Paper Doll

Paper Doll’s NAPO 2017 Recap: Samsill Upgrades Pop N’ Store & Pleases Paper Mommy

Every year at the NAPO conference, we look forward to seeing new products and hearing about upgrades to ones we’ve seen before. This was definitely the case with Paper Doll‘s visit to the Samsill booth at NAPO 2017, and it was a delight to know that Samsill paid attention to customer and professional organizer feedback for making their products even better.

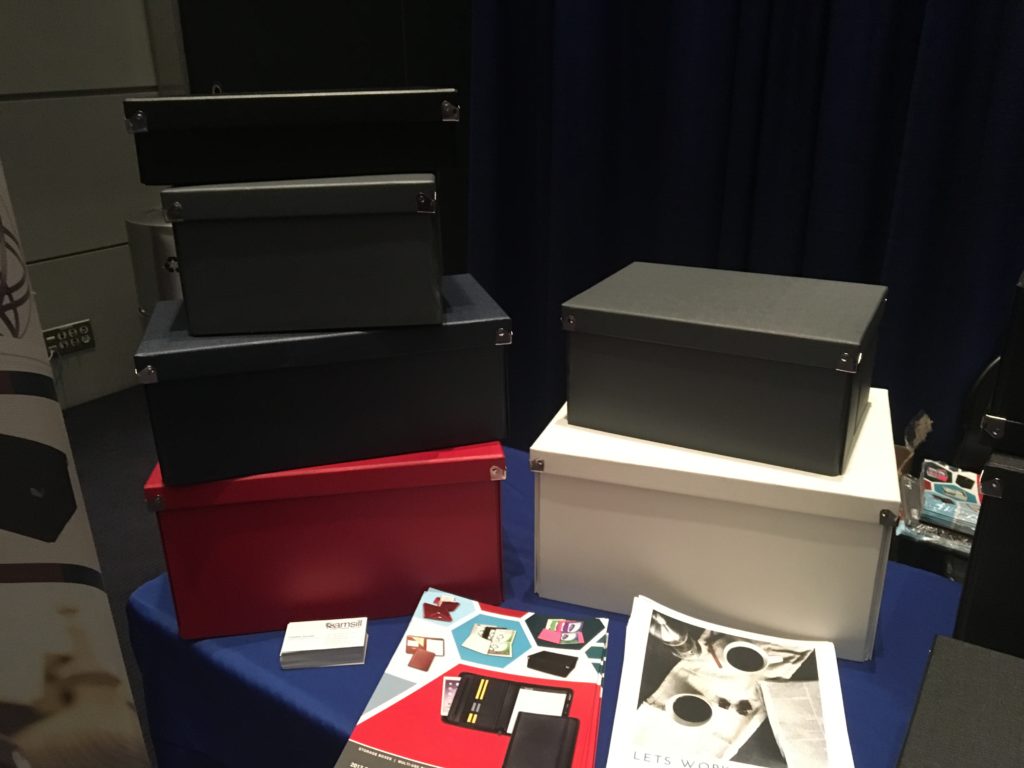

In last year’s Paper Doll‘s NAPO2016 Recap: Samsill’s Duo & Trio & Pop…Oh, My!, we took the time to get to know Samsill, previously famous mainly for its binders, and got to explore its new offerings, particularly the Pop N’ Store line of attractive storage boxes, flat-packed but ready to POP up into functional form in five seconds.

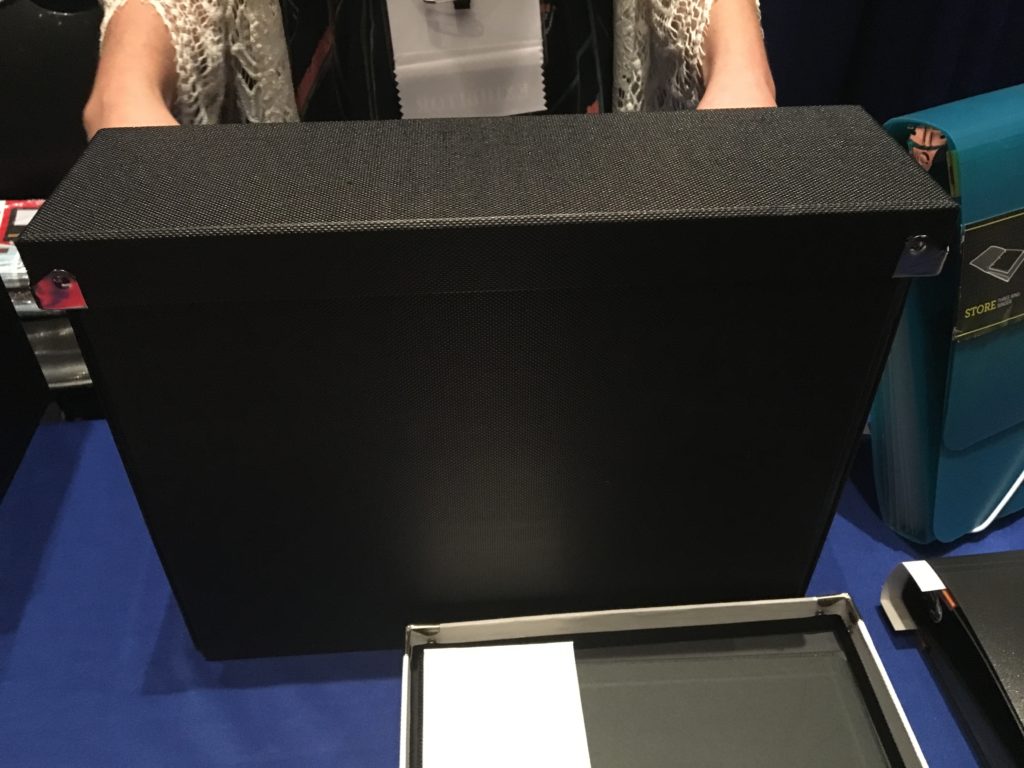

The Pop N’ Store boxes introduced last year are made of heavy-duty chipboard and are covered with Lotus Seed™ textured paper. The corners of the original Pop N’ Stores are metal-reinforced for added durability and charming aesthetics, while the box bottoms are covered in a scratch-resistant fabric designed to protect delicate surfaces, like fancy-schmancy tabletops and shelves. The boxes are made of 100% recycled material and 70% post-consumer material.

Samsill really understands the advantage of flat-packed, collapsible, stackable storage. College kids need an easy way to move into and out of their dorm rooms and apartments; office-dwellers enjoy the ability to mix-and-match supplies as needed without having excess empty boxes on display; and professional organizers love being able to bring solutions to clients without giving up breathing room in our vehicles.

Originally, the lidded, decorative storage boxes came in six colors (black, navy, red, brown, grey and white) and five sizes with the following (internal) dimensions:

- Document Box (12″ x 8.5″ x 3″) for $11.99

- Essential Box (14.625″ x 7.5″ x 5.34″) for $12.99

- Medium Document Box (12″ x 8.625″ x 5.8″) for $14.99

- Medium Square Box (9.75″ x 9.75″ x 5.75″) for $11.99

- Mega Box (14.625″ x 11.875″ x 7.34″) for $16.99 all at Amazon

But it was this year’s newcomer to the Pop N’ Store collection that really caught my eye. First, however, some personal background. Longtime readers of the blog know that the inspiration for all things organizational is Paper Mommy of Paper Mommy Knows Best fame. Unfortunately, last December, Paper Mommy was viciously attacked by a rogue comforter while stripping her bed and had a bad fall, directly into a wall, fracturing her C2 vertebra and her wrist.

Note, even with a severely fractured wrist, Paper Mommy maintained perfectly manicured fingernails. However, it must be noted, in the final score, it was Wall: 1, Paper Mommy: 0.

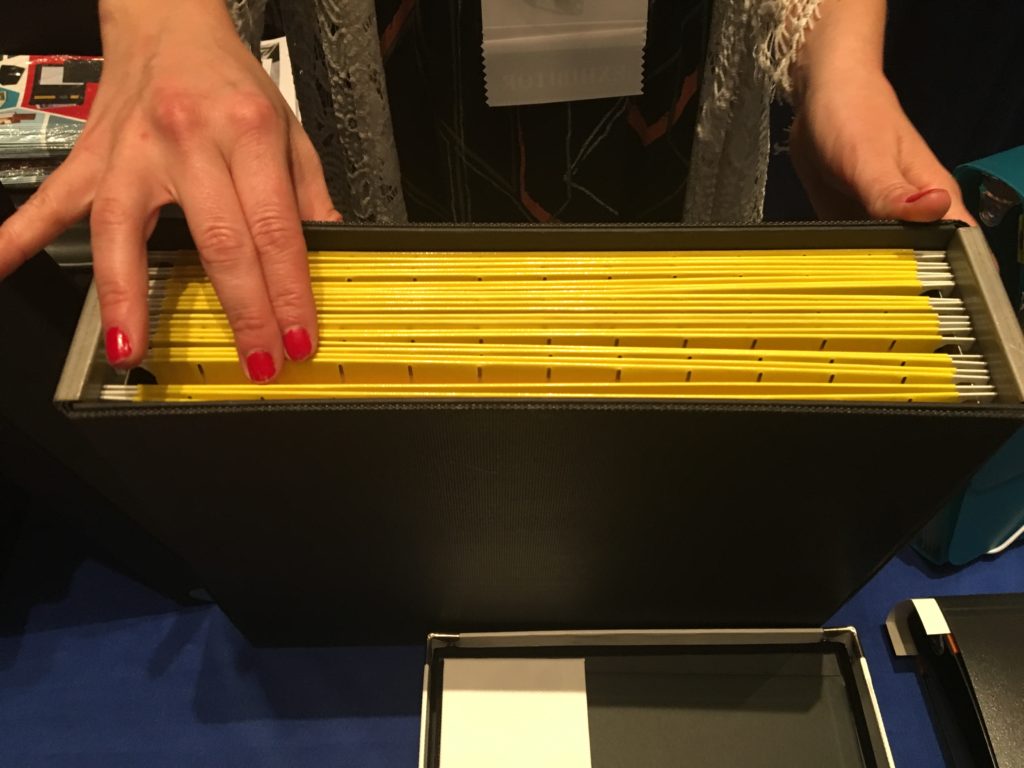

It’s a testament to how loveable she is that I flew to Paper Mommy HQ in Buffalo in mid-January to help her tackle all of her financial and medical paperwork. Normally, Paper Mommy‘s files are kept in her kitchen office drawer, but accessing them while one-handed and wearing a neck brace was proving to be problematic. However affable she is in general (and that’s a lot), as a client, she was a bit persnickety, and rejected all suggestions for potential desktop file boxes. However, I believe that if we’d known about Samsill’s newest line extension, she’s have acquiesced happily!

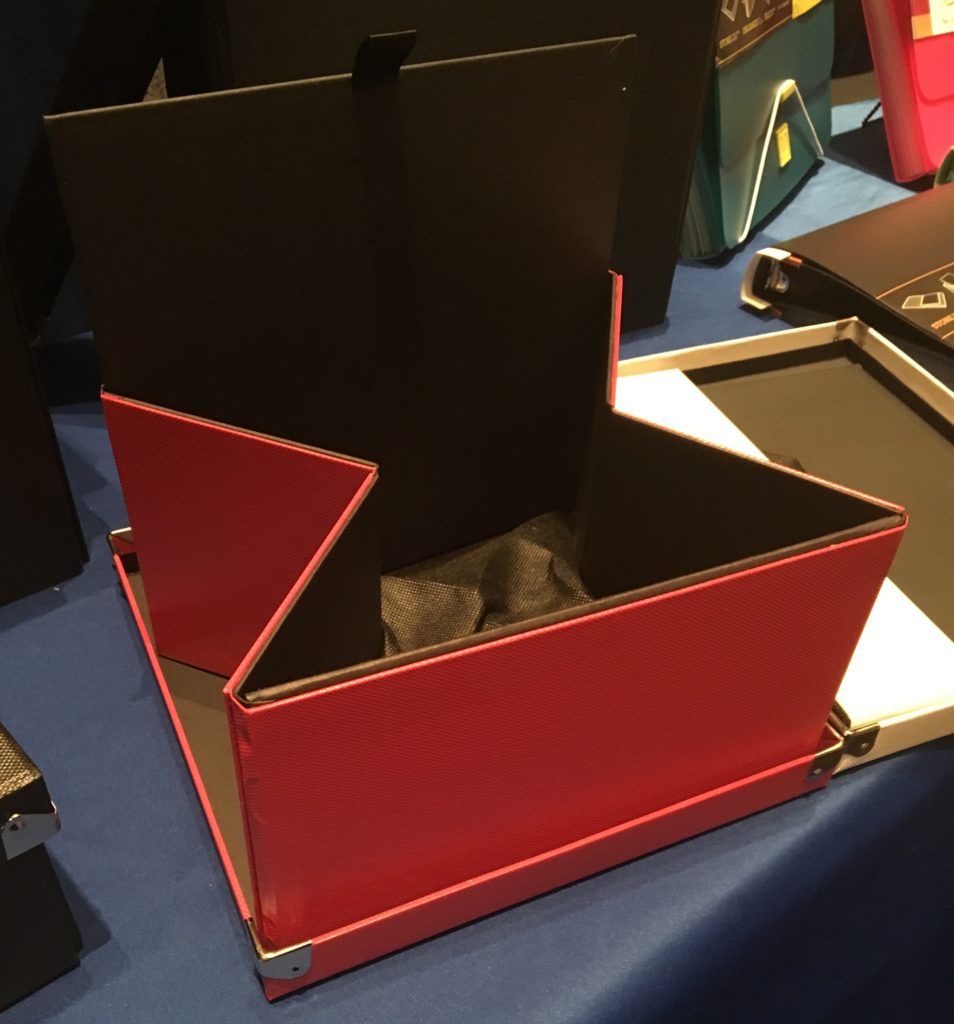

The organizing community told Samsill, “Hey, we love the Pop N’ Store boxes, but why don’t you have a filing box? Something flat-packed and pop-up-able, but with a hanging file rail?” So Samsill made one. And, “Oh, could it have a lid, too?” And Samsill said, “Make it so!”

Along with the file box, there’s also a new cube-style box for fitting perfectly with those Ikea-esque cube shelves, and a new smaller box for corralling small doodads.

These new boxes have been designed with the same heavy-duty chipboard and Lotus Seed™ textured paper, so they’re as sturdy and elegant as the original Pop N’ Stores. For next year, I hope Samsill continues to upgrade this series by adding bright, cheery colors. (Black, navy, red, brown, grey and white are fine for oh-so-serious workplaces, but for the rest of us, let’s hope Samsill brings their usual penchant for brightness to this line, too!)

The products are so new, the measurements and pricing have not yet been announced. Follow Samsill’s accounts on Facebook and Twitter to be updated when they become available.

Above, I caught Samsill’s Digital Marketing Associate, Christine Hampel, chatting with New York City professional organizer Leslie Josel. In addition to being Paper Doll‘s fellow Cornell University alum (Go Big Red!), author/organizer/inventor Josel is a stellar student organizer, head honcho of Order Out of Chaos, and the mastermind behind the award-winning Academic Planner: A Tool for Time Management® (deserving of a blog post in its own right).

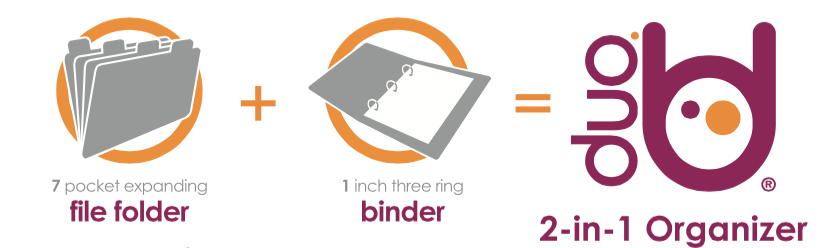

The Samsill DUO 2-in-1 Organizer combines a seven-pocket expanding accordion file with a 1″ three-ring binder. The file portion holds up to 225 sheets of paper, and the accordion-style expanding section includes blank write-on index tabs so you can customize your labels. The DUO weighs 14.6 ounces and measures 9.8″ x 1.5″ x 11.8″.

I’ve previously described the DUO as a grown-up Trapper Keeper, perfect for storing tax prep documents or financial information (budget, bills, coupons, and shopping lists), family medical files (with categories for tests, prescriptions, and dietary rules), or household plans (with sections for decorating, monthly upkeep, garden plans, etc).

The durable and water-resistant DUO is made of PVC-free, acid-free, archival-safe, environmentally flexible polypropylene and comes in hot pink, turquoise, green, burgundy, orchid, black, light blue, and coral.

The DUO (seen below, right, in hot pink and green) was originally designed with dual elastic clasp and cord closure to provide access to each portion (pockets or binder) individually while maintaining a secure closure to either or both sections.

Leslie Josel’s work with students led her to provide feedback to Samsill regarding how to improve the already-nifty DUO and TRIO portfolios we’ve previously covered. For example, note the original DUO on pink on the left, with the dual elastic. Leslie found that her students were having trouble manipulating the two elastic bands and keeping the DUO open, so Samsill is modifying the design to include a Velcro closure and other rumored advances.

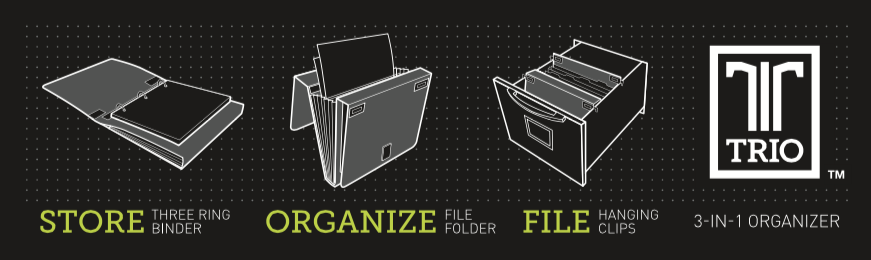

The TRIO, Samsill’s 3-in-1 Organizer, which also got so much attention last year (seen in black and turquoise, above, left), has all the same features as the Duo.

However, the TRIO also has retractable hangers, turning the entire TRIO into a combination hanging file, binder, and interior folder set. Store it in a file cabinet, filing drawer in your desk or desktop file box. Thanks to the hangers, even though the Trio is poly, you never need to worry it’ll slide to the bottom of the drawer.

The word is that there are also design modifications on the horizon for Samsill’s TRIO, but shhhhhhh. Spoilers, Sweetie.

Watch Samsill’s blog for updates, such as the post for their new Padfolios, and find Samsill products on Amazon.

Paper Doll’s NAPO 2017 Recap: New Twists on Time Timer

The concept of time management (as opposed to its practice) is simple: identify your priorities, spell out the tasks to complete, and focus on them for a period of time. When appropriate, transition to other tasks. Done!

But what if “time” is a fuzzy concept for you? Well, you wouldn’t be the first. Not long after returning from NAPO 2017, I took one of Tara McGillicuddy’s superb ADDClasses.com webinars, ADHD and Punctuality: Even You Can Learn to Be On Time with ADHD Coach Lynne Edris. Although I have an innate sense of the passage of time, possibly from my prior career working in television (where time is, literally, money), the issue of conceptualizing time in order to work productively with it is something that plagues many who seek help with organizing and productivity.

During the webinar, Edris talked about how some of the contributing characteristics of ADHD, including distractibility, impulsiveness, and hyper focus, impact time blindness, as defined by Dr. Russell Barkley.

WHAT DOES TIME LOOK LIKE? WHAT DOES TIME FEEL LIKE?

When you have a strong sense of time, you are aware of what time it is now, how much time you have left (to perform a task, or before you have to change gears and transition to a new task or location), and generally how quickly time appears to be passing. When your sense of time is wonky, your productivity can feel cursed.

I once had a client, a successful engineer, who overestimated how much time some tasks would take (causing him to procrastinate and avoid the labor) and underestimate how long others usually lasted (leading to double-booking as meetings ran long). As a test, I once encouraged him to work for fifteen minutes on a task he’d been avoiding, while I observed him. After eight minutes, he looked up, exasperated, certain that I had lost track of time and that far more than fifteen minutes had elapsed. Nope. Again at twelve minutes, he was sure either I or my timer was off. In terms of engineering, this client was a genius, but he had the conceptual sense of time of a pre-schooler. And he’s not alone.

Of course, none of these factors are unique to those with ADHD. I think we have all experienced time dilation such that ten minutes in the final act of our favorite television show can speed along (darn you, Shonda Rhimes!) while ten minutes while waiting in the “little room” at the doctor’s office, relentlessly bored and denied the ability to people-watch, drags by.

Learning how time works — mapping the representational to the reality — can also be problematic. For example, we know that digital time is harder for children to comprehend than analog time — and this can be the case for some adults, too. Take this anecdote about the author Douglas Adams:

In the early days of personal computers, he said, people got very excited that their spreadsheet programs could finally create pie charts. This was considered a revolutionary advance, because as everyone knows, a pie chart visually represents a part-whole relationship in a way that is immediately obvious—a way that, to be more specific, mere columns of numbers did not. Well, the hands of an analog timepiece form wedges that look very much like a pie chart, and like a pie chart, they represent a sort of part-whole relationship in a way that requires a bare minimum of mental effort to comprehend. Not so digital timepieces, which for all their precision say nothing about the relationship of one time of day to another.

It’s just harder to conceptualize — visualize — the passing of time with digital clocks. They’re merely numbers separated by colons. But the analog clock provides a clear visual distinction between moments — and this is the central advantage of one of the most popular time management tools the organizing and productivity industry has ever seen: Time Timer®.

The original Time Timers were plastic, battery-operated, analog countdown clocks. Rather than a minute hand and second hand, Time Timers had red, circular cellophane-like discs that diminished in size (from a maximum of 360° coverage for an hour) until the time was up, and then the red portion disappeared (hiding behind the clock display) and a buzzer went off. Kids (and adults) using the Time Timer were able to get a sense of the “feel” of how time passed.

Paper Doll has covered Time Timer many times, most recently in our detailed coverage of NAPO 2016’s Organizers’ Choice Award Winners. But our friends at Time Timer know that time marches on, and so do they. Let’s look at some new developments on the time front!

NEW DURATIONS — THE LONG AND THE SHORT OF IT

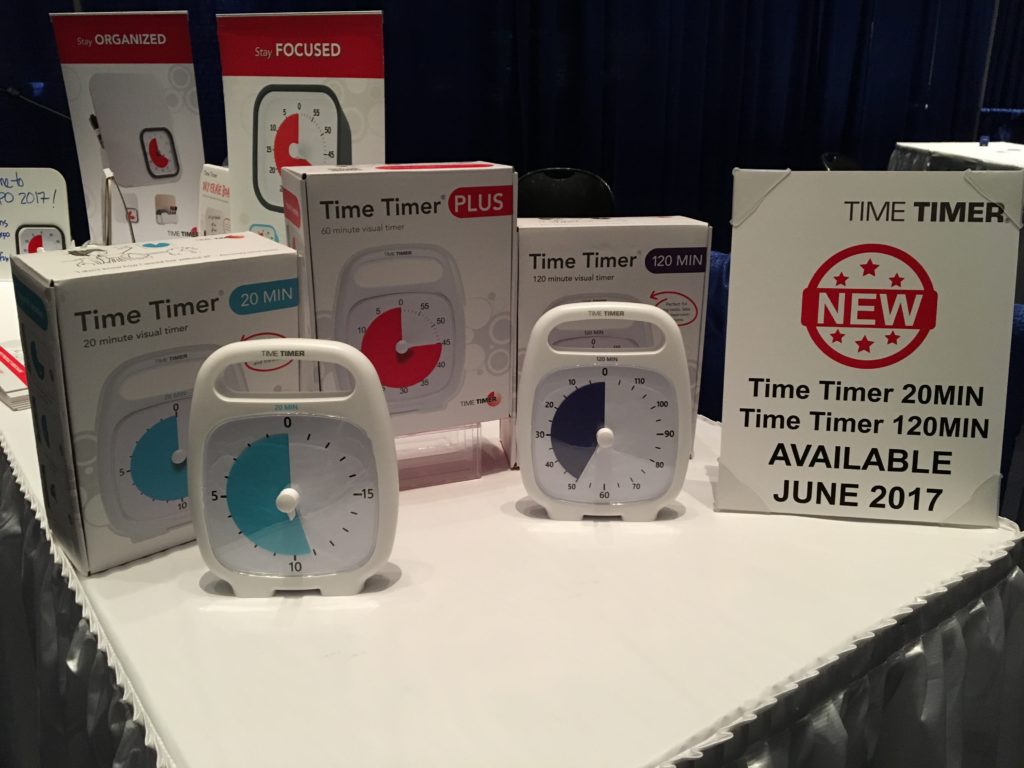

Historically, all of the Time Timers (the Plus with the quick-grab handle, the 3″, 8″, and 12″ handle-free versions, and the adorable and brightly colored little Mods) have all had one thing in common: they measured durations of up to 60 minutes. For children, and for anyone who has a general difficulty with visualizing time flowing, this makes sense — the Time Timer emulates how time elapses on a clock face.

The two new versions of the Time Timer look like the traditional (white) Plus with the quick-grab handle, but have two new distinctive features. First, the new versions come in two different durations: 20 minutes and 120 minutes. Second, for the first time, instead of red, the time-elapsed disc is in new colors, robin’s egg blue for the 20-minute timer and purple for the two-hour version.

The 20-minute Time Timer is designed to offer a greater visual impact for shorter tasks like homework blocks and practicing musical instruments, as well as keeping on-task for workplace meeting agenda items. Because it doesn’t emulate the hour-long clock face, it’s definitely better suited for those who understand how time flows, but merely need visual reminders of its passage. I think it’s an attractive addition to the line, but feel Time Timer missed a chance to capitalize on the productivity industry’s love for the Pomodoro Technique and should have created a 25-minute timer.

I can see the 120-minute version of the Time Timer working well for high school and college students taking timed practice tests and for keeping both adults and kids on-task for larger projects.

Both of the new versions run $38.95, use one AA battery, and have a volume control for the “done” tone. Both will be available as of June 2017.

THE BIG NEW TWIST

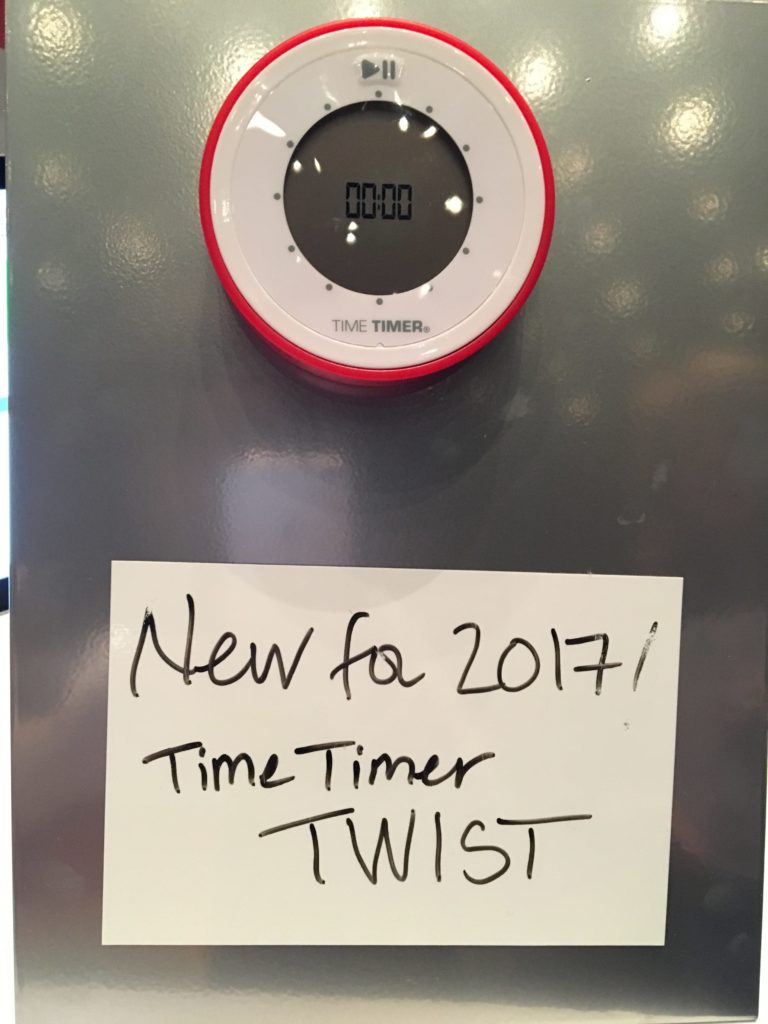

You know you’re at a conference for professional organizers when you hear people squeal in delight from across the room — over a new timer shape! The hubbub of the expo this year was definitely, “Have you seen the Twist?” Chubby Checker would have been impressed!

The first thing you notice is that this new Time Timer is round! As all other versions of the Time Timers could stand on their own, you might wonder how to ensure that you can see the face. Magnets, baby! The external ring is in the classic Time Timer red, while the ring around the face is white, with a grey central section for the time display.

Set this unique timer for up to 90-minute durations by turning the outer ring. Verify the timer digitally, but watch it count down in an analog format — silently, of course, like all other Time Timers. Then stick it on your fridge or filing cabinet for an elegant way to visualize the passage of time.

THERE’S AN APP FOR THAT

Fans of Time Timers were delighted a few years ago when the iPhone and Android apps were launched, and the multi-color Time Timer iPad app wasn’t far behind. With all three, you can customize your countdown timers, save and name them for re-use, change colors, create alert options, and more. What was missing was a desktop app — until now.

The Time Timer Desktop App comes in eight languages: English, Danish, Dutch, French, German, Japanese, Portuguese, and Spanish. It’s compatible with Mac and Windows, and sells for $19.95.

OH, WILL YOU LOOK AT THE TIME?!

In addition to a wide variety of timers, apps, and watches loved by most organizers, there’s a special place in Paper Doll‘s heart for one particular Time Time accessory: the Time Timer Dry Erase Board.

This small, desktop-suitable, dry-erase board has a cut-out space perfect for my favorite Time Timer, the Mod (with the Berry cover). Heather Rogers, Time Timer’s VP of Marketing and Operations, illustrates the advantages of the board, which runs $18.95, below.

(Now they just need a magnetic Twist/dry-erase combo!)

THE ADVANTAGES OF VISUALIZING TIME

Even people who are adept at managing time, in general, can be led astray due to excitement or adrenaline. At my NAPO-Georgia meetings, a modern Time Timer is on display to ensure that speakers maintain focus and keep to the schedule. At a recent committee meeting, we used a classic Time Timer to ensure nobody had to be the bad guy and cut off overenthusiastic participants. Time Timer’s website notes a variety of uses of their products in different realms, including:

At Work

- Maximize efficiency with LEAN manufacturing principles—time is money!

- Keep meetings on track at a glance, giving everyone equal time to participate.

- Creatives: generate ideas more quickly through timed brainstorming.

- Healthcare: keep schedules moving and effectively manage time spent with patients and clients.

- Sales: deliver succinct, impressive presentations without the “mental math” of how much time remains.

At School

- Teach the concept of time and learn to visualize time as a measurement: What does “5 minutes” really mean?

- Manage transitions in (and out of) the classroom.

- Transition “ownership,” allowing educators to be children’s ally, not the “enforcer” of the classroom schedule.

- Keep students calm, focused, and aware of time during practice and while conducting timed standardized tests to satisfy state standards.

At Home

- Ease and manage daily routines: morning, dinner, cleanup, bath & bedtime.

- Monitor turns and time for homework, computer use, instrument practice and play time.

- Manage time-outs: help children calm down and watch frustration fade as the red disk vanishes.

- Encourage punctuality: when the red disk disappears, we’ll go!

- Organize: keep track of valuable time and break large, overwhelming projects into small, manageable 10-minute activities.

Do you use a Time Timer? Is there a version you’d like them to make? Share in the comments.

Paper Doll’s NAPO 2017 Recap: Schooling the Organizers

What do professional organizers do at a conference, you may wonder. Do we rearrange the hotel room furniture, tell the housekeeping staff how to declutter their carts, and roam the halls looking for dysfunction we can set right? (Maybe, no, and sorry, but I’ve been sworn to secrecy.)

Each year, Paper Doll takes time out to share the delights of the National Association of Professional Organizers (NAPO) annual conference and expo. Sure, the focus here on the blog is generally on the goodies at the expo — the products and services that delight and surprise us (so I can delight and surprise you) — but I always like to take time out to share what happens with the rest of the conference.

Today, before we settle in for multiple posts on the wares displayed at NAPO2017 in Pittsburgh, I’d love to tell you about what we learned.

EDUCATIONAL TRACKS

Some professional organizers are Certified Professional Organizers or aspire to do so, and our conference is one of the many ways we earn some of our Continuing Education Units (CEUs). But all of the professional organizers attending our conference, no matter how little or great their experience, travel far and wide for the exemplary educational opportunities available.

This year’s NAPO conference had six educational tracks:

- Business Operations & Growth — These sessions focused on topics like getting media attention, hiring teams to grow your business, speaking professionally, leadership concepts, and some behind-the-curtain discussions about the profession.

- Client Interaction — I always tell clients that the difference between cleaners and professional organizers is that cleaners focus on the stuff, and professional organizers focus on the person who owns the stuff. In this track, we covered working with clients in mourning, non-verbal communication skills, eliminating “brain clutter,” building rapport via listening skills, and understanding our clients with ADHD.

- Niches — There are more than 40 sub-specialties within the professional organizing field. During NAPO2017, educational sessions covered ADHD (including improving communication when one spouse has ADHD and empowering those with ADHD), working with estates, organizing academic professionals, and offering virtual organizing services.

- Residential Organizing — From organizing overwhelmed families and understanding our clients’ unspoken concerns, to smart space design and appraising household possessions, attendees had multiple options for investigating new niches for their residential-oriented organizing services.

- Technology in Organizing — Technology sessions provided knowledge about eliminating email overwhelm, technology tools for productivity, time management and technology strategies for the home, and using Evernote to capture and organize clients’ memories.

- Workplace Productivity — From business consulting and corporate productivity and organizing sessions to How to Prioritize When Everything is Important to an introduction to QuickBooks, this track improved attendees’ ability to expand their expertise in productivity issues for themselves and their clients.

PAPER DOLL GETS SCHOOLED

I like to mix things up and take offerings from all of the tracks. Some years, I lean more toward one theme, like technology or productivity, but this year, different mini-themes began to emerge. For example, on the first full day of the conference, I noticed that I was focusing on death. It may sound maudlin, but it was actually a very enlightening day.

First, I attended Empowering the Grieving Client to Organize with Joy, presented by Dorothy Clear, CPO®. In the residential side of my organizing practice, I’m called in to help clients who have been stuck, either unable to process grief or find themselves dealing with the detritus of the fugue state in the aftermath of a loss. Western society tends to think of mourning and grief as finite — measured in eight days or six months or a year — by which time people are expected to be “whole” again, but anyone who has suffered grief knows that it comes in waves. Thus, grief is less like having the flu and more like having a chronic illness — there are good days and bad ones, and a small thing can cause the day to turn on a time.

In Dorothy’s excellent session, we learned how to recognize the physical manifestations of grief, and delved into the differing types of grief, including anticipatory grief, unanticipated grief, ambiguous grief, and complicated grief. Dorothy also taught us strategies for working with our clients to create bonding and rapport, witnessing their tales, counteracting negativity, and managing backsliding — all of which will help us support our clients’ goals and processes in a more compassionate, customized way.

As my “Death Day” continued, I attended Organizing Dead People, a session presented by NAPO superstar (and my friend) Judith Kolberg. Only our Judith could take a topic so potentially depressing and imbue it with such lightness, with a sense of humanity and humor, to make it bearable and educational.

From Judith, we learned how to ease the burdens of grieving families and survivors by eliminating laborious and time-consuming decluttering, identifying essential documents, and providing expertise about local resources. From creating a plan with the executors, to clearing clutter, to helping with the disbursal of possessions, Judith provided a wealth of expertise and strategies for organizing those who have gone on to their reward.

The next day of the conference saw me focusing on technology and productivity, two intertwined topics. I began with Nine Technology Tools to Skyrocket Productivity, presented by the twin geniuses friend-of-the-blog Brooks Duncan and fancy-shoe-wearing Amy Payne, CPO®.

From tools for maintaining contact with, and organizing information about, our current and prospective clients and vendors, to password management software, to text expansion tools for saving yourself the headache of writing the same phrases millions of times, this session was a gem. (And I’ll be sharing some deeps secrets they imparted over the coming weeks.) There were well-beloved tools like Evernote (which I used to prepare my conference posts), and Hazel (automated organization software for Mac about which I’ve heard Brooks talk for years but haven’t yet managed to start using). But there were also surprises, like “quick capture” video tools Jing and Snagit (I usually use Quickcast), and a fascinating diagram/flowchart-maker called LucidChart. I’m giving myself the advice I’d give clients, and blocking time on my schedule this month to learn how these newer tools can help me help my clients.

In the afternoon, I was excited to finally meet podcaster and productivity coach Zachary Sexton in person after so many tweets. His session on being Busily Unproductive was like a personalized coaching session crossed with a refresher course in counteracting the unproductive “stuck” feeling we often face. I left this session with a brainstormed (and now, prioritized) list of things that will move me forward toward my goals.

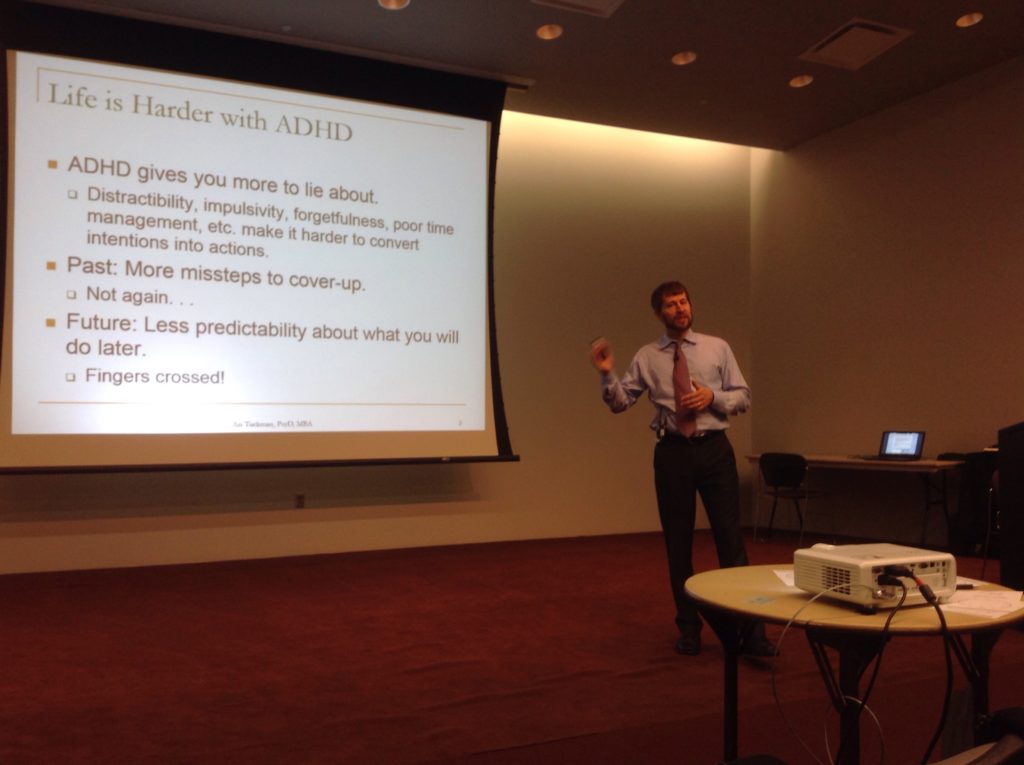

By Saturday morning, I was ready for a deep dive into psychology, and nobody shares knowledge about ADHD better than Dr. Ari Tuckman, author of More Attention, Less Deficit, and whose repeat performances at our NAPO conference are the stuff of legend.

This year, Dr. Tuckman spoke on What Are Your Clients’ Favorite Lies? — and anyone who has ADHD (and many of us who don’t) will recognize the falsehoods we tell ourselves, from “This will just take a minute,” to “I don’t need to write that down — I’ll remember it!” Dr. Tuckman walked us through strategies to help all of us understand and defend against these mindsets.

To close out the major educational sessions, my friend and Nashville colleague Liz Jenkins, just up the road from Paper Doll HQ in Chattanooga, shared Beyond the Label Maker: Tools of the Trade. Unfortunately, Liz moves so quickly around the stage, that the adorable shot of her trying on a headlamp for our amusement is just a blur — perhaps she’s a superhero? — but here’s Liz, on the left, with LA’s John Trosko and New York City’s Amy Neiman.

After 15+ years in the business of organizing, it may be surprising but there’s still a wealth of resources (and tactics) to be learned from our colleagues and the way they organize, but Liz floored us with her “BoBs” (kits) of essentials. And now I’ve learned about Zott’s adhesive dots.

EXTRA CREDIT MATERIAL

In addition to formal educational sessions, our conference attendees heard a keynote from Jones Loflin entitled Grow, Cultivate, Prune and Harvest: How to Blossom Even in Times of Change. (And who among us doesn’t struggle with change? I’ve been known to say that I love novelty, but hate change, so I suspect that mean I was ripe for what Jones had to share. Meanwhile, organizing superstar Monica Ricci (my chapter president when I joined NAPO more than fifteen years ago), led two star-studded business leadership panels.

By far the most popular aspect of the conference this year was the addition of three concurrent discussion sessions during which attendees watched TED Talks and delved into the issues in a hearty round-robin of discussion.

- Presidents’ Award-winning NAPOite Hazel Thornton led a presentation on Susan Cain’s The Power of Introverts for a discussion on Networking for Introverts.

- Katie Tracy led a discussion of Amy Cuddy’s Your Body Language Shapes Who You Are (from which you might know about “superpower poses”).

- I attended the Debbie Lillard-moderated presentation on Tim Urban’s Inside the Mind of a Master Procrastinator. It’s one of my favorite TED Talks, and I believe we all have known the Panic Monster and Instant Gratification Monkey. We not only examined the procrastination obstacles our clients face, but became a unified support group in search of strategies for our own issues with putting things off.

NEXT LESSONS

In the upcoming posts, I will be sharing the highlights of the NAPO2017 expo — the most intriguing products and services. Check them out here:

- Paper Doll’s NAPO 2017 Recap: New Twists on Time Timer

- Paper Doll’s NAPO 2017 Recap: Samsill Upgrades Pop N’ Store & Pleases Paper Mommy

- Paper Doll’s NAPO 2017 Recap: A Sneak Peak at Smead’s All-in-One® Organizer Kits

I’d like to leave you with two thoughts.

First, thousands of professional organizers around the world commit to expanding our education and expertise so that we can help our clients reach their goals. Whether our clients are new parents or students or office managers, people with ADHD or physical disabilities or anxiety, or those seeking to straighten out their homes or workspaces or their tasks or their thoughts, there are professional organizers working to learn and grow to help them. If you or someone you know would like to be more organized or productive, please visit NAPO’s provider search tool.

Second, Paper Doll has been covering NAPO conferences for a long time. Just type “NAPO Conference” into the search box on the left side of the blog, and you’ll have quite the organizing adventure.

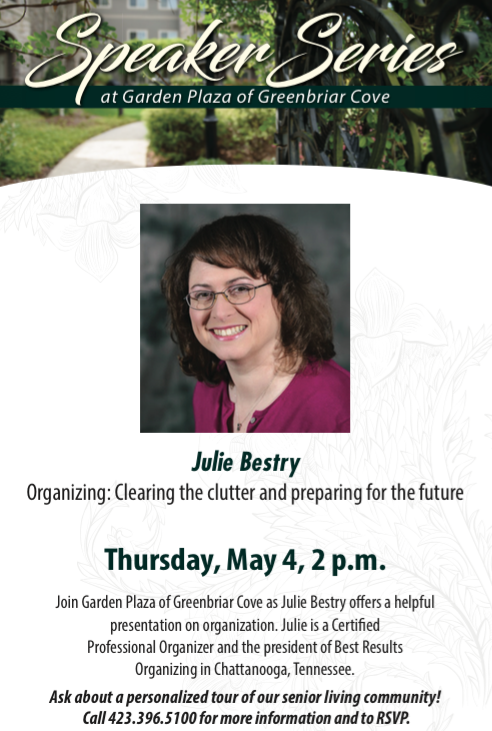

Paper Doll Doubles Down on Downsizing: Chattanooga-area Event

In this space, we usually talk about organizing paper, information, and finances. Of course, we often dig deeply into the intellectual and emotional reasons why we keep clutter, and how we can best arrange what’s left. But if you spend any time peeking behind the curtain here at Best Results Organizing (that’s Paper Doll HQ to you blog readers), you know that my services and expertise extend beyond on the realm of paper and information.

Over the past few years, one arm of my business has focused on helping individuals and couples downsize to prepare for the next stages in their lives. Sometimes, this is just clearing the decks to make room for more of the fun stuff of retirement. Other times, it’s in preparation for a move — to a smaller home or senior living. This has included a variety of speaking engagements, including the following upcoming presentation.

If you find yourself in the Chattanooga, Tennessee or North Georgia area, please consider attending. The presentation will cover:

- All the reasons why it’s so difficult to let go of things, even things we know we don’t need and won’t use

- How to understand the three types of relative value of the things you might downsize — sentimental value, financial value, and practical value

- What goes into determining marketability of the items you might want to sell, including rarity, age, and condition, and why not everything “old” is an antique, and not everything collected is a “collectible”

- Strategies for coping with the stresses of downsizing

- How to choose where downsized items should go when they leave your home

- and much more…

So, if you are starting to think about downsizing for the next stage in your life, and you’re in Paper Doll‘s general geographic area, please call Garden Plaza to RSVP.

Of course, that’s not all that’s going on for Paper Doll. I’m spending this week in Pittsburgh with my fabulous colleagues at the National Association of Professional Organizers Annual Conference and Expo. I’m looking forward to telling you about all the organizing wonders I see and what we learn in our classes.

Paper Doll’s Tax Time 2017: Shredding Advice and Free Shredding Coupons

Americans had a few extra days to file their taxes this year. The usual April 15th deadline that so many of us dread fell on a Saturday. Normally, the deadline would be pushed to the following Monday, but because April 17th is Emancipation Day, a legal holiday in Washington, DC, tax returns were granted another reprieve, until April 18th.

But what about a reprieve from all of the paper clutter that results from preparing your taxes? Have you completed your federal and state (and perhaps local/municipal) returns only to find that you are being crowded out of your workspace by a mountainous “to shred” pile?

Tax time is the perfect opportunity to clear out your file folders, your desk drawers, your purses, wallets and pockets, and to shred all those random receipts and documents that you don’t need to support your tax returns. Why? To protect your identity!

Of course, if you don’t know what you need to keep vs. what you should shred, Paper Doll has you covered with Do I Have To Keep This Piece of Paper?

DO-IT-YOURSELF

Shredding isn’t difficult, but it’s also not much fun.

OK, it’s not much fun for most people, Weird Al aside. But it can be made convenient.

In most cases, consistent use of a medium-sized shredder for your home office or small business should suffice to keep the backlog at bay and keep your papers from piling up in between tax seasons. If you don’t yet have a shredder or are in the market for a new one, some of the basic things to consider are:

- Capacity — There are three key criteria:

1) How many sheets of paper can you feed at one time? While shredders are generally rated by the number of sheets shredded simultaneously, Paper Doll believes many manufacturers are a bit too optimistic in self-reporting. Aim for the highest capacity shredder in your budget range.

2) How much paper can you load in any session without the motor pooping out on you? This won’t generally be listed on the box, so take some time to read user reviews at Amazon and ConsumerSearch.

3) What else can you shred besides paper? While not everyone will have a need to destroy CDs/DVDs, the shredder you select should, at the very least, be able to handle stapled paper and expired credit cards.

- Ease of Use — The main concerns are an adequate-width feeder and an easy-to-empty receptacle or bin. The nicest shredders have a removable bin that slides out like a drawer or tips out like a laundry chute, but these tend to be more expensive than the budget versions, where the shredding mechanism lifts off to reveal a metal or rubber receptacle. Avoid the low-rent shredders that only provide a mechanism to set atop a trash can — these are usually ill-fitting, poorly balanced and lead to a flurry of shreds on your carpet, which furry animals and tiny humans will spread far and wide.

- Features — Any decent shredder should have an auto-start function, such that as long as your shredder is turned on, you should be able to insert documents to shred. A “forward” function keeps the motor running whether you are shredding or not. The “reverse” function is important for helping you clear paper jams quickly, especially when you feel immediate friction and realize you’re trying to shred too much paper at once.

- Aesthetics — While the design of a shredder shouldn’t be your main concern, an overly noisy or ugly shredder may be a deal breaker. Whenever possible, test a friend’s shredder or ask a sales associate to help you test a floor model. The noise a shredder makes isn’t exactly pleasant, but some have more vibration or grinding than others.

- Shred Size and Shape — You want a cross-cut or micro-cut shredder. The rare old-style strip-cut shredders offer less protection against prying eyes. Cross-cut shredders reduce your paper to squiggles. Micro-cut shredders pulverize papers even more finely, but may be overkill (in terms of both function and cost) for personal use.

- Shredder Size — There’s no polite way to say this: size matters. Clients purchase desktop mini-shredders in hopes that the small size and convenience of easier access will make them more inclined to routinely shred junk mail. However, I find most desktop shredders lack the gravitas needed to handle daily work. The feeders tend to be too small for ease of usability — usually about 5″ wide, while typical mail is 8 1/2″ wide. Even smaller paper generally has to be folded in order to fit into desktop feeders. Perhaps Paper Doll is spoiled, but the ability to shred a short stack of paper without having to fold or spindle in order to mutilate is essential. Mini-shredders are not designed for power-shredding, but even applying relaxed standards, they still tend to overheat quickly, either from lumpy paper gumming up the works or over-exhaustion. A mini-shredder is a lot like an Easy-Bake® Oven. Yes, it can do what it promises, but would you cook Thanksgiving dinner without a full-sized oven?

SHREDDING SERVICES

You know how important it is to shred the paper that you no longer need for tax, legal or proof-of-ownership purposes, because merely tossing them in the trash could make you ripe for identity theft. But you also know that once your shred pile is as tall as the youngest of your tax-deductible dependents, your personal shredder is going to wimp out before you get through everything.

Of course, you may not have the time, space, or shredding firepower to shred your own documents. If that’s the case, there are a wide variety of companies that offer document destruction services nationwide, including Shred-It, Iron Mountain, Shred Nations, and Pro-Shred. If you need help finding shredding services in your areas, you can turn to the National Association for Information Destruction. The NAID’s interactive map will locate shredding companies nearest to you. Just type in your geographic location (or keep clicking the plus sign to get a close-up of your area.)

In addition to shredding specialists, you can pay to have your paper shred retail locations like FedEx Office, the UPS Store, Staples, and Office Depot/Office Max. Prices range from 99 cents per pound, upward.

Office Depot/Office Max is offering a coupon for up to 5 pounds of free document shredding from now through April 29, 2017.

This photo is just a facsimile. So, click on the above link, print it out, clip it, gather up your shredding and get that pile of paper clutter out of your office (or off your kitchen table).

Staples also has a coupon — for 2 pounds of free shredding with code 23733. You’ll have to click the link to locate the coupon on the resulting page and print it or send it to your mobile device.. Please note that this coupon expires April 22, 2017.

FREE SHREDDING OPTIONS

Various universities, government agencies, and community groups partner with shredding companies throughout the year for events billed as shred-a-thons and shred days. Be sure to Google one of these terms and your city or town name to find events near you. Many are held in mid-to-late April, so don’t delay.

See? It doesn’t have to be so taxing, after all. Declutter, protect your identity, and save money!

Follow Me