Paper Doll

Organize Your College-Bound Student for Grownup Life: Part 3

Parents, you’re counting down the precious days left with your college-bound students. Meanwhile, they’re counting down until they experience “freedom” and (gulp) adult responsibilities. In recent posts, we’ve covered a wide variety of skills and information to ensure they are prepared for the world beyond having you as a backup ride, bank, chief cook, and bottle-washer.

Organize Your College-Bound Student for Grown-Up Life: Part 1 identified essential legal documents and insurance policies, and reviewed the key financial skills every first-year student needs.

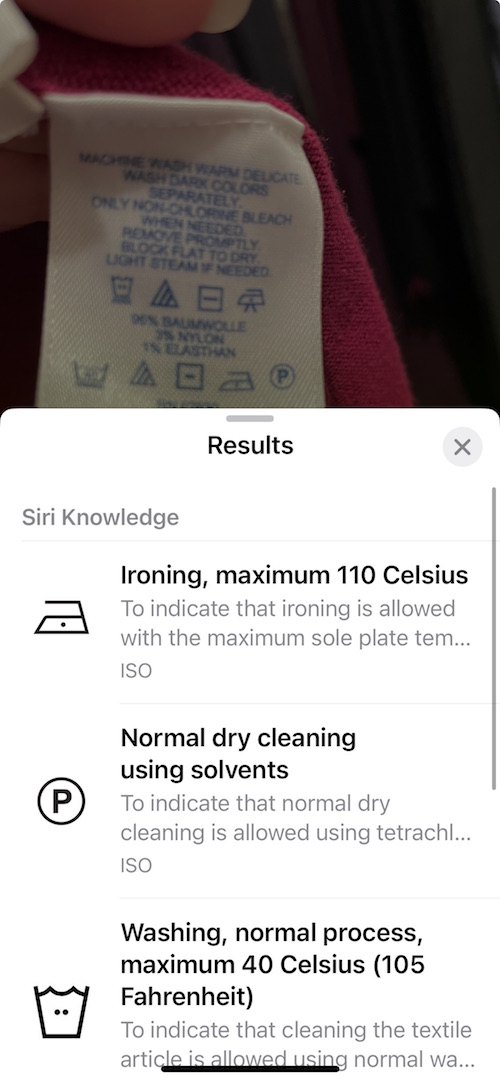

Organize Your College-Bound Student for Grownup Life: Part 2 looked at communication skills, staying safe on campus and off, and the under-appreciated life lessons of mastering laundry.

This third installment of the college life skill syllabus delves into keeping all the time management balls in the air, developing an academic safety net, being a safe car operator, and social etiquette to ensure good relationships. There’s even a smattering of bonus life skills.

We finish up with with a bibliography of reading resources for you and for your college-bound student.

HOW TO MASTER TIME AT COLLEGE

In high school, time is fairly regimented; the bell rings every fifty minutes, moving students on to their next classes. There’s study hall to get a start on homework, and teachers provide periodic, staged deadlines for students to show their progress and keep from falling behind; they turn in a topic idea, then a bibliography, outline, first draft, and finally a completed report. Class periods before tests are earmarked for reviews. Academic prep time is spoon-fed.

In college, the freedom to set your own schedule has the drawback of requiring an adult sense of perspective on prioritizing what’s important (and not just urgent or fun). Wide swaths of free time must be divvied up and self-assigned: for studying new material, doing problem sets, completing projects, and preparing for exams.

Food and clean clothes are not delivered by magic fairies; they may require transportation, funds, labor, and time!

College-bound kids may not want to take advice regarding time management, but try to start conversations to get them thinking about how to:

- Wake up on time — If they can’t count on conscientiousness, encourage them to make breakfast plans with a friend who can swing by prod them. Also, point them toward Do (Not) Be Alarmed: Paper Doll’s Wake-Up Advice for Productivity.

- Develop a schedule — In order to make time for academics, extracurriculars, sleep, exercise, and self-care, discuss the value of time-blocking and planning an ideal week, then tweaking as the semester goes along. Keeping a schedule in one’s head is a recipe for disaster; a paper or digital planner makes sure nothing falls through the cracks. A few helpful guides:

- Highlights from the 2023 Task Management & Time Blocking Summit

- Surprising Productivity Advice & the 2023 Task Management & Time Blocking Summit

- Paper Doll Shares Secrets from the Task Management & Time Blocking Summit 2022

- Struggling To Get Things Done? Paper Doll’s Advice & The Task Management & Time Blocking Virtual Summit 2022

- Playing With Blocks: Success Strategies for Time Blocking Productivity

- Develop and maintain healthy routines to support their goals — Brainstorm ideas for how to ensure healthy habits (exercise, eating actual meals somewhere near meal times, etc.) by linking activities to make a chain of positive behaviors.

- Don’t fight your body clock — In business, we’re often made to feel like there’s something wrong with us if we’re not morning people, but in college, people look askance if you don’t want to party all night. There’s no shame in needing an early night if you have an 8 a.m. class.

- Get out in front of procrastination — We procrastinate because we’re nervous about how something will turn out. We’d prefer our Present Self feeling comfortable; Future Self is on its own.

Explain how to beat procrastination by understanding its causes and then incorporating good planning, prioritizing, and decision-making techniques (like the Eisenhower Decision Matrix), and locating accountability support. These Paper Doll posts can help:

-

- Paper Doll On Understanding and Conquering Procrastination

- Use the Rule of 3 to Improve Your Productivity

- Frogs, Tomatoes, and Bees: Time Techniques to Get Things Done

- Count on Accountability: 5 Productivity Support Solutions

- Paper Doll Sees Double: Body Doubling for Productivity

- Flow and Faux (Accountability): Productivity, Focus, and Alex Trebek

- Paper Doll Shares 8 Virtual Co-Working Sites to Amp Up Your Productivity

They can even try some Study with Rory Gilmore videos, including this one that incorporates the Pomodoro Technique!

I can’t think of a better expert for your college (and college-bound high school) students, especially those with ADHD, than my fabulous colleague Leslie Josel. She’s the one who developed an amazing Academic Planner for middle-grade and high school students, and I interviewed her for Paper Doll Peeks Behind the Curtain with Superstar Coach, Author & Speaker Leslie Josel.

Order Leslie’s book, How to Do It Now Because It’s Not Going Away: An Expert Guide to Getting Stuff Done, before the semester gets too far, and you’ll help your first-year college student conquer procrastination, develop excellent study skills, and really dissipate their stress.

Other real-world manners and etiquette tips college-bound students might not have absorbed:

Dining

- Know which is your bread and which is your drink — Make the OK sign with both hands on the table in front of you. One makes a lowercase “b” (on your left) and “d” (on your right). The “b” for bread means your bread plate goes to your upper left; the “d” for drink means the glass to your upper right is yours. Don’t butter an entire slice of bread or roll and then eat it (except at your own breakfast table). Break off a bite-sized piece of bread, apply butter (or jam, etc.) and eat.

- Wait until everyone has been served (or seated with their dining tray) to eat. Don’t gobble your food. You are not Cookie Monster.

- Don’t rush to leave before your companions are done eating. (If you need to leave to get to class, apologize for not staying until the other person is finished.)

- Know when and how much to tip in restaurants, for pizza delivery, etc.

Social Interactions

- Introductions — Know how to properly introduce yourself and others in a social setting, with first and last names.

- Handshake — Offer a firm (not limp, not crushing) handshake, smile, and make eye contact. (If eye contact makes you uncomfortable, remember, it’s not a staring contest. Connect, then look anywhere in the general vicinity of the other person’s face.)

- Personal space — Respecting others’ personal space in social and professional settings requires situational and cultural awareness and understanding the nuances of physical boundaries. Don’t touch people without asking.

- Phones — Don’t look at your phone when you’re eating or socializing with others unless responding to something urgent. Put phones away at the meal table.

- Thank You Notes — A good thank you note, sent promptly, goes a long way to show appreciation after receiving a gift, being hosted, getting interviewed, or being the beneficiary of an act of kindness.

- RSVP — Explain that not replying to an RSVP inconveniences a host. Replying in a timely manner and committing to that response helps the host plan (financially and logistically).

- Online social interactions — A digital footprint lasts forever, and online behavior matters. Being a jerk online has the potential to ruin a reputation just as much as being a jerk at a party.

- Networking — Your college kid isn’t thinking about the business world, but people help and do business with those they know, like, and trust. Help them see the importance of strengthening connections by sharing personal stories where maintaining connections, being generally useful, and even sending a LinkedIn connection request with a personalized message can mean a lot down the road.

Cultural Sensitivity

Good cross-cultural etiquette means not judging people who don’t follow the above guidelines.

Respect diversity. Understand cultural differences in manners, and be open to learning and adapting when doing study abroad or interacting in other cultural settings.

Use language that’s respectful, inclusive, and kind.

CARE FOR THE CAMPUS CAR

@the_leighton_show The low fuel warning also doesn’t stop my wife from going to @target #teenagers #drivinglessons #driving #parentsoftiktok #funny

Even if your student has been on the road for a few years, being a car owner (or responsible party) is different from driving Mom’s car to school. Car care can be a mystifying area of adulthood.

Oversee that inspections and major maintenance gets done when your student is home for breaks, and jointly go through the recommended auto maintenance schedule in the car’s manual. Help them figure out how to either do basic car care or to get it done professionally.

Teach the basics, like how to:

- Fill the gas tank before it’s only 1/4 full (and not when the gas light comes on). This is especially important if they attend school in wintery locales.

- Fill the tank on a schedule, not when it’s empty, but perhaps every Saturday after lunch. (And don’t try to put diesel in a non-diesel vehicle!)

- Download an app for finding the best gas prices, like Gas Buddy.

- Know how to check the oil before the oil light comes on. Oil and filter changes don’t have to be done as frequently as they used to, due to synthetic oil, but it still must be done.

- Know how to check tire pressure and fill tires properly.

- Know what the dashboard lights mean. — I once heard someone call the tire pressure alert the “Surprise Light.”

- Understand how to check and change fuses, replace windshield wipers, and know when to seek a professional mechanic.

Prepare them for emergencies. They should:

- Know how to jump start a car — If you’re sending your kids off to college with jumper cables, teach them how to use them! Consider also writing out step-by-step instructions and tucking it in with the cables.

- Know how to change a flat tire — Not everyone has the physical strength to change a tire, and not all locations are safe. Spring for a membership in AAA or similar roadside emergency service.

- Know what to do in case of an accident, or if someone breaks their window or steals the car:

DON’T GET SCAMMED AT COLLEGE

According to a study by the Better Business Bureau, 18-24 year-olds are more often victims of scams than senior citizens! Teaching college students to recognize and avoid scams is crucial. Encourage a skeptical mindset.

Common Scams Targeting College Students

Just as I wrote about scams that target seniors in Slam the Scam! Organize to Protect Against Scams, there are many that target college students, including:

- Scholarship and grant scams — Legitimate scholarships don’t ask for fees.

- Student loan scams — Be wary of companies that promise to forgive or lower student loans for a fee. Confirm loan information through the school’s financial aid office or consult government (.gov) websites like Federal Student Aid.

- Housing scams — When seeking off-campus housing, avoid listings requiring upfront payments before touring properties. Use reputable rental sites; don’t send money via wire transfer.

- Job scams — Know that legitimate employers don’t ask for bank information until you’ve been officially hired. Be wary of job offers promising high pay for minimal work.

Watch for Red Flags

- Urgency and high pressure tactics — The world is full of deadlines, but scammers use fear of missing out to create a sense of urgency. Don’t become a victim by being pressured to act quickly without time to analyze what’s happening.

- Unsolicited Offers — Be dubious about any unsolicited contact from outside of the school’s usual resources, whether by email, phone, or (especially) text, whether seeking personal information or offering services, funds, or assistance.

- Unusual Payment Methods — Students need to understand that payment by check or credit card is normal, but requests for payment by gift card, wire transfers, or cryptocurrency are hallmarks of scams. Legitimate transactions use secure, traceable payment methods.

- If a financial loan, grant, paid internship, or side hustle seems “too good to be true,” especially if the college’s financial aid office or academic departments doesn’t know anything about it, it’s likely a scam.

Always do independent research and verification. Check websites, Google to make sure phone numbers and addresses aren’t fake, and seek unbiased reviews. Consult trusted sources, including professors and advisors, college financial aid and work/study divisions, and yes, parents.

Online Safety

GenZ will be dubious that parents can advise them on online safety, but talk about:

- Privacy Settings — Adjust social media privacy to limit personal information visible to the public.

- Phishing Scams — Be wary about emails, texts, or social media direct messages that appear to be from trusted individuals or institutions but ask for personal information or money, or contain suspicious links. Pick up the phone and verify by calling people or institutions directly.

- Secure Websites — Look for “https://” in the URL and the padlock icon in the URL bar before entering personal or financial information!

Report Scams

- Report scams to campus security, local police, and organizations like the Federal Trade Commission (FTC) fraud division, the Consumer Financial Protection Bureau, and the U.S. Department of EducationOffice of Inspector General (OIG).

- Document — Keep records of all suspicious communications and transactions to support resolving issues.

RANDOM LIFE SKILLS

The Adulting Manual by Milly Smith

Organize Your College-Bound Student for Grownup Life: Part 2

From living with strangers to not having parents and teachers overseeing study habits and self-care, college is a melange of delightful freedom and terrifying responsibility.

Last week, in Organize Your College-Bound Student for Grown-Up Life: Part 1, we reviewed the serious side of what to make sure your kids have and know before heading off to college. We covered making sure they know their Social Security number by heart, having a a handle on important contacts and key medical information, and getting registered to vote and knowing how to exercise their rights to vote.

We looked at legal documents, like Power of Attorney for Healthcare (AKA: healthcare proxy) documents, FERPA waivers, and HIPAA releases, which in combination ensure that a college student has someone they trust looped into their medical situations and able to make medical decisions if they are unable to.

We also started developing punch lists of adulting information and skills, starting with the essentials related to financials and insurance.

And, because people pay more attention to serious things when they can take a moment to breathe, I included a few Chip Leighton “texts from college students” videos from The Leighton Show. More are peppered in this post. (As with last week, click near the lower left portion of the video to un-mute.)

@the_leighton_show Posting one more for all the parents dropping kids off at college #teenagers #college #freshmanyear #text #funny ♬ original sound – The Leighton Show

HOW TO COMMUNICATE BEYOND TEXTS AND EMOJIS

Recently, I was surprised to find that most younger people don’t ring doorbells or knock; they text when they pull up outside. (Honestly, to keep from waking babies or making dogs go nuts, this is pretty smart!)

Gen Z students have often managed to get through life without learning some adulting skills with regard to communication and interaction. Before dropping them off on campus, make sure your kids have these skills.

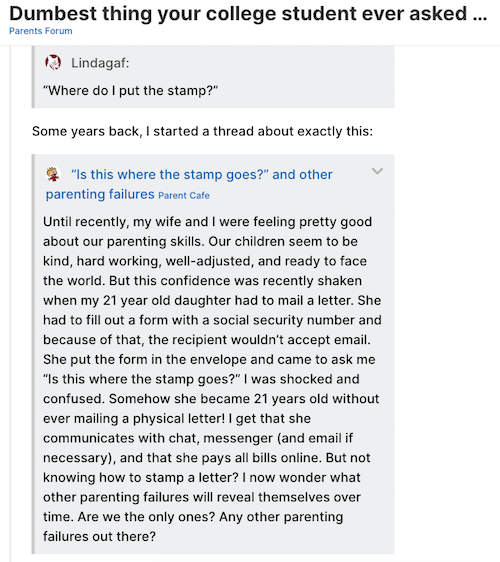

- How to write, address, and mail a letter. Somewhere around fourth grade, they taught us how to write a “friendly” letter and a business letter, including the entire format of date, “inside address,” salutation, body, and appropriate closing. They also taught us how to address an envelope, where to put the return address, and where to place the stamp. Apparently, this is not taught anymore, as evidence by various Reddit threads, including the one below.

- How to sign their name in cursive. Some elementary schools stopped teaching cursive in 2010, though there now seems to be a backlash against the removal. Whether or not your student knows how to write (even remotely legibly) in cursive, make sure they understand how to sign their legal name.

- How to write a grown-up, professional email. Use a clear subject line that indicates the purpose of the message. Write in full, grammatically-correct sentences. Spell check. Don’t use emoji or slang. (Seriously, no cap.) Except in a rare case when asked to do so, don’t address female professors as “Mrs.” That’s a social honorific, and this isn’t kindergarten. They’re either Professor or Doctor or (if TAs or adjuncts) Ms. (unless they ask you to use their first name). Don’t address professors of any gender as “Bro” or “Dude.” (This goes for verbal communication, too!)

- How to schedule an appointment (and how to reschedule or cancel one) — Your kid knows how to log into a web site and pick a time slot, but Gen Z is particularly phone-averse. Role play with them how to make a call to request an appointment with a doctor or dentist, to get their hair cut, to have their car evaluated or repaired, etc. Teach them how to summarize why they’re calling (whether to a gatekeeper or for voicemail).

- How to leave voicemail — Guide them not to say, “Um, so this is Joe. I need you to call me back” without any hint of why. Young people are often nervous about calling strangers, so they should plan the message, mentally or even in writing. Encourage them to think about why they’re calling — and what result (information? permission? assistance?) they need.

This is good advice for grownups, too, especially those suffer from social anxiety. Practice eases the process. State your name, phone number, and reason for calling so the recipient can do their legwork and get back to you at their convenience without wasting their time (or yours on a cycle of call tag).

- How to write a thank you note — In case it’s been a while since you impressed upon your child the importance (and power) of this habit, share a classic Paper Doll post, Gratitude, Mr. Rogers, and How To Organize a Thank You Note and remind them, once again, that grandparents are more likely to send gifts (money? Apple gift cards? freshly baked cookies?) when thanked for their actions.

- How to apologize authentically and effectively — Whether your student eats her roommate’s last yogurt or commits a more unpardonable act, don’t let kids go off to college without this essential life skill. Make sure they understand that “I’m sorry you got mad” is not an apology.

There’s an easy formula:

-

- Use the words, “I’m sorry” or “I apologize.”

- Take responsibility and state what you actually did wrong.

- Illustrate that you understood the impact of your actions on the other individual.

- Explain how you’ll ensure it won’t happen again, or show how you’ll make reparations.

STAY SAFE, ON CAMPUS AND OFF

There will likely be a safety workshop during orientation week. Encourage your student to attend and to understand what kind of built-in infrastructure the campus has for safety.

Be Safe When Walking Around

When I attended college, we had a Blue Light service, poles throughout campus with blue lights at the top and telephones connected to Campus Safety. You could make a direct call (without a coin) or just hit the handsets as you ran from a horror movie monster (let’s ignore the more serious alternative) and campus safety peer volunteers and personnel would come out in force. There were also free “blue light buses” on campus to ferry people home safely at night. I was delighted to find out that this system is still in place, with some modern tech additions.

Nowadays, most campuses have high-end safety systems and apps. Still, encourage students to program the campus security number into their phones and know how to request an official campus peer escort. Other advice to impart:

- Don’t walk alone, especially at night. Take heavily-trafficked routes with good lighting.

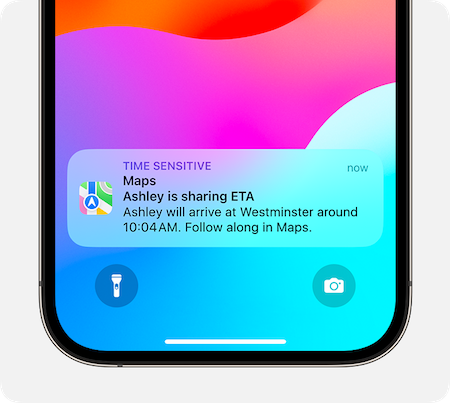

- Let your roommate or BFF know where you are headed, and program your phone to share your real-time location (one time or ongoing) and ETA:

- You’re probably not going to convince your college kid to never ride with strangers, but you can fund an Uber or Lyft account to make it easier to get home if they’ve gone to a concert or club off campus. You may also want to discuss GrownandFlown.com’s The 7 Ride Share Safety Tips Every Teen Needs to Know.

Be Safe in Your Dorm and When Out and About

- Lock your room when not in it (so you don’t walk in to any surprises), or when you are, but lots of others aren’t around.

- Close and lock your windows when you are sleeping or not in your dorm, especially if you’re on the ground floor.

- Program campus housing numbers into phones.You might be locked out of the dorm without keys or key cards or wallet, but nobody goes anywhere without their phones anymore.

Hopefully, you’ve had lots of conversations with your teen about how to have situational awareness when walking around (or studying, especially alone), how to be safe at parties, and how to figure out whom to trust. These kinds of skills can take many years to develop, but open conversations are the beginning.

This is an organizing blog, not a parenting blog, but I fervently hope that just as many parents will teach their sons the importance of not victimizing as they teach their daughters how not to be victims.

For more in-depth advice, You may also want to share:

- How to Stay Safe on a College Campus (US News & World Report)

- 9 Ways to Stay Safe on Your College Campus (Safewise)

- 10 Campus Safety Strategies for College Students (RAINN)

- Campus Safety Guide (Best Colleges)

Be Safe During Emergencies

Personal safety doesn’t just include watching out for bad guys. Your kids had fire drills in school, but they’re used to following an grownups instructions. Now that they’re the grownups, make sure they know:

- How and when to call 911 vs. the police non-emergency line vs. the campus health center vs. the resident hall director).

- When to go to the ER vs. urgent care, or the health center, or a family doctor (or to call the health insurance Ask-A-Nurse line…or Dr. Mom)

- How to use a fire extinguisher. When I visited my old campus for my reunion in June, I saw that fire extinguishers had changed; they were neither the massively heavy ones I recalled from my youth nor the can-of-whipped-cream style I have at home. Have them read the instructions.

- Pay attention to the exits when entering classroom or building, and know the safe exit path for the dorm.

While it’s designed primarily for families, your student might find Paper Doll Organizes You To Prepare for an Emergency to be a useful starting point.

Be Safe When Interacting with the Police

If you or anyone in your family or close circle is Black (or you’ve ever watched a Shonda Rhimes show), you almost certainly know about The Talk and have had it, and multiple iterations of it, before sending a child to college.

However, if you are not a member of a visible minority, your have probably been privileged to not have to think about this. Role-model and practice so your college-bound student knows what to do if they are stopped while driving, riding, or walking — or if the police come to their dorms to make inquiries — or if they participate in a campus protest.

If you watch police procedurals, you’re probably familiar with the concept of swatting, the practice of making a prank call to emergency services in order to get armed police officers dispatched to someone’s address. It happens to congressional representatives and judges, but it also happens to random people, including college students. It apparently started with online gamers being targeted by others playing the game.

Almost nobody gets through life without interacting with police officers, and whether it’s municipal police or campus security, student needs a skill set for handling potentially scary interactions.

Again, this post is about organizing adulting skill sets. Beyond, “stay calm and don’t escalate,” I won’t advise you regarding what you should tell your children, but encourage you to talk to them about how to do it safely and with some starting points:

- ACLU’s Know Your Rights: Stopped By Police (ACLU)

- Dealing With Campus Police: Top 3 Legal FAQs For College Students (FindLaw)

- Black Parents Describe “The Talk” They Give to Their Children About Police (Vox)

HOW TO STAY HEALTHY AT COLLEGE

Nobody gets to college without having had a booboo or a cold or a stomach bug, but a lot of parents find that their newly independent children experience a sense of amnesia once any of these things happen at college. Use the following as prompts to make sure your kids are ready for dealing with the owies of adult life.

Be Prepared for Medical Ickiness

Everyone eventually gets the crud, and being away from home makes it worse. However, knowing how to handle the experience makes having the yuckies marginally better. Make sure students know:

- How to treat a sore throat, toothache, upset stomach (and related intestinal distresses) and minor viruses.

- How to recognize symptoms (like a high fever) requiring professional medical intervention.

- How the dosage on OTC and prescription medicine works. There’s a reason why it says “take no more than X in 24 hours” — because people thought X “in one day” meant they could have X at 11:45 p.m. and again at 12:15 a.m. Medication doesn’t follow a calendar.

- How to fill and refill a prescription — If you’ve always done it for them, your student may not know about prescription numbers or number of refills available.

- How to take maintenance medication or perform health activities without you having to remind them — You won’t be able to ask, “Did you take your ADHD meds today?” or “How many times did you check your blood glucose today?” Your student knows how to set an alarm on the phone, but walking them through how to label the alarms to make it clear which meds are for that specific alarm could help. Even “experienced” adults with established schedules forget to take meds when on vacation; college schedules are stress-inducing and can lead to forgetting, so help them help themselves.

- Where the nearest 24-hour pharmacy is, before they need it — At some point, your student will need Pepto or condoms or feminine sanitary products or a COVID test at 3 a.m. Being prepared is half the battle.

- How to do First Aid — Not everybody was a scout. I’m often shocked by people (OK, men. It’s always men) who don’t know how to properly clean a small wound, remove a splinter, or put on a bandage. You can’t anticipate everything — minor and major — need to know, so share the National Safety Council’s First Aid Video Library link. It’s impressive.

- How to fill out health insurance forms at the doctor’s office. — Seriously, your kid should know their blood type without having to call and ask you. (That’s why I told you last week to give them copies of their medical history information.)

Booboo Bear Photo by Pixabay

How to Deal with College Life Ickiness

- How to safely drink/consume things you’d prefer they didn’t partake of at all.

- How to help a friend who has unwisely or unsafely imbibed or consumed something. This might range from treating hangovers to knowing how to use NARCAN to the calling 911!

- How basic hygiene works. Wash hands! — Feel like you shouldn’t have to explain this to an adult? Reread Organize Your Health: Parental Wisdom, Innovation, and the New Time Timer® Wash. Yes, it’s from the first year of COVID, but the unfathomable reminder that people forget to wash their hands is timeless.

- Wash water bottles. — We didn’t even have bottled water when I was in college. Now, Stanley cups (not the hockey kind) are everywhere. And no, just because there’s only water in it doesn’t mean it’s clean. Microbes are icky. (Secret cleaning trick? Denture tablets!)

How to Deal with Grown-Up Issues

I hope you and your student have the kind of relationship where you can discuss “adult” things without (too much) awkwardness. I was lucky that Paper Mommy always made a safe space to talk about difficult issues, but not everyone has that ability (or that parent).

You may have had that other version of “The Talk” with your student in adolescence, but whether you’re dealing with reproductive care or mental health or anything sensitive, at the very least encourage your college-bound student to talk. Say that you hope they’ll talk to you, but even if not, that there are many safe places (starting with the campus health center) to find accurate information and supportive care. Some of the issues they may need to contend with include:

- Safe sex

- How to use contraception properly

- How to say no, at any point in the process, and maintain healthy boundaries

- How to be secure consent and step back if there is no consent

- Mental health

- How to recognize the signs of depression or anxiety (or other mental health concerns) in themselves and their friends, including social isolation or an increase in risky behaviors, or changes in academic performance, mood, sleep or eating habits, or personal hygiene.

- Where to seek mental health help, on campus or virtually

- Self-care — Remind your beloved child of their options for caring for their mental health, including:

- taking breaks

- exercising

- getting out in nature

- talking to friends

- journaling

- calling home

- speaking with a therapist

- understanding that everyone has problems, they are manageable, and there is support available

For your purposes, peruse Empowering Wellness: Supporting Freshman Health and Well-Being from College Parents of America, and perhaps get your kid a copy of something like The Greatest College Health Guide You Never Knew You Needed: How to Manage Food, Booze, Stress, Sex, Sleep, and Exercise on Campus before they leave for campus.

Organize Your College-Bound Student for Grown-Up Life: Part 1

In a matter of weeks, fresh-faced first-year college students will be headed off to begin their adult lives.

Everyone needs a little organizational guidance on this path. Last week, I re-shared a popular post from the Paper Doll vault, Paper Doll & Real Simple Organize Dorm Rooms: SUPER-EXTENDED Edition, looking at how to organize a dorm room for maximum comfort and productivity.

There’s a lot of support out there for getting the right stuff to make college life easier. IKEA has created a stellar master list of what to take to college that likely exceeds whatever your student’s department of residence life has forwarded. If you care mainly about having the right electronic solutions, you can scroll through pieces like Back to School — 10 Cool Tech Gadgets for 2024.

Taking advantage of the “college lists,” reminiscent of the photocopied (and previously, mimeographed) lists of teacher’s required school supplies, can put most parents and students on a fairly level playing field. Well, at least in terms of the tangibles, like basic creature comforts necessary to sleep, study, and snack while paying at least a modicum of attention to personal hygiene and health while at college.

The stuff is one thing. However, not all 18-year-olds arrive at college with the same levels of maturity, knowledge, and awareness of the world. TikTok, Instagram, and YouTube sensation Chip Leighton of The Leighton Show hit it big the last past few years with his series of videos of funny texts from teenagers.

But Leighton really caught my eyes with the texts from college students. These texts, and the rush of comments from parents illustrating their own young people’s texts, help us realize that parents and guardians may need to do more than they realize to prepare offspring for independent life on the planet.

Some things are universal — students arrive at college not having a handle on how to do laundry or manage their finances. But the deeper I’ve gone into talking with clients with kids at college (and, yes, reading the hysterical — and embarrassing — stories from parents in Leighton’s comments sections), I’ve realized that there are ways in which kids are ill-prepared for college (and life beyond) in a ways that adults may not realize.

Today’s post and the rest of this series is a starter kit for the issues to discuss with your college-bound Gen-Zers before they risk endangering their lives, messing up their financial histories, or embarrassing themselves in front of age cohorts who have been better prepared for life “in the real world.”

ESSENTIAL INFORMATION AND PAPERWORK

Before we get into what your college students need to know, we should look at what documents they need to possess and understand.

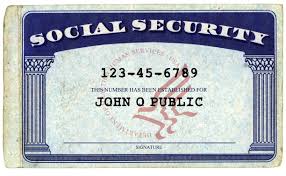

Social Security Number

If you’re an American, your kid already has Social Security numbers. But do they actually know it?

This is the number you most need to memorize for the next six or more decades. Once at college, students will find they need to provide a student ID number and Social Security number on forms all the time. If they haven’t memorized it as a result of the college application process, now is the time to help them remember it.

You’ll have to discuss whether it makes sense for your student to take the actual card to school, or if it’s best kept safely in the family home until or unless they need it for official reasons. If they do take it to school, remind them that it shouldn’t live in their wallet or anywhere it could be lost or easily stolen.

Contact information for the important people in their lives

Yes, college-bound students mainly text people, but at some point, you might point out that if they send a real letter (or even a postcard) to Grandma, she might be inclined to send back money or a tin of cookies or some sort of care package.

College students need to have phone numbers, email addresses, and mailing/shipping addresses at the ready. And while yes, they can text Mom and Dad for the answers, warn them that they may end up as an example on Leighton’s TikTok or Instagram page!

What to Do With Print Photos You Do — and Don’t — Want

Let’s talk about photos.

No, not the 4th of July selfies where you look gloriously happy. I’m not even talking about digital photos at all, but prints.

If you’ve only ever taken photos with a phone, did you know that’s only been possible since 1999? Babies born the week the iPhone was invented are about to be seniors in high school. And before then, there were digital cameras, but really only since the 1990s.

For most of photographic history, photos were printed on paper. (And yes, if you’ve got a headache thinking that I even need to explain this, I feel your pain, fellow oldster.) This means that many of our houses are filled with envelopes and boxes and albums of print photos, some of which aren’t very good.

DIGITAL VS. ANALOG PHOTOS: WHY IT’S HARD TO DISCARD ONE AND NOT THE OTHER

You may be wondering what the big deal is. If you’ve only (or mainly) got digital photos, you’re probably happy to let them sit there on your phone or in cloud backup. Maybe you make slide shows to display on a digital photo frame or create photo books, but they probably aren’t bothering you.

People enjoy their digital photos because we’re all used to immediately deleting bad shots. Mom is squinting into the sun or our midriffs look bulge-y? Hit that trash can icon! We’re generally comfortable with deleting items from our photo stream.

And yet, as I’ve seen time and again with friends and clients, the prospect of throwing out any print photo seems to make people wince.

We're generally comfortable with deleting items from our photo stream, but the prospect of throwing out a print photo seems to make people wince. Share on XPeople second-guess themselves when faced with a photo that resembles nothing so much as 99% thumb with a blurry background.

Recently, a client and I flipped through a stack of his late father’s photos from the 1950s. They ranged from high school dance snapshots to Korean-era war era Army training. All were shot in black-and-white, and while several were fairly crisp and well-lit, many were blurry, and either washed out or too dark.

Client’s mystery photo circa 1956

This one was not only impossible to identify (boxes? filing cabinets? Is that Mr. Potato Head?). His father, who’d meticulously noted the participants in most photos, had just written, “Beats me” on the reverse.

The reverse of the mystery photo: “Beats Me”

For six decades, this print stayed in the stack, sandwiched between personally and historically relevant photos. Why do we do this?

Maybe it’s because we’re completists. We have the negatives and we worry that if we throw out the print, the numbers won’t match up, and someone, some day, will be upset by the imbalance.

Perhaps it’s because we don’t trust our own judgment. Compared to the high quality photography we’re capable of now, old shots are pretty poor. We’ve got thirty-seven identical photos of the lilac bush in the corner of the front yard from 1978. We’re sure they’re useless. But what if we’re wrong? What if these shots are artistic? What if we discard the one that’s actually the best?

Fearing our own taste (or lack thereof) we keep bad prints, even though we wouldn’t hesitate to prune these from our photo streams right after snapping them.

Or maybe it’s just because analog things feel more real to us than digital things? Thus, the loss of the tangible seems real, whereas the digital even doesn’t seem real in the first place, so letting go doesn’t bother us.

If I make the decision to give away a hardcover because I know I’ll never read it again, I often feel disconcerted, even though this is what I do professionally. When a borrowed library ebook automatically gets returned (unread or even only partially read), I just shrug. There’s no distress. They’re just not real to me. I suspect for some of us, it’s the same with digital photos. But prints?

HOW TO ORGANIZE THE PRINT PHOTOS YOU DO WANT: A CHEAT SHEET

Some print photos are like a warm hug.

Paper Doll and big sister, spring 1968

Handling an embarrassment of print photo riches is a labor of love. You must:

- Separate the wheat from the chaff and eliminate what you don’t want. (See next section.)

- Sort photos, whether chronologically or by event types (birthdays, holidays, etc.) or themes.

- Determine how you’ll store print photos:

- Photo Albums — Unlike the bulky flip albums of the sixties or the sticky “magnetic” albums of the 1980s, today’s experts recommend albums with acid-free, lignin-free pages to prevent photos from yellowing or deteriorating, and photo corners or sleeves to hold the print photos in place without any adhesive touching them.

- Photo Boxes — Step up from shoe boxes and seek out acid-free, lignin-free photo boxes that store the photos vertically (and safely), with labeled dividers and indexes to keep prints organized and categorized.

Find New Life for Unfinished Needlework Projects and Pre-Loved Stuffed Animals

It’s rare that Paper Doll wanders away from the productivity topics of organizing paper, information, and time management, but a few intriguing services were shared with me recently and may be just what some readers need to put a smile on their faces.

When I work with organizing clients to help them downsize or declutter, some things are always easier to let go off than others. Whether we have ample time or are restricted due to an impending move or change in life circumstances, I always try to begin with the areas of a home that have lesser sentimental attachments. It’s just easier to declutter a bathroom cabinet, linen closet, or kitchen than it is to reduce personal memorabilia, photos, or keepsakes.

Today, we’re going to look at some novel ideas for letting go of things you no longer need or can’t use as-is, but are having difficulty parting with because you feel an obligation to the item in question or the person who owned it.

LOOSE ENDS

Some people just have the knack for knitting, crocheting, and needlework projects.

For example, my grandmother (Paper Mommy‘s mother) supplied the family with an inordinate number of multicolored knit afghans (and, admittedly one set of toddler mittens with square, too-short compartments for thumb and fingers). Her sister, my great-aunt, created a sumptuous brocade coat, sewed an inspired wedding gown, and crocheted the loveliest butter-yellow sundress — all for my sister’s Barbies.

The skills, however, did not pass down to later generations. Finding Paper Mommy sewing on a loosened button, my sister squinted and inquired, “Who are you and what have you done with my real mother?!” I, myself, have never stooped to, but have considered, fixing a ripped seam with a stapler.

Of course, my family is not your family, and your mileage may vary. (In which case, could you help me with this hem?)

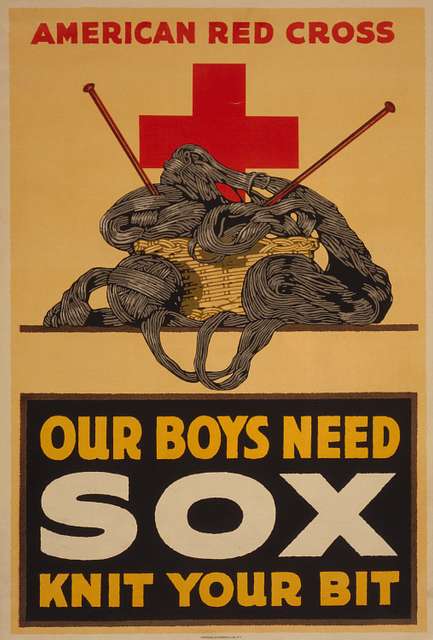

Public Domain, Library of Congress, circa 1944

When You Are At Loose Ends with Unfinished Knitting/Needlework Projects

Have you ever gone through the closets or drawers of a loved one who has passed away to find that they’ve left behind a number of unfinished needlework projects? So many of my clients have found that their spouses or parents or grandparents have left half-finished sweaters or blankets. These left-behind pieces of handiwork reside in a no-man’s land, neither finished projects nor purely raw materials.

Or, have you known people who have derived great satisfaction from their needlework projects but are no longer able to complete them due to serious illness or disability? I have clients, for example, who suffer from conditions ranging from macular degeneration to debilitating arthritis to Parkinson’s, and they have had to relinquish their needlework hobbies.

It can be demoralizing for them to have these unfinished projects mocking them, so they may stuff them away in cabinets or closets. Meanwhile, it’s heartbreaking to give up on the idea of them being transformed into enjoyable pieces.

If you’re an accomplished knitter, and the yarn selection appeals to you, and you have the time and energy, you might take up the project yourself and finish it. But if one or more of those circumstances doesn’t apply?

Yes, you could donate the unfinished piece, as is, and leave it for the universe to match the project to the right person, but what if you could help the universe along?

Enter Loose Ends, a free service for getting your loved one’s needlework projects completed.

The founders, Jen Simonic and Masey Kaplan are avid knitters who found that they both had the experience of friends asking them to complete needlework projects originally begun by loved ones who had passed away. They were enthusiastic to do so, but recognizing the joy of wearing or using something a loved one created, they realized that there was an opportunity to create and share more joy.

In doing so, they built an organization that turns the clutter of unfinished projects into beautiful collaborations involving those who started the projects, the loved ones who see a chance for completing them, and volunteers who bring the projects to fruition.

Loose Ends turns the clutter of unfinished projects into beautiful collaborations involving those who started the projects, the loved ones who see a chance for completing them, and volunteers who bring the projects to fruition. Share on XSimonic and Kaplan see themselves and Loose Ends, now a 501(c)3 nonprofit (as of May 2023), as matchmakers. Their website notes that, “In knitting patterns, this is noted as K2Tog (knitting two together).” Not being a knitter, I’ll take their word for it.

How Loose Ends Works

Imagine you’ve gone through Grandma’s craft room, identifying all the unfinished sweaters or doilies or baby blankets. You can submit these unfinished projects to Loose Ends and Simonic and Kaplan’s team will survey the Loose Ends database of “finishers” to find a likely match based on geography, skill level, and the ineffable “druthers,” of what volunteers’ profiles show as their interests.

Loose Ends then contacts the finishers to see if the project is a good match, and if so they introduce the finisher and project owner by email.

Then, like any good yenta (matchmaker), Loose Ends leaves the project owner and finisher to develop the project-completion relationship in their own time and manner. (Of course, if it’s necessary, the Loose Ends team is available for troubleshooting problems, offering advice, or reassigning the project to a different finisher, if circumstances proves necessary.)

It usually takes up to a few weeks to find a finisher for a project, and then more time for the finishers to receive the project from the sender. As I discussed in Paper Doll On Understanding and Conquering Procrastination, it takes activation energy to get the ball rolling.

I imagine how much activation energy it must take just for someone to reach out for help; it might take quite a bit for the project owner to move to the next step of communicating with a finisher and even more to finally ship the project.

Finishers, whether they are knitters, crocheters, quilters, or other types of textile crafters, sign up online; similarly, project owners submit their projects online.

What Projects Will Loose Ends Accept?

Loose Ends has a detailed FAQ section, but you may be wondering who actually qualifies to have their projects finished by Loose Ends volunteers. The criteria related to who started the project and the material and projects involved:

- The original crafter must be deceased or unable to do handwork due to illness or disability. (In other words, this isn’t a service for people just looking to get free needlework done! These volunteers are lovingly completing projects started by those who are unable to do so.)

- The project must be partially begun. (So, no sending in Grandma’s unopened needlepoint kits.)

- The project and its materials must be free of moths and moth eggs. Similarly, they will not accept any contaminated yarn or rotting materials. (You would think that this would go without saying, but during my time as a professional organizer, I’ve seen people try to “donate” things that are dirty or otherwise, for want of a better term, yucky. You wouldn’t want someone sending something yucky to your home; right?)

- The project must be clean and not smell of mothballs or mold. If the project has been in a home with cigarette smoke, Loose Ends will try to match the project to a volunteer finisher whois not bothered by the scent of cigarettes.

- The project owner must want the project back — to keep! (I don’t imagine this means you can’t give the blanket to your kids.)

Submitted projects don’t have to involve knitting. Loose Ends notes that the projects can involve “any textile handwork… knit, crochet, sewing, quilting, mending, rug-making, Tunisian crochet, embroidery, cross-stitch, needlepoint, weaving, etc.”

I didn’t even know what Tunisian crochet was, but apparently it’s not quite as exotic as you might think, and involves the stitching used to make afghans.

Logistics and Costs

Understandably, the more specialized the craft, the more time it may take to match the project to the finisher, and if the project and its finisher are far apart geographically, shipping in both directions will increase the time.

Speaking of geography, finishers and project owners need not be in the United States. Work can come from or be finished anywhere in the world! As of six months ago, Loose Ends had 19,000 finishers in 64 countries!

Public Domain Photo Circa 1914-1918

Library of Congress CALL NUMBER: POS – WWI – US, no. 118 (C size) [P&P]

Finishers complete projects at no cost, but (understandably) any shipping costs in both directions get covered by the project owner. Loose Ends works to minimize costs by matching individuals in nearby geographic areas whenever possible.

Impressively, the site notes that if a project requires acquisition of extra materials, JOANN Fabric and Craft Stores (Loose Ends’ partner) will supply anything available at their stores at no cost. (Editor’s Note: JOANN has recently filed for chapter 11 bankruptcy, so it’s not clear if this will have an impact on their future support.) However, if a project requires the purchase of supplies elsewhere, that’s the project owner’s responsibility.

Sundries, Notions, and Benefits

What if you (or your loved one) had no projects to finish, but oodles of fabrics, yarn, or craft supplies? Loose Ends can’t accept those materials, but they’ve amassed a huge state-by-state and country-by-country list of organizations that can give new life to these supplies. Go to their donations page and scroll down.

Speaking of donations, if you’d like to donate financially to Loose Ends’s efforts, you can do so through Zeffy, a Canadian donation processing company for nonprofits that does not charge fees.

Paper Doll may not be into crafting, but I find Loose Ends to be a lovely project with benefits for all.

Are you an inveterate knitter whose family and friends just don’t want or need one more sweater, lap blanket or tea cozy? If you just can’t give up the clickety-clacking of your needles, this gives you a fun project to work on without fear of adding fuzzy clutter to your space or the spaces of those you love. (I’m sorry, but some of us just don’t need any more yarn things!)

Meanwhile, those who’ve lost someone one can get one final gift of connection, completed lovingly by a crafter who shares their loved one’s passion for handiwork.

The finished project becomes a legacy instead of a piece of clutter.

For a more in-depth discussion of Loose Ends, co-founder Jen Simonic just appeared on the most recent episode of the video podcast Fiberchats, hosted by Irina Shaar.

LOVED BEFORE

My fabulous colleague Janice Simon, better known as The Clutter Princess, knows I’m a sucker for nifty projects like Loose Ends and recently sent me a TikTok about another sweet service, this one saving the environment while reducing household stuffed animal clutter.

If you’ve got stuffies that your children have outgrown (or which were given to you by boyfriends later found to be poopyheads) then you know how difficult it can be to move them onward.

We professional organizers usually consider donation first whenever helping clients let go of excess possessions. Stuffed animals and other such toys can be donated to standard charities like Goodwill, hospitals, shelters for unhoused individuals and families, domestic violence shelters, daycare centers, social services agencies, and organizations like Stuffed Animals for Emergencies (SAFE), which give them to the police departments to share with children who’ve experienced a trauma.

The problem? These donations generally need to be brand-new, or at least very gently used, toys. Typically, well-loved stuffed toys generally can’t be donated for hygiene reasons.

The alternative to donation, especially for once-loved but beaten-up fuzzy friends, is the landfill, and nobody wants that.

And, of course, if you believe that your stuffed friends won’t find loving owners through donation, and you can’t bear the thought of them ending up on the junk heap, how will you ever bear letting them go at all? It’s no wonder that so many people have houses filled with ignored, dust-gathering stuffed animals!

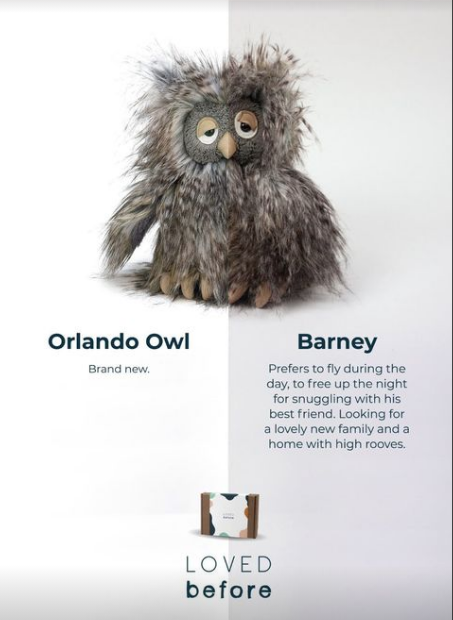

Loved Before, a London, UK-based organization, has found an alternative for giving new life to old “soft toys” (what we call stuffed animals). Their mission is to:

make a difference by recycling pre-loved toys into “eco toys” that are not only adorable but also sustainable. We believe through the medium of soft toys we can teach the importance of preserving our planet to future generations.

Loved Before sees itself as the first eco-friendly, fully sustainable soft toy adoption agency.

Donate Your Stuffies — And Their Stories

Loved Before accepts donations of soft toys in “all shapes, sizes, species and conditions,” no matter whether they are store-bought Steiff, Gund, Beanie Babies, or Build-a-Bear friends or multi-generational, wonky, and handmade with love. (However, they can’t accept plastic toys or those with electronic or mechanical parts.)

People are invited to pack the soft toys/stuffed animals to donate securely in a cardboard box, along with a return address (in case the process goes awry and the package must be returned to the sender). You can even include a little note with contact information so Loved Before can assure you that your little friend has arrived at its destination safely.

Along with your donation, you’re encouraged to write up the life story of your sweet little stuffed friend. Attach it with a string or ribbon tied around the neck or waist. It’s helpful to “add a clear descriptions or even photos” so Loved Before can be sure they’re matching the right life story to the right stuffie, especially if you’re sending more than one.

Including your soft toy’s life story is optional, but contributes to the delight of how they will be matched to future families. Loved Before provides prompts to help you become your toy’s biographer, like:

- What are the likes and dislikes of your teddy?

- What is your teddy looking for in a new home?

- Do you have any memories or funny stories with your teddy?

- How has your teddy helped or been special to you?

- Is there anything you’d like to say about yourself?

Package up your soft toy and biography and either book a drop-off appointment at, or ship it to, Loved Before’s HQ:

202 Heath Road

LU73AT

Leighton Buzzard

Bedfordshire, UK

or register to donate it at one of their UK roadshow donations.

UK? Yes, unfortunately for all of us on on this side of the pond, Loved Before currently operates only in the UK. However, they’re looking to expand their efforts globally, and are even seeking volunteers worldwide to reduce the landfill and spread joy.

The Loved Before Spa Experience & Photo Shoot

But wait. Why can these used, possibly shmutzy soft ties be donated? That’s the nifty part!

Loved Before states that although it’s overarching mission is to “change perspectives through the medium of eco-friendly soft toys, our biggest commitment is to ensure all of our pre loved soft toys are safe and clean.”

To ensure safety, every toy gets a “health check.” Then, to make sure that every little stuffed friend is sparklingly clean, Loved Before sends them for a full-on spa experience to clean and re-fluff these “pre-loved” toys.

The actual spa process varies by individual stuffie, and depends on the age, condition, and materials of the soft toy in question. All are “thoroughly cleaned, repaired, and disinfected to ensure cleanliness and safety.”

Want to see what’s going on during this process? Loved Before documents the entire experience on their Instagram page (and you can see many of the new adoptees and friends on their TikTok).

Eventually, your soft friends make their way through the spa for a full shampoo-and-set (plus any necessary refreshing) and then have their own personal photoshoot before being added to the Loved Before adoption center.

The Path to Happily Ever After

Once stuffed friends are spa-pretty and have their photo shoot, they are ready to be adopted, and their photos and stories of their adventures go up on the Loved Before store site in anticipation of them being re-homed to find new their new families!

“Meet” the adoptees newly-ready for adventures by going to the Loved Before website each Monday at 8 pm GMT (3 pm EST). Want a reminder to make sure you get to see each new, delightful adoptee? Subscribe to be sent reminders via a link in the banner!

You can peruse potential adoptees by:

- brand (Aurora World, Beanie Babies, Build-a-Bear, Charlie Bears, Gund, Jelly Cat, Keel, Merrythought, Steiff, Wild Republic, etc.),

- species (bears, giraffes, dinosaurs, etc.), or

- collection (teenies, mythical creatures, woodland or sea creatures, farm animals, famous “celebrity” characters, etc.)

It’s also possible to see who has been recently adopted.

Once you select a new friend to adopt, click to purchase — I mean, process your adoption fees.

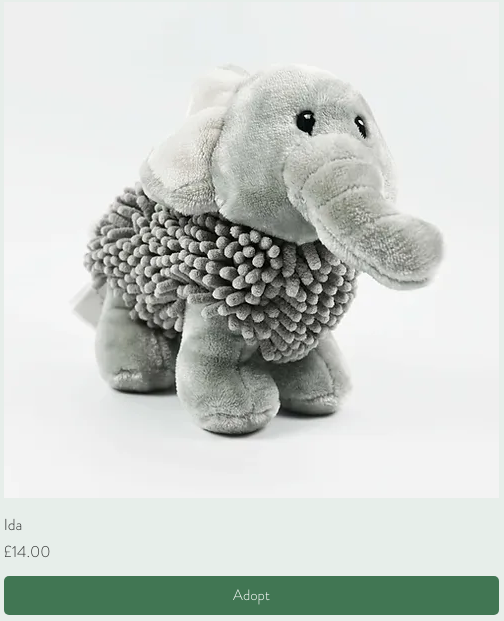

“Meet Ida, the soft toy with a passion for folklore! This little cutie loves listening to stories about mythical creatures and magical adventures. One time, I caught Duha trying to cast a spell with a wand made of popsicle sticks! Always keeping me entertained with their whimsical imagination.”

Loved Before uses fully recyclable, biodegradable, and sustainably sourced materials for all packaging.

The Benefits of Loved Before

Original families who no longer have the space for, or the tiny humans to give attention to, the soft toys can lovingly find them refreshed bodies and new families.

Children (and adults) have the delight of finding new eco-friendly chums with whom to share adventures.

The landfill stays clear of stuffies.

At least half of the profit from each sustainable soft-toy adoptee goes to Make-A-Wish UK. (Read more about Loved Before’s charity model.)

Final Thoughts

Yes, Loved Before is in the UK, so it’s much farther away than the 100 Acre Woods to send your stuffies or adopt from there. Still, it’s heartwarming to read about the little friends who’ve found new lives with their new families in an environmentally sound way, and we can be hopeful that their efforts will go global sooner rather than later. Here’s the latest update on that very thing!

(P.S. If anyone knows how to center a YouTube short on WordPress, please let me know in the comments!)

Follow Me