Archive for ‘Paper Organizing’ Category

Organize to Help the Seniors in Your Life With Technology

We love technology. However, it does not always love us.

Technology is not always (or even often) intuitive, which makes it hard to organize the technology and the content provided by the technology. This is especially true for our parents and grandparents (or ourselves, if we happen to be seniors).

Whether the seniors in your life embrace technology or eschew it, the digital realm has a lot to offer them.

Health and Safety Technology

- Wearable fitness trackers like Fitbit, Garmin, and Apple Watch (and associated apps) for tracking:

- nutrition and calories burned

- steps taken and stairs climbed

- health metrics like heart rate, blood pressure and glucose levels

- Reminder alerts and alarms for taking medicine and testing blood pressure and blood glucose.

- Phone-based magnifiers for helping read medicine bottle labels and prescription instructions.

- Phone-based cameras for supporting memory (noting parking locations, remembering hotel names and room numbers, etc.).

- Videoconferencing for telehealth allows seniors to stay connected with their physicians for regular visits and making inquiries without having to venturing out to drive in inclement weather or seek rides when an in-person appointment isn’t necessary.

- Fall detection and emergency hotline hardware and software, or medical alert systems, allow seniors to get help if they suffer falls or medical emergencies in their homes, even if they are not positioned near their phones or are unconscious.

Paper Mommy and I call these the “I’ve fallen and I can’t get up” buttons after the grating commercials.

They range from wearables like bracelets and pendants to wall-based systems, and are connected through phone lines to base stations, so if someone suffers an emergency, they can “call” through that base station, like an intercom. If the user does not respond to the service’s inbound call, emergency services are dispatched. Common systems include Life Alert, Medical Guardian, and ADT Medical Alert.

Smart Home Technology

As with health technology, a variety of smart home technologies can make life easier and more convenient for all users, but especially seniors. These include:

- smart lighting and blinds

- smart plugs and timers that turn appliances off and on

- digital monitoring systems for temperature control, CO2 detection, humidity, and air quality

- smart thermostats

- robot vacuums

- GPS-based trackers to locate lost items

- digital doorbell cameras to help monitor who is at the front door (delivery staff, visitors, bad guys, etc.)

Digital monitoring and home management can make it easier for seniors with low mobility or low vision to be able to care for their homes and personal comfort with minimal effort.

For more on smart home tech for seniors, the New York Times’ Wirecutter site has a great piece on the 14 Best Smart Home Devices to Help Aging in Place.

Entertainment and Social Connection Technology

There is no age limit on enjoying books, TV, movies, or music, but the same technology that brings a wider variety of options into our homes, but these technologies are not always intuitive. It’s not that Spotify or Netflix is easier to to use when you’re 25 than when you’re 85, but those who have always lived with technology are quicker to note and understand user interface changes and make quicker guesses as to where missing options may be hiding.

Retirees who no longer interact with others in the workplace or at as many social gatherings as previously can benefit from all the modern offerings, including:

- Smart TVs with cable or satellite programming

- Streaming entertainment from mainstream services like Amazon Prime, Netflix, Apple+ TV, Hulu, as well as niche programming services like BritBox or BroadwayHD.

- Music streaming services like Spotify, Apple Music, Amazon Music, or Pandora

- Podcasting apps

- Book and audiobook services and apps like Audible, Libby, and others that allow you to purchase entertainment or borrow from your public library.

When Tech Go Wrong

We’ve all dealt with the frustration of tech going wonky. The difference is that the younger we are, the more likely we are to recognize a problem that we’ve seen before and recall how to solve it. We’re more likely to visit the service’s FAQ pages or Google the problem. Seniors, however, may be both less likely to have experienced (or recall experiencing) similar problems and less adept at digital search and the right prompts to solve the problem easily.

When I got in the car to run errands this weekend, in place of the digital clock on my car’s navigation screen, it just said “–:–“ so I immediately went to the on-screen settings icon. However, on the resulting screen, the date/time icon was greyed out. I vaguely recalled this having happened once before, so I wasn’t immediately worried that my car was “broken” or that there was an expensive onboard computer problem.

First, I checked Twitter (I refuse to call it X) reports of widespread problems. Twitter is still my go-to for “is it happening right now” technology issues unless it’s an internet-based issue, in which case I follow the steps I described in Paper Doll Organizes the Internet: 5 Tools for When the Web Is Broken.

Then I Googled “Kia date/time setting greyed out and not working” on my phone. I got varying reports of it being a satellite issue that would self-correct; others suggested pulling one of two different fuses and/or resetting the onboard programming.

I can just shout, “Hey, Siri, what time is it?” so this wasn’t an emergency. Thus, so I didn’t get flustered, and figured if the problem continued I would check it out later in the weekend. An hour later, after a trip to Walmart (where the cashierless payment technology had everyone frustrated), I returned to my car to find the clock working again.

Now, take a moment to imagine your Great-Grandpa dealing with this clock kerfuffle, getting progressively more annoyed that the auto manual’s index and table of contents yielded no immediate solutions. Would he head to the search engines? Would he become agitated?

We all love technology and we all hate when tech doesn’t work as it’s supposed to. The only difference is that the younger we are, and the more privileged (financially, socially, educationally) we are, the more exposure we’ve likely had to potential solutions. The best thing we can do to make technology easier for our elders is to help them when we can, and connect them to others who can help them when we are not able to do so.

HOW TO HELP THE SENIORS IN YOUR LIFE WITH TECHNOLOGY

Let’s get the giggles out of the way, first.

Don’t laugh at them. When possible, do laugh with them.

This should be obvious. But it’s also hard. While serving as Paper Mommy‘s tech support over the phone, I kept trying to point out the lock icon so that she could recognize secure websites.

Because we couldn’t see one another’s screens, I was trying to give her landmarks, and I could tell she was looking in the right location in the URL bar at the top of the screen, but she kept not seeing the lock icon. Finally, Paper Mommy, frustrated, insisted “It’s not there! The only thing there is something that looks like a little purse.”

![]()

By Santeri Viinamäki, CC BY-SA 4.0

Um. OK. I had to laugh. While yes, to anyone thinking in terms of technology, that secure URL icon is a padlock. But if you’re in your 70s or 80s and haven’t been technology-focused for your entire adulthood, yep, it’s a purse. A green handbag.

Start with, and explain, the basics. Use proper lingo when you can, but if your person just can’t get a handle on remembering the term “scroll bar,” try saying, “Do you remember the vertical bar that makes the screen move up and down, like an elevator?” Use vivid, memorable language, and be prepared to backtrack. Often.

Let them make mistakes. Many seniors are afraid that they will “break” the computer or gadget by clicking on the wrong link. Assuming you’ve covered the basics of avoiding phishing and other scams (see below), assure them that changing settings isn’t going to void the warranty or damage the software or the hardware.

Do not condescend. If this senior is your senior (parent or grandparent), remember how many times they needed to help you learn how to use a spoon or spell your name.

Be patient. Go slowly and be as patient as you can be. (And if you can’t be patient with your mom even though you are known for being patient with clients or colleagues, recognize that you and your favorite senior will have different perspectives, and find them an alternate IT help desk, once that doesn’t look like you.)

Explain online dangers and prepare them for what they should NEVER do. Technology doesn’t need to be scary, but it often is, and especially so for seniors. Teach the seniors in your life about phishing scams, how to identify the true source of emails (by hovering over the sender name and looking at the actual domain name of the address), how to look for secure sites (and the “purse”), and how companies and banks and the government will never call or email and ask for passwords or other information.

For more on this, refer to my post from March, Slam the Scam! Organize to Protect Against Scams.

Teach them where to look for resources and how to ask search engines for help. My mom once called me because every bit of text on her Facebook screen had turned German. I knew immediately that this was because Facebook had a word cloud of language names in the lower right-hand corner of the screen.

If you were holding an iPad (as she was) on the right side, it would be easy to press your thumb on one of the languages and change your settings. (Facebook has since moved this element off the main screen.)

I’d once accidentally turned my Facebook default language to French, and had to Google the solution, and my Google-fu is pretty strong. However, to the uninitiated senior, it can be tempting to ask a question as you might ask someone sitting next to you on the couch: “Why is my Facebook in German?” However, to yield a more helpful answer (at least until our AI overloads take complete control), a better query might have been, “revert Facebook default language from German to English.”

Search engine language is not intuitive, but we can all — including seniors — learn better queries to find help more quickly.

Customize accessibility settings when seniors get new devices. Sometimes, just making text larger or addressing basic accessibility issues will make the entire navigation process easier for them.

BUILD ON INITIAL GUIDANCE WITH MORE COMPLEX TECH SUPPORT

Use Screen-Sharing Technology Options

If you’re helping a senior long-distance, it can be maddening for both of you. They may feel rushed, and you might be knocking your head against the wall because they can’t “see” what you know or believe to be right there!

At minimum, seek solutions that grant you remote screen viewing so you can see what they’re doing at their end and provide tactical directions. Be aware that there’s often a delay between what they’ve done and what you see, so just as when you’re working on the phone, try to discourage them from jumping multiple steps ahead.

In addition, there are remote access software programs and apps that allow you to manipulate someone else’s device from wherever you are. This is how the help desks at Apple and other big software and hardware companies guide you through IT troubles. Unfortunately, it’s also how scammers get access to your loved one’s computers, so it’s important that they understand not to provide this access to anyone they don’t know unless they are seeking the help of an authorized, respected technology expert and NOT someone who randomly calls and claims that “There is a problem with your Microsoft computer.” (There isn’t.)

I used to help Paper Mommy and my virtual clients with LogMeIn, which is now $30/month) However, there are still free and affordable options for providing remote tech support to your beloved seniors, including:

- Zoom will let you request or offer remote access (as part of your account). It works on computers as well as iOS and Android devices.

- Microsoft Teams has a similar function for sharing content, as well as giving and receiving control.

- TeamViewer used to be free, but (as with most remote access programs, has moved to a subscription model for all users). Still, $24.90/year for a single user remote license should give you piece of mind that you can help your senior for less than fifty cents a week.

- Chrome Remote Desktop — This option is free and low-cost. You may find that you need to help your senior set up Chrome Remote Access first to make the process work.

All of the above options will work whether you and your senior have the same platform (Apple or Windows) or are mismatched. Other options require you to be using the same platform.

- Apple Mac users have a few options. If you’re both using Apple computers, you can make use of the free Apple Remote Login, but as with the Chrome option above, you’ll need to set it up in advance.

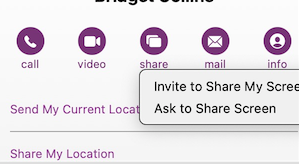

- Alternatively, without any advanced prep, (and again, if you’re both using Macs), you can use “Screen Share” from within the Messages app:

-

-

- Open the Messages app on your Mac.

- Select a conversation with your senior relative or friend. (If you haven’t ever texted with them, start a new conversation.)

- Click the “i” button in the upper right-hand corner of the window. A set of options will drop-down.

- Click “Share.”

- Ask your senior to share their screen. (Alternatively, they can also go to this same menu and invite you to view their screen.) They’ll get a pop-up requesting permission to share their screen with you. They need their “Control My Screen” option selected and should click “Accept.” From this point, you can control their Mac and show them what to do, step-step, or fix problems yourself.

-

Finally, I find it helpful to initiate a Facetime (Mac-to-Mac) call before starting the process, but you can also speak on the phone while troubleshooting.

- Windows users have similar built-in options, including Quick Assist and Windows Remote Desktop Connection.

Write Down Instructions, Step-By-Step

Don’t expect seniors to remember intricate processes they’ve only seen once or twice, or to intuit the workings after minimal practice.

When one of my clients (senior or otherwise) is learning new processes on the computer or another device, I teach the step and then write it down on a numbered list. Once we’re all done, I create a title with “if,” such as “If you want to listen to your new voicemails…” or “If you want to download an app from the App Store…”

Make a notebook of these lessons so your senior can flip through the pages, or even create an index in the front. (And yes, can type these lessons and store them in Notes, Dropbox, or Evernote if that’s something your senior is comfortable navigating.)

HOW TO OUTSOURCE TECH SUPPORT FOR SENIORS

Do you and your senior end up fighting when you try to help with tech? Sometimes, the best way to help is to arrange alternate help. (This is why, when adult children and their seniors spar over downsizing, bringing a professional organizer in is the best option.)

Outsource To Your Teenager(s)

Assign your teens to help their grandparents (or neighbors or friends who are grandparent-ish age).

Too few young people have the opportunity to learn from older generations, and this kind of bond can be good for both groups. Seniors will feel younger when engaging with teen family members, and the teens can connect with grownups with different perspectives on career, family, life, and history. (And shockingly, they’ll be more patient with Grandma than they are with you.)

AARP’s Senior Planet

Senior Planet is a free technology service sponsored by AARP, but you don’t have to be an AARP member to use it. (That said, at $16/year for anyone over 50, AARP’s discounts and educational resources definitely make it valuable.)

Senior Planet offers in-person virtual sessions, in-person classes in major cities, and online classes, like “How to Choose a New Computer.” There’s a hotline for those who need immediate assistance for simple questions. It’s available weekdays from 9 a.m. to 8 p.m. Eastern, during which Senior Planet’s “technology trainers” (employees and volunteers) can answer questions about email, texting, app notifications, video conferencing, and other tech conundrums.

Anyone needing personalized tech help can call the hotline at 888-713-3495 or fill out a form to schedule a help session.

Cyber Seniors

Cyber Seniors is a volunteer-based, non-profit organization and is available at no cost to users. Most volunteers are in their late teens and twenties and have training to serve as “digital mentors” to seniors. Think of it as digital natives guiding digital immigrants through the cyber world.

Cyber Seniors provides both one-on-one individualized support and as well as group education.

For individual needs, fill out a request form with general information(contact email, birthdate) and situation (device type, etc.), and then select an appointment date and time for a volunteer to contact you by phone. Once the mentor calls, you explain what you’re trying to do (e.g., attach a photo to an email, set up a Facetime call, change the settings in a program). Users can request a specific mentor by name or work with anyone on the CyberSeniors team, so if Grandma meshes well with a certain person, request a repeat session.

Cyber Seniors offers weekday group webinars over Zoom on tech and cybersecurity (and other) topics, and recorded prior webinars are also accessible.

GoGo Quincy

GoGoQuincy, promising “tech support for non-techies” started as a service to help seniors with but has expanded to assist anyone, no matter the age, with technology difficulties. For up to one call per month, the service is free; after that, there’s a $5/month fee plus $11 per call, so if there’s any chance you or your senior might be making more than two calls a month, the unlimited plan (for $19/month) is the way to go. (Reviewers note that experts didn’t try to upsell memberships or get callers to sign up for the paid service. Still, I’d encourage exhausting free options first.)

GoGo Quincy has a telephone hotline if you need immediate technology assistance; otherwise, schedule a session through the GoGo Quincy website.

Hire a Technology Specialist

Your best bet for a loved one (or yourself) maybe to hire a professional technology consultant. I have senior clients who are active in their non-tech lives but for various reasons need support with their web sites, social media, or ever-more-complex devices, and having a paid consultant, either on retainer or paid per call, gives them confidence that they’re getting professional level services.

Online, you can find a variety of in-person and virtual technology coaches, like Tech Coaches or Candoo Tech.

Additionally, there are professional organizers, working both locally and virtually, who can assist with making technology more accessible. My technology-minded colleagues in the National Association of Productivity and Organizing Professionals (NAPO) can be found by going to NAPO’s website and conducting a search, as follows:

- Go to NAPO.net.

- Select “Professional Directory” from the FIND A PRO drop-down menu at the top of the screen. Alternatively, you can scroll down the page past the photo banner to where you see the words the following:

- On the resulting search page (which defaults to a radius search), type in the requested information and select Digital Organizing from the residential organizing drop-down. The screen will refresh, giving you professionals guide you in organizing your technology.

Consider Artificial Intelligence

It’s not always ready for prime time, but there are AI options for getting tech support when humans aren’t available. One option is HelpMee.ai, which promises patient, voice-enabled conversations and screen sharing to guide seniors step-by-step through computer problems.

HelpMee.ai has multiple price points, from a free trial for 20 minutes of support, to three different levels of monthly support ($9.99/month for 1 hour, $19.99/month for four hours, and $24.99/month for 8 hours of support.

With all of these options, seniors can enjoy the benefits of technology while minimizing the frustrations. Don’t give up on helping your seniors with tech, and don’t let them give up, either!

If you have your own favorite tips and services for helping seniors with technology, please share in the comments.

52 Ways to Say NO to a Request So You Can Say YES to Your Priorities

Do you ever find yourself avoiding contact with other people out of sheer self-preservation and fear that they’ll ask you to add one more unfulfilling task or obligation?

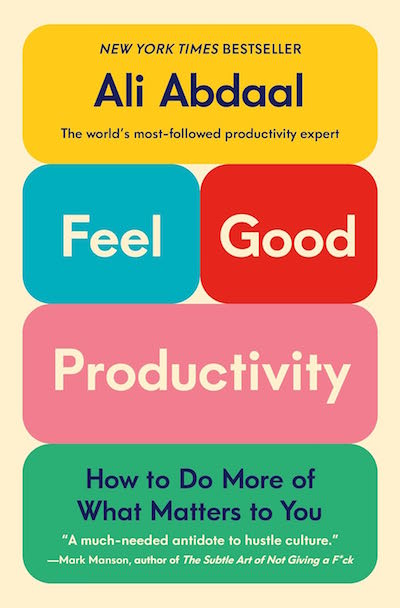

Recently, I read Ali Abdaal’s Feel Good Productivity: How To Do More of What Matters To You. The book serves as a sort of primer on the various macro and micro productivity concepts and strategies that we discuss at the Paper Doll blog. The book accents engaging in tasks that will increase your energy rather than drain it.

Do you ever find yourself avoiding contact with other people out of sheer self-preservation and fear that they’ll ask you to add one more unfulfilling task or obligation?

Recently, I read Ali Abdaal’s Feel Good Productivity: How To Do More of What Matters To You. The book serves as a sort of primer on the various macro and micro productivity concepts and strategies that we discuss at the Paper Doll blog. The book accents engaging in tasks that will increase your energy rather than drain it.

Abdaal’s idea of an “energy investment portfolio” particularly caught my attention. At its most basic, the energy investment portfolio is a deeply prioritized and categorized plan of attack, such as we reviewed when talking about the Eisenhower Matrix in posts like Use the Rule of 3 to Improve Your Productivity and Frogs, Tomatoes, and Bees: Time Techniques to Get Things Done.

Part of this approach is based in clarifying which of the things on your list are your someday “dream” investments (your big, ambitious projects for which you likely have little time right now) and your “active investments” (projects and tasks which you are or should be giving your greatest attention right now).

The key to Abdaal’s energy investment portfolio, an homage to a financial investment portfolio, is limiting the number of projects on your list of “active investments.” There’s only so much you can do right now, and those things better energize you if you don’t want to hide from them.

To explore this concept more before dipping into the book, check out Abdaal’s The Energy Investment Portfolio article and the video below:

This popped to the forefront of my mind as I started reading Cal Newport’s newest book, Slow Productivity: The Lost Art of Accomplishment Without Burnout. (Slow productivity, like the slow food, slow media, and slow travel movements, is about improving life by cutting back on speed and excess, and instead focusing on intentionality and quality.)

Newton caught my eye with an extended discussion of my beloved Jane Austen. Most biographies always paint her as successful because she would sneak in writing efforts in the precious few quiet moments she had to herself. Newport notes that her nephew James Austen’s descriptions of Austen’s writing style seem “to endorse a model of production in which better results require you to squeeze ever more work into your schedule” and calls this a myth.

Indeed, modern biographers have found the reverse, that Austen “was not an exemplar of grind-it-out busyness, but instead a powerful case study of something quite different: a slower approach to productivity.”

As true Austen aficionados know, once Austen (as well as her sister and elderly mother) moved from Southhampton to quiet Chawton cottage, she was able to escape most societal obligations and focus on writing. Quoting from Newton:

Abdaal’s idea of an “energy investment portfolio” particularly caught my attention. At its most basic, the energy investment portfolio is a deeply prioritized and categorized plan of attack, such as we reviewed when talking about the Eisenhower Matrix in posts like Use the Rule of 3 to Improve Your Productivity and Frogs, Tomatoes, and Bees: Time Techniques to Get Things Done.

Part of this approach is based in clarifying which of the things on your list are your someday “dream” investments (your big, ambitious projects for which you likely have little time right now) and your “active investments” (projects and tasks which you are or should be giving your greatest attention right now).

The key to Abdaal’s energy investment portfolio, an homage to a financial investment portfolio, is limiting the number of projects on your list of “active investments.” There’s only so much you can do right now, and those things better energize you if you don’t want to hide from them.

To explore this concept more before dipping into the book, check out Abdaal’s The Energy Investment Portfolio article and the video below:

This popped to the forefront of my mind as I started reading Cal Newport’s newest book, Slow Productivity: The Lost Art of Accomplishment Without Burnout. (Slow productivity, like the slow food, slow media, and slow travel movements, is about improving life by cutting back on speed and excess, and instead focusing on intentionality and quality.)

Newton caught my eye with an extended discussion of my beloved Jane Austen. Most biographies always paint her as successful because she would sneak in writing efforts in the precious few quiet moments she had to herself. Newport notes that her nephew James Austen’s descriptions of Austen’s writing style seem “to endorse a model of production in which better results require you to squeeze ever more work into your schedule” and calls this a myth.

Indeed, modern biographers have found the reverse, that Austen “was not an exemplar of grind-it-out busyness, but instead a powerful case study of something quite different: a slower approach to productivity.”

As true Austen aficionados know, once Austen (as well as her sister and elderly mother) moved from Southhampton to quiet Chawton cottage, she was able to escape most societal obligations and focus on writing. Quoting from Newton:

This lesson, that doing less can enable better results, defies our contemporary bias toward activity, based on the belief that doing more keeps our options open and generates more opportunities for reward. But recall that busy Jane Austen was neither happy nor producing memorable work, while unburdened Jane Austen, writing contentedly at Chawton cottage, transformed English literature.

Dubious? Look at the entries on this Jane Austen timeline, starting from 1806 onward! And let’s face it, without Austen, there would be no inspired homages, like Bridgerton, and for any of you who just spent the weekend transfixed by the first half of season three, that’s a fate not worth contemplating. I’m sure I’ll have more to share about this book as I get further on, but I was captivated by the chapter on Newport’s first principle of slow productivity, based on this finding. Principle #1 is simply Do Fewer Things.Strive to reduce your obligations to the point where you can easily imagine accomplishing them with time to spare. Leverage this reduced load to more fully embrace and advance the small number of projects that matter most.

YOU ARE ALLOWED TO SAY NO

From Abdaal and Newton to past Paper Doll posts, we know we have to focus our attention on fewer but more rewarding things. We must learn to emphatically say NO. Yes, you have to pay your taxes (or be prepared to suffer the consequences). You have to obey traffic laws. (Ditto). You have to feed your children (or at least arrange for them to be nourished). But you do not have to be in charge of cleaning out your company’s break room fridge. You do not have to buy your spouse’s birthday gift for your mother-in-law. (That’s your spouse’s job.) You do not have to join a book club or serve on your homeowner association’s planning committee or go to dinner with someone you really don’t want to date! There are various situations when we should be saying no to taking on new obligations.- You have more on your plate than you can handle comfortably (or safely for your mental or physical health).

- Your energy level is depleted (or you believe it would be depleted) by anything being added to your obligations.

- The new task doesn’t fit your skill set or interests.

- The task is unappealing because of the situation (the location, other people involved, the monetary cost)

- You just don’t wanna.

THE POWER OF SAYING NO

Organizing is as much about saying no as saying yes. Thus, I help clients determine what tangible possessions belong in their spaces and their lives, and which don’t. Some acquisitions were wisely planned purchases; others were picked up on impulse. Some are gifts given out of love, while others were given out of a sense of obligation. Still other things were abandoned on our metaphorical doorsteps (or, in the case of grown children who have flown the nest, things were abandoned in our basements, attics, closets, cupboards and corners). Just as clients must discern the difference tangible items that make their lives more appealing, robust, and fulfilled vs. those that crowd them out of their spaces, they must also evaluate how acquired activities can clutter their hours and days and diminish enjoyment of other experiences. Some activities, we choose with enthusiasm; others have been pressed upon us. Perhaps your early May serf imagines that the late September version of you will be delighted to give a speech or take on another committee role. Frustratingly, we always imagine that Future Us will be less busy. And we have all occasionally been guilted or cajoled into obligatory participation. Some tasks or roles have acceptable tradeoffs. I know that Paper Mommy didn’t enjoy the blessings of being a “room mother” year-after-year, going on field trips to the nature preserve or the science museum and having to help corral other people’s unruly offspring. But (luckily) she enjoyed hanging out with tiny Paper Doll, and the experience gave her opportunities to tell hysterical anecdotes to her friends. You may not necessarily want to serve on the awards committee, coach your child’s soccer team, or help interview new applicants at work, but the benefits sometimes outweigh the costs. The key, however, is to protect yourself from requests for your time and labor that drain your energy and cause resentment by taking time away from your larger priorities. If you don’t have the power to say no, freely, then you don’t really have the power to say yes. Whether stuff or tasks, things should enter your life with your consent. But if you’re unused to declining, it will require effort to exercise new mental muscles. The rest of this post offers strategies to help you avoid being saddled with the clutter of new obligations and eliminate tasks that no longer fit your life, or at least the life you want to lead.GET RID OF THE GUILT

There are many reasons why people fear saying no, but they almost always come down to fearing others’ reactions. Sometimes, this has to do with social roles and the belief that our life’s role is to do for others. But remember my Flight Attendant Rule: You must put the oxygen mask over your own nose and mouth before attending to those traveling with you. Overloading yourself makes it impossible to be there for others, whether at your job, in your family, or among your friends or in your community. (And think back to what Abdaal said about investing your energy.) Guilt also comes from the fear that saying “No” will make you sound mean or unduly negative. The examples below will help you craft responses that are firm in guarding your boundaries but upbeat and positive in attitude so as to cushion your response in a way that feels more like kindness than rejection. And in each case, the response means “No” without ever verbalizing the word.FIRST, TAKE A PAUSE

Being polite is a given; being kind is a virtue. Imagine you’re having a rough day. You’re rushing to get to a client meeting but your tiny human is just not interested in putting on her shoes so you can get everyone into the car. Traffic is bad, and just as you get everyone unloaded, a PTA parent corners you with an “assignment.” It would be instinctual to lash out and say, “Can’t you see I’m drowning? Can’t you see my nice suit for a presentation has dried cream of wheat on it because the tiny humans decided to have a food fight? What in the blankety-blank-blank makes you think I give a good bleep-bleep about organizing school spirit day?! I have no spirit, why should I care if everyone shows up wearing the same colors and why should I be the one to tell them to do it? Is your life so ridiculously so small and pitiful that school colors matter at all?!” Instinctual, but halfway through that tirade, you’d notice parents making their own tiny humans back away from you, and furtively glancing at one another, and possibly at the school security guard. Your youngest is two, but you can now imagine parents giving you (and your kids) wide berth until all your offspring have graduated. (The one upside is that nobody will ever ask you to volunteer again!) Instinct can make you blow up; taking a moment to pause and having a plan in place to say no without feeling like you’ve become a wild banshee may preserve your reputation (allow your kids to be able to invite friends over…someday).NEXT, SHOW GRATITUDE

Start by thanking the person making the request. Thank them? I can hear you screaming from here. Yes, get in the habit of thanking people for asking for your help, whether you’re being asked to do something prestigious like speak at a conference or something that’s basically scut work. There are so many people, particularly those who are elderly or in the disability community, whose potential value is ignored by society, so take a moment to appreciate being considered at all. Don’t thank them just because it’s polite; thank them because it gives you a moment to feel valued and appreciated, and because it forces you to pause and gather your resolve. Begin with something like:- I appreciate you thinking of me for this.

- Thank you for making me feel valued in our community (or workplace)

- Thank you for considering me for this role, but I have to decline [for reasons].

- I’m honored that you thought of me for this, but I have to pass [this time].

PICK AN APPROACH

Not every request requires the same style of response.Assertive Stance

When dealing with an equal, whether professionally or socially, address the person in a straightforward manner, making clear that the rejection is not about them (or their pet project) but about you. This way, you avoid them giving all sorts of reasons why they’ll be able to wave their magic wants and eliminate the aspect of the project you see is problematic. But focus on yourself, and there’s little most people can say. (Obviously, if you encounter someone who thinks you should give up caring for your ill grandmother so you can do bus duty at the child’s school, you have my permission to fake-call your grandmother in front of this person to make them uncomfortable. Really go for it. “I know you need me to change your catheter/clear your feeding tube/relieve you of your unremitting loneliness since Grandpa died, but Betty here says she doesn’t feel you’re as important as bus duty.”) State your situation without getting into the weeds. Focus firmly on setting and maintaining your boundaries, and use “I” statements to keep the rejection focused on what you can control.- Unfortunately, I have to decline this opportunity. My plate is already full.

- I’m sorry, but I can’t take on any more projects at the moment.

- I need to focus on my existing priorities right now.

Photo by RepentAndSeekChristJesus on Unsplash

- I’ve promised my children/spouse that I won’t take on any more activities that keep me away from the family. I’m sure you understand.

- I need to decline this to maintain my work-life balance.

- I’m prioritizing my health and well-being right now, so I can’t commit to anything extra.

- I’ve learned to recognize my limits, and I can’t stretch myself any thinner.

- I’m trying to prioritize my well-being, and taking on more isn’t conducive to that.

- I’ve realized I need to make more time for myself, so I have to decline.

- Again, I’ll have to decline. It’s just not feasible for me right now.

- As I said, I appreciate the offer, but I have to say no.

- That won’t be possible.

Gentle Stance

Sometimes, you don’t feel that your professional or social relationship with the requesting individual is equal. For whatever, you may feel that you have to be more diplomatic or offer explanations that the other person will feel is more valid. There are a few ways to approach this. The best way to approach this is to express enthusiasm for the offer and/or the project or regret that you can’t participate, or a combination, before identifying intractable obstacles. However, be cautious in how effusive you are about your enthusiasm and/or regret so as not to overplay your hand.- This sounds fascinating. I wish I could say yes, but I have to decline because [reasons]

- I’m sorry, but I won’t be able to participate because [commitments/reasons]

- I’d love to help, but I’m already committed [to several specific prior obligations]

Delaying Approach

Instead of an outright no, it may be useful to suggest the possibility of a postponement of your involvement. However, I caution you to only use this method if it’s realistic. It’s not fair to get someone’s hopes up that they will be able to count on you in the future, so only use this method if you believe it’s likely you will be able to help at some later point (or you believe there’s no likelihood you’ll be put in this situation again). It might sound like:- Ouch, there’s so much on my plate right now, so I’m not able take this on at the moment. Can we revisit this in [specific timeframe, like next semester or 3rd Quarter]?

- I can’t commit right now, but let’s touch base after the holidays and see if my availability has changed.

- I’ve decided to focus more on my career right now. Maybe next season.

Helpful Approach

Sometimes, your “no” reflects your specific circumstances, but you do value the project, organization, or effort. If so, expand upon the ways of declining above, but add helpful suggestions or offers, like:- That won’t be possible, but I’m able to send you some bullet points on how I accomplished goals during the eleven (freakin’) years I served as committee chair!

- I’m not able to take on this role, but I’d be happy to donate [X dollars, or my backyard, or my unused bongo set].

- I’m really not qualified, but let me tell you who would be perfect for this.

- So, yeah, based on everything I just said, I can’t do this, but TJ just rolled off the nominating committee and might be looking for some new role.

- I’m not the right person for this, but this is right up Diane’s alley. She’s got an accounting background and is already at the school on Tuesday nights while her daughter is at drama club.

Sometimes, the helpful approach isn’t for the other person, but for you. There will be times, usually in the workplace, where you will be asked to do something where, though the task is couched as a request, it’s really an order. You won’t be able to say no (and indeed, we would need another whole post, or possibly a book, to cover handling this). If you’re asked to tackle something where you lack the skill set, the desire, and the time to handle this new project and everything else on your plate, don’t panic. Thank the person for their confidence in you (again, always start from a position of gratitude unless you’re actually ready to quit the job), reiterate all of your (work) obligations and ask for guidance in prioritizing.

Two more options you might want to use, in combination with other responses, are flattery and humor.

Flattery

Sometimes, you can inveigle the other person into deciding they deserve better than what you are (un)willing to give:- Thank you for thinking of me, but I have too many obligations right now. I wouldn’t want to risk not giving this important project the attention it deserves.

- Thanks, but I would rather decline now than risk doing a mediocre or rushed job. Your [project/committee/idea] deserves someone’s best effort.

Humor

In J.D. McClatchy’s Sweet Theft: A Poet’s Commonplace Book, writer and translator Estelle Gilson shares a translation of a rejection issued by a Chinese economic journal to someone who had submitted a paper.“We have read your manuscript with boundless delight. If we were to publish your paper, it would be impossible for us to publish any work of lower standard. And as it is unthinkable that in the next thousand years we shall see its equal, we are, to our regret, compelled to return your divine composition and to beg you a thousand times to overlook our short sight and timidity.”

The first time I read it, I laughed at the audacity of the hyperbole (even as I accounted for the cultural expectations likely inherent in the message). However, upon rereading, I recognized that while the Chinese recipient may (or may not) have found the rejection funny enough to be uplifting, humor may help you powerfully judge the “no” to a softer landing.

Lightening the mood makes it easier to state the refusal. You’ll feel more like you’re performing a “bit” and it’s just a touch distracting for the person on the receiving end. You don’t have to actually be funny ha-ha, but goofiness, snark, or hyperbole can dissipate the tension (or give you time to think of an exit line).

The first time I read it, I laughed at the audacity of the hyperbole (even as I accounted for the cultural expectations likely inherent in the message). However, upon rereading, I recognized that while the Chinese recipient may (or may not) have found the rejection funny enough to be uplifting, humor may help you powerfully judge the “no” to a softer landing.

Lightening the mood makes it easier to state the refusal. You’ll feel more like you’re performing a “bit” and it’s just a touch distracting for the person on the receiving end. You don’t have to actually be funny ha-ha, but goofiness, snark, or hyperbole can dissipate the tension (or give you time to think of an exit line).

- I tried cloning myself, but it did NOT go well. The FBI made me destroy my machine.

- If I agree to this, my cat might stage a protest. Can’t risk a kitty rebellion.

- I’d love to help, but my superhero cape is at the dry cleaners.

Remember, you are not asking for permission to say no. You are engaging in polite (and hopefully kind) communication in navigating the tricky negotiations of social and professional diplomacy. Saying “no” to adding an unfulfilling obligation to your schedule lets you say “hell, yes!” to your priorities, your loved ones, your self-care, and your dreams. Saying 'no' to adding an unfulfilling obligation to your schedule lets you say 'hell, yes!' to your priorities, your loved ones, your self-care, and your dreams. Share on X

Cool, Sustainable Packing and Shipping Solutions for Earth Day

Nobody will ever call Paper Doll an outdoorsy person. I’m as indoorsy as you can get. People shout about being “at one with nature” but I’m definitely at two with nature; we couldn’t be less compatible. When I saw this video, I thought, yeah, that’s me. (OK, it’s Retta. But philosophically, it’s me.)

So, in a “Ground Control to Major Tom” way, I definitely recognize that Earth is the only home we have, and with Earth Day 2024 just a week away, I’ve had some paper-related sustainability issues on my mind. In particular, after recently helping a client try to downsize, corral, and store packing and shipping materials that had taken over space in her home, I started looking at how we could reduce mess but be more planet-friendly.

TRADITIONAL SHIPPING AND PACKING SUPPLIES

When I was in college, Paper Mommy regularly sent me care packages: mail and magazines I’d received at the house, homemade baked goods and packaged snack surprises, articles from our hometown newspaper, and stick-figure cartoons she drew of herself with curly hair and big feet, signed off with funny and loving captions.

I’d pick up my package downstairs in the student union and then my friends and I would head upstairs to the dining hall, where I’d perform a show-and-tell of all the contents. There was always so much packing material that we all had a blob of it to throw in the trash along with the remains of our dining trays.

While the items in the care package were still memorable, the packing material wasn’t. She might have used bubble wrap, but this was definitely decades before we all had those plastic “air pillows” that come in our Amazon boxes. I suspect Paper Mommy alternated crumpled newspaper and styrofoam peanuts, depending on what she was shipping.

Newsprint

In the olden days, newsprint was commonly used as a packing supply. Newsprint is inexpensive, low-quality, absorbent paper; it’s made from coarse wood pulp and primarily used for printing — you guessed it — newspapers. So, people just crumpled their news and sports sections after having read them and turned them into box filling. (Sometimes Paper Mommy included the comics when she sent care packages so I could smooth them out and read the funny papers as an added treat.)

Printed newspapers are dying, so most people are unlikely to have enough on-hand to pack items for shipping. Unless you’re already a daily subscriber, it’s not an optimal solution. And you’re not going to want to buy weeks and weeks of newspapers in advance of packing delicate items for a move.

You can buy rolls or stacks of “clean” newsprint paper without ink. This is often used as packing paper for shipping and moving, and there are environmentally-friendly versions. For example, you can purchase pads of it, like this package of 360 sheets of Tree House paper. It’s soft, clean newsprint made of recyclable materials.

Paper Doll Shares How To Select a Shredder, Shred Responsibly, and Save

Much of the following post originally appeared in 2021 and has been updated for 2024 with current product links and shredding discounts.

Klop. KaKLOP! Klunkety klunkety. KaKLOP! Grrrrrr uggggggg. KaKLOP!

No, unlike the officer at U.S. Strategic Command (STRATCOM), I haven’t let a tiny human take over my keyboard. The above is a close approximation of the sound my shredder made last weekend when, after two decades of faithful service and about halfway through shredding documents no longer necessary for tax time, it gave up the ghost.

At first, I thought I might have just fed one too many staples into the grinding teeth of my little document destruction devil. But, when I lifted the shredder from the bin and turned it over, nothing was stuck in the teeth. However, as I shifted the up-ended shredder motor from my left hand to my right, I could hear something sliding back and forth within. Ruh-roh!

Far more curious than mechanically inclined, I took a screwdriver to the whole housing unit, wondering if I might be able to just stick something back in place. (Yeah, go ahead and laugh.) Sadly, I found that a large octagonal metal washer (for want of a better description) had broken completely in half. The wheels on this bus were NOT going to go round and round any longer. I had to buy a new shredder.

DIY SHREDDER ESSENTIALS

Although I haven’t had to purchase a shredder in a long time, this is not my first shredding rodeo. Many of my clients find themselves either buying a first or replacement shredder as part of our work when we’re organizing and purging paper. So at least I knew what I needed to consider.

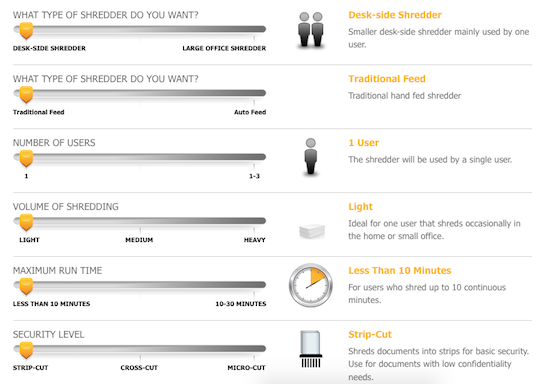

I hate to be crude, but size matters: the size of your shredder unit, the size of your “shreds,” and the size of the pile (or capacity) you can shred at one time.

Shredder Unit Size

There are three general sizes/types of shredder units: mini, medium, and heavy-duty.

Don’t buy a mini.

Yes, I know, regular readers of this blog recognize that I rarely invoke absolutes; the world is far more grey than black-and-white. However, unless you are buying a shredder for a child, I want to discourage you from buying a mini, or desktop, shredder.

Paper Doll’s Ultimate Guide to Tax-Smart Organizing: 2024

Every few years, I share a series of tax-related organizing tips for readers. Recently I’ve received inquiries from first-time filers asking for how to even begin the process. So, today’s post mixes tax-related news with a larger baseline of how to accomplish preparing and submitting your 2023 tax return.

Note: I’m neither an accountant nor a tax preparer. I don’t even play one on television. But I do help my clients find, organize, and make sense of the documents they need in order to prepare their tax returns.

ESSENTIAL TAX INFO TO KEEP ORGANIZED

Tax Deadlines

The federal Tax Day is April 15, 2024 (unless you live in Maine or Massachusetts, where it’s April 17, 2024).

If you file a (valid) extension request, you must file your tax return by October 15, 2024. Note, you still have to PAY what you (estimate that you) owe by April 15th to avoid a fine. However, if you strongly believe you’re not going to owe anything, you may file late (without filing for an extension) and there’s no penalty fee. But then you’ll also be delaying getting a refund if you’re owed one, so Paper Doll advises against procrastinating.

How To Prepare and File Your Taxes

You have a variety of options for how you prepare and file your federal taxes:

- Prepare your taxes yourself on paper forms. Like a caveman. And you’ll have to do your own math.

- Hire an accountant or CPA firm. You still have to gather all of your forms and your receipts and tell your tax preparer all the wiggly little oddities in your life last year, but you won’t have to do math. The complexity of your return (and how well you organized your supporting document) will determine the cost of the service.

- Visit a tax preparation service like H&R Block or Jackson Hewitt. Find them in independent storefronts or at desks inside big box stores, like Walmart. However, you may want to reconsider this option.

Color Of Change, in collaboration with Better IRS, just released a report called Preying Preparers: How Storefront Tax Preparation Companies Target Low-Income Black and Brown Communities. In it, they cite that many of these companies are unqualified, hiring non-accountant “unenrolled tax preparers,” who are neither credentialed nor certified in tax policy and regulations, and who do not adhere to continuing education requirements — and in 43 states aren’t even obliged to meet basic standards!

As such, many of these unenrolled preparers have been found to have made excessive errors; indeed, one study by the U.S. Government Accountability Office (GAO) found that only 10% of preparers at large tax prep chains calculated tax refunds correctly! Additionally, many of these companies are preying on low-income and minority taxpayers by charging for advances on refund checks, and promoting unnecessary tax products and high-interest refund anticipation loans.

- Use online tax preparation software, like TurboTax, H&R Block Online, TaxAct, Cash App Taxes, and Free Tax USA. They’ll hold your hand through prompting questions and you won’t have to do the math, but you’re ultimately responsible if you misunderstand a question or make an error. And it can be pricey!

The IRS already receives copies of our income information directly from employers, banks, investment companies, etc., so why do we have to do all of this? And why is it so expensive, especially for those who don’t even owe? Because these companies lobby and bribe — ahem, sorry, contribute — to congressional representatives’ election campaigns to prevent the federal government from creating a free option for all!

More Affordable Filing Options

The IRS estimates that Americans spend an average of $250 to prepare and file their taxes, but there are options for lessening that burden.

- If you are age 60 or older, make $64,000/year or less, are disabled, or need language support, you can get free help from IRS-certified volunteers in the Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs.

-

-

- Find VITA and TCE program locations at the IRS locator page.

- Seek related help from the AARP Tax-Aide Service.

- The United Way can connect you to preparation and filing assistance via MyFreeTaxes.

-

- If you’re a member of the military (or a military family), you can prepare and file a federal return and up to three state returns, for free, through MilTax. Eligibility requires that you are:

-

- An active-duty service member, and/or their spouse and dependent child(ren).

- A member of the National Guard and National Guard Reserve (no matter your activation status).

- Survivors of deceased active-duty service members, National Guard, or National Guard Reserve members (without regard to activation status or conflict).

- Honorably discharged, retired service members from all branches, including the Coast Guard, if you’ve been discharged within the past 365 days.

- Designated family members of service personnel who’ve been authorized to manage the eligible member’s financial affairs during deployment. Similarly, any designated family member of a service member deemed “severely injured” and not capable of handing their own financial affairs.

-

- If your 2023 adjusted gross income (AGI) was $79,000 or less in 2023, you can use the government’s Free File program. Here, the IRS partners with online tax preparers each year and eligible users (for 2023 filing, that means those with an adjusted gross income (AGI) of $79,000 or less) can file federal taxes with no fee. (State tax costs vary.)

However, the contracted companies change year-to-year, so if you prefer to maintain your data in your account, making it easier to do year-to-year comparisons and be prompted to recall charitable recipients and sources of W2s, 1099s, etc., next year you may have to decide between switching to a new program partner or paying for what was once free.

Some past participating partners in the Free File program have been problematic. The Federal Trade Commission (FTC) found that TurboTax engaged in deceptive advertising (forcing up-selling), and investigated H&R Block for improperly handling and deleting customer data (as well as for deceptive advertising).

Unsurprisingly, both companies have supported legislation to ban the IRS from offering free tax filing services.

- If you qualify, try the US government’s new Direct File trial program. Only 12 states (Arizona, California, Florida, New Hampshire, New York, Nevada, Massachusetts, South Dakota, Tennessee, Texas, Washington, and Wyoming) are participating in this trial effort.

Direct File eligibility is limited to those with income from employment (reported via W2), unemployment compensation, or from Social Security, so self-employed individuals, gig workers, and those with pensions can’t use it. To try Direct File, you have to take the Standard Deduction and can’t itemize. (You can have up to $1500 in interest or savings bond income, but not earnings through payment apps, rent, or prizes. Wages are limited to $200,000, or $125,000 if you are filing Married Filing Separately.)

Unfortunately, Direct File’s future is uncertain. The Biden administration allocated $15 million from the Inflation Reduction Act for IRS to evaluate the viability of a a free online tax preparation and filing service, with $80 billion apportioned for over the next decade. However, Congress’ debt ceiling agreement “clawed back” some of those funds.

Special K: It’s Not Just for Breakfast Anymore

Do you have an online platform on Etsy or eBay, or use a payment platform to sell through your website? Then you may have heard rumblings about the 1099-K form finally getting the $600 rule up and running. Well, it’s been delayed again.

The rule is designed so that anyone who receives money from a third-party network like Venmo, Cash App, PayPal, Square, or Stripe for having made $600 or more in sales for either goods or services would receive a Form 1099-K by late January or early February (when we’re supposed to get all of our 1099s). But the IRS has repeatedly delayed implementing the rule, so some people have received 1099-Ks and others haven’t, causing confusion.

So, if you got a 1099-K, check to make sure the numbers match the income you believe you received. (If there’s a mismatch between your records and the form, contact your financial network and correct it before you file your return.)

If you didn’t get a 1099-K, that doesn’t mean that you can fib to the IRS! You must report all taxable income, even if someone who was supposed to send you a form didn’t do their job.

Photo courtesy of Chris Potter/CCPix at www.ccPixs.com under CC 2.0

START THE TREASURE HUNT

Know What You Spent

Start by gathering expense information, like:

- receipts for tax-deductible purchases — check paper receipts as well as email confirmations of purchases

- statements or summaries from ongoing accounts. (On Amazon, select the year from the drop-down under Your Orders in your account. Don’t forget to check the tab for digital orders, too!)

- online financial dashboards — Mint closed in March, so plan to find a new dashboard like Quicken Simplifi, Empower, or YNAB.

Gather tangible information in a folder labeled Tax Prep 2023, or use something like the Smead All-In-One Income Tax Organizer. Just having it all together will be the first step toward tabulating the correct amounts.

Gather Ye Forms

Most of the essential data you’ll enter into your tax return will come as supporting documents called information returns. These are sent to you by others — employers, banks, brokerage houses, schools, casinos, etc. — and they’re required to mail them by January 31st! That scary-but-official mail you threw on top of the microwave the week before Valentine’s Day? Move the oven mitts and get looking!

The rest of this post is an update of past year’s posts, laying out the different kinds of forms you might need.

MONEY YOU RECEIVED

W-2 (Wage and Tax Statement)

If you were an employee at any point in 2023, your employer should have sent one W2 copy to you and one to the IRS, reporting how much you were paid (in wages, salaries, and/or tips). If applicable, it should also indicate how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state, and local taxes, FICA, unemployment insurance, and a few other withholdings are considered statutory payroll tax deductions. Statutes (that is, laws) require them, so your employer can’t just blow off withholding this money and sending it to the right agencies.

Sometimes, a court might rule that an an employee’s wages may be garnished, but this has nothing to do with sprigs of parsley. People behind on child support payments or who owe money in lawsuits may have money removed from their earnings, before it ever gets to their paychecks, to ensure it goes directly to whomever is owed.

Your W-2 may also report voluntary payroll deductions. These are amounts withheld from your paycheck because you’ve granted permission. These may include your portion of health and life insurance premiums, contributions to your 401(k) or other retirement fund, employee stock purchasing plans, one-time or ongoing donations to the United Way, union dues, etc.

Photo by The New York Public Library on Unsplash

Did you get multiple copies of the same W-2? Employers submit copy A directly to the Social Security Administration for FICA and keep copy D for their own records. Copies B and C are for you (the employee) – you send one to the IRS with your federal tax return and keep one for your own records. Then, they provide copies 1 and 2 to file with applicable state or local tax authorities. (I’ve never figured out why W-2 copies 1 and 2 aren’t called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, FF, and G, skipping E entirely?)

I've never figured out why W-2 copies 1 and 2 aren't called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, and G, skipping E entirely? Share on X

In theory, a W-2 should be mailed to the address listed on your W-4. (Don’t be confused. The W-4, is the form that tells your boss how much to withhold based on your number of dependents you have.)

Smaller companies may just hand you your W-2 instead of mailing it, but if your W2 is missing, consider:

- Did you change employers last year? You should have received W-2s from each employer. (If you changed jobs at the same company, you’ll receive one W-2 from each employer, not one per position. If you changed companies within a larger corporation, though, you may get one for each.)

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down to give you your W-2. Keep the Madge in HR updated!

Don’t assume that if you don’t have your W-2, then nobody knows what you made. Remember, the IRS got Copy A. The IRS knows what you made, so be sure you do, too! (If your former company went out of business or is otherwise not returning your calls, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

Examine your W-2 it carefully. Do the numbers seem right? Compare them to the final pay stub you got for last year. Calendar years may end mid-week (or even mid-pay period), so the numbers won’t correspond perfectly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return.

W-2G (Certain Gambling Winnings)

Gambling Photo by Aidan Howe on Unsplash

The W2G is the freewheeling cousin of the W-2. While a W-2 is for money you make while working, the W-2G is what you get while playing. If you win more than $600 in any gambling session at a casino – whoohoo! – the “house” should request your Tax ID (generally your Social Security number) and either prepare a W-2G on the spot or send it to you in January.

Casinos aren’t interested in keeping up with your losses, just your winnings, so they only tell the IRS about what they paid you. If you gamble and want to deduct losses, the IRS requires you have provide receipts, tickets, statements, or other records to support both your winnings and losses.

1099s (Income)

A 1099 is a form that basically says, “Hey, we paid you some money for something, but you weren’t an employee.” You get a copy; the IRS gets a copy. Easy-peasy.

There’s not just one type of 1099; actually, there are 22 different kinds of 1099s. Some of the more common are:

This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account.

Internet-only banks may require you to log into your account to get your 1099-INT, so don’t count on it coming by mail. If you received less than $10 in interest, your bank may not send a 1099-INT.

Do you own stock or other taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equal; ask your tax professional if you have any that seem unusual or complicated. Whether you receive dividend checks or your dividends are held in a DRIP (a direct re-investment plan), if you didn’t earn at least $10 in dividends, you are unlikely to receive a 1099-DIV.

This random form is subtitled “Certain Government Payments” and can cover everything from state unemployment compensation to tax refunds, credits, and offsets at the state and local level. It can also be used to report payment of taxable grants, agricultural payments, and other nifty things where a state or local government gives you money.

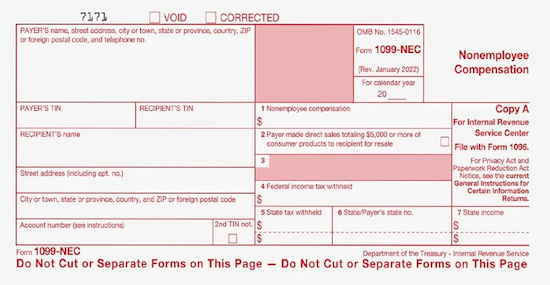

This new(ish) form replaces some uses of the 1099-MISC. If you’re self-employed (a freelancer, an independent contractor, etc.), you should get a 1099-NEC. However, 1099-NEC just started in 2021, so people unfamiliar with it may send you a 1099-MISC by mistake.

Another problem is that even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-NEC. So, if you are self-employed or irregularly employed, it’s essential to keep track of your own incoming revenue. Otherwise, if the person who paid you ever gets audited, it could trigger some messy situations for you, too.

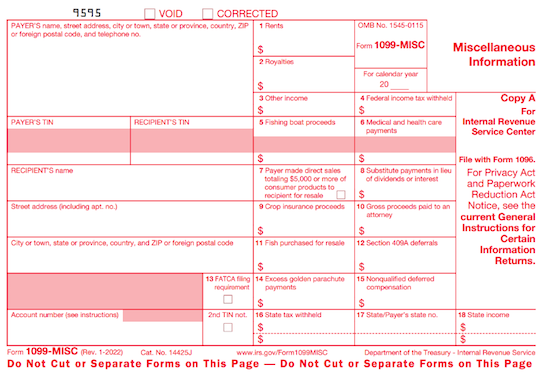

Now that this form no longer covers income for freelances and independent contractors, it’s truly more “miscellaneous.” Seriously, it’s the junk drawer of tax forms!

It’s used to report payment of royalties, broker payments, certain rents, prizes and awards, fishing boat proceeds (yes, really!), crop insurance proceeds, and some payments to attorneys that wouldn’t be reported on a 1099-NEC, like if you received a settlement and had to pay an attorney a portion of it. In general, once people get used to the 1099-NEC, you’ll only get this miscellaneous form to report truly miscellaneous payments.

SSA-1099 (Nobody knows why the numbers and letters are reversed on this one form! It must be done by the same people who label the copies of W-2s and bra sizes!)

If you receive Social Security benefits, you should receive an SSA-1099. (Non-citizens living outside the US, like widows/widowers receiving spousal Social Security benefits, may get a SSA-1042.) The 1099-SSA tends to come on a long form, folded and sealed such that it makes its own envelope. It may look like junk mail, so watch out and replace it, if necessary!

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that someone forgave a debt, like a mortgage or a credit card balance. You may owe tax on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, and got to keep it in your pocket, it’s as if you received money.

1099s sometimes hide in plain sight. Sometimes, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope — sometimes perforated at the bottom of a quarterly or end-of-year financial statement. Be sure to check all that boring-looking official mail. Brokerage houses often sent multiple forms as a “combined 1099,” scrolling across multiple pages. Check the reverse sides of forms, in case you’re missing one.

MONEY YOU PAID

1098 (Mortgage Interest)

A 1098 is not a 1099 with low-self-esteem. The vanilla, no-frills 1098 reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. Renters don’t get 1098s; neither do homeowners who’ve paid off their mortgages.

There are also sub-types of 1098s for things other than interest on property loans:

- 1098-T indicates tuition you paid; you’ll get this from a college or training school.

- 1098-E shows you’ve paid interest on a student loan and will come from your lender.

- 1098-C indicates the donation value of a car, boat or airplane by fancy-pants, monocle-wearing Mr. and Mrs. Thurston Howell.

Photo by Diego F. Parra from Pexels

1095-A (Health Insurance Statement)

The 1095-A is also called the Health Insurance Marketplace Statement. If you purchased coverage through a state or federal exchange, this helps you determine whether you are able to receive an additional premium tax credit or have to pay some back.

Related forms include the 1095-B (supplied by companies with fewer than 50 employees), detailing the the type of coverage you had, the period of coverage, and your number of dependents, so you can prove you had the Minimum Essential Coverage (MEC) required by law. A 1095-C is similar, but for employers with more than 50 employees.

SPECIAL 1040 FORM FOR SENIORS

Are you a senior? If you are over 65, instead of filing the standard 1040 form, you can file the 1040-SR. The main benefit is that this form, when printed, uses a larger font and provides easier readability.

FINAL THOUGHTS

If you receive a mysterious form, or have questions about how to use a form, the IRS has a surprisingly easy Forms, Instructions and Publications Search. Again, I am a Certified Professional Organizer, not an accountant, so please address any concerns to a tax specialist.

Making sure you have all of the necessary forms in hand will make it much easier to prepare your tax return. Once you file your taxes, make a list of all the forms you received this year, and tuck that list into your tickler file for next January. Check off each form as it arrives, and you’ll have a better sense of when you’ll be ready to start working on your 2024 taxes in 2025.

Follow Me