Paper Doll Assigns a Homework Paper: The Schumer Box

Hello, Boys and Girls!

Do you know about the Schumer Box? It’s named after Chuck Schumer. Do you know who Mr. Schumer is?

Uh, no. Actually, that’s Mr. Shuester from Glee. He’s very pretty and does a mean Singin’ in the Rain. But this is Chuck Schumer:

Yes, I know, it’s easy to confuse the two. It helps to know that Mr. Shue (as the Glee kids call him) tends to wear sweater vests and break into Broadway show tunes.

As far as Paper Doll knows, Senator Chuck Schumer isn’t known for extemporaneous dance moves. But he is known for pro-consumer innovations, like the Schumer Box. (No, that isn’t the dance step that will replace The Dougie. You’re on your own for that. This is a family-language blog — I can’t even share the video.)

Back in the wild days of the 1980s, when Paper Doll was in college, credit card offers flowed as freely as water. (Back then, water also flowed as freely as water, coming from a faucet rather than a bottle.) But all the dazzling card offers hid their scary “gotcha” secrets in tiny 8-point font on the backs of agreements sandwiched between glossy brochures.

In 1988, then-Congressman Schumer, as part of the Federal Truth In Lending Act, helped pass a law ensuring that credit card companies would have to disclose all fees and rates clearly. (Thanks to lobbying from the credit card companies and the boondoggle that is politics, the Schumer Box didn’t go into effect until twelve years later, in 2000.)

Consumers really needed a way to simplify all the gobbledygook about credit card terms and more easily compare credit card rates and fees. It’s hard to imagine now how difficult direct comparison between cards was back then, but now all credit card companies use a unified format, and they are required by law to put key disclosures in 12-point type and long-term interest rates in 18-point type.

THE SCHUMER BOX: THE BASICS

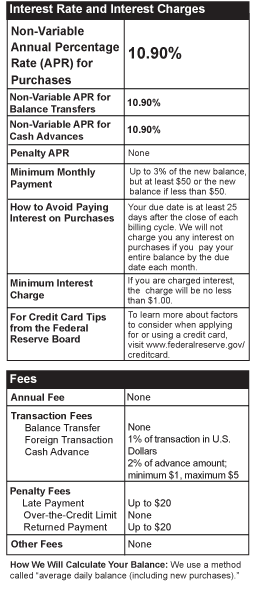

The Schumer Box is a two-column chart summarizing all of the possible fees and rates related to a credit card. Information includes:

- Annual fees, if applicable

- Annual percentage rates (APR) for purchases

- Other APRs, including those for balance transfers, cash advances, and default APRs

- Grace periods

- Finance/interest charge calculation methods

- Other transaction fees, including those for balance transfers, cash advances, late payments, and exceeding the credit limit

If you flip through all the shiny pages credit card companies send, you’ll find a simple text box that looks something like this:

The Federal Reserve even has a great little presentation on how to best use the Schumer Box — click on “Learn More About Your Offer” or select a printable PDF version.

LIMITATIONS OF THE SCHUMER BOX

The Schumer Box works well for what it is, but it really doesn’t go far enough…and perhaps no little chart could. Too much is beyond the scope of the chart and needs to go into the fine print.

For example, a credit card company’s Schumer Box may say that the APR is “8.99% variable*”, where the asterisk leads to the fine print that explains that the APR (i.e., annual percentage rate) is dependent upon the Prime Rate. If the prime lending rate goes up or down, the interest rate charged by a card with a variable interest rate will change.

It’s not the Schumer Box’s fault, per se. This is how modern financial terms are used. Since the box focuses on essentials, it’s assumed that the consumer knows these things and is paying attention.

So, pay attention.

In addition to using the Schumer Box to compare credit card (and balance transfer) offers side-by-side, consumers should make sure they know all of their rights. For a refresher course on the subject, check out Paper Doll‘s Give Yourself Some Credit: An Update on the CARD Act from early this summer.

THE SCHUMER BOX OF THE FUTURE

Earlier this year, the Pew Charitable Trusts conducted a study and found that the average length of the checking account disclosures of the ten largest banks in the United States ran 113 pages. Further research by Pew found that the vast majority of Americans, no matter their political party, favored clearer, simpler, briefer disclosure statements.

Last week, the Pew Charitable Trusts joined with various consumer organizations to submit a request to the Consumer Financial Protection Bureau, asking the CFPB to require banks to provide disclosures regarding overdraft options, fees, policies regarding posting of deposits and withdrawals, and dispute-resolution procedures. The letter specifically requests that the CFPB institute a one-page disclosure Consumer Choice Box, patterned after the Schumer Box. (Take a peek — it’s kind of pretty!)

Similarly, if you’ve ever tried to read your cell phone agreement, you know that a little clarity of disclosure might be a good thing. The Consumer Federation of America and five sister consumer groups have submitted Truth in Billing commentary to the Federal Communications Commission regarding wireless billing practices. A Schumer Box for cell phones could be on the way!

FINAL THOUGHTS

As always, Paper Doll‘s posts should never be construed as recommending irresponsible or unwarranted use of credit — credit card clutter is too closely associated with paper clutter and tangible clutter. (And anxiety clutter.) Each consumer must make his or her own decision regarding credit cards. But, if you are going to secure credit, I’m sure Senator Schumer and Mr. Shuester would agree…do your homework!

Follow Me