Archive for ‘Taxes’ Category

Paper Doll’s Tax-Smart Organizing Tips: 2021

Photo by Khaosai Wongnatthak at Vecteezy

I know this will be hard to believe, but “doing” your income taxes does not have to be painful. (Paying your taxes is another issue altogether.) The key to succeeding is, no surprise, getting organized — knowing what information you need, what specific forms to expect, and having it all ready when the questions are asked.

Today’s post will give you some guidance regarding what you need to organize to get your taxes completed. But first, you should be aware of some important news regarding preparing your 2020 tax return.

TAX NEWS YOU CAN USE TO KEEP ORGANIZED

Tax Deadline Changed

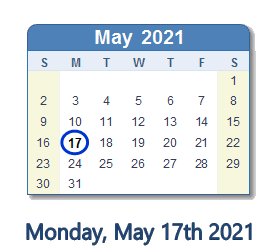

Most years, Tax Day is April 15th, give or take a day for weekends or special holidays. (For example, in 2023, April 15th falls on a Saturday, so Tax Day would normally be April 17th, the following Monday. However, that’s Patriots’ Day in Massachusetts, Maine, and several other states, so Tax Day will be April 18, 2023, nationally.) In 2020, due to the pandemic, the IRS moved the federal Tax Day forward to July 15, 2020, and most states delayed their tax filings, too.

Last week, after leaving people guessing for several months, the IRS announced that Tax Day 2021 has been delayed one month to Monday, May 17, 2021.

Note: this extension only refers to individual tax returns; federal estimated quarterly payments and other federal tax deadlines haven’t changed. Thirteen states have already changed their tax deadlines to May 17, 2021, with more considering a change, so please consult your own state’s revenue department websites for up-to-date information in your state.

I encourage you to pretend that the IRS did not delay the date, and use this as an opportunity to set up small blocks of time, even 20 minutes each evening over the course of a week or so, to gather your resources. If you work on your taxes in small chunks of time, bit by bit, it won’t seem so overwhelming. Again, once you have all the information, it’s just about being able to answer the questions.

Unemployment Funds “Bonus”

Did you receive unemployment benefits during 2020? (You should have a 1099-G if you did!) Many Americans did, including self-employed individuals who had never been able to collect unemployment previously. Often, people are so relieved to receive these funds that they do not consider that unemployment payments are taxable and they do not opt to have taxes deducted, assuming (or hoping) that by April of the next year, their financial fortunes will have improved. This can be problematic even when there isn’t a global pandemic going on!

If you did not think about paying taxes on that compensation, there’s a little good news. Although it’s really rare for this kind of retroactive relief, as part of the American Rescue Plan of 2021, the first $10,200 of unemployment benefits earned in 2020 will not be taxable for people with incomes of less than $150,000.

Last week, most of the online tax preparation companies updated their software to adjust for this. If you started doing your taxes weeks or days ago but didn’t finish, when you log in you may be surprised to see that your amount owed is lower or your refund is higher. Whoohoo!

Nick Youngson via CC BY-SA 3.0 Alpha Stock Images

Are you Old School? Do you do your taxes on paper? The IRS has released instructions and a worksheet for taking advantage of that $10,200 exclusion for unemployment compensation. (Cheatsheet: you’re going to focus on line 7 of your 1040!)

What if you already filed your taxes? You may be thinking that you’ll have to file an amendment to your tax return in order to get money refunded to you. Not so fast! Hold your horses!

The IRS has stated that individuals who have already filed their returns and who paid taxes on their unemployment benefits (either through them being taken out by their states or on their recently-filed returns) should NOT amend their returns. Rather, the IRS will be recalculating those returns and money will be refunded to individuals by direct deposit or check, depending on their circumstances.

Again, for those of you in the back, still high-fiving about this income not being taxable: the IRS will automatically process refunds to account for the first $10,200 in unemployment benefits! Don’t amend your taxes for this!

Stimulus Not Taxable

You may have received a federal stimulus check in 2020, $1200 for each individual under a certain income threshold plus $500 for each dependent child. Your stimulus payment is NOT taxable. Why? Because, due to the way the law was written, stimulus checks are not considered “income.” Rather, they are advance payments of a tax credit, and tax credits aren’t taxable income.

However, if you were eligible but did not receive your stimulus check, you will be able to report that fact on your return to apply it toward your taxes owed or refund due. You do this by claiming the Recovery Rebate Credit. Your accountant or tax software will know how to handle this, but keep your eye on line 30 of your 1040 form. (Do you like reading the nuts and bolts? Check out page 58 of the IRS tax instructions for the Recovery Rebate Credit worksheet.)

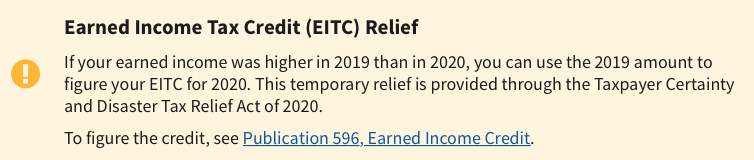

Earned Income Tax Credit (EITC) Option

Those of you who earned less in 2020 than in 2019 (and that includes a lot of people) have a delightful surprise awaiting you. When doing your 2020 taxes, you have the option of using either your 2020 or 2019 income to calculate your Earned Income Tax Credit.

Special Forms for Seniors

Are you a senior? As of last year, if you are over 65, instead of filing the standard 1040 form, you can file the 1040-SR. The main benefit is that this form, when printed, uses a larger font and provides easier readability.

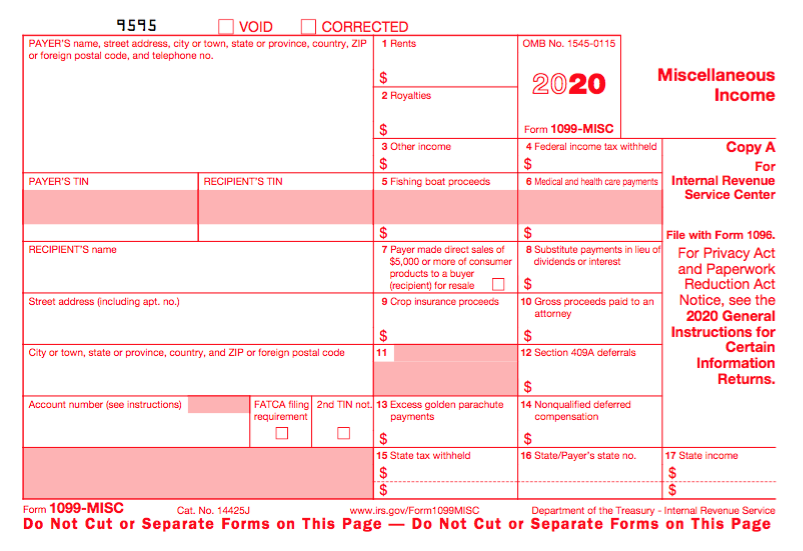

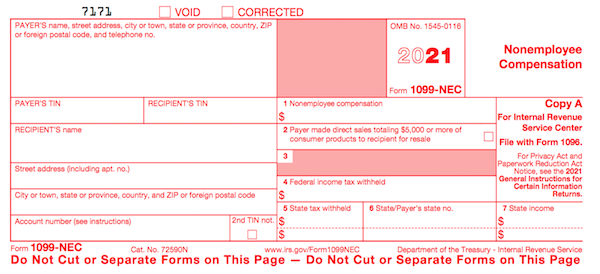

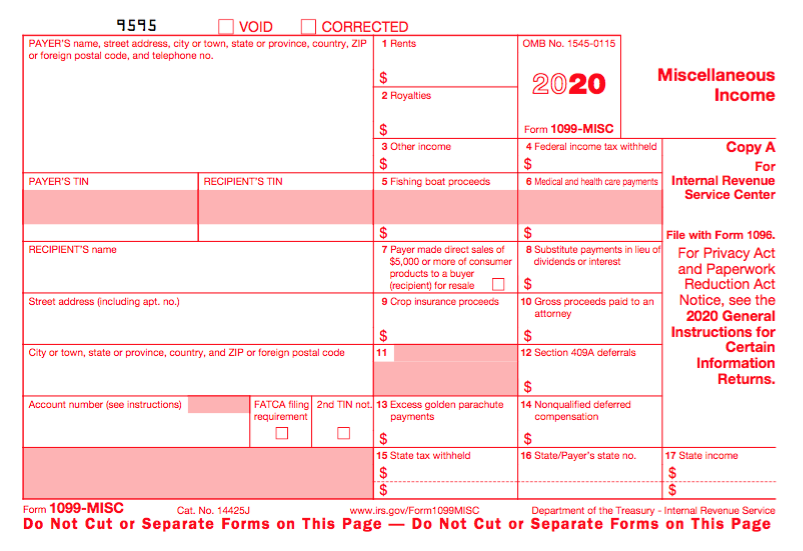

New Kind of 1099 for Freelancers

In the past, freelancers, independent contractors, and similar non-employees received the 1099-MISC — you know how organizers feel about a “miscellaneous” category! This year, there’s a new form, the 1099-NEC for non-employee compensation. (See below for more on this new form.)

Photo courtesy of Chris Potter/CCPix at www.ccPixs.com under CC 2.0

KNOW WHAT YOU SPENT

The best time to get ready for doing your taxes in 2021 was back in early 2020, but something tells me you were a little distracted by world events and trying to buy toilet paper. To file your taxes for this most wackadoodle of years, you’re going to have access a lot of information about your 2020 spending, like:

- receipts for tax-deductible purchases (check for paper receipts as well as email confirmations of purchases)

- statements for ongoing accounts

- an online financial dashboard (like Quicken, Mint, Personal Capital, or YNAB)

If you made a lot of Amazon purchases this year (and really, who didn’t?), especially if you are self-employeed and can expense office supplies and other work-related items, you can select “2020” from the drop-down section under Your Orders in your Amazon account; digital orders (such as for educational materials) have their own drop-down, three tabs to the right. To download your entire Amazon order history, go to the Amazon Request My Data page.

Gather all your tangible information in a folder labeled Tax Prep 2020, or use something like the Smead All-In-One Income Tax Organizer. Just having it all together will be the first step toward tabulating the correct amounts.

GATHER YE FORMS

Of course, most of the big-ticket items you’ll be entering into tax software (or, gulp, on paper forms) comes not from the little receipts and statements you get during the year, but from the official forms you receive.

It all starts with the supporting documents called information returns. These are sent to you by others – employers, banks, brokerage houses, schools, casinos, and others. The law requires these entities to send them to you by February 1, so you shouldn’t have to do much searching. They should have shown up in your mail. So that scary-but-official mail you threw on top of the microwave the week before Valentine’s Day? Move the oven mitts and get looking!

MONEY YOU RECEIVED

W-2 (Wage and Tax Statement)

Did you have an employer in 2020 (even for part of it)? Then you should have received a W-2. Your employer is supposed to send one copy to you and one to the IRS, reporting how much you were paid (in wages, salaries, and/or tips). If applicable, it should also indicate how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state, and local taxes, FICA, unemployment insurance, and a few other withholdings are considered statutory payroll tax deductions. Statutes (that is, laws) require them. Duh!

Sometimes, a court might rule that an an employee’s wages may be garnished, but this has nothing to do with sprigs of parsley. People behind on child support payments or who owe money in lawsuits may have money removed from their earnings, before it ever gets to their paychecks, to ensure it goes directly to whomever is owed.

Your W-2 may also report voluntary payroll deductions. These are amounts withheld from your paycheck because you’ve granted permission. These may include your portion of health and life insurance premiums, contributions to your 401(k) or other retirement fund, employee stock purchasing plans, one-time or ongoing donations to the United Way, union dues, etc.

Photo by The New York Public Library on Unsplash

You probably got multiple copies of the same W-2. Employers submit copy A directly to the Social Security Administration (remember that FICA we talked about?) and keep copy D for their own records. Copies B and C are for you (the employee) – you send one to the IRS with your federal tax return and keep one for your own records. Then, copies 1 and 2 are provided to file with any applicable state or local tax authorities. (I’ve never figured out why W-2 copies 1 and 2 aren’t called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, FF, and G, skipping E entirely?)

I've never figured out why W-2 copies 1 and 2 aren't called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, and G, skipping E entirely? Share on XIn theory, a W-2 should be mailed to the address listed on your W-4. (Don’t be confused. The W-4, is the form that tells your boss how much to withhold based on your number of dependents you have an any necessary adjustments.) Many smaller companies don’t bother mailing the W-2 and just hand them to you, but given how many people are still working from home and how iffy the postal service has been (cough, cough), you might have to Zoom or send an email to Madge in HR. Some things to consider:

- Did you change employers last year? You should have received W-2s from each employer. (If you changed jobs at the same company, you’ll receive one W-2 from each employer, not one per position. If you changed companies within a larger corporation, though, you may get one for each.)

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down to give you your W-2. Keep the boss updated!

Don’t assume that if you don’t have your W-2, then nobody knows what you made. Remember, the IRS got Copy A. The IRS knows what you made, so be sure you do, too! (If your former company went out of business or is otherwise not returning your calls, possibly due to COVID weirdness, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

Examine your W-2 it carefully. Do the numbers seem right? Compare them to the final pay stub you got for last year. Calendar years usually end mid-week (and sometimes, mid-pay period), so the numbers won’t correspond exactly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return.

W-2G (Certain Gambling Winnings)

The W2G is the freewheeling cousin of the W-2. While a W-2 is for money you make while working, the W-2G is what you get while playing. If you win more than $600 in any gambling session at a casino – whoohoo! – the “house” should request your Tax ID (generally your Social Security number) and either prepare a W-2G on the spot or send it to you in January.

Casinos aren’t interested in keeping up with your losses, just your winnings, so they only tell the IRS about what they paid you. If you do go gambling and want to deduct losses, the IRS requires you to be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

(And yeah, all of 2020 did seem like a gamble. You’re right.)

1099s (Income)

A 1099 is a form that basically says, “Hey, we paid you some money for something, but you weren’t an employee.” You get a copy; the IRS gets a copy. Easy-peasy.

There’s not just one type of 1099; actually, there are a whole bunch of 1099s. Some of the more common are:

Got a bank account? This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account. Internet-only banks often require you to log into your account to get your 1099-INT, so don’t count on it coming by mail. If you received less than $10 in interest, your bank may not send a 1099-INT.

Do you own stock or other taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equal; ask your tax professional if you have any that seem unusual or complicated. Whether you receive dividend checks or your dividends are held in a DRIP (a direct re-investment plan), if you did not earn at least $10 in dividends, you are unlikely to receive a 1099-DIV.

This form is subtitled “Certain Government Payments” and can cover everything from state unemployment compensation to tax refunds, credits, and offsets at the state and local level. It can also be used to report payment of taxable grants, agricultural payments, and other nifty things where a state or local government gives you money.

1099-NEC (NEW!!!)

As noted above, this is a new form designed to take some of the weight off the 1099-MISC (see below). If you’re self-employed (a freelancer, an independent contractor, etc.), you should get a 1099-NEC, starting this year. However, people are unfamiliar with this form and may still send you 1099-MISC until the 1099-NEC is more widely known.

Another problem is that even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-NEC. So, if you are self-employed or irregularly employed, it’s essential to keep track of your own incoming revenue. Otherwise, if the person who paid you ever gets audited, it could trigger some messy situations for you, too.

Now that this form no longer covers all the different forms of income for freelances and independent contractors, it is truly more applicable to call it “miscellaneous.” It will generally be used to report payment of royalties, broker payments, certain rents, prizes and awards, fishing boat proceeds (yes, really!), crop insurance proceeds, and some payments to attorneys that wouldn’t be reported on a 1099-NEC, like if you received a settlement and were required to pay an attorney a portion of it. In general, once people get used to the 1099-NEC, you’ll only get this miscellaneous form to report truly miscellaneous payments.

SSA-1099 (Nobody knows why the numbers and letters are reversed on this one form! It must be done by the same people who label the copies of W2s and bra sizes!)

If you receive Social Security benefits, you should receive an SSA-1099 or an SSA-1042s, the latter being for non-citizens who live outside the United States but receive benefits. (For example, widows or widowers who are receiving spousal benefits.) The 1099-SSA tends to come on a long form, folded and sealed such that it makes its own envelope.

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that a party has forgiven a debt, like a mortgage or part of a credit card balance. You may owe tax on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, and got to keep it in your pocket, it’s as if you received money.

Your 1099s sometimes hide in plain sight. Occasionally, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope – sometimes perforated, at the bottom of a quarterly or end-of-year financial statement, so be sure to check all that boring-looking official mail that arrives. Multiple forms may be sent as a “combined 1099,” scrolling across multiple pages, so check the reverse of other forms, in case you seem to be missing one.

MONEY YOU PAID

1098 (Mortgage Interest)

A 1098 is not a 1099 with low-self-esteem. The vanilla, no-frills 1098 reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. Renters don’t get 1098s; neither do homeowners who’ve paid off their mortgages.

There are also sub-types of 1098s for things other than interest on property loans:

- 1098-T indicates tuition you paid; you’ll get this from a college or training school.

- 1098-E shows you’ve paid interest on a student loan and will come from your lender.

- 1098-C indicates the donation value of a car, boat or airplane.

Photo by Diego F. Parra from Pexels

1095-A (Health Insurance Statement)

The 1095-A is also called the Health Insurance Marketplace Statement. We are all generally required to have health insurance. If you purchased yours through a state or federal exchange, this document helps you determine whether you are able to receive an additional premium tax credit or have to pay some back.

Related forms include the 1095-B (supplied by companies with fewer than 50 employees), detailing the the type of coverage you had, the period of coverage, and your number of dependents, so you can prove you had the Minimum Essential Coverage (MEC) required by law. A 1095-C is similar, but for employers with more than 50 employees.

FINAL THOUGHTS

While I spelled out the most common ones, there are other, less common, information returns. If you receive a mysterious form, or have questions about how to use a form, the IRS has a surprisingly easy Forms, Instructions and Publications Search. Also, I am a Certified Professional Organizer, not an accountant, so please address any concerns to your friendly neighborhood tax preparer.

Making sure you have all of the necessary forms in hand will make it much easier to prepare your tax return. Once you have filed your taxes, make a list of all the forms you received this year, and tuck that list into your tickler file for next January. Check off each form as it arrives, and you’ll have a better sense of when you’ll be ready to start working on your 2021 taxes in 2022.

Paper Doll Says The Tax Man Cometh: Organize Your Tax Forms

Eugene O’Neill wrote The Iceman Cometh. It’s about the human need for self-deception in order to carry on with life.

Well, I’ve got news for you. The taxman also cometh. Try as we might to deceive ourselves, we have only a little more than a month before we must complete our annual (and sometimes painful) math homework for the government. So pop some Beatles (or Beyoncé) into your sound system, and let’s get started.

Photo courtesy of Chris Potter/CCPix at www.ccPixs.com under CC 2.0

The key to approaching your taxes is to be organized. (You’re on the Paper Doll blog. Were you expecting something more Zen?) And before you can start preparing your return, you need to know the numbers. Where are the numbers? On the forms!

GATHER YE FORMS

Every taxpayer’s situation is different. If you are single, had only one job all year, and lived in the state where you were employed, and have no investments outside of your retirement accounts, the number of forms you receive may be minimal. If you’re married, have a family, or have complicated investments, or bought or sold a house (or other property), you’ll have to gather more paperwork.

It all starts with the supporting documents called information returns. These are sent to you by others – employers, banks, brokerage houses, schools, casinos, and others. The law requires these entities to provide them to you (generally by January 31st), so you shouldn’t have to do much searching. They should have shown up in your mail. So that scary-but-official mail you threw on top of the microwave the week before Valentine’s Day? Move the oven mitts and get looking!

MONEY YOU RECEIVED

W-2 (Wage and Tax Statement)

Ever had a job? If you did, and you lasted more than a day, you should have received a W-2. Your employer is supposed to send one copy to you and one to the IRS, reporting how much you were paid (in wages, salaries, and/or tips). If applicable, it should also indicate how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state, and local taxes, FICA, unemployment insurance, and a few other withholdings are considered statutory payroll tax deductions. Statutes (that is, laws) require them.

Sometimes, a court might rule that an an employee’s wages may be garnished, but this has nothing to do with sprigs of parsley. People behind on child support payments or who owe money in lawsuits may have money removed from their earnings, before it ever gets to their paychecks, to ensure it goes directly to whomever is owed.

Your W-2 may also report voluntary payroll deductions. These are amounts withheld from your paycheck, where you’ve granted permission. These may include your portion of health and life insurance premiums, contributions to your 401(k) or other retirement fund, employee stock purchasing plans, one-time or ongoing donations to the United Way, union dues, etc.

You probably got multiple copies of the same W-2. Employers submit copy A directly to the Social Security Administration (remember that FICA we talked about?) and keep copy D for their own records. Copies B and C are for the employee – you send one to the IRS with your federal tax return and keep one for your own records. Then, copies 1 and 2 are provided to file with any applicable state or local tax authorities. (I’ve never figured out why W-2 copies 1 and 2 aren’t called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, FF, and G?)

I've never figured out why W-2 copies 1 and 2 aren't called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, and G? Share on XIn theory, a W-2 should be mailed to the address listed on your W-4. (Don’t be confused. The W-4, which has a spanking-new look this year, is the form that tells your boss how much to withhold based on your number of dependents you have an any necessary adjustments.) Many smaller companies don’t bother mailing the W-2 and just hand them out to staff.

It’s March and you still don’t have yours? If you still work at the same company, go visit Madge in HR; if you’re long gone from that job (for good or ill), pick up the phone and call. Some things to consider:

- Did you change employers last year? You should have received W-2s from each employer. (If you changed jobs at the same company, you’ll receive one W-2 from each employer, not one per position. If you changed companies within a larger corporation, though, you may get one for each.)

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down to give you your W-2. Keep the boss updated!

Don’t assume that if you don’t have your W-2, that nobody knows what you made. Remember, the IRS got Copy A. The IRS knows what you made, so be sure you do, too! (If your former company went out of business or is otherwise dodging your calls, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

Examine your W-2 it carefully. Do the numbers seem right? Compare them to the final pay stub you got for last year. Calendar years usually end mid-week (and sometimes, mid-pay period), so the numbers won’t correspond exactly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return.

W-2G (Certain Gambling Winnings)

The W2G is the freewheeling cousin of the W-2. While a W-2 is for money you make while working, the W-2G is what you get while playing. If you win more than $600 in any gambling session at a casino – whoohoo! – the “house” should request your Tax ID (generally your Social Security number) and either prepare a W-2G on the spot or send it to you in January.

Casinos aren’t interested in keeping up with your losses, just your winnings, so they only tell the IRS about what they paid you. If you do go gambling and want to deduct losses, the IRS requires you to be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

1099 (Income)

A 1099 is a form that basically says, “Hey, we paid you some money for something, but you weren’t an employee.” You get a copy; the IRS gets a copy. Easy-peasy.

There’s not just one type of 1099; actually, there are a whole variety of 1099s. Some of the more common are:

Got a bank account? This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account. Internet-only banks often require you to log into your account to get your 1099-INT, so don’t count on it coming by mail. If you received less than $10 in interest, your bank may not send a 1099-INT.

Do you own stock or taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equally; ask your tax professional if you have any that seem unusual or complicated. Whether you receive dividend checks or your dividends are held in a DRIP (a direct re-investment plan), if you did not earn at least $10 in dividends, you are unlikely to receive a 1099-DIV.

If you’re self-employed (a freelancer, an independent contractor, etc.), you should get a 1099-MISC. The problem is that even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-MISC. So, if you are self-employed or irregularly employed, it’s essential to keep track of your incoming revenue. Otherwise, if the person who paid you ever gets audited, it could trigger some messy situations for you, too.

Your 1099s sometimes hide in plain sight. Occasionally, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope – sometimes perforated, at the bottom of – a quarterly or end-of-year financial statement, so be sure to check all that boring-looking official mail that arrives. Multiple forms may be sent as a “combined 1099,” scrolling across multiple pages, so check the reverse of other forms, in case you seem to be missing one.

If you receive Social Security benefits, you should receive a SSA-1099 or an SSA-1042s, the latter being for non-citizens who live outside the United States but receive benefits. (For example, widows or widowers who are receiving spousal benefits.) The 1099-SSA tends to come on a long form, folded and sealed such that it makes its own envelope. If you did not receive your SSA-1099, you can log into your only Social Security account to access it.

And no, I have no idea why it’s called an SSA-1099 instead of a 1099-SSA. Obviously it was put together by the same people who created those extra 1099 pages…and bra sizing.

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that a party has forgiven a debt, like a mortgage or part of a credit card balance. You may owe tax on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, and got to keep it in your pocket, it’s as if you received money.

MONEY YOU PAID

1098 (Mortgage Interest)

A 1098 is not a 1099 with low-self-esteem. The straight-up 1098 reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. Renters don’t get 1098s; neither do homeowners who’ve paid off their mortgages. There are sub-types of 1098s for things other than interest on property loans.

- 1098-T indicates tuition you paid; you’ll get this from a college or training school.

- 1098-E shows you’ve paid interest on a student loan and will come from your lender

- 1098-C indicates the donation value of a car, boat or airplane. (Yes, even if you donated through 1-877-Kars4Kids.)

Photo by Daniel Salcius on Unsplash

1095-A (Health Insurance Statement)

The 1095-A is also called the Health Insurance Marketplace Statement. We are all generally required to have health insurance. If you purchased yours through a state or federal exchange, this document helps you determine whether you are able to receive an additional premium tax credit or have to pay some back.

Related forms include the 1095-B, supplied by companies with fewer than 50 employees, detailing the the type of coverage you had, the period of coverage, and your number of dependents, so you can prove you had the Minimum Essential Coverage (MEC) required by law. A 1095-C is similar, but for employers with more than 50 employees.

FINAL THOUGHTS

The post reviewed the most common in-bound forms you are likely to need (along with receipts for purchases and confirmations of donations), to help you prepare your income taxes. There are other, less common, information returns. If you receive a more mysterious form, or have questions about how to use a form, the IRS has a surprisingly easy Forms, Instructions and Publications Search.

Making sure you have all of the necessary forms in hand will make it much easier to prepare your tax return. Once you have filed your taxes, make a list of all the forms you received this year, and tuck that list into your tickler file for next January. Check off each form as it arrives, and you’ll have a better sense of when you’ll be ready to start working on your taxes.

With everything in hand, it’ll be harder to stick to that self-deception O’Neill wrote about in The Iceman Cometh, but knowing you’re prepared for the taxman may make you feel better.

If you drive a car, I’ll tax the street.

If you try to sit, I’ll tax your seat.

~The Beatles, “Taxman”

Back-to-School Organizing News You Can Use: 3 Solutions to Save Time, Money, and Serenity

Wait, it was just Independence Day! Why are we talking about back-to-school organizing? In ye olden days, when I grew up in Buffalo, New York, where kids still don’t go back to school until after Labor Day, talking about back-to-school so soon after the 4th of July would be like stores putting up Christmas decorations right after Halloween. (Oh…right.)

But there’s a method to the madness. In many parts of the country, students go back to school in the middle of the summer. In my county in Tennessee, the public schools start on August 3rd, and mere miles from me in Georgia, students go back on the first of August. But even for kids going back to school in September, that’s only about eight weeks from now. Instead of rushing to get everything done, here’s a roundup of ways to organize your approach to the back-to-school season.

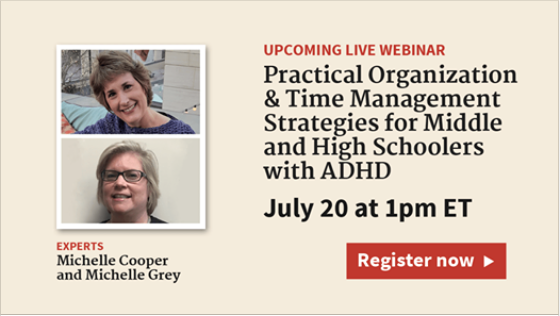

ORGANIZE YOUR ADHD STUDENT – FREE WEBINAR

Paper Doll‘s colleagues (and longtime friends), Michelle Cooper and Michelle Grey of Student Organizers of Atlanta will be presenting a free, live webinar entitled Practical Organization and Time Management Strategies for Middle and High Schoolers with ADHD on July 20, 2017, at 1 p.m. ET.

Presented as part of ADDitude Magazine‘s ongoing webinar series, the webinar will provide strategies for:

- Managing the day-to-day organizational challenges facing students both inside and outside of the classroom

- Understanding your child’s “thinking style” and finding organizing methods and tools that fit his or her style

- Using organizational systems that will improve his or her chances of academic success

- Collaborating with your child and the teachers to support his or her efforts at organization

- Using products, books, and websites to ease the process of organization for your student

Register for the webinar and take it live, or you can use the replay link to watch (or rewatch) the webinar for free, any time up through next January 20, 2018.

Learn more about ADDitude and check out the other webinars in the series. If your child is heading to college, both of you might want to watch the webinar on July 11, 2017, entitled The College Transition Guide for Teens with ADHD.

ORGANIZE YOUR FINANCES – TAX-FREE HOLIDAYS

Over the four weekends from July 21 through August 13, sixteen states will be having tax-free holiday weekends. In general, these states allow retailers to sell clothing and footwear, school supplies, computers, and sometimes backpacks, books, and other “tangible personal property” without charging sales tax. In my state, that’s a savings of 9.25%. Combine that with various 10%-25%-off sales, and that’s a great opportunity to stock up on necessities.

Note: Some states, such as Georgia, have discontinued their tax-free holidays, so be sure to check out states adjacent to yours.

Click on the name of your nearest state to be directed to that state’s official tax-free holiday page.

Alabama (July 21-23, 2017)

Tax-free: Clothing (up to $100), Computers (up to $750), School supplies (up to $50), Books (up to $30)

Arkansas (August 5-6, 2017)

Tax-free: Clothing and footwear (up to $100), Clothing accessories and equipment (up to $50), School and academic art supplies (no dollar limit)

Connecticut (August 20-26, 2017)

Tax-free: Clothing and footwear (up to $100)

Florida (August 4-6, 2017)

Tax-free: Clothing, footwear, wallets, and bags (up to $60), School supplies (up to $15/item), Computers (up to $750)

Iowa (August 4-5, 2017)

Tax-free: Clothing and footwear (up to $100)

Louisiana (August 4-5, 2017)

Tax-free: Tangible Personal Property (3% tax rate up to $2,500; a 2% state sales tax exemption applies, so qualified purchases are subject to only 3% state sales tax)

Maryland (August 13-19, 2017)

Tax-free: Clothing & footwear (up to $100)

Mississippi (July 28-29, 2017)

Tax-free: Clothing & footwear (up to $100)

Missouri (August 4-6, 2017)

Tax-free: Clothing (up to $100), Computers/peripherals (up to $1,500), Software (up to $350), Graphing calculators (up to $150), School supplies (up to $50)

New Mexico (August 4-6, 2017)

Tax-free: Clothing and footwear (up to $100), Computers, tablets, and e-readers (up to $1,000), Computer equipment (up to $500), Book bags and backpacks (up to $100 per item), maps and globes (up to $100 per item), Calculators (up to $200), School supplies (up to $30)

Ohio (August 4-6, 2017)

Tax-free: Clothing (up to $75), School supplies (up to $20)

Oklahoma (August 4-6, 2017)

Tax-free: Clothing and footwear (up to $100)

South Carolina (August 4-6, 2017)

Tax-free: Clothing (no limit) School supplies (no limit), Computers, printers, peripherals, and software (no limit)

Tennessee (July 28-30, 2017)

Tax-free: Clothing (up to $100), School and art supplies (up to $100), Computers (up to $1,500)

Texas (August 11-13, 2017)

Tax-free: Clothing, backpacks and school supplies (up to $100)

Virginia (August 4-6, 2017)

Tax-free: Clothing (up to $100), School supplies (up to $20), Energy Star products (up to $2,500) and a variety of hurricane-preparedness items.

Tax-free holiday tips:

- The price limits generally refer to the price-per-item cost, not your entire purchase. However, if a store is placing limits on entire purchases and you have a large family, you might want to have your older, more responsible children stand in line and pay with cash.

- Make a list of what each child needs before you get to the store. (Check with your school to see if a grade-appropriate list has been posted online.) It’s tempting to buy anything that seems like a bargain, but acquiring what you don’t need just because it’s a “deal” is the fast track to clutter.

- Set a budget for each shopping category.

- Shopping with smaller children will stress you (and your kids) out, so consider trading shopping and babysitting time with a friend or split babysitter costs while you and your friend hunt for bargains together. Let older children participate – use it as an opportunity to practice math skills (“How much is this shirt if it’s marked as 15% off?”) and encourage them in finding good deals on high-quality products. The more responsible they are, consider rewarding them with the amount by which they came in under budget to apply toward something fun.

- Remember to keep your receipts in case you find that you need to return something; note each retailer’s return policy.

ORGANIZE YOUR STUDENT’S SCHEDULE – A NEW KIND OF PLANNER

As mentioned a few weeks back when I was talking about Time Timer, many people, especially students, can have trouble mastering the concept of the passing of time, which makes it difficult to properly plan academic and life tasks. When I was in middle and high school, almost nobody used a planner or a calendar. These were the days when Trapper Keepers were the height of organizational technology and pocket-sized assignment notebooks yielded the best option for academic time management. Somewhere during the <mumble mumble> intervening decades, schools started providing and/or requiring student planners to help keep up with homework assignments, projects, and tests.

These planners give students the opportunity to mark down what they must do. It’s not clear, however, that students get the time management skills and system-training they need to master the intricacies of juggling academics, extracurriculars, part-time jobs, and familial obligations, or learn when to complete it all. That’s where Leslie Josel comes in.

Professional organizer Leslie Josel of Order Out of Chaos, is not just a colleague and friend; she’s also a fellow Cornell University alum, so when I first heard about her product line for students, I paid particular attention.

Paper Doll with Leslie Josel, © 2017 Best Results Organizing

At first, Leslie’s organizing practice concentrated on working with chronically disorganized clients, people with ADHD, students with learning challenges, and clients with hoarding behaviors. Eventually, (like Michelle and Michelle, above), she expanded her offerings to include coaching services for both students and parents. In 2016, Leslie expanded her company’s product division and officially launched Products Designed With Students in Mind.

Leslie’s big idea was the Academic Planner: A Tool for Time Management®. The 2017-2018 Academic Planner comes in two sizes: letter-sized (8 1/2″ x 11″) and personal-sized (8 1/4″ x 8 1/2″), both for $18.99. Based on an academic year calendar, the planners run July through June. They’re spiral bound, but also three-hole punched to allow students to pop them right into their binders.

Each size is available in four styles of planners: Jamie (black), Riley (orange/blue), Taylor (white) and Paper Doll‘s personal favorite, Violet (pink/purple). The interior pages measure 7” x 11”, offering up more than the typical space for writing down assignments and activities.

Introductory Pages

The front pages, measuring the same size as the front and rear cover of the planner, include:

- a contact information section so a lost planner can be easily returned

- a class schedule (subject, period, instructor, room #, days) to quickly acclimate students for the new year (and give a fellow student, armed with the contact info, an easy way to find the owner at the right classroom and return a lost planner)

- a Welcome Letter from Leslie to parents

- a detailed set of Planner Pointers, providing excellent guiding tips for making smart use of the planner. (My favorite? Writing “No Homework” if none was assigned so the student never has to wonder if he or she just forgot to write something down.)

- a two-page Planner Use Guide, showing the planner in action — noting assignments, reminders (“Get permission slips signed!”), after-school activities and previews for the next week

- Homework Helpers, tips that could only come from a professional organizer experienced with helping students gain control of their work.

- a sample Project Planning Guide to help plan long-term assignments (Students can download more guides for future projects.)

- a two-page School Year at a Glance

Planner Pages

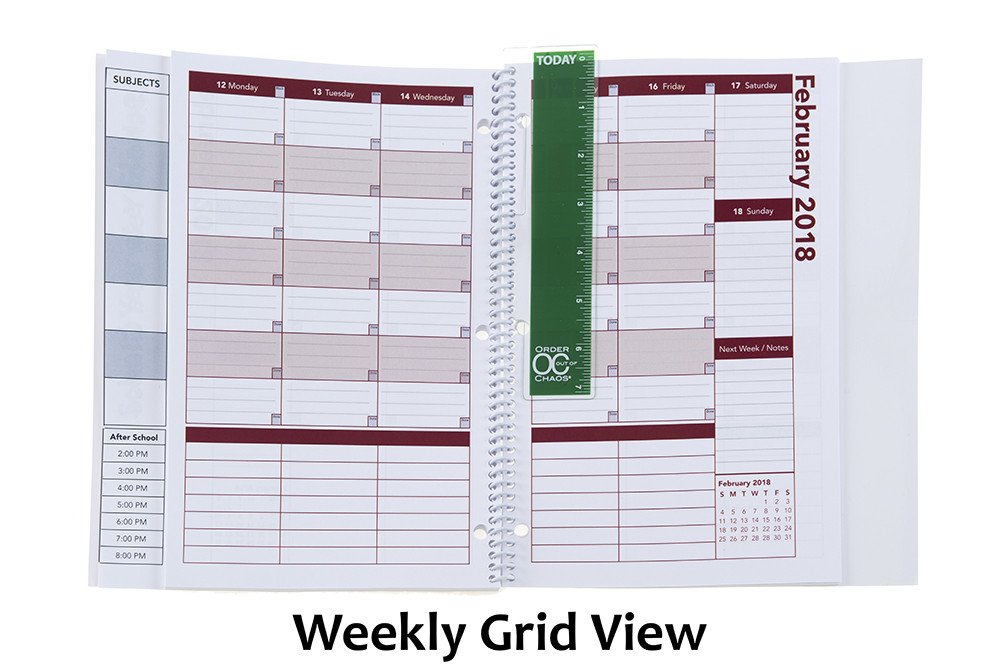

On the last (extra-sturdy) full-sized front page, the Academic Planner has a vertical index page that peeks out from behind (and to the left) of the actual planner pages. This index page means that students record their class subjects (in up to 7 subject boxes) only once. Then everything on the upper calendar sections of the planner pages lines up with the appropriate class subjects, course by course, horizontally (with days of the week arrayed, vertically) across a two-page layout. (You can download a sample planner page.)

The next row (in the personal-sized planner, only) is for To Do items.

Below that, there’s an hour-by-hour schedule from 8 a.m. until 8 p.m. Typical student planners only cover the academic day and don’t take into account post-school activities, like doctor’s appointments, tutoring, clubs, rehearsals, sports, and jobs. This planner provides oodles of space for all of those activities and recognizing conflicts (just like in the best calendar planners for adults). This really helps students see the forest and the trees of weekly time management.

Other Features

- At the start of each month, there’s a left-side full-page monthly calendar with space to note major events, holidays, and vacations, and adequately plan longer-term projects.

- The right-side Notes page facing the calendar offers up ample room for planning, notes, and the kinds of serious thoughts only people between 12 and 18 can understand.

- There’s a clear poly pocket at the rear of the planner for safely keeping notes, permission slips, and other documents too small for a student’s binder.

- A bonus Academic Planner Accessories Pack (sold separately, for $8.97) includes a plastic page marker that clips into the spiral binding, so it’s easy to find the current week in the planner, a set of monthly tabs, and a really bright, sunny set of useful stickers.

But of course, measurements, styles, and features don’t give credit to what the 2017-2018 Academic Planner: A Tool for Time Management® can actually do to help students. For that, let’s go to the video!

Enjoy your summer, but remember that a little organizing now can make back-to-school the most wonderful time of the year!

Disclosure: Some of the links above are affiliate links, and I may get a small remuneration (at no additional cost to you) if you make a purchase after clicking through to the resulting pages. The opinions, as always, are my own. (Seriously, who else would claim them?)

Paper Doll’s Tax Time 2017: Shredding Advice and Free Shredding Coupons

Americans had a few extra days to file their taxes this year. The usual April 15th deadline that so many of us dread fell on a Saturday. Normally, the deadline would be pushed to the following Monday, but because April 17th is Emancipation Day, a legal holiday in Washington, DC, tax returns were granted another reprieve, until April 18th.

But what about a reprieve from all of the paper clutter that results from preparing your taxes? Have you completed your federal and state (and perhaps local/municipal) returns only to find that you are being crowded out of your workspace by a mountainous “to shred” pile?

Tax time is the perfect opportunity to clear out your file folders, your desk drawers, your purses, wallets and pockets, and to shred all those random receipts and documents that you don’t need to support your tax returns. Why? To protect your identity!

Of course, if you don’t know what you need to keep vs. what you should shred, Paper Doll has you covered with Do I Have To Keep This Piece of Paper?

DO-IT-YOURSELF

Shredding isn’t difficult, but it’s also not much fun.

OK, it’s not much fun for most people, Weird Al aside. But it can be made convenient.

In most cases, consistent use of a medium-sized shredder for your home office or small business should suffice to keep the backlog at bay and keep your papers from piling up in between tax seasons. If you don’t yet have a shredder or are in the market for a new one, some of the basic things to consider are:

- Capacity — There are three key criteria:

1) How many sheets of paper can you feed at one time? While shredders are generally rated by the number of sheets shredded simultaneously, Paper Doll believes many manufacturers are a bit too optimistic in self-reporting. Aim for the highest capacity shredder in your budget range.

2) How much paper can you load in any session without the motor pooping out on you? This won’t generally be listed on the box, so take some time to read user reviews at Amazon and ConsumerSearch.

3) What else can you shred besides paper? While not everyone will have a need to destroy CDs/DVDs, the shredder you select should, at the very least, be able to handle stapled paper and expired credit cards.

- Ease of Use — The main concerns are an adequate-width feeder and an easy-to-empty receptacle or bin. The nicest shredders have a removable bin that slides out like a drawer or tips out like a laundry chute, but these tend to be more expensive than the budget versions, where the shredding mechanism lifts off to reveal a metal or rubber receptacle. Avoid the low-rent shredders that only provide a mechanism to set atop a trash can — these are usually ill-fitting, poorly balanced and lead to a flurry of shreds on your carpet, which furry animals and tiny humans will spread far and wide.

- Features — Any decent shredder should have an auto-start function, such that as long as your shredder is turned on, you should be able to insert documents to shred. A “forward” function keeps the motor running whether you are shredding or not. The “reverse” function is important for helping you clear paper jams quickly, especially when you feel immediate friction and realize you’re trying to shred too much paper at once.

- Aesthetics — While the design of a shredder shouldn’t be your main concern, an overly noisy or ugly shredder may be a deal breaker. Whenever possible, test a friend’s shredder or ask a sales associate to help you test a floor model. The noise a shredder makes isn’t exactly pleasant, but some have more vibration or grinding than others.

- Shred Size and Shape — You want a cross-cut or micro-cut shredder. The rare old-style strip-cut shredders offer less protection against prying eyes. Cross-cut shredders reduce your paper to squiggles. Micro-cut shredders pulverize papers even more finely, but may be overkill (in terms of both function and cost) for personal use.

- Shredder Size — There’s no polite way to say this: size matters. Clients purchase desktop mini-shredders in hopes that the small size and convenience of easier access will make them more inclined to routinely shred junk mail. However, I find most desktop shredders lack the gravitas needed to handle daily work. The feeders tend to be too small for ease of usability — usually about 5″ wide, while typical mail is 8 1/2″ wide. Even smaller paper generally has to be folded in order to fit into desktop feeders. Perhaps Paper Doll is spoiled, but the ability to shred a short stack of paper without having to fold or spindle in order to mutilate is essential. Mini-shredders are not designed for power-shredding, but even applying relaxed standards, they still tend to overheat quickly, either from lumpy paper gumming up the works or over-exhaustion. A mini-shredder is a lot like an Easy-Bake® Oven. Yes, it can do what it promises, but would you cook Thanksgiving dinner without a full-sized oven?

SHREDDING SERVICES

You know how important it is to shred the paper that you no longer need for tax, legal or proof-of-ownership purposes, because merely tossing them in the trash could make you ripe for identity theft. But you also know that once your shred pile is as tall as the youngest of your tax-deductible dependents, your personal shredder is going to wimp out before you get through everything.

Of course, you may not have the time, space, or shredding firepower to shred your own documents. If that’s the case, there are a wide variety of companies that offer document destruction services nationwide, including Shred-It, Iron Mountain, Shred Nations, and Pro-Shred. If you need help finding shredding services in your areas, you can turn to the National Association for Information Destruction. The NAID’s interactive map will locate shredding companies nearest to you. Just type in your geographic location (or keep clicking the plus sign to get a close-up of your area.)

In addition to shredding specialists, you can pay to have your paper shred retail locations like FedEx Office, the UPS Store, Staples, and Office Depot/Office Max. Prices range from 99 cents per pound, upward.

Office Depot/Office Max is offering a coupon for up to 5 pounds of free document shredding from now through April 29, 2017.

This photo is just a facsimile. So, click on the above link, print it out, clip it, gather up your shredding and get that pile of paper clutter out of your office (or off your kitchen table).

Staples also has a coupon — for 2 pounds of free shredding with code 23733. You’ll have to click the link to locate the coupon on the resulting page and print it or send it to your mobile device.. Please note that this coupon expires April 22, 2017.

FREE SHREDDING OPTIONS

Various universities, government agencies, and community groups partner with shredding companies throughout the year for events billed as shred-a-thons and shred days. Be sure to Google one of these terms and your city or town name to find events near you. Many are held in mid-to-late April, so don’t delay.

See? It doesn’t have to be so taxing, after all. Declutter, protect your identity, and save money!

Taxing Conversations (Part 3): Form-Free Organizing

For most people, anticipating tax time falls on a continuum from vague annoyance to full-blown anxiety. Getting organized isn’t a panacea against all that causes us stress, but it can inoculate us against the worst of it. (As Paper Doll always says, organizing can’t prevent catastrophes, but it can help make them less catastrophic.)

In our last two posts, we’ve looked at the basics for getting started organizing for tax time (including making use of the IRS’s new Get Transcript service), and we’ve tried to make some sense out of W-2s and the myriad 1099s and 1098s that organizations and institutions are obligated to provide you.

But what about other documents, the kinds that don’t come on forms? Most will be proof of deductible financial transactions. While some may be provided directly to you at the time (like receipts for deductible expenses), others may be sent as part of correspondence. And, of course, other types of proof will require you do some hunting and gathering.

There are a few main categories to consider.

YOUR HEALTH

You could (and probably should) maintain a folder with the receipts and annotated (paid) statements for all of your family’s out-of-pocket doctor’s visits and other medical care. At the end of the year, flipping through this folder allows you to summarize your medical expenses and determine if you’ve met the IRS threshold for deducting them. If you use a financial dashboard like Mint and are faithful about making sure expenses are assigned to the right categories, you may not have to do any math at all.

For reference, effective this year, you may only deduct medical expenses that exceed 10% of your adjusted gross income. (If you are 65 or older, the old 7.5% applies until 2017.)

If you have health insurance coverage, your company probably creates an annual summary indicating how much health care you’ve used and the amount you paid/owed to medical providers during the course of the year. For example, Blue Cross Blue Shield calls theirs a personal health statement.

The trick is that most people have no idea that their insurance companies create these summaries, as they tend not to be mailed to policy holders. Insurers save mailing costs and hope you’ll know to log into your online account to search for your summary. (If your medical expenses for the prior year are too low to qualify to be deductible, just save a PDF of your summary for your records; don’t bother printing.)

If your insurance company doesn’t create annual summaries, you can usually use the “You Owe” column of the Explanation of Benefits (EOB) that your insurer sends after doctor’s visits, hospitalizations and procedures (and you should definitely be able to log in or call to request copies of these, if you’ve discarded them). If your medical expenses are low, no further effort is needed, but if it looks like you’ll be able to take deductions, using your annual summary or EOBs will give you a handle on which receipts or dated statements you’re seeking for tax support.

In the future, try to be vigilant about saving medical expense receipts, as your EOBs and insurance company summaries are not considered proof of what you spent on deductible medical expenses, only indications of what you owed to medical providers. Collect receipts for:

Medical care expenses: Be sure to only count expenses for which you paid and not portions paid by the insurance company or “network savings.” (That’s the amount knocked off the bill simply because you have insurance. If you were uninsured, you’d be charged more than the total paid by you and the insurance company!)

Pharmaceutical expenses: Call or visit your pharmacy to request a printout of all pharmaceutical purchases you made for yourself and your children during the prior tax year. (Because of privacy laws, your spouse may have to make a separate request.) Using only one pharmacy for prescriptions is advantageous.

Health Savings Account documentation: For every qualified medical expense you pay through your health savings account (HSA) or medical savings account (MSA), keep a record of the name and address of each person or company you paid and the amount and date of the payment. Since HSAs can be used to cover everything from orthodontia and acupuncture to durable medical equipment and contact lens solution, be sure to save your receipts, and if a receipt doesn’t clearly describe what you actually purchased, make a note at the top to ease your efforts at tax time.

Medically-necessary travel expenses: If you (or a family member) have conditions that require travel for treatment, you can deduct the travel costs. Keep a paper or digital log of the miles driven and use the current IRS standard mileage rate for medical purposes for 2013 (or 2014).

YOUR HOME

Home purchases: Maintain records regarding the purchase (or sales) documentation for a house, as well as records for closing costs, home inspections, fees paid to real estate agents and any records regarding private mortgage insurance.

Casualty and theft losses require documentation. For thefts, you’ll need to have proof of ownership (that’s why we recommend saving “big ticket” item receipts and videoing a household inventory), proof of theft (usually via a police report) and the date that the item was stolen (to proove it falls in the appropriate tax year).

For proof of loss due to casualty, maintain insurance company confirmation letters regarding the date and cause (ice storm, lightning, fire, auto accident, etc.) of a loss, estimates of original costs and costs of repair/replacement vs. what your insurance company will or will not pay (or has paid), and proof of ownership.

Moving expenses relate to actual costs (movers, truck rental, storage, etc.) and mileage. Did you move more than 50 miles in order to work at a new job/location? Check out IRS Publication 521 regarding what you’ll have to document.

Other home-related paperwork to save include:

- Receipts and records regarding any home improvement efforts you’ve made which materially increase the value of your home (which will have a tax implication when you sell).

- Records of purchases for your primary residence that qualify you for the Energy Star tax credits for the applicable year. This gives you credit for 10-30% of costs for energy-efficient purchases, including biomass stoves, various heating/air conditioning devices, insulation, water heaters and windows and doors, geothermal heat pumps, residential small wind turbines, and more.

YOUR HEART

Childcare/Eldercare costs: To take advantage of the Child and Dependent Care Credit, you’ll need documentation of the name, address, and Tax ID number for any care provider you’ve used for your kids or other dependents. Whether you’re using a babysitter from down the street or employing the services of a daycare facility (for either children or adults), use federal form W-10, Dependent Care Provider’s Identification and Certification.

Even if you’re not planning to run for elected office, be sure you’re not running afoul of Nanny Tax rules regarding FICA (Social Security and Medicare) and FUTA (unemployment insurance). Use a Nanny Tax calculator and keep careful records of what you paid, when, what you withheld and what you submitted to the IRS.

Charitable donations: You may get a nice form letter on a non-profit’s stationery, or they may bury your acknowledgment as tiny text in asterisked comments at the bottom of requests for further donations, so be diligent about opening your mail. A charitable contribution confirmation should include the name of the qualifying charitable organization, a date of donation or at least the date of the acknowledgment (i.e., something to prove the tax year of the donation) and a dollar amount (or a description of materials if an “in-kind” (non-monetary) donation was made).

Not every charity confirms donations in writing. For your protection, keep your own records regarding donations you make. Use the charitable request letter or even a plain piece of paper to mark the date, dollar amount and method by which you paid (check number or credit card name), and file it away. Again, if you use a financial dashboard, identifying all of your donation amounts will be easier. If not, read through your credit card statements and highlight the charitable donations.

YOUR HEAD

Educational expenses: Higher learning can be deducted and the number and type of credits (the Hope Credit, Lifetime Learning Credit, American Opportunity Credit), Savings Bond programs and more can be dizzying. Just be sure that in addition to keeping your 1099-T (for tuition) and 1099-E (for educational interest), maintain transcripts that show your periods of academic enrollment, as well as canceled checks, credit card statements or other receipts that verify the dates of payment and amounts you spent on tuition, books, lab materials, student fees, etc.

Work-related costs: Un-reimbursed employee expenses may include costs for your vehicle or for travel, meals, entertainment or even client gifts. Unfortunately, you have to itemize and not take the Standard Deduction for these to do you any good, and your combined itemized expenses must exceed 2.5% or more of your AGI. Since you have no way of knowing in January what kinds of expenses your employer might force you to rack up in July, start maintaining a folder for these records right away. If you didn’t save receipts during the year, your credit card should provide proof for the largest of the expenses, like airfare and hotel costs.

Proof of payment for jury duty: Yes, it’s your civic duty, and yes, you probably got paid less per day than what you spent at Starbucks to stay awake in the jury box. You might receive a 1099 if you racked up enough days of service, but be sure to keep your own records regarding this kind of payment. If your employers required you to turn your jury duty payments over them, keep records so you can request an adjustment to reduce your AGI.

Tips: If you work in the food industry or a personal service profession where you receive tips, the IRS expects you to keep track of and report what you’ve made. (Yes. Really.) Use a mobile app like TipCounter or Tip Log to record of the tips you took in and what you were required to “tip out” to other support staff members (like bus boys, shampooers, etc.). If you prefer paper, keep a notebook; the IRS form 4070A is pretty clunky.

Self-employed/small business expenses: If you own your own business, you need a unique, separate filing system for all your business-related expenses, including tax paperwork. Check the classic Paper Doll post Organizing Your Tax Paperwork–Part 3: Get Your Business (Receipts) Off The Ground to make sure you capture all the essentials.

I hope this series of Taxing Conversations helps you ramp up your efforts to organize for tax time. Remember, Paper Doll is a professional organizer; in the language of the web, IANAA (I am not an accountant) and IANYA (I am not your accountant). For individual tax-related questions, please contact an authorized tax preparation specialist or financial planner.

Follow Me