Paper Doll

Paper Doll Says The Tax Man Cometh: Organize Your Tax Forms

Eugene O’Neill wrote The Iceman Cometh. It’s about the human need for self-deception in order to carry on with life.

Well, I’ve got news for you. The taxman also cometh. Try as we might to deceive ourselves, we have only a little more than a month before we must complete our annual (and sometimes painful) math homework for the government. So pop some Beatles (or Beyoncé) into your sound system, and let’s get started.

Photo courtesy of Chris Potter/CCPix at www.ccPixs.com under CC 2.0

The key to approaching your taxes is to be organized. (You’re on the Paper Doll blog. Were you expecting something more Zen?) And before you can start preparing your return, you need to know the numbers. Where are the numbers? On the forms!

GATHER YE FORMS

Every taxpayer’s situation is different. If you are single, had only one job all year, and lived in the state where you were employed, and have no investments outside of your retirement accounts, the number of forms you receive may be minimal. If you’re married, have a family, or have complicated investments, or bought or sold a house (or other property), you’ll have to gather more paperwork.

It all starts with the supporting documents called information returns. These are sent to you by others – employers, banks, brokerage houses, schools, casinos, and others. The law requires these entities to provide them to you (generally by January 31st), so you shouldn’t have to do much searching. They should have shown up in your mail. So that scary-but-official mail you threw on top of the microwave the week before Valentine’s Day? Move the oven mitts and get looking!

MONEY YOU RECEIVED

W-2 (Wage and Tax Statement)

Ever had a job? If you did, and you lasted more than a day, you should have received a W-2. Your employer is supposed to send one copy to you and one to the IRS, reporting how much you were paid (in wages, salaries, and/or tips). If applicable, it should also indicate how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state, and local taxes, FICA, unemployment insurance, and a few other withholdings are considered statutory payroll tax deductions. Statutes (that is, laws) require them.

Sometimes, a court might rule that an an employee’s wages may be garnished, but this has nothing to do with sprigs of parsley. People behind on child support payments or who owe money in lawsuits may have money removed from their earnings, before it ever gets to their paychecks, to ensure it goes directly to whomever is owed.

Your W-2 may also report voluntary payroll deductions. These are amounts withheld from your paycheck, where you’ve granted permission. These may include your portion of health and life insurance premiums, contributions to your 401(k) or other retirement fund, employee stock purchasing plans, one-time or ongoing donations to the United Way, union dues, etc.

You probably got multiple copies of the same W-2. Employers submit copy A directly to the Social Security Administration (remember that FICA we talked about?) and keep copy D for their own records. Copies B and C are for the employee – you send one to the IRS with your federal tax return and keep one for your own records. Then, copies 1 and 2 are provided to file with any applicable state or local tax authorities. (I’ve never figured out why W-2 copies 1 and 2 aren’t called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, FF, and G?)

I've never figured out why W-2 copies 1 and 2 aren't called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, and G? Click To TweetIn theory, a W-2 should be mailed to the address listed on your W-4. (Don’t be confused. The W-4, which has a spanking-new look this year, is the form that tells your boss how much to withhold based on your number of dependents you have an any necessary adjustments.) Many smaller companies don’t bother mailing the W-2 and just hand them out to staff.

It’s March and you still don’t have yours? If you still work at the same company, go visit Madge in HR; if you’re long gone from that job (for good or ill), pick up the phone and call. Some things to consider:

- Did you change employers last year? You should have received W-2s from each employer. (If you changed jobs at the same company, you’ll receive one W-2 from each employer, not one per position. If you changed companies within a larger corporation, though, you may get one for each.)

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down to give you your W-2. Keep the boss updated!

Don’t assume that if you don’t have your W-2, that nobody knows what you made. Remember, the IRS got Copy A. The IRS knows what you made, so be sure you do, too! (If your former company went out of business or is otherwise dodging your calls, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

Examine your W-2 it carefully. Do the numbers seem right? Compare them to the final pay stub you got for last year. Calendar years usually end mid-week (and sometimes, mid-pay period), so the numbers won’t correspond exactly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return.

W-2G (Certain Gambling Winnings)

The W2G is the freewheeling cousin of the W-2. While a W-2 is for money you make while working, the W-2G is what you get while playing. If you win more than $600 in any gambling session at a casino – whoohoo! – the “house” should request your Tax ID (generally your Social Security number) and either prepare a W-2G on the spot or send it to you in January.

Casinos aren’t interested in keeping up with your losses, just your winnings, so they only tell the IRS about what they paid you. If you do go gambling and want to deduct losses, the IRS requires you to be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

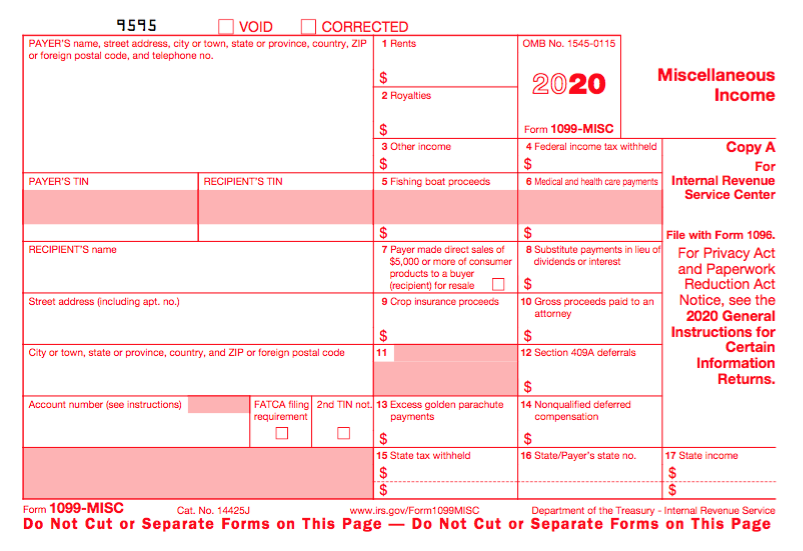

1099 (Income)

A 1099 is a form that basically says, “Hey, we paid you some money for something, but you weren’t an employee.” You get a copy; the IRS gets a copy. Easy-peasy.

There’s not just one type of 1099; actually, there are a whole variety of 1099s. Some of the more common are:

Got a bank account? This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account. Internet-only banks often require you to log into your account to get your 1099-INT, so don’t count on it coming by mail. If you received less than $10 in interest, your bank may not send a 1099-INT.

Do you own stock or taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equally; ask your tax professional if you have any that seem unusual or complicated. Whether you receive dividend checks or your dividends are held in a DRIP (a direct re-investment plan), if you did not earn at least $10 in dividends, you are unlikely to receive a 1099-DIV.

If you’re self-employed (a freelancer, an independent contractor, etc.), you should get a 1099-MISC. The problem is that even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-MISC. So, if you are self-employed or irregularly employed, it’s essential to keep track of your incoming revenue. Otherwise, if the person who paid you ever gets audited, it could trigger some messy situations for you, too.

Your 1099s sometimes hide in plain sight. Occasionally, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope – sometimes perforated, at the bottom of – a quarterly or end-of-year financial statement, so be sure to check all that boring-looking official mail that arrives. Multiple forms may be sent as a “combined 1099,” scrolling across multiple pages, so check the reverse of other forms, in case you seem to be missing one.

If you receive Social Security benefits, you should receive a SSA-1099 or an SSA-1042s, the latter being for non-citizens who live outside the United States but receive benefits. (For example, widows or widowers who are receiving spousal benefits.) The 1099-SSA tends to come on a long form, folded and sealed such that it makes its own envelope. If you did not receive your SSA-1099, you can log into your only Social Security account to access it.

And no, I have no idea why it’s called an SSA-1099 instead of a 1099-SSA. Obviously it was put together by the same people who created those extra 1099 pages…and bra sizing.

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that a party has forgiven a debt, like a mortgage or part of a credit card balance. You may owe tax on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, and got to keep it in your pocket, it’s as if you received money.

MONEY YOU PAID

1098 (Mortgage Interest)

A 1098 is not a 1099 with low-self-esteem. The straight-up 1098 reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. Renters don’t get 1098s; neither do homeowners who’ve paid off their mortgages. There are sub-types of 1098s for things other than interest on property loans.

- 1098-T indicates tuition you paid; you’ll get this from a college or training school.

- 1098-E shows you’ve paid interest on a student loan and will come from your lender

- 1098-C indicates the donation value of a car, boat or airplane. (Yes, even if you donated through 1-877-Kars4Kids.)

Photo by Daniel Salcius on Unsplash

1095-A (Health Insurance Statement)

The 1095-A is also called the Health Insurance Marketplace Statement. We are all generally required to have health insurance. If you purchased yours through a state or federal exchange, this document helps you determine whether you are able to receive an additional premium tax credit or have to pay some back.

Related forms include the 1095-B, supplied by companies with fewer than 50 employees, detailing the the type of coverage you had, the period of coverage, and your number of dependents, so you can prove you had the Minimum Essential Coverage (MEC) required by law. A 1095-C is similar, but for employers with more than 50 employees.

FINAL THOUGHTS

The post reviewed the most common in-bound forms you are likely to need (along with receipts for purchases and confirmations of donations), to help you prepare your income taxes. There are other, less common, information returns. If you receive a more mysterious form, or have questions about how to use a form, the IRS has a surprisingly easy Forms, Instructions and Publications Search.

Making sure you have all of the necessary forms in hand will make it much easier to prepare your tax return. Once you have filed your taxes, make a list of all the forms you received this year, and tuck that list into your tickler file for next January. Check off each form as it arrives, and you’ll have a better sense of when you’ll be ready to start working on your taxes.

With everything in hand, it’ll be harder to stick to that self-deception O’Neill wrote about in The Iceman Cometh, but knowing you’re prepared for the taxman may make you feel better.

If you drive a car, I’ll tax the street.

If you try to sit, I’ll tax your seat.

~The Beatles, “Taxman”

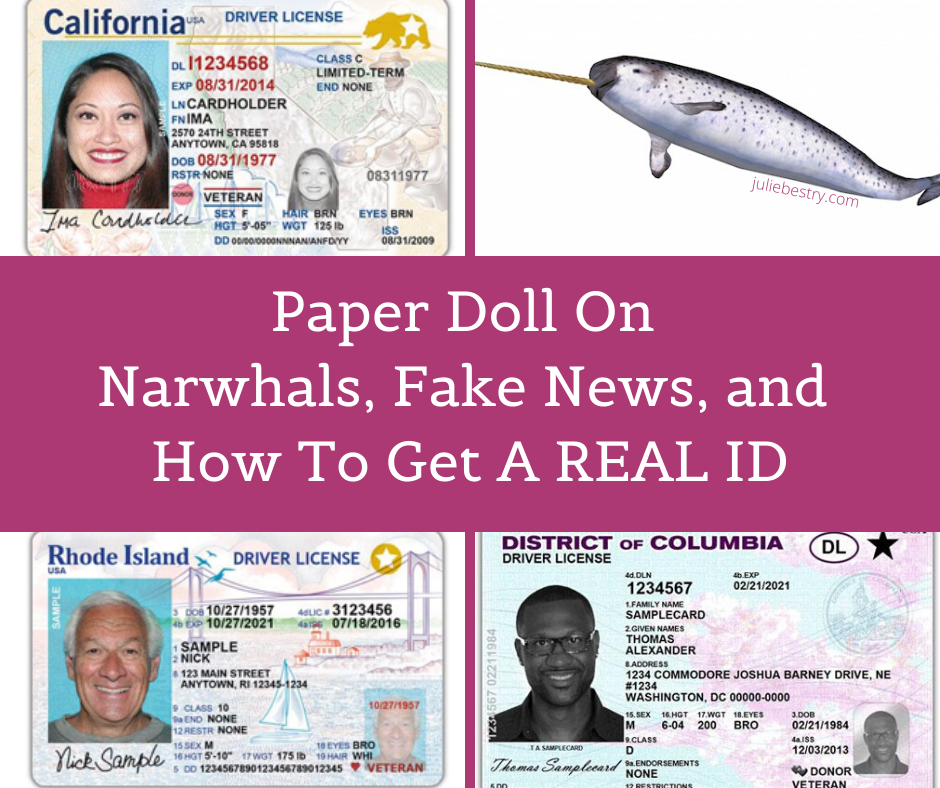

Paper Doll On Narwhals, Fake News, and How To Get A REAL ID

Sometimes, it seems like reality is subjective.

Sometimes, it seems like reality is subjective.

Real Housewives.

Fake news.

Real animals that seem like they should be fake. Don’t try to tell me that you believed narwhals were real when you first learned about them. I mean, unicorn fish? (Yes, I know they’re mammals.)

Narwhal Isolated by Piotr Siedlecki under the CC0 Public Domain License

Fake IDs. (My sister once had a fake ID, a driver’s license that had belonged to a family friend. They even shared a birthday. However, they did not share the same color eyes…and when quizzed by a bouncer, my sister didn’t know what eye color she was supposed to have had. Oops.)

REAL IDs.

WHAT IS A REAL ID?

Effective October 1, 2020 May 3, 2023 May 7, 2025, the REAL ID Act passed by the Congress in 2005, will finally go into effect. (Note: the date has changed several times due to COVID, but this is the effective date as of the DHS announcement in December 2022.)

As of that date, if you don’t have a REAL ID, identification that complies with the requirements of the REAL ID Act, your access to certain locations will be limited. The act, passed in the shadow of 9/11, did the following:

- It set clearer standards for government-issued photo IDs (like driver’s licenses, non-driver ID cards, and other government-issued cards), establishing a uniform set of security standards.

- The act prohibits any of the various government agencies (including the TSA) from accepting forms of identification that don’t meet the new standards.

- It’s supposed to add an extra layer of security to the process of flying by making it harder to acquire false documents and use them to board airplanes.

WHY DO YOU NEED A REAL ID?

Given the above, the main reason people will want to make sure their IDs are REAL ID-compliant is so they can board airplanes to fly for business, pleasure, and those uncategorized trips in between (to take care of ill relatives, look for houses in the cities to which they’re moving, visit a speciality doctor or clinic, or otherwise go somewhere too far away or inconvenient to drive or take the train). Basically, if you want to fly, you’ll need a REAL ID.

“But wait, what about passports?” you may be wondering. That makes you a smartypants! The document you use must be REAL ID-compliant unless you are using using an alternative acceptable document such as a passport or passport card, or a state-issued Enhanced Driver’s License.

But flying isn’t the only reason you might need a REAL ID. They will also be required to enter federal buildings (such as to give testimony or participate in legal procedings in a federal courthouse, and to enter nuclear power plants. Unless you are Homer Simpson, the former is a bit more likely than the latter, and flying more common than either one.

Please note: You cannot be required to show a REAL ID to vote. (I mean, unless your assigned polling place is on an airplane, in a federal building, or in a nuclear power plant. But that would be weird.)

As of this writing, there are seven states with voter ID laws, but they only issue REAL ID-compliant driver’s licenses and state IDs; in Georgia, Mississippi, Texas, and South Dakota, you can use an expired license as ID to vote, while in Hawaii, Utah, and Colorado, your ID must be current; in all seven, there are alternatives to using REAL ID. (For more on current state-by-state ID requirements for voting, VoteRiders.org has a great article, How Does Real ID Relate to Voter ID?)

The Act doesn’t require you to present identification anywhere it’s not currently required for accessing a federal facility, like the public areas of the Smithsonian Institute. And, again, the federal building or facility isn’t prohibited from accepting other forms of identity documents (such as a U.S. passport or passport card). But as we’ve discussed before on this blog the majority of Americans do not have valid passports. Currently, only 42% of Americans hold them. Granted, that’s a huge increase in the past few decades. In 1990, only 4% of Americans had passports. When I wrote about Passport Day in 2011, that number had reached 30%.

Children under 18 are not required to have REAL ID-compliant identification.

MINIMUM DOCUMENT REQUIREMENTS

For a state-issued ID (whether a driver’s license or other identification card) to be valid to serve as a REAL ID, it must include the following infomation:

- The person’s full legal name.

- The person’s date of birth.

- The person’s gender.

- The person’s driver’s license or identification card number.

- A digital photograph of the person.

- The person’s address of principle residence.

- The person’s signature.

- Physical security features designed to prevent tampering, counterfeiting, or duplication of the document for fraudulent purposes.

- A common machine-readable technology, with defined minimum data elements.

In addition, states (and territories) have a whole slew of rules to follow regarding how they must organize and use the documentary evidence they receive.

For example, states must retain any paper copies of the documents you provide for a minimum of 7 years or scanned/capture images of those source documents for a minimum of 10 years. (I suspect the federal government might need the help of some professional organizers to accomplish all of this!)

Shockingly, some states didn’t previously require photos even for driver’s licenses, but now all REAL IDs will require “facial image capture” and must establish “an effective procedure to confirm or verify a renewing applicant’s information.” (Isn’t it a bit surprising that wasn’t required before?)

All states will need to confirm Social Security account numbers with the Social Security Administration and check with other states to make sure your old licenses have been “terminated.”

States will also have to limit the validity period of all driver’s licenses and (non-temporary) ID cards to 8 years.

HOW DO YOU GET A REAL ID?

First, gather your documents. You will need to present the following original or certified documents to your state to apply for a REAL ID.

- Proof to establish citizenship or legal presence – Again, if you have a passport or passport card, you’re covered. Otherwise, you’ll need official documentation to prove you are a citizen.

- Proof of your full Social Security number – Find your official Social Security card. If you’ve lost yours, you’ll want to replace your Social Security card before trying to apply for a REAL ID.

- Two proofs of residency of the state in which you currently reside.

- Documentation of any name changes (due to marriage, divorce, adoption, change of name associated with a gender reassignment, etc.) explaining a discrepancy between the names on all your forms of proof

In general, you will apply to the local branch of your state’s Department of Motor Vehicles or equivalent. You will be be required to apply in-person, and it’s possible that only some (or even one) DMV location in your community will process these applications.

HOW DO I KNOW IF MY ID IS A REAL ID?

Look in the upper right-hand corner of your ID. Do you see a star that looks like any displayed below?

No star? It’s not REAL ID-complaint. Chance are that if you haven’t gotten a new state-issued ID card in the last couple of years, you probably don’t have a Real ID.

Tangential story: When I started college, it was right after the drinking age in New York State had gone from 19 to 21. A friend from a state that did not put birthdates on driver’s licenses and confidently ordered a beer to go with his dinner. The server squinted, puzzled that there was no birthdate.

“Oh, we don’t have birthdates on our driver’s licenses in [his home state].” The server was puzzled. “Then how do I know if you’re legal?” My friend smiled warmly and pointed to the top right corner of his ID. “See that green sticker that says 21? That’s how you know I’m at least 21. It’s a Green 21!” Mollified, the server handed him back his ID and wandered off to get his burger and beer.

Yes, readers, he randomly found a tiny, round, green sticker with 21 imprinted on it, and had the notion to put it on his license. The world was a lot less complicated in the mid-1980s.

DO I REALLY HAVE TO GET A REAL ID RIGHT NOW?

Not necessarily. Maybe you’re thinking, “But I have another five years left on my current driver’s license. Why should I pay a fee to get a new one?”

No plans to visit a nuclear power plant in the near future? Great! Pretty sure you won’t need to visit any federal buildings. OK. But flying? There are all sorts of unanticipated emergencies where you might unexpectedly need to fly. Wouldn’t you rather be prepared?

As mentioned above, there are alternatives to getting newly-issued REAL IDs in the short term, but most people are unlikely to have the majority of them. They include:

- Driver’s licenses or other state photo identity cards issued by Department of Motor Vehicles (or equivalent)

- U.S. passport

- U.S. passport card

- DHS trusted traveler cards like Global Entry, NEXUS, SENTRI, FAST (but see the next section)

- U.S. Department of Defense ID, including IDs issued to dependents

- Permanent resident card

- Border crossing card

- State-issued Enhanced Driver’s License (Currently only Michigan, Minnesota, New York, Vermont, and Washington issue these types of licenses.)

- Federally recognized, tribal-issued photo ID

- HSPD-12 PIV card (Personal Identification Verification Credentials are granted to federal government employees and contractors.)

- Foreign government-issued passport

- Canadian provincial driver’s license or Indian and Northern Affairs Canada card

- Transportation worker identification credential

- U.S. Citizenship and Immigration Services Employment Authorization Card (I-766)

- U.S. Merchant Mariner Credential

If you opt to put off getting a REAL ID, make sure that you always keep your passport and/or any of these other identification cards accessible. If you keep your passport in your bank’s safe deposit box and unexpectedly find out on a Saturday afternoon that you need to fly on Sunday, you’ll be out of luck.

WHAT’S THE HUBBUB ABOUT GLOBAL ENTRY CARDS?

You can use your Global Entry card, if you already have one, and the benefits of Global Entry are great. You get to keep your shoes, belt, and light jackets on when going through security, you don’t have to empty your pockets, and you can keep your little bag of liquids inside your carry-on.

There’s one small hitch. The current administration has just ruled that residents of New York State will not be allowed to renew or apply for new Global Entry cards, and it’s uncertain at this time if other states’ residents will be banned. (This is a complex political issue outside the parameters of an organizing blog. Please visit your preferred search engine for more details.)

GET REAL

Bottom line: if there’s any chance that you will be flying in 4th Quarter 2020 2nd Quarter 2023 (as of spring 2022) and you don’t have a passport, now is the time to gather your documents and apply for your REAL ID. The lines will only get longer as October approaches.

Finally, if you read the list of alternative IDs and were surprise that there is still a U.S.Merchant Marine, be assured you are not the only one. But like narwhals, they’re real. But Green 21s? Not so much.

Paper Doll Wraps Up the Holiday Season (Sneakily, Diagonally, and Intangibly)

Welcome to the home stretch of the holiday season.

Maybe you’re reading this while standing in a long line because this is the first chance you’ve had to shop and you were shocked to find that your favorite online store sold out of the only thing on your special person’s list.

Perhaps you bought all your presents last summer, wrapped and labeled them, and stored them in your secret hiding place months ago.

Either way, how are you going to keep the gifts a surprise until unwrapping time?

HIDING PLACES

I think the best place to keep gifts, wrapped or otherwise, from the prying eyes of tiny humans and others with insatiable curiosity is in an old suitcase. People will check under beds and in closets, but nobody looks in those cheerless valises in the basement, the ones that are faux leather and lack wheels and haven’t been used in 40+ years.

Yes, as a professional organizer, I encourage people to donate or recycle things that they don’t use, but quietly repurposing that blue suitcase circa 1978 counts as recycling!

Other options worth considering:

- Hidden in plain site — Would your kids (or your spouse) show any interest in prying up the lid of a Bankers Box labeled “2015 Tax Receipts,” “college textbooks,” or something similarly boring? Probably not. (Piling other stuff on top couldn’t hurt.) If you’re the only one in your house who cooks, a small wrapped gift or two hidden in the back of a kitchen cabinet, inside a rarely-used fondue pot, may be just what you need to stymie the sneaky searchers.

- Your friends’ & neighbors’ houses — One solution is just to trade storage. Take your wrapped gifts in boxes or lidded tubs to your cousin’s, co-worker’s, or BFF’s place, and return with hers. You can even tell your family not to bother snooping because you’ve made this trade. (Note: if your kids and their kids are friends, one may spy on the other’s behalf.)

- The trunk of your car — Obviously, this works in only two situations, when you normally have an incredibly tidy trunk (with ample room to store a gift-filled box labeled “work project”) or if you normally have a predictably packed and untidy trunk (in which case you need to hollow it out and hide gifts underneath the faux facade of mess. (Do not mark any boxes as “donations” or someone may unhelpfully deliver all your holiday gifts to charity!)

- Attics — The upside is that children and pets generally can’t get up to the attic on their own. The downside? It’s probably not that easy for you to get up there, either. Also, it’s probably dusty, there may be “critters” and there’s almost certainly temperature and humidity variations throughout the year. Keep that in mind if you’re storing any gifts that are sensitive to those kinds of changes, and store the gifts in a tightly lidded tub.

- Laundry hamper — Let’s face it; nobody is enthusiastic about doing laundry. Your kids aren’t about to suddenly volunteer to take the laundry from your room, even to please Santa.

- Trash bags — Big, black trash bags or leaf bags, especially if you have an attic, or garage, or basement with a variety of things already obscured by bags, may be the ticket. The problem? If there’s anyone who ever visits your house trying to be “helpful,” they may assume it’s trash and toss it out.

If your storage is at a premium and you have to keep wrapped gifts out and on display — and this trick works once you’re ready to put the gifts under the tree — fake the name tags. Instead of Mom, Dad, Aunt Jen, etc., make yourself a cheat sheet matching real names to “gift” names and put presents out for Lizzo, Daenerys, Baby Yoda, and so on.

WRAPPING SAVVY

Paper Doll is terrible at wrapping any gifts that don’t come in perfectly rectangular shapes. Back in NAPO2014: It’s a Wrap! Organizing Your Wrapping Supplies with Wrap It!, I told a story of my wrapping failures (and shared this adorable photo of a now-late-20s young man).

Many years ago, I offered up some alternatives for people with wrapping skill deficits:

It’s a Wrap! Wrapping Paper Alternatives, Furoshiki & Frogs (2008)

Paper Doll Wraps Up the Holidays and Makes It All Stick (Part 1) (2011)

Paper Doll Wraps Up Some Alternatives to Wrapping Paper (Part 2) (2011)

I’m obviously not the only person who has trouble wrapping presents, because the hottest video on the internet in the past few weeks has been one that went viral with ways to wrap gifts in unusual ways, and especially spotlighting wrapping gifts diagonally.

In case you haven’t seen it, be sure to press PLAY below and crank the volume. Oh, and stop by @BlossomHacks to give them some love. As often happens on the internet, credit got lost along the way, and most people were not aware that Blossom DIY created the video (which UK bookseller Waterstones made viral).

Wrapping gifts got a whole lot easier with these clever ideas! pic.twitter.com/sP4MXhpBBu

— Blossom (@BlossomHacks) December 14, 2019

By the way, if you care, Popular Mechanics has a feature on the math behind the diagonal wrapping hack.

WRAPPING and PACKING and SHIPPING, OH MY!

Finally, I’m an organizing and productivity expert, not a wrapping, packing, and shipping expert (my recent post, This “Magic” Product Makes Shipping Packages as Easy as Wrapping Leftovers, notwithstanding).

Luckily, our friends at Quill have more expertise on these issues and have been kind enough to share their infographic to take you through each of these holiday headaches with aplomb.

Gift wrapping, packing, and shipping hacks to save money and make your life easierInfographic by Quill

Gift wrapping, packing, and shipping hacks to save money and make your life easierInfographic by Quill

A FINAL WORD

Of course, the best gifts don’t necessarily need to be wrapped or shipped. As we’ve talked about many times, gifts don’t need to be things at all.

We’ve spoken many times about how you can give gifts of experiences. Consider adventures (like the NASCAR Racing Experience or an afternoon in an escape room), entertainment (tickets to sporting events, museum exhibits, concerts, theater events, six months of Netflix or Hulu, or a year of Amazon Prime), practicality (gift certificates for car washes or an auto club membership like AAA), or consumables (homemade or subscription-based, or gift certificates to restaurants or coffee houses). And, of course, gifts of organization and productivity never go amiss.

Happy holidays, and I hope whatever you give (and receive) gifts makes life a little (or a lot) more joyous.

This “Magic” Product Makes Shipping Packages as Easy as Wrapping Leftovers

Packing and shipping is not exactly rocket science. And yet Paper Doll hears a lot about shipping-avoidance and packing-box frustration. In a perfect world, whenever we wanted to ship something, we’d have the ideal sized box (so as not to waste space, and also not to have one of those almost-sealed, bulging boxes where the flaps quite don’t meet). We’d also have just the right amount of padding material to prevent jostling, and it would all be easily recyclable.

Packing and shipping is not exactly rocket science. And yet Paper Doll hears a lot about shipping-avoidance and packing-box frustration. In a perfect world, whenever we wanted to ship something, we’d have the ideal sized box (so as not to waste space, and also not to have one of those almost-sealed, bulging boxes where the flaps quite don’t meet). We’d also have just the right amount of padding material to prevent jostling, and it would all be easily recyclable.

My clients tell me they procrastinate on returning purchases and shipping care packages, birthday gifts, and other things because – although they have lots of boxes and bubble mailers thanks to their online shopping habits – nothing is ever the right size. This isn’t just a frustration; it’s also a financial issue.

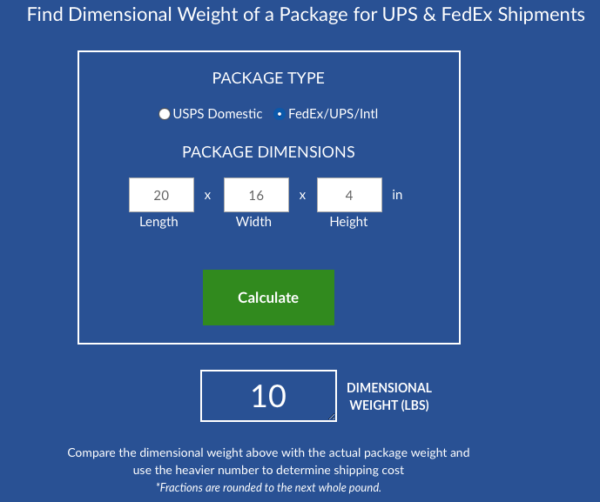

In 2015, the major players in the ground shipping world, like UPS and FedEx, stopped pricing solely by the pound. They realized that a lot of relatively light packages were being shipped, and that cost them money. So, they started using dimensional weight, which had already been the practice for air-shipped packages.

What is dimensional weight?

The shipper calculates the cubic size of a package by multiplying its length, width, and height. Once the dimensional weight is calculated, they compare it to the actual weight of the package and the larger of the two is used to determine the package’s actual “billable” weight.

Need some help with the math? Google dimensional weight shipping calculators, like this one from ShippingEasy.com.

What does this all mean for you? A small thing in a bigger box will cost you more than that same thing in a smaller box, which means you have to keep even more shipping supplies on hand to find the just-right solution, and that causes clutter.

If only someone had a better idea. Oh, wait. Someone did!

SCOTCH™ FLEX & SEAL SHIPPING ROLL

3M is a marvel of innovation. The same parent company that brought us Post-It® Notes and Command hooks has done it again. They’ve invented a shipping solution that requires keeping less packing material and fewer supplies, takes less time, and creates a smaller dimensional weight for the things you ship.

And, honestly, I’m not persuaded that it isn’t some kind of magic.

Scotch™ Flex & Seal Shipping Roll

First, let’s get an overview of the product, with some fun, bouncy music.

Cool, eh? So, let’s dig deeper. How does this product save space, time, and money?

Eliminate clutter

What do you keep on hand for shipping packages? Boxes, right? Probably lots and lots of Amazon (and other) boxes. Maybe USPS “priority” boxes (which always seem to be way too large or just a little too shallow)? A family member bought a gorgeous Kitchenaid stand mixer and had it shipped. It came in a glossy, specially-carved Kitchenaid box (with a photo of the mixer on the package) inside a matching, plain, cardboard Kitchenaid-branded box (each with specially-placed handles for ergonomic carriage) and the whole thing was inside a box that would have made a nice toddler playhouse.

I bet you don’t just hoard boxes. I bet you have bubble wrap. (And not nice rolls of bubble wrap, but pre-used bubble wrap that someone in your house has popped and flattened along the edges, right?) Or maybe you have styrofoam peanuts. Or those clear, little balloons that look like nothing so much as an inflated zip-lock sandwich bag without the zipper?

And where are you storing these cardboard boxes, bubble mailers, poly bags, bubble wrap, and package stuffing? Probably wherever you can find to put it, and likely not in a very sound system. (No, I’m not peeking in your windows while you’re sleeping. Promise!)

Because the Flex & Seal allows you to customize your package to fit precisely around the edges of your item, there’s no wasted space in the box and no unnecessary padding to keep on-hand. Scotch’s marketing claims to save up to 50% on supplies, time, and space vs. using boxes. I don’t know how they arrived at that statistic, but it does mean that you can take up less space, and the roll can be stored horizontally or vertically, like a rolled-up yoga mat.

Save time

My clients are invariably piling up to-be-shipped items on the dining room table or on kitchen counters because they anticipate (often correctly) that it will be time-consuming to find a suitably-sized box, pad and pack the item(s) safely, and seal everything confidently. Scotch™ Flex & Seal Shipping Roll promises make packing as simple as:

- Cut a piece of the roll long enough to sandwich the item you’re shipping.

- Fold the Flex & Seal over whatever you’re shipping.

- Press to seal it by continuing to press around the three (non-folded) edges. (Imagine you’re wrapping your Thanksgiving leftovers in aluminum foil before putting them in the freezer. Or, as the product’s web site says, “Make sure you’re pressing gray surface to gray surface. A helpful way to remember it: Do not wrap like a present, fold and press like a calzone!”)

That’s it. Print out your label and affix it to the package. Wheeeee!

Secure and immobilize your package.

Scotch™ Flex & Seal Shipping Roll may look like a prettier version of bubble wrap, but it harbors a secret superpower. Flex & Seal is constructed with three layers.

The blue outer layer is tough and durable, making the package water-resistant and tear-resistant. The clear middle layer is bubble wrap, but seems slightly less inflated (and is difficult to pop), creating firm cushioning for the package.

And the grey inner layer is MAGIC. (OK, I’m sure it’s science, but Paper Doll can’t figure out how it works!) This inner layer’s “adhesive technology” makes it stick securely to itself but not whatever you’re shipping!

Scotch™ Flex & Seal Shipping Roll sticks to itself and not to what you put inside! What kooky shipping witchcraft is this? Click To TweetOnce you fold the Flex & Seal over your item (sandwiching it), just press firmly for a guaranteed seal. Folded and smushed (for another scientific term), the Flex & Seal conforms to the shape of whatever you’re shipping, immobilizing it to protect against wiggling during shipping.

Save money.

The marketing for the Flex & Seal Shipping Roll notes that by eliminating extra packing and shipping supplies, and securely sealing around the shape of whatever you’re shipping, it can reduce the package’s dimensional weight, as we discussed above. That should reduce your costs. Yay!

WHO CAN USE THIS?

Anyone who can comfortably maneuver scissors should be able to use the Flex & Seal. (If you’re doing a LOT of packing, consider a paper cutter in lieu of scissors.) If you – like Paper Doll – sometimes have trouble wrapping presents and fear this might be too similar of an experience, fear not. I’ve been known to unroll too little or too much wrapping paper and then the paper crumples and creases as I try to get just the right amount. Flex & Seal is thicker and sturdier, so that’s not an issue. Also, unlike rolls of wrapping paper, Flex & Seal is only 15″ wide, only a few inches longer than a paper towel roll, so it’s not unwieldy.

So, who can use this?

- People who rarely need to send packages. If you never have boxes or bubble mailers on hand and put off shipping things because you lack room to store them, this makes things pretty easy.

- People who send packages all the time – Grandparents? Check. Crafters who share their creations for fun or profit? Check. Small business owners who ship small, fiddly things? Check. Authors who autograph and ship copies of their books? Check!

When shouldn’t you use Scotch™ Flex & Seal? If you’re shipping something delicate or fragile, stick to a traditional packaging set-up, like a cardboard box with firm but flexible padding and a tight seal. Also, because the inner grey layers must be matched up, it’s not suitable for large packages.

ENVIRONMENTAL ISSUES

Flex & Seal is recyclable. Scotch™ advises just removing the label before dropping the packaging off at a plastic bag recycling location. While not all communities have plastic bag (or plastic film) recycling centers, you can enter your zip code into the search bar at PlasticFilmRecycling.org to find a center near you.

However, I am concerned that not all labels are so easy to peel off. My 10-foot roll of Flex & Seal came to me wrapped in actual Flex & Seal! (How’s that for good advertising? It was very meta.) But both the marketing label (promoting other 3M products) and the UPS label would not peel off cleanly, so I’m not sure if that renders the package un-recycle-able.

HOW TO OPEN FLEX & SEAL PACKAGING

I’ll admit, I was puzzled when my Flex & Seal Shipping Roll (again, wrapped in Flex & Seal) arrived. I saw that I could just cut it open with scissors, but I didn’t want to accidentally cut what was inside. But I also couldn’t just pull on opposite sides of the packaging as if I were opening a bag of potato chips.

In the end, I guessed (correctly), and carefully used the scissors on the corner of the packaging, but I’m betting I wasn’t the only uncertain person, as Scotch™ produced this video to set people straight about three different methods for opening Flex & Seal packaging!

VARIETIES OF FLEX & SEAL SHIPPING ROLL

Scotch™ Flex and Seal Shipping Roll comes in four sizes:

- 10′ long x 15″ wide

- 20′ long x 15″ wide

- 50′ long x 15″ wide

- 200′ long x 15″ wide (suitable for small business shippers or people with LOTS of grandchildren)

As for styling, well, there’s not a lot of variety. The standard is the blue exterior with the grey interior.

Looking for something a bit more festive for the holidays? That regular sky blue is cheery enough (and sorta suitable for Hanukkah) but if you’re looking for something a little more Christmassy, Scotch™ has created a Limited Edition Holiday Color (which you and I may recognize as “red”).

LOCATIONS AND PRICING

Scotch™ Flex & Seal Shipping Roll is available online at Amazon and Shoplet, and at Target, Walmart, Office Depot, and Staples. Prices range from about $8.50 for the 10′ roll to $99 for the 200′ roll.

Disclaimer: As part of a voluntary program, I help 3M evaluate some of their products. 3M sends me free samples and I analyze them, and give my honest opinion on their site. I had just received my 10′ roll when I saw that my colleague Seana Turner had included Flex & Seal in her post, Seana’s Top Gifts for 2019, which gave me the idea to write this post. Be assured that all opinions are my own. (Who else would claim them?)

Avoid the Lost & Found: Keep Track of Your New Goodies with Tile

Seek and ye shall find. Or, at least you hope so. But the more stuff you have, the easier it is to lose things.

Earlier this year, Paper Doll shared Bluetooth solutions for keeping track of your gone-missing items in the post Paper Doll Finds Your Lost Keys, Wallets, and Phones: Bluetooth Trackers 2019 and the follow-up, Paper Doll Finds Your Lost Eyeglasses: Technology Beyond Checking the Top of Your Head.

If you are frustrated that your things go missing and you haven’t tried a Bluetooth tracker, this post is for you. With Black Friday, Cyber Monday, and a plethora of holiday gift-shopping situations on the horizon, we are all – ourselves, our families, and all of our recipients – going to have to keep track of stuff and the paraphernalia we need to keep our stuff working. Hence this update post on Tile.

In Paper Doll Finds Your Lost Keys, Wallets, and Phones, we covered Bluetooth basics and the most popular solutions, including Tile. If it’s been a while since you read the post, or you’re new to the world of Bluetooth trackers, I encourage you to revisit that post and see the magic of having tiny doodads keeping track of the things you bury, wander away from, or which wander away from you (in the hands of tiny humans, furry friends, or your last rideshare experience).

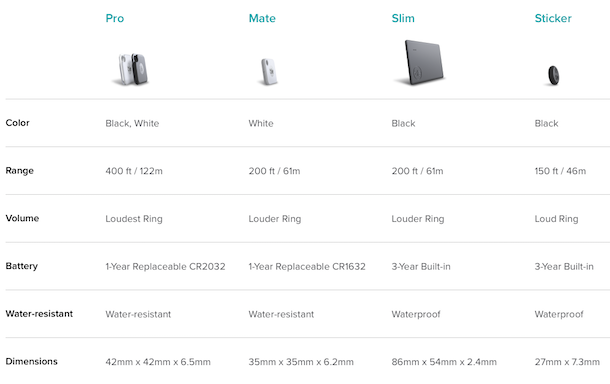

Previously, the last line of Tile products offered three main options, the Pro, Mate, and Slim, as it appeared below.

The three designs were different from one another in terms of sizes, Bluetooth ranges, alarm volumes, but all were designed to attach to your possessions (keys, wallets, cameras, umbrellas, fancy water bottles, favorite stuffed animals, backpacks, remote controls, etc.).

The key commonality was that with a quick tap on the app, you could find your lost stuff, and even have it give you a “yoohoo!” (Far from your stuff? As we explained in the original post, Tile’s community of users extends the reach of your search, as if a whole posse of detectives were on the case.)

Recently, Tile introduced a brand-new “hardware” lineup that improves upon the characteristics of the prior projects. Basically, that chart above is “soooo 2019” and the refreshed items include some interesting updates.

TILE SLIM

Remember the Tile Slim? (See that old info on the right of the chart?) The NEW Tile Slim has received quite the upgrade! Instead of a flat square, it’s now shaped like a credit card, perfect when you’re looking at a “low-profile” design, like in a wallet or a business card case. (Seriously, have you ever set down your business card case at a conference to shake hands or examine something in an expo or because you’re talking with your hands? No? Just me?)

The Slim is still 2.4mm thick (about the thickness of two credit cards, but wider (86mm instead of 54mm) to fit comfortably in all the places you’d store credit, debit, loyalty, or business cards.

Previously, the Tile Slim had a 1-year built-in (non-replaceable) battery; the battery now lasts three years. The range has been doubled from 100 to 200 feet (from 30 to 61 meters), and has a louder ring to help you find what’s yours more quickly.

The Slim is available in black, only, and costs $29.99.

TILE STICKER

Tile recognized that some stuff is just plain small, and small stuff needs smaller Tiles. Otherwise, your stuff gets lumpy and the “feel” just isn’t right. This led to the new Tile Sticker.

The Sticker is Tile’s smallest tracking solution. These little dots of Bluetooth power are waterproof and adhere to your items with Tile’s time-tested adhesive backing that can stick to anything. (OK, don’t stick it directly on the dog, however often he gets lost! That’s just not cool.)

The Stickers have a 3-year battery life and a range of 150 feet. Like the Slim, the Stickers are only available in Black.

They sell for $39.99 for a 2-pack or $59.99 for a 4-pack.

TILE MATE and PRO (UPDATED)

Tile hasn’t forgotten the rest of their lineup. To round out these improvements, Tile has expanded the Bluetooth range to enable zippier search and more reliable “finding” for both the Tile Mate from 150 to 200 feet (from 45 to 60 meters) and the Tile Pro from 300 to 400 feet (from 90 to 122 meters).

For those who care about styling, the Mate is available in White for $24.99, and the Pro is available in Black or White for $34.99.

HOW TILE WORKS

TILE 2020 LINEUP COMPARED

As you can see, the Tile Pro is the only version that gives you a choice of colors, and it has the loudest ring and double the range of any of the other products. But it’s also the thickest.

The Mate is smaller but thicker than the Slim, and you can replace the battery, but (like the Pro) it’s merely water-resistant, not waterproof like the Slim (and the Stickers). But the Mate does have a replaceable battery.

So, depending on each object you want to track, you’ll want to decide what’s the most important feature(s) for you for that object.

HOW TO CHOOSE

Color – Do you need your Tile to blend in with the surroundings? Do you really need to make a fashion statement? If aesthetics are truly your thing, there are always decorative Tile Skins.

Range – Where do you use your stuff? If you’re affixing it to a remote control or something else that never leaves your house, or if you live in a small apartment rather than a McMansion, a huge range may not be as important as it would be for something you schlep to work, school, and the beach.

Volume – As with range, if you’ve got sharp ears (or a child, teenager, or dog with sharp ears), having the loudest alarm may not be important, but if you’re buying Tiles for the great-grandparents or you work or hang out in a loud environment, the Sticker’s volume may not be loud enough for your needs.

Battery – Ah, the eternal debate: a longer-lasting built-in battery or a shorter, replaceable battery? It’s a personal choice, but I know I’d rather replace a battery than a whole device.

Water-resistance – Is your tiny human carrying her backpack through some raindrops or does she like to dump all the remotes in the (filled) bathtub? It’s worth considering.

Dimensions – How big is the “thing” that you don’t want to lose? How concerned are you about style and fit vs. function?

COMBO and MULTI PACKS

Recognizing that few of us need to track merely one thing, Tile has a variety of combo and multi-packs to fit a range of situations. I encourage you to sit down with your holiday gift list and figure out what gifts you’re giving might be augmented by the insurance policy of a Bluetooth tracker like Tile. Then take a reality check in your household and figure out what everyone is always misplacing, and go from there.

Tile Essentials: 2 Tile Stickers, 1 Tile Slim, 1 Tile Mate available for $69.99

Tile Pro Combo: 2-Pack (one black, one white) at $59.99 and 4-Pack (two black, two white) at $99.99

Tile Mate: 4-Pack for $69.99

Tile Mate/Slim Combo: 2 Mates and 2 Slims, available for $74.99

GOOGLE NEST

In October, Tile partnered with Google to make search even easier via the Google Nest device. So, if you’ve got a Google Nest (formerly Google Home), instead of using your phone and the Tile app, you can ask your Google Assistant to yoohoo your Tile devices for you. So, if you say, “Hey Google, make my wallet ring!” it’ll do that for you. (The 21st century is weird that way.)

If you don’t have a Nest, you can still tell your Google Assistant what to do. However, although you won’t have to tap your phone, you’ll still need your phone with the Tile app running somewhere nearby so the Tile app can tell your Tile doohickey to ring.

FINAL WORD

No matter what you acquire this holiday season, whether for yourself or for others, Bluetooth trackers are still only part of the story. Whatever you’ve got (or intend to acquire) make sure it serves your needs, and consider letting whatever languishes in drawers and cabinets be a blessing to someone else via donation. Don’t keep what you don’t need. (But if you’re having trouble keeping track of what you do need, Bluetooth trackers are pretty cool.)

Follow Me