Paper Doll Says The Tax Man Cometh: Organize Your Tax Forms

Eugene O’Neill wrote The Iceman Cometh. It’s about the human need for self-deception in order to carry on with life.

Well, I’ve got news for you. The taxman also cometh. Try as we might to deceive ourselves, we have only a little more than a month before we must complete our annual (and sometimes painful) math homework for the government. So pop some Beatles (or Beyoncé) into your sound system, and let’s get started.

Photo courtesy of Chris Potter/CCPix at www.ccPixs.com under CC 2.0

The key to approaching your taxes is to be organized. (You’re on the Paper Doll blog. Were you expecting something more Zen?) And before you can start preparing your return, you need to know the numbers. Where are the numbers? On the forms!

GATHER YE FORMS

Every taxpayer’s situation is different. If you are single, had only one job all year, and lived in the state where you were employed, and have no investments outside of your retirement accounts, the number of forms you receive may be minimal. If you’re married, have a family, or have complicated investments, or bought or sold a house (or other property), you’ll have to gather more paperwork.

It all starts with the supporting documents called information returns. These are sent to you by others – employers, banks, brokerage houses, schools, casinos, and others. The law requires these entities to provide them to you (generally by January 31st), so you shouldn’t have to do much searching. They should have shown up in your mail. So that scary-but-official mail you threw on top of the microwave the week before Valentine’s Day? Move the oven mitts and get looking!

MONEY YOU RECEIVED

W-2 (Wage and Tax Statement)

Ever had a job? If you did, and you lasted more than a day, you should have received a W-2. Your employer is supposed to send one copy to you and one to the IRS, reporting how much you were paid (in wages, salaries, and/or tips). If applicable, it should also indicate how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state, and local taxes, FICA, unemployment insurance, and a few other withholdings are considered statutory payroll tax deductions. Statutes (that is, laws) require them.

Sometimes, a court might rule that an an employee’s wages may be garnished, but this has nothing to do with sprigs of parsley. People behind on child support payments or who owe money in lawsuits may have money removed from their earnings, before it ever gets to their paychecks, to ensure it goes directly to whomever is owed.

Your W-2 may also report voluntary payroll deductions. These are amounts withheld from your paycheck, where you’ve granted permission. These may include your portion of health and life insurance premiums, contributions to your 401(k) or other retirement fund, employee stock purchasing plans, one-time or ongoing donations to the United Way, union dues, etc.

You probably got multiple copies of the same W-2. Employers submit copy A directly to the Social Security Administration (remember that FICA we talked about?) and keep copy D for their own records. Copies B and C are for the employee – you send one to the IRS with your federal tax return and keep one for your own records. Then, copies 1 and 2 are provided to file with any applicable state or local tax authorities. (I’ve never figured out why W-2 copies 1 and 2 aren’t called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, FF, and G?)

I've never figured out why W-2 copies 1 and 2 aren't called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, and G? Click To TweetIn theory, a W-2 should be mailed to the address listed on your W-4. (Don’t be confused. The W-4, which has a spanking-new look this year, is the form that tells your boss how much to withhold based on your number of dependents you have an any necessary adjustments.) Many smaller companies don’t bother mailing the W-2 and just hand them out to staff.

It’s March and you still don’t have yours? If you still work at the same company, go visit Madge in HR; if you’re long gone from that job (for good or ill), pick up the phone and call. Some things to consider:

- Did you change employers last year? You should have received W-2s from each employer. (If you changed jobs at the same company, you’ll receive one W-2 from each employer, not one per position. If you changed companies within a larger corporation, though, you may get one for each.)

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down to give you your W-2. Keep the boss updated!

Don’t assume that if you don’t have your W-2, that nobody knows what you made. Remember, the IRS got Copy A. The IRS knows what you made, so be sure you do, too! (If your former company went out of business or is otherwise dodging your calls, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

Examine your W-2 it carefully. Do the numbers seem right? Compare them to the final pay stub you got for last year. Calendar years usually end mid-week (and sometimes, mid-pay period), so the numbers won’t correspond exactly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return.

W-2G (Certain Gambling Winnings)

The W2G is the freewheeling cousin of the W-2. While a W-2 is for money you make while working, the W-2G is what you get while playing. If you win more than $600 in any gambling session at a casino – whoohoo! – the “house” should request your Tax ID (generally your Social Security number) and either prepare a W-2G on the spot or send it to you in January.

Casinos aren’t interested in keeping up with your losses, just your winnings, so they only tell the IRS about what they paid you. If you do go gambling and want to deduct losses, the IRS requires you to be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

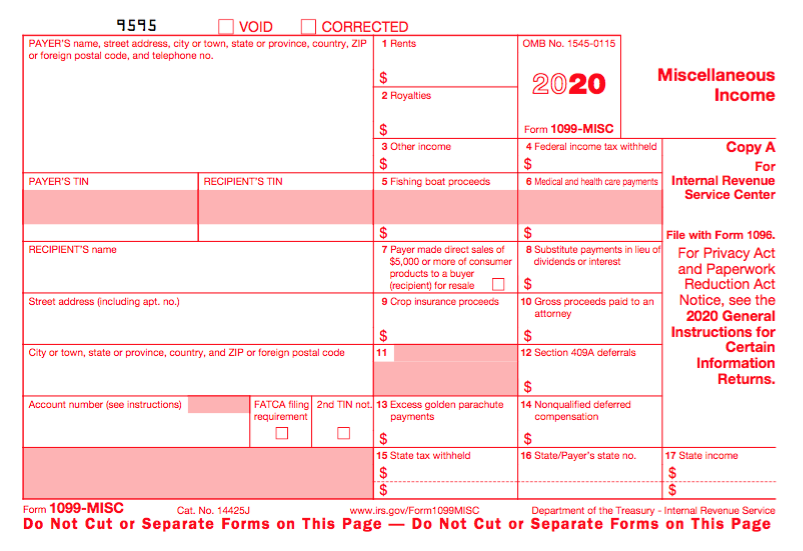

1099 (Income)

A 1099 is a form that basically says, “Hey, we paid you some money for something, but you weren’t an employee.” You get a copy; the IRS gets a copy. Easy-peasy.

There’s not just one type of 1099; actually, there are a whole variety of 1099s. Some of the more common are:

Got a bank account? This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account. Internet-only banks often require you to log into your account to get your 1099-INT, so don’t count on it coming by mail. If you received less than $10 in interest, your bank may not send a 1099-INT.

Do you own stock or taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equally; ask your tax professional if you have any that seem unusual or complicated. Whether you receive dividend checks or your dividends are held in a DRIP (a direct re-investment plan), if you did not earn at least $10 in dividends, you are unlikely to receive a 1099-DIV.

If you’re self-employed (a freelancer, an independent contractor, etc.), you should get a 1099-MISC. The problem is that even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-MISC. So, if you are self-employed or irregularly employed, it’s essential to keep track of your incoming revenue. Otherwise, if the person who paid you ever gets audited, it could trigger some messy situations for you, too.

Your 1099s sometimes hide in plain sight. Occasionally, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope – sometimes perforated, at the bottom of – a quarterly or end-of-year financial statement, so be sure to check all that boring-looking official mail that arrives. Multiple forms may be sent as a “combined 1099,” scrolling across multiple pages, so check the reverse of other forms, in case you seem to be missing one.

If you receive Social Security benefits, you should receive a SSA-1099 or an SSA-1042s, the latter being for non-citizens who live outside the United States but receive benefits. (For example, widows or widowers who are receiving spousal benefits.) The 1099-SSA tends to come on a long form, folded and sealed such that it makes its own envelope. If you did not receive your SSA-1099, you can log into your only Social Security account to access it.

And no, I have no idea why it’s called an SSA-1099 instead of a 1099-SSA. Obviously it was put together by the same people who created those extra 1099 pages…and bra sizing.

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that a party has forgiven a debt, like a mortgage or part of a credit card balance. You may owe tax on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, and got to keep it in your pocket, it’s as if you received money.

MONEY YOU PAID

1098 (Mortgage Interest)

A 1098 is not a 1099 with low-self-esteem. The straight-up 1098 reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. Renters don’t get 1098s; neither do homeowners who’ve paid off their mortgages. There are sub-types of 1098s for things other than interest on property loans.

- 1098-T indicates tuition you paid; you’ll get this from a college or training school.

- 1098-E shows you’ve paid interest on a student loan and will come from your lender

- 1098-C indicates the donation value of a car, boat or airplane. (Yes, even if you donated through 1-877-Kars4Kids.)

Photo by Daniel Salcius on Unsplash

1095-A (Health Insurance Statement)

The 1095-A is also called the Health Insurance Marketplace Statement. We are all generally required to have health insurance. If you purchased yours through a state or federal exchange, this document helps you determine whether you are able to receive an additional premium tax credit or have to pay some back.

Related forms include the 1095-B, supplied by companies with fewer than 50 employees, detailing the the type of coverage you had, the period of coverage, and your number of dependents, so you can prove you had the Minimum Essential Coverage (MEC) required by law. A 1095-C is similar, but for employers with more than 50 employees.

FINAL THOUGHTS

The post reviewed the most common in-bound forms you are likely to need (along with receipts for purchases and confirmations of donations), to help you prepare your income taxes. There are other, less common, information returns. If you receive a more mysterious form, or have questions about how to use a form, the IRS has a surprisingly easy Forms, Instructions and Publications Search.

Making sure you have all of the necessary forms in hand will make it much easier to prepare your tax return. Once you have filed your taxes, make a list of all the forms you received this year, and tuck that list into your tickler file for next January. Check off each form as it arrives, and you’ll have a better sense of when you’ll be ready to start working on your taxes.

With everything in hand, it’ll be harder to stick to that self-deception O’Neill wrote about in The Iceman Cometh, but knowing you’re prepared for the taxman may make you feel better.

If you drive a car, I’ll tax the street.

If you try to sit, I’ll tax your seat.

~The Beatles, “Taxman”

Well, I guess we can’t use the “I don’t have time to take care of this” excuse this year, right? No time like the present to dig in and get all the necessary materials together. Thanks for sharing this… it can all be so complicated!

While we’re all at home, there seems to be more overwhelm because there’s less differentiation between personal and work time. I think I’ll have to write a blog post, or several, about that! A little bit of tax time every day, eh?

Julie, This is a fabulous (and very complete) overview of all the forms a person may (or may not) need. I love the way you explained them.

Thanks, Diane. Of course, as Seana noted, now we have no excuse not to work on our tax returns! 😉

As a Canadian, this is almost a foreign language to me, but I do love the Beatles!

All you need is love…

LOL. I’m sure it’s all easier up there. And these were only the most common forms!

What a complete post about tax documents! And in addition, just reading about it surely will inspire or perhaps nudge many to get things going. As you said, we have only a month remaining before the 2019 tax returns are due. I am familiar with all the forms you mentioned except for the W2G. As you may have guessed, I’m not a gambler. But good to know in case something changes.

As odd as it may seem, I actually enjoy preparing the tax summaries with all the supporting documents for us and also for some of my clients.

Thank you, Linda! I feel like overwhelm keeps us from starting, but once we realize, oh, it’s not all that complicated, it’s just silly numbers for names. If the documents were called, “Money you made at work” or “Gambling winnings” or “Tuition you paid,” nobody would stress about it.

And I’m not a gambler, but someone I know wins often.

I love preparing OTHER people’s taxes. Just not my own.

Not my favorite thing to do and like Seana, I guess I don’t have an excuse to put it off since you’ve shared so much helpful info. LOL ? I look forward to the day when I can file taxes without processing paperwork. Fingerprint scan, maybe? ?

Then even more information about our lives will have to be networked. That’s a thriller movie, right there!

Thank you for this detailed article on tax forms, you give a clear explanation of each form’s purpose. Everyone could use a resource like this when gathering their tax forms together.

Thank you, Nancy. Because I do my own taxes, I used to assume everyone knew about these forms, but every year, I encounter people dealing with taxes for the first time — new widows whose husbands used to do the taxes, young adults who never had income, people who are new to the US tax system, etc. My favorite is the one for gambling winnings! (I never gamble, so I never win, but I still think it is nifty.)

Great article. Thanks for the detailed information. Your blog is by far the best source I’ve found.