Archive for ‘Paper Organizing’ Category

How to Use Cathedral Thinking and Intentional Words to Organize Your Year

We’re not quite a week into the year. And yet, if you had resolutions, you may have already broken them. Vowed to eat healthy, but that boozy New Year’s Day brunch blew that plan out of the water? Planned to exercise daily, but those two days back at work wore you out, so you slept in instead of going to the gym this weekend?

You aren’t alone. In fact, the second Friday in January is known as Quitter’s Day because so many people have already tossed their resolutions by that day. Research by Baylor College of Medicine found that 88% of people give up their New Year’s Resolutions by the end of January; a large percentage of the remainder part ways with their resolutions before the end of April.

WHY DON’T NEW YEAR’S RESOLUTIONS WORK (FOR MOST PEOPLE)?

It’s not that resolutions can’t work, but that people generally go about them in the wrong way.

Unrealistic Expectations

It’s cute when three-year-olds tell you they’re going to be princesses, basketball stars, or wizards. But if you’re a grownup and you “resolve” that you’re going to change who you are in some massive way, your ambitious goals may get in the way of reality.

If you set an aspirational goal that’s so ambitious that you can’t possible achieve it, you’re guaranteeing that you’ll be discouraged each time you hit a setback or your progress is glacial.

Think about what I wrote in Paper Doll Explains Aspirational vs. Inspirational Clutter. Just as when you fill your space with tangible aspirational clutter, filling your head with an aspiration to achieve something lofty without the any undergirding infrastructure guarantees disillusionment and falling short.

Black-and-White Thinking

It’s common to approach goal-setting with an all-or-nothing mentality.

“Either I will publish a Pulitzer Prize-winning novel this year (even though I haven’t written anything since college)!” or “I’m going to keep this house perfectly organized every day from now on (even though I haven’t seen my keys in three weeks)!” leads people to give up when they hit the first bump in the road, so they stop writing or putting things away.

Too often, people craft their resolutions as, “I’m going to completely change how I behave” and that means that the minute they revert to their innate habits, they declare a loss. (A hot fudge sundae doesn’t mean your diet is dead and buried; tomorrow, have a salad.)

We don’t need a new year, or a new month, or even a new day to continue on with our goals. As I talked about in Organizing A Fresh Start: Catalysts for Success, we can always find new opportunities to re-set.

Shame-based Motivation

- Are you a carrot or stick person? Are you motivated to win something for the glory or by fear of not achieving?

- Are you more likely to go after a goal because it’s something you truly desire, or because you’ve been guilted into it?

- Do you want to achieve something because it’s your dream, or because you’ve been conditioned through social pressure (or from your mother-in-law or your work frenemy) to do something?

If you only set a goal because someone makes you feel bad about who you are now (whether in terms of your shape, your status, or your accolades), that extrinsic motivation probably isn’t going to have staying power to get you out of bed to run on a rainy morning or to get your butt on the piano bench to practice scales.

If you’re focused on something negative and are shamed (or shaming yourself) into changing who you are, that self-criticism is going to prevent you from making any sustainable change.

And whenever we don’t meet our resolutions, that above-mentioned black-and-white thinking can lead to low self-esteem, feelings of inadequacy, and poor mental health.

Lack of Strategic Planning

If you rang out the old year by resolving to “lose weight in 2025” or even to “lose 25 pounds in 2025,” you were resolving to magically achieve something. You can’t really “do” a resolution.

This is why the concept of SMART goals is so popular, because they promise that if you sit down and define your goals by making them specific, measurable, attainable, relevant, and time sensitive, and strategize how you’ll take action, when, and how often, and are clear on your purpose, you’ll stand a better chance. I’ve written about that often, and back in 2014 in Achieve Your Goals: Modern Truths Behind the Urban Legend, I spelled out my alternative steps to really making your goals come alive.

Merely stating your resolution without spelling out the strategies and actionable tactics is a recipe for a pretty weak soup of achievement.

For more on the problematic nature of New Year’s resolutions, read:

- The Psychology Behind Why New Year’s Resolutions Fail (VeryWellMind.com)

- New Year’s resolutions often don’t last. Here’s why they fail and how to keep them, according to an expert. (CBS)

- Why New Year’s Resolutions Don’t Work (And What You Can Do Instead!) (Forbes)

Instead, Make Real Change Through Intentions and Habits

Set positive intentions — When you do create goals, focus on whatever you want to achieve because the goal uplifts you, not because you’re trying to avoid something. (Will you be delighted, or will you only be avoiding a negative result? Unless you’re motivated by the stick, find the carrot…or the cookie.)

Have a plan, not a dream — Identify any obstacles you’ve faced in the past anticipate what may arise in the future so you can develop strategies to overcome them.

Set small, achievable objectives — You’re not going to put away everything the minute you are done with it, but you can set a timer for ten minutes before your lunch break to file away everything that’s piled up on your desk during the morning. Keep breaking down large aspects of change into ever-smaller, more manageable tasks.

In fact, if you really want to change your behaviors, I suggest reading (or re-reading) James Clear’s Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones.

Clear’s book is one of the most approachable guides to making small behavioral changes so that you can replicated them and build on them to achieve what you want.

Treat yourself with kindness — Don’t beat yourself up over backsliding; use it as an opportunity to investigate what’s tripping you up and look for creative solutions. The goal is to catch yourself winning.

Acknowledge that setbacks happen to everyone; focus on progress, not perfection. (Perfection is boring! Figuring out why you always throw your coat on a chair instead of hanging it up or always procrastinate about refilling prescriptions gives you opportunities to win!)

Seek — and accept — support! — There’s a reason people say it takes a village and that no man is an island. Humans are social animals; we’re not meant to do it all ourselves. Whether you seek the support of family or friends, delegate lesser tasks to staffers so you can focus on improving your unique skills, or work with a counselor, therapist, or professional organizer who can provide accountability and training, don’t feel like you have to go it alone.

GO LONG; MAKE A CHANGE

I’m just not a fan of resolutions. I am far more enamored of changing habits. If resolutions work for you and help you make a fresh start, go for it. But if you struggle with resolutions, it’s OK. There are better ways to introduce change in your life.

Longtime Paper Doll readers know that I’m a big fan of using words to create a positive mindset. Once I have a vision for what I want my life (or my year) to look like, I can build a theme and see if each habit or action dovetails or departs from that theme. And we’re going to look at that in a moment. But I’ve recently been introduced two additional concepts for guiding your thoughts and actions.

Cathedral Thinking

Greta Thunberg has been quoted as saying, “Avoiding climate breakdown will require cathedral thinking. We must lay the foundation while we may not know exactly how to build the ceiling.”

Oooh, cathedral thinking! I’m picturing time-lapse video of a cathedral being built from the foundation upward as the people and the city around the area change and grow over decades and centuries.

I was unfamiliar with the term “cathedral thinking” before I heard Thunberg’s quote, and did some research. Officially, cathedral thinking is a mindset focused on long-term planning and thinking about the future rather than the present. Originating in medieval Europe, the concept developed from the fact that builders of grand cathedral began projects they knew would not reach fruition in their lifetimes; they were thinking generationally.

Duomo di Orvieto (Orvieto Cathedral) Umbria, Italy @2018 Julie Bestry

Cathedral thinking is a way to view the problems we face as challenges requiring effort — sometimes collective effort by that village — and an investment of time, and perhaps money, over the long haul. When you’re talking about building literal cathedrals, that long-term planning, investment in the future prioritization of sustainability can create a tangible monument to the work you’ve put in.

But ever since I heard Thunberg’s quote, I’ve been thinking about how cathedral thinking applies to building our future selves. Maybe our initial goals are short-term: to get our homes or offices organized, or to learn how to say no to obligations that don’t fulfill us, to go to the gym, or start eating healthy.

But none of these goals exist in a vacuum. We don’t want to lose weight because the number on the scale is somehow meaningful. We’re not decluttering (merely) so that our homes look more orderly. We’re not culling the energy vampire tasks from our schedules so we’ll have a more balanced work-life schedule. Those are the interim benchmarks; those are the foundations and scaffolding and various levels of the cathedral of our individual selves.

But our true cathedrals are who and what these habits will help us become. Better eating, exercise, self-care, stress-reduction, and organized spaces mean that we will be happier, healthier, and alive and vital for longer so that we can be with the people we love, doing the things we care about.

Anyone doing a reality check knows we don’t write books to become rich; almost no published authors are making that kind of bank; nor are artists. Instead, it’s about legacy.

James Clear suggests that we can change our habits by aligning them with our identity. “I am the kind of person who eats five servings of vegetables a day” or “I am the kind of person who hangs up her clothes” may not be true, yet, but it’s tying acts to the self-image to which one aspires.

As long as that identity isn’t so aspirational as to seem out of reach, it can override the tendency we all have to blow off our goals when we just aren’t feeling it; when we just don’t wanna.

Your aspirational goals are part of your legacy, and your legacy is going to take a lifetime to build. You are a cathedral. Start by laying the foundation, and keep the future generations (that is, iterations) of your identity moving forward.

Make a Change

I’m sure you’ve heard the saying that “insanity is doing the same thing over and over again and expecting different results.”

We all struggle. Change is scary. Fear of failure, fear of success, and annoyance (and avoidance of annoyance) keep us stuck, year after year.

Recently, I was thinking about how, ever since the start of the pandemic, I’ve felt stuck. I work hard to stay safe, in terms of my health. I still wear a mask in indoor public settings and avoid crowds. But in the last six weeks, I’ve still had health issues; first, as I reported last month, I had a rough bout of vertigo; then mid-December, I had a cold (and it was, though lingering, just a cold). I petulantly resented that I’ve taken all of these precautions, have missed out on a lot of the joys of life in these years since 2020, and still got sick.

We all take precautions to protect ourselves professionally or personally, to avoid pain (the stick) but that often means we never get the carrot or the cookie. Eventually, as I wrote about in Paper Doll Says: Don’t Get Stuck in a Rut — Take Big Leaps, we have to get out of our comfort zones.

This was in my head when I had a conversation last week with the always-fabulous Deb Lee, productivity consultant, connector-of-humans, and amazing friend. Deb was talking about marketing and entrepreneurship expert Amy Porterfield, and how she often advises people to Do Something Different. You can listen to Amy’s podcast, #497: Do Something Different: A Method For Getting Unstuck, for a sense of how this philosophy, of doing something in a different way, can shake you out of your rut, blow out the cobwebs, and bring new ideas and new opportunities.

And it wasn’t just Deb quoting Amy. Within a day, my colleague and the best darned Evernote Expert you could want to know (and I’m saying that as someone who has been an Evernote Certified Expert for the past decade), Stacey Harmon of Harmon Enterprises, echoed the same idea. In her newsletter, she talked about how she chooses a word/concept of the year, and for this year, Stacey wrote,

“For 2025, I’ve chosen “Do things differently. Get different results.”

(In her newsletter, she talks about how each year, she creates a custom Evernote Home cover image containing her word or phrase of the year, overlying a photo that’s attractive to her and is in alignment with her goal. Read more about how Stacey tracks her word/phrase of the year in Evernote.)

Although hers isn’t my phrase for 2025, I’m borrowing the inspiration to remind myself to spread my wings a bit more and embrace a larger life.

USE YOUR WORDS TO ORGANIZE THE LIFE YOU WANT

Most years, I blog about the advantage of selecting a word or phrase of the year to create your mindset. While resolutions state where you want to end up and goals allow you to spell out the habits that can get you there, words or mottos for the year are different.

Scrabble Tile Photo by Brett Jordan on Unsplash

Whether you pick a word or phrase or song doesn’t matter. Rather, all formats of these words allow to set your intentions for where you want to focus your energy for the coming year in a way that uplifts and expands instead of setting restrictions and boundaries.

Last year, in Toss Old Socks, Pack Away 2023, and Adjust Your Attitude for 2024, I talked about my approach to each new year.

In particular, I went deep and wide into the concept of the personal review, a method for reflecting on the year that’s ended to get a sense of what is really meaningful to you (in categories like health, finances, professional development, business, relationships, personal growth, and community) for guiding your approach to the new year.

I recommended the amazing Year Compass, for doing your annual review and for developing your hopes, dreams, goals, and plans for the coming year.

And I’d picked the word UPGRADE as my guiding word of 2024, but explained that it was battling it out with PRONOIA. I wrote:

Don’t worry if you’ve never heard of it. Honestly, the first time I heard the word, I assumed it was made up. It’s opposite of paranoia; a person experiencing pronoia believes that the world around them conspires to do them good. Obviously, taken to extremes, it might seem like psychological or spiritual irrationality.

But Buddist principles haven’t been working for me, I’m still trying to get a handle on the Stoics I talked about in Toxic Productivity Part 2: How to Change Your Mindset. I feel the pull of a bigger change in my life, and I think “pronoia” dovetails with the idea of a life upgrade.

Thus, I keep coming back to the Carly Pearl song in which I first heard the word “pronoia.”

This year, I’ve decided to upgrade the word “pronoia” to be my personal life motto. The concept that the world conspires in your favor is just too inspiring to apply to only one year.

Once you do your personal review, you’ll know what you want to accomplish this year, and more importantly, why. Maintain the motivation and energy of your “why” with a word or phrase that reflects the overall concept you want your year to engender. It’s not about losing weight, or maybe even health, but a word that reflects beyond the literal to the the larger idea of how you want to feel. Maybe buoyant or lighthearted or delighted?

Consider:

- a word of the year

- multiple words (like a trio of words) of the year

- a quote or motto or mantra of the year

- a song of the year (or a song title, or a lyric)

Whatever you select is your personal theme for the coming year. Whatever you want to remember about your goals and your attitude is what this word or phrase or mantra will reflect.

But don’t just leave your word sitting there on a notepad. Your goal is the best product or service — it’s the business of you. Use your (organized) space to keep your attention on your intention for the year, the building of your personal cathedral.

Advertise your theme word(s) anywhere or everywhere it’ll catch your attention. Don’t let it fade into the woodwork!

Promote your theme to yourself wherever you need a little push to live in accordance with the values you’re setting for yourself. Display it:

- on a sticky note on the fridge or your bathroom mirror

- on a bookmark you’ll see each time you open or close whatever book you’re reading

- on a both sides of the door leading to and from your garage, so you’ll be reminded of it when coming and going

- on one of those fun little felt word board with changeable letters placed so you see it from your desk chair or wherever you spend the most time

- on the lid or door of the washing machine, to remind you that those “adulting” tasks deserve appreciation

- on the door to your closet so you’ll be reminded to dress and act in accordance with your theme

- as the title of a vision board, along with images reflecting the meaning of your motivating words, phrases, and songs.

- on the lock screen of your phone

- as the desktop graphic of your computer

- on whatever software allows you to customize your home screen (like Stacey’s advice for Evernote Home)

Don’t just engage your visual sense. Add an auditory component:

- Change your wakeup alarm on your phone to your theme song.

- Record yourself speaking your word or mantra (or have a loved one do it) and use the sound file as an alarm to remind you periodically at a point in the day when your inspiration is likely to flag.

- Recite your word or phrase every night before you go to sleep and upon waking. Make it a mantra.

Whatever you pick should soothe and motivate, providing you with clearer sense of the vision you want your actions to reflect. Picture it on a banner as you cross the finish line, or carved into the marble over the doorway of your personal cathedral.

Find Your Inspiration

You don’t have to rush to find your word or phrase. A year is 365 days and we’re only six days in. And if you find that the word your pick is ill-fitting, like a jacket that’s too tight in the shoulders, you can change it.

To get you started, peruse:

Choose a One-Word Theme: We Review Our 2024 Themes and Reveal Our 2025 Themes (Happier Podcast with Gretchen Rubin)

One Word Themes for 2025 (Gretchen Rubin)

How To Choose A Word Of The Year (Elizabeth Rider)

New Year Intention (Jonda Beattie)

246 Word of the Year Ideas for a Better 2025 (GoodGoodGood.co)

2025 Word of the Year Ideas (Morgan Harper Nichols has 60 great, often unexpected words)

2025 Word of the Year (and 100 ideas for yours) (Elizabeth McKnight)

Paper Doll’s Words of Intention

I’ll be honest — I’m not ready for 2025. I usually use the last two weeks of the year to do my annual review and find the right word or phrase for the coming year. But, as mentioned, I had the creeping crud from the week before Christmas until close to the new year, and haven’t yet found my word. I’m leaning toward ENGAGE.

I liked having a word and a song last year, and keep hearing Florence and the Machine’s Dog Days Are Over running through my head, but suspect it’s one of those songs where I’m not sure that the lyrics mean what I think they mean. I’ve noticed that Natasha Beddingfield’s 2004 hit, Unwritten, is playing everywhere lately, and feel like it’s speaking to cautious, perfectionist me:

I break tradition

Sometimes my tries are outside the lines

We’ve been conditioned to not make mistakes

But I can’t live that way

Songwriters: Danielle A. Brisebois / Natasha Anne Bedingfield / Wayne Steven Jr Rodrigues

Unwritten lyrics ©2004 Sony/ATV Music Publishing LLC

Whatever I choose, I’m considering the advice of Deb and Stacey, and remembering the words of essayist and novelist Susan Sontag, in her Reborn: Journals and Notebooks, 1947-1963, where she emphasized courageously taking leaps and embracing change:

“I must change my life so that I can live it, not wait for it.”

Do you have a word, phrase, motto, or song of the year to support your 2025 mindset?

Use the Zeigarnik Effect to Finish Off Your Unfinished Tasks

Nothing is so fatiguing as the eternal hanging on of an uncompleted task.

~ William James

Yes, I know I’ve used this quote here before, but it’s an important one, especially at this time of the year.

As I type this post, there’s barely more than a week left in 2024. As we look toward 2025, I can’t help thinking about what I didn’t quite finish this year. (Yes, even professional organizers fall short of our sometimes-lofty goals.)

THE ZEIGARNIK EFFECT: WAITERS AND THE CUSTOMERS WHO HAVEN’T PAID

Tasks left un-done scratch at the brain. There’s even a name for it — the Zeigarnik Effect.

As the theory of this phenomenon goes, people remember tasks that are unfinished or interrupted better than the ones they complete. Initially, psychologist Kurt Lewin recognized that waiters had clearer recollections of the orders of patrons who hadn’t yet paid for their orders. Once everyone paid, the waiters basically wiped their brains and couldn’t recall the details of the orders anymore.

This is why I am always so dubious of Law & Order episodes when the police track down a suspect by credit card order to pump the bartender or waiter for details. Invariably, although paid (and ostensibly tipped), servers seem to still remember all the details. Yet somehow these Manhattan waiters remember not only the patrons’ orders but what their dates looked like and the basics of the conversations they were having? Is the world of Dick Wolf a Zeigarnik-free zone?

But I digress.

The central concept of the Zeigarnik Effect is that once you start a task, there’s a “task-specific tension” created in the brain which keeps the task active. Basically, when you start something but don’t finish it, it’s like it’s still on the burner on the stove, and (assuming you’re not distracted by other things you’ve started), that tension pushes you to work on the task. Get interrupted again? The tension persists.

Once you actually do finish the work, the tension is relieved. Keeping that continuous tension up — having the task pop to the top of your To-Do list, putting a sticky note on your steering wheel, etc. — keeps the essentials of the task accessible to the part of your brain that says, “Damn, I really have to work on that!”

(Usually, men get the credit for women’s work, but in a striking rarity, the effect is named not for Lewin, but for Lithuanian-Soviet psychologist Bluma Zeigarnik, who continued the line of research of her friend and mentor, Lewin.)

The Zeigarnik Effect keeps unfinished tasks sticky in the brain and work in several ways to get you across the finish line. Unfinished tasks can prompt you to finish them by acting on your brain in the following capacities. They:

- Serve as Mental Reminders — You naturally keep remembering things you started but haven’t finished doing. The unfinished tasks stay top-of-mind, prompting your brain to say, “Hey, you got interrupted (or got bored and wandered away) but this thing is still here! Don’t forget about it!”

Wooden Brown Scrabble Tiles Photo by Brett Jordan on Pexels

- Boost Motivation — The next time you curse your brain for reminding you of an unfinished tasks, give yourself a little slack. This mental tension can increase your drive and magnify your focus to resolve those icky, lingering tasks. Sometimes, that motivation may just be, “Dang, I don’t want to be reminded of this again!” but that’s motivation in its own right.

- Build Momentum — My clients hear me say this all the time, but “Small victories breed success.” Even — and sometimes especially — when you take action on the tiniest of unfinished tasks, it can create a domino effect. Have you ever noticed that when you knock something off your list, particularly something that’s been hanging out there a little too long, it gives you the push to tackle more and larger tasks?

- Give You the Satisfaction of Closure — That “whoohoo!” you get from finishing something? It can make you feel like a bit of a superhero. It can work magic. That relief you get when something is no longer hanging over you frees up mental energy so you can set (and tackle) new goals.

Sidebar on the Zeigarnik Effect and ADHD

Of course, the Zeigarnik Effect is just a typical psychological phenomenon and may not hold up under all circumstances. For example, if you’re undergoing a lot of stress, whether at work, or due to illness, or an upheaval in your relationship, an unfinished task that has nothing tangible or digital bringing your attention back to it may just, in effect, escape your brain and fall out of your ears.

When I started to write this post, I wondered whether anyone had researched the relationship between the Zeigarnik Effect and the experiences of individuals with ADHD. They have, but it turns out some of my initial instincts were wrong.

Since the Zeigarnik Effect says that that people remember incomplete tasks better than completed ones, I figured that people with ADHD might have so many simultaneous thoughts and unfinished tasks that newer unfinished tasks would push older ones off the burner. Nope. Or at least, not always.

Actually, the research shows that there’s sometimes a heightened sense of unfinished task recall in individuals with ADHD. Even with all my professional work with organizing clients who have ADHD, I still figured they’d forget more of their unfinished tasks. In actuality, the research shows that the brains of people with ADHD often keep unfinished tasks active, which has just as problematic an effect as forgetting — it increases mental clutter.

So, it’s a good news/bad news situation. The Zeigarnik Effect isn’t making people with ADHD forget their not-yet-completed tasks; it’s just filling their brains with a lot of blinking lights about those tasks. And that “mental tension” that’s supposed to be good for remembering creates real, human tension (that is, stress), that hurts productivity. Ouch.

Luckily, research also indicates that planning is a particularly effective mitigation strategy for reducing the stressful aspects of the “mental tension” of the Zeigarnik Effect. According to Harnessing Two Horsemen of Productivity Havoc, the kind of detailed planning we talk about here at Paper Doll HQ all the time really helps.

Florida State University researchers found that when people with ADHD were allowed to create their own super-specific plans for completing their unfinished projects, the distracting Zeigarnik-esque thoughts went poof! As we talk about here all the time, planning is powerful; it frees up your mental resources and quiets all those Zeigarnik beeps and boops in your brain reminding you of what needs to get done.

But there’s a hitch. I suspect it works for people for ADHD much like it works for those of us without ADHD (especially when we’re overwhelmed), which goes back to why we’ve got unfinished business at the end of the year.

The Zeigarnik Effect has our brains full of stuff we have yet to finish. So we look at when the thing has to be completed, and think, “Aha, I’ll make a plan to attack it.” The problem is that, too often, we either see no deadline (so we don’t feel any pressure to complete a task) or we see a deadline far on the horizon — perhaps several weeks out — and our brain convinces us that it’s easy-peasy-lemon-squeezy, we have plenty of time, and we procrastinate. Oops.

So, be sure to embrace the advice in Paper Doll On Understanding and Conquering Procrastination when planning your attack on whatever is incomplete.

For what it’s worth, I wasn’t entirely wrong about ADHD and forgetting. In one study on the impact on prospective memory — that is, the ability to remember to perform an intended action in the future — researchers looked at activity-based prospective memory in people with ADHD found that the Zeigarnik Effect can influence how unfinished tasks or “intentions” remain active in memory.

Their findings suggests that the ADHD brain sometimes puts uncompleted tasks in a state of “suspended activation,” which can adversely impact task recall and completion upon waking up. (This points to the idea that if your unfinished task is going to remain unfinished overnight, you’re going to need more support than if you just have to remember to take the pot off the stove in the next five minutes.)

For what it’s worth, whether you have ADHD or not, research shows that intentionally starting a task, even for the briefest bit of time, can increase the likelihood of returning to the task again and completing it.

ZEIGARNIK YOURSELF INTO FINISHING THE LINGERING TASKS

We can’t finish everything.

Finish Line Photo by RUN 4 FFWPU

Finish Line Photo by RUN 4 FFWPU

I know, that’s a shocking comment on someone who comes here each week to tell you how to organize and be productive, but it’s the truth. It’s why I don’t believe in Inbox: Zero, or Laundry Basket: Zero, or any other Task:Zero mentality.

Seriously, the email, like the laundry, keeps coming. Unless your family members are all about to become nudists, the laundry will always be piling up, and while you can try to keep up with it, like all those inbound emails, when it comes down to it, email and laundry aren’t why you are here on this planet.

Finish what you can, and what you must, and get on living your life. The goal is to have more time to focus on what matters most to you, not to have the emptiest in-boxes.

As we head into the final week of the year, I encourage you to finish up as many of the small, hanging-on tasks you can, just so you can go into the new year unencumbered and more revved up for the tasks and projects about which you feel passionate.

- Make a list — Santa isn’t the only one who is busy making lists and checking them twice. Grab a pad of paper or your phone (because you’ll want to be mobile) and walk around your house (and if applicable, your office) and make a list of all of your unfinished tasks and projects. The Zeigarnik Effect means that a bunch of these tasks are in your brain already, or at the periphery of your focused thought, but some tasks may have edged others off the front burners. Write them all down.

- Delete what doesn’t matter anymore — I know, this feels like failure. But it’s not. Before you can really prioritize what matters, you have to let go of the things that really don’t matter anymore. It doesn’t mean those things never mattered (though they might not have), just that dragging them around with you is doing yourself a disservice.

If it’s been three months since your friend’s birthday, give up the belief that you’re going to time-travel back and send her the perfect card. Forgive yourself (as she’d forgive you) and send her a New Year’s card with all the good gossip about why your life has you so frazzled. You remembered her birthday is September 20th. You just forgot that September 20th was September 20th when September 20th came around.

If there was a grant you were going to apply for, but the deadline has passed, or a work opportunity that you never quite got things together to pursue, forgive yourself and move on. The universe will present new opportunities. Not all unfinished tasks have to be finished. Focus on the ones that shine a light on what fits your values and goals in your life and at work.

- Break down the list into smaller component pieces. — You’ve heard this before: projects are not tasks. You can’t DO a project. Divide every item on your list into small, actionable tasks. This will reduce your sense of overwhelm, making it easier to start…and then to finish.

- Identify your priorities — Let’s face it, some lingering tasks are more vital than others, and the amount of time they take to accomplish isn’t always the key factor.

There are big things you may not have finished. There are small ones, too. Spend one 25-minute Pomodoro to see how they rank. It’s OK to revise your priorities. You don’t have to create a list of 72 ranked items, but get a highlighter and pick out what will give you the most bang for your buck.

If you started it and still value it, see the next bullet. If you didn’t tackle it at all but want to keep it on your list, dig a little deeper and define what the obstacles have been so you can tackle the tasks with awareness.

What are the most important ones to start so you can finish? Do those first!

- Commit to a time and place for taking action — Someday is not a day on the calendar. If you don’t schedule when you’re going to work on a task, you’re not going to start working on that task.

This is where time blocking comes in handy. You don’t have to schedule working on that 2024 bookkeeping task for 3:15 p.m. this Thursday. But if you have a block for doing financial tasks every Thursday afternoon, it’ll be easy to slot that bookkeeping into a cozy spot on your schedule. Revisit my past posts on time blocking to get thinking about the kinds of blocks you need to tackle your overhanging tasks:

Playing With Blocks: Success Strategies for Time Blocking Productivity

Frogs, Tomatoes, and Bees: Time Techniques to Get Things Done

Paper Doll Shares Secrets from the Task Management & Time Blocking Summit 2022

Highlights from the 2023 Task Management & Time Blocking Summit

I have previously written a lot about activation energy and its importance in getting you over the hump when motivation isn’t doing the trick. William James had a nifty quote about this, too:

“Action seems to follow feeling, but really action and feeling go together; and by regulating the action, which is under the more direct control of the will, we can indirectly regulate the feeling, which is not.”

We can’t wait to be inspired. Sometimes, we just have to take out the trash, replace the light bulb, or call to complain about a mistake on the bill, whether we feel like it or not. But it’s easier to do if there’s a slot on the calendar for household care or dealing with problems.

- Celebrate every win — There’s a reason why so many of us write down things we’ve already done on our task list for the day, just so we can check them off. Having done something, and particularly something that’s been hanging over us for a while, is an accomplishment.

Acknowledge each and every completed task. It will reinforce your sense of satisfaction and motivate you to keep taking action. Nobody is saying you have to shout it from the rafters (though that would be cool), but perhaps go out for a nice meal to celebrate and see if you can spot a server doing a great job remembering all the orders.

Once you have it on your schedule, give some thought to where you’ll work on this task. Find the right environment, or create a virtual one to get you in the mood. I’m already tickled to use this Gilmore Girls-themed video so I can finish my tasks at Luke’s Diner in Stars Hollow.

You might prefer a Yule Log video like the ones that used to run on television on Christmas Day. Youtube is full of them, and there’s even a playlist of the best. But if you’d like to feel like someone is cozily keeping you company while you check items off your list, perhaps Nick Offerman’s ten-hour Yule Log might be the way to go.

FINISHING UP

In James Clear’s 3-2-1 newsletter from Thursday, November 14, 2024, I was introduced to Emily Dickinson’s poem Forever – is composed of Nows – (690), on the power of the moment.

Take advantage of the upcoming moments in the quiet lull between now and the end of the year. Use these moments to get started. You don’t have to DO THE THING, but you can plan to do the thing.

You don’t have to rebalance your financial portfolio to make your retirement more accessible. But you can call and make an appointment with your financial planner, or with a certified financial planner if you don’t already have one. (And hey, my colleagues at Eddy & Schein Group have even put together some guidance on Wrapping Up Year-End Personal Financial Affairs regarding with whom you should be speaking, and about what, in terms of your money life.)

Perhaps your hanging-on task is spending down your flexible spending account (FSA). If your employer permits it, you can carry over up to $640 of unused funds from 2024 into 2025, but why not get your goodies, now? You set aside money, pre-tax, for healthcare stuff; don’t let it go to waste because you forgot to check what you could buy. Look up how much you’ve got left in your account, and then Google your options. For example, Yahoo Tech has 35 Surprising Things You Can Buy with Your FSA Money. (Seriously, did you know you could buy an Oura ring with your FSA?)

Organize Your Charitable Donation Strategy

Every day last week, your email inbox was filled with Black Friday and Cyber Monday notifications. But starting today and throughout the month, you’ll probably notice an influx of requests for charitable donations.

This starts with tomorrow’s Giving Tuesday, a unified movement that:

…unleashes the Power of Radical Generosity around the world. GivingTuesday reimagines a world built upon shared humanity and generosity.

Our global network collaborates year-round to inspire generosity around the world, with a common mission to build a world where generosity is part of everyday life.

Whether it’s making someone smile, helping a neighbor or stranger out, showing up for an issue or people we care about, or giving some of what we have to those who need our help, every act of generosity counts, and everyone has something to give.

The term “radical generosity” is defined as the concept that the suffering of others should be as intolerable to us as our own suffering. This may seem like an odd topic for an organizing blog, but I believe that organizing your efforts can allow radical generosity to reinvigorate the delight of giving.

THE UNIVERSALITY OF CHARITABLE GIVING

In Judaism, the concept of tikkun olam means “to repair the world,” and refers to the notion that people have a responsibility to improve the world through acts of kindness and social justice. Judaism also has the concept of tzedakah, commonly used to mean charity, but more fully is explained by the notion of making the world a more just place.

Though I am no expert on other faiths, I do know that charity is an important tenet throughout faith practices. In Christianity, it’s reflected in 2 Corinthians 9:7, “Each one must give as he has decided in his heart, not reluctantly or under compulsion, for God loves a cheerful giver.” Islam notes that the prophet Muhammad said, “Charity does not decrease wealth” to point out the value to the benefactor as well as to those who receive kindness.

In Hinduism, “There is none other who does greater good than the one who removes the hunger of those in a difficult situation, helpless, weak and disturbed.” And Sikhs believe in the concept of sewa, which means “selfless service,” helping others without expecting any reward or personal gain.

Of course, donating money (and goods) is not a concept specific to any one religion, or indeed any religion at all. Ideas such as charity and mutual aid (where a community shares and exchanges resources and services to help one other) can be found in every nation and at every income level. People make donations in their houses of worship and to their schools, to strangers on the street and to well-known non-profits.

Donating money (as well as volunteer time and skill) is a great way to model your values to your children and to others in your community. You could limit round-robin gift exchanges at work or among your extended family and work together to donate funds or effort to non-profits or causes that reflect your highest good.

So yes, thoughtful giving is good (and good for you), but the requests for giving can be overwhelming.

Just like how the clutter of too many possessions in a household can paralyze someone and prevent them from knowing what to do next, a mailbox or inbox cluttered with charitable donation requests can be problematic, particularly during the holiday season from Thanksgiving through the New Year, when everyone is focused on gratitude and lovingkindness.

But if you woke up to seventy-three charitable requests today, you might not be feeling very grateful, loving, or kind. I get it.

THE CHALLENGES OF CHARITABLE GIVING

There are a variety of obstacles people face when inundated with charitable requests.

Stress

- Being inundated by a flood of donation appeals — Non-profits know that you’re in a giving mood (or are feeling pressured to be in a giving mood). People are accustomed to donating at the end of the year, whether for religious, social, or tax reasons, so the donation campaigns behind mailers and emails and social media requests are part of the design.

- Pressure and guilt — It’s common to feel obligated to respond to every request with a donation or gift, even when it exceeds one’s budget or doesn’t align with one’s values. Nobody wants to feel selfish, but it’s important not to give more of yourself than you can afford.

Fears about security

- Increases in frauds, hoaxes, and scams — Sometimes, “charitable” requests come from bad guys using guilt trips and names just similar enough to real charities that it’s common to worry about whether your gift will get to anyone except a thief’s pockets.

- Validity of a charity — Even if a charity is “real,” even if it’s well-known, it doesn’t necessarily mean that a sizable portion of the funds raised will get to the expected recipients. Sometimes a shocking percentage of those donation funds go toward administration, chief executives, advertising, and anywhere but where you’d hope it would go.

Financial anxieties

- Budget constraints and unrealistic goals — At this time of year, our wallets pulled in different directions, like taffy. You’re likely to want to earmark funds for holiday gifts, meals, and travel, on top of regular expenses, but it can be tough to find the Benjamins for donations. Being overly ambitious with our charitable giving leads to the same kind of anxiety as when we’re overly ambitious about gift-giving to friends and family. It feels good in December, but when our January bank and credit card statements arrive? Ouch!

- Unplanned donations — There’s a reason you hear financial advisors talking about planned giving. Planning is organized, and when you are organized, you feel in control. When unexpectedly faced with an in-person appeal for a donation, the emotion of the experience combined with social pressure (on top of financial pressure) can prompt you to spend more than you can comfortably do.

Emotional kerfuffles

- Family disagreements — You thought the political arguments at the Thanksgiving table were stressful? Imagine trying to come up with a plan for family giving when the members of the family are of two minds regarding who is “deserving” of family donations. If one person wants to give to the NRA and another to support of LGBTQ+ teens, but the funds need to come from one couple-owned or family-managed source, sparks may fly.

- Decision fatigue — The sheer volume of need can be overwhelming. Everyone wants your money, and so many charities and worthy causes requesting donations, it’s often difficult to decide which ones to support.

- Charitable burnout — People who donate regularly may feel resentful from the ever-increasing demands during the holiday season.

- Compassion fatigue — Let’s face it. We’re human. Constant reminders of those who are hungry, abused or victimized, troubled, or struggling can become wearying, especially for those who already struggle with some of the harder emotions of the holiday season. While such requests often remind us to feel grateful for what we have, it’s not unusual to feel guilty for not feeling quite so grateful about our own struggles.

OVERWHELM COMES FROM LACK OF PRIORITIZING, PLANNING, AND ORGANIZATION

Over the past 23 years I’ve worked as a professional organizer, one of the constant holiday-time struggles my clients face is what to do about all of the charitable donation requests. Several years ago, I worked with a client on her backlog of important documents and papers. We were making great progress until I arrived one day to find her agitated. She admitted that she’d been “hiding” some papers because they were so stressful for her to think about.

In a room we’d never entered, there were desks, tables, chairs, and a bed, and a variety of other horizontal surfaces covered in envelopes — most of which had never been opened — all seeking donations! There were multiple years of requests!

At first, this sweet woman had just given a few dollars to everyone who asked, but that just led to more and more requests. (I’m not saying that non-profits sell their mailing lists, but yes, some non-profits sell, or at least “rent” their mailing lists. It’s ethically questionable, so before you give, you may want to read a charity’s privacy policy regarding whether they will share donor information without prior consent.)

The client and I started by eliminating all requests from prior giving seasons, then deleted duplicates (and triplicates). Then we developed a strategy that works for most people.

START WITH YOUR BUDGET

Just as some people prefer to say they are on an “eating plan” rather than a “diet,” feel free to think of this as a giving plan, rather than a budget. The idea is to set boundaries you can live with, as it makes no sense to donate so much to end hunger that you will be eating ramen noodles every day to make up for your economic shortfall!

Consider these factors:

- How much can you reasonably afford to give? This requires first having a handle on all of your fixed and variable expenses.

- Would you like to allocate a percentage of your monthly budget for donations? Do you prefer to tithe, set aside a fixed dollar amount per month, or pick some other percentage approach?

- Do you prefer to give an annual gift or arrange monthly contributions?

- If you choose monthly donations, do you want to donate to the same charity every month, or multiple charities but during different months?

- Do you want to set aside extra money (in monthly petty cash) for unexpected, ad hoc requests by organizations or individuals? (You might choose to keep a stash of gift cards for grocery stores or restaurants to give to unhoused or struggling folks you come across, rather than giving cash, to prevent them from becoming victimized by thieves.)

- Does your company offer an annual charitable donation match? If so, taking advantage can stretch your donation dollars!

FOLLOW THE MONEY

You will want to track your donations to make it easier to file your taxes and take all possible deductions.

If you respond to mailed requests for donations, you can write a note on the donation letter, stating how much you donated, on what date, by what method (check number or which credit card). Put that in your tax prep folder for the current year. When/if you get an official letter from the charity thanking you for your donation, match it to the corresponding note and staple it.

If you tend to make donations online, be sure to print a copy of your receipt as a PDF (if you want to keep records electronically) and maintain a donation folder on your computer or in your cloud storage. (You could also print receipts on paper and put them in your tax prep folder; just don’t double-count donations that appear in digital and print form.)

Of course, you can also use financial apps, budgeting software, or spreadsheets to track your charitable contributions. The more money you donate, or the more complex and numerous your donations, the more cautious you will want to be to keep these records for tax purposes. But tracking your donations is about more than just taxes.

In the heyday of magazines, as soon as you’d renew a subscription, you’d start getting reminders to renew again. The more subscriptions, the harder it would be to realize you were being prompted so often that you were subscribing more than once every twelve months. Well, with charities it can be much the same thing. Keep a written record of when you’ve donated to make sure you’re not donating more often than you planned.

CHOOSE YOUR CHARITIES, DON’T LET THEM CHOOSE YOU

Professional organizers often talk with clients about the dangerous power of advertising and in-store displays. We can be going along, thinking we’re doing great with our spending plans and then all-of-a-sudden we are sucker-punched by an enticing commercial or a product display. We didn’t plan to buy it. We didn’t need it. But oops, we got it.

Those donation emails and envelopes may as well be shouting: “This offer is available for a limited time only. Operators are standing by!” but the truth is that non-profits are always in need of money. You may get dozens of requests for donations in December, but your contributions will be no less valuable, life-saving, or appreciated if sent three or six months down the line. Unless you have a very specific need for making a very specific dollar amount of donations before the end of the calendar year, don’t let yourself feel pressured.

Decide on your giving goals in advance. Make this a giving plan.

Prioritize Your Values First

When you try to downsize a closet on your own, you might pick up one article of clothing and ask yourself “keep or set free?” (whether “set free” means toss or consign or donate or use as a rag). A straight-up yes/no choice can be difficult. But if a professional organizer asks you to first pick your ten favorite pieces from your closet and set them aside, it will be much easier to start evaluating your less-loved pieces.

Similarly, if you’re facing a mountain of charitable giving requests, choosing yes or no may feel like you are saving or damning the recipients of each non-profit. No wonder you’re stressed!

So, start by prioritizing the causes that align most closely with your values. For example, those might be:

- education

- the arts

- health/medical

- hunger

- animals

- children

- the environment

- faith communities

- disaster relief

- international relief

- social causes

- political causes

- at-risk communities

- marginalized communities

Once you’ve identified a general cause area that matters to you, you can narrow your focus. You can determine whether you want to donate locally to keep funds in your community or donate to a national effort with a more powerful network of resources.

Research Potential Charities

You do not have to reinvent the wheel. There are some excellent resources for evaluating non-profits and explaining how they rank on transparency, impact, and mission alignment. Consider:

Charity Navigator

Charity Navigator has been around for almost 25 years, and has rated 225,000 charities. Their ratings focus on the “cost-effectiveness and overall health of a charity’s programs, including measures of stability, efficiency, and sustainability.”

GuideStar

Candid’s GuideStar focuses on non-profits in the United States. Search to verify a charity’s legitimacy, learn whether contribution will be tax deductible, view up to three years of a non-profit’s IRS Form 990, read revenue and expense data for the current fiscal year, and learn about a charity’s CEO, Board Chair, and Board of Directors.

BBB Wise Giving Alliance

Give.org, the Better Business Bureau’s Wise Giving Alliance, generates reports that address all of the issues a donor might want to consider, including governance, finances, results reporting, transparency, and appeal accuracy

Charity Watch

Charity Watch, originally founded in 1992 as the American Institute of Philanthropy (AIP) claims to be the only independent charity watchdog in the United States. Charity watch notes that they “dive deep into charity audited financial statements, tax filings, state solicitation filings, and other information so we can let you know how efficiently a charity will use your donations to fund the programs you want to support. CharityWatch exposes nonprofit abuses and advocates for your interests as a donor.”

GiveWell

Rather than focuses only on financials, GiveWell conducts “in-depth research to determine how much good a given program accomplishes (in terms of lives saved, lives improved, etc.) per dollar spent.”

If you decide you want to focus on local charities, you’ll need to do more of your own legwork. For example, if you want to support a local shelter, food bank, or other community initiative, read the website, research who sits on the board of directors, and see where local news media has covered the impact of these charities.

Concentrate on local efforts that focus on long-term community solutions and have a record of efficient use of funds and a history of measurable results.

DEVELOP A DONATION STRATEGY

Once you know which causes are meaningful to you, you can delete or discard donation requests from causes that aren’t high on your list of values.

Yes, really.

Charitable causes are important, but not all causes have to be equally important to you, just as they need not be equally important to all individuals. You get to pick what you value.

Once you identify the causes you value, you can research the specific charities in each.

Let’s say eliminating hunger is important to you. It’s possible you’ll get requests from Feeding America (a nationwide network of more than 200 food banks), the World Food Programme (an international organization within the United Nations that provides food assistance worldwide), No Kid Hungry (providing grants to schools and partners to end child hunger), Meals on Wheels (working to end hunger and loneliness among the elderly), etc.

- Collect all the requests that come in via mail or email in a “holding area” until you’re ready to research them.

- Research the charities to see which appeal to you the most.

- Decide the number of charities to which you will give.

- Pick the frequency of your donations: one time or recurring?

- Divide your giving budget by the number of donations.

- Donate in a way that works for you.

- Record and track your donations for tax purposes. (Save receipts and acknowledgment letters in your paper or digital files)

- Evaluate amounts and charities annually.

For example, might decide to give to one national charity, once per year, in an amount that feels generous to you. Conversely, you might pick four of these charities and give once per quarter.

Alternatively, you could set up a monthly payment to one (or more charities) on your credit card, but you’ll want to revisit that plan annually to make sure the charity still fits your values.

Or, this process of reviewing your values may make you turn your attention to local concerns. You could still give small donations to one or more of the charities that fits you criteria, but then you could contact a local elementary school and offer to pay all outstanding meal fees. In many school districts, children whose families are behind on their lunch fees are unable to get hot lunches and are given cold lunches that make them a target of bullying. In other districts, they simply get no lunch at all. Hungry children cannot learn.

You could pick an amount to pay toward students’ outstanding lunch debt each month, or pool resources with your colleagues or neighbors to pay off those debts once or twice per year.

This is merely one example. You can make lots of donations in December to lots of charities, and then skip the rest of the year. You can pick twelve charities and give equal amounts, one per month, all year, and revisit the charities you’ll choose each year. Or you can mix-and-match local and national donations as you see fit.

The key is to mindfully research, plan, and track your giving so that it allows you to feel generous (and lucky to be able to help) rather than overwhelmed by charitable request clutter and anxious about the entire experience.

LIMIT DONATION ANXIETY

Creating a giving plan and sticking to it (at least for one year) will allow you to eliminate the excess requests before they pile up, but there are additional things you can to do keep from feeling like a Grinch.

Limit the solicitations that come your way.

If you are getting too much donation request mail or email — which, again, is really just (earnest) advertising, it’s OK to click to unsubscribe from the email or call to opt-out of the mailing lists.

Alternatively, you can use a dedicated email address (like PaperDollDonations@gmail.com) whenever you make donations. That way, you only need to check that address when you’re looking for donation confirmations for tax purposes, or when you’re in the mood to actually look at the plethora of mail sent your way. But it never has to hit your main inbox.

Let Go of the Guilt

Just because you receive address labels does not obligate you to make a donation to a charity, just as receiving a holiday card from a distant acquaintance does not obligate you add the individual to your card list. Don’t let them turn advertising techniques into a free ticket on the Guilt Trip Express. Use your brain — then give from the heart.

Learn to say “No” gracefully. Just as you cannot keep everything you ever bought or were gifted, you cannot donate to ever cause that asks.

To increase your comfort with saying no, prepare a mental (or written) script for declining requests.

Remind yourself (and if you wish, explain to others) that you have a planned giving strategy. You have organized your giving to ensure that your efforts are mindful and value-driven. You can, if you wish, give an ad hoc donation, but you can also just say you’ll be happy (if you will be) to consider a donation in your next giving cycle in 2026.

Finally, remember that you need not always give money. Donating your possessions, time, and service to non-profits can be even more valuable than the amount of money you could afford to donate.

Speaking of volunteering, we are sometimes asked to donate our time and effort to worthy causes at the holidays when our schedules least allow us to help. (Also, many popular volunteering activities, like serving meals at shelters, are booked quickly during the holidays.) But guess what? Shelters and food kitchens need volunteers year-round! Just as money is needed just as much on July 25th as on December 25th, our support of our neighbors, in our schools, in faith communities, and in standing up for others is always needed, no matter the season.

Happy Giving Tuesday (and Giving Season). Intentional and organized giving is rewarding. Build a sustainable, organized habit of giving and you will feel more in control of your finances, less stymied by paper and digital clutter, and less likely to feel burned out.

Keep the spirit of giving alive in a way that uplifts you.

Whoopsie! What To Do When Your Week Doesn’t Go As Planned

This isn’t the post I planned to write today.

And last week’s post never got written. In fact, last week did not go as planned at all. It went BOOM!

VERTIGO, BUT WITHOUT JIMMY STEWART

It all started last Sunday evening. I was chatting on the phone with a friend and getting ready to start writing a post for Janet Barclay’s excellent monthly Organizing and Productivity Blog Carnival. Usually I submit a post from the Paper Doll vault, but this time I wanted to write a new post, specifically for the carnival. (We’ll get to that later.)

As my friend and I were talking, I sat on the edge of the bed and then lay down to stretch my back. Immediately, I was overcome with a powerful sense of vertigo — not mere dizziness, or as though the room were spinning, but as though I weighed tons and was going to go barreling through the Earth. While it was not the worst I’ve felt in my entire life, it would rank in the top three.

Publicity Poster from Alfred Hitchcock’s 1958 Vertigo

I’ve had benign paroxysmal positional vertigo (BPPV) twice before, and both times it was quickly dispatched by a seemingly magical series of movements called the Epley Maneuver. I’ve seen it be such a freaking miracle that I’m a typical explanatory video in this post. (Think of it as organizing for the inner ear!)

Unfortunately, this time, Epley let me down.

The next six hours seemed to pass like jump-takes in a movie. It was 6:35 p.m. and I was on the phone with Paper Mommy. The next thing I knew, it was almost an hour later. And then another hour. My insurance company has Teladoc built-in, and I’d previously registered, so I used the app to reach a physician for a video consult.

As a professional organizer, here’s how I thought it should work: I register for everything in advance (which I had). I click the button and provide my reason for seeking an appointment (which I did). And then I’d be connected with a medical professional.

Nope.

Although I registered for Teladoc when it first became available, I still had to try to type/dictate my medical history, all while lying flat on the floor and spinning. And I had to provide the address and phone number of my pharmacy…which was written on my prescription bottles…in the other room. (Crawling was agonizing. Have you ever seen someone try to do the backstroke on plush carpet? It was not pretty.)

After all that, I got a message saying someone would be with me within ten minutes. Then a message saying that {name redacted} was reading my file. Then a message saying, “Oops, sorry, we’ve canceled your video appointment. If you still need help, please try to schedule another Teladoc appointment.” Seriously?!

As I went through the entire process again, I noted the clock on my phone. I’d have sworn only minutes had passed, but almost another hour had gone by.

I’ll spare you readers the sordid medical details, but by the time I finally spoke to a Teladoc physician, I was instructed to call 911. When I asked why, the response was troubling enough that I only asked if someone could just take me to the ER.

I live upstairs. The prospects of having to go downstairs by myself to let first responders in or having them break down my door were equally unpleasant. Instead, I called my local bestie, Jen, to see if her husband could stay with her kids, and she immediately headed over to take me to the emergency room.

Moms know everything! She arrived with all sorts of Mom Emergency Paraphernalia, including an old-fashioned ice pack.

Although the panic was secondary to the rollicking vertigo and related symptoms, Paper Doll offers a full-service blog atmosphere, so may I also share this advice from Valera Health’s Mastering the Art of Panic Attack Prevention: From Panic to Peace (bolded emphasis is mine):

The keywords here are ice and sweets. If you’re able to, grab a cold washcloth, water bottle or ice cube and rub it on your face. Panic attacks can induce hot flashes so cold stimuli may help you to cool down and calm down, which in turn can shorten panic attacks and make them more bearable. Another way to try this type of sensory grounding is to quickly dunk your head or face under cold water (make sure the water isn’t too freezing first!).

Some people prefer to do the “sour candy trick” instead by sucking on a super sour candy when feeling panicked. The tart taste helps with refocusing and shifting attention away from the symptoms of a panic attack. If you’re prone to panic attacks, we recommend carrying sour candy around whenever you’re out and about so you always have them handy, just in case.

MAKING SENSE IN THE AFTERMATH OF AN EMERGENCY

Once the emergency, itself, is over, you’re left mopping up the mess. Dealing with the aftermath of a natural disaster or a medical situation is usually more problematic than coping with your schedule, but eventually, you’re going to have to turn your eyes to the smoking piles of debris that used to be your carefully planned schedule.

You may not be able to do much right away. I collapsed into bed as soon as I got home from the ER. Though the meds they’d given me had me sleepy while there, my brain was spinning almost as much as the room had been. I had SO MUCH planned for the week prior to Thanksgiving. How would I get back on track?

The following are some of the concepts I put into practice. Whether you have a family emergency or just something that keeps you down for the count, these ideas should be useful until you can see a light at the end of the tunnel.

Assess the Damage

Whether you’ve taken to your bed with the flu or a tree has toppled across your driveway (as happened to so many after this hurricane season), you can’t take action right away. But when you do have a sane, cogent moment to breathe, grab your calendar and your To Do list, and either a pad and pen or a blank Word doc or Evernote note.

Don’t be listless! Take a moment to list everything in your schedule that was disrupted (or will be disrupted).

That first morning was a Monday. Normally I would have completed the weekly Paper Doll post on Sunday night and spent the day doing marketing tasks, sharing my post and those of my organizing colleagues. Again, I hadn’t written the post, which I’d intended to submit to the blog carnival, but even if I had, dragging myself to the computer and lifting my head to the screen was a non-starter. But the world wasn’t going to end because my post hadn’t shown up in someone’s mailbox or social media feed.

Later that day, I had an appointment to get my hair cut, and had blocked time to prepare for guesting on Frank Buck’s Get Organized! podcast on Tuesday.

Tuesday’s schedule included the podcast recording, a first-time physical therapy appointment, a two-hour co-writing session, and two webinars I’d planned to attend.

As the week went on, I had client sessions, prospect consultations, and the variety of life activities (bill-paying, shopping, preparing for this week’s Thanksgiving adventures) that everyone has.

In addition, I had to figure out how (when the world was still spinning, though at a slightly less malevolent pace) to get my prescriptions filled and talk to my own physician regarding some things I suspected I’d need beyond what the ER had advised.

When I floated up into consciousness on Monday, at least I knew what was on my plate.

Prioritize Key Activities

In Use the Rule of 3 to Improve Your Productivity (which I invite you to read and embrace with all your heart and soul and calendar), I reviewed all the ways to manage your schedule and To Do list to keep life from getting in the way. But, as with my week last week, sometimes life is a giant elephant and you have no choice but to let it get in the way.

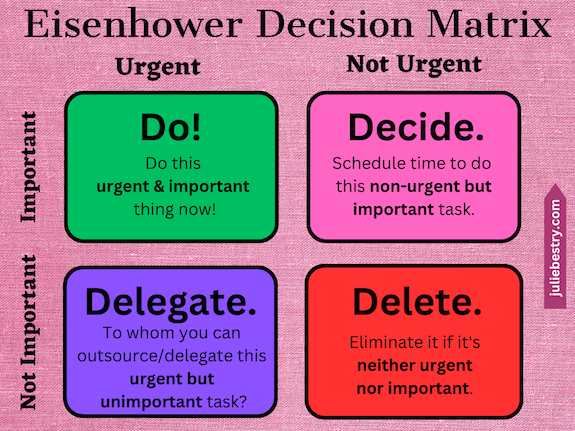

In that post (and further, near the end of Paper Doll Shares Presidential Wisdom on Productivity) I explained that when you’re overwhelmed, a great way to prioritize what you have to get done (and how and when to do it) is the Eisenhower Decision Matrix.

The Eisenhower Matrix gives you the opportunity to graph each task from your brain-dumped list to identify where it falls along a continuum of importance and urgency.

In a typical week of my schedule, what’s important is anything that brings in money, protects from “danger” (whether that’s a late fee or something more problematic), or directly impacts someone else. What’s urgent is anything that is time-specific in the short-term.

Identify What to Do, Decide (and Delay), Delegate, or Delete

Do

As I looked at the tasks, I realized that while my hair cut was not important, it was urgent to cancel so that my stylist would not be inconvenienced by a no-show. The podcast recording on Tuesday would have been both important (to me and to Frank) and urgent. And I had to arrange to get my prescriptions filled, as it turned out that one medication required me to be present at the pharmacy; it couldn’t be filled in absentia.

I sent two texts (to my stylist and to Frank) and arranged to get my prescriptions filled.

Decide

At this point, my wobbly brain decided that I could delay considering anything else until after more sleep. I didn’t know if I’d be able to go to my physical therapy appointment on Tuesday or my client on Wednesday, but I let that be Tuesday Julie’s responsibility. I crawled back in bed.

Delegate

I didn’t really have anything to delegate. I did, however, let my friend and colleague Hazel Thornton know what was going on in case I did not show up to our Tuesday co-writing session or a regularly scheduled Friday night Zoom.

I get it. Delegating is hard. Sometimes, it involves asking for a favor, and most of us are loathe to presume upon others or to seem as though we aren’t operating at 100%.

But delegating — whether it involves asking a friend to take you to the emergency room or trusting your spouse to take care of family responsibilities even if they won’t get done the way you would do them or giving the nod to an employee to handle something you would normally do yourself — is essential.

We can’t do everything. Even if we could, we shouldn’t. Leaning on others — respectfully — strengthens all of our human bonds.

This is my friend Jen, who rescued me. We’re afternoon tea buddies.

Sometime in the mid-1970s, I had a big event happening in third grade. I think I was giving a presentation, or maybe getting an award. Parents were going to be in attendance. But when I woke up that morning, my father told me that Paper Mommy had fallen and cracked her ribs during the night and would not be coming to school. I’m not sure how she managed it in those scant daylight moments before I woke up, but Paper Mommy had already arranged for my sister (eleven years my senior and attending college locally, living in the dorms) to be my plus-one at this event.

If she could have been there, she would have. That’s how Paper Mommy rolls. But she made sure that my eight-year-old self felt loved and valued without schlepping her wounded self to a ridiculous elementary school event. My sister rocked it!

Delete

My plan had originally been to write last week’s post about children’s books on organizing and productivity, and I would have included a link to Paper Doll Interviews Melissa Gratias, Author of Seraphina Does Everything! and talked about both my favorite books in these categories, as well as a few surprises from my childhood bookshelf.

I forgave myself for not writing the post and deleted it from my sense of self-obligation. By the time I left the emergency room, I told myself I could just submit some other post I’d previously written about organizing and productivity books.

For example, I could have submitted Paper Doll Presents 4 Stellar Organizing & Productivity Resources, which referenced Hazel’s What’s a Photo Without the Story? How to Create Your Family Legacy and reviewed her Go With the Flow! The Clutter Flow Chart Workbook.

That post also reviewed Kara Cutruzzula’s Do It Today: An Encouragement Journal, and Ellen Faye‘s Productivity for How You’re Wired: Better Work. Better Life.

I could have submitted Paper Doll Introduces 5 New and Noteworthy Books By Professional Organizers, which reviewed:

- Emotional Labor: Why A Woman’s Work Is Never Done by Dr. Regina F. Lark, Ph.D, CPO® and Judith Kolberg

- Organizing and Big Scary Goals: Working with Discomfort and Doubt to Create Real Life Order by Sara S. Skillen

- Filled Up and Overflowing: What to Do When Life Events, Chronic Disorganization, or Hoarding Go Overboard by Diane Quintana, CPO®, CPO-CD® and Jonda Beattie, M. Ed.

- Mind Body Kitchen: Transform You & Your Kitchen for a Healthier Lifestyle by Stacey Crew

- Perfectly Arranged by Liana George

I could even have have bent the rules and submitted a link to the Book page at Best Results Organizing where I list my favorite organizing and productivity books.

Sigh.

But in the end, I slept through most of the ensuing days and missed the deadline to submit anything at all (likely disappointing nobody but myself). And sometimes, just as we have to tell ourselves that it’s OK to delegate, we have to accept that it’s OK to delete things from our task list.

Although I bowed out of Janet’s The Best Organizing and Productivity Books – Productivity & Organizing Blog Carnival, twelve of my colleagues had great submissions, and I hope you’ll read them. And Sabrina Quairoli wrote a post called Children’s Books About Organizing Their Lives! Although it’s different from what I would have written (or may still eventually write), knowing that topic is out there in the world made it easier to delete this from my list.

Create a Realistic Recovery Plan

Before I was a professional organizer, I was a television program director. Partially because of my Type A personality and partially because the television industry eats people and spits them out, being realistic about what you could get done in a day wasn’t actually realistic.

We were expected to be able to do everything, at any moment. After two days out with the flu, I once almost passed out in the hall and ended up just working on the cold floor where there was nowhere to fall.

That’s wackadoodle.

Nowadays, I teach clients to break down their tasks into manageable steps and schedule them across the upcoming days or weeks to avoid overwhelm.

When your week has been blown to smithereens, you absolutely have to be realistic. Sometimes (OK, often), that means being prepared to change direction more than once. When Tuesday hit, I felt worse (until my doctor called in that additional prescription). I revisited everything on my list, and applied the Eisenhower Decision Matrix again.

I decided to not do anything on Tuesday beyond rescheduling that physical therapy appointment to the end of the week and canceling client sessions. Y’know what? The nice physical therapist was glad I was taking care of myself, and rebooked me without a fee. My sweet Wednesday client was soothingly concerned and called to see if her adult daughter could bring me any groceries when she’d be in my neighborhood.

Everything that I tell my clients — that it’s OK to stop and take care of yourself, and that people will generally understand — was true.

Remember to Communicate

Once you evaluate your priorities and figure out what you have to delay, delegate, or delete, make sure you communicate the essentials to the people who can make your life easier, as long as they know what’s going on. That may be family members, friends, colleagues, or team members.

Set realistic expectations, ask for help where and when you can, and just keep them updated on delays. At some point later, you’ll want to renegotiate deadlines, but until you’re feeling clear-headed and calm, you won’t really know what will fit where on your calendar.

Be Flexible with Replacement Dates

Whatever “whoopsie” of a week you’re trying to recover from, it won’t help to triple-stack the next week. Don’t try to overcompensate and “make up for lost time” — you’ll burn out.

Just as we always discuss when talking about time blocking, set aside blocks of unscheduled time in future weeks to catch up. But don’t fill every block of time. You need buffer time and breathing space.

Reflect On What You Might Do Differently Next Time

We always learn more from our mistakes and kerfuffles than we do from our successes. If your week gets blown up by an unanticipated event, use it as a learning experience.

Block a little time on your schedule for the next week to evaluate how you handled the disruption. Consider what kinds of changes, contingency plans, emergency backup, etc., you might put in place to make next time (and there’s always some kind of “next time”) into a softer landing.

Give Yourself Grace

Julie circa 1999 would have tried to show up for work the next day, and attempting to barrel through every task, even while dizzily wobbling into colleagues and walls and copy machines.

Julie circa 2024 made sure that nobody was left in the dark, didn’t over-apologize, and got about 18 hours of sleep each day for most of a week. And everything turned out fine.

Appreciate Normal Weeks

Organize Your Sleep When the Clocks Change and Beyond

Are you feeling wonky? If you live in North America, you turned your clocks back (or let all your digital ones do it themselves) over the weekend. (If you live in the UK, you did it a week ago. I don’t know what’s up with that, but you may still be feeling wonky.)

Although most of the negative effects of time change happen when we are springing forward to begin Daylight Saving Time, falling back to end it can still leave people struggling to wake up and feeling out of sorts for a few days, leading to some bumps in productivity.

So, if you’re feeling a little rough, don’t worry. Today’s post offers some gentle tips for feeling a little more at ease when the time on the clock and the time inside your head don’t feel friendly toward one another.

HELP YOUR BODY ADJUST TO THE TIME CHANGE

Whether you’re dealing with the time change in the spring or fall, the best way to adjust is always to shift your schedule gradually.