Paperless vs. Less Paper: 6 Ways to Reduce Paper Consumption

If you’ve ever been overwhelmed by the influx of papers in your office, home and life, you’ve probably considered the concept of “going paperless.” But what does going paperless mean?

In many ways, our modern society is already moving towards a paperless protocol. In the old days, you probably used to get a paycheck on periodic Fridays; you still get paid, but most employees get their money via direct deposit. We used to take photos using film and then take them to the corner drugstore (or mail them off) and await an envelope of photo “prints” we could pass around. Now, not only do we not have to wait (because you can tell within seconds whether a photo is worth keeping), but the shots are shared via Facebook, Flickr and any of a variety of digital methods — no prints necessary. But can we get rid of paper altogether?

PAPERLESS ISN’T FOR EVERYONE…OR EVERY SITUATION

As a professional organizer, I hear stories all the time about how the lack of a piece of paper has brought about someone’s financial downfall. For example, if you go to paperless billing and automated payments, your bill doesn’t show up in your mailbox. Sure, you probably get an emailed statement or invoice, but be honest: how often do you let your inbox pile up with unread email when things get crazy?

An envelope that says “Important information about your account” will likely catch your attention more quickly than one of dozens (or hundreds) of daily emails. And if you’re set up for automatically-debited payments and aren’t diligent about checking your online accounts (and especially if you’re not receiving paper bank statements either), it’s easy to miss duplicate charges, fraudulent charges, and account mistakes. One client didn’t read her emails and didn’t realize her credit card account had been compromised; because her replacement credit card didn’t arrive, and because she wasn’t aware of the problem, she didn’t know that all of the bills set to be automatically paid by her credit card failed to be paid at all, as the new card was never activated. Bad news all around.

This doesn’t mean, obviously, that trading paper for digital is a bad idea, per se. It’s just that paperless is probably an unreasonable approach for most people in some circumstances. Instead, I encourage you to find the ways you can use less paper while still maintaining control over your information, finances and life.

6 STEPS TO LESSEN YOUR PAPER CONSUMPTION

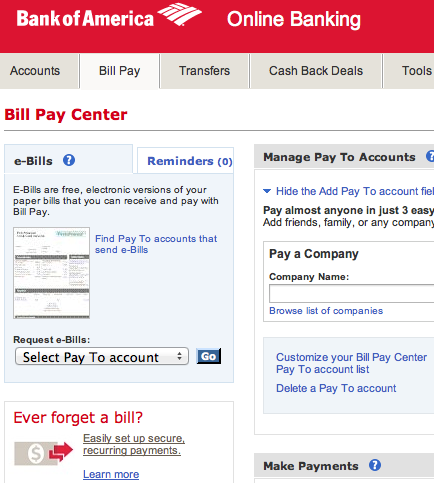

1) Opt for electronic bill-pay — but don’t necessarily agree to paperless billing. If you’re used to paying your bills the old-fashioned way, explore your bank’s online bill-paying services. It’s much faster to pay from one central, secure location at your financial institution’s web site than visiting the site for each credit card, utility and lender.

You’ll only have to actively deal with one password, and you’ll keep a closer tab on your bank balances (especially, if like many people, you’ve meandered away from balancing your checkbook manually). You’ll save money on stamps and envelopes, and you’ll worry less about payments getting lost in the mail.

However, for what it’s worth, Paper Doll is not deeply enamored with the idea of auto-debit for all accounts. It’s a great solution to make sure you don’t ever forget any of your major payments (mortgage, car loan, etc.), but I’ve seen enough allegedly closed client gym memberships rise from the dead with zombie bank debits. Assuming your bank account will generally have enough funds to cover auto-debits at any point in the month, you can arrange for minimum (or higher) credit card payments, insurance bills and any other charges that would cause you (financial) pain if a payment were missed, but I advise against giving every vendor carte blanche to debit your account.

2) Consider paperless billing, but only if you are certain that you have the ability and the willingness to be diligent about checking your accounts online (whether or not auto-debits are in place). A quick glance at an excessive water bill can let you know that you’ve got a plumbing leak, and a high cell phone bill could mean you need to have a talk with your teens about texting overages.

If you tend not to operate anywhere in the vicinity of Inbox: Zero, it’s unreasonable to expect that you’ll pay full attention to e-bills. Paying bills on time can be difficult for a variety of reasons, whether you’re receiving and/or paying them digitally or manually. To gain mastery over timely paying of bills, start with:

- Paper Doll’s Strategies for Paying Bills on Time: Part 1

- Paper Doll’s Strategies for Paying Bills on Time: Part 2

3) Limit the flutter of paper receipts by taking advantage of e-receipts. Digital receipts come in a number of flavors. You may have noticed that Staples and Office Depot now ask you, at the point of purchase, whether you’d like a paper receipt, a digital receipt, or both. If you opt for a digital receipt from a brick-and-mortar store, make sure that when it gets to your inbox, you have a plan for moving it to a sub-folder (for tax-deductible receipts) or trash, as is necessary.

There are lots of apps for making paper receipts a thing of the past. How you manage your receipts is less important than making sure you do manage them so that you neither get buried in digital or paper receipt piles nor lose what you need for tax or proof of ownership purposes. To get a handle on creating a systematic approach to dealing with your receipts, start with my Seven Steps to Conquering Receipt Clutter Flutter. And be sure to review some of the posts where we’ve discussed digital receipt management options:

- Digital Receipt Management Tools (Part 1): OneReceipt, Shoeboxed and a Slice of Lemon

- Digital Receipt Management Tools (Part 2): Itemize, MyThings, MyReceipts, Risiti & PlanetReceipt

4) Digitize what you need — but don’t expect to scan everything.*

Scanning is a great way to reduce your long-term paper collection, if not consumption. Professional organizers have found that upwards of 80% of what gets traditionally filed is never looked at again, particularly if users are not conscientious and systematic about differentiating between what’s essential and what’s tossable before starting the scanning process. Don’t make the same mistake with what you “file” by scanning.

Select a scanning solution that fits your style and needs. An all-in-one printer/scanner/copier or desktop scanning system (like NeatDesk or Fujitsu ScanSnap) works in the office or home; a portable scanner (like Doxie or NeatReceipts) is better if you work from a coffee shop or the carpool lane. Know whether your scanner works equally well with Mac and Windows, has manual or automatic sheet-feeding, and allows for double-sided simultaneous scanning.

Research whether the system assigns automatic (and obscure) names to documents or prompts you to title them on your own, and test the software to make sure the user interface isn’t so awkward that you’ll procrastinate and avoid your scanning tasks.

Echo your paper system’s hierarchy (assuming you have one) and label your digital files with precision. With paper, you use logos, colors, fonts, and familiarity with layouts to help you discern the difference between your bank’s monthly statement and your kids’ report cards. With digital files, you’re generally working with file names only, so be specific.

You may have heard it’s not necessary to organize scanned documents into hierarchical files because optical character recognition (OCR) software and desktop search engines let you search for keywords or phrases within files. While this is generally true, if you’ve had limited success organizing your papers in the past, you may not have the time or inclination to learn how to tag with keywords, use complex search functions or remember exactly matching search terms. Desktop search can be a boon, but relying on it as an organizing tool (or really, a permission-for-not-organizing tool) may not work for you.

Back up your digital file archives to secure off-site hard drives, cloud storage, or both.

Know yourself. If you think scanning is less work than sorting, purging and filing, you’ll be disappointed. Scanning has a plot of plusses, but it’s not painless. There may be less heavy lifting, but there will still be a lot of heavy thinking.

Finally, just because a document is scanned doesn’t mean that the original can be destroyed. Consult your attorney, CPA, or professional organizer regarding which documents must be maintained in original formats, like VIP documents (birth certificates, Social Security cards, etc.).

5) Print less often. Print fewer documents. Retain more information.

So much of what we find online seems like great resources for our aspirational selves, the “we” we want to be, but printing just leads to more paper pileup. Take the time to learn how to keep digital information in digital form by using everything from advanced bookmarking with apps and tools like Pocket to the spiffier options we’ve previously discussed:

- Site-Saving Bookmarklets: Keeping Up With Online Reading While Reducing Paper Clutter (Note: this is a classic post; many of these options now have apps as well.)

- Paper Doll On Paperless vs. Less Paper: Send To Kindle, iPrint & Paperless Post

- Understanding Evernote: What, Why, and How

6) Take notes digitally. It’s beyond the scope of this post to review the numerous options for notetaking on your phone, gadget or computer, whether via tiny app or robust software. From Evernote to Simple Note to SpringPad to OneNote to practically every third app out there, you can find a digital solution for capturing all the information coming towards you each day, organizing it and keeping it safe.

MINDFUL, PAPER-LESS

This is just a quick glance at how you can reduce the paper in your life. In broad strokes, consider the following rules:

- Limit what paper comes into your home or office. Be discerning about what stays and why.

- Know the rules about why to keep documents and for how long.

- Give yourself permission to let go of paper you don’t need (like directions to places you won’t go again or instruction manuals in languages you don’t read) and recycle or shred the excess.

Instead of chasing some mythical paperless perfection, aim to realistically use less paper and master what you keep.

*Note: portions of the section on scanning were excerpted from my new book, 57 Secrets for Organizing Your Small Business.

I am gradually going paperless, but I can’t see taking the time to go back and deal with my old files. By the time I purge what I don’t need any more, it doesn’t leave enough to make it burdensome to keep the rest.

These are some fantastic tips – I just might have to get your new book for my Kobo!