Archive for ‘Financial’ Category

26 Ways to Celebrate GO Month to Get More Organized and Productive

Happy New Year! Happy GO Month!

Each January is Get Organized & Be Productive (GO) Month. Back in 2005, NAPO (then called the National Association of Professional Organizers) proclaimed the first Get Organized Month, as a national public awareness campaign about organizing and our profession.

A decade later, the month was expanded to incorporate productivity, just two years before we officially became the National Association of Productivity & Organizing Professionals. Our purpose remains the same. All of us — professional organizers, productivity specialists, declutterers, coaches, etc. — celebrate how we improve the lives of our clients by creating environments and developing skills to support productivity, health, and well-being.

Practitioners like Paper Doll are here to help you create systems and skills, improve your homes, workspaces, and attitudes, and live your best, most productive life.

For more great organizing and productivity tips during GO Month, you can also follow NAPO’s Social Media Accounts:

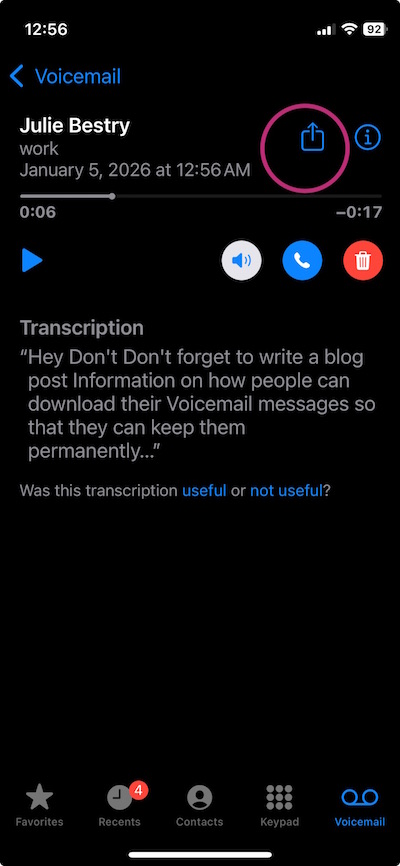

Today’s post offers some 26 ice cream samples of organizing and productivity tactics to make 2026 a little easier.

ORGANIZE YOUR PAPER IN 2026

1) Create a Tax Prep Folder

April 15th will be here before you know it. From now through February, you’ll receive tax documents (1099s, 1098s, W2s) in the mail. You may also get emails reminding you to log in to brokerage and other accounts to download your important tax documents.

Don’t wait until the last minute to gather these items. It’s not just good organizing advice, but helpful financial advice, too, because the sooner you get your important tax documents together, the faster you (or your accountant) can get you your refund, or at worst, let you prepare for the size of your tax bite.

Your tax prep folder doesn’t have to be fancy; a plain tabbed folder kept at the front of your financial files section should suffice. However, if you’re dealing with a lot of documents, you might prefer a dedicated accordion-style folder like the Smead All-in-One Income Tax Organizer.

2) Roll Out the Red Carpet for Your VIPs

Make 2026 the year that you get your affairs in order. Estate documents and other essential paperwork must be created, obviously, but also reviewed and updated on a periodic basis.

As I’ve said before, this aspect of organizing may be boring (if you aren’t a professional organizer), but boring is good! If your VIPs are boring, it means that you and your family won’t ever experience any ugly surprises during difficult times, like when someone is in the hospital, when there’s been a death in the family, or even when dealing with the aftermath of a natural disaster.

Start by reading these from-the-vault posts to figure out your next steps.

- How to Replace and Organize 7 Essential Government Documents

- How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

- The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

- Paper Doll’s Ultimate Guide to Organizing Yourself to Get a REAL ID

- Paper Doll’s Ultimate Guide to Getting a Document Notarized

- Paper Doll’s Ultimate Guide to Legally Changing Your Name

- A New VIP: A Form You Didn’t Know You Needed

Then list documents you already have (and their locations) and identify what you need to create, and then plan meetings with your family and a trusted advisor to set things in motion.

3) Declutter and Preserve Your Family Photos and Memorabilia

Two years ago, a beloved client passed away, and I’ve been working with his son to go through more than a century of photos, from passed-down black-and-white picures of ancestors on both sides of the family to lighthearted snapshots and travelogues from the gentleman’s young military years. We review prints and slides, as well as delicate (and crumbling) correspondence.

Do you have print photos that would be lost in case of a fire or flood because you don’t have the negatives (or store them with the photos)? Would digital photos on your phone be lost if your phone got smushed or stolen? You need backup!

I’m not suggesting you do this every day in January, but make a plan. What if you spent an hour every Sunday morning sorting through photos? Could you invite a family member or friend to help you consider what to keep and what categories to use?

Contact a NAPO member who specializes in organizing photos, or visit The Photo Managers to find experts who can help you safeguard your photo history.

While I’m on the subject, I absolutely have to recommend, yet again, my colleague Hazel Thornton‘s What’s a Photo Without the Story? How to Create Your Family Legacy.

In Digital Disaster Prep: How to Organize Your Tech Info Before You Need It earlier this year, I walked readers through all sorts of information you need to know before something goes wrong with your tech. Do you know where to find your:

- IP Address

- Network and router information

- ISP contact information

- Device Identifiers

- Operating system license keys

- Software and game activation codes

Your household probably added some hardware and software goodies this holiday season. This is the perfect time for you to read the post and start logging all of your essential tech information.

ORGANIZE YOUR TIME IN 2026

10) Track Your Time to Figure Out Where Your Time Is Going

Set yourself, and your calendar, free.

14) Pick a Problem-Solving Day

Theming your days can make you more productive because you don’t have to keep switching tasks. Marketing Mondays or Financial Fridays let you schedule a block of similarly-themed tasks so you can focus and get into “flow.”

I encourage clients to pick one day of the week for problem-solving. Block a few hours on a specific day for sitting on the phone and asking, repeatedly, for someone to escalate your call. This is the day you set aside for time to get help on whatever is making your computer do THAT THING.

Knowing that you have a slot firmly in place will allow you to worry less about getting problematic or frustrating things accomplished, and because there’s one place in your schedule for solving problems, you will be able to focus when that day arrives.

Meet Your Organizing Elves: The Pros Who Help Get Your Life in Order

Recently, at the end of a session, my client joked that I was her own Santa’s elf. We laughed, but her description is not that far from the truth.

YOU AND SANTA BOTH NEED ORGANIZATIONAL SUPPORT

Santa’s elves (and Mrs. Claus and the reindeer, of course) help keep Santa from becoming overwhelmed. After all, Santa is basically running a multi-national corporation.

Certainly, he has to control the means of production for his factory. Can you imagine how much paperwork (and how many computer files) it takes to source, order, acquire, and unpack the resources before the toyshop starts making the toys?

But our friend Kris Kringle also manages a customer base of upward of two billion children (the current number of the world’s newborns through fourteen-year-olds), not even counting all the people for whom the magic of the holidays involves believing in Santa. I’m sure, at some point in the late 20th-century, Santa had to learn how to manage a computer database and CRM system to keep straight not only who was on the nice vs. naughty lists, but track them as their behavior meandered from one to the other and back again.

Due to non-compete clauses, nobody’s ever ascertained whether Santa has only one sleigh or a huge fleet with one for each of the 24 time zones to which he delivers. Nonetheless, keeping up with the vehicle maintenance and registration requirements in 195 nations must be quite the task!

Time management is a huge headache, too. Not only do those requests for toys and bikes and little red wagons (and all the modern digital doodads) need to be filled, wrapped, and packed onto the sleigh, but timing all of these deliveries in one night, with no respite for bad weather or reindeer infighting, has to be wearying.

It’s a good thing Santa has his elves.

My clients often feel the same oppressive weights upon them, even if they don’t necessarily have the same international fame as the guy in the big red suit. Whether you need to deal with organizing and productivity pitfalls at home or at work, in your computer or your kitchen, your closet or your warehouse, there are professionals who can give you support.

Perhaps between preparing for Thanksgiving and the winter holidays, entertaining company, trying to make headway on languishing projects with end-of-year deadlines, and figuring out how to make space for everything coming in (to your home, to your schedule, and to your life), you have realized that you could use a little elf-like magic as you go into next year.

Today’s post is a chance for you to get to know all of the organizational (and organizing-adjacent) experts who can help you reduce overwhelm, coach your decision-making, and bring subject-matter expertise to help you overcome obstacles (whether tangible, temporal, or cognitive) so you can be your best self.

(Heh. Maybe that should be my holiday marketing campaign: I’ll be my best elf so you can be your best self.)

PROFESSIONAL ORGANIZERS AND PRODUCTIVITY SPECIALISTS

We professional organizers and productivity gurus didn’t all start out and orderly elves. Paper Doll was a television executive. Many, many of my colleagues were teachers. Some were attorneys, social workers, hoteliers, accountants, designers, and so many other types of professionals.

Sometimes, we felt like we were on the Island of Misfit Toys, but almost as if by holiday magic, we all found where we truly belong. And yes, we know that not all elves are always so lucky to find their fit right away.

NAPO

Longtime readers of Paper Doll are already familiar with the concept of professional organizers, but many people are surprised by the variety of services we provide.

If you think a professional organizer is just about moving the stuff around, I’ve got a surprise for you. As I tell my clients, “Housekeeping is about the stuff; professional organizing is about the person who owns (and uses, and maintains) the stuff.”

Housekeeping is about the stuff; professional organizing is about the person who owns (and uses, and maintains) the stuff. Share on XAmong the professionals in the National Association of Productivity and Organizing Professionals (NAPO), there are plenty of generalists. In just the past few weeks, I’ve:

- helped a client pare down a collection of family photos and slides ranging from the late 1800s to the 1970s

- organized holiday charitable requests, identified the client’s philanthropic priorities, and oversaw the donation process

- supported a client with cognitive decline to maintain daily productivity

- decluttered and downsized: cleaning supplies in kitchen cabinets, books and décor from bookshelves, a wardrobe that largely no longer served a client’s physique or style, and more

- assisted clients in accessing funds by searching for unclaimed property, organizing supporting documentation for class action suits, and submitting claims for health insurance

- reworked a client’s overly-ambitious December schedule so that she actually had time to enjoy the holidays.

Although I do specialize in paper and information management and productivity coaching, my in-person clients seek my help for solving all manner of organizing-related mysteries and kerfuffles in their lives, and it’s the same for my colleagues.

Some professional organizers specialize in particular types of clients:

- people with chronic disorganization or hoarding disorders

- individuals with brain-based conditions ranging from ADHD and autism to traumatic brain injuries to dementia

- people with physical disabilities

- seniors

- new parents

- children

- older students

- solopreneurs and small business professionals

Others in our field focus on particular types of spaces for downsizing, clutter control, and organizing in:

- kitchens

- closets

- living spaces (main and guest bedrooms, living rooms, bathrooms)

- home offices

- playrooms

- basements

- attics

- storage units

- work spaces (like professional kitchens, law offices, physicians offices, science labs, theaters, etc.)

We also specialist in particularly kinds of services that cross the “who” and “where” categories, like:

- time management coaching

- paper management

- digital organizing

- organizing and managing photographs and memorabilia

- financial organizing, including bill-paying, budgeting assistance, and bookkeeping

- estate management

- medical history management

- household management

- eco-organizing

- home inventorying

- home staging

- yard/garage/estate sale management

- packing and unpacking for moves

- space planning and design

This doesn’t even begin to take into account the services some professional organizers provide to businesses, including: business automation, corporate operations, event planning, records management, technology training, and more.

Basically, are overwhelmed by it, exhausted by it, stymied by it? Do you “just” need someone to come in and do it (or teach you how to do it — or how to do it better)? If it takes less time and you can focus on what’s important to you — then organizing and productivity specialists can help.

To find a professional organizer, visit the NAPO directory directly, or navigate from NAPO’s front page to the Find a Pro menu at the top. Search geographically or within a radius from your zip code, pick the business and/or residential specialties in which you need assistance, and review the list of my colleagues provided.

And don’t forget, much of the work we do with and for our clients can be done virtually, so you can pick that option from the specialty drop-down if you’re open to getting help from afar.

NAPO members represent thousands of separate professionals, coming together to gain continuing education and support one another so that we can support our clients.

Certification, Certificates, and Skills

When the NAPO directory provides you with names to peruse, you may see some additional notes.

Certified Professional Organizers (CPOs) are those of us who have attained credentials reflecting specific standards. That originally included 1500 hours (now 1000 hours) of paid client-centric work prior to sitting for a comprehensive exam (among other requirements), adhering to the BCPO Code of Ethics for Certified Professional Organizers, and obtaining continuing education in a variety of subjects during a three-year certification period.

For more about certification, you can check out the “What is a Certified Professional Organizer” tab here on my website, including my article, In Checkbooks And Underwear Drawers: What Certified Professional Organizers Offer Our Clients.

Specialist Certificates — In addition to the deep and wide subject matter expertise needed for certification, NAPO members may also hold certificates in specialized subjects, including:

- Brain-based conditions

- Household management

- Life transitions

- Move management and home staging

- Residential Organizing

- Team productivity

- Work productivity

Institute for Challenging Disorganization

Founded in 1990 by my colleague Judith Kolberg and originally called the National Study Group on Chronic Disorganization, the Institute for Challenging Disorganization (ICD) has as its mission to provide organizing professionals and the public with education and helpful strategies, and conduct research, regarding chronic disorganization.

Membership in NAPO and subscribership in ICD often overlap, and professionals in our field may obtain a variety of ICD specialist certificates related to chronic disorganization, hoarding disorders, and other related conditions.

Other Organizing and Productivity Associations

There are helpful organizing elves everywhere!

Outside of the United States, there’s an ever-growing universe of organizing and productivity professionals.

For our colleagues to the north, Professional Organizers in Canada (POC) has a similar search engine to NAPO’s. At their Find An Organizer page, you can specify services areas and specialties as well as languages spoken. (You didn’t think Santa’s elves spoke only English, right?)

NAPO, ICD, and POC do not stand alone. We have colleagues around the world as part of the International Federation of Professional Organizing Associations, including:

- Associaçāo Nacional de Profissionais de Organizaçāo e Produtividade (ANPOP, in Brazil)

- Association of Professional Organizers of Spain (AOPE)

- Association of Professional Declutterers and Organisers (APDO, in the UK)

- L’Associazione Professional Organizers Italia (APOI, the site at which Paper Doll supplements her Duolingo Italian practice by trying to discern meaning)

- Chinese Association of Life Organizers (CALO)

- Finnish Association of Professional organizers (FAPO)

- Federation Francophone des Professionnels de l’Organisation (FFPO, in France)

- Hong Kong Association of Professional Organizers (HAPO)

- Heart Home and Space Organizer (HHS, in Taiwan)

- Japanese Association of Life Organizers (JALO, not to be confused with Ja-Lo AKA: Jennifer Lopez)

- Korean Association of Professional Organizers (KAPO)

- National Association of Black Professional Organizers (NABPO, headquartered in Atlanta)

- Nederlandse Beroepsvereniging van Professional Organizers (NBPO, in the Netherlands)

- Swedish Association of Professional Organizers (SBPO)

Several times a month, I am asked by friends, former classmates, clients, and random acquaintances to provide referrals and recommendations for professional organizers to help people’s loved ones, whether across the continent or across the world. It’s heartening to know that I have colleagues in so many places, ready to help those who are seeking a little more space or serenity.

OTHER ORGANIZING-RELATED PROFESSIONAL ELVES

In addition to ICD and POC, and the National Association of Black Professional Organizers (NABPO) referenced above, NAPO has other affiliate organizations.

Daily Money Managers

Santa has to deal with financial transactions in 180 different worldwide currencies. Your finances may not be so complex, but whatever your needs, whether to help Grandma keep up with her retirement investments or to just make sure the bills get paid on time, the American Association of Daily Money Managers (AADMM) has financial organizing professionals to assist you.

Daily Money Managers (DMM) offer a wide variety of personal financial services to individuals and families, and manages financial tasks including bill-paying and oversight, budgeting, and record keeping. Some serve as fiduciaries for clients who are incapacitated.

Aging/Geriatric Care Professionals

Santa and Mrs. C. aren’t exactly spring chickens, and like all of us, may someday need support.

The professionals in Aging Life Care Association (ALCA) specialize in aging and disability issues while ensuring client “safety, continuity, and dignity.” As experts in health and human services, they can assist and advocate for families caring for older adult relatives or individuals with disabilities. They can partner with professional organizers and senior move managers whenever clients and their families are going through major life transitions — whether they’re downsizing so family members can age in place or to help them relocate to other living situations.

Photo Organizers

Many NAPO professional organizers are comfortable helping their clients organize their photos or find solutions for digitizing them. But The Photo Managers (formerly the Association of Personal Photo Organizers) use their passion for photo collections and personal storytelling to assist clients with culling, organizing, and digitizing photos, as well converting older media to newer formats and sharing pictures.

OTHER MONEY ELVES

Every year, I learn about new types of professionals who can help me help my clients overcome the obstacles that clutter their daily lives. These include:

Claims Assistance Professionals

As I discussed in Organize and Lower Your Medical Bills: Spot Errors, Negotiate Costs, and Save Money, there are a variety of medical billing specialists, medical cost advocates, and patient advocates. In addition, if you’re drowning in medical claim paperwork that makes no sense, or you’re getting the runaround from the insurance company, you may want to reach out to a claims assistance professionals through The Alliance of Claims Assistance Professionals.

Financial Advisors

Knowing what to do with your money can be confusing, and it’s scary to wonder whether the advice you’re being given is good for you, or just good for an advisor taking a percentage of what you earn.

Before considering hiring a financial advisor, talk to the elves in your life: your family members, friends, and colleagues who seem to handle their dollars with sense. I am neither a fiduciary nor a money maven, but I do recommend that if you’re seeking help with building your financial future, you should find a fee-only financial planner. That’s someone you pay a flat fee, rather than a percentage, to provide you with advice.

The National Association of Personal Financial Advisors (NAPFA) is a great first start. You can also find Certified Financial Planners via the location search at PlannerSearch.org.

Appraisers

A professional organizer can help you divide the wheat from the chaff when you’re figuring out what to donate and what to keep; we’ll hold your hands when we tell you that your collection of mini Beanie Babies you got at McDonalds will not fund your retirement. We may help you research the provenance and potential value of what you own. But no organizing professional is going to tell you for certain whether that piece of furniture or jewelry or coin collection is worth. For that, you need an appraiser.

An art appraiser is not a stamp appraiser; fields of specialty range from wine to textiles, furniture to musical instruments, coins to fine art to books. Start with an accredited appraisal association like:

to find the experts that can help you understand the value of your property and make wise decisions regarding what to do with what you own.

Certified Divorce Financial Analyst

Paper Doll hopes you never have to deal with a divorce (unless it’s something that will make your life better). However, I’ve worked with enough clients going through the divorce process to know that attorneys don’t have the bandwidth to deal with some of the intricacies of the financial situation.

Certified Divorce Financial Analysts are professionals who can help you figure out the complex financial aspects of your divorce. This may help you secure an equitable share of marital assets in order to plan your financial future.

If you or someone you know needs support in this area, start with the Institute for Divorce Financial Analysts.

OTHER HOUSE ELVES

When you hear house elves, you probably think of Harry Potter. As a GenXer who grew up near Canada, I start daydreaming about house hippos.

But I digress.

In addition to the residential professional organizer services covered by NAPO and her sister organizations, there is some crossover into home relocation specialties.

Senior Move Managers

The National Association of Senior and Specialty Move Managers is made up of relocation specialists. They’re focused on strategies for helping older adults (and their families) with the relocation process, including downsizing, as well as packing and unpacking, and assisting with logistics.

Home Stagers

In the olden days, when you wanted to sell your house, you hired a real estate agent. They told you to clean the house and pop a sheet of cookies in the oven to make things smell nice. Over the last few decades, however, home staging — literally staging your home to make it possible for prospective buyers to imagine themselves living there — has become a big deal.

Staging can involve removing objects that are overly personal or reflect particular belief systems, subtracting or adding furniture or décor to create a particular aesthetic, and generally working to show a house off in the best light.

As with senior move managers, you will likely find some crossover between NAPO/IFPOA professionals, but to find a home stager in your area, start with the Real Estate Staging Association and the America Society of Home Stagers and Redesigners.

Obviously, your organization and productivity needs are complicated, and by talking about elves, I am not entirely making light of anyone’s struggles.

Sometimes you just need a handy-person to help you lift and carry things to the attic or out to the curb; however, most of the time, a professional organizer or productivity specialist is the ideal person to guide you through the myriad decisions to make to move your life in the direction you want.

And when the real obstacles are not the things, but ourselves, and special services are needed, their are ADHD coaches, life coaches — even decision-making coaches — and mental health professionals!

Today’s post is a reminder that whatever is causing clutter in your space, your schedule, your finances, or your mind, you’re not alone. Reaching out to experts is a gift you can give a loved one — or yourself.

I suspect Santa would approve.

Show Me the Money — A 2025 Guide to Finding Forgotten Funds & Unclaimed Property

Whether you spend a small fortune over each Black Friday/Cyber Monday weekend or you’re super-cautious with your dollars and cents throughout the year, I bet you’d like to have more money. And I bet you’d particularly like to have more of your own money — money that has been kept from you for some reason — back in your own pocket.

MISSING MONEY AND UNCLAIMED PROPERTY, REDUX

One of my most popular posts is one I published almost three years ago: Lost & Found: Recover Unclaimed Money, Property, and Savings Bonds. In it, I explained the basics of unclaimed property. To borrow from myself:

The term unclaimed property is what you’ll hear most often when searching for lost money in various types of accounts. Unclaimed property usually refers to funds that a government (federal, state, or local) or business owes you because you’ve, quite literally, left it unclaimed.

It’s possible that you’re so organized with your paperwork that you feel affronted that I’ve implied you might have just haphazardly left money sitting around. But I’m not saying you’re absent-mindedly leaving piles of cash wrapped in newspapers like Uncle Billy in It’s a Wonderful Life. (By the way, that $8000 deposit that ended up in Mr. Potter’s hands would be worth

$121,762 in 2023$132,913.23 in 2025! Maybe Uncle Billy should have tied the money to one of those strings around his fingers.)

Thomas Mitchell as Uncle Billy, searching the bank’s trash cans for the lost Savings & Loan deposit. Let’s boo Mr. Potter!

I posited the various reasons why money gets separated from its rightful owner.

Sometimes, you’re due a refund, but the refund sits so long that a company loses track of you. Several years ago, when I began working with a client, I had sorted through all of his bills and paperwork to figure out what we could discard, what should be filed, and what required action. Typically, that last category involves paying a bill, but in his case, we found that he was owed money. He and his late wife had opened a retail store credit card to purchase a service they’d later canceled. A prorated amount was returned to the credit card, but because they never used the card again, the balance just sat there, neither accruing interest nor being used, statement after statement.

Happily, in this case, one call to the credit card company (and many, many transfers between departments) later, and within a week, he had a check for the amount. Better yet, that credit card company doesn’t send statements in months when there’s no (positive or negative) balance, so it also meant that he had less paper clutter!

Other times, you and your money are parted because you’ve done a magic trick and disappeared. Think of times when you’ve put down money, such as a security deposit for an apartment or a local utility account. The landlord or company holds your money as security, or collateral, in case you skip out on your payments. In many cases, that money is held in an interest-bearing account.

In the best case scenario, when you terminate your lease and cancel your utilities, you get back your deposit plus a little bonus (of interest) for your troubles. The problem is that too often (and particularly when we are younger), we’re so focused on where we’re headed that we miss out on what we are owed. However, if you left no forwarding address (and remember, in the olden days, when we moved, our phone numbers did not move with us), landlords and utility companies had no way to reach out and return that money.

In theory, that money is/should always be turned it over to the state.

These are only the most common examples of money that may have been left behind when you jetted off to the next part of your life. And, of course, most of us know the frustration of someone else not being clear about what or where valuable funds may be.

There are a variety of situations where your money might go unclaimed. Consider this a mental checklist to jog your memory of money that may have disappeared or been forgotten.

Financial Accounts

- Abandoned bank accounts

- Abandoned credit union accounts

It’s not uncommon to calculate how many outstanding payments will need to clear and leave only a bit more than that amount in a bank or credit union account you plan to close. The payments clear, and then the forgotten accounts often lay dormant, occasionally collecting interest.

Most bank and credit union accounts require some sort of activity — even just the deposit of $1, once per year — to be considered active. Banks won’t put in too terribly much effort before turning money over to the state.

Employment-Related Funds

It’s one thing to quit a job and leave behind forgotten leftovers in the break room fridge, but so many people manage to ghost their own money.

- Un-cashed checks or failed direct deposits — I’ve had clients who had been so overwhelmed and overworked that when they switched jobs, they forgot to cash their final paychecks. (Yes, even though most people are regularly paid via direct deposit, final checks are often issue with old-fashioned paper checks.)

I have also seen people fail to notice or remember — in the chaos of moving — that a final check was never actually direct-deposited; or perhaps that payment was issued, but the direct deposit failed to go through because the old bank account was already closed. I’ve seen all of these! And other payments may go un-deposited. Un-cashed checks might include:

-

- paychecks

- employment bonuses

- refunds of expenses submitted to your employer

- sales commissions

- vendor checks

Poor Milton. They kept moving his desk, and the Payroll Department could never find him.

Investment Instruments

It’s common for people to have chaotic investments. I try to get clients to list all of their accounts, but often have to play detective.

When you’re fresh out of college, you may have a few savings bonds (far from their maturity dates) and nothing else to speak of. However, after a variety of jobs (particularly if you started working before the era of 401(k)s and Roth IRAs), you may have picked up (and then failed to roll over) a smattering of retirement accounts.

If you came into adulthood before mutual funds were really a thing, your investment portfolio may include a random collection of individual stocks, some of which are in DRIPs (dividend re-investment plans) and others where you randomly get checks for $1.53 or $4.52…which you try to remember to deposit and then find smushed in the pocket of your winter coat on the first cold day of the season.

Consider the following investment instruments you may have forgotten that you even had after a lifetime of cross-country moves:

- 401(k)s

- Stocks

- Mutual fund holdings

- Bonds

- Other securities that were never transferred or claimed

- Dividend checks

- Fractional share cash-out checks

- Savings bonds — If you’ve lost your savings bonds, be sure to read the latter part of Lost & Found: Recover Unclaimed Money, Property, and Savings Bonds.

- Israeli bonds — Note, if you do not have your original paper bonds, be prepared to jump through some hoops!

People change addresses, firms merge or dissolve and then change names, stocks split or get sold off — whether they lost track of you or you lost track of them, it’s all worth tracking down.

Insurance Policies

Have you ever seen Gerber Life Insurance — yes, like the Gerber baby food. It’s whole life insurance advertised to parents to give their children life-long guaranteed coverage. Debating the pros and cons of getting life insurance for children is beyond the scope of this post; however, paying attention to organizing the documentation/paperwork for such policies is key.

After having been a professional organizer now for almost a quarter of a century, I have worked with many clients who, when they clear out their elderly parents’ homes, find random references or partial documents for those kinds of baby life insurance policies. In every case, the cash value of those policies have long-since stopped increasing in value.

Sometimes, they’ve been able to cash out directly but often the policies have been sold and resold to other insurers who have lost track of the policy-holders and turned the money over to the applicable state governments. (Are you noticing a trend? Even companies with everything organized by 21st-century computers don’t want to keep up with the nickels and dimes of seemingly abandoned accounts.)

Insurance-related money may be owed to you in the form of:

- Matured insurance policies

- Terminated insurance policies

- Life insurance payouts

- Annuities

- Unclaimed insurance refunds — If the beneficiaries of insurance policies fail to claim death benefits, or policy-holders never cash refund checks (either because they never receive them or because they pile the mail on top of the microwave and it gets lost), that money goes unclaimed.

Legal Balances

If you won a million-dollar judgment, Paper Doll suspects you’d probably notice if you forgot to accept payment, but there are a variety of funds (usually far less than seven figures) that are legally yours but may be forgotten. When you go spelunking for unclaimed property, you may find you are due money for:

- Trust distributions

- Inheritance-related funds — This is a good reminder that your heirs can’t claim assets that they don’t know exist, so make sure you provide detailed records for your loved ones. For more on that, check out two classic Paper Doll posts: Reference Files Master Class (Part 2) — Financial and Legal Papers and How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

- Unclaimed court deposits

- Escrow funds from real estate deals

- Proceeds from legal settlements or judgments — These may include class-action payouts, money returned to you for bond or bail, garnished wages meant to cover unpaid child support payments.

A client’s ex-husband once owed her a significant amount of back child support; she couldn’t collect because when the ex had arranged to be paid “under the table” so as not to have his wages garnished. However, when he won a significant judgment in an unrelated lawsuit, my client was able to receive what was due to her and her children because she had made the effort to keep the state agency overseeing child support enforcement updated whenever she moved.

- Royalties owed for minerals, oil, gas, or other assets you own. (Your Grandma once owned land in Oklahoma or Texas? Think Dallas, but with more paperwork and fewer shoulder pads.)

- Royalties owed for creative works, like published books or music, recorded performances, etc.

Have you ever heard of Sixto “Sugar Man” Rodriguez? He was a Mexican-American musician in the late 1960s and 1970s, whose songs focused on the societal difficulties facing those living in poverty. When his albums sold poorly in the United States, he ended his music career. Unbeknownst to Rodriquez, his music was so popular and influential in South Africa that it was said he sold more records there than Elvis Presley. But for decades, he wasn’t aware of, or paid royalties for, his talents — as told in 2012’s Oscar-winning documentary Searching for Sugar Man, fans even mistakenly thought he was no longer alive!

If you’re due royalties make sure you are findable!

FIND GENERAL UNCLAIMED PROPERTY OR FUNDS

As I explained in the original post three years ago, there’s not one central database for all unclaimed property. Generally, unless the money you’re seeking is in a special category (see further below), you should start your search in the unclaimed property office for each state in which you have lived.

Begin with Unclaimed.org, the website of the National Association of Unclaimed Property Administrators. (For detailed instructions for your search, see my original post.)

To search for multiple states simultaneously head directly to MissingMoney.com.

MissingMoney.com allows you to just type a first and last name, and all possibilities for that name, across all state databases, will come up.

FIND MISSING RETIREMENT AND EMPLOYMENT BENEFITS

Do you vaguely recall having some funds trickling into a pension or 401(k), but you’ve had several jobs, homes, and kids since then? Is it all fuzzy?

If you’ve kept meticulous records, you may have files about your old retirement accounts; if you’ve kept mediocre records, you may have an old address book with the names of former colleagues whom you could find on Facebook or LinkedIn, and ask if they remember what retirement benefits you were supposed to have. However, there are more official methods for tracking down your hard-earned benefits.

Retirement Savings Lost and Found Database

Did you know that the US Department of Labor’s Retirement Savings Lost and Found Database can help you find your lost or missing retirement funds? Run by the Employee Benefits Security Administration (EBSA), the database should be your first stop if you or a loved one has lost track of an old pension or 401(k). Per the website:

EBSA is helping America’s workers and beneficiaries search for retirement plans that may still owe them benefits by establishing a public Retirement Savings Lost and Found Database through the SECURE 2.0 Act of 2022.

This database serves as a centralized location to find lost or forgotten benefits and get information on how to obtain those funds. Learn about the tools and resources available for you to recover your hard-earned benefits.

Visit lostandfound.dol.gov — but note that to access the database, you’ll need a valid ID-Proofed Login.gov account, first.

Once in, you’ll be able to search for any retirement plans that were a) linked to your Social Security number and b) sponsored by private-sector employers and unions. The database includes:

- Defined-benefit pension plans — any kind of benefit plan that guarantees either a lump-sum payment when you retire or a lifetime monthly payment, like an annuity

- Defined-contribution plans — accounts that employees fund during the years that they work, such as 401(k)s, and which continue to grow while they work and after they retire.

The Retirement Savings Lost and Found Database doesn’t include Social Security benefits, personal investments like individual retirement accounts (IRAs) or retirement plans sponsored or overseen by religious organizations or government entities. So, if you’re a senator or a nun (or, y’know, a court clerk or church secretary), this database isn’t for you.

Pension Benefit Guaranty Corporation

Have you ever worked for a private-sector company or organization whose retirement plan went kaput?

The Pension Benefit Guaranty Corporation (PBGC) Database, is responsible for holding any unclaimed benefits for current or employees where the retirement plan ended and not everyone got their payout.

Search the database to find your benefit plan; just enter your name and the last four digits of your Social Security number. Once you verify that PBGC is holding your benefits, follow the instructions for submitting documentation to claim them. (Once again, a plug for getting your Very Important Papers organized).

Other Retirement Benefits Solutions

The National Registry of Unclaimed Retirement Benefits (NRURB) operates a free database to assist former employees, employers, and plan managers to find one another and ease the problem of distributing retirement benefits that have been forgotten (by the accountholder) or abandoned (by the plan administrator). They use Department of Labor data and information from employers to help identify lost and/or unpaid benefits.

Speaking of abandoned plans, the Department of Labor’s EBSA also operates an Abandoned Plan Search database to help you find a plan abandoned by its administrator. (Maybe those administrators need to hire some professional organizers?)

If you’re still having trouble securing your company-sponsored retirement benefits, you may want to contact the non-profit Pension Rights Center. They operate the U.S. Administration for Community Living’s Pension Counseling and Information Program, and if your company or pension plan operates in one of the thirty states they serve, you may be able to access their free legal services.

Find Unpaid Wages through WOW

Did you know that if an employer breaks labor laws, the Department of Labor’s Workers Owed Wages program is empowered to try to recover your back wages?

If you think you may be owed back wages from your employer, search the WoW database. Don’t dilly-dally, though, as they only hold unpaid back wages for three years.

Find the database at https://www.dol.gov/agencies/whd/wow.

FIND UNCLAIMED LIFE INSURANCE POLICIES

Unclaimed insurance payments are typically turned over to the state. However, there are some situations where money may be owed related to federal insurance policies.

- VA Life Insurance Unclaimed Funds — The U.S. Department of Veterans Affairs (VA) has a database for searching unclaimed insurance funds. The VA holds onto money it owes to current or former policy holders or beneficiaries of those policies whom they’ve been unable to locate.

When my father, a WWII veteran, died in 2018, I had access to the paperwork related to a life insurance policy he was given upon leaving the Army at the end of the war. Contrary to expectations when dealing with government agencies, I was able to resolve all of my questions with one call. However, had I not had access to any of the paperwork, the link above would have been my first stop.

Note: the database doesn’t include funds from Servicemembers’ Group Life Insurance (SGLI) or Veterans’ Group Life Insurance (VGLI) policies from 1965 to the present day.

- FHA-Insurance Refunds – Homeowners who previously had an FHA-insured mortgage may be eligible for refunds issued by the U.S. Department of Housing and Urban Development (HUD).

Click on the link above to access the HUD database. Scroll down and provide your name, FHA case number, city, and state.

FIND UNCLAIMED MONEY FROM BANKING & INVESTMENTS

Did your bank fail? What about your credit union? Were you scammed by someone like Bernie Madoff?

- If you had money in an FDIC-insured bank that failed, you can search for your unclaimed funds at https://closedbanks.fdic.gov/funds/.

- If your money was in a failed credit union liquidated by the National Credit Union Administration, the NCUA.gov site’s Unclaimed Deposits database can connect you to your funds.

- Were you an investor parted from your money as a result of a bad-faith investment manager? The Securities and Exchange Commission (SEC) lists “enforcement cases” where individuals or companies money to their investors. You can check the status of distributions to harmed investors at SEC Claims Funds.

THINK OUTSIDE THE MONEY BOX

All of the categories described above cover unclaimed funds that someone else is holding. However, you may have money, or something just as good as money, hiding in your drawers and glove compartments and under the piles of papers on your desk:

- Unused loyalty points, rewards, and frequent flyer miles — These represent quasi-lost money, things with value but only if you use them. Bear in mind that some unredeemed points, rewards, and miles have expiration dates or may be considered abandoned if you don’t use them (or the apps/accounts) for a long while.

- Unredeemed gift certificates, store credits, refunds, or vouchers from retailers service-based companies. Depending on the state in which you live, they may be treated as unclaimed property if they go unused too long. Remember that year Aunt Gertrude told you that she schlepped out in a snow storm to get you that gift card for for Bed, Bath, and Beyond, and a Toys ‘R Us gift card for your tiny human? Uh-oh. Too late now. Stores close or restructure, and value goes poof!

- Contents of safe-deposit boxes — When people move or pass away, families may forget about the contents of old safe deposit boxes, and it’s very hard to reunite tangible property with original owners or beneficiaries.

In short: unclaimed property is often “anything owed to you that you forgot existed.” Take time to search for whatever may be owed to you or loved ones who can no longer search for themselves.

Remember, unclaimed property comes in many forms, from many possible sources.

As always, when you keep good (and organized) records (with account numbers and names of institutions, and your own addresses over the years), the search and claim processes will be easier. When searching databases, consider that your identity (or that of a deceased loved one) may not have been quite so organized — check name variations: with and without maiden names, nicknames, initials vs. middle names, etc.)

Good luck finding unexpected funds!

Organize and Lower Your Medical Bills: Spot Errors, Negotiate Costs, and Save Money

Last week, after I shared How to Track, Lower, or Cancel Your Recurring Subscription-Based Bills, a number of readers and clients were curious about the bill negotiation services listed, and quite a few wished there were a similar service for other types of expenses. In particular, I kept hearing that people wanted help negotiating (and fixing) bloated medical bills.

Estimations vary widely, but according to the latest medical billing statistics, upward of 80% of (non-pharmaceutical) medical bills contain errors that end up resulting in extra costs. This is problematic for everyone: you get bills you can’t afford, the providers don’t always get paid what they are due, and it all leads to widespread mistrust of the healthcare industry, per Medical Billing Errors Statistics: Impact on Patient Trust – A Complete Analysis.

WHY ARE THERE SO MANY ERRORS IN MEDICAL BILLING?

- Complexity — The US healthcare system has a hugely complex set of billing procedures. The more complex any system, the more you introduce the possibility of mistakes. Errors could be made by healthcare providers in billing or by insurance companies in the process of reimbursing medical costs.

- Failure to verify insurance — Although every doctor’s office and medical facility asks you for your insurance card, photocopies it, and queries whether your insurance has changed, that doesn’t mean that the person whose job it is to do the typey-typey will actually enter the information correctly. I’ve often seen clients have their old insurance companies/plans billed even after they’ve changed policies or gone on Medicare.

- Data entry errors and poor medical coding — Did you know that 52% of denied claims are due to coding mistakes? And almost 70% of billing errors are related to coding mistakes!

When you go to the doctor or to a hospital, various staff members are responsible for documenting what happened (what lab tests were run, what medications were given, what procedures were performed, etc.).

Next, someone has to enter the codes for each of those tests, medications, or procedures by selecting the proper code (from thousands) and then typing that code.

Bad handwriting, mistyping, or miscommunication on the part of the healthcare worker(s), and mis-coding are all possibilities for introducing mistakes. In terms of miscoding, it can be an issue of typing the wrong code, outright, or unbundling (where they mistakenly bill for multiple coded procedures or services that should be covered by one comprehensive, collective code).

- Poor training, disorganized billing procedures, and delayed filing — Healthcare provider offices generally do a great job at providing healthcare, but often struggle with hiring and maintaining a back office that handles billing and insurance issues.

One of my clients owned a (let’s call it) healthcare-adjacent office; a staffer involved in billing was unsure of some insurance procedures and had somehow failed to submit insurance billing for an entire subsection of patients for more than a year before the behavior was uncovered. How would you feel about getting a healthcare bill 18 months after services were rendered? How likely is it your insurance company would pay it?

- Red tape — Every year, changes in the software (and now, introduction of artificial intelligence) in medical records software means new opportunities for someone, somewhere, to make a boo-boo.

It’s not just the billing department’s fault!

On top of the creation of such errors, the perpetuation of them is, sadly, laid at the feet of healthcare consumers (i.e., patients).

Yes, it’s the job of the various levels of administration in the healthcare community to stop making these errors, but in the end, it’s our responsibility to know what our insurance policies cover, review our bills when they arrive, compare the bills with our insurance coverage, research whatever seems like an overage, and question excess charges.

Yes, I heard you groan.

None of this means you’re stuck with massive bills. You have options for verifying the charges, lowering costs, and even getting help reducing and paying for correct bills.

According to a 2023 University of Southern California study, 25% of individuals “who reached out for any reason had their bill corrected,” and a significant number were able to acquire a payment plan or lowered rates. 74% of those who sought help for a billing error reported the mistake was corrected, and of those who sought help with an unaffordable bill, 76% received some kind of financial relief. Among those attempting some kind of price negotiation, 62% got a lower bill.

So, it’s worth trying to solve the problem, but it all starts with organizing yourself to set the record straight!

HOW TO DIY ASSESS AND NEGOTIATE YOUR MEDICAL BILLS

When a medical bill arrives, don’t be too quick to pay it. Instead, follow this path:

- Know how your insurance plan works. If don’t have a handle on it, read Paper Doll Explains Your Health Insurance Explanation of Benefits.

- What’s your deductible (and have you reached it yet)?

- Have you reached your out-of-pocket maximum for the year?

- Examine your bill — Yes, you have to open your mail. I know it can seem scary, but just like you must see the doctor rather than just hoping an illness or injury will go away, you have to investigate your bills.

- Are the dates of service accurate? Are you being charged for services on dates you weren’t even there?

If you’re in the ER on a Friday night and the hospitalist (the doctor who oversees your case while you’re there) writes orders to admit you, but there’s no room available until Saturday at Noon, you might get billed for an ER visit on Friday night as well as a hospital room for Friday, Saturday, and however many more days you’re hospitalized, even though you never had a room on Friday. That can be a multi-thousand-dollar mistake!

-

- If it says why you were treated or seen, does the description of services, procedures, or tests seem right?

- Is there something weird on the bill? People have been charged ridiculous amounts for “mucous recovery systems.” That’s a box of tissues.

- Are there outsized charges for toiletry items or “administering” over-the-counter medications? An overzealous keystroke could turn a 1 into a 10 or a 10 into 100 count, dramatically increasing costs.

- Request an itemized bill — If you’re dealing with a hospital, the initial bill they send you is a big, fat summary that gives you no indication of what they’re saying they provided. Immediately call to request an itemized bill; if they give you guff, send a request via Certified Mail. Once you get the itemized summary, scrutinize it like it’s your job.

- Review it in detail, line-by-line. Can you square the referenced services with your experiences? If you were unconscious or otherwise unaware of every type of treatment you received, you should still be able to note anything egregious. Are they saying they amputated a limb that you still have? That they removed an appendix that’s still inside you (or that you had removed several years previous to this claim)? I recently read about a woman who fought a hospital charge for a circumcision — for her infant daughter!

- Do you see any duplicate charges?

- Were you charged for something that should have been included? Most insurance plans don’t let surgeons charge for follow-up office visits within 90 days of a major surgery or 10 days of minor surgeries.

- Check to see if the coding is accurate — In addition to incorrect codes due to human error, fraudulent charges may come from “upcoding” where a procedure or treatment is coded as something more complex than what you received. Coding includes:

- Current Procedural Terminology (CPT) codes for procedures (developed by the American Medical Association)

- ICD-10-CM for diagnoses

- HCPCS Level II for supplies, drugs, and services not covered by CPT codes (developed by the Centers for Medicare & Medicaid Services.

- Cross-reference your bill and your Explanation of Benefits (EOB), whether on paper or in your insurance plan dashboard.

- Has your medical provider already (and properly) billed your insurance company? If your bill seems Daddy-Shark-sized, it may be that the provider sent you a bill without having already processed the claim through your insurance.

- Check to make sure the healthcare provider filed the claim with the right insurance company.

- Look at your EOB to see if your insurance plan has rejected the claim. If so, you’ll likely see remark codes, letters or numbers next to why the claim was not paid. Somewhere in the EOB will be footnotes corresponding remark codes, clues to potential errors in the coding. I once helped a client figure out that her doctor’s office filed a claim stating that she’d had two flu shots, 30 days apart. She’d actually had one flu shot and then, the next month, the first of two Shingles vaccinations.

- The remark codes may also tell you that the reason your claim was not paid is valid. For example, most insurance companies only cover an A1C blood test for people with diabetes every 90 or 120 days; while your provider’s office should know this and not perform tests more often, it’s ultimately your responsibility to make sure you know what your insurance plan will cover and call your provider’s attention to conflicts before you accept service.

- Research the average cost (in your state) of whatever medical procedure you had done. Both the Healthcare Cost and Utilization Project and the Healthcare Bluebook have databases spelling out these costs. You can also use FairHealthConsumer.org to find the fair market price of medical procedures.

- Make a list of the issues in bullet-point form so that you are clear on what you want to explain and challenge. Take note of the claim number(s) so that the healthcare provider billing office and/or insurance company knows which claims you’re discussing.

- Call your healthcare provider’s billing office.

- Be polite. It’s the old, “You get more flies with honey than you do with vinegar” routine, although nobody ever wants flies. But you do want fewer pesky charges.

- Stick to the point. They can’t help you if they aren’t clear on the problem.

- Detail what looks wrong, using your list to guide you. Let them know you think there are (or may be) administrative or medial errors in the billing and specify your evidence.

- Ask for clarification — in writing, if necessary.

- Don’t agree to pay if you still don’t understand a charge, or think they’re still mistaken.

- Dispute bills you think are still wrong with your provider and/or insurer. Consider seeking outside assistance (as described below).

- Negotiate payment options, if necessary — If the bill is correct, you still have alternatives if you can’t afford to pay it now and in full. Many providers, particularly hospitals, will work with you to arrange payment plans, lump sum discounts, or even financial hardship assistance (also called charity care or uncompensated care).

SEEK ASSISTANCE NEGOTIATING YOUR MEDICAL BILLS

DIY is great, because you reap all of the cost savings.

DIY is also awful, because you have to spend your precious time on the phone with medical billing department phone trees, weary employees, and insurance providers. If you’re still recovering from whatever caused you to need medical care, or if you have a chronic condition, this may use up all of your time, energy, and spoons.

And, of course, if you are recovered and back to work, you’re probably trying to maximize your time to catch up on everything you missed while being waylaid by illness or injury.

How do you decide it’s time to bring in outside help?

- If you’re feeling so overwhelmed by the process that you procrastinate on even picking up the phone, that’s a good indication that progress won’t be made without support. The longer you go without addressing bills that seem wrong, the less likely you’ll be to recoup mistaken or excessive charges.

- If your bill is enormous or your insurance issues are complex, and you’ve got no idea where to start, get help.

- If you suspect that the crazy-huge bill isn’t merely because they forgot to bill your insurance company but because there are errors or overcharges for which you don’t feel confident about your investigative skills, call in the experts.

- If you’ve already attempted to negotiate wackadoodle charges or resolve disputes and all you’ve got to show for it is an empty bottle of Tylenol for your headache, sore throat, and cauliflower ear from battling billing departments by phone.

How to Find Experts to Help with Negotiating Medical Bills

If you’re overwhelmed by the DIY process, seek a professional. As a Certified Professional Organizer, I have done the legwork with clients to help them handle the DIY portion of the medical billing nightmare. I’ve sorted and collated paperwork, helped clients draft letters requesting itemized billing, and sat by their side on speakerphone, helping interpret medical billing language and supporting them while they ask questions.

However, this isn’t my area of expertise; while I’ve racked up many hours in solving my own and my clients’ medical billing headaches, it’s always best to call upon an specialist. Similarly, just as many of my NAPO colleagues who specialize in financial organizing may be able to offer support, so too may our fello specialists in the American Association of Daily Money Managers (AADMM).

But your best bet, particularly if you’ve got frustrating, complicated, or huge medical billing issues, is to work with an expert.

Medical Billing Specialists

In general, seek someone using the professional title of medical billing advocate or medical bill negotiator.

This kind of specialist can review your bills for both obvious errors (like billing an elderly man for removal of an ovary or billing you for medication you never received and which would never be used to treat whatever you had) and mystifying coding errors, as well as instances of overcharging.

Then, with your authorization, they can negotiate with healthcare providers and insurance companies on your behalf to reduce costs.

Medical billing advocates and negotiators specialize in reviewing medical bills, cross-referencing them with insurance, and identifying errors (and instances of fraud). Their services also include negotiating with healthcare and insurance providers to correct the errors, obtain discounted rates, and sometimes get more beneficial payment arrangements.

To find a medical billing advocate to analyze and potentially negotiate your errant healthcare bills, start with the professional directories in this field:

- National Association of Healthcare Advocacy (NAHAC)

- Alliance of Professional Health Advocates (APHA)

- UMBRA Health Advocacy

- Greater National Advocates

If the sticky wicket of the billing problem is your insurance company, an associated organization is the Alliance of Claims Assistance Professionals and Advocates (ACAP), whose members provide medical claims assistance and patient advocacy for a fee.

Note: some advocates and specialists will work on a contingency basis, taking a cut of whatever they save you; others will charge a flat fee. Before engaging the services of a professional, make sure you understand their billing methods.

Related Specialists

Additionally, the Patient Advocate Foundation (PAF) connects healthcare consumers and their families with case managers who can help with both health and expense-related support, including access to care, assisting with applications for health insurance and related government programs, appealing insurance denials, getting support for co-pays and insurance premiums, applying for free or low-cost healthcare programs, and obtaining billing discounts or setting up payment plans.

Other professionals may also be able to provide support. For example, patient advocates (whether independent, associated with healthcare systems, or provided by your employers’ Employee Assistance Program (EAP)) may be able to walk you through the wonkiest parts of the billing and insurance and help you resolve questions and problems.

If you suspect fraud or are dealing with a particularly complex legal dispute, you may need to hire an attorney specializing in the legal side of resolving medical billing claims. And, if you do believe you’re dealing with an instance of fraudulent medical billing, you might want to contact the offices of your state’s attorney general or insurance commissioner.

ENGAGE A BIG MEDICAL BILL NEGOTIATION COMPANY

Between the time I started researching this post and publication, a number of the larger billing negotiation companies, designed to take advantages of scale to negotiate billing on a patient’s behalf, like CoPatient, have ceased operations. Still, you do have options.

Medical Cost Advocate

Medical Cost Advocate (MCA) — In addition to medical bills, MCA also negotiates dental bills and health insurance claims. They also provide on-call advocacy for employer groups, and concierge healthcare advocacy services for families and executives needing more ongoing insurance and billing assistance than they have time to address.

Once you create a personally-identifying account profile (a step you can skip on future visits), use your login ID to share billing information, check the status of any bill negotiation, and review a final report of any achieved savings.

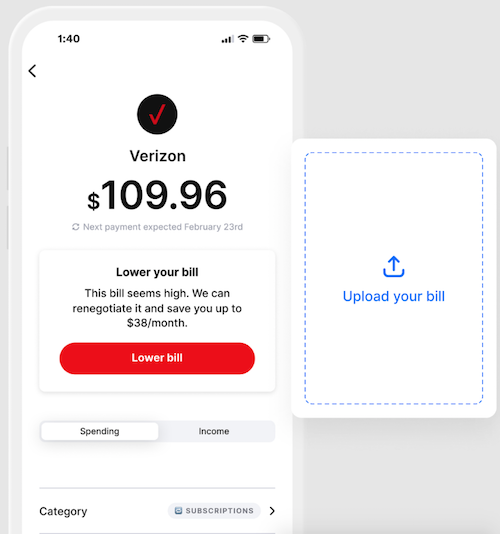

Start with some data entry. Confirm information about the patient (whether that’s you or your dependent), like date of birth, mailing address, phone number, etc. Include your insurance provider’s information (if you have coverage) to cross reference who has responsibility for which costs.

Next, either upload the bill or enter the billing information in their system so MCA has information about the medical provider, the procedure or services to be assessed and negotiated, the amount already paid and/or still due, and the status, such as whether you have submitted the bill to your insurance carrier.

You’ll also enter payment authorization for MCA’s negotiation services, approve the terms and conditions, and authorize a credit or debit charge (equal to the percentage of the savings they negotiate).

MCA charges 35% of the total savings achieved on negotiated medical bills, and takes nothing if not successful. When everything is complete, you’ll get emailed a savings report.

Note that Medical Cost Advocates won’t take on billing negotiations for costs under $600, so this is better used for big bills related to a hospitalization or root canal, not your doctor’s office co-pay.

MCA claims that their services typically save their clients anywhere from 20% to 50%. While there’s no guarantee your bill will be lowered, bill submission process is easy enough to make it worth your (small) effort.

Goodbill

Goodbill offers similar medical bill negotiation services but specializes in hospital billing.

Goodbill’s user interface is intuitive. You start with a simple screen that asks you basic questions about your experience and the billing.

After you authorize Goodbill to access your hospital bill and medical records, they combine team expertise with Goodbill’s AI software to review and analyze your bill and medical records with the goal of identifying bogus, unnecessary, or inflated charges, bad coding, or related mistakes.

If Goodbill finds discrepancies between what they should have billed and what they did bill, they’ll sent you a draft of a formal negotiation letter, enumerating the mistakes and the possible savings. If you approve, Goodbill will forward the letter to the hospital and follow-up with negotiations as necessary until the problem is resolved.

Goodbill charges a fee only if they’re able to negotiate a discount. While I could not identify the specific fee structure on their site, it’s a percentage of the savings, with a cap of $1,000.

If you’re unable/unwilling to follow the DIY approach to negotiated your costs in the first place, there’s no monetary risk to you to turn the problem over to either company.

DollarFor

Although DollarFor previously offered medical bill negotiation services, they have suspended this offering. However, they have a robust library of DIY negotiation tips and resources, including a hardship letter template, a sample negotiation script, and settlement letter template, worth your exploration.

MEDICAL BILLING IMPACT ON CREDIT HISTORY

Finally, know that medical debt no longer has the same impact on your credit score as before. As of April 2023, the major credit reporting agencies (Equifax, Experian, and TransUnion) have made the following changes:

-

Debts smaller than $500 aren’t listed on credit reports and no longer impact credit scores.

-

Consumers have a one-year grace period before medical bills in collection appear on credit reports, providing ample time review, negotiate, and resolve disputes over medical billing and insurance errors.

-

Repaid older debts should be removed from your credit report. Unpaid medical debt older than one year and greater than $500 will still show up on your credit reports for up to seven years, potentially damaging credit scores. However, if you (or your insurer) repay medical debt already in collections, the credit bureaus will remove the debt from your reports.

How to Track, Lower, or Cancel Your Recurring Subscription-Based Bills

Subscriptions aren’t just for magazines anymore. Financially speaking, a subscription is anything for which you have an ongoing expense for a non-essential service. And I bet you have a bunch of them.

According to a recent study by CNET, American adults spend an average of $90 per month on subscriptions. Additionally, another study found almost one-half (48%) of those surveyed registered for at least one free trial and then forgot or neglected to cancel.

Photo by Markus Winkler on Unsplash

WHAT IS A SUBSCRIPTION MANAGER?

A subscription manager is an app or platform that centralizes information to help users gain better control over their finances and make more informed spending decisions. Most track, organize, and manage recurring payments for subscriptions by:

- scanning bank and credit card information to identify subscriptions

- listing all subscriptions in one place

- tracking expense increases over time to help analyze spending patterns and identify opportunities to reduce costs

- organizing and sorting by subscription name, cost, billing cycle, or due date

- identifying redundancies (like a standalone subscription for a streaming service as well as one acquired through an Amazon Prime 7-day trial)

- setting up payment reminders before renewals or payment due dates (to help avoid late fees or unintended renewals of free trials or forgotten subscriptions)

Additionally, some subscription management tools and apps can negotiate costs or assist in canceling subscriptions, making it easier to terminate services you no longer need.

CONSIDERATIONS FOR CHOOSING A SUBSCRIPTION TRACKER

Price

Look for free options, or free tiers (or trials) on platforms that offer multiple levels. You can always upgrade if a premium tier offers a feature you find beneficial once you’ve mastered the free plan. Too often, we sign up for paid software-as-a-service plans and don’t them; a tracker will reverse that habit, so don’t go to all the effort to get rid of your other recurring payments only to end up with one for a tracker you don’t need!

Remember: platforms with services to negotiate a discount or rebate for a forgotten/unused subscription will take a portion — like a finder’s fee — of what they’ve saved you for the coming year. There’s no such thing as a free lunch; in return for picking up your lunch tab (that is, negotiating the refund after cancelation or price reduction) the app gets your pickle or a handful of your fries!

Security

In order to track your expenses to find recurring costs, these platforms must access your bank accounts and credit cards. Thus, protect your online safety by verifying that whatever platform you choose uses:

- bank-level security

- end-to-end encryption

- two-factor authentication

Once you find a service that passes those tests, dig into their boilerplate security and privacy language to make sure the app doesn’t sell or share any of your personal information.

Features and Functions

A subscription tracker will analyze the data in your bank and credit card statements to identify recurring charges and create reminders about them.

More advanced trackers should be able to cancel subscriptions with minimal input from you, negotiate lower bills on your behalf, and if part of a larger financial dashboard suite, help you quickly and easily create a budget.

Ease of Use

The point of a subscription expense tracker is to make your life easier. You want an app that’s intuitive so you’ll be able to add, delete, or change information or navigate your way around without much study. If an app is has so many bells and whistles that you have to consult Google or Chat GPT for instructions so managing the software becomes a second job, you won’t use it.

Read reviews to make sure it will be relatively easy to:

- set up and sync the app with the information in bank and credit card accounts

- identify recurring payments and set reminders to pay them

- navigate the app

- negotiate billing with relatively little input on your part

- cancel accounts with minimal effort

DO I REALLY NEED AN APP TO TRACK, LOWER OR CANCEL SUBSCRIPTION COSTS?

Short answer? No, you don’t.

I call SiriusXM every year to lower my costs, and help clients do the same. I can’t fathom why anyone would actually spend the exorbitant full price, but the “negotiated” lower cost feels reasonable.

How to DIY Your Subscription Management

Canceling a subscription-based service (unless it’s a gym membership) is also fairly straightforward, but not fun.

If you’re organized, patient, and diligent, especially if you don’t have a lot of subscriptions, you can handle the process yourself:

1) Create a spreadsheet with columns for the subscribed service or license, how you pay for it, when it renews (monthly, quarterly, annually), and the cost.

2) Pull up the past year of bank and credit card statements.

Why a year? Although many subscription-based transactions are monthly, some are paid quarterly or annually. Streaming services generally charge monthly, but I have a marketing-based service for my business that, until last year, charged me quarterly. And once a year, I pay Apple for ongoing Applecare and an online service to protect this blog from the thousands of attempted comment spams. These subscriptions are easy to forget!

3) List your recurring expenses, starting with your most recent statement.

Run your fingers down the transactions, and each time you spot a new one, log the key elements.

4) Work your way through a statement until you’ve captured every recurring expense until you’ve reviewed a year’s worth of statements and aren’t finding previously un-logged subscriptions. You will find more than you realized.

5) Repeat the process with every bank account and credit card statement.

6) Group the recurring expenses in an appropriate category. For example:

- Entertainment — streaming video and audio, paid podcasts, Patreon memberships

- Utilities — telephone, cable, internet, security systems

- Fitness — gym, online workout classes, premium apps for devices like Fitbit or Peleton

- Health — supplement subscriptions, concierge medical services

- Food — meal prep services, food delivery services

- Professional expenses at the paid tier — Zoom Pro, Evernote, AI tools, Microsoft 365

7) Evaluate each item by category.

- Are there duplicates, like an ad-supported Hulu subscription offered through your cable company as well as a paid bundle for Disney+ and Hulu?

- Do you have unnecessary subscriptions, like a membership to a gym where you no longer live?

- Do you have subscriptions that you never use? Are the apps are no longer appealing? Does something make them difficult to use? Do you just need someone to guide you until you master it and take advantage of what it has to offer?

8) Contact each vendor to negotiate costs or cancel services you don’t want to accept as-is.

Whew. There are several disadvantages to this process.

- It takes time. If you call, you may have to navigate a complex phone tree, repeatedly hearing how important your call is, and sit on hold for eons.

- They may give you a hard sell or push you to upgrade, convincing you that your cable and internet costs will decrease if you add cell service through them, but then you’d have to port your number from your original cell company, which you may like, lose your legacy status, and have to deal with those annoyances, and may find your rates going up a year hence. Be strong!

Recently, I worked with a client with cognitive decline; they sign up for services the don’t need; we call, they authorize me to speak on their behalf, and usually, we accomplish our goals fairly easily.

However, one company that keeps calling and tricking her has a habit of asking invasive and unnecessary questions, over and over, about why we wants to cancel and attempts to scare us into what will happen without this expensive auto part protection on the 11-year-old car that’s almost never used.

Having more moxy than Chandler Bing, I just keep insisting that we does not want the service anymore, and by law we have the right to cancel. (Occasionally, I have to invoke the possibility of calling the Attorney General of the state in which they’re headquartered.)

- It involves talking to other people. If you’re an introvert (or a young millennial or GenZ), the idea of having to talk to someone on the phone may nauseate you.

- It’s frustrating to talk to a bot (or an online agent typing from a bot-like script).

- You’ll still have to monitor your bill to make sure that your charges are reduced or stopped.

- You’ll have to schedule reminders to prompt you to cancel free trials before you get charged.

Can you pause subscriptions instead of canceling them?

Maybe you’d rather temporarily stop paying for a subscription while you can’t use the service. For example, when my car was stolen [Organize to Prevent (or Recover From) a Car Theft], I didn’t want to pay for Sirius XM for the two months my Kia was being repaired. I paused my subscription, but they sent me a notice after four weeks that they were going to start charging again, and I had to call to re-pause it.

There are a few reasons you might want to pause instead of cancel:

Maintain your viewing or listening history — Got a busy few months at work and won’t be able to watch your favorite shows? Maybe you’ll be traveling in the Australian Outback and won’t have cell signal to listen to streaming music and podcasts? When you’re ready again, you want your apps to show you what episodes you left off at and what’s on your to-be-watched lists.