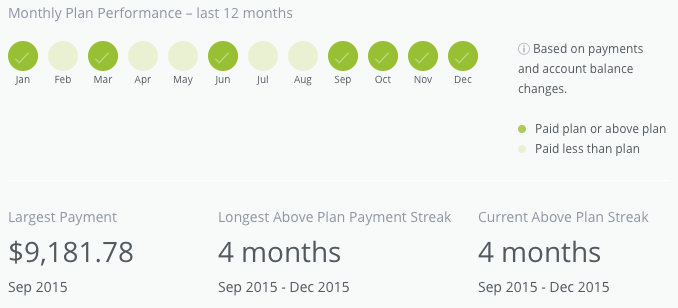

Mint — If you’re using Mint as a complete financial dashboard service, its Financial Goals feature is ideal for paying off specific debts — one or many. Once you sync the service with your accounts, you can select which accounts you want to include in your debt payoff goals. Mint will already know your interest rate and minimum payment, and will display how your payoff options will impact interest owed over time.

As you make monthly payments, because Mint will already be tracking your money, the system will display how you’re progressing toward your monthly goal (telling you, for example, that you’ve paid “$73 toward your goal of $200 for the month) and how you’re progressing toward your overall goal.

If you have multiple types of debt, like personal debt, business debt and medical debt, you can create multiple goals and view them separately or on one screen. However, note that the goals element of the dashboard service is only viewable from a browser, not from the Mint app.

Ready for Zero — As with Mint, once you sync all of your accounts, Ready for Zero knows your account details: balance, minimum payment, interest rate, etc., and auto-updates when you make payments, add debt, etc. It has similar sliders for setting your approach to your goals, but Ready for Zero’s app seems to be more seamlessly integrated with the browser version, and overall, offers much more variety of display views and reminders. If visual feedback helps you stay motivated, this is a great option.

Of course, if you’re experiencing crushing debt, organizing your information and game plan is just one aspect of financial recuperation. Debt counseling is an important option, but there are a variety of predatory and/or irresponsible so-called debt counselors out there. Begin your search with the National Foundation for Credit Counseling to find an NFCC-Certified Consumer Credit Counselor.

11) Lower Your Interest Rates

You can’t walk into Target and tell the cashier you’d like a discount on toothpaste, or warn the front desk clerk at your hotel that you’d prefer to pay only one-third the hotel tax. You can’t just ask for better deals! Or can you?

There’s little chance of getting your bank to bump your measly .087% savings account interest rate up to 5%, let alone double-digits. That’s just not how banking works. But credit card interest rates are more complex. Sure, the rate you’re charged is dependent upon your credit history, credit score and earning power, but the credit card industry is highly competitive. If you have an unblemished payment history and have been a solid customer, you can try to request a better interest rate.

First, log into your online account for each lender and see if there are already options for things like changing your payment date, requesting a higher credit limit, or getting a lower interest rate. (Don’t get a higher limit for ego’s sake; you don’t need it.) You may be able to handle this with a few clicks. If not, call your lender, be cheerfully polite, and once you’ve identified yourself with your name, account number and all matter of ridiculous levels of proof, tell the representative something like:

I’ve been a loyal customer of [credit card company], pay my bills on time and have been generally happy, but I’ve been receiving offers in the mail from other credit card companies with lower APRs. To be as financially responsible as possible, I want a lower rate on my card. Before I cancel my card with [your company] and switch, I wanted to see what you could do to help me.

And then shut up. You might get a grumpy rep and a rejection, or you might get good news. Either way, you’re out nothing except your time.

If requesting a change in interest rate from your own lender doesn’t work, you can always initiate a balance transfer, either to one of your other cards or a new credit card, for 0% or a very low rate, but balance transfers come with their own caveats:

- There are fees attached, usually 2-5% of the value of the transfer; this fee is added on top of your transferred debt and is subject to the same interest rates that apply to the transferred amount.

- These are short-term interest reduction periods, usually for 9-18 months; any unpaid debt as of the end of the transfer period will be charged interest at whatever the card’s normal rate might be.

- You should only transfer debt to cards that already have a zero balance, and do not charge new purchases on the card until the transferred debt is paid off. Otherwise, with multiple concurrent interest rates on one card, your progress towards repayment will be muddied.

12) Ask and Ye Shall Receive…Better Deals and Discounts

If you’ve ever seen those long, convoluted blog and Facebook posts about extreme couponing, you may think you don’t have what it takes to lower your costs. However, getting good deals doesn’t have to be complicated. Whether you’re trying to buy something at a lower price or reduce the cost of a service for which you’re already paying, try these options:

Let your fingers do the walking. The next time you’re going to buy something online, stop at your favorite search engine first and type in “[name of store where you’ll be shopping anyway] discount” and you’ll be amazed at the number of coupon code sites that will pop up, including:

From free shipping to percentage discounts, it often takes no more than a few extra minutes to find a rewarding promotional code to use at checkout.

Ask for a better rate. Using the same kind of script described above for lowering your interest rates, call your phone or cable company, or similar service provider, and explain that you’ve been a loyal customer for [X number of] years, have been offered discounts by other providers, or have seen lower rates and inducements the company has offered to new customers, and ask what can be done to keep you happy.

Ramit Sethi of I Will Teach You To Be Rich walks through how to have these kinds of conversations with confidence.

In 2014, NPR’s This American Life did an interesting segment on the concept of the “Good Guy” discount — and how sometimes, just asking for a price break can work. What could it hurt?

Threaten (politely) to cancel your service. This is the next level up from merely asking. It takes a little more aplomb, and may require you asking to get transferred to the Retention Department, but state your case, reference competitor pricing, and then be quiet. At first, they will inevitably try to up-sell you to services you don’t want or need. But stand your ground and it’s more likely that not that you’ll be offered six months or more of discounted service. I have one client who merely calls to cancel her satellite radio service every time she’s billed and achieves a discount in return for her few minutes of effort; with many of my clients, we set aside a “canceling” session a few times a year to see how many discounts we can get.

David Bach, better known for his Finish Rich financial advice empire, wrote a great book a few years ago called Fight for Your Money: How to Stop Getting Ripped Off and Save a Fortune. It’s a superior resource for developing the skills necessary to master a system that’s gamed in favor of large companies.

Too anxious to talk to reps personally? That’s OK, as you can use the same approach online. You’ll often find that if you go into your online account for an entertainment, dating, or gaming service (e.g., Hulu, Netflix, Match, X-Box Live) and “cancel” your account, you’ll get a pop-up notice offering a discount if you’ll keep your account active. Sometimes, the cancelation will go through, but you’ll receive an email within the day, inducing you to reactivate.

And, of course, you can put any of your newfound windfall toward debt-reduction or savings goals!

Next time, in the final post of this series, we’ll look at ways to organize how you get paid, how to make your spending habits boost your return on investment, and fun options to learn more about mastering your money.

Paper Doll’s 16 Ways To Organize Your Money In 2016 — Part 2

Your money has different personalities. Some just sit there like your college roommate’s freeloading boyfriend, drinking your milk and putting the empty carton back in the fridge. (Y’know, those investments you were talked into, but which have gone nowhere?) And some are delightful surprises, like friends who show up to drag you to the movies when you’ve had a bad day. (Think of that crisp $20 bill you find in your jeans pocket after doing laundry.) But your money won’t organize itself.

In Part 1 of 16 Ways To Organize Your Money In 2016, we looked at accessing and organizing the information others have about you in your credit report and credit score, and what you can do to improve your finances by tracking and making wise decisions about your expenses.

Today, we’ll look at more tips for keeping your money life in order.

6) Organize Your Financial Information

All the paper and digital information you have regarding your finances represents money going out (bills and statements for fixed necessities and variable luxuries) and money coming in (birthday checks from Grandma, your direct-deposit paycheck, investment interest and dividends). To keep control of your finances, to help you prepare your taxes, and to safeguard your financial future, it’s important for this information to be accurate and accessible.

The financial paperwork we receive or create usually breaks down into these sub-categories:

Outgoing Money

When you get a paper bill, you either tear off the stub to mail it back with your payment and keep the remainder, or you pay online and keep the whole statement/invoice. When I help my clients organize their financial information, we start by breaking the paper piles into categories:

- Monthly or periodic household bills (e.g., rent/mortgage, utilities, insurance, etc.)

- Credit cards statements

- Loans (e.g., home equity, auto, college, personal, etc.)

- Medical bills (which may be ad hoc or part of an ongoing payment plan)

- Anything else being paid on a regular or predictable basis (e.g., piano lessons, tuition, personal chef, professional organizer, fitness trainer) for which you wish to keep careful records

In this case, your basket is your financial information filing system. Usually, I advise this approach:

- Label (and alphabetize) tabbed interior folders within each sub-category. It doesn’t matter if you use generic terms (cable, power, water) or company-specific (Comcast, CityPower, Valley Water Authority) — just be sure to choose labels that reflect how you think. For credit cards, if you have more than one card from any one issuing company, you may want to put the last four digits of the card number on the label (Discover-1234, Amex-9876), just to help you file quickly. If your system is complicated, you’ll find excuses not to use it. Stay simple.

Group related sub-categories in hanging files in a filing cabinet, milk-style file crate, or desktop file box. - File the backlog in reverse-chronological order.

- File paper bills as you pay them.

Alternatives to file folders are three-ring binders and accordion folders. However, binders require three-hole punching of papers, and each additional step leads people to procrastinate. Accordion folders can work for college students and those with very few expenses, but a system you can expand as your financial complexity increases will be easier to maintain.

If you get all your bills and statements digitally, there’s no need to print them out; just set up a new behavioral system to acquire the information, label it, and store it.

You can manually download each statement, or use FileThis, an app/service which, once linked to your account, fetches your online statements and bills so you can pay them and store them as you see fit. Let everything live in the FileThis Cloud, on your computer, or in Evernote, Box, Dropbox or Google Drive. (FileThis ranges from free to $5/month, depending on your needs.)

You can manually download each statement, or use FileThis, an app/service which, once linked to your account, fetches your online statements and bills so you can pay them and store them as you see fit. Let everything live in the FileThis Cloud, on your computer, or in Evernote, Box, Dropbox or Google Drive. (FileThis ranges from free to $5/month, depending on your needs.)

To create a uniform digital system for labeling (for example, bill name and date, like Verizon-2016-1). Some people prefer to keep all of the digital invoices in one online folder and use search to find what they want; others (like Paper Doll) prefer a folder hierarchy system that matches the one described above for paper.

Finally, while some people refute the idea of maintaining bills once they’ve been paid, I suggest it for a couple of reasons. First, many companies only provide access to a limit period of billing, sometimes only a year or six months, making it difficult to source errors or track information. Second, for those who tend to be disorganized with their finances, a tangible (paper) system yields a greater sense of control.

Incoming Money

Incoming revenue information may involve pay stubs from employment, alimony or child support payments received, Social Security income, disability payments, IRA disbursements, personal loan repayments (to you), lottery winnings, and stock dividends (if not part of a dividend reinvestment plan). If you’re regularly getting money from any source, or have gotten a large lump sum for something other than employment, make a folder (or folders) to maintain records until tax time.

Transitional Money

The above categories talk about what you are doing to your money, but others show what your money is doing, with or without you. Bank statements for checking, savings, and trusts represent collections of funds in transition. They may accrue interest or have fees associated with them, so take time each month to make sure these accounts reflect what you think they should.

Brokerage statements contain investment information. Sort these by investment type: retirement, college savings, goal-related (like a vacation fund), first, and further sub-categorize (and alphabetize) by company or specific investment. So, in the Retirement hanging folder, you might have interior folders for your 401(k), an old 403(b) that remains in place, IRAs with Fidelity or Vanguard, and so on. Each account should have its own folder.

Simulated Money

Some of your records represent money that’s not real yet. These files might include quarterly or annual statements reflecting either regular or atypical benefit plans for your job, such as if you’re vested in an employee stock ownership plan. If you’re not particularly active in managing this information, maintaining it in digital form will keep you from getting overwhelmed.

You can also have a folder in this section for gift certificates, gift cards and store credits so you can keep track of the money value owed to you. If you prefer to keep them portable, a Card Cubby is a nice alternative to mixing them into your financial filing.

Keep stock certificates, bearer bonds, or other papers of significant value in your safe deposit box or fire-proof safe.

7) Create Tax Prep Folders (for the tax year just ended and for the one to come)

Depending on your financial situation, one folder per year might suffice; if your financial life is complex, you might want a handful of folders for each year’s incoming tax forms, charitable donation receipts, medical expense annual summaries from your insurance company, etc. Create a safe place for incoming papers to land and you’ll be ahead of the game.

Any day now, you’ll start receiving official-looking forms (1098s to indicate interest income you’ve paid on certain loans, 1099s to show interest, dividends, and other payments to you, W2s from employers, etc.) to help you prepare your taxes for last year. To get an idea of the forms to expect, these tax-related Paper Doll posts will walk you through it:

Taxing Conversations: Organizing the Essentials & a New Tax Tool

Taxing Conversations (Part 2): Organizing Fun With Forms

Taxing Conversations (Part 3): Form-Free Organizing

Securing these documents (plus any items that pop up when you’re following the steps in #6, above) will make tax time run much more smoothly, whether you file on your own or use a preparer.

8) Organize a (Socially) Secure Future

Cleaning up your credit history will organize your past; getting a handle on your expenses, financial paperwork, and taxes will take the wobble out of your financial present. But what about your future? Banking (if you’ll pardon the pun) on Powerball isn’t going to do it.

There are numerous ways for minimizing taxes and maximizing your odds for a financially secure future, and if you don’t have one or more of the alphabet soup of IRAs, 401(k)s or 403(b)s, you should be talking to a financial advisor about how to get started. But whatever your retirement plan, there’s one program in which you’re probably already participating (unless you work for the railroads): Social Security.

Start by signing up for your online Social Security account, as I’ve been pestering you about since Paper Doll Makes a Statement: The Social (Security) Network.

If you haven’t yet signed up yet, go to the my Social Security website and click on Create An Account. Once you create your account, you’ll be able to track your earnings and verify that they’ve been properly reported (by you and/or your employer), and get estimates of your future benefits. If you’re already receiving benefits, accessing your account enables you to obtain a letter with proof of benefits (often needed for legal and financial purposes), change your address and direct deposit payment information, and manage your benefits.

If you have already set up your account, change your password! The Social Security Administration actually makes you do what you’re already supposed to do — update your password every six months. If you haven’t, it’ll prompt you to do so when you log in.

Speaking of Social Security, take your card out of your wallet or purse — you shouldn’t be carrying it around with you.

As we talked about in What’s In Your Wallet (That Shouldn’t Be)?, in the wrong hands, your Social Security card is an invitation to identity theft and financial fraud. Memorize your number for when you have to unexpectedly fill in forms. (Really, it’s like a phone number, just nine digits.) Put the actual card in your VIP (very important paper) file system or in your fireproof safe, and only pull it out when you need it.

As we talked about in What’s In Your Wallet (That Shouldn’t Be)?, in the wrong hands, your Social Security card is an invitation to identity theft and financial fraud. Memorize your number for when you have to unexpectedly fill in forms. (Really, it’s like a phone number, just nine digits.) Put the actual card in your VIP (very important paper) file system or in your fireproof safe, and only pull it out when you need it.

Can’t find your Social Security Card? Report it, especially if you think you’ve been the victim of identity theft, and then replace it.

9) Save for More Than Retirement: Cheating the Obstacles to Willpower

I know, I know. Saving isn’t sexy. But a beach vacation is. And not having to go into credit card debt to pay for next year’s Christmas presents is an idea that gets the blood flowing. But saving is difficult. Usually, in order to save money, you have to use up all your reserves of willpower to keep from spending it in the first place.

What’s willpower, really? Psychologists have defined it as the ability to delay gratification, resisting short-term temptations in order to meet long-term goals. But the more you delay gratification, the more worn-down and put-upon you can feel.

So, why not do an end-run around willpower? Automate! No, you don’t need to be a robot; you just need to take the ongoing decision-making (to put money aside) out of the equation. Make the decision once and be done with it.

Remember last time, in step #5, you audited your expenses and figured out what bills you could lower? Let’s say you lowered your monthly entertainment expenses by $18 and your phone/communication bills by $11, and maybe eliminated a few other ongoing items by about $15 a month. On their own, that may seem a pittance, but that’s $44 every month. Set up an automatic transfer from your checking to your savings account for $11 per week.

Of course, even if you haven’t identified ways to pare down your spending, as long as you’re not at risk of falling into the red, having small amounts automatically transferred to savings on a regular basis is a way to improve your savings rate without feeling you’re being denied life’s pleasures.

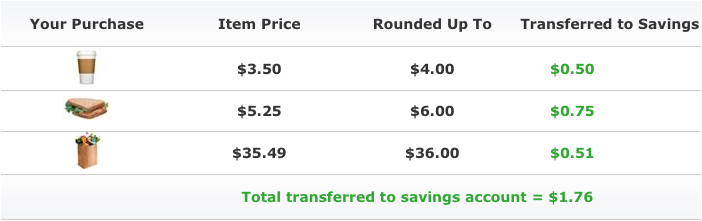

There are other automated savings options. Bank of America’s Keep the Change Program helps its customers save by rounding up each debit card purchase to the nearest dollar, and sequestering that extra money in savings but allowing you to track the movement of money via online banking. For example:

Prefer a little more tech support? The Digit web service works similarly. Once you link Digit to your checking account, it analyzes your spending patterns, predicts your cash flow, and transfers small but varying amounts of your money to your Digit account in an FDIC-insured bank.

You won’t earn interest, but whenever you want your money, just text Digit, and the money can be transferred back to you, so you could wait until you reach a benchmark amount, like $500, and then transfer that to savings.

Digit sends one text each day to let you know your new checking account balance; it can also text you how much your bank balance has changed over the prior two days, and can list all your debits from the prior day. The more you use it, Digit not only helps you save, but also gain more awareness of your spending habits. Isn’t that organized?!

Still to come in this series: organizing to get out of debt, streamline getting paid, using technology to achieve your financial goals, and more!

Follow Me