Give Yourself Some Credit: An Update on the CARD Act

Almost a year and a half ago, Paper Doll told you about the benefits of the Credit Card Accountability and Disclosure Act of 2009, a honking-big name for an omnibus set of protections for consumers. Some provisions went into effect in late 2009, while most rolled out between February and August, 2010. As a reminder, those protections included the following:

BILLING IMPROVED:

Credit card statements must be mailed to consumers 21 days before the payment is due. All those variable pay-by time limits also went away, so no matter what credit card you pay, you’re on time if your payment arrives by 5 p.m. on the due date. If you tend to be poky, know that late fees have been capped a $25 for a first offense and $35 for a second late payment within a six-month period. And a late fee can’t exceed the amount owed, so if you’re late paying at bill of $10, your late fee is curtailed at $10.

Monthly credit card statements now indicate how long it will take to pay off a balance (including all that pesky interest) if you make only minimum payments. Previously, credit card issuers were like the man behind the curtain, showing you only the minimum payment and hiding the true (scary) picture of your increasing debt. Bills also now include toll-free numbers to find out more about credit counseling.

INTEREST RATE MODIFICATIONS REGULATED:

Credit card companies must provide 45 days’ advanced notice regarding changes to interest rates and fees.

Credit card issuers can’t increase rates on existing balances unless one or more of the following is true:

- Your payments have been more than 60 days late

- The teaser (i.e., introductory) rate on your card has expired

- Your card has a variable interest rate tied to a financial index that has increased

Credit card issuers can’t increase the rate on new purchases in the first year you hold a credit card, not counting the expiration of an introductory teaser rate.

Teaser rates must stay in effect for at least six months.

Any payments over the minimum amount due must be applied to balances with the highest interest rate. Thus, if you have a balance at a low promotional rate and another at your higher, regular rate, that high balance (and the interest on it) won’t keep growing.

UNFAIR LENDING PRACTICES CURTAILED:

Universal default was eliminated. That was where a credit card company could raise your rates if you defaulted on some other credit card, even one operated by an unrelated company.

Two-cycle billing was eliminated. That was where card issuers were averaging your daily balances from the previous billing cycle, so that you were basically getting billed on charges for which you’d already paid.

Credit card issuers can’t market on college campuses or at events sponsored by colleges, or entice them with nifty gifties, like T-shirts, mugs, and gadgets.

Applicants under 21 have to have an adult co-sign for their credit cards unless they can provide proof of an ample regular income.

CONSUMER CONTROL INCREASED

Over-limit fees are now opt-in only. That means that if you don’t have enough left on your credit limit to buy that weird floofy thing in the fancy boutique, your card issuer can’t just let the purchase go through and charge you a ridiculous over-limit fee unless you’ve previously agreed to it. (And why would you?) You get to decide whether you’d rather have the snooty girl behind the counter tell you the purchase has been declined or whether you’d rather sink further into debt, beyond your limit, and pay a huge fee on top of it.

(Paper Doll would like you remind you that you need not ever see the snooty salesgirl again; you can’t say the same about your money woes.)

Consumers who get dinged for paying late can reclaim their prior (lower) interest rates if they pay on time for six consecutive months. Thus, significant (over 60+day) late payments can trigger penalty interest rates, but consumers can’t be stuck with higher rates in perpetuity.

DID IT WORK?

It’s been almost a year since the last of these regulations went into effect. Your credit card bills now nag you, warning that if you don’t pay off that expensive gadget right away, and only make minimum payments, you’ll eventually pay double (triple?) its cost in interest. This past year’s freshman college class isn’t already on its way to graduating with massive revolving consumer debt. And as we continue to slowly climb out of a recession, credit card companies aren’t mailing us letters telling us our credit lines are going down or our interest rates are going up tomorrow.

Before the passage of the CARD Act, naysayers (primarily those with a vested interest in keeping the prior status quo) predicted doom and gloom if the proposed provisions became law. However, a report entitled, Credit Card Clarity: CARD Act Reform Works put out by the Center for Responsible Lending found that:

“Contrary to credit card industry claims, the new rules have not caused prices to increase or access to credit to fall. Instead, they have benefited the public by making credit card pricing significantly more transparent. Price transparency is likely to lower costs long term by spurring competition and making it harder for issuers to manipulate or arbitrarily raise prices.”

The CRL noted in its key findings that:

- New rules have reduced the difference between stated rates and actual rates paid on credit cards, resulting in more transparent pricing. An estimated $12.1 billion in previously obscure yearly charges are now stated more clearly in credit card offers.

- Once the economic downturn is taken into account, the actual rate consumers have paid on credit card debt has remained level.

- Direct-mail offers have been extended at a volume and pace consistent with economic conditions.

Other studies agree that the legislation has improved the overall environment for credit card users. For example, a survey by Bankrate revealed that in 2011, 79% of cards had no over-limit fee, compared to 60% in 2010.

Thus, the CARD Act has led to improved disclosure and fairer lending practices. However, there remain some mixed reactions to some aspects of the new rules:

1) During the lag between when the CARD Act was passed and when the last provisions were put into place, many credit issuers hiked interest rates.

However, despite claims that interest rates would continue to rise, the Pew Charitable Trusts‘ new study, A New Equilibrium, found that interest rates have generally stabilized, and that requiring lenders to abide by fair practices has not had a detrimental impact on consumers. Further, many conclude that most rates that have risen are due more to issues related to the economic landscape, including unemployment and general individual creditworthiness.

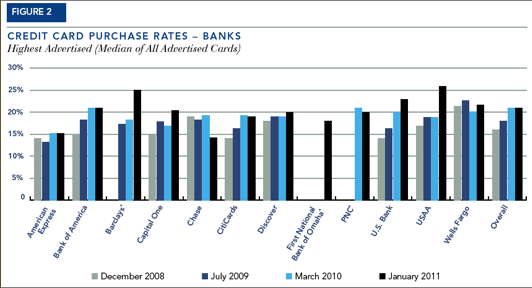

For a comparative view, Pew has charts showing the year-to-year rate changes of credit card purchase rates and cash advance rates for 12 major credit card lenders and 12 credit unions, 2008 through 2011.

2) The CARD Act didn’t block new fees from being assessed. And assessed they were! Lenders started charging (or charging more) for everything from paper statements to annual fees, from cash advance fees to foreign currency transaction charges. Minimum finance charges and inactivity fees have also increased. However, there’s nothing to say lenders wouldn’t have started or increased such fees if they hadn’t been forced to scale back their predatory lending and lack of transparency.

3) Larger banks issued less consumer credit. However, during this same period, smaller banks and credit unions have become more competitive, loaning more (and to more consumers) than they had previously.

4) Credit card companies started issuing more variable-rate cards, allowing them to bypass the CARD Act regulations and increase rates even when a consumer isn’t delinquent. This, in particular, points out why it’s so important to comparison-shop for new credit cards and not accept the first offer that comes in the mail.

WARNING FOR BUSINESS OWNERS…and INDIVIDUALS

CARD Act regulations only apply to consumer credit card debt. If you hold a business credit card for your small business, or have opted for a business card marketed as a “professional card”, you are not guaranteed protection under any of the CARD Act stipulations.

Many solopreneurs and micro-business owners have opted for business credit cards in lieu of business loans in hope that doing so might improve the tax deductibility of their business expenses, unaware that the lack of protections are numerous. Further, credit card companies market a preponderance of such protection-devoid cards to individuals with less than a $50,000 annual income and who have no actual business dealings, inveigling them to apply for cards that lack the protections they’d otherwise have if they opted for consumer-oriented cards.

Some lenders, including Bank of America and Capital One, have voluntarily elected to abide by the some of the same regulations for their business credit cards, but none are required to do so and they may choose to reverse such policies at any time. Research by the Pew Charitable Trusts, in a new study entitled U.S. Households At Risk From Business Credit Cards found that:

—67% of business credit cards still include high penalty rates for late fees that exceed the regulated rates for consumer credit cards.

—80% of business (or “professional”) cards include an “any time” clause, allowing terms and conditions to change at any time, with any (or no) amount of warning.

—84% of business cards apply (or reserve the right to apply) cardholder payments to lower rate balances before higher rate balances.

—Penalty fees are virtually unrestricted for late payments or other violations of the terms and conditions on business credit cards.

See Table 1 of the Pew report for a side by side comparison of protections (or lack thereof) between consumer and business credit cards.

Last week, four members of the U.S. Senate called for the Federal Reserve Board to require increased disclosure on business credit cards and to crack down on false marketing practices related to professional and business credit cards. And so, we wait.

Paper Doll is in no way recommending carrying revolving debt or spending beyond one’s means. However, whatever your financial choices, it’s important to be an educated consumer and know your rights.

Dear Readers, have you noticed what the CARD Act has meant for your personal clutter of debt, or the piles of credit card statements and offers in your mailboxes? Please share your thoughts in the comments section.

Follow Me