Archive for ‘General’ Category

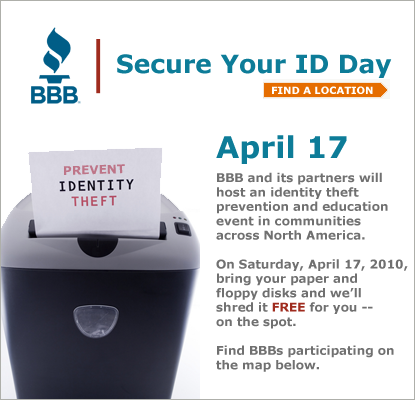

Special Post: Secure Your ID Day: BBB-Sponsored Shredathons on Saturday

On Saturday, April 17, 2010, 55 Better Business Bureau locations are helping you observe Secure Your ID Day by sponsoring community shred-a-thons.

Will The Real Paper Doll Please Stand Up?

A Boy Named Sue May Hate His Name (but that doesn’t mean you can steal it!)

The Big OUCH!!! (Medical Identity Theft–Part 1)

Doctor, It Hurts When Total Strangers Do This! (Medical Identity Theft, part 2)

So moms and dads, small business owners, volunteers and professional organizers, gather up any paper (and computer discs) with personally-identifying information (but which you no longer need), and transport it (securely!) to your one of the participating U.S. or Canadian Better Business Bureau locations. BBB-partnered document destruction specialists in your area will shred your documents (for free) and help you preserve your good name.

Remember, you are the only you you’ve got.

Remember, you are the only you you’ve got.

A Mysterious Stranger Will Declutter Your Paper: Organizing Fortune Cookie Fortunes

An admirer is concealing his affection for you.

Confession: the above are taken from the slips of fortune cookie fortunes I found in my own home this week. I have a sneaking suspicion there might be others, hiding in dark corners of jewelry boxes, an old wallet, possibly bookmarking and Jane Austen. (Poor Jane, who never knew the joys of Crab Rangoon, sweet & sour anything, or the delights of Kung Pao!)

WHY FORTUNE COOKIES?

Paper Doll does not obsessively dine on Chinese takeout meals. And my home is generally lacking in other kinds of paper clutter and floozies. So why have I saved these? And why, when I usually talk to you about organizing serious paperwork like financial and medical files, or solutions for dealing with paper trail overwhelm, am I talking about these inconsequential slips of paper?

Well, I could blame it on Erin Doland, the dazzling Editor-in-Chief at the Unclutterer blog. A few months back on Twitter, Erin had recommended The Fortune Cookie Chronicles by former New York Times journalist, Jennifer 8 Lee. Given Erin’s reputation for good taste in writing, fellow blogger Jeri Dansky and I jumped in.

It’s not hard to explain why the book resonated so much with me.

Love of good food? Check.

Fascinatingly delivered history lessons about the immigrant experience over the past century and a half? Check!

An entertaining catalog of culinary anthropology detailing how Chinese food became so popular in the United States, even in tiny towns dotting the South and Midwest and in Orthodox Jewish communities? Check!

A collection of mysteries about that darn General Tso, how Chinese cuisine launched a food delivery revolution, and even the true origins of fortune cookies? Check and mate!

But all of these fascinations would not have been worthy of a Paper Doll post. What does this have to do with organizing?

Around the same time I was reading Lee’s Chronicles, I noted, not for the first time, that almost any time I organized a desk, whether at a business or in a home office, and often, when I organized kitchens and bedrooms, we’d turn up a handful of loose fortunes. Occasionally, they’d be push-pinned to a bulletin board or taped up on a computer monitor or slid under a glass desktop. In general, however, these clients were not the type to hold on to either floozies or loose scraps of other “omens”, like daily horoscopes. There seems to be something special about fortune cookie fortunes.

What is it about fortune cookie fortunes that makes so many feel the need to save them? What’s the difference between Paper Mommy scribbling “You’re going to do great today!” on a piece of scrap paper from her desk, tucking it in with my peanut butter sandwich, and a fortune cookie fortune?

I asked people on Twitter and Facebook what they do with their fortunes. Some professional organizers, like Julie Bavington, were straightforward about ejecting the clutter: “Fortunes are just paper scraps. I toss ’em.”

Others, such as a usually-organized marketing expert I know, said “Sometimes I keep the REALLY great ones, but after a while they disappear. As in, I have no clue where I put them.”

FORTUNE SAVER PROFILES

I’ve found three types of fortune savers. First are those who tend to save everything, not by decision, per se, but through lack of making decisions regarding what to keep or toss.

Second are the people who feel really strongly about portents and omens. According to Lee, it’s common for some people to burn “really good” fortunes right there in restaurants in order to ensure good luck, a custom I imagine has been greatly reduced by the removal of ashtrays from restaurants now that most states have eliminated smoking in eateries. These people, if they aren’t “burners”, may have developed their own personal superstitions, where it just doesn’t feel right to let go of the fortunes, as if it will scatter the good luck.

For this second type, it will do no good for me to make the point that these fortunes are generated by freelance fortune writers, fed into a computer and spat out according to an algorithm of so many of fortune #2735 every so many seconds. Intellectually, they know that the slips of paper carry no power…but they feel better…safer…holding on to them.

The third type knows just the opposite. They know that fortune cookie fortunes, like photos, upbeat horoscopes and encouraging notes from our loved ones, have immense power. Fellow professional organizer Janice Simon replied to my fortune cookie inquiry on Twitter, saying “I kept some of my fortunes in a jar and would pull one out when I needed a pick-me-up.” We know our best lipstick, our lucky baseball caps and the fortune that says An admirer is concealing his affection for you can put a little extra spring in our step. We, ourselves, imbue fortunes with the power to raise our spirits. We, turn our good fortunes into self-fulfilling prophecies. (Haven’t you noticed most people only toss their boring or disappointing fortunes?)

So why not hold onto some of the better messages…as long as we can keep them corralled in an organized fashion, so they don’t shower down around our feet every time the air conditioner blows? If you can’t part with your fortune cookie fortunes, there are quite a few options for keeping them organized.

BOOK ‘EM

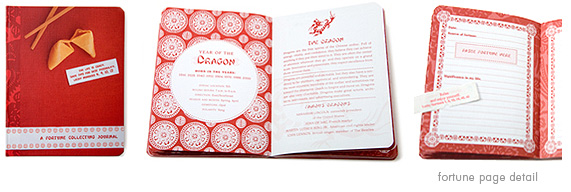

Jennifer 8 Lee writes about Michael Moskowitz, who, in order to keep track of his own favorite philosophical fortunes, ended up backing the foreign manufacture of a Fortune Album. The Floridian couldn’t purchase just one, so when Lee interviewed him, he still had crates of unsold albums to unload. Lee’s book must have brought him good fortune, though, because the site now states that there are only 300 albums remaining!

Paper Doll is also charmed by the Spoon Sister’s fortune cookie album, with a place to paste fortunes and jot down related thoughts.

Of course, you could also tape or staple fortunes to pages in any notebook, from a fancy Moleskine to a speckled composition book, and write journal entries about with whom you dined and what thoughts the fortunes brought to mind.

SHOOT THEM

With everything from not-so-gently loved stuffed animals to broken rocking chairs to poufy dresses fifty years out of fashion (and taking up more than their fair share of the closet), we professional organizers often recommend some variation on the old taunt: “Take a picture — it’ll last longer!”

Indeed, each photo of tangible objects can reduce the clutter without adversely impacting the memory or the feeling you equate with the item. Consider collecting the loose fortunes from around your house, arranging them on a piece of paper (Perhaps red? That sounds like good feng shui!), and take a photo. The digital version would make great wallpaper for your computer, or you could put the snapshot up on your bulletin board for inspiration.

BLOG THEM

You wouldn’t be the first, or the last, if you transcribed the messages on those tiny slips and turned them into blog posts. Paper can burn or fade, but thanks to the Wayback Machine, even long-abandoned web sites and blogs now live forever.

Blogger Josh Madison devoted an entire post dedicated to hundreds of his collected fortunes. (Paper Doll‘s favorites? The time management-themed “An inch of time is an inch of gold” and the focus-oriented “Dedicate yourself with a calm mind to the task at hand.” Apparently paper organizing isn’t a very common fortune motif.)

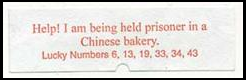

Although submissions to Weird Fortune Cookies ended last year, there’s a fine collection of the bizarre and silly, including this often-told classic:

GET KOOKY

The FortuneKookie.com is a fortune cookie themed social networking site that gets a little kooky with the various options for storing your cookie messages without actually keeping the slips of paper. Sign up for a free account, create your profile, and start logging in the fortunes you receive, which you can do via the web site or your mobile phone.

You may choose to share your fortune, either at your personalized URL (e.g., http://FortuneKookie.com/PaperDoll) or via social networking on FortuneKookie’s Facebook application or tweeted directly to your Twitter stream. Or, you can just use the site as a digital notebook to keep track of your fortunes. Click the on-screen cookie to get your daily fortune, horoscope-style. Even purchase a fortune shirt, a customized T-shirt with your favorite fortune from among their collection…or use one of your own.

GO OLD SCHOOL

Those of Paper Doll‘s readers who were born in the 90’s or after probably don’t remember a world before CDs, but somewhere beyond the golden age of vinyl and the forgettable age of 8-tracks, we made mix tapes for our friends, and found that fortune cookie slips were the perfect size to serve as nifty, if inexact, labels for those cassettes.

GO HIGHBROW…OR LOW-TECH

For some, precious metals and jewels are the only way to be organized. For them, this engraved silver fortune cookie keepsake box from Memorable Gifts might do the trick.

However, this 14 karat gold fortune cookie pendant with Pav diamonds from Neiman-Marcus is purely for show.

For the more handicraft-oriented, memorabilia-enchanted, DIY crowd, any small box or tin could could be decoupaged with a collection of fortunes and then used as a keepsake box for future acquisitions. Again, Paper Doll isn’t necessarily a proponent of keeping massive quantities of fortune cookie slips, but if you’re inspired to be a collector, a centralized location will at least keep your showcase tidy.

THERE’S AN APP FOR THAT

What if you’re watching your weight and can’t afford to be tempted by piquant cuisine? There’s even a free fortune cookie application available for iPhones and the iPod Touch that lets you shake your screen or tap it to break open the photo confection (because that’s the way the cookie crumbles) and reveal your fortune. The creators of the app must know how difficult it is for people to let go of their fortunes, because there are options to share the digital versions via email or social networking profiles.

Whether you toss your fortunes when the meal is over or treat the messages with the affection normally accorded to love letters, whatever your fortune cookie personality, Paper Doll wishes you great fortune and an organized life!

The Ultimate Treasure Map: Creating A Document Inventory

“Help!”

Professional organizers hear that call each time the phone rings. This time, the voice on the other end of the phone belonged to a lovely woman whose elderly father had recently passed away in another state. My new client now had boxes and binders and duffel bags full of insurance papers, trust documents, personal bookkeeping and pretty much everything except her father’s fourth grade fractions homework. There was such a volume of paperwork, and it arrived in such a state of disarray, that it was causing her to feel understandably overwhelmed.

Modern life is complex, and the papers needed to manage the ins and outs of it tend to suffer abuse and neglect. My client’s father probably assumed there was always a little more time to make sense of the paperwork. Elsewhere, I’ve seen clients depend on their keen memories to identify the location and details of important documents, but the vagaries of fate can be unkind to us…and our memories.

Today’s post isn’t about how long to hold on to your papers, or even where to organize your Family Files. Today is about making sure you know what documents you possess, where they are to be found, and what they represent.

Creating A Document Inventory

Use the sample categories below to take inventory of what documents you possess. A simple spreadsheet with worksheets for each category will allow you to update and make changes as necessary. Not all individuals possess or even need all documents, but hopefully these lists will serve as a trigger to help you craft your inventory and search for items that might be missing. For each applicable document, list the location and the date it was created or updated, as well as other essentials, as noted.

Location, Location, Location

If documents are in your home, specify the exact location, including the room and storage method, such as:

Home Office, in the Blue 2-Drawer Filing Cabinet, in the Legal Section

Master Bedroom Closet, in the Fireproof Safe

Colonel Mustard, in the Conservatory, with a lead pipe (Just making sure you’re paying attention.)

For documents kept outside the home, be as specific as possible. “Safe Deposit Box” is not enough. Instead, list the safe deposit box number, the bank name, branch address and phone number.

If a document is located at the office of your attorney, CPA, financial planner, real estate agent, or even your brother-in-law, list the person’s name, address, phone number and email address. It may seem excessive now, but in a befuddling emergency, or if you’re not able to provide information to your family, the extra details will be a comfort.

And, of course, back up your digital document inventory, and keep any paper copies in safe locations, away from prying eyes.

VIPs–Very Important Papers

Review these past posts to help you replace any missing vital documents:

Top Ten Vital Documents–Do You Know Where Your VIPs Are?

More VIPs–Very Important Papers Beyond the Top Ten

For each of the following, note the document’s location, as well as the license or certificate number (if applicable), and the date issued. In most cases, your originals will be in a safe deposit box or safe, so it’s helpful to note the locations of the originals and, when available, certified copies.

Lifecycle Documents

Birth Certificates

Adoption Papers

Marriage Licenses

Domestic Partnership Agreements

Separation Agreements

Divorce Decrees

Pre/Post-Nuptial Agreements

Child Custody Agreements

Religious Documents–Baptismal certificates, religious annulments, Ketubahs & Gets (Jewish marriage and divorce certificates), etc., as applicable for your faith

Citizenship/Service Documents

Citizenship Papers/Applications

Passports

Social Security Cards (Remember, don’t carry these around with you!)

Military Discharge Papers

Other Personal Papers

Immunization Records

Employment Contracts

End of Life Contracts–Arrangements for funeral services, burial or cremation, perpetual care, etc. If you’ve worked with an estate planner, these documents may be grouped in an estate binder.

Assets

Retirement Investments: These might be Qualified Retirement Plans through employers, Individual Retirement Accounts (IRAs) you’ve set up for yourself, or Annuities. For each (because over the course of your life, you’re likely to pick up more than a few), list the following:

- The type: For retirement plans through work, note if it’s a: Pension, 401(K), Profit-Sharing Plan, or ESOP (Employee Stock Ownership Plan); for IRAs, note whether it’s a Traditional, Roth, Spousal, SEP, or SIMPLE IRA. For annuities, note whether they are fixed, variable or deferred.

- The account number

- Login/User name and password for online access

- Contact information (toll-free number, web site)

- Names of investments held (i.e., the name of each mutual fund, stock, real estate address, etc.)

- The name of the Representative/Custodian; if it’s an employer-sponsored plan, note the contact name/phone number/email for the applicable employer.

- Location of periodic statements

Non-Retirement Investments: This is generally all of the “stuff” that might be considered valuable by the rest of the world. If you have items of deep sentimental value, such as genealogical records or private letters, you might want to make a separate worksheet in your inventory spreadsheet for sentimental/personal assets.

For each of the following, identify where the statements and purchase/sale paperwork reside. Use items 1-7 above, but for type, specify investment types:

*Bank Accounts–List brick and mortar banks and credit unions and well as web-only banks, and try to recall checking, savings, money market, CDs and any other banks and financial instruments. If another financial institution takes over your bank, be sure to update names and contact data.

*Brokerage Accounts

*Stocks

*Bonds

*Mutual Funds

*College Funds–529s or other educational savings plans

*Custodial Accounts/Minor’s Trusts

*Deferred Compensation Plans–If you have an agreement with an employer to receive a lump sum as of a particular date, note an estimate of the amount you expect to receive and the anticipated date.

*Stock Options

Other Assets

*Deeds to real estate/property

*Titles for automobiles, boats, airplanes

*Loans payable to you, by individuals or companies

*Other tangible assets–collectibles/collections, timeshare property, etc.

*Home Inventory–This document (often combined with a video inventory) is essential for helping you recoup losses after a disaster like a fire or flood, or after a home invasion and theft. We’ll cover household inventories in greater detail in an upcoming Paper Doll post.

Liabilities

In addition to listing the locations and essential contact information for the liabilities below, create a summary of the terms of the agreements for quick reference.

Mortgages on property

Loans for auto, boats, etc.

HELOCs (Home Equity Lines of Credit)

Other Lines of Credit

Credit Cards with outstanding debt

Personal Loans

Ongoing Accounts–Household utilities (land line and/or cellular telephone, internet services, gas, electric and water), personal accounts/memberships (gym memberships, clubs, etc.), and any other accounts for which payments are auto-debited from credit cards or bank accounts or are charged on a recurring basis.

Benefits/Insurance

Social Security–List your Social Security Number and the location of your annual statements. If you’re already receiving benefits, list the bank name, location, contact information and bank account number into which your benefits are deposited.

Military Retirement Benefits–If you receive a military pension, note your Veteran’s Administration Number, your pension plan name/type, the bank name, location, contact information and bank account number into which your benefits are deposited. For reference, list your branch of the military and dates of service. Note: If you’re currently in the armed services, keep the Department of Defense’s Military OneSource number (800-342-9647) handy.

Life Insurance–We tend to collect life insurance policies over time. In addition to the policies you purchase, or are purchased on your behalf by employers, it’s not uncommon to have tiny no-cost policies associated with credit cards and bank accounts, the purpose of which is usually to induce you to eventually increase the value by putting in your own money. Many of my clients have also unearthed Gerber and other life insurance policies purchased by their parents when they were young. Two different clients of mine, both in their sixties, recently came across “baby” policies and cashed them in for small, but not inconsequential, amounts.

In addition to all the contact information and the location of the policies, note the insurance carrier (i.e., company), the policy number, the exact type of life insurance (term, whole), the named party being insured, the beneficiary (primary, secondary, etc.), the cash value and the face value, as well as the annual premium, if applicable.

Health Insurance–In addition to regular health policies, note Medicare Parts A & B, Medigap, prescription drug, vision, dental and secondary health care policies.

Disability Insurance

Long-Term Care Insurance

Auto

Homeowners

Renters

Umbrella

Riders for art, antiques, jewelry, etc.

For the above policies, in addition to the contact information and location of the documents, note the insurance carrier, policy number and thumbnail summary of benefits.

Taxes

Let’s say you keep last year’s tax return in your desk drawer, the prior six years of returns in your reference files and the returns dating back to when you were a soda jerk at the malt shop in a closet under the stairs. However you do it, document where those tax returns are.

Why? The W-2s in your tax returns contain information that might be essential for getting your Social Security and Medicare benefits. Why else? Tax returns tend to hold all sorts of gems about stock sales and financial history that might be necessary to your heirs if not all of your records are as finely honed as your document inventory.

Estate Planning Documents

In most cases, if you’ve had an attorney help you develop an estate plan or trust, all of your documents will be collated in a big binder. In theory, your attorney should also keep a copy of the documents. List both locations–for the copies in his/her possession and in yours.

Last Will and Testament

Trusts–Depending on the complexities of your life, these may include living trusts, charitable trusts, life insurance trusts and/or minors’ trusts.

Medical Power of Attorney

Living Will/Medical Directives

Organ Donation Form

General Power of Attorney

Guardianship Papers

Advisors/Important Contacts

In addition to keeping track of each document’s location and a summary of what it entails, your inventory should include contact information for all the experts in your life, including:

Legal–Attorneys used for estate planning, setting up trusts, creating wills, handling adoptions, etc., as applicable

Financial–Banker, CPA/Accountant, Certified Financial Planner, Stock Broker, Mortgage Broker, Real Estate Agent, Retirement Plan Benefits Manager, IRA Administrator, Employer’s Human Resources Director, etc.

Other–Primary care physician, medical specialists, religious/spiritual leaders

Updating the Inventory

Any time you change insurance policies, roll a 401(k) over to an IRA, or experience major life changes, you should update your records right away. But if you’ve just spent six months searching for a job, battling your inner Bridezilla, or learning how to feed triplets, updating your document inventory is probably the last thing you want to do.

Put an Update Day on your schedule. Pick dates somewhere soon after you’ve completed your taxes, while your financial situation is still fresh in your mind. Plan a few 45-minute sessions over the course of a few weeks and review one category at a time.

Obviously, you’re not going to create this kind of inventory in one sitting. In, fact, you might not be ready to put this together at all until you’ve organized your files and taken the mortgage paperwork off the top off the fridge and your health insurance policy out of the laundry room. But this should give you a start for figuring out what kinds of documents you have, what kind you need, and how to create a treasure map of your most important documents.

3rd Annual Be A Fool For (Organizing) Your Books Extravaganza

I would be most content if my children grew up to be the kind of people who think decorating consists mostly of building enough bookshelves.

~Anna Quindlen

It’s become our habit at Paper Doll to celebrate an upcoming April Fool’s Day with a post on wacky and wondrous ways for organizing a book collection. In 2008, we visited the now-famous Stairbookcase, talked about organizing by color and chatted a bit about virtually organizing one’s library. Last year, we delighted in upside-down bookshelves, houses of books, and bookshelves that wrapped right around the reader.

This year, we have another embarrassment of riches with regard to idiosyncratic, quirky and just plain weird ways of organizing (if we can really call it that) our books.

Hanging Around

This year’s major theme was a fait accompli. Every endeavor to research quirky book collections bought up link after link of ways to suspend books (and sometimes disbelief). It’s difficult to assure ourselves that these hanging methods do not damage the spines of books. Thus, think of this post is a museum tour and not a how-to or should-do. No aesthetic should supersede the structural integrity of your reading material.

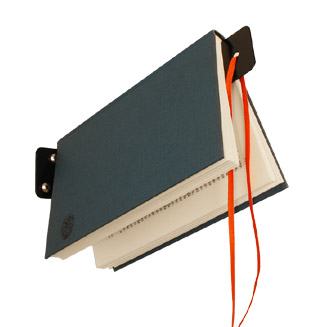

Das Rote Paket, a German housewares company noted for its engaging designs, offers the Buchhalter, a combination bookmark and book holder. Indeed, to paraphrase the manufacturer, what holds your place in the book is what holds your book in place.

Imagine a steel ruler with the last few inches bent at 90 degrees. The shorter bent part affixes to the wall, and the book hangs, of its own accord, on the marked page. It comes in black, white and orange. Sadly, Paper Doll‘s preference of pink, as illustrated but not listed on the product page, appears to be either no longer manufactured or a bit of bait-and-switch.

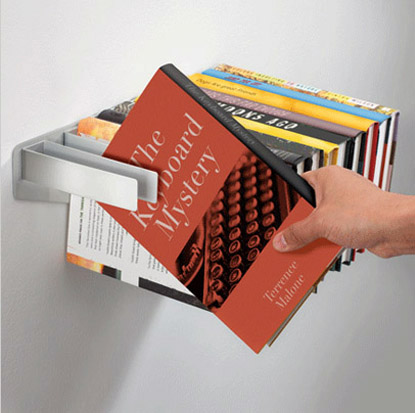

Rather than shelving one book at a time — one by the front door, when watching for the school bus to arrive, one next to the tub when you need Calgon (and a good book) to take you away — Umbra’s Flybrary Bookshelf puts a number of these little horizontal “You Must Be This Tall (To Read This Novel)” book-suspending bars together:

The Flybrary Bookshelf seems to sell out frequently, but you should be able to purchase it from a variety of retailers, including RevDesign and Heliotrope.

The nifty home design and dcor site Crib Candy pointed me towards Korean design studio Samulnoli’s Book Hangers. Designed by Wonsuk Cho, they offer an intriguingly modern (if bizarre) way to come out of the closet and let your (book)freak flag fly — by putting your books back in the closet.

It appears Samulnoli either had no plans to manufacture the Book Hangers or prefers to keep them a secret from the buying public. Still, the artistic line of the trouser hanger style is nifty to behold.

Samulnoli combines hanging with hugging for the Movement Bookcase. Bent nails were painted and doll hands and feet attached to create limbs posed at oddly lifelike angles. The nails, attached to a backing board, can be positioned to allow the books to serve as torsos, hanging between the arms and balancing on the legs. Here, books not only contain characters; they become characters.

Designer Sungmin Hong’s own description is as charming as the book display is quirky and unfeasible:

Shall We Take Tea In the Library?

I really don’t know what to make of Nar, a combination coffee table and bookshelf from the nal & Bler Studio.

Aesthetically unusual and daring, it combines two of my concerns–damaging books by hanging them and damaging books by spilling frappuccinos on them. Indeed, at nal & Bler’s site, I learned that this anxiety provocation is intentional! Of this winner of the 2005 Istanbul Design Week Best Design Award, the creators say that the

Okay, then.

No Visible Means Of Support

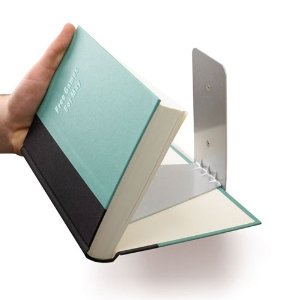

In recent years, floating bookshelves have become all the rage in design circles (or so Paper Doll has been told by people who actually know such things).

Chiasso’s Invisible Bookshelf claims to hold up to 20 pounds of books (in other words, your reading list for Thursdays). Just affix one of your larger hardcover books into the shelf bracket, and then add a stack of books. Two hidden rivets hold the hardcover book in place, turning your bottom book into the actual shelf. Put up a few of these around a room to create a funky library. Paper Doll can even imagine some hipster putting up a circular pattern of twelve Invisible Bookshelves on one wall, and then placing a clock in the middle.

Similar floating shelves in steel or nickel, made by Umbra, are available from Amazon and elsewhere.

And of course, you can design your own with a little help from this DIY Network video …if, unlike Paper Doll, you aren’t frightened by a sentence that begins with “All you need is a nail gun…”). I kid, of course. We are gearing up for April Fool’s Day, right? If you’d really like to try this, Reader’s Digest’s Family Handyman offers plans and step-by-step instructions for making your own floating bookshelves.

Tall Tales From Tall Books

Although not designed specifically for books, I was enthralled by London’s Catherine Green-designed Rolling Shelf.

While I personally prefer bookshelves to be all-books, all-the-time, with no knickknacks to interrupt the flow, the appeal of this construction is easy to see. One end of the Rolling Shelf is made of multiple narrow blocks of wood held together with fabric to create a flexible hinge, roll-able, to make room for taller items, as necessary. The Brobdingnagian giants of Jonathan Swift’s Gulliver’s Travels would surely approve.

Up & At ‘Em

Not every enchanting design is for hanging your books up. Some just lead you to put them up…up…and away. The always-magnificent Apartment Therapy blog has us looking up to the rafters for bookshelves made out of plywood planks attached to the wooden supports of a loft above:

The author notes that the ceiling is a lower than usual, and obviously Paper Doll would never encourage shelving books anywhere that might entail standing on something less than secure. If you have any heavy-footed Fee-Fi-Fo-Fummers shaking the house, I’d also be inclined to keep the books secured from sliding forward and off of the shelves, perhaps with a bungee cord.

Not Quite A Soak In The Tub

Earlier, I mentioned the “Calgon, Take Me Away” aspect of enjoying a good book in the bath. Swedish artist/designer Malin Lundmark seems to have taken that idea to its logical, if also impractical, conclusion with this Library Bathtub Armchair.

One assumes that this doesn’t have working plumbing (unless you resign yourself to reading only plastic or rubber baby bath-books). And how would you get in…or out, even if you only hoped to use it as an armchair? Only Lundmark knows for sure, and she isn’t telling.

From Furniture to Whole Buildings

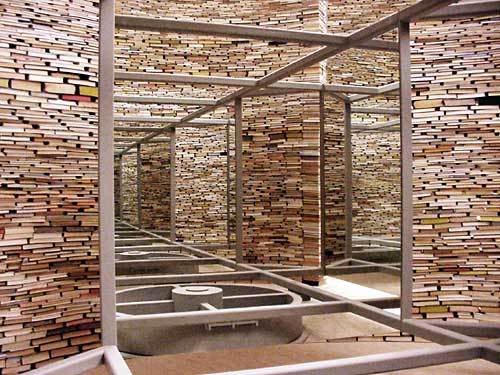

Sometimes, you don’t want to read a book about architecture; you may want to see some architecture made from books. For that, take a peek at The Book Cell. This bit of eco-architecture was created by artist Matej Kren as part of his Book Cell Project, originally on display at Lisbon’s Centro de Arte Moderna.

Yep, the little building is created solely from books. Of course, we saw little cabins made of books in last year’s Fool for (Organizing) Books post, but the Book Cell is a little different. The novels used for this project were all borrowed from the Foundation Calouste Gulbenkian. At the end of the installation, the design was set to be taken apart, and the books returned to the Foundation for their original purpose…for spreading knowledge and ideas.

Kren built the octagonal framework, filled it with a vast selection of books, and then removed the frame. Of course, this wasn’t Kren’s first rodeo. He’d already made his name in the late 90’s, installing Idiom, a tower of books, in the entrance hall of the Prague Municipal Library, and his Gravity Mixer,

was a rotunda made entirely from books, at the 2000 Expo’s Czech Pavilion in Hanover, Germany.

Climbing The Walls…With Books

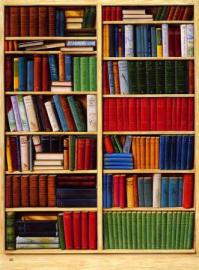

And finally, if you have the opposite problem of most of us, and rather than having too many books to shelve or organize, you have too few, you can take advantage of book-themed wallpaper, such as the magnificent, hand-printed faux library wallpaper of Deborah Bowness:

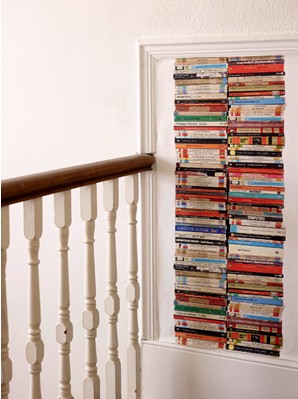

For colorful (and eerily realistic) designs, the UK’s Tracy Kendall has three different styles of wallpaper: neatly stacked paperback books,

, messy piles of hardcovers, and even vertical stacks of magazines.

, messy piles of hardcovers, and even vertical stacks of magazines.There are also bookcase photo half murals with self-adhesive backing, like this one from Creative Wallcovering, which you can quickly affix to your wall in four parts.

It’s a few days away, but I hope all my readers have a lovely, safe-pranks-only, April Fool’s Day. Paper Doll remains…a fool for books.

Lost and Found: Social Security Statements

Clutter, lack of systems, and general daily life can all conspire to work an unfortunate kind of magic in a less than entertaining day: things disappear. As part of an ongoing, periodic series, Lost and Found, we review the important papers in your life, and discuss how to replace them if they seem to have gone into witness protection.

Have you ever heard of OASDI? That’s the Old Age, Survivors and Disability Insurance Program, or what we generally call Social Security. If you work in the United States and have an employer, 6.2% of your paycheck (up to $6621, on up to $106,800 of earnings, annually) goes to the OASDI program. Your employers pay an equivalent portion. If self-employed, you pay the employee and employer portions–that’s 12.4%. (And, not to get too far into the minutia, but an additional 1.45% is withheld from payroll for employees, and employers pay a matching amount, such that 2.9% funds Medicare.)

What Is the Social Security Statement?

Three months before your birthday each year, the Social Security Administration mails you a statement of your prior calendar year’s earnings and estimates. It’s a bi-fold piece of white paper, with black text and green accent ink, and says “Your Social Security Statement” at the top. (View Wanda Worker’s sample statement.)

What Information Does the Social Security Statement Provide?

Your annual statement is designed to give you a snapshot of:

–your earnings, on which you (and/or your employers) have paid Social Security taxes over the years

–the estimated benefits you (and your family) may receive as a result of your earnings

Page 2 of your statement outlines the benefits you should receive in various categories:

Retirement–You must have 40 credits, of which you can earn up to four per year, to qualify for retirement benefits. For 2009, for example, $1090 in wages or self-employment earnings equaled one credit. If you haven’t yet earned 40 credits, your statement will tell you how many you have earned; after 40, it merely acknowledges you’ve qualified for benefits.

The retirement section explains, based on current laws and dollar values, the monthly benefits you would receive if you retired at your full retirement age (which varies according to birth year), as well as at ages 62 (the earliest age at which you can apply for retirement benefits) and 70. (A delayed retirement age usually means increased average earnings, and therefore increased benefits; there’s also a special late retirement benefit.

To get an immediate and personalized benefit statement, you can use the online Retirement Estimator.

Disability–tells how much money you would receive per month if you became disabled now.

Family/Survivors–explains the varying benefits your survivors might get per month, in varying situations, if you were to become disabled or die.

Medicare–tells you whether you have earned enough credits to qualify for Medicare and reminds you to enroll in Medicare three months prior to your 65th birthday, no matter when you actually retire.

Page 3 lists every year in which you’ve had reported earnings for both Social Security and Medicare, dating from your first year of employment. Any years in which you did not have earnings will show as zero.

In addition to data specific to your personal earnings and estimated benefits, the statement is chock-full of helpful, easy-to-understand information about your Social Security account, statement and options. I urge you to read your statement when it arrives.

Why Do I Have To Look At The Statement?

Your retirement and disability benefits are dependent upon the accuracy of your record. If your tax returns or old 1099s say one thing and your statement says another, be concerned.

If the earnings numbers are higher than your tax records indicate they should be, you may be a victim of identity theft wherein someone is using your Social Security number for employment (and possible other purposes, like insurance fraud). Don’t just think:

“Hey! Nifty! I’m getting bonus benefits because I’m getting credit for the earnings of the bad guy who stole my identity.”

If the bad guy hasn’t been paying taxes on his earnings, it could mean some audits in your future.

If the earnings numbers are lower than your records indicate they should be, it probably means you have not been credited for work you did and payments you made into the OASDI program.

Not worried enough to do anything about these errors because you’re so far from retirement? Then worry about your family, because if you become disabled or shuffle off this mortal coil, you’re leaving your family with a lot of extra paperwork and the possibility that errors will go unchallenged and you or they will not receive deserved benefits.

Why Don’t I Have My Social Security Statement?

If you aren’t currently employed because you’re raising children, caring for a relative, taking a sabbatical, in school or are otherwise not involved in the workforce (for reasons other than retirement), it might be easy to fail to notice that your Social Security Statement hasn’t arrived. Or, if it does come, you quickly file it away, assuming there were no changes since the previous statement, because you hadn’t been working, and you’d fail to note earnings credited to you for work you hadn’t done.

Are you missing your most recent Social Security Statement? Assuming you don’t have mailbox elves, your statement may be missing for a number of reasons:

- You’re not yet 25 years of age. The Social Security Administration doesn’t begin sending statements to workers prior to age 25.

- You’ve started receiving benefits based on your record.

- You’re 62 or older and have started receiving benefits based on your (current or former) spouse’s record.

- You’ve changed addresses since the last time you paid federal taxes and neither you nor your employer notified the Social Security Administration or the IRS.

- You may be a victim of identity theft.

- Your statement may be lost somewhere in the mail.

How Do I Replace a Lost or Missing Statement?

If your Social Security Statement has not arrived by the month prior to your birthday, contact the Social Security Administration at 800-772-1213 or fill out the form to request your statement. Be prepared to provide your:

- Name as shown on your Social Security card. (If you’ve remarried, divorced, or otherwise changed your name since issuance of the card, deal with that after you’ve procured your statement and verified accuracy.)

- Social Security number

- Date of birth

- Place of birth

- Mother’s maiden name

In all likelihood, you will be given the option of waiting in a phone queue or having a representative call you back. Unless you have lots of free time or a speakerphone, opt for the call back, which will likely come within 30 minutes. When they do call back, make sure they have your correct mailing address; addressing errors could lead to your statement being mis-delivered, increasing the chance of identity theft.

What Do I Do If The Information On My Statement Is Wrong?

There are a variety of reasons the information on your statement may be wrong. When I’ve worked with my organizing clients to get records corrected, we’ve seen errors based on:

–Wrong Social Security number (e.g., inverted numbers, 4s that looked like 9s on W-4s)

–Wrong Employer Identification number

–Misspelled names, or nicknames used instead of legal names

–Two Social Security numbers–This usually happens when parents apply for a card on a child’s behalf, but due to a lost card, the now-adult reapplies but provides slightly different information.

–Identity theft

Call 800-772-1213 (and be prepared for the wait or the call back). In order to better help you correct bad information, the representative will need to ask you a variety of financial questions. At a bare minimum, be ready to provide last year’s earnings data for verification. You’ll find this on your copy of your tax returns.

You can correct information dating back to any time in your earnings history; however, be prepared to find that the further back you go, the more complex the investigation will be, and the more essential your records will be to solving any mysteries. (This is why Paper Doll pesters…I mean encourages…you to maintain your financial files so carefully.)

A Success Story

A client and I recently unearthed a handful of crumpled 1099s for three consecutive years in the 1980’s, an old Social Security statement and an aged Post-It reminder, from the client to herself, to correct some errors. When my client was working at her first job, she transposed some digits when providing her Social Security number on her W-4…and her employer never asked to see her actual card for verification. Thus, none of her earnings for the years at those jobs were ever credited to her.

The idea of trying to get the situation fixed had been overwhelming. My client assumed she had to write a letter to the Social Security Administration, and while she procrastinated on the dreaded task, the associated documents became part of a mlange of papers (elementary school registrations, recipes, expired oil change coupons) from that era that sat, collecting dust.

I encouraged her to call the Social Security Administration while we continued sorting and filing. She had to speak very slowly and distinctly (and repeat information) to the computer, and eventually she opted to be placed in a queue for a callback. Twenty minutes later, a helpful representative listened as we explained the situation. Because we had the original 1099s in hand, we were able to read her the taxpayer identification number of the employer and report the earnings as listed on them. In due course, each year’s earnings (for the right name but wrong Social Security number) were identified in the system and re-applied to the correct account.

A long-procrastinated project was completed, and my client is now credited for the hard work she did so long ago. Was it fun and entertaining? No. But neither did she have to leave her home, spend any money, fill out complicated forms or stand in any lines to correct an error made when she was too young to know how important those darn Social Security numbers really are.

Do I Have To Keep All My Social Security Statements?

Some professional organizers would probably tell you no, that keeping the most recent statement should suffice. And certainly, if you’re in your 20s, the prospect of eventually keeping every statement might seem daunting. However, maintaining statements from age 25 to 65 only means 40 pieces of paper. And given the advancements of the digital age, I’m sure paper statements will eventually be replaced by secure online accounts. But for now, I’m advising my clients and readers to hold on to their statements. It’s the easiest way to track errors that either begin at, or are carried over from, a particular starting point.

It’s just one manila folder in your Family Filing system; if you’re really pressed for space, you can scan the statements. But do maintain the information so that if any questions arise in the future, you can provide documentation…and have a little security.

Prior Lost and Found posts can be found here:

Lost And Found: Tax Returns (and memories of 9th grade science class)

Lost And Found: Savings Bonds (and saving yourself a headache later on)

Lost And Found: A Different Kind of Stock (Certificate) Tip

Lost and Found: GONE in 6 seconds: Your Wallet!

Follow Me