Archive for ‘General’ Category

A Consensus on the Census: Counting On An Important Piece of Paper

Last week, Paper Doll received a number of messages from readers, friends and even Paper Mommy, all on the same point of frustration. You see, they’d received a letter from the government. I got the same letter, and I bet you did, too:

Dear Resident:

About one week from now, you will receive a 2010 Census form in the mail. When you receive your form, please fill it out and mail it in promptly.

Your response is important. Results from the 2010 Census will be used to help each community get its fair share of government funds for highways, schools, health facilities, and many other programs you and your neighbors need. Without a complete, accurate census, your community may not receive its fair share.

Thank you in advance for your help.

Sincerely,

Robert M. Groves

Director, U.S. Census Bureau

The comments I received all came down to one main concern. Why was the government spending money sending mail to tell us they were going to send us mail? Why waste the postage? Why waste the paper?

I was surprised. I knew that in some circles, the Decennial Census can be controversial, but this was the first time I’d heard complaints about paper clutter! So, I hope Director Groves won’t mind if I take the initiative and review some issues about the form that has a direct impact on the next ten years (and more) of our nation.

Why The Census?

The goal of the 2010 Census is to count every person living in the United States as of April 1, 2010. In a nation this populated and diverse, maybe that date calls to mind a fool’s errand, but it’s essential. It’s also required by law.

Article 1, Section 2 of the U.S. Constitution requires that a census be completed every ten years: “The actual enumeration shall be made within three years after the first meeting of the Congress of the United States, and within every subsequent term of 10 years, in such manner as they shall by Law direct.” The first census was in 1790, via door-to-door visits from federal marshals, and 3,929,214 people were counted. We’ve continued counting every ten years, even through wartime. In 2000, the census counted over 281 million people.

The census counts, simply, how many people live where. This allows for apportionment of federal (and state) funds for:

Health services: emergency services, hospitals, community health providers

Social services: senior centers, schools (including teachers), job training programs

Infrastructure: highways, bridges, tunnels, transportation systems (buses, rapid transit, etc.)

The data collected doesn’t just ensure an appropriate share of funding and the administration of programs. It also dictates our representation in government. If you recall your Social Studies classes, you know that the Decennial Census determines your state’s apportionment in the House of Representatives.

Who Gets A Census Form?

Every household gets a form, from parents with 2.5 children to the Octomom…citizens, non-citizen residents, and the undocumented. Whether here legally or not, whether one has a traditional family household, lives alone with seven cats, or shares space with a flatmate who drinks your milk even when the carton is clearly labeled with your name, every household should be counted. The census also documents dorm-dwellers and others who live in collective housing, like long term care facilities and prisons.

What’s Asked?

It’s true, the census used to ask lots of questions. There’s a reason it, like the 1040, was called The Long Form. One in six households used to get a…well, long form. It asked detailed social and economic questions. The household in which Paper Doll lived during the 1990 census included 7 graduate students, and we got the long form. Even those without compunction over providing personal information were weary of answering all those questions.

No more. The 2010 Census asks just ten questions, including name, age, gender, date of birth, ethnicity/race, and home ownership. Apparently the infamous census question about the presence of indoor plumbing has been deleted.

Want to see the questions now? The Census web site displays each of the 10 questions so you can have a sense of what you’ll be asked. Strangers on airplanes volunteer (and ask for) information far more personal than these basic, mostly demographic, questions.

Privacy Issues

First, the purpose of the census is to obtain accurate but general statistical data. As the 2010 Census won’t use the long form, there are no detailed questions about your social or economic situation. Plus, no Census Bureau employee is ever permitted to reveal any identifiable information about any person, household, or business–that includes names, addresses (including GPS coordinates), and telephone numbers. The penalty is up to $250,000 and five years in prison.

Next, by law (92 Stat. 915, Public Law 95-416), individual census records are sealed for 72 years. The odd number dates back to when life expectancy was less than 65 years, in order to protect the privacy of individuals by barring the release of personal information during someone’s lifetime. (In 2002, the individual data for the 1930 census was released.)

[Records have not always been so well protected. During World War II, the Second Powers Act of 1941 repealed legal protection of census records and gave the FBI access to them. The Act was repealed in 1947, and subsequent cases have always upheld protection of census data.]

Let’s assume that if you’re reading Paper Doll, you’re an adult–we’ll say 18. The records from your census form will be made available in 2082, when you’re 90. If you’re 43, you’ll be 115 when your individual census records will become available. Somehow, one doubts you’ll feel particularly exposed.

Controversies

Paper Doll uses this space for non-political purposes, but to be fair, I must acknowledge that the Decennial Census is not without controversy. For example, because the census is used for the apportionment of seats in the House of Representatives (and of electors to the Electoral College), the counting of non-citizens in census figures is disputed.

Counting prisoners in the counties in which they are incarcerated (instead of at their prior residences) is seen as skewing the statistics on population and racial demographics. And not counting Americans traveling abroad fails to count Mormon missionaries, which citizens of Utah often feel lessens their proportional representation. (While other faiths, of course, also conduct missions, the geographic diversity is not believed to have as profound an impact on the Census figures of other states.)

The census uses hot deck imputation, a statistical method for “filling in the gaps” and assigning data when/where there is none — a concern that could easily be minimized by more people filling in the forms!

All of these are issues worthy of debate, but in Paper Doll‘s opinion, these are issues related to the use of the data, and not the data collection, itself. Which brings us back to the paper.

Why the Preview Letter?

Why does the government send us mail telling us they’re going to send us mail? Isn’t it a waste of money?

If every person in this country had excellent time management skills, opened the mail on a daily basis and dependably mailed bills, RSVP cards and other replies, then yes, it would be a bit of a waste. But, collectively as a nation, we don’t.

Professionals in consumer research (and anyone, like Paper Doll, who took lots of survey design courses in graduate school) will tell you that the best way to get a response is to tell target audiences what you will be seeking from them, then send the survey and even follow it with a postcard or other reminder. It’s long been a lynchpin of Nielsen ratings survey methods. Medicare recently did the same thing with an optional survey. (Apparently Paper Mommy wasn’t pleased by that extra paper, either.)

I think of these advanced warnings letters less as nagging and more like “Save the Date” cards that brides send out to make sure you’ll give priority to their weddings. The government is inviting us to participate in something that is one of our few community obligations, and they’re giving us a heads-up.

More importantly, they’re saving money. Our money. The preview letters boost return rates, and the more forms returned, the fewer temp workers that have to be hired. In other words, people aren’t the only things the Census Bureau counts–they’re counting pennies, too. As Director Groves told the Wall Street Journal, “For every 1 percent increase in households that will respond by mail, taxpayers save about $85 million in operational costs associated with census takers going door to door”, following up with households that didn’t mail back the form. Research shows that using the preview letters for the 2000 Census boosted response by 6%; people have just forgotten they received those letters ten years ago.

The paper is recycled (and recyclable), the Census Bureau surely gets a break on postage, and the methods are proven to save money. (Maybe in 2020 they can send us e-vites?)

Don’t Get Scammed

One last note. Unfortunately, the same swindlers who pretend to be Nigerian princes want to use the 2010 Census as an opportunity to separate you from the little green pieces of paper in your wallet. Don’t let them.

The Census Bureau doesn’t send emails. The Census Bureau doesn’t send you to a link to answer questions online. There’s no way to get paid for filling out census questions. There are no census contests whereby you can win a prize for giving additional information. No political party conducts the census.

If you don’t mail back your form and are visited by a census taker, check to make sure he or she has a valid ID badge with an expiration date and a Department of Commerce watermark. Census takers are only allowed to ask you the same 10 questions as on the form, and are trained to do the survey outside the door, so be wary of anyone seeking entrance into your home or monetary solicitations. If you have any doubts, request the census taker’s supervisor’s contact information or call your regional Census Bureau office to verify an identity.

There is no cost to participate and the Census Bureau will never ask you for your credit or debit card number, PIN numbers, or any of your banking information. Ever.

Most importantly, the Census Bureau WILL NOT ASK FOR YOUR SOCIAL SECURITY NUMBER.

Please share these anti-fraud facts with any young adults who will be participating for the first time and with any elderly or other friends or relatives whom you feel might be at risk for being scammed.

Familiarize yourself with what the Census Bureau has to say about fraud attempts, and report suspected fraudulent email to ITSO.Fraud.Reporting@census.gov and fraudulent mail to the U.S. Postal Inspection Service at postalinspectors.uspis.gov.

If you receive a follow-up call to clarify information on your form, you can call the Census Bureau’s National Processing Center before providing any information to make sure it’s on the up-and-up. And if someone claiming to be a census taker shows up without the proper credentials, call the police.

Stand Up and Be Counted

The Decennial Census, with all of its related issues, is still the best way to make sure we have the health and human services and infrastructure we need, in the right proportions, and to comply with the Constitutional requirements regarding apportionment of representation in Congress. I encourage you to read and recycle Director Groves’ preview letter, fill out the 2010 Census (10 questions in 10 minutes) and count yourself in!

Don’t Sink Your Battleship: Replacing Lost Board Game Rules

Allstate Insurance runs a commercial where the deep baritone of Dennis Haysbert (yes, the former president on 24) intones, “In the last year, we’ve learned a lot. We’ve learned that meatloaf and Jenga can be more fun than reservations and box seats, and who’s around your TV is more important than how big it is…”

Sure, he’s selling insurance, but Dennis is not entirely wrong about Jenga, or games in general. Media outlets have noted that millennials are driving a revival in board games. Throughout the country – indeed, the world, board game clubs like GRAB, the Grand Rapids Area Board Gamers, are on the rise, and game nights are popping up in living rooms, bookstores and coffee houses around the country. There are even Play-a-Thons, game-playing events for raising charitable donations. Playing games with family, old friends, and new contacts who want to join you in conquering Risk’s Oceana can be an inexpensive diversion.

The Games

So maybe you’ve decided to dig out those beloved games. The older they are, the more likely the boxes have crumbled. Safeguarding games and game pieces isn’t difficult. Zip-type plastic baggies can house game cards, tokens, and faux currency and make it easy to see what you have at a glance. For a less D-I-Y approach to keeping things together, there are nifty and durable blue, orange and purple Game Savers boxes to save the day (or at least the game).

The structural integrity of my own family’s Scrabble set, circa 1954, which resides at my sister’s home, gave out a while ago. The tiles are corralled in a lovely Crown Royal bag.

The cracked and lid with the fading rules and all of the requisite pieces, is housed in a drawstring linen handbag cover. The wooden letter tiles, and maybe even the game board, might last anothehalf-century. The instructions? Not so much!

The cracked and lid with the fading rules and all of the requisite pieces, is housed in a drawstring linen handbag cover. The wooden letter tiles, and maybe even the game board, might last anothehalf-century. The instructions? Not so much!

In the past, we’ve found online solutions for misplaced appliance manuals, so it seemed likely there would be some good online options to help game lovers, as well.

The Rules

If you’ve lost your board game rules and other game instructions, or if you’ve been dithering over whether to toss old coffee-stained rules with lime green Play-Doh ground into the stapled crevices, it’s good to know there are 21st-century alternatives for resuscitating mid-20th-century games:

Hasbro maintains an alphabetical (though not easily searchable) database of over eleven thousand downloadable rules for toys and games standard-bearers like those of Milton-Bradley and Parker Brothers, as well as newer members of their game family.

Hasbro’s customer service section not only covers game rules and instructions, but information on recalls as well as order forms for replacement parts for everything from Ants in the Pants to all the variations of Yahtzee. Did you know there was a Yahtzee Deluxe, Toy Story and Spiderman versions of Yahtzee, and even Yahtzee Texas Hold ‘Em? Similarly, you can find PDF rules for about 80 different versions of Monopoly, from the 1935 classic, to French and Spanish language versions, to Star Wars and Spongebob editions.

Mattel, otherwise known as the House that Barbie Built, is a repository for many of your favorite games that haven’t come under the Hasbro umbrella. While their huge database is overwhelmingly given over to dolls, action figures and toys, you can still download the instructions for all their games, including card-based UNO (in its various incarnations), Apples-to-Apples and Skip Bo, as well as the Othello-like Reversi.

Board Game Capital is an excellent source for over 100 games. The links connect to a panoply of rules, ranging from traditional games like checkers and chess, to historically popular board games like Monopoly and Scrabble, Payday and Life, Stratego and Risk. There are modern favorites like Trivial Pursuit and Cranium, children’s classics, like Candyland and Chutes and Ladders, and even board games based on television shows, like CSI and Friends.

Non-board games also share space in the collection, so if you’ve been dying to prove your spouse has been bending the rules to Balderdash or Battleship, Othello or Uno, Connect 4 or Jenga, here’s your chance to set the record straight.

![]()

LoveToKnow offers rules and background information for board game novices, veterans and even collectors. Their database divides games into categories for searching by type, in case you remember the general gist of a game, but not the name. For example, you’ll find strategy board games (Stratego, Mastermind), abstract strategy games (Mancala, Crokinole) and even adult-themed games (but please don’t blame Paper Doll if you get injured playing Naked Twister or are overserved playing a version of Monopoly that replaces real estate with alcohol).

The Spruce Crafts has a massive section of the website devoted to a mega-blog of posts on popular board game rules and strategies. Monopoly or Mancala, Crokinole or card games, you’re sure to find something to pique your interest in becoming a better gamer.

Fundex is another option for game rules and instructions, with a database of PDF rules for some of the wackier three-dimensional games, like Gnip Gnop, as well as traditional games like Tiddly Winks, Hangman and Pickup Sticks (who knew Pickup Sticks had rules?), and even Spanish language games like El Chavo Loteria.

The Versions

The Versions

Sometimes, missing rules aren’t the problem, but missing, or at least conflicting, memories of the rules of the game. Recently, a friend bought her nieces the newest version of Clue, a game she and her sister loved as a child. As she began regaling her nieces with the rules, she realized that the instructions printed with the game set varied widely from the procedures she recalled. No, her memory wasn’t faulty. Clue (originally Cluedo in its 1948 UK debut) recently got a makeover as reported on NPR: new rules, new weapons, and a first name for Miss Scarlett! (Colonel Mustard would be shocked, I’m sure!)

Many board game companies update the rules periodically, whether to provide alternate forms of enjoyment or to speed completion of the game to maintain player interest (which, if you’ve ever spent hours in Monopoly’s version of Atlantic City, you’ll probably appreciate). So, the online versions don’t just provide the rules, but often the historic versions of the rules. For example, with some deep downward scrolling at Board Game Capital, you can find original Scrabble rules, as well as various classic and speed die rules. So, before one of your players throws down a challenge to another’s gamesmanship, do not pass Go and do not collect $200; make sure everyone is playing by the same version of the rules.

Bonus Points

For those of you who can’t get enough of board games, you might also like to meander through the following:

The Game Cabinet is a low-tech hobbyist hideout mixing the old-timey (Parcheesi, jacks and marbles), modern classics (Life), non-board 3-D games (Battleship) and the bizarre (Kids of Catan, O’NO99). Scroll down to the bottom and get lost in the options.

Drumond Park is the UK’s leading game company, carrying adult and children’s titles. If you’re an expat or just a fan of UK games like Articulate, Rapid Dough, Pig Goes Pop or The Logo Board Game, Drumond Park has the rules online.

Board Game Geek has an extensive wiki (i.e., a collaboratively created informative site) of rules for board-style, electronic and other games in English, German, Dutch, French and other languages. To locate the rules, click on your preferred language in the Links column (rather than the name in the Game column). Board Game Geek is also a rich source of forums and discussion on various North American and European game topics.

House Rules

Once you’ve printed out the rules for your favorite games, be sure to keep them with the associated game’s paraphernalia to avoid having to go through this search all over again. Real game aficionados (or parents of sticky-handed tots) may even want to slide each rule page into a plastic sheet protector, or upload the rules directly to Evernote with each game document tagged as “board game” to allow for easy access.

And if your family has developed some interesting or wacky “house rules” for playing a favorite game, take time to commit them to paper or a digital archive so that future generations will know how and why you played it that way.

Let the games begin!

Greening Your Greetings: Recycling and Reusing Greeting Cards

I confess–I love greeting cards. While shopping for my sister’s birthday card in February, I saw three cards perfect for Paper Mommy‘s birthday in April–two suitable for public display, and one that will send her into paroxysms of private giggles. (Even professional organizers have areas of “aspirational acquisition”.)

According to the Greeting Card Association, U.S. consumers purchase approximately 7 billion greeting cards each year. Another 700 million are sold in Canada. That’s a lot of cards! In fact, that’s about 128,000 tons of paper and 3 million trees!

Paper Doll readers may recall that we’ve covered greeting card strategies before–we focused mainly on how to cope with letting go of them. I’ve never counseled eliminating greeting cards, however, because a carefully-selected card with a heart-felt, handwritten message has the power to uplift, motivate, and comfort in a way that an email often cannot. Most of us find that the cost (financial and environmental) is outweighed by the intended emotional impact of sending a card to a friend or loved one.

Now, some new, inspired products have developed a way for you to to feel comfortable with buying and letting go of cards, while helping the environment a teeny bit, as well. If greening your greetings appeals to you, check out these options.

At the 2010 Green Products Expo in New York City a few weeks ago, one cute entry presented a new way to recycle and reuse greeting cards.

regreet™ uses labels and special mailing supplies to give new life to your previously-received (OK: used) greeting cards, while saving money (on new cards) and saving the planet.

regreet™ doesn’t make cards, per se. They actually create a Greeting Kit, which includes all the components (made with recycled materials, of course) that you need to reuse/repurpose greeting cards, including:

4 journey labels

4 signature labels

4 sheets of notepaper

4 envelopes

The Greeting Kit also includes four “hop along” sets (get it? frogs…hop? Too cute!) with the same contents as above. With each card you send, you include a “hop along” set to enable cards to go on future journeys. (You can also buy regreet™ single sets, with one label each for journey and signature, one piece of notepaper, one envelope and an instruction sheet.)

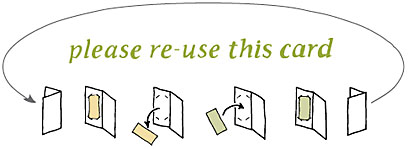

To start a card you’ve received on a new journey, apply an adhesive-backed signature label over what the prior sender wrote, and use the matching notepaper if you want to write more. Then affix a uniquely-coded journey label to the back of the card. Put the card and “hop along” set into the regreet™ envelope, and mail it off.

For an added twist, they’ve designed “journey codes” so you can track where your card travels over time. When you enter the code from the back of the card, you’ll see a mapped tour of the card’s journey to you (if you didn’t originate that card’s journey) and each successive trip, with a summary of miles. You can even click to see the city, state and zip code, plus date received, for each trip, and the miles traveled on each hop.

OK, so there’s a bit of a privacy issue, especially if you know your friends’ friends’ zip codes. If you send your best buddy a card via regreet™, but find she eventually re-regreets it to your high school frenemy, will you feel betrayed? Would you still be proud of your spouse for saving the environment if you learned he/she sent a birthday card to a a long-ago ex? Well, Kermit did say it’s not easy being green. But, if you’re green and confident, regreet™ may be the way for you to go.

regreet™ donates a portion of profits to charitable organizations. This year, their non-profit partners are Susan G. Komen for the Cure, 4H, and the Nature Conservancy. You simply enter the Direct the Donation code from the back of your regreet™ Kit on the donation screen and select the non-profit from the drop-down menu, and your vote, collected with others, determines the proportion of profits that go to each charity.

Last week, Lisanne Oliver, Australian professional organizer, author and blogger, helped spread the word regarding recyclable cards from Australian card-maker Merry-go-round.

The Merry-go-round cards aren’t just green, but gorgeous. Their designers are well-known Australian children’s book illustrators with a collective warm sensibility that melted even mean old Paper Doll‘s heart. Of these artists, Merry-go-round says:

Take a peek below and visit the artists’ page to click on the thumbnails of these limited edition cards and to get a closer look.

The cards are designed with slits (you know–tab A goes into slot B) to attach your message, written on a separate piece of paper. Your recipient, once he or she has marveled at the loveliness of the card and the pitch-perfect sentiment of the message, can keep the words, but recycle/reuse the card by replacing your message with a new one for a new recipient. Every card includes two message slips to get you started, and instructions on how to make more and continue to reuse the card.

So, you send your daughter a card of congratulations for graduating middle school. She tucks your message in her box of secrets (hidden where she thinks you’ll never find it), and sends the card on to a friend, with her own message, written in that disemvoweled text-speak so popular these days. And so on…

The cards are green from the get-go, using uncoated 100% post-consumer recycled paper stock via a manufacturing process that would make the greenest heart swoon: Process Chlorine Free (so no nasty chemicals in the bleaching process), production-related waste water is recycled and cleaned, they use natural gas to power the process, and manufacturing waste is recycled into good stuff like fertilizer and cement.

The beautiful cards can be purchased online, directly from Merry-go-round, in sets of six or as individual cards (or sets of four of the solo designs). The time management aficionado in me adores Slow Down, but all you parents might get a particular warm fuzzy out of The Kiss. (Please do share your favorites of any of these cards in the comments section, below.)

Of course, if you eschew online stores and prefer to stand in a card shop and “take inventory” (as PaperMommy says), perusing and comparing each card to the next, be prepared to travel. Merry-go-round cards are not sold in North America and are available only through Australian and New Zealand vendors…but I bet if we spread the word, distribution will grow wider.

According to Lisanne, who has already had the opportunity to send a card, there are little heart-shapes on the reverse of the cards. These are apparently designed to let you color in a heart each time the card is used to track the number of lives it has had. This allows users to swell with pride at their part in the chain of eco-sustainability without risking the jealousies inherent in the journey code tracking above.

I should note, regreet™ isn’t the first trackable card, nor has Merry-go-round cornered the market on reusable cards. Our neighbors to the north have that distinction.

Slingshot Cards bills itself as the “World’s First Reusable and Trackable Greeting Card”. First, the cards are FSC-certified and made of post-consumer recycled cardstock. (They’re made much like the Merry-go-round cards, but with wind energy to power the manufacturing.)

Next, the cards are hand-finished to include hemp fiber SlingShot strings (to hold the message inserts in place). Each card comes with two blank inserts–one for the buyer to write to the first recipient, and one for the first recipient to pass on. To keep the cycle going, Slingshot Cards provides MS Word and PDF versions of their Greeting Template (from which you can impart your own message), but you could also slide photos, newspaper clippings, coupons or anything else under the SlingShot strings:

Each Slingshot card has its own tracking number. When you get one of these cards, visit the tracking page, enter your card number, and then your name, plus a general location (city/state/country), occasion and date received. (In a world where people declare their exact locations on FourSquare throughout the day, Paper Doll is probably woefully old fashioned in suggesting you replace your real name with a privacy-protecting nickname or non de plume…but that’s just the way I roll.)

Slingshot has added an email notification system, so that you can get a message each time a card you’ve registered arrives somewhere else, and Slingshot’s goal is to have every card make 20 separate journeys.

You can shop Slingshot’s online store (remember, these are Canadian dollars!) for individual cards or 4- or 8-pack sets of outdoor and nature themed cards. (Paper Doll is a fan of the lighthouse, beach and sunflower themes.)

Five percent of Slingshot’ profits go to The Fruit Tree Planting Foundation, an international non-profit focused on fighting hunger and improving the environment.

So, if you also love sending greeting cards — Paper Doll‘s birthday is coming up in just a few weeks — get going on greening those greetings!

Organizing Your Tax Paperwork–Part 3: Get Your Business (Receipts) Off The Ground

For solopreneurs, IRS Form Schedule C, Profit and Loss From Business, is used to report all of your revenue and expenses. It’s fill-in-the-blank: “Hey, I earned this! Hey, I spent this!” As long as you don’t turn it into a MadLib with crazy, non-deductibles, there’s nothing to fear.

When you are the business, it’s not all that hard to know what papers you need to save to keep the tax man happy. If a piece of paper relates to money that came in or money that went out, there’s a tax category for it. If you know the categories and put in minimal time each day (seriously, making a Hot Pocket takes longer), tax paperwork need not be stressful.

There are two separate elements to dealing with your business finances. First, you need a plan to deal with the paperwork–the receipts/proofs of purchases. Then, you need to decide how and when you’ll cope with the collection and interpretation of the information from the paperwork. The IRS wants to know how much you spent in specific categories, so each little receipt or credit card statement line is worth money to you in terms of potential tax deductions. So, don’t think of the tax paperwork as boring…think of it as bits of treasure.

At the most basic (but least efficient), you could throw every business receipt in a box until tax time, then sort by expense category, then put on your green eye shades and tally up the totals on your abacus or adding machine in order to enter the figures on your Schedule C. And if this were 1977, it would be fine and dandy, though still heavy on the end-of-year labor.

Modern marvels of software, from Quickbooks to the free, online program Outright, can help you keep track of your income and expense data with a minimal learning curve. If you don’t want to learn how to work with new programs, you can create your own little program using a spreadsheet, with rows to record each transaction’s date, purchase method (check #? cash? credit card?), revenue or expense information and amount. Then, make each column correspond to each category that has to be reported to the IRS, and just add up each column. You don’t have to know even the teeniest bit about double-entry bookkeeping–it’s more like playing Business Bingo!

Set a task bar alert or alarm for a specific time/day each week to record what you took in and spent (and in which categories), and maintain a folder for any of the following Schedule C categories that apply to your business. Keeping the paper categories separate will help you track expenses over time and ease any decisions you need to make, either for taxes or general finances. Doing the math on an ongoing basis keeps you aware of your business operations and eliminates the fear of tax time.

Income

Gross Receipts and Sales–Not everyone will send you a 1099 for work you’ve done, so it’s essential to keep track of your own income. The easiest method is to deposit all income into your business checking account (remember, don’t commingle business and personal finances!) and then keep a copy of your written deposit slip or, if you’re using one of the great new OCR ATMs, the photocopy deposit slip showing the actual checks and/or cash you deposited.

Returns and Allowances–Did someone return a product you sold? Did you give a refund because of a satisfaction-guarantee policy? Save written documentation so you don’t end up paying taxes on revenue you didn’t get to keep!

Expenses

Advertising–Don’t just think in terms of newspapers, magazines, radio and TV. Remember to include costs for business card and brochure printing, promotional items, phone directory ads, pay-per-click web fees, catalogs, event sponsorships, fees paid to public relations specialists and anything else that gets your company some attention!

Car & Truck Expenses–When you start using a vehicle for business, you decide whether you want to take actual expenses or mileage expenses. If the former, you’ll maintain receipts for fuel, oil changes, repairs, tires, insurance, etc. If you go with mileage, you’ll need to know the year’s starting and ending odometer readings, and maintain a mileage notebook (or smartphone app) to keep track of all business-related miles driven. The number of business miles driven in a year is multiplied by that year’s IRS mileage rate–for 2009, it’s 55 cents/mile.

Even if you’re using the mileage method, you get to count parking fees and tolls. You’ll have to go through the toll attendant line to get a receipt, adding another 20 seconds to your day, but the money does add up. Request receipts for parking fees, and make a notation of where you were (if it’s not obvious from the receipt), with whom and why. If you often need to park at meters, develop your own little record book that you can keep in the console or glove compartment.

Commissions & Fees–Do you pay for referrals? Do you have salespeople working on straight commission? Be sure to keep detailed records of whom you’ve paid, when and for what, so you won’t have to depend on your memory next April.

Contract Labor–Did you hire a sub-contractor to help with a big job or you pay a teenager to distribute flyers for your company at a local event? Remember, for contractors whom you paid more than $600 for contract work, you’ll need to provide a 1099-MISC to them and to the IRS.

Depreciation & Section 179 Expense Deduction–This is where you break down a huge purchase into the allowable deductible portion. Let’s say you bought a piece of equipment for five zillion dollars. You can’t deduct all 5 zillion in one calendar year, so you need to keep track of the allowed deductible portion, each year, until you’ve fully deducted it. Don’t let the formal-sounding “Section 179” scare you–it’s just a way to allow small businesses to purchase “tangible, depreciable, personal property which is acquired for use in the active conduct of a trade or business” and deduct expenses in the year of purchase, rather than amortizing it over time.

Employee Benefit Programs–If you pay for accident and health plans, group term-life insurance or dependent-care assistance programs for your employees, whether you pay annually or on any regular or irregular schedule, keep the paperwork that shows when you paid and for what.

Insurance (Non-Health)–Do you have business insurance, including policies for errors and omissions? Keep records of the premiums you paid.

Interest–This category includes expenses paid for business mortgages and loans, as well as business credit cards. Here’s yet another great reason for completely separating your business and personal expenses. If you place business expenses on a business credit card (one on which you make no personal charges), interest is deductible. If, however, you charge all of your business expenses on a card you also use for household expenses, the interest is commingled and the IRS will cast a big old frowny face on your deductions. Keep those finances separate!

Legal & Professional Services–Did you hire an attorney or CPA, or pay for a logo design or web site creation? Keep copies of charges and proof of payment.

Office Expenses–This category is for all the cool Sharpies and Post-Its, as well as postage. If it’s a necessary expense for your administrivia, for writing with (pens, pencils, cool markers), writing upon (copy paper, stationery, notepads), sticking things together (staples and staplers, tape, glue) or tearing them apart (staple removers), make sure receipts go straight to your wallet and that they get removed when your data entry alarm goes off.

Pension & Profit Sharing Plans–Did you contribute to a pension, profit-sharing or annuity plan for employees? Maintain monthly records. (However, you’ll put contributions for your own retirement directly on your 1040.)

Rent/Lease of vehicles/machinery/equipment and/or property–This applies to property or space other than your home office. If you rented office space, get your landlord to provide either a monthly receipt for payments or an annual summary in writing.

Repairs & Maintenance–This is where you keep receipts for “incidental” repairs, not for remodeling or anything that adds so much to the value of your space that you’ll have to amortize it over time.

Supplies–Keep receipts for anything you purchased for use in order to do the work of your business, per se, rather than the administrivia or paperwork.

Taxes & Licenses–Do you pay for an annual business license for your city and/or county? Whether it’s a flat fee only, or a fee plus a tax as a percentage of your gross revenues, you’ll want to maintain a record of what you paid. This category also includes state and local taxes you paid, including business-related property and payroll taxes. If you collected taxes from customers, the amount you collected (and were paid) will go under your income category, but will be offset here. Don’t forget licenses required by your state and/or profession or trade.

Travel, Meals & Entertainment–This is a huge category; entire books are written on this topic. The basics, however, are that travel expenses (other than food and entertainment) are fully deductible as long as they’re business-related, but meals and entertainment are generally deductible at only 50%. So, if you fly to a conference and stay overnight for a week, your airfare and hotel will be deductible (as will be tips to housekeeping, dry cleaning, late hotel check-out fees, rental cars and airport shuttles, and various incidentals you wouldn’t have to pay if you were snuggling on the couch at home). However, that $200 dinner you bought for yourself and your big client? Only $100 is deductible (and only half the dinner tip, too). I guess the IRS figures you have to eat, wherever you are.

Utilities–This is where you need to keep track of utilities related solely to your business. (If you have a home office, expenses like electricity will have been factored on Form 8829.) Also note that many digital tax preparation services, like TurboTax, tend to refer to “Communications” as a separate category, although they assign the totals to the Utilities section. Be sure, whichever method you use, not to include these items twice. Remember to take note of what you spent for extra landlines (beyond your primary home line), voicemail and other phone services, cellular service, internet service, data packages for mobile devices and any other communications-related expenses.

Wages–If you have actual employees, rather than contract labor, keep very careful track of payroll wages (plus FICA, Medicare and FUTA) for entry in this category. If you use a payroll company, they should provide you with summary data for each payroll period, as well as an annual total.

Other–While we professional organizers tend to avoid unlabeled categories, this is a good place to put items for which the typical solo professional might be saying, “But hey, where’s the category for…?” Although Schedule C doesn’t make a separate category, there’s no reason you can’t create separate files for each major “miscellaneous” category you need, including: continuing education expenses (conferences and seminars, ongoing or one-time-only classes, educational resources), business gifts, outsourced business services (printing, photocopying, binding, virtual assistants), etc.

There are a few other types of expense paperwork a typical self-employed person will need. If you qualify for the home office deduction, you’ll need to have a handle on both office-specific expenses and household-wide expenses (like rent/mortgage, utilities, etc.) for a percentage equivalent to the percentage of space in your home that the office encompasses. This is yet another reason why Paper Doll encourages you to maintain an organized Family File system. For more information, check out the categories on Form 8829 (Expenses for Business Use Of Your Home)and the detailed instructions.

Did you know that self-employed people can deduct up to 100% of their health insurance premiums? Don’t just think, “Oh, I just paid my insurance premium. It was X. I’ll multiply that by 12.” Rates tend to go up annually, and also tend to increase when you age out of a particular age-group category, so you may have paid two or three different monthly premium amounts in any given year. Check your statements!

So, set a reminder alarm or start each business day by entering the previous day’s income and expenses by category. You’ll have greater mastery over your business finances, and you’ll be amazed at how quickly you will finish your taxes.

Organizing Your Tax Paperwork–Part 2: Health, Home, Heart & Head

Last week, we talked about the information return documents (W-2s, 1099s and 1098s) that delineate how much money you’ve received (from employers, financial institutions, etc.) and how much you’ve paid (either directly or indirectly) in various federal and regional taxes. But that’s just the beginning of your paperwork.

Then there are documents you received (and should have saved) as a result of some kind of transaction–receipts or records essential for completing personal or family taxes. Today’s post reviews which documents you should locate to complete your 2009 returns, and which you can begin collecting to make next year’s tax preparations even easier.

But first, do you have everyone’s Social Security cards? Sure, you’ve probably had your own number memorized since you took the SATs, but are you certain you know your spouse’s number? Your children’s? The elderly relative for whom you are the sole support? If you pay alimony, do you know your ex-spouse’s number?

A major cause of audits is a mismatch between information provided to the IRS by third parties (e.g., via W-2s and 1099s) and that provided by you. If a Social Security number is off by even one digit, it impacts not only your likelihood of being audited, but also your earnings history, and therefore, your eventual benefits.

So what documents do you need? There’s financial proof that is (or should be) delivered directly to you via some kind of correspondence and proof that you must retrieve at the time of a transaction, for various categories:

- Your Health

Medical insurance company summaries of out-of-pocket health expenditures for last year might be a goldmine if your family’s medical expenses were high. Unlike miscellaneous deductions, which need only combine to 2.5% of your adjusted gross income, medical expenses must exceed 7.5% of your AGI to be deductible–otherwise, you’d just take the Standard Deduction.

If your insurance company doesn’t automatically mail monthly or annual summaries, call to find out if there’s a way to log into your account to access and print a 2009 summary (and save you a lot of math). If not, you can usually use the “You Owe” column of the Explanation of Benefits your insurer sends after doctor’s visits, hospitalizations and procedures. This will give you a handle on which receipts or dated statements you’re seeking.

Be vigilant about saving medical expense receipts, as your EOB’s and insurance company summaries are not legal proof of what you spent on deductible medical expenses, only indications of what you owed to medical providers. Collect receipts for:

–Traditional medical expenses–Be sure you’re counting only medical expenses you paid and not portions paid by the insurance company or in the section on the Explanation of Benefits generally referred to as network savings. (That amount isn’t something you paid, or even something paid by the insurance company. It’s the amount knocked off the bill simply because you have insurance. If you were uninsured, you’d be charged more than the combined total normally paid by you and the insurance company. Oy!)

–Pharmaceutical expenses–Did you know you can call or go into your pharmacy and request a printout of all pharmacy purchases you made for yourself or your children? This is a major organizational advantage of using only one pharmacy–one printout. Because of privacy laws, your spouse may have to make a separate request.

–Health Savings Account documentation–For every qualified medical expense you pay through your health savings account (HSA) or medical savings account (MSA), it’s essential to keep a record of the name and address of each person or company you paid and the amount and date of the payment. Since HSAs can be used to cover everything from orthodontia and acupuncture to durable medical equipment and contact lens solution, be sure to save your receipts, and if a receipt doesn’t clearly describe what you actually purchased, make a note at the top to ease your labor at tax time.

–Medically-necessary travel expenses–Did you know that if you (or a family member) have conditions that require travel for treatment, you can deduct the travel costs? Either keep a log of the miles you drive your car for medical purposes and use the standard mileage rate, or, if you have a penchant for minutia, you can record gas and oil expenses directly related to any medically-necessary travel.

- Your Home

Home purchases–This year, with so many taxpayers taking advantage of the $8000 First-Time Homebuyer Credit, the issue of home purchase record-keeping is especially important. Be sure to maintain records regarding the purchase (or sales) documentation for a house, as well as records for closing costs, home inspections, fees paid to real estate agents and any records regarding private mortgage insurance.

Casualty and theft losses require documentation. For thefts, you’ll need to have proof of ownership (that’s why we recommend saving “big ticket” item receipts and videoing a household inventory), proof of theft (usually via a police report) and the date that the item is believed to have been stolen (to be sure it falls in the appropriate tax year).

For proof of loss due to casualty, you’ll want to maintain insurance company confirmation letters regarding the date and cause (ice storm, lightning, fire, auto accident, etc.) of loss, estimates of original costs and costs of repair/replacement vs. what your insurance company will or will not pay (or has paid), and proof of ownership.

Moving expenses relate to actual costs (movers, truck rental, storage, etc.) and mileage. Did you move more than 50 miles in order to work at a new job location? Check out IRS Publication 521 regarding what you’ll have to document.

Other home-related paperwork to save:

–Receipts and records regarding any home improvement efforts you’ve made which materially increase the value of your home (which will have a tax implication when you sell)

–Records of purchases for your primary residence that qualify you for the Energy Star tax credits this year–This gives you credit for 30% of costs up to $1500 worth of energy-efficient purchases, including biomass stoves, various heating/air conditioning devices, insulation, water heaters and windows and doors.

- Your Heart (Loved Ones and Philanthropy)

Childcare/Eldercare costs–To take advantage of the Child (or Dependent) Care Credit, you’ll need documentation of the name, address, and Taxpayer/Employer Identification number for any care provider you’ve used for your kids or other dependents. Whether you’re using a babysitter from down the street or employing the services of a daycare facility (for either children or adults), use federal form W-10, Dependent Care Provider’s Identification and Certification.

Plus, even if you’re not planning to run for elected office, be sure you’re not running afoul of Nanny Tax requirements regarding FICA (Social Security and Medicare) and FUTA (unemployment insurance). Keep records of what you paid (and when), what you withheld and what you submitted to the IRS.

Confirmation of donations from charitable agencies–You may get a nice form letter on the non-profit’s stationery, or they may bury your acknowledgment as tiny text in asterisked comments at the bottom of requests for further donations, so you really do need to be diligent about opening your mail. A confirmation should include the name of the qualifying charitable entity, a date of donation or at least the date of the acknowledgment (i.e., something to prove the tax year of the donation) and a dollar amount or a description of materials, if an “in-kind” (non-monetary) donation was made.

Not every charity confirms donations in writing. In past blogs, I’ve noted that for your protection, you should keep a “Tax Prep-Charity” folder into which you put documentation of any donations you make. If a charity sends you requests for money and you return a check or credit card authorization with the payment stub, use the rest of the page to mark the date, dollar amount and method by which you paid (check number or credit card name), and file it away.

- Your Head (Hobbies, Jobs, and Education)

Education expenses can be deducted in a variety of ways too numerous (and complex) for this arena–and then there are credits (the Hope Credit, the Lifetime Learning Credit, the American Opportunity Credit), Savings Bond programs and more. In addition to keeping your 1099-T (for tuition) and 1099-E (for educational interest), be sure to maintain transcripts that show your periods of academic enrollment, as well as canceled checks, credit card statements or other receipts that verify the dates of purchase and amounts you spent on tuition, books, lab materials, student fees, etc.

Notice of gambling or lottery winnings should come via W-2Gs, but even if a casino or lottery agency doesn’t send you a notice, you can be sure the government knows about your winnings. They certainly don’t know about your losses, however, which is why, if gambling is a big part of your lifestyle, you’ll want to keep a diary of your gambling losses to offset your winnings.

To deduct your losses, the IRS requires that you must be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses. They’d like your diary to include the date and type of gambling activity, the name and address where you gambled (apparently “Joe the Bookie” isn’t going to suffice), names of persons present and amount you won or lost. Paper Doll doesn’t imagine that the personality attributes for gambling aficionados and those for detailed diary-keepers would dovetail, but hey, I’m just here for the organizing.

Un-reimbursed employee expenses may include expenses for your vehicle or for travel, meals, entertainment or even client gifts. Unfortunately, you have to itemize (i.e., not take the Standard Deduction) and your combined itemized expenses must equal 2.5% or more of your adjusted gross income. Since you have no way of knowing in January what kinds of expenses your employer might force you to rack up in July, start maintaining a folder for these records right away.

Tips–Do you work in the food industry or a personal service profession where you receive tips? The IRS expects you to keep track of and report what you’ve made. They’ve even created form 4070A with lines for each day of the month–print 12 of them–to help you maintain your record of the tips you took in and what you were required to “tip out” to other support staff members (like bus boys, shampooers, etc.).

Proof of payment for jury duty–Most people get less than $9/day (though some municipalities are now paying up to $40/day), but since it’s reported to the government, you need to keep your records, too, so you can report it as miscellaneous income. If your employers required you to turn your jury duty payments over them, you’ll want records so you can request an adjustment to reduce your AGI.

Self-employed/small business expenses–If you own your own business, Paper Doll hopes you have a carefully-created filing system for all your business-related expenses. But just in case, next week’s post will be all for you, reviewing the kinds of records you need to maintain to ease the small business tax-time burden.

Remember, Paper Doll is a professional organizer. In the parlance of the web, IANAA (I am not an accountant) and IANYA (I am not your accountant). For tax-related questions, please contact an authorized tax preparation specialist or financial planner.

Follow Me