Archive for ‘Legal’ Category

Paper Doll’s Ultimate Guide to Organizing Yourself to Get a REAL ID

On Friday, I renewed my driver’s license. Typically, that wouldn’t be blog-worthy.

I’ve lived in Tennessee for more than three decades, and generally I’ve been able to renew my license at a little kiosk that looks like an ATM. I’d verify some information on a screen, get a new (horrible) photo taken, and pay with my debit card, all in the vestibule of the DMV while avoiding the packed waiting area.

Not this time, though. I wasn’t merely renewing my license; I made an appointment to apply for my REAL ID, and had to engage with the DMV representative behind the glass barricades.

WHAT IS A REAL ID?

In 2005 (and yes, that really was twenty years ago), Congress passed the REAL ID Act in the long shadow of 9/11-related security concerns. The Act did the following:

- Set clearer standards for government-issued photo IDs — So, if you have a driver’s license, your great-grandmother has a non-driver ID card, or someone you know has different government-issued ID card, they will all fall under an established and uniform set of security standards so everyone will be on the same page.

- Prohibited various government agencies (including the TSA) from accepting forms of identification that don’t meet the new standards. For quite some time, TSA agents had some wiggle room in letting people on airplanes even when/if they didn’t have proper identification (such as when they lost their wallet or had their ID stolen, and showed up at the airport desperate to make a flight). No more.

- Added an extra layer of security to the process of flying — Having uniform requirements for flying makes it much harder for someone to use false documents to board an airplane or gain access to secure facilities.

Basically, the REAL ID Act established minimum security standards for state-issued driver’s licenses, permits, and ID cards to reduce identity fraud.

REAL ID: A LONG TIME COMING

Dear Paper Doll Readers, you know I always try to share information with you in good faith, but ever since I originally blogged about the REAL ID, the US Department of Homeland Security has turned me into the boy who cried wolf.

Originally, the federal government wanted the new regulations to go into effect in 2008, but many states and territories opposed to the immense effort it would take to comply.

First, not all states had required photos for driver’s licenses; conversely, REAL IDs require facial image capture and states need “an effective procedure to confirm or verify a renewing applicant’s information.” To anyone who has watched too many episodes of Law & Order and other police procedurals, it’s a bit surprising that not every state was verifying that faces and names matched!

Second, states would have to confirm Social Security account numbers with the Social Security Administration and cross-check to make sure old or expired licenses were “terminated” in other state’s systems before taking effect in the state where someone was applying.

Third, states were going to be required organize and maintain the documentary evidence submitted. For example, each state would be need to either retain paper copies of documents for a minimum of 7 years or scanned/capture images of those source documents for a minimum of 10 years.

Fourth, states must limit the validity of all driver’s licenses and (non-temporary) ID cards to 8 years; some states had previously kept IDs valid for ten years.

Lacking professional organizers to keep their processes straight, state governments were not particularly keen on having make these changes! Kerfuffles ensued. From 2012 through 2018, states and territories acted in fits and starts.

Eventually, the federal government announced that it would require REAL IDs effective October 1, 2020. However, as we all know, 2020 didn’t exactly turn out as anyone planned, and the CARES Act (remember that $2.2 trillion COVID stimulus package?) delayed the start to September 30, 2021. Later, after several more changes to documentation and funding regulations, the date was pushed to May 3, 2023.

And now, finally, the official date appears to be on the horizon: May 7, 2025, which is (as of this writing), 57 days away!

If you already have a REAL ID-compliant license or other identification, you’re good, but if your license wasn’t due to renew over the past five years or so, you might have figured there was no need to rush to upgrade. But now, it’s time to pay attention.

WHY MIGHT YOU NEED A REAL ID?

Now that you understand why the government has been working toward this change for the last twenty years, you may wonder how it affects you. Why might you need a REAL ID?

1) You Need a REAL ID to Fly

As of May 7, 2025, in order to board an commercial aircraft, your identification must be REAL ID-compliant. Some people seem to believe that flying for particular purposes makes the new law inapplicable to them, but just to be clear, the REAL ID Act will apply no matter what kind of commercial flying you will be doing, including:

- business travel

- vacation/pleasure travel

- heading to college (or taking your children to/from college)

- accompanying minor children during a custody transferral

- traveling to care for ill relatives

- getting health care from specialists in distant cities

- looking for houses in a city to which you’re moving

United Airlines Red Carpet, courtesy of 1950sUnlimited, CC BY-NC 2.0

Do you need a REAL ID to fly on a private plane?

Yes!

Even if your non-commercial flight has private screening or you travel through a private FBO (fixed-base operator), the REAL ID act still sets — and the TSA must enforce — a minimum security standard for all air travel.

Do you need a REAL ID to fly on Air Force One?

No, but that’s because it’s categorized as a military (not commercial) aircraft used for official government travel. Journalists and politicians authorized to fly on Air Force One go through such thorough vetting by the Secret Service that gathering documents to secure a REAL ID will seem like a walk in the park.

Do you need a REAL ID to fly a crop duster?

Nope.

A crop duster is an agricultural aircraft, so flying in one is not considered commercial airline travel and therefore doesn’t fall under the REAL ID requirements. However, to work as an agricultural pilot, you must earn a private pilot license, a commercial rating, and a tail-wheel (conventional gear) airplane endorsement, and get specific agricultural aviation training. That seems like a lot of extra effort to just to avoid going to the DMV to get your REAL ID.

Do you need a REAL ID to fly firefighting aircraft (like air support to drop water or fire suppression chemicals on a fire)?

Sometimes, actually, yes. These aircraft, like those operated by Cal Fire during the recent fires, are sometimes considered commercial aircraft. I was surprised, too.

If you’re not familiar with these aircraft that drop water or pink suppression chemicals, may I point you to the CBS TV show Fire Country, or if you’re feeling up for something sappy but wonderful, the star-studded aerial firefighting movie Always, a remake of a WWII-era film A Guy Named Joe.

Do you need a REAL ID to fly on a rocket like SpaceX, Virgin Galactic, or Blue Origin?

Yes! These non-NASA rockets are considered commercial flights. Pack your REAL ID.

But no, you don’t need a REAL ID to go hot air ballooning like Dorothy in The Wizard of Oz, as there are no TSA checkpoints in the sky!

Can’t you just use a passport to fly? What about a Trusted Traveler card?

What a smartypants you are! In order to fly, you must have a REAL ID-compliant document, which includes a US passport or passport card (the acquisition of which already requires the kind of documentation required for a REAL ID).

However, most Americans do not have valid passports. Currently, only ~45% of Americans hold one. If you have a passport, you’re set; if not, and you aren’t likely to do international travel, a state-issues REAL ID is a more economical choice.

Trusted Traveler program cards, like Global Entry, TSA Pre-Check, NEXUS, SENTRI, and FAST are REAL ID-compliant, but are pricier than a driver’s license and may not be applicable to your lifestyle.

What about a state-issued Enhanced Driver’s License?

Michigan, Minnesota, New York, Vermont, and Washington issue these for land or sea border crossings with Canada, Mexico, and the Caribbean. They require the same documentation and count as REAL ID-compliant; if you have one, you already know it. But if you don’t, and unless you live in these states and don’t have a passport, go ahead and upgrade your driver’s license.

2) You Need a Real ID to Enter Secure Federal Buildings

If you have reason to enter any secure federal buildings, you’ll need REAL ID-compliant documentation.

Panorama of United States Supreme Court Building at Dusk courtesy of Joe Ravi, CC BY-SA 3.0

You may be thinking, “When the heck will I ever have to go into a secure federal building? I’m not a judge or legislator!” However, you might go to a federal building to:

- apply for or renew certain federal benefits — For example, some Social Security Administration offices are in federal buildings.

- access services at a VA facility — While most VA medical centers won’t require REAL ID, some administrative offices do.

- attend an immigration or visa appointment

- work in or visit a federal agency — If you’re a contractor or consultant, or if you’re applying for a federal job, or if you need to visit the IRS, EPA, or Department of Labor, know that such offices are in federal buildings

- attend a public hearing or town hall — Agencies hold open meetings for the public on policy matters.

- attend a government conference or training — Federal agencies host public events, seminars, and professional development sessions.

- retrieve records or conduct research — Agencies like the National Archives or Library of Congress require in-person access to certain records.

- serve on a federal jury or grand jury

- give testimony in legal proceedings — And no, if you’re accused of a crime at the federal level, you can’t get out of being tried for that crime just because you don’t have a REAL ID.

- report to a federal probation or parole office

- visit an inmate in a federal detention center

The REAL ID Act doesn’t require you to present identification anywhere it’s not currently required for accessing a federal facility.

So, while all federal buildings have security, they don’t all count as “secure federal facilities.”

You don’t need a REAL ID to visit the National Archives museum or its reading rooms, but you do need a valid form of identification to enter the research rooms. Similarly, you don’t need a REAL ID to visit the public areas of the Smithsonian Institute.

3) You Need a REAL ID to Enter Nuclear Power Plants

Do you work in a nuclear power plant?

Are you a government employee whose job it is to inspect nuclear power plants? Engineers, safety inspectors and maintenance crews often have to visit plants for inspections and upgrades.

Are you a government regulator from the Nuclear Regulatory Commission or the Environmental Protection Agency?

Are you a vendor or contractor for a nuclear power plant? Whether you restock the candy machines or service the bathroom plumbing or do public speaking events for the staff, you’ll need a REAL ID-compliant document to gain access.

Are you a first responder? Emergency personnel, firefighters, and HAZMAT teams often train in nuclear facilities.

Are you an energy industry professional or a policymaker taking a tour? Are you a journalist? A researcher? You’ll need that REAL ID!

Are you a teacher or professor planning on taking your students to visit a nuclear power plant? If you’re taking third graders on a tour of a nuclear power plant — wow, that’s weird — they wouldn’t need to be REAL ID-compliant, but if you’re a college professor, your age 18+ students would.

Are you Homer Simpson?

One assumes this also applies to Mr. C. Montgomery Burns (Homer’s boss) and sycophantic Smithers. However, Mr. Burns is a billionaire, and they seem be getting a lot of special treatment lately. Your mileage may vary.

WHEN DON’T YOU NEED A REAL ID?

- If you’re a kid — Children under 18 are not required to have REAL ID-compliant identification.

However, I strongly encourage you to make sure your college-bound students get their IDs as soon as they are able, particularly if they attend school more than a few hours’ drive away. From Spring Break to getting home for a family emergency or a funeral, help them be prepared.

- If you’re showing ID to vote — You can’t be required to show a REAL ID to vote.

The REAL ID Act is for maintaining security, so as long as your assigned polling place is not on an airplane, in a secure federal building, or in a nuclear power plant, you should not be required to have or show a REAL ID-compliant identification. (For more on IDs for voting, see my post, The Ultimate Guide to Organizing Yourself to Vote.)

What if you aren’t a US citizen?

If you’re a tourist, you’ll have a passport, which serves the same purpose. If you are neither a citizen nor tourist but are lawfully present in the United States, you can obtain a REAL ID, provided you can demonstrate your legal presence and meet other requirements.

Remember, this doesn’t just include citizens of the 50 states and Washington, DC. If you live in Guam, Puerto Rico, American Samoa, the US Virgin Islands or the Northern Mariana Islands, the REAL ID Act applies to you, too.

REAL ID MINIMUM DOCUMENT REQUIREMENTS

To be a valid REAL ID-compliant state-issued ID (whether a driver’s license or other identification card), it must include the following:

- Full legal name

- Date of birth

- Gender*

- Driver’s license or identification card number

- A digital photograph

- Address of principle residence

- Signature

- Physical security features designed to prevent tampering, counterfeiting, or duplication of the document for fraudulent purposes.

- A common machine-readable technology, with defined minimum data elements.

*Until recently, the gender marker on a passport could be M, F, or X. However, the current administration has announced that the X marker will no longer be allowed on renewed/new passports issued and the marker must match the individual’s assigned sex at birth. However, at least right now, states can make their own rulings regarding gender markers on REAL IDs.

Remember, REAL ID is a set of standards, not a national identification card. Each state issues its own unique licenses and ID cards.

SO, HOW DO YOU GET A REAL ID?

First, gather your documents. You will need to present the following types of original or certified documents to your state to apply for a REAL ID.

- Proof to establish citizenship or legal presence — Again, if you have a passport or passport card, you’re covered. Otherwise, you’ll need official documentation, like:

- a birth certificate

- US Certificate or Consular Report of Birth Abroad

- a valid, unexpired Permanent Resident card issued by DHS or INS

- a certificate of citizenship or naturalization

- an unexpired employment authorization document issued by DHS

- an unexpired foreign passport with a valid US visa and approved I-94 form

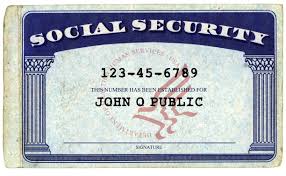

- Proof of your full Social Security number — Find your official Social Security card. If you’ve lost yours, replace your Social Security card as I explained in How to Replace and Organize 7 Essential Government Documents before applying for a REAL ID. However, my state gave me the option of alternatively showing a W-2, 1099, or payroll check stub bearing my SSN.

- Two proofs of residency of the state in which you currently reside — My state offered more than a dozen options, including a recent home utility bill, a vehicle registration, a voter registration card, an IRS tax return, a bank statement, and a variety of other financial and insurance documents.

- Documentation of any name changes — due to marriage, divorce, adoption, change of name (associated with a gender reassignment or otherwise, etc.), explaining a discrepancy between the names on all your forms of proof.

Safeguard your documents; don’t just put them in a manilla folder where they can fall out or damaged by inclement weather. I used a teal Container Store vinyl zippered document pouch because it looked like it might rain.

Next, make an appointment to apply at a local branch of your state’s Department of Motor Vehicles or equivalent. You must apply in-person, and it’s possible that only some (or even one) DMV location in your community will process these applications. Don’t just show up when you have a free afternoon, unless your idea of fun is rubbing elbows with random strangers in uncomfortable plastic seats.

Make yourself look presentable. You’ll be showing this ID all the time. (Also note: you’ll be required to take off your glasses for the photo, so try not to squint.)

Give yourself ample time to arrive. (I was told to arrive 15-minutes before my appointment. I got stuck behind a train and was only 10 minutes early.)

Be prepared to check in on your phone using a QR code. Many people were befuddled by this process and it delayed their appointments.

Be kind; the DMV staff goes through a lot. The wonderful representative processing my application spilled some serious tea about the way some people behave. (People apparently show up for their appointments while on drugs. People get high and then suddenly feel the need to renew their licenses? Seriously?)

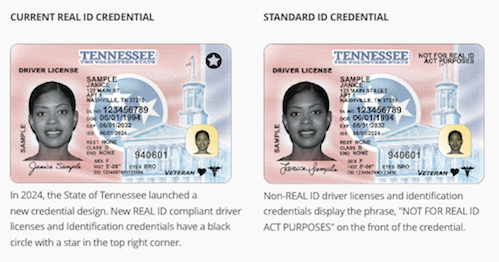

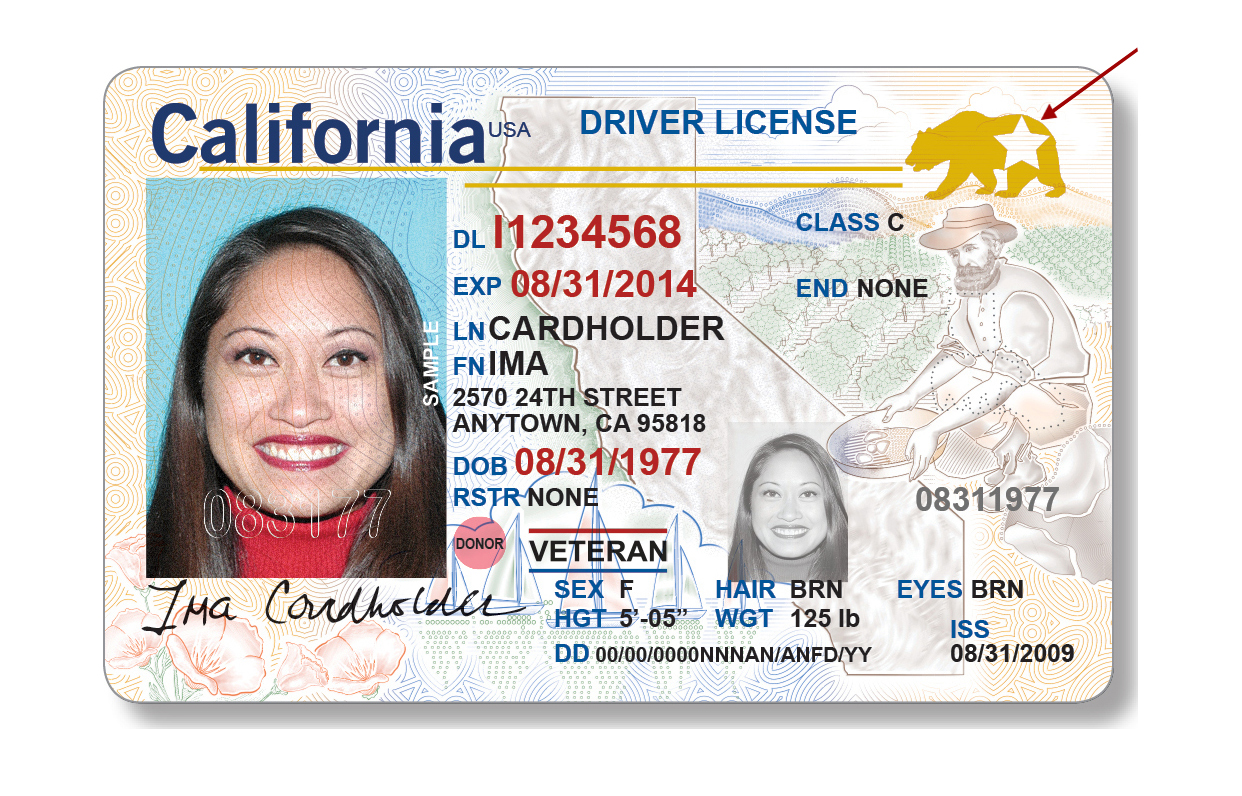

HOW DO I KNOW IF MY ID IS A REAL ID?

Look in the upper right-hand corner of your ID. Do you see a star that looks like any displayed below?

No star? It’s not REAL ID-complaint. (In addition to the star, Enhanced Driver’s Licenses will have an image of the United States flag and the word “Enhanced” at the top of the card.)

For further information, check the Department of Homeland Security‘s REAL ID Frequently Asked Questions page.

Because my papers are organized, it took me about five minutes to gather my documents, and another five to make the appointment online. Even delayed by the train, I arrived ahead of my 2 p.m. appointment.

When my number was called a few minutes later, I was walked through the process of providing all of my documents, signing required statements, and getting my photo taken. At one point, all of the women behind the counter and several applicants stopped to call attention to a very handsome man with a dazzling smile (who looked quite a bit like the actor Donald Glover) getting his ID photo taken.

Dani Pudi, Betty White, and Donald Glover Doing the Anthropology Rap

I was back in my car at 2:21 p.m. It had taken longer to fix my hair for a good DMV photo than to apply for my REAL ID.

Getting organized makes obtaining a REAL ID REAL(ly) painless.

The Ultimate Guide to Organizing Yourself to Vote

WHAT DOES VOTING HAVE TO DO WITH ORGANIZING?

WHAT DOES VOTING HAVE TO DO WITH ORGANIZING?

The word organize has three common meanings:

- to arrange, assemble, or put in order your tangible stuff (or activities or thoughts) so you can access what you need when you want it, to be more productive

- to coordinate, assemble, and unify a group, as when organizing a search party for a missing child or organizing in a union to collectively bargain

- to mobilize in support of a cause or effort you value, like Save the Seals (remember that, GenX?) or “Fix the Pot Hole on Main Street!”, or to get a candidate elected or a ballot proposition approved or rejected

In the United States, National Voter Registration Day is September 17, 2024, and no matter what you believe regarding any given issue or candidate, it’s hard to make a difference if your resources and information are disorganized.

To that end, today’s non-partisan post includes everything you need to know to exercise your right to vote, no matter your opinion on candidates, propositions, or pot holes.

(Dear non-US readers; please feel free to post non-partisan links about organizing to vote in your countries in the comment section.)

KNOW YOUR “WHY”

We do not have government by the majority. We have government by the majority who participate.

~ Thomas Jefferson

No matter which candidates get your vote or what positions you take on any given issue, don’t let disorganization to be an obstacle to voting.

If you’re an American citizen over the age of 18, you have the right to cast votes regarding a wide variety of national issues and policies, including:

- The Economy

- The Environment and Energy policy

- Foreign policy

- Healthcare

- Immigration

- Reproductive and Family Issues

- Veterans’ Affairs

It’s not just federal policies and candidates. You never know when you’ll care about a school board vote that impacts your kids, a zoning issue, or a noise ordinance related to a neighbor’s teenage beau boosting Peter Gabriel’s In Your Eyes at maximum decibels in the wee hours.

Voting preserves your right to have a say in how your community (school district, town, city, state, and nation) will be governed. It also allows you to model community organization and civic responsibility for your children or grandchildren.

REGISTER TO VOTE

Let’s start with the basics of voter registration.

Know your state’s voting eligibility requirements.

You would think voting eligibility requirements would be uniform across all fifty states, but nope. (Note: residents of the United States’ territories can vote in presidential primaries, but not the presidential election, nor in Congressional or Senate races.)

Between 1812 and 1860, property ownership qualifications to vote were progressively abolished. In 1870, non-white men gained the right to vote. Until the 19th Amendment, ratified in 1920, only twenty states granted women the right to vote.

Even then, in effect, only white women were guaranteed suffrage, as poll taxes and civic literacy tests disenfranchised the poor and people of color. (Poll taxes were stuck down by the 24th Amendment; the Voting Rights Act of 1965 outlawed discriminatory state voting practices.)

Native Americans weren’t granted the right to vote until 1924, and that right wasn’t guaranteed until 1948. And of course, the 26th Amendment lowered the minimum voting age requirement from 21 to 18 in 1971, when Paper Doll was only four years old, but already really wanted to vote.

Federal voting regulations aside, individual states have varying rules regarding voter eligibility. In order to vote in federal and state elections, you must be a citizen, of “sound mind,” and over the age of 18, but most states have residency requirements.

In 1972, the U.S. Supreme Court struck down one-year residency requirements, ruling that anything in excess of 30 to 50 days violated equal protection of the Fourteenth Amendment.

And given that residency implies an address, the passage of the National Voter Registration Act of 1993 and 2002’s Help America Vote Act — in addition to modernizing voting technology — removed registration impediments and ruled unhoused people may not be denied the right to vote based on their lack of a permanent address.

Thirteen states (Alaska, Connecticut, Delaware, Florida, Georgia, Idaho, Montana, New Jersey, Utah, Vermont, West Virginia, Wisconsin, and Wyoming) and Puerto Rico do not require a mailing address, and in Arizona and Nebraska, homeless citizens may use county clerks’ offices and court houses as their mailing addresses.

Most states have regulations restricting the voting eligibility of convicted felons while in prison or on parole, while convicted felons in Kentucky and Virginia lose the right to vote in perpetuity. (Florida recently reversed its law in this regard, but … it’s complicated.)

Know your state’s voter registration deadline

As befits a nation that initially considered itself to be a collection of smaller nations, each state has its own voter registration deadlines.

Twenty-two states require registration between 16 and 30 days prior to Election Day (Tuesday, November 5th this year). Six states require registration from 1 to 15 days prior to election day, and twenty-two states and Washington, DC allow registration at your polling place on Election Day.

Fill out the “paperwork” to register to vote.

Your paperwork may not be on paper; forty-three states (plus DC and Guam) allow online voter registration, up from only fourteen in 2008 when I first wrote about organizing to vote. However, you must register to vote by mail or in person in Arkansas, Mississippi, Montana, New Hampshire, South Dakota, Texas, and Wyoming.

Notably, North Dakota does not require voters to register, having abolished advanced registration in 1951! As long as you’ve lived in the state for 30 days and have valid ID, you can vote.

To register:

- Check online, call, or drop by your Board of Elections to request a registration application.

- The National Voter Registration Act of 1993, also called the Motor Voter Act, made it possible to register when you apply for or renew a driver’s license or at government agencies when applying for public assistance and disability.

- Find your state election offices at USA.gov, or Google “board of elections” or “election commission” and your county name plus the state (because there are 31 Washington Counties, 26 Jefferson Counties, and 25 Franklin Counties).

- Use the master voter registration document at Vote.org, or scroll down on that page to find your state’s voter registration site.

Review your voter registration card and keep it safe

Voter registration cards show your voting precinct (which determines where you vote) and districts (e.g., Congressional, State Senate and House, school district, county/city district, etc.) for individual campaigns, referenda, and ballot initiatives.

File your card with your VIP papers, and make a notation on your calendar to bring your card to the polls on Election Day (or on early voting days, if applicable). You may only need your photo ID, but I recommend always taking your voter registration card with you to vote, especially if you registered recently.

SPECIAL CIRCUMSTANCES FOR REGISTERING AND VOTING

If you or someone you know needs assistance with registering to vote and securing a ballot, check the following resources.

College Students

Students should determine whether they will register to vote in their home states or at school. They are likely to be first-time voters and unfamiliar with residency requirements, party registration, absentee ballots, and the election process. These resources will help.

- Away at College: Where Do You Vote? (FindLaw)

- How to Vote in College: Know Your Rights (BestColleges)

- Out of State College Student Voting Guide (All-In Challenge)

- Voting as a College Student (Vote.org)

Disabled Voters

- The Americans with Disabilities Act and Other Federal Laws Protecting the Rights of Voters with Disabilities (ADA.gov)

- Resources for Voters with Disabilities (US Election Assistance Commission)

- Voters with Disabilities Activated (National Disabilities Rights Network)

- Voting with a Disability (Vote.gov)

- Voting Accessibility (US Election Assistance Commission)

Members of the US Military

- Military and Overseas Voters UOCAVA (US Election Assistance Commission)

- Military Voters (Federal Voting Assistance Program)

- Voting During Military Service (FindLaw)

- Voting While You’re Away From Home: The Absentee Voting Process (Military One Source)

Overseas and Expat Voters

Are you an American citizen reading Paper Doll from somewhere outside of the U.S.? Howdy! These non-partisan sites can help you register and vote from abroad:

- Election Assistance Commission

- Federal Voting Assistance Program

- Overseas Vote Foundation

- Vote from Abroad

Unhoused voters

- Every One Votes (National Alliances to End Homelessness) — including A Toolkit to Ensure People Experiencing Homelessness Can Exercise Their Right To Vote

- The Homeless Vote: Can You Legally Cast a Ballot? (FindLaw)

- Step-by-Step Voting Guide for People Experiencing Homelessness (United States Interagency Council on Homelessness)

- Voting for People with Nontraditional Residences (The National Conference of State Legislatures)

- You Don’t Need a Home to Vote (The National Coalition on the Homeless ) includes a voter information primer and a 2024 voting rights manual

CHECK YOUR VOTER REGISTRATION

Perhaps you registered to vote years or decades ago. Even if you wore an “I Like Ike” button, registering to vote once is not enough. Even after you register, there are multiple ways you can fall off the rolls, as Archie Bunker learned years ago!

If you haven’t voted in several election cycles — whether presidential or mid-term elections — your state may remove you from the rolls.

If you move, even within a state, you have to register in your new location. Update your registration even if you move neighborhoods in the same town, as dividing lines for school and legislative districts are narrowly drawn.

You may be purged from the rolls by accident, such as if you share a name with someone who died, or intentionally as part of partisan disenfranchisement efforts.

Check your voter registration soon, before the deadline for registering in your locale, to ensure that you are able to vote on election day. Contact your local board of elections, or go to https://www.vote.org/am-i-registered-to-vote/ to use the state-by-state lookup.

LOCATE YOUR POLLING PLACE

Your voter registration card should specify your polling place. Alternatively, many boards of elections or election commissions let you safely log in to your registration with information like your name, birthdate, and part of your Social Security number (which they already have on record).

Or, use Vote.org’s Polling Place Locator.

Photo by Elliott Stallion on Unsplash

If you have early voting in your jurisdiction, it may be at a different polling place than the one listed on your registration card. My Election Day polling place is within walking distance of my home; however, to avoid inclement weather or having to rush on a client day, I vote at one of the four early voting locations in my city.

OR, ARRANGE TO VOTE BY MAIL

Voting by mail has become more popular, particularly since COVID, but as with other voting regulations, the rules vary by state. This method, usually referred to as an absentee ballot, reduces crowding at the polls, increases voter participation, and makes it easier for college students, people with disabilities, members of the armed services, travelers, and others to cast their votes.

In eight states (California, Colorado, Hawaii, Nevada, Oregon, Utah, Vermont, and Washington) and the District of Columbia every eligible voter can vote by mail. (And in Colorado and Oregon, all eligible voters are mailed a ballot without even having to request one.)

Voters in those eight states and DC can generally return ballots through the USPS, in-person at election offices, or in secure drop-boxes. In states that have in-person voting, voters may still opt to vote at the polling place.

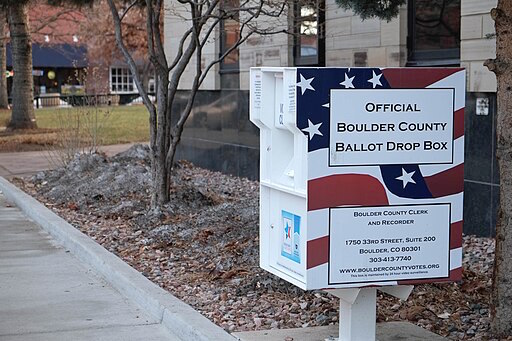

Paul Sableman, CC BY 2.0, via Wikimedia Commons

But what if you live in the 42 states and 14 territories that don’t run all elections by mail? There, eligible voters must request a ballot.

Some have a “no-excuse” ballot system; request a ballot for any reason. Other states require you submit a “valid excuse,” which might be that you will be out of state for business or out of the country due to work or military service, that you will be hospitalized or otherwise too infirm to vote; some states let everyone over 65 vote by mail.

The duration of absentee ballot status can vary. In some states, like New York or Georgia, once you request an absentee ballot, you’ll receive one for all elections, whether federal, state, or local, general elections or primaries. In others, voters must request absentee ballots for every single election in which they intend to vote.

Scroll down on this FindLaw page for a comprehensive list of each state’s requirement for requesting an absentee ballot and voting by mail. Where applicable, it provides a link to each state’s absentee ballot application.

Make sure you’re registered to vote by the applicable deadline, then contact your county’s Board of Elections or your state’s Secretary of State for an absentee ballot.

SECURE THE RIGHT IDENTIFICATION

Your voter registration card proves you registered (at some point) but it can’t be used as ID to vote.

If you live somewhere like Dixville Notch, a tiny New Hampshire polling district of four registered voters, the poll worker is likely your daughter-in-law or third grade teacher who knows you. However, most jurisdictions require you to show some kind of government photo ID, like a driver’s license, state-issued ID card, military or tribal ID, or a passport, and even locations without strict voter ID laws require first-time voters who’ve registered online or by mail to show ID.

Other states accept non-photo identification with proof of name and address. For example, in Arizona you can bring your Indian Census card; in Kansas, government-issued concealed carry handgun or weapon licenses and government-issued public assistance ID cards are acceptable ID; Virginia allows valid student IDs.

Even states that are strict regarding photo ID have exemptions, such as for those with a religious objection to being photographed, or have impediments to getting an ID (due to indigence or after a natural disaster). Wisconsin has confidential voting for victims of domestic abuse, sexual assault, or stalking.

Check your state’s voter ID laws at your board of elections website or this list from the National Conference of State Legislatures.

Alternatively, use the map at VoterRiders.org and the cursor over your state to see what proof of identification your state requires. States are divided by strict and non-strict photo ID laws, strict and non-strict non-photo ID laws, and states with no specific ID required.

If you have none of the appropriate categories of identification required by your state, you’ll want to get a state-issued photo ID card. In most cases, this will require presenting a copy of your birth certificate, as explained in How to Replace and Organize 7 Essential Government Documents.

All this aside, if you don’t have your ID, you can generally cast a provisional ballot by signing an affidavit, signing a poll book, and providing biographical information. (You may also cast a provisional ballot if your identity or right to vote is challenged by a poll worker or election official, or if your name is not on the poll or registration list on Election Day.)

MAKE A PLAN FOR WHEN AND HOW YOU WILL VOTE

Very little gets done unless you organize your schedule to do it.

Think of voting the way you might think of leaving on a trip. Normally, you might get in your car, drive to the airport, park, and fly. Or perhaps you arrange to have a friend drive you. But if you wait until the last minute and you have a dead battery or flat tire, or your friend’s child has the flu but no baby sitter, you’d have to scramble to figure out whether you’d call another friend, get a rideshare, or find some other solution.

Voting is not time-specific, but it’s day-specific, and the lines in some precincts can be as long as those for TSA. And if you were planning to vote after work, but you got delayed by weather or traffic, you might be cutting it close.

When and how will you vote?

Look at your schedule and figure out:

- Will you vote by mail? How will you remember to get your ballot in the mail or to a drop-box by deadline?

- Will you vote early? What day? How will you accommodate your schedule and remind yourself to go? At which early voting polling place can you vote?

- If you’re voting on Election Day, what time will you go and how will you get there?

Borrow some accountability and vote with a friend. Arrange to vote together (early or on Election Day) or even drop your mail-in votes at a drop-box together, then celebrate your right to vote with an ice cream, adult beverage, or meal.

How will you get to the polls?

If you’re going to the polls in person, either on Election Day or when voting early, plan how you’ll get there, and create a backup plan in case something goes awry.

If you are able, offer rides to those who may lack transportation or the physical ability to get to the polls on their own.

If you need help getting to the polls:

- Ask friends or neighbors how they are voting and see if you can ride with them.

- Ask if your house of worship is transporting congregants to the polls for early voting.

- Get free rides to vote early via Lime, as well as access to free scooters and e-bikes through Vote Early Day.

- Check to see if your locality offers free public transportation via bus or rail on Election Day.

- Call your public library or your state’s League of Women Voters to find out what assistance is available locally to help voters get to the polls.

- Ride Lyft, partnering with Levi Strauss & Co. and Showtime/MTV, to providing discounted rides to the polls.

RESEARCH THE BALLOT

Democracy cannot succeed unless those who express their choice are prepared to choose wisely. The real safeguard of democracy, therefore, is education.

~Franklin D. Roosevelt

You may be able to log into your board of elections or election commission site to see a sample ballot prior to any local, primary, or general election. Alternatively, use:

- League of Women Voters‘ Vote 411 — Provide your state to get your voting information. Closer to the election, click on the Candidate and Ballot Measure Information tab.

- LWW’s 411 also offers a personalized ballot — Enter your address and view (or print) ballot guidance.

- Ballotpedia is a digital encyclopedia of elections. Pick federal, state, and local elections, as well as ballot measures, from the sidebar to aid your research, or look up your sample ballot.

- Vote.org has a See What’s On Your Ballot feature.

Then, evaluate candidate and party web sites, read news articles, and ask the opinion of people you respect.

PROTECT YOUR RIGHTS

We don’t want seven-year-olds or random Peruvians or visitors from Alpha Centauri to pick our city councilperson or mayor, but we do (or at least should) want everyone citizen to be able to exercise the right to vote without fear of threats or violence, or even ignorance on the part of un untrained person.

I mean, how often have we heard about the airport employee who insists that people with driver’s licenses from New Mexico or the District of Columbia need to show passports because they don’t know these places are in the United States?

If you are in line when the polling hours close, stay in line. By law, as long as you are in line, you are guaranteed the right to vote.

If you are threatened with violence or otherwise experience or observe intimidation:

- Report intimidation to the Election Protection Hotline at 1-866-OUR-VOTE. (Put the number in your phone.)

- Report threats to your state and local election officials.

If you are denied the right to vote:

- Give a sworn statement to a poll worker that you satisfy the qualifications to vote in your state, and then proceed to cast a ballot (or provisional ballot).

APPRECIATE HOW YOU GOT THE RIGHT TO VOTE

Over the centuries, many have fought to secure and protect your right to vote. The following three videos from U.S. Capitol Historical Society explain the evolution of the Constitutional amendments that secured that right.

Not only is Tuesday, September 17, 2024 National Voter Registration Day, but it’s also Constitution Day. What better way to celebrate than to make sure you’re organized and registered to vote.

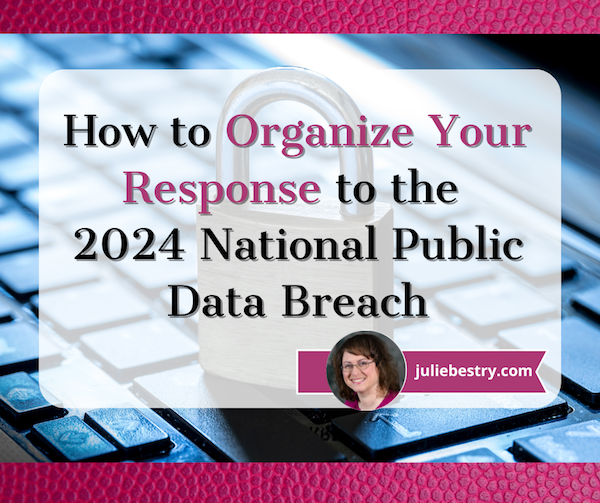

How to Organize Your Response to the 2024 National Public Data Breach

Hack! Breach! Data theft!

You see a news story about yet another company getting hacked, or you receive a letter from some service provider telling you that their servers were “breached.” Sometimes the letter offers advice, or perhaps a year of free credit monitoring.

Organizing your records, passwords, financial resources, and entire identity to protect against identity theft is exhausting. It would be understandable if you tend to tune out any news about such hacks and breaches.

Over the past week or so, however, you might have heard about a particularly nasty breach, leaving bad guys with access to millions of Social Security numbers. That probably made you sit up and take notice…and get queasy.

THE UNPRECEDENTED BREACH OF SOCIAL SECURITY NUMBERS AND MORE

At the outset, I should note that contrary to popular perception — the Social Security Administration was not hacked. The federal government wasn’t breached.

Who Got Hacked and When?

A Florida-based data brokerage company, National Public Data (NPD), got hacked. You may wonder how NPD got so much personal data in the first place. It, like many companies of its kind, scrapes data from wherever they can, including federal and state public records databases like voter registries, DMV records, professional license filings, birth/marriage/death records, criminal and civil course records, and non-public databases.

So, private information, by way of how the modern world works, gets stored somewhere over which we have no control, and then scraped, gobbled up by companies like NPD. They then turn around and sell our private data to anyone willing to pay — from employee background-check sites to private investigators (not cool, Sam Spade!) to data resellers.

According to NPD, the crime took place in December 2023; it just took a while to become known (and then a lot longer for NPD to own up to it). It’s not clear who actually stole the data.

What is clear is that the breach became known in on April 7, 2024, when a hacker group identified as USDoD posted on the dark web, offering an estimated 2.9 billion individual rows of data records for $3,5000,000. Jeez Louise!

At this point, various “bad actors” (by which I don’t mean David Hasselhoff or Pauly Shore) began posting on the dark web and leaking about the availability of the purloined data.

The breach was reported by the Daily Dark Web in a piece entitled NationalPublicData.com Hack Exposes a Nation’s Data:

The leaked data, which spans from the years 2019 to 2024, is of unprecedented magnitude, comprising 2.9 billion rows. The sheer volume of information involved is monumental, with the compressed data reaching 200GB to a staggering 4TB when uncompressed. The breached database includes comprehensive citizen information, firstname, lastname, middlename, name_suff, address,city, county name, phone 1,aka1 fullname, ssn and more. Such a massive breach raises serious concerns regarding data privacy, security, and the potential for widespread misuse or exploitation.

However, Daily Dark Web also noted that there was “a strong possibility that the assertion may be exaggerated and that the data could have been scraped from publicly available sources. Additional scrutiny and analysis are required to validate or refute these allegations.”

You’d expect that the mainstream media might attack this story like a dog with a bone, but few outlets took any notice. Instead, they focused on all the usual wars, natural disasters, sports, bird flu, Taylor Swift, and Congress trying to shut down TikTok.

Then, on July 21, 2024, someone leaked exactly what was stolen. Members of the cybercrime community Breachforums released in excess of 4 terabytes of data they claimed had been stolen (though not by them) from NPD.

Photo by Markus Spiske on Pexels.com

What Did the Hackers Get?

The breach contained massive database holdings at the nationalpublicdata.com domain, stealing Social Security records, phone numbers, physical address histories, and some email addresses of many millions of Americans. Information datasets from Canada and the United Kingdom were also included.

Per Troy Hunt, a regional director of Microsoft and founder of Have I Been Pwned (a site that helps people determine whether their email address has been included in data breaches), there were also 70 million rows from a database of U.S. criminal records.

Techcrunch referred to the data stolen as “partly legitimate — if imperfect.”

Brian Krebs of Krebs on Security further wrote that Atlas Data Privacy Corp. researchers found that there were 272 million unique Social Security Numbers in the entire records set, and that most of the records had a name, Social Security Number, and home address; approximately 26% of those records also included a phone number.

Apparently Atlas verified a subset of 5,000 addresses and phone numbers, and found that those records were, with “very few exceptions” for people born before January 1, 2002. So, maybe your college student is safe. But the rest of us? Oy.

Atlas also found that the average age of consumers in the records was 70 — with approximately two million records related to people who would be at least 120 years old at this point, so at least some of have already shuffled off this mortal coil, taking their credit lines with them.

This still leaves a lot of questions. Which data got out? Was it accurate or out of date? Which data was for deceased persons and which for real, live peeps? And what good data is paired with bad data?

If you’re feeling cyberwonky, read Troy Hunt’s Inside the “3 Billion People” National Public Data Breach. Hunt states that, “[t]here were no email addresses in the Social Security number files.” So, figuring out how bad it all is may take a while, because it’s hard to know what info is current and properly matched to your public identity.

Where Do Things Stand Now?

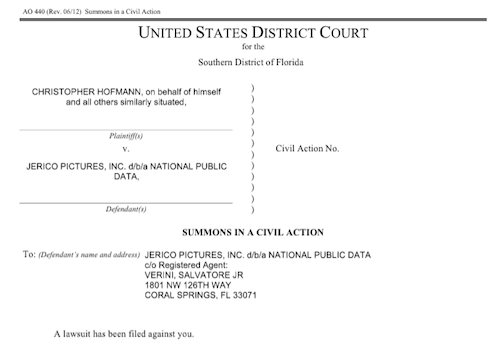

Mainstream media finally took notice on August 1, 2024, when California resident Christopher Hoffman filed a class action suit. Even then, NPD didn’t respond publicly until Friday, August 16, 2024, more than two weeks later, four months after the breach was originally reported, and more than eight months after the initial crime occurred!

And when NPD finally did post a milquetoast-y comment, it merely said that the breach involved a “third-party bad actor that was trying to hack into data in late December 2023, with potential leaks of certain data in April 2024 and summer 2024.” Well, duh.

That’s not even all! According to two Bleeping Computer pieces, National Public Data Confirms Breach Exposing Social Security Numbers, and Hackers Leak 2.7 Billion Data Records with Social Security Numbers, on August 6, 2024, “another threat actor known as Fenice shared for free the most comprehensive variant of the database with 2.7 billion records, with multiple records referring to a single person” and further, the “threat actor known as “Fenice” leaked the most complete version of the stolen National Public Data data for free on the Breached hacking forum.”

Meanwhile, in finger-pointing worthy of the Spider-Man memes, this Fenice claimed that the data breach was actually conducted by a different threat actor named “SXUL” rather than USDoD. (What, nobody’s named Mike anymore?)

(I created this from a meme generator. Apologies for offended artistic tastes.)

So, our data was stolen, priced for sale for $3.5 million, and then offered up for free to hackers, but nobody told us regular folk until the lawyers wanted attention for a class action suit?

If you feel like you need an aspirin, you’re not alone. Nothing about this feels particularly organized. Or fair.

This class action suit is a big deal, because, as the plaintiff’s law firm explained in a press release, Hoffman was not a customer of NPD. None of us were.

Thus, unlike when we get those letters from our doctor’s office or credit card companies, we never voluntarily gave our personal information to NPD in the first place, so most Americans (and Canadians, and citizens of the UK) won’t even know if they’ve been affected by the breach until or unless something along a continuum from hinky to financially catastrophic happens.

As a result, it’s essential to take action and organize your resources against potential fallout.

HOW TO KNOW IF YOUR INFORMATION WAS HACKED

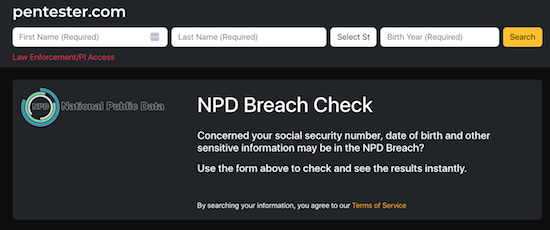

The cybersecurity firm Pentester accessed the files included in the breach and created a free database/breach check of the stolen information — but with Social Security numbers redacted, birthdates partially redacted, and phone numbers and street addresses in the clear.

I know it doesn’t look very impressive, but experts and journalists, including at Time Magazine, have recommended using it.

Enter your first name, last name, state, and birth year. It will search billions of leaked records and note whether your information was included in the breach.

If your data isn’t found, you’ll get an error message instead of a list of records. Yay! Except that’s the starting point, not the finish line. Boo!

- Check every state you’ve lived in. Ever.

- Check your maiden name, or any other name by which you’ve been known, legally or otherwise.

- Check for your significant other, your parents, your kids, and pretty much everyone you care about. (I mean, you could also search for your horrible boss, the kid who stuffed you in a locker in seventh grade, and your ex-mother-in-law, just to enjoy a little schadenfreude. I won’t tell.)

However, will only tell you is whether your information is out there, somewhere, naked. Your next step is protect that data from molestation as best you can.

PROTECT YOURSELF AGAINST YOUR DATA BEING USED AGAINST YOU

Monitor your financial life

You should already be regularly checking your bank accounts and credit card statements for anomalies. Either log in to one at a time or use a financial dashboard like Empower, Rocket Money, or one of the other popular alternatives to the late, lamented Mint.

Next, monitor your credit reports.

Longtime Paper Doll readers know that I always advise using AnnualCreditReport.com, which, by law, guarantees a free credit report from each of the three credit reporting bureaus per year. Better yet, after the onset of the COVID pandemic and the related financial chaos that ensued, Equifax, Experian, and Trans-Union temporarily offered free weekly credit reports.

The bureaus extended those offers twice over the years, and as of last October, the Federal Trade Commission reported that AnnualCreditReport.com will now permanently make available weekly credit reports at no charge so that consumers can dispute errors, be watchful for any fraudulent account openings or changes, and report identity crimes at IdentityTheft.gov.

While you’re pulling your own credit report, pull them for your children, too. Even the existence of a credit report for a child who has never applied for credit is a big, honking sign that something fraudulent may have occurred.

Place a fraud alert on your credit file

This requires that any creditors contact you before making changes to any of the accounts you already have or before opening any new accounts in your name. You needn’t contact all three credit bureaus; rather, once you request a fraud alert with one bureau (say Equifax), the other two (Experian and Trans-Union) will be notified.

Per a law passed in 2018, fraud alerts stay in place for a full year (unless you rescind it earlier), and victims of identity theft and related crimes can secure an extended fraud alert for seven years. Previously, fraud alerts lasted only 90 days.

Also, the law requires that each of the credit reporting bureau must automatically send you a free credit report after you request a fraud alert. Scrutinize them carefully.

To request a fraud alert, contact one of the three credit bureaus’ fraud alert divisions:

- Equifax — or call 1-800-525-6285

- Experian — or call 1-888-397-3742

- TransUnion — or call 1-800-680-7289 (Note: an extended TransUnion fraud alert must be requested by mail.)

But before you choose this path, there’s a better option.

Freeze your credit file

A credit freeze is different from a fraud alert. While the fraud alert says that creditors have to contact you before changing or opening accounts, a freeze says, “Nope. Do not pass GO. Do not collect $200.” A freeze prevents any new loans or credit from being taken out in your name — even by you!

A credit freeze is different from a fraud alert. A fraud alert requires creditors contact you before changing/opening accounts; a freeze says, *Nope. Do not pass GO. Do not collect $200.* A freeze prevents any new loans/credit from… Share on XThe freeze stays in place until or unless you revoke it. So, if you need to buy a new car, seek a student loan or mortgage, or apply for a credit card, you can temporarily remove the freeze. After you secure funding, you can put the freeze back on.

Ice Photo by Enrique Zafra at Pexels.com

- Contact each of the three credit bureaus.

Unlike with the fraud alert, where you only have to contact one of the credit bureaus, you’ll need to contact all three at the following freeze division links or numbers:

-

- Equifax — or call 888-397-3742

- Experian — or call 866-478-0027

- TransUnion — or call 800-916-8800

You must create an account with login credentials before you can proceed to request a freeze.

- Keep your PINs in a safe place.

When you place a freeze on your credit, you’ll get PIN. You’ll need those PINs to defrost — I mean, unfreeze — your credit later. (Note: I helped a less tech-savvy client in her 80s accomplish this on Friday, and we learned that TransUnion no longer requires a PIN; your TransUnion login will suffice.)

Where you safeguard your PIN depends on the standard methods that you already use; you don’t want to be dependent upon your memory of an out-of-character decision.

- Write PINs down and put them in your fireproof safe or safety deposit box.

- Enter PINs in your digital password manager.

- Put PINs in your secure password book in code.

Do NOT put them on a sticky note affixed to the front of your computer. Do NOT write them in a little notebook that you take out of your home.

- Protect the credit files of your loved ones and those in your care

That 2018 law guarantees that you can freeze (and unfreeze) your own credit for free. (This is different from a credit lock, which requires a subscription to a credit bureaus’ services.) In addition to setting a freeze for yourself, you can obtain a credit freeze for your children under the age of 16. (Minors aged 16 or 17 may request their own freezes.)

Photo by Julia M Cameron on Pexels.com

Because minors can’t apply for loans, people rarely check children’s credit history. In theory, there shouldn’t even be a credit bureau file for a child, so when young adults start out trying to get student loans or credit cards, they may be in for a shock to learn that someone has already destroyed their credit!

For more on preventing children from being the victims of identity theft, check out:

https://consumer.ftc.gov/articles/how-protect-your-child-identity-theft

Additionally, if you serve as a conservator or guardian, or if you hold someone’s Power of Attorney, you may secure a free credit freeze for them, as well.

Why else should you get a credit freeze?

Any time you are at greater risk of identity theft, whether through a massive data breach, a run-in with a bad roommate, a breakup with a creep, or you’ve had your wallet stolen or your home burgled, a credit freeze can give you peace of mind that nobody will be able to access credit in your name.

Similarly, if elderly relatives develop dementia or anything that impairs their cognitive capacity, they can become prey to predatory lenders and charlatans selling everything from scammy auto repair warranties to non-existent services. A credit freeze prevents scams from moving past the spam stage.

Military Fraud Alerts

Members of all United States military branches have an additional resource that predates the 2018 law. They can set active duty alerts, allowing them to place a fraud alert for one year, renewable for the entirety of their deployment.

For Equifax, use the online form for an Active Duty Alert or call 800-525-6285. Meanwhile Experian has an online form but no phone number, and TransUnion has a phone number (800-680-7289) but no online form.

As a bonus, securing an active duty alert prompts the credit reporting agencies to remove a service member from the marketing lists for sneaky pre-screened credit card offers. (Service members can request to be added back, but who wants that junk mail?)

DON’T GET SCAMMED

Even partial information allows scammers to contact you, pretending they’re preventing scams. A caller might fake being from your bank or credit card, alerting you to a hacking risk. They may request you log into one of your accounts and change passwords (to something they provide) for “testing” purposes that might sound reasonable if you’ve been interrupted while chasing a toddler or running a meeting.

Photo by mohamed_hassan from PxHere

Be vigilant. If contacted by phone, text, or email, don’t respond, even (or especially) if the contact appears to already have some of your data. They’re using what they DO have to get you to reveal what they DON’T have — more of your private information. Call your financial institution directly.

The Social Security Administration won’t call you. They won’t email. They won’t text you. (Government sites may email or text two-factor authentication codes when you log into a federal site, like ssa.gov, but that’s initiated by you.)

My March post, Slam the Scam! Organize to Protect Against Scams, focused mainly on scams targeting seniors, but will help you protect yourself and loved ones from most common scams, and provides resources to help you learn more.

The Hill‘s August 15, 2024 piece, Was your data leaked in massive breach?: How to Know, and What to Do Now, has a good point about the likelihood of being at risk:

“If you’re a high-value individual that maybe has a high net worth or works at a company that they can extort you, you might actually be a real target,” Kyle Hanslovan, CEO of cybersecurity firm Huntress, previously told Nexstar. “For the masses though, the everyday common person, you’re more of a target of opportunity.”

Most people shouldn’t spend too much time worrying about what may happen if their information ends up in the wrong hands. Instead, Hanslovan recommends keeping an eye on your important accounts and making sure you’re prepared to act in case something does go wrong.

“It stinks for privacy, but it kind of normalizes just what’s happening,” Hanslovan said. “It doesn’t make it right, and it definitely doesn’t wave, you know, a company’s true fiduciary responsibilities to protect your data.”

Someone should tell NPD that.

Other Ways to Keep Bad Guys From Using Your Data to Hack You

- Make your passwords long and complex. Using at least 16 characters, with a mix of capitals, lowercase, numbers, and special symbols, will make it hard to hack you.

Image Source @2024 Hive Systems

- Use a password manager for all your longer, more complex passwords.

- Turn on two-factor or multifactor authentication for as many of your online accounts as allow it. (That’s like when you get a text or email with a code to enter before your login is authenticated.) Alternatively, you can use an authenticator app.

- Set up account alerts for your bank, investment, and credit card accounts, particularly to flag online or in-person purchases or ATM transactions outside of the US.

- Keep security software updated on your computer and phone.

- Don’t check financial accounts on insecure Wi-Fi networks; wait until you’re home, on secured WI-Fi network.

WHAT TO DO IF YOUR DATA IS USED FRAUDULENTLY

- File a police report.

- Report fraud to the Federal Trade Commission.

- If someone uses your Social Security number, report it at IdentityTheft.gov.

ONE LAST WEIRD THING

You may have noticed something odd about the class action suit. You’d expect National Public Data’s parent company to have a tech-leaning name, like InfoDynamics or Identidata.

Nope. The parent company is Jerico Pictures Inc., a Florida-based film studio owned by Salvatore (Sal) Verini, Jr., a retired deputy with the Broward County Sheriff’s office who fashions himself as an actor, producer, and writer.

Verini is also listed as the owner of companies called Trinity Entertainment Inc., National Criminal Data LLC, Shadowglade LLC (which sounds like a housing development in a horror movie produced by a company with a name like Jerico Pictures), and Twisted History LLC, which sounds like a joke.

Meanwhile, victims of data hacking won’t be doing a lot of laughing.

REFERENCES

As a Certified Professional Organizer®, I often help clients protect their identities and financial information. However, I am not a cybercrime specialist, nor do I play one on television. To research the specifics of this breach, in addition to the many government and tech-oriented links in the above post, I used a clarifying mainstream sources, including:

- 7 On Your Side steps to take to keep personal information safe amid latest data breach (WABC-TV)

- Hackers May Have Stolen Your Social Security Number in a Massive Breach. Here’s What to Know. (CBS News MoneyWatch)

- How to Check if Your Information Was Compromised in the Social Security Number Breach (Time Magazine)

- It’s Free to Freeze Your Credit: Here’s What You’ll Need to Do (HerMoney.com)

- The Weirdest ‘3 Billion People’ Data Breach Ever (The Verge)

- What to Know about Credit Card Freezes and Fraud Alerts (FTC.gov)

Keep your eyes open and your personal information close to the vest.

Reference Files Master Class (Part 2) — Financial and Legal Papers

As we move through Get Organized & Be Productive (GO) Month, the annual initiative sponsored by the National Association of Productivity & Organizing Professionals (NAPO), it’s the perfect time to revisit classic posts and essential concepts in paper organizing.

Two weeks ago, we looked at Paper Doll Shares 12 Kinds of Paper To Declutter Now, and while the items listed there aren’t the only papers you can purge, they’re a great start for lessening the clutter so you can see what you own, need, and must organize.

Last week, we began our modern refresh of the basics with Reference Files Master Class (Part 1) — The Essentials of Paper Filing. You can sort and purge papers without those filing resources, but having them allows you to create a system that can grow and expand as your needs change. Even somewhat orderly stacks and piles are better than disarray, but a good filing system assures you that everything won’t be sent into chaos when the kids and pets (or spouses behaving like kids and pets) chase one another through the house.

As I’ve been teaching my professional organizing clients for 22 years, all reference papers can fall into one of five categories. Today, we’ll be reviewing the first two:

- Financial

- Legal

- Medical

- Household

- Personal

FINANCIAL FILES

In almost any household, whether you’re a family of one or 10 (and I mean, geez, even the Brady Bunch, with Alice, only had nine!), financial paperwork makes up the bulk of almost any personal or family filing system.

It’s the nature of living in a Western, capitalist society in the 21st-century — everything centers around whatever represents having or owing little green pieces of paper. At least our Canadian readers have much more colorful currency.

Canadian Frontier Banknotes @2006 Bank of Canada

Your financial files keep track of money coming in (in Yoda-speak, quite literally, in-come), money going out for expenses, money we are investing and (hopefully) growing for future use, and everything related to money we give governments to run things. (If we don’t have the focus and energy to organize our financial paperwork, how would we ever deal with having to raise our own armies and fill our own potholes?!)

Let’s look at each of these categories, in turn.

Transitional Money

Most of your files will relate to money that’s coming to you or paid (or at least owed) by you. But all that money tends to funnel through a few central locations that serve as receiving and funding sources. Generally, these are bank (or credit union) accounts and brokerage accounts.

Bank/credit union statements reflect the monthly status of checking, savings, and trust accounts. These represent collections of funds that are in transition, basically at a weigh-station until you determine where the money is going. Accounts may accrue interest or have fees associated with them, and some (like certificates of deposit) act like investment accounts, but are still basically interest-bearing accounts. Take time each month to make sure these accounts reflect what you think they should.

Brokerage statements reflect investments. Separate these by investment type, like retirement, college savings, goal-related (vacation funds, Christmas Club accounts, etc.), first, and then sub-categorize (and alphabetize) by company. So, in the Retirement hanging folder, you might have interior folders for your 401(k), an old 403(b), IRAs with Fidelity and Vanguard, and so on. Each account should have its own folder.

Clearly label folders with the financial body (bank, brokerage, etc.) and account type; if you have more than one account of the same type at the same institution, put the last four digits of the account number on the file label.

Income

However many people in your household have a job (or jobs), income is likely reflected by pay stubs from employment. In ye olden days, they were truly stubs from checks received from employers. Nowadays, almost everyone gets paid electronically by direct deposit, but often receives printed pay “stubs” showing not merely what was earned, but any deductions from the paycheck. Common deductions include:

- FICA (payroll tax, which goes to Social Security and Medicare)

- Other income tax (federal/state/local)

- Insurance premiums for health, life, and disability coverage

- Retirement contributions (which may or may not be matched by employer contributions)

- Charitable contributions (also called payroll giving) like United Way

- Wage garnishments for child support or other

- Union dues

(If your income is derived from your own business, keep business files separated from personal files.)

While employment is the main category, it’s not the only type of income. You may also receive paperwork reflecting receipt of alimony or child support, Social Security income, disability payments, IRA disbursements, personal loans repaid to you, stock-dividends (outside of a dividend reimbursement plan) and lottery or gambling winnings.

This leaves aside illegal proceeds; Tony Soprano isn’t likely to give you a 1099 for the bribe he paid you. (Tony Soprano also didn’t give me a lot of options for clean language, even when I found a really applicable filing-related, if potty-mouthed, clip.)

Whether you regularly receive money or get a one-time lump sum, keep records for tax and other legal reasons (like divorce and child support proceedings, Medicaid evaluations, etc.)

Maintain an interior folder for each type of income you usually receive to make it easy to check your 1099s against when preparing your taxes. If you have multiple sources of income within one type (and get lots of paperwork for each), label a folder with the name of each high-volume payer.

Outgoing Money (Expenses)

In business, they’re called Accounts Payable. These are your regular (monthly, quarterly, annual, etc.) plus occasional (unexpected) lump-sum payments, reflected by bills or statements, like:

- Monthly/periodic personal/household bills — rent or mortgage, utilities, auto or health insurance, etc.

- Credit cards statements

- Loans — personal, auto, college, home equity, etc.

- Medical bills — these may be one-time or part of an ongoing payment plan

- Tuition —

- Miscellaneous invoices or payment records reflecting anything for or which you wish to keep careful records, like tutoring, music lessons, tuition, professional organizer, fitness trainer, etc.

If your bills are paid by automatic withdrawal, verify that the proper amount was removed from your bank account or charged to your credit card, and then file the papers away. (For now, we’re assuming paper files; we’ll cover scanning and digital filing in the future.)

You may not enjoy the paperwork, but ignoring money issues won’t make them go away. If you struggle with keeping track of finances, learning to manage them in paper form makes money feel tangible, builds financial management skills, and increases financial awareness.

Ignoring money issues won't make them go away. If you struggle with keeping track of finances, managing them in paper form makes money feel tangible and 'real,' builds financial management skills, and increases financial awareness. Share on XIf you receive paper bills but pay each individually online, write the confirmation number and date of payment on the statement. If you still pay by check, tear off the stub to mail back with your payment (assuming you’re not doing online bill-pay), note the check number and date of payment on the larger, non-stub portion of the statement.

Create an interior (manila) folder for each account you hold. It doesn’t matter if you use generic terms (cable, power, water) or company-specific (Spectrum, ConEdison, Springfield Water). The key is to create labels that reflect the way you think. Keep it simple — the more complicated the system, the more friction will prevent you from filing things away.

If you have multiple accounts for the same company — for example, one water bill for your city penthouse and one for your summer cottage (or more likely, one bill for each of several student loans), label folders to differentiate between the two. (So: “Water — Park Avenue” vs. “Water — Park Avenue”; “College Loan — 1st National” vs. “College Loan — Fred’s Bank.”)

For credit cards, if you have more than one card from any one issuing lender, put the last four digits of the card number on the label (AmEx – 4321, AmEx – 9876) to help you file or access papers quickly.

Label a hanging folder for each sub-category. If you have more than one hanging folder’s worth of interior folders, just label the first in the sequence. It will be obvious from the interior labels that you’re still in that same sub-category.

Taxes

Create at least one tax-prep folder, or have one for medical expense records, one for charitable donation records and a third for “other” tax issues. Each January, when you start receiving W-2s and 1099s, pop them in your Tax Prep [Year] file folders. Once your taxes are completed, create an interior folder for a copy of your filed return and all supporting documentation.

As an alternative to collecting active tax filing year documents in file folders, you may want to sequester them in a portable tax according file, whether pre-made like the Smead All-in-One Income Tax Organizer.

24 Smart Ways to Get More Organized and Productive in 2024

Happy New Year! Happy GO Month!

January is Get Organized & Be Productive (GO) Month, an annual initiative sponsored by the National Association of Productivity & Organizing Professionals (NAPO). We professional organizers and productivity experts celebrate how NAPO members work to improve the lives of our clients and audiences by helping create environments that support productivity, health, and well-being. What better way to start the year than creating systems and skills, spaces and attitudes — all to foster a better way of living?!

To start GO Month, today’s I’m echoing Gretchen Rubin’s 24 for ’24 theme that I mentioned recently, and offering you 24 ways to move yourself toward a more organized and productive life in 2024. There are 23 weekdays in January this year, so if you’re feeling aspirational and want to conquer all of these, you can even take the weekends off as the last item is a thinking task rather than a doing task.

I broke these organizing and productivity achievements down by category, but there’s no particular order in which you need to approach them, and certainly you don’t need to accomplish every one on the list, in January or even all year. Jump in and get started — some only take a few minutes.

PUT LAST YEAR AWAY

1) Make many happy returns!

Did you know that shoppers will return $173 billion in merchandise by the end of January? Chances are good that you (or someone for whom you oversee such things) got gifts that need to be returned.

Don’t put it off. The longer you wait, the more clutter will build up in your space, and the more likely you will be to suffer clutter-blindness until the return period has expired. Most stores have extended return policies during the holidays, but they can range upward from 30, depending on whether you have a gift receipt.

The Krazy Coupon Lady blog reviews the 2024 return deadlines for major retailers. She notes that you’ll get your refunds faster by returning items to the brick & mortar stores rather than shipping them back. You’ll also save money, because some online retailers charge a restocking fee.

2) Purge your holiday cards.

While tangible greeting are getting fewer and farther between, you probably still got a stack. Reread them one last time, and then LET THEM GO.

Did Hallmark or American Greetings do the heavy lifting, and the senders just signed their names? Toss them into the recycling bin. Paper Doll‘s grants you permission to only save cards with messages that are personal or resonant.

If they don’t make you cry, laugh, or go, “Ohhhhh,” don’t let them turn into the clutter you and your professional organizer will have to toss out years from now when you’re trying to downsize to a smaller home! It’s a holiday message, not a historical document; you don’t transcribe your holiday phone conversations and keep them forever, right?

The same goes for photos of other people’s families. You don’t have to be the curator of the museum of other people’s family history; let them do that.

3) Update your contacts.

Before you toss those cards, check the return addresses on the envelopes and update the information in your own contacts app, spreadsheet, or address book.

Next, delete the entries for people you’ll never contact again — that ex (who belongs in the past), that boss who used to call you about work stuff on weekends (ditto), people who are no longer in your life, and those who are no longer on this mortal coil.

If you don’t recognize the name of someone in your contacts, Google them or check LinkedIn (is it your mom’s doctor? your mechanic?) and if you still don’t know who it is, you’re obviously not going to be calling or texting them. Worst case scenario, if they text you, you can type back, “New phone, who dis?”

BOX UP YOUR INBOXES

4) Delete (most of) your old voicemails.

How often do you return a call only to hear, “The voicemail box is full and is not accepting messages. Please try again later.” When someone calls you and requests you call them back but their voicemail is full, it’s frustrating because it makes more labor for you.

Do you assume that it’s a cell phone and text them? (I believe texting strangers without permission is a breach of etiquette.) Plan to call back later? Assume that they’ll see the missed call and get back to you, starting another round of phone tag? ARGH!

Dial in to your voicemail and start deleting. Save phone numbers for anyone you’ll need to contact and log anything you may need to follow up on. But unless you’re saving a voicemail for legal purposes or because you can see yourself sitting in an airport, listening to a loved one’s message over and over (cue sappy rom-com music), delete old voicemails.

If you’ve got a landline, clear that voicemail. If you’ve still got an answering machine, how’s the weather in 1997? Yeah, delete old messages.

Smith.ai has a great blog post on how to download important voicemails (from a wide variety of phone platforms) to an audio file. Stop cluttering your voicemail inbox!

5) Clear Your Email Inboxes

Start by sorting your inbox by sender and deleting anything that’s advertising or old newsletters. If you haven’t acted on it by now, free yourself from inbox clutter! Delete! Then conquer email threads, like about picking meeting times (especially if those meetings were in the past).

Take a few minutes at the end of each day to delete a chunk of old emails. To try a bolder approach, check out a classic Paper Doll post from 2009, A Different Kind of Bankruptcy, on how to declare email bankruptcy.

6) Purge all of your other tangible and digital inboxes.

Evernote has a default inbox; if you don’t designate into which folder a saved note should go, your note goes somewhere like Paper Doll‘s Default Folder. Lots of your note-taking and other project apps have default storage that serves as holding pens. Read through what you’ve collected — sort by date and focus on the recent items first — and either file in the right folders or hit delete!

Walk around your house or office and find all the places you tend to plop paper down. Get it in one pile. (Set aside anything you’ll absolutely need in the next few days to safeguard it.) Take 10 minutes a day to purge, sort, and file away those random pieces of paper so that you always know where they are.