Archive for ‘Financial’ Category

Organize Back-to-School Savings: Tax-Free Holidays & Discount Codes

Photo by Kelli Tungay on Unsplash

Finances are tight these days. (Let’s be real — when aren’t they?) Inflation is frustrating our bank balances, and corporations are reaping record profits, frustrating our sense of fairness and propriety. Energy costs are surging just as it’s ridiculously hot in most of North America (and elsewhere). And while gas prices have dropped 40-straight-days as of the writing of this post, it’s not like that makes it any more delightful to pay at the pump.

And now, shockingly, it’s time to start thinking about organizing for back-to-school shopping.

Depending on where you live, you’re either nodding or looking shocked; if it’s the latter, it’s because you live, like I did when I grew up in Buffalo, New York, where kids don’t go back to school until after Labor Day. So for you, talking about back-to-school in July is like putting up Christmas decorations right after Halloween. (Oy. Never mind.)

The point is, there’s something going on right about now that can help you organize your financial resources for the back-to-school period.

ORGANIZE YOUR FINANCES WITH TAX-FREE HOLIDAYS

Throughout the year, many states have tax-free holiday weekends or weeks, and they are usually clustered in these mid-summer weeks to coincide with the back-to-school season for the southern states, where students return to school in early August, rather than post-Labor Day.

These states generally allow retailers to sell clothing and footwear, school supplies, computers, and sometimes backpacks, books, and other “tangible personal property” without charging sales tax. In my state, that’s a savings of 9.25%. Combine that with various 10%-off to 40%-off sales, and that’s a great opportunity to stock up on necessities.

Seventeen states scheduled back-to-school tax-free holiday weekends or weeks in 2022. If your state is not listed below, consider clicking on the name of your nearest state to be directed to that state’s official tax-free holiday page.

Note: Alabama’s tax-free holiday period has already occurred (July 15-17, 2022, and generally starts on the third Friday in July and ends at midnight on the following Sunday); watch the Alabama Department of Revenue website for 2023’s schedule.

Arkansas (August 6-7, 2022)

Tax-free: Clothing and footwear (up to $100); clothing accessories and equipment (up to $50); school and academic art supplies; scholastic instructional materials (including, but not limited to books) (no dollar limit)

Connecticut (August 21-27, 2022)

Tax-free: Clothing and footwear (up to $100)

Florida (various tax-free dates — see below)

May 14-August 14, 2022: children’s books

July 25-August 7, 2022: Clothing, footwear, and accessories (up to $100); school supplies (up to $50); learning aids and jigsaw puzzles (up to $30); computers and accessories for personal/non-commercial use (up to $1500).

Note: this overlaps with a year-long tax-free Florida holiday on baby/children’s clothing, shoes, and diapers, from July 1, 2022-June 30, 2023.

Illinois (August 5-14, 2022)

Reduced tax rate to 1.25%: Clothing and school supplies (up to $125)

Iowa (August 5-6, 2022)

Tax-free: Clothing and footwear (up to $100)

Maryland (August 14-20, 2022)

Tax-free: Clothing & footwear (up to $100)

Mississippi (July 29-30, 2022)

Tax-free: Clothing & footwear (up to $100)

Missouri (August 5-7, 2022)

Tax-free: Clothing (up to $100); computers/peripherals (up to $1,500); software (up to $350); graphing calculators (up to $150); school supplies (up to $50)

New Mexico (August 5-7, 2022)

Tax-free: Clothing and footwear (up to $100); desktop or laptop computers, tablets or notebooks (up to $1,000); computer peripherals/hardware (up to $500); school supplies (up to $30)

Ohio (August 5-7, 2022)

Tax-free: Clothing (up to $75); school supplies (up to $20)

Oklahoma (August 5-7, 2022)

Tax-free: Clothing and footwear (up to $100)

South Carolina (August 5-7, 2022)

Tax-free: Clothing and shoes (no limit); school supplies (no limit); backpacks (no limit); computers, printers, peripherals, and software (no limit)

Tennessee (July 29-31, 2022)

Tax-free: Clothing (up to $100); school and art supplies (up to $100); desktop, laptop, and tablet computers (up to $1,500)

Texas (August 5-7, 2022)

Tax-free: Clothing and accessories; footwear; school supplies; and backpacks (each up to $100)

Virginia (August 5-7, 2022)

Tax-free: Clothing, accessories, and footwear (up to $100); school supplies (up to $20)

West Virginia (August 5-8, 2022)

Tax-free: Clothing (up to $125 limit); accessories, and footwear (up to $100); school supplies (up to $20)

In most cases, retailers should abide by the discounts or tax-free status whether the purchases are made at brick & mortar stores, online, or by phone.

However, so that you don’t experience any surprises, be sure to double-check that the online/phone venues from which you order understand your state’s tax holiday regulations. (In case you’re wondering, yes, Amazon participates in state sales tax holidays as long as you purchase the products exempted during your state’s tax holiday. And no, I have no idea how Amazon’s computers work that magic. I still haven’t figured out how Kohl’s magically makes my receipt so much less than I’m always expecting!)

Tax-free holiday tips:

- The price limits above generally refer to the price-per-item cost, not your entire purchase. If the per-item limit is $100 and your entire bill for clothing comes to $250, but no one item is more than $100, you’re golden.

- Make a list of what each family member needs before you get to the store. (Check with your school to see if a grade-appropriate supply list has been posted online. If your school does not provide a list prior to the start of the school year, consider an online supply list organized by grade level.) It’s tempting to buy anything that seems like a bargain, but acquiring what you don’t need just because it’s a “deal” is the fast track to clutter.

- Set a budget for each shopping category so that you’re not tempted to go hog-wild, and consider what each of your students might need vs. what you can keep in a central home school supply area for all to share.

- Shopping with smaller children may stress you (and your kids) out, so consider trading shopping and babysitting time with a friend or split babysitter costs while you and your friend hunt for bargains together.

- Let older children participate — use it as an opportunity to practice math skills (“How much is this shirt if it’s marked as 15% off?”) and encourage them in finding good deals on high-quality products. The more responsible they are, perhaps reward them with the amount by which they came in under budget to apply toward something fun.

- Remember to keep your receipts in case you need to return something; note each retailer’s return policy. Again, this is a great opportunity to teach financial and organizing skills. Show them how you calculated your budget and checked the purchases against the bottom line. Have tweens and teens help you take note of return policy dates and file receipts pending any possible returns.

- Remember that tax-free holidays aren’t just for kids! In most cases, there’s a $100 limit on clothing and shoes for any age person. After all, a shirt a 15-year-old can wear might just as easily be worn by a 30-year-old, and there’s very little way to differentiate school supplies from office supplies. (What do you mean grownups aren’t supposed to use unicorn stickers and fuzzy troll pencil toppers?)

- I’m going to say this a second time — set a budget. And stick to it. The point of saving money is to have more of it, not to buy more of what you don’t necessarily need. Focus on needs, then surprise and delight yourself and your kids with a few wants, as well.

And as long as we’re talking about saving money, here are a few discounts of which you might want to take advantage, as long as you’re doing the back-to-school thing.

Bixbee

Nobody likes sales emails, but I have to admit it. Once I learned of Bixbee a few years ago, I became obsessed with their cool kid products, which include backbacks, lunchboxes, sleeping bags, and kids’ accessories.

Bixbee, maker of ergonomically-smart backpacks built with the anatomy of tiny humans in mind, has some products that will charm your kids (and their spines) and keep clutter at bay.

Also, if your kids’ backpacks or lunchboxes are super-cool and fun, they’re less likely to leave them on the bus, or in their gym lockers, or just lose them altogether, which means you won’t have to make duplicate purchases…which means you save money. Whoohoo!

Bixbee also has delightful luggage and duffels for ease of traveling, rain boots and T-shirts, water bottles and just a whole bunch of kid-friendly goofiness.

You didn’t ask me, but of course I have favorites, like the Sparkalicious Ruby Raspberry Butterflyer Backpack

and the Monkey Backpack and the matching Monkey Lunchbox:

Bixbee is having a back-to-school sale. Get 25% off any purchase with the code BACK2SCHOOL but hurry, because this discount code expires on Wednesday, July 27, 2022!

Bixbee is also offering free Standard Shipping (for US customers only) on all orders over $60.00 and a FREE folder and stickers with every backpack order! (Who doesn’t love stickers?)

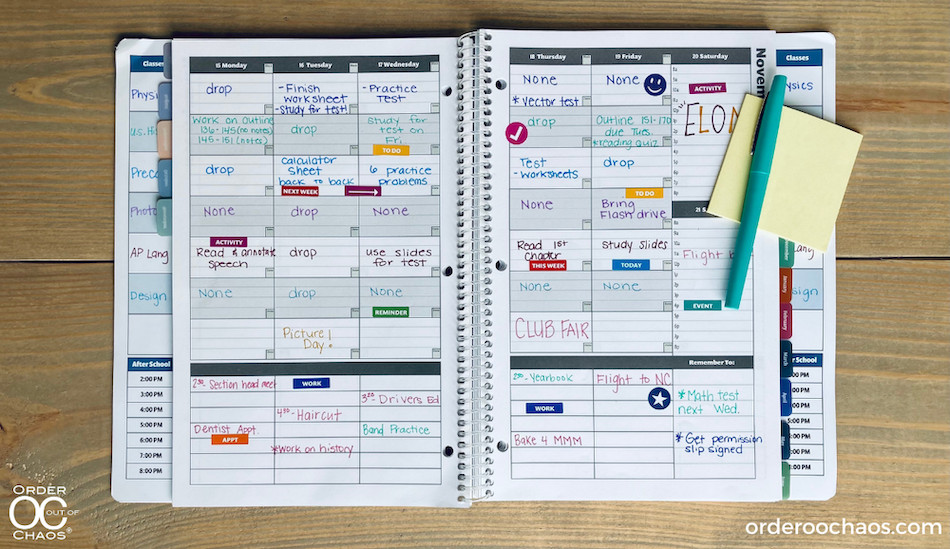

Academic Planner: A Tool for Time Management®

If you’ve been a reader of the Paper Doll blog for a while, then you know that professional organizer Leslie Josel of Order Out of Chaos, is a colleague, friend, and fellow Cornell University alum. And I love every darned thing this smarty-skirt does!

(For more about Leslie, you can read Paper Doll Peeks Behind the Curtain with Superstar Coach, Author & Speaker Leslie Josel. Go. Read. Come back. We’ll wait.)

Paper Doll with Leslie Josel, © 2017 Best Results Organizing

I’ve written many, many times about Leslie’s Academic Planner: A Tool for Time Management®. The central concept behind the planner is the need to better enable students to “see” time and all of the related obligations. If you’re brand new to the Academic Planner, you can start here:

The Academic Planner has even won the 2018, 2020, and 2022 Family Choice Award!

The spiral-bound 2022-2023 Academic Planner comes in two sizes: letter-sized planner with after-school planning (8 1/2″ x 11″) and smaller personal-sized with all-day planning (8 1/4″ x 8 1/2″), both for $19.99. Based on an academic year calendar, the planners run July through June.

The spiral-bound 2022-2023 Academic Planner comes in two sizes: letter-sized planner with after-school planning (8 1/2″ x 11″) and smaller personal-sized with all-day planning (8 1/4″ x 8 1/2″), both for $19.99. Based on an academic year calendar, the planners run July through June.

Four styles of planners in each size

The letter-sized planners with after-school planning come in LimeLight, Pretty In Pink, Blues Brothers, and WhiteOut. The interior pages measure 7” x 11”, offering up more than the typical space for writing down assignments and activities. It has 7 subject boxes and after-school planning capabilities starting at 2p.m., and is ideal for elementary, middle, and high school students and those that are virtual learning or homeschooled.

The smaller, personal-sized planner with all-day planning come in Men in Black, Purple Rain, Yellow Submarine, and AquaMan. They have 6 subject boxes and all-day planning capabilities, starting at 8:00am. These work well for high school, college, and homeschool students and even adults!

Introductory Pages

The front pages, measuring the same size as the front and rear cover of the planner, include:

- a contact information section so a lost planner can be easily returned

- a class schedule (subject, period, instructor, room #, days) to quickly acclimate students for the new year (and give a fellow student, armed with the contact info, an easy way to find the owner at the right classroom and return a lost planner)

- a Welcome Letter from Leslie to parents

- a detailed set of Planner Pointers, providing excellent guiding tips for making smart use of the planner. (My favorite? Writing “No Homework” if none was assigned so the student never has to wonder if he or she just forgot to write something down.)

- a two-page Planner Use Guide, showing the planner in action — noting assignments, reminders (“Get permission slips signed!”), after-school activities and previews for the next week

- a Study Planning Guide to help prepare for tests and quizzes

- a sample Project Planning Guide to help plan long-term assignments

- a two-page School Year at a Glance

Planner Pages

On the first and last (extra-sturdy) full-sized, the Academic Planner has a vertical index page that peeks out from behind (and to the left and right) of the actual planner pages. This index page means that students record their class subjects only once. Then everything on the upper calendar sections of the planner pages lines up with the appropriate class subjects, course by course, horizontally (with days of the week arrayed, vertically) across a two-page layout.

The next row in the smaller planner is for To-Do items by day. In the letter-sized planners, the left and right front pages provide hourly slots from 2 p.m. until 8 p.m. for students to log after school activities and obligations, like clubs, athletic practice, rehearsals, and jobs.

Other Features

- At the start of each month, there’s a left-side full-page monthly calendar with space to note major events, holidays, and vacations, and adequately plan longer-term projects.

- The right-side Notes page facing the calendar offers up ample room for planning, notes, and the kinds of serious thoughts only people between 12 and 18 can understand.

- There’s a clear poly pocket at the rear of the planner for safely keeping notes, permission slips, and other documents too small for a student’s binder.

- There are oodles of extras, like a library of printouts, downloads, videos, and “how-tos”, as well as downloadable resources like Project and Study Planning Guides, Time Trackers, Homework Checklists, Planner Pointers, Study Skills Videos.

- A bonus Academic Planner Accessories Pack (sold separately, for $10.99) includes a plastic page marker that clips into the spiral binding, so it’s easy to find the current week in the planner, a set of monthly tabs, and a really bright, sunny set of useful stickers.

Whew! That was a lot. To really do justice to the 2022-2023 Academic Planner: A Tool for Time Management®, take a detailed walk-through with Leslie herself. It’s like having a private coaching session!

Whew! That was a lot. To really do justice to the 2022-2023 Academic Planner: A Tool for Time Management®, take a detailed walk-through with Leslie herself. It’s like having a private coaching session!

And since this post is about saving money for back-to-school, use the promo code PLANNER20 at checkout to get 20% off any academic planners you purchase directly from the Order Out of Chaos website. This promo code expires September 30, 2022.

(If you prefer to order through Amazon, the 8 1/2″ x11″ planner and 8 1/2″ x 8 1/4″ planner sell for the same price.)

Enjoy your summer, but remember that a little planning and organizing now can make back-to-school shopping less costly, less stressful, and a bit more sunny!

And, just a reminder if you missed my last post, Paper Doll on Planning & Prioritizing for Leadership, we’re only one week into the free, 3-week, The Leader’s Asset interview series. You can still register and catch my interview this Wednesday, July 27, 2022.

Disclosure: Some of the links above are affiliate links, and I may get a small remuneration (at no additional cost to you) if you make a purchase after clicking through to the resulting pages. The opinions, as always, are my own. (Seriously, who else would claim them?)

Paper Doll’s 10-Minute Tasks to Make Difficult Moments Easier

Lately, I’ve been considering that it’s a bit ironic that February, the shortest month of the year, is National Time Management Month. We collectively assign the month with the fewest days to figure out how to achieve goals that would solve so many frustrations.

Wouldn’t a 31-day month be better for that?

A Necessary Caveat About “Time Management”

Time management, obviously, is a misnomer. We don’t really manage time, which is fixed. Every person gets the same 60 seconds every minute, the same 60 minutes every hour, the same 24 hours every day, and of course, 525,600 minutes in a year.

(With apologies to all of you who’d rather watch the Broadway version, linked above, than Glee‘s, but YouTube is really cracking down on music videos being played anywhere but their own platform.)

Rather, we must try to manage our attention, our energy, and our labor. Though we have the same amount of time, none of us has the exact same quality of our time, nor the same obligations.

The single, healthy, unencumbered twenty-something with a salaried office job has more (financial, as well as temporal) resources than the mom of two working multiple retail jobs, or the person going to school while taking care of an elderly parent, or the individual struggling to make it through these crazy times with a chronic illness, visible or invisible.

Often, when the media has articles on time-saving tasks, they fail to acknowledge the complexities of life. If you are beyond the juggling and are full-on struggling, we professional organizers and productivity consultants see you. And we know that when the you-know-what hits the fan, you’ve got limited energy and time to deal.

So, today’s post has ten-minute tasks (or projects that can be handled as a series of ten-minute tasks) that will make things easier for you and your family when things get “ouchie.”

Check and Update Your Beneficiaries

You don’t even have to do these all at once, though if your paperwork is already organized, it should only take you a couple minutes for each. Though the time investment is small, the ease of mind it will bring (both now, and in the future) is tremendous.

And yes, you can even consider these two separate tasks (the checking and the updating) so you can make two different checkmarks on your task list.

Pull out the file folders or head to your online accounts and check to see who you previously listed as your primary and secondary beneficiaries for any of the following you may have:

- life insurance policies

- annuities

- pension accounts

- Individual Retirement Accounts (IRAs)

- 401(k)s, 403(b)s, and other retirement accounts

- profit-sharing plans

- brokerage/investment accounts

Obviously, a beneficiary is someone who gets a benefit. When we’re looking at financial documents, beneficiaries are the people (or sometimes entities) that the account holder designates as the recipient of any assets in that account when the account holder eventually shuffles off this mortal coil. (I know, nobody likes to use the world “death” or think about it, but that’s why we have life insurance policies, wills, and similar accounts and documents — to make things easier when someone has passed away.)

“The Reading of the Will” — central to any good murder mystery

In most cases, setting a beneficiary (and usually both a primary and secondary beneficiary) is part of the required paperwork. Some states (usually “community property states”) require you to list your spouse (if you have one) as your primary beneficiary for retirement and other accounts.

You may be wondering, if you have a will, why do you need to name beneficiaries? That’s a darned good question.

The main reason is that when a person dies, a will goes through “probate,” a legal process where the court in your jurisdiction supervises all the assets in your estate getting distributed hither and yon. Depending on the situation, it can be murky and complicated, and take a long time, which is pretty miserable if your people need those funds.

However, whenever you have a beneficiary set in your insurance policies and various financial accounts, that money can go straight to your intended recipient as soon as the insurance or financial institution gets proof that you are no longer among us. That usually just amounts to a certified copy of the death certificate and some proper ID.

If you set your beneficiaries for any of these accounts several years ago, you may have picked someone no longer appropriate — parents who are no longer living (or not able to manage their own finances), former spouses or significant others, or even friends who are not part of your active life anymore.

I went through the “check the beneficiaries” process with one client who was shocked to realize that she’d never gone back to revise the beneficiary on a small 401(k) plan she’d never bothered to roll over from a job decades earlier. (Note to readers: don’t do that. Roll over your retirement accounts so you don’t have to hope your former employers have stayed solvent and managed your funds properly.)

Imagine my client’s shock when she realized that her [expletive deleted], [expletive deleted]ing [expletive] of a [expletive deleting] ex-[expletive deleted] husband was still her beneficiary! Be assured it did not take her ten full seconds, let alone minutes, to get cracking on changing that beneficiary!

Imagine my client's shock when she realized that her *expletive deleted*, *expletive deleted*ing *expletive* of a *expletive deleted*ing ex-*expletive deleted* husband was still her beneficiary! Share on XIf you never set your beneficiaries before or your want or need to change them, you’ll need a few pieces of information, like their Social Security numbers, birth dates, and contact information (like phone numbers, email addresses, and mailing addresses).

EXTRA CREDIT: Here’s a time-saver so you don’t have to go through this entire process in the future:

- Create a spreadsheet (or even a handwritten note) with the first column listing all of your account names.

- Create a column and list all of the beneficiaries as they stand now.

- Create a column entitled “as of” and list today’s date.

- Any time you acquire a new policy, add a line to this list. Any time you revise a beneficiary, revise the spreadsheet.

This way, whenever you’re not sure whether you’ve updated your beneficiary, you’ll only have to look in one place.

EXTRA, EXTRA CREDIT: Checking your beneficiaries is easy and quick. Changing/updating them should be easy, but how quickly you can accomplish it depends on whether your insurance or financial institution will let you do this all online. But making this list is definitely easy and quick.

However, to take it a step further, fancy-up this spreadsheet with another ten-minute (or so) task.

Add columns for your account number, and the name, email address, and phone number of your insurance agents and financial brokers associated with each policy or account. Create a column to explain what kind of policy or account it is. And then make sure that someone you trust, like the person who has your Power of Attorney, has a copy or can access it when/if necessary.

Put Your Emergency Contacts On Ice

“Downtown Hospital Ambulance” by sponki25 is licensed under CC BY 2.0

In the early 2000s, first responders in the UK started suggesting that people list their “In Case of Emergency” contacts as “ICE” on their cell phones to make those contacts easy to locate. The idea quickly took hold in North America.

While first responders, themselves, generally don’t have the time (or authorization) to contact someone for you, nurses and hospital staff often do need to obtain important medical information when you are not able to provide it. That’s where your contacts come in.

As cell phones got fancier, the lock screens made accessing ICE contacts more difficult, but now, even if you are not able to respond, medical personnel may be able to use your thumb print access or facial recognition to get your emergency contact info.

But there’s something else you can quickly do to make sure your emergency contacts can, um, get contacted. Add your emergency contacts to your cell phone’s lock screen.

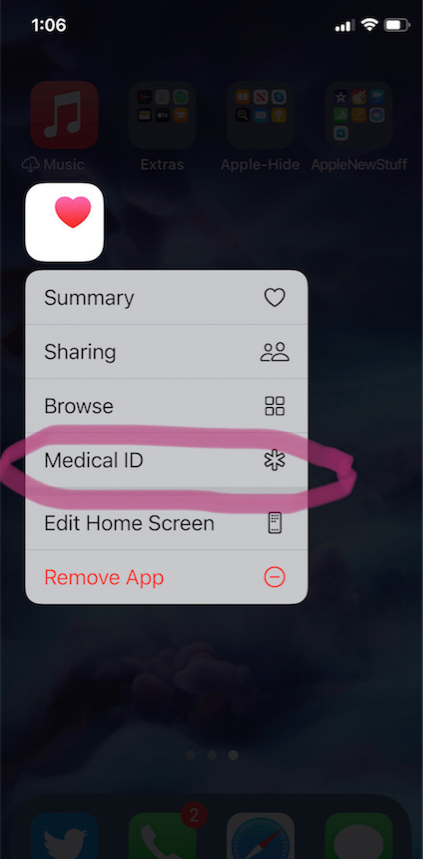

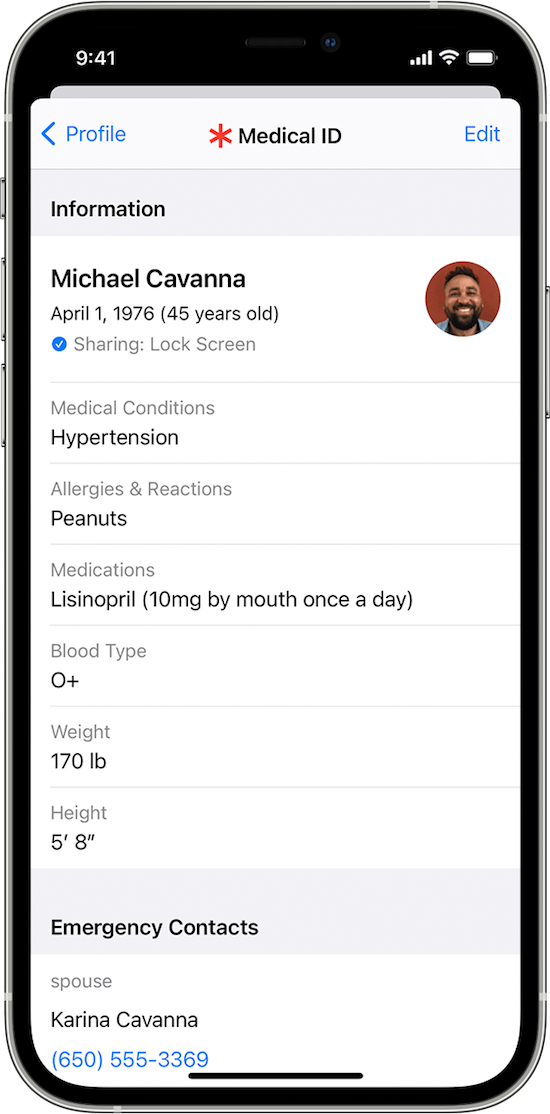

On an iPhone:

1) Go to the Medical ID screen. You can get there one of three ways:

- Long-press on the Health app icon. That will bring up a screen that looks like this:

- You can also manually open the Health App by tapping on it, then on your profile image, and then selecting Medical ID.

- Or go to Settings, then Health, then Medical ID.

2) Tap Edit.

3) Fill in all the fields that you want, but if there’s nothing significant, it’s better to type “none” than to leave it blank (so that you’re not leaving anything open to interpretation). There are fields for medical conditions, allergies, medications, blood type, weight, height, and emergency contacts. (Bingo!)

At the top, there’s an option to put in your photo. Do that; it ensures that an emergency responder can verify this is your phone.

4) Choose a name and phone number (or two names and numbers) for your Emergency Contact(s). Be sure you select names/numbers that already exist in your contacts list.

5) Scroll down to the section for Emergency Access.

6) Enable “Show When Locked” and “Share During Emergency Call.”

7) Tap “Done” at the top right corner to save your info.

Now, go look at your lock screen. You should see the word “Emergency” in the lower left corner of your iPhone. If your phone is locked and someone taps that, they can see your emergency information but nothing else.

If you don’t see the word “Emergency” there, hold down your power button (or power and volume-down buttons) as if you were going to turn off your phone and you’ll see the Medical ID access. (I guess it all depends on which version of iOS you’re using.)

For more information about the iOS Medical ID, Apple has a detailed page of instructions and explanations.

Assuming you have a photo somewhere on your phone to add in the photo field, this can usually be completed in well under 10 minutes. (The only sticking point is if someone has many medications or allergies they have to list.)

On an Android Phone

Although Android phones do not have one default health-related app, you can easily show your emergency contacts on your lock screen in one of two ways.

Method #1

- Open your Settings app.

- Tap “User & Accounts” and then select “Emergency Information.”

- Tap “Info” and then “Edit information” to enter any medical information you want to store.

- Tap “Add Contact” to add a person from your contacts list. Note, you might have to click on “Contacts” first to be presented with the list

Method #2

Android phones will let owners put any message directly on the lock screen.

- Open your Settings app.

- Tap “Security & Location.”

- Tap “Settings” next to “Screen lock.”

- Tap “Lock screen message.”

- Type your primary emergency contact (and, if applicable, any medical conditions). You could type, “In Emergency, call Lin-Manuel Miranda” and his number. What? Can you think of someone more comforting to have around in an emergency? OK, maybe Stanley Tucci. Or Paper Mommy.

- Tap “Save.”

After you’ve set this up, your ICE information can be found by swiping upward on the lock screen and tapping EMERGENCY and then “Emergency information.”

Do An Inventory of Your Essential Documents

An emergency is the worst time to realize you have no idea where your important documents are. Do you know which of these documents you have and where you can find them?

- Birth Certificate

- Social Security card

- Marriage License and Certificate

- Divorce Degree

- Military Separation Papers

- Death Certificate

- Passport

- Durable Power of Attorney for Finances

- Healthcare Proxy or Durable Power of Attorney for Healthcare

- Living Will or Advanced Medical Directive

- Last Will and Testament

- Digital Will

- Driver’s License

- Voter Registration card

- Vaccination Record

- COVID Vaccinate Card

- Professional license(s)

- Other licenses

As with the beneficiaries section above, a great way to save time is to make a list (think of it as a treasure map) of where each of these documents are located. Use Excel or a Google spreadsheet and take note of what the document is and where it’s located (e.g., your family filing system, fireproof safe, safe deposit box, wallet, etc.).

EXTRA CREDIT: For good measure, for your passport, driver’s license, and any other licenses, take note of the expiration date.

And then for really good measure, put a reminder task in your phone to alert you one month before your any of these items expire to make sure you address renewals. (Give yourself a longer lead-time to renew your passport; also, as you’ve probably not been traveling out of the country in the last two years, you should check to make sure your passport hasn’t already expired.)

If you have a lot of documents, just do a few every day and you’ll be amazed at what a few ten-minute tasks can do to put your mind at ease.

EXTRA, EXTRA CREDIT: The Paper Doll archive has extensive information about what documents you should have and what to do if they’re missing. These posts are a great place to start.

How to Replace and Organize 7 Essential Government Documents

How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Protect and Organize Your COVID Vaccination Card

Paper Doll acknowledges that I write longer-than-typical blog posts. Feel free to consider reading each one to be a 10-minute task. But the knowledge you gain will contribute to your ability to use your time more efficiently. Because, the more you know, the better prepared you are for any eventuality.

Snap Some Photos to Take Key Information With You

Unlike the vital documents listed in the prior section, there are some pieces of information you are more likely to lack at the most inconvenient times.

Toy car accident image by Andrea Closier on Pixabay

For example, if you have an auto accident and the police or first responders won’t let you get back into your car for safety reasons, you wouldn’t be able to get your auto registration and car insurance paperwork out of your car. Yes, you’d have it at home, but that would slow everything down.

Or perhaps you need to fill a prescription at a different pharmacy from usual, perhaps when you’re on vacation, and they don’t already have your pharmaceutical company discount card on record.

Or maybe you’re unexpectedly with your spouse or child or senior parent in the emergency room, and the physicians want to know what medications, at what dosages, prescribed by what healthcare providers, the patient is taking. If that information is pinned to the fridge at home, but you came directly to the ER from somewhere else, that’s frustrating.

This is where the magic of modern cell phones (which we usually bemoan for the time they steal from us) comes in handy. Consider any of the following:

- auto registration form

- auto insurance card

- health insurance card

- homeowner’s insurance card

- pharmaceutical company discount cards

- handwritten instructions of how to get to a room or office you visit infrequently

- a list of the size/type of batteries and light bulbs you use for which items in your home so that you never again have to unscrew a light bulb just to know what voltage and whether you want a skinny-base or a fat-base bulb)

- etc., for whatever is important in your life.

You could snap all of these as photographs and store them in a photo album in your phone’s photo section. Name it “Remember” or “Vital” or whatever will catch your eye.

If you want to go to the effort of scanning the document and sending it to your phone, that’s fine, but iOS has created an easy option using the Notes app.

- Open a new or existing note.

- Tap the cute little camera icon.

- Tap “Scan Documents.”

- Focus your document, card, medicine label or whatever within your camera’s viewing area.

- Then you have two options:

- Let the auto-capture work its magic as the item comes into the viewfinder and auto-focuses, or

- Click the shutter button (or one of the volume buttons) to capture the scan

- Drag the corners of the scan to do any necessary adjustments.

- Tap “Keep Scan.”

- Scan more fiddly stuff to keep it handy or tape Save if you’re done.

From here, you can save the scan in your Notes or Files app in your phone itself, or upload it to a synced app, like Dropbox or Evernote:

As an all-Apple user, I don’t have an Android-specific scanning suggestion; if you do, please add your voice in the comments.

The next time a new insurance card or other piece of important information comes your way, take a snapshot or scan to ensure you’ll have whatever you might need when you are out and about.

As I often say, organizing can’t prevent all catastrophes, but it can make many of them less catastrophic. I hope these various ten(ish)-minute tasks will help ease many of the ickier moments in life for you.

Organize To Pay Your Bills On Time

Photo by Leone Venter on Unsplash

After I wrote Ask Paper Doll: Should I Organize My Space and Time with Color? last week, I got to thinking about how color relates to finance, at least in terms of expressions.

Even though black usually signifies something dire, if you’re “in the black,” it means that you’ve got a net positive income, while finances that are “in the red” are considered bleak, signifying debt greater than revenue.

When you’re “in the pink” you’re in good health, financially or otherwise. And, although it would seem to make more sense that being “in the green” would mean you were flush with money, English lacks that expression. And I’ve learned that in Italian, “Sono al verde,” which literally translates as “I am at the green” means “I’m broke.” Language is funny.

You know what’s not funny? Late payments. Fines for late payments. Increased interest rates because of late payments. Lower FICO scores because of a history of late payments!

During consultations with new organizing clients, people often express frustration over difficulty paying their bills on time. Generally, it’s not that they lack the funds, but that their bill-paying systems get out of whack and fail to fit into their already overstuffed, overburdened schedules. Today, we’re going to look at strategies to get bills paid on time.

BEYOND THE BUDGET: KNOW THE WHO, WHAT, WHEN, WHERE, AND WHY

You might expect that I’d bring up the topic of a budget. Certainly, knowing all of your financial obligations is important to a smoothly-run financial life. As Charles Dickens said,

Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.

Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery. ~ Charles Dickens Share on XIn order to pay your bills on time, it’s essential to know when they are due, and (if applicable) how that relates to when your income will arrive.

Make a chart of all of your creditors and bills. It’s best to do this on a spreadsheet, like Excel or Google Sheets so you can update the chart over time.

- Note when bills are due. Usually, you have three kinds of bills:

- Bills that are due on or around the same date every month (like rent/mortgage, health insurance, utility/cable/internet bills, credit card bills, etc.)

- Bills that are due on a regular cycle but not every month. They may arrive quarterly, like water bills, auto, renter’s, or homeowner’s insurance premiums, or tuition bills, or annually, like professional dues, memberships, or auto registration renewals.

- Bills that a have no regular cycle. These may be one-off bills, like occasional department store credit card purchases or service providers who bill at their convenience, sometimes after you’ve long forgotten about the expense.

- List the amounts or ranges of your regular bills.

- Some of your bills will have the same dollar amount every month, like health insurance or your cell phone bill, because they are regulated by a contract. (These are the ones that for which it is easiest to set up automated payments.)

- Other bills will vary by month due to different usage or consumption, like electric bills or credit card statements.

- List the amounts or ranges of your regular bills.

- Learn and list the penalty of paying late! — My office landline (yes, I said land line!) payment is due on the 28th of the month, but there’s a grace period until the 8th of the following month, at which point the extra fee is about $3. No biggie. However, the average late fee for U.S. credit cards is $36, and that doesn’t take into account that late payments can trigger higher interest rates. If your credit card balance includes a 0% balance transfer, you could lose that rate if you make even one late payment. Oh, and late payments can also wreck your FICO score.

Photo credit: Simon Cunningham under Creative Commons CC By 4.0 Deed

- Make a column for each month of the year so you can mark when you’ve made a payment. This way, you’ll regularly see your progress and recognize when a payment hasn’t been made.

Yes, this sounds like homework, and you may be thinking that if you had the time to do homework in the first place, you’d be able to pay your bills on time.

However, having a sense of how many bills you have, in what amounts, due when, and with what penalty for paying late, can make all the difference in getting your finances in order.

PICK YOUR BILL-PAYING STYLE

No one bill-paying system is necessarily better than the others, but picking a method that works for you will help you stay committed to the process.

Pay Bills the Day They “Arrive”

This simple strategy requires the least amount of advanced planning and you’ll never have to worry that procrastination will lead to late fees.

If you get your bills by mail:

Bring in the mail every day, open the envelopes, toss out extraneous junk and “shiny” advertising material, and pay your bills immediately. Done! (Now log that you’ve paid it on the chart.) People rarely have more than a few bills each day, and if you get in the habit of doing this diligently, it’ll take only a few minutes out of your daily schedule.

Photo by Abstrakt Xxcellence Studios from Pexels

If you have opted out of paper bills:

Open your email every day, log in (to either your bank’s bill-pay site/app, or the account’s website), pay your bill, and log that you’ve done it. Bing, bang, boom!

Paying bills the day they arrive saves time (because it’s easy to complete quickly), eliminates anxiety regarding whether you may forget to pay, and helps you stick to your budget. If you pay for all of the things for which you have already obligated yourself, you’re less likely to spend on wants before needs.

This is the easiest system, but it’s also the least-often used.

Some people avoid this option because they lack the funds to pay each bill on the day it arrives. If our two biggest bills (for example, mortgage and insurance) arrived on the same day, it might wipe out (or even exceed) our checking account balances. So, there may be a practical reason to skip this method.

But there are far more common reasons why people don’t pay their bills as they arrive.

For some, there are psychological or philosophical obstacles to using this strategy. They may think, for example:

“I’m not going to pay this bill until right before it’s due. They don’t deserve my money one minute earlier than necessary!” [Insert your own “harrumph” as necessary.]

We see this most often when someone wants to avoid paying a credit card bill before the due date. People are fine paying for their electricity or health insurance, because they see that they’re getting the benefit already, so payment feels “fair.” But with credit cards, it’s common to forget that payment was actually due upon purchase; the cards simply shifted the time frame. People forget that a credit card bill is actually an IOU, the debt having been incurred in the past.

If you struggle with this philosophy, there’s still a way to pay bills as they arrive to prevent late payments.

If you pay bills online, log in now but schedule each payment for a day or two before it’s due. (Waiting until the day it’s due can cause holiday/weekend kerfuffles.)

If you pay by check, write out the checks, but put them in your tickler file (see below) or clip them to the calendar page of the date when you’re comfortable mailing them so only that final step remains.

“I don’t like paying my bills in dribs and drabs. I want to pay them all at once.”

This is similar to not wanting to hang up one shirt, or not wanting to file each piece of paper as you finish with it, or not wanting to wash each dish (or put it in the dishwasher) when done eating. It makes sense…until you find yourself with a backlog.

Sure, there’s something to be said for flow, doing a large project once and pushing through it to give your the satisfaction of completing a major task. However, the more we let our clothes pile up on the exercise machine, the more we let our filing pile up in the office, and the more we let the dishes pile up in the sink, the more of a behemoth the task seems, and the more likely we are to procrastinate altogether.

The downside of procrastinating on those tasks are wrinkled clothes, messy offices, and dried-on kitchen yuckiness. The downside of procrastinating on bill-paying? Late fees, increased interest rates, and lowered FICO scores.

Tickle Yourself Organized

If you don’t do something immediately, you have to do it later. Sadly, that’s just one of the laws of physics, that we can’t go back in time. (That said, if you find yourself with a time machine or TARDIS, please let Paper Doll know. I have some experiments I’d like to try.)

Later requires a system, and a system requires both geographic and behavioral changes from what you’ve been doing thus far.

Photo by Nataliya Vaitkevich from Pexels

Geographically, you need a bill-paying center with the following tools:

- Tickler file, or at least a bill-paying folder

- Letter opener (to avoid paper cuts and add pizzazz to opening envelopes)

- Calculator or calculator app

- Pencil and scrap paper (if you have an untenable relationship with calculators)

- Envelopes

- Stamps

- Return address labels

- Non-washable gel-ink pens (to deter identity theft and fraud) to write out checks OR a printer if you prefer computer-generated checks

This assumes you’re getting your bills in the mail and paying them by check. If you’re paying them digitally, you can skip the envelopes, stamps, and return address labels.

The behavioral process is similar to the pay-upon-arrival system. Show up for mail call. (Seriously, I want you to open your mail every day. But if you absolutely won’t, at least put all of your mail in one spot, near your bill-paying area, and commit to opening ALL the mail at least once per a week.)

Open the envelopes, toss out the glossy advertising inserts, and if you pay online, toss the envelopes, too. Even if you’re not going to pay right away, process each bill immediately to keep it from ending up on top of the microwave or mixed in with your third grader’s math homework.

Eyeball each statement to review the charges, note any unexplained fees, and check for new policies and/or errors. (The sooner you catch a billing error or a policy change you don’t like, the easier it is to address.)

Circle or highlight the payment due date. Then figure out how far ahead you want to pay the bill. Take a glance at the calendar to make sure there are no weekends or federal holidays that might cause delivery obstacles.

If the due date is consistently inconvenient (because of when you get paid, or when lots of other bills are due), ask the vendor to change the date to a more convenient one. Many credit cards let you change your due date from inside the account profile.

Once you’ve opened each bill and figured out when you want to pay it, arrange them in chronological order by due date with the one due soonest on top. You can stop here and just tuck the stack in a folder, but longtime readers know that I encourage you to use a tickler file.

I used to tell folks to put the bills in slots at least 7 days in advance of when they’re due, but with the change in postal service delivery speeds, I encourage mailing at least ten days in advance or paying online. Or, make it even easier on yourself and only pay bills one day per week (like Tuesdays), and then just pick a pay date that’s two Tuesdays (or whichever) prior to the due date.

6 Steps to Ease Your Way Into Organizing the New Year

Happy New Year! Paper Doll knows that the first week of any new year (let alone after the year we’ve just escaped), can be daunting. Instead of weighing you down with homework, how about we set you up for success with some simple strategies that will ease you into a more organized approach to this year? Deal?

START WITH BABY STEPS

When it comes to clutter, it’s not the space it takes up in your house, it’s the dent it puts in your life!

When it comes to clutter, it's not the space it takes up in your house, it's the dent it puts in your life! Share on XIf you’re late every day because you can’t find your keys or your kids can’t find their homework, that’s a much bigger deal than a cluttered guest room closet or piles of old birthday party photos that haven’t been scrapbooked. (Need I explain to younger readers that photos used to be on paper?)

Focus on your biggest daily stressors, break them down into small, actionable steps, and solve those first.

For example, each night after dinner, sort through and declutter one kitchen drawer. When you change for bed, flip through five hangers to see what’s ready to depart. Put a table near the door for the daily launch pad of essential items you need to take with you. Hang a key hook and charging station there and make it a nighttime ritual with your kids to check that everything you’ll need the next day is there.

Don’t even know where to start? Try some of these easy options to organize your finances, your health, and your life – no heavy lifting required:

- Make a tax prep folder. Just grab a folder, label it Tax Prep 2020, and as documents start trickling in this month, you’ll at least have some place to stow them. (Don’t know what to watch for? Read last year’s Paper Doll Says the Tax Man Cometh: Organize Your Tax Forms to get a head start.)

If you want to get a little more advanced, consider Smead’s All-in-One Income Tax Organizer.

- Flip through your new 2021 planner or your digital calendar to see what medical appointments are already scheduled. Make a list of all the doctor’s appointments that you need — family doctor/GP, pediatrician, dentist and orthodontist, ophthalmologist and/or optometrist, OB/GYN, and any specialists, as appropriate.

Check all those appointment cards at the bottom of your bag or thrown in the junk drawer to make sure you’ve scheduled them on your calendar. Then pick up the phone and make all the other appointments now. (Going forward, always schedule your next appointment before you leave their offices. See if you can make one day a week, like Mondays, your “appointment” day so that you’ll get it out of the way early in any week.

- Look through your wallet and VIP files to see what needs to be renewed — driver’s license, car registration, passport, etc. Instead of marking just the expiration date, make notations on your calendar to handle renewals enough in advance so nothing falls through the cracks.

GIVE UP TOLERATING WHAT BRINGS YOU DOWN

Last summer, in Organize Away Frustration: Practice the Only Good Kind of Intolerance, we talked about this at length. Take notice of the things that annoy you, whether it’s a closet too cluttered that you can’t close the door, a light fixture that keeps flickering, or a cable bill that should be renegotiated with a gentle threat to cut the cord. If something doesn’t bring you closer to the life you want to be living, make this the year you let it go. Don’t tolerate what doesn’t delight you.

Do a brain dump. Think of a brain dump as mental hygiene, like the cognitive equivalent of brushing your teeth. Ever have the taste of garlic or fish in your mouth after dinner, such that you couldn’t really enjoy your dessert? A brain dump, where you get everything out of your head and onto paper, let’s you stop thinking of things and start thinking about them, in context. Taste your life!

Try to make a list of everything that you know you have to do in order to stop being frustrated. Go room to room and write down what you need to address. (If you’re the kind of person who really needs categories, you can create columns for things that are free or only require your own effort vs. things that require payment.)

Once you have the list, you can start working through what are immediate priorities, what’s worth scheduling, and what can go on the “I’ll do it if I’m so bored it’s between doing this task or watching paint try” list.

Feel free to tackle the tasks in any order you choose, but come up with a plan. Easiest-to-hardest helps you gain confidence; hardest-to-easiest makes everything less stressful because you’ve tackled the most difficult item first. Doing the free tasks first gives you time to budget for the more costly ones, but if you can purchase freedom from a frustration, it’ll release mental energy for other tasks.

STOP USING CLUTTER AS A TO-DO LIST

- Are you keeping a holiday gift on the dining table so you’ll remember to write a thank you note?

- Do you have boxes of donations in the middle of the hall to prompt you deliver them?

- Are you keeping a receipt to remind you to get someone to pay you back for their half of a gift (or to remind yourself to pay them back)?

- Is your unopened electric bill sitting out to remind you to pay it?

- Do you have months’ old email in your inbox hoping that keeping it there will push you to reply?

How’s that working for you? Instead, follow these steps.

- Clear your desk or a space at your kitchen or dining room table to give yourself work space.

- Take five minutes and look around the room you’re in. What do you see that’s out of place because you’re (intentionally or otherwise) using it to prompt you to do something?

- Grab a notebook and for each thing that’s in the wrong place, write down what you should be doing, instead. Yes, this gives you a To Do list that will stare you in the face (but we’ll get to that).

- Put the item away so that it’s no longer clutter.

- DO THE THING!

©2010 Allie Brosh, Hyperbole and a Half, via MemeGenerator

Let’s see how this works. Unpack and put away the holiday gift and go grab a notecard, envelope, return address label and stamp. Put it down on your cleared desk space.

Now, here’s the first tricky part. You can either write out the thank you note right now (check out my Gratitude, Mr. Rogers, and How To Organize A Thank You Note for guidance) and then you won’t use all your mental energy procrastinating about it, or you can put it on your To Do list. If you write the note now, you can put it on your To Do list and check it off your list, all at once, giving you an immediate sense of accomplishment! Whoohoo!

Repeat the process. Carry the donation boxes to your car, then eyeball your calendar to figure out when you can deliver the donations. Schedule the task, delegate it to a family member, or use GiveBackBox to schedule a free pickup.

And again! Use your favorite app, like Zelle, CashApp, Paypal (or ugh, fine, Venmo) to pay or request money and either file or shred the receipt as necessary. Pay the electric bill. Reply to the email or declare bankruptcy on it.

FOLLOW THE ICE CREAM RULE

So maybe your clutter is there because you don’t know where else to put it.

I tell my clients, “Don’t put things down, put them away.” By “away,” we assume you’ve already got a location in mind. Good organizing systems have two parts: the where & the how. If you bring home a bag with three items, ice cream, toilet paper, and breakfast cereal, I’m pretty sure you’re going to put the ice cream away in the freezer first (and immediately) to keep from having a melted, sticky mess. The freezer is the “where” but putting the ice cream away first is the “how.” It’s so innate, you don’t even think about.

Clutter comes from deferring that decision making. With ice cream, you don’t even have to stop and think; it’s instinct built from life-long experience. With everything else entering your home (whether a purchase, a gift, or a freebie), decide on a home before you buy or bring it in. Once it’s in your space, build time into your calendar for how/when you’ll deal with maintaining it or getting it back to where it lives.

Do you bristle at the idea of planning when you’ll do things? Maybe you feel like scheduling things belongs in the category of “budgets” and “diets” — it’s about The Man trying to keep you down!

The thing is, if you’re organized, you probably already have a system and your system feels like a safety net rather than a suffocating obligation. If you’re NOT organized, you’ll just have to trust that a system – a plan, if you will – makes life more organized so you don’t have to keep thinking about these things.

What are the triggers in your system? When will you do laundry: when the laundry basket is full or when it’s Tuesday morning after breakfast? When will you file financial papers? When your in-box is overflowing, or when your computer dings to tell you it’s 11:45a on Wednesday?

Remember: “Someday” is not a day on the calendar. Until something is innate, having an auditory or visual trigger (or both) will help remind you where and when to put things away.

REMEMBER THAT EVERYTHING SHOULD HAVE A HOME…BUT NOT EVERYTHING HAS TO LIVE WITH YOU

Systems are important, but don’t forget a universal truth: not everything you own needs to stay in your orbit forever.

Give what is no longer age-, size-, or lifestyle-appropriate new life via charity or consignment. Let it be a blessing to someone else.

Give what is no longer age-, size-, or lifestyle-appropriate new life via charity or consignment. Let it be a blessing to someone else. Share on XIf it’s broken and you’re not willing to spend the time or money to repair it, let it go. If you have an emotional attachment to something that’s broken, outdated, or takes up too much space to keep, take a photo of you holding it or wearing it. Then set it free!

Setting up a donation station in your home is as easy as putting a box or plastic tub in your utility room, mudroom, or garage. When you’re doing laundry or sorting through toys in the playroom, if it doesn’t fit your life, take it to the donation box right away. When the box is full, log the contents (if you’ll be taking a deduction), and send it to your favorite non-profit. Don’t wait until you have lots of boxes – one box of useful items or clothes, sent on its way, is more useful to others than mountains of boxes that never make it out of your home.

Are your file folders bulging? Do I Have To Keep This Piece of Paper? gives you a clear idea of what you need to keep and for how long. The rest? Shred and send on its way! Buh-bye!

FOLLOW THE BUDDY SYSTEM

Getting your space, time, and priorities in order can be overwhelming, but you don’t have to go it alone. For accountability and support in reaching your organizing goals, buddy up with:

- Your spouse – Trade the chore you hate (unloading the dishwasher) for the one that annoys your spouse (folding laundry) and you’re each less likely to procrastinate.

- Your kids – Make organizing a game – play Beat the Clock with your kids to see who can collect the most things that don’t belong in the living room before the song ends, and then work together to put the items away.

- Friends – Make organizing social, even when you can’t get together. Text “fashion show” photos or do a Zoom call as you organize your closets. (Friend-of-the-blog Nancy Haworth of OnTask Organizing and I did this last week! I got rid of big-shoulder-pad 80s-style blazers and she jettisoned clothes that pre-dated her strong, lithe, “certified exercise instructor” shoulders!)

- A professional organizer – As a Certified Professional Organizer®, I know how much my clients get out of having someone who knows the ropes guide them in making solid decisions and developing systems to surmount those challenging obstacles. Find a professional organizer near you by using the search function for the National Association of Productivity and Organizing Professionals (NAPO).

Speaking of which, it’s January, so that means it’s GO (Get Organized and Be Productive) Month! It’s the perfect time to focus on making your life run the way you want it to. Happy New Year, Happy GO Month, and just plain…be happy!

Back-to-School Organizing News You Can Use: 3 Solutions to Save Time, Money, and Serenity

Wait, it was just Independence Day! Why are we talking about back-to-school organizing? In ye olden days, when I grew up in Buffalo, New York, where kids still don’t go back to school until after Labor Day, talking about back-to-school so soon after the 4th of July would be like stores putting up Christmas decorations right after Halloween. (Oh…right.)

But there’s a method to the madness. In many parts of the country, students go back to school in the middle of the summer. In my county in Tennessee, the public schools start on August 3rd, and mere miles from me in Georgia, students go back on the first of August. But even for kids going back to school in September, that’s only about eight weeks from now. Instead of rushing to get everything done, here’s a roundup of ways to organize your approach to the back-to-school season.

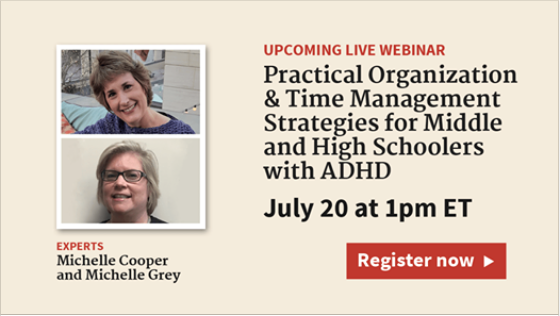

ORGANIZE YOUR ADHD STUDENT – FREE WEBINAR

Paper Doll‘s colleagues (and longtime friends), Michelle Cooper and Michelle Grey of Student Organizers of Atlanta will be presenting a free, live webinar entitled Practical Organization and Time Management Strategies for Middle and High Schoolers with ADHD on July 20, 2017, at 1 p.m. ET.

Presented as part of ADDitude Magazine‘s ongoing webinar series, the webinar will provide strategies for:

- Managing the day-to-day organizational challenges facing students both inside and outside of the classroom

- Understanding your child’s “thinking style” and finding organizing methods and tools that fit his or her style

- Using organizational systems that will improve his or her chances of academic success

- Collaborating with your child and the teachers to support his or her efforts at organization

- Using products, books, and websites to ease the process of organization for your student

Register for the webinar and take it live, or you can use the replay link to watch (or rewatch) the webinar for free, any time up through next January 20, 2018.

Learn more about ADDitude and check out the other webinars in the series. If your child is heading to college, both of you might want to watch the webinar on July 11, 2017, entitled The College Transition Guide for Teens with ADHD.

ORGANIZE YOUR FINANCES – TAX-FREE HOLIDAYS

Over the four weekends from July 21 through August 13, sixteen states will be having tax-free holiday weekends. In general, these states allow retailers to sell clothing and footwear, school supplies, computers, and sometimes backpacks, books, and other “tangible personal property” without charging sales tax. In my state, that’s a savings of 9.25%. Combine that with various 10%-25%-off sales, and that’s a great opportunity to stock up on necessities.

Note: Some states, such as Georgia, have discontinued their tax-free holidays, so be sure to check out states adjacent to yours.

Click on the name of your nearest state to be directed to that state’s official tax-free holiday page.

Alabama (July 21-23, 2017)

Tax-free: Clothing (up to $100), Computers (up to $750), School supplies (up to $50), Books (up to $30)

Arkansas (August 5-6, 2017)

Tax-free: Clothing and footwear (up to $100), Clothing accessories and equipment (up to $50), School and academic art supplies (no dollar limit)

Connecticut (August 20-26, 2017)

Tax-free: Clothing and footwear (up to $100)

Florida (August 4-6, 2017)

Tax-free: Clothing, footwear, wallets, and bags (up to $60), School supplies (up to $15/item), Computers (up to $750)

Iowa (August 4-5, 2017)

Tax-free: Clothing and footwear (up to $100)

Louisiana (August 4-5, 2017)

Tax-free: Tangible Personal Property (3% tax rate up to $2,500; a 2% state sales tax exemption applies, so qualified purchases are subject to only 3% state sales tax)

Maryland (August 13-19, 2017)

Tax-free: Clothing & footwear (up to $100)

Mississippi (July 28-29, 2017)

Tax-free: Clothing & footwear (up to $100)

Missouri (August 4-6, 2017)

Tax-free: Clothing (up to $100), Computers/peripherals (up to $1,500), Software (up to $350), Graphing calculators (up to $150), School supplies (up to $50)

New Mexico (August 4-6, 2017)

Tax-free: Clothing and footwear (up to $100), Computers, tablets, and e-readers (up to $1,000), Computer equipment (up to $500), Book bags and backpacks (up to $100 per item), maps and globes (up to $100 per item), Calculators (up to $200), School supplies (up to $30)

Ohio (August 4-6, 2017)

Tax-free: Clothing (up to $75), School supplies (up to $20)

Oklahoma (August 4-6, 2017)

Tax-free: Clothing and footwear (up to $100)

South Carolina (August 4-6, 2017)

Tax-free: Clothing (no limit) School supplies (no limit), Computers, printers, peripherals, and software (no limit)

Tennessee (July 28-30, 2017)

Tax-free: Clothing (up to $100), School and art supplies (up to $100), Computers (up to $1,500)

Texas (August 11-13, 2017)

Tax-free: Clothing, backpacks and school supplies (up to $100)

Virginia (August 4-6, 2017)

Tax-free: Clothing (up to $100), School supplies (up to $20), Energy Star products (up to $2,500) and a variety of hurricane-preparedness items.

Tax-free holiday tips:

- The price limits generally refer to the price-per-item cost, not your entire purchase. However, if a store is placing limits on entire purchases and you have a large family, you might want to have your older, more responsible children stand in line and pay with cash.

- Make a list of what each child needs before you get to the store. (Check with your school to see if a grade-appropriate list has been posted online.) It’s tempting to buy anything that seems like a bargain, but acquiring what you don’t need just because it’s a “deal” is the fast track to clutter.

- Set a budget for each shopping category.

- Shopping with smaller children will stress you (and your kids) out, so consider trading shopping and babysitting time with a friend or split babysitter costs while you and your friend hunt for bargains together. Let older children participate – use it as an opportunity to practice math skills (“How much is this shirt if it’s marked as 15% off?”) and encourage them in finding good deals on high-quality products. The more responsible they are, consider rewarding them with the amount by which they came in under budget to apply toward something fun.

- Remember to keep your receipts in case you find that you need to return something; note each retailer’s return policy.

ORGANIZE YOUR STUDENT’S SCHEDULE – A NEW KIND OF PLANNER

As mentioned a few weeks back when I was talking about Time Timer, many people, especially students, can have trouble mastering the concept of the passing of time, which makes it difficult to properly plan academic and life tasks. When I was in middle and high school, almost nobody used a planner or a calendar. These were the days when Trapper Keepers were the height of organizational technology and pocket-sized assignment notebooks yielded the best option for academic time management. Somewhere during the <mumble mumble> intervening decades, schools started providing and/or requiring student planners to help keep up with homework assignments, projects, and tests.

These planners give students the opportunity to mark down what they must do. It’s not clear, however, that students get the time management skills and system-training they need to master the intricacies of juggling academics, extracurriculars, part-time jobs, and familial obligations, or learn when to complete it all. That’s where Leslie Josel comes in.

Professional organizer Leslie Josel of Order Out of Chaos, is not just a colleague and friend; she’s also a fellow Cornell University alum, so when I first heard about her product line for students, I paid particular attention.

Paper Doll with Leslie Josel, © 2017 Best Results Organizing

At first, Leslie’s organizing practice concentrated on working with chronically disorganized clients, people with ADHD, students with learning challenges, and clients with hoarding behaviors. Eventually, (like Michelle and Michelle, above), she expanded her offerings to include coaching services for both students and parents. In 2016, Leslie expanded her company’s product division and officially launched Products Designed With Students in Mind.

Leslie’s big idea was the Academic Planner: A Tool for Time Management®. The 2017-2018 Academic Planner comes in two sizes: letter-sized (8 1/2″ x 11″) and personal-sized (8 1/4″ x 8 1/2″), both for $18.99. Based on an academic year calendar, the planners run July through June. They’re spiral bound, but also three-hole punched to allow students to pop them right into their binders.

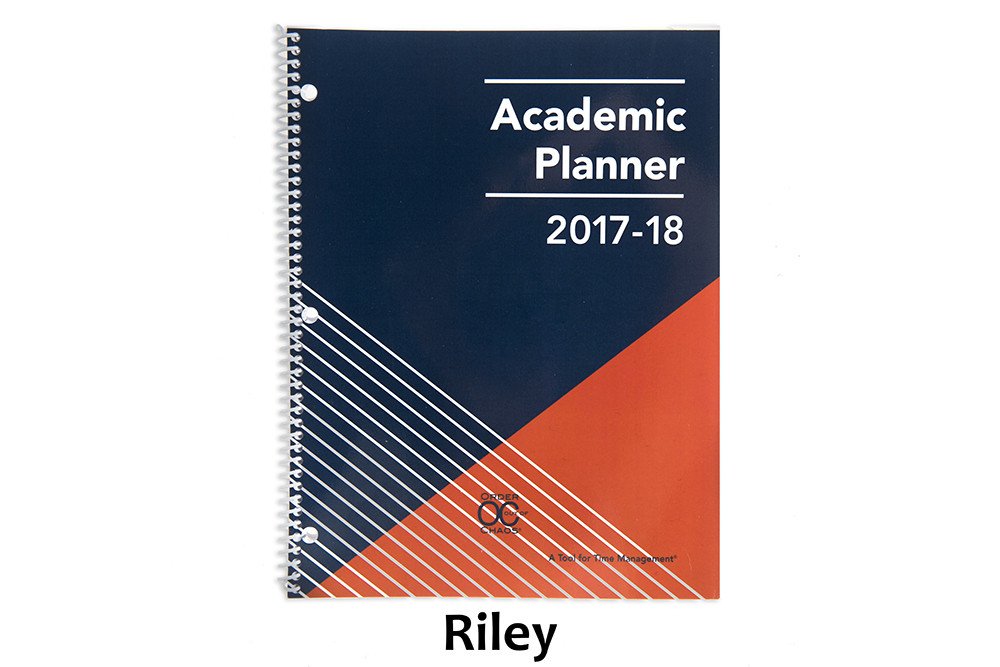

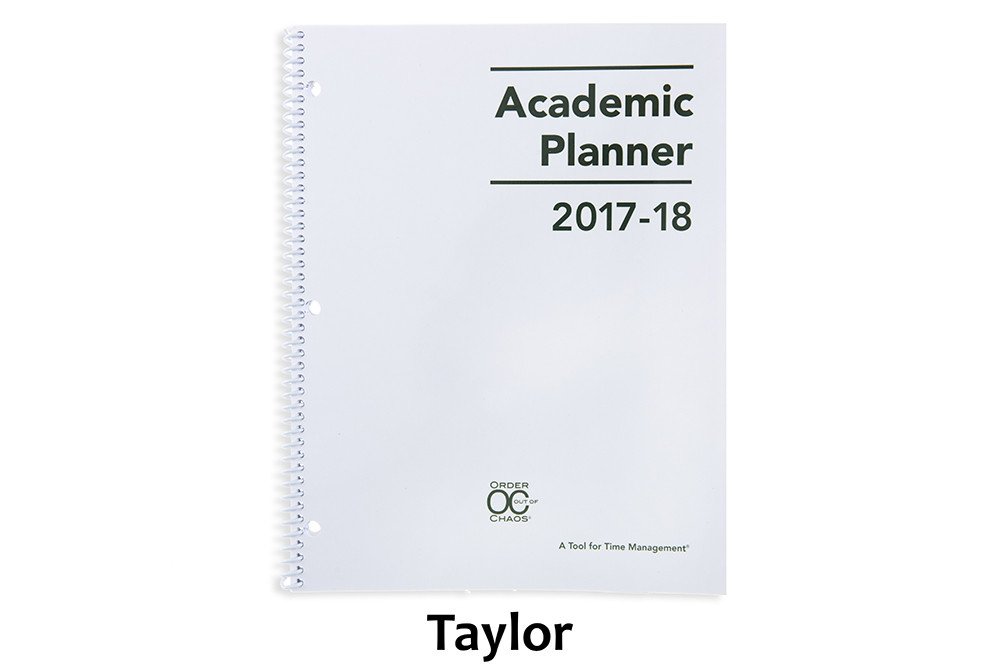

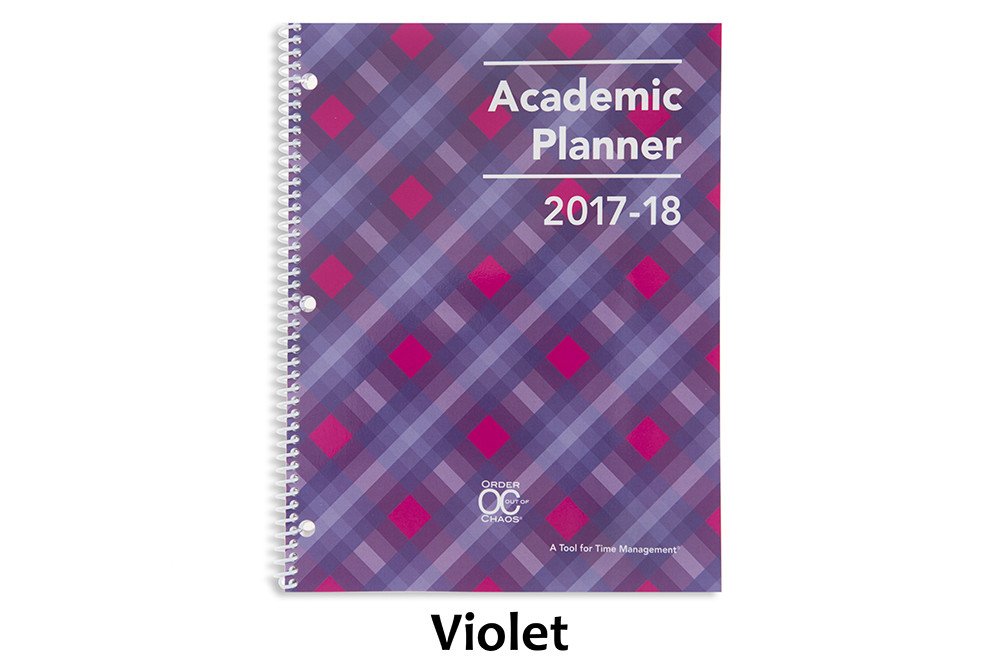

Each size is available in four styles of planners: Jamie (black), Riley (orange/blue), Taylor (white) and Paper Doll‘s personal favorite, Violet (pink/purple). The interior pages measure 7” x 11”, offering up more than the typical space for writing down assignments and activities.

Introductory Pages

The front pages, measuring the same size as the front and rear cover of the planner, include:

- a contact information section so a lost planner can be easily returned

- a class schedule (subject, period, instructor, room #, days) to quickly acclimate students for the new year (and give a fellow student, armed with the contact info, an easy way to find the owner at the right classroom and return a lost planner)

- a Welcome Letter from Leslie to parents

- a detailed set of Planner Pointers, providing excellent guiding tips for making smart use of the planner. (My favorite? Writing “No Homework” if none was assigned so the student never has to wonder if he or she just forgot to write something down.)

- a two-page Planner Use Guide, showing the planner in action — noting assignments, reminders (“Get permission slips signed!”), after-school activities and previews for the next week

- Homework Helpers, tips that could only come from a professional organizer experienced with helping students gain control of their work.

- a sample Project Planning Guide to help plan long-term assignments (Students can download more guides for future projects.)

- a two-page School Year at a Glance

Planner Pages

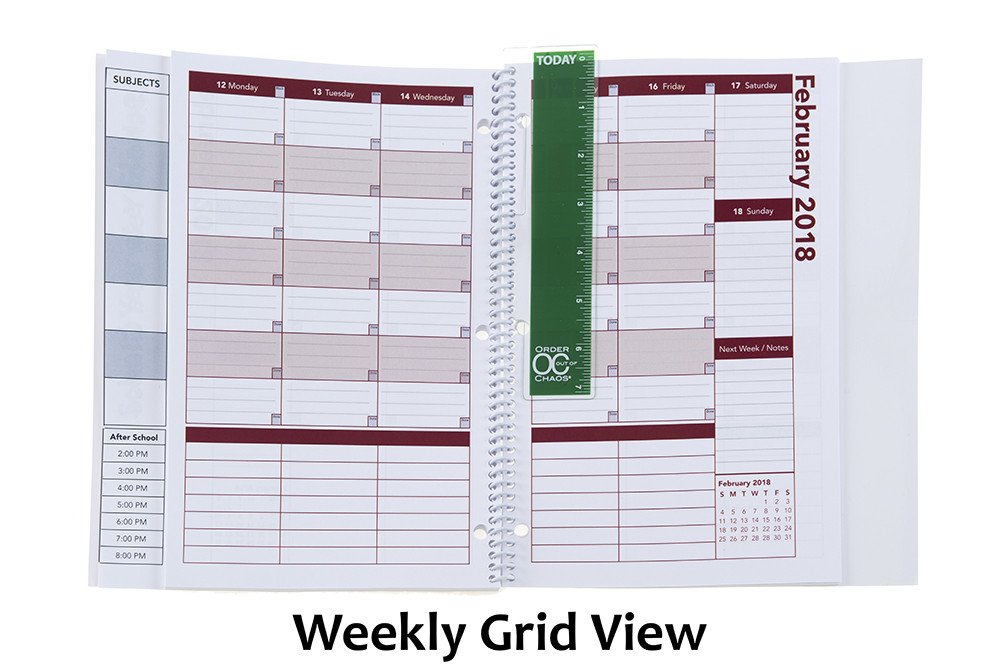

On the last (extra-sturdy) full-sized front page, the Academic Planner has a vertical index page that peeks out from behind (and to the left) of the actual planner pages. This index page means that students record their class subjects (in up to 7 subject boxes) only once. Then everything on the upper calendar sections of the planner pages lines up with the appropriate class subjects, course by course, horizontally (with days of the week arrayed, vertically) across a two-page layout. (You can download a sample planner page.)

The next row (in the personal-sized planner, only) is for To Do items.

Below that, there’s an hour-by-hour schedule from 8 a.m. until 8 p.m. Typical student planners only cover the academic day and don’t take into account post-school activities, like doctor’s appointments, tutoring, clubs, rehearsals, sports, and jobs. This planner provides oodles of space for all of those activities and recognizing conflicts (just like in the best calendar planners for adults). This really helps students see the forest and the trees of weekly time management.

Other Features

- At the start of each month, there’s a left-side full-page monthly calendar with space to note major events, holidays, and vacations, and adequately plan longer-term projects.

- The right-side Notes page facing the calendar offers up ample room for planning, notes, and the kinds of serious thoughts only people between 12 and 18 can understand.

- There’s a clear poly pocket at the rear of the planner for safely keeping notes, permission slips, and other documents too small for a student’s binder.

- A bonus Academic Planner Accessories Pack (sold separately, for $8.97) includes a plastic page marker that clips into the spiral binding, so it’s easy to find the current week in the planner, a set of monthly tabs, and a really bright, sunny set of useful stickers.

But of course, measurements, styles, and features don’t give credit to what the 2017-2018 Academic Planner: A Tool for Time Management® can actually do to help students. For that, let’s go to the video!

Enjoy your summer, but remember that a little organizing now can make back-to-school the most wonderful time of the year!

Disclosure: Some of the links above are affiliate links, and I may get a small remuneration (at no additional cost to you) if you make a purchase after clicking through to the resulting pages. The opinions, as always, are my own. (Seriously, who else would claim them?)

Follow Me