Archive for ‘Paper Organizing’ Category

How to Collect, Organize, and Preserve Family Memories and History (Part 2) — The Methods

Last week, in How to Collect, Organize, and Preserve Family Memories and History (Part 1) — The Questions we looked at why you might want to collect family memories and stories.

It’s easy to think that it’s all about “genealogy,” which can seem like a dry topic to those who haven’t delved into wacky and wondrous family stories. But we saw how embracing family history can do more than clarify what’s happening in family photos (or make those strangers in black-and-white come alive and feel more three-dimensional). Family stories can help tether us to a genetic continuum and weave us into a tapestry going back generations and extending broadly across time and locations.

For example, when I started my business, I felt like I was adrift, the first person to really “start” a business. When asked for her profession, Paper Mommy usually puts down “part-time brain surgeon” for fun, and while motherhood is an intellectual and physical triumph, it doesn’t ecacly bring in the Benjamins. My father was an attorney and judge, but in the late 1940s, he joined an already existing practice.

But focusing on those stories I told you last week, I can place myself along a continuum of business owners: my material great-grandfather owned his own bakery (with my great-grandmother, who ran it); my paternal grandfather, who co-owned a tailors’ notions shop; my maternal grandfather, who traded in scrap metal (though decommissioned battleships seem more grandiose than “scrap” would imply).

Last week’s post also detailed a wide variety of questions to help get conversations started about family history and memories. We know that some people (and some generations) find it hard to talk about themselves, so it’s no surprise their children don’t ask questions; they don’t realize there’s anything to ask! Hopefully, the prompts I provided last week will give you a starting point to talk with your family about the rich tapestry of their lives.

But what will you do with these stories once you’ve gathered them, and how will you preserve them for future generations?

HOW TO CAPTURE MEMORIES AND STORIES — THE BASICS

Capturing your loved ones’ stories can be as simple or as robust as you choose, and you don’t necessarily have to invest in apps or platforms in order to create a record of someone’s legacy.

Take notes

Start with the basics. If you just want to make sure you get the details of what happened, you could take notes as your Grandpa tells his stories.

Scribbling notes by hand can be more surreptitious; even though we know that taking notes on our phones or computers is more efficient, and putting them into Evernote or even a Google doc will come easily, typing while they’re talking may seem dismissive to older folks. (Don’t we all feel like our doctors aren’t paying attention to us when they stay buried in their computers, tapping away as we describe our ills?)

There are only slightly more complex technological options that, once they are set up, allow you to interact more freely and naturally.

Capture your conversation with audio

The voice memo function on your phone or computer is a good choice when you’re in the middle of cooking or traveling and your relative surprises you by telling a story. You can quickly record them without missing a detail.

On iPhone, use the robust Voice Memo app. (It’s in your utilities folder, but for easier access, put it on your home screen.) On Android, use the built-in Sound Recorder app or download any of a variety of free or paid audio apps.

Shoot video of family stories

Using video adds even more color to a family story than just audio, but capturing it can be touchy. The last thing you want is for your Auntie to feel like the paparazzi are sticking cameras in her face, and you don’t want her to be focused on how she looks.

GenZ, Gen A, and younger millennials use their phones as if they are extensions of their fingers. Depending on your age and experience, you may be all-thumbs or quite adept at shooting video with your phone. The more easily you grab your phone and unobtrusively focus and hold it still, the more at ease Great-Grandma will be at telling her story of how she came to America.

If you can turn on your phone, set it up to stay steady, and give all of your attention to the narrative, everything will go more smoothly. Otherwise, develop a shorthand with your teen or tween, so while they play cinematographer, it lets you take the role of interviewer.

Set up a remote video call

The above options work great if you’re taking advantage of serendipity and spontaneously capturing a relative telling a story. But if you want to plan to capture memories, you’ll need to add some structure.

One good option is setting up Zoom, or any similar remote video service, and starting a conversation that way. There are a view key issues to consider:

- Ease of use — The basics of Zoom aren’t difficult; Paper Mommy is 88, and like most people, she took to using Zoom during the pandemic. But the email invitations, with the myriad links and phone numbers, can be overwhelming to users of all ages. When you set up a call, make sure that your interviewee(s) have as little confusion as possible; pare down the instructions to the absolute essentials or do it when someone in the family or a friend can help them set up. Nobody is at their storytelling best after thirty minutes of fighting their technology.

- Preparation vs. capturing lightning in a bottle — You know your family members. Some might freeze up if they’re asked questions; if their Nervous Nellies, send them at least a few of the prompting questions a day or two in advance. Other folks work best when they are spontaneous. You’ll need different methods for different family members.

- Recording — Pick a robust video platform option that allows you to record the call and access the file quickly and easily.

- Screen-sharing and other features — If you want to use photos to help prompt someone’s recall, make sure your video platform has a screen-sharing function, and set up the photos in a folder or slide-show, so you aren’t so distracted by the fiddly stuff that you break up the flow of your storyteller’s narrative.

You can work your way through the prompt questions I provided last week, but be sure you leave space for them to go off on tangents and surprise and delight you with unexpected tales!

Incorporate family photos into their stories

If you are handy with DIY, there are online companies where you can combine photos and text (like family stories) into a photo book (or a series of them). Popular sites include:

- Shutterfly — Browse from a collection of templates, select one, and upload your photos in JPEG format) into the pre-selected slots. Then add text, design elements, and other customizations. Shutterfly also has a free 24-hour designer service.

- Mixbook — Customize the design complexity and apply styles and themes.

- Google Photos — With prices starting at $14.99, you can customize hardcover or softcover book with custom captions, text, and collages on any page.

The above options help preserve visuals, but offer limited space for narratives.

These snaps of Paper Mommy and my sister illustrates just one of a several family stories regarding my mother doing our hair. Here, Paper Mommy zealously, lopsidedly cutg my sister’s bangs. Luckily, there are no photos of the day I was sent out into the world with pink hair-setting tape still in my hair.

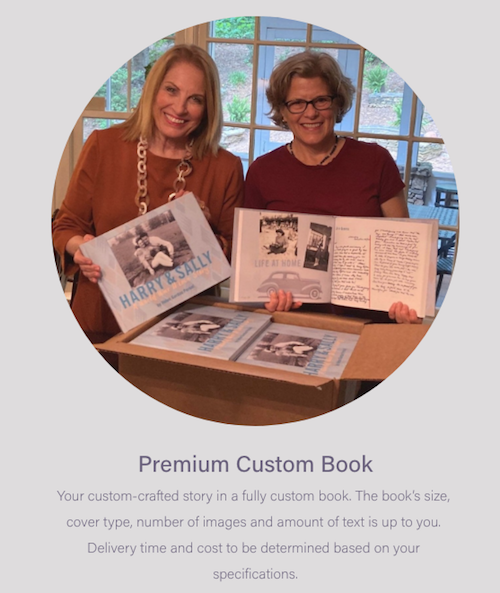

However, if you’d prefer a more white glove service rather than fighting with online settings, consider something like Jiffy Page‘s Pixorium. I’ve worked with clients to help them pare down their photos and then hand them off to Pixorium to scan and preserve digitally. They do a stellar job, but where they really shine is in helping develop custom story books.

Pixorium doesn’t just help preserve photos and make story books. Jiffy’s people are storytellers. Bring your photos, tell your story, even provide a manuscript of family history. Pixorium will listen, ask questions, and create a book that respects and reflects your family’s legacy. (Be sure to check out Pixorium’s YouTube page for great photo and legacy advice.)

Explore creative options for collecting family memories

The above options are more familiar, straightforward approaches to getting your family to tell stories and capture them, but if your family is up for some adventure, try something atypical.

This summer, I was intrigued by Perfect Pixel Moment‘s blog post on Medium, 12 New Ways to Preserve Family Memories, which included ideas like creating a family podcast series, developing a family blog, producing multi-generational family cooking videos, and more. Check it out.

What to do with what you collect

What you do with the notes, audios, and videos you capture is up to you. As with tangible organizing, you have to sort, merge, and edit your specific categories before organizing things into final form.

Whether you share raw footage or edit everything into a meaningful presentation, a documentary, or private YouTube channel is your choice. For now, focus on gathering and preserving the information while your storytellers are with you and up to the task of narrating their rich histories.

PLATFORMS FOR CAPTURING FAMILY MEMORIES IN BOOK FORM

There a huge number of services and apps designed to help you collect, organize, preserve, and share your family’s memories. The rest of this post explores just a few.

Storyworth

Storyworth is a subscription-based service. You select a weekly email prompt from the database of hundreds of “tell me about your life” questions. Your recipients respond with their own emails.

Unlike the broad, overarching prompts I suggested in last week’s post, Storyworth’s questions are more pointed and varied, including, “Can you sing your favorite lullaby?” and “What is one of your greatest fears?” (You can also edit the suggested questions or use your own.)

Stories are private by default and available to download by only authorized family members. At the end of the year, the responses to the prompts are bound into a book.

A standard package includes a year’s worth of weekly story prompts to help you interview one “storyteller,” online access for an unlimited number of family members (as authorized by you), and one 6″ x 9″ hardcover book with a black & white interior and a full color cover.

You can’t apply any of your own formatting, change fonts, etc., but the books can include photos. (The storyteller attaches photos to their email responses.) Once the responses are submitted, you and/or the storyteller can log in and edit responses and add captions to the photos, though some online reviews have mentioned the editing process can be finicky.

Extra books can be ordered, as follows:

- $39: Black and white interior, up to 480 pages

- $79: Color books, up to 300 pages

- $99: Color books above 300 pages, up to 480 pages

If you purchase multiple subscription packages, you can opt to blend multiple family members’ stories into one book.

A package is $99 for a year, with domestic shipping included.

Founded by Nick Baum to capture his father’s stories, Storyworth is independent and family-owned, and has been in business for over a decade.

Storyworth is best suited for a loved one who is comfortable with technology, in good enough health to read on-screen prompts and reply on their own, and eager enough to overcome procrastination or inertia and respond to a weekly email.

You know your relatives best. Will they feel like this is homework to slog through or an opportunity to shine?

Because stories are captured in print form (even with photos), they lack the vividness of platforms with audio and/or video. However, history tells us that print books will always be accessible, while digital A/V formats quickly become obsolete.

My Life In a Book

A similar biographical approach is offered by My Life in a Book, with questions selected from a database (though you can create your own questions to reflect the uniqueness of your relatives’ experiences).

Prompts come to your recipient via email, and replies are returned similarly, though there is a voice-to-text option, which allows someone to narrate stories directly into the online system.

Additionally, unlike the weekly flow of Storyworth, My Life in a Book allows you to customize the frequency of the arrival of the questions. Chatty Cathy can get them faster; Silent Sam can be asked less often.

This platform has a more structured biographical approach, with themes for the books:

- Preserving Memories fits the theme of tracking the lives of parents and grandparents

- Baby’s First Moments preserves important memories for new parents

- The Story of Us helps couples track their lives together

- I’m Writing a Book About You lets you create a book for and about a special loved one

My Life in a Book offers collaborative editing, so both the storyteller and any family members with access can help edit responses and even add photographs. You can also get real-time notifications to update you when your loved one has responded.

Users have input into the final book, including selecting from a variety of cover designs, choosing from a palette of color themes, and choosing different cover font text (but not interior fonts). Depending on the selected style, you may either select a pre-designed image or use a custom photo.

My Life in a Book is also $99, and shipping of books is free domestically and to Canada, UK, Australia, and New Zealand; there are shipping fees to other countries. Upgrades (at additional cost) include audiobook versions, additional print copies, and gift boxes for print books.

Remento

Remento is a worth considering if your loved one might feel more comfortable narrating a story rather than typing it.

There are still weekly prompts (which can include user-provided photo prompts), but the storyteller speaks the response into the system using a smartphone or computer; there are no logins or downloads, and reviewers report that it only requires a few clicks to get started.

Remento records and transcribes the recordings into stories printed as hardcover books.

Additionally, the books are printed with QR codes, which, when scanned, play the original recording used to write the chapters. Thus, future generations not only get the book, but get to hear the voice of the storyteller (at least as long as Remento is in business).

Remento uses artificial intelligence. Once the narration is recorded, you get to choose your preferred writing style (first-person, third-person, or transcript). From there, Remento’s Speech-to-Story™ AI technology turns your storyteller’s voice into a polished, edited written narrative. You can also customize the book’s title, color, and cover photo.

Remento is currently priced at $99, for which you get unlimited prompts and recordings, unlimited collaborators, and one premium, color-printed book. (If you subscribe to their mailing list at the bottom of the front page and are willing to get updates and notifications for sales and giveaways, you get $10 off.)

Remento is a little more focused on the journey (involving the whole family in encouraging responses to the prompts) than the destination (creating a book). All authorized family members can collaborate, watch the recordings as they’re submitted, send reactions to what’s been created (thereby providing the family storyteller with positive feedback), and select new prompts for future use.

As with the above options, your loved one will still need to keep up with prompts to get value, but the easy audio interface may make the experience more inviting than having to reply in writing.

Getting reactions on each uploaded story may be a positive experience (like getting a thumbs-up “like” on Facebook) or might be distracting and yield self-consciousness.

MULTIMEDIA PLATFORMS FOR PRESERVING FAMILY HISTORY

Books are fabulous, and your great-great-great-great grandchildren will probably be able to read text, as long as it’s not written in cursive. But if you want your family’s memories to come alive, and you want your own grandchildren to feel like they really knew your grandparents, there’s no substitute for audio and video.

StoryCorps

StoryCorps is a grand-daddy (or grand-mommy) of preserving family legacies, dating back to 2003, but it comes at it from a different perspective from most other platforms.

StoryCorps is a nonprofit project founded by a public radio producer, committed to the notion that we all have important stories to tell and that ALL of our stories matter. StoryCorps mission is to “help us believe in each other by illuminating the humanity and possibility in us all — one story at a time.”

I have a lump in my throat just reading that!

StoryCorps has a collection of more than 700,000 stories, the largest archive of its kind. Rather than creating a recorded family history for just generations of your people, you can create a story for future generations of people all over.

You have a few options for creating stories:

- Record with StoryCorps’ self-directed tools. If you can get in the same room with your loved one, use the StoryCorps App. Use my prompts from last week’s post, invent your own, or use StoryCorps’ prompts — then ask away. Alternatively, if your loved ones are elsewhere, whether across the city or across the world, you can record stories together via your web browsers using StoryCorps Connect. Either way, you can preserve your conversations using StoryCorps DIY resources.

- Alternatively, you and a loved one can record a conversation at one of the StoryCorps recording sites with the help of a facilitator. This adds a nice professional layer to the question-and-answer experience and may help your loved one feel more inspired. At the end of the session you get a recording of your interview and a copy is sent to the American Folklife Center at the Library of Congress. Talk about legacy!

- StoryCorps Mobile Tours — Each year for the last 15 years, StoryCorps has been going on a nationwide mobile tour. As I was writing last week’s post, I just happened to learn that they’re just up the road from me in Knoxville, TN, through the end of the month!

- StoryCorps Atlanta Booth — The StoryCorps facility at the Atlanta History Center has recorded and preserved thousands of conversations since 2013. If you’re in or near Atlanta, book an appointment to “interview” your loved one in person or even virtually, by phone. (They can feel like they’re on NPR, being interviewed by Terry Gross or Mary Louise Kelly!)

- Military Voices Initiative — This program provides a way for service members, veterans, and military families across America to honor and listen to their loved one’s stories. Book an appointment to preserve their memories (and your questions) in person or virtually at one of their Military Voices Initiative stops.

Some segments may even air on NPR, and I’ve seen beautiful StoryCorps personal histories set to animated video on StoryCorps’ TikTok channel. In fact, the following video prompted this part of the post series.

For more stories, see StoryCorps’s archive and YouTube page.

StoryCorps is free to all users.

Obviously, StoryCorps isn’t the right option for capturing an entire lifetime of memories, let alone the stories of all of your loved ones. However, the professionalism of the production experience may inspire your family members who may be dubious about having something to say, or who are shy about sharing their stories, to open up a bit. Consider StoryCorps as a way to delight in the storytelling experience and use it as an on-ramp for refreshing memories.

STORII

Storii recognizes that not everyone is going to be comfortable with typing their stories or even clicking around on an app or website. It’s designed for Great-Grandpa, who grunts at computers and cell phones whenever he sees them in public. (And for folks who, for whatever reason, have difficulty with technology.)

Storii uses actual phone calls to collect memories. Unless Great-Grandpa predates Alexander Graham Bell inventing the telephone in 1876, I think you’re safe.

Set up an account profile (in Storii’s iOS or Android app) for your loved ones to receive phone calls, whether on a cell phone or landline; alternatively, they can call in. (No smartphone or internet is required.)

Next, choose prompting questions from more than 1000 life story questions in their database (broken down into guiding categories like life, family, religion, career, or legacy), and/or craft some of your own.

Schedule up to three automated incoming calls per week at a time you know is good for your loved one, or arrange for them to call in to record their responses. Storii records and transcribes the calls, and adds them to your profile.

Record interactive responses. You and other family members can listen to the recordings and respond with audio, video, photo, and text responses.

Access the recordings as audiobooks or downloadable PDF books. Recordings can be shared with other family members by secure links or via emails.

If you think your storytellers won’t be at ease if they’re “surprised” by a question (even on a scheduled call), there are a few options.

They (or you) can log in to their Storii profile to see all upcoming questions (and remove, re-order, or add custom questions). If your loved ones don’t have (or don’t want to use) internet, and aren’t keen on getting you involved, they can call in to Storii at any time to hear their next upcoming question.

They can also just hang up after they hear the question on the scheduled call, and Storii will keep asking the same question until it’s either answered or skipped.

Storii’s pricing is $9.99/month or $99/year.

We have just scratched the surface of the DIY options and formal platforms for capturing, organizing, and preserving your family’s stories. But Paper Doll has one more trick up her sleeve. Next week, we’ll close out this series with AI-assisted platforms and apps for creating those family legacies. See you next time!

How to Collect, Organize, and Preserve Family Memories and History (Part 1) — The Questions

It’s hard to believe that we’re in the final stretch of the year; next month will be Thanksgiving, with the various winter holidays coming up right behind. It may be a joyous time spent with family or one marked by an empty seat at the table, a time of sharing new and old stories and, sometimes, grieving the questions un-asked and stories never told.

Over the next two posts, we’re going to look at ways of gathering and preserving your family stories so that future generations will have no regrets about what they’ve missed.

PAPER DOLL’S FAMILY HISTORY (AND FICTION)

Paper Doll is naturally curious. I have annoyed Paper Mommy (both as a child and as an adult) by insistently begging for tales. “Tell me a story about your grandparents that I haven’t already heard!” or “Tell me about when you were in school!” I urge my mother, to her frustration. She retorts, “I tell you things when I remember them. I can’t call up stories at the drop of a hat!”

As someone who is practically built out of words and memories, I can’t fathom it. Ask me about my first day of kindergarten, or my first date (an extremely embarrassing skating story everyone somehow remembers clearly) or the day I bought my car, and I can recite it as if it happened thirty minutes ago.

My family finds this annoying.

I find the lack of stories annoying. I want a complete biography, with footnotes, of my mother’s life — every conversation and experience I missed from the day she was born until I was a toddler, I want filled in. And the ones I know by heart, I still want to hear her tell them over and over again, complete with accents and narrative flourishes.

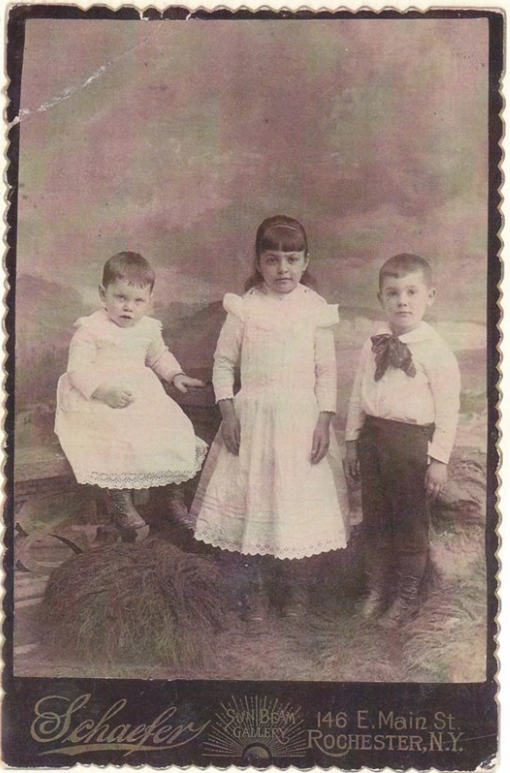

My favorites? The time in her nursery school education class where the miniature turtle went missing after the toddlers left, but (after a length search) was found in the back of a teeny toy dump truck. The time when my great-grandmother, who ran terrified of a dog chasing her from the streetcar and hid on the floor of the closet during thunderstorms, nonetheless ascended a ladder and climbed in a window when she was locked out of the house. (That’s my mother’s Bubbe on the far right, below.)

I know how my mother’s father came to America. He, his father, and his brother set out from home in Poland so his brother could take a boat to America, but (as you likely learned in Social Studies), people with diseases of the eye could not be admitted. (It’s an imprecise analogy, but imagine your nine-year-old’s pinkeye caused your family to be turned away at Disney World!) My great-uncle’s suitcase was thrust into my grandfather’s hands, and the teenager set off for America.

I’ve heard a few stories about my Poppy, some surely apocryphal. (Only many decades later did we start to doubt the tale of his job unloading cargo on the docks: a burlap bag of chocolate burs open, upon which he and his fellow worker filled their pockets with chocolate and ran away. Um, did chocolate ever come wrapped in nothing but burlap?)

Other stories were also questionable, such as when he told of a man running a food cart being asked for a hot dog. The cart only served fish, so the cart owner gave the man a fish sandwich, and the man was heard saying it was the best-tasting hot dog he’d ever had! (Years later, my grandmother, feeding my toddler uncle, urged him to eat the yummy hot dog he’d been requesting. It was a soft-boiled egg. Perhaps my Poppy’s story was the catalyst?)

Still, there are verifiable stories. My grandfather bought part ownership of a decommissioned battleship as scrap metal, and later owned an apartment complex he named after my sister. A friend researching genealogy found a Depression-era news article about him being robbed of of hundreds of dollars cash (because he didn’t believe in banks) but was not destitute because he’d also hidden money in his socks.

And once, my mother exited a downtown summer camp reunion luncheon to find her father — a Jewish man from Poland — at the head of Buffalo’s St. Patrick’s Day parade!

And yet, we know nothing of his life before he came to America except his mother was tall and that his father was, circa 1910, the captain of the town’s fire brigade. When my maternal grandparents were visiting in the mid-1970s, my grandfather slipped on the Buffalo ice and went to the hospital. Fed up with the pesky questions demanded by the hospital, my grandmother snapped when the nurse wanted my grandfather’s mother’s name, and made up a random name that sounded shtetl-appropriate.

Paper Doll with Poppy, circa 1968 or 1969 (The booklet we’re “reading” says it “will tell you how you can become a Computer Programmer.”)

As I described in The Great Mesozoic Law Office Purge of 2015: A Professional Organizer’s Family Tale, it was only when I closed down my father’s law office that I connected with his cousin and learned that my paternal grandfather, whom I always imagined to have grown up in vague immigrant-era poverty, was decidedly more Upstairs than Downstairs.

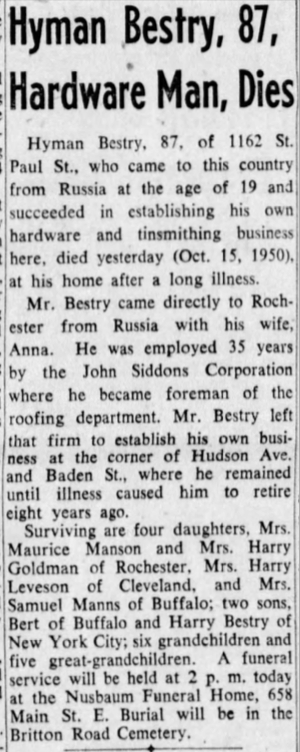

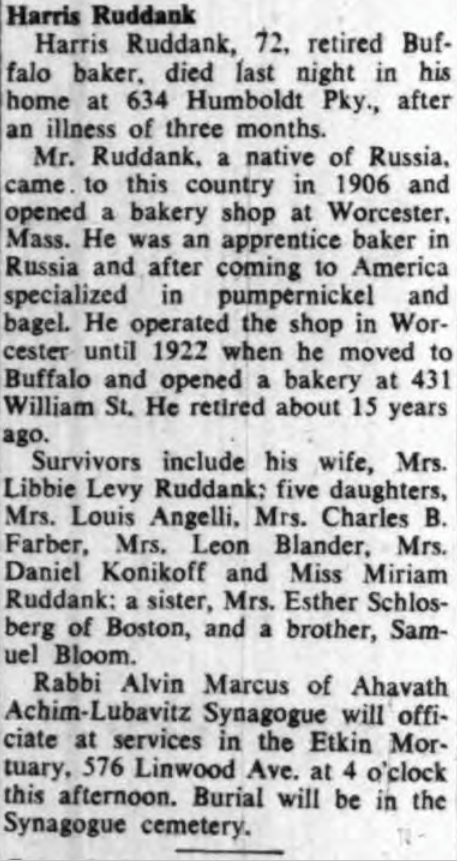

Indeed, until recently I knew nothing of my father’s father’s family, and have been fascinated by what my genealogist friend’s have found. I didn’t even know my great-grandfather’s name before reading this obituary, let alone that he owned a hardware and tinsmithing store. (When was the last time you heard about “tinsmithing?”)

I only knew of two of my grandfather’s sisters; two others plus a brother were surprises to me. Nor had I learned that my grandfather’s brother became a Broadway performer and impresario! Why was I never told these stories? My father was more interested in his future than his family’s past, I suppose.

Speaking of my father, he was a clotheshorse and chronically disorganized. So, I was amused to find this post, referencing my Great Uncle Mike “Harry” Bestry:

Damon Runyon wrote in Short Takes, for example, that Harry Bestry owns or owned “3,000 Charvet neckties, which is more than Charvet has now, 75 suits of clothes by an expensive tailor, 75 pairs of shoes, each pair made to order and nicely treed, and hats and shirts and overcoats and sweaters in similar profusion.” He added that a friend of Bestry once reported one could barely get into the man’s apartment “because of the amount of wearing apparel stashed away on the premises.”

There’s something odd about knowing that the person who created Guys & Dolls wrote about my relative. Odder still that this could absolutely have been a description of my own father.

When I was home in June, helping downsize and declutter the family basement, I found a scrapbook my father’s first wife made of their trip to New England in 1951 and a few after that. His bride’s careful penmanship next to each piece of memorabilia detailed not only their trip, but the era. On the same page, she extolled the virtues of a restaurant meal but also noted the antisemitism of the hotelier announcing that the hotel — at which my father and she (both Jewish) had been welcomed — was restricted. No Jews allowed. (They departed before nightfall.)

[If you’re unfamiliar with this era in American history, you might want to see the Gregory Peck film based on the Laura Z. Hobson novel, Gentleman’s Agreement, in which Peck plays a journalist who goes undercover as a Jewish man to explore post-War antisemitism.]

As I reviewed the scrapbook, I absorbed the details of each crumbling page which had been lovingly assembled over seventy years ago by a woman who died perhaps sixty years ago. I was fascinated by the notations of someone to whom I had only a tangential relationship, narrating weeks in the life of someone with whom I shared half my DNA.

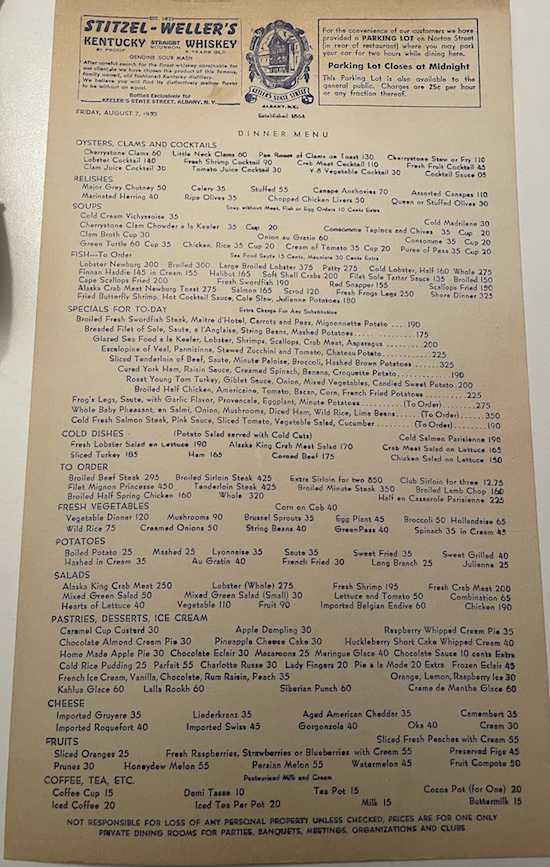

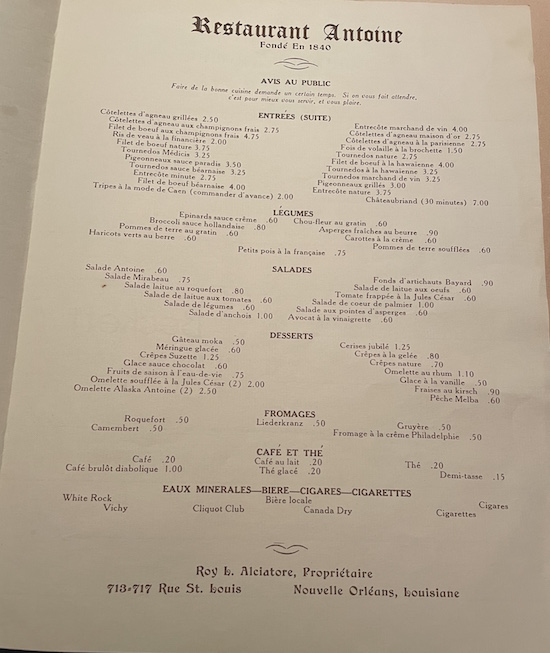

Of course, family history comes with world history. I was fascinated by the prices on the menus.

At Keeler’s State Street in Albany (established 1864), a whole baby pheasant with sides of lima beans and wild rice could be had for $3.50, with desserts from 30 to 60 cents. (Eat up quickly! Parking was twenty-five cents an hour!)

Meanwhile, New Orleans’ Restaurant Antoine (founded 1840, and which still exists) cost them a prettier penny. It was a multi-page menu, but my focus was on the eye-popping price of $7 for chateaubriande! Splurge further: $1.25 for a Crêpe Suzette for dessert.

WHY CAPTURE YOUR FAMILY HISTORY?

This is all to say that if you aren’t inclined to ask, and if your relatives aren’t inclined to tell, it can be difficult to create any sense of family legacy, either for yourself for for generations that come after.

In her excellent book, What’s a Photo Without the Story?: How to Create Your Family Legacy, my friend and colleague Hazel Thornton details why you might want to gather your stories and those of your family and your ancestors. At the start of the book, she explains that doing so will:

- Give depth and meaning to your photos.

- Make history come alive!

- Preserve family legends (rumored or proven).

- Give children a sense of belonging and help them feel more secure.

- Make us feel connected to our families , and to the world around us.

- Help us better understand our families, and ourselves.

Moving? Here’s Your No-Stress Change of Address Checklist

ADVENTURES IN MOVING

A month ago, my best friend of almost forty years called me from her car. “Where are you?” I asked, expecting her to be somewhere en route between where she lives in New Jersey and somewhere near New York City. I was surprised to find out that she was in Central New York, headed toward Western New York (where I’m from), to look for a house to buy!

My BFF and her significant other had gone to a financial advisor to talk about the usual financial and tax planning topics as they approach a decade that will see many changes — from the last of the “kids” leaving home to their eventual retirements. Among his suggestions was to buy a home. While that wasn’t feasible in the very expensive area where they currently live, they contemplated moving closer to the areas where both had grown up.

Apparently, the housing market is pretty wacky right now. Home prices are up 30% from where they were just before the pandemic, a mere five years ago! Inventory is low, and demand is high. The morning I spoke to my friend, she’d had a list of six houses to look at the next day; by the time we chatted, three had already sold. Forty-eight hours later, they’d bought a (cute) house!

Photo by David Gonzales on Pexels (And no, that’s not my BFF’s house, but it’s cute.)

One of my other closest friends recently surprised me with a home announcement, too. He and his new spouse live in the south in separate cities; they’ve been working toward finding a city that worked for both of them as one can work remotely and the other was contemplating retirement.

This summer, while visiting a friend in the northeast, they decided to explore communities within driving distance, and unexpectedly found their “forever” home and, like my BFF, closed on a house quickly. Their move is happening as I write this!

As my area of expertise is paper, my initial concerns for both friends involved making sure they were registered to vote in time (per my advice in The Ultimate Guide to Organizing Yourself to Vote) and that they’d get their addresses changed so they’d be sure to get their mail and not miss any important notices or payments.

WHY YOU MIGHT CHANGE YOUR ADDRESS

Is mail that important? I mean, most of us get a lot less paper mail than we used to. Fewer people send cards and letters; people post their vacation photos on social media instead of sending postcards. Many folks take advantage of a one-time $5 credit if they get their utility bills by email (or have them auto-debited with email or text notifications after the fact).

Still, mail is can be vital, and making sure that your mail gets to you will make at least one aspect of the moving process less stressful. There are a few different kinds of address changes:

- Permanent changes of address for all concerned — This happens when you (and possibly your family or household members) change houses (or apartments) and leave (theoretically) for a different home.

- Permanent changes of address of address for only one member of a household, such as when one person moves out after a divorce, ostensibly never to return.

- Temporary, but long-term change of address for one person — Let’s say your kid is headed to college. If she’s staying in town and coming home every week to do her laundry and “borrow” the contents of your fridge, maybe no change of address is necessary. But if she’s headed across the state or country, she’ll want to change her address for most things until May, when she either moves back or tells you she’s going to bum around Europe to find herself.

- Temporary change of address for one person — There are various reasons for this option, but all involve being away from your home (for work or other obligations) for a length of time, with an expectation of returning.

Last November, Paper Mommy fell and broke her pelvis, then contracted pneumonia, and due to some medical neglect that makes me want to punch walls, had three hospitalizations and two stints in rehab over the course of two months.

My mother didn’t need to change her address to the hospital or rehab location — a family friend was able to collect her mail and bring it to her. But my sister, who relocated from her home state to my mom’s house for most of two months (and worked remotely while helping with my mom’s recovery), did redirect her mail, temporarily.

Similarly, I’ve had clients who have home bases but travel extensively and long-term for work. One relocates for six weeks out of every quarter to train different divisions of her company.

Another client is a “locum tenens,” a Latin word that refers to medical professionals (or sometimes clergy) who work temporarily in different locations. For example, travel nurses are temporary healthcare professionals who are hired to address staffing shortages, particularly when patient volume surges or there are higher seasonal demands. Assignments can range from four weeks to much longer, and 13-week assignments are not unusual. Nobody wants to be without their mail that long.

Some locums return to a home base between jobs; others move from one job to the next, living in temporary housing in each location. Getting mail wherever they are feels a bit more like home.

HOW TO CHANGE YOUR ADDRESS

Whatever your reason for changing your address, you’re going to want to organize your approach.

Get the details right

Do not pass go, do not collect $200. Before you submit your change off address for official notifications or share your new digs with friends, make sure you have the details exactly correct, including the full ZIP Code with extension.

I live in an apartment, and my address includes a street address (that applies to thousands of residents of many hundreds of apartments) as well as an apartment number, which is mine alone. Over the years I’ve been here, several new residents have mistakenly listed my apartment number as theirs, and I’ve gotten their mail and packages.

If the mail looks important, I’ve tried to find the person via social media and meet them in the parking lot to give them their mail; if it doesn’t seem vital, I usually write “no such addressee at this location” and return it to to the post office. But not everyone will do that, and you really don’t want to risk your mail or packages ending up with someone who isn’t as cool as Paper Doll.

- Verify your exact address with your real estate agent, landlord, or apartment complex management. You may need to start the change of address process before you get all your paperwork, so be sure to clarify via text or email to ensure it’s correct.

- Don’t make assumptions regarding the address based on what you’ve seen when visitinh. On Friends, Monica Gellar’s apartment’s fictional address 495 Grove Street; the building you see on the show is actually 90 Bedford Street, at the corner of Bedford and Grove in Manhattan. You’re not a TV character, but your home may have an address on one street even if the main (or only) entrance is on the cross street.

- Double-check to make sure that your new home is properly identified as Road, Court, Lane, Boulevard, Circle, etc. Many subdivisions have similar street names with only the final qualifier differentiating among them. (Want to go down a rabbit hole? Read What’s the Difference between an Ave, St, Ln, Dr, Way, Pa, Blvd, Etc.?)

A few months ago, I was on the phone with a friend who built a home in a new subdivision. He’d been delivered a package for a home with the same number as his on the next street over. He thought he’d do a good deed and walk the package over to them while we chatted. Unfortunately, the next street over was not numbered the same way, so the true recipient’s home wasn’t approximately behind his, but much farther away. Eventually, he cut through some backyards back to his house, got his car, and re-attempted the delivery. Again, not everyone is that helpful!

- Double-check the directional terms, like 129 West 81st Street (that’s Jerry Seinfeld’s place, in Apartment 5A). Make sure you ask for sound-alike numbers (five/nine, fifth/sixth) to be spelled out (in case you get Mr. Rogers’ old 4802 Fifth Avenue house).

- If you’re buying a recently-constructed home, triple-check. Sometimes, a developer may change the street names between when the plans were submitted to the post office and the municipality put up the street signs.

- Check to see if your street is actually registered with the post office. It’s hard to believe, but some developers sometimes forget this step.

![]()

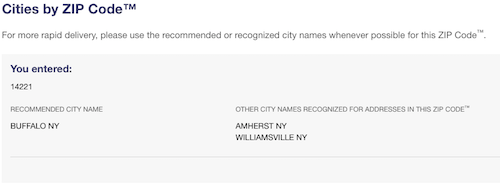

This is fairly easy. Look up your address on the United States Postal Service ZIP Code Lookup site. Enter what you have of the address, and it should return the proper ZIP Code, including the four-digit extension.

You can enter the address to get other details, the city and state to figure out the ZIP code, or the ZIP code to determine the right name for your location. For example, my childhood home is considered in Buffalo, New York, but known by other names:

WHO NEEDS TO KNOW TO KNOW YOUR NEW ADDRESS?

Once you know to where you’re relocating, start spreading the news.

Start with the Post Office

Submit a change of address through the United States Postal Service. You can walk in to any post office and fill out a change of address form, or file a change of address online. (The USPS page also helps you change your address for the purposes of changing your voter registration address.)

Click to identify whether this is a change of address for an individual, family, or business. Provide your full name and email address (to which your confirmation will go); USPS also requires a mobile phone number in order to verify your identity and mitigate fraud.

Select whether you will be returning to your address within six months (to classify whether your change of address is considered temporary or permanent).

Choose the date when you wish mail forwarding to begin. (The minimum duration for a temporary change of address is 15 days. The initial forwarding period is restricted to 6 months, but can be extended up to 1 year.)

After you provide your old and new addresses, you’ll be charged the whopping fee of $1.10, by credit or debit card, for security purposes.

Standard mail forwarding lasts for a year. After that, you can pay for extended mail forwarding at the rate of $22.50 for six more months, $33.50 for an additional year, or $44.50 for eighteen months. At that point, you should have cycled through just about every annual bill and notification and should be able to notify everyone who might have slipped through the cracks in the year after your move.

Filing your change of address with the postal service will cover most of your incoming mail, but is only temporary.

The following should help get you on your way to recalling everyone else you need to notify.

Notify Government Agencies

Only you know which government agencies you deal with at the federal, state, and local levels, but start with these:

- The Internal Revenue Service — It should be obvious, but the IRS really needs to know where you live. It’s also to your advantage for them to be able to find you; you don’t want to miss out on refunds, rebate or stimulus checks, or important notices.

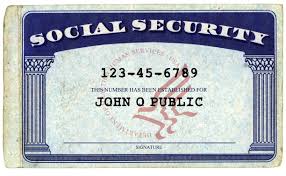

Fill out IRS Form 8822; learn more at the IRS Address Change page. Alternatively, you can submit your change of address on your next tax return, by phone, or by mailing a written statement that includes your full name, Social Security Number, and old and new addresses to the address to which you mailed your last return. (Yes, you probably filed online with Turbotax, but that’s what their instructions say. Use this IRS page to find a good mailing address.)

- Social Security Administration — If anyone in your household gets (or soon will receive) disability, retirement or survivor benefits and you live in any of the 50 states, DC, Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, or American Samoa, log into your account and use Social Security’s online system to change your address; you can also call 800-772-1213, Monday through Friday, 7 a.m. to 7 p.m. EST, but expect to provide information to prove your identity.

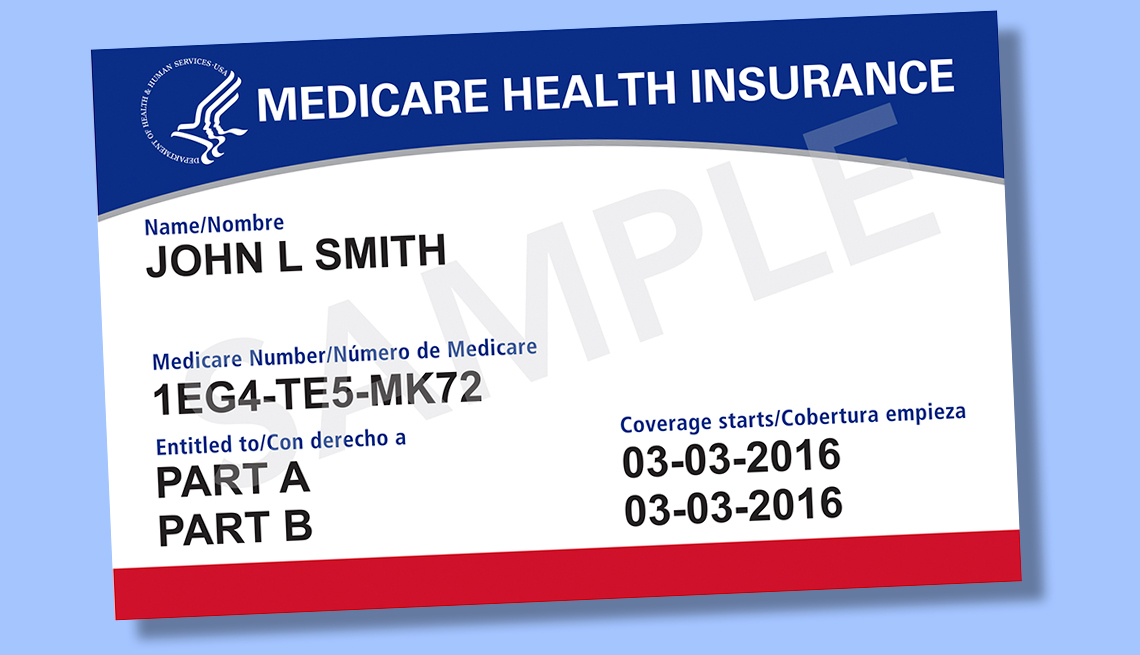

- Medicare — To change your address with Medicare, you must contact the Social Security Administration, as described above.

- Healthcare.gov — If you get your healthcare through the federal exchange rather than a state exchange or private insurance, log into your account and update your current application online. If you are moving within the same state, you can update your application online, by phone, or in person — but not by mail. However, if you move to a different state, changing your address is not enough; you will need to submit a new application and select new health insurance.

- Department of Veterans Affairs — If you or a member of your household has been in the military and receives military benefits (or will in the future), be sure to keep the address updated, either online in your VA.gov profile or use the Department of Veterans Affairs’ change of address printable form. Note that changing it in your online profile will speed the information across all divisions.

This is also important if you are the executor of a will or responsible for the estate of someone with military experience service. Make sure the VA can find you.

- U.S. Citizenship and Immigration Services — Most resident non-U.S. citizens need to report their changes of address within ten days of moving within the United States or U.S. territories; this should be done through your USCIS online account. If there’s a reason you can’t update your USCIS address online, you can download and fill out Form AR-11 to submit an Alien Change of Address Form.

Note that changing your address with the USPS will not change your address with USCIS and USPS will not forward your mail from USCIS, so you’ll want to jump on this.

- Voter Registration Offices — If you move, whether it’s across the street or to the other side of town, you need to update your address with your local board of elections. A change of address even within the same congressional district may still change your voting options for city or town council, school board, and other local issues.

If you move to a different county, city, or state, you’ll need to register to vote in that locale. As you learned in my post on voting, different states have different rules regarding the methods (in-person, by mail, online) for registering to vote and changing your address. You can also register to vote or change your registration information, including your address, via Vote.org.

- Department of Motor Vehicles — Contact your state’s DMV to find their online change of address page (if you’re moving within the same state) or registration information (if you are changing states).

- Toll Pass Agencies — Don’t forget to update your address with whatever toll pass accounts you use. Look at your transponder if you’re not sure what agency handles your toll pass. EZ-Pass, for example, covers twelve states, and services I-PASS in Illinois, and other regional agencies in North Carolina, Indiana, Kentucky, and Florida.

- Unemployment Offices — Depending on your state, relocating while you receive unemployment benefits can be tricky. (If you move to a different state, your benefits will likely end.) Notify your state’s unemployment agency as soon as you being the moving process. In most states, the easiest way to update your address will be to log in to your state’s unemployment benefits online account. If you aren’t sure where to start, the Department of Labor has contact information for all state unemployment insurance offices.

Finally, if you are certified or licensed by your state to fly a plane or maneuver a boat, to fish or hunt, or to perform your profession, be sure to contact that government agency to update your address.

Contact Financial Institutions

Even if you conduct all of your financial transactions online, your providers need to know where you live because some financial rules and regulations are governed by the state in which in the accountholder resides. So, create a checklist for any and all of the following:

- Banks and credit unions where you hold accounts

- Brokerage houses and investment services, for retirement and non-retirement investments

- Credit reporting agencies — Officially, you only need to notify your creditors. However, it’s worth your effort to check Equifax, Experian, and TransUnion after the move to make sure your address has been properly updated. Log in to all three via AnnualCreditReport.com.

Little House Photo by Kostiantyn Li on Unsplash

- Insurance companies — Whether you have auto, homeowners, renters, health, or dental insurance, long-term care or life insurance, umbrella policies, or coverage for your business — if you’ve got insurance, notify them of your address change. In most cases, changing your address will change some aspect of your coverage, especially the cost.

- Lenders — Got credit cards? Auto or personal loans? (Obviously, if you’ve got a mortgage or a HELOC, those will be going away when you move, but the bank will still need to be able to contact you for a while.)

- Online financial accounts — Whether it’s Paypal, CashApp, Venmo, or Zelle, make sure your address is updated in the accounts. Where you reside impacts legal terms and conditions.

Tell the Boss Man (or Boss Lady)

You may not get a physical paycheck anymore, but your employer needs to know where to send tax forms and other official documents.

If you work remotely and change your state of residence, tell your HR department!

Notify Your Utility Companies

When you move, you (generally) don’t take your services with you, but you may keep the same account number. Notify the following when you change your address:

- Electric company

- Gas company

- Sewer service provider

- Trash/Waste/Recycling service providers

- Water company

- Internet service provider

- Telephone companies — You may not have a landline anymore, but you almost certainly have a phone. Be aware that the taxes you pay on cellular phone service are determined by the county in which your account is registered. If you use online billing, it may be to your advantage to keep your cell service registered to your old zip code, but your provider’s Terms and Conditions may not allow this.

- Television service provider — Sure, if you have cable or satellite service, that will change depending on where you move. However, the tax you’re charged for streaming services will change depending on the state to which you move.

- Other entertainment providers — Whether you subscribe to music or gaming services like Spotify or Twitch, or have tangible subscriptions for magazines and newspapers, update your address.

WHO ELSE NEEDS TO KNOW YOU’VE MOVED?

Notifying the above folks will keep you from getting into trouble or debt, but don’t forget all of the other individuals and companies that need to be able to find you.

Household Services

Depending on where you move, your household service providers, whether a big company like Terminex or the nice lady who dusts your piano, will need to know how to contact you, whether to continue providing services or finalize paperwork. Start with these and brainstorm whom else you might need to contact:

- Alarm company

- Housekeepers

- Lawn and garden care

- Pest control

- Pool maintenance

- Snow plowing/shoveling

Healthcare Providers

- Internists/Family practitioners

- Pediatricians

- Specialists (OB/GYNs, ophthalmologists, endocrinologists, etc.)

- Dentists

- Orthodontists

- Veterinarians — If you have a pet with a microchip, update the chip’s registration to reflect your new address so Fido or Fluffy can be safely returned to you!

- Pharmacies, especially online pharmacies

Other Professionals

- Attorney

- Accountant

- Bookkeeper

- Financial advisor

- Personal coaches

- Professional organizer

Schools/Caregivers

- Daycare providers — for childcare, eldercare, or pet care

- School administrative offices — Every school needs your change of address: preschool, elementary, middle, and high schools as well as college, whether you are a student, parent or alumni.

- Tutors — Don’t be so busy with your move that your forget to tell your son’s algebra tutor or your daughter’s piccolo instructor that you moved. It’s no fun to stand at someone’s front door, ringing the bell and having nobody answer.

- Activity administrators — If your kids are in gymnastics or Tae Kwon Do, or you participate in any community organizations, make sure to update your address with them. Yes, the USPS mail forwarding will prompt you to remember this, but the sooner you update this information directly, the less chance there will be to miss something important.

Online Connections

Do you get meals from companies like Blue Apron or Hello Fresh? Make sure your food follows you to your new home.

Do you use food/shopping delivery services like Door Dash or Uber Eats? I’ve seen more than one tweet or TikTok video with someone ordering delivery for the first time in a long time and only realizing after they ordered that the delivery was going to the city where they used to live. (It’s universally agreed that when that happens, you tell the driver to keep the meal and enjoy it!)

Be sure to update your address at Amazon and other retailers where you shop online. Got an Amazon (or other) wish list? Change that address too, or your friends will be upset when they send you birthday presents that you don’t get!

Do you travel? Update your addresses for your hotel, airline and other frequent-user accounts

Tell Your Peeps

You’re not going to forget to give your mom your new address, but remember to update your friends and members of your personal circle, including:

- Extended family and friends — The upside is that you may get sent a housewarming present!

- Civic organizations and clubs to which you belong

- Houses of worship and religious organizations

Business Contacts

I could write an entire post about whom your business should contact regarding a changed address. But for personal mail regarding your professional life, consider:

- Professional associations

- Licensing and certification boards

- Formal networking groups

- Affiliate programs from which you are expecting commissions

All of the above assumes that you’ve moved house in the United States. If you move to another nation, be sure to register your address with the U.S. embassy or consulate in your new country. This will ensure that you receive essential updates about safety, security, and emergencies in your area.

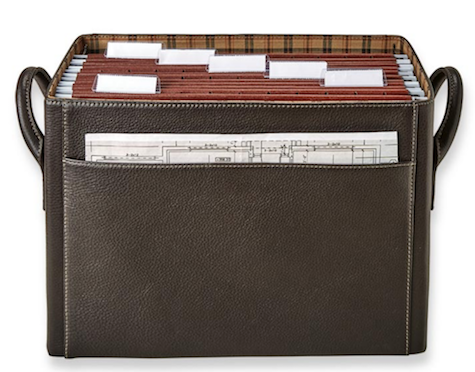

Paper Doll Explores the Best of Desktop File Boxes

September always gets me thinking about school supplies, and office supplies are really just school supplies for grownups (and for all of us pretending to be grownups).

So, when an editor friend (now at Yahoo! Life), contacted me for a few organizing-related pieces, and asked me what my favorite under-$20 organizing item was, I immediately knew that I was going to pick something related to paper. (I mean, come on, I’m Paper Doll!)

See Your Way Clear: Organize With Transparent Sticky Notes

Longtime Paper Doll readers know that I’ve had a complex relationship with sticky notes. On the one hand, in the very first month of this blog, all the way back in 2007, I railed against writing things on random pieces of loose paper in Stay Far From Floozies: Avoiding the Loose Paper Trap.

On the other hand, over the years I’ve broadened my approach. It’s not the sticky notes, per se, personified by 3M’s Post-it® Notes, that left me chagrined, but the act of writing things you want to remember on any visible piece of paper, without rhyme, reason, or organizational process. To that end, I’ve shared a wide variety of pro-sticky note posts, including:

- Organizing With Post-it® Notes: Revenge of the Floozies — Three years after coining the expression “floozies” for loose paper and casting aspersions on sticky notes, I praised the ways you could effectively use sticky notes to keep yourself organized in the office, in dorm rooms and when studying, financially, and when planning projects.

- Sticky to the Extreme: Organizing Information in Extreme Situations with Post-it® Extreme Notes — These super-powered stickies handle the extreme conditions of heat, cold, humidity while preserving powerful delivery of the message.

- Paper Doll Adds a Pop of Color with Bright & Sunny Office Supplies offered up a colorful review of the Post-it’s ten different themed families of note hues for brightening your work day.

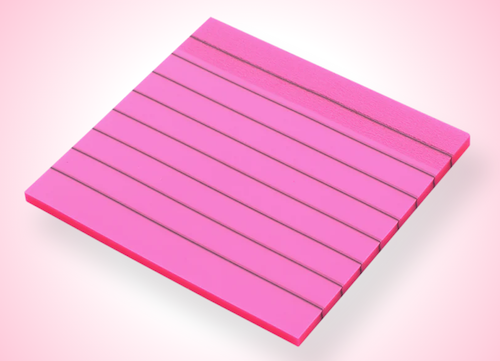

- Paper Doll Shares 3 Quirky & Cool New Office Supplies looked at the niftiness of lined sticky notes (and devices for neatly making bullets and lines on them)

- Emerson, Angelou, Ted Lasso, Tashlich & Zen Monks: Letting Go for a Fresh Start was ostensibly about new perspectives and giving yourself a new beginning, but it also introduced 3M’s super-nifty Super Sticky Big Notes, 11″ x 11″ and 15″ x 15″ sticky notes.

- Paper Doll Helps You Find Your Ideal Analog Habit Tracker — They may look like they’re just tiny scraps of paper, but both traditional sticky notes and specialty items (mini-lists, planners, and habit-trackers) in the Noted by Post-it® line offer cheery solutions for keeping your life organized. We looked at an expanded view of some of the Noted products in In Search of Lost Time: Productivity, Proust, and the Culture of Availability.

So, let me be perfectly clear: stickies have have a place in organizing — as long as they’re used intentionally, mindfully, and not randomly.

With all this in mind, today’s Paper Doll post explores another intriguing sticky note option reminiscent of the novelty we discussed back in 2012 when I looked a different transparent office supply solution, in Paper Doll Rolls the Highlight Reel: Removable Highlighter Tape.

BENEFITS AND USES OF TRANSPARENT STICKY NOTES

When it comes to organizing thoughts and information, I want the benefits of transparent sticky notes to crystal clear.

In case you’ve never seen a transparent sticky note, think of it as combining the functions of tracing paper and sticky notes.

Transparent sticky notes — which, to be fair, I generally more translucent or slightly “frosted” than entirely transparent — offer several benefits that distinguish them from traditional opaque ones, especially for organizing and annotating. Additionally, the notes (though not the writing) are waterproof and are generally more durable than traditional sticky notes.

Having trouble envisioning how they work? Take a peek:

Academic Uses

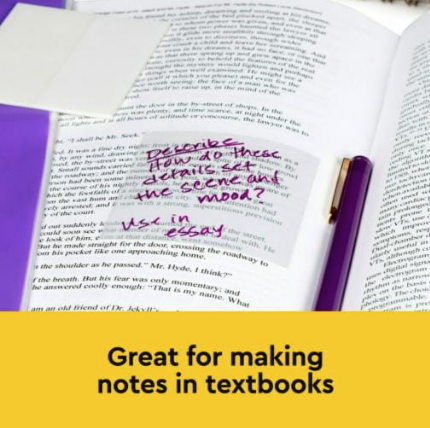

Transparent sticky notes are ideal for students at all levels, but particularly in high school and college, especially when studying texts where annotations are helpful or even necessary but the page or document must not be permanently altered.

Transparent sticky notes allow students to scribble questions, ideas, connections, and thoughts directly over content. The notes can be applied, easily removed or repositioned, and (if carefully stored) applied again later.

- Overlay Text or Drawings Without Obscuring What’s Beneath

Transparent sticky notes allow you to place and affix notes directly over text or diagrams without covering the printed content.

This is particularly useful for annotating books and textbooks, source documents, or presentations where you want to preserve visibility of the original material.

Science textbooks often include complex illustrations of plants, processes, or anatomical design. Students can learn a few elements at a time, add explanatory text to the overlaid sticky notes, remove the note to test themselves, and create new ones for different elements.

- Highlight and Emphasize Information

By placing a transparent sticky note over a portion of text or an image, you can use a highlighter or writing implement to highlight, annotate, or draw attention to specific details without making permanent marks on the original material.

You can use a highlighter directly on a clear transparent sticky note; tinted translucent notes let you both color code concepts or categories and serve the same accenting purpose as a traditional highlighter.

Teachers can write comments pointing to specific areas of a student’s work while not damaging the masterwork, and tutors can add explanatory guidance to notes and then remove them when coaching students to remember what was on them.

Students using printed textbooks can highlight or annotate content, remove and re-affix the notes for studying and self-testing, and then re-sell the practically pristine textbook to the college bookstore after the final exam! (Yes, I know college students primarily use digital textbooks now, but they still read many novels and auxiliary books and use workbooks in traditional formats.)

- Copy content to paste into notes

Remember how I said that transparent sticky notes work like a combination of a traditional sticky note and tracing paper? Trace directly from your text book and then affix what you’ve traced into your handwritten notes.

The hand-brain connection means that students will remember the material much better from the experience of hand-tracing than they might if they only photocopied an illustration or chart.

Organizational Uses

This is an organizing blog, after all, so we should look at the organizing advantages.

- Layer for Enhanced Organization

You can layer transparent sticky notes on top of one another or over documents without losing sight of the information underneath. This can be useful in complex planning, when you want to group ideas visually without obscuring the main content.

Again, students can use layering for studying illustrations or maps, adding their notes and layering different types of content on top of the original material, with layer upon layer adding more nuance and detailed information. (I’m reminded of my 9th grade Social Studies class where, when faced with a blank mimeographed map of Africa, we had to learn (and later fill in on subsequent weeks), the country names, then the capitals, then the colonial influences, and the top exported product. I could have really used transparent notes, but regular Post-it® Notes hadn’t made it to our school supplies yet!)

- Reorganize Ideas Easily

One of the great benefits of traditional sticky notes is that you can move them around, but again, transparent/translucent sticky notes augment that benefit. They allow for more flexible, real-time organization of thoughts, whether they’re used on a document or handout, the page of a textbook or workbook, or even on a large-format item like a map, poster, or whiteboard.

Improve Every Stage of a Project

When you work (or study) in a creative field, your work often has many iterations. Having an overlay for things that aren’t (yet) perfect gives you flexibility to be creative without fear of losing a creative draft or burst of genius.

- Clear the Way for Creative Work

Transparent sticky notes can help for artists, designers, and creators who need to annotate their thoughts without hiding underlying sketches or design elements. Create temporary markups and adjustments without altering the original work.

Musicians might create an overlay with the conductor’s suggestions written on an angle, above or below the measures, bars, and notes.

- Collaborate and Brainstorm

In collaborative environments — picture a Mad Men-style creative team or a garage band figuring out how different instruments and vocals might come together — transparent sticky notes enable participants to add thoughts or ideas on top of shared content, whether on a design, blueprint, or lyric sheet.

The ability to make changes without altering the original fosters more flexible brainstorming sessions without fear of losing track of the original document or a sequence or flow of ideas.

Who else might use transparent sticky notes?

The unique properties make transparent sticky notes a versatile option in various context. In addition to traditional students and teachers in an academic setting, who else might use these notes?

- Authors — Most authors now edit galley copies of their books digitally, directly in PDF files. However, editing that way isn’t always comfortable. Writers might choose to make notes (on clean copies of their galleys or even printed drafts) and then highlight changes on transparent stickies.

- Memoirists — Reading your own handwritten journals to help document the history of your thoughts and actions? You probably don’t want your 2024 handwritten notes directly on the pages of your circa-1981 Snoopy diary, but overlaying transparent sticky notes helps the you in the present engage with the you of the past.

- Researchers — When faced with a variety of primary sources that can’t be doodled upon (or when you don’t have access to a copy machine but would prefer to handwrite your notes layered over a document), a transparent note can help you make a deeper connection between your thoughts and the original work than taking notes on a computer or pad of paper.

- Book reviewers — Whether you review books professionally or just for Amazon or Goodreads, it’s helpful to have your contemporaneous thoughts while reading and your highlighted quotes at the ready. If you find marking up books to be almost sacrilegious, transparent stickies are a great option.

- Cooks — Some people take recipes in cookbooks as gospel; others like to “doctor” things up. If you were experimenting as you went, you might not want each changed variable to be written onto the original recipe, but you’d still want to track the changes you made until (or even after) you achieved delicious perfection. TheKitchn blog post This Mind-Blowing BookTok Trend Will Change the Way You Use Your Cookbooks is a bit hyperbolic but does show the use case in action.

- Attorneys — Boilerplate contracts are in computers, and paralegals make the revisions digitally as instructed. But most lawyers can be seen reviewing photocopies of contracts and mocking them up with revisions. Transparent sticky notes would let them see the original contract language, highlight relevant passages, and make revisions; similarly, they might use transparent notes to help them accent points in transcribed depositions and testimony they want to refer to in court.

- Spiritual adherents — Whether you participate in some kind of formal Bible study or just like reading holy texts from any of a variety of comparative religions, you probably don’t want to scribble your thoughts in the (or any) “Good Book.” Use transparent sticky notes to highlight and annotate questions, feelings, or motivational elements.

- Crafters — Whether you’re trying to map colors for a needlepoint project or adjust the measurements on a pattern, writing directly on the instructions or designs can get messy, especially if you need to revise your notes. A transparent overlay lets you adjust without the mess.

How might you use a transparent or translucent sticky note?

CHALLENGES PRESENTED BY TRANSPARENT STICKY NOTES

While transparent sticky notes offer many benefits, they do have some downsides to consider.

Potential for Residue

Some brands of transparent sticky notes might leave a slight residue, especially if left on delicate surfaces for an extended period. (Bibles and textbooks from before the1950s tend to have pages that are as thin as tissue paper.)

Obviously, this varies depending on the quality of the adhesive used, and higher-end (and honestly, brand-name) versions will typically avoid this problem. If the book or document you’re using is delicate, test it on a back page, like in the glossary or index.

Adhesive Strength

Transparent sticky notes may not be adhere as strongly as traditional opaque sticky notes, particularly on rougher surfaces. Unlike the recycled paper of traditional sticky notes, the slightly slick material used to make transparent sticky notes makes the notes more durable but the adhesive may be less durable. This means they might peel off more easily, especially on surfaces that aren’t perfectly smooth or when the notes are repositioned (or applied, removed, and re-applied) multiple times. Again, test them.

Writing Challenges

Depending on the material, certain pens and markers may not write as well on transparent sticky notes. This can limit their functionality (compared to traditional paper-based sticky notes) if you (like Paper Doll) prefer one specific type of pen. Again, brand-name versions are likely to allow a greater variety of pen use; Post-it® shows multiple examples of workable writing implements.

Less Absorbent Surface

Unlike paper sticky notes, which easily absorb ink, transparent sticky notes are usually made from plasticky or filmy material, like stiff, glossy tracing paper. This can cause ink to smear or take longer to dry.

Most of the TikTok videos I found on the topic are in agreement that mechanical pencils, ball-point pens, and markers work best, and that water-based highlighters and pens are the least effective. If you use markers or gel pens, especially if you also intend to highlight what you’ve written, be sure to let the ink dry thoroughly before touching or highlighting.

Limited Color Options

While some transparent sticky notes come in pastels and neons, they usually lack the range of vibrant colors available with opaque sticky notes, especially the myriad Post-it® colors. This can limit your ability to color-code effectively when organizing ideas. You can easily find colorful options, but perhaps not your preferred color schemes.

Glare and Reflection

Due to their transparent nature, this kind of sticky note may glare under certain lighting conditions, making them more difficult to read or see clearly in brighter environments or on glossy surfaces.

Cost

Transparent sticky notes, whether brand name Post-it® versions or generic, tend to be slightly more expensive than their opaque counterparts, so if you’re on a budget or need a lot of them, the cost could be a drawback.

If you’re using these sticky notes for creative, academic, or professional purposes where clear visibility is key, these downsides may be manageable. However, for heavy-duty or everyday use, traditional sticky notes are usually going to be more practical.

VARIETIES OF TRANSPARENT STICKY NOTES

According to the website, Post-it® Transparent Notes come in 7 varieties, all with 36 notes per pad (though I was able to find an additional 10-pack of the clear version at Staples.com for a whopping $26.46)!

- original transparent (clear) pad ($7.29 at Staples.com or $5.35 at OfficeSupply.com)

- a two-pack with one original clear pad and one blue pad

- a three-pack assortment (pink, orange, and green) pads ($12.59 at Quill)

- a five-pack assortment (purple, orange, pink, blue, and green)

- an eight-pack with four clear pads and one pad each of orange, pink, blue, and green

- an eight-pack with two pads each in blue, pink, green, and orange ($14.99 at Amazon)

Leather

Leather

(I’ve yet to figure out how TikTok Shop advertisers and companies like Temu and Shein can afford to price their products so low. Caveat emptor.)

(I’ve yet to figure out how TikTok Shop advertisers and companies like Temu and Shein can afford to price their products so low. Caveat emptor.)

Follow Me