Archive for ‘Financial’ Category

Paper Doll’s 16 Ways To Organize Your Money In 2016 — Part 1

Two of the most popular and enduring New Year’s Resolutions are to get organized and to save more and spend less. In honor of 2016, over the next few posts, we’re going to look at 16 ways to organize your finances with small, easy steps you can take today.

1) Pull your credit history.

How? Pulling your credit reports is easy. Just go to AnnualCreditReport.com and click on “Request Yours Now.” You’ll be prompted to answer some questions about things like your prior addresses or current or previous loans. (They really want to make sure it’s you, so think before you click.)

Because you’ll be supplying personal financial information, you want to pull your reports from a secure computer, preferably one on your own network, rather than a public computer. If you’d prefer to avoid the web altogether, you can call toll-free at 1-877-322-8228 to request your report, or download, print, fill out, and mail a paper form.

Why? Your credit report includes information that is used to determine interest rates on loans and mortgages, rates you’re charged for insurance, and even whether or not you can rent an apartment or get hired for a job. The best way you can be certain that creditors have properly reported your financial activities, not misconstrued someone else‘s honest activities as yours, and haven’t let bad dudes secure credit in your name, is to check your credit history.

You are guaranteed one free credit report from each of the three credit reporting agencies (Equifax, Experian and Trans-Union). You could just contact them individually, but the Fair and Accurate Credit Transactions Act (FACTA) of 2003 made it federal law to guarantee your right to access your report, for free, once each year.

Once you’ve convincingly proven that you are who you say you are, go ahead and print (or better yet, save a PDF of) your credit reports. And make a note on your calendar to check again next year.

When? You can choose to pull all three reports simultaneously once per year, or stagger them and pull one report from each agency whenever you like, perhaps every four months. While experts sayl that the staggered approach is more likely to catch an error quickly, most people are not diligent about remembering to pull their reports on a regular basis. If you’ve never pulled your credit history before, I suggest pulling all three reports simultaneously, familiarizing yourself with the formats, and then you can decide what you want to do going forward.

2) Check — and, if necessary, dispute — your credit history.

According to a Federal Trade Commission study, 20% of consumers have errors on at least one of their credit reports, and 5% have errors which could adversely impact them during the lending process.

Just as buying (and even watching) exercise DVD won’t help you achieve your resolutions to lose fat and gain muscle if you don’t actually do the workout, downloading your credit report is an exercise in futility of you don’t actually review it. Go through it page by page, line by line:

- Are there credit cards or financial accounts you never opened? (Note, credit card lenders often buy one another out, especially with store-specific credit lines, so be sure to cross-check account numbers to make sure something unfamiliar isn’t just the product of a buyout.)

- Are there addresses or places of employment that don’t pertain to you? (Minor errors, like misspellings, are worth fixing, but don’t necessarily require disputation. Correct them to prevent confusion in the future, especially when filling out forms where you have to jump through hoops to verify your identity.)

- Does it list liens or judgments against you that have no relation to your actual financial history?

- Is there information that should no longer appear on your history, such as a bankruptcy that is more than 10 years old?

If there are mistakes on your credit report, contact the appropriate credit reporting agency and the lenders in question to dispute the errors.

3) Check your credit score.

Although you’re guaranteed access to your credit reports for free, there’s no such promise for your credit score. You hear a lot about your FICO score, but different lenders access multiple scores to assess the interest rates they will offer you for credit cards, auto loans, and mortgages. You can purchase your individual credit scores from each of the credit reporting agencies, or buy bundled scoring from MyFICO.com.

LendingMemo.com

However, unless you’re getting ready to make a major purchase, you have a variety of free options to gain access to least one of your credit scores, which should give you a ballpark sense of your official creditworthiness. Barclaycard, Citi, Discover, First Bankcard, US Bank and others offer credit scores to customers on their web sites; Discover also provides credit scores on monthly bills. In addition, some banks and credit unions are offering free scores to customers as inducements for their loyalty, and CreditKarma, is a surprisingly non-spammy option for accessing your score.

In Paper For Your Plastic: Organizing a Better FICO Score, I’ve written about how understanding the makeup of the FICO score can help you improve your creditworthiness in the eyes of lenders. Since that post was written, new rules about medical indebtedness guarantee that unpaid medical debt will carry less weight than other types of consumer debt, and any medical debt eventually paid off will be removed from your credit history immediately, even if it had been in arrears.

4) Track your expenses.

With the advent of online banking, automatic transfers, and even mobile payment (like Apple Pay), it seems like nobody writes checks anymore. But that means people have gotten out of the habit of reconciling or balancing their checkbooks. It may seem to make sense — no checks, no checkbooks, but we still have checking accounts, and so whether they are paper or digital, I think we need check registers.

When we all wrote checks, we were forced to pay attention to where our money was going, but with all of those swipe-and-done transactions, we’re far less likely to notice how much money is draining out of our accounts until the money is gone. And with automatic transfers, we tend not to look too closely at the bills that come on a monthly basis, so we may not notice errors (fraudulent or otherwise) until it’s well past the date they might be reversed.

At the very least, set an alarm or alert on your computer, phone or tablet to remind you to check your bank account and credit card statements monthly, before manually paying or allowing automatic payments to go through. (Weekly would be better, if you hope to catch fraud.)

Write down or track everything you spend during this first month of getting your finances organized. If you’re just getting started with tracking expenses, it will help to do a little bit every day. When you’re sitting in front of your computer to authorize a payment, mark it in your paper checkbook register. (Your bank will give them to you for free.) Yes, it may seem old-fashioned, but the observer effect notes that the act of observation changes the phenomenon being observed. So, just as Weight Watchers has proven that journaling calories and activity has a positive impact on weight loss, you’ll likely see that the mere act of tracking your expenses to organize them will improve your finances.

When you come from a day of shopping, pull the receipts out of your wallet, and mark anything that drafted from your checking account in your register, and put your credit card receipts in an envelope for easy access. If you follow along daily, it shouldn’t take more than five minutes (unless, of course, you’re a BIG spender), but the value will be returned to you.

Periodically, by checking your online accounts, and certainly once your monthly statement is generated (whether on paper or digitally), check in with your finances:

- Balance your checkbook register, even if you haven’t written actual checks in eons.

- Check receipts against your online bank and credit card statements.

- Visually scan your credit card statements as soon as they arrive, and call to verify anything that looks hinky.

Once you’re familiar with your spending patterns, especially if you rarely use cash, it’s also a great idea to set up an online financial dashboard service with web- and app-based trackers like Mint. But to start this process, you’ll pay more attention to those little drips and drops of funds if you put pen to paper. (We’ll talk more about financial dashboards in the upcoming posts of this blog series.)

Being organized doesn’t just mean sorting the paperwork and digital receipts. It means knowing what you have and where you have it, keeping what works and getting rid of what doesn’t suit your goals.

5) Audit your ongoing expenses.

Clutter piles up when we don’t think about whether we even want or need something. Financial clutter piles up the same way. No matter what you pay monthly, quarterly or annually for a service, if you don’t think about whether you still want it (or want it at that price), your expenses are likely to get out of control.

Comb through your digital and paper records, and consider your subscriptions and ongoing purchases. What purchases duplicate what your household already buys? What could you replace with a better deal? What could you eliminate altogether? Consider the following categories:

Video: Do you have Amazon Prime, Netflix, Hulu, and cable/satellite? Are you watching enough of each to justify keeping them all? (Paper Doll is a huge TV fan, but even I find it’s sometimes worth my while to pause a subscription for a few months when life is too busy to catch up with all my stories.)

Audio: Do you have satellite radio in your car, like Sirius XM? What about subscriptions to Apple Music and premium streaming music via Spotify or Beats? If you already have Amazon Prime, could you scale back on paid streaming? Could you bear to listen to commercials and drop from paid streaming to free versions?

Reading: Do you have ongoing (digital or paper) magazine and newspaper subscriptions that you never get around to reading? Do the magazines pile up until you guiltily toss them in the recycling bin?

Communication: They’ll have to pry my landline from my cold, dead hands, but for some people, the switch to mobile-only makes good financial sense. Also, have you checked to make sure your cell phone plans line up with the number of minutes, texts, and data you use?

Computers: From Evernote to Dropbox for storage and collaboration to the various plugins that keep a blog running to software and app subscriptions and upgrades, there’s a truth to be told. Just like with some relationships, when it comes to some digital loves, the bloom is off the rose.

Gaming: Paper Doll doesn’t judge. (OK, she does, but…) If you’re actually playing and enjoying the various MMORPG or online or interactive games for which you pay, more power to you. But if your digital ranch has long gone untended and you haven’t logged in for a long while, it might be time to cull the herd.

IRL, or In Real Life: Do you belong to a gym, associations or clubs? Do you go often enough to make the fees expenses worth what you’re paying? If you haven’t been active in a while, cancel, or see if your membership can be suspended for a few months, until you can gauge your interest.

Gifts: Do you automatically renew your grandpa’s golf magazine or your BFF’s CatFancy? Make sure they still want these particular benefits of your largesse. (And, in general, think about giving gifts of experiences rather than tangible objects.)

Professional expenses: Do you need to renew dues or pay for certifications or licenses? Just make sure you still participate in all of those activities before continuing to rack up expenses.

Just as with our new year, this is only the beginning. The rest of this series of 16 financial organizing strategies will share more tips about organizing your financial paperwork, budgeting with the help of technology, lowering your expenses, streamlining how you get paid, and more.

Ten 10-Minute Financial Tasks to Organize Your Finances

[Editor’s note 4/27/2020: As we all cope with another month sheltering in place, financial issues are causing anxiety. Even if you’re not feeling highly motivated (or motivated at all), this classic Paper Doll post is filled with quick tasks to help you get a handle on your financial situation and feel more empowered.]

Readers, at three weeks into the new year, most people have petered out in their attempts to achieve their resolutions, or they’ve not even started, waiting until after they’ve taken down the tree or gotten the kids back to school. But the clock is ticking, and time is money. And while love of money may be the root of all evil, money itself is what keeps us from living in a van down by the river.

So today, Paper Doll is offering up a fast-forward kick-in-the-tush for organizing those little green pieces of paper we all like so much.

To that end: take ten minutes a day, for the last ten days of January, to take ten tiny steps toward getting your finances in order.

1) Sign up for your online Social Security account.

IRA. 401(k). 403(b). No matter how you’re saving for your retirement, there’s one program in which you’re pretty much guaranteed to be participating (unless you work for the railroads): Social Security. If your senior years are dependent upon your retirement savings, investments and benefits, wouldn’t it make sense to ensure the information is organized?

A few years ago, in Social Security Goes Paperless & Gets Lean, Green & A Little Mean, I told you about how the paper Social Security statements we’d been receiving annually were being discontinued.

A year later, I announced the new SocialSecurity.gov online account program in Paper Doll Makes a Statement: The Social (Security) Network.

But did you sign up?

If you haven’t yet signed up yet, now’s the time to do it. Go to the my Social Security website (let’s just ignore their e.e. cummings-esque decision not to capitalize “my”), and click on Create An Account to get started. Once you create your account, you’ll be able to track your earnings and verify that they’ve been properly reported (by you and/or your employer), and get estimates of your future benefits. If you’re already receiving benefits, accessing your account enables you to obtain a letter with proof of benefits (often needed for legal and financial purposes), change your address and direct deposit payment information, and manage your benefits.

If you have already set up your account, change your password. Now! The Social Security Administration actually makes you do what you’re already supposed to do — update your password every six months. If you haven’t, it’ll prompt you to do so when you log in. (Speaking of passwords, just this week, SplashData released a list of the worst passwords of 2014. Don’t use those. C’mon.)

2) Take your Social Security card out of your wallet.

Seriously, dude. We’ve talked about this (in What’s In Your Wallet (That Shouldn’t Be)?). Your Social Security Card, in the wrong hands, is an invitation to identity theft and financial fraud. Memorize your number for when you have to unexpectedly fill in forms. (Really, it’s like a phone number, just nine digits.) Put the actual card in your VIP (very important paper) file system or in your fireproof safe, and only pull it out when you need it.

Seriously, dude. We’ve talked about this (in What’s In Your Wallet (That Shouldn’t Be)?). Your Social Security Card, in the wrong hands, is an invitation to identity theft and financial fraud. Memorize your number for when you have to unexpectedly fill in forms. (Really, it’s like a phone number, just nine digits.) Put the actual card in your VIP (very important paper) file system or in your fireproof safe, and only pull it out when you need it.

Can’t find your Social Security Card? Report it, especially if you think you’ve been the victim of identity theft, and then replace it.

3) Pull your credit report annually.

Yup, we’ve talked about this, too. Over and over and over. The only way to make sure that creditors have properly reported your financial activities, and to ensure that you’re protected against bad guys securing credit in your name, is to check your credit history.

To that end, the federal government mandated the creation of a free joint program among the credit reporting agencies (Experian, Equifax and TransUnion) at AnnualCreditReport.com. Click, answer enough identifying questions about past addresses and financial history to convincingly prove that you are who you say you are, and print (or make a PDF of) your credit report.

And then here’s the thing: read it. Downloading your credit report and not looking at it is like buying exercise videos and not taking the shrink-wrap off the DVDs. It creates clutter in your space, maintains clutter in your life (messy finances, like lumpy physiques), and keeps your future (financial) health insecure. Downloading your credit report and not looking at it is like buying exercise videos and not taking the shrink-wrap off the DVDs.

Remember, your credit report doesn’t automatically include your credit score. You generally have to pay each of the three credit reporting agencies extra for that. But that doesn’t mean you have to pay — DiscoverCard and other credit card companies have started to provide FICO scores (for more on that, check our classic Paper For Your Plastic: Organizing a Better FICO Score) and CreditKarma, a company enabling you to track your credit score over time, is a non-icky consumer option.

4) Look back at 2014.

Did you get married? Divorced? Have a baby? Adopt? Did your own little company shoot through the roof? You’ll be doing lots of paperwork soon to work on your taxes for last year, but don’t forget about setting things up for the coming year.

If you’re employed by someone else, you may be subject to more or fewer withholding exemptions. Sit down with your HR department to figure out how to change your withholdings on your W-4.

If you pay self-employment taxes, be sure to adjust your quarterly estimated taxes accordingly.

5) Balance your portfolio (and not on the top of your head).

The best way to organize your future finances is to be an active participant and know what you’re invested in, in what proportions, and keep tabs as the economy changes the balance of your holdings. Paper Doll isn’t a financial consultant. I read Money and Kiplinger’s and watch the quarterly statements on my investments, and I don’t have a clue about the math on my own.

Sit down with your financial advisor, if you have one, or find a fee-only financial planner through the National Association of Personal Financial Advisors (NAPFA), and find out where your money is: in what companies or mutual funds, in what types of accounts (growth, income, real estate, magic beans, etc.), in what proportions, and create a plan for getting your financial future organized.

6) Create, or add to, your emergency fund.

Experts used to say to keep three-to-six months’ worth of expenses in a liquid emergency fund. (And no, as much as Paper Doll believes diet Coke should be legal tender, this means your money is immediately accessible.) During the recent volatile economic years, that’s been upgraded to eight months.

Not even close? Keep reading for baby steps to help you get there.

7) Create a spending plan.

The word “budget” is about as appealing as the word “diet” — and about as effective. Instead, take a few minutes as your mail comes in each day to jot down what you pay each month, or use a financial dashboard like Mint to track all of your spending and income. Review expenses, including:

- Rent or Mortgage

- Insurance (health, homeowners/renters, auto, etc.)

- Utilities (electricity, gas, cable, internet, land line, cell phone, data plans)

- Child-related (baby sitters, tutors, music lessons, activity fees)

- Home-related (homeowners’ association dues, cleaners, lawn care, exterminators)

- Credit card bills

- Student loan payments

- Other debts (car loans, personal loans, etc.)

- Controllable expenses (groceries, dining out, clothing, personal purchases)

Show up for mail call. Avoiding the truth about your financial situation is like not going to the doctor because you’re afraid of the diagnosis. The sooner you know what’s going on, the quicker things can start improving.

Know your income and your monthly expenses. If the latter seems to outstrip the former, prioritize what can be cut (even temporarily). Knowledge is power.

8) Automate savings. Don’t play games.

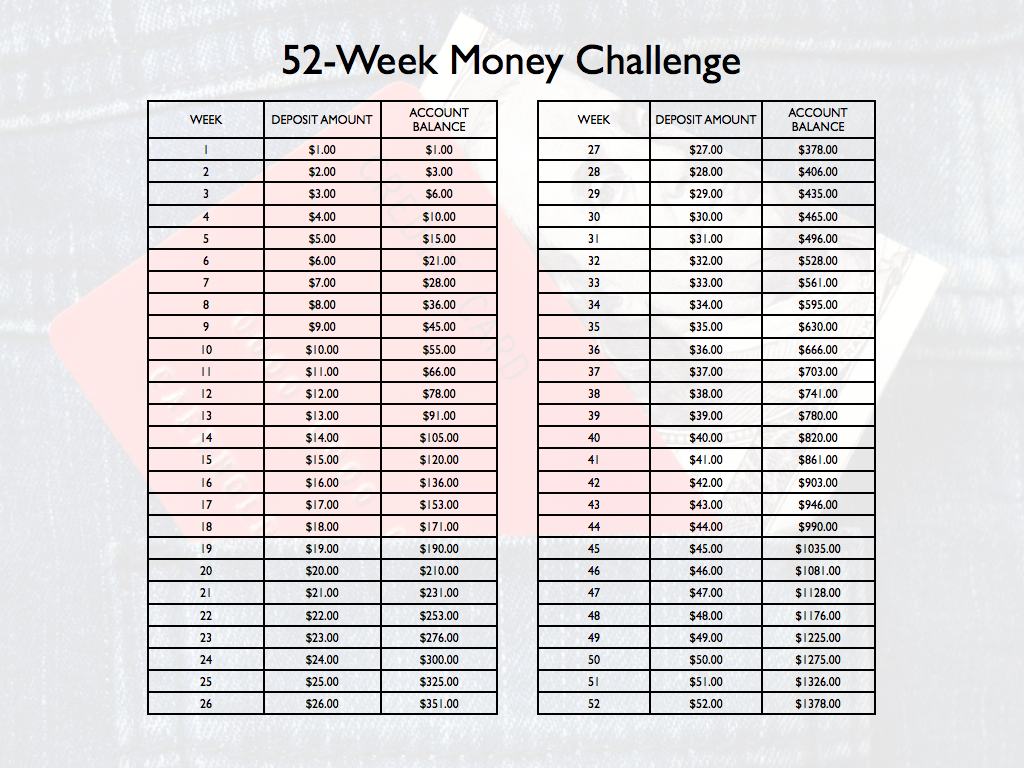

Have you heard about the 52 Week Savings Challenge? This got big exposure in 2014 and has been making the rounds again. I’d love to credit the graphic below, but it’s simply been EVERYWHERE for the past year-plus, and nobody’s taken credit.

The theory was that each week of the year, you bank one dollar more than the week prior. What’s a dollar? What’s a couple bucks? Keep it up and after 52 weeks, you’ll amass close $1400 (plus interest), almost painlessly. Conceptually, it’s appealing, but I’ve got worries.

The theory was that each week of the year, you bank one dollar more than the week prior. What’s a dollar? What’s a couple bucks? Keep it up and after 52 weeks, you’ll amass close $1400 (plus interest), almost painlessly. Conceptually, it’s appealing, but I’ve got worries.

Let’s start with the plan as written. Sure, $3 is no biggie for most of us. But as you go along and head toward the end of the year, it might be hard to find a loose $47 or $50 every week. From Thanksgiving to the end of the year, alone, that’s $296, and for people who are struggling, that’s a toughie. (For those who increase each week’s savings by $10 instead of $1, the end of the year would be similarly problematic.)

One solution might be to move backward or mix it up. Start at $52 at the start of January, decreasing the amounts each month. Or number scraps of paper 1-52, put them in a jar and pick one out each week to transfer to savings.

A larger problem with the system is that it’s hard to automate transfers with an incremental increase. You probably can’t tell your bank to take $X+1 and transfer that each week. But you know that it’s easier to do something when you don’t need to find motivation to accomplish it.

I think it makes more sense to automate your savings. How much do you want to save this year? Divide by 52, and whether you’re putting away $5 or $500 (lucky you!), set up an automatic transfer through your bank, or consider seeing if your employer will split your direct deposit between two accounts.

9) Identify to what’s expiring when, and what it’ll cost you.

If you’ve completed task #7, you’ve got a handle on regular expenses, but what payments do you make annually, or upon expiration? Don’t be surprised — review last year’s credit card and bank statements and think about past financial annoyances. For example:

- Amazon Prime — Did you get in on the low rate last year before it bumped up?

- Annually renewed gift subscriptions — Do you regularly bestow largesse?

- Discounted services — Did you get a discounted 12-month package from your cable company? Is your low-rate cell contract up?

- Professional expenses — Do you need to renew dues or pay for certifications or licenses?

- Travel costs — Do you need to renew your passport, Global Entry or Trusted Traveler programs, or airport lounge memberships?

10) Don’t guess. Know.

Being organized doesn’t just mean sorting the paperwork or the emails that come every month. It means knowing what you have and where you have it, keeping what works and getting rid of what doesn’t suit your goals.

- Write down everything you spend. (If you never use cash, a financial dashboard may suffice, but you’ll pay more attention to those little drips and drops of funds if you put pen to paper.)

- Balance your checkbook register, even if you haven’t written actual checks in eons.

- Check receipts against your online bank and credit card statements.

- Scan your credit card statements as soon as they arrive, and call to verify anything that looks hinky.

It’s your money, honey. Your finances are like children. Keep them safe, help them grow, and they’ll make sure you have a happy old age.

Taxing Conversations (Part 3): Form-Free Organizing

For most people, anticipating tax time falls on a continuum from vague annoyance to full-blown anxiety. Getting organized isn’t a panacea against all that causes us stress, but it can inoculate us against the worst of it. (As Paper Doll always says, organizing can’t prevent catastrophes, but it can help make them less catastrophic.)

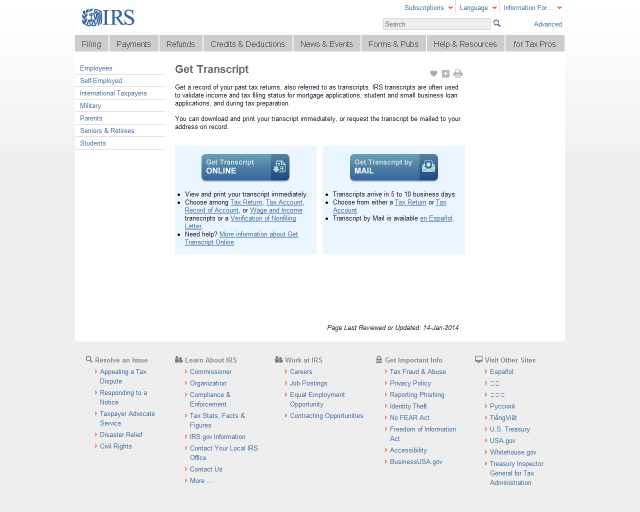

In our last two posts, we’ve looked at the basics for getting started organizing for tax time (including making use of the IRS’s new Get Transcript service), and we’ve tried to make some sense out of W-2s and the myriad 1099s and 1098s that organizations and institutions are obligated to provide you.

But what about other documents, the kinds that don’t come on forms? Most will be proof of deductible financial transactions. While some may be provided directly to you at the time (like receipts for deductible expenses), others may be sent as part of correspondence. And, of course, other types of proof will require you do some hunting and gathering.

There are a few main categories to consider.

YOUR HEALTH

You could (and probably should) maintain a folder with the receipts and annotated (paid) statements for all of your family’s out-of-pocket doctor’s visits and other medical care. At the end of the year, flipping through this folder allows you to summarize your medical expenses and determine if you’ve met the IRS threshold for deducting them. If you use a financial dashboard like Mint and are faithful about making sure expenses are assigned to the right categories, you may not have to do any math at all.

For reference, effective this year, you may only deduct medical expenses that exceed 10% of your adjusted gross income. (If you are 65 or older, the old 7.5% applies until 2017.)

If you have health insurance coverage, your company probably creates an annual summary indicating how much health care you’ve used and the amount you paid/owed to medical providers during the course of the year. For example, Blue Cross Blue Shield calls theirs a personal health statement.

The trick is that most people have no idea that their insurance companies create these summaries, as they tend not to be mailed to policy holders. Insurers save mailing costs and hope you’ll know to log into your online account to search for your summary. (If your medical expenses for the prior year are too low to qualify to be deductible, just save a PDF of your summary for your records; don’t bother printing.)

If your insurance company doesn’t create annual summaries, you can usually use the “You Owe” column of the Explanation of Benefits (EOB) that your insurer sends after doctor’s visits, hospitalizations and procedures (and you should definitely be able to log in or call to request copies of these, if you’ve discarded them). If your medical expenses are low, no further effort is needed, but if it looks like you’ll be able to take deductions, using your annual summary or EOBs will give you a handle on which receipts or dated statements you’re seeking for tax support.

In the future, try to be vigilant about saving medical expense receipts, as your EOBs and insurance company summaries are not considered proof of what you spent on deductible medical expenses, only indications of what you owed to medical providers. Collect receipts for:

Medical care expenses: Be sure to only count expenses for which you paid and not portions paid by the insurance company or “network savings.” (That’s the amount knocked off the bill simply because you have insurance. If you were uninsured, you’d be charged more than the total paid by you and the insurance company!)

Pharmaceutical expenses: Call or visit your pharmacy to request a printout of all pharmaceutical purchases you made for yourself and your children during the prior tax year. (Because of privacy laws, your spouse may have to make a separate request.) Using only one pharmacy for prescriptions is advantageous.

Health Savings Account documentation: For every qualified medical expense you pay through your health savings account (HSA) or medical savings account (MSA), keep a record of the name and address of each person or company you paid and the amount and date of the payment. Since HSAs can be used to cover everything from orthodontia and acupuncture to durable medical equipment and contact lens solution, be sure to save your receipts, and if a receipt doesn’t clearly describe what you actually purchased, make a note at the top to ease your efforts at tax time.

Medically-necessary travel expenses: If you (or a family member) have conditions that require travel for treatment, you can deduct the travel costs. Keep a paper or digital log of the miles driven and use the current IRS standard mileage rate for medical purposes for 2013 (or 2014).

YOUR HOME

Home purchases: Maintain records regarding the purchase (or sales) documentation for a house, as well as records for closing costs, home inspections, fees paid to real estate agents and any records regarding private mortgage insurance.

Casualty and theft losses require documentation. For thefts, you’ll need to have proof of ownership (that’s why we recommend saving “big ticket” item receipts and videoing a household inventory), proof of theft (usually via a police report) and the date that the item was stolen (to proove it falls in the appropriate tax year).

For proof of loss due to casualty, maintain insurance company confirmation letters regarding the date and cause (ice storm, lightning, fire, auto accident, etc.) of a loss, estimates of original costs and costs of repair/replacement vs. what your insurance company will or will not pay (or has paid), and proof of ownership.

Moving expenses relate to actual costs (movers, truck rental, storage, etc.) and mileage. Did you move more than 50 miles in order to work at a new job/location? Check out IRS Publication 521 regarding what you’ll have to document.

Other home-related paperwork to save include:

- Receipts and records regarding any home improvement efforts you’ve made which materially increase the value of your home (which will have a tax implication when you sell).

- Records of purchases for your primary residence that qualify you for the Energy Star tax credits for the applicable year. This gives you credit for 10-30% of costs for energy-efficient purchases, including biomass stoves, various heating/air conditioning devices, insulation, water heaters and windows and doors, geothermal heat pumps, residential small wind turbines, and more.

YOUR HEART

Childcare/Eldercare costs: To take advantage of the Child and Dependent Care Credit, you’ll need documentation of the name, address, and Tax ID number for any care provider you’ve used for your kids or other dependents. Whether you’re using a babysitter from down the street or employing the services of a daycare facility (for either children or adults), use federal form W-10, Dependent Care Provider’s Identification and Certification.

Even if you’re not planning to run for elected office, be sure you’re not running afoul of Nanny Tax rules regarding FICA (Social Security and Medicare) and FUTA (unemployment insurance). Use a Nanny Tax calculator and keep careful records of what you paid, when, what you withheld and what you submitted to the IRS.

Charitable donations: You may get a nice form letter on a non-profit’s stationery, or they may bury your acknowledgment as tiny text in asterisked comments at the bottom of requests for further donations, so be diligent about opening your mail. A charitable contribution confirmation should include the name of the qualifying charitable organization, a date of donation or at least the date of the acknowledgment (i.e., something to prove the tax year of the donation) and a dollar amount (or a description of materials if an “in-kind” (non-monetary) donation was made).

Not every charity confirms donations in writing. For your protection, keep your own records regarding donations you make. Use the charitable request letter or even a plain piece of paper to mark the date, dollar amount and method by which you paid (check number or credit card name), and file it away. Again, if you use a financial dashboard, identifying all of your donation amounts will be easier. If not, read through your credit card statements and highlight the charitable donations.

YOUR HEAD

Educational expenses: Higher learning can be deducted and the number and type of credits (the Hope Credit, Lifetime Learning Credit, American Opportunity Credit), Savings Bond programs and more can be dizzying. Just be sure that in addition to keeping your 1099-T (for tuition) and 1099-E (for educational interest), maintain transcripts that show your periods of academic enrollment, as well as canceled checks, credit card statements or other receipts that verify the dates of payment and amounts you spent on tuition, books, lab materials, student fees, etc.

Work-related costs: Un-reimbursed employee expenses may include costs for your vehicle or for travel, meals, entertainment or even client gifts. Unfortunately, you have to itemize and not take the Standard Deduction for these to do you any good, and your combined itemized expenses must exceed 2.5% or more of your AGI. Since you have no way of knowing in January what kinds of expenses your employer might force you to rack up in July, start maintaining a folder for these records right away. If you didn’t save receipts during the year, your credit card should provide proof for the largest of the expenses, like airfare and hotel costs.

Proof of payment for jury duty: Yes, it’s your civic duty, and yes, you probably got paid less per day than what you spent at Starbucks to stay awake in the jury box. You might receive a 1099 if you racked up enough days of service, but be sure to keep your own records regarding this kind of payment. If your employers required you to turn your jury duty payments over them, keep records so you can request an adjustment to reduce your AGI.

Tips: If you work in the food industry or a personal service profession where you receive tips, the IRS expects you to keep track of and report what you’ve made. (Yes. Really.) Use a mobile app like TipCounter or Tip Log to record of the tips you took in and what you were required to “tip out” to other support staff members (like bus boys, shampooers, etc.). If you prefer paper, keep a notebook; the IRS form 4070A is pretty clunky.

Self-employed/small business expenses: If you own your own business, you need a unique, separate filing system for all your business-related expenses, including tax paperwork. Check the classic Paper Doll post Organizing Your Tax Paperwork–Part 3: Get Your Business (Receipts) Off The Ground to make sure you capture all the essentials.

I hope this series of Taxing Conversations helps you ramp up your efforts to organize for tax time. Remember, Paper Doll is a professional organizer; in the language of the web, IANAA (I am not an accountant) and IANYA (I am not your accountant). For individual tax-related questions, please contact an authorized tax preparation specialist or financial planner.

Taxing Conversations (Part 2): Organizing Fun With Forms

Last time, we talked about simple steps for organizing the paperwork for your taxes. As Paper Doll mentioned, it all begins with gathering the right documents. Every taxpayer’s situation is different, but we’ll review the most common items you should be seeking and collecting in your Tax Prep folder.

Today, we’ll review the tax support documents called information returns. These are sent to you from outside entities and the law requires them to be provided, generally by January 31st, so they should require the least amount of effort on your part.

W-2 (Wage and Tax Statement)

If you’ve ever had a job, you’ve probably received a W-2. Not to be confused with a Federal W-4 (the form you fill out so that your employer knows how much tax to withhold), the W-2 is the form your employer gives you (and sends to the IRS) to report how much you were paid (in wages, salaries and tips) and, if applicable, how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state and local taxes, FICA, unemployment insurance and a few other withholdings are considered statutory payroll tax deductions. Statutes, or laws, require them. Wage garnishments for lawsuits or child support may be the result of non-statutory legal rulings specific to an individual. Your W-2 may also indicate other amounts withheld from your check, which are voluntary payroll deductions. These can include health and life insurance premiums, 401(k) or other retirement contributions, regular donations to the United Way, union dues, etc.

There are generally multiple copies of the same Form W-2. Your employers submit copy A directly to the Social Security Administration and keep copy D for their records. Copies B and C are for you — you send one to the IRS with your federal tax return and keep one for your own records. And, just to make sure you’re paying attention, copies 1 and 2 are provided to file with any applicable state or local tax authorities. (Don’t ask why they aren’t copies E and F. Paper Doll suspects it’s just to perturb her.)

Employers should mail W-2s by the last day of January, so if you haven’t received yours by Valentine’s Day, contact Human Resources (or, y’know, Madge, with the beehive hairdo, down the hall, as applicable). W-2s are usually mailed to the address listed on your W-4, though small businesses may just hand them to employees. Consider a few issues:

- Did you change employers recently? If you had more than one job this year, be sure that you have received W-2s from each employer. If you changed jobs at the same company, you’ll generally only receive one W-2 from each employer, not one per position.

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down and give you your W-2. Keep the boss updated!

Just because you don’t have your W-2 doesn’t mean the IRS didn’t get its Copy A. The IRS knows what you made, so be sure you do, too! (If your employer is no longer in business or is otherwise not responsible to your requests, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

When you receive your W-2, examine it carefully. Do the numbers seem right? If possible, compare them to the final pay stub you got for last year. Because the calendar year ended mid-week (and therefore, mid-pay period for most people), the numbers won’t correspond exactly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return. (And again, that’s a good thing!)

W-2G is a cousin of the W-2. If you go to a casino and win more than $600 in any gambling session (congrats, by the way!), the “house” will request your Tax ID and either prepare a W-2G on the spot, or send it to you in January of the following year. Note: the IRS knows about your winnings, but not about your losses. To deduct losses, the IRS requires you to be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

1099

A 1099 is a form that basically says, “hey, we paid you some money for something other than being an employee.” You get a copy; the IRS gets a copy.

There’s not just one type of 1099; actually, there are a whole variety of 1099s. Some of the more common are:

Got a bank account? This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account. Internet-only banks, like CapitalOne360, require you to log into your account to get your 1099-INT, so don’t count on it coming by mail.

Do you own stock or taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equally; ask your tax professional if you have any that seem unusual or complicated.

This is what you may receive from a client or customer if you were an independent contractor (i.e., self-employed) or if you got any kind of miscellaneous revenue for doing work for someone else when you were not actually considered an employee. Even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-MISC. This is why, if you are self-employed or irregularly employed, it’s still vital to keep track of your incoming revenue.

Your 1099s may be hiding in plain sight. Sometimes, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope as (or even perforated, at the bottom of) a quarterly or end-of-year financial statement, so be sure to check all the “official” mail that arrives. Multiple forms may be sent as a “combined 1099,” scrolling across multiple pages, so check the reverse of other forms, in case you seem to be missing one.

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that a party has forgiven a debt, like a mortgage or part of a credit card balance. You may owe money on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, it’s as if you received money.

The IRS maintains a list of other types of 1099s and 1099-related forms.

1098 (Mortgage Interest Statement)

A 1098 is not a 1099 with low-self-esteem. This form reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. If you rent, you won’t have a 1098; the same goes if you paid off your mortgage prior to the most recent tax year.

There are sub-types of 1098s for things other than interest on property loans. For example, you might receive a 1098-C from a charitable organization if you donated car, boat or airplane. (Paper Doll suspects that if you donated an airplane, you probably tripped over my blog post on your way to Happy Millionaire Magazine.) Your college might provide you with a 1098-T to indicate you paid tuition, or a financial institution might send a 1098-E to show you’ve paid student loan interest.

Chance are good that you will receive a W-2, 1099 and/or 1098 in any given year, but there are many other less common information return forms. This lengthy list and description of all tax-related forms can help you if you receive something mysterious and vaguely official in your mailbox.

Again, these are the forms that others are required to send to you. Next time, we’ll finish up by exploring other kinds of paperwork that you may need to locate and organize to prepare your taxes, primarily documents that may take a little nagging or detective work on your part.

Taxing Conversations: Organizing the Essentials & a New Tax Tool

The other day, I asked a potential client how well she thought her family was doing on keeping up with tax paperwork. She mentioned that they have a “tax drawer” where they collect everything related to taxes. Perhaps she thought I’d be judgmental, but I think she and her family are head and shoulders above where most American taxpayers are at this point in the year.

If tax time has given you a headache in the past, Paper Doll has some suggestions for obtaining, sorting and maintaining the forms and supporting material you (or your accountant) will need by April 15th.

The basics of getting ready for tax time aren’t that scary. Five simple steps should get you on your way.

1) Create a folder called Tax Prep 2013. Yes, 2013. In any given year, you’re preparing tax returns for the prior fiscal year.

While you’re at it, you may as well create your folder for Tax Prep 2014, so you’ll have it handy throughout the coming year. For many of my residential organizing clients, we create a hanging folder for tax prep with a variety of tabbed folders for the subset of paperwork that comes into the home throughout the year: Charity (donation receipts), Medical Expenses (sometimes divided into separate folders for prescriptions and doctor visits), Educational Expenses and more. However, if you’ve made it to 2014 without a system for tackling 2013’s receipts, one nicely labeled folder is a great start.

Although Paper Doll prefers tabbed folders because they store easily with the rest of your family filing system, you might like to consider something like the Smead Tax Organizer to corral your documents.

The faster you locate the essential documents, the sooner you can complete your return and earn one of two prizes, either a tax refund or more time to figure out how to come up with the funds to pay your taxes.

2) Watch your mailbox. Most financial institutions still send tax forms through the mail. If you’re not in the habit of opening your mail as soon as it arrives, January is the perfect time to start a new, good habit. Financial institutions have a nasty habit of hiding 1099s (of which, more next time) at the bottom of long annual statements or as enclosures with fourth quarter statements — so again, read your mail.

3) Watch your email inbox. No, you probably won’t receive tax documents via email, as it’s not secure. Financial institutions make a lot of security-related mistakes, but that’s not generally one of them. However, you will likely receive email notifications that you can log in to your online accounts at banks, brokerage houses, etc., to download and/or print your tax forms.

Caveat: this is also the time of year when phishers are trying to get their hands on your Social Security number and other vital information. Do not click on links embedded in emails to get to your online financial accounts. Type the URLs yourself, and make sure that https:// appears in the URL box so you know you’re gaining secure access.

4) Review your prior year’s tax return and supporting materials. (Hopefully, you’ve got them collated in a folder somewhere.) Make a quick list of all the forms and documents you used when preparing a previous year’s taxes. When January’s over, compare the list with what you have in your folder to see what forms might be missing or what recurring donations you might have made but forgotten. This year may not be identical to last year — you may have given to different charities, sold stock or closed an old savings account. But knowing which documents you received previously will help you eyeball the situation and recall changing circumstances.

5) Let the Taxman help. There are a few reasons you might be missing your old tax paperwork. Maybe you prepared your taxes online and had only a few forms and just tossed them in a drawer. Perhaps your paperwork is still in storage because you moved during the year. Or it’s possible that organizing your paperwork hasn’t been your major priority. Happily, getting your old tax returns has never been easier.

In the olden days (that is, before last week), if you wanted copies of your taxes, you had to either trundle down to your local Internal Revenue Service office, fill out forms, and wait in line, or you had to submit forms by mail and wait about ten business days for your forms to arrive by mail. Paper Doll suspects you neither want to cool your heels at the IRS office or have your tax documents slowly wing their way to you. (Oddly, we tend to worry less about mailing our financial information to the IRS than having them send it back to us.)

The good news is that effective immediately, the IRS has created Get Transcript, a real-time online tax transcript request service. (“Transcript” is the fancy term the IRS uses to refer to digital of old tax returns.) For what it’s worth, Get Transcript isn’t merely useful for preparing your taxes. When you apply for mortgages, small business loans, and student loans, presenting an IRS transcript is usually a quick shortcut for helping you validate your income and tax filing status.

Create a Get Transcript account with your name and email address. You’ll be emailed a confirmation code; once you enter it into the system (which you need to do within thirty minutes of receipt, so don’t dawdle), you’ll provide a variety of identity verification information and then set up a secure profile. Expect this part to take 5-10 minutes — but you’ll only have to do this once.

Get Transcript allows you to get your actual tax transcript (a copy of your original return) or an account transcript (which shows amendments or changes made by you, your tax preparer or the IRS). If you want a document that shows a combination of your original return and supporting information as well as the revisions, you must request a record of account transcript.

Select the type of transcript, year, and the reason you’re requesting it (e.g., mortgage, student loan, immigration, housing assistance, etc.). Your transcript will display on the screen. Save it as a PDF so that you can maintain a digital record on your computer or in the cloud. Don’t forget to sign out of your IRS account when you’re done.

Next time, we’ll review all of those official letters-and-numbers forms that can make tax preparation so stressful, and we’ll follow up with the supporting materials that you may need to collect on your own.

Taking just fifteen minutes to organize today will help make tax time much less stressful. Why not get started now? Dig through your “tax drawer,” climb into your mailbox, and start gathering the essentials.

Follow Me