Archive for ‘Seniors’ Category

Slam the Scam! Organize to Protect Against Scams

Being organized and productive depends on having systems in place. The problem is that sometimes things happen that throw all of our carefully curated systems out the window. Things like getting the flu, having your car break down (or get stolen), your computer crashing — or getting scammed.

It’s shockingly easy to fall for a scam, and frustratingly difficult to recover financially and legally after being a victim. It may require time, money, the services of specialists (like attorneys) and more. The best thing you can do is to organize yourself to protect against being victimized.

SCAMMERS PREY ON EVERYONE

You may have heard about a recent viral article in The Cut by Charlotte Cowles, the online magazine’s financial advice columnist. You wouldn’t have expected someone with that professional identity to write a column entitled, The Day I Put $50,000 in a Shoe Box and Handed It to a Stranger. But she fell for a scam, and she fell hard. And now, risking public and professional embarrassment, she has spoken out.

For weeks, there’s been debate online regarding what happened to Cowles. Many people can’t imagine that a grown woman with a professional background in financial writing could have been fooled by the ring of scammers who convinced Cowles that they were representatives of Amazon, of the Federal Trade Commission, and of the CIA.

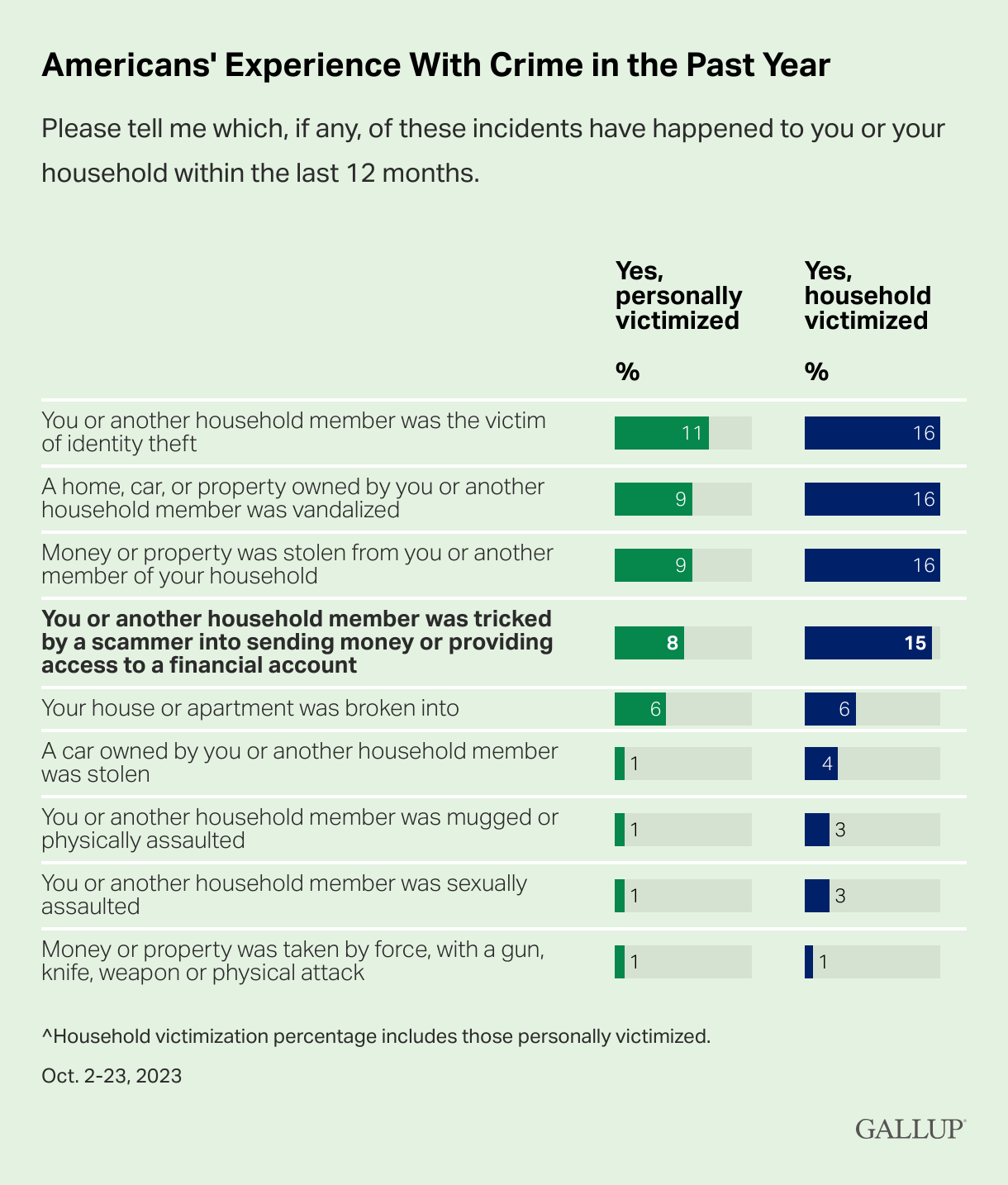

But scams are real, they are everywhere, and we need to organize ourselves (and warn our loved ones) to be vigilant. Gallup found that 15% of American households were victims of financial scams just last year.

Graph provided by Gallup

And, while we tend to think of victims as being older, every demographic group is at risk. In fact, younger adults (like Gen Z and the youngest Millennials) are overrepresented as victims of scamming (at 22%); meanwhile Gen Xers like Paper Doll and Baby Boomers are somewhat less likely to be scammed, at 9% and 14%, respectively.

The rate of victimization is lower among adults without a college education and with lower incomes than those who have college educations and who earn at least $50,000 per year. One might surmise that both of the latter groups have more opportunity to be warned and prepared to identify elements of scams.

But people with education, experience, savvy, and money can also be scammed. Last month, author Cory Doctorow wrote How I Got Scammed, explaining how a Christmas holiday travel week, a failed ATM transaction, and the post Alaska Air 737 Max door-plug disaster created a perfect storm for him being taken advantage by a phone-phishing fraudster pretending to be from his credit union.

Sometimes, a scam is obvious. Out of nowhere, you’ll be cooking or watching TV and the phone will ring. A mysterious and heavily accented speaker will say that there is “something seriously wrong with your Microsoft computer.” It doesn’t matter if you actually have a Mac, or if you don’t even have a computer. They’ll use that wearily patient voice so identifiable as IT customer support.

You immediately know it’s fake; but would your grandparents? Would your teenager?

Other scams are less obvious because they come wrapped in the kind of tech-related language we see every day. In just the 24 hours prior to writing this post, Paper Doll and Paper Mommy experience attempted scams.

I received an email claiming that I’d purchased $500+ in services, and if had not made those purchases, I should immediately click to be connected with the company’s fraud department. Of course, merely hovering my cursor over the return email address (displayed as the company’s name) showed it was actually sent by gibberishletters@Yahoo.com. Real companies don’t use Yahoo addresses; in theory, they shouldn’t even use Gmail addresses. Dependable companies have their own domains.

Meanwhile, Paper Mommy got the all-too-common email advising her to click because her iCloud was full. [Be assured, her iCloud was not full. It has a backup of her iPad and probably a few dozen photos and not much more.] Paper Mommy may be 87, but she is one smart cookie, and even if she hadn’t received one of these same phishing attempts previously, she knows enough to verify such things.

However, it’s common enough to get random notification texts, popups, and emails claiming that something is awry. One of the immediate clues is bad spelling, grammar, or punctuation, something that older generations are more likely to take seriously; a 50- or 70-year-old is more likely to immediately realize that a poor command of English (in an email sent, ostensibly, by an American company to an American customer) is a sign of a scam. Thus, given the propensity of younger people for text-speak and a lesser reliance on standard usage, younger adults might be more easily tripped up.

Still other scams prey on the inclination of individuals to be good natured. One popular scam comes in the guise of a text regarding a sick or injured dog. The sender addresses you by the wrong name and says that they’re at the vet; their dog won’t eat and is whimpering, and they’re waiting for assistance. I “fell” for such a scam a few months ago, in that I replied and said, “Sorry, you have the wrong person. I hope everything turns out OK for you and the dog.”

Sad Doggie Photo by Bruno Cervera at Pexels

I thought nothing more of it until the person kept texting and trying to inveigle me in conversation, asserting that I must be a dog lover, too. (Readers, while I’d hate for you to think I’m a Disney villainess, I’m not fond of animals in person, though I do love monkeys, puppies, kittens, and penguins, as long as they’re on my device screens and nowhere near me.)

I Googled, and immediately found that this is a long-running scam to convince text recipients to get emotionally enmeshed in the condition of the dog, and end up giving money. One can understand how Congressman George Santos managed to set up fake Go Fund Me accounts for animal care and steal the proceeds. People are softies and want to be kind.

We’re also inclined to be law-abiding. There have been a number of jury duty scams where recipients get calls or texts saying that there’s a bench warrant for them to be arrested because they have not shown up for jury duty. Sometimes, recipients are warned that deputies are on the way to arrest them unless they pay a fee over the phone, or buy gift cards and send them to the caller.

Government agencies don’t text you out of the blue. In most cases, none but teeny, hyper-local government offices will even email. They certainly don’t take payment in gift cards.

Scams are designed to prey on your lack of experience or information, your good nature, and your fear of getting in trouble (as with Cowles’ example). Do not let scammers waste your time, ruin your productivity, or take advantage of your goodwill.

SOCIAL SECURITY: SLAM THE SCAM DAY

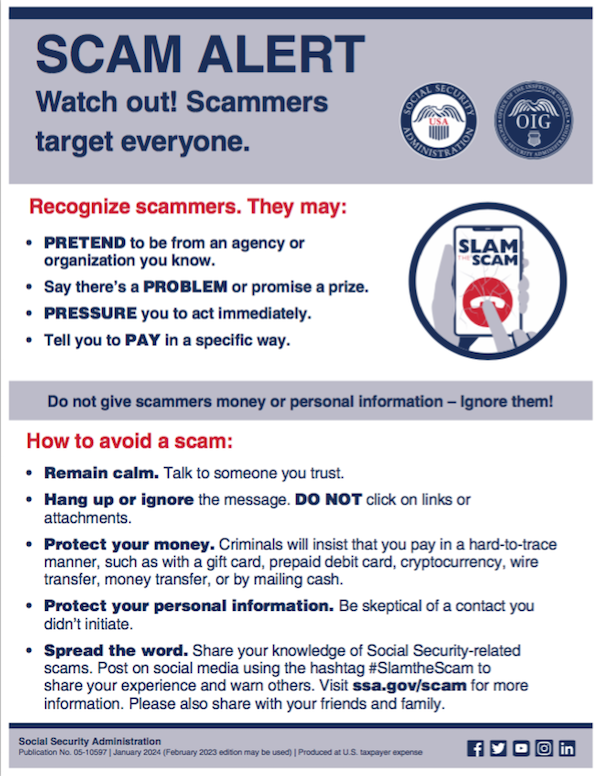

The Social Security Administration has declared this Thursday, March 7, 2024 Slam the Scam Day!

On National Slam the Scam Day and throughout the year, the SSA provides tools to help seniors and others recognize scams related to Social Security and prevent scammers from stealing both funds and personal information.

Social Security and Paper Doll want you to protect yourself, your loved ones, and people in your community this Slam the Scam Day by educating everyone about government imposter scams. Discuss the issue and let people in your life know they shouldn’t be embarrassed to report if they shared personal information or suffered a financial loss. It’s important to report scams as quickly as possible, both to aid recovery and identify the culprits.

The Social Security Administration encourages us to share their Scam Alert fact sheet to help educate others about how to protect themselves. Report Social Security-related scams to the Social Security Office of the Inspector General (OIG).

If you do encounter scammers in any way related to Social Security, report the scam online with as much information as you have regarding the characteristics of their claims.

Social Security encourages you to visit www.ssa.gov/scam for more information and follow the SSA OIG accounts on Facebook, Twitter, and LinkedIn. Those accounts aren’t going to share the newest viral dances or memes, but will keep you informed of the latest nasty tactics. Please consider sharing this post with the #SlamtheScam hashtag on your social media platforms.

OTHER SCAMS TARGETING SENIORS

Scams targeting seniors aren’t limited to those involving Social Security.

The “Grandma, I’m in Jail!” scam has been prevalent for more than a decade. Your phone rings and you hear a young person’s distraught voice begging for help. The caller, ostensibly your grandchild, has somehow accidentally run afoul of the law and is in jail. “Please send bail money but don’t tell Mom and Dad,” the caller begs, providing a phone number and case number; you call as directed and the faux police officer verifies the case number and takes your money. These scams assume Grandma doesn’t hear your voice often enough to recognize it on the phone.

Help your grandparents not fall for such scams by 1) explaining how they work and 2) calling them more often so that they recognize your voice!

Photo by RepentAndSeekChristJesus on Unsplash

Elders are often the victims of medical scams designed to impersonate legitimate agencies related to Medicare, diabetes supplies, medical equipment, hospice, and more. Romance scams, which prey on lonely people of all ages, but especially tender-hearted seniors, are also on the rise.

The American Association of Retired Persons (AARP) is great resource for keeping on top of scams targeting the elderly. Bookmark AARP’s Scams and Fraud page to learn about new schemes as they become known.

KNOW THE SCAMMERS’ TRICKS

Similar to “Grandma, I’m in Jail” is “Dad, I’ve had a car accident!” There’s loud traffic noise (and perhaps sirens) in the background and the faux-distraught caller is saying that they’ve caused an accident and that the police say they need to pay a fine right away. Don’t fall for it.

Remember how I said that government agencies won’t ask for payment in gift cards? Neither will your boss. The Do Me a Favor scam shows up via email or text, when your boss (or maybe the CEO of your company) sends a message asking you to purchase gift cards for a work-related charity promotion, promising to pay you back after he receives them.

Yeah, no. The email or text may look like it’s coming from your work contact, your church leader, or your Facebook friend, but it’s almost certainly not.

Similarly, your friends aren’t going to be at the Paris Olympics and lose their wallets and ask you to send them money via Facebook.

The best way to organize yourself against scams is to stay informed of what scams are popular. When you know what to expect, it’s easier to identify scammers and avoid engaging.

- 5 Financial Scams To Avoid in 2024 as Expert Warns Fraud Has Reached ‘Crisis Level’ (NASDAQ)

- 6 Top Scams to Watch Out for in 2024 (AARP)

- 10 Scams You Should Know About in 2024 (Express VPN)

- 17 Facebook Marketplace scams to avoid in 2024 (Lifelock)

- Credit Card Scams to Know in 2024 (and How to Avoid Them) (Time Magazine)

- Five Biggest Frauds To Watch Out for in 2024 (Kiplinger)

- The Latest Scams You Need to Be Aware of in 2024 (Experian)

- No Love for Romance Scammers in 2024 (IRS)

DON’Ts AND DOs TO KEEP YOURSELF SAFE FROM SCAMMERS

DON’T CLICK — If you receive an email or text with links to your bank or other financial account, go instead to the official website and log in from there. If you don’t know the URL, look it up on the back of your bank or credit card or on your statements. And, as you’ve been told since the dawn of email, do not click on attachments from somebody you don’t know.

DON’T TRUST — The Caller ID may say that the inbound call is coming from your bank or the IRS, but it’s ridiculously easy to “spoof” (that is, fake) the identity of a caller. Consider not answering; scammers rarely leave voicemail.

Don’t assume that the caller having the last four digits of your Social Security number or even all of the digits of your account number is on the up-and-up; there’s just too much of our private information on the dark web. Instead, hang up and call the official number for your financial institution and request to be connected to the fraud department.

DON’T DIVULGE — If a stranger claiming to be from your bank or credit card’s fraud department contacts you, ask for a case number. Do not give out your personal information. Do not give out your PIN.

DON’T SAY YES — Do not answer questions in the affirmative. That is, if they ask, “Is this Jane Smith?” don’t say yes; if you must say something, reply, “What is this regarding?” Your voice could be recorded and cloned for AI-related scams. The less you say, the better.

DON’T RUSH (OR BE RUSHED) — It’s the nature of scammers, like the stereotypical used car salesman, to use the pressure of time to get you act against your best interest. Don’t be fooled into making a decision or taking action quickly. Check with advisors, whether more technologically savvy friends or relatives, your accountant or financial advisor, your attorney, or the police.

DO READ UP — The American Bankers Association has a nifty website called BankersNeverAskThat.com. The site explains what to watch out for in terms of email, text, phone, and payment app scams, and also has a great eight-question quiz where you can walk through the situations (on your own, or as part of coaching with a loved one) to identify whether something is a scam or legitimate.

For reference, I did pretty well, but I dithered on the question regarding payment app alerts; if you’ve only recently begun using apps like Zelle, Venmo, or other peer-to-peer payment services, you might find the example sneaky, too, so read (and share) AARP’s How to Avoid Scams on Zelle, Venmo and Other P2P Apps.

The site offers a goofy “retro” scam-themed video game and a series of lighthearted videos to drive the point home.

DO HAVE FAMILY PASSWORDS — Schools have security that was non-existent when I was a kid; there are lists of who is allowed to pick up little Johnny or Janey from school to ensure not only that there’s no Stranger Danger but that wackadoodle exes and pushy in-laws don’t insert themselves between you and your kids. Modern parenting includes having family passwords so that if someone says, “Hi, your mommy told me to come pick you up from soccer practice today,” even if the child recognizes Mommy’s best friend as Auntie Karen, the kids know to wait for the official password.

This concept should be applied to families at all ages. Have a communication password designed so that if Grandma or Dad or College Kid gets a call purporting to be from one of the others and is in in need of emergency funds, there’s a level of security involved. (But, y’know, if Grandma calls from jail too often, maybe let her think about the consequences of her actions for a little while.)

DO TELL THE AUTHORITIES — No matter how embarrassing it is to have been scammed, it’s important to report suspected and actual scams.

- Notify your bank, credit card company, brokerage, or other financial institution immediately. If scammers have actually taken your money via credit card, the company should be able to flag the transaction as fraud and reverse it immediately; other financial institutions may also be able to freeze the transaction and save your money. Take screenshots of texts or emails, and don’t delete the original messages in case law enforcement wants to dig more deeply into the source code.

- Contact the police, and file a police report. Do not be dissuaded if the police officer seems blasé about the crime.

My credit card company once notified me that someone had used my card number to buy an inordinate amount of mail order men’s underwear and stereo equipment. Algorithms had already flagged the purchases as fraud, but they asked me to file a police report. The police officer who took the report at my workplace could not have looked more bored if I’d asked him to watch paint dry. It doesn’t matter. Report!

- File reports with applicable state and federal agencies. Whether the case involves the Social Security Administration, Medicare, or other federal crimes, report scams to the applicable agencies. The Federal Bureau of Investigation (FBI) and the Federal Trade Commission (FTC), as well as your state’s bureau of investigation all have fraud departments. Learn more at the FTC’s Reportfraud.ftc.gov and the FBI’s Internet Crime Complaint Center at IC3.gov.

THE FUTURE OF SCAMS

Scams — and scammers — aren’t going away. There will always be scammers who take advantage of anyone more easily duped because they have less information, less experience, and fewer people watching out for them. But, as I alluded to earlier, there are higher tech scams on the horizon.

Artificial intelligence is scary. I bet you’ve heard about deepfakes, video imitations made to sound and look like a real person is saying something they never actually said.

Voiceprints and voice cloning constitute the audio version of deepfakes. A scammer can record you — or take your teenager’s Instagram or TikTok video — and create a completely new message using words and expressions that were never actually said, and then create an “emergency” where it’s believable that money or your Social Security number or other private information is requested. If your college-age kid still hasn’t memorized his Social Security number, you might be tempted to believe it if “he” calls from a spoofed number that looked like his and says he’s filling out a form at school and needed his (or your) digits.

Voice cloning is already being used. Scammy deepfake videos could just as easily be to sent via Facetime or text video. Be careful.

FUNNY THINGS (NOT) TO DO TO SCAMMERS

You shouldn’t engage with scammers, so don’t emulate Paper Mommy or her friend in the stories below. Still, it’s fun to imagine retribution against bad guys.

When I was a teen, my mother was visiting a friend, a suburban woman of (shall we say) means. A phone scammer interrupted their visit and was urgently pushing some sort of financial scheme. Mom’s friend told the caller that she was sorry, but he’d have to wait, that her husband busy shoveling the cow s***.

Later, my mother spoke of her friend’s response with a twinkle in her eye.

Paper Mommy, as longtime readers know, is a hoot. After a friend briefly fell prey to the “Grandma, I’m in jail!” scam (until she learned that her teen grandson was fast asleep in his own bed), Paper Mommy began plotting her revenge on scammers. A few years ago, she called me with delight to report that the day she’d been anticipating had finally arrived.

“Grandma, I need your help!” the voice implored. The scammer had already made a tactical error; much to Paper Mommy‘s chagrin, neither my sister nor I have made her a grandmother. My mom tut-tutted as the scammer wove his tale, offering periodic, “Oh, no, darling! … Oh, you poor thing? … You need me to send you money?”

She kept him on the line for eons, repeatedly leading the evil-doer to believe she was prepared to turn over her credit card number to secure grandson’s release. Oh, she just had to find her purse. Oh, fiddlesticks, where was her wallet? Just when his frustration led him to almost crack and he implored, “Grandma, aren’t you going to help me?” my mom uttered her Oscar-worthy line:

“No, Sweetheart. I never really liked you that much.” Click.

#SlamTheScam

A New VIP: A Form You Didn’t Know You Needed

Brown Plush Bear Patient Photo by Kristine Wook on Unsplash

As a professional organizer for 20 years, I am rarely stumped by organizing-related questions, especially those having to do with vital documents or what I call VIPs (very important papers). However, a client recently presented me with an article making a recommendation for a particular document, and it sent me down a rabbit hole of research.

THE USUAL SUSPECTS: VIPS AND HOW TO MAINTAIN THEM

Over the past years, we’ve discussed (at length) the essential documents everyone should have and how to organize and keep them safe. Posts covering these topics have included:

How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Ask Paper Doll: Do I Really Need A Safe Deposit Box?

Paper Doll’s Ultimate Guide to Getting a Document Notarized

Over the years, we’ve looked at documents granted by a government entity, like birth and marriage certificates, divorce decrees and custody documents, citizenship and military separation papers, passports, and Social Security cards.

We’ve also reviewed essential documents you must create for yourself (or with assistance), including home inventories, insurance policies, estate planning documents (like wills and trusts, pre- and post-nuptial agreements), and living wills (also known as advanced medical directives).

And, for ensuring that your loved ones can take care of you (and you can take care of them) in the event of incapacitation, we have always accented the importance of having both a Durable Power of Attorney for finances and Durable Power of Attorney for healthcare (known in some states as a healthcare proxy).

BEHOLD: THE POWER OF ATTORNEY

A Durable Power of Attorney for financial decisions is necessary if you are unable to make financial decisions or take financial actions on your own. This might occur if you are ill and lack the cognitive capacity to make your own decisions (such as if you’re comatose, heavily medicated, or experiencing some sort of dementia), but it might also come in handy in other circumstances.

Imagine that you are taking an around-the-world cruise or hiking in the Himalayas. In such cases, communication may be spotty or impossible. If the stock market were tanking or a financial opportunity of great importance occurred, or if your return were delayed and you needed to make sure your child’s college tuition was paid or some other financial arrangement was secured, knowing that someone with your Power of Attorney for financial concerns was handling everything would certainly put your mind at ease.

A Durable Power of Attorney for healthcare, or a healthcare proxy, is similarly important if you are unable to make your own healthcare decisions, pretty much for the same reasons initially outlined. If you are physically or cognitively incapacitated and need someone to make decisions on your care, it’s essential to have that paperwork in place.

And, as a periodic reminder to all parents who’ve recently sent their kids off to college, without a Power of Attorney for healthcare or healthcare proxy in place, if your away-at-school adult child were ill and had not granted you PoA for healthcare, the college’s health center or local hospital would not be allowed to provide you with any information about your child’s condition or care.

So, Power of Attorney documents are pretty darned important. You want them in place so that your spouse, partner, adult child, or trusted friend or advisor can be kept informed of your situation and can, if necessary, make decisions and take actions on your behalf.

This is the be-all and end-all of advice we paper specialists generally need to give. But guess what? We’ve been missing a pretty important document related to older adults!

BEYOND THE POA: THE DOCUMENT YOU DIDN’T KNOW YOU NEEDED

Let’s imagine your spouse is 65 or older. Or perhaps we’re talking about your parent, or another slightly older loved one. (I say slightly older, as now that Paper Doll has reached 55, the age of 65, when you can get Medicare coverage, doesn’t seem that far off.) Or perhaps you’re the one with Medicare.

You’d assume that as long as Powers of Attorney had been executed with regard to financial and medical decisions, then everything would be A-OK. Right?

Mostly. But not entirely.

It turns out that, by law, if you want someone (your spouse or significant other, your adult child, your caregiver, etc.) to speak to Medicare on your behalf, having a both a Durable Power of Attorney for financial issues and one for medical issues is not enough.

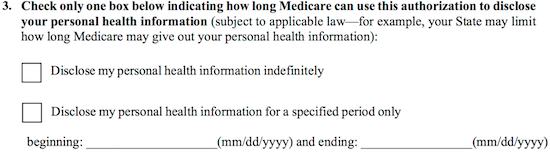

Perhaps because each state has a different variation on PoA forms, or perhaps because the government just likes to be wackadoodle, Medicare requires you grant prior authorization via a surprisingly under-mentioned form called the 1-800-MEDICARE Authorization to Disclose Personal Health Information Form or CMS-10106. (Doesn’t that just roll trippingly off the tongue?)

You must fill out the CMS-10106 well in advance if you want someone to potentially be able to discuss any of the following with Medicare:

- Medicare eligibility

- Medicare claims

- Plan enrollment (including part D or other drug plans)

- Payment of premiums

- Other information, including payments to beneficiaries

So, if you have Medicare, are you thinking “Whoops!” and wondering what happens if you have secured your financial and healthcare PoAs but haven’t ever filled out this authorization?

It turns out there’s a quirky loophole. If a person HAS done both of their PoA forms but hasn’t actually filled out this authorization form, it’s entirely not a catastrophe. That’s because the person who fills out the form has to be either one of the following:

- the beneficiary (that is, the person on Medicare)

OR

- the personal representative of the person on Medicare (that is, the person who has the Powers of Attorney, or otherwise has been granted authorization over your information).

So, yes, if you’re the person with the Power of Attorney for a Medicare beneficiary, you can authorize yourself to let Medicare talk to you about someone’s health and payment information. And if that seems a little weird to you, well, you’re not the only one.

The problem is that if someone hasn’t ever filled out the CMS-10106 in advance and their personal representative has to do it, it’ll take time to process because you have to MAIL it to Medicare.

That’s right — you can’t submit the authorization form online or even by fax. You have to mail it, like it’s 20th century, to a post office box in Lawrence, Kansas!

Organize to Help First Responders: The Vial Of Life

Last time, we talked about the importance of being able to communicate vital medical information to first responders when we’re on the road. Having that Yellow Dot on the car means that even if you (or your passengers) are unable to communicate, paramedics will know where to look – in the glove box! – for information that will save precious time and ensure the correct treatment.

But what about when you’re not mobile? What if you (or Grandma or someone else with serious health issues) get ill at home and emergency services are called. What if you (or they) can’t explain medical history to first responders. As we discussed last time, it’s never comfortable to talk about these things, but thinking about them in the present can make the future a bit less stressful.

“Downtown Hospital Ambulance” by sponki25 is licensed under CC BY 2.0

Certainly, you can (and should) keep careful medical records and have them available so that loved ones and medical professionals can help you in an emergency, as we discussed in Paper Doll on the Smead Podcast: How To Get Organized When You Have a Chronic Illness. But having a tidy binder or a medical file doesn’t help you if the paramedics don’t know where to find it.

VIAL OF LIFE

The Vial of Life, where “LIFE” stands for Lifesaving Information for Emergencies, is a program that enables you to collect all of your essential medical information, keep it accessible to first responders, and includes an attention-getting flag so it can’t be overlooked. As with the Yellow Dot Program, the Vial of Life is designed to speak for patients when they are unable to speak for themselves. Vial of Life is most commonly used by senior citizens, but anyone with medical conditions that could trigger an inability to communicate (such diabetes, epilepsy, heart disease, etc.) could benefit from participating.

The elements of the Vial of Life kit are also similar to those of the Yellow Dot. You’ll need:

- a sticker or decal, usually placed on the front of the refrigerator, to alert first responders that there’s a container in or on the fridge

- a labeled vial, much like a medicine bottle, kept in the front of the fridge; recently, the literal vial has been replaced in many communities by a zip-lock plastic bag or plastic/vinyl pouch attached to the front of the refrigerator)

- medical information forms, folded and rolled into the vial (or placed flat in a bag or pouch), containing vital medical information

The materials are typically free, and the forms can usually be downloaded from the web and printed.

First responders throughout the US and Canada have been trained to look for a decal or sticker at the entrances to homes and/or on the front of the fridge.

Public Service Announcement: The less clutter on the fridge – the fewer year-old wedding invitations and expired oil change coupons – the easier it will be for first responders to see the Vial of Life decal.

HOW TO PARTICIPATE

There are a variety of regional and agency options for obtaining your Vial of Life kit. Google “Vial of Life” and your community name; if your local hospital, pharmacy, or community groups aren’t offering resources, the most straightforward way is directly through VialOfLife.com.

Go to VialOfLife.com.

Order UV-coated vinyl decals for your home online or by calling 888-931-1010. (You can purchase bulk order kits for your organization.) Alternatively, you can print your own stickers directly from the Vial of Life site onto adhesive-backed paper.

Create an online account. Provide your email address and create a password, and then give your name, mailing address, and phone number(s). You’ll be asked whether you want to participate in the First Responders Program, which gives medical personnel remote access to your information during an emergency.

NOTE: You don’t have to become a member, but if you do, you can update your information online as your prescriptions and medical situations change. If you choose not to become a member, any time you want to update your medical or personal information, you can print multiple copies of a blank form to fill in by hand, or return to the site to re-enter everything and print a typed copy. (View the site’s privacy policy here.)

Log in with the credentials you just created.

Create a new Vial of Life. Once you log in, you’ll be prompted to create a new vial. You’ll be asked for four types of basic information:

- Basic information

First, re-enter your full name and contact information. I’m not sure why this information can’t be directly imported from your account creation, but I suspect it’s to allow one person – a wife, for example – to create one family account and then create separate vials for herself, her spouse, and perhaps a grandparent or other person residing in the home, all without creating additional accounts.

You’ll also enter your gender, height, weight, hair color, blood type, and religion (much as you’d fill out in any hospital admittance form). There’s a section for adding whether you use a pacemaker or defibrillator (and a space for inputting the model number) or hearing aids, and for noting hearing impairment.

The next section asks about vision, whether you wear glasses and/or contact lenses, if you are blind in either eye or if either eye is artificial, and what your native language is. (Paper Doll would like to note that all of this information is useful, but it’s perhaps not entirely well organized. Harrumph.)

- Medical history

This section has two essay-style boxes. The first asks if you have any identifying marks, ostensibly to better identify who the patient actually is. The second asks, broadly, for all the conditions for which you’ve been treated in the past. (Again, Paper Doll isn’t in love with the organizational system here, and would prefer if the official program had a series of prompting checkboxes to ensure that users don’t forget any vital health events.)

- Current medical information

This section asks for your doctors’ contact information, the conditions for which you’re currently being treated and your current medications. The form does not ask for dosages, but I suggest you list both dosages and the frequency with which you take these meds. Where the form asks whether you have any medication allergies, if you are allergic to latex, I encourage you to list that, too.

The current medical information section has spaces for information regarding your last hospitalization and your medical insurance policy information. There are sections for noting whether you have a living will and whether you are an organ donor (and to whom medical professionals should speak regarding each issue).

- Emergency contact

The form has spaces for the name and contacting information for your emergency contact and what their relationship is to you.

I should note, another great unofficial program is listing your emergency contacts in your cell phone as ICE (in case of emergency). My phone, for example, lists “ICE Paper Mommy (and her contact info).”

Take a moment to add one or two of your emergency contacts to your cell phone directory. Just type ICE in the last name section and the person’s entire name (and perhaps their relationship to you) in the first name section. This way, if first responders check the I’s in your contact list, they’ll see ICE right away.

Once you fill out the form, you can save it (if you have created an account) and print the form. If you choose to save, the system will return you to a screen giving you the options to edit, print, or delete the vial you have saved.

THE NEXT STEPS

Put your Vial of Life together.

As I mentioned, some versions of the Vial of Life use an actual vial, but the Vial of Life Project recommends maintaining all of your information in a zip-lock bag. (If you get a kit from a community organization, you may be given a branded vinyl pouch.) Fold or roll the form (so it fits) and add any other pertinent information, including a DNR (Do Not Resuscitate) form, a recent photo of yourself, a recent EKG, your living will, and anything else you think might be pertinent.

Affix a Vial of Life decal to the baggie or vial.

Store your Vial of Life so it’s visible!

If you’re using a vial/bottle, place it in a very visible space on a high shelf. Don’t hide it among the eggs and soy sauce packets!

If you opt for the baggie, attach it to the front of the fridge. The Vial Of Life Project recommends doing so with tape, which probably won’t be aesthetically pleasing, so you might want to use a magnetized clip, such as those used for chip bags or for attaching papers to your filing cabinet. (The vinyl pouches tend to be magnetic.)

Attach the baggie or pouch near eye-level so it can be spotted quickly. (Your local first responders may have specific recommendations, such as to attach it to the top left side of the front of the fridge. Call your local firehouse to ask what they prefer.)

Affix a Vial of Life decal to your front door or in a highly visible front window (much like you’d affix a security company decal).

HISTORY OF VIAL OF LIFE and OTHER OPTIONS

The origin of the Vial of Life isn’t well-documented. We know that someone started putting vital information into medicine bottles and attached them to the interior of the fridge in a visible manner. Word spread over the years, and various community programs started offering advice on how to create a vial. Eventually, the Sacramento chapter of the American Red Cross handed off their resources to Vital-Link, Inc., one of the early “I’ve-fallen-and-I-can’t-get-up” medical alert companies.

For twenty years, the Vial of Life Project has operated as a 501(c)(3) non-profit and supplies free Vial of Life kits and decals/stickers to individuals and partner organizations, including senior citizen groups and community centers, pharmacies and hospitals, government agencies, towns and cities, Red Cross chapters, and various volunteer groups. (The American Senior Safety Agency, a medical alert company, covers the cost of the decals.)

The Vial of Life Project isn’t the only game in town. It’s founder specifically left the Vial of Life name in the public domain so that the program could be duplicated and used by other agencies and organizations. Although it’s the best-known, and costs nothing for individuals, there are a variety of alternative options, such as the File of Life.

StoreSmart, the same company that offers unofficial Yellow Dot stickers and envelopes, sells vinyl, magnetic-backed, closed-sided medical information pouches suitable for displaying at your home or office. They also sell window/door stickers and have free, downloadable medical information forms.

Whether you order the official Vial of Life, get a branded kit from your local hospital, pharmacy, or community group, purchase an alternative, or make your own, consider using the Vial of Life and encouraging your loved ones to do the same

Be healthy, be safe, and be organized.

Organize To Help First Responders: The Yellow Dot Program

Most of us spend time thinking about how to prevent medical emergencies. We try to exercise and eat healthily. We make doctor’s appointments, get all of the appropriate medical screening tests for our age group and gender, and we learn how to manage our health conditions in hopes of preventing complications.

Nobody likes to think about medical emergencies, but for the same reason we buy insurance (whether auto, home, health, or, in the worst case scenario, life insurance), we need to prepare for the unexpected. And when the unexpected does happen, we depend on first responders, particularly emergency medical technicians and paramedics, who have the training necessary to help us get safely treated.

So why not help the helpers?

“Downtown Hospital Ambulance” by sponki25 is licensed under CC BY 2.0

In our next two posts, we’re going to look at two resources to organize essential medical information so that first responders can render aid when we need it, whether we’re out and about, or at home.

YELLOW DOT PROGRAM

At a DiabetesSisters meeting a few years ago, someone mentioned the existence of Tennessee’s Yellow Dot program, but almost nobody in the room was aware of this life-saving project.

The Yellow Dot Program, available at no cost to participants, was initially developed as a regional program in the early 2000s. It is now a national program sponsored and funded by the United States Department of Transportation as a result of the work of the 113th Congress, the bill having been introduced by West Virginia’s Senator Joe Manchin III.

The purpose of the program is to help automobile drivers and their passengers communicate vital information to medical personnel (as well as police, firefighters, and other first responders) during road emergencies, like car accidents.

In case drivers or passengers are incapacitated, in shock, or are otherwise unable to communicate about their medical conditions, car owners can affix yellow stickers to their rear windshields to alert first responders that occupants of the car may require specialized medical attention. (Smaller stickers are available for motorcycle use.) Although state programs tend to accent Yellow Dot for use by senior citizens, anyone with a serious health condition or atypical health situation should consider making use of the program.

The stickers let first responders know to look in the glove compartment for a kit: a yellow plastic folder, container, or envelope. In it, they will find information regarding:

- the medical conditions, allergies, recent surgeries, and special needs of anyone riding in the car who might require special care

- lists of current prescriptions, dosages, and prescribers

- emergency contact information

- a photograph of the person so that he or she can be quickly identified as needing special attention

The Yellow Dot Program maintains no centralized database at any government or community level, so individuals concerned about privacy breaches should feel at ease. The information is maintained in the glove compartment and is not accessed by anyone (except the owner or passenger of a vehicle) unless there is an emergency situation.

At the meeting where I first learned about the Yellow Dot Program, we talked about the importance of police and medical personnel knowing that someone in the car might be suffering from hyper- or hypoglycemia, which can appear to the untrained eye to resemble drunkenness, stroke, dementia, or other health conditions.

Research shows that 90,000 to 100,000 individuals die each year due to adverse drug reactions, some of which result from standard treatments “in the field” to which an individual may be allergic. Similarly, an accident victim who has had a recent surgery may be at greater risk for complications, and first responders need to know that.

HOW TO PARTICIPATE

If you know someone who has a medical condition that might require special on-the-scene treatment by EMTs and paramedics, encourage them to sign up for the Yellow Dot Program. Management of the program varies by location, and though it’s overseen by state Departments of Transportation, management often occurs at the county level.

While some programs allow online sign-up, other communities require that participants come to an enrollment station or registration center (often at the nearest DMV, although some local businesses sponsor the printing of Yellow Dot stickers and kits and help enroll participants). Help your loved ones gather the vital paperwork – including medical and prescription information and a current photo – to put in the yellow folder to be kept in the glove compartment, and make sure you or they actually put the sticker on the rear windshield!

Although the Yellow Dot Program is funded nationwide, it is voluntary, and many states have declined to participate; other states have shown interest but have not yet rolled out their programs. If your state is listed (below) without a link, there is likely no centralized program in your state, and you will need to call or search for your county’s transportation department or division of aging services. (Yes, Paper Doll feels this is all very disorganized at the state and federal levels! Harrumph!)

Iowa

Kansas

Massachusetts (search “Yellow Dot Program” and the name of your town rather than county)

Minnesota

New Hampshire

North Carolina

Note: In 2017, Illinois mysteriously canceled participation in the Yellow Dot Program, but encourages all drivers to register with the state’s emergency contact database, which serves a similar function.

If yours isn’t one of participating states listed belong, contact your state’s Department of Transportation to inquire if and when the Yellow Dot program will be available for you. While you’re waiting, you can purchase an unofficial National Yellow Dot Program kit (with stickers and standard or folding pockets) directly from retailer StoreSMART in various batch sizes (from 2 to 2500) or in packages of five from Walmart.

In addition to the stickers and kits, StoreSMART has free, downloadable PDF medical forms. (You can also review the websites of the participating states, above, as many, such as Alabama, have their own downloadable medical forms, accessible to all.)

COMMUNITY OPPORTUNITIES

Various communities have found opportunities to use the yellow dots beyond private vehicles. Adult day care centers for senior citizens and people with disabilities, as well as traditional day care centers for children, can make use of the program by helping individuals in their care (and caregivers or parents) develop a person-specific packet, and make copies for family vehicles, program/center vehicles, and care centers.

Next time, we’ll be talking about the Vial of Life program, and how to ensure that first responders can locate your essential medical information when they attend to you at home. Until then, be healthy, be safe, and be organized.

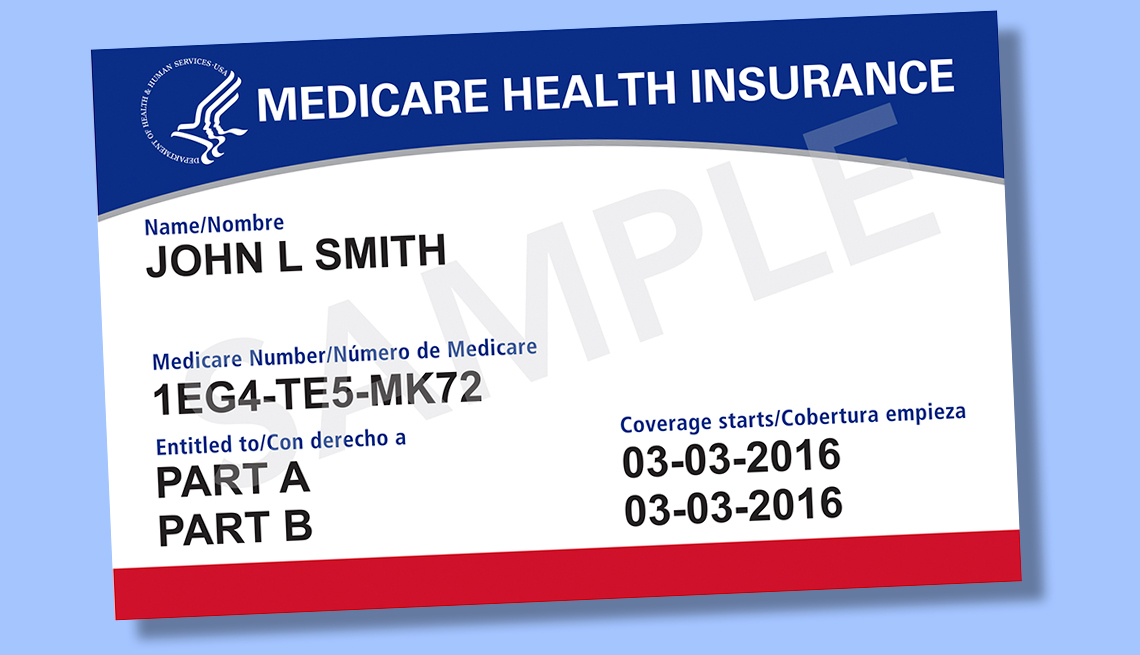

Paper Doll on the New Medicare Cards: How To Organize Against Identity Theft & Scams

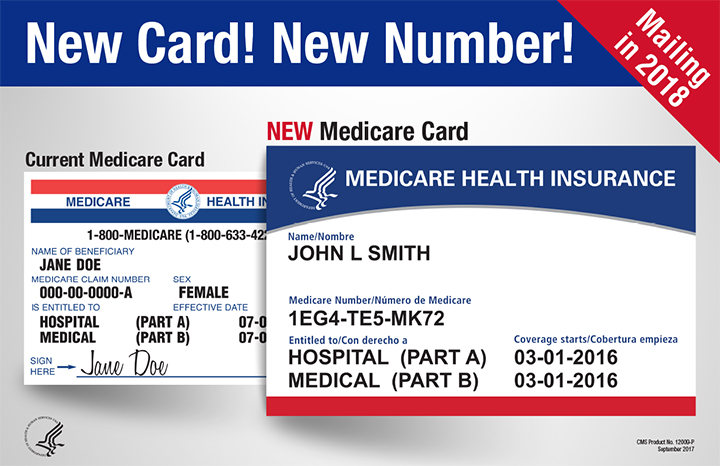

Are you one of the almost 60 million Americans enrolled in Medicare? Are your parents or grandparents? If so, it’s important to know that all Medicare recipients will soon be getting new identification cards. The first of the new cards will be mailed starting April 1, 2018, and the rollout will continue through April 30, 2019.

Why the Change?

According to the Centers for Medicare and Medicaid Services (CMS), the new cards will better protect an enrollee’s identity and guard against fraud. Basically, the hope is that the new Medicare ID cards will make it much harder for the bad guys to scam Medicare recipients and steal their identities.

The new Medicare cards will have less personally identifying information than in the past. Cards won’t have the bearer’s Social Security number, gender, or signature.

Each new card will have a computer-generated Medicare Beneficiary Identifier (MBI) assigned specifically to each Medicare enrollee. The MBI will be a combination of eleven numbers and letters, and healthcare providers (including physicians, labs, and hospitals) will be required to bill using MBI instead of Social Security numbers.

Medicare has created a special website, go.medicare.gov/NewCard just to help people feel more at ease with the changes. (CMS has special links available to help healthcare providers and office managers, health insurance and drug plans, employers and media, and individual states cope with the change.)

But what do you have to do?

Step one is to be aware that the change is coming. If you’re a Medicare recipient, or your parents, grandparents, or older friends have Medicare, start by letting them know the cards are on their way.

Doctor’s offices will be asked to play the following video for the benefit of their Medicare patients, and I encourage you to share this video via social media so that other enrollees and their loved ones can be apprised of what’s going on.:

Cards will come automatically. Benefits stay the same. There’s nothing else you absolutely have to do. However, if you’ve moved recently or are just starting to receive benefits, the Social Security Administration urges Medicare enrollees to make sure the agency has their correct address on file.

Log into your Social Security account at socialsecurity.gov/myaccount (What? you didn’t follow Paper Doll’s advice for setting up your online Social Security account? Not even when I pestered you about it?) or call 800-722-1213 to update your address in the system.

[One special note: Every Medicare enrollee is getting a new Medicare card, but if you are also enrolled in a Medicare Advantage Plan (like an HMO or PPO), your Medicare Advantage Plan ID card is your main card for Medicare. So hold onto your Medicare Advantage Plan ID card, and keep it for whenever you need healthcare care. However, healthcare providers may ask you to show your new Medicare card, so keep it ready, too.]

So what’s the catch?

The Department of Justice reports that identity theft for seniors aged 65 and above is a serious problem. In fact, in 2014, the most recent year for which statistics have been released, 2.6 million seniors are victims of identity theft annually! (The Federal Trade Commission has released a document explaining the seven most common identity theft schemes targeting seniors.)

There’s little doubt that scammers and identity thieves are already anticipating this Medicare card change, using potential confusion to their scummy, scammy advantage. However, sharing some basic information can help protect those most in danger of being victimized.

Spread the word (to Dad, Grandma, Aunt Gertrude, and your older pals) that if any of the following things happen, it’s a scam.

If you’re called on the telephone and asked to pay to receive your new Medicare card, hang up. The card is free to all Medicare recipients.

If you’re called and asked for your Social Security number and bank number in order to get your new card, hang up. Medicare won’t call you. Medicare doesn’t need to know your banking information. Ever.

If you’re called and told you will lose your Medicare benefits if you don’t send money or provide your banking info or credit card now, roll your eyes and hang up.

If there are any “fragile” seniors in your life who may be at risk for being coerced, assure them that if they ever get such a call, they should hang up without fear. If they are still ill at ease, tell them to ask for the caller’s name and number and say that their “financial representative who handles all of these tasks” for them will return the call. Then, you can call and report these ne’er-do-wells to the police.

What’s the Timeline?

Medicare beneficiaries in Delaware, Maryland, Pennsylvania, Virginia, West Virginia, and the District of Columbia will be the first to receive the replacement cards (between April and June). Medicare enrollees in Alaska, American Samoa, California, Guam, Hawaii, the Northern Mariana Islands, and Oregon will also start getting their cards in the April to June 2018 range. If you’re in any other state, the mailing date is merely defined as “after June 2018” and the rollout will continue over the course of the next twelve months. Almost 60 million recipients getting new cards means a lot of mail to process!

Medicare recipients will have until 1/1/2020 before they are required to use the new card, and while both cards will be valid until that date, getting the new card in action and shredding the old card will ensure protection. I also encourage you to make a photocopy of your new Medicare card (just as I always advise photocopying the contents of your wallet) and keep it in a safe place, like your fireproof safe with your other VIPs (very important papers).

For more on the important documents that should (and shouldn’t) be in your wallet, refer to these classic Paper Doll posts:

What’s in Your Wallet (That Shouldn’t Be)?

What’s in Your Wallet (That Should Be)?

What’s in Your Wallet (Part 3): A Little Insurance Policy

Lost and Found: GONE in 60 Seconds: Your Wallet

Stay healthy. Stay aware. Stay organized!

Follow Me