Paper Doll

Toxic Productivity, Part 4: Find the Flip Side of Productivity Hacks

If you reside in the United States or Canada, you’re coming off the end of a long holiday weekend, an opportunity to rest, relax, and regenerate.

Do you feel relaxed? Or do you feel the itch to be accomplishing something on your to-do list? Do you feel that whatever you got done last week might not quite be enough, and that by taking an actual weekend off — not just two whole weekend days, but an extra holiday — you’re coasting? Cheating? If so, you definitely won’t be the only one.

PREVIOUSLY ON PAPER DOLL…

Throughout this series on toxic productivity, we’ve looked at what society can do to vanquish unsustainable expectations, how we can change our outlook and mindset, and what we can physically do to loosen the ropes with which we’ve bound ourselves. Before we go any further, I encourage you to catch up on the concepts and references we’ve looked at so far:

Toxic Productivity In the Workplace and What Comes Next

Toxic Productivity Part 2: How to Change Your Mindset

Toxic Productivity Part 3: Get Off the To-Do List Hamster Wheel

We can lobby for changes in societal expectations regarding excessive corporate demands on our productivity. We can read wisdom (and get therapy) to examine how we’ve internalized toxic belief systems and developed, as Anna Codrea-Rado calls it, productivity dysmorphia.

We can even recognize the finitude, or shortness, of life, and get off the hamster wheel by adding mindfulness and rest (in terms of non-competitive exercise) and more recuperative sleep, eliminating multitasking, and digging deeply to figure out what we want out of life and who we are.

But if none of that floats your boat, even if I’ve convinced you that toxic productivity is a danger to you, your loved ones, and society, these measures may just be too hard to incorporate in the life you’re already living. Trust me, I get it.

USING THE PRODUCTIVITY HACKS YOU KNOW AND LOVE

So, today, we’re going to look at the same productivity strategies, tactics, and “hacks” that are recommended to conquer lack of productivity — whether that’s a problem with procrastination, prioritization, or planning —and see if we can find ways to use them to stem the tide of toxic productivity.

Start At the Atomic Level

In James Clear‘s Atomic Habits, he posits that all of our outcomes — our productivity (for good or ill), our self-care, our financial state — are a “lagging result” of our habits. In other words, there’s a cumulative effect of what we do that, when repeated over and over, leads to where we’ve arrived.

To achieve what we want, Clear believes that we generally either try to change our habits in the wrong way, or we try to change the wrong things. Clear notes that we approach things in three ways:

- We try to change our outcomes (achieve more work, make more money, lose a certain amount of weight).

- We try to change our habits.

- We try to change our identities — including our belief systems, our views of the world, and our self-images.

Toxic Productivity Part 3: Get Off the To-Do List Hamster Wheel

“Nothing is so insufferable to man as to be completely at rest…. He then feels his nothingness.”

~ Blaise Pascal, Pensées

Two weeks ago, in Toxic Productivity In the Workplace and What Comes Next, we looked at the external forces that drive unsustainable expectations and eventually burnout. We also examined what other industrialized nations have been doing to stem this dangerous trend.

Last week, in Toxic Productivity Part 2: How to Change Your Mindset, we examined productivity dysmorphia, the disconnect between objective achievements and our emotions about those accomplishments. When we experience productivity dysmorphia, the very act of pursuing productivity (to the neglect of all else) means we lose the ability to savor or enjoy what we have accomplished.

That second post focused on the ways to change our mindset about productivity. We examined how hedonic adaption gets us so used to our status as achievers, as worker bees, that eventually we will be unable to sustain that behavior and burn out. We reviewed the research that showed our brains require downtime and countered the many myths that exist about productivity.

Most importantly, we started a discussion regarding the role of work (and achievement, in general) in our identities, starting with Charlie Warzel and Anne Helen Petersen asking “Who would you be if work was no longer the axis of your life?” and considering the “finitude” of life (in the words of Oliver Burkeman and the Stoic philosophy of Seneca). We left off in contemplation that our value is not in what we do but in who we are — in being, not doing.

Today, we’re going to explore developing an appreciation of being over doing, seeing how our actions need not be achievements, per se, but can be experiences, valued solely for the potential delights they offer.

REVISITING FINITUDE: THE MACRO AND MICRO APPROACH

Our time on this rock is limited. A central tenet Burkeman’s 4000 Weeks: Time Management for Mortals is the ability to see the shortness of life, examine your goals and values, and maximize spending your time on what matters most. This isn’t some hippy-dippy philosophy that says that if we all stop worrying about work or making money, we’ll find ourselves in a vast utopia.

Rather, it notes that life is hard, life is short, and feeling like you only have a right to be here if you’re accomplishing things that make money — whether for your company or yourself (even, or especially, if you are your company) — leads to frittering away the most valuable commodity: life.

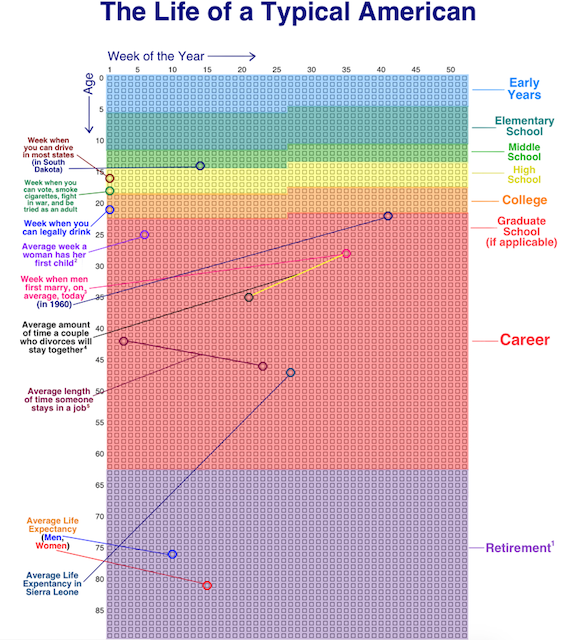

Tim Urban’s stellar Wait But Why blog broke ground in this arena. Allowing for a little more time on the planet than Burkeman, Urban posited that we might have 90 years of life, so 4680 weeks rather than 4000.

One of his most famous posts, back in 2014, urged readers: visualize your life in years, your life in months, your life in weeks, your life in number of remaining SuperBowls…to appreciate what you do with your time.

For example, I’ve got got 2860 of my weeks behind me. It’s tempting to use these kinds of visualizations for dismay; certainly they can lead to existential angst and even more productivity dysmorphia. “See?” one might yelp! “I have even less time to make the widgets! To earn the money!” And yet, as we’ve seen over the last two weeks, that attitude just leads to focusing more on the quantifiable value you create for others; we want to look at quality, not quantity.

But, we can still turn to Urban for guidance. As a follow-up to his macro look at the finitude of life, he developed a way to organize and examine our lives at the micro level in 100 Blocks a Day.

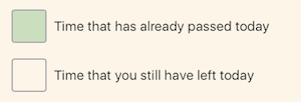

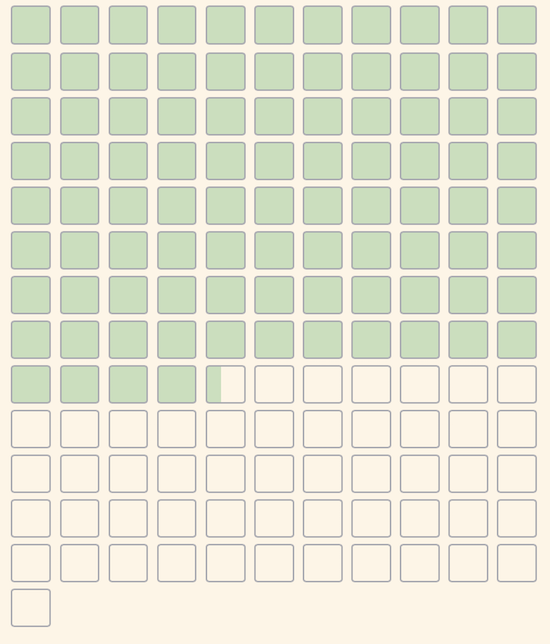

Inspired by Urban, nomadic programmer Jama of Notion Backups, has identified a way to pause and reflect, giving perspective on where you are, chronologically speaking, in your day (rather than in your life). Rectangles.app gives you a quick glance at how much of today has gone by, in ten minute increments, as of the point in your day when you click the link. Click later in the day, more boxes turn green.

For example, when I visited and took this screenshot, I’d made it through 93 1/3 ten-minute blocks in my day.

When faced with how much of your day has passed and how much is left, you might have the following reactions:

- Yikes, I’d better get cracking! (A good motivation if you’ve been staring at social media or playing a video game for hours on end, for sure.)

- Yikes, I’ve been working and working, and I’ve only written 17 TPS reports and attended 5 hour-long meetings! (A likely sign of productivity dysmorphia creeping in around the edges.)

- Yikes, all I’ve done all day is work. I haven’t talked to anyone I love, I haven’t exercised or gotten any fresh air. I haven’t laughed. (And here’s where the magic might begin!)

If you’ve been experiencing signs of burnout due to toxic productivity, give this approach a try. Click on Rectangles and think about the day you’re having. Maybe even text the link to a friend, describe your day thus far, and get a reality check from someone who sees you more clearly.

HOW TO GET OFF THE HEDONIC TREADMILL & STOP KEEPING SCORE

If you’ve gotten this far in this blog series, you might recognize that you (or someone you care about) is experiencing signs of toxic productivity or productivity dysmorphia. If you have trouble valuing what you’ve already accomplished, and especially if you experience difficulty spending your time on anything you can’t point to as an accomplishment, this section is for you.

We aren’t going to begin by saying, “Stop doing so much work” because that’s too big a step. Instead, I’m going to ask you to review the forthcoming suggestions and pick one or two to try, and carve out time in your schedule for doing them. Consider, on your first day, taking two or three of those boxes above, and before they pass by and turn green, experiment. Walk. Nap, Meditate.

Take a Walk

Exercise is great for us — it clears our heads and lets us reset to that default mode network we learned about last week from Jay Dixit’s We’re Doing Downtime Wrong in NeuroLeadership.

Of course, not all exercise is equal. Yoga is supposed to be good for us because it’s (mostly) gentle on the body, it focuses on correct breathing techniques, it improves strength, balance, and flexibility, it eases pain and benefits cardiac health, it dissipates stress, and much more. But yoga’s particularly advantageous for drop-kicking toxic productivity because there’s no scorekeeping.

Yes, I suppose you might feel competitive with the person next to you in class (not that you have to take a class) who has a more fluid downward-facing dog than yours. But in general, completing a yoga class feels less like, “I am a valid person because I can check today’s yoga off my list” and more, “Wow, my neck is no longer making that clicky-sound when I turn to the right!”

Contrast this with golf, for example, famously called, “a good walk spoiled.” (And no, trivia buffs, Mark Twain didn’t say that. He died in 1910, but the first reference to it was in 1948. The originator is a mystery.) Golf, indeed any game that involves precision and scorekeeping, probably isn’t going to help decrease your sense of always chasing after the next accomplishment, the next win.

Let’s start by stopping. Let’s stop counting our steps and counting the filled rings. (I’m not saying you can’t monitor your health-based metrics, but try strapping your Fitbit to your ankle to keep yourself from obsessively checking your step count.)

The great thing about walking is that there’s very little else of a truly productive nature, in terms of output, at least, that can be done while walking. You can’t handwrite, and while you can type or dictate into your phone, anything more than the odd inspiration is going to slow your pace and then stop you altogether, either because you’ll have forgotten to walk or you’ll fall right into a fountain.

For your mental health, the best thing you can do is just walk and explore your thoughts. Of course, that can be scary. Sometimes, the basis of toxic productivity is that one keeps working to avoid one’s thoughts. (Therapy can really help with that. Nudge, nudge.)

If you’re truly uncomfortable being alone with your own thoughts, try listening to soothing music or, if you must, a podcast. But the idea of this particular exercise (no pun intended) is to ease you into the notion of being comfortable doing nothing that earns you gold stars, nothing to check of the list. Try to walk to just walk.

One resource that might help is 52 Ways to Walk: The Surprising Science of Walking for Wellness and Joy, One Week at a Time by Annabel Streets.

Toxic Productivity Part 2: How to Change Your Mindset

Last week, in Toxic Productivity in the Workplace and What Comes Next, we addressed systemic toxic productivity, when the workplace demands a seemingly endless series of achievements, undue (and unreciprocated) loyalty, and more of one’s heart, soul, and time than is reasonable. We also touched on the concept of personal toxic productivity, or productivity dysmorphia.

Going forward, we’re going to look at what we can do to give ourselves some grace and separate our productivity from our identity. Today, we’re focused on changing the way we think about ourselves and what we accomplish.

But first, let’s look at three stories that illustrate what toxic productivity is not.

WHAT TOXIC PRODUCTIVITY IS NOT

Story #1: At the end of April, my delightful colleague Linda Samuels wrote a blog post entitled How to Successfully Let Go Now Even If It’s Only For Today. In that post, she described how she enjoys getting things accomplished and often feels compelled to do so. She had a list of what she intended to accomplish on that particular Sunday, but was beckoned by the beautiful spring wearther and instead enjoyed a day in nature with her husband. In my blog comment, I gently teased her:

LOL, I’m glad you let go, but I think I see your problem right away, Linda. You had a to-do list for a Sunday. Sunday is the weekend. You’re not supposed to DO anything on the weekends except eat, play, and be entertained in the first place! 😉 No housework, no work-work, just enjoying yourself. I’m glad you let go; now we need to help you plan letting go as your weekend task so you don’t even try to work!

Linda is not an example of toxic productivity. She’s self-driven, but she also knows how and when to let go and grant herself buffer time to enjoy life.

Story #2: Another colleague (we’ll call her X), is a real go-getter. She had been working to create a virtual course, but has not yet made it go live because she’s so busy with her client load and is booked through the end of the summer. Disappointed that she hasn’t completed this combined educational/marketing tool, we’ve pointed out that the whole purpose of making people aware of one’s expertise is to get clients, and she already has more clients than spaces on the calendar! The girl is in serious demand!

Meanwhile, a few months back, X contracted COVID. Luckily, she had very mild symptoms, but of course she was quarantining. With no work to do, she headed outside and spent her quarantine weeding her garden! (Apparently, X didn’t know that the only acceptable reaction to being ill is to mope, wear fuzzy socks, and intersperse reading trashy magazines with bingeing guilty pleasure TV!)

X is also not an example of toxic productivity. She’s a product of a particular cultural background that especially prizes hard work and efficiency, but she also enjoys vacationing with her husband and entertaining friends around her pool.

Story #3: My BFF is a full-on, leaning-in career woman now that her children are all grown, but I recall a time when, for the 43rd conversation in a row, I was giving her a hard time about working so hard. She was raising four kids, volunteering in many realms, and though she had a bad case of bronchitis, was — as I was speaking with her on the phone — making cupcakes for a school bake sale!

As only a BFF can push, I pointed out that 1) she was sick and did not need to be doing anything for anyone else, 2) she could have sent her husband to the store to buy cupcakes, and 3) nobody wanted her bronchitis-germy cupcakes anyway! (I’m sure my voice went up three octaves by the time I got to the end of my diatribe.)

If I didn’t know better, I might think my BFF might be an example of toxic productivity. But she’s actually an example of systemic expectations of mental load, emotional labor, and American women unintentionally embracing the societal view that a woman’s value is based on what she does for others. (For superb writing on how to counter this, check out Emotional Labor: Why A Woman’s Work Is Never Done and What To Do About It, by my colleagues Regina Lark and Judith Kolberg.)

Toxic Productivity In the Workplace and What Comes Next

WHAT IS TOXIC PRODUCTIVITY?

Productivity is a good thing, right? You’re hitting the goals you (or your team, or your boss) set, you’re working effectively (on the right things) and efficiently (zooming steadily toward your accomplishments). What could be bad?

Toxic productivity is when that drive to be productive is taken to unhealthy extremes. In a toxic work environment, employees lose motivation and self-esteem due to the external forces created by employer policies and/or management, as immediately recognizable in the now-classic Office Space.

However, toxic productivity can also stem from unhealthy expectations for what personal productivity should look like, and this can be driven by the workplace, by parental and educational influences since childhood, and even by genetic makeup.

Self-generated toxic productivity reads as workaholism, a drive not only to be productive at all times (and sometimes at all costs), but to appear productive at all times. In the past year, it has been called productivity dysmorphia, an expression which if not coined, was certainly popularized by Anna Codrea-Rado. (We’ll dig deeper into her article next time!)

Because it is the impulse for productivity as a process, rather than the achievement of the end result, that characterizes a sense of success, for someone suffering toxic productivity, there’s no sense of satisfaction. For the workaholic, there’s always an aching pit in the stomach that the end result could have been better or that they could have accomplished more. There’s no joy in crossing the finish line, because there’s always another finish line.

Those dealing with workplace-driven toxic productivity may fear losing seniority status or career security if productivity decreases. But for those whose identities are tied to what they have accomplished, self-esteem is often derived from getting stuff done, so it can be hard to find a personal off-switch. Work/life balance — a dubious concept in the first place — is hard to achieve when you identify your value in life by what you achieve at work.

For those whose identities are tied to what they have accomplished, self-esteem is often derived from getting stuff done, so it can be hard to find a personal off-switch. Share on XAre you asking, “What’s the problem?” Focusing on productivity means high achievement, and if your sense of self is measured by what you achieve, how will you ever get off that roller coaster? How will you ever stop chasing the high of “having done the thing” you set out to do? When do you get to breathe?

If you always feel that you should be getting more done, you may feel guilty when you’re not producing — and this can include needing that sense of accomplishment through housework, hobbies, or any competitive impulse where the drive eclipses the enjoyment.

If you feel more and more worn out rather than energized by whatever you do, that’s toxic. And like any poison, it will drain you of your vitality.

An obsession with productivity can not only lead to a lack of productivity, but can eventually cause leisure sickness, where during your downtime, with family, or while on vacation, you’re unable to relax and enjoy the moment, as you may become disconnected from the idea of existing without working toward a productive end.

Today’s post is going to focus on toxic productivity in the workplace, and what’s being done to countermand it. Next week, we’re going to dig deeper and look at how we can target toxic productivity and productivity dysmorphia at the individual and societal levels to be productivite in a more healthy way.

TOXIC PRODUCTIVITY AROUND THE WORLD

Have you ever heard of 996? China made the news last year because many workers were on a 996 schedule, working 9 a.m. to 9 p.m., six days a week!

Meanwhile, in Japan, there’s a corporate culture that leads to workers performing up to 80 hours of overtime, often unpaid, each month. It’s called Karōshi, “death by overwork,” and it’s marked by an extreme performance of company loyalty, both on and off the clock. Employees, legally granted twenty vacation days per year, regularly fail to take half of them.

For what it’s worth, this overwork doesn’t help Japan’s productivity, which falls behind the United States, France, Germany, Italy, the UK, and Canada.

Lest you think that this is only a problem in the Far East, be assured that this kind of toxic productivity is alive and not-so-well right here in the United States. For example, according to Project Time Off, in 2016, 55% of Americans did not use all of their paid time off. That’s 658 million unused vacation days, one-third of which did not roll over to the next calendar year or get reimbursed financially. Poof. That time off just disappeared, and the dollar value of that time went into company coffers.

In 2019, the last pre-pandemic year on record, 768 million vacation days went unused — and less than a quarter of Americans used all of their available paid vacation! Oddly, a 2019 study showed that one in three Americans would be willing to take a cut in pay in order to get unlimited vacation days. This is pretty puzzling. Workers want more vacation, but they’re unwilling or unable to take all of the paid days they have!

Why might this be? A recent TikTok (sigh, yes, I’ve become one of those people) showed an imagined conversation. A representative of Human Resources was cheerleading the advent of summer work hours, where staff would be allowed to leave at 3 p.m. on Fridays. Dubious, the worker asked if workload expectations would be scaled back accordingly.

The “boss” character noted that staff would be encouraged to work late on Thursday evenings to make up the workload. After the employee pointed out the irony, the boss character noted that, simply put, they wanted both the same level of productivity and credit for offering work/life balance.

The grim humor aside, this is the reality for most workers, and it’s not just about vacation hours. More and more, I’m seeing articles about “sad desk salads,” popularized by the Jessica Grosse novel of the same name.

From Life Is Too Short for Work Salad to The “Sad Desk Lunch” is Now Even More Depressing as Employees Return to the Pandemic-Era Office to this older (not-entirely-comedic) video, Sad Desk Lunch: Is This How You Want to Die?, the toxic drive for productivity (or to appear productive) is dangerous.

The problem isn’t salad, but dining at one’s desk while continuing to work through lunch. We know the continued sitting is bad for physical health. The lack of socializing (even for introverts) and inability to take cognitive breaks from labor (and physical breaks from the workplace to get fresh air) are bad for mental health.

None of this is new. Workers’ fears of being replaceable and the corporate message of being a “company man” or “company woman” have been around for a long while. And now, there’s an overwhelming uncertainty as we struggle through a third summer of COVID and into inflation and a prospective recession. (Sorry, this isn’t the usual chirpy Paper Doll topic!)

Of course, if there’s been one positive of the these past 2 1/2 years, it’s that workers are no longer willing to be taken advantage of. I’m sure you’ve noticed that there are fewer cashier lanes open in stores, and most restaurants have signs on the front door, warning patrons that they are short-staffed. While I don’t want to get political, I completely agree with this tweet:

Periodic reminder: there is no labor shortage. There is a shortage of jobs that treat workers with dignity and an excess of corporate greed.

— Robert Reich (@RBReich) June 10, 2022

CONQUERING TOXIC PRODUCTIVITY FROM THE TOP DOWN

The tweet’s point is apt, but the question becomes, how can we maintain healthy productivity in the face of corporate greed?

In the middle of the 20th century, that was a role filled by unions. Now, productivity will be controlled in three ways: by governments setting policies for the betterment of society, by companies recognizing their long-term self-interest in treating employees better, and by individuals either working from within to change company culture or leaving for different workplaces or starting their own businesses.

(Full disclosure: A little more than twenty years ago, I left a toxic industry, and a particularly toxic workplace, and became a professional organizer. The impact on my physical and mental health was an absolute net positive. But, of course, becoming self-employed is not a panacea for everyone, as we’ll discuss in greater detail in next week’s post.)

Japanese efforts to counter Karōshi were iffy at best; they mandated that employees took their vacation days and set corporate office lights on timers to go off at 10 p.m. And, like the TikTok example, they shortened work hours on the last Friday of some months, but it turns out this was more of a marketing effort to get workers to use their off hours to shop!

So what might actually work?

Curtailed Office Hours and Remote Work

You may have seen on the news last week that 70 companies of varying sizes, from mom-and-pop restaurants to corporate entities, in the United Kingdom are testing 4-day workweeks this summer. Like the TikTok example with a token carving away of two hours, these blue-collar and white-collar workers will be paid for their usual (generally, 40) hours per week, but will only have to show up for 80% (so, generally 32 hours); in most cases, the same level of productivity will be expected.

On the one hand, this will give parents the opportunity spend more time with their children, and all workers the chance to make medical appointments and attend to other life necessities. On the other hand, if workers are on-site (whether in offices, restaurants, or stores), they’ll lack the appealing flexibility of work-from-home jobs that became so popular during the earlier stages of the pandemic.

And the research does overwhelmingly show that WFH office workers did not need micromanaging and were as, or more, productive than when they were in the office. Indeed, an Owl Labs study found that, “On average, those who work from home spend 10 minutes less a day being unproductive, work one more day a week, and are 47% more productive.”

That said, there are people who missed the camaraderie of the office and the transitional headspace of commutes. Remote work is one way to improve working satisfaction and defuse the toxic productivity bomb, but it isn’t a solution for everyone.

Better Work/Life Boundary Expectations

In 2016, France took a different approach. Recognizing that the digital, always-on era means that office employees can’t achieve “work/life balance” if there’s increasingly little daylight between their “work obligations” and their actual lives. So, France amended its labor laws such that in any company of 50 employees or more, you cannot email an employee after official work hours.

BOOM!

French Café Photo by Stephanie LeBlanc on Unsplash

Imagine leaving work, going to a café, and not having to be bothered about work until the next workday!

This “right to disconnect” rule isn’t the only thing France has done to improve quality of life. All workers get 30 paid vacation days a year and 16 weeks of fully paid family leave. For comparison, the United States has no nationally guaranteed paid vacation policy and no national policy guaranteeing any paid family leave. Just saying.

Oh, and in case you didn’t make it to 1:48 into the video at the top of this post, France is second only to the US in terms of productivity (GDP per hour worked).

A year after France created this right to disconnect, Italy did the same, and then Spain! In 2018, Belgium followed suit, announcing that 65,000 federal civil servants would no longer have to answer calls or emails from their bosses outside of working hours. Portugal passed a labor code banning employers from pestering employees during their “rest period” except for emergencies, and this applies to both office workers and remote workers. Managers who breach the policy can be fined!

Oh, and last year? Ireland instituted a right to disconnect rule applying to all employees. Your boss can’t contact you by email, phone, or text during your off hours.

Does your workplace (or nation) have any policies that ameliorate the tendency toward toxicity? Please share in the comments, below.

Next week, we’re going to continue this series by delving more deeply into what we, individually, can do to shut down personal tendencies toward toxic productivity and reverse productivity dysmorphia. We will examine:

- Healthy productivity strategies

- Ways to unplug from work and from a sense of obligation to do rather than just be

- Beneficial habits and routines

- A reading list for seeing yourself, and what you accomplish, in a more wholesome way.

Cool and Colorful Desktop Solutions to Organize Your Workspace

June is odd. In much of the county, school has let out (or soon will) and both kids and teachers have been set free. New graduates are gearing up to start their first jobs, while some workplaces have started to shift to summer hours or half-day Fridays. It’s already in the 90°s for many of us, and mojo is in short supply, but the bulk of us aren’t getting summer vacation.

I have a short series coming up soon about lack of motivation, burnout, toxic productivity, productivity dysmorphia, and ways to beat the psychological obstacles to getting organized and staying inspired. But today, we’re going to look at something a little more lighthearted. Sometimes, a little retail therapy (even just via window shopping) can improve our moods and make us a bit more motivated to tackle our stuff, tasks, and spaces.

So, here are a few of the products I’ve seen lately that made me pause and go, “Hmmm.” Be sure to jump into the comments and let me know what you think!

MOFT INVISIBLE LAPTOP STAND

Sometimes, minimalist products can maximize results.

Whether you’re working at your desk at HQ, from your home office or kitchen table, on an airplane, at a picnic table in the sunshine, or in the corner coffee shop, the ergonomics of your workspace setup is important. When you have a permanent desk, it’s easy to arrange for a monitor riser so that your screen is at the right height, but portable risers can be heavy and inconvenient, and working while mobile can bring unexpected miseries. Wouldn’t it be nice to have something lightweight and easy to maneuver?

Enter Moft, maker of device accessories. They state, “Most productivity accessories are rigid, bulky and heavy-eeping you tied to a specific location. We wanted to create something flexible, functional, and non-intrusive that goes everywhere we go, allowing us to be productive anywhere life’s adventures take us.”

MOFT’s Invisible Laptop Stand is hard to describe but quick to impress. When flat and not in use, it’s ridiculously thin at only 0.1″ thick. It’s constructed out of “vegan” leather (didn’t we used to call that vinyl?) and heavy-duty fiberglass.

When flat, you’d barely notice it, but once attached to the bottom of your laptop (with residue-free adhesive) and adjusted to either of the two possible angles, the 3-ounce stand supports up to 18 pounds of laptop weight.

With built-in magnets, you can easily raise your laptop to the right height in a snap. There are two elevation angles to maximize your comfort. Use the “high-lifting” mode when you are sitting, and raise your laptop 3 inches (at a 25° angle); if you’re using a standing desk or working at a counter, consider the “low-lifting” mode of 2 inches to raise your laptop to a 15° angle.

Since it’s lightweight, portable, and (usually) attached to your laptop, there’s no need to create other space in your bag to accommodate it and you won’t have to worry you’ll forget or misplace it.

The Invisible Laptop Stand comes in Silver, Space Grey, Jean Grey (like the character from X-Men), Wanderlust Blue, Sunset Orange, Cool Grey, and Jet Black. (And yes, if you click through the photos at the site, you can see that all those greys really are different.) There are also limited-edition versions, sold two-for-the-price-of-one, in Pink (shown below) and Gold, sold only in the US.

The adhesive is residue-free and can be removed and reapplied (or attached to different computers) up to half a dozen times.

The MOFT Invisible Laptop Stand can be used with laptops measuring between 11.6″ and 15.6″. However, they don’t recommend using it with laptops that have vents on the bottom surface, as the stand would block airflow. For users with laptops with bottom vents, they recommend their non-adhesive version (available only in Silver and Space Grey). Because it doesn’t stick to the back (bottom) of your computer, setup in a twinge slower, but still easy, and works with computers measuring 11.6″ to 16″ (with the exception of 14″ MacBooks, which have little rubber feet).

The adhesive versions of the MOFT Invisible Laptop Stand are $24.99; the non-adhesive versions are $29.99. They are sold directly at the MOFT site; Amazon sells them at the same price, but has a very limited availability of colors.

For those using a multiple-device workspace, note that MOFT also makes stands for tablets and phones.

SPECTRUM WALL HANGER

Are you at the point in your year where you really wish you’d invested in a full-sized wall calendar for planning big-picture projects, but you can’t justify the expense of wasting half a year of calendar pages? Or, if you know there are undated wall calendars, you may be uninspired by them.

Poketo’s Spectrum Wall Planner may be just what you need to brighten your office and your mood.

Each of the twelve pages in this poster-sized wall planner looks like it has made friends with the color schemes at Pantone. (Need a refresher? Read Ask Paper Doll: Should I Organize My Space and Time With Color?) The pages are undated, so you can start planning with your summer months and continue on through to next spring.

While I’d be inclined to post two months simultaneously (this month and next month), Poketo encourages users to decorate your walls with anywhere from 4-12 planner pages to make this a more powerful long-term planning tool. You can use any poster hangers or adhesives you have available, though they do sell an Acrylic Poster Hanger for $32. (At that price, obviously, hanging only one or two pages concurrently would make more sense that a 12-month set.)

The 12 monthly pages each measure 30.0″ x 20.6″ and are made of FSC-Certified tree-free paper to be gentler to the environment. (Unfortunately, the site does not reference whether the paper is made from stone or other materials.)

The Spectrum Wall Hanger is $48. (To be clear, this is not a reusable or dry-erase product; it’s one-and-done, so only invest if you’re craving bright colors to brighten your space.)

Poketo also carries a line of tree-free Geometric Sticky Notes in “Warm” and “Cool” tones for $8 per set to help theme or code your wall planner. The 5″ x 5″ notes sets come with 15 notes per shape and 60 notes per pad.

CABLE WRANGLER

Longtime readers of the Paper Doll blog know that I love magnetic things. Way back in 2014, I sang the praises of the MOS system in Paper Doll’s Cable Conundrums & the MOS: Magnetic Organization System.

I still use two, a silver aluminum version at my desk to match my Mac products (now silver and purple) and a white plastic version at my bedside, to ensure that when I unplug a lightning (or other) cable from a device, I don’t have to go searching for where it’s squiggled itself away. I loved that it worked horizontally or vertically, and that the price was reasonable.

Sadly, the MOS is no more. Sewell, the company that originally manufactured it no longer lists it, and Amazon, Apple, and all of the other stores that offered it as a solution to cables and cords running amok show it to be unavailable. Sigh. However, while I preferred the triangular, space-age version, I have found a potential replacement in a more parallelogramatic, domed form (3.24″ along each side of the square base).

Smartish offers four colorful versions of the Cable Wrangler magnetic cord organizer, and it operates pretty much in the same way as MOS, but more colorfully.

The squat magnetic base is stable and sits neatly on a desk, kitchen counter, bedside table, or gaming station. It comes in one of four cloth-covered designer versions: No. 2 Pencil Grey, Lightly Toasted Beige, Teal Me More, and I’m Blushing. The grey is perfect for that back-to-school collegiate look, while the beige says, “Nancy Meyer-directed movie starring Diane Keaton or Meryl Streep, set on a California or New England beach,” or what GenZ and the Millennials are calling the “Coastal Grandmother” aesthetic. Of course, the pink-toned I’m Blushing was designed specifically for Paper Doll.

Cables stay put due to magnets, but if your particular cable isn’t feeling very “attractive” (that’s Smartish’s joke, if you don’t like it), you can use one of the three (included) magnetic “collars” (similar to the ones MOS had) to help improve the magnetic attraction and keep the cable stuck to the Wrangler. See it in action, below.

The Smartish Cable Wrangler is available at the Smartish site for $19.99, or with a 6-foot lightning cable and two-port wall charger for $39.99. For those who prefer to shop via Amazon Prime, all versions are $24.99. (Amazon also sells the Cable Wrangler with a cable and wall charger for $39.99.)

MUTESYNC: A MUTE BUTTON FOR YOUR VIDEO CALLS

“Hey, whoever’s dog is barking, can you mute yourself?”

“You’re on mute!”

“You’re still muted!”

Thanks to the pandemic, we’ve been in a Brady Bunch-boxed video conferencing mode since 2020, but doesn’t seem like any of us are getting much better at remembering to mute and un-mute. What we all need is the equivalent of that old Staples’ “Easy Button.”

Well, the folks at MuteSync came up with exactly that, an Easy Button for muting/un-muting yourself and for prompting you to pay attention when you aren’t quick to do the right thing.

Instead of rushing your hand to the mouse or touch-screen to wake up the display, make your command icons visible, and click them to change your status, just tap the big, old button on your desk. BAM! MuteSync took their idea to Kickstarter, and it was a huge success! (I mean, of course it was. Seriously, how often do you say/hear “You’re on mute!” in a week?)

When you push the mute button (or even when you mute and unmute from your video meeting platform), the MuteSync mute button light changes! (And, duh, it mutes you.)

MuteSync buttons sync with Zoom, Google Meet, Microsoft Teams, Whereby and (with some hiccups) Discord; as of yet, there’s no love for Butter (my favorite under-appreciated video conferencing app).

Both Mac (from MacOS 10.10 (Yosemite) upward) and Windows (7.7 and above) are supported. Note that if you are using one of the conferencing platforms in the browser, MuteSync only supports Chrome and Brave, not Safari. Also, it does not work with phones or tablets, at least not yet. (But, honestly, finding the mute button on a phone or tablet is even harder, so they need to get on that!)

MuteSync requires the installation of a free, downloadable app, and the button connects to your computer (or hub) via an included USB-C cable.

Tapping the button toggles your mute on and off, and changes color to alert you (and anyone in your workspace) that you are muted (or, yikes!, not muted).

MuteSync users get the “Easy Button,” but also get an extra bonus, a free virtual mute button that lives in the menu bar at the top of the Mac or in the Windows system tray. The virtual button stays in sync with whatever’s going on with your conferencing platform, so if you’ve hit the mute button in Zoom, or tapped the MuteSync mute button, or even if the host has muted you (don’t worry, I’m sure she muted everyone but the speaker, so don’t take it personally!), the virtual button will work in lockstep.

The durable plastic MuteSync mute button is 2.4″ square and 0.4″ high, taking up minimal desk space. The bottom has a rubber pad to ensure that it grips the desk tightly and doesn’t go sliding around.

Because different people have different ideas of which colors mean on and off, you can customize the colors and brightness levels of the button’s eight LED light options.

You’ll still have to train your kids, your spouse who acts like a kid, and your exuberant pets so they understand which colors mean they should “shush”. And, if you’re like my peeps on my Friday night professional organizers call (you know who you are!), you may have to train your kitties to avoid stepping on the buttons when they think they’re the stars of the show.

Take a peek at the MuteSync video, and surf around the website, which has a variety of support videos and is written by folks with a fun, goofy sense of humor.

The MuteSync button is $49 at their website, as well as at Amazon.

While this is great for conferencing, I periodically have to record videos on Zoom, and I’ve got a horrible habit of narrating to myself (not-quite under my breath) when I have to switch from video to screen sharing, and when I have to pause in between steps. Yes, editing would allow me to deal with all of that, but I’m not always so technologically savvy (or inclined) with video editing; being able to quickly hit “mute” before before doing any fancy clicks would save me quite a bit of frustration.

What do you think? Could you use a portable, practically invisible, laptop stand? An attention-getting calendar? A fashion-forward cable organizer? An Easy Button to mute and un-mute your video calls?

Please share in the comments and let me know what you think, and what features or colors you wish had been included?

Follow Me