Archive for ‘Financial’ Category

Paper Doll’s 16 Ways To Organize Your Money In 2016 — Part 3

Whether it’s that shiny nickel that burns a hole in your Garanimals pocket at age 5 or the wallet overflowing with wrinkled receipts or a hot mess of old abandoned 401(k)s that have never been rebalanced or rolled over, money can be a source of pleasure or pain. This series on organizing your finances is designed to give you some actionable ideas for gaining more control over your money in 2016. Review the first nine strategies in Part 1 and Part 2, and continue with today’s money-organizing tips.

10) Organize yourself out of debt.

“Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.” ~ Charles Dickens, David Copperfield

It might seem as though getting out of debt would have little to do with organizing — perhaps you think it’s solely a matter of making more money or spending less. In theory, both of those things should help you get out of debt; in reality, humans are irrational. To get ahead on your debt repayment, you’ll need to add a little rationality to your approach:

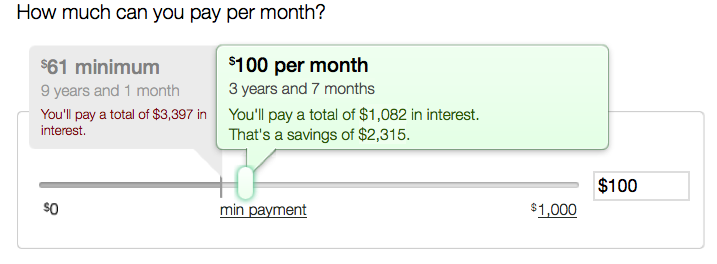

- Stop paying only the minimums — Recognize that just because your bill tells you that $34 is the minimum you have to pay doesn’t mean that’s what you should pay. The less you pay each month, the more interest you’ll pay over time, and the longer it will take you to pay off your debt. It’s in each lender’s interest for you to pay as little as possible beyond the minimum, because it keeps you indebted (and them in business), and because the minimums are so small, they seem inconsequential, leading you to take on more debt. Obviously, your goal is to pay off all unsecured, revolving debt each month; if you can’t, at least throw as much money at your debt as possible.

- Let your right hand know what the left hand is doing — If you have money in savings or investments earning low interest, but credit card or other debt at high interest, consider applying the former to the latter. If you’re earning less than 1% on $1000 but racking up interest at 13% on $1000 in credit card debt, you are losing money. Of course it’s always important to have a liquid (that is, accessible) financial cushion for emergencies, but letting debt pile up each month while low-earning funds wallow, you may be penny wise but pound foolish. Make sure your savings/investing brain is talking to your debt-payment brain by getting a reality check; use the National Foundation for Credit Counseling “Debt or Invest” calculator to see where your money will best serve you.

- Make sure your head and heart converse — Being rational is important, but if you’re in a constant struggle against your instincts, it will be hard to stick to a repayment plan. Pull up your most recent statement for every credit card and take note of the interest rates. If you have three credit cards, for example, you might have three different amounts at three different rates. Now that you’re not paying merely the minimum, you might be tempted to take the total amount you’ve earmarked to pay off debt and divide it equally among those three credit cards every month. Not so fast! There are better methods that work, either logically or psychologically, and both have advantages and disadvantages.

The Snowball Method — With this strategy, you pay the minimum on all debts except the smallest, and throw all the rest of your budgeted debt-reduction funds toward paying off that smallest debt. Armed with this bit of success, you’ll rebalance your efforts and take all the money you’d been putting against the smallest balance, and now apply it (plus what you were already applying) to the next-lowest balance, and so on. This method has a psychological reward — by focusing on the smallest debt owed, you’ve got something in your “win” column to motivate you to stay committed to the plan. But it’s not particularly logical — by focusing on balances rather than interest rates, your total debt keeps growing.

The Debt Avalanche Method — Line up your debts by interest rate, pay the minimum toward all but the highest-rate debt, and put all of your available money (salary, birthday money, funds raised from selling your books or your plasma, etc.) toward the highest rate debt. This method is logical, but it lacks the immediate sense of victory of the Snowball Method.

Still not sure how much to put toward your individual debts? There are some great no-cost debt calculators available to help you, including:

Mint — If you’re using Mint as a complete financial dashboard service, its Financial Goals feature is ideal for paying off specific debts — one or many. Once you sync the service with your accounts, you can select which accounts you want to include in your debt payoff goals. Mint will already know your interest rate and minimum payment, and will display how your payoff options will impact interest owed over time.

As you make monthly payments, because Mint will already be tracking your money, the system will display how you’re progressing toward your monthly goal (telling you, for example, that you’ve paid “$73 toward your goal of $200 for the month) and how you’re progressing toward your overall goal.

If you have multiple types of debt, like personal debt, business debt and medical debt, you can create multiple goals and view them separately or on one screen. However, note that the goals element of the dashboard service is only viewable from a browser, not from the Mint app.

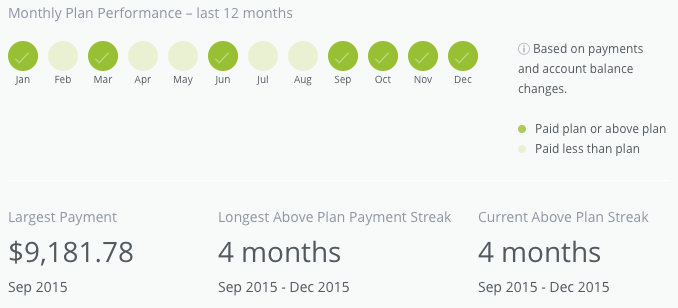

Ready for Zero — As with Mint, once you sync all of your accounts, Ready for Zero knows your account details: balance, minimum payment, interest rate, etc., and auto-updates when you make payments, add debt, etc. It has similar sliders for setting your approach to your goals, but Ready for Zero’s app seems to be more seamlessly integrated with the browser version, and overall, offers much more variety of display views and reminders. If visual feedback helps you stay motivated, this is a great option.

Of course, if you’re experiencing crushing debt, organizing your information and game plan is just one aspect of financial recuperation. Debt counseling is an important option, but there are a variety of predatory and/or irresponsible so-called debt counselors out there. Begin your search with the National Foundation for Credit Counseling to find an NFCC-Certified Consumer Credit Counselor.

11) Lower Your Interest Rates

You can’t walk into Target and tell the cashier you’d like a discount on toothpaste, or warn the front desk clerk at your hotel that you’d prefer to pay only one-third the hotel tax. You can’t just ask for better deals! Or can you?

There’s little chance of getting your bank to bump your measly .087% savings account interest rate up to 5%, let alone double-digits. That’s just not how banking works. But credit card interest rates are more complex. Sure, the rate you’re charged is dependent upon your credit history, credit score and earning power, but the credit card industry is highly competitive. If you have an unblemished payment history and have been a solid customer, you can try to request a better interest rate.

First, log into your online account for each lender and see if there are already options for things like changing your payment date, requesting a higher credit limit, or getting a lower interest rate. (Don’t get a higher limit for ego’s sake; you don’t need it.) You may be able to handle this with a few clicks. If not, call your lender, be cheerfully polite, and once you’ve identified yourself with your name, account number and all matter of ridiculous levels of proof, tell the representative something like:

I’ve been a loyal customer of [credit card company], pay my bills on time and have been generally happy, but I’ve been receiving offers in the mail from other credit card companies with lower APRs. To be as financially responsible as possible, I want a lower rate on my card. Before I cancel my card with [your company] and switch, I wanted to see what you could do to help me.

And then shut up. You might get a grumpy rep and a rejection, or you might get good news. Either way, you’re out nothing except your time.

If requesting a change in interest rate from your own lender doesn’t work, you can always initiate a balance transfer, either to one of your other cards or a new credit card, for 0% or a very low rate, but balance transfers come with their own caveats:

- There are fees attached, usually 2-5% of the value of the transfer; this fee is added on top of your transferred debt and is subject to the same interest rates that apply to the transferred amount.

- These are short-term interest reduction periods, usually for 9-18 months; any unpaid debt as of the end of the transfer period will be charged interest at whatever the card’s normal rate might be.

- You should only transfer debt to cards that already have a zero balance, and do not charge new purchases on the card until the transferred debt is paid off. Otherwise, with multiple concurrent interest rates on one card, your progress towards repayment will be muddied.

12) Ask and Ye Shall Receive…Better Deals and Discounts

If you’ve ever seen those long, convoluted blog and Facebook posts about extreme couponing, you may think you don’t have what it takes to lower your costs. However, getting good deals doesn’t have to be complicated. Whether you’re trying to buy something at a lower price or reduce the cost of a service for which you’re already paying, try these options:

Let your fingers do the walking. The next time you’re going to buy something online, stop at your favorite search engine first and type in “[name of store where you’ll be shopping anyway] discount” and you’ll be amazed at the number of coupon code sites that will pop up, including:

From free shipping to percentage discounts, it often takes no more than a few extra minutes to find a rewarding promotional code to use at checkout.

Ask for a better rate. Using the same kind of script described above for lowering your interest rates, call your phone or cable company, or similar service provider, and explain that you’ve been a loyal customer for [X number of] years, have been offered discounts by other providers, or have seen lower rates and inducements the company has offered to new customers, and ask what can be done to keep you happy.

Ramit Sethi of I Will Teach You To Be Rich walks through how to have these kinds of conversations with confidence.

In 2014, NPR’s This American Life did an interesting segment on the concept of the “Good Guy” discount — and how sometimes, just asking for a price break can work. What could it hurt?

Threaten (politely) to cancel your service. This is the next level up from merely asking. It takes a little more aplomb, and may require you asking to get transferred to the Retention Department, but state your case, reference competitor pricing, and then be quiet. At first, they will inevitably try to up-sell you to services you don’t want or need. But stand your ground and it’s more likely that not that you’ll be offered six months or more of discounted service. I have one client who merely calls to cancel her satellite radio service every time she’s billed and achieves a discount in return for her few minutes of effort; with many of my clients, we set aside a “canceling” session a few times a year to see how many discounts we can get.

David Bach, better known for his Finish Rich financial advice empire, wrote a great book a few years ago called Fight for Your Money: How to Stop Getting Ripped Off and Save a Fortune. It’s a superior resource for developing the skills necessary to master a system that’s gamed in favor of large companies.

Too anxious to talk to reps personally? That’s OK, as you can use the same approach online. You’ll often find that if you go into your online account for an entertainment, dating, or gaming service (e.g., Hulu, Netflix, Match, X-Box Live) and “cancel” your account, you’ll get a pop-up notice offering a discount if you’ll keep your account active. Sometimes, the cancelation will go through, but you’ll receive an email within the day, inducing you to reactivate.

And, of course, you can put any of your newfound windfall toward debt-reduction or savings goals!

Next time, in the final post of this series, we’ll look at ways to organize how you get paid, how to make your spending habits boost your return on investment, and fun options to learn more about mastering your money.

Paper Doll’s 16 Ways To Organize Your Money In 2016 — Part 2

Your money has different personalities. Some just sit there like your college roommate’s freeloading boyfriend, drinking your milk and putting the empty carton back in the fridge. (Y’know, those investments you were talked into, but which have gone nowhere?) And some are delightful surprises, like friends who show up to drag you to the movies when you’ve had a bad day. (Think of that crisp $20 bill you find in your jeans pocket after doing laundry.) But your money won’t organize itself.

In Part 1 of 16 Ways To Organize Your Money In 2016, we looked at accessing and organizing the information others have about you in your credit report and credit score, and what you can do to improve your finances by tracking and making wise decisions about your expenses.

Today, we’ll look at more tips for keeping your money life in order.

6) Organize Your Financial Information

All the paper and digital information you have regarding your finances represents money going out (bills and statements for fixed necessities and variable luxuries) and money coming in (birthday checks from Grandma, your direct-deposit paycheck, investment interest and dividends). To keep control of your finances, to help you prepare your taxes, and to safeguard your financial future, it’s important for this information to be accurate and accessible.

The financial paperwork we receive or create usually breaks down into these sub-categories:

Outgoing Money

When you get a paper bill, you either tear off the stub to mail it back with your payment and keep the remainder, or you pay online and keep the whole statement/invoice. When I help my clients organize their financial information, we start by breaking the paper piles into categories:

- Monthly or periodic household bills (e.g., rent/mortgage, utilities, insurance, etc.)

- Credit cards statements

- Loans (e.g., home equity, auto, college, personal, etc.)

- Medical bills (which may be ad hoc or part of an ongoing payment plan)

- Anything else being paid on a regular or predictable basis (e.g., piano lessons, tuition, personal chef, professional organizer, fitness trainer) for which you wish to keep careful records

In this case, your basket is your financial information filing system. Usually, I advise this approach:

- Label (and alphabetize) tabbed interior folders within each sub-category. It doesn’t matter if you use generic terms (cable, power, water) or company-specific (Comcast, CityPower, Valley Water Authority) — just be sure to choose labels that reflect how you think. For credit cards, if you have more than one card from any one issuing company, you may want to put the last four digits of the card number on the label (Discover-1234, Amex-9876), just to help you file quickly. If your system is complicated, you’ll find excuses not to use it. Stay simple.

Group related sub-categories in hanging files in a filing cabinet, milk-style file crate, or desktop file box. - File the backlog in reverse-chronological order.

- File paper bills as you pay them.

Alternatives to file folders are three-ring binders and accordion folders. However, binders require three-hole punching of papers, and each additional step leads people to procrastinate. Accordion folders can work for college students and those with very few expenses, but a system you can expand as your financial complexity increases will be easier to maintain.

If you get all your bills and statements digitally, there’s no need to print them out; just set up a new behavioral system to acquire the information, label it, and store it.

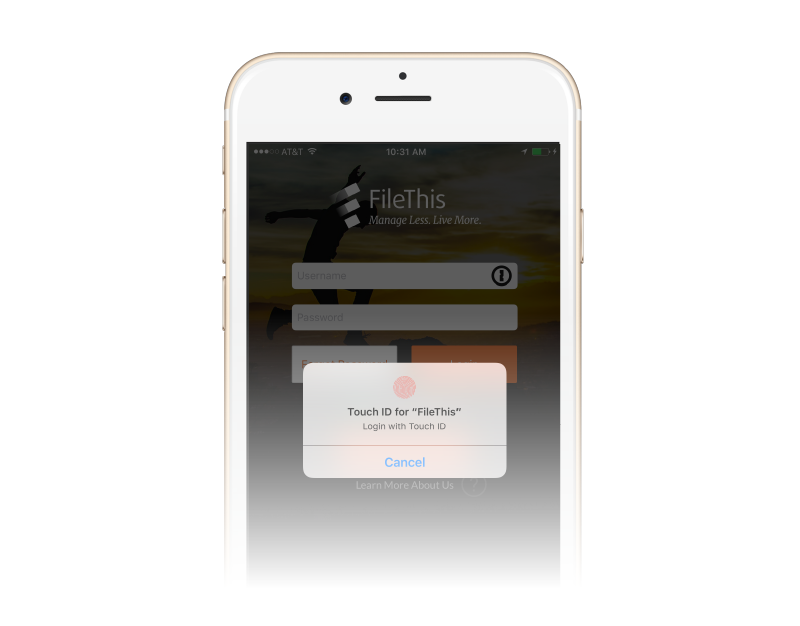

You can manually download each statement, or use FileThis, an app/service which, once linked to your account, fetches your online statements and bills so you can pay them and store them as you see fit. Let everything live in the FileThis Cloud, on your computer, or in Evernote, Box, Dropbox or Google Drive. (FileThis ranges from free to $5/month, depending on your needs.)

You can manually download each statement, or use FileThis, an app/service which, once linked to your account, fetches your online statements and bills so you can pay them and store them as you see fit. Let everything live in the FileThis Cloud, on your computer, or in Evernote, Box, Dropbox or Google Drive. (FileThis ranges from free to $5/month, depending on your needs.)

To create a uniform digital system for labeling (for example, bill name and date, like Verizon-2016-1). Some people prefer to keep all of the digital invoices in one online folder and use search to find what they want; others (like Paper Doll) prefer a folder hierarchy system that matches the one described above for paper.

Finally, while some people refute the idea of maintaining bills once they’ve been paid, I suggest it for a couple of reasons. First, many companies only provide access to a limit period of billing, sometimes only a year or six months, making it difficult to source errors or track information. Second, for those who tend to be disorganized with their finances, a tangible (paper) system yields a greater sense of control.

Incoming Money

Incoming revenue information may involve pay stubs from employment, alimony or child support payments received, Social Security income, disability payments, IRA disbursements, personal loan repayments (to you), lottery winnings, and stock dividends (if not part of a dividend reinvestment plan). If you’re regularly getting money from any source, or have gotten a large lump sum for something other than employment, make a folder (or folders) to maintain records until tax time.

Transitional Money

The above categories talk about what you are doing to your money, but others show what your money is doing, with or without you. Bank statements for checking, savings, and trusts represent collections of funds in transition. They may accrue interest or have fees associated with them, so take time each month to make sure these accounts reflect what you think they should.

Brokerage statements contain investment information. Sort these by investment type: retirement, college savings, goal-related (like a vacation fund), first, and further sub-categorize (and alphabetize) by company or specific investment. So, in the Retirement hanging folder, you might have interior folders for your 401(k), an old 403(b) that remains in place, IRAs with Fidelity or Vanguard, and so on. Each account should have its own folder.

Simulated Money

Some of your records represent money that’s not real yet. These files might include quarterly or annual statements reflecting either regular or atypical benefit plans for your job, such as if you’re vested in an employee stock ownership plan. If you’re not particularly active in managing this information, maintaining it in digital form will keep you from getting overwhelmed.

You can also have a folder in this section for gift certificates, gift cards and store credits so you can keep track of the money value owed to you. If you prefer to keep them portable, a Card Cubby is a nice alternative to mixing them into your financial filing.

Keep stock certificates, bearer bonds, or other papers of significant value in your safe deposit box or fire-proof safe.

7) Create Tax Prep Folders (for the tax year just ended and for the one to come)

Depending on your financial situation, one folder per year might suffice; if your financial life is complex, you might want a handful of folders for each year’s incoming tax forms, charitable donation receipts, medical expense annual summaries from your insurance company, etc. Create a safe place for incoming papers to land and you’ll be ahead of the game.

Any day now, you’ll start receiving official-looking forms (1098s to indicate interest income you’ve paid on certain loans, 1099s to show interest, dividends, and other payments to you, W2s from employers, etc.) to help you prepare your taxes for last year. To get an idea of the forms to expect, these tax-related Paper Doll posts will walk you through it:

Taxing Conversations: Organizing the Essentials & a New Tax Tool

Taxing Conversations (Part 2): Organizing Fun With Forms

Taxing Conversations (Part 3): Form-Free Organizing

Securing these documents (plus any items that pop up when you’re following the steps in #6, above) will make tax time run much more smoothly, whether you file on your own or use a preparer.

8) Organize a (Socially) Secure Future

Cleaning up your credit history will organize your past; getting a handle on your expenses, financial paperwork, and taxes will take the wobble out of your financial present. But what about your future? Banking (if you’ll pardon the pun) on Powerball isn’t going to do it.

There are numerous ways for minimizing taxes and maximizing your odds for a financially secure future, and if you don’t have one or more of the alphabet soup of IRAs, 401(k)s or 403(b)s, you should be talking to a financial advisor about how to get started. But whatever your retirement plan, there’s one program in which you’re probably already participating (unless you work for the railroads): Social Security.

Start by signing up for your online Social Security account, as I’ve been pestering you about since Paper Doll Makes a Statement: The Social (Security) Network.

If you haven’t yet signed up yet, go to the my Social Security website and click on Create An Account. Once you create your account, you’ll be able to track your earnings and verify that they’ve been properly reported (by you and/or your employer), and get estimates of your future benefits. If you’re already receiving benefits, accessing your account enables you to obtain a letter with proof of benefits (often needed for legal and financial purposes), change your address and direct deposit payment information, and manage your benefits.

If you have already set up your account, change your password! The Social Security Administration actually makes you do what you’re already supposed to do — update your password every six months. If you haven’t, it’ll prompt you to do so when you log in.

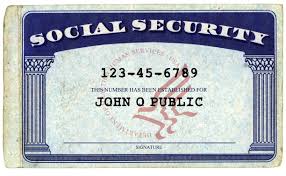

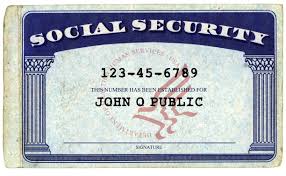

Speaking of Social Security, take your card out of your wallet or purse — you shouldn’t be carrying it around with you.

As we talked about in What’s In Your Wallet (That Shouldn’t Be)?, in the wrong hands, your Social Security card is an invitation to identity theft and financial fraud. Memorize your number for when you have to unexpectedly fill in forms. (Really, it’s like a phone number, just nine digits.) Put the actual card in your VIP (very important paper) file system or in your fireproof safe, and only pull it out when you need it.

As we talked about in What’s In Your Wallet (That Shouldn’t Be)?, in the wrong hands, your Social Security card is an invitation to identity theft and financial fraud. Memorize your number for when you have to unexpectedly fill in forms. (Really, it’s like a phone number, just nine digits.) Put the actual card in your VIP (very important paper) file system or in your fireproof safe, and only pull it out when you need it.

Can’t find your Social Security Card? Report it, especially if you think you’ve been the victim of identity theft, and then replace it.

9) Save for More Than Retirement: Cheating the Obstacles to Willpower

I know, I know. Saving isn’t sexy. But a beach vacation is. And not having to go into credit card debt to pay for next year’s Christmas presents is an idea that gets the blood flowing. But saving is difficult. Usually, in order to save money, you have to use up all your reserves of willpower to keep from spending it in the first place.

What’s willpower, really? Psychologists have defined it as the ability to delay gratification, resisting short-term temptations in order to meet long-term goals. But the more you delay gratification, the more worn-down and put-upon you can feel.

So, why not do an end-run around willpower? Automate! No, you don’t need to be a robot; you just need to take the ongoing decision-making (to put money aside) out of the equation. Make the decision once and be done with it.

Remember last time, in step #5, you audited your expenses and figured out what bills you could lower? Let’s say you lowered your monthly entertainment expenses by $18 and your phone/communication bills by $11, and maybe eliminated a few other ongoing items by about $15 a month. On their own, that may seem a pittance, but that’s $44 every month. Set up an automatic transfer from your checking to your savings account for $11 per week.

Of course, even if you haven’t identified ways to pare down your spending, as long as you’re not at risk of falling into the red, having small amounts automatically transferred to savings on a regular basis is a way to improve your savings rate without feeling you’re being denied life’s pleasures.

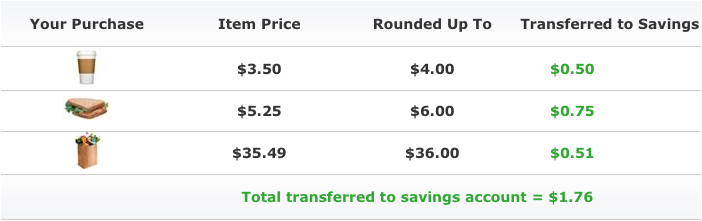

There are other automated savings options. Bank of America’s Keep the Change Program helps its customers save by rounding up each debit card purchase to the nearest dollar, and sequestering that extra money in savings but allowing you to track the movement of money via online banking. For example:

Prefer a little more tech support? The Digit web service works similarly. Once you link Digit to your checking account, it analyzes your spending patterns, predicts your cash flow, and transfers small but varying amounts of your money to your Digit account in an FDIC-insured bank.

You won’t earn interest, but whenever you want your money, just text Digit, and the money can be transferred back to you, so you could wait until you reach a benchmark amount, like $500, and then transfer that to savings.

Digit sends one text each day to let you know your new checking account balance; it can also text you how much your bank balance has changed over the prior two days, and can list all your debits from the prior day. The more you use it, Digit not only helps you save, but also gain more awareness of your spending habits. Isn’t that organized?!

Still to come in this series: organizing to get out of debt, streamline getting paid, using technology to achieve your financial goals, and more!

Paper Doll’s 16 Ways To Organize Your Money In 2016 — Part 1

Two of the most popular and enduring New Year’s Resolutions are to get organized and to save more and spend less. In honor of 2016, over the next few posts, we’re going to look at 16 ways to organize your finances with small, easy steps you can take today.

1) Pull your credit history.

How? Pulling your credit reports is easy. Just go to AnnualCreditReport.com and click on “Request Yours Now.” You’ll be prompted to answer some questions about things like your prior addresses or current or previous loans. (They really want to make sure it’s you, so think before you click.)

Because you’ll be supplying personal financial information, you want to pull your reports from a secure computer, preferably one on your own network, rather than a public computer. If you’d prefer to avoid the web altogether, you can call toll-free at 1-877-322-8228 to request your report, or download, print, fill out, and mail a paper form.

Why? Your credit report includes information that is used to determine interest rates on loans and mortgages, rates you’re charged for insurance, and even whether or not you can rent an apartment or get hired for a job. The best way you can be certain that creditors have properly reported your financial activities, not misconstrued someone else‘s honest activities as yours, and haven’t let bad dudes secure credit in your name, is to check your credit history.

You are guaranteed one free credit report from each of the three credit reporting agencies (Equifax, Experian and Trans-Union). You could just contact them individually, but the Fair and Accurate Credit Transactions Act (FACTA) of 2003 made it federal law to guarantee your right to access your report, for free, once each year.

Once you’ve convincingly proven that you are who you say you are, go ahead and print (or better yet, save a PDF of) your credit reports. And make a note on your calendar to check again next year.

When? You can choose to pull all three reports simultaneously once per year, or stagger them and pull one report from each agency whenever you like, perhaps every four months. While experts sayl that the staggered approach is more likely to catch an error quickly, most people are not diligent about remembering to pull their reports on a regular basis. If you’ve never pulled your credit history before, I suggest pulling all three reports simultaneously, familiarizing yourself with the formats, and then you can decide what you want to do going forward.

2) Check — and, if necessary, dispute — your credit history.

According to a Federal Trade Commission study, 20% of consumers have errors on at least one of their credit reports, and 5% have errors which could adversely impact them during the lending process.

Just as buying (and even watching) exercise DVD won’t help you achieve your resolutions to lose fat and gain muscle if you don’t actually do the workout, downloading your credit report is an exercise in futility of you don’t actually review it. Go through it page by page, line by line:

- Are there credit cards or financial accounts you never opened? (Note, credit card lenders often buy one another out, especially with store-specific credit lines, so be sure to cross-check account numbers to make sure something unfamiliar isn’t just the product of a buyout.)

- Are there addresses or places of employment that don’t pertain to you? (Minor errors, like misspellings, are worth fixing, but don’t necessarily require disputation. Correct them to prevent confusion in the future, especially when filling out forms where you have to jump through hoops to verify your identity.)

- Does it list liens or judgments against you that have no relation to your actual financial history?

- Is there information that should no longer appear on your history, such as a bankruptcy that is more than 10 years old?

If there are mistakes on your credit report, contact the appropriate credit reporting agency and the lenders in question to dispute the errors.

3) Check your credit score.

Although you’re guaranteed access to your credit reports for free, there’s no such promise for your credit score. You hear a lot about your FICO score, but different lenders access multiple scores to assess the interest rates they will offer you for credit cards, auto loans, and mortgages. You can purchase your individual credit scores from each of the credit reporting agencies, or buy bundled scoring from MyFICO.com.

LendingMemo.com

However, unless you’re getting ready to make a major purchase, you have a variety of free options to gain access to least one of your credit scores, which should give you a ballpark sense of your official creditworthiness. Barclaycard, Citi, Discover, First Bankcard, US Bank and others offer credit scores to customers on their web sites; Discover also provides credit scores on monthly bills. In addition, some banks and credit unions are offering free scores to customers as inducements for their loyalty, and CreditKarma, is a surprisingly non-spammy option for accessing your score.

In Paper For Your Plastic: Organizing a Better FICO Score, I’ve written about how understanding the makeup of the FICO score can help you improve your creditworthiness in the eyes of lenders. Since that post was written, new rules about medical indebtedness guarantee that unpaid medical debt will carry less weight than other types of consumer debt, and any medical debt eventually paid off will be removed from your credit history immediately, even if it had been in arrears.

4) Track your expenses.

With the advent of online banking, automatic transfers, and even mobile payment (like Apple Pay), it seems like nobody writes checks anymore. But that means people have gotten out of the habit of reconciling or balancing their checkbooks. It may seem to make sense — no checks, no checkbooks, but we still have checking accounts, and so whether they are paper or digital, I think we need check registers.

When we all wrote checks, we were forced to pay attention to where our money was going, but with all of those swipe-and-done transactions, we’re far less likely to notice how much money is draining out of our accounts until the money is gone. And with automatic transfers, we tend not to look too closely at the bills that come on a monthly basis, so we may not notice errors (fraudulent or otherwise) until it’s well past the date they might be reversed.

At the very least, set an alarm or alert on your computer, phone or tablet to remind you to check your bank account and credit card statements monthly, before manually paying or allowing automatic payments to go through. (Weekly would be better, if you hope to catch fraud.)

Write down or track everything you spend during this first month of getting your finances organized. If you’re just getting started with tracking expenses, it will help to do a little bit every day. When you’re sitting in front of your computer to authorize a payment, mark it in your paper checkbook register. (Your bank will give them to you for free.) Yes, it may seem old-fashioned, but the observer effect notes that the act of observation changes the phenomenon being observed. So, just as Weight Watchers has proven that journaling calories and activity has a positive impact on weight loss, you’ll likely see that the mere act of tracking your expenses to organize them will improve your finances.

When you come from a day of shopping, pull the receipts out of your wallet, and mark anything that drafted from your checking account in your register, and put your credit card receipts in an envelope for easy access. If you follow along daily, it shouldn’t take more than five minutes (unless, of course, you’re a BIG spender), but the value will be returned to you.

Periodically, by checking your online accounts, and certainly once your monthly statement is generated (whether on paper or digitally), check in with your finances:

- Balance your checkbook register, even if you haven’t written actual checks in eons.

- Check receipts against your online bank and credit card statements.

- Visually scan your credit card statements as soon as they arrive, and call to verify anything that looks hinky.

Once you’re familiar with your spending patterns, especially if you rarely use cash, it’s also a great idea to set up an online financial dashboard service with web- and app-based trackers like Mint. But to start this process, you’ll pay more attention to those little drips and drops of funds if you put pen to paper. (We’ll talk more about financial dashboards in the upcoming posts of this blog series.)

Being organized doesn’t just mean sorting the paperwork and digital receipts. It means knowing what you have and where you have it, keeping what works and getting rid of what doesn’t suit your goals.

5) Audit your ongoing expenses.

Clutter piles up when we don’t think about whether we even want or need something. Financial clutter piles up the same way. No matter what you pay monthly, quarterly or annually for a service, if you don’t think about whether you still want it (or want it at that price), your expenses are likely to get out of control.

Comb through your digital and paper records, and consider your subscriptions and ongoing purchases. What purchases duplicate what your household already buys? What could you replace with a better deal? What could you eliminate altogether? Consider the following categories:

Video: Do you have Amazon Prime, Netflix, Hulu, and cable/satellite? Are you watching enough of each to justify keeping them all? (Paper Doll is a huge TV fan, but even I find it’s sometimes worth my while to pause a subscription for a few months when life is too busy to catch up with all my stories.)

Audio: Do you have satellite radio in your car, like Sirius XM? What about subscriptions to Apple Music and premium streaming music via Spotify or Beats? If you already have Amazon Prime, could you scale back on paid streaming? Could you bear to listen to commercials and drop from paid streaming to free versions?

Reading: Do you have ongoing (digital or paper) magazine and newspaper subscriptions that you never get around to reading? Do the magazines pile up until you guiltily toss them in the recycling bin?

Communication: They’ll have to pry my landline from my cold, dead hands, but for some people, the switch to mobile-only makes good financial sense. Also, have you checked to make sure your cell phone plans line up with the number of minutes, texts, and data you use?

Computers: From Evernote to Dropbox for storage and collaboration to the various plugins that keep a blog running to software and app subscriptions and upgrades, there’s a truth to be told. Just like with some relationships, when it comes to some digital loves, the bloom is off the rose.

Gaming: Paper Doll doesn’t judge. (OK, she does, but…) If you’re actually playing and enjoying the various MMORPG or online or interactive games for which you pay, more power to you. But if your digital ranch has long gone untended and you haven’t logged in for a long while, it might be time to cull the herd.

IRL, or In Real Life: Do you belong to a gym, associations or clubs? Do you go often enough to make the fees expenses worth what you’re paying? If you haven’t been active in a while, cancel, or see if your membership can be suspended for a few months, until you can gauge your interest.

Gifts: Do you automatically renew your grandpa’s golf magazine or your BFF’s CatFancy? Make sure they still want these particular benefits of your largesse. (And, in general, think about giving gifts of experiences rather than tangible objects.)

Professional expenses: Do you need to renew dues or pay for certifications or licenses? Just make sure you still participate in all of those activities before continuing to rack up expenses.

Just as with our new year, this is only the beginning. The rest of this series of 16 financial organizing strategies will share more tips about organizing your financial paperwork, budgeting with the help of technology, lowering your expenses, streamlining how you get paid, and more.

Ten 10-Minute Financial Tasks to Organize Your Finances

[Editor’s note 4/27/2020: As we all cope with another month sheltering in place, financial issues are causing anxiety. Even if you’re not feeling highly motivated (or motivated at all), this classic Paper Doll post is filled with quick tasks to help you get a handle on your financial situation and feel more empowered.]

Readers, at three weeks into the new year, most people have petered out in their attempts to achieve their resolutions, or they’ve not even started, waiting until after they’ve taken down the tree or gotten the kids back to school. But the clock is ticking, and time is money. And while love of money may be the root of all evil, money itself is what keeps us from living in a van down by the river.

So today, Paper Doll is offering up a fast-forward kick-in-the-tush for organizing those little green pieces of paper we all like so much.

To that end: take ten minutes a day, for the last ten days of January, to take ten tiny steps toward getting your finances in order.

1) Sign up for your online Social Security account.

IRA. 401(k). 403(b). No matter how you’re saving for your retirement, there’s one program in which you’re pretty much guaranteed to be participating (unless you work for the railroads): Social Security. If your senior years are dependent upon your retirement savings, investments and benefits, wouldn’t it make sense to ensure the information is organized?

A few years ago, in Social Security Goes Paperless & Gets Lean, Green & A Little Mean, I told you about how the paper Social Security statements we’d been receiving annually were being discontinued.

A year later, I announced the new SocialSecurity.gov online account program in Paper Doll Makes a Statement: The Social (Security) Network.

But did you sign up?

If you haven’t yet signed up yet, now’s the time to do it. Go to the my Social Security website (let’s just ignore their e.e. cummings-esque decision not to capitalize “my”), and click on Create An Account to get started. Once you create your account, you’ll be able to track your earnings and verify that they’ve been properly reported (by you and/or your employer), and get estimates of your future benefits. If you’re already receiving benefits, accessing your account enables you to obtain a letter with proof of benefits (often needed for legal and financial purposes), change your address and direct deposit payment information, and manage your benefits.

If you have already set up your account, change your password. Now! The Social Security Administration actually makes you do what you’re already supposed to do — update your password every six months. If you haven’t, it’ll prompt you to do so when you log in. (Speaking of passwords, just this week, SplashData released a list of the worst passwords of 2014. Don’t use those. C’mon.)

2) Take your Social Security card out of your wallet.

Seriously, dude. We’ve talked about this (in What’s In Your Wallet (That Shouldn’t Be)?). Your Social Security Card, in the wrong hands, is an invitation to identity theft and financial fraud. Memorize your number for when you have to unexpectedly fill in forms. (Really, it’s like a phone number, just nine digits.) Put the actual card in your VIP (very important paper) file system or in your fireproof safe, and only pull it out when you need it.

Seriously, dude. We’ve talked about this (in What’s In Your Wallet (That Shouldn’t Be)?). Your Social Security Card, in the wrong hands, is an invitation to identity theft and financial fraud. Memorize your number for when you have to unexpectedly fill in forms. (Really, it’s like a phone number, just nine digits.) Put the actual card in your VIP (very important paper) file system or in your fireproof safe, and only pull it out when you need it.

Can’t find your Social Security Card? Report it, especially if you think you’ve been the victim of identity theft, and then replace it.

3) Pull your credit report annually.

Yup, we’ve talked about this, too. Over and over and over. The only way to make sure that creditors have properly reported your financial activities, and to ensure that you’re protected against bad guys securing credit in your name, is to check your credit history.

To that end, the federal government mandated the creation of a free joint program among the credit reporting agencies (Experian, Equifax and TransUnion) at AnnualCreditReport.com. Click, answer enough identifying questions about past addresses and financial history to convincingly prove that you are who you say you are, and print (or make a PDF of) your credit report.

And then here’s the thing: read it. Downloading your credit report and not looking at it is like buying exercise videos and not taking the shrink-wrap off the DVDs. It creates clutter in your space, maintains clutter in your life (messy finances, like lumpy physiques), and keeps your future (financial) health insecure. Downloading your credit report and not looking at it is like buying exercise videos and not taking the shrink-wrap off the DVDs.

Remember, your credit report doesn’t automatically include your credit score. You generally have to pay each of the three credit reporting agencies extra for that. But that doesn’t mean you have to pay — DiscoverCard and other credit card companies have started to provide FICO scores (for more on that, check our classic Paper For Your Plastic: Organizing a Better FICO Score) and CreditKarma, a company enabling you to track your credit score over time, is a non-icky consumer option.

4) Look back at 2014.

Did you get married? Divorced? Have a baby? Adopt? Did your own little company shoot through the roof? You’ll be doing lots of paperwork soon to work on your taxes for last year, but don’t forget about setting things up for the coming year.

If you’re employed by someone else, you may be subject to more or fewer withholding exemptions. Sit down with your HR department to figure out how to change your withholdings on your W-4.

If you pay self-employment taxes, be sure to adjust your quarterly estimated taxes accordingly.

5) Balance your portfolio (and not on the top of your head).

The best way to organize your future finances is to be an active participant and know what you’re invested in, in what proportions, and keep tabs as the economy changes the balance of your holdings. Paper Doll isn’t a financial consultant. I read Money and Kiplinger’s and watch the quarterly statements on my investments, and I don’t have a clue about the math on my own.

Sit down with your financial advisor, if you have one, or find a fee-only financial planner through the National Association of Personal Financial Advisors (NAPFA), and find out where your money is: in what companies or mutual funds, in what types of accounts (growth, income, real estate, magic beans, etc.), in what proportions, and create a plan for getting your financial future organized.

6) Create, or add to, your emergency fund.

Experts used to say to keep three-to-six months’ worth of expenses in a liquid emergency fund. (And no, as much as Paper Doll believes diet Coke should be legal tender, this means your money is immediately accessible.) During the recent volatile economic years, that’s been upgraded to eight months.

Not even close? Keep reading for baby steps to help you get there.

7) Create a spending plan.

The word “budget” is about as appealing as the word “diet” — and about as effective. Instead, take a few minutes as your mail comes in each day to jot down what you pay each month, or use a financial dashboard like Mint to track all of your spending and income. Review expenses, including:

- Rent or Mortgage

- Insurance (health, homeowners/renters, auto, etc.)

- Utilities (electricity, gas, cable, internet, land line, cell phone, data plans)

- Child-related (baby sitters, tutors, music lessons, activity fees)

- Home-related (homeowners’ association dues, cleaners, lawn care, exterminators)

- Credit card bills

- Student loan payments

- Other debts (car loans, personal loans, etc.)

- Controllable expenses (groceries, dining out, clothing, personal purchases)

Show up for mail call. Avoiding the truth about your financial situation is like not going to the doctor because you’re afraid of the diagnosis. The sooner you know what’s going on, the quicker things can start improving.

Know your income and your monthly expenses. If the latter seems to outstrip the former, prioritize what can be cut (even temporarily). Knowledge is power.

8) Automate savings. Don’t play games.

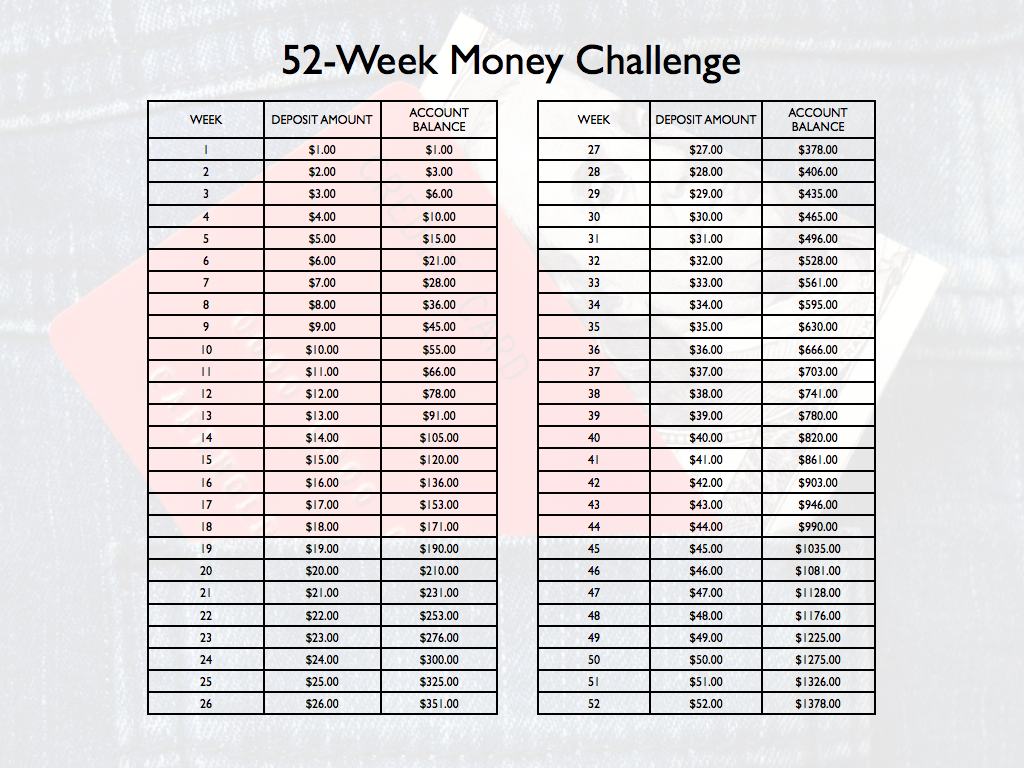

Have you heard about the 52 Week Savings Challenge? This got big exposure in 2014 and has been making the rounds again. I’d love to credit the graphic below, but it’s simply been EVERYWHERE for the past year-plus, and nobody’s taken credit.

The theory was that each week of the year, you bank one dollar more than the week prior. What’s a dollar? What’s a couple bucks? Keep it up and after 52 weeks, you’ll amass close $1400 (plus interest), almost painlessly. Conceptually, it’s appealing, but I’ve got worries.

The theory was that each week of the year, you bank one dollar more than the week prior. What’s a dollar? What’s a couple bucks? Keep it up and after 52 weeks, you’ll amass close $1400 (plus interest), almost painlessly. Conceptually, it’s appealing, but I’ve got worries.

Let’s start with the plan as written. Sure, $3 is no biggie for most of us. But as you go along and head toward the end of the year, it might be hard to find a loose $47 or $50 every week. From Thanksgiving to the end of the year, alone, that’s $296, and for people who are struggling, that’s a toughie. (For those who increase each week’s savings by $10 instead of $1, the end of the year would be similarly problematic.)

One solution might be to move backward or mix it up. Start at $52 at the start of January, decreasing the amounts each month. Or number scraps of paper 1-52, put them in a jar and pick one out each week to transfer to savings.

A larger problem with the system is that it’s hard to automate transfers with an incremental increase. You probably can’t tell your bank to take $X+1 and transfer that each week. But you know that it’s easier to do something when you don’t need to find motivation to accomplish it.

I think it makes more sense to automate your savings. How much do you want to save this year? Divide by 52, and whether you’re putting away $5 or $500 (lucky you!), set up an automatic transfer through your bank, or consider seeing if your employer will split your direct deposit between two accounts.

9) Identify to what’s expiring when, and what it’ll cost you.

If you’ve completed task #7, you’ve got a handle on regular expenses, but what payments do you make annually, or upon expiration? Don’t be surprised — review last year’s credit card and bank statements and think about past financial annoyances. For example:

- Amazon Prime — Did you get in on the low rate last year before it bumped up?

- Annually renewed gift subscriptions — Do you regularly bestow largesse?

- Discounted services — Did you get a discounted 12-month package from your cable company? Is your low-rate cell contract up?

- Professional expenses — Do you need to renew dues or pay for certifications or licenses?

- Travel costs — Do you need to renew your passport, Global Entry or Trusted Traveler programs, or airport lounge memberships?

10) Don’t guess. Know.

Being organized doesn’t just mean sorting the paperwork or the emails that come every month. It means knowing what you have and where you have it, keeping what works and getting rid of what doesn’t suit your goals.

- Write down everything you spend. (If you never use cash, a financial dashboard may suffice, but you’ll pay more attention to those little drips and drops of funds if you put pen to paper.)

- Balance your checkbook register, even if you haven’t written actual checks in eons.

- Check receipts against your online bank and credit card statements.

- Scan your credit card statements as soon as they arrive, and call to verify anything that looks hinky.

It’s your money, honey. Your finances are like children. Keep them safe, help them grow, and they’ll make sure you have a happy old age.

Taxing Conversations (Part 3): Form-Free Organizing

For most people, anticipating tax time falls on a continuum from vague annoyance to full-blown anxiety. Getting organized isn’t a panacea against all that causes us stress, but it can inoculate us against the worst of it. (As Paper Doll always says, organizing can’t prevent catastrophes, but it can help make them less catastrophic.)

In our last two posts, we’ve looked at the basics for getting started organizing for tax time (including making use of the IRS’s new Get Transcript service), and we’ve tried to make some sense out of W-2s and the myriad 1099s and 1098s that organizations and institutions are obligated to provide you.

But what about other documents, the kinds that don’t come on forms? Most will be proof of deductible financial transactions. While some may be provided directly to you at the time (like receipts for deductible expenses), others may be sent as part of correspondence. And, of course, other types of proof will require you do some hunting and gathering.

There are a few main categories to consider.

YOUR HEALTH

You could (and probably should) maintain a folder with the receipts and annotated (paid) statements for all of your family’s out-of-pocket doctor’s visits and other medical care. At the end of the year, flipping through this folder allows you to summarize your medical expenses and determine if you’ve met the IRS threshold for deducting them. If you use a financial dashboard like Mint and are faithful about making sure expenses are assigned to the right categories, you may not have to do any math at all.

For reference, effective this year, you may only deduct medical expenses that exceed 10% of your adjusted gross income. (If you are 65 or older, the old 7.5% applies until 2017.)

If you have health insurance coverage, your company probably creates an annual summary indicating how much health care you’ve used and the amount you paid/owed to medical providers during the course of the year. For example, Blue Cross Blue Shield calls theirs a personal health statement.

The trick is that most people have no idea that their insurance companies create these summaries, as they tend not to be mailed to policy holders. Insurers save mailing costs and hope you’ll know to log into your online account to search for your summary. (If your medical expenses for the prior year are too low to qualify to be deductible, just save a PDF of your summary for your records; don’t bother printing.)

If your insurance company doesn’t create annual summaries, you can usually use the “You Owe” column of the Explanation of Benefits (EOB) that your insurer sends after doctor’s visits, hospitalizations and procedures (and you should definitely be able to log in or call to request copies of these, if you’ve discarded them). If your medical expenses are low, no further effort is needed, but if it looks like you’ll be able to take deductions, using your annual summary or EOBs will give you a handle on which receipts or dated statements you’re seeking for tax support.

In the future, try to be vigilant about saving medical expense receipts, as your EOBs and insurance company summaries are not considered proof of what you spent on deductible medical expenses, only indications of what you owed to medical providers. Collect receipts for:

Medical care expenses: Be sure to only count expenses for which you paid and not portions paid by the insurance company or “network savings.” (That’s the amount knocked off the bill simply because you have insurance. If you were uninsured, you’d be charged more than the total paid by you and the insurance company!)

Pharmaceutical expenses: Call or visit your pharmacy to request a printout of all pharmaceutical purchases you made for yourself and your children during the prior tax year. (Because of privacy laws, your spouse may have to make a separate request.) Using only one pharmacy for prescriptions is advantageous.

Health Savings Account documentation: For every qualified medical expense you pay through your health savings account (HSA) or medical savings account (MSA), keep a record of the name and address of each person or company you paid and the amount and date of the payment. Since HSAs can be used to cover everything from orthodontia and acupuncture to durable medical equipment and contact lens solution, be sure to save your receipts, and if a receipt doesn’t clearly describe what you actually purchased, make a note at the top to ease your efforts at tax time.

Medically-necessary travel expenses: If you (or a family member) have conditions that require travel for treatment, you can deduct the travel costs. Keep a paper or digital log of the miles driven and use the current IRS standard mileage rate for medical purposes for 2013 (or 2014).

YOUR HOME

Home purchases: Maintain records regarding the purchase (or sales) documentation for a house, as well as records for closing costs, home inspections, fees paid to real estate agents and any records regarding private mortgage insurance.

Casualty and theft losses require documentation. For thefts, you’ll need to have proof of ownership (that’s why we recommend saving “big ticket” item receipts and videoing a household inventory), proof of theft (usually via a police report) and the date that the item was stolen (to proove it falls in the appropriate tax year).

For proof of loss due to casualty, maintain insurance company confirmation letters regarding the date and cause (ice storm, lightning, fire, auto accident, etc.) of a loss, estimates of original costs and costs of repair/replacement vs. what your insurance company will or will not pay (or has paid), and proof of ownership.

Moving expenses relate to actual costs (movers, truck rental, storage, etc.) and mileage. Did you move more than 50 miles in order to work at a new job/location? Check out IRS Publication 521 regarding what you’ll have to document.

Other home-related paperwork to save include:

- Receipts and records regarding any home improvement efforts you’ve made which materially increase the value of your home (which will have a tax implication when you sell).

- Records of purchases for your primary residence that qualify you for the Energy Star tax credits for the applicable year. This gives you credit for 10-30% of costs for energy-efficient purchases, including biomass stoves, various heating/air conditioning devices, insulation, water heaters and windows and doors, geothermal heat pumps, residential small wind turbines, and more.

YOUR HEART

Childcare/Eldercare costs: To take advantage of the Child and Dependent Care Credit, you’ll need documentation of the name, address, and Tax ID number for any care provider you’ve used for your kids or other dependents. Whether you’re using a babysitter from down the street or employing the services of a daycare facility (for either children or adults), use federal form W-10, Dependent Care Provider’s Identification and Certification.

Even if you’re not planning to run for elected office, be sure you’re not running afoul of Nanny Tax rules regarding FICA (Social Security and Medicare) and FUTA (unemployment insurance). Use a Nanny Tax calculator and keep careful records of what you paid, when, what you withheld and what you submitted to the IRS.

Charitable donations: You may get a nice form letter on a non-profit’s stationery, or they may bury your acknowledgment as tiny text in asterisked comments at the bottom of requests for further donations, so be diligent about opening your mail. A charitable contribution confirmation should include the name of the qualifying charitable organization, a date of donation or at least the date of the acknowledgment (i.e., something to prove the tax year of the donation) and a dollar amount (or a description of materials if an “in-kind” (non-monetary) donation was made).

Not every charity confirms donations in writing. For your protection, keep your own records regarding donations you make. Use the charitable request letter or even a plain piece of paper to mark the date, dollar amount and method by which you paid (check number or credit card name), and file it away. Again, if you use a financial dashboard, identifying all of your donation amounts will be easier. If not, read through your credit card statements and highlight the charitable donations.

YOUR HEAD

Educational expenses: Higher learning can be deducted and the number and type of credits (the Hope Credit, Lifetime Learning Credit, American Opportunity Credit), Savings Bond programs and more can be dizzying. Just be sure that in addition to keeping your 1099-T (for tuition) and 1099-E (for educational interest), maintain transcripts that show your periods of academic enrollment, as well as canceled checks, credit card statements or other receipts that verify the dates of payment and amounts you spent on tuition, books, lab materials, student fees, etc.

Work-related costs: Un-reimbursed employee expenses may include costs for your vehicle or for travel, meals, entertainment or even client gifts. Unfortunately, you have to itemize and not take the Standard Deduction for these to do you any good, and your combined itemized expenses must exceed 2.5% or more of your AGI. Since you have no way of knowing in January what kinds of expenses your employer might force you to rack up in July, start maintaining a folder for these records right away. If you didn’t save receipts during the year, your credit card should provide proof for the largest of the expenses, like airfare and hotel costs.

Proof of payment for jury duty: Yes, it’s your civic duty, and yes, you probably got paid less per day than what you spent at Starbucks to stay awake in the jury box. You might receive a 1099 if you racked up enough days of service, but be sure to keep your own records regarding this kind of payment. If your employers required you to turn your jury duty payments over them, keep records so you can request an adjustment to reduce your AGI.

Tips: If you work in the food industry or a personal service profession where you receive tips, the IRS expects you to keep track of and report what you’ve made. (Yes. Really.) Use a mobile app like TipCounter or Tip Log to record of the tips you took in and what you were required to “tip out” to other support staff members (like bus boys, shampooers, etc.). If you prefer paper, keep a notebook; the IRS form 4070A is pretty clunky.

Self-employed/small business expenses: If you own your own business, you need a unique, separate filing system for all your business-related expenses, including tax paperwork. Check the classic Paper Doll post Organizing Your Tax Paperwork–Part 3: Get Your Business (Receipts) Off The Ground to make sure you capture all the essentials.

I hope this series of Taxing Conversations helps you ramp up your efforts to organize for tax time. Remember, Paper Doll is a professional organizer; in the language of the web, IANAA (I am not an accountant) and IANYA (I am not your accountant). For individual tax-related questions, please contact an authorized tax preparation specialist or financial planner.

Follow Me