Archive for ‘General’ Category

Paper Doll Starts a Taxing Conversation–The Subject of Brackets

Song lyrics. (“Hold me closer, Tony Danza,” indeed.)

Turns of phrase. (Seriously, it’s “I couldn’t care less.” If you could care less, it would mean you cared some amount at all. And aren’t you trying to point out that you really, really don’t care?)

How things work. (When I was a child and saw PaperMommy adjust her rear-view mirror to keep the bright lights of the cars behind us out of her eyes, I assumed adjusting the mirror somehow reflected the brights back at the drivers, alerting them that they needed to somehow reduce the glare. I still think we need an invention like that.)

While in conversation with some very well-versed, knowledgeable folks, I was recently surprised to learn how many people are confused by brackets.

No, not those brackets. We’re a bit early to be talking about March Madness. Though, if you need one, there’s a downloadable 64-team tournament bracket template here.) Rather, I’m talking about the term “tax bracket”. It seems many folks think that if you’re in the 25% tax bracket, that 25% of what you earn each year goes to taxes. That’s not how it works.

[Note: This is not the venue to argue tax reform, flat taxes or political positions. It’s merely an opportunity to make sure we all understand how we are taxed on the little green pieces of paper we earn. So no crankiness in the comments section, OK?]

Let’s start with the basics. For 2010, for singletons like Paper Doll, it works like this:

If you made any money at all, up through but not exceeding $8,375, then you’re in the 10% tax bracket with regard to FEDERAL taxes. That means, on whatever taxable income you have, Uncle Sam will tax you at 10% of the amount. So yes, in that lowest tax bracket, all of your income is being taxed the same amount as your bracket — 10%.

Of course, even that is quite simplified. Our system isn’t set up for us to pay taxes on everything we make. Thus, the 10% tax bracket isn’t levying a tax on 10% of what you made, per se, but on 10% of your adjusted gross income, which is a fancy way of saying “the total (gross) amount you earned, minus deductions and exemptions”.

So let’s say you made the highest amount ($8,375) in that lowest bracket; then you’d be taxed $837.50. But what if you made more? Here’s where it changes.

If you make between $8,375.01 and $34,000, then you’re in the 15% tax bracket. But wait…that doesn’t mean you’ll be paying 15% on everything you made (or, again, more correctly, on your adjusted gross income).

Let’s say your adjusted gross income is the highest possible in this category, $34,000. 15% of that would be $5,100, but that’s NOT what you’ll pay in taxes. Instead, you’ll pay 10% on the first $8,375 (i.e., $837.50) plus 15% of the amount over $8,375. The difference between the amount up to which you’d pay at the 10% level ($8,375), and the total you made ($34,000), is $25,625.

So, if you made $34,000, you would pay:

10% on the first $8,375 (.10 x $8,375 = $837.50)

+

15% on the next $25,625 (.15 x $25,625 = $3,843.75)

= $837.50

+$3843.75

————–

= $4681.25

Remember how I noted that 15% of the total $34,000 would be $5,100? Well, $4681.25 is $418.75 less than 15% of the total. Sure, it’s not king’s ransom, but if you were going along thinking you were going to be paying 15% on everything, that’s good news.

Thus, your tax bracket refers to the highest percentage at which your last dollar earned will be taxed, and not the level at which all of your (adjusted gross) income will be taxed.

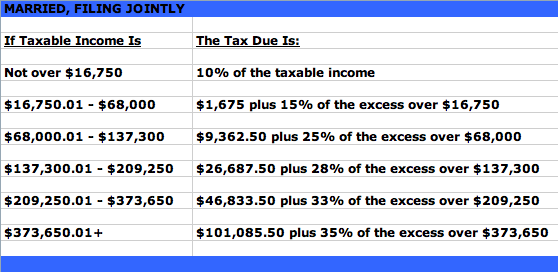

Obviously, deductions and credits and exemptions (oh, my!) play a big role in determining one’s adjusted gross income. Also, to get a general idea of what taxes one might pay on that adjusted gross income, filing status plays a major part. There are separate tax bracket charts for those who fall into each of the following situations:

1) Single — If you were legally separated (or divorced) at the end of the calendar year, you can file as single.

2) Married, filing jointly — This category, not surprisingly, is for married couples pooling all of their income and paying taxes based on their total incomes and combined available deductions. You must have been married on the last day of the year to select this filing status.

3) Married, filing separately — Although this is usually disadvantageous from a financial perspective, it’s sometimes wise or necessary for married couples to file separately. For example, if one spouse suspects the other of tax evasion, he or she can file separately and avoid liability for any taxes, penalties and/or interest that would be due if the other spouse’s evasion were found out. Also, if one spouse owes taxes while the other would get a refund (and the spouses strictly separate their finances), or if a couple is separated, but not yet divorced, filing separately may be necessary.

4) Head of Household — If you are not married but can claim a dependent for at least one half of the tax year, Head of Household status can be advantageous, because the tax rates are lower than with the “Single” category and the standard deduction is higher.

5) Qualifying Widows/Widowers with Dependent Child(ren) — This is the category for anyone who is unmarried, has cared for a dependent for more than half of the tax year and whose spouse died within the past two tax years. It provides the same advantages as “Married, filing jointly”.

The 2010 tax rates (which did not appreciably change from 2009) are further detailed in an IRS PDF.

Of course, all of this refers solely to federal income taxes. State income taxes have their own particular flavors of rules and number of brackets. Some states have no income tax (like Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming), while others (New Hampshire and Tennessee) only levy tax on dividend- and interest-based income and not earned income. Some states allow personal exemptions and/or deductions for federal income tax payments; others have no allowances.

Tax brackets at the state levels range from one flat tax percentage for everyone (in Colorado, Illinois, Indiana, Massachusetts, Michigan, Pennsylvania and Utah) to twelve separate brackets in Hawaii (edging out Missouri’s ten, and Iowa and Ohio’s nine, brackets). Income brackets range from Alabama’s low of $500 up to Maryland’s $1,000,001.

So, it’ll come as no surprise to you that taxes are complicated. In the coming weeks, we’ll look at some ways to avoid scams and get help with preparing your taxes to ensure they are done accurately and so that you do not miss out on any opportunities.

How To Avoid Paper Management Mistakes–Part 3: Libel of Labels

“Don’t rely too much on labels, for too often they are fables.”

~Charles H. Spurgeon

“Once you label me, you negate me.”

~Sren Kierkegaard

“Labels are devices for saving talkative persons the trouble of thinking.”

~John Morley, Viscount of Blackburn

Outside of the organizing field, the view of labels is twofold. We’re warned against labeling, for fear of reducing that which is labeled to something without nuance. You remember the final soliloquy of The Breakfast Club, don’t you?

Conversely, the advertising industry (remember “Libby’s Libby’s Libby’s on the Label, Label, Label“?), would have us believe that without labeling, we’d be lost in a sea of confusion.

As a fan of John Hughes, it pains me to say this, but when it comes to paper management, I must side with Don Draper. Labeling is essential.

Over the last two weeks, we reviewed some of the major mistakes of paper management in Paper Doll Explains How To Avoid Paper Management Mistakes — Part 1 and How To Avoid Paper Management Mistakes–Part 2: Fat Vs. Skinny Jeans:

Mistake #1: You Have No Physical System At All

Mistake #2: You Have No Behavioral System In Place

Mistake #3: You Toss Just About Every Piece of Paper in the Trash

Mistake #4: You Save Everything Until the Paper Crowds You Out

Today, we look at the final set of paper management mistakes that can keep you from having a productive, useful system.

Mistake #5: You Don’t Know How to Label Your Files

In organizing, good function tends to come from good form. In order to organize, you must first purge that which is unnecessary and then take the rest and sort it so that like is grouped with like. We reviewed this with Mistake #1 about having no physical system whatsoever. If you just toss everything together, you have a salad and not a system. Without labels, you don’t know if you have a Side or a Caesar.

Mini-Mistake #5A: You Don’t Label Anything

Nomenclature is important. In your closet, if you mix together all colors and sizes and styles of shirts, it will make it hard to dress in the morning. If, however, all of the long-sleeved dress shirts are grouped together, then all of the short-sleeved dressy casual shirts, and the printed T-shirts, you’ll find it easier to locate what you need. You don’t necessarily need to label parts of your closet with the names of the shirt types.

Individual papers, however, live inside opaque file folders, so the folder can’t show you what’s within. Every manila folder looks alike, with the contents obscured just the same as if you stored each article of clothing in an identical garment bag. Thus, labeling tells you what you have, specifically.

Mini-Mistake #5B: You Have a Labeling System That Is Too Broad

If your categories are too broad, and a file folder is labeled as “financial papers”, you will soon find the folder overflowing and it will be impossible to find the exact paper, for the exact date, that you need. Narrowing the categories down only slightly will yield, not surprisingly, only a slight improvement.

“Bank Statements” or “Brokerage Statements” might be fine categories if you have only one of each type of account and never augment or change. If, however, you have a personal checking account with Wells-Fargo, a business checking account with Bank of America and a savings account with ING, you might save a few seconds when filing a particular bank statement in a catch-all banking file, but you’ll waste precious time if trying to retrieve it.

Mini-Mistake #5C: You Have a Labeling System That Is Too Narrow

Another common mistake I see is that, having neglected to visualize any kind of hierarchy in advance, people will create a file folder and label it such that it reflects the one piece of paper it holds. Thus, I’ll find file folders labeled:

IRA Statement 3rd Quarter 2008

Car Insurance Bill 6/2009

Karen’s Report Card — Spring 3rd Grade

There’s so little in each folder, and each folder is labeled so narrowly as to allow such a tiny subset of all of the papers owned, that the user is wasting folders, space, time, effort and efficiency.

A folder can actually neatly contain a year or more of IRA statements. (If end-of-year statements duplicate the information on the monthly or quarterly statements, shred the interim papers.) Even if one has a penchant for saving old (and not necessarily needed) insurance policy documentation, a folder can probably hold one car’s (or one household’s cars’) policies for multiple years. And, in most cases, all of Karen’s report cards from Kindergarten through graduation can likely fit tidily in one folder.

Sidebar on Specificity

I’m an unapologetic fan of specificity. Unless a client has a particular reason to contravene my usual approach, I’m more likely to make a file with the name of each individual account. For example, I’ll use the actual bank name, account type and maybe even the last four digits of the account number if the client has complex financial holdings. Similarly, I’m far more likely to create file folders that state the company name: Comcast, Verizon, Bank of America, Terminex. However, if you tend to move frequently enough that your label names might change every few years, it’s certainly fine to create general categorical labels: Cable, Phone, Mortgage, Exterminator.

Not every professional organizer agrees with this technique. Many of my colleagues find my method a bit fussy; they’re fans of the Freedom Filer approach, which files away monthly non-deductible bills (like utilities, for example) in a dated folder for the appropriate month, with the expectation that most pieces of paper filed away will not need to be accessed again. This approach also allows for quick and easy destruction for collected months that have aged out of the records retention schedule’s “current” category.

When it comes to filing, there are few absolutes. Experts differ, but I think you’ll find that we’d all agree that you should pick a system that works for you, and stick with it. Commitment to a system, rather than the system itself, is usually the final arbiter of success.

Sidebar on Fat vs. Fit Files

When we talked about Mistake #4 last week, we noted, in general, the importance of purging as necessary. Well, don’t just slim down your system — keep individual files lean, too, and label accordingly.

So, instead of a file for all business expenses, you may choose to have one to correspond with each business expense category on the Schedule C (if you’re a sole proprietor or LLC). If your personal medical history file is so thick that it’s causing the hanging folder to bow and bend, break the file down chronologically (Medical History 1996-1999, 2000-2004, 2005-2009, 2010+) so that no file is thicker than about 1/2″-3/4″, and aim for your hanging folders to have no more than three interior files, each.

Keeping your files neither too fat and all-encompassing to be handy nor so specific as to be inefficiently and useless, will help you find the papers you need whenever you need them.

Sidebar on Uniformity

No matter how much specificity you choose when labeling files, seek uniformity in your naming system. If one folder says ’96 Hyundai Repairs, while another says Maintenance For Mary’s Car, even if the two are placed together in your filing system, the lack of uniformity will make your brain stop, for just the slightest moment, when you’re searching for what you need. Opt for parallel structure in labeling.

Mini-Mistake #5D: You Have Messy, Unreadable Labels

Paper Doll has two types of handwriting: the relatively neat, painstaking cursive I use for Thank You notes, condolence letters, and the rare check, and the scribble I use for grocery lists and phone numbers transcribed from voice mail. A lifetime of using computers has eroded whatever handwriting skills Ms. Minklein, my beloved second and third grade teacher, imparted to me.

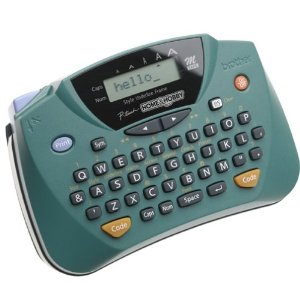

If you have exquisite penmanship, I encourage you to save time and resources and to label your files on your own, with a sharp Sharpie or other pen. However, if your handwriting resembles nothing so much as a two-year-old’s attempts at map-making, I encourage you to invest a small amount of money in a label maker. Brother no longer makes my adored PT-65 but both Brother and Dymo, the leaders in labeling, have excellent hand-held label maker lines.

In the coming months, this space will present a comparative analysis of brands and models and the keys to selecting a label maker, but for most household and small office purposes, any affordable label maker with a QWERTY keyboard should suffice.

Sidebar on Authority:

Although I have yet to find any academic research on the subject, it’s my professional belief and experience that users are more likely to file away their papers when their paper management system bears the “official” imprint of typewritten labels. I suppose those who are iconoclasts might rebel against “the Man”, but I’ve found that neat, uniform, typed labels tend to incline people towards loyally maintaining their filing systems more so than handwritten, scribbled labels.

Mini-Mistake #5E: You Have a Labeling PLACEMENT System That is Too Complicated

Labeling isn’t just about what it says on the label. Some systems rise or fall on the complexity of how and where they are labeled. To that end, I suggest two rules:

Skip 1/5 cut label tabs. You’ve seen those manila file folders with tiny one-inch tabs positioned at left, left of center, center, right of center and right. These tabs are simply too small to create meaningful labels unless you choose the absolute smallest font-size on your label maker or hand-print in teeny, tiny letters, thereby making the labels fit, but less easy to read from a distance. Just say no. Stick with 1/3 cut label tabs.

Don’t fuss over placement. I know people who have strict rules regarding placement of file folders and hanging folders tabs. For example, they’ll require that all major categories run behind one another, such that all financial accounts should be kept in left-tab files and that sub-categories must be center-tabbed and sub-sub-categories right-tabbed. Conversely, others will require that each successive folder in a system, from to back, should change tab position, from left, to center, to right, and over to left again.

There are two major problems with such approaches.

First, in both cases, if you run out of folders of the “correct” type — if, for example, you want to add a new financial folder but are out of left-tab folders, or if you need to add a new type of insurance policy, but the next folder should be a right-tab and you are out of right-tab folders, you’re stuck. Would you rather rush out and buy a new box of folders ASAP, or risk putting off completing your filing system until the next time you might feel inspired?

The second problem only involves the left-center-right (lather, rinse, repeat) label method. If you had a new sub-category to add, but the folders behind that category have already “restarted” the left-center-right pattern, your new folder will be the odd man out. A rigid system just sets you up for failure because it violates Mini-Mistake #4e, the one about leaving no room for the future.

For those of you who just don’t worry that much about file placement, I applaud you.

However, for you readers who are perfectionist procrastinators who can’t get started for fear of eventually encountering a “failure”, I have one secret. Did you know that you could flip folders inside-out? It can be a little more obvious that you’ve done so with colored folders than standard manila, but if you flip a left-tab folder inside-out, you now have a right-tab folder, and vice versa. It’s no miracle, but it helps keep the paper management process moving forward when things get bogged down.

Again, the simpler you can make your system, the better. As Albert Einstein said:

“Everything should be made as simple as possible, but no simpler.”

Most people think Einstein was probably thinking about quantum mechanics or the mysteries of the universe when he said that. But before he was a world-famous physicist, Einstein worked in a patent office. And throughout his career, he was surrounded by paper clutter. Albert Einstein knew about paper management mistakes. Just imagine what magnificent things he might have discovered if he’d just been a little more organized.

How To Avoid Paper Management Mistakes–Part 2: Fat Vs. Skinny Jeans

Last week, in How To Avoid Paper Management Mistakes–Part 1, we noted that while rewards for doing as we ought can inspire many of us to organize our space, time and resources, the rest of us do best when a cautionary tale warns us against dangerous mistakes. We already touched on two such mistakes:

Mistake #1: You Have No Physical System At All

Mistake #2: You Have No Behavioral System In Place

Today, we continue with guidelines for what to avoid in our paper lives:

Mistake #3: You Toss Just About Every Piece of Paper in the Trash

Certainly tossing all of your paper in the trash, without sorting, maintaining or organizing any of it has one advantage — you will never drown in paper clutter. However, discarding all paper that crosses your path has the potential to create a number of problems because much of our paper is, indeed, necessary for functioning in the 21st century.

Legal Distress — Maintaining legal and/or certain types of financial documentation can keep you out of trouble with the IRS or the police, and may protect your interests in cases of civil litigation. Such issues include tax returns and supporting material, insurance policies, records of sale of property, real estate, and cars in order to prove legal ownership, etc. Proving identity and citizenship can also be very difficult in the absence of the proper paperwork.

Financial Disarray — Although many records are available online, not all are accessible after a period of time (sometimes six months, in the case of bank statements). Although you know you paid off your student loans or your mortgage, poor record-keeping on the part of lenders can lead to harassment and even errant foreclosures until or unless you can provide verifiable proof. Indeed, the importance of accessing certain paperwork for legal and financial reasons is the notion behind our periodic Paper Doll series, Lost and Found:

Lost and Found: Social Security Statements

Lost And Found: Tax Returns (and memories of 9th grade science class)

Lost And Found: Savings Bonds (and saving yourself a headache later on)

Lost And Found: A Different Kind of Stock (Certificate) Tip

Lost and Found: GONE in 6 seconds: Your Wallet!

Identity Theft — We’ve had frequent discussions regarding the dangers of identity theft:

Will The Real Paper Doll Please Stand Up? (Organizing to Prevent Identity Theft)

A Boy Named Sue May Hate His Name (but that doesn’t mean you can steal it!)

The Big OUCH!!! (Medical Identity Theft–Part 1)

Doctor, It Hurts When Total Strangers Do This! (Medical Identity Theft, part 2)

and it always bears repeating that proper shredding (instead of just tossing) of paperwork containing personal information is one key to maintaining your good name, as we reviewed in:

Shredding the Documents: Finding Your Shredding Solution

Of course, maintaining a system of paperwork isn’t limited to serious documents. It’s also important to evaluate the relative value of reference paperwork, which includes those items that will help improve quality of life. Examples include family medical records and professional and educational history and records.

Sentimental items should also be considered. While it may seem that Paper Doll spends a good deal of time discouraging you from keeping some types of sentimental papers:

Hallmark Holidays and American Greetings: Cutting Card Clutter

Whistler’s Mommy Invites Grandchild Moses and Raggedy Andy Warhol for a Playdate

careful readers will note that I’ve never argued in favor of a records retention schedule (of which, more later) for sentimental paperwork, and in fact usually push for preservation of the kinds of paper that warm our hearts:

A Valentine to Paper

Zing Went the Strings of My Heart: Organizing Your Love Letters

True emotional attachment, even more so than storage space, should be the primary guiding principle in maintaining papers of sentimental value.

Thus, you can’t just toss out all the paper. Many documents must be saved for legal or financial reasons, and while certain types can be maintained in digital form, the papers themselves ought not to be tossed, but destroyed, to protect against identity theft (and, in the case of imprudent love letters, public scandal).

Mistake #4: You Save Everything Until the Paper Crowds You Out

Are your files overstuffed? With our physical health, a precursor to medical problems like diabetes or high blood pressure is expanded girth. Excessive weight, in and of itself, seems like an aesthetic problem, but it often portends more serious difficulties. Similarly, if you save every document (even if you’ve avoided Mistake #1 of having no physical system), your paper management storage space is likely to be quickly overgrown, and your patience with sticking with a behavioral system (and avoiding Mistake #2) will almost certainly be exhausted.

Thus, saving every piece of paper that comes into your life is hardly better than saving nothing at all. At least if you rid yourself of every piece of paper (even that which you need for legal or financial reasons), you actually know what you’re missing…because you’ve tossed it all. But, if you can’t let your fingers do the walking because there’s not a bit of space to add a piece of paper, let alone get your hands around a hanging file to pull it out and review it, your system is overweight.

Yes, just as we can move from skinny jeans to fat-day jeans, we can increase the size of our paper management storage space. However, just as we know that Chico’s sizing of 0, 1, 2 and 3 in lieu of standard sizing of 2-16 is merely placating our egos, we know darn well that adding another file crate or cabinet is not the solution to all of our paper troubles.

Overstuffed filing systems come from making the following mini-mistakes:

Mini-Mistake #4A: You Never Purge Your System — Let’s go back to the closet example from last week. In your wardrobe, if you never review what clothing you have, never let go of items that no longer fit or are out of fashion, then when your drawers get full, you are likely to start piling new (or just newly washed) clothes on top of your dresser, on the floor, and on end tables until your clothing organizing system collapses.

With your paper, clutter will similarly mount if no time is made to review what you own. Echoing our wardrobe example, give special attention to the things that no longer “fit” or are “out of fashion” in your financial, household and personal sections of your family filing system. While most of your legal and medical documentation will likely be maintained long-term, these other areas should be pruned annually.

–For financial documents, use a solid records retention schedule from your CPA or pick up my ebook, Do I Have To Keep This Piece of Paper?

–For household paperwork, make sure that the manuals you keep represent appliances you still own, and consider moving to digital solutions, such as we discussed here:

Put Manuals on Automatic–Organizing Owner’s Manuals (Part 1-Paper)

Put Manuals on Automatic–Organizing Digital Owner’s Manuals (Part 2)

[Editor’s Note: As of 2018, there are newer posts on this topic, including:

Paper Doll’s Manual Override – Part 1: Declutter and Organize Owner’s Manuals

Paper Doll’s Manual Override – Part 2: Twelve Resources To Find An Owner’s Manual

Paper Doll’s Manual Override – Part 3: Create & Organize A Digital Owner’s Manual Library

–For personal filing, practice will help you hone your own internal records retention schedule. With your personal history, you’ll soon see that keeping 20 copies of a ten-year-old resume is impractical. You might decide to go digital or keep a resume file with one resume reflecting each major career transition, to help you maintain awareness of your successes and growth.

In terms of your personal interest, be ruthless — five-year-old restaurant reviews or ten-year-old travel articles are unlikely to reflect current times, and much of the “informational” paperwork you’ve saved on a variety of subjects can be found in more updated searches on the internet.

Before letting yourself keep a non-legal, non-financial reference item, ask yourself:

What’s the worst that can happen if I let go of this piece of paper?

Where can I find this information if I don’t save the paper?

Ponder what we discussed last week, in terms of scheduling an annual review of your files, and remember to block small segments of time for purging papers so that you don’t burn yourself out. (Leave intensive organizing sessions to the professionals!)

Mini-Mistake #4B: You Save Unnecessary Filler — I tell clients that when they process the mail, outer envelopes and “shiny stuff” (advertising materials) should be the first to go into the trash. Unless you’re saving an outer envelope to indicate a postmark of date-of-receipt for legal purposes, your paper management filing system should be largely free of envelopes, and entirely free of “stuffer” material. Don’t pay with your space to help them advertise to you!

Mini-Mistake #4C: You Don’t Store Papers Flat — Unfold whatever you’re filing. A six-page brokerage statement folded in half takes up twice as much depth in the filing cabinet as it would if it were unfolded, but none of the height or width space is recouped. Plus, every time you need to search for a document, you’ll have to pull out the entire folder and unfold each document until you find what you want.

If you must fold a legal sized document to make it fit your letter-sized system, fold up only the bottom quarter and make a tight crease — the vital data (names, addresses, account numbers, dates) will almost certainly be visible at the top.

Things may disappear on the internet, but that’s why Mr. Peabody and his boy, Sherman, came along with the Wayback Machine.

In one form or another, whatever is on the web is permanent. There’s just too much to print. Trust that without printing, you’ll be able to find what you need. Review what we’ve discussed here:

Site-Saving Bookmarklets: Keeping Up With Online Reading While Reducing Paper Clutter

and if you’re still not ready to go print-free, try an experiment similar to that we use with clients who compulsively shop.

Keep a notebook and each time you are tempted to print out an email or web page to go directly into filing system (i.e., you’re not taking the document with you to a meeting or on a trip), scribble a note in your notebook regarding what you would have printed and where it is (saved on your hard drive, bookmarked in your browser, etc.) If, after a month, you still feel a strong urge to print and file, go ahead, but at least you’ll have given yourself a Time-Out to carefully consider the move.

Mini-Mistake #4E: You Leave No Room For the Future — When overhauling your system, and periodically, during maintenance, aim to keep 20% of your drawer space available for expansion. When you’re down to less than a fist’s worth of space, it’ll be harder to slide hanging files along the rails. If you can’t slide the files behind the file you want away from you, or the files in front of the one you want towards you, giving your file enough wiggle room to let you expand it with the flick of a finger to allow you to drop items at the front or rear, then your system is too tight.

Again, it’s like your closet. If you return from the dry cleaners with a freshly laundered blouse but the hangers are so tightly packed that you can’t slide them to the left or right, you’ll give up on putting away the blouse where it ought to go, and you’ll plop it down anywhere, leading to a dysfunctional mess.

Next week, we’ll finish up paper management mistakes by looking at labeling and how to balance the content in your files so that they are neither too narrow nor too all-encompassing, enabling you to chunk saved papers into reasonably-sized portions — the paper equivalent of skinny jeans.

Paper Doll Explains How To Avoid Paper Management Mistakes — Part 1

Some people learn well from rules regarding what they should do, what they ought to do. These are the always-prepared scouts, the by-the-book officers of the law, and at least a healthy percentage of professional organizers. However, sometimes it’s more instructive, more motivating, more urgent, when we hear what we ought not to do.

Be honest, aren’t you more likely to schedule a doctor’s appointment after reading a cautionary tale of someone who ignored a medical symptom? When you hear of a computer crash (or this week, when you heard that the cure for cancer might be on a stolen laptop that was not backed-up), don’t you back up your files or start Googling Carbonite or Mozy?

We’re simply programmed to pay better attention to what NOT to do. This week and next, we’ll examine some of the biggest mistakes people make with their paper management systems.

Mistake #1: You Have No Physical System At All

Papers are everywhere. OK, maybe not everywhere. Maybe you’ve never found a 1099 in the lettuce crisper or a bank statement propped against a toothbrush holder. But whether your papers are merely limited to all the horizontal surfaces near your desk or are defying the laws of physics throughout your home and office, you’ve got only a rudimentary idea of where anything is, and everyone is dependent upon your memory of where something might last have been seen.

The Solution? Create a system!

Recall our Golden Rule of Organizing: “Don’t put things down. Put them away!” where “away” signifies the home where an item belongs. With paper, that means having a system of categories (and subcategories) to enable grouping like items together. While an occasional piece of paper might have two equally logical homes, guesswork will be eliminated 99% of the time.

When prospective clients contact me for help with paper, the first thing I ask, before I inquire about what’s causing them problems and what’s working well, is, “Do you have a filing system?” It doesn’t matter whether their systems involve a state of the art filing cabinet, a neon pink milk crate or thirty labeled shoeboxes, the very first step is to put some kind of system in place for handling the three types of paper in life:

Reference – This is all of the documentation you’re likely to need to put your hands on. In most cases, paper management solutions for reference work best in file folders or three-ring binders, but we’ve examined myriad solutions. Take some time to travel through the Paper Doll archives to locate solutions for all your reference paper systems. We first covered setting up a Family Filing system:

Family Filing—As easy as (eating) pie

Financial Filing—Scrapbooking snapshots of your money’s life

Mom, why is there a receipt stuffed in the turkey?

I Fought the Law…and the Paperwork Won!

Patient: “Doctor, it hurts when I do this.” Doctor: “Then don’t do that!”

Paper Dolls Live In Paper Households

I Hope Nobody Ever Writes a Nasty Tell-All Called “Paper Doll Dearest”!

Financial and legal paperwork may not always live at home, which is why we’ve talked about how to Safeguard Your Very Important Papers: Safe Deposit Box Basics. We’ve also reviewed, at length, how to deal with your medical paperwork.

Vital Signs: Organizing For A Medical Emergency, Part 1

Vital Signs: Gathering Information During/After A Medical Emergency–Part 2

Vital Signs: Maintaining Your Family’s Medical Records–Part 1 (Paper)

Vital Signs: Maintaining Your Family’s Medical Records–Part 2 (Digital)

Paper Cuts: Don’t Let Hospital Billing Errors Bleed You Dry

While financial, legal, and medical paperwork tend to live in your main filing system, your household papers, regarding the running of the home and the things in it, often need systems developed in other household locales:

A Recipe for Decluttering: Kitchen Paper

Organizing Your Takeout Menus, or How NOT To Order Like Bob Newhart

Boom! Crash! “Honey, where’s the user manual?”

Put Manuals On Automatic: Organizing Owner’s Manuals: Part 1 (Paper) & Part 2 (Digital)

Organizing Your Car Maintenance Records

And, of course, there are systems (physical and behavioral) for handling the most personal paperwork in your life:

Zing Went the Strings of My Heart: Organizing Your Love Letters

Action – You know I’m a big fan of using a tickler file, whether that’s an accordion-style

file or 43 folders (31 daily and 12 monthly) in a desktop file box or drawer. Each action-oriented piece of paper represents a task you need to perform, so unless you’re going to tackle a task today, figure out when’s the earliest or optimum day to handle it, assign the task to that date and tuck the paper away. (Of course, the behavioral side of your system requires that you’ll check your tickler!)

Archive – The whole history of your life need not be at your fingertips. If you no longer need a piece of paper for action or immediate-access reference purposes but aren’t ready to let it go, at least get it out of your Prime Real Estate. Box it up in a Bankers Box and tuck it in storage or go digital, scan the material and recycle or shred the paper.

Mistake #2: You Have No Behavioral System In Place

You’ve got filing cabinets, hanging files…even a label maker. You might once have had a working system. But it’s been weeks (months? years?) since you’ve put things away in any designated spot.

The Solution? Build maintenance rituals into your schedule!

There are no filing fairies. No folder elves. No matter how nifty it would be, files and folders and ticklers do not perform a “Beauty & the Beast” musical number while you’re sleeping. It’s all up to you.

Think of your physical filing system like the kitchen. You have a sink, dishwasher, pots and pans, and kitchen cabinets, all physical accoutrements ready to handle your food preparation, dining, and cleaning system. But the hardware isn’t enough.

Imagine that you start your day in a hurry, rush to get out the door and fill the kitchen sink with sticky, syrupy breakfast dishes and glasses thick with the remnants of pulpy orange juice. Perhaps you manage to make it home for lunch, between appointments, and have just enough time to move your lunch dishes from the kitchen table to the sink. And then there’s the all-too-brief snack time before piano lessons or soccer games.

By the time you get home for dinner, you’re faced with the prospect of washing all of the dishes, or even scraping and rinsing the dishes so they can go in the dishwasher, just so that you’ll have the requisite room to prepare dinner. That prospect is likely to be daunting enough to convince you to order pizza or get take-out. Lather, rinse, repeat — but eventually, you’ll run out of clean dishes and your kitchen will become an untenable mess. However, when you get in the habit of washing the dishes right after eating and emptying the dishwasher right before bed, even if you momentarily resent the fact that you are so put-upon that you must do such harsh physical labor…deep down, you know that your life runs more smoothly with these tasks completed.

Similarly, you can see that a paper management system with the hardware (file folders, hanging folders, cabinets or cubes, etc.) but with no behavioral system in place is a recipe for ruin. When you need something NOW, like the phone bill that was due yesterday or the policy number for your auto insurance, digging through piles of where you last saw something is not only less than ideal; it makes things worse.

If, like Paper Doll, you don’t cook, perhaps you’d prefer to think of your paper management system like the one you should have for organizing your closet. There are tasks you perform daily or at least weekly (hanging up clothing, putting away laundered items) and tasks that are handled less often (like seasonal closet switches or purging of excess).

Similarly, figure out what you need to do and when you’ll do it:

Whenever you feel overwhelmed

Turn off the ringer and the computer alerts, place a Quarantine sign on your door and follow the instructions here:

WhitePaper RAFTing: Adventures In Paper Organizing

Daily

Get in the habit of putting away each piece of paper when you’re done with it. I’m not a strong proponent of the OHIO (Only Handle It Once) Rule, but I do believe that as soon as you receive a piece of paper, you should try to figure out what’s the very next thing you have to do with it. If it triggers a task, either do it, delegate it or put it in your tickler file. If it’s reference, file it away. Once your physical system is up and running, it shouldn’t take more than five or ten seconds to put away any piece of paper.

What about a To File Pile, you ask? Well, sure, you could put a tray on top of your filing cabinet and plan to file everything all in one fell swoop, daily or even weekly. But without diligence, that gets perilously close to our sticky kitchen example.

Let technology prompt you to put papers away. If you work in an office, set an alarm on your computer to alert you fifteen minutes before your lunch hour and fifteen minutes before you close up for the day. At home, set alarms to remind you to check your tickler file at the start of each day and tidy papers before you amble away from your desk.

Weekly

Book time on your calendar, preferably Friday afternoons, for catching up on abandoned tasks. No, that’s not being defeatist; it’s being a realist. Life is messy. Kids get sick, washing machines overflow, catastrophes happen at work and at home. Building a paper management backup system into your life is like an insurance policy. If you’re all caught up, you can release the blocked time for something more fun.

Might you put off these daily and weekly tasks because you fear boredom will set in? Get yourself an accountability buddy. Arrange to phone or Skype a friend and do your procrastinated-upon tasks at the same time. You don’t even have to both be doing the same thing, just as long as you’re both aware that the other has this set task to complete. It’s a distance/virtual version of what Judith Kolberg calls body doubling. There’s something soothing about performing (or even appearing to perform) a similar task simultaneously. (If your chum’s procrastinated-upon task is a cardio workout, you might want to mute Skype or only talk to your friend at the start and end of the appointed time.)

Annually

Normally, you’ll be concerned with what you put into your paper management system (filing) and what you need to access from it (retrieval). However, unless you encounter an overstuffed system, apparent duplicates that require a careful examination to differentiate or some kind of disaster, you’ll rarely be concerned by all the stuff you never need.

That’s where the reviewing and purging parts of your behavioral system will come in. We’ll discuss the process of winnowing an overstuffed paper management system next week. For now, just block time on your calendar for the annual process. At the office, pick the part of the year where demands are low and the phones are quiet — for example, between Christmas and New Year’s or in July or August. For personal files, it might be when the kids are at summer camp.

You won’t have to do it all at once, but plan time to purge your filing system a little bit every day during the blocked period.

Start at the front and move backward. If you’re dealing with client files (or anything alphabetical), aim to manage one or two letters a day. You might find you’ve got extra work cut out for you when handling the A’s, M’s and S’s (that’s just the way things work out), but you’ll be able to double-up on the days you get K, Q, U, V, X, and Z.

Next week, we’ll continue with more paper management mistakes, like overstuffed file systems and bad labeling practices. Until then, please back up your computer — especially if you’ve found the cure for cancer.

A Rose By Any Other Name: Paper Doll Straightens Out Name Change Paperwork

Thus, although the family name was Urdang, my great-grandfather’s brother became Mr. Urdank. When my great-grandfather arrived at Ellis Island with his wife and two of his (eventually six) daughters, the officials had a bit more trouble and listed him as Rudank. (PaperMommy tells me he would eventually change his name to “Grampa”.) Some time later, the third brother, Sam, arrived in the United States, with an accent even less easily parsed. With no other recourse, Ellis Island officials took broad license filling out the paperwork.

And this is how the three Urdang brothers became Urdank, Rudank and Bloom!

People change names all the time. Historically, it’s been the norm for women to take their husbands’ names when they marry. Nowadays, couples blend names after their unions or domestic partnerships, such that Spouse Onename and Spouse Othername jointly take the surname Onename-Othername (or Othername-Onename), or invent new last names altogether.

Children of the Age of Aquarius have opted to change first names from Moonbeam to Madison or Generosity to George. Some just want to separate from the past (bad parents, bad marriages, bad decisions) and change their full names.

NAME CHANGE RULES

Name changes are generally legally permissible as long as you aren’t changing for a fraudulent purpose, such as avoiding arrest or debts, or changing your name to that of a celebrity to profit off of his or her identity. Persons convicted of certain felonies may also be prohibited from changing their names.

You can’t select a name that includes numbers other than Roman numerals, so don’t get cute and insert a silent 7 in the middle of your new name. Each state has its own regulations, so rules vary. The Minnesota Supreme Court refused to allow a Mr. Dengler to change his name to 1069, but stated that Ten Sixty-Nine would be allowable. And though you generally can’t change your name to include a profanity or racial slur, there’s no prohibition on names in poor taste.

Some states, like California, allow one to simply by use the new name. However, in almost all cases, whether the new name is a result of court order, marriage, divorce, or adoption, legally changing one’s name is preferred, especially if you plan to travel or earn money.

THE LEGAL PROCESS

A legal change of name requires paperwork — accessing old VIPs (Very Important Papers), filling out forms, acquiring documentation heralding new identities and notifying everyone hither and yon.

Name Change By Court Order

If you’re changing your name for any reason other than a revised marital status, you’ll have to get a court order to do so. Different municipalities have different regulations — you may need to address a civil, probate or superior court — and fees will vary by jurisdiction. Contact an attorney or your county registrar to ascertain the specifics.

In general, however, the process will require some combination of the following procedures and documents:

–Complete a Petition for Name Change

–Submit a form for Court Order Granting Change of Name for the judge to sign

–File a legal backer form, authorizing notification of creditors re: name change

–Submit a notice of petition to the public. This involves publishing the intended name change in a number of periodicals in your community, usually in the classified sections of “penny saver” newspapers to save costs. Once you receive an affidavit that the ad(s) have been published, submit this to the court with the other forms.

–Acquire an Affidavit of Consent, if required. This may be needed if you are changing a minor child’s name to match the name of a new step-parent and newly-married parent.

–Send an Affidavit of Service of Notification to appropriate authorities. This is used if the person changing names is an alien resident, a former convict or an attorney.

Once all the essential forms are signed and notarized by the court clerk in your jurisdiction, make and safeguard copies and submit the originals for approval. A court hearing may be necessary to defend your reason for changing your name or to battle any objections raised by the notice of petition — if, for example, you owe a debt under the old name, or some party has a grievance regarding the name change.

Once approved, you will receive your Order Granting Change of Name, the court order which serves as legal proof of your name change. You’ll need this document (and likely your birth certificate or proof of former name) to make all other changes.

*Note: In some states, persons seeking a name change due to domestic violence have the right to have their records sealed. Speak with an attorney or a domestic violence agency to get more information regarding your state’s regulations.

Name Change By Marriage (or Divorce)

Getting married doesn’t, per se, legally change one’s name, though the process is smoother than seeking a court order. Do, however, decide in advance what you want your name to be. If your marriage license says Name Oldname Lastname but you intend to live as Name Oldname (hyphen) Lastname, you’ll need to get the license right before you can move forward.

Similarly, if you’ve divorced, your divorce degree will serve the same purpose as a certified marriage license if you intend to revert to the name you went by prior to your marriage.

NOTIFICATIONS

In this era of airline travel, you’re likely to be detained if your ticket says Mrs. Mary Newname and your passport still lists you as Ms. Mary Oldname, even if you bring your marriage license, invitation and catering bill up to the gate. So, book honeymoon travel in your old name, just to be safe. Once the honeymoon is over, though, it’s time to handle the paperwork.

Gather Proof

If you’ve gotten married, be sure you have official (certified) copies of your marriage license — with “bumpy” raised seals. The municipal office with whom you registered and filed for your license (i.e. in the community where you got married, not necessarily where you live) will likely provide you with one official copy as part of your licensing fee. You’ll need to contact that office for extras.

If you’ve filed with the court for a name change or have divorced, be sure to have certified copies of the court order or divorce decree. You’ll often need to show proof of your former name, so acquire official copies of your birth certificate, too.

Satisfy Uncle Sam First

Driver’s License — South Carolina and Wyoming expect you to change your driver’s license to reflect your new name within ten days of your wedding, and other states have similar, though less urgent, deadlines. (Apparently, you can gain 300 pounds, dye your hair platinum and switch to blue contact lenses without notifying the DMV, but start using your new name and boy, does the DMV get cranky!) Call or check your state’s web site for details and bring copies of your certified marriage license, divorce decree or court order.

Social Security Card — Contact the Social Security Administration at 800-772-1213, and don’t fall for any emails or junk mail promising to get you a new card for a fee. The Social Security Administration doesn’t charge for new cards due to name charges. (Heck, you get 10 free replacement cards in a lifetime!) Follow the prompts and the automated system will walk you through the steps for filling out an SS-5 and getting a new card. Alternatively, you can follow the instructions on the Social Security Administration’s web site. You’ll have to fill out the application and provide official copies of documents proving your legal name change, your identity and either your U.S. citizenship or immigration status.

*Note: If you immediately move to a new state after marrying (or otherwise changing your name), the Patriot Act requires that you change the name on your Social Security card BEFORE you acquire a new driver’s license.

Passport — The U.S. Department of State has different requirements for issuing passports reflecting name changes, depending on whether one’s last passport was issued within the last year or earlier, and whether you have documentation to prove (via marriage license or court order) your name change. Review the linked page and follow the steps to determine if you can submit your documentation by mail or must apply in person, and whether there are fees associated with your situation.

Voter Registration Card — Go to DeclareYourself.org, click on “Register to Vote”, fill out the initial screen and after you click “continue”, click the box where it says:

“I have registered to vote before, but:

_This application is for a change of name.”

and proceed with the form. Of course, you can also pick up a voter registration form at your public library or Department of Motor Vehicles.

Tell Everyone Else

Next, you’ll want to notify all of the following entities. To save time filling out forms, you might want to consider acquiring a uniform name change form, such as Nolo’s Declaration of Legal Name Change. Then notify:

- The Post Office — You aren’t required to do this, but you’ll be getting mail in your old name and new name for a while, so make sure your box lists both or that your post office knows about the new identity. (Don’t trust that your postal carrier knows you well enough to field errant mailings. Your carrier takes vacations, holidays and sick days, and you don’t want to risk important mail going missing.)

- Insurance companies — Update your health insurance policy and cards first, then automobile, homeowners, etc.

- Your employer(s) and/or the Payroll or Human Resources departments

- Banks — Order checks and deposit slips bearing your new name.

- Brokerage houses where you hold investment or retirement accounts — You may wish to have those who previously listed you as a beneficiary update their records, as well.

- Credit card companies

- Utilities and other essential services

- Other companies with which you have accounts, particular those you pay or which pay you (such as affiliate marketing companies)

- State or other licensing agencies for operation/ownership of firearms, boats, planes

- Internal Revenue Service and your state and local tax authorities

- Veteran’s Administration

- Professional licensing or certification entities

- Other entities with regard to legal documents including wills, health care proxies, mortgages, leases, trusts, Power of Attorney documents, etc.

- Friends and associates (so they know how to address you)

- Doctors, dentists, therapists and other health professionals

- College alumni associations

- Clubs, gyms, and other memberships

Also, periodically, check your credit report at AnnualCreditReport.com to make sure nobody has fraudulently opened accounts in your old name.

If the thought of doing this all on your own gives you a headache and writer’s cramp, help is available.

I’mAMrs, originally a Canadian service that now serves the U.S., Australia, the UK and South Africa, has an appealing approach for new brides (and grooms). A $29.95 standard package includes forms for updating your passport, Social Security card, voter registration card and driver’s license. The premium package at $49.95 provides unlimited access to a database of forms for notifying financial institutions, retailers, utilities, lenders, insurers, publications, medical professionals and more.

Fill in your essential information just once, select the forms you wish to use, and I’mAMrs will auto-complete each form. Proofread, stuff the envelopes, stamp and mail off your documents. If an organization doesn’t have an official name change form, I’mAMrs will create a personal notification letter and advise you on how to proceed.

I’mAMrs notes that its packages work equally well for same-sex couples, and Paper Doll can’t imagine why it wouldn’t be suitable for those changing their names for reasons other than matrimony.

Name That Bride offers a free online kit, including forms and checklists to help brides and grooms with the name change process. Name That Bride will also mail you a kit of forms for $20, if you’re unable to download or print forms.

Readers, when I become Mrs. Paper Doll-Clooney, you’ll be the first to know.

Follow Me