Archive for ‘Taxes’ Category

Taxing Conversations (Part 2): Organizing Fun With Forms

Last time, we talked about simple steps for organizing the paperwork for your taxes. As Paper Doll mentioned, it all begins with gathering the right documents. Every taxpayer’s situation is different, but we’ll review the most common items you should be seeking and collecting in your Tax Prep folder.

Today, we’ll review the tax support documents called information returns. These are sent to you from outside entities and the law requires them to be provided, generally by January 31st, so they should require the least amount of effort on your part.

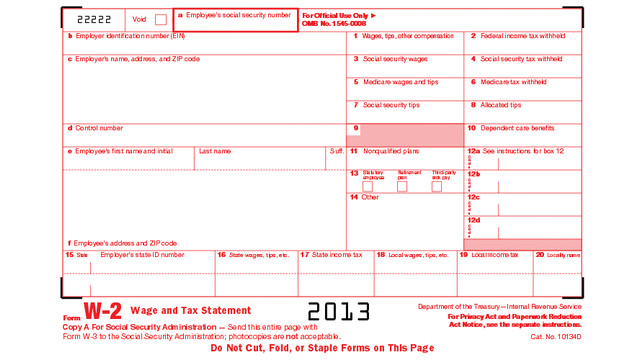

W-2 (Wage and Tax Statement)

If you’ve ever had a job, you’ve probably received a W-2. Not to be confused with a Federal W-4 (the form you fill out so that your employer knows how much tax to withhold), the W-2 is the form your employer gives you (and sends to the IRS) to report how much you were paid (in wages, salaries and tips) and, if applicable, how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state and local taxes, FICA, unemployment insurance and a few other withholdings are considered statutory payroll tax deductions. Statutes, or laws, require them. Wage garnishments for lawsuits or child support may be the result of non-statutory legal rulings specific to an individual. Your W-2 may also indicate other amounts withheld from your check, which are voluntary payroll deductions. These can include health and life insurance premiums, 401(k) or other retirement contributions, regular donations to the United Way, union dues, etc.

There are generally multiple copies of the same Form W-2. Your employers submit copy A directly to the Social Security Administration and keep copy D for their records. Copies B and C are for you — you send one to the IRS with your federal tax return and keep one for your own records. And, just to make sure you’re paying attention, copies 1 and 2 are provided to file with any applicable state or local tax authorities. (Don’t ask why they aren’t copies E and F. Paper Doll suspects it’s just to perturb her.)

Employers should mail W-2s by the last day of January, so if you haven’t received yours by Valentine’s Day, contact Human Resources (or, y’know, Madge, with the beehive hairdo, down the hall, as applicable). W-2s are usually mailed to the address listed on your W-4, though small businesses may just hand them to employees. Consider a few issues:

- Did you change employers recently? If you had more than one job this year, be sure that you have received W-2s from each employer. If you changed jobs at the same company, you’ll generally only receive one W-2 from each employer, not one per position.

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down and give you your W-2. Keep the boss updated!

Just because you don’t have your W-2 doesn’t mean the IRS didn’t get its Copy A. The IRS knows what you made, so be sure you do, too! (If your employer is no longer in business or is otherwise not responsible to your requests, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

When you receive your W-2, examine it carefully. Do the numbers seem right? If possible, compare them to the final pay stub you got for last year. Because the calendar year ended mid-week (and therefore, mid-pay period for most people), the numbers won’t correspond exactly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return. (And again, that’s a good thing!)

W-2G is a cousin of the W-2. If you go to a casino and win more than $600 in any gambling session (congrats, by the way!), the “house” will request your Tax ID and either prepare a W-2G on the spot, or send it to you in January of the following year. Note: the IRS knows about your winnings, but not about your losses. To deduct losses, the IRS requires you to be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

1099

A 1099 is a form that basically says, “hey, we paid you some money for something other than being an employee.” You get a copy; the IRS gets a copy.

There’s not just one type of 1099; actually, there are a whole variety of 1099s. Some of the more common are:

Got a bank account? This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account. Internet-only banks, like CapitalOne360, require you to log into your account to get your 1099-INT, so don’t count on it coming by mail.

Do you own stock or taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equally; ask your tax professional if you have any that seem unusual or complicated.

This is what you may receive from a client or customer if you were an independent contractor (i.e., self-employed) or if you got any kind of miscellaneous revenue for doing work for someone else when you were not actually considered an employee. Even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-MISC. This is why, if you are self-employed or irregularly employed, it’s still vital to keep track of your incoming revenue.

Your 1099s may be hiding in plain sight. Sometimes, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope as (or even perforated, at the bottom of) a quarterly or end-of-year financial statement, so be sure to check all the “official” mail that arrives. Multiple forms may be sent as a “combined 1099,” scrolling across multiple pages, so check the reverse of other forms, in case you seem to be missing one.

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that a party has forgiven a debt, like a mortgage or part of a credit card balance. You may owe money on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, it’s as if you received money.

The IRS maintains a list of other types of 1099s and 1099-related forms.

1098 (Mortgage Interest Statement)

A 1098 is not a 1099 with low-self-esteem. This form reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. If you rent, you won’t have a 1098; the same goes if you paid off your mortgage prior to the most recent tax year.

There are sub-types of 1098s for things other than interest on property loans. For example, you might receive a 1098-C from a charitable organization if you donated car, boat or airplane. (Paper Doll suspects that if you donated an airplane, you probably tripped over my blog post on your way to Happy Millionaire Magazine.) Your college might provide you with a 1098-T to indicate you paid tuition, or a financial institution might send a 1098-E to show you’ve paid student loan interest.

Chance are good that you will receive a W-2, 1099 and/or 1098 in any given year, but there are many other less common information return forms. This lengthy list and description of all tax-related forms can help you if you receive something mysterious and vaguely official in your mailbox.

Again, these are the forms that others are required to send to you. Next time, we’ll finish up by exploring other kinds of paperwork that you may need to locate and organize to prepare your taxes, primarily documents that may take a little nagging or detective work on your part.

Taxing Conversations: Organizing the Essentials & a New Tax Tool

The other day, I asked a potential client how well she thought her family was doing on keeping up with tax paperwork. She mentioned that they have a “tax drawer” where they collect everything related to taxes. Perhaps she thought I’d be judgmental, but I think she and her family are head and shoulders above where most American taxpayers are at this point in the year.

If tax time has given you a headache in the past, Paper Doll has some suggestions for obtaining, sorting and maintaining the forms and supporting material you (or your accountant) will need by April 15th.

The basics of getting ready for tax time aren’t that scary. Five simple steps should get you on your way.

1) Create a folder called Tax Prep 2013. Yes, 2013. In any given year, you’re preparing tax returns for the prior fiscal year.

While you’re at it, you may as well create your folder for Tax Prep 2014, so you’ll have it handy throughout the coming year. For many of my residential organizing clients, we create a hanging folder for tax prep with a variety of tabbed folders for the subset of paperwork that comes into the home throughout the year: Charity (donation receipts), Medical Expenses (sometimes divided into separate folders for prescriptions and doctor visits), Educational Expenses and more. However, if you’ve made it to 2014 without a system for tackling 2013’s receipts, one nicely labeled folder is a great start.

Although Paper Doll prefers tabbed folders because they store easily with the rest of your family filing system, you might like to consider something like the Smead Tax Organizer to corral your documents.

The faster you locate the essential documents, the sooner you can complete your return and earn one of two prizes, either a tax refund or more time to figure out how to come up with the funds to pay your taxes.

2) Watch your mailbox. Most financial institutions still send tax forms through the mail. If you’re not in the habit of opening your mail as soon as it arrives, January is the perfect time to start a new, good habit. Financial institutions have a nasty habit of hiding 1099s (of which, more next time) at the bottom of long annual statements or as enclosures with fourth quarter statements — so again, read your mail.

3) Watch your email inbox. No, you probably won’t receive tax documents via email, as it’s not secure. Financial institutions make a lot of security-related mistakes, but that’s not generally one of them. However, you will likely receive email notifications that you can log in to your online accounts at banks, brokerage houses, etc., to download and/or print your tax forms.

Caveat: this is also the time of year when phishers are trying to get their hands on your Social Security number and other vital information. Do not click on links embedded in emails to get to your online financial accounts. Type the URLs yourself, and make sure that https:// appears in the URL box so you know you’re gaining secure access.

4) Review your prior year’s tax return and supporting materials. (Hopefully, you’ve got them collated in a folder somewhere.) Make a quick list of all the forms and documents you used when preparing a previous year’s taxes. When January’s over, compare the list with what you have in your folder to see what forms might be missing or what recurring donations you might have made but forgotten. This year may not be identical to last year — you may have given to different charities, sold stock or closed an old savings account. But knowing which documents you received previously will help you eyeball the situation and recall changing circumstances.

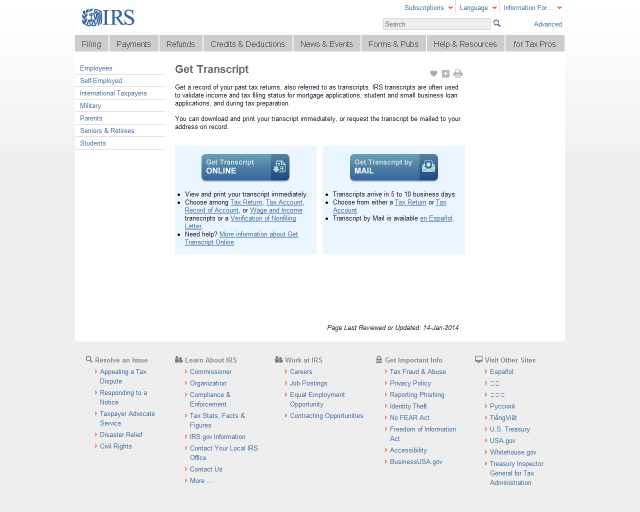

5) Let the Taxman help. There are a few reasons you might be missing your old tax paperwork. Maybe you prepared your taxes online and had only a few forms and just tossed them in a drawer. Perhaps your paperwork is still in storage because you moved during the year. Or it’s possible that organizing your paperwork hasn’t been your major priority. Happily, getting your old tax returns has never been easier.

In the olden days (that is, before last week), if you wanted copies of your taxes, you had to either trundle down to your local Internal Revenue Service office, fill out forms, and wait in line, or you had to submit forms by mail and wait about ten business days for your forms to arrive by mail. Paper Doll suspects you neither want to cool your heels at the IRS office or have your tax documents slowly wing their way to you. (Oddly, we tend to worry less about mailing our financial information to the IRS than having them send it back to us.)

The good news is that effective immediately, the IRS has created Get Transcript, a real-time online tax transcript request service. (“Transcript” is the fancy term the IRS uses to refer to digital of old tax returns.) For what it’s worth, Get Transcript isn’t merely useful for preparing your taxes. When you apply for mortgages, small business loans, and student loans, presenting an IRS transcript is usually a quick shortcut for helping you validate your income and tax filing status.

Create a Get Transcript account with your name and email address. You’ll be emailed a confirmation code; once you enter it into the system (which you need to do within thirty minutes of receipt, so don’t dawdle), you’ll provide a variety of identity verification information and then set up a secure profile. Expect this part to take 5-10 minutes — but you’ll only have to do this once.

Get Transcript allows you to get your actual tax transcript (a copy of your original return) or an account transcript (which shows amendments or changes made by you, your tax preparer or the IRS). If you want a document that shows a combination of your original return and supporting information as well as the revisions, you must request a record of account transcript.

Select the type of transcript, year, and the reason you’re requesting it (e.g., mortgage, student loan, immigration, housing assistance, etc.). Your transcript will display on the screen. Save it as a PDF so that you can maintain a digital record on your computer or in the cloud. Don’t forget to sign out of your IRS account when you’re done.

Next time, we’ll review all of those official letters-and-numbers forms that can make tax preparation so stressful, and we’ll follow up with the supporting materials that you may need to collect on your own.

Taking just fifteen minutes to organize today will help make tax time much less stressful. Why not get started now? Dig through your “tax drawer,” climb into your mailbox, and start gathering the essentials.

Follow Me