Paper Doll

Paper Doll Sees Double: Body Doubling for Productivity

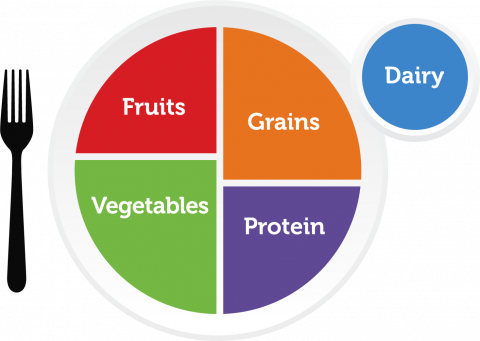

Knowing what you have to do and doing it aren’t the same things. If you were raised in the 1980s or 1990s, you learned you were supposed to eat according to the food pyramid. Nowadays, there’s the updated MyPlate approach to healthy eating, to make sure everyone gets the right proportions of fruits and vegetables, grains, protein, and dairy each day.

But knowing how you should eat doesn’t mean that you’ve never contemplated chowing down on break room doughnuts for breakfast. And it’s not just fictional characters like Olivia Pope who’ve had wine and popcorn for dinner.

And while sometimes family, friends, and colleagues can lead us astray from nutritional goals, it’s been proven that hanging out with people whose health goals are similar to yours can help keep you on the straight and narrow.

Simply put, when you’re with people who model good behavior, you’re more likely to participate in that good behavior. So, what does this have to do with organizing or productivity?

BODY DOUBLING AND ACCOUNTABILITY

Two years ago, I wrote Count on Accountability: 5 Productivity Support Solutions, one of the most popular posts I’ve had in the 15+ years I’ve been writing the Paper Doll blog. The concept of getting accountability support to conquer procrastination and achieve more productivity really resonated.

Perhaps you only know about body doubles in movies or on TV. That kind of body double often appears when the featured character is doing something the actor can’t do, like a backflip or fancy dance move. Subsets of body doubles are stunt doubles, or in the case of some films with a bit of nudity, “butt doubles.” However, when we’re talking about productivity, the “butt” is not about someone else’s; it’s about getting your own derriere into the chair to attack avoided tasks.

In that post two years ago, I explained the body doubling technique developed in the ADHD community. In support groups, participants found that when another person was present, participating in quiet tasks with a similar (non-distracting) energy, it helped the individual maintain focus and motivation. We professional organizers often work as body doubles with clients (both those with ADHD and those without) because it successfully creates an environment for focused work.

Any of us on our own (but particularly clients with ADHD) might (intentionally or unintentionally) delay working on a task or get distracted. Realized or unrealized anxiety about a task — fear of failure, for example — can prevent someone from starting, but you have to start in order to have anything you can improve upon. (See: “You can’t edit a blank page.”)

When a project is hanging over your head, you might find ways to delay or distract yourself, but when someone is there, investing their time in you (and you’re investing your time and money to achieve your goals), body doubling helps you push past the anxiety and be more productive.

As a professional organizer, when I’m body doubling with a client, we may be working side-by-side or across from one another. I may pre-sort piles of papers into categories (bills to pay, documents to review, items to file) while the client is working through one category at a time to complete distinct tasks. Students quietly studying for an exam in the library or doing homework in study hall are similarly using the body doubling method to achieve focus and productivity.

Scientific research on the benefits of body doubling are scant, but I can think of at least six (interlocking) ways in which body doubling advances an individual’s ability to stick with a task:

- Accountability — By definition, accountability is “the obligation or willingness to accept responsibility for one’s actions.” You may feel like introducing a second party to get your own work done is cheating, but it’s not.

Really, accepting responsibility means marshaling all of your resources to attack a problem and achieve the stated outcome. If a body double, accountability partner, mastermind or study group, workout partners, or anyone else can help you achieve your goals by their mere presence in your life, availing yourself is no different from having a state-of-the-art computer, a current eyeglass prescription, or properly-fitting running shoes. A body double is just a quiet, human-shaped resource for maintaining accountability.

Studying in Library Photo by Robert Bye on Unsplash

- Social pressure — If someone present with you expects you to get something done, you’re probably going to stick with it and do it. Of course, we’re not all equally responsive to the presence and expectations of others.

Gretchen Rubin’s work on her Four Tendencies framework (how we respond to inner and outer expectations) is a great place to start for understanding the role of social pressure in getting things accomplished.

Some people are Upholders, disciplined at meeting both their own expectations and those of others. Me? I’m an Obliger. I’ve got superior discipline when someone is waiting for me to do something. I am always on time to meetings or appointments, and I deliver what is expected of me by deadlines. However, I’m iffy at goals that only satisfy my own preferences.

Rebels can’t be forced or convinced, but the beauty is that a body double isn’t a boss or a manager telling you what to do. The body double is just mirroring what you’re doing. There’s nothing to rebel against; the body double is just along for the ride. Meanwhile, Questioners can’t be convinced by expectations, only their own pathway to finding meaning in the task. As with Rebels, the body double’s role is as travel companion.

The key is that for those who struggle with getting started or sticking with a task, a partner or several can improve the likelihood of reaching goals.

- Project or task orientation cues — On their own, many people have difficulty maintaining focus on the project at hand. This can be the result of any of a variety of executive function disorders or just a byproduct of living in the 21st century.

For every work-related search you do on Google, you’ll encounter numerous links — both on the search page and then in the sidebars, body, and bottom of the articles you’re reading — specifically designed to take you somewhere else on the web.

On our own, we go down rabbit holes and can’t find our way back to the original link or get trapped in dozens of open browser tabs. Body doubling means that just on the periphery of our consciousness, we’re aware that someone else is present, and that keeps us tethered to our work. We may go astray, but our body double’s presence can bring us (and our focus) back to the here and now.

- Biological cues — The experience of participating in body doubling and mirroring the body double’s behavior can help activate some nifty neurotransmitters. Literally, doing the task cues the bodily systems to kick start, making it easier to hunker down and do the work.

Do It Now Scrabble Tiles by Brett Jordan on Unsplash

- Task execution — “Well begun is half done.” (Aristotle) “You don’t have to be good to start … you just have to start to be good!” (Joe Sabah) “Only put off until tomorrow what you are willing to die having left undone.” (Pablo Picasso)

Such quotes are all well and good, but if you’re using procrastination to soothe your present discomfort, you already know you’re going to feel worse as the deadline approaches. To borrow from what I wrote in my original post on accountability:

Canadian psychology professor and all-around expert on procrastination, Timothy Pychyl, author of Solving the Procrastination Puzzle: A Concise Guide to Strategies for Change, explains that procrastination isn’t just delay. He explains that procrastination is “a voluntary delay of an intended act,” one where the person procrastinating is cognizant that the delay is going to have a cost, whether that cost is financial, interpersonal, professional, legal, or otherwise.

When we procrastinate, we know that there’s no upside; we aren’t merely weighing a logical choice between two options of equal value. It’s less, “geez, how can I decide on whether to go on this romantic anniversary date with my spouse or prepare for my presentation this week?” and more, “Eek, I’m feeling icky about doing this thing for some reason and I’ll latch on to any random thing, like bingeing a sit-com I’ve seen in its entirety three times!”

Experts like Pychyl have found that at its base, procrastination is “an emotion regulation strategy” – a way to cope with a particular emotion while failing to self-regulate and perform a task we know we need to do. We convince ourselves we’d rather feel good now, thereby causing more trouble for our future selves.

Getting started on those tasks is hard. But the minute you have another person there with you, you’ve got a (silent) partner whose presence makes getting procrastinating less possible and doing the (appropriate) activity a smidgen easier.

- Extended focus — It’s common to have trouble sticking with tasks that are boring, repetitive (and thus boring) or lengthy (again, yawn). The presence of others who match your energy and behavior type (reading, writing, doing math homework, sorting, etc.) sprinkles a little extra fairy dust to keep focus a bit longer.

If you were doing a series of Pomodoros (25 minutes of work, 5 minute breaks) on your own, you might give up after one or two. Someone else doing the same or similar tasks in your nearby environment is kind of like keeping pace with another random jogger or bicyclist on your route. If you were on your own, you might give up, but just a little bit of what I think of “competitive companionship” may be all you need to keep going.

To learn more about body doubling, consider:

Could a Body Double Help You Increase Your Productivity? (CHADD)

‘Body doubling,’ An ADHD Productivity Tool, Is Flourishing Online (Washington Post)

Use Body Doubling to Increase Your Productivity (Life Hacker)

How Body Doubling Helps When You Have ADHD (VeryWellMind.com)

I Tried A ‘Body Doubling’ App To Help With Focus – It’s Weird But It Works (Refinery 29)

What to Know About the ‘Body Doubling’ Trend That’s Keeping People with ADHD on Task (Men’s Health)

CO-WORKING FOR ACCOUNTABILITY

Body doubling as a method of accountability has been on my mind lately. In addition to regular client-related work and this blog, I have four special projects in the course of six weeks. I’m being interviewed for a podcast and for a video summit, participating an online summit requiring me to make a video and appear on live virtual panels, and I’ve got an in-person speaking engagement next week. Yikes!

All of these projects require research, writing, and finessing of verbal expression. (I like to be prepared, even when I will eventually have to be extemporaneous.) Deep down, I know it will be fine, but we all have bits of performance anxiety seep in. Timothy Pychyl might say that my temptation toward procrastination is a bit of (messed-up) emotional regulation strategy. But I’ve had (and will soon have more) help in sorting it all out.

Co-Writing Sessions

I’m a member of the Authorship and Publishing Special Interest Group (SIG) in the National Association of Productivity and Organizing Professionals (NAPO). We have monthly meetings and an email group for supporting one another as we write books, articles, blog posts, presentations, and other projects.

Last week, the SIG began holding weekly two-hour co-writing sessions. A small number of us log on to a Zoom call, talk about what we hope to accomplish, and then settle down to write. We each muted our microphones (especially important for me, as I tend to think out loud, which would make it hard to be a silent body double for anyone else), content in the knowledge that if we needed to reach out to our fellow writers, we could type a message into the Zoom chat.

When I minimized the Zoom window, instead of it dropping into the Mac dock or otherwise hiding, it turned into a tiny, floating, repositionable window (about 3/4″ high by 2″ wide). I could see one of my co-writers — in miniature — and it reminded me that I had a goal and that someone <waves hands> out there is on my side in the effort to get my project done.

At the top of the next hour, we turned our mics back on just long enough to check in, offer support, and return to our writing for another hour. I used the first co-writing session to prepare my notes for the summit interview two days later, and felt so confident and prepared because I had this co-writing time.

These are drop-in sessions on a fixed day each week; the participants will change according to each writer’s need and availability, but I’m already looking forward to the next one.

“Making Space to Write” Virtual Writing Retreat

In some ways, that co-writing session was a practice run for an event this past Friday, January 27th. Two of our Authorship & Publishing colleagues, Standolyn Robertson and Leslie Hatch Gail, put a lot of planning into the event. Registration was required, and we had an hour-by-hour retreat agenda.

We were encouraged to set our goals in advance, and once we arrived, after brief introductions and some housekeeping announcements, we hunkered down for 45 minutes of quiet writing time, nudged by a slide with a motivating quote.

(Per participant requests, I am not including any identifying photos.)

Because the live Zoom screen showed the participant gallery and a shared slide, the minimized floating screen wasn’t showing me my colleagues, just the slide. I thought that might lessen my feeling that I was being body doubled, but it didn’t. I was always aware (and calmed by) the slide’s reminder of everyone’s presence.

From then on, at the top of each hour we had 15-minute “human breaks” to stretch, address any biological needs, and answer a prompt slide prompt. Questions were lighthearted and ranged from “What hobbies are you participating in?” to “What was your best purchase in the last year?” We entered our answers on the chat screen, had a little verbal interaction on Zoom, but at the quarter hour mark, we all went back to writing.

What fascinated me was that every time I’d get to a logical stopping point in my writing, ready to take a breather, I’d look at the clock and see it was just the 59 minute mark of the hour!

Around 1 p.m. (in my time zone), we took an hourlong lunch break. Some attendees had to run errands, but for the majority who stayed, it was like having a lunch with co-workers, something we professional organizers (mostly solopreneurs) rarely get to do. Finally, after a full day of writing, we had a social hour during which time we played a rousing and hysterical online version of Scattergories.

Lost & Found: Recover Unclaimed Money, Property, and Savings Bonds

Treasure Chest by Immo Wegmann on Unsplash

Treasure Chest by Immo Wegmann on Unsplash

There are many reasons to keep your paperwork organized, but I think the most compelling one is that many VIPs (very important papers) are the equivalent of money.

Your Social Security card, for example, is key to proving who you are, and if someone gets his or her hands on your card (or even just the number) and a little bit of other information, you may suffer from years of financial strife due to identity theft.

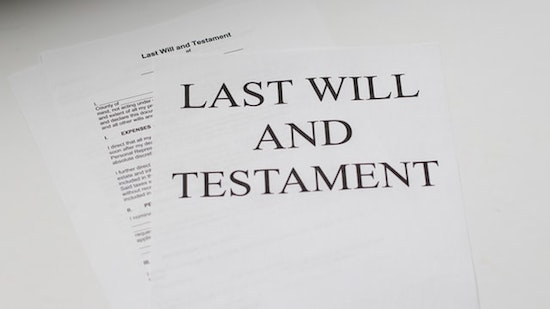

A lost last will and testament means that a family could have to spend months or years lacking access to resources promised to them because of the difficulty of proving the deceased’s intentions for funds and possessions.

If you lose your birth certificate, you may not be able to replace other essential documents if they go missing or get destroyed in a fire or natural disaster.

Lose your passport without enough time before an international trip, and your vacation or work plans could be scuttled, leaving aside the potential for identity theft of a more-than-financial nature.

Paper Doll has covered a wide variety of topics over the years on accessing lost documents, creating essential ones you lack, and keeping them all safe so they are not lost in the future. These posts include:

Ask Paper Doll: Do I Really Need A Safe Deposit Box?

How to Replace and Organize 7 Essential Government Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Protect and Organize Your COVID Vaccination Card

A New VIP: A Form You Didn’t Know You Needed

Today, we’re going consider options for recovering lost property. Consider it a treasure hunt!

RECLAIM LOST “PROPERTY”

When I say “property,” what do you think of? Perhaps real estate?

Maybe that reality show Property Brothers with Canadian twins Drew and Jonathan Scott?

When you hear “lost property,” it’s possible you think of the boilerplate language on one of those claim tickets you get when you leave your coat at the fancy coat check room at a swanky venue.

So What Is Unclaimed Property?

The term unclaimed property is what you’ll hear most often when searching for lost money in various types of accounts. Unclaimed property usually refers to funds that a government (federal, state, or local) or business owes you because you’ve, quite literally, left it unclaimed.

It’s possible that you’re so organized with your paperwork that you feel affronted that I’ve implied you might have just haphazardly left money sitting around. But I’m not saying you’re absent-mindedly leaving piles of cash wrapped in newspapers like Uncle Billy in It’s a Wonderful Life. (By the way, that $8000 deposit that ended up in Mr. Potter’s hands would be work $121,762 in 2023! Maybe Uncle Billy should have tied the money to one of those strings around his fingers.)

Thomas Mitchell as Uncle Billy, searching the bank’s trash cans for the lost Savings & Loan deposit.

There are all sorts of reasons money may get separated from its rightful owner.

Perhaps you put a security deposit down on an apartment when you were in college, but after graduation you were heading across the country to start your first job. Your roommate returned the keys to the landlords, got the OK that you hadn’t left the place in a horrifying state, and similarly disappeared into the adult world, leaving no forwarding address for either of you.

In many cases, by law, your security deposit was placed in an account (perhaps interest-bearing, perhaps not) and should have been returned to you when your lease ended. If your landlords were playing by the rules, rather than deciding to take the money and run, they should have turned it over to the state.

Similarly, it’s common to have to pay a deposit when opening an account for certain utilities. While some utilities keep these deposits until you move and close your account, others have (little-advertised) rules stating you can request your deposit be returned after a set period of good payment history. Sometimes, however, if you don’t actually request your deposit back, it just sits there, eventually going unclaimed, and being sent to the state.

When I helped one of my clients, a gentleman in his 60s, search for unclaimed property in his name, we found a life insurance policy that his parents took out in his name when he was an infant. It had long since stopped increasing in value, so he claimed it and cashed out.

Or maybe your Great Uncle Horace left you oodles of money in his will, but his last valid address for you was three states and 22 years ago? (My condolences on Horace. We always heard good things about him.)

Unclaimed property can be in the form of cash, uncashed checks (including stock dividends), insurance policies, abandoned bank accounts, forgotten security deposits, or even tangible property in the case of safe deposit boxes.

Life gets busy. It’s OK. Don’t play the blame game. Instead, play finders keepers and locate your missing money!

Where Can You Find Your Unclaimed Funds?

Unfortunately, there’s no central repository for all unclaimed property. Instead, you can search in each applicable state’s unclaimed property office.

Start with Unclaimed.org, the website of the National Association of Unclaimed Property Administrators.

Once there, scroll down and select your state by clicking on the location on the map. If you are from a United States territory like Puerto Rico or the U.S. Virgin Islands, or from one of several Canadian provinces (Alberta, British Columbia, New Brunswick, or Quebec), click on the appropriate link below the map, or use the yellow “Select Your State or Province” button. This will take you to a specific unclaimed property office, like the Office of New York State Comptroller’s Search for Lost Money page or Tennessee’s unclaimed property search (with a snazzy alternative address of ClaimItTN.gov).

To begin your search at any of these state sites, provide whatever information you have available, but at least a first and last name (or, if you’re searching money owed to a company or non-profit, the entity’s legal name). Some state search sites will also ask for a city in order to narrow the parameters.

If you want to search for multiple states simultaneously (let’s say you have lived in many locations, or you’re searching for abandoned accounts for a relative who has passed away and are unsure where they might have had lived), visit MissingMoney.com.

MissingMoney.com allows you to just type a first and last name, and all possibilities for that name, across all state databases, will come up.

Whether you use a state search or a multi-state search, the resulting page should provide a series of options. If you find a listing for yourself (or a relative), you’ll likely see some combination of the following information:

- the name of the owner of the unclaimed property

- any co-owner’s name, if applicable

- the last known address of the owner (possibly including the street address, city, state, and/or zip code, though some states hide some of the information)

- the state in which the unclaimed property is held (if you’re doing a multi-state search)

- the amount or value of money being held (which may be listed as an exact dollar amount, a range (like $50-$100, or >$500), or “undisclosed); if the property is tangible rather than monetary, you may or may not get a clue to what it might be.

How Do You Claim Your Funds?

If you find a match for unclaimed property on your state’s page or through MissingMoney.com, you’ll need to file a claim to prove that you own the account or property. Similarly, if you are claiming it on behalf of a relative who cannot act on their own behalf or a person who has passed away, you must prove their connection to the property as well as show that you are the party authorized to file a claim.

Whatever search method you choose, as long as you go through a government web site, know that searching for the unclaimed property is free, as is filing your claim. (Please don’t get scammed by a site promising to funds that are due to you anyway. While some services are valid and may relieve you of labor searching for large 5- and 6-digit recoveries, I encourage you to exhaust all free options first.)

Each state or province will have its own rules regarding claim submission. While most prefer you to submit your claim online, some still let you submit by mail. Answer all of the questions to the best of your ability, and assuming you are able to substantiate that you have a right to the funds, the account will be processed in due time and sent to you.

For individuals, businesses, and non-profits, you will have to submit proof of identity, address, and ownership. For individuals, your identity can usually be proven by a scan/copy of your driver’s license, passport, or Social Security number; please be cautious about transmitting your Social Security number through the mail and be sure you are using secure web sites marked HTTPS.

Proof of ownership of property will vary. Options might include your Social Security number, employment pay stubs, W2s or 1099s, or utility bills.

If you’re making a claim on behalf of someone who is living, you will need to provide the appropriate documentation, which might included a copy of a child’s birth certificate or legal adoption order (if the money is due to someone under 18), proof of a claimant’s age, and a court document or other signed legal documents proving you have the authority to act on the actual owner’s behalf. These could include letters of guardianship or conservatorship, a trust agreement, or a Power of Attorney document.

If you are making a claim on behalf of someone who has passed away, you’ll have to submit a death certificate as well as a will or other court documents, like a Small Estate Affidavit and a Table of Heirs. (These are state-specific.)

What To Do Once You Get Your Now-Claimed Funds?

After you submit your claim, if you are able to sufficiently able to prove your right to the funds, you will eventually be sent a check. Verifying your identity and rights to the funds can take a while, though many states try to complete the processing within thirty days.

Once you receive your money, usually by check, deposit the funds as soon as possible. Do not run the risk of losing the check and starting the whole process over!

Depending on the source of the funds, you may have to pay state and/or federal tax on the claimed money.

For example, if this is a deposit returned to you, you would not owe tax on the amount of your deposit, but tax might be due on any interest the account earned. The same is true regarding funds from abandoned bank accounts; the principal would not be income, but interest would likely be taxable. Of course, if the money would initially have been taxable had you received it on time (such as with stock dividends), it will still be taxable, but as income in the tax year in which you are receiving it.

What About Unclaimed Money in Other Countries?

Are you a fancy-schmancy world traveler? Maybe someone in your family lived abroad?

Unfortunately, there’s no central repository for tracking money left behind in your Tunisian bank account or a security deposit your mom paid during her semester abroad in Paris. (You may find some solace in the links collected by the Global Payroll Management Institute.)

However, the US government’s Foreign Claims Settlement Commission does oversee unpaid foreign claims for covered losses. That’s government-speak for money you are owed for lost funds or real property in the following circumstances:

- a foreign government “nationalizes” your property (whether that’s the money in your account or the house you owned)

- damage to property you owned that was caused by military operations

- injury to civilian and military personnel

If any of these apply to you, review the Unpaid Foreign Claims page and fill out a certification form (linked on that page). There’s also a link for Standard Form 1055, if you’re filing on behalf of someone who has died.

LOST SAVINGS BONDS

Once upon a time, it was popular to give United States savings bonds as gifts when people got married, had babies, graduated from college, got confirmed or Bar or Bat Mitzvahed, or otherwise had a rite of passage.

In ye olden days, you’d go to your bank to buy a savings bond, and get a receipt for your purchase as well as a paper certificate to give to the recipient. With the old EE savings bonds, you could purchase a bond at half the face value, and then a few decades later, your investment would double to the face value. If you waited a little longer, the bond would keep earning interest, at least for a while. (If your bonds are more than 30 years old, they have likely stopped earning interest.)

Nowadays, savings bonds are registered electronically, which makes everything much easier. However, with the old bonds, without the certificates in hand, the process gets complicated.

The problem was that these called SAVINGS bonds — but people often treated them as if they were called “throwing-them-in-a-box-hidden-under-the-bed” bonds. That’s fine for a while, but once your bond stops earning interest, it would make sense to cash it in and find another wise investment option. That’s hard to do if you don’t have the bond.

What Should You Do If You Can’t Find Your Savings Bonds?

If you’re sure you have savings bonds, but can’t find your paperwork, you have a few alternatives:

- Check your safe deposit box or fireproof safe — Free, except for the value of your time.

- Search through those boxes of stuff your parents or guardians gave you when they retired to Boca or Shadytime Retirement Village. Again, free except for the value of your time.

- Ask your family members to check their safe deposit box(es) and/or fireproof safe(s) and send you (via secure shipping) your bond certificates — Depending on whether you live across the street or across the country from your loved ones, this will come at variable cost in terms of their time, delivery service fees, and you getting roped into providing IT support for your parents now that they’ve got you on the phone.

- Contact the Feds — If you can’t find your bonds, or know they were definitely lost, stolen, or damaged, this may be your only alternative.

If you’ve lost your original savings bond’s nifty tangible certificate, you have two options:

- replace your original bond with a digital* bond (held in your Treasury Direct account); or

- cash in your bond (possibly losing value if you decide to cash it in before it has reached maturity)

*Note: If your lost bond is a now-defunct HH bond, you can get a substitute paper bond. For EE or I-series, they must be digital

If you’re really lucky, even if you’ve lost the actual bond, someone in your family may have kept track of the serial number of the bond. If not, you’ll have to help the government perform a search. Go to the U.S. Treasury’s website at www.TreasuryDirect.com and fill out Form 1048 to locate savings bonds registered all the way back to 1935.

Random Treasury Trivia

EE savings bonds took the place of World War II-era E-series or “Liberty bonds,” which date back to WWI!

HH-series bonds, popular as gifts for GenXers and Millennials, only came in the paper format and existed from 1980 through 2004, and they stop earning interest in 2024. That’s next year. Yes, really. So it’s a good time to start looking for your HH bonds! I-series bonds were introduced in 1998.

Interested in buying bonds but not sure how they work? Treasury Direct has a whole page comparing EE and I-series bonds. Be sure to check out the rules and options for buying savings bonds.)

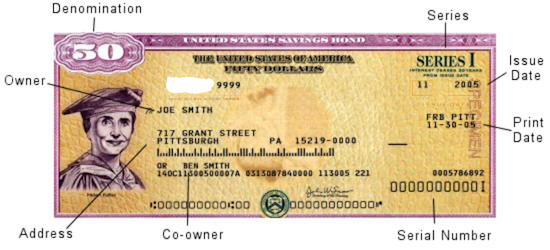

On Form 1048, you’ll be asked to provide as much information as possible, including the:

- Issue date (or a range of dates, if you are uncertain)

- Bond certificate serial numbers (if you have them)

- Inscription information on the bonds, including names, addresses as Social Security numbers.

- Whether the bonds were lost, stolen or destroyed. If the bonds were stolen and a police report was made, you will need to append that, as well. The government wants to know all the gory details, so if your Great-Aunt Gertrude started a food fight at Thanksgiving and your savings bonds were drowned in gravy, explain. Or, y’know, explain if your town had a flood. Whatever.

- If you are not the named party on the bond certificate, you will have to explain your right to access the bonds; for example, are you the parent or guardian of a minor, the conservator or legal representative of another adult, or the executor of the will of a now-deceased party? (Note: if the person named on the bond is deceased, you will also need to include a certified copy of the death certificate.)

- Then, you’ll have to state whether you want substitute (digitally-held) bonds or payment in return for cashing in your bond.

You will need the form to be certified by a Notary Public. Review Paper Doll’s Ultimate Guide to Getting a Document Notarized for your options.

Finally, mail the form to:

Treasury Retail Securities Services

P.O. Box 9150

Minneapolis, MN 55480-9150

What If You’re Not Even Sure If There Were Savings Bonds?

All of the above tells you what to do if you know you received the bonds, but they’ve since been lost, stolen, or destroyed (as in irretrievably folded, spindled, or mutilated…or drowned in gravy).

But maybe you’re not sure if your hazily-recalled bonds ever existed? Maybe you (or someone on your behalf) purchased bonds but they never arrived. Maybe you got hit on the head with a falling anvil and can’t remember if you ever had a bond, or maybe you think a deceased loved one owned savings bonds but you can’t find them?

If any of the above situations apply, visit the Department of the Treasury’s Treasury Hunt link. Enter your (or your loved one’s) Social Security number and state, and if there’s a match, the site will let you know what to do next to locate matured savings bonds, those that are uncashed but no longer earning interest.

This just scratches the surface of the unclaimed funds, property, and financial instruments that can be recovered with a little bit of effort. Invest a few moments to let your fingers do the walking and see if you can recover what’s been lost.

If you DO find money owed to you, please come back and share the story (but not confidential information) in the comments.

Paper Doll Helps You Find Your Ideal Analog Habit Tracker

![]()

If you cannot measure it, you cannot improve it.

~ Lord Kelvin (William Thomson, 1st Baron Kelvin)

If you cannot measure it, you cannot improve it. ~ Lord Kelvin (William Thomson, 1st Baron Kelvin) Share on XTHE BENEFITS OF HABIT TRACKING

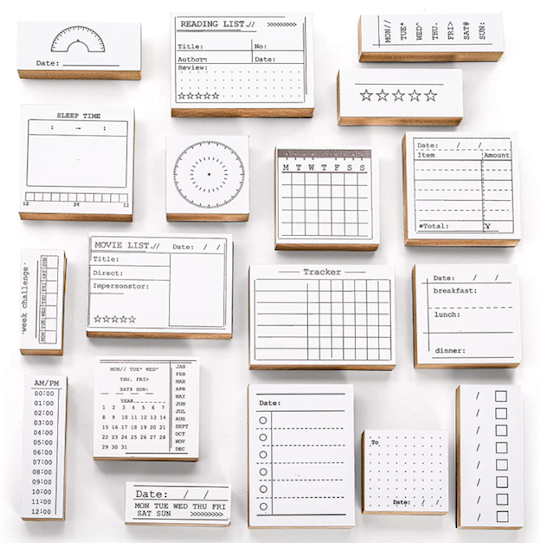

Over the past two weeks, in Organize Your Annual Review and Mindset Blueprint for 2023 and Paper Doll’s 23 Ideas for a More Organized & Productive 2023, we touched on the importance of building good habits, either in and of themselves or to replace deleterious ones. We talked about the wisdom of James Clear, author of Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones.

Clear’s best-seller, which should be read in its entirety, talks about how successfully tiny habits (at the metaphorically microscopic, atomic, level) are based in four laws of habit creation:

- Make it obvious

- Make it attractive

- Make it easy

- Make it satisfying

In chapter 16 of the book, Clear references the essential nature of habit tracking, and ties habit tracking to the above four laws, but I’d like to speak directly to the last one. He states, “One of the most satisfying feelings is the feeling of making progress.” Well, duh!

And how can we verify our progress? Well, often, we can measure it by looking at the end result. If we’re trying to lose weight, we can measure our progress in having to tighten our belts or buy smaller clothes. If your kids are making progress toward doing better in school, improved grades will eventually make it obvious.

But it takes time to see that kind of progress, and if we’re going to keep motivated, to stick with our habits, we’re going to need to be satisfied daily. We need to see a sign of progress, no matter how minuscule, often. That’s where habit tracking comes in.

Habit tracking gives us an immediate sense of progress, even if the progress is only in our willingness to make an effort.

Persistence is the measurement of your belief in yourself. ~ Brian Tracy

Persistence is the measurement of your belief in yourself. ~ Brian Tracy Share on XTHE DRAWBACKS OF HABIT TRACKING

I should note that there are some inherent drawbacks to tracking our habits.

Our intention is to draw our attention to what we’re doing so that we can strengthen our resolve and recognize our struggles so that we may overcome them.

However, it’s easy to become so focused on our string of achievements that we become obsessed. When that happens, any time we do end the streak has the potential to demoralize us and weaken our resolve to get back on the horse.

If you tell yourself that you will run every day, but the weather is so stormy that “it’s not fit outside for man nor beast,” you may see your options as two-fold and rigid: risk life and limb and frostbite to hit your goal and mark that X or dot on your tracker, or leave it blank. That’s black and white thinking.

And if you leave it blank, you may feel like you’ve already lost. Somewhere, in the back of your head, despondency sets in, and failure to achieve your goal on one day can make you feel like a failure overeall, uninspired to get back to your habit the next day.

But this is an unnecessary dichotomy. Our habit goals are just that, goals. Doing something is always better than doing nothing.

If you can’t run three miles today, could you sprint up and down the stairs in your house, or work out along with a walking or dancing video?

If you miss your 10,000 steps and only manage 7500, could you do 500 extra steps for the next 5 days (or 250 for the next 10, or …)?

Maybe you promised yourself you’d practice the piano for 30 minutes a day, but your work and childcare schedule made that impossible; could you just play some scales to stay limber, or play one song to boost your spirits and remind yourself why this is a goal habit in the first place?

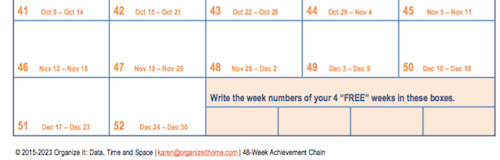

My colleague Karen Sprinkle created a wonderful 48-Week Achievement Guide, an e-book explaining how to use her patented chart for logging progress on goals. She recognized the inherent loss of momentum that comes from not getting to check off a day or week of a habit.

Thus, Karen’s chart creates space for four FREE weeks, weeks in which you have a “get out of jail free” card to not achieve your goals, while not exactly wrecking your streak, either.

Maria White interviewed Karen for episode #13 of her Enuff with the Stuff podcast, entitled Finally Accomplish Goals Using the 48-Week Achievement Guide. Take a listen.

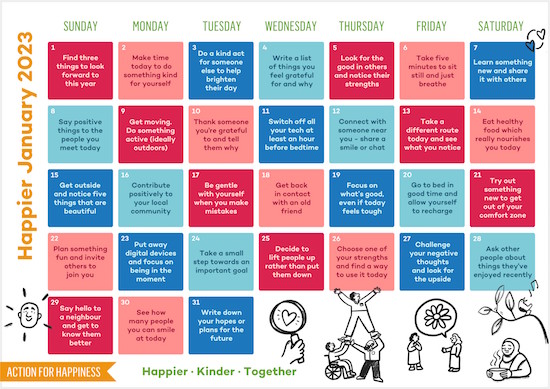

DON’T BREAK THE CHAIN: THE BASIC CONCEPT

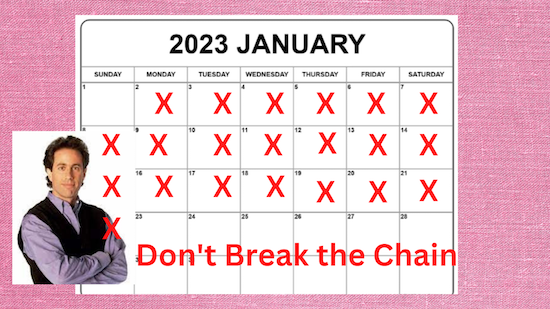

One of the best known tales of habit tracking comes from Jerry Seinfeld, master of his own (habit tracking) domain. Once asked how he wrote so many jokes, he explained that early in his career, he made a commitment to himself to write one joke a day.

Just one joke. But one joke every day.

He didn’t tell himself he had to have a Tonight Show monologue. He didn’t push himself to write a sitcom script. He just had to write one joke each day.

Seinfeld had a large wall calendar in his apartment, which showed all the dates in the year. Each time he wrote a joke, he marked the calendar with a red X, and as the story goes, he eventually had a long chain of red X’s to create a visual cue to show how he’d been consistently putting in the effort.

Did he need talent? Of course. Comedic timing? Without question. But Seinfeld’s advice to young comedians was simple: Don’t break the chain!

The chain of red X’s on the calendar is just the simplest form of habit tracking.

AUTOMATED HABIT TRACKERS

The easiest (though not necessarily the best) kind of habit tracker is one that is automatic, or done for you by something or someone else.

I recently bought a new scale, and realized that it had a Bluetooth function. I didn’t really need a scale with Bluetooth, but I was intrigued to find that once I connected it to the iPhone app (which itself connects to the Fitbit app), my scale tells the app not only my weight, but also my BMI, metabolic age, the percentage of my body made up by water and of skeletal muscles, my bone mass and muscle mass, and all the percentages of my fat that is body fat, subcutaneous fat, and visceral fat. And I hope that’s the last time I ever use the word “fat” in this blog!

My point is that all I have to do is to step on the scale (which I do only once per week so as not to obsess) and the app and the magic of Bluetooth does all the rest.

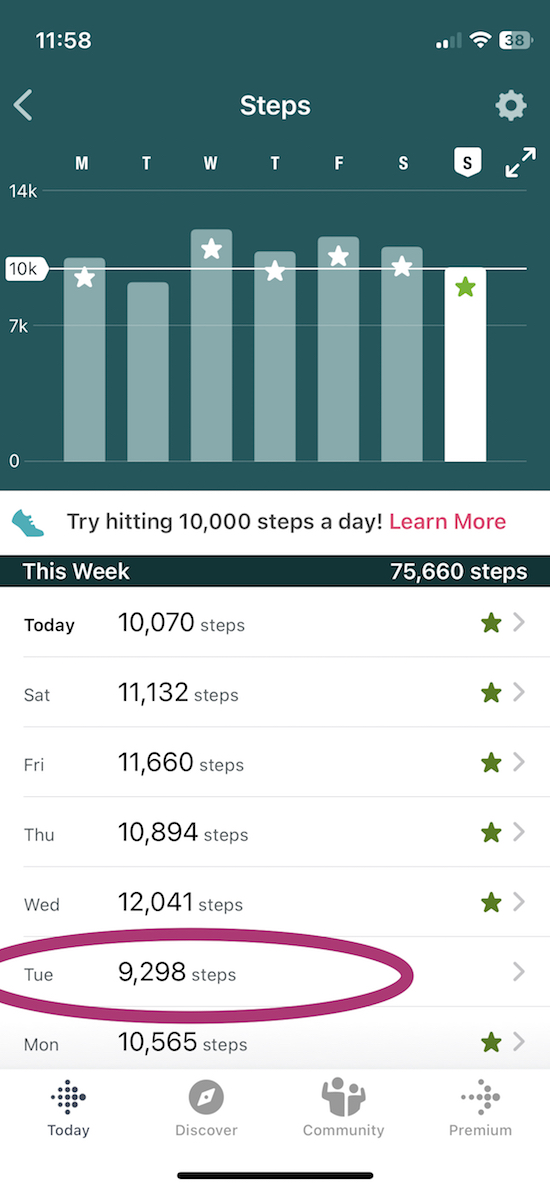

Similarly, while I can (and admittedly do) look at my Fitbit tracker on my wrist, the app takes care of tracking my efforts. Here’s how I did this past week.

Note: while I didn’t make my 10K goal steps on Tuesday last week, I made up for it the next day. I didn’t get down on myself for it, because I knew that progress, not perfection, is key to building habits.

There are even “smart” water bottles that measure and communicate (again, by Bluetooth) with an app to track how much you’ve hydrated!

Paper Doll’s 23 Ideas for a More Organized & Productive 2023

Happy New Year! And welcome to GO (Get Organized) Month 2023, where we celebrate efforts to make our spaces more organized and make ourselves more productive.

We in the National Association of Productivity and Organizing Professionals (NAPO) love this opportunity to help you make this year your best. To that end, today’s post offers up 23 ideas for achieving what you want this year in your space, schedule, and life.

CREATE A FRESH MINDSET

1) Learn last year’s lessons to build next year’s success.

You were probably super-busy last week, but I encourage you to read the final Paper Doll post of 2022. (Trust me, it was a good one!)

Organize Your Annual Review & Mindset Blueprint for 2023 is full of questions and resources for figuring yourself (and your last year) out.

I often joke to clients that while I’m not a mental health professional, I am like a marriage counselor between you and your stuff. Well, last week’s post is like a cross between a therapy session and a deep dive with your BFF. It rejects the demoralizing proposition of resolutions in favor of creating a fresh, motivating mindset for the coming year, whether with a word, quote, or motto of the year, and uses signage, a vision board, or a music playlist to keep your eyes on the prize that is your new and improved life.

2) Don’t take my word for it. Listen to James Clear.

If you’ve been paying attention to the news in the “habit” realm at all in the last few years, you know that James Clear wrote Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones, a book that takes the research of habit researchers (like Charles Duhigg in his The Power of Habit) and makes it all actionable.

Organize Your Annual Review & Mindset Blueprint for 2023

The holiday week is the perfect time of year to plan for next year, to set goals and intentions, and get a fresh start. Of course, you don’t need a new year for that. Check out Organizing A Fresh Start: Catalysts for Success from this past September to see all the ways you can find inspiration for fresh starts quarterly, monthly, weekly, and each day.

But before we can design the coming year, it’s essential to review the past, and to get a handle on what worked (and didn’t) so that we can use that knowledge to set us up for future successes.

LOOK IN THE REAR-VIEW MIRROR

On the very businesslike side of the productivity realm, this is called an annual review. People in the corporate world often experience this in terms of a sometimes-feared, often-maligned annual performance review.

That’s where you tell your boss how you think you did during the course of the year (in hopes of a raise, promotion, and an atta-boy/atta-girl), and your boss tells you how the company thinks you did (in hopes that you’ll be so thankful to have a job, you won’t notice that any extra money is going to the CEO’s newest yacht).

But a personal annual review, which can cover both lifestyle and professional topics, is solely for your own benefit. It’s to help you figure out the who, what, where, why, and how of your past year so that you can find the common threads (or snags) in your successes (or challenges).

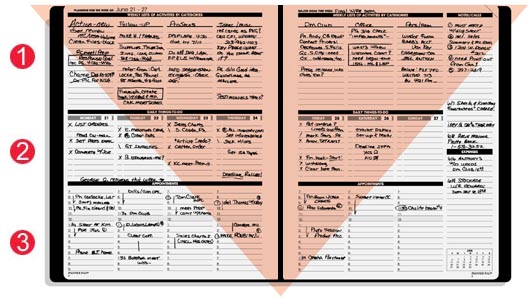

Gather Supplies

The process is as formal or informal as you’d like, but I encourage you to start with some of the tools you use to create the structure of your year:

- planner or calendar

- journal

- correspondence — email or text threads — with your best friend, accountability partner, or mastermind group

- a sense of your values

With a pen and paper (or fresh Evernote note or blank document), sift through what you’ve written and logged about your life over the past year. Where did you go, with whom did you meet, and what did you do? As if you were reading a mystery, you’ll find yourself noticing clues to patterns in your year. (Feel free to wear your Sherlock Holmes deerstalker hat.)

There are a few kinds of clues, and depending upon your life and work, as well as what you value, different clues will yield evidence for making different kinds of decisions.

Know Your Values

Speaking of values, these are not uniform across nations, regions, communities, families, or even periods of our lives. In the United States Army’s Basic Combat Training, they focus on seven values: loyalty, duty, respect, selfless service, honor, integrity, and personal courage. Conversely, the immigration portal for the Durham Region of Ontario, Canada lists Canadian values as “equality, respect, safety, peace, nature – and we love our hockey!”

If you’re not quite sure how to identify the values that help you plan your life, here are some great resources:

Nir Eyal’s 20 Common Values [and Why People Can’t Agree On More] (Eyal is the author of Indistractible: How to Control Your Attention and Choose Your Life.)

James Clear’s 50 Core Values list (Clear is the author of Atomic Habits.)

Brené Brown’s 118 Dare To Lead List of Values (Brown is the author of Dare to Lead, as well as Daring Greatly, Rising Strong, and The Gifts of Imperfection.)

The Happiness Planner’s List of 230 Core Personal Values

Some people highly value achievement and contribution; for others it’s balance and inner harmony. For me, it’s knowledge, usefulness, and humor.

We’ll get to how to use your values in a bit. For now, it’s just helpful to go through one (or more) of these lists and identify from three-to-five overarching values that resonate with you and how you aspire to live your life.

Ask Qualitative Questions

The Good

- What challenges made me feel smart, empowered, or proud of myself this year?

- What did I create?

- What positive relationships did I begin or nurture?

- Who brought delight to my life?

- Who stepped up or stepped forward for me?

- What was my biggest personal highlight or moment I’d like to relive?

- What was my biggest professional moment I’d want to appear in my bio?

- What’s a good habit I developed this year?

The Neutral

- What did I learn about myself and/or my work this year?

- What did I learn how to do this year?

- What did neglect or avoid doing out of fear or self-doubt?

- What did I take on that didn’t suit my goals or my abilities?

- What was I wrong about? (Note: Being wrong isn’t a negative. Not one of us knows everything. In the words of Dr. Maya Angelou, “Do the best you can until you know better. When you know better, do better.”

The Ugly

- What challenges made me feel weaker or less-than?

- Whom did I dread having to see or speak with this year?

- Who let me down?

- Whom did I let down?

- What did I do this year that embarrassed me (professionally or personally) or made me cringe?

- When did I hide my light under a bushel?

- What am I faking knowing how how do? — Instead of pretending you know how to do something but are choosing a different path, ask for help. Make decision about what to do from a position of strength rather than weakness.

- What’s a bad habit I regret taking up or continuing?

- Where did I spend my time wastefully or unproductively? (It’s social media. For all of us.)

- Where did I spend my money wastefully or unwisely? (Target? Let’s take a poll. Was it Target?)

Although most of these are questions I’ve developed over the years, the inspiration for including this list came from the Rev Up for the Week weekly newsletter put out by Graham Allcott, author of How to Be a Productivity Ninja, among other titles.

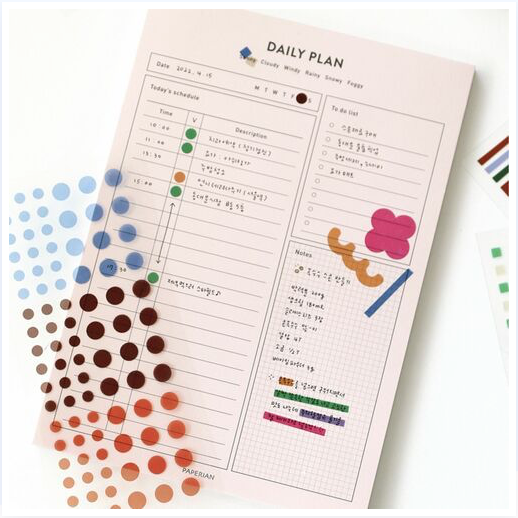

However, if you want a journal that you could place on display to clock your habit tracking as the day goes by, there are a variety of styles, from gridded notebooks to artistic visions.

However, if you want a journal that you could place on display to clock your habit tracking as the day goes by, there are a variety of styles, from gridded notebooks to artistic visions.

Follow Me