Ask Paper Doll: Do I Really Need A Safe Deposit Box?

This is part of a recurring series of Ask Paper Doll posts where you can get your burning organizing questions answered by Paper Doll, a 20-year veteran professional organizer and amateur goofball.

Dear Paper Doll:

I finally feel like a grown-up. I’ve read your blog long enough to know what papers I’m supposed to have. I’ve learned not to put things awaiting action on the front of the fridge, and how to put away my financial files. But my Boomer parents keep telling me that I should have a safe deposit box. Do I really need one? Can’t I just buy a home safe? And if I do need one, what should I put in it that I can’t just keep in my files or my wallet?

Signed,

Boxed-In About Adulting

First, I’m glad to know that readers are paying attention to the advice I give in posts like How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents and The Professor and Mary Ann: 8 Other Essential Documents You Need To Create. (And yes, trade in the fridge door for a Tickler File and you’ll be much more productive.) You have all the prerequisites for a degree in adulting, so consider this topic an elective.

Let’s start with the basics, whether you even need (or should want) a safe deposit box. This is one of those issues that depends on your life and lifestyle.

Safe Deposit Boxes Photo by Tim Evans on Unsplash

CONSIDER GETTING A SAFE DEPOSIT BOX IF:

You want a completely private location in which to store and review your documents or possessions.

You want to keep track of where your vital documents are located and want them all in one central location, perhaps because you change apartments or living situations (in the same community) with frequency and don’t want to worry about the safety of these items.

You want your loved ones to have easy access to important documents even if you are unavailable (traveling, ill, etc.) and have designated a Power of Attorney or have arranged to have a trusted co-renter of the box.

You want to protect your important documents (and possibly other possessions, such as fine jewelry, coin collections, medals, photographs, and written or photo/video home inventories for insurance purposes) from theft, fire, flood or natural disaster. But remember, you still have to insure valuables, and there’s no guarantee the bank won’t be burgled or burned down.

You have family heirlooms and precious documents that are too fragile or delicate to be left in the open in a home where children, pets, and circumstances could cause damage.

You are concerned that if a fireproof home safe is light enough for you to take with you during a disaster, it would also be portable enough for thieves to carry away into the night. Also, you recognize that they keys or combinations to home safes are much easier for thieves to crack than getting through brick-and-mortar bank security.

Stock Certificate Image by pictavio from Pixabay

So, maybe you’ve got stock certificates, Great Grandma’s diamond earrings, a collection of gold coins, or a bunch of rare baseball cards. Banks have video cameras and alarm systems, fire-protection and sprinkler systems, and high-tech locks; the vaults in which the safe deposit boxes are ensconced are reinforced and secured, designed to withstand not only bandits but natural disasters like wildfires, floods, tornadoes and hurricanes. Do you need or want that level of security?

SKIP GETTING A SAFE DEPOSIT BOX IF:

You relocate cities with frequency, whether due to work, family, academic, or volunteer obligations.

You aren’t sure you’ll be able to afford the ongoing safe deposit box rental prices. (Yes, you can just remove the items from box, but why start a system unless you’ve got a plan for keeping up with it?)

The main things you’d keep in a safe deposit box are things you might need to access quickly and urgently. Banks are closed on Sundays, most of Saturdays, evenings, and holidays. During the first year of COVID, many branches had limited hours, and some closed altogether, directing patrons elsewhere. You can cash a check at a bank branch down the street; you can’t retrieve items from your box at Branch A by going to Branch B.

You prefer to live off the grid and don’t want “The Man” to know where you are or what documents you possess.

The documents you’d keep in the safe deposit box would be copies, not originals, and you’re comfortable with scanning documents to the cloud or to a flash drive or hard drive. (If you’re not that worried about fire, flood or theft and have few vital documents and no collections, you may be willing to chance the cost of replacement fees.)

If any of these apply to you, a portable, fireproof, waterproof safe might satisfy your needs. However, as noted above, they can be stolen or safe-cracked. Be clear on your own situation.

WHAT YOU SHOULD/COULD KEEP IN A SAFE DEPOSIT BOX

Silver Safe Deposit Boxes Photo by olieman.eth on Unsplash

Your safe deposit box is a good place to store difficult (but not necessarily impossible) to replace items that you don’t need to access often.

- VIPs — Keep the originals of your very important papers specific to someone’s status as a human, like: birth certificates, adoption papers, marriage licenses, divorce decrees, citizenship papers, and death certificates. Consider keeping your Social Security card in your safe deposit box, too. (Either way, never, ever keep your Social Security card in your wallet! If it’s stolen, it’s like losing a one million dollar bill in terms of the potential for identity theft.) These documents can be replaced, but not quickly or without cost.

- Military records and discharge papers — for example, DD 214s. These documents may be required when applying for post-military jobs and for getting veterans-related benefits. If you’re not job-hunting or the veteran has not just passed away, quick access isn’t likely to be needed and a safe deposit box is a great, secure location.

- Copies (but not the originals, and not the sole copies) of your will, Power of Attorney, and Healthcare Proxy (Medical Power of Attorney) documents.

- The deed to your house and any other property you own. Similarly, it can be helpful to store settlement papers, property and title surveys, and other real estate documents you don’t want to lose in a household kerfuffle.

- The titles to your vehicles, boats, planes, space shuttles, etc.

- Paper certificates for any stocks or bond you own, including US savings bonds. Most stocks and bonds are held electronically these days, so don’t worry if you don’t have the certificates. (Digital shares are called book-entry shares; they aren’t fancy and calligraphied, but it’s easier to keep track of them.)

- A printed or digital home inventory. This may be as simple as a spreadsheet or as detailed as a combination video and electronic documents. You’ll want multiple copies kept safe in case you need to file a claim with your homeowner’s or renter’s insurance policy.)

- Printed or digital copies of important documents for your business, including contracts and other vital records.

- Any documents you consider private and/or sensitive that you wouldn’t want your kids, neighbors, houseguests, cleaning service, or other random people to find. This could be copies of a deposition from a divorce, ugly correspondence you are keeping as legal proof, or anything that would make for a juicy Lifetime movie of the week.

- Jewelry and collectibles — BUT ONLY IF THEY ARE INSURED! The FDIC doesn’t insure the contents of your box; that’s your responsibility. Don’t plan on keeping your entire jewelry collection in a bank’s vault unless you are the queen of a small nation. Just store pieces you wear on very special occasions or those you’re saving for the next generation.

- Family keepsakes you want to protect from toddlers, pets, or other potentially damaging sources.

- Any other documents or small items that would be hard or expensive to replace, and for which the bank seems safer than your own living space.

- Hard drives and/or flash drives, with mountable backups of your computer or important data.

WHAT YOU SHOULD NEVER KEEP IN A SAFE DEPOSIT BOX

- Large amounts of cash — Sometimes, it’s all about the Benjamins, but not when you’re looking at a safe deposit box.

I get it; the bank already has tons of cash lying around, so why wouldn’t it be smart to keep all your money hanging with its little green friends? There are a few reasons.

First, your cash won’t be earning any interest, and even if we weren’t experiencing an inflationary period, you’re wasting the incredible opportunity value of compound interest!

Second, as I noted, safe deposit boxes can’t be accessed on weekends, holidays, or after hours, so you’ll be limited as to when you can lay your hands on your cash. If you’ve got this much cash and want to keep it so liquid that you’re not willing to invest it in stocks, bonds, mutual funds, CDs, or retirement funds, at least keep it in a savings or checking account you can access, 24/7, with a debit card or transfer from online banking!

Third, hard, cold cash (and any other assets) that you keep in a safe deposit box (rather than a bank account) won’t be protected by the Federal Deposit Insurance Corp., nor covered under FDIC rules. Deposit cash in your bank account and it’s insured up to $250,000 per depositor per bank. However, plunk cash into in your safe deposit box and it isn’t insured at all!

Yes, currency in your safe deposit box is less likely to catch on fire, get stolen, or be accidentally donated than if you stuffed it in your mattress. But there’s little worse you can keep in your box.

- Your will — What’s possibly worse that keeping cash in your safe deposit box? Keeping the only legal copy of your will. Unless you’ve arranged for a co-renter, someone with signature access to the box and who knows where the key is, your family will be out of luck if you pass away.

Last Will and Testament Photo by Melinda Gimpel on Unsplash

Your loved ones would have to secure a court order to access the will and other contents of the box, and that requires the costly services of an attorney. Your attorney should keep the official copy, and other copies can be kept on file at home, with your executor, and/or in the cloud. While we’re at it…

- Original, sole copies of vital documents that your family might need if you become incapacitated — If you’re the only person with access to your safe deposit box and you have not designated someone as having Power of Attorney (or stored the only existing copy of the Power of Attorney paperwork in the box), lack of access to originals of your living will/medical directives and other life or end-of-life instructions could create a nightmare.

- Your passport, if there’s ANY chance you’ll need it urgently — Do you (or might you) work for a company that will require you to go abroad on a moment’s notice? Are you an international spy? (OK, I know, you can’t tell me if you are.) You probably figure that you would know if you’d ever need your passport urgently.

But trust Paper Doll; just because you’ve never needed your passport urgently in the past, doesn’t mean there aren’t a number of reasons you might in the future.

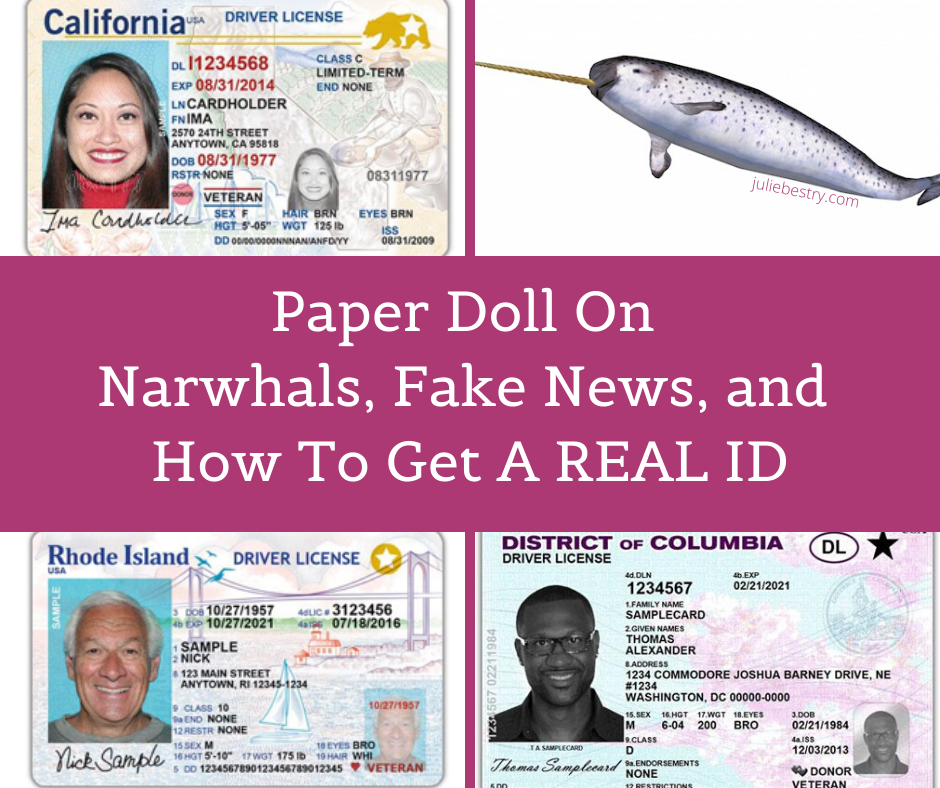

Back in February 2020, in Paper Doll on Narwhals, Fake News, and How To Get a REAL ID, I explained that by the 4th Quarter of 2020, everyone would need a REAL ID (driver’s license with star logo or a passport) to fly, or to enter federal buildings (to give testimony or participate in legal procedings in a federal courthouse) or nuclear facilities. (Hear that, Homer Simpson?)

Due to COVID, that date has been pushed a few times, and is now rescheduled to May 3, 2023.

Maybe you’ve never used your passport before, or perhaps never used it without planning a trip 6 months in advance. But is it possible that you’ll have your wallet stolen the week before a domestic trip and your passport will be your only alternative?

Or might you need to enter a federal building (for perfectly legal, rational, wouldn’t-mind-being-seen-on-the-news-doing-so reasons)? Could an elderly relative get injured while on vacation in Europe or your college-age kid get sick while on Spring Break in Jamaica and you’d have to fly internationally at a moment’s notice? Consider the possibilities before putting your passport in the box.

- Uninsured valuables — Yes, your jewelry and collectibles are probably safer at the bank than in your rental apartment, house, or nursing home. But make sure you notify your insurance company so they attach a value-appropriate rider to your homeowner’s or renter’s policy.

- Spare keys — Dude! If you lock your keys in the car or lock yourself out of the house, it’s probably not going to be during banker’s hours! Think of the person you trust most in the world; now ask yourself if your mother (or MY mother) would trust that person. If you’d trust them to drive your car or babysit your kids, that’s a good indicator of someone to whom you can give a spare key.

- Anything illegal — You shouldn’t need Paper Doll to tell you this, but don’t put stolen goods, fireworks, drugs, toxic or hazardous substances, or anything that’s a no-go with the law.

HOW TO GET A SAFE DEPOSIT BOX

Before you rent a safe deposit box, figure out everything you’re going to want to keep in it. Gather everything up and lay it out someplace safe from the prying, sticky hands tiny humans (or furry friends), like on your dining table or in the guest room.

Knowing how much you have will help you determine how large a box to get. Rental rates of vary by size, as well as by bank or credit union, region of the country, and other factors, and can range from as little as $20 to several hundred dollars per year, so don’t “over-rent” on the space you need.

Box depths are standard (generally about 18-22 inches), but height and width dimensions vary. The smallest boxes are usually 3″ x 5″, but unless you have very few documents, you’d have to roll your papers to make them fit. Medium boxes range from 3″ x 10″ to 10″ x 10″. The largest safe deposit boxes in consumer banks and credit unions tend to be about 15″ x 15″, though larger specialty boxes can be arranged at banks that cater to clients who have large financial holdings.

Select a bank branch convenient to your home or work. Don’t quibble over a few dollars if you’ll have to schlep across town. Consider when you’ll want to access the box, either for retrieval or for putting items in.

Ask about policies and fees. What are the key replacement fees? Charges for drilling boxes if keys are lost? (Safe deposit box keys are TINY! Put them somewhere safe and where you’ll remember to find them!) Is there comfortable (or any) seating available in the vault, in case you need time to go through the contents of your box and need to sort documents?

Think carefully about whether you want to share access with a co-renter, like your your spouse, parent(s), adult child(ren), business partner(s) or friend(s). You can’t just designate someone as a co-owner and give them a key. They’ll have to sign the signature card and show photo ID both at the time of rental and to gain access.

Remember, if you don’t have a co-renter, your Power of Attorney designee can act on your behalf for financial and other urgent matters and can access the box for you, but PoA designations cease upon your death. Eventually, the executor of your will can gain access (depending on the probate and estate procedures of your state), but this can be a lengthy process. If your possessions and documents are relatively simple, you’re probably better off naming as co-renter someone (like Paper Mommy) in which you can place great trust.

Make an appointment to rent and “move into” your box. Be prepared to fill out some forms, sign a lease agreement, and pay for the initial rental term. Make sure co-renters are available to come to the appointment as well.

Bring your photo ID. Co-renters? Samesies!

Bring the items you wish to store. Before you leave the house or office, create an inventory list, and bring a copy of the list with you. As you place the items or documents in the box, check them off your list.

Take a photo of the items in the box. Take a photo and/or adjust your list whenever you add or remove documents or possessions.

Bring gallon-size zip-lock plastic bags for protecting items in case of floods or sprinkler system malfunctions. If your box is high enough, safeguard delicate non-flat items from water damage with plastic food containers. Put a your name and contact information inside the container so that items can be identified as yours in the aftermath of any disaster.

Keep your key somewhere safe and memorable.

Don’t be like my dad. When we emptied out his office, as I described in The Great Mesozoic Law Office Purge of 2015: A Professional Organizer’s Family Tale, we found an envelope with my father’s familiar scrawl in red ink: “This is the envelope for the key to Eva’s safe deposit box in Miami, which we closed.” Eva was Paper Mommy‘s mother; she died in 2001. He would never have been able to find the envelope if the key had been needed, but kept an empty envelope telling us where the key had been!

Even if someone unauthorized has your key, they won’t be able to access your safe deposit box, as proof of identification and signature is required in tandem with a key. Key loss, however, may require drilling of the box — and that can be pricey!

REMINDERS AND CONSIDERATIONS

Possessions can be damaged or stolen. Faulty sprinkler systems, actual fires, floods and yes, even bank robberies, can lead to loss or damage of your items. So maintain an inventory at home of the contents of your safe deposit box, just as you might keep a home inventory of your possessions in the box.

The contents of your box will NOT be available 24/7/365. There’s a reason they’re called bankers’ hours — generally 8a – 5p, Monday through Friday, with some wiggle room on Saturday mornings and occasional late Friday hours. Don’t put something in the box that you might need to access quickly or urgently.

Access to your safe deposit box can be frozen. The IRS can block your access if you’re in a dispute with them. If law enforcement officials (including the Department of Homeland Security) believe you and/or the contents of the box are related to illegal activity (drugs, guns, explosives, or stolen items), a court order can be issued to give law enforcement access to the contents of your box.

Your safe deposit box can be declared “abandoned” — If you stop paying your rental fee, don’t maintain communication with the bank, and nobody in your family or overseeing your estate knows you had a safe deposit box, the contents of the box will eventually be turned over to your state’s Unclaimed Property division. Make sure your loved ones or legal representatives know you have a box, where it is, and the location of the key.

As always, there’s so much solid and helpful information here! Although we have a safe deposit box, I had never considered putting things into a container with contact information in case of a disaster. And you’re so right about keeping a list and taking photos – I freaked out for months when I had forgotten I put some jewelry in ours to keep it secure during a cross-town move. Another totally genius “everything you always wanted to know and more” post, my friend!

Thank you so much, Sara. I know it was an especially long post, but I tend to think of these as “if you only read ONE thing” kinds of posts. I appreciate your kind words!

Hubby and I had a safe deposit box about 20+ years ago. We were watching Alias a lot and Sydney seemed to always find the most important stuff in safe deposit boxes.

We considered getting a black light and writing things in lemon juice to store in it. Alas, we never came into possession of any Rambaldi artifacts, so our need for the safe deposit box diminished.

Besides, there was no safe deposit box that Anna Espinosa couldn’t crack, so what’s the point?

LOL. What about a giant and growing red blobby ball? And I like doing the lemon juice invisible ink thing, just because.

The important thing to remember is: FRANCIE DOESN’T LIKE COFFEE ICE CREAM!!!

Great advice, Julie.

When my dad was in hospice, I found out from my dad’s attorney that unless there is a person who is granted access to the safe-deposit box, the box will go into probate. If a will or other important documents are in there, you will not be able to access them until probate is completed.

Fireproof hanging folder safes work nicely in homes and can be transported when you move.

Yep to what you wrote about probate, as I said in the section on how how to get a safe deposit box. And you’re so right about safes designed for using hanging folders. I am always amazed that people buy fireproof safes that have no hanging rails or which are only suited for “stuff” instead of paper. I feel like that’s an important message — get the filing kind!

I’ll share this with you because we’re good friends. Believe it or not, when I was really young, maybe 10 or 11, I convinced my parents to let me get my own safety deposit box. I don’t remember what I even stored in it or why they said “yes” that request. So of course I had to organize it. Well, decorate it. On the day I opened the box, I went to the bank with my mom. I had gone with her many times before when she visited HER safety deposit box. I brought all of my valuables. Again, I’m not sure what they were. But before I loaded them in the narrow box, I lined the bottom with a fake leopard skin fabric. My mom thought it was hilarious. My 10 year old self wanted my valuables to be cozy. The box is long gone, but I still have that small piece of fabric. Nuts, right?

Okay, I love this story Linda!

Happy you enjoyed it, Seana. My mom used to love telling this to me.

This is a fabulous story. I think it shows that you like to personalize and take ownership and not just go along with conformity. Your treasures were just as valuable to you as some dude’s baseball cards might be to him, and money is certainly not the only way to measure value.

Not only that, but I remember Paper Mommy taking me to the bank to open my first bank account. I remember how seriously she took the transactions, and teaching me these kinds of life skills. (I also remember that this bank branch, which replaced what had been a restaurant, smelled like hamburgers!)

This might be my favorite blog comment EVER! Thank you for sharing it.

I thought you’d get a kick out of this, Julie. I’m glad you did and stoked that this was your “favorite blog comment ever.” I feel honored.

You’re so right that “conformity” is not my style. And even at this young age, I thought and did things differently. Frankly, I think it was something my parents encouraged in me and my siblings.

Love that your mom was your life skills mentor. And what a funny memory that your first bank location (previously a restaurant) smelled like hamburgers. On a funny coincidental twist, my first bank (savings account) which I opened before the safe deposit box time, is now a restaurant. I’ve never been there, but I wonder if it smells like money? 🙂

LOL! And now I can’t stop humming the line from Hamilton, “Your perfume smells like your Daddy’s got money!”

You always give such thorough advice, Julie. There really is a lot to think through on this topic. I think “back in the day,” this was the most secure option. As you point out, the COVID experience really opened my eyes to the limitations of having valuable items in a location other than my house. The other complication has been the great era of “banks eating other banks.” When there is an acquisition, banks can close or change their policies. This has happened a lot around me. Still, there are times when a safe deposit box makes sense.

I laughed out loud when reading about not putting the only copy of your will in your own box. Too funny! Let’s think, people!!

You’re absolutely right on all of this, Seana, plus I think safe deposit boxes are no longer a valuable commodity for banks. They used to think that it would draw foot traffic, and people would be more likely to feel like a bank was “their” bank and open more accounts, CDs, etc. However, these days, banks are far less likely to push the concept of safe deposit box because it requires too much staff time to address.

And all day, people have been telling me that their friends, relatives, and clients keep their wills in their boxes. I suspect most people didn’t pay attention and assume their spouse or kids can just take the key and open the box without signature access having been arranged. Nope!

Growing up, going with my parents to ‘visit’ their safe deposit box had an air of mystery to it. They were all hush-hush about what was in it and as a kid, I couldn’t believe what they had to go through just to access it.

Now, I have one of my own and never thought to wrap papers and other items in plastic bags to protect them from damage. Next time I go to the bank, I’m bringing some baggies and taking pics of the contents with my iPhone. It’s been a while–I don’t remember everything that’s in there!

I know exactly what you mean about that air of mystery; I always thought they must be so cool from watching old black & white movies. And chances are that nothing will ever do damage to the contents to a box, but water damage seems far more likely than anything we’d see in an action movie like Ocean’s 11!

And definitely take photos; it’ll save you so much time in the future!

Julie,

Very informative post on safe deposit boxes. I remember back in the day always making trips to the bank with my parents and grandparents to put things in and out of the box.

Thanks for reading, Janet! And yes, there’s something sort of mysterious and nostalgic about safe deposit box use.

Great advice, Julie. As with many of the others, I used to have a safe-deposit box. It just became too cumbersome and tedious. As you note, banks are not always open. I have copies of various important documents stashed with my attorney and trusted others. The originals are in a secure spot in my home. I also have copies in cloud storage. I love all the details you provide here, Julie.

Thanks, Diane. You’ve perfectly illustrated my point that different people have different needs and that a safe deposit box isn’t the ideal for everyone.

I appreciate you reading and commenting!

[…] This is a box you rent at your bank. My friend Julie Bestry wrote a very thorough piece on safety deposit boxes, so check out her post for more information. […]