Paper Doll

Organize Your Social Security Account Securely with Multi-Factor Authentication

A few years ago, we discussed how Social Security replaced the annual paper statements (for individuals under age 60) with an online system called My Social Security, and I explained the steps for registering for an account. (Officially, it appears everywhere as “my Social Security,” complete with the italicized, lowercase “my” and color-coding, which Paper Doll finds frustrating and will not emulate, but let’s stay on point.)

In step #8 of the Paper Doll’s 16 Ways to Organize Your Money in 2016, I reminded you of the importance of registering for your My Social Security account.

My Social Security is similar to your IRA, 401(K), and other retirement-related websites, in that it provides essential information for planning your retirement. At the website, you can see your estimated benefits if you were to retire early (at age 62), at your full retirement age (for Paper Doll, that’s 67) or later, at age 70. You also have the opportunity to view your complete earnings record (and taxes paid for both Social Security and Medicare purposes), back to the first time you filed your taxes. For example, my record begins in 1984.

In addition to providing comforting figures (or spurring you to improve your retirement-related investment habits), the My Social Security online account gives you other opportunities. You can:

- Provide eligibility proof (for yourself or your family) that you have qualified to receive Medicare, disability, retirement, or related benefits.

- Identify under-reporting errors, generally caused when an employer neglects to provide an accurate 1099 to the IRS.

- Identify over-reporting errors, which most often happens when you’re a victim of identity theft. If someone fraudulently uses your Social Security number when applying for a job (which they would be unable to get under their own name and number), that income can be erroneously applied to your Social Security record.

Starting this month, as the result of an executive order for all federal agencies to provide more secure authentication for their online services, the Social Security Administration is creating an additional level of security to protect users’ privacy. Social Security, like other agencies that that provides online access to its customer’s personal information, will be using multi-factor authentication. That’s a fancy way of saying Social Security will be using more than one method to make sure you are really you.

It also means that you’ll have to do a little more to prove that you are you. Annoying? Well, wouldn’t it be more annoying to have someone fraudulently log into your Social Security account?

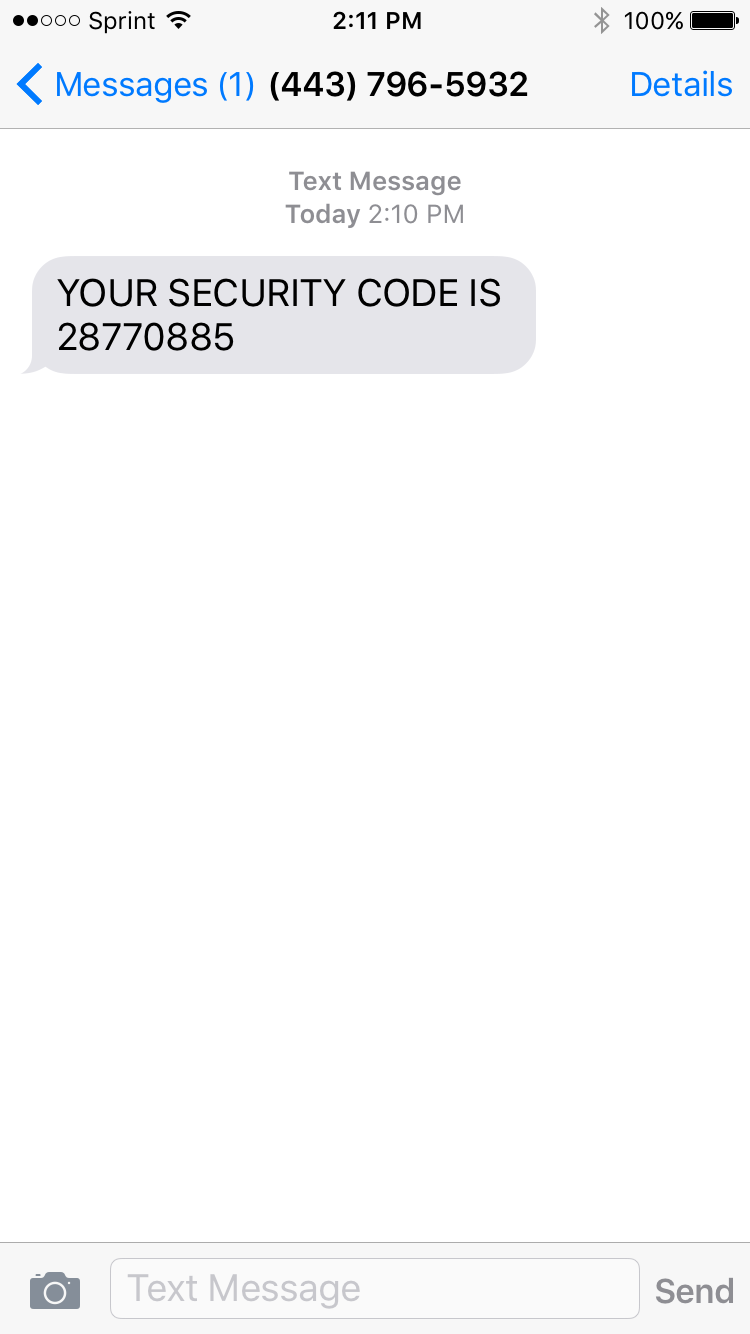

Effective immediately, when you sign into your Social Security account at ssa.gov/myaccount, you will still use your username and password, as always. However, the site will then ask you to add your text-enabled cell phone number. From then on, every time you log into your Social Security account, the system will text you a one-time security code you will then enter on-screen before you can successfully complete your log-in.

So, if you already have a My Social Security account, you can go test it out:

Step 1: Sign in with your username and password. (Remember, Social Security makes you change your password every 6 months, so be prepared to make note of your new password somewhere secure, like your password notebook or password app, and not on a sticky note next to the computer!)

Step 2: Get a text message from Social Security. It won’t say it’s coming from Social Security — there will just be a phone number and a one-time security code.

Step 3: Submit the security code by entering the code from the text into the field on the screen and hit “submit.”

That’s it! Because I had my phone next to the computer, the whole process took about six seconds. If you have to go hunting around your home or office for your phone, it might take a few extra minutes. Still, pretty easy for helping protect your data, eh?

There are some potential downsides to this plan, of course.

You have to have a text-enabled cell phone. If your first reaction is, “That’s silly. EVERYONE has texting!” then you’re probably younger, have some form of disposable income, and are used to texting. But not everyone has texting. Until mere months ago, Paper Doll enjoyed the gentle chiding of colleagues over this very issue.

Yes, it’s true, I had a flip phone and a 2000-era legacy account for 300 minutes for $30/month. I didn’t text because it’s nearly impossible to text out on a dumb-phone, and I froze texting on my plan so I wouldn’t be charged for incoming spam calls and wrong numbers. However, because texting has “almost zero marginal cost” for service providers, the advent of unlimited talk-and-texting plans means that upwards of 88% of Americans have access to unlimited texting.

If you don’t have an unlimited plan, your cell phone provider’s text message (and possibly data) rates may apply.

You have to be willing to provide your cell phone number to the Social Security Administration. But y’know, they have your address, they have access to all your tax returns, and they know how much money you make and will get back. Unlike your favorite coffee bar or fast food place, they probably won’t be tempted to sell your cell phone number to other marketers. I can’t be certain, but I think your cell phone number is pretty safe with Social Security.

So, from now on, if you want to be able to log into your account, you’ll have to be willing to adhere to two-factor/multi-factor authentication, and not only know your user name and password (which, again, Social Security makes you change every six months), but you’ll have to have your cell phone nearby so that when you log in, you can pause for a few seconds and type in that special code.

If you don’t have a text-enabled cell phone [note: it doesn’t have to be a smart phone] or you don’t want to give up your digits, you won’t be able to access your Social Security account. That doesn’t mean you’re out of luck — you’ll just have to contact Social Security “Old School” by phone, US Mail, in person, or by email.

Multi-factor authentication isn’t the wave of the future; it’s the wave of the present. My bank just upgraded its online app, and I went through the same process to prove my identity. The bank also gave me the option of using my thumb or fingerprint to log into my account. I have no doubt that future options will include voice authentication or retinal scans — perhaps psychic readings, someday! The point is, the safer your information is, the safer your financial future is, and isn’t that a goal of a more organized life?

The Pareto Principle, the Internet of Things, and Paper: A Printer to Make You Smile

Do you hate your printer? OK, hate is a strong word, but let’s talk.

My first printer, a noisy dot-matrix Imagewriter II, was part of my first Mac purchase in December 1985. It had a sleek white housing, took continuous-form feed (or fan-fold) paper (which, at the time, we likened to paper towels), and took black ink only. It had a few simple lights and buttons that didn’t require reading a manual to understand. It was sleek, did what it was told, and aside from being incredibly heavy, fit well with my student life requirements.

I’ve had a few printers in the past three decades, but none as pleasing as that Imagewriter II. Epsons and Canons and HPs, oh my! They’ve frozen, their drivers have mysteriously failed, and they have crankily refused to print with black ink when the cyan (that’s yellow, y’know) was not tippy-top. My current printer, since it was about six months old, refuses to print unless I unplug it from the power supply and plug it in again before printing. Every. Darn. Time.

You’d think there would have to be a better way! Well, one 27-year-old German industrial designer thought so, too.

PAPER

Ludwig Rensch had an idea. What if printers weren’t horrible, awful, frustrating pieces of technology that we depended upon for providing tangible representations of information, but were instead easy to use and nifty to gaze upon, and did what we needed?

His prototype? Paper: A Printer You Actually Want

In Rensch’s words:

Paper is a machine that can print, scan and copy in a pleasant way. It communicates its function, provides clear feedback and uses physical controls to operate the key functions with ease.

Seriously? No randomly blinking lights that are reminiscent of Morse Code but have no clear meaning?

No refusal to print in black and white unless three other color inks are full?

No ugly metal and plastic blob that makes your kitchen or living room feel industrial?

Well, that is a breath of fresh air.

THE BASICS

Instead of the black and grey boxes we’ve come to know, Rensch’s Paper is a brightly colored, lightweight, all-in-one printer/scanner/copier.

Imagine having a traditional flatbed printer or scanner but then turning it on its side. In lieu of a traditional stack of copy paper, Rensch’s Paper prints or copies to a continuous sheet (sans tractor-feed holes) on an upright paper roll with pages cut one slice at a time, much like Berg’s Little Printer, which I wrote about in Indulgences, Unitaskers and Paper Doll’s Take on the Little Printer.

Instead of black or grey plastic and metal that’s suited for office space, Rensch designed something that adds some quirky color. (Although Paper Doll, herself, has a lifelong history detesting the color orange, this blog will not hold that against Paper.)

The revised design makes it more compact, space-saving and mobile. There’s just one switch to select “scan” or “copy,” the LEDs let you know the status of Paper’s ink levels, and there’s a handle on top so you can pick it up at a moment’s notice without feeling like you’re carrying all your worldly possessions like in the closing scene from Fiddler on the Roof.

THE PRINCIPLES

As a professional organizer, I was delighted to see that Rensch developed the user interface to follow the Pareto Principle: 80% of your success comes from 20% of your effort. In organizing, we usually take that to mean that 80% of the time, we wear 20% of our clothes (wearing and washing, and storing them for easy access and wearing them again), while kids play with 20% of their toys, and so on. We focus on that to show how, when we discard some subset of the 80% were rarely use or touch, we regain space without regretting the loss of what we’ve donated or tossed.

Rensch says:

This is where the paradox of technology kicks in. Devices become incredibly complicated. Microwaves, Remote Controls, TVs, Cars, Ovens, Printers, Coffee Machines – they all have features that the majority of the owners never use. That is because they don’t know how or why, and they’re not willing to spend time and energy to learn how to use something. Especially in the days of streamlined services and apps, that make life so easy without instructions or efforts, it seems ridiculous that one has to read a user’s guide to heat up some food.

Rensch applied the Pareto Principle, considering the likelihood that 80% of the time, we only use 20% of the features of office appliances like printers, copiers, and scanners, so why create bulk and disarray with more than is needed? To achieve his goal, Rensch started at the beginning: he defined a printer’s key functions, analyzed the required procedures and simplified everything until he had created an easy-to-learn, simple-to-understand, aesthetically pleasing, and minimalistic product.

THE INTERNET OF THINGS…USED BY REGULAR PEOPLE

Rensch designed his Paper printer/scanner/copier as part of his graduate thesis Interacting with Things, which looked at how machines can be used more intuitively, and he asked three basic questions:

- Is it possible to transfer the quality of a digital user experience to an everyday object?

- Can we use physical feel to improve digital experiences?

- Are we able to make the information and the opportunities of the internet more tangible and experience them in physical things?

Then, he applied his concepts to three designs: Paper, PostPoster (an interactive graphical poster that uses a specialized conductive paint to generate sounds), and Musikbox 1188 and its app, a Bluetooth loudspeaker that lets you listen to music from your friend’s phone, tablet, or computer even if your friend (and her gadgets) are on the other side of the world.

The ever-expanding concept of the Internet of Things, upon which Rensch’s work is predicated, is key to understanding his designs. The Internet of Things, or IoT, is like where your Nest programmable thermostat or your “fridge of the future” can talk to your phone or computer and to one another to make your life more enjoyable. The thermostat can increase the A/C on a hot day so it’s just perfect when you walk in the door, but also send you an alert if your furnace is acting weird and the pipes might burst in winter. Meanwhile, your fridge can detect when you’re low on milk, your ingredients are about to expire, or you’re lacking what you need for the recipe you programmed in for Saturday — and then auto-order more groceries!

While most designers are eager for this Rise of the Machines and are welcoming our new programmable toaster overlords, the rare detractors are usually concerned with the security of IoT. Rensch, however, is more concerned about the humanity of it (per his thesis):

It’s the age of the smartphones. Like no other technology in the recent decades, they become part of our lives. Services offered in the internet allow us to do really complex stuff in no time, with no effort and in pleasant ways, for instant [sic] sell a bike to someone, find directions in foreign places and do business on the go. Static information that was bound in books and maps is now fluid and accessible from everywhere at everytime.

But these developments also must be viewed critically.

Even these miracle-machines have their down-sides. We all know people who are sunken into their Smartphone screens, absorbed by virtual worlds. And from time to time, we’ve been that person. All the Apps and Services are good and useful on their own, but to take care of everything only with our phones is distracting us from the outside world and our environment. Interactions with screens demand an enormous amount of concentration and leave the human motor functions and haptics unused.

Paper looks a lot like a throw-back to the days of mechanical buttons and dials, making use of the user’s fine motor skills to tune in the desired solution with basic physical controls and verify them with simple light signals. In that way, it reminded me of an old radio, where you turned the dial and when you hit upon an AM or FM station clearly, the tiny light would shine brightly.

Paper could work manually, only, but Rensch designed it to operate as an Internet of Things device — but better. According to Rensch, the device is meant to be seen as more of an “aesthetically pleasing creative tool that brings together the analog and digital worlds for transferring content from one to the other.”

Paper hasn’t left the virtual world behind. It can be operated via its own app on your mobile device or at a website in your computer’s browser.

To really appreciate the experience of using Paper, which to me, harkens back to my first experience with the design of Apple products, check out the video.

IN THE REAL WORLD

Of course, and I’m sure you expected this, there is sad news for those of us eager to try Paper out. You see, Paper is not-ready-for-prime-time because of the economics of the Office Supply Industrial Complex. Your frustrating HP or Epson is frustrating because it’s cheap, and it’s cheap because the companies know they can hook you with the low-price printer and weigh you down with printer ink made only for your style of printer, forcing you to come back time and again for a cyan you don’t really want or need.

Without Big Ink money to subsidize the development, manufacturing, and distribution of Rensch’s Paper, this pretty little thing won’t be on desks (or kitchen counters) anytime soon. We can only hope that the big guys will take Rensch’s approach under advisement, and give us a printer/scanner/copier we’d actually enjoy using.

The 2016 NAPO Organizers’ Choice Awards

Organizing is about losing (getting rid of things that no longer serve your goals, whether that’s clutter or bad habits) and winning (freeing up space in your home and office, time in your schedule, and peace in your thought processes).

Every year, the attendees of the National Association of Professional Organizers’ NAPO Conference and Expo vote for the best of the best among exhibitors. Categories in the 2016 NAPO Organizers’ Choice Awards include the best residential and business products, the best residential and business services, and an overall “Best In Show” award for whatever really captured the attention of the professional organizers and productivity experts in attendance.

And the winners were…

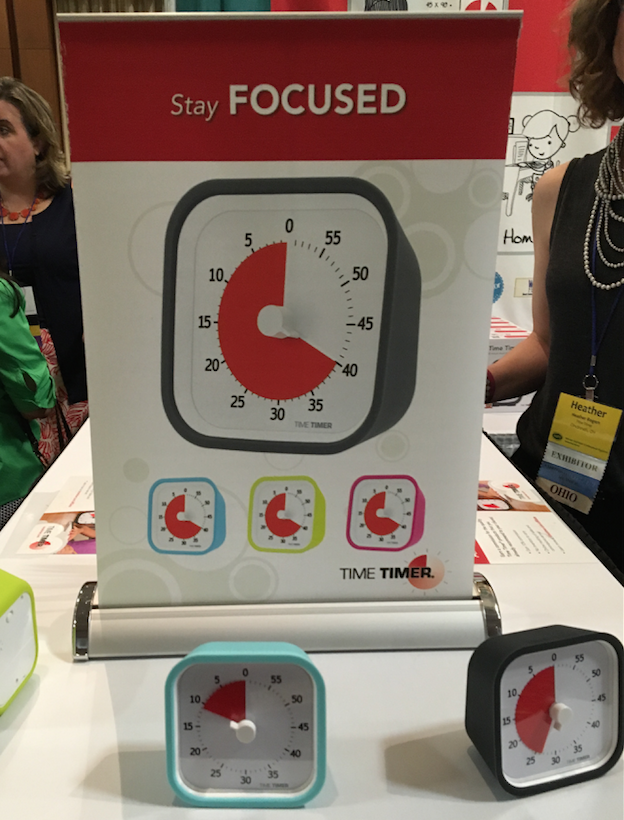

BEST RESIDENTIAL PRODUCT: Time Timer (modeled by Heather Rogers)

Few time management products could be considered more of a classic than Time Timer, which was already a beloved tool when I started my professional organizing business more than 15 years ago. At that time, back when dinosaurs roamed the earth, I owned one of the original Time Timers, an analog timer with a patented thick, red, circular “fanning-out” disc-like covering that diminished in size (from a maximum of 360° coverage for an hour) until time was up, and the red portion disappeared (hiding behind the clock display).

Few time management products could be considered more of a classic than Time Timer, which was already a beloved tool when I started my professional organizing business more than 15 years ago. At that time, back when dinosaurs roamed the earth, I owned one of the original Time Timers, an analog timer with a patented thick, red, circular “fanning-out” disc-like covering that diminished in size (from a maximum of 360° coverage for an hour) until time was up, and the red portion disappeared (hiding behind the clock display).

It was obvious that Time Timer provided a superlative way to explain the passage of time in a variety of circumstances — for teaching children the concept of time, for giving all participants in a discussion group equal time speaking (without needing an orchestra to “play them off”), for keeping meetings on task and on time, and for helping clients with ADHD and other time-related challenges master their appreciation of the passage of time. Let’s let Time Timer tell it:

The Time Timer product line has expanded in a variety of ways. From the original boxy Time Timer, there are now six varieties:

- Time Timer PLUS, with a quick-grab handle, a rugged case, and a durable clear lens to protect its patented red disk, measures 5.5″ x 7″ and requires one AA battery. It’s whisper-silent.

- Time Timer 3″, tiny enough to be tucked anywhere

- Time Timer 8″, perfect for your desktop, bedside, or anywhere you’re working

- Time Timer 12″, ideal for an office or meeting session, so you can see it from across the room

- Time Timer MOD is a 3.5″ x 3.5″ version that adds a little color to your productivity. The MOD features a colorful, removable, silicone cover for an extra layer of protection, like a thick smartphone skin. You can purchase the MOD with a Sky Blue, Charcoal Gray, or Lime Green cover, and there’s a Berry cover available separately.

- Time Timer MOD Sprint Edition ties in with the Jack Knapp book, Sprint, and comes with a Quick Start Guide highlighting the key principles of the “design sprint” framework developed by Google teams.

These Time Timers range from $29 to $39 on the Time Timer website.

Over the years, the Time Timer line branched out to include watches for a personal approach to managing time, from staying on task at work, home, or while doing school work to remembering to take medications or transition to the next location or task.

- Time Timer Watch PLUS Small — The small watch comes in Berry, Sky Blue, and Lime Green, with clock, timer, and alarm functions, vibrating and audible alerts, repeatable time segment settings (for interval training, Pomodoro productivity, etc.). The small watch has a soft silicone watch band designed to fit wrist circumferences of 4.75″ to 7″.

- Time Timer Watch PLUS Large, for larger wrists, has all of the same features, but measures 5.5″ to 8.25″ and comes only in Charcoal Grey.

Both styles of watches are $84.95.

Finally, because the need for time management doesn’t just live in the tangible world, there are Time Timer apps for the iPhone, iPad, Android phones, as well as Mac and Windows apps, offering customized timers. Prices range from $0.99 to $19.95.

BEST BUSINESS PRODUCT: Fujitsu ScanSnap

Longtime readers of Paper Doll know that good paper management sometimes means determining which information should exist in digital form, and that means mastering the skill of scanning.

Two years ago, in NAPO2014: Wirelessly Scanning the Horizon — What’s New in Scanning?, we looked at the Fujitsu ScanSnap iX500 Desktop Scanner. With an output resolution of up to 600 dpi for black and white (and 300 dpi for color), the ability to scan single-sided or duplex, a 25 page-per-minute scanning speed, a 50-page automatic document feed, one-button searchable PDF creation, and wireless scanning to Mac, PC, iOS or Android devices, the iX500 is still the belle of the scanning ball as far as professional organizers and productivity experts are concerned.

But the iX500 is only one member of the ScanSnap family, which also includes the mobile, handheld Fujitsu Document Scanner ScanSnap iX100. This little guy is only 14.1 ounces, so it lets you scan receipts and contracts on a business trip, school notes from the library or college dorm, or recipes and plastic ID cards from anywhere to your PC or Mac as well as well as your iOS or Android device. Via USB or Wi-Fi, the iX100 lets you scan to PDF (or even searchable PDF, if you’re using your computer), JPEGs, editable Word and Excel docs (again, on the computer), and send your scans via the ScanSnap Cloud feature to your Dropbox, Evernote, Google Drive, and other cloud services.

Paper Doll has often covered the best ways to decide if and what to scan, in classic posts like in Get Organized Month: Paper Control 102–Advanced Topics & Office Hours and Paperless vs. Less Paper: 6 Ways to Reduce Paper Consumption. However, I recognize that when it comes to the intricacies of the technical side of scanning, I am definitely not the ultimate expert. That’s why, on your behalf, dear readers, I rub elbows with someone who is. (Actually, in this person’s case, he’s super-tall, so his elbows would probably clock me in the ear, but you get the idea.)

If you’re new to going paperless, you definitely want to become familiar with Brooks Duncan of DocumentSnap. Start with his blog post, Going Paperless in 5 Easy(ish) Steps, and move on to his website for others of his gems:

- DocumentSnap Blog — from scanning into Evernote (and exporting out of it) to creating your own private cloud to document search, Brooks is your guy.

- Sign up to get his Paperless Cheat Sheet (linked from the front page) so that you can approach scanning in the right way.

- If you’re going to go the ScanSnap route, look into his Unofficial ScanSnap Setup Guide ($5 each for Mac or Windows, $8 for both.)

- And finally, if you’re thinking of scanning to the cloud, check out Brooks’ Paperless Security Guide, which, at $7, is a steal.

In addition to Time Timer and ScanSnap, the two big productivity stars, other winners of the 2016 NAPO Organizers’ Choice Awards included:

BEST BUSINESS SERVICE: NAPOSure

NAPOSure offers customized professional insurance for practitioners in the organizing and productivity fields. This includes coverage for property, loss of income, professional liability, auto, and employee bonding.

Because the federal government is slow to assign new NAICS industry classification categories, many professions that have existed for multiple decades (including professional organizers and productivity experts, coaches, ADHD specialists, and a variety of technology-related professionals) lack aAICS categorization, which makes it difficult to ensure appropriate professional insurance. For years, professional organizers were categorized by insurance companies as interior designers, even though that coverage approach was, at best, inappropriate. NAPOSure was the first insurance designed and customized for professional organizers.

Metropolitan Organizing’s Geralin Thomas has an excellent short post on How To Get the Best Insurance Coverage for Your Organizing Business, including selecting the appropriate types and levels of coverage.

BEST RESIDENTIAL SERVICE: 1-800-Got-Junk

We know that even if our clients are comfortable with purging the excess from their homes, not everything can find its way to a logical and useful next “home” via consignment or donation. Sometimes, stuff is broken, too far out of date, or otherwise too damaged to be of use to anyone, and that’s when 1-800-Got-Junk comes to the rescue. If you’ve got something non-hazardous that “two strong, able-bodied crew members can lift,” then they can get it out of your space.

This full-service junk removal company offers the upfront pricing, convenient pickups, and responsible disposal services that make professional organizers and our clients feel confident using. 1-800-Got-Junk was voted Best Residential Service, because they’ll pick up your household detritus, including old appliances and TVs, mattresses, furniture, carpets — even hot tubs! But they also service businesses, and will remove “junk” and recycle computers, monitors, and printers from your office space.

BEST IN SHOW: Lock & Rollin’ Flooring Solutions

I’m a generalist, working with both residential and business clients, but I specialize in paper and information management. So, I’m not often involved with garage and attic organizing systems, or other “heavy-duty” tools. However, clients are often looking for recommendations, and it was interesting to learn about Lock & Rollin’s Flooring Solutions.

Designed to help turn attics and crawl spaces into safe storage options, Lock & Rollin’ uses 32″ lightweight slats which slide together to form adjustable lengths of roll-out flooring that fit between attic joists. The creators state that it holds up to 250 pounds per square foot while being lighter than typical attic flooring, like plywood, so it should be easy enough to lift and carry, and they say it’s resistant to mold, mildew, and termites.

Lock & Rollin’ was surrounded by crowds throughout the conference, so all I could see while craning my neck was something that looked like a seriously heavy-duty Transformers-style yoga mat. At the risk of associating myself with an annoying “As Seen on TV” late-night commercial, as someone who fears falling through an unfinished attic floor, I found this video to be both explanatory and intriguing.

Congratulations to all the NAPO2016 Organizers’ Choice Award Winners!

Disclosure: Some of the links above are affiliate links, and I will get a small remuneration if you make a purchase after clicking through the links. The opinions, as always, are my own. (Who else would claim them?)

Paper Doll Takes a Play Break with Edo: Organizing the Imagination

Here at Paper Doll, the focus is almost always on how paper (and the information it represents) can be better managed to improve your productivity, reduce your stress, save you time, and put your money to good use. We don’t usually talk about play.

Here at Paper Doll, the focus is almost always on how paper (and the information it represents) can be better managed to improve your productivity, reduce your stress, save you time, and put your money to good use. We don’t usually talk about play.

“Play is often talked about as if it were a relief from serious learning. But for children play is serious learning. Play is really the work of childhood.” ~ Mr. Fred Rogers

Abraham Maslow (yes, for those of you who just barely recall Psych 101, the Hierarchy of Needs dude) said, “Almost all creativity involves purposeful play.”

And Maria Montessori, founder of the Montessori approach, based her eponymous schools on the principles of self-directed activity, hands-on learning, and collaborative play.

While we strive for order and productivity, we sometimes fail to notice that creating disorder, and then order out of that, is how children (and creative adults) make sense of the world.

When I work with (adult) clients to help them divest themselves of their own clutter, we start with some basic questions: Do you wear it or use it? When was the last time you used it, accessed it or read it? If it were more accessible, would that increase how often you incorporate it into your life or work? Does it fit with who you are, or who you are actively trying to be?

Understanding organizing issues with children it isn’t very different — though they may lack the self-awareness to discuss their toys and clutter. They snuggle with beloved stuffed animals that are “loved to death,” with floppy ears missing, and own bins of crayons worked down to the nubs. But more often, they have popular and expensive toys, given by well-meaning grownups who remember not a whit of childhood, that languish in toy chests or on shelves, while the cardboard boxes in which they were shipped become playhouses, or rocket ships, or science labs, or any of a million other things that fuel the imagination.

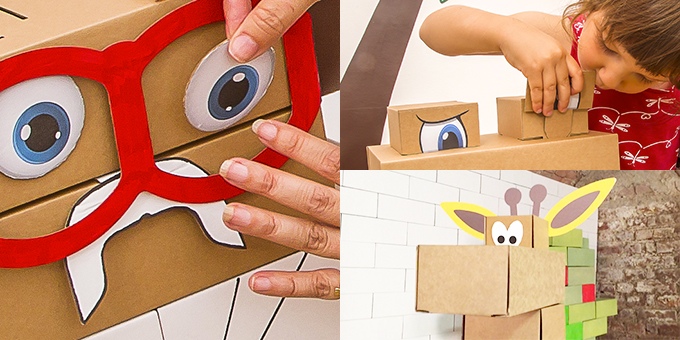

It’s with this notion, that cardboard boxes or bricks can organize a child’s play so that it’s robust, fulfilling, and full of reinvention, that we look today at Edo.

EDO

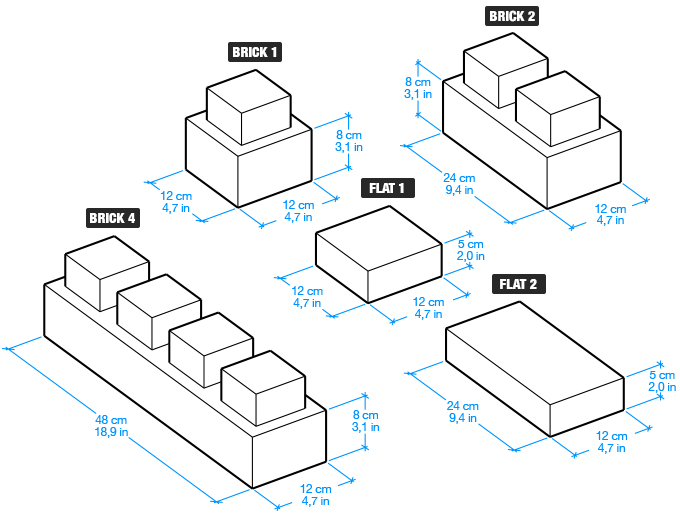

Edo are sturdy, flat-packed building blocks made of high-quality micro-corrugated cardboard. The Italian trio who created Edo developed the patent-pending features to provide a perfect strength-to-weight ratio in the assembled bricks. Parents (or older kids) simply fold the bricks into shape and then are ready to build new worlds.

In the words of the creators:

With Edo, kids can create and play with their own ideas. The possibility to create something from scratch stimulates imagination and creativity. The dimension of the blocks and the chance to create life-size buildings develops spatial awareness and social skills. Edo lets kids play alone while inspiring the creative thought process and easily gets contagious in groups of all sizes.

Edo currently has three types of double-decker Lego-like (but, y’know, cardboard!) bricks based on combining single-decker pieces folded from the “flats.”

Edo is environmentally friendly, as the bricks are made of recycled cardboard, and they are 100% recyclable. The dye colors are non-toxic, and the creators state that the cardboard will be FSC-certified in the United States and will have CE-certification in the European Union.

Once properly assembled, each Edo block can support at least 100 pounds, though the video below shows ways to push the envelope! (So, I guess…don’t show the video to Grandpa?)

They come in Havana (or what we’d call cardboard brown), Icy White, or (eventually) in a mix of five colors (green, red, yellow, blue, and orange). The individual bricks can be colored, spray-painted, or otherwise “transformed over and over again to tell countless stories.”

Add-on kits with accessories, such as ears and eyes for making animals, people, or monsters, can be purchased separately. Of course, DIY accessories can be made at home, by parents and children, with scraps of cloth, junk jewelry, pipe cleaners, and whatever else has outlived its otherwise practical usage.

The annoyance of many types of children’s toys is that when they are not being played with, they turn into a mess. Small items like toy cars and small blocks fall to the bottom of toy chests or bins never to be seen again unless the chests or bins are completely upended. Larger toys don’t fit anywhere, and, at best, get pushed against a wall, untidily. However, Edo can be stacked, even turned into a wall of bricks, flush against a playroom, bedroom, or family room wall.

Edo can also be used for functional storage and utilitarian purposes. You can turn it into a bookshelf, a bed-side table, a drawing table or child’s desk (with a smooth surface placed on top). As the web site notes, “You can also build the legs for a coffee table to be used with any top and of course you can create other furniture.”

The delightful Edo has a Kickstarter right now, with three weeks to go. Please visit their page to view their package descriptions in greater detail. Right now you can get:

- Edo 25 — a sort of starter kit

- Edo 100 (also available in a two-pack) — you can build almost anything, including a T-Rex!

- Edo 500 — for developing serious Edo architecture!

- The Edolinis (also available in a two-pack) — 27 blocks plus three pairs of eyes to create life forms for which the creators hope to develop sets of clothes and uniforms, such as for firefighters, business-suited office workers, doctors, and construction workers.

- Choose Your Animal (also available in a two-pack) — Pick a crocodile, giraffe, or elephant!

- The Snowy Castle of Wonders — If this were available with enough pieces to build it for a full-size adult, Paper Doll would move in.

Pledge prices range from $35 for the smallest set to over $500 for the 500-piece set (which is more suitable for a school or entertaining all the kids in your neighborhood). Shipping is available to the United States, Canada, and European Union countries. Delivery dates for orders placed through the Kickstarter are planned for October 2016. [Edited to note: Ten hours after this Paper Doll post went live, and one week into the Kickstarter, Edo’s creators have canceled the funding campaign, with explanatory notes in English and Italian. Happily, this is a temporary pause, and Edo’s campaign reboot should be back up in September, in time for the holidays. Timing, eh?]

Oh, and even if you don’t have kids, the concept still holds that play boosts productivity.

Now skedaddle! Go play!

Paper Doll’s NAPO2016 Recap: Smead Takes On Coloring, Minis, and Corners

As we discussed in last week’s Paper Doll post on Samsill’s new products, there’s a particular delight to the pseudo-shopping aspect of attending the NAPO Expo. For me, there’s a specific magic in the air when I get to see exciting new products from our industry stalwarts, and nowhere is that more true when I get to see new paper management products.

Yep, I’m an office supply fangirl. Particularly a paper-related office supply fangirl. That may explain why, although I love all my NAPO Corporate Associate Members and NAPO Conference Expo vendors, I have a special place in my heart for my friends at Smead, who have been kind enough to have me on their Keeping You Organized video podcast twice, once to talk about small business organizing, and again to discuss organizing-related fears.

So, of course, as soon as NAPO President Ellen Faye cut the Expo ribbon with those giant scissors, I made a beeline to my Smead buddy, Leiann Wright.

With file folder aficionados (say that three times, fast) crowding around the booth, it took three visits over two days to learn everything about the new offerings, and I’m still finding items in the 2016 New Product Guide that I missed in person!

Today, we will focus on just a few of the new products that had conference-goers talking.

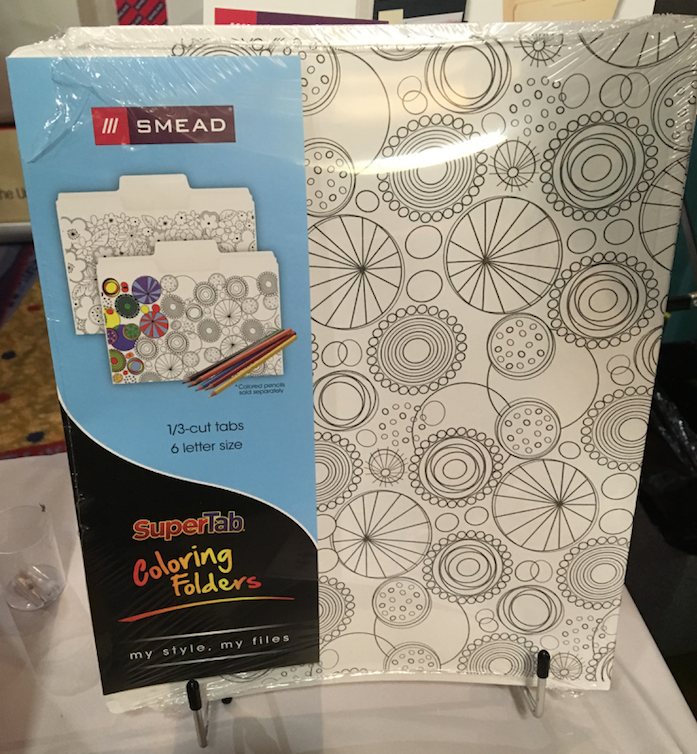

SuperTab® Coloring Folders

Smead’s SuperTab® folders aren’t exactly new. I originally reviewed them back in Paper Doll Dishes Out the Super Goodies back in 2011. Back then, I explained that with larger tabs, one could:

Smead’s SuperTab® folders aren’t exactly new. I originally reviewed them back in Paper Doll Dishes Out the Super Goodies back in 2011. Back then, I explained that with larger tabs, one could:

1) Use Larger Text — This makes it easier to see labels from across the room, assists those with all variety of vision issues from aging eyes to macular degeneration, and ensures that offices with files bearing many similar-appearing labels (Johnson/Jonson/Johnsen) can be discerned with relative ease.

2) Use Multiple Lines of Description — Although brevity is the soul of wit, and although we professional organizers usually advise keeping file folder labels as simple as is serviceable, sometimes a label just has to say more.

3) Use Icons — In addition to labels, colored dots, stickers and other icons can be used to help categorize the content of a folder, and the larger the tab, such as with SuperTab® folders, the more expansive the available space for adding definition and clarity.

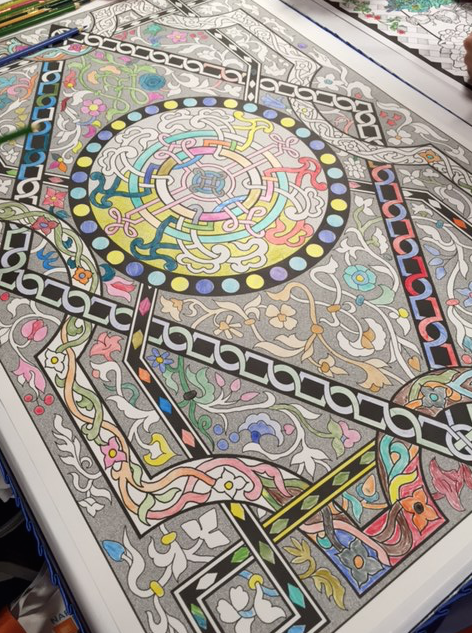

This new product takes the practicality of the 90% larger tab of the original SuperTab® and combines with a colorful new trend.

As Paper Doll doesn’t have any artistic inclinations (and recently went into anxiety-mode at a recent visit to one of those paint-the-pottery places), I have long wondered what it was about these best-selling and highly coveted adult coloring books I was missing. So many of my high-profile colleagues, including Deb Lee, Janine Adams, and Danielle Liu, enjoy this pastime that this year’s NAPO conference planners added a lounge area with oversized coloring pages at which my friends could be found doodling in spare moments, when in prior years, they might have chugged coffee or returned phone calls.

If you’re unfamiliar with this latest habit of adults pulling out crayons and markers to color, I direct you to A Neuroscientist Patiently Explains the Allure of the Adult Coloring Book from New York Magazine. My favorite aspect of this article notes:

Our prefrontal cortex is responsible for coordinating thousands of decisions each day, from which socks we should wear to life-altering relationship and career choices. As an unconscious response to this so-called daily “decision fatigue,” making a series of small, inconsequential decisions (teal or mahogany for this squiggly line?) may give us a refreshing sense of self-control after a long day of big, important ones.

Smead SuperTab® Coloring Folders are letter-sized and come in geometric and floral designs. The tabs are 1/3-cut and constructed of 11 pt. (reinforced) paper stock, which works with colored pencils, crayons, and markers. The bottoms of the folders are scored for up to 3/4″ expansion, and all folders are made of 10% recycled content with 10% post-consumer material.

I should note that 11 pt. paper stock is a little less robust than the 14 pt. heavyweight folder stock I prefer, but I suspect that for typical office work, aesthetic appeal may outweigh (pardon the pun) sturdiness for those who are visually focused or inclined to reduce stress with conference call coloring.

Find the Smead SuperTab® Coloring Folders at office supply stores and Amazon, in packs of 6 or 12, with a dozen running about $12.

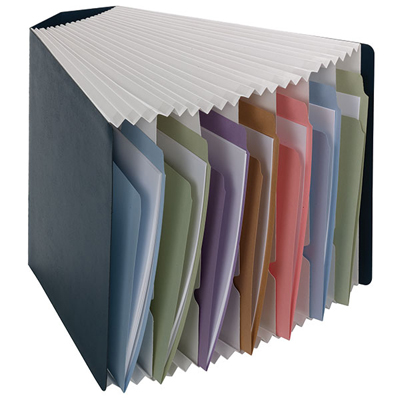

Mini Stadium® File

Fans of the original Smead Stadium® File, which we reviewed in our NAPO 2010 Conference Expo Recap, liked the fact that it was portable, lightweight, and (surprisingly) sturdy. It had 12 pockets, could hold up to 900 sheets of paper, and most importantly, was stepped like a riser or stadium to ensure that nothing could be hidden.

The Mini Stadium® File has many of the same features as the original, but is more compact, so it’s suitable for correspondence and small projects you need to keep on your kitchen counters, dorm room desks, and small offices. As always, the idea is that if you clear your paper clutter, categorize it, and contain it, you’ll get your space and sanity back. Smead has taken this approach to the desktop file box and made it fun-sized.

The three pockets are tiered and fixed so the papers don’t fall to the bottom of the organizer, and is suitable for holding both papers and folders. There’s also a small, low-profile, flat outer pocket. Like its predecessor, the Mini comes in Navy with fully lined Tyvek® gussets to allow for expansion. The Mini also includes labels for alphabetical (A-Z), monthly (Jan-Dec), and daily (1-31) filing, as well as household subjects and blank indexing.

Right now, the Smead Mini Stadium® File seems to be sold primarily at smaller online office supply stores and at Amazon, where it costs $19.95.

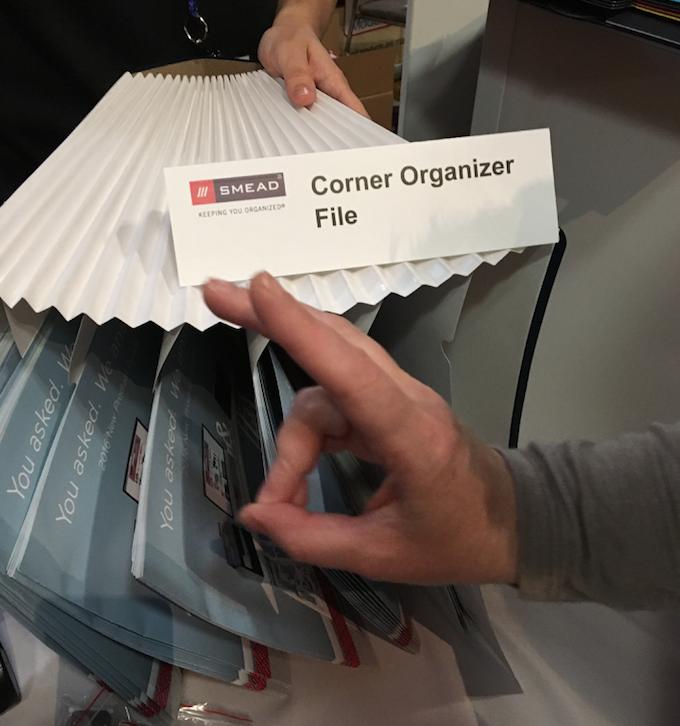

Corner Organizer File

Smead Corner Organizer, with Bunny Ears

While the two prior products are updates of popular Smead products, the Corner Organizer File seems to turn a product on its head, or at least its side. Picture if the traditional Stadium were turned 90° and cut on an angle to provide accessible storage in a corner, where two walls, a desk/wall edge, or the top of a filing cabinet meets a cubicle divider. Paper Doll‘s first thought was that it worked to make typically dead spaces more accessible much like Lazy Susan kitchen cabinets allow you to store food or small appliances in the netherworld where two cabinets meet at right angles.

Smead’s Corner Organizer is letter sized, Navy with a white interior, and has seven expanding pockets. It’s suitable for storing top-tab and side-tab folders. Like the Mini Stadium® File, the Corner Organizer File doesn’t seem to be distributed by the major office supply big box stores, but you can find it at a variety of smaller and online stores, as well as Supply Geeks and aAmazon for about $28.

These are just a few of the Smead products that caught my eye at NAPO2016. Be assured that after our recap series, I’ll be circling back to discuss some of their fun new poly products — poly expanding files, poly file boxes, and poly pockets — as well as new document wallets, line extensions for Viewables, and soooo much more about folders. Until then, enjoy this photo of professional organizer Lita Daniel showing of her grown-up approach to today’s moment of Zen.

Photo courtesy of Dan Slutsky, NAPO Photographer Extraordinaire

Photo courtesy of Ellen Delap, NAPO President-Elect

Follow Me