Archive for ‘Taxes’ Category

Organize Your Charitable Donation Strategy

Every day last week, your email inbox was filled with Black Friday and Cyber Monday notifications. But starting today and throughout the month, you’ll probably notice an influx of requests for charitable donations.

This starts with tomorrow’s Giving Tuesday, a unified movement that:

…unleashes the Power of Radical Generosity around the world. GivingTuesday reimagines a world built upon shared humanity and generosity.

Our global network collaborates year-round to inspire generosity around the world, with a common mission to build a world where generosity is part of everyday life.

Whether it’s making someone smile, helping a neighbor or stranger out, showing up for an issue or people we care about, or giving some of what we have to those who need our help, every act of generosity counts, and everyone has something to give.

The term “radical generosity” is defined as the concept that the suffering of others should be as intolerable to us as our own suffering. This may seem like an odd topic for an organizing blog, but I believe that organizing your efforts can allow radical generosity to reinvigorate the delight of giving.

THE UNIVERSALITY OF CHARITABLE GIVING

In Judaism, the concept of tikkun olam means “to repair the world,” and refers to the notion that people have a responsibility to improve the world through acts of kindness and social justice. Judaism also has the concept of tzedakah, commonly used to mean charity, but more fully is explained by the notion of making the world a more just place.

Though I am no expert on other faiths, I do know that charity is an important tenet throughout faith practices. In Christianity, it’s reflected in 2 Corinthians 9:7, “Each one must give as he has decided in his heart, not reluctantly or under compulsion, for God loves a cheerful giver.” Islam notes that the prophet Muhammad said, “Charity does not decrease wealth” to point out the value to the benefactor as well as to those who receive kindness.

In Hinduism, “There is none other who does greater good than the one who removes the hunger of those in a difficult situation, helpless, weak and disturbed.” And Sikhs believe in the concept of sewa, which means “selfless service,” helping others without expecting any reward or personal gain.

Of course, donating money (and goods) is not a concept specific to any one religion, or indeed any religion at all. Ideas such as charity and mutual aid (where a community shares and exchanges resources and services to help one other) can be found in every nation and at every income level. People make donations in their houses of worship and to their schools, to strangers on the street and to well-known non-profits.

Donating money (as well as volunteer time and skill) is a great way to model your values to your children and to others in your community. You could limit round-robin gift exchanges at work or among your extended family and work together to donate funds or effort to non-profits or causes that reflect your highest good.

So yes, thoughtful giving is good (and good for you), but the requests for giving can be overwhelming.

Just like how the clutter of too many possessions in a household can paralyze someone and prevent them from knowing what to do next, a mailbox or inbox cluttered with charitable donation requests can be problematic, particularly during the holiday season from Thanksgiving through the New Year, when everyone is focused on gratitude and lovingkindness.

But if you woke up to seventy-three charitable requests today, you might not be feeling very grateful, loving, or kind. I get it.

THE CHALLENGES OF CHARITABLE GIVING

There are a variety of obstacles people face when inundated with charitable requests.

Stress

- Being inundated by a flood of donation appeals — Non-profits know that you’re in a giving mood (or are feeling pressured to be in a giving mood). People are accustomed to donating at the end of the year, whether for religious, social, or tax reasons, so the donation campaigns behind mailers and emails and social media requests are part of the design.

- Pressure and guilt — It’s common to feel obligated to respond to every request with a donation or gift, even when it exceeds one’s budget or doesn’t align with one’s values. Nobody wants to feel selfish, but it’s important not to give more of yourself than you can afford.

Fears about security

- Increases in frauds, hoaxes, and scams — Sometimes, “charitable” requests come from bad guys using guilt trips and names just similar enough to real charities that it’s common to worry about whether your gift will get to anyone except a thief’s pockets.

- Validity of a charity — Even if a charity is “real,” even if it’s well-known, it doesn’t necessarily mean that a sizable portion of the funds raised will get to the expected recipients. Sometimes a shocking percentage of those donation funds go toward administration, chief executives, advertising, and anywhere but where you’d hope it would go.

Financial anxieties

- Budget constraints and unrealistic goals — At this time of year, our wallets pulled in different directions, like taffy. You’re likely to want to earmark funds for holiday gifts, meals, and travel, on top of regular expenses, but it can be tough to find the Benjamins for donations. Being overly ambitious with our charitable giving leads to the same kind of anxiety as when we’re overly ambitious about gift-giving to friends and family. It feels good in December, but when our January bank and credit card statements arrive? Ouch!

- Unplanned donations — There’s a reason you hear financial advisors talking about planned giving. Planning is organized, and when you are organized, you feel in control. When unexpectedly faced with an in-person appeal for a donation, the emotion of the experience combined with social pressure (on top of financial pressure) can prompt you to spend more than you can comfortably do.

Emotional kerfuffles

- Family disagreements — You thought the political arguments at the Thanksgiving table were stressful? Imagine trying to come up with a plan for family giving when the members of the family are of two minds regarding who is “deserving” of family donations. If one person wants to give to the NRA and another to support of LGBTQ+ teens, but the funds need to come from one couple-owned or family-managed source, sparks may fly.

- Decision fatigue — The sheer volume of need can be overwhelming. Everyone wants your money, and so many charities and worthy causes requesting donations, it’s often difficult to decide which ones to support.

- Charitable burnout — People who donate regularly may feel resentful from the ever-increasing demands during the holiday season.

- Compassion fatigue — Let’s face it. We’re human. Constant reminders of those who are hungry, abused or victimized, troubled, or struggling can become wearying, especially for those who already struggle with some of the harder emotions of the holiday season. While such requests often remind us to feel grateful for what we have, it’s not unusual to feel guilty for not feeling quite so grateful about our own struggles.

OVERWHELM COMES FROM LACK OF PRIORITIZING, PLANNING, AND ORGANIZATION

Over the past 23 years I’ve worked as a professional organizer, one of the constant holiday-time struggles my clients face is what to do about all of the charitable donation requests. Several years ago, I worked with a client on her backlog of important documents and papers. We were making great progress until I arrived one day to find her agitated. She admitted that she’d been “hiding” some papers because they were so stressful for her to think about.

In a room we’d never entered, there were desks, tables, chairs, and a bed, and a variety of other horizontal surfaces covered in envelopes — most of which had never been opened — all seeking donations! There were multiple years of requests!

At first, this sweet woman had just given a few dollars to everyone who asked, but that just led to more and more requests. (I’m not saying that non-profits sell their mailing lists, but yes, some non-profits sell, or at least “rent” their mailing lists. It’s ethically questionable, so before you give, you may want to read a charity’s privacy policy regarding whether they will share donor information without prior consent.)

The client and I started by eliminating all requests from prior giving seasons, then deleted duplicates (and triplicates). Then we developed a strategy that works for most people.

START WITH YOUR BUDGET

Just as some people prefer to say they are on an “eating plan” rather than a “diet,” feel free to think of this as a giving plan, rather than a budget. The idea is to set boundaries you can live with, as it makes no sense to donate so much to end hunger that you will be eating ramen noodles every day to make up for your economic shortfall!

Consider these factors:

- How much can you reasonably afford to give? This requires first having a handle on all of your fixed and variable expenses.

- Would you like to allocate a percentage of your monthly budget for donations? Do you prefer to tithe, set aside a fixed dollar amount per month, or pick some other percentage approach?

- Do you prefer to give an annual gift or arrange monthly contributions?

- If you choose monthly donations, do you want to donate to the same charity every month, or multiple charities but during different months?

- Do you want to set aside extra money (in monthly petty cash) for unexpected, ad hoc requests by organizations or individuals? (You might choose to keep a stash of gift cards for grocery stores or restaurants to give to unhoused or struggling folks you come across, rather than giving cash, to prevent them from becoming victimized by thieves.)

- Does your company offer an annual charitable donation match? If so, taking advantage can stretch your donation dollars!

FOLLOW THE MONEY

You will want to track your donations to make it easier to file your taxes and take all possible deductions.

If you respond to mailed requests for donations, you can write a note on the donation letter, stating how much you donated, on what date, by what method (check number or which credit card). Put that in your tax prep folder for the current year. When/if you get an official letter from the charity thanking you for your donation, match it to the corresponding note and staple it.

If you tend to make donations online, be sure to print a copy of your receipt as a PDF (if you want to keep records electronically) and maintain a donation folder on your computer or in your cloud storage. (You could also print receipts on paper and put them in your tax prep folder; just don’t double-count donations that appear in digital and print form.)

Of course, you can also use financial apps, budgeting software, or spreadsheets to track your charitable contributions. The more money you donate, or the more complex and numerous your donations, the more cautious you will want to be to keep these records for tax purposes. But tracking your donations is about more than just taxes.

In the heyday of magazines, as soon as you’d renew a subscription, you’d start getting reminders to renew again. The more subscriptions, the harder it would be to realize you were being prompted so often that you were subscribing more than once every twelve months. Well, with charities it can be much the same thing. Keep a written record of when you’ve donated to make sure you’re not donating more often than you planned.

CHOOSE YOUR CHARITIES, DON’T LET THEM CHOOSE YOU

Professional organizers often talk with clients about the dangerous power of advertising and in-store displays. We can be going along, thinking we’re doing great with our spending plans and then all-of-a-sudden we are sucker-punched by an enticing commercial or a product display. We didn’t plan to buy it. We didn’t need it. But oops, we got it.

Those donation emails and envelopes may as well be shouting: “This offer is available for a limited time only. Operators are standing by!” but the truth is that non-profits are always in need of money. You may get dozens of requests for donations in December, but your contributions will be no less valuable, life-saving, or appreciated if sent three or six months down the line. Unless you have a very specific need for making a very specific dollar amount of donations before the end of the calendar year, don’t let yourself feel pressured.

Decide on your giving goals in advance. Make this a giving plan.

Prioritize Your Values First

When you try to downsize a closet on your own, you might pick up one article of clothing and ask yourself “keep or set free?” (whether “set free” means toss or consign or donate or use as a rag). A straight-up yes/no choice can be difficult. But if a professional organizer asks you to first pick your ten favorite pieces from your closet and set them aside, it will be much easier to start evaluating your less-loved pieces.

Similarly, if you’re facing a mountain of charitable giving requests, choosing yes or no may feel like you are saving or damning the recipients of each non-profit. No wonder you’re stressed!

So, start by prioritizing the causes that align most closely with your values. For example, those might be:

- education

- the arts

- health/medical

- hunger

- animals

- children

- the environment

- faith communities

- disaster relief

- international relief

- social causes

- political causes

- at-risk communities

- marginalized communities

Once you’ve identified a general cause area that matters to you, you can narrow your focus. You can determine whether you want to donate locally to keep funds in your community or donate to a national effort with a more powerful network of resources.

Research Potential Charities

You do not have to reinvent the wheel. There are some excellent resources for evaluating non-profits and explaining how they rank on transparency, impact, and mission alignment. Consider:

Charity Navigator

Charity Navigator has been around for almost 25 years, and has rated 225,000 charities. Their ratings focus on the “cost-effectiveness and overall health of a charity’s programs, including measures of stability, efficiency, and sustainability.”

GuideStar

Candid’s GuideStar focuses on non-profits in the United States. Search to verify a charity’s legitimacy, learn whether contribution will be tax deductible, view up to three years of a non-profit’s IRS Form 990, read revenue and expense data for the current fiscal year, and learn about a charity’s CEO, Board Chair, and Board of Directors.

BBB Wise Giving Alliance

Give.org, the Better Business Bureau’s Wise Giving Alliance, generates reports that address all of the issues a donor might want to consider, including governance, finances, results reporting, transparency, and appeal accuracy

Charity Watch

Charity Watch, originally founded in 1992 as the American Institute of Philanthropy (AIP) claims to be the only independent charity watchdog in the United States. Charity watch notes that they “dive deep into charity audited financial statements, tax filings, state solicitation filings, and other information so we can let you know how efficiently a charity will use your donations to fund the programs you want to support. CharityWatch exposes nonprofit abuses and advocates for your interests as a donor.”

GiveWell

Rather than focuses only on financials, GiveWell conducts “in-depth research to determine how much good a given program accomplishes (in terms of lives saved, lives improved, etc.) per dollar spent.”

If you decide you want to focus on local charities, you’ll need to do more of your own legwork. For example, if you want to support a local shelter, food bank, or other community initiative, read the website, research who sits on the board of directors, and see where local news media has covered the impact of these charities.

Concentrate on local efforts that focus on long-term community solutions and have a record of efficient use of funds and a history of measurable results.

DEVELOP A DONATION STRATEGY

Once you know which causes are meaningful to you, you can delete or discard donation requests from causes that aren’t high on your list of values.

Yes, really.

Charitable causes are important, but not all causes have to be equally important to you, just as they need not be equally important to all individuals. You get to pick what you value.

Once you identify the causes you value, you can research the specific charities in each.

Let’s say eliminating hunger is important to you. It’s possible you’ll get requests from Feeding America (a nationwide network of more than 200 food banks), the World Food Programme (an international organization within the United Nations that provides food assistance worldwide), No Kid Hungry (providing grants to schools and partners to end child hunger), Meals on Wheels (working to end hunger and loneliness among the elderly), etc.

- Collect all the requests that come in via mail or email in a “holding area” until you’re ready to research them.

- Research the charities to see which appeal to you the most.

- Decide the number of charities to which you will give.

- Pick the frequency of your donations: one time or recurring?

- Divide your giving budget by the number of donations.

- Donate in a way that works for you.

- Record and track your donations for tax purposes. (Save receipts and acknowledgment letters in your paper or digital files)

- Evaluate amounts and charities annually.

For example, might decide to give to one national charity, once per year, in an amount that feels generous to you. Conversely, you might pick four of these charities and give once per quarter.

Alternatively, you could set up a monthly payment to one (or more charities) on your credit card, but you’ll want to revisit that plan annually to make sure the charity still fits your values.

Or, this process of reviewing your values may make you turn your attention to local concerns. You could still give small donations to one or more of the charities that fits you criteria, but then you could contact a local elementary school and offer to pay all outstanding meal fees. In many school districts, children whose families are behind on their lunch fees are unable to get hot lunches and are given cold lunches that make them a target of bullying. In other districts, they simply get no lunch at all. Hungry children cannot learn.

You could pick an amount to pay toward students’ outstanding lunch debt each month, or pool resources with your colleagues or neighbors to pay off those debts once or twice per year.

This is merely one example. You can make lots of donations in December to lots of charities, and then skip the rest of the year. You can pick twelve charities and give equal amounts, one per month, all year, and revisit the charities you’ll choose each year. Or you can mix-and-match local and national donations as you see fit.

The key is to mindfully research, plan, and track your giving so that it allows you to feel generous (and lucky to be able to help) rather than overwhelmed by charitable request clutter and anxious about the entire experience.

LIMIT DONATION ANXIETY

Creating a giving plan and sticking to it (at least for one year) will allow you to eliminate the excess requests before they pile up, but there are additional things you can to do keep from feeling like a Grinch.

Limit the solicitations that come your way.

If you are getting too much donation request mail or email — which, again, is really just (earnest) advertising, it’s OK to click to unsubscribe from the email or call to opt-out of the mailing lists.

Alternatively, you can use a dedicated email address (like PaperDollDonations@gmail.com) whenever you make donations. That way, you only need to check that address when you’re looking for donation confirmations for tax purposes, or when you’re in the mood to actually look at the plethora of mail sent your way. But it never has to hit your main inbox.

Let Go of the Guilt

Just because you receive address labels does not obligate you to make a donation to a charity, just as receiving a holiday card from a distant acquaintance does not obligate you add the individual to your card list. Don’t let them turn advertising techniques into a free ticket on the Guilt Trip Express. Use your brain — then give from the heart.

Learn to say “No” gracefully. Just as you cannot keep everything you ever bought or were gifted, you cannot donate to ever cause that asks.

To increase your comfort with saying no, prepare a mental (or written) script for declining requests.

Remind yourself (and if you wish, explain to others) that you have a planned giving strategy. You have organized your giving to ensure that your efforts are mindful and value-driven. You can, if you wish, give an ad hoc donation, but you can also just say you’ll be happy (if you will be) to consider a donation in your next giving cycle in 2026.

Finally, remember that you need not always give money. Donating your possessions, time, and service to non-profits can be even more valuable than the amount of money you could afford to donate.

Speaking of volunteering, we are sometimes asked to donate our time and effort to worthy causes at the holidays when our schedules least allow us to help. (Also, many popular volunteering activities, like serving meals at shelters, are booked quickly during the holidays.) But guess what? Shelters and food kitchens need volunteers year-round! Just as money is needed just as much on July 25th as on December 25th, our support of our neighbors, in our schools, in faith communities, and in standing up for others is always needed, no matter the season.

Happy Giving Tuesday (and Giving Season). Intentional and organized giving is rewarding. Build a sustainable, organized habit of giving and you will feel more in control of your finances, less stymied by paper and digital clutter, and less likely to feel burned out.

Keep the spirit of giving alive in a way that uplifts you.

Paper Doll Shares How To Select a Shredder, Shred Responsibly, and Save

Much of the following post originally appeared in 2021 and has been updated for 2024 with current product links and shredding discounts.

Klop. KaKLOP! Klunkety klunkety. KaKLOP! Grrrrrr uggggggg. KaKLOP!

No, unlike the officer at U.S. Strategic Command (STRATCOM), I haven’t let a tiny human take over my keyboard. The above is a close approximation of the sound my shredder made last weekend when, after two decades of faithful service and about halfway through shredding documents no longer necessary for tax time, it gave up the ghost.

At first, I thought I might have just fed one too many staples into the grinding teeth of my little document destruction devil. But, when I lifted the shredder from the bin and turned it over, nothing was stuck in the teeth. However, as I shifted the up-ended shredder motor from my left hand to my right, I could hear something sliding back and forth within. Ruh-roh!

Far more curious than mechanically inclined, I took a screwdriver to the whole housing unit, wondering if I might be able to just stick something back in place. (Yeah, go ahead and laugh.) Sadly, I found that a large octagonal metal washer (for want of a better description) had broken completely in half. The wheels on this bus were NOT going to go round and round any longer. I had to buy a new shredder.

DIY SHREDDER ESSENTIALS

Although I haven’t had to purchase a shredder in a long time, this is not my first shredding rodeo. Many of my clients find themselves either buying a first or replacement shredder as part of our work when we’re organizing and purging paper. So at least I knew what I needed to consider.

I hate to be crude, but size matters: the size of your shredder unit, the size of your “shreds,” and the size of the pile (or capacity) you can shred at one time.

Shredder Unit Size

There are three general sizes/types of shredder units: mini, medium, and heavy-duty.

Don’t buy a mini.

Yes, I know, regular readers of this blog recognize that I rarely invoke absolutes; the world is far more grey than black-and-white. However, unless you are buying a shredder for a child, I want to discourage you from buying a mini, or desktop, shredder.

Paper Doll’s Ultimate Guide to Tax-Smart Organizing: 2024

Every few years, I share a series of tax-related organizing tips for readers. Recently I’ve received inquiries from first-time filers asking for how to even begin the process. So, today’s post mixes tax-related news with a larger baseline of how to accomplish preparing and submitting your 2023 tax return.

Note: I’m neither an accountant nor a tax preparer. I don’t even play one on television. But I do help my clients find, organize, and make sense of the documents they need in order to prepare their tax returns.

ESSENTIAL TAX INFO TO KEEP ORGANIZED

Tax Deadlines

The federal Tax Day is April 15, 2024 (unless you live in Maine or Massachusetts, where it’s April 17, 2024).

If you file a (valid) extension request, you must file your tax return by October 15, 2024. Note, you still have to PAY what you (estimate that you) owe by April 15th to avoid a fine. However, if you strongly believe you’re not going to owe anything, you may file late (without filing for an extension) and there’s no penalty fee. But then you’ll also be delaying getting a refund if you’re owed one, so Paper Doll advises against procrastinating.

How To Prepare and File Your Taxes

You have a variety of options for how you prepare and file your federal taxes:

- Prepare your taxes yourself on paper forms. Like a caveman. And you’ll have to do your own math.

- Hire an accountant or CPA firm. You still have to gather all of your forms and your receipts and tell your tax preparer all the wiggly little oddities in your life last year, but you won’t have to do math. The complexity of your return (and how well you organized your supporting document) will determine the cost of the service.

- Visit a tax preparation service like H&R Block or Jackson Hewitt. Find them in independent storefronts or at desks inside big box stores, like Walmart. However, you may want to reconsider this option.

Color Of Change, in collaboration with Better IRS, just released a report called Preying Preparers: How Storefront Tax Preparation Companies Target Low-Income Black and Brown Communities. In it, they cite that many of these companies are unqualified, hiring non-accountant “unenrolled tax preparers,” who are neither credentialed nor certified in tax policy and regulations, and who do not adhere to continuing education requirements — and in 43 states aren’t even obliged to meet basic standards!

As such, many of these unenrolled preparers have been found to have made excessive errors; indeed, one study by the U.S. Government Accountability Office (GAO) found that only 10% of preparers at large tax prep chains calculated tax refunds correctly! Additionally, many of these companies are preying on low-income and minority taxpayers by charging for advances on refund checks, and promoting unnecessary tax products and high-interest refund anticipation loans.

- Use online tax preparation software, like TurboTax, H&R Block Online, TaxAct, Cash App Taxes, and Free Tax USA. They’ll hold your hand through prompting questions and you won’t have to do the math, but you’re ultimately responsible if you misunderstand a question or make an error. And it can be pricey!

The IRS already receives copies of our income information directly from employers, banks, investment companies, etc., so why do we have to do all of this? And why is it so expensive, especially for those who don’t even owe? Because these companies lobby and bribe — ahem, sorry, contribute — to congressional representatives’ election campaigns to prevent the federal government from creating a free option for all!

More Affordable Filing Options

The IRS estimates that Americans spend an average of $250 to prepare and file their taxes, but there are options for lessening that burden.

- If you are age 60 or older, make $64,000/year or less, are disabled, or need language support, you can get free help from IRS-certified volunteers in the Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs.

-

-

- Find VITA and TCE program locations at the IRS locator page.

- Seek related help from the AARP Tax-Aide Service.

- The United Way can connect you to preparation and filing assistance via MyFreeTaxes.

-

- If you’re a member of the military (or a military family), you can prepare and file a federal return and up to three state returns, for free, through MilTax. Eligibility requires that you are:

-

- An active-duty service member, and/or their spouse and dependent child(ren).

- A member of the National Guard and National Guard Reserve (no matter your activation status).

- Survivors of deceased active-duty service members, National Guard, or National Guard Reserve members (without regard to activation status or conflict).

- Honorably discharged, retired service members from all branches, including the Coast Guard, if you’ve been discharged within the past 365 days.

- Designated family members of service personnel who’ve been authorized to manage the eligible member’s financial affairs during deployment. Similarly, any designated family member of a service member deemed “severely injured” and not capable of handing their own financial affairs.

-

- If your 2023 adjusted gross income (AGI) was $79,000 or less in 2023, you can use the government’s Free File program. Here, the IRS partners with online tax preparers each year and eligible users (for 2023 filing, that means those with an adjusted gross income (AGI) of $79,000 or less) can file federal taxes with no fee. (State tax costs vary.)

However, the contracted companies change year-to-year, so if you prefer to maintain your data in your account, making it easier to do year-to-year comparisons and be prompted to recall charitable recipients and sources of W2s, 1099s, etc., next year you may have to decide between switching to a new program partner or paying for what was once free.

Some past participating partners in the Free File program have been problematic. The Federal Trade Commission (FTC) found that TurboTax engaged in deceptive advertising (forcing up-selling), and investigated H&R Block for improperly handling and deleting customer data (as well as for deceptive advertising).

Unsurprisingly, both companies have supported legislation to ban the IRS from offering free tax filing services.

- If you qualify, try the US government’s new Direct File trial program. Only 12 states (Arizona, California, Florida, New Hampshire, New York, Nevada, Massachusetts, South Dakota, Tennessee, Texas, Washington, and Wyoming) are participating in this trial effort.

Direct File eligibility is limited to those with income from employment (reported via W2), unemployment compensation, or from Social Security, so self-employed individuals, gig workers, and those with pensions can’t use it. To try Direct File, you have to take the Standard Deduction and can’t itemize. (You can have up to $1500 in interest or savings bond income, but not earnings through payment apps, rent, or prizes. Wages are limited to $200,000, or $125,000 if you are filing Married Filing Separately.)

Unfortunately, Direct File’s future is uncertain. The Biden administration allocated $15 million from the Inflation Reduction Act for IRS to evaluate the viability of a a free online tax preparation and filing service, with $80 billion apportioned for over the next decade. However, Congress’ debt ceiling agreement “clawed back” some of those funds.

Special K: It’s Not Just for Breakfast Anymore

Do you have an online platform on Etsy or eBay, or use a payment platform to sell through your website? Then you may have heard rumblings about the 1099-K form finally getting the $600 rule up and running. Well, it’s been delayed again.

The rule is designed so that anyone who receives money from a third-party network like Venmo, Cash App, PayPal, Square, or Stripe for having made $600 or more in sales for either goods or services would receive a Form 1099-K by late January or early February (when we’re supposed to get all of our 1099s). But the IRS has repeatedly delayed implementing the rule, so some people have received 1099-Ks and others haven’t, causing confusion.

So, if you got a 1099-K, check to make sure the numbers match the income you believe you received. (If there’s a mismatch between your records and the form, contact your financial network and correct it before you file your return.)

If you didn’t get a 1099-K, that doesn’t mean that you can fib to the IRS! You must report all taxable income, even if someone who was supposed to send you a form didn’t do their job.

Photo courtesy of Chris Potter/CCPix at www.ccPixs.com under CC 2.0

START THE TREASURE HUNT

Know What You Spent

Start by gathering expense information, like:

- receipts for tax-deductible purchases — check paper receipts as well as email confirmations of purchases

- statements or summaries from ongoing accounts. (On Amazon, select the year from the drop-down under Your Orders in your account. Don’t forget to check the tab for digital orders, too!)

- online financial dashboards — Mint closed in March, so plan to find a new dashboard like Quicken Simplifi, Empower, or YNAB.

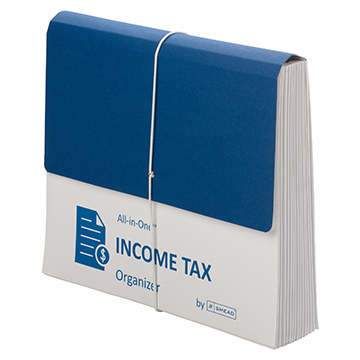

Gather tangible information in a folder labeled Tax Prep 2023, or use something like the Smead All-In-One Income Tax Organizer. Just having it all together will be the first step toward tabulating the correct amounts.

Gather Ye Forms

Most of the essential data you’ll enter into your tax return will come as supporting documents called information returns. These are sent to you by others — employers, banks, brokerage houses, schools, casinos, etc. — and they’re required to mail them by January 31st! That scary-but-official mail you threw on top of the microwave the week before Valentine’s Day? Move the oven mitts and get looking!

The rest of this post is an update of past year’s posts, laying out the different kinds of forms you might need.

MONEY YOU RECEIVED

W-2 (Wage and Tax Statement)

If you were an employee at any point in 2023, your employer should have sent one W2 copy to you and one to the IRS, reporting how much you were paid (in wages, salaries, and/or tips). If applicable, it should also indicate how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state, and local taxes, FICA, unemployment insurance, and a few other withholdings are considered statutory payroll tax deductions. Statutes (that is, laws) require them, so your employer can’t just blow off withholding this money and sending it to the right agencies.

Sometimes, a court might rule that an an employee’s wages may be garnished, but this has nothing to do with sprigs of parsley. People behind on child support payments or who owe money in lawsuits may have money removed from their earnings, before it ever gets to their paychecks, to ensure it goes directly to whomever is owed.

Your W-2 may also report voluntary payroll deductions. These are amounts withheld from your paycheck because you’ve granted permission. These may include your portion of health and life insurance premiums, contributions to your 401(k) or other retirement fund, employee stock purchasing plans, one-time or ongoing donations to the United Way, union dues, etc.

Photo by The New York Public Library on Unsplash

Did you get multiple copies of the same W-2? Employers submit copy A directly to the Social Security Administration for FICA and keep copy D for their own records. Copies B and C are for you (the employee) – you send one to the IRS with your federal tax return and keep one for your own records. Then, they provide copies 1 and 2 to file with applicable state or local tax authorities. (I’ve never figured out why W-2 copies 1 and 2 aren’t called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, FF, and G, skipping E entirely?)

I've never figured out why W-2 copies 1 and 2 aren't called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, and G, skipping E entirely? Share on XIn theory, a W-2 should be mailed to the address listed on your W-4. (Don’t be confused. The W-4, is the form that tells your boss how much to withhold based on your number of dependents you have.)

Smaller companies may just hand you your W-2 instead of mailing it, but if your W2 is missing, consider:

- Did you change employers last year? You should have received W-2s from each employer. (If you changed jobs at the same company, you’ll receive one W-2 from each employer, not one per position. If you changed companies within a larger corporation, though, you may get one for each.)

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down to give you your W-2. Keep the Madge in HR updated!

Don’t assume that if you don’t have your W-2, then nobody knows what you made. Remember, the IRS got Copy A. The IRS knows what you made, so be sure you do, too! (If your former company went out of business or is otherwise not returning your calls, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

Examine your W-2 it carefully. Do the numbers seem right? Compare them to the final pay stub you got for last year. Calendar years may end mid-week (or even mid-pay period), so the numbers won’t correspond perfectly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return.

W-2G (Certain Gambling Winnings)

Gambling Photo by Aidan Howe on Unsplash

The W2G is the freewheeling cousin of the W-2. While a W-2 is for money you make while working, the W-2G is what you get while playing. If you win more than $600 in any gambling session at a casino – whoohoo! – the “house” should request your Tax ID (generally your Social Security number) and either prepare a W-2G on the spot or send it to you in January.

Casinos aren’t interested in keeping up with your losses, just your winnings, so they only tell the IRS about what they paid you. If you gamble and want to deduct losses, the IRS requires you have provide receipts, tickets, statements, or other records to support both your winnings and losses.

1099s (Income)

A 1099 is a form that basically says, “Hey, we paid you some money for something, but you weren’t an employee.” You get a copy; the IRS gets a copy. Easy-peasy.

There’s not just one type of 1099; actually, there are 22 different kinds of 1099s. Some of the more common are:

This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account.

Internet-only banks may require you to log into your account to get your 1099-INT, so don’t count on it coming by mail. If you received less than $10 in interest, your bank may not send a 1099-INT.

Do you own stock or other taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equal; ask your tax professional if you have any that seem unusual or complicated. Whether you receive dividend checks or your dividends are held in a DRIP (a direct re-investment plan), if you didn’t earn at least $10 in dividends, you are unlikely to receive a 1099-DIV.

This random form is subtitled “Certain Government Payments” and can cover everything from state unemployment compensation to tax refunds, credits, and offsets at the state and local level. It can also be used to report payment of taxable grants, agricultural payments, and other nifty things where a state or local government gives you money.

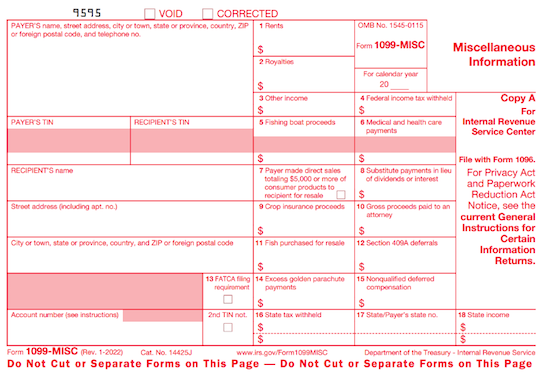

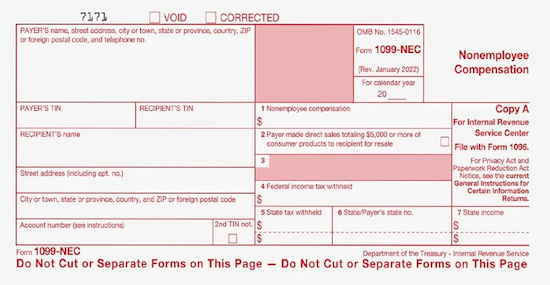

This new(ish) form replaces some uses of the 1099-MISC. If you’re self-employed (a freelancer, an independent contractor, etc.), you should get a 1099-NEC. However, 1099-NEC just started in 2021, so people unfamiliar with it may send you a 1099-MISC by mistake.

Another problem is that even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-NEC. So, if you are self-employed or irregularly employed, it’s essential to keep track of your own incoming revenue. Otherwise, if the person who paid you ever gets audited, it could trigger some messy situations for you, too.

Now that this form no longer covers income for freelances and independent contractors, it’s truly more “miscellaneous.” Seriously, it’s the junk drawer of tax forms!

It’s used to report payment of royalties, broker payments, certain rents, prizes and awards, fishing boat proceeds (yes, really!), crop insurance proceeds, and some payments to attorneys that wouldn’t be reported on a 1099-NEC, like if you received a settlement and had to pay an attorney a portion of it. In general, once people get used to the 1099-NEC, you’ll only get this miscellaneous form to report truly miscellaneous payments.

SSA-1099 (Nobody knows why the numbers and letters are reversed on this one form! It must be done by the same people who label the copies of W-2s and bra sizes!)

If you receive Social Security benefits, you should receive an SSA-1099. (Non-citizens living outside the US, like widows/widowers receiving spousal Social Security benefits, may get a SSA-1042.) The 1099-SSA tends to come on a long form, folded and sealed such that it makes its own envelope. It may look like junk mail, so watch out and replace it, if necessary!

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that someone forgave a debt, like a mortgage or a credit card balance. You may owe tax on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, and got to keep it in your pocket, it’s as if you received money.

1099s sometimes hide in plain sight. Sometimes, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope — sometimes perforated at the bottom of a quarterly or end-of-year financial statement. Be sure to check all that boring-looking official mail. Brokerage houses often sent multiple forms as a “combined 1099,” scrolling across multiple pages. Check the reverse sides of forms, in case you’re missing one.

MONEY YOU PAID

1098 (Mortgage Interest)

A 1098 is not a 1099 with low-self-esteem. The vanilla, no-frills 1098 reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. Renters don’t get 1098s; neither do homeowners who’ve paid off their mortgages.

There are also sub-types of 1098s for things other than interest on property loans:

- 1098-T indicates tuition you paid; you’ll get this from a college or training school.

- 1098-E shows you’ve paid interest on a student loan and will come from your lender.

- 1098-C indicates the donation value of a car, boat or airplane by fancy-pants, monocle-wearing Mr. and Mrs. Thurston Howell.

Photo by Diego F. Parra from Pexels

1095-A (Health Insurance Statement)

The 1095-A is also called the Health Insurance Marketplace Statement. If you purchased coverage through a state or federal exchange, this helps you determine whether you are able to receive an additional premium tax credit or have to pay some back.

Related forms include the 1095-B (supplied by companies with fewer than 50 employees), detailing the the type of coverage you had, the period of coverage, and your number of dependents, so you can prove you had the Minimum Essential Coverage (MEC) required by law. A 1095-C is similar, but for employers with more than 50 employees.

SPECIAL 1040 FORM FOR SENIORS

Are you a senior? If you are over 65, instead of filing the standard 1040 form, you can file the 1040-SR. The main benefit is that this form, when printed, uses a larger font and provides easier readability.

FINAL THOUGHTS

If you receive a mysterious form, or have questions about how to use a form, the IRS has a surprisingly easy Forms, Instructions and Publications Search. Again, I am a Certified Professional Organizer, not an accountant, so please address any concerns to a tax specialist.

Making sure you have all of the necessary forms in hand will make it much easier to prepare your tax return. Once you file your taxes, make a list of all the forms you received this year, and tuck that list into your tickler file for next January. Check off each form as it arrives, and you’ll have a better sense of when you’ll be ready to start working on your 2024 taxes in 2025.

24 Smart Ways to Get More Organized and Productive in 2024

Happy New Year! Happy GO Month!

January is Get Organized & Be Productive (GO) Month, an annual initiative sponsored by the National Association of Productivity & Organizing Professionals (NAPO). We professional organizers and productivity experts celebrate how NAPO members work to improve the lives of our clients and audiences by helping create environments that support productivity, health, and well-being. What better way to start the year than creating systems and skills, spaces and attitudes — all to foster a better way of living?!

To start GO Month, today’s I’m echoing Gretchen Rubin’s 24 for ’24 theme that I mentioned recently, and offering you 24 ways to move yourself toward a more organized and productive life in 2024. There are 23 weekdays in January this year, so if you’re feeling aspirational and want to conquer all of these, you can even take the weekends off as the last item is a thinking task rather than a doing task.

I broke these organizing and productivity achievements down by category, but there’s no particular order in which you need to approach them, and certainly you don’t need to accomplish every one on the list, in January or even all year. Jump in and get started — some only take a few minutes.

PUT LAST YEAR AWAY

1) Make many happy returns!

Did you know that shoppers will return $173 billion in merchandise by the end of January? Chances are good that you (or someone for whom you oversee such things) got gifts that need to be returned.

Don’t put it off. The longer you wait, the more clutter will build up in your space, and the more likely you will be to suffer clutter-blindness until the return period has expired. Most stores have extended return policies during the holidays, but they can range upward from 30, depending on whether you have a gift receipt.

The Krazy Coupon Lady blog reviews the 2024 return deadlines for major retailers. She notes that you’ll get your refunds faster by returning items to the brick & mortar stores rather than shipping them back. You’ll also save money, because some online retailers charge a restocking fee.

2) Purge your holiday cards.

While tangible greeting are getting fewer and farther between, you probably still got a stack. Reread them one last time, and then LET THEM GO.

Did Hallmark or American Greetings do the heavy lifting, and the senders just signed their names? Toss them into the recycling bin. Paper Doll‘s grants you permission to only save cards with messages that are personal or resonant.

If they don’t make you cry, laugh, or go, “Ohhhhh,” don’t let them turn into the clutter you and your professional organizer will have to toss out years from now when you’re trying to downsize to a smaller home! It’s a holiday message, not a historical document; you don’t transcribe your holiday phone conversations and keep them forever, right?

The same goes for photos of other people’s families. You don’t have to be the curator of the museum of other people’s family history; let them do that.

3) Update your contacts.

Before you toss those cards, check the return addresses on the envelopes and update the information in your own contacts app, spreadsheet, or address book.

Next, delete the entries for people you’ll never contact again — that ex (who belongs in the past), that boss who used to call you about work stuff on weekends (ditto), people who are no longer in your life, and those who are no longer on this mortal coil.

If you don’t recognize the name of someone in your contacts, Google them or check LinkedIn (is it your mom’s doctor? your mechanic?) and if you still don’t know who it is, you’re obviously not going to be calling or texting them. Worst case scenario, if they text you, you can type back, “New phone, who dis?”

BOX UP YOUR INBOXES

4) Delete (most of) your old voicemails.

How often do you return a call only to hear, “The voicemail box is full and is not accepting messages. Please try again later.” When someone calls you and requests you call them back but their voicemail is full, it’s frustrating because it makes more labor for you.

Do you assume that it’s a cell phone and text them? (I believe texting strangers without permission is a breach of etiquette.) Plan to call back later? Assume that they’ll see the missed call and get back to you, starting another round of phone tag? ARGH!

Dial in to your voicemail and start deleting. Save phone numbers for anyone you’ll need to contact and log anything you may need to follow up on. But unless you’re saving a voicemail for legal purposes or because you can see yourself sitting in an airport, listening to a loved one’s message over and over (cue sappy rom-com music), delete old voicemails.

If you’ve got a landline, clear that voicemail. If you’ve still got an answering machine, how’s the weather in 1997? Yeah, delete old messages.

Smith.ai has a great blog post on how to download important voicemails (from a wide variety of phone platforms) to an audio file. Stop cluttering your voicemail inbox!

5) Clear Your Email Inboxes

Start by sorting your inbox by sender and deleting anything that’s advertising or old newsletters. If you haven’t acted on it by now, free yourself from inbox clutter! Delete! Then conquer email threads, like about picking meeting times (especially if those meetings were in the past).

Take a few minutes at the end of each day to delete a chunk of old emails. To try a bolder approach, check out a classic Paper Doll post from 2009, A Different Kind of Bankruptcy, on how to declare email bankruptcy.

6) Purge all of your other tangible and digital inboxes.

Evernote has a default inbox; if you don’t designate into which folder a saved note should go, your note goes somewhere like Paper Doll‘s Default Folder. Lots of your note-taking and other project apps have default storage that serves as holding pens. Read through what you’ve collected — sort by date and focus on the recent items first — and either file in the right folders or hit delete!

Walk around your house or office and find all the places you tend to plop paper down. Get it in one pile. (Set aside anything you’ll absolutely need in the next few days to safeguard it.) Take 10 minutes a day to purge, sort, and file away those random pieces of paper so that you always know where they are.

HIT THE PAPER TRAIL

7) Embrace being a VIP about your VIPs.

You need your Very Important Papers for all sorts of Very Important Reasons. If the last few years have proven anything, it’s that life is unpredictable, so we need to find ways to make things as predictable and dependable as possible.

Yes, putting together essential paperwork isn’t fun. It’s boring. But you want it to be boring. The more boring your vital documents are, the more it means there will be no surprises for your loved ones in troubling times (like during and after an illness, after a death, while recovering possessions after a natural disaster) or even when you’re just trying to accomplish something like getting on an airplane.

Start with these posts, then make a list of any document you already have (and where it is), and another list of what you need to create, and plan meetings with your family and a trusted advisor to set things in motion.

How to Replace and Organize 7 Essential Government Documents

How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Paper Doll’s Ultimate Guide to Getting a Document Notarized

Paper Doll’s Ultimate Guide to Legally Changing Your Name

A New VIP: A Form You Didn’t Know You Needed

8) Create your tax prep folder now so you’ll be ready for April 15th.

Do you toss non-urgent mail on top of the microwave? Might those important 1099s and 1098s and 1095-A and W-2s get lost? Don’t lose deductions, pay more taxes, or get in trouble with the IRS!

By the end of January, you’ll start getting tax documents in the mail. Pop them in a folder in your financial files or in a dedicated holder like the Smead All-in-One Income Tax Organizer.

Paper Doll’s Secrets: Shred Successfully & Save Money

Klop. KaKLOP! Klunkety klunkety. KaKLOP! Grrrrrr uggggggg. KaKLOP!

No, unlike the officer at U.S. Strategic Command (STRATCOM), I haven’t let a tiny human take over my keyboard. The above is a close approximation of the sound my shredder made last weekend when, after two decades of faithful service and about halfway through shredding documents no longer necessary for tax time, it gave up the ghost.

At first, I thought I might have just fed one too many staples into the grinding teeth of my little document destruction devil. But, when I lifted the shredder from the bin and turned it over, nothing was stuck in the teeth. However, as I shifted the up-ended shredder motor from my left hand to my right, I could hear something sliding back and forth within. Ruh-roh!

Far more curious than mechanically inclined, I took a screwdriver to the whole housing unit, wondering if I might be able to just stick something back in place. (Yeah, go ahead and laugh.) Sadly, I found that a large octagonal metal washer (for want of a better description) had broken completely in half. The wheels on this bus were NOT going to go round and round any longer. I had to buy a new shredder.

DIY SHREDDER ESSENTIALS

Although I haven’t had to purchase a shredder in a long time, this is not my first shredding rodeo. Many of my clients find themselves either buying a first or replacement shredder as part of our work when we’re organizing and purging paper. So at least I knew what I needed to consider.

I hate to be crude, but size matters: the size of your shredder unit, the size of your “shreds,” and the size of the pile (or capacity) you can shred at one time.

Shredder Unit Size

There are three general sizes/types of shredder units: mini, medium, and heavy-duty.

Don’t buy a mini.

Yes, I know, regular readers of this blog recognize that I rarely invoke absolutes; the world is far more grey than black-and-white. However, unless you are buying a shredder for a child, I want to discourage you from buying a mini, or desktop, shredder.

I admit, most “desktop” shredders are not hand-cranked and adorable like the one above. Indeed, most are more like the Aurora AS420C Desktop Style Cross-Cut Shredder below, in that it looks spiffy. But looks can be deceiving.

Often, I find that clients purchase desktop mini-shredders hoping that the small profile and easy desktop access will incline them toward keeping up with their shredding. However, the opposite is true.

Often, I find that clients purchase desktop mini-shredders hoping that the small profile and easy desktop access will incline them toward keeping up with their shredding. However, the opposite is true.

Tiny shredders like the one above only take four sheets at a time (vs. 8 or 12 for a more serviceable shredder), fed through its 4 1/2-inch “throat,” or feeder slot. As most mail is 8 1/2-inches wide, anything not already folded into halves or thirds will need to be folded before fed. If you’ve got a multi-page credit card or utility bill (AmEx bills are usually a ridiculous number of pages, for example), you’ll have to separate the bill and feed just a few pages at a time. And the entire shredder can only accommodate 40 sheets, meaning you’ll have to repeatedly empty the basket.

You may not ever need to power-shred, but mini- or desktop shredders just aren’t designed for the kind of paper that the average household, and especially the home-based office or actual office, needs to destroy. I‘ve said it before: A mini-shredder is a lot like an Easy-Bake® Oven. Yes, it can do what it promises, but would you cook Thanksgiving dinner without a full-sized oven?

'A mini-shredder is a lot like an Easy-Bake® Oven. Yes, it can do what it promises, but would you cook Thanksgiving dinner without a full-sized oven?' Share on XFor typical home use, and for one-person offices, a medium-sized shredder should suffice. It should be able to handle four to six gallons of shredded paper (or about 150 to 400 sheets).

If you work in a large office, particularly one that deals with medical paperwork (covered by HIPAA regulations) or client financial information, you will want a shredder designed for large-capacity, heavy-duty shredding, one with an eight-gallon or larger basket/bin. (You’ll also be looking at a shredder that costs many hundreds of dollars, rather than one in the $30-$150 range.)

Shred Size (and Shape)

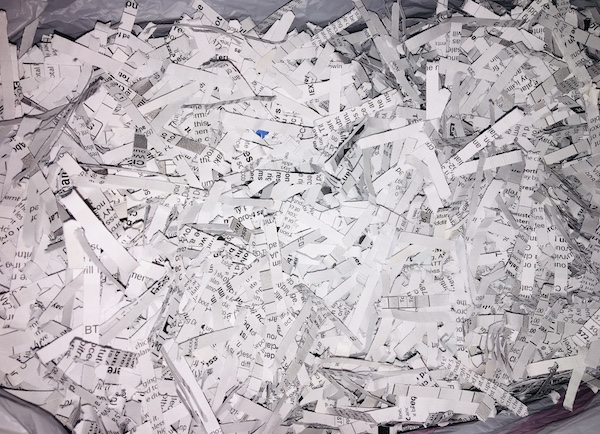

There are generally three types of shred sizes produced by consumer shredders. (Industrial shredders can pulverize paper into a fine dust, but that might be going overboard for destroying old bank statements.) These are known as strip-cut, cross-cut, and micro-cut.

Shockingly, I have another absolute for you: don’t buy the old-style strip-cut shredders; they’re rarely sold anymore, but even if you see a good deal at a garage sale, pass it by. Strip-cut shredders offer poor identity theft protection if someone really wants to get their hands on your data.

You will want a cross-cut or micro-cut shredder. A cross-cut shredder reduces your paper to 1-inch to 1 1/2-inch squiggly strips; such shredders are considered secure or “medium-security” and are rated P-4 or P3 security levels, respectively. On average, a cross-cut shredder shreds paper into 200 pieces (for a P3-rated shredder) or 400 pieces (for a P4-rated shredder). At home or in a one-person office, a cross-cut shredder will suffice.

A micro-cut shredder chops paper into tiny fragments; micro-cut shredders are rated P5, P6, or P7 (the latter is also called nano-cut, and recommended for government and classified documents) in terms of security levels, shredding papers into 2000, 6000, or 12,000 pieces, respectively.

For an office that deals with HIPAA compliance, financial data, or spycraft, consider a micro-cut shredder. However, this is going to be over overkill (in terms of both function and cost) for use in a home office. (I mean, unless you’re a work-from-home spy, in which case…cool, dude!)

Capacity

There are three aspects to consider when looking at the capacity of a shredder:

1) How many sheets of paper can you feed at one time?

Most shredders you’ll be looking at for home use will be listed as handling 5-10 sheets at a time; for an office, a capacity of 10-18 sheets can be fed at one time. (There’s some cross-over in the home and office categories.) Bear in mind that at the home level, staples and thicker paper can reduce the number of sheets that can be safely fed at one time.

Heavy-duty shredders designed for office use can accommodate anywhere from 13 to 38 sheets at a time, with those at the higher level being much pricier.

While shredders are generally rated by the number of sheets shredded simultaneously, Paper Doll believes many manufacturers are a bit too optimistic in self-reporting. Just aim for the highest capacity shredder in your budget range.

2) How long can you shred before the shredder conks out? (This is called the shredder’s duty cycle.)

Ever get the red light while you’re shredding? This is the “Do not pass GO, do not collect $200!” message that means your shredder needs to cool down. Promotional materials usually claim that smaller shredders for home use can operate for two-to-three minutes continuously before needing a 20-to-30 minute break.

That doesn’t seem like very much time, but recognize that if you’ve got your shredder set to “on” rather than “automatic,” the shredder is only operating while you are pushing papers through. So, skip the automatic setting, take a few seconds between each multi-page pile of papers, and you’ll be OK.

Shredding companies have started listed their duty cycles on promotional material, but official capacity and real-world usage can be at odds, so do read the reviews.

3) What else can your shredder accommodate besides paper?

Any shredder you acquire should be able to handle stapled papers and (expired) credit cards. Most should also be able to shred CDs and DVDs, but if you have a lot of data on disk, be sure to check that your intended purchase can accommodate what you need to shred.

Other Considerations

Aesthetics — Unlike cell phones and other modern electronic devices, nobody seems to have given any thought to whether a shredder is attractive (to the eye or to the ear). I have yet to see a shredder in designer colors, and you’re pretty much limited to combinations of black and silver.

Obviously, design shouldn’t be your main concern, but you are likely to avoid using an ugly shredder or one that screeches. (Remember The Great Mesozoic Law Office Purge of 2015? When we cleaned out my father’s law office, he had an ancient, “yellowing” beige shredder. It was capital-U ugly, but Paper Mommy needed a shredder and was convinced she’d make use of it. Yeah. No.)

With regard to sound, whenever possible, test a friend’s shredder or ask a sales associate to help you test a floor model. The noise a shredder makes won’t exactly be pleasant, but some have more vibration or grinding than others.

Ease of Use — The main concerns are an adequate-width feeder and an easy-to-empty basket or bin. The nicest shredders have a removable bin that slides out like a drawer or tips out like a laundry chute, but these tend to be more expensive than the budget versions, where the shredding mechanism lifts off to reveal a metal or rubber receptacle. Avoid the low-rent shredders that only provide a mechanism to set atop a trash can; these are usually ill-fitting, poorly balanced, and lead to a flurry of shreds on your carpet, which furry animals and tiny humans will spread far and wide.

Special features — Some shredders, particularly those designed for a communal workspace, market special features at a higher price. For example, Fellowes markets a “100% Jam-Proof” micro-cut shredder for $1726.99! Others promote energy savings and quiet operations. As always, consider how often you’ll be using your shredder to determine how much extra you are willing to pay for special features.

At the lower end of the scale, you may want to consider the basket or bin into which you shred. The bin for my shredder, the one that bit the dust, was made of metal mesh, which meant that a lot of the shredding dust poured into the air if I didn’t use a bag, but when I used a bag, I couldn’t tell when it was almost full. Further, most shredders are designed so that the shredding unit/lid won’t fit properly into the bin if you’ve lined it with a bag, and if they do, most grocery-style plastic bags are smaller than the bin, so you’re not able to use your full capacity.

My new purchase warns not to use a bag; however, the base is made of a solid plastic (much like a trashcan) so there’s no shred dust plume, and has a nice window to give me a sense of when I’m about to reach maximum capacity. At that point, I must carefully lift up the shredding unit, tilt and flip it quickly to avoid spreading bits of shreds everywhere, and then I can upend the whole bin into the trash.

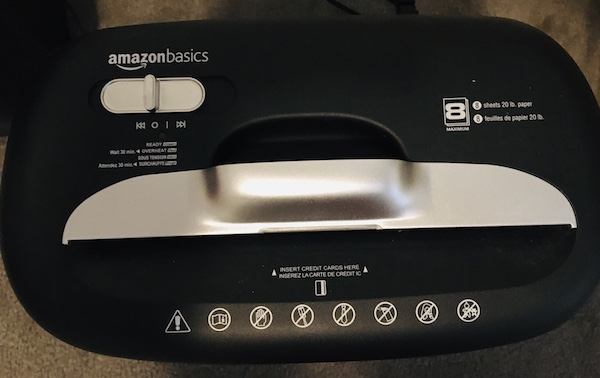

There’s always a trade-off. I’m frugal and don’t have a lot of demands, aside from my shredder not making the “Klop. KaKLOP! Klunkety klunkety. KaKLOP! Grrrrrr uggggggg. KaKLOP!” sound more often than every few decades. I purchased the Amazon Basics 8-sheet shredder because it was on sale last week, running five dollars less than it is right now, and because it was a Best Seller (probably because it’s so inexpensive). But again, because you need to live and work with it, it’s important to pick a shredder with the features you need and want.

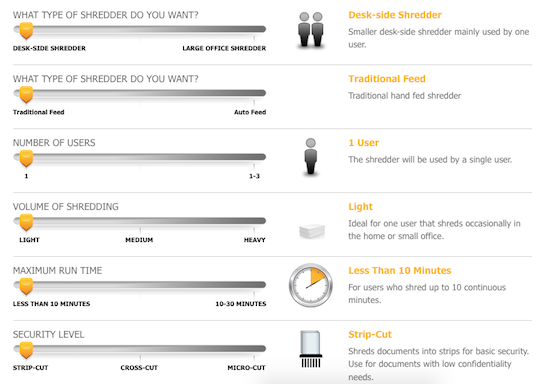

Still not sure what you want? Fellowes offers an interactive Shredder Selector tool to help you choose among a variety of features, including shredder capacity, feeder type, number of users, volume of shredding, maximum run time, security level, shredder safety, and even a few extras.

PROFESSIONAL SHREDDING SERVICES

You already know how important it is to shred the paper that you no longer need for tax, legal, or proof-of-ownership purposes; merely tossing them in the trash could make you a quick victim of identity theft. But you also know that once your shred pile is as tall as the youngest of your tax-deductible dependents, your home-rated shredder is likely to wimp out before you get through your seasonal pile shredding.

If you lack the time, space, shredding power, or intestinal fortitude to conquer your backlog of shredding, you have a variety of options for getting professional help. A number of companies are available nationwide to help with document destruction, including:

You are likely to have local and regional shredding companies at your disposal as well.

If you need help finding shredding services in your area, turn to the National Association for Information Destruction.

NAID’s interactive map will locate shredding companies nearest to you. Enter your zip code and the system will provide you with a map and list of document destruction services in your area. You can also narrow your search to filter for different kinds of destruction certifications.

Note: Most shredding services offer a combination of drop-off and secure pick-up services; if your office or organization requires regularly scheduled shredding, you can arrange for periodic pickups.

Many retail locations also have relationships with document destruction services. In these situations, you generally self-serve your papers into a slot in a large, locked container that looks much like the garbage and recycling cans you wheel to the street on trash day; the shredding companies usually do pickups every week-to-two weeks and either shred paper in a specialized truck in the store’s parking lot, or trade out an empty bin and take the full one to their physical operations.

Getting your shredding done in the same parking lot where you pick up your groceries or get your office supplies is convenient (and less labor than shredding piles of paper for yourself), but the cost is likely to be a little more than you’d pay if dealing directly with a document destruction service. Prices typically range from 99 cents per pound, upward.

Check with your local retail locations to see if, how, and at what price they offer shredding services. Start with:

Before you go, be sure to check the retailers’ sites for discounts, or use your favorite search engine to search “[store name] shredding coupon 2021” to see what discounts are currently available.

Tax time is usually one of the best times of year to get discounts on shredding. For example, as I write this post, FedEx office is offering a 40% discount on shredding services, so their usual $1.49/pound costs just $0.89/pound from April 1 – May 31, 2021. (No coupon required.)

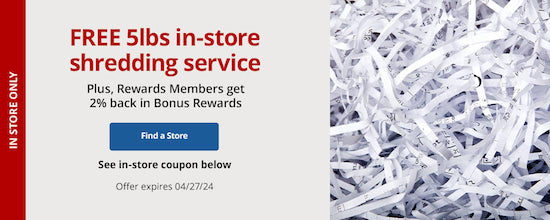

Office Depot tends to change their discount offerings each month. Right now, Office Depot is offering 5 pounds of in-store shredding for free and 20% off any one-time shredding pick-up service. The photo below is a facsimile, so scroll to the bottom of the Office Depot shredding page and click “print” for the coupon you prefer.

FREE SHREDDING EVENTS

Throughout the year, various government agencies, community groups, senior centers, houses of worship, and universities partner with shredding companies for free events billed as shredathons and shred days.

Document destruction companies (like Iron Mountain, Shred-It, Pro-Shred, and Shred Nations) bring their giant paper-chomping trucks so you can get your papers securely shredded on-site. While these events have been less common throughout the pandemic, a quick Googling indicates that they’re starting up again.

Search these terms plus your city or town name to find events near you. Many are held in mid-to-late April, so don’t delay. In addition, the Better Business Bureau also sponsors free shredding events associated with Secure Your ID Day. Canton, Ohio kicks off their event this coming Saturday, April 10, 2021, with many more around the country continuing throughout the month.

Tax time is the perfect opportunity to clear out your file folders, your desk drawers, your purses, wallets, and pockets, and to shred all those random receipts and documents that you don’t need to support your tax returns, keep you legal, or prove ownership of your stuff.

Of course, if you don’t know what you need to keep vs. what you should shred, Paper Doll has you covered with Do I Have To Keep This Piece of Paper?

Whether you shred at home or work, use a service, or attend a shredding event, plan time in your schedule to shred. Declutter, protect your identity, and save time and money!

Follow Me