Archive for ‘Medical’ Category

Whoopsie! What To Do When Your Week Doesn’t Go As Planned

This isn’t the post I planned to write today.

And last week’s post never got written. In fact, last week did not go as planned at all. It went BOOM!

VERTIGO, BUT WITHOUT JIMMY STEWART

It all started last Sunday evening. I was chatting on the phone with a friend and getting ready to start writing a post for Janet Barclay’s excellent monthly Organizing and Productivity Blog Carnival. Usually I submit a post from the Paper Doll vault, but this time I wanted to write a new post, specifically for the carnival. (We’ll get to that later.)

As my friend and I were talking, I sat on the edge of the bed and then lay down to stretch my back. Immediately, I was overcome with a powerful sense of vertigo — not mere dizziness, or as though the room were spinning, but as though I weighed tons and was going to go barreling through the Earth. While it was not the worst I’ve felt in my entire life, it would rank in the top three.

Publicity Poster from Alfred Hitchcock’s 1958 Vertigo

I’ve had benign paroxysmal positional vertigo (BPPV) twice before, and both times it was quickly dispatched by a seemingly magical series of movements called the Epley Maneuver. I’ve seen it be such a freaking miracle that I’m a typical explanatory video in this post. (Think of it as organizing for the inner ear!)

Unfortunately, this time, Epley let me down.

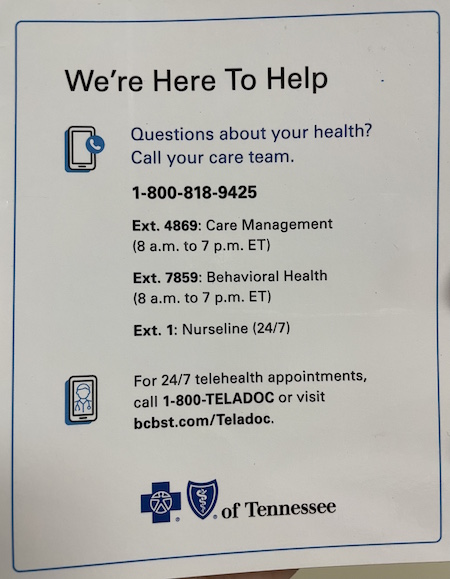

The next six hours seemed to pass like jump-takes in a movie. It was 6:35 p.m. and I was on the phone with Paper Mommy. The next thing I knew, it was almost an hour later. And then another hour. My insurance company has Teladoc built-in, and I’d previously registered, so I used the app to reach a physician for a video consult.

As a professional organizer, here’s how I thought it should work: I register for everything in advance (which I had). I click the button and provide my reason for seeking an appointment (which I did). And then I’d be connected with a medical professional.

Nope.

Although I registered for Teladoc when it first became available, I still had to try to type/dictate my medical history, all while lying flat on the floor and spinning. And I had to provide the address and phone number of my pharmacy…which was written on my prescription bottles…in the other room. (Crawling was agonizing. Have you ever seen someone try to do the backstroke on plush carpet? It was not pretty.)

After all that, I got a message saying someone would be with me within ten minutes. Then a message saying that {name redacted} was reading my file. Then a message saying, “Oops, sorry, we’ve canceled your video appointment. If you still need help, please try to schedule another Teladoc appointment.” Seriously?!

As I went through the entire process again, I noted the clock on my phone. I’d have sworn only minutes had passed, but almost another hour had gone by.

I’ll spare you readers the sordid medical details, but by the time I finally spoke to a Teladoc physician, I was instructed to call 911. When I asked why, the response was troubling enough that I only asked if someone could just take me to the ER.

I live upstairs. The prospects of having to go downstairs by myself to let first responders in or having them break down my door were equally unpleasant. Instead, I called my local bestie, Jen, to see if her husband could stay with her kids, and she immediately headed over to take me to the emergency room.

Moms know everything! She arrived with all sorts of Mom Emergency Paraphernalia, including an old-fashioned ice pack.

Although the panic was secondary to the rollicking vertigo and related symptoms, Paper Doll offers a full-service blog atmosphere, so may I also share this advice from Valera Health’s Mastering the Art of Panic Attack Prevention: From Panic to Peace (bolded emphasis is mine):

The keywords here are ice and sweets. If you’re able to, grab a cold washcloth, water bottle or ice cube and rub it on your face. Panic attacks can induce hot flashes so cold stimuli may help you to cool down and calm down, which in turn can shorten panic attacks and make them more bearable. Another way to try this type of sensory grounding is to quickly dunk your head or face under cold water (make sure the water isn’t too freezing first!).

Some people prefer to do the “sour candy trick” instead by sucking on a super sour candy when feeling panicked. The tart taste helps with refocusing and shifting attention away from the symptoms of a panic attack. If you’re prone to panic attacks, we recommend carrying sour candy around whenever you’re out and about so you always have them handy, just in case.

MAKING SENSE IN THE AFTERMATH OF AN EMERGENCY

Once the emergency, itself, is over, you’re left mopping up the mess. Dealing with the aftermath of a natural disaster or a medical situation is usually more problematic than coping with your schedule, but eventually, you’re going to have to turn your eyes to the smoking piles of debris that used to be your carefully planned schedule.

You may not be able to do much right away. I collapsed into bed as soon as I got home from the ER. Though the meds they’d given me had me sleepy while there, my brain was spinning almost as much as the room had been. I had SO MUCH planned for the week prior to Thanksgiving. How would I get back on track?

The following are some of the concepts I put into practice. Whether you have a family emergency or just something that keeps you down for the count, these ideas should be useful until you can see a light at the end of the tunnel.

Assess the Damage

Whether you’ve taken to your bed with the flu or a tree has toppled across your driveway (as happened to so many after this hurricane season), you can’t take action right away. But when you do have a sane, cogent moment to breathe, grab your calendar and your To Do list, and either a pad and pen or a blank Word doc or Evernote note.

Don’t be listless! Take a moment to list everything in your schedule that was disrupted (or will be disrupted).

That first morning was a Monday. Normally I would have completed the weekly Paper Doll post on Sunday night and spent the day doing marketing tasks, sharing my post and those of my organizing colleagues. Again, I hadn’t written the post, which I’d intended to submit to the blog carnival, but even if I had, dragging myself to the computer and lifting my head to the screen was a non-starter. But the world wasn’t going to end because my post hadn’t shown up in someone’s mailbox or social media feed.

Later that day, I had an appointment to get my hair cut, and had blocked time to prepare for guesting on Frank Buck’s Get Organized! podcast on Tuesday.

Tuesday’s schedule included the podcast recording, a first-time physical therapy appointment, a two-hour co-writing session, and two webinars I’d planned to attend.

As the week went on, I had client sessions, prospect consultations, and the variety of life activities (bill-paying, shopping, preparing for this week’s Thanksgiving adventures) that everyone has.

In addition, I had to figure out how (when the world was still spinning, though at a slightly less malevolent pace) to get my prescriptions filled and talk to my own physician regarding some things I suspected I’d need beyond what the ER had advised.

When I floated up into consciousness on Monday, at least I knew what was on my plate.

Prioritize Key Activities

In Use the Rule of 3 to Improve Your Productivity (which I invite you to read and embrace with all your heart and soul and calendar), I reviewed all the ways to manage your schedule and To Do list to keep life from getting in the way. But, as with my week last week, sometimes life is a giant elephant and you have no choice but to let it get in the way.

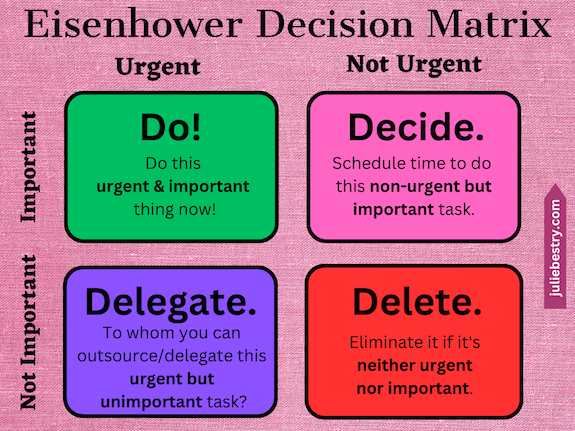

In that post (and further, near the end of Paper Doll Shares Presidential Wisdom on Productivity) I explained that when you’re overwhelmed, a great way to prioritize what you have to get done (and how and when to do it) is the Eisenhower Decision Matrix.

The Eisenhower Matrix gives you the opportunity to graph each task from your brain-dumped list to identify where it falls along a continuum of importance and urgency.

In a typical week of my schedule, what’s important is anything that brings in money, protects from “danger” (whether that’s a late fee or something more problematic), or directly impacts someone else. What’s urgent is anything that is time-specific in the short-term.

Identify What to Do, Decide (and Delay), Delegate, or Delete

Do

As I looked at the tasks, I realized that while my hair cut was not important, it was urgent to cancel so that my stylist would not be inconvenienced by a no-show. The podcast recording on Tuesday would have been both important (to me and to Frank) and urgent. And I had to arrange to get my prescriptions filled, as it turned out that one medication required me to be present at the pharmacy; it couldn’t be filled in absentia.

I sent two texts (to my stylist and to Frank) and arranged to get my prescriptions filled.

Decide

At this point, my wobbly brain decided that I could delay considering anything else until after more sleep. I didn’t know if I’d be able to go to my physical therapy appointment on Tuesday or my client on Wednesday, but I let that be Tuesday Julie’s responsibility. I crawled back in bed.

Delegate

I didn’t really have anything to delegate. I did, however, let my friend and colleague Hazel Thornton know what was going on in case I did not show up to our Tuesday co-writing session or a regularly scheduled Friday night Zoom.

I get it. Delegating is hard. Sometimes, it involves asking for a favor, and most of us are loathe to presume upon others or to seem as though we aren’t operating at 100%.

But delegating — whether it involves asking a friend to take you to the emergency room or trusting your spouse to take care of family responsibilities even if they won’t get done the way you would do them or giving the nod to an employee to handle something you would normally do yourself — is essential.

We can’t do everything. Even if we could, we shouldn’t. Leaning on others — respectfully — strengthens all of our human bonds.

This is my friend Jen, who rescued me. We’re afternoon tea buddies.

Sometime in the mid-1970s, I had a big event happening in third grade. I think I was giving a presentation, or maybe getting an award. Parents were going to be in attendance. But when I woke up that morning, my father told me that Paper Mommy had fallen and cracked her ribs during the night and would not be coming to school. I’m not sure how she managed it in those scant daylight moments before I woke up, but Paper Mommy had already arranged for my sister (eleven years my senior and attending college locally, living in the dorms) to be my plus-one at this event.

If she could have been there, she would have. That’s how Paper Mommy rolls. But she made sure that my eight-year-old self felt loved and valued without schlepping her wounded self to a ridiculous elementary school event. My sister rocked it!

Delete

My plan had originally been to write last week’s post about children’s books on organizing and productivity, and I would have included a link to Paper Doll Interviews Melissa Gratias, Author of Seraphina Does Everything! and talked about both my favorite books in these categories, as well as a few surprises from my childhood bookshelf.

I forgave myself for not writing the post and deleted it from my sense of self-obligation. By the time I left the emergency room, I told myself I could just submit some other post I’d previously written about organizing and productivity books.

For example, I could have submitted Paper Doll Presents 4 Stellar Organizing & Productivity Resources, which referenced Hazel’s What’s a Photo Without the Story? How to Create Your Family Legacy and reviewed her Go With the Flow! The Clutter Flow Chart Workbook.

That post also reviewed Kara Cutruzzula’s Do It Today: An Encouragement Journal, and Ellen Faye‘s Productivity for How You’re Wired: Better Work. Better Life.

I could have submitted Paper Doll Introduces 5 New and Noteworthy Books By Professional Organizers, which reviewed:

- Emotional Labor: Why A Woman’s Work Is Never Done by Dr. Regina F. Lark, Ph.D, CPO® and Judith Kolberg

- Organizing and Big Scary Goals: Working with Discomfort and Doubt to Create Real Life Order by Sara S. Skillen

- Filled Up and Overflowing: What to Do When Life Events, Chronic Disorganization, or Hoarding Go Overboard by Diane Quintana, CPO®, CPO-CD® and Jonda Beattie, M. Ed.

- Mind Body Kitchen: Transform You & Your Kitchen for a Healthier Lifestyle by Stacey Crew

- Perfectly Arranged by Liana George

I could even have have bent the rules and submitted a link to the Book page at Best Results Organizing where I list my favorite organizing and productivity books.

Sigh.

But in the end, I slept through most of the ensuing days and missed the deadline to submit anything at all (likely disappointing nobody but myself). And sometimes, just as we have to tell ourselves that it’s OK to delegate, we have to accept that it’s OK to delete things from our task list.

Although I bowed out of Janet’s The Best Organizing and Productivity Books – Productivity & Organizing Blog Carnival, twelve of my colleagues had great submissions, and I hope you’ll read them. And Sabrina Quairoli wrote a post called Children’s Books About Organizing Their Lives! Although it’s different from what I would have written (or may still eventually write), knowing that topic is out there in the world made it easier to delete this from my list.

Create a Realistic Recovery Plan

Before I was a professional organizer, I was a television program director. Partially because of my Type A personality and partially because the television industry eats people and spits them out, being realistic about what you could get done in a day wasn’t actually realistic.

We were expected to be able to do everything, at any moment. After two days out with the flu, I once almost passed out in the hall and ended up just working on the cold floor where there was nowhere to fall.

That’s wackadoodle.

Nowadays, I teach clients to break down their tasks into manageable steps and schedule them across the upcoming days or weeks to avoid overwhelm.

When your week has been blown to smithereens, you absolutely have to be realistic. Sometimes (OK, often), that means being prepared to change direction more than once. When Tuesday hit, I felt worse (until my doctor called in that additional prescription). I revisited everything on my list, and applied the Eisenhower Decision Matrix again.

I decided to not do anything on Tuesday beyond rescheduling that physical therapy appointment to the end of the week and canceling client sessions. Y’know what? The nice physical therapist was glad I was taking care of myself, and rebooked me without a fee. My sweet Wednesday client was soothingly concerned and called to see if her adult daughter could bring me any groceries when she’d be in my neighborhood.

Everything that I tell my clients — that it’s OK to stop and take care of yourself, and that people will generally understand — was true.

Remember to Communicate

Once you evaluate your priorities and figure out what you have to delay, delegate, or delete, make sure you communicate the essentials to the people who can make your life easier, as long as they know what’s going on. That may be family members, friends, colleagues, or team members.

Set realistic expectations, ask for help where and when you can, and just keep them updated on delays. At some point later, you’ll want to renegotiate deadlines, but until you’re feeling clear-headed and calm, you won’t really know what will fit where on your calendar.

Be Flexible with Replacement Dates

Whatever “whoopsie” of a week you’re trying to recover from, it won’t help to triple-stack the next week. Don’t try to overcompensate and “make up for lost time” — you’ll burn out.

Just as we always discuss when talking about time blocking, set aside blocks of unscheduled time in future weeks to catch up. But don’t fill every block of time. You need buffer time and breathing space.

Reflect On What You Might Do Differently Next Time

We always learn more from our mistakes and kerfuffles than we do from our successes. If your week gets blown up by an unanticipated event, use it as a learning experience.

Block a little time on your schedule for the next week to evaluate how you handled the disruption. Consider what kinds of changes, contingency plans, emergency backup, etc., you might put in place to make next time (and there’s always some kind of “next time”) into a softer landing.

Give Yourself Grace

Julie circa 1999 would have tried to show up for work the next day, and attempting to barrel through every task, even while dizzily wobbling into colleagues and walls and copy machines.

Julie circa 2024 made sure that nobody was left in the dark, didn’t over-apologize, and got about 18 hours of sleep each day for most of a week. And everything turned out fine.

Appreciate Normal Weeks

Reference Files Master Class (Part 3) — Medical Papers

For our final post of Get Organized & Be Productive (GO) Month, we’re continuing our refresh of classic posts and essential concepts in paper organizing. So far, we’ve looked at:

Paper Doll Shares 12 Kinds of Paper To Declutter Now

Reference Files Master Class (Part 1) — The Essentials of Paper Filing

Reference Files Master Class (Part 2) — Financial and Legal Papers

Today, we continue onward with the next element of the reference papers in your personal or family filing system.

- Financial

- Legal

- Medical

- Household

- Personal

MEDICAL FILES

There’s a special name the information you maintain about your medical life: a personal health record (PHR). With the financial and legal documents we covered last week, I strongly recommended using to develop your file management skills; however, you’ll see that with medical information, I recommend a hybrid approach with paper and sometimes a digital one.

Your Role as Personal/Family Medical Historian

You may wonder why you might need to keep medical paperwork of any kind. After all, don’t the doctors all have your files? It’s not like the average person has a collection of all their own dental X-rays and test results laying around. But there are certain reasons you should keep at least some of your medical information, if not your actual records. For example:

- When you go to a new health care provider or visit the hospital, you will be asked for a detailed medical history. Will you really remember the years and types of all of your (or your family members’) illnesses, surgeries, and complications? Which physicians were seen and what their contact information was? Which medications caused allergic reactions? It’s your job to provide that information.

- If you change health insurance companies or apply for life insurance, you’ll have to provide a detailed medical history. If you are found to have given even the teeniest of wrong answers, your policy could be voided retroactively and you could be on the hook for hundreds of thousands of dollars of healthcare!

- First responders may need information in a hurry. This is why you need to keep updated copies of your medication lists (medication names, dosages, prescribing physicians) in multiple places, immediately accessible. (See Organize to Help First Responders: The Vial Of Life for details on this specific issue.)

- Quick access to accurate information may determine a medical course of action. For example, if your college student calls to say they had a minor accident and the student health center wants to know how long ago they had a tetanus booster, don’t you want to give the right answer? (Better yet, arm your adult kids with copies of their records so they’ll know!)

Doctor With Stethascope Photo by Online Marketing impulsq on Unsplash

- If you’re in the ER or at Urgent Care and are asked a question about your medical history, you can’t rely on your primary care physician’s records. The doctor’s staff may be unreachable on weekends and holidays, or in the evenings, or on inclement weather days.

- Your physician or dentist may retire with little notice, giving you no chance to get copies of records. (I’ve had three doctors and a dentist retire in the last 5 years. Yes, I’m starting to take it personally!)

- If you can prove you’ve already been tested for certain things, you may be able to avoid unnecessary (and expensive) medical tests.

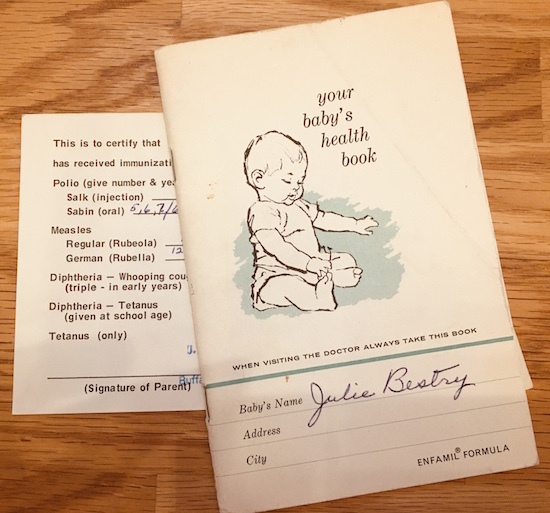

- If you have proof of immunizations, you can make sure you’re protected against all sorts of yuckies without having duplicate ouchies! (Yes, these are the correct medical terms.) Proof also ensures that your children can attend school or go to summer camp. (You do not want to spend the days prior to driving cross-country to your student’s new campus rushing to find a physician who will squeeze your 18-year-old in for shots.)

- Speaking of immunizations, if you ever work or vacation outside North America, you may need proof of health and immunization for travel; you don’t want to have to contact your doctor over and over and be beholden to their convenience and schedules. (For more, check the CDC’s Yellow Book on Traveler’s Health.)

Additionally, you may be responsible for making decisions or overseeing care for someone else. This might be your child or your spouse, where you can rely on your memory. But what if you’re involved in the care of an elderly and/or ailing relative? Wouldn’t you prefer they had this information organized and available to you?

And what if you’re the one who is ill and needing someone to advocate for your medical well-being? While it’s important for your healthcare proxy (the person with your medical Power of Attorney) to have access to the full picture, sometimes it’s just helpful for your loved ones to be able to provide educated input when you are feeling woozy or distressed.

Methods for Organizing Medical Information

To start, create a hanging folder for each person in the household. How many internal folders you’ll need for each person depends on how much information pertains to each individual.

One folder may suffice for younger, healthier individuals with limited records. However, my clients often use three — one for medical information, one for dental information (often including extensive orthodontia plans), and one for vision (to track vision changes and safely keep eyeglass or contact lens prescriptions until needed). If anyone in the family has a specific, ongoing medical condition (diabetes, arthritis, etc.) add extra interior folders as needed so you can track specialized medical information.

There are other auxiliary methods for maintaining medical records:

- 3-ring binders — If you or someone in your family has a complicated medical situation, a chronic illness, or is undergoing cancer treatment or dialysis, and is visiting many doctors and hospitals, often having to supply information repeatedly, a sectioned-three ring binder for mobile use may make it easier for you to take notes or have providers make copies of your information. Consider this an adjunct to your paper file system, with sections for appointment dates, notes, special instructions, and test results.

- Medical Organizer — If you are in college or newly graduated, your filing space in a dorm or small apartment may be limited. To get you started, you may want to use a something like the multi-pocked Smead All-in-One Healthcare and Wellness Organizer.

Paper Doll Explains Your Health Insurance Explanation of Benefits

[Editor’s note: This post originally appeared on October 9, 2023. Some content has been added or modified to provide more robust explanations.]

In more than two decades as a professional organizer, I’ve found that people have disorganized papers because they don’t create and maintain working systems for organizing what they need and letting go of what they don’t. Eight years ago, I talked about how fear plays a huge role in what people decide to keep (or fail to decide, and thus end up keeping).

If I ask someone, “Why do you have this?” whether “this” is a document or a never-worn article of clothing or a piece of broken furniture, the answer often betrays an unspoken fear. Sometimes, that fear may be related to anticipation of an unpleasant emotion — if you give away the itchy sweater (in a color that makes you look like you have the flu) that Aunt Gertrude gave you, will you eventually feel you are betraying late Aunt Gertrude?

Other times, particularly with papers, people hold onto documents long after they’ve served any useful purpose out of fear of what might happen if they need, but don’t have, that paper. This is why I developed Do I Have To Keep This Piece Of Paper?

I can tell you that that the item I see clients keep the most of, and the most often, and the longest after they’ve ceased being necessary, are health insurance Explanation of Benefits documents.

Sometimes, organizing clients ask, “How long do I need to keep these?” but more often, they don’t ask at all. Explanation of Benefits can often seem mysterious or scary. People know they aren’t medical bills, per se, but they don’t know what they are, or what they’re supposed to do with them. Understandably, if you don’t know why you have something, you’re going to be afraid to let it go. But that way, madness lies.

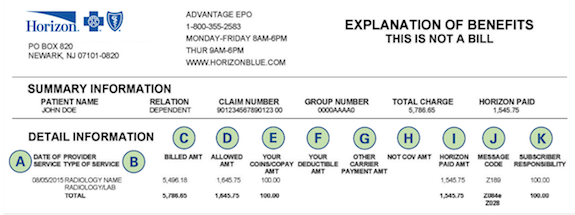

EXPLAINING THE EXPLANATION OF BENEFITS

First, I should clarify that while many insurance companies call these pieces of mystery mail “Explanation of Benefits” (EOBs for short), they go by other names. Depending on your insurance provider and your region of the country, the title of the document may be any of the following:

- Explanation of Payment (EOP) — Used interchangeably with EOB — a document explaining the payment or coverage details for a healthcare claim.

- Explanation of Review (EOR) — This serves the same purpose as an EOB or EOP.

- Benefits Statement or Statement of Benefits — Either term emphasizes the benefits of one’s health insurance policy re: covering (or not covering) a specific healthcare claim.

- Claim Summary or Claim Explanation — Some insurance providers use these terms to describe how a medical claim was processed, including the payment details and any patient responsibilities.

You might also see payment summary, healthcare summary, coverage explanation or remittance advice. Whatever they’re called, the purpose is to inform you about how a medical claim has been processed, including what portion of the claim is covered by insurance and what you (may) owe.

It’s a summary of the whole process from what the provider charged to what each responsible party owes, and it’s supposed to make it easier for you to understand what has happened. The problem? EOBs are often designed to be as clear as mud.

What does an EOB show?

These documents are designed to convey the following:

- Who received treatment or service — This could be you or anyone included on your policy, like a spouse or child.

- The date of a medical service or procedure — Your child may have had a well-child visit, or perhaps you had the yuckies and needed a full workup and blood tests. If you had an appendectomy, not only will your surgeon’s actions be listed, but so will the services of the anesthesiologist and other specialists in attendance, plus medications, tests, and other details of your hospital stay.

- The name of the physician, lab, clinic, etc. — You may not recognize the name listed if your medical provider sends blood or tissue to a lab for analysis, or an X-ray, CT scan, or MRI requires review.

- Non-covered codes — Not everything done for your health is covered by your insurance policy. In a perfect world, whatever your provider felt was necessary would be covered, but (sigh) that’s not how it works. There may be random letters or numbers indicating why something wasn’t covered due to a wide variety of circumstances, including

- a provider, clinic, or hospital is not in-network for you (meaning, not on a list of pre-approved providers).

- a procedure or treatment not included among the items covered by your policy.

- a procedure or treatment requires pre-approval but you didn’t get it pre-approved — This may not be covered even though, if you had asked for it to be pre-approved, they would have approved it and covered it (that is, paid for it).

- a procedure or treatment is allowed, but only so often in a given time frame — For example, mental health appointments or physical therapy sessions may be limited to (for example) 10 sessions in a calendar year.

Also, while some appointments may be allowed at any time in a given year, others must be scheduled 365+ days apart. So, if you had your eye exam or mammogram 363 days ago, you may be out of luck in terms of your insurance company paying.

The A1C blood test allows physicians to track blood glucose levels over a rolling period of time; most insurance companies require 90+ days in between tests. Sometimes, medical offices are good about making sure your appointments aren’t scheduled closer than 90 days apart so that you can actually get your A1C test done (and covered), but as a patient, it’s in your best interest to know what your policy covers, and how often, so you don’t pay extra.

- The total charged by the physician, clinic, lab, hospital, or pharmacy.

- The network savings — OK, I get it your eyes have glazed over at this point. If you’ve never had much reason to see lots of doctors, go to the hospital, have a baby, or just use much of your medical insurance, this may be one of the mysteries that causes you to toss your EOBs on top of the microwave or stuff them in a drawer. I promise you a sidebar in a minute to answer all of your questions!

- The amount the insurance company paid your provider — This is self-explanatory, or it should be. If there are no codes in the “Non-covered codes” section, then you should be able to eventually match up all of your numbers to see why your insurer paid your provider as it did. We’ll get back to that.

- Your co-pay — Your policy might require you to pay a specific amount for each medical visit or pharmacy purchase. It’s common for there to be one level of charge (say, $20) for your primary care physician and another (perhaps $60) for specialists; similarly, you may have different levels of co-pays for generic, preferred, and non-preferred prescriptions.

- Your co-insurance — Co-insurance is the percentage of your medical healthcare costs you share with your insurance company, usually after meeting your deductible. For example, if you have an 80/20 co-insurance, once you hit your deductible, your insurance company will pay 80% of covered (that is, allowed) costs, and you’ll pay the remaining 20%…until you hit your out-of-pocket maximum.

- Other insurance — Depending on your stage in life, you might only be familiar with having one kind of health insurance at a time. However, if you have (for example) Medicare, you might also have a secondary health insurance policy that covers a percentage of what’s left over after your primary policy (or Medicare) pays.

- “You owe(d) provider” — This is usually the bottom line, and it tells you what, all-told, you should have to pay your doctor, the pharmacy, the clinic, the lab, or whomever. In a perfect world, the bill you get matches that amount, it’s what you expect, and everyone’s happy.

Still with me? Health insurance in the United States can be confusing, though many insurers try to make it more comprehensible.

But how does it all work?

Here’s how you imagine it works. You have a tiny booboo and you have insurance. You go to your doctor and she fixes your booboo. You pay the doctor your co-pay of $20 and you leave. After you walk out the door, someone who works for your doctor does the typey-typey thing on a computer, relaying codes for the procedure you had done, and the insurance company pays the doctor the rest of what the doctor charges, and everyone’s happy. Right?

Well…not necessarily. Things may be more complicated, and you may find yourself lost:

- If the typey-typey person types the wrong code, perhaps for something your insurance doesn’t cover, then you may get an EOB full of “Nuh-uh, we’re not going to pay for this!” codes and then you’ll get a bill from the doctor for hundreds or thousands of dollars you weren’t expecting.

- The typey-typey person may not get around to billing the insurance company, or the insurance company may be pokey and not pay them as fast as they want, and you might get a bill for the whole amount. This is why, when you get a bill you aren’t expecting, you must always:

- Look at the bill to see if it lists the insurance company’s paid portion

- Look at the EOB to see if the insurance company is saying they paid something that the administrative office (the typey-typey folks) haven’t yet processed.

- The numbers don’t add up. Before you get stressed about this, it helps to know how insurance works. Too often, I hear clients say, “I hit my deductible already this year, so I don’t know why the doctor is sending me a bill” or “The amount the insurance company paid the provider plus the amount I paid doesn’t add up to what it says the doctor is charging.” Both of these are easy to explain, but because they don’t teach any of this in school, most people don’t learn it until or unless they experience serious medical situations.

“Why am I still getting billed if I’ve already hit my deductible?”

The deductible issue often confuses people. First, you pay a monthly premium (think of it like a subscription) to have insurance. Only instead of getting to watch the newest juicy goodness on Netflix, your premium gives you some benefits.

Along with the premium, you get may get certain things for which you don’t have to pay extra, like a flu shot or an annual exam. But for lots of other things, like doctors’ appointments and procedures, you will likely have a copay or co-insurance, as we discussed above. All of these charges add up until you hit your deductible.

Your deductible is the amount you must pay out of pocket for covered healthcare services before your insurance plan starts to pay. Once you’ve met your deductible, then your insurance plan will usually cover a percentage of the remaining costs as defined by your plan.

Then, if you keep racking up medical expenses, there’s a point at which you may hit your out-of-pocket maximum. As you may have guessed, that’s the maximum you’ll have to pay out of your own pocket, after which (not counting your monthly premiums), the insurance company pays for everything…until you hit the end of the year. And then on January 1st, everything re-sets to zero.

Happy New Year by Sincerely Media on Unsplash

Let’s say your deductible is $1000 and your out-of-pocket maximum is $5000. That means that until you hit your deductible (and paid $1000) you will pay providers whatever your insurance policy says you must pay up to that amount. That includes co-pays and co-insurance for doctors, pharmacies, and everyone else.

Once you’ve paid $1000 (either in one lump sum or in a bunch smaller payments), your insurance kicks in, and from the next dollar of medical expenses (so, $1001) up to $5000 (your out-of-pocket maximum), your insurance company will pay a percentage (often 80%) and you’ll only be responsible for the remaining (often 20%) until you reach your out-of-pocket maximum.

But why don’t the numbers add up?

Remember those “network savings?” Insurance companies and the providers in their networks have a deal. Their contractual agreements say that if their policyholders are serviced by these doctors (or hospitals or pharmacies), there’s a limit on how much they can charge.

Let’s look at it in action.

If you have no insurance: Your doctor fixes your booboo and charges you $1000. You pay your doctor $1000. No coupons, no discounts. No paperwork.

If you have insurance, but haven’t hit your deductible for the year: Your doctor fixes your booboo and charges $1000. The insurance company immediately says, “Hey, Doc, we’ve got a deal. You aren’t allowed to charge our policyholders $1000. You can only charge $400!” The doctor grumbles.

The insurance company pays nothing (because you haven’t hit your deductible) but you get the benefit of a discounted total cost that is much lower than what the doctor wanted to charge. And everything you pay, including this $400, adds up until you hit your deductible.

If you have insurance, have hit your deductible, but haven’t hit your out-of-pocket maximum: Now, the insurance company pays a big chunk (like 80%) of covered costs and you pay the rest. Everything you’ve paid toward your deductible, plus everything you pay now, piles up as you head toward your out-of-pocket maximum.

If you have insurance, have hit your deductible, and have hit your out-of-pocket maximum: This is that weird circumstance where you’ve had so many medical expenses in a year (boo!) that you finally end up not having to pay for anything (yay!).

So, fixed booboos and tonsils removed and whatnot later, all of your out-of-pocket expenses reach your maximum, $5000. As of the next dollar of medical expenses, $5001, insurance pays for everything, and you shouldn’t even have to peek at the paperwork beyond eyeballing those great “You owe provider $0.00” lines.

WHY DO YOU NEED AN EOB?

So, now that you know what an EOB says and why the numbers are sometimes wacky, you may be wondering why you need them, and perhaps more importantly, how long you have to keep them. This is why, when my clients ask me, “Do I have to keep these EOBs?” or “How long do I have to keep these EOBs?” the answer is, it depends.

(Sorry, campers. With so much in the world of paper and information organizing, the answer is always some variation on “it depends.”)

As much as you don’t want to do it, as a policyholder, it’s really important to review your EOBs carefully to ensure accuracy so you understand your financial obligations related to healthcare services.

If you pay every bill the doctor sends, without checking it against your EOBs, you might be overpaying by either duplicating what insurance has already paid (or is in the process of paying) or paying more than the discounted rate you’re due because of network savings.

If you pay every medical bill w/o checking it against your EOBs, you might be overpaying by either duplicating what insurance has already paid or paying more than the discounted rate you're due because of network savings. Share on XEOBs exist so that:

- You can understand real healthcare costs. Your EOB breaks down what the doctor charged, what the insurance company actually “lets” them charge, and what (if anything) the insurance company paid on your behalf. When you see all the actual numbers, you may get a sense of whether you’re overpaying for health insurance (vs. the coverage you’re getting for your needs), and you’ll definitely have a better sense of how U.S. healthcare finances work. (Sorry. You’ll probably want a cookie or a nap to cheer you up after that.)

There’s transparency so the process doesn’t seem so opaque. Yes, unless you take delight in checking the math, just seeing the billed charges, allowed amounts, network savings/contractual adjustments, and your responsibility (including deductibles, copayments, and/or coinsurance) gives you the opportunity (whether or not you take it) to get a handle on what the real costs of your health issues are.

- You can verify how a claim was processed — I’m sure most administrative offices for medical practitioners and hospitals are stellar professionals. But people make mistakes, and computers make it easy to make mistakes, and those mistakes can have real consequences for you as a healthcare consumer. If you get a bill that doesn’t match your EOBs, it gives you the opportunity to call attention to the discrepancy. EOBs help you verify that your insurance claims were processed correctly and that your insurance benefits (for which you pay!) get applied accurately.

Gavel: Creative Commons/U.S. Air Force photo by Airman 1st Class Aspen Reid/af.milvv

Gavel: Creative Commons/U.S. Air Force photo by Airman 1st Class Aspen Reid/af.milvv

- You have documentation to help with disputes and appeals — Again, the EOB lays out the process by which a claim was handled. When you see in black-and-white that a procedure or treatment wasn’t covered due to a “non-covered code” that you don’t think is applicable, you can chase down the error to dispute it or work with your medical provider to appeal.

- You get documentation for your medical and financial records. — You don’t need to keep your EOBs for tax purposes, per se. The IRS doesn’t consider your EOBs as proof of your medical costs; that’s because EOBs don’t say what you paid, but what the insurance company paid. Yes, an EOB indicates what the insurance company believes you owed the doctor, pharmacy, or hospital, but is not proof that you actually paid for those expenses.

EOBs document what healthcare services you received and the associated costs. As such, they can help you track information to accurately prepare your taxes with regard to healthcare-related tax deductions and remember what reimbursement you want to seek from health savings accounts (HSAs) or flexible spending accounts (FSAs).

- You can use EOBs to help you plan your future healthcare expenses. Eyeballing your EOBs will help you estimate the out-of-pocket costs you and your family generally use. This might help you plan how you budget for anticipated medical expenses (especially early in each calendar year, before you’ve hit your deductible).

HOW LONG SHOULD YOU KEEP YOUR EOBs?

I find that almost everyone saves their EOBs much longer than necessary.

For Typical Individuals and Families

If your medical history is uncomplicated (and your insurance company allows you to access your EOBs online in your health insurance portal), especially if the EOBs are accessible for at least one year, you may want to request that they cease sending you paper copies.

If, in a typical year, you get one EOB after your annual checkup and another after you get a mammogram, and that’s about it, just check your EOBs online. If you like to keep your own records, download the digital version as a PDF you can keep in your own digital records on your computer or in the cloud. As always, keep your digital records backed up!

For most people, I recommend keeping your EOBs for about one year, or at least until you do your taxes for the prior calendar year. This way, you can track your healthcare expenses, compare them with any medical bills you receive, and ensure that insurance claims have been processed correctly.

Most of my clients will actually compare and contrast numbers when paper documents are set side-by-side; highlight, circle, or otherwise note important figures. Start the year with one folder, like “EOBs 2024.” If you tend to have a lot of medical bills (perhaps if you’re dealing with an ongoing health concern for which you have lots of medical appointments), make a folder for each calendar quarter.

For Complex or Special Situations

If you get involved in a dispute or lawsuit with either a medical provider or your insurance company, keep all of the relevant bills, EOBs, correspondence, and contemporaneous notes you take during phone calls or meetings until the dispute is resolved or the lawsuit is settled or adjudicated.

If you have difficulty wrangling these EOBs and bills, work with a professional organizer (like me!) who can make sense of paperwork. Find one near you (or who works virtually) at the National Association of Productivity and Organizing Professionals.

And if you have trouble resolving a claim, enlist the help of an independent Claims Assistance Professional (CAP) through the The Alliance of Claims Assistance Professionals.

When An EOB Is Not Really What You Need

EOBs are designed to track financial information about your medical experiences.

So, yes if you’ve got complicated or chronic long-term conditions, EOBs may help you track the history of your illness, the dates of important procedures, and the physicians you have seen.

However, I encourage clients to either scan older EOBs or use them to develop a log of the timeline and essential information in a spreadsheet before discarding the actual paperwork. Reduce the paperwork and streamline the data!

For more information on maintaining your health records, read Reference Files Master Class (Part 3) — Medical Papers.

No matter what, be sure to protect your (and your family’s) privacy and your personal information. Shred EOBs to prevent identity theft or unauthorized access to your health information.

As we reach the last quarter of the year, it’s helpful to review EOBs to get a sense of your medical benefit usage so you can plan whether it makes sense to have a procedure this year (if you’ve already hit, or are close to hitting, your out-of-pocket) of see if you’ve been over- or under-insured this year in order to plan next year’s coverage.

Stay organized, stay safe, and be healthy!

How to Organize Support for Patients and Families in Need

The following anecdote from inspirational teacher, speaker, and author John Perricone has been making the rounds on the web:

Several years ago, I invited a Buddhist monk to speak to my senior elective class, and quite interestingly, as he entered the room, he didn’t say a word. (That caught everyone’s attention). He just walked to the board and wrote this:

“EVERYONE WANTS TO SAVE THE WORLD, BUT NO ONE WANTS TO HELP MOM DO THE DISHES.”

We all laughed. But then he went on to say this to my students: “Statistically, it’s highly unlikely that any of you will ever have the opportunity to run into a burning orphanage and rescue an infant. But, in the smallest gesture of kindness — a warm smile, holding the door for the person behind you, shoveling the driveway of the elderly person next door — you have committed an act of immeasurable profundity, because to each of us, our life is our universe.”

This is my hope for you for the New Year, that by your smallest acts of kindness, you will save another’s world.

Recently, I’ve had small acts of kindness on my mind. Some friends, both near and far, have been going through difficult times, and it has had me thinking about what I can do for them, especially when I’m not close enough to help do the dishes.

Dishwashing Photo by Pavel Danilyuk

Most of the time, our goal in getting organized it to make our lives easier and prevent unfortunate things from happening. However, sometimes, through nobody’s fault, bad things happen. People get sick or injured, or family member die, or people just go through dark times, and no matter how organized they were (or we were on their behalf), life gets upended.

When that happens, when a family member or friend is in bad shape and everyone has to pull together to help take care of that individual or their family, organization is the key to making everything a little less chaotic.

In today’s post, we’re going to look at some strategies and resources for helping when someone you know is sick or injured or recovering, and they or their household could use a little support.

ASSESS THE SITUATION

We can’t presume to know what someone else needs, even if we’ve been in the same situation, or even if we’ve helped that same person before.

An organizing client recently told me that she and her husband had needed little assistance after the birth of their first child, but experienced profound difficulties after their second was born prematurely. She was in the hospital for an extended ime, and the baby was in the NICU for months after that.

After the first birth, she needed only a little errand-running and someone to sit with the baby so she could shower or nap. After the second, she and her husband felt exhausted and overwhelmed, and needed support for everything from meals and childcare to housekeeping and someone to check if they’d paid the bills.

Most people will welcome some assistance, while others struggle with the idea of letting well-intentioned others make arrangements. So, talk to them or their caregiver to get a sense of what kind of support they will need, want, and accept. Common categories of assistance might include:

- Grocery shopping — Depending on the individual’s or family’s preference, you may perform a weekly inventory and create a shopping list to share with others helping to cook, or you might help the family set-up and learn how to use online grocery shopping apps and arrange for delivery by someone in the support network.

- Cooking — Whether you’re helping with meal preparation in the home, or cooking at your house and delivering, ensure that everyone’s dietary preferences and restrictions are considered. It does nobody any good to have a freezer full of pasta-based casseroles if someone has a gluten sensitivity. (As much as everyone is environmentally conscious, this is one time when using disposable containers to lessen inconvenience should be considered.)

- Cleaning — When you don’t feel well, messy or dirty surroundings will make everything worse. Imagine the relief of a clean bathroom and a tidy kitchen for someone spending most of their time at home or in medical settings.

- Childcare and transportation to/from school and extracurriculars — This might be a good fit for friends who are parents of the children’s classmates, but don’t forget to invite “aunties” and “uncles,” relatives or not. When things are stressful at home, whether there’s an illness or a new baby, getting a special day out with grownup who isn’t a parent or grandparent can make a child feel valued and like a VIP.

- Errand-running — Having someone who can dependably pick up prescriptions or make store returns ensures that the household can still run (somewhat) smoothly without daily stressors.

- Pet care — Fido and Fluffy may not be able to talk about their feelings, but you know they sense that something is going on. Some people in the support network might limit their efforts to feeding and cleaning up after pets, while others might be up for taking pets on an adventure to the dog park or the groomer.

Toddler Walking Dog by Robert Eklund on Unsplash

- Transportation to medical appointments — Imagine how uplifting it would be have a trusted friend take you to your appointments and feel, even for a little while, like the company you’re keeping with them is just a normal excursion!

- Serving as a scribe during medical appointments — Being ill is stressful, and it’s hard to focus when you’re not feeling physically and/or mentally at your best. Having a trusted, confidential friend available to take notes, and maybe even to ask questions if you see they’re looking confused, could be a huge comfort. (It’s a plus if the person has any medical background, like a retired nurse or PA, but in a pinch, you’d be surprised how much someone picks up watching two decades of Grey’s Anatomy.)

- Acting as entertaining/distracting company during chemo or other treatments, and during convalescence. Again, whatever someone can do to make a moment or an hour feel “normal” might be a blessing.

- Emotional support, both for the person and their caregiver(s) — This is an especially good category for loved ones who live at a distance. Having someone in the Pacific Time Zone who’s awake and able to offer a shoulder when everyone in your time zone is asleep gives patients (and their families) the chance get what they need without feeling burdensome. Encourage people who can’t participate in more formal support schedules or visit in person to be there however they can, even if that’s a card or a texted meme.

Read about others way to help.

How to Help Someone Who is Sick (An impressive list from the Kansas Health System)

How Not to Help a Friend in Need (New York Times)

50 Thoughtful Gift Ideas & Gestures for a Friend in Need (PrettyWellness.com)

Do not just ask, “What can I do?”

This puts the onus on someone whose mental reserves are already taxed to try to conceptualize what they need and try to feel comfortable asking for a favor. Instead, your goal is to to say, “Here are the things we’ve thought of. What are you comfortable letting us do? Is there anything we’ve forgotten that we could add to the list?”

CREATE A SUPPORT NETWORK

Even if you’re the sibling, the in-law, or the best friend, you can’t do it alone. If someone you love is going through any kind of illness, treatment, or recovery, or is otherwise in a difficult position (for example, is in grief or suffering depression), you can’t be the magic wand that solves all the problems. What you can be is a project manager so that, together, you can all maneuver that wand to make a little comforting magic.

Gather your community.

With the permission of your loved one and/or their partner or caregiver, reach out to friends, family members, neighbors, and colleagues to see who is willing and able to help. Use social media, email, texts, or phone calls to inform people what you’re trying to do and why, and ask for their support.

Make clear that you’d much rather someone take on a smaller role and be able to contribute than to take on too much and not be able to provide what’s promised when the time comes.

Don’t presume that everyone is equally skilled and comfortable with all tasks. Provide a list of the tasksto be completed, and ask individuals to state where and when they’re able to help. People who love to cook will find it easy to “make double” when preparing meals, while those with flexible schedules and a love of kids will probably be eager to play taxi from school to ballet or soccer and then home.

Coordinate a schedule.

Once you have a group of people who are ready to help, you’ll want to establish a schedule that ensures the person you’re supporting receives consistent help without overwhelming any one individual.

This may involve setting up rotating shifts for different categories of tasks or assigning specific days to different people. Some in the network will have a great deal of flexibility while others can only help on weekends or evenings. Meet people where they are.

Communicate clearly.

Once everyone is on-board with providing support, select a method to ensure clear and open communication.

Rotary Phone by Sam Loyd on Unsplash

Different people (and definitely different generations) have decidedly varying communications preferences. Boomers and retirees might not mind phone calls, while GenZ and Millennials (and folks with jobs that require a lot of intense focus) are more likely to prefer texting or emails, so they can reply at their convenience. Create a master list with everyone’s name, phone number, email number, and preferred contact method, and if everyone is amenable, share it as a spreadsheet in Google Drive or a note in Evernote.

Sometimes, you’ll want to communicate with the entire group rather than individuals, and email might work best. There are also online platforms (as we’ll discuss below) to help develop support calendars, allowing individuals to sign up for the tasks and times that work best for them.

Communicate with the person/family, too. If people are going to be showing up to drop off food, make sure they know the schedule, and get the OK for how things get delivered or accomplished. They may prefer that nobody come to the house before 10 a.m., or that meal deliveries come to the side/back door (which may be easier for a recovering person to access), or that they get a text ten minutes in advance of anyone showing up.

Remember the importance of privacy and confidentiality.

I can tell you from first-hand experience that being a patient, whether for an acute condition or a chronic one, means having to give up far too much privacy and dignity. Remind and encourage everyone involved to respect the individual’s confidentiality. Someone may feel great about having delivered three days of meals to the family and want to share that warm fuzzy on social media, but nobody’s humblebrag should come at the expense of another person’s privacy.

Of course, it should go without saying that only the individual you’re supporting (or, if applicable, the family) should be sharing medical updates (unless a proxy is asked to do so).

Consider crowdsourcing professional support.

Depending on the individual’s needs, the support community may want to provide funds to help accomplish professional work when the individual in crisis is unable to perform their usual tasks. Help might include a professional organizer for household functionality, a daily money manager to keep up with finances, or an academic tutor for the children.

Your network might want to gift the individual in-home massages or salon services (manicures, hair/scalp care, skin care, etc.) to boost their spirits and support their physical well-being.

Embrace flexibility.

As you likely know, health conditions can be unpredictable and do not abide by the calendar. Be prepared to adapt and reconfigure the support schedules as needs change.

USE SUPPORT RESOURCES THAT ALREADY EXIST

There’s no need to reinvent the wheel. Take advantage of resources that can complement the efforts you’re already making.

Meal and Support Scheduling Platforms

Caring Bridge — One of the best-known platforms of its kind, Caring Bridge exists to help provide updates during a health crisis. It’s like a cross between a personalized web site and social media in that family or assigned parties can create posts updating someone’s health status and needs, and others can provide supportive comments. However, Caring Bridge also has a planner that allows volunteers to offer help with all the categories described above.

Caring Bridge is free to use, has no advertising, and is a non-profit.

Meal Train — This calendar platform lets family, friends, neighbors, and colleagues sign up to provide meals for the person/family in need. It takes a lot of the administrative weight off of whomever is project-managing the family’s support, and Meal Train provides a straightforward way to organize and coordinate meal deliveries to ensure that the patient is getting nourishment and that the household isn’t eating takeout pizza for weeks on end.

- Create a free Meal Train page for the person/family whom you’re supporting.

- Enter the dates when meals will be needed.

- Fill in all of the preferences including favorite foods, food allergies/sensitivities, and the ideal drop-off times to avoid disturbing the patient or family.

- Share the Meal Train link with everyone in the support network so they can sign up to provide meals.

Members of the support network might benefit from reading some of Meal Train’s helpful articles, like:

11 Trips: Meal Train Etiquette for the Savvy Participant

6 Tips for Delivering your Meal

When Dropping Off a Meal, Should I Stay or Should I Go?

Although Meal Train is free, there’s a Pro level for $15/month for groups that might need to oversee multiple support pages. For example, if your house of worship or community group makes a point of supporting families in need, Meal Train Pro is an option.

Lotsa Helping Hands — is similar to Caring Bridge and Meal Train in that it supports the creation of a caregiving community. You can organize and coordinate all of the cooking, cleaning, errand-running and other tasks described earlier in this post, and individuals can sign up to provide support based on the person’s/family’s specific needs and each individual’s capacity.

The platform includes a care calendar for volunteers to sign up for tasks, an announcement page for updating everyone on progress or setbacks, a “well wishes” pages for sending messages to the patient and family, and a photo gallery for sharing supportive pictures.

Specialized Platforms

Not everyone makes an ideal volunteer for providing meals. But just because you (by which I mean I) can’t cook doesn’t mean you can’t provide a meal. Sure, you can use a service like Door Dash or GrubHub to dial up a person’s favorite restaurant meal and have it delivered, but sometimes you want a person to have a real home-cooked meal, even if you know they’re better off not having it cooked in your home.

To that end, I was delighted to discover Lasagna Love.

Lasagna Love provides delicious lasagnas for those in need. It might be for a patient, a family who has had a new baby, or even for someone you know who is just going through a really rough patch. Lasagna Love is a bit of a community, itself. You can:

- Request a lasagna for yourself or someone in need — Search by zip code to see if Lasagna Love is operational near you. You’ll get matched to a local lasagna chef to coordinate a date and time, and then you’ll get a safe and contactless delivery of lasagna!

- Volunteer to make lasagnas for people who have requested them.

- Donate to the cause!

- Sponsor a lasagna chef through Patreon.

The site describes its efforts this way (emphasis mine):

Lasagna Love is a global nonprofit and grassroots movement that aims to positively impact communities by connecting neighbors with neighbors through homemade meal delivery. We also seek to eliminate stigmas associated with asking for help when it is needed most. Our mission is simple: feed families, spread kindness, and strengthen communities.

Something tells me that the Buddhist monk in John Perricone’s classroom would approve. After all, if you’re making the lasagna for someone who needs it, it’s goes one step beyond helping Mom do the dishes. It’s may be a small act of kindness, but one with huge potential results.

If you think you’d like to become a lasagna chef, learn how to get involved at the website and take a peek at the simple graphic, below.

Make lasagna once or become an ongoing lasagna chef or find a balance somewhere in between. Hear more directly from Rhiannon Menn, the founder:

While Lasagna Love was a brand new concept to me, the next resource is the one I’ve known about the longest, and have been gratified to recommend it to clients and others who have sought referrals.

Cleaning for a Reason — This 501(c)(3) nonprofit organization provides free home cleaning to patients battling cancer.

Cleaning for a Reason connects its trusted network of 1200 residential cleaning companies, cleaning industry volunteers, and community volunteers with cancer patients and their families to provide a clean, healthy environment.

Patients or their loved ones can apply for two free home-cleaning sessions and use this page to find a service provider. Cleaning for a Reason serves all individuals and families with any type of cancer, and patients are eligible if they’re recovering from cancer surgery, in cancer treatment, or in hospice care.

Cleaning for a Reason allows applications to be submitted by family, friends, and colleagues, as well as caregivers, doctors, and nurse navigators, but asks that you first verify that the patient is willing to accept the services.

Hear more from the founder, Debbie Sardone:

You can read about the program at the Cleaning for a Reason site and on the Facebook page.

If someone you care about is ill or going through a difficult time, anything you do to let them know they are loved and valued will help. However, if you’re able to project-manage or volunteer by providing organized and consistent support, it will make a significant difference in their well-being during challenging times.

Whether you do the dishes, make a lasagna, organize the troops, or come armed with two boxes of tissues, it’s worth repeating: “By your smallest acts of kindness, you will save another’s world.”

Paper Doll’s 10-Minute Tasks to Make Difficult Moments Easier

Lately, I’ve been considering that it’s a bit ironic that February, the shortest month of the year, is National Time Management Month. We collectively assign the month with the fewest days to figure out how to achieve goals that would solve so many frustrations.

Wouldn’t a 31-day month be better for that?

A Necessary Caveat About “Time Management”

Time management, obviously, is a misnomer. We don’t really manage time, which is fixed. Every person gets the same 60 seconds every minute, the same 60 minutes every hour, the same 24 hours every day, and of course, 525,600 minutes in a year.

(With apologies to all of you who’d rather watch the Broadway version, linked above, than Glee‘s, but YouTube is really cracking down on music videos being played anywhere but their own platform.)

Rather, we must try to manage our attention, our energy, and our labor. Though we have the same amount of time, none of us has the exact same quality of our time, nor the same obligations.

The single, healthy, unencumbered twenty-something with a salaried office job has more (financial, as well as temporal) resources than the mom of two working multiple retail jobs, or the person going to school while taking care of an elderly parent, or the individual struggling to make it through these crazy times with a chronic illness, visible or invisible.

Often, when the media has articles on time-saving tasks, they fail to acknowledge the complexities of life. If you are beyond the juggling and are full-on struggling, we professional organizers and productivity consultants see you. And we know that when the you-know-what hits the fan, you’ve got limited energy and time to deal.

So, today’s post has ten-minute tasks (or projects that can be handled as a series of ten-minute tasks) that will make things easier for you and your family when things get “ouchie.”

Check and Update Your Beneficiaries

You don’t even have to do these all at once, though if your paperwork is already organized, it should only take you a couple minutes for each. Though the time investment is small, the ease of mind it will bring (both now, and in the future) is tremendous.

And yes, you can even consider these two separate tasks (the checking and the updating) so you can make two different checkmarks on your task list.

Pull out the file folders or head to your online accounts and check to see who you previously listed as your primary and secondary beneficiaries for any of the following you may have:

- life insurance policies

- annuities

- pension accounts

- Individual Retirement Accounts (IRAs)

- 401(k)s, 403(b)s, and other retirement accounts

- profit-sharing plans

- brokerage/investment accounts

Obviously, a beneficiary is someone who gets a benefit. When we’re looking at financial documents, beneficiaries are the people (or sometimes entities) that the account holder designates as the recipient of any assets in that account when the account holder eventually shuffles off this mortal coil. (I know, nobody likes to use the world “death” or think about it, but that’s why we have life insurance policies, wills, and similar accounts and documents — to make things easier when someone has passed away.)

“The Reading of the Will” — central to any good murder mystery

In most cases, setting a beneficiary (and usually both a primary and secondary beneficiary) is part of the required paperwork. Some states (usually “community property states”) require you to list your spouse (if you have one) as your primary beneficiary for retirement and other accounts.

You may be wondering, if you have a will, why do you need to name beneficiaries? That’s a darned good question.

The main reason is that when a person dies, a will goes through “probate,” a legal process where the court in your jurisdiction supervises all the assets in your estate getting distributed hither and yon. Depending on the situation, it can be murky and complicated, and take a long time, which is pretty miserable if your people need those funds.

However, whenever you have a beneficiary set in your insurance policies and various financial accounts, that money can go straight to your intended recipient as soon as the insurance or financial institution gets proof that you are no longer among us. That usually just amounts to a certified copy of the death certificate and some proper ID.

If you set your beneficiaries for any of these accounts several years ago, you may have picked someone no longer appropriate — parents who are no longer living (or not able to manage their own finances), former spouses or significant others, or even friends who are not part of your active life anymore.

I went through the “check the beneficiaries” process with one client who was shocked to realize that she’d never gone back to revise the beneficiary on a small 401(k) plan she’d never bothered to roll over from a job decades earlier. (Note to readers: don’t do that. Roll over your retirement accounts so you don’t have to hope your former employers have stayed solvent and managed your funds properly.)

Imagine my client’s shock when she realized that her [expletive deleted], [expletive deleted]ing [expletive] of a [expletive deleting] ex-[expletive deleted] husband was still her beneficiary! Be assured it did not take her ten full seconds, let alone minutes, to get cracking on changing that beneficiary!

Imagine my client's shock when she realized that her *expletive deleted*, *expletive deleted*ing *expletive* of a *expletive deleted*ing ex-*expletive deleted* husband was still her beneficiary! Share on XIf you never set your beneficiaries before or your want or need to change them, you’ll need a few pieces of information, like their Social Security numbers, birth dates, and contact information (like phone numbers, email addresses, and mailing addresses).

EXTRA CREDIT: Here’s a time-saver so you don’t have to go through this entire process in the future:

- Create a spreadsheet (or even a handwritten note) with the first column listing all of your account names.

- Create a column and list all of the beneficiaries as they stand now.

- Create a column entitled “as of” and list today’s date.

- Any time you acquire a new policy, add a line to this list. Any time you revise a beneficiary, revise the spreadsheet.

This way, whenever you’re not sure whether you’ve updated your beneficiary, you’ll only have to look in one place.

EXTRA, EXTRA CREDIT: Checking your beneficiaries is easy and quick. Changing/updating them should be easy, but how quickly you can accomplish it depends on whether your insurance or financial institution will let you do this all online. But making this list is definitely easy and quick.

However, to take it a step further, fancy-up this spreadsheet with another ten-minute (or so) task.

Add columns for your account number, and the name, email address, and phone number of your insurance agents and financial brokers associated with each policy or account. Create a column to explain what kind of policy or account it is. And then make sure that someone you trust, like the person who has your Power of Attorney, has a copy or can access it when/if necessary.

Put Your Emergency Contacts On Ice

“Downtown Hospital Ambulance” by sponki25 is licensed under CC BY 2.0

In the early 2000s, first responders in the UK started suggesting that people list their “In Case of Emergency” contacts as “ICE” on their cell phones to make those contacts easy to locate. The idea quickly took hold in North America.

While first responders, themselves, generally don’t have the time (or authorization) to contact someone for you, nurses and hospital staff often do need to obtain important medical information when you are not able to provide it. That’s where your contacts come in.

As cell phones got fancier, the lock screens made accessing ICE contacts more difficult, but now, even if you are not able to respond, medical personnel may be able to use your thumb print access or facial recognition to get your emergency contact info.

But there’s something else you can quickly do to make sure your emergency contacts can, um, get contacted. Add your emergency contacts to your cell phone’s lock screen.

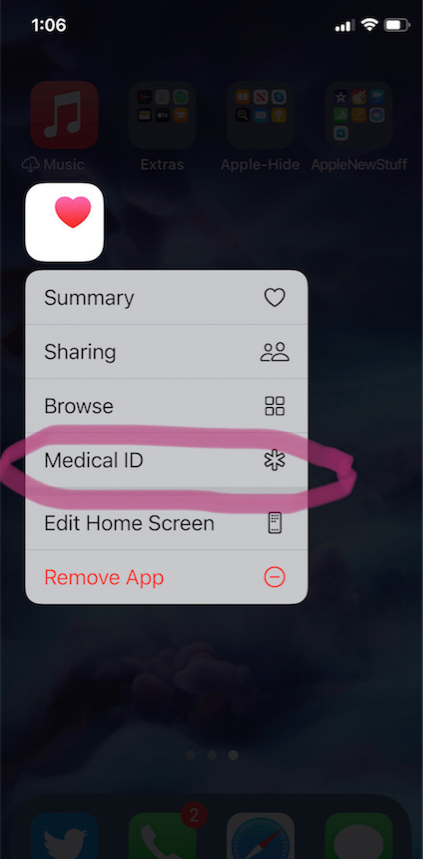

On an iPhone:

1) Go to the Medical ID screen. You can get there one of three ways:

- Long-press on the Health app icon. That will bring up a screen that looks like this:

- You can also manually open the Health App by tapping on it, then on your profile image, and then selecting Medical ID.

- Or go to Settings, then Health, then Medical ID.

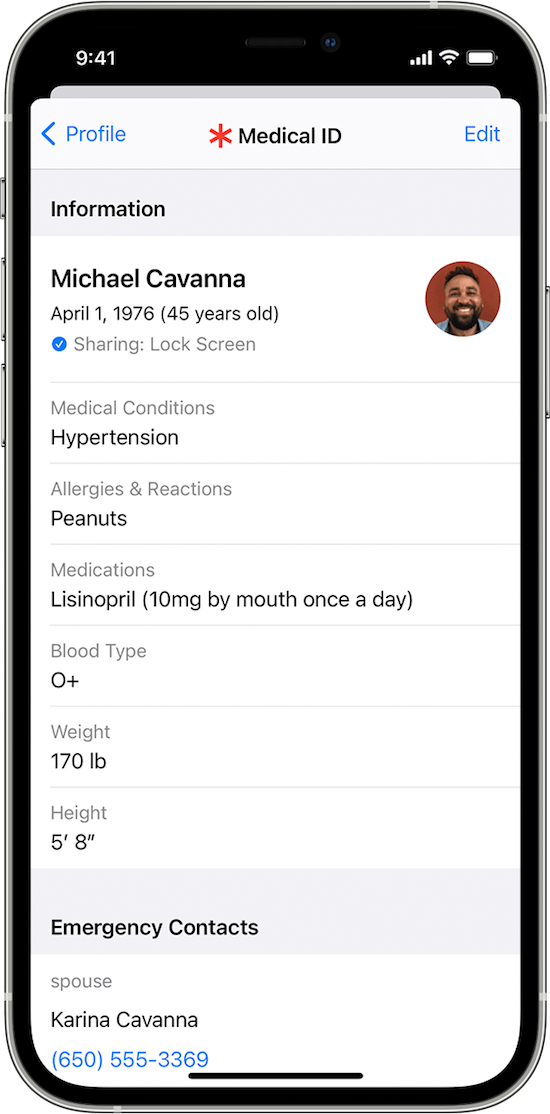

2) Tap Edit.

3) Fill in all the fields that you want, but if there’s nothing significant, it’s better to type “none” than to leave it blank (so that you’re not leaving anything open to interpretation). There are fields for medical conditions, allergies, medications, blood type, weight, height, and emergency contacts. (Bingo!)

At the top, there’s an option to put in your photo. Do that; it ensures that an emergency responder can verify this is your phone.

4) Choose a name and phone number (or two names and numbers) for your Emergency Contact(s). Be sure you select names/numbers that already exist in your contacts list.

5) Scroll down to the section for Emergency Access.

6) Enable “Show When Locked” and “Share During Emergency Call.”

7) Tap “Done” at the top right corner to save your info.

Now, go look at your lock screen. You should see the word “Emergency” in the lower left corner of your iPhone. If your phone is locked and someone taps that, they can see your emergency information but nothing else.

If you don’t see the word “Emergency” there, hold down your power button (or power and volume-down buttons) as if you were going to turn off your phone and you’ll see the Medical ID access. (I guess it all depends on which version of iOS you’re using.)

For more information about the iOS Medical ID, Apple has a detailed page of instructions and explanations.

Assuming you have a photo somewhere on your phone to add in the photo field, this can usually be completed in well under 10 minutes. (The only sticking point is if someone has many medications or allergies they have to list.)

On an Android Phone

Although Android phones do not have one default health-related app, you can easily show your emergency contacts on your lock screen in one of two ways.

Method #1

- Open your Settings app.

- Tap “User & Accounts” and then select “Emergency Information.”

- Tap “Info” and then “Edit information” to enter any medical information you want to store.

- Tap “Add Contact” to add a person from your contacts list. Note, you might have to click on “Contacts” first to be presented with the list

Method #2

Android phones will let owners put any message directly on the lock screen.

- Open your Settings app.

- Tap “Security & Location.”

- Tap “Settings” next to “Screen lock.”

- Tap “Lock screen message.”

- Type your primary emergency contact (and, if applicable, any medical conditions). You could type, “In Emergency, call Lin-Manuel Miranda” and his number. What? Can you think of someone more comforting to have around in an emergency? OK, maybe Stanley Tucci. Or Paper Mommy.

- Tap “Save.”

After you’ve set this up, your ICE information can be found by swiping upward on the lock screen and tapping EMERGENCY and then “Emergency information.”

Do An Inventory of Your Essential Documents

An emergency is the worst time to realize you have no idea where your important documents are. Do you know which of these documents you have and where you can find them?

- Birth Certificate

- Social Security card

- Marriage License and Certificate

- Divorce Degree

- Military Separation Papers

- Death Certificate

- Passport

- Durable Power of Attorney for Finances

- Healthcare Proxy or Durable Power of Attorney for Healthcare

- Living Will or Advanced Medical Directive

- Last Will and Testament

- Digital Will

- Driver’s License

- Voter Registration card

- Vaccination Record

- COVID Vaccinate Card

- Professional license(s)

- Other licenses

As with the beneficiaries section above, a great way to save time is to make a list (think of it as a treasure map) of where each of these documents are located. Use Excel or a Google spreadsheet and take note of what the document is and where it’s located (e.g., your family filing system, fireproof safe, safe deposit box, wallet, etc.).

EXTRA CREDIT: For good measure, for your passport, driver’s license, and any other licenses, take note of the expiration date.

And then for really good measure, put a reminder task in your phone to alert you one month before your any of these items expire to make sure you address renewals. (Give yourself a longer lead-time to renew your passport; also, as you’ve probably not been traveling out of the country in the last two years, you should check to make sure your passport hasn’t already expired.)

If you have a lot of documents, just do a few every day and you’ll be amazed at what a few ten-minute tasks can do to put your mind at ease.

EXTRA, EXTRA CREDIT: The Paper Doll archive has extensive information about what documents you should have and what to do if they’re missing. These posts are a great place to start.

How to Replace and Organize 7 Essential Government Documents

How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Protect and Organize Your COVID Vaccination Card

Paper Doll acknowledges that I write longer-than-typical blog posts. Feel free to consider reading each one to be a 10-minute task. But the knowledge you gain will contribute to your ability to use your time more efficiently. Because, the more you know, the better prepared you are for any eventuality.

Snap Some Photos to Take Key Information With You