Paper Doll

Ultimate Guide to Organizing the Passport Process: In Person, By Mail, & Now: Online!

If you’re organized in approaching the experience, travel can broaden the horizons and delight the senses, as I have talked about in posts like:

- Paper Doll’s 5 Essential Lists For Planning an International Vacation

- Paper Doll on the Smead Podcast: Essential Lists For Organized Travel

- Paper Doll Organizes Your Space, Money, and Well-Being While Traveling

Of course, one large part of international travel is having an up-to-date passport, which I covered dating all the way back to 2010, when I wrote “May We See Your Papers?”: Passport Cards and Trusted Travelers. As you can imagine, a lot has changed since then.

And, in fact, a lot has changed in the world of passports as recently as last month! But first, let’s start with the basics.

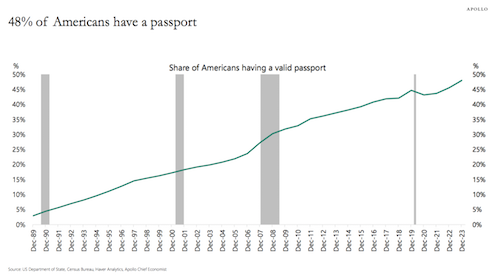

THE GROWTH IN PASSPORT POPULARITY

In 1990, only 4% of citizens of the United States held passports. This was consistently a shock to Europeans, where international travel between nations was common. Certainly some of this was due to the immensity of the United States, per the old joke:

Texan: “I’m from the great state of Texas. My state is so big that you can get on a train, ride for a day and a night, and still be in Texas!”

Rhode Islander: “We used to have trains like that in Rhode Island.”

However, our expanse of land is not the only reason many Americans didn’t feel the need for a passport. Prior to 9/11, we Americans traveled in a much less restricted way. However, when the Intelligence Reform and Terrorism Prevention Act came into effect in January 2007, the law required U.S. citizens to have valid passports when traveling by air between the United States and Canada, Mexico, Central and South America, the Caribbean, and Bermuda.

Previously, traveling (by land, sea, or air) to these areas was fairly easy and required no passports. (Indeed, having grown up in Buffalo, I recall the many times my family or friends would dive to Canada for the day or even just for dinner, needing only to tell the customs officer our location of birth and whether we had anything to declare.)

US Department of State, Census Bureau, Haver Analytics, Apollo Chief Economist

Over the course of decades, the number of American citizens holding passports has continued to rise. Back in 1997, only 6.3 million U.S. passports were issued; in 2017 the State Department issued a record 21.4 million passports. Now, 48% of U.S. citizens, just slightly less than half, hold valid passports.

Unfortunately, I have no statistics on how many people leave for the airport having forgotten their passports.

BENEFITS OF HOLDING A PASSPORT

Holding a valid U.S. passport comes with a number of benefits beyond having a photo that rivals your driver’s license pic as being one of the least appealing shots ever taken of you.

A passport isn’t just a nifty little book for getting pretty stamps. It’s an essential document that facilitates domestic and international travel, and serves as a crucial form of identification and proof of citizenship. In particular, a U.S. passport comes with additional benefits, including:

Visa-Free Travel — Your U.S. passport allows you visa-free or visa-on-arrival access to much of the world, making international travel easier and more convenient. In fact, current holders of a United States passport may travel to 188 (of 193) countries and territories without a travel visa, or with a visa-on-arrival.

Consular Protection and Services — In case of emergencies (like loss of one’s actual passport, natural disasters, legal issues, etc.), U.S. citizens can receive assistance from U.S. embassies and consulates around the world.

Global Entry Program —U.S. passport holders can apply for Global Entry, which expedites customs processing when you return home, saving time navigating airport lines.

Ease of Travel to U.S. Territories — Your U.S. passport lets you travel seamlessly to U.S. territories such as Puerto Rico, Guam, and the U.S. Virgin Islands. No, you don’t have to have a passport to travel to these locations — because they are part of the United States — but having a U.S. passport makes it much easier to travel to territories without any additional documentation.

HOW TO APPLY FOR A PASSPORT

Let’s assume you’re an adult applying for your own passport for the first time. (If you’re seeking a first-time passport for a child under the age of 16, the rules are different.)

Gather Required Documents

This is where being organized comes in handy. Gather the following documentation:

- Proof of Citizenship — Usually, a certified birth certificate will suffice, but if you weren’t born in the United States, you’ll need a Consular Report of Birth Abroad (CRBA), a Certificate of Naturalization, or a Certificate of Citizenship.

- Proof of Identity — No, a note from your mother will just not do. Be prepared to show a valid driver’s license, government ID, or a military ID, and bring a photocopy, too.

- Passport Photo — Your latest Instagram selfie may be gorgeous, but you’ll need a passport photo that meets specific requirements: 2″ x 2″, in color, taken within the last six months, with a white or off-white background. You also aren’t allowed to smile! There are apps to help you, but if you’re a member of AAA, I encourage you to get your photo taken there. I’m a “blinker” and the nice ladies at AAA put up with SO MUCH blinking until we secured a decent photo.

Missing any of these essential documents? Check out my post How to Replace and Organize 7 Essential Government Documents.

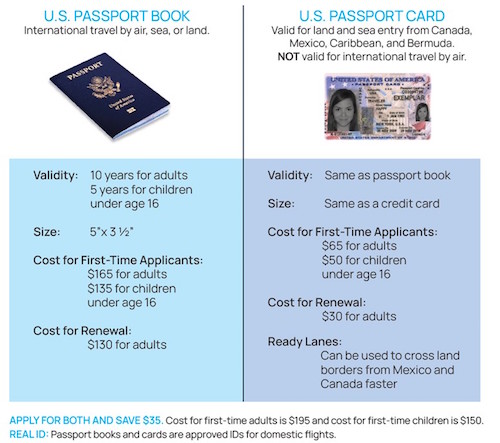

Fill Out Form DS-11

- Fill out Form DS-11 online using the Department of State’s form filler or download a PDF and print it. Alternatively, pick up a paper copy from a passport acceptance facility or any U.S. post office. The DS-11 lets you apply for a passport book, a passport card*, or both. If you think there’s a chance that you’ll be traveling a lot (did you win an around-the-world trip?), request a larger passport book with more visa pages. Just check the large book box at the top of the DS-11 form; there’s no extra charge.

- DON’T SIGN THE FORM until instructed to do so at the passport acceptance facility. Seriously, do not sign the form or you’ll have to start all over.

*A passport card is a wallet-sized, plastic passport (so it has no visa pages) that serves as proof of your United States citizenship and identity, with the same length of validity as the passport book. However, it’s not valid for international travel by air; you can only use it to travel by land or sea between the United States and Canada, Mexico, Bermuda, and Caribbean countries.

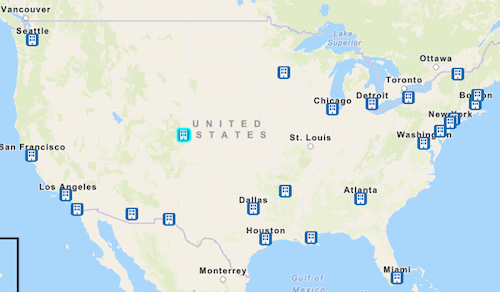

Submit Your Application in Person

- Visit a passport acceptance facility in person. Depending on your location, this may be a post office, library, or other designated location, with official staff for handling passport acceptance. The Department of State has a search page; put in your zip code to find the closest options for your needs. If your travel is urgent and in the next three weeks, make an appointment at a passport agency location.

- Bring everything (the completed Form DS-11, proof of citizenship, proof of identity, passport photo, and the required fees (check or money order, only)) with you to the passport acceptance facility.

(There are also special passport acceptance fairs for processing new passports, but mostly only in New Jersey and Georgia.)

Pay the Fees

- As of the latest update, the total cost for a first-time adult passport book is $165 ($130 application fee to the U.S. Department of State and a $35 execution fee to whatever facility takes your application); for a passport card, it’s $65 ($30 application fee, $35 execution fee); for both, it’s $195 ($160 application fee, $35 execution fee).

- For expedited service (see below for details), add $60 to your application fee; add the weirdly specific $21.36 to your application fee if you want your completed passport shipped 1-2 days after issuance.

- Check the current fee schedule, as fees can change over time.

Wait for Processing

- Enroll in email updates to track your passport’s status.

Have your eyes glazed over while reading this? Perhaps a video is more your style.

RENEW YOUR PASSPORT THE TRADITIONAL WAY: BY MAIL

This is all well and good, but what if you’ve had a passport forever, or applied for one the first time you ever read a Paper Doll post about passports, but now need to renew?

Mailboxes by EraserGirl licensed under the Creative Commons Attribution 2.0 Generic license

Well, the simple act of renewing your passport was never particularly simple (or swift). The traditional method of renewing your passport by mail still requires the following steps:

Make sure you meet the renewal requirements

- You must have your old, undamaged passport in your possession so you can mail it in — The problem? If you travel frequently for work or your personal life, you might have had to cancel trips because you would not have (or would not know if you’d have) your passport back in time.

- The passport had to have been issued within the last 15 years to you when you were at least 16 years of age. — The problem? If a college student has to renew a passport received as a child. It’s not always easy for college-age people to accomplish all the steps to renew their passports, as they’ll likely have to get their original documents from their parents, get themselves somewhere to take an acceptable passport photo, and get to a location that helps with passport renewals by mail.

- The passport must have been issued in your current name unless you can provide, by mail, a document like a marriage certificate, divorce decree, or court order showing a change of name to affirm gender. (For more on this topic, check out Paper Doll’s Ultimate Guide to Legally Changing Your Name.)

- Your passport had to have never been reported lost or stolen (even if you later reported it found or returned).

Fill out the passport renewal form, DS-82

Note, this is not the same DS-11 you use to apply for an original passport, so don’t think you can just send in a photocopy of your old form!

Access the DS-82 online with the passport form filler tool or downloading and printing a PDF and filling it out by hand. Print out the DS-82 and fill it out completely (and, honestly).

Put it all together

Package up and mail the form with your original passport book and/or passport card (which the State Department will return to you by mail), plus:

- a passport photo that follows all the rules stapled to the application form

- any applicable name certified change documents (the State Department will return your copies)

- a personal check or money order made out to the U.S. Department of State for the cost of renewing plus all applicable fees. No credit cards. No cash. No Venmo. Again, if you’ve got a college kid hoping to take a semester abroad, these things may come as a surprise to them. Whether you’re writing a personal check for yourself or your college kid (who may not even have a checking account), be sure to write the full name and date of birth of the applicant at the top of the check!

Send this application package via a trackable method

The State Department can give you status updates once your passport is in the system, but it doesn’t know whether your envelope is in your corner mail box, at the post office, or sitting on a tarmac at an airport in a random city.

A Sidebar on Passport Renewal Fees

There’s a lot going on with passport fees. To start, it costs $130 to renew a passport book, $30 to renew a passport card, and $160 if you want to simultaneously renew both (and sadly, there are no discounts for renewing both at the same time).

However, if you want to speed up your renewal by mail, there are a few different approaches.

- Expedited service — Think of this as if you were buying a double-caf macchiato for the folks at the State Department to get them to speed up their time spent processing your passport. This adds an extra $60 to your application.

- Faster delivery of your completed passport — This is separate from speeding along the work of the State Department. For an extra (again, weirdly specific) fee of $19.53, the State Department will mail your completed passport (whether you have paid for expedited service or not) within 1-2 days of issuance, and you will receive it within 1-2 days of them having mailed it.

You can also speed everything along by sending your renewal packet (with your application, photo, check, old passport, and any supporting documents) via the US Postal Service’s Priority Mail.

Per the State Department, the current routine processing time for passport renewals is 6-8 weeks; for expedited service, it’s running 2-3 weeks. And these estimates only account for processing, not for mailing (in both directions).

What if you need a super-speedy renewal? In an urgent situation, you can make an appointment to visit a passport agency. You can only secure such an appointment if you have urgent emergency travel to a foreign country in the next 14 calendar days, such as if an immediate family member outside of the United States has died, is dying and/or in hospice, or has a life threatening injury (or if you need a foreign visa in the next 28 calendar days).

Note, if you live in the northeast, you’ll have your pick of options for passport agencies; in the southeast, Atlanta and Miami are your only choices. However, a huge portion of the interior of the United States is a multi-day drive from a passport agency office, so be organized and plan ahead!

Depending on whether you’ve already applied for your renewal and time is getting short or the trip (or the passport renewal) has caught you by surprise, there are different approaches to securing an appointment, so click the above link to see your options.

To wrap it all up, here’s how you renew your passport using the traditional renewal-by-mail method.

NEW: RENEW YOUR PASSPORT ONLINE!!!

Now that you know the standard way to renew your passport (book or card) by mail, here’s a curveball. The United States Department of State has an intriguing new “beta” program where you can renew your passport online!

As of June 2024, eligible American citizens can skip the lines at the post office to renew their passports!

Just don’t think this is going to speed up the process, or expect that it’s going to be significantly more convenient, at least in the near term. However, if you’re eligible, you can at least renew your passport while sitting in your jammies at home.

Woman in PJs at Computer designed with Bing Image Creator

Note, that this is a “beta” release of the online passport renewal system means they are still working the kinks out. Some aspects of the online passport renewal system are similar to what you’d do if you processed everything by mail, but there are several differences, depending on your personal status and your previous passport situation.

Online renewal requirements related to you

- You are at least 25 years old.

- You are not changing the name, gender, date of birth, or place of birth associated with your current passport. So, online renewal isn’t appropriate for anyone who has changed their name since their last passport was issued, whether due to marriage, divorce, matching their gender, or otherwise.

- You won’t be traveling internationally for at least 8 weeks from the date you submit your application. There’s no expedited service during the beta phase of this renewal by mail, so this program isn’t faster; it’s just (when everything else works), easier and prevents you have having to schlep out in the 90°+ temperatures.

- You live in the United States (in either a state or a territory). If you’re living in a foreign country or have an Army Post Office (APO) or Fleet Post Office (FPO) address, you don’t qualify for passport renewal by mail. (Again, this is likely because of beta program. Requirements are likely in flux.)

Online renewal requirements related to the passport

- You’re applying to renew a regular (tourist) passport. This online program doesn’t cover renewals of specially-issued passport statuses, like diplomatic, official, or service passports. So, if you’re a new American diplomat, like the Stephanie Syptak-Ramnath, our brand-new U.S. Ambassador to Peru, you’ll have to renew by mail (or, y’know, get your fancy assistant to help).

- The passport you are renewing was issued between 2009 and 2015, or over 9 years but less than 15 years from the date you plan to submit your application, and it is (or was) valid for 10 years.

- You have your passport with you, and it is not damaged or mutilated, and you have not previously reported it as lost or stolen. Unlike when you renew by mail, you’ll be keeping that passport with you; don’t mail it in!

A few other differences exist. For example, you don’t have to (and indeed, can’t) pay your renewal fees by check. Instead, pay your passport renewal fee by credit or debit card. Yes, this means you can get points or airline miles. Yay!

You can upload a digital passport photo. However, it still has to follow all the same requirements, so again, no goofy selfies!

Finally, understand that the passport you’re renewing will be canceled after you submit your application so you can’t use it for international travel in the interim.

Once you know you are eligible:

- Create an account at MyTravel.gov.

- Sign in to your new account and select the option to renew your passport to start your application. Don’t worry if you get interrupted; you can save your application and finish it later. However, you only have 30 days to complete the application once it’s started; after that, you’ll need to start from scratch.

- Enter information about your current passport and travel plans.

- Upload your digital photo, following all of the rules.

- Digitally sign the application and pay for your application fee(s). You’ll get a series of confirmation emails letting you know that the payment is pending, then that it’s been processed. (This may take up to three days.) If something goes wrong and they can’t process the payment, they’ll let you know that, too, so be sure to check your spam folder if you don’t see update emails.

- Wait a week; then enroll to get updates in the Online Passport Status System. (Yes, it’s silly that this isn’t an automatic part of the account set-up process.) They’ll notify you as your status changes, such as when your application is in process, when it gets approved, and then when your passport is mailed.

Sticking points of the ‘beta’ passport renewal program

You can’t necessarily start your application at the time or on the day of your choice.

The system opens for a limited mid-day Eastern Time window each day, and closes once they reach their limit for the day. So, if you try to start your application at 4 p.m. on Thursday and you’re not allowed in, you can either try again the next day (or any other day) or renew by mail.

The State Department just began this program in June, so they’re limiting the number of applications accepted each day so they can monitor the program’s real-time performance. They want to make sure the software (and the employees using the software) aren’t inundated and that nothing breaks. (This is a good thing, so don’t be that person, like in the TikTok skits, complaining that a restaurant won’t stay open past official hours because you’re hungry and arrived late.)

Eventually, this online passport renewal program will get a full launch, and we can expect some (but not all) of the requirements may be relaxed.

WHAT SHOULD YOU DO NOW?

- Look at your passport to see when it expires.

- Consider your travel plans (or make some travel plans) and figure out how far in advance you need to renew to be able to travel. Many countries won’t allow you entry if your passport expires within six months.

- If your passport expires in the coming year, renew it now so that you don’t have to worry about additional fees for expedited processing or shipment.

- If you don’t have a passport at all, consider the possibilities. It’s not just so you can travel internationally at the drop of a hat if you win a free trip or get offered a job requiring international travel. A passport also offers advantages for flying domestically.

- If your college-aged (or college-bound) kids don’t have a passport, encourage them to apply this summer. If they suddenly have the opportunity to study abroad, visit college friends, or participate in exciting school programs (like performing or playing sports abroad), they’ll usually have a very brief time in which to make arrangements.

Still need encouragement? If you renew your passport and go to France, you can send your envious friends postcards and letters emblazoned with La Poste‘s new scratch & sniff “La Baguette” postage stamps!

From Glitter to Macaroni (Part 2): Storing and Displaying Children’s Art

(DRAWING) THE CART BEFORE THE HORSE

Last week, in From Glitter to Macaroni (Part 1): Downsizing and Organizing Children’s Art, we looked at the key elements of digging out from under so that you’re house doesn’t have three-inch thick wallpaper layers of kiddie art.

To recap the key concepts:

- Children live in the moment, enjoying the process of creating art for its own sake. They enjoy applause and appreciation, but by the next day, they’re usually ready to move on, so you should be, too.

- Ask questions to show you’re curious about junior’s artistic choices and thinking.

- Have a plan for collecting the art and host at least a weekly review where you figure out what to purge and what to maintain, at least for the near-term.

- To help you cull the excess, focus on keeping masterpieces (original artwork) and let go of reproductions (coloring book pages, paint-by-numbers, etc.).

- Record the name of the little artist and the date.

If you regularly purge, you’ll feel more confident that whatever you store or semi-permanently display is the best of the best!

HOW TO STORE CHILDREN’S ART

As last week’s post explained, kids create so much art, and so quickly, that thinking you’ll put it all on the fridge or kitchen counter is a recipe for clutter. You need a plan for storage of any art projects that you hope to maintain (both short-term and long-term) without displaying. There’s just no room to show it all off!

Unfortunately, this is the one category of paper that doesn’t lend itself to the filing solutions we usually discuss, like vertical filing folders and three-ring binders with sheet protectors, such as we’d illustrated in Reference Files Master Class (Part 1) — The Essentials of Paper Filing. Those solutions work for pieces that are 8 1/2″ x 11″ emblazoned with only crayon or pencil, but thick paints, glitter, and glue often prevents paper from maintaining structural integrity and laying flat.

Flat Files

In the professional art world, instead of vertical filing cabinets, art pieces and blueprints may be rolled for shipping or travel, but are generally stored in flat files, cabinets with short but deep metal drawers. The problem? Flat files tend to be expensive and ill-suited for children’s art created by anyone but Richie Rich.

For example, this small, 5-drawer Safco Products 4969LG flat file is $710!

At 32″ deep x 46.25″ wide x 16.25″ high, (after a proper culling of lumpy finger-paintings and nature studies made from small sticks and cotton ball clouds) you could probably store all of the elementary school art. But for $710 you could buy a Disney World four-park, four-day ticket and still have $300 left over for concessions, T-shirts, sun-block, and decades of memories!

While yes, the above flat file it will let you store pieces of up to 40-inches in depth, your child’s Kraft-paper, full-sized self-portrait could also just be rolled up to fit in the tube of a used-up roll of wrapping paper!

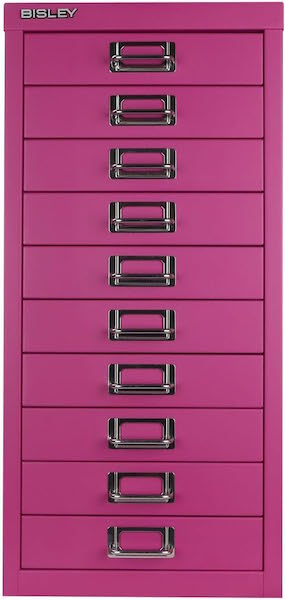

There are more affordable flat files with more storage space (covering less horizontal real estate), like this pretty Bisley 10 Drawer Steel Under-Desk Multidrawer Storage Cabinet, available in ten colors, including black, charcoal, light grey, a truly sickly green, navy, orange, red, steel blue, white, and as seen here, fuchsia.

At 15″ deep x 11″ wide x 24″ high, it’s a smaller profile solution that works if your prolific artists create relatively narrow (dimensionally-speaking) works. It’s “only” $260, and can be used for storing art and school supplies, too. But eleven inches of width and 15 inches of depth is decidedly small for the often-expansive creativity of a Mini Mary Cassatt or Tiny (tinier?) Toulouse Lautrec.

Given that, I encourage you to seek less expensive, more portable art storage solutions.

Clean Pizza Boxes

As I mentioned last week, a (clean, new) pizza box is the right size to handle the weekly collection of art creation. As your kids get older and you do seasonal and end-of-school reviews, these can be repurposed for winnowed longer-held collections.

Sure, you can tip your favorite pizzeria cashier to save you a few extra boxes when you pick your next pie, but do you want to be beholden to maintaining a friendly relationship with Mario to keep you in pizza boxes until your kids hit middle school (and stop creating art)? And when he goes off to college, are you prepared to start fresh with his replacement?

Assuming not, consider buying a stack of white, Kraft, or themed pizza boxes directly from Amazon or a restaurant supply store like Webstaurant Store. (I recommend white or Kraft boxes so that you can label accurately (“Jamie’s Artworks—1st Grade” or “Chris’ Creativity — 2024”) without cartoonish distractions.

These boxes often come in packs of 50 for about $30-$45, so split a batch with the other parents in your carpool or PTA.

Just be sure to get boxes that are at least 12″ square, as most children’s art won’t fit in the 10″ x 10″ boxes. You can also select options that come in 14″ or 16″ (or even larger) sizes, so explore box style you want to see the different sizes available.

Try one box for each child for gathering a week’s worth of art for curation meetings, storing it on a shelf in the kitchen pantry or mudroom, and another more permanent box for each child into which you put the weekly “best-of” selections.

Art Portfolios Bags

Hard-sided art portfolios cases are a popular resource for professional artists to store work or carry their best pieces. However, children’s art tends to be larger and “lumpier,” so portfolio cases aren’t the best option. Instead, opt for large format portfolios and portfolio bags.

The standard is something like the Classic Red Rope, Paper Artist Portfolio with Soft Woven Handle. All versions come with a 2-inch expandable gusset, and comes in multiple sizes (14″ x 20″, 17″ x 22″, 20″ x 26″, 23″ x 31″, and 24″ x 36″), with prices ranging from $16-$24.

These are lightweight and constructed with heavy-duty recycled paper, ideal for inexpensive paper art storage. Find them on Amazon at the link above or in your local art supply stores. Stand these up along the back wall of a child’s closet or slide them behind a child’s bookcase or dresser to keep art tucked out of the way. You might also consider using using these in combination with pizza boxes, with the pizza boxes for weekly collection and the portfolios for longer-term storage.

For more visually stimulating storage options, you’ll find lots of zippered plastic/nylon portfolio bags, like this SUNEE 19″ x 25″ Art Portfolio Bag. The nylon strap and edging are sewn into the mesh cloth for extra durability, and it’s semi-transparent so you can immediately realize, “Ah, it’s Katie’s art collection.”

Use one portfolio for each child, labeled with the name on the outside. Don’t try to combine different children’s art in the same storage, especially when they are small.

Aim to keep relatively equivalent numbers of art pieces (per week, per semester, etc.) for each child. If your kid makes it to middle school or high school and is still creating massive numbers of pieces — prolific creation is a rarity after 6th grade — then you have an actual artist on your hands and have my permission to treat this as an interest/hobby (much like sports or musical performance). But when your kids look back in adolescence to what you’ve retained from their tiny tot years, spare yourself family strife and aim for balance.

Capturing Memories

The location doesn’t matter as long as you have adequate space to keep these collections accessible (and file them away regularly). Remember, legal-sized filing cabinets will give you more length, but chance are good that what you need most is more width. If you fold children’s art to make it fit, the paint and glue will crack and flake; glitter will come loose.

You can also choose clear plastic bins to store the art that you decide to keep, memory box-style.

Whatever storage method you use, clearly label each box, bin, portfolio, or folder with the child’s name and the date range. As I noted last week, you may think that you’ll never forget when your Tiny Titian or Mini Matisse created each piece of art, but I guarantee you that 30 years from now, you won’t be able to tell which kid did which.

WHERE TO DISPLAY CHILDREN’S ART

Minimize the backlog, then consider which tangible pieces on display.

Identify a location for a rotating display.

Rotate the art regularly to keep it fresh. Display this week’s award winners and replace them frequently. (Remember, kids live in the moment, so don’t make VIP displays about a moment six months ago!)

Art galleries have both permanent exhibits and rotating ones that allow fresh, inspiring work to grab the attention of visitors. Permanent exhibits (like the collection of family photos on the wall next to the staircase) are lovely, but it’s the rotating exhibits that will catch the eye. The question becomes, where shall it all go?

The American standard is to display art on the fridge. This worked well when everyone had a big white (or avocado green) refrigerator that happily accepted a plethora of magnets. Nowadays, more and more of our boxy chill chests have non-magnetic fronts and are designed to be pieces of art themselves.

Before you run to the 1960s-Classic-Fridges-Are-Us Emporium for your next art wall installation, recognize that there are alternatives to hanging art where your lunch lives.

Invest in a large cork bulletin board.

Pick a bulletin board like you might see in a typical classroom, such as this one from Quartet.

Find full-sized, framed cork boards on Amazon or at office or school supply stores. Alternatively, buy individual cork tiles — array them in a uniform grouping or artistically around a child’s room or playroom — to affix to your walls.

Display the art as-is, right on the cork, or cover the entire board with dollar-store wrapping paper or kraft or butcher paper. Your kids can even draw on or decorate the paper, first, creating a meta-message of art-on-art, or add drawings and designs around the posted art.

Perhaps, use just one cork tile in a high traffic area of the home to showcase the Masterpiece of the Week!

The board does not have to be cork, per se. Customizable felt boards and panels, like these from Felt Right, can make a child’s bedroom or playroom wall bold and exciting as a background display option.

Princess Castle from Felt Right

Wallpaper an unfinished space, like a basement or work area.

Art can be a fun way to decorate your child’s room as well as any other casual area, like a guest room, mud/utility room, playroom or basement, whether you use a cork board or not.

The walls of a basement laundry room are likely to be gunmetal grey and depressing. Charming and colorful children’s art can brighten the area (and the mood of laundry day) immensely. Easily and safely attach artwork to walls with removable 3M’s Command-brand traditional or re-positionable Poster Strips.

Match your child’s magnetic personality!

Chalkboard paint allows children to create masterpieces directly on the wall, but magnetic paint is actually a storage solution for existing art.

Try a brush-on paint like Rustoleum’s Magnetic Primer or Magnetize It! Magnetic Paint & Primer so your wall surface will hold magnets for displaying artwork, schoolwork, and more. Alternatively, use a sprayable magnetic paint primer, like Krylon’s. Find them at Amazon or home supply stores, and then paint your wood, metal, masonry, drywall, or plaster walls.

From Glitter to Macaroni (Part 1): Downsizing and Organizing Children’s Art

I suspect that in the past (almost) 18 years, Paper Doll has covered the entire span of paper organizing topics. Just in the past few years, we’ve reiterated the essentials for all the documents that keep your financial, legal, medical, household, and personal life running:

- Paper Doll Shares 12 Kinds of Paper To Declutter Now

- Reference Files Master Class (Part 1) — The Essentials of Paper Filing

- Reference Files Master Class (Part 2) — Financial and Legal Papers

- Reference Files Master Class (Part 3) — Medical Papers

- Reference Files Master Class (Part 4) — Household and Personal Papers

We’ve also delved into specialty topics, like paperwork hoops to jump through for handling insurance, changing your name, helping a loved one with Medicare, or organizing recipes, and we’ve repeatedly looked at organizing solutions for storing and organizing papers:

- Organize for an Accident: Don’t Crash Your Car Insurance Paperwork [UPDATED]

- Paper Doll’s Ultimate Guide to Legally Changing Your Name

- A New VIP: A Form You Didn’t Know You Needed

- Calm Cooking Chaos (Part 1): Organize Your Paper Recipes

- Paper Doll Refreshes Your Paper Organizing Solutions

- Paper Doll’s Guide to Picking the Right Paper Planner

However, after delving deeply into the Paper Doll archives, I found that it has been 13 years since I’ve visited the topic of one of the most unwieldy types of paper: children’s art!

With the school year ending and all those lockers, cubbies, and book bags getting cleaned out, this is the perfect time to refresh our look at children’s art.

ARE YOU STRUGGLING TO RUN AN ART GALLERY FOR TINY HUMANS?

Parents (and grandparents) sometimes find themselves with secondary careers as curators of pop-up museums catering to a very narrow category of visual media. Do you often imagine yourself the director of something along the lines of the Family History Museum of Kindergarten Arts and Crafts (FHMKAC) or the Modern Museum of Macaroni (MMM)?

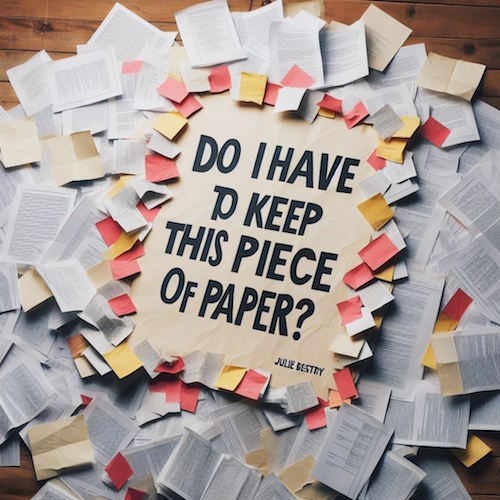

With most types of paperwork, we can determine what to keep and for how long based on document destruction and records retention schedules, such as those I provide in Do I Have To Keep This Piece of Paper?

For items without legal or financial rules, we can analyze the situation to see what makes the most sense. If we opt for paper instead of digital users manuals, a series of simple file folders and binders will suffice, and the documents can be discarded when we no longer own the gadget. Our clippings for a dream wedding or trip to Spain generally go away one the event or trip has passed and the photographic of the experience supplants the files.

But children’s art? Figuring out how and when to let that go may be a toughie for several reasons. For example:

- You’re a sentimental softie and it’s hard for you to let go of anything related to your kids. (You’re my client who kept the purple mimeographed instructions on how to get to the right school administrative office to register your child for first grade…in 1978.)

- You haven’t got a clue what most of the art is supposed to be. Your toddler hasn’t quite managed enunciating, so you’re taking the stance that a picture is worth a thousand words.

- You’re a fairly new parent and haven’t previously experienced the inundation of art that comes from tiny humans creating new projects every single day.

- You are certain that your child is a prodigy. You assume everything is stellar and that museums someday be falling over themselves to acquire Little Dude or Dudette’s Early Period work.

Children’s Art Photo by cottonbro studio at Pexels

- Your family of origin never organized art. Either your parents saved everything you created or it all went in the bin. If it’s the latter, you weren’t taught the tricks of separating wheat from chaff in the tiny tot art world. If it’s the latter, you may resent not being able to trace your MiniMe artistic path and resentment fuels your unwillingness to make judgements about your kid’s artwork.

- You’re digital in almost every other area of your life. You receive and pay bills online, and rarely even receive mail. Your child’s school sends every message through a digital portal. You and your spouse keep everything in Dropbox or OneNote or Evernote. You may not even have experience managing paperwork of any kind, but paper without labels, dates, or clear categories makes your eyes glaze over.

- You’ve tried to declutter, but the art has taken over. You’d wave a white flag, but every white piece of paper and white t-shirt in your home has already been turned over to your picayune Picasso. At this point, you no longer recall what color your refrigerator is because the doors and sides are covered with all of the major artistic methods: watercolor, oil(y Play-doh or sticky jam-hands), and mixed media (painted, sparkly macaroni)!

Never fear. Whatever your situation, there’s a path to making sense of all those artistic endeavors.

HOW TO CULL CHILDREN’S ART

When children are very young, every artistic effort may seem like a masterpiece, but soon enough, parents can become overwhelmed by the embarrassment of finger-painted riches. At some point, you realize you’re either going to have to start buying Frigidaires in bulk, or you’re going to run out of display space in the kiddie art gallery you used to call your home.

There are no records retention schedules for crayoned drawings of your family, each with out-of- proportion body parts in front of a boxy house with a yellow sun in the upper left corner of the page. Culling children’s art is neither an art nor a science, but a labor of love wrapped in papier maché and held in place with colored pipe cleaners.

Culling children's art is neither an art nor a science, but a labor of love wrapped in papier maché and held in place with colored pipe cleaners. Share on XWe’ll start with looking at the basics for winnowing the collection, and next week, we’ll move on to both standard and creative ways to display the artwork. Remember these general concepts:

Kids live in the moment

For children, the charm of creating of art is the experience making it. Unlike adults, they rarely create art to get adulation or social media likes. Whatever they’re doing right now is what matters to them.

Tiny Paper Doll in Deep Work Mode, Circa 1968

A toddler is enjoying the experience of goopy blue and yellow making green under his fingers.

A first grader delights in the representational aspect of getting the whole family, plus Bluey and Elsa, onto the front yard; the fact that Frozen’s princess towers over Dad is entirely beside the point.

New art is good art

Because kids are little art factories, the stuff arrives fast and furiously, and their favorite pieces are whatever they’ve made most recently. Praise it! Stick to age-appropriate questions and comments (“Is that blue?” “Wow, look how tall Daddy is! Oh, that’s actually a spider? What a cool spider!”)

Little Boy Creating Art Photo by Oleksandr P on Pexels

But know that they’ll move on from their blue periods with nary a glance backward, unless you make them think they’re supposed to care about the past efforts.

Be an art collector — for the short term

Don’t feel like you have to display all art, either immediately or at all. Your tiny human is new to the planet and doesn’t know there’s a cultural expectation of putting every piece of art on the fridge or on display in general.

Your tiny human is new to the planet and doesn't know there's a cultural expectation of putting every piece of art on the fridge or on display in general. Share on XMaybe your child will angle to have art displayed (or at least shown off) each night when parents have returned home from work. If the tidiest and easiest way to do that is to display today’s illustrations on the fridge, that’s cool, but if possible, from an early age, consider this like a Today’s Specials board at a café. But tomorrow or next week, they can come down to make way for the next collection.

Perhaps your child is such a little art factory that morning crafts have been forgotten by the time the lunchtime juice box has been abandoned. Try to follow your little one’s cues instead of making too big a deal of the retention aspect. Again, they live in the moment, and so should you!

Separate the masterpieces from the reproductions

We’ve all seen the coloring-book outline of a human hand turned masterfully into a Thanksgiving Tom Turkey with the application of crayons.

Thanksgiving! Happy Thanksgiving Turkey Hand Print Magnet designed and sold by aarniviita on Teepublic

It’s the pre-school version of paint-by-numbers and is a mere reproduction. As you start thinking about what to keep vs. save, yield household space for the masterpieces, the originals that only your child could have made.

Schedule a Weekly Curation Meeting

You are the head curator of this museum; the tots are your assistants. Give yourself permission to collect the week’s art and evaluate it all at once. A good option is a large (clean) pizza box, one for each child. It’ll corral the art until you’re ready for the weekly Curation Meeting.

- Communicate — Once you develop a process, discuss it with your child on an age-appropriate basis. Your two-year-old doesn’t need to know why every finger paint and scribble seems to have a short-term showing; your first grader, however, needs to understand (and eventually participate) in the decision process.

- Create limits and set boundaries — Explain that you have limited space and that by letting go of some art, you are making room to highlight new creations. This can be part of a larger, ongoing discussion with your children regarding how the world is filled with options but your home is for the most useful and beautiful things, and how making decisions about what to keep and what to send on its way is all part of life.

- Choose the best — Involve junior in selecting a few special pieces from that week to keep. You may ask, “What’s your super-duper favorite?” but recognize that your child may have very different evaluative criteria, picking a piece because it was fun to make or because she got to share the best crayon with her BFF. You’re teaching decision-making and value assessment, but remember that perspective, especially with regard to art, is personal!

Mom and Child Discussing Art Photo by Ketut Subiyanto at Pexels

- Allow for sentiment — For new new parents, the process may be difficult, especially when your child is too young to weigh in, and every piece feels like proof of a milestone achieved. At this weekly stage, it’s OK to keep items that have special significance to you, such as the first drawing that actually looks like something, particular holiday-themed art, or pieces that reflect significant moments in your child’s development.

- Document the legacy — You may doubt me, but twenty years from now, you will be hard-pressed to figure out which of your formerly-tiny geniuses created that giant lizard-fish-horse-princess-robot. During your weekly curation meeting, pencil in the name of your little artist and the date on the reverse of the artwork.

Establish Regular Decluttering Rituals

Purging weekly is a great start to keep yourself from drowning in sparkly construction paper and 473 identical drawings of a tree. However, you’re going to want to establish periodic curation meetings to go back over the things you’ve kept during those weekly curation meetings.

When kids are younger, that might be monthly. Once they are in school, opt for a seasonal review. Go through the collected art at the end of each season or semester to decide what to keep and what to let go. If you fall behind throughout the year, at least be sure to wrap up the school year to collect what was most representative of the just-ended grade level.

Make this decluttering ritual one that fits your family’s style, whether formal or casual. No matter the tone, establish a routine purging session, a special event where you and your child review and reminisce before making decisions.

WHAT TO DO WITH ART YOU AREN’T KEEPING

Let’s face it. Not everything your child creates is going to go up on the wall of a museum. Most really need not go up on your fridge. (Yes, I’m sure grownup Angolo di Cosimo didn’t imagine his little drawing of a rich patron’s kid would be famous some day, but your two-year-old’s scribble using three different brown crayons just isn’t in contention for the Louvre or Uffizi.)

Portrait of Giovanni de’ Medici as a Child Holding a Goldfinch, circa 1545 by Agnolo di Cosimo. (I shot this at the Galleria degli Uffizi in Florence in September 2018.)

Toss

If it’s goopy, sticky, or critter-attracting, let it go (but do it after the kids go to sleep, as nobody needs to see their creations head to their ultimate resting places). If it’s got macaroni (or any other foodstuffs) stuck to it, let it go. Organic materials attract insects and creepy-crawlies, and while Mrs. Frisby and the Rats of NIHM might have literary merit, you don’t want the main characters coming by to sniff and taste the art at your house.

Recycle

If the artwork is on recyclable paper and not very sentimental, consider recycling it. For example, as long as it’s clean (and clear of organic materials), construction paper is recyclable. Make a point of knowing what types of paper are recyclable and which are not. For example, Kraft paper is recyclable, but tissue paper is not.

Gift

While you don’t want to inundate grandparents, older siblings off at college, or lonely neighbors with absolute mountains of art, it might help (when one or two pieces just barely fail to make the weekly cut) to share with loved ones.

Kids who are just mastering writing can “sign” their masterpieces, and you can add a note to Grandpa to explain what the piece actually is, if it’s not quite representational art (assuming you have a good guess at the content).

Donate

Some organizations or nursing homes appreciate receiving children’s artwork to brighten their spaces. There are also organizations like Fresh Artists which will enlarge, print, and display art in public spaces supported by corporate sponsors. Explore your local and regional options.

Repurpose

For for giving older art new life for a shorter duration, try it as:

- Gift Wrap: Use large-format art (such as the kind drawn on big rolls for Kraft paper) as unique wrapping paper for gifts.

- Craft Projects: Turn artwork into calendars, bookmarks, greeting cards, or other craft projects.

- Collages: Group smaller pieces into a collage to preserve memories in a compact form.

Next time, we’ll look at how to store favorite pieces of children’s art (but seriously, just what makes the cut!) and how to display the special pieces. Until then, start thinking about the places in your home where you might brighten things with whimsical displays of really modern art.

Organize to Help the Seniors in Your Life With Technology

We love technology. However, it does not always love us.

Technology is not always (or even often) intuitive, which makes it hard to organize the technology and the content provided by the technology. This is especially true for our parents and grandparents (or ourselves, if we happen to be seniors).

Whether the seniors in your life embrace technology or eschew it, the digital realm has a lot to offer them.

Health and Safety Technology

- Wearable fitness trackers like Fitbit, Garmin, and Apple Watch (and associated apps) for tracking:

- nutrition and calories burned

- steps taken and stairs climbed

- health metrics like heart rate, blood pressure and glucose levels

- Reminder alerts and alarms for taking medicine and testing blood pressure and blood glucose.

- Phone-based magnifiers for helping read medicine bottle labels and prescription instructions.

- Phone-based cameras for supporting memory (noting parking locations, remembering hotel names and room numbers, etc.).

- Videoconferencing for telehealth allows seniors to stay connected with their physicians for regular visits and making inquiries without having to venturing out to drive in inclement weather or seek rides when an in-person appointment isn’t necessary.

- Fall detection and emergency hotline hardware and software, or medical alert systems, allow seniors to get help if they suffer falls or medical emergencies in their homes, even if they are not positioned near their phones or are unconscious.

Paper Mommy and I call these the “I’ve fallen and I can’t get up” buttons after the grating commercials.

They range from wearables like bracelets and pendants to wall-based systems, and are connected through phone lines to base stations, so if someone suffers an emergency, they can “call” through that base station, like an intercom. If the user does not respond to the service’s inbound call, emergency services are dispatched. Common systems include Life Alert, Medical Guardian, and ADT Medical Alert.

Smart Home Technology

As with health technology, a variety of smart home technologies can make life easier and more convenient for all users, but especially seniors. These include:

- smart lighting and blinds

- smart plugs and timers that turn appliances off and on

- digital monitoring systems for temperature control, CO2 detection, humidity, and air quality

- smart thermostats

- robot vacuums

- GPS-based trackers to locate lost items

- digital doorbell cameras to help monitor who is at the front door (delivery staff, visitors, bad guys, etc.)

Digital monitoring and home management can make it easier for seniors with low mobility or low vision to be able to care for their homes and personal comfort with minimal effort.

For more on smart home tech for seniors, the New York Times’ Wirecutter site has a great piece on the 14 Best Smart Home Devices to Help Aging in Place.

Entertainment and Social Connection Technology

There is no age limit on enjoying books, TV, movies, or music, but the same technology that brings a wider variety of options into our homes, but these technologies are not always intuitive. It’s not that Spotify or Netflix is easier to to use when you’re 25 than when you’re 85, but those who have always lived with technology are quicker to note and understand user interface changes and make quicker guesses as to where missing options may be hiding.

Retirees who no longer interact with others in the workplace or at as many social gatherings as previously can benefit from all the modern offerings, including:

- Smart TVs with cable or satellite programming

- Streaming entertainment from mainstream services like Amazon Prime, Netflix, Apple+ TV, Hulu, as well as niche programming services like BritBox or BroadwayHD.

- Music streaming services like Spotify, Apple Music, Amazon Music, or Pandora

- Podcasting apps

- Book and audiobook services and apps like Audible, Libby, and others that allow you to purchase entertainment or borrow from your public library.

When Tech Go Wrong

We’ve all dealt with the frustration of tech going wonky. The difference is that the younger we are, the more likely we are to recognize a problem that we’ve seen before and recall how to solve it. We’re more likely to visit the service’s FAQ pages or Google the problem. Seniors, however, may be both less likely to have experienced (or recall experiencing) similar problems and less adept at digital search and the right prompts to solve the problem easily.

When I got in the car to run errands this weekend, in place of the digital clock on my car’s navigation screen, it just said “–:–“ so I immediately went to the on-screen settings icon. However, on the resulting screen, the date/time icon was greyed out. I vaguely recalled this having happened once before, so I wasn’t immediately worried that my car was “broken” or that there was an expensive onboard computer problem.

First, I checked Twitter (I refuse to call it X) reports of widespread problems. Twitter is still my go-to for “is it happening right now” technology issues unless it’s an internet-based issue, in which case I follow the steps I described in Paper Doll Organizes the Internet: 5 Tools for When the Web Is Broken.

Then I Googled “Kia date/time setting greyed out and not working” on my phone. I got varying reports of it being a satellite issue that would self-correct; others suggested pulling one of two different fuses and/or resetting the onboard programming.

I can just shout, “Hey, Siri, what time is it?” so this wasn’t an emergency. Thus, so I didn’t get flustered, and figured if the problem continued I would check it out later in the weekend. An hour later, after a trip to Walmart (where the cashierless payment technology had everyone frustrated), I returned to my car to find the clock working again.

Now, take a moment to imagine your Great-Grandpa dealing with this clock kerfuffle, getting progressively more annoyed that the auto manual’s index and table of contents yielded no immediate solutions. Would he head to the search engines? Would he become agitated?

We all love technology and we all hate when tech doesn’t work as it’s supposed to. The only difference is that the younger we are, and the more privileged (financially, socially, educationally) we are, the more exposure we’ve likely had to potential solutions. The best thing we can do to make technology easier for our elders is to help them when we can, and connect them to others who can help them when we are not able to do so.

HOW TO HELP THE SENIORS IN YOUR LIFE WITH TECHNOLOGY

Let’s get the giggles out of the way, first.

Don’t laugh at them. When possible, do laugh with them.

This should be obvious. But it’s also hard. While serving as Paper Mommy‘s tech support over the phone, I kept trying to point out the lock icon so that she could recognize secure websites.

Because we couldn’t see one another’s screens, I was trying to give her landmarks, and I could tell she was looking in the right location in the URL bar at the top of the screen, but she kept not seeing the lock icon. Finally, Paper Mommy, frustrated, insisted “It’s not there! The only thing there is something that looks like a little purse.”

![]()

By Santeri Viinamäki, CC BY-SA 4.0

Um. OK. I had to laugh. While yes, to anyone thinking in terms of technology, that secure URL icon is a padlock. But if you’re in your 70s or 80s and haven’t been technology-focused for your entire adulthood, yep, it’s a purse. A green handbag.

Start with, and explain, the basics. Use proper lingo when you can, but if your person just can’t get a handle on remembering the term “scroll bar,” try saying, “Do you remember the vertical bar that makes the screen move up and down, like an elevator?” Use vivid, memorable language, and be prepared to backtrack. Often.

Let them make mistakes. Many seniors are afraid that they will “break” the computer or gadget by clicking on the wrong link. Assuming you’ve covered the basics of avoiding phishing and other scams (see below), assure them that changing settings isn’t going to void the warranty or damage the software or the hardware.

Do not condescend. If this senior is your senior (parent or grandparent), remember how many times they needed to help you learn how to use a spoon or spell your name.

Be patient. Go slowly and be as patient as you can be. (And if you can’t be patient with your mom even though you are known for being patient with clients or colleagues, recognize that you and your favorite senior will have different perspectives, and find them an alternate IT help desk, once that doesn’t look like you.)

Explain online dangers and prepare them for what they should NEVER do. Technology doesn’t need to be scary, but it often is, and especially so for seniors. Teach the seniors in your life about phishing scams, how to identify the true source of emails (by hovering over the sender name and looking at the actual domain name of the address), how to look for secure sites (and the “purse”), and how companies and banks and the government will never call or email and ask for passwords or other information.

For more on this, refer to my post from March, Slam the Scam! Organize to Protect Against Scams.

Teach them where to look for resources and how to ask search engines for help. My mom once called me because every bit of text on her Facebook screen had turned German. I knew immediately that this was because Facebook had a word cloud of language names in the lower right-hand corner of the screen.

If you were holding an iPad (as she was) on the right side, it would be easy to press your thumb on one of the languages and change your settings. (Facebook has since moved this element off the main screen.)

I’d once accidentally turned my Facebook default language to French, and had to Google the solution, and my Google-fu is pretty strong. However, to the uninitiated senior, it can be tempting to ask a question as you might ask someone sitting next to you on the couch: “Why is my Facebook in German?” However, to yield a more helpful answer (at least until our AI overloads take complete control), a better query might have been, “revert Facebook default language from German to English.”

Search engine language is not intuitive, but we can all — including seniors — learn better queries to find help more quickly.

Customize accessibility settings when seniors get new devices. Sometimes, just making text larger or addressing basic accessibility issues will make the entire navigation process easier for them.

BUILD ON INITIAL GUIDANCE WITH MORE COMPLEX TECH SUPPORT

Use Screen-Sharing Technology Options

If you’re helping a senior long-distance, it can be maddening for both of you. They may feel rushed, and you might be knocking your head against the wall because they can’t “see” what you know or believe to be right there!

At minimum, seek solutions that grant you remote screen viewing so you can see what they’re doing at their end and provide tactical directions. Be aware that there’s often a delay between what they’ve done and what you see, so just as when you’re working on the phone, try to discourage them from jumping multiple steps ahead.

In addition, there are remote access software programs and apps that allow you to manipulate someone else’s device from wherever you are. This is how the help desks at Apple and other big software and hardware companies guide you through IT troubles. Unfortunately, it’s also how scammers get access to your loved one’s computers, so it’s important that they understand not to provide this access to anyone they don’t know unless they are seeking the help of an authorized, respected technology expert and NOT someone who randomly calls and claims that “There is a problem with your Microsoft computer.” (There isn’t.)

I used to help Paper Mommy and my virtual clients with LogMeIn, which is now $30/month) However, there are still free and affordable options for providing remote tech support to your beloved seniors, including:

- Zoom will let you request or offer remote access (as part of your account). It works on computers as well as iOS and Android devices.

- Microsoft Teams has a similar function for sharing content, as well as giving and receiving control.

- TeamViewer used to be free, but (as with most remote access programs, has moved to a subscription model for all users). Still, $24.90/year for a single user remote license should give you piece of mind that you can help your senior for less than fifty cents a week.

- Chrome Remote Desktop — This option is free and low-cost. You may find that you need to help your senior set up Chrome Remote Access first to make the process work.

All of the above options will work whether you and your senior have the same platform (Apple or Windows) or are mismatched. Other options require you to be using the same platform.

- Apple Mac users have a few options. If you’re both using Apple computers, you can make use of the free Apple Remote Login, but as with the Chrome option above, you’ll need to set it up in advance.

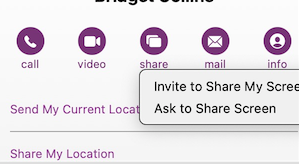

- Alternatively, without any advanced prep, (and again, if you’re both using Macs), you can use “Screen Share” from within the Messages app:

-

-

- Open the Messages app on your Mac.

- Select a conversation with your senior relative or friend. (If you haven’t ever texted with them, start a new conversation.)

- Click the “i” button in the upper right-hand corner of the window. A set of options will drop-down.

- Click “Share.”

- Ask your senior to share their screen. (Alternatively, they can also go to this same menu and invite you to view their screen.) They’ll get a pop-up requesting permission to share their screen with you. They need their “Control My Screen” option selected and should click “Accept.” From this point, you can control their Mac and show them what to do, step-step, or fix problems yourself.

-

Finally, I find it helpful to initiate a Facetime (Mac-to-Mac) call before starting the process, but you can also speak on the phone while troubleshooting.

- Windows users have similar built-in options, including Quick Assist and Windows Remote Desktop Connection.

Write Down Instructions, Step-By-Step

Don’t expect seniors to remember intricate processes they’ve only seen once or twice, or to intuit the workings after minimal practice.

When one of my clients (senior or otherwise) is learning new processes on the computer or another device, I teach the step and then write it down on a numbered list. Once we’re all done, I create a title with “if,” such as “If you want to listen to your new voicemails…” or “If you want to download an app from the App Store…”

Make a notebook of these lessons so your senior can flip through the pages, or even create an index in the front. (And yes, can type these lessons and store them in Notes, Dropbox, or Evernote if that’s something your senior is comfortable navigating.)

HOW TO OUTSOURCE TECH SUPPORT FOR SENIORS

Do you and your senior end up fighting when you try to help with tech? Sometimes, the best way to help is to arrange alternate help. (This is why, when adult children and their seniors spar over downsizing, bringing a professional organizer in is the best option.)

Outsource To Your Teenager(s)

Assign your teens to help their grandparents (or neighbors or friends who are grandparent-ish age).

Too few young people have the opportunity to learn from older generations, and this kind of bond can be good for both groups. Seniors will feel younger when engaging with teen family members, and the teens can connect with grownups with different perspectives on career, family, life, and history. (And shockingly, they’ll be more patient with Grandma than they are with you.)

AARP’s Senior Planet

Senior Planet is a free technology service sponsored by AARP, but you don’t have to be an AARP member to use it. (That said, at $16/year for anyone over 50, AARP’s discounts and educational resources definitely make it valuable.)

Senior Planet offers in-person virtual sessions, in-person classes in major cities, and online classes, like “How to Choose a New Computer.” There’s a hotline for those who need immediate assistance for simple questions. It’s available weekdays from 9 a.m. to 8 p.m. Eastern, during which Senior Planet’s “technology trainers” (employees and volunteers) can answer questions about email, texting, app notifications, video conferencing, and other tech conundrums.

Anyone needing personalized tech help can call the hotline at 888-713-3495 or fill out a form to schedule a help session.

Cyber Seniors

Cyber Seniors is a volunteer-based, non-profit organization and is available at no cost to users. Most volunteers are in their late teens and twenties and have training to serve as “digital mentors” to seniors. Think of it as digital natives guiding digital immigrants through the cyber world.

Cyber Seniors provides both one-on-one individualized support and as well as group education.

For individual needs, fill out a request form with general information(contact email, birthdate) and situation (device type, etc.), and then select an appointment date and time for a volunteer to contact you by phone. Once the mentor calls, you explain what you’re trying to do (e.g., attach a photo to an email, set up a Facetime call, change the settings in a program). Users can request a specific mentor by name or work with anyone on the CyberSeniors team, so if Grandma meshes well with a certain person, request a repeat session.

Cyber Seniors offers weekday group webinars over Zoom on tech and cybersecurity (and other) topics, and recorded prior webinars are also accessible.

GoGo Quincy

GoGoQuincy, promising “tech support for non-techies” started as a service to help seniors with but has expanded to assist anyone, no matter the age, with technology difficulties. For up to one call per month, the service is free; after that, there’s a $5/month fee plus $11 per call, so if there’s any chance you or your senior might be making more than two calls a month, the unlimited plan (for $19/month) is the way to go. (Reviewers note that experts didn’t try to upsell memberships or get callers to sign up for the paid service. Still, I’d encourage exhausting free options first.)

GoGo Quincy has a telephone hotline if you need immediate technology assistance; otherwise, schedule a session through the GoGo Quincy website.

Hire a Technology Specialist

Your best bet for a loved one (or yourself) maybe to hire a professional technology consultant. I have senior clients who are active in their non-tech lives but for various reasons need support with their web sites, social media, or ever-more-complex devices, and having a paid consultant, either on retainer or paid per call, gives them confidence that they’re getting professional level services.

Online, you can find a variety of in-person and virtual technology coaches, like Tech Coaches or Candoo Tech.

Additionally, there are professional organizers, working both locally and virtually, who can assist with making technology more accessible. My technology-minded colleagues in the National Association of Productivity and Organizing Professionals (NAPO) can be found by going to NAPO’s website and conducting a search, as follows:

- Go to NAPO.net.

- Select “Professional Directory” from the FIND A PRO drop-down menu at the top of the screen. Alternatively, you can scroll down the page past the photo banner to where you see the words the following:

- On the resulting search page (which defaults to a radius search), type in the requested information and select Digital Organizing from the residential organizing drop-down. The screen will refresh, giving you professionals guide you in organizing your technology.

Consider Artificial Intelligence

It’s not always ready for prime time, but there are AI options for getting tech support when humans aren’t available. One option is HelpMee.ai, which promises patient, voice-enabled conversations and screen sharing to guide seniors step-by-step through computer problems.

HelpMee.ai has multiple price points, from a free trial for 20 minutes of support, to three different levels of monthly support ($9.99/month for 1 hour, $19.99/month for four hours, and $24.99/month for 8 hours of support.

With all of these options, seniors can enjoy the benefits of technology while minimizing the frustrations. Don’t give up on helping your seniors with tech, and don’t let them give up, either!

If you have your own favorite tips and services for helping seniors with technology, please share in the comments.

52 Ways to Say NO to a Request So You Can Say YES to Your Priorities

Do you ever find yourself avoiding contact with other people out of sheer self-preservation and fear that they’ll ask you to add one more unfulfilling task or obligation?

Recently, I read Ali Abdaal’s Feel Good Productivity: How To Do More of What Matters To You. The book serves as a sort of primer on the various macro and micro productivity concepts and strategies that we discuss at the Paper Doll blog. The book accents engaging in tasks that will increase your energy rather than drain it.

Do you ever find yourself avoiding contact with other people out of sheer self-preservation and fear that they’ll ask you to add one more unfulfilling task or obligation?

Recently, I read Ali Abdaal’s Feel Good Productivity: How To Do More of What Matters To You. The book serves as a sort of primer on the various macro and micro productivity concepts and strategies that we discuss at the Paper Doll blog. The book accents engaging in tasks that will increase your energy rather than drain it.

Abdaal’s idea of an “energy investment portfolio” particularly caught my attention. At its most basic, the energy investment portfolio is a deeply prioritized and categorized plan of attack, such as we reviewed when talking about the Eisenhower Matrix in posts like Use the Rule of 3 to Improve Your Productivity and Frogs, Tomatoes, and Bees: Time Techniques to Get Things Done.

Part of this approach is based in clarifying which of the things on your list are your someday “dream” investments (your big, ambitious projects for which you likely have little time right now) and your “active investments” (projects and tasks which you are or should be giving your greatest attention right now).

The key to Abdaal’s energy investment portfolio, an homage to a financial investment portfolio, is limiting the number of projects on your list of “active investments.” There’s only so much you can do right now, and those things better energize you if you don’t want to hide from them.

To explore this concept more before dipping into the book, check out Abdaal’s The Energy Investment Portfolio article and the video below:

This popped to the forefront of my mind as I started reading Cal Newport’s newest book, Slow Productivity: The Lost Art of Accomplishment Without Burnout. (Slow productivity, like the slow food, slow media, and slow travel movements, is about improving life by cutting back on speed and excess, and instead focusing on intentionality and quality.)

Newton caught my eye with an extended discussion of my beloved Jane Austen. Most biographies always paint her as successful because she would sneak in writing efforts in the precious few quiet moments she had to herself. Newport notes that her nephew James Austen’s descriptions of Austen’s writing style seem “to endorse a model of production in which better results require you to squeeze ever more work into your schedule” and calls this a myth.

Indeed, modern biographers have found the reverse, that Austen “was not an exemplar of grind-it-out busyness, but instead a powerful case study of something quite different: a slower approach to productivity.”

As true Austen aficionados know, once Austen (as well as her sister and elderly mother) moved from Southhampton to quiet Chawton cottage, she was able to escape most societal obligations and focus on writing. Quoting from Newton:

Abdaal’s idea of an “energy investment portfolio” particularly caught my attention. At its most basic, the energy investment portfolio is a deeply prioritized and categorized plan of attack, such as we reviewed when talking about the Eisenhower Matrix in posts like Use the Rule of 3 to Improve Your Productivity and Frogs, Tomatoes, and Bees: Time Techniques to Get Things Done.

Part of this approach is based in clarifying which of the things on your list are your someday “dream” investments (your big, ambitious projects for which you likely have little time right now) and your “active investments” (projects and tasks which you are or should be giving your greatest attention right now).

The key to Abdaal’s energy investment portfolio, an homage to a financial investment portfolio, is limiting the number of projects on your list of “active investments.” There’s only so much you can do right now, and those things better energize you if you don’t want to hide from them.

To explore this concept more before dipping into the book, check out Abdaal’s The Energy Investment Portfolio article and the video below:

This popped to the forefront of my mind as I started reading Cal Newport’s newest book, Slow Productivity: The Lost Art of Accomplishment Without Burnout. (Slow productivity, like the slow food, slow media, and slow travel movements, is about improving life by cutting back on speed and excess, and instead focusing on intentionality and quality.)

Newton caught my eye with an extended discussion of my beloved Jane Austen. Most biographies always paint her as successful because she would sneak in writing efforts in the precious few quiet moments she had to herself. Newport notes that her nephew James Austen’s descriptions of Austen’s writing style seem “to endorse a model of production in which better results require you to squeeze ever more work into your schedule” and calls this a myth.

Indeed, modern biographers have found the reverse, that Austen “was not an exemplar of grind-it-out busyness, but instead a powerful case study of something quite different: a slower approach to productivity.”

As true Austen aficionados know, once Austen (as well as her sister and elderly mother) moved from Southhampton to quiet Chawton cottage, she was able to escape most societal obligations and focus on writing. Quoting from Newton:

This lesson, that doing less can enable better results, defies our contemporary bias toward activity, based on the belief that doing more keeps our options open and generates more opportunities for reward. But recall that busy Jane Austen was neither happy nor producing memorable work, while unburdened Jane Austen, writing contentedly at Chawton cottage, transformed English literature.

Dubious? Look at the entries on this Jane Austen timeline, starting from 1806 onward! And let’s face it, without Austen, there would be no inspired homages, like Bridgerton, and for any of you who just spent the weekend transfixed by the first half of season three, that’s a fate not worth contemplating. I’m sure I’ll have more to share about this book as I get further on, but I was captivated by the chapter on Newport’s first principle of slow productivity, based on this finding. Principle #1 is simply Do Fewer Things.Strive to reduce your obligations to the point where you can easily imagine accomplishing them with time to spare. Leverage this reduced load to more fully embrace and advance the small number of projects that matter most.

YOU ARE ALLOWED TO SAY NO

From Abdaal and Newton to past Paper Doll posts, we know we have to focus our attention on fewer but more rewarding things. We must learn to emphatically say NO. Yes, you have to pay your taxes (or be prepared to suffer the consequences). You have to obey traffic laws. (Ditto). You have to feed your children (or at least arrange for them to be nourished). But you do not have to be in charge of cleaning out your company’s break room fridge. You do not have to buy your spouse’s birthday gift for your mother-in-law. (That’s your spouse’s job.) You do not have to join a book club or serve on your homeowner association’s planning committee or go to dinner with someone you really don’t want to date! There are various situations when we should be saying no to taking on new obligations.- You have more on your plate than you can handle comfortably (or safely for your mental or physical health).

- Your energy level is depleted (or you believe it would be depleted) by anything being added to your obligations.

- The new task doesn’t fit your skill set or interests.

- The task is unappealing because of the situation (the location, other people involved, the monetary cost)

- You just don’t wanna.

THE POWER OF SAYING NO