Archive for ‘Legal’ Category

A New VIP: A Form You Didn’t Know You Needed

Brown Plush Bear Patient Photo by Kristine Wook on Unsplash

As a professional organizer for 20 years, I am rarely stumped by organizing-related questions, especially those having to do with vital documents or what I call VIPs (very important papers). However, a client recently presented me with an article making a recommendation for a particular document, and it sent me down a rabbit hole of research.

THE USUAL SUSPECTS: VIPS AND HOW TO MAINTAIN THEM

Over the past years, we’ve discussed (at length) the essential documents everyone should have and how to organize and keep them safe. Posts covering these topics have included:

How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Ask Paper Doll: Do I Really Need A Safe Deposit Box?

Paper Doll’s Ultimate Guide to Getting a Document Notarized

Over the years, we’ve looked at documents granted by a government entity, like birth and marriage certificates, divorce decrees and custody documents, citizenship and military separation papers, passports, and Social Security cards.

We’ve also reviewed essential documents you must create for yourself (or with assistance), including home inventories, insurance policies, estate planning documents (like wills and trusts, pre- and post-nuptial agreements), and living wills (also known as advanced medical directives).

And, for ensuring that your loved ones can take care of you (and you can take care of them) in the event of incapacitation, we have always accented the importance of having both a Durable Power of Attorney for finances and Durable Power of Attorney for healthcare (known in some states as a healthcare proxy).

BEHOLD: THE POWER OF ATTORNEY

A Durable Power of Attorney for financial decisions is necessary if you are unable to make financial decisions or take financial actions on your own. This might occur if you are ill and lack the cognitive capacity to make your own decisions (such as if you’re comatose, heavily medicated, or experiencing some sort of dementia), but it might also come in handy in other circumstances.

Imagine that you are taking an around-the-world cruise or hiking in the Himalayas. In such cases, communication may be spotty or impossible. If the stock market were tanking or a financial opportunity of great importance occurred, or if your return were delayed and you needed to make sure your child’s college tuition was paid or some other financial arrangement was secured, knowing that someone with your Power of Attorney for financial concerns was handling everything would certainly put your mind at ease.

A Durable Power of Attorney for healthcare, or a healthcare proxy, is similarly important if you are unable to make your own healthcare decisions, pretty much for the same reasons initially outlined. If you are physically or cognitively incapacitated and need someone to make decisions on your care, it’s essential to have that paperwork in place.

And, as a periodic reminder to all parents who’ve recently sent their kids off to college, without a Power of Attorney for healthcare or healthcare proxy in place, if your away-at-school adult child were ill and had not granted you PoA for healthcare, the college’s health center or local hospital would not be allowed to provide you with any information about your child’s condition or care.

So, Power of Attorney documents are pretty darned important. You want them in place so that your spouse, partner, adult child, or trusted friend or advisor can be kept informed of your situation and can, if necessary, make decisions and take actions on your behalf.

This is the be-all and end-all of advice we paper specialists generally need to give. But guess what? We’ve been missing a pretty important document related to older adults!

BEYOND THE POA: THE DOCUMENT YOU DIDN’T KNOW YOU NEEDED

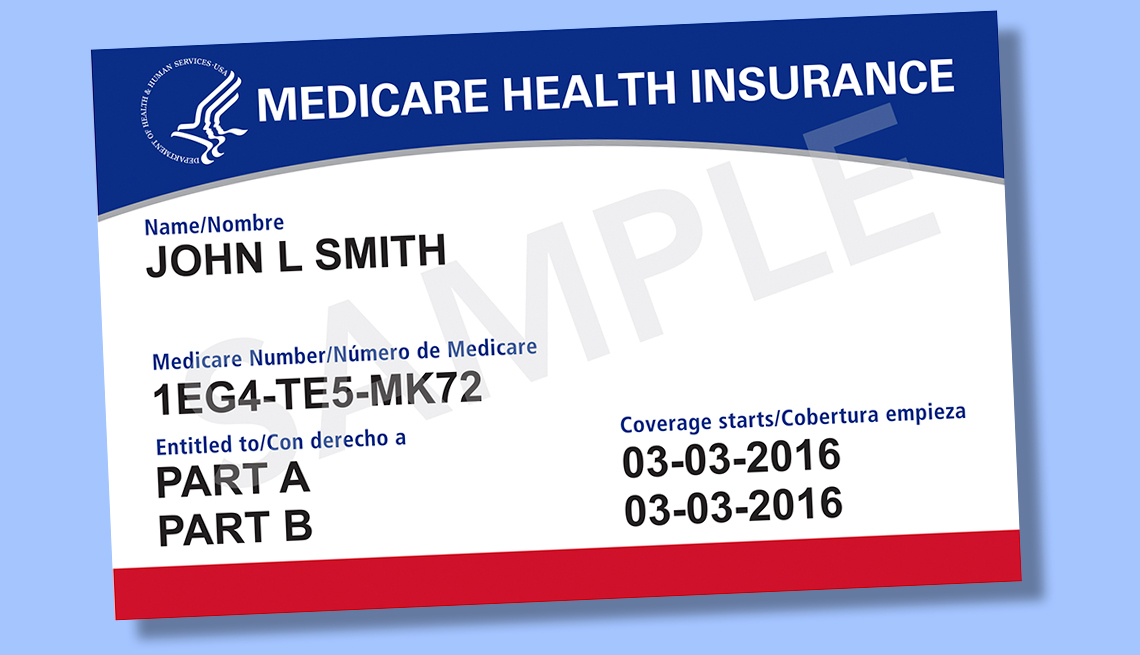

Let’s imagine your spouse is 65 or older. Or perhaps we’re talking about your parent, or another slightly older loved one. (I say slightly older, as now that Paper Doll has reached 55, the age of 65, when you can get Medicare coverage, doesn’t seem that far off.) Or perhaps you’re the one with Medicare.

You’d assume that as long as Powers of Attorney had been executed with regard to financial and medical decisions, then everything would be A-OK. Right?

Mostly. But not entirely.

It turns out that, by law, if you want someone (your spouse or significant other, your adult child, your caregiver, etc.) to speak to Medicare on your behalf, having a both a Durable Power of Attorney for financial issues and one for medical issues is not enough.

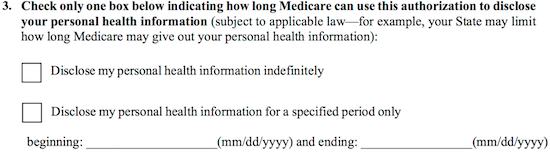

Perhaps because each state has a different variation on PoA forms, or perhaps because the government just likes to be wackadoodle, Medicare requires you grant prior authorization via a surprisingly under-mentioned form called the 1-800-MEDICARE Authorization to Disclose Personal Health Information Form or CMS-10106. (Doesn’t that just roll trippingly off the tongue?)

You must fill out the CMS-10106 well in advance if you want someone to potentially be able to discuss any of the following with Medicare:

- Medicare eligibility

- Medicare claims

- Plan enrollment (including part D or other drug plans)

- Payment of premiums

- Other information, including payments to beneficiaries

So, if you have Medicare, are you thinking “Whoops!” and wondering what happens if you have secured your financial and healthcare PoAs but haven’t ever filled out this authorization?

It turns out there’s a quirky loophole. If a person HAS done both of their PoA forms but hasn’t actually filled out this authorization form, it’s entirely not a catastrophe. That’s because the person who fills out the form has to be either one of the following:

- the beneficiary (that is, the person on Medicare)

OR

- the personal representative of the person on Medicare (that is, the person who has the Powers of Attorney, or otherwise has been granted authorization over your information).

So, yes, if you’re the person with the Power of Attorney for a Medicare beneficiary, you can authorize yourself to let Medicare talk to you about someone’s health and payment information. And if that seems a little weird to you, well, you’re not the only one.

The problem is that if someone hasn’t ever filled out the CMS-10106 in advance and their personal representative has to do it, it’ll take time to process because you have to MAIL it to Medicare.

That’s right — you can’t submit the authorization form online or even by fax. You have to mail it, like it’s 20th century, to a post office box in Lawrence, Kansas!

Organize for an Accident: Don’t Crash Your Car Insurance Paperwork [UPDATED]

[Editor’s note: This post originally appeared on Paper Doll on 1/23/2020 and has been revised and updated as of 8/8/2022. As many college students are headed off or back to their universities with cars, this is an ideal time to discuss the finer points of auto insurance.]

(Image by Andrea Closier on Pixabay)

What happens when an unstoppable force meets an immovable object?

In January 2020, Paper Doll was sitting at a traffic light, preparing to make a turn, when the car behind me answered that physics question. Luckily, it was more of a THUD or a BAM than a CRUNCH. However, even the most minor of fender benders can be scary and overwhelming. It’s definitely not the time to wish you’d been more organized with your car insurance paperwork.

Even the most minor of fender benders can be scary and overwhelming. It's definitely not the time to wish you'd been more organized with your car insurance paperwork. Share on XToday, we’re going to look at the different kinds of paperwork you need, and how to organize it, to make sure you are protected and confident regarding your car insurance.

APPLYING FOR CAR INSURANCE

Whether you’re new to driving, are changing insurance companies, or are insuring a new car in your household, there are certain documents you’re going to need when you apply. Having everything in order ahead of time will make the process move more smoothly. You will need information about yourself, any other drivers covered on the policy, and the vehicle, such as:

Social Security Number(s) — You will need the SSN of anyone who is to be covered on your policy.

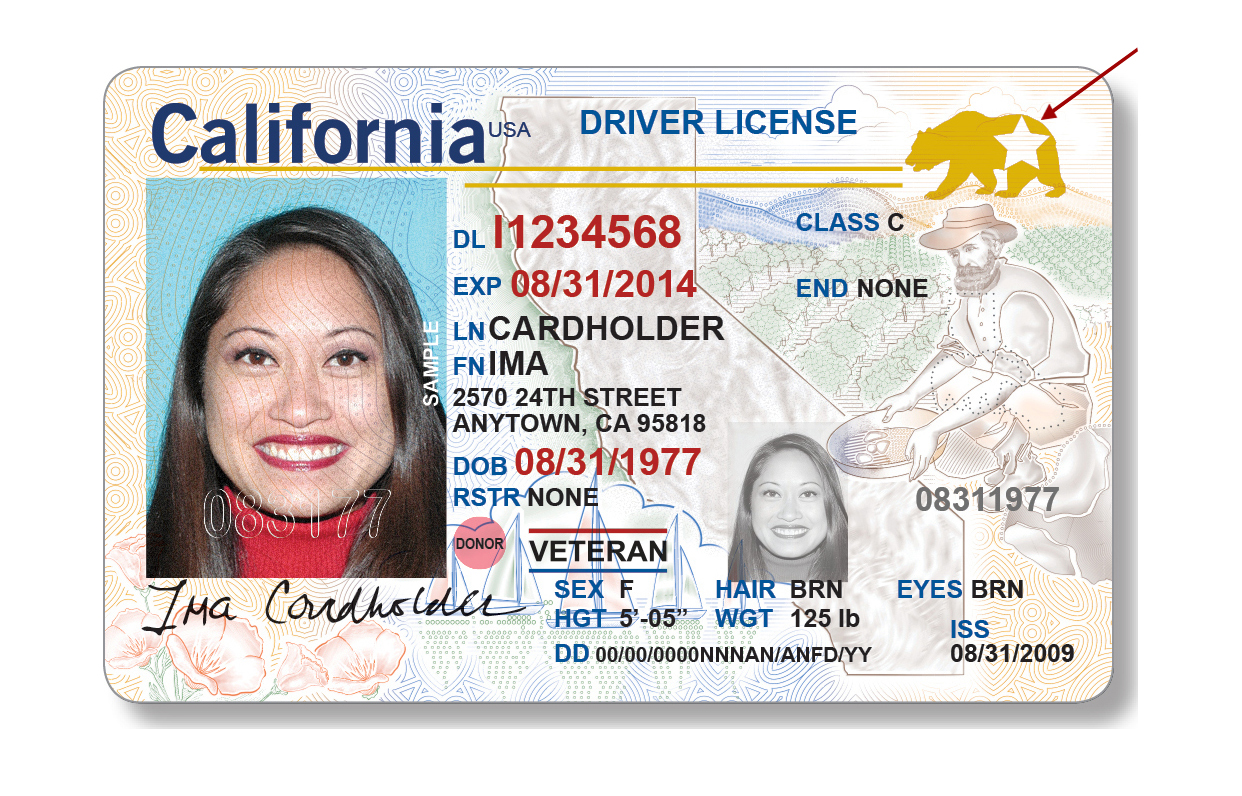

Your Driver’s License — Some insurance companies will only need the license number; more old-school agents may want a photocopy of your license. If, like me, you don’t like letting your license out of your hands, make a few photocopies of your license and you’ll have them when you need them.

Your insurance company isn’t just verifying that you are licensed to drive. They’re going to check your driving record — also called a Motor Vehicle Report (MVR) in some areas — to verify that your license hasn’t expired or been suspended, and to see whether you’ve had any accidents, convictions, or traffic violations. Most states look at your driving record for the last three years; however, there are exceptions. Kansas and New Jersey reports go back five years; Colorado, Indiana, and West Virginia look back seven years.

WalletHub has a state-by-state guide to getting a copy of your MVR, with links, in case you want to check it for accuracy before seeking insurance. In my state, I can get a copy for $5 in person or or online; nationwide, costs range from $2 to $25 (sometimes plus processing fees to use debit/credit cards) per report. Be prepared to use an authentication app, like Google Authenticator, or receive a text or email or verify your identity.

Do not be scammed into using a non-governmental service that promises to get your MVR online for you; they up-charge a significant amount and are usually not any faster than going through your state’s website.

Financial History — Insurance companies do standard credit checks, so it’s a good idea to check your credit history at AnnualCreditReport.com (and not one of the shady copycats), as well as your credit score, to make sure there are no mistakes.

Your Current Insurance Declarations Page – You know that long page (or set of pages) in your policy with big numbers like $300,000/$500,000? (More on that, below.) Having that page will allow your new insurer to provide you with an apples-to-apples quote.

Vehicle Information Number (VIN) — This 17-character identifier is unique to your car and is built into your dashboard or imprinted in your driver’s side door frame. Your insurer uses this to verify that the car is not stolen and doesn’t have any problematic history.

Discount-Related Paperwork — There are a variety of ways to get a discount on car insurance. Your driving record (MVR) will verify if you qualify for a “good driver” discount, and you (or your teenager or college student) may be able to submit a current report card to qualify for a “good student” discount. To get the discount, students usually need to be under 25 and have no at-fault or moving violations on their MVR. A GPA of 3.0 (on a 4.0 scale) or Honor Roll/Dean’s List status is generally required.

You can also get multi-car discounts if you and your spouse both have cars, or multi-policy discounts if you carry homeowners’ or renters’ insurance with the same company.

If you’re over a certain age, you may be able to take a safe driver course, like one offered by AARP, to lower your rates.

You might be eligible for affinity discounts if you are a member of certain clubs, organizations, alumni associations, or sororities/fraternities. There are also often occupational discounts for members of certain professions, including first responders and medical professionals, educators, and government employees, so it’s worth asking your agent what discounts exist before you get too far in the application process.

ORGANIZING YOUR INSURANCE PAPERWORK

Once you have an auto insurance policy in place, you’re going to have paperwork. The more organized you can be, up-front, the less stress you’ll have to deal with in case of an accident or other issue.

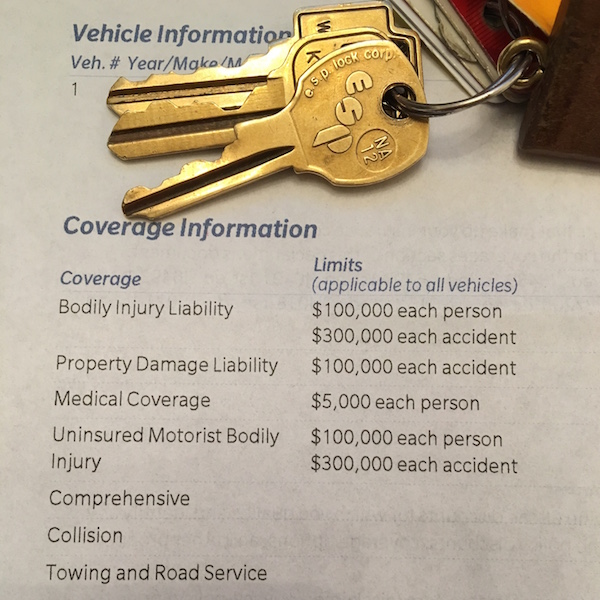

Policy

This is the multi-page legal document that tells you everything about your coverage. It can be overwhelming. Make sure you go over it with your insurance agent so that you know and understand the essential elements of your policy, particularly the items on your declarations page, which spells out your coverage:

- Liability (also called Bodily Injury Liability) — These are the limits on your policy per person per accident. You may see $100,000/$300,000, which means you’re covered for any medical expenses and/or lost wages for anyone (including other drivers, passengers, and even bystanders) injured in an accident you cause, up to that amount.

- Property Damage — This pays to repair or replace things that get damaged (in an accident you cause), like other people’s cars, items in their cars that get damaged, actual property (like someone’s garage or mailbox). The dollar limit is quoted per accident. Be sure you understand the difference between collision and comprehensive. Collision covers damage to your car when it collides with another car, or a tree, or a Bob’s Big Boy. Comprehensive covers damage to your car caused by things like vandalism or theft by hooligans, or “natural” disasters (hail, tornadoes), a tree toppling onto your car, or Bambi taking a running leap at your hood.

Your policy may combine liability and property damage into one category, so you might see it listed with three numbers, like “100/300/50” which means $100,000 for injuries per person, $300,000 for total injuries per accident, $50,000 for damages to property.

Depending on your state, your policy may also have (or even require) special types of insurance options, like:

- Uninsured and underinsured motorist coverage — If someone hits you but doesn’t have enough (or any!) insurance, it will cover injuries if you or your passengers get hurt. Basically, you’re insuring yourself against people who aren’t responsible enough to have (enough) insurance. There’s also a line item for uninsured motorist property damage; as you may have guessed, it covers your car if the person who hits you doesn’t have insurance.

- Personal injury protection insurance (PIP) — If you live in a “no-fault” state, this pays out for medical expenses for minor injuries or lost wages for you or your passengers. (Liability coverage is only invoked if the costs go beyond what PIP covers.)

- Medical payment coverage — Like PIP, this covers you or your passengers’ accident-related injuries, no matter which driver is at fault. It doesn’t cover lost wages, and the limits tend to be $5,000-10,000.

Your policy may also cover things like glass replacement damage, towing and road service, accident forgiveness (to keep your rates from going up after an accident claim) and loss of use (for a car rental while a vehicle is being repaired).

I encourage clients to make a file folder for each insurance policy they own (auto insurance, homeowners, etc.) and keep it in the Legal section of your Family File System.

The declarations page is a good cheat sheet for all of your coverage. You may want to make a photocopy and keep it in your glove compartment, or take a photo/scan to save in Evernote, Dropbox, or a similar app accessible on your phone.

Notes for Canadian Readers

Please note that all of the above refers to purchasing auto insurance in the United States. In Canada, different language is used. For example, in addition to provincial and territorial mandatory coverage, there are optional policies including “collision, specified perils, comprehensive, and all perils.” If you are seeking information regarding auto insurance (and organizing insurance paperwork) in Canada, please confer with an insurance professional (or a member of Professional Organizers in Canada).

Bills for Premiums

Insurance companies usually give you the option of paying annually, twice per year, or monthly. The less often they have to invoice you, the more likely you are to get a discount, so paying every six months can save you a bit over monthly bills.

If you receive paper bills, mark the payment date, amount, method of payment (and confirmation number, if applicable) on the invoice and file it in the Financial section of your Family File System.

If you tend to go paperless, print a PDF or take a screen shot of the confirmation screen and keep it in a “paid invoices” folder on your computer, and be sure to able it clearly, like “2022-May Ins-Car.”

Re-shopping Insurance Policies

In April 2022, I made a few calls to investigate the rates of competitive auto and rental insurance policies. When I found an auto policy that was significantly lower than what I’d been paying (while not increasing my associated renter’s policy) for an equivalent policy with an equally reputable insurance company, I contacted my agent.

I was surprised, delighted, and then admittedly annoyed when my agent “magically” found me an even more competitive rate. (A reminder: companies generally do not go looking for ways to reduce consumer costs!) However, even though I was staying with my same insurance company where I’d been for 24+ years, my policy was technically with a new sub-company, and my “accident forgiveness” guarantee went away, as if I were a new policy holder. However, I was able to retain that status with a $20 one-time fee. Caveat emptor!

So, do consider shopping for better rates/discounts at least every couple of years. It’s not fun, but it’s not as inconvenient as you might imagine. If you like your current insurance agent/company, give them the opportunity to surprise, delight, and slightly annoy you by magically finding better rates.

Proof of Insurance Cards

This little card has your name and address, your car’s VIN, make, and model, your insurance company’s name and contact information, and your policy number. It is the only document that verifies the coverage on each of your cars, so keep your proof of insurance somewhere safe in case you need to present it to a police officer or someone with whom you’ve had a driving “misadventure,” or to have information handy if you need to file a claim or report damage to your insurer.

Most insurance companies provide two proof of insurance cards on one piece of paper with your policy renewal. Consider putting one in your wallet and one in your glove compartment. If your glove box is not always tidy, you may want to consider something that keeps important documents front and center, like this car insurance and registration card holder in a bright color.

Paper Doll’s Ultimate Guide to Getting a Document Notarized

When I was little, I thought a notary public was “Note of Republic.” After all, the concept of [“thing] of [location]” is a known form of expression. Consider Governor of Minnesota, Justice of [the] Peace, or Man of La Mancha. I figured “Note of Republic” meant that it was a document related to our country.

C’mon, it’s weird to hear “public” after a word. We have Certified Public Accountants, not Certified Accountants Public! We’re used to public school, public pool, public park, public relations. What the heck, I wondered when I first saw the expression properly written, was a notary?

Yes, I’m a grownup now, and (mostly) understand what notaries do, but unless you have used a notary’s services or are a notary yourself, you might wonder how it all ensures your legal documents are organized and squared away.

WHAT DOES A NOTARY DO?

Notary Stamp by Stephen Goldberg on Unsplash

According to the State of Tennessee (where Paper Doll resides), a notary public is:

a person of integrity who is appointed to act as an impartial witness to the signing of an important transaction and to perform a notarial act, which validates the transaction. A notary’s primary purpose is to prevent fraud and forgery by requiring the personal presence of the signer and satisfactorily identifying the signer.

Let’s look at how those elements come into play:

- a person of integrity — The rules vary by state, but generally, you have to be at least 18 years old, a citizen of the United States (though in some states, you need only be a permanent resident), either reside in the state or operate a business in that state, and be able to read and write in English.

You also have to submit an application and purchase a notary surety bond, which is like an insurance policy in that it protects the public in case a notary makes a grievous error.

As you might guess, people with felony records would not fall under the “person of integrity” definition and can’t become notaries. However, while we can all imagine various failures of integrity (bullying, gossiping, cheating at Scrabble), those don’t generally prevent someone from becoming a notary.

- act as an impartial witness — notaries can’t notarize their own signatures, transactions in which they are participants, or documents for their family members or friends.

- requiring the personal presence of the signer — until recently, “personal presence” was literal, but as we will see later, a virtual presence is sometimes an option.

- satisfactorily identifying the signer — this involves the signer being able to provide documents that prove identity.

WHAT ARE THE DIFFERENT TYPES OF NOTARIZATION?

If you’ve never had to get something notarized before, you may assume that there’s just one kind of notarization, where the notary says, “Yup, I’m acknowledging that I just saw you sign this thing.” But it’s more complicated than that.

There are main three types of notarizations:

1) Acknowledgements — The notary is saying, “OK, I just saw this person [verified as the lovely Ms. Nell Fenwick] sign this document willingly; there was no mustache-twirling Snidely Whiplash threatening to tie this person to the railroad tracks if they didn’t sign over the rights to their goldmine.” (What, don’t tell me you never watched Dudley Do-Right!)

There are some essential elements here:

- The signer (that’s Nell) has shown up in front of the notary.

- The notary has been able to positivity identify the person is actually Nell (according to the individual state’s regulations).

- The signer has either signed the document before showing up or must sign it in the notary’s presence.

- The signer has to be able to communicate directly to the notary that the signing is willingly done, at least in 49 states. However, in Arizona, the law allows signers to communicate their willingness to the notary through a translator.

(Also, for the purposes of this blog post, Nell and Snidely are in the United States, not Canada where the cartoon takes place. With apologies to my international readers, non-US notary regulations were far too complex to include in today’s post!)

The notary is required to make sure that the individual understands what the document is and what it means and what the consequences are, in addition to being willing to sign and not under any appearance of being coerced.

Obviously, notaries are not mind-readers; they can’t be certain a person isn’t in an emotionally abusive relationship or having their loved one held for ransom, but a notary can refuse to notarize a document if something seems seriously hinky. The notary can ask all sorts of questions, ranging from the kinds of questions first responders ask accident victims to those of a more legal nature. If the signer appears drunk or under the influence of dugs, or to be suffering from dementia or is otherwise seems cognitively, the notary can (and must) decline to notarize the document.

Acknowledgments are used when you’re getting any of a variety of documents signed, like a contract, a Power of Attorney, or a last will and testament.

2) Jurats — This old-timey, legalese expression (also known as “verification upon oath or affirmation” means that the signer is swearing (or affirming) to the notary that the contents of document they are signing are true.

- As a signer, you must show up and sign the document in front of the notary.

- In many (but, to Paper Doll‘s surprise, not all) states, the notary must verify the signer’s identity.

- The notary administer’s a verbal oath (or affirmation) and the signer must respond aloud* in such a away as to confirm mutual understanding. No nods or thumbs-up are allowed.

*I tried to find verification of what is required if the signer is deaf or is not able to speak, and while there don’t seem to be uniform answers, I was able to learn that communication through a translator or sign interpreter is not enough, though the notary and signer are allowed to communicate in sign language, via writing notes on paper, or typing on a computer, tablet, or cell phone, as long as they are in one another’s presence.

In theory, signers are supposed to raise their right hands while making the oath or affirming (just like in a courtroom), but it’s not required by law. (It’s just to make it obvious that this is more serious, legally speaking, than telling your college roommate’s mom that your roommate is in the shower she’s actually sleeping at her boyfriend’s dorm.)

The idea of an oath or affirmation may ring a bell if you’ve watched a lot of courtroom dramas and have heard, “Do you solemnly swear…”

In brief, an oath is a pledge before a religious entity. As some faiths do not allow oaths to be taken in civil settings, and as some people do not adhere to religious precepts, individuals get a choice. For more on the difference, the National Notary Association has made a short video to explain:

A jurat is used when you must notarize testimony. Imagine you are asked to notarize your statement that you witnessed Ms. Lucy Van Pelt promise not to pull the football away from Mr. Charlie Brown but then she pulled the football away, causing him to kick at the air, fall on his back, and complain of seeing stars.

There are different forms or certificates that notaries use for each notarization, whether acknowledgements or jurats. Generally, an acknowledgment certificate will say something like “acknowledged before me” (where “me” is the notary), while the jurat certificates will say something like, “subscribed and sworn to (or affirmed) before me.”

3) Copy certifications — This is when a notary confirms that the copy of a document is an exact match to the original version. Not all states allow this type of notarization.

Notaries can also provide other services. They can administer oaths, like those given to people deposed in legal depositions. (Notaries can’t administer oaths of office for government service or in a military setting, though.) In Maine, South Carolina, and Florida, they can also perform marriage ceremonies!

Pretty much any kind of document can be notarized except for government vital records documents, like birth and death certificates, or marriage certificates. Notaries aren’t allowed to notarize, make, or certify copies of these; instead, you have to go to the appropriate government agency to get certified copies. For more on that, see Paper Doll‘s post from last year, How to Replace and Organize 7 Essential Government Documents.

HOW CAN YOU PREPARE TO GET SOMETHING NOTARIZED?

First, be sure you know exactly what you need to get notarized and fill in all of the blank spaces (except, as applicable, the signature line).

Next, make an appointment with a notary. While you can sometimes show up at a notary’s office, you wouldn’t want random people showing up to your place of work, unannounced, and have to squeeze them in. Be cool, dude.

Verify the fees you’ll be paying and ask how the notary accepts payment. Notary fees differ by state and notarization type, are set by law for most states, so you can check with your state’s Secretary of State’s office for the basic fees; however, notaries can charge separate fees for travel and for remote services.

Notaries at banks may not charge anything for the service, and notary at companies (like the UPS Store) may allow any of the payment methods the company already accepts for other services. But self-employed notaries are allowed to make up their own payment policies, and might require payment by cash or check; don’t assume they’ll take Venmo.

Bring your photo ID. Remember, the notary’s job is, in part, to verify that signers are who they claim to be, and that can’t be done if the signers do not present valid ID. Usually, a government-issued ID with a photo, like a driver’s license or password, is required.

If someone lacks legal identification, the situation isn’t impossible, but it’s fraught. For example, let’s say that Grandpa is in an assisted living facility, hasn’t driven in a decade, and doesn’t have a passport or a government issued photo ID. In many states, the signer can call upon “credible identifying witnesses,” people willing to swear to the notary that they know Grandpa and that he is who he says he is. But Grandpa’s witnesses are going to have those required forms of identification.

Speaking of ID, make sure the name on your ID matches the name you’re using on the documents you need to have notarized. If you’ve recently gotten divorced and have returned to your “maiden” name, or have married and taken your spouse’s name or hyphenated your names, you’ll need to show ID that reflects that change.

Make sure everyone who needs to sign is available for the appointment. (If someone in your family always shows up late, you might want to “accidentally” tell them a slightly earlier time — or drive them yourself!)

Know what the heck you’re going to be signing and what it means. The notary has to make sure that the signer is willing to sign and fully aware of what they’re signing. Paper Doll shouldn’t have to tell you this, but don’t show up at the notary’s office after a boozy brunch. (In the case of Grandpa, above, you might want to warn him that the notary might ask some questions to make sure he’s mentally alert and not signing under duress, so he’s not offended by the questions.)

Be prepared to sign the notary’s log book, which is also known as a public journal. Most states require that notaries keep a log book or journal of all the notary-related acts they perform. It covers all the nitty-gritty details of the transaction, so if a notarized document goes missing, gets stolen or altered, or anything becomes a matter of legal dispute, the record can be set straight. Plus, it keeps everything so nice and organized.

A few years ago, a friend contacted me and asked if I would serve as a witness so that her elderly mother could get some documents signed and notarized. In addition to having to sign my name on the various documents as a witness, I had to sign the notary’s log book/journal, provide my photo ID, write my driver’s license ID number, and provide my thumbprint (which was less messy than I expected, but made me feel like a character on Law & Order).

WHERE CAN YOU FIND A NOTARY?

Photo by Matthias Süßen, CC BY-SA 4.0 , via Wikimedia Commons

You may assume that because any notary can notarize your document that any notary will, but that’s not the case. For example, several years ago I needed to sign a document for Paper Mommy and have my signature witnessed and notarized.

Most banks provide notary services, and I was delighted to see that Bank of America provides fee-free notary services. So, I went to Bank of America, where I had both personal and business accounts, but once they saw that it was a Power of Attorney document, I was told that bank employees were not allowed to notarize it, as a matter of company policy.

In the end, I got my signature notarized at the UPS Store just up the block from the bank. It felt odd to be getting a legal document notarized next to people buying bubble wrap and making Amazon returns, but the process was quick and easy, and the fee was reasonable.

In addition to banks and credit unions, you may be able to find notary services at any of the following:

- Law firms — Sometimes paralegals and legal secretaries are notaries, and the process will be faster than trying to see an attorney-notary.

- Real Estate firms — Call your agent; if you’re a renter, ask your friends if any of them loved their real estate purchase experience and how they got documents notarized.

- Accountants — You may be out of luck if you file your taxes with H&R Block or TurboTax, but if you have a relationship with an accountant (and aren’t pestering her during tax season), you might get lucky.

- Package shipping stores like the UPS Store (hey, it worked for me) and FedEx Office (which they offer through a virtual service, of which there’s more below)

- AAA — Most regional AAA offices provide free notary services as part of membership. However, AAA can’t notarize business contracts, mortgages, or wills; if you’ve got to notarize an auto sale, Power of Attorney documents, trusts, or affidavits, though, you’ll be fine. You can’t always make appointments at AAA, so you may end up sitting in the lobby for a while until it’s your turn.

- Public libraries — Many library systems have notaries on staff; you may have to go to a branch that is not where you usually borrow, so call to verify which branches have notaries available. The notaries at your library may be limited as to which documents they can notarize; mine can notarize sworn statements, Power of Attorney documents, rental agreements, copy certifications, and more, but can’t notarize real estate transactions, wills, divorce papers, employment verification forms, Homeland Security I-9 Forms, or documents in languages other than English.

- Colleges — If a member of your family attends a college or university, call the bursar’s office. They’re likely to have someone on-staff with notary credentials or will know where to go.

You can also find notaries the old-fashioned way, by searching the Yellow Pages, using a search engine (e.g., type “notary services [your town]” into Google), or searching statewide notary databases.

Weirdly, there does not seem to be a database of notary databases (which feels awfully disorganized of them), so you’ll have to search for your state’s database through a search engine or by looking at your state’s Secretary of State website.

You don’t have to go to the notary; notaries will come to you!

Over the last few decades, mobile notaries have become a thing. The same notaries whom you can visit for services may provide mobile notary services for an additional fee. Type “mobile notary near me” into your favorite search engine.

As I mentioned earlier, when a friend needed to have her mother’s documents signed, witnessed and notarized, my experience as a professional organizer (and resource researcher) came in handy, and I was able to recommend a wonderful Chattanooga notary public. While there was an additional fee for him to travel to my friend’s location, it far outweighed the inconvenience (and likely impossibility) of getting her elderly and infirm mother to the notary’s office.

Thus, you’ll want to weigh the cost of us using a mobile notary against the convenience of having someone come to you.

WHAT IF YOU CAN’T GET TO A NOTARY (AND ONE CAN’T GET TO YOU)?

A notary can’t just notarize a person’s signature over the phone or Zoom. I know. Bummer.

That said, as a result of lessened bureaucracy due to the COVID pandemic, there’s Remote Online Notarization, or RON. (No, not Ron Weasley from Harry Potter, though it really does seem pretty magical.)

Remote online notarization companies connect a signer with commissioned notaries public (yes, that’s the official plural of notary public, like attorneys general or culs-de-sac) who are authorized to notarize documents remotely via a webcam.

When I originally started researching this post, 24 states allowed notaries to do RON; 24 had temporary regulations allowing it during COVID, and two had weird limits. Then Connecticut rescinded authorization but ten more states made it permanent. But last week, the House of Representatives passed the Remote Online Notarization Bill, which (assuming it passes the Senate) should make secure online remote notarization much easier to access.

Two of the best known remote online notarization service providers are Notarize and NotaryCam.

First up, Notarize.

Who knew notarization could be so funny?

Download the iOS or Android version of the Notarize app or use your computer’s browser. Then snap a photo of the document and upload it (or upload a PDF, or drag-and-drop the document onto the computer’s browser). Then provide your proof of identity, and connect to the notary via the platform’s webcame. Pricing for individuals starts at only $25.

NotaryCam is similarly priced at $25 (or $79 if you’re outside the US). Your document has to be a PDF, and while you can use a Mac or PC, if you don’t want to fiddle with plugins, use Chrome or Firefox. When mobile, iOS is fine but NotaryCam sounds pretty iffy about using Android.

Both platforms are secure, legal, and operate 24/7/365. For what it’s worth, NotaryCam seems oriented more toward real estate and other professionals than toward consumers; Notarize is a little more intuitive and aimed toward both a Regular Joe consumer audience as well as professional.

Have you ever had adventures in getting something notarized? Please feel free to share in the comments.

Finally, now that you’ve made it through this master class in notarization, you deserve a little fun. If you watch to the end, you’ll find that Inspector Fenwick of the Royal Canadian Mounted Police could have used the services of a notary to figure out who was whom!

Photo by

Photo by

Follow Me