Archive for ‘General’ Category

Give With An Open Heart, Not A Cluttered Desktop

By popular request, Paper Doll is revisiting (with many updates) a favorite topic: dealing with charitable giving requests.

It’s not just ads and coupons, inveigling you to spend your precious little green bits of paper. This early, only a small percentage of your mail yields greetings from those early-bird friends who addressed holiday cards while they watched the Macy’s Thanksgiving Day Parade, the National Dog Show and the football games. The biggest contribution to all that Mail Call Clutter? Requests for charitable giving!

It’s easy to become overwhelmed. Certainly, you want to help further the causes about which you’re concerned (children, healthcare, the environment, animals, education, poverty…and the list goes on), but you may be troubled by multiple isues regarding the charitable giving process:

Limited Funds

No one individual (heck–not even Bill Gates, Warren Buffett and Oprah “You get a car and you get a car!” Winfrey, combined, for a total bankroll of $101.7 billion), possesses the funds to solve all of the world’s troubles. The folks on Forbes Magazine’s 2010 list of the 400 Richest Americans can’t even do it all. Thus, you may wonder if your contribution, even if it’s more than you can comfortably provide, has the power to make a difference.

Competing Interests

Weighing charitable giving options against one another can paralyze you into doing nothing, letting the piles of requests (and their associated letters and “gifts” of greeting cards and return address labels) creep across the kitchen table and overtake your office desk.

Just as you couldn’t take as much as you wanted from the Thanksgiving buffet because the elastic in your waistband might snap, your finances are finite and the number of charitable giving options, even just the non-profits actively seeking your help, are practically infinite. Responding to each request is no more suitable an answer than ignoring them all but still letting the papers clutter your surroundings and the guilt of non-responsiveness clutter your heart and mind.

Frustration & Confusion Over Repeated Requests

While non-profits certainly have more lofty goals than scamming you out of your money sooner than you planned, they nonetheless present you with an onslaught of requests. If you give to Charity A in December, not only will you receive repeated requests over the ensuing months for “Special Giving Opportunities” to Charity A, but in many cases, you will receive requests from similarly-themed Charities B, C, D to double-Z because many non-profits earn revenue by selling their “lists”.

It’s enough to turn anyone into a Scrooge. So, how can you resolve these frustrations?

Instead of choosing between the weight of guilt or the fear of exceeding your holiday (or monthly) budget, remember that there are better alternatives to feeling pressured into sitting down and writing a check to every cause that owns a bulk mail stamp–and none involve getting a sub-prime loan, robbing street-corner Santas or letting charitable clutter creep through your home. Instead:

1) Plan your charitable giving budget. Although a good number of people tithe or block a specific percentage of their earnings for charitable giving, many find themselves startled when facing multitudes of unexpected donation requests. The only way to give with your heart, without resentment, is to budget your donations as you would budget for all other expenditures.

Next, and this may shock those of you who have been conditioned by “This offer is available for a limited time only. Operators are standing by!” messages, but non-profits are always in need of money. In fact, some receive the bulk of their donations in the Fourth Quarter and then suffer from lack of funds by the middle of the next year. Just because you get dozens of requests for donations in December, your contributions will be no less valuable, life-saving or appreciated if sent three or six months down the line. Pace yourself.

Create and label a manila folder to collect all of the requests you receive for holiday donations, and during a quiet moment on New Year’s Day or soon after, sip some hot cocoa and review them. Make a note on your calendar and treat this as if it were a formal appointment with the director of each of the non-profit organizations.

Start by picking the charities that mean the most to you. Ask yourself, “If I could donate to only one charity, which non-profit would give me the greatest joy to help? Which would make me feel the most satisfied in my choice?”

There’s no wrong answer. While one person might donate to help political prisoners in an impoverished nation, another might choose to support an animal shelter two blocks away. One of you might choose to donate to medical research to find a cure for a disease that afflicts millions while another might give to one neighborhood family whose home burned down in a fire. It’s not all up to you — give with confidence that while you handle your share, millions of other similarly good-hearted people are doing the same.

Remember: you can’t give to everyone, but you can feel good about to whom you choose to give.

As you sort through the requests, determine:

1) How much can you comfortably afford to give each month? (Don’t forget any donations to which you’ve already obligated yourself via pledges, such as to your house of worship, your alma mater or public TV/radio stations.)

2) How often do you want to donate? To how many charities?

Do you want to give to 12 charities, and assign one to each month of the year (or maybe four, with one per quarter)? If so, tuck the envelopes away in your tickler file or bill-paying center. In this way, you can keep the spirit of giving alive throughout the year without being overwhelmed or over budget.

Or, would you prefer to give to one or two particular charities all year long? Set up a recurring donation on the same day of the month through your online bill-paying system. (You could schedule payments via credit card, but that costs the non-profit extra merchant account fees.)

2) Budget cash for ad hoc giving, such as when you encounter a Salvation Army bell-ringer or want to purchase a meal for a homeless person.

Set aside $5 or $10 in singles in a separate section of your wallet so you can make unplanned donations without breaking your budget. After all, it’s hard to give with an open heart if you’re feeling resentful about a pinch in your pocketbook.

3) Partner with others to achieve a charitable giving goal. For example, propose that you and your networking colleagues (or you and your Pilates class buddies), donate the monetary equivalent of one networking lunch or one post-class Jumpy Java to one specific charitable goal.

Or, if you wish to keep the spirit going all year, create a charitable giving club the same way you’d start an investment club. Instead of collecting articles about stocks and mutual funds, collect the brochures and request letters from non-profits and bring them to your group meetings. (You’ll be less inclined to let a charitable request languish atop your microwave if you know a group member feels passionately about that cause.)

4) Invest time in educating yourself about charities. Not all non-profits are created alike. Learn about the charities to which you are considering giving financial support. Find out what percentage of donations will be used for funding programs, research, etc., and what percentage goes towards advertising, paying staff, etc. Investigate potential recipient charities via: GuideStar.org‘s basic level provides free access to information that lets you verify a charity’s legitimacy, learn whether your prospective contribution will be tax deductible, view a non-profit’s IRS Form 990, or find out more about their programs, mission statement and financial activities. The database is huge, with well over one million non-profits included.

GuideStar.org‘s basic level provides free access to information that lets you verify a charity’s legitimacy, learn whether your prospective contribution will be tax deductible, view a non-profit’s IRS Form 990, or find out more about their programs, mission statement and financial activities. The database is huge, with well over one million non-profits included.

The Better Business Bureau’s web site for charities offers Wise Giving Reports, explains charity accountability standards and provides background information on all the non-profits in the accredited charity directory.

The Better Business Bureau’s web site for charities offers Wise Giving Reports, explains charity accountability standards and provides background information on all the non-profits in the accredited charity directory.

![]() The American Institute of Philanthropy operates CharityWatch.org. Review their A-Z (well, A-Y, from the AARP Foundation to the Youth Development Fund) listings of hundreds of charities to learn more about their operations.

The American Institute of Philanthropy operates CharityWatch.org. Review their A-Z (well, A-Y, from the AARP Foundation to the Youth Development Fund) listings of hundreds of charities to learn more about their operations. CharityNavigator.org evaluates the financial health of thousands of America’s largest charities. Browse by charity name or category, and check out the blog, articles and charity ratings.

CharityNavigator.org evaluates the financial health of thousands of America’s largest charities. Browse by charity name or category, and check out the blog, articles and charity ratings.

5) Give donations that keep on giving.

Microlending organizations like Kiva (one of Oprah’s 2010 Favorite Things) allow people to lend small amounts of money, via the internet, to micro-financing institutions in developing countries. Your money partners with other donations to meet a recipient’s financial needs for starting a small business abroad.

You can narrow the list by business type, read the profiles and pick the recipients of your loan/donation. When that loan is repaid, your money goes back into a kitty to help others. You can even emulate Oprah and give a Kiva gift certificate.

Kiva promotes dignity, accountability and transparency, and loan recipients have a repayment rate of 98.99% on the $176,949,100 that has been borrowed thus far.

6) Give (actual) gifts of charity

Some people have everything, need nothing, and want only world peace and tranquility. But even the most high-minded of us like unwrapping something shiny. Revel in special opportunities to provide gifts that, while not tangible for the giftee, provide ineffable meaning for them and something essential and tangible to the third-party recipients (e.g., the hungry, the impoverished, the innocent, the needy). Organizations like Heifer International let you donate a flock of ducks or part of a water buffalo and invite heaping the gleeful honor of “ownership” on your recipient.

Be sure to make a notation on the request letter to show how much you sent, on what date, using what method (check, credit card, etc.). File the letter in the tax prep section of your family files until you receive an official confirmation of your donation from the non-profit.

In the meantime, feel good. You did a good deed for someone else, and you halted the charitable clutter creep.

7) Give Up The Guilt

Just because you receive address labels does not obligate you to make a donation to a charity, just as receiving a holiday card from a distant acquaintance does not obligate you add the individual to your card list. Don’t let them turn advertising techniques into a free ticket on the Guilt Trip Express. Use your brain — then give from the heart.

Finally, remember that you need not always give money. Donating your possessions, time and service to non-profits can be even more valuable than the amount of money you could afford to donate.

Keep the spirit of giving…just let go of the piles of requests.

The Gift Card Revolution (Part 3): Top 10 Tips For Organizing Your Gift Card Experience

Over the last few posts, we’ve discussed the relative merits and drawbacks of gift cards, looked at how the changing regulations improve consumer rights, and examined the traits that the best cards have in common. We also looked at how to get rid of unwanted cards without giving up on the monetary value they hold.

Gift cards, the sleek, modern embodiment of gift certificates, help you give portable, desirable, clutter-free gifts that ensure your loved ones get what they really want. As we head into gifting season, Paper Doll encourages you to keep the following in mind to keep your gift card usage organized:

1) Purchase, give and redeem gift cards with confidence by knowing the regulations. As a reminder, the main highlights of the new rules are:

- Gift cards can’t expire for at least 5 years from date of issuance or the last date the card was loaded/reloaded with funds (provided it’s a store gift card or general-use prepaid card, and not a phone card).

- Gift card issuers can’t charge inactivity or dormancy fees for at least 12 months after the last use, whether that involves redeeming or adding funds.

- Every gift card must include disclosure of fees, an expiration date and a toll-free telephone number or website where you can get more information.

Read the fine print. Although the new federal regulations (and any more stringent regulations your state may have in place) provide more legal protections than previously, as I mentioned a few weeks ago, the ECO Card Act exempted cards produced prior to April 10, 2010 from the new disclosure agreements until January 31, 2011. Thus, while the cards you buy from this February onward are required to have all terms (expiration dates, fees, etc.) listed right on the card, the ones you purchase this holiday season may not bear all the essential information.

Since the new rules do require retailers to provide the details via general advertising, signage in the stores, language on their websites and during customer service calls, don’t feel squeamish about searching out the information and insisting cashiers or customer service reps provide you the necessary information before you plunk down your money.

2) Get the best deals. First study, then shop.

Review the research from Bankrate’s study to know what features each merchant’s card has, and peruse ScripSmart’s Best Cards list from last week to build your own version of Oprah’s Favorite Things. Be sure to skip the merchants on Scripsmart’s Cards To Avoid list.

Find the best discounts on the cards you’ve decided to purchase. Stick with companies that offers a 100% guarantee, like Plastic Jungle and Gift Card Rescue, as we discussed last week. Also consider checking out

GiftCardGranny, which acts like Expedia or Travelocity, but for gift card sites. GiftCardGranny receives the inventories of the major gift card discounters and displays all options so you can compare apples to apples (or iTunes to iTunes) to get the best discounts. Once you find the deal you want, click through GiftCardGranny’s site to take you to the discounter to make your purchase.

GiftCardGranny also helps you check your gift card balances. If your pre-new regulations card lacks a toll-free number, or your two year old has taken a Magic Marker to the surface of your gift card, just click through GiftCardGranny’s gift card balance page to get the toll-free number, web address and, if applicable, store locator for brick-and-mortar merchants.

EBates, best known for digital rebates providing cash back for shopping online through the EBates portal, offers a nifty gift card incentive. Since EBates is a portal, you’re really doing all of your online shopping at the actual web sites of your favorite online merchants — you’re just getting there through a middleman. Imagine if every time you walked into your favorite store at the mall, there were a doorman who slipped you a tip. It’s like that.

When you sign up for an EBates account and then purchase a gift card after clicking through their site, they’ll credit you and give you cash (well, a check) back…with no paperwork required! How organized!

Get extra bang for your buck when using your gift cards online. Use your favorite search engine to locate discount or coupon codes. For example, Google “YummyRestaurant discount code” or “SuperCoolStore coupon code” and review what comes up at sites like Retail Me Not, Current Codes and Coupon Cabin. Canadian readers can use Retail Me Not’s Canadian page, Good Bazaar and Voucher Codes. When you shop, you’ll either go through the portal to apply the discount or be alerted to type in a provided coupon code at checkout, lowering your initial cost; then apply your gift card to the total.

3) Avoid fraud.

Whether you buy a gift card at the store or via one of the online discount marketers, once you get the gift card home, call the toll-free number or check the online URL to verify the balance on your card. It should equal what you paid. If not, call or return to the store as soon as possible and speak to Customer Service. If you purchased from a discounter, take advantage of the 100% guarantee to get a replacement card or your cash back.

(If you got the item as a gift, let your benefactor know. If he or she still has the receipt, you can report the fraud and have a fair chance of having the value replaced.)

4) Read the business headlines.

Know who is on the brink of bankruptcy or in the middle of restructuring. Unless you’re buying a card you know will be used right away, opt for stores with robust bottom lines. Whether you follow mainstream media or web sites like Google Financial News or the online Wall Street Journal, educate yourself.

5) Help your recipients get all they deserve.

If you purchase a gift card in a large denomination, or you believe the recipient might not use it right away, ask the cashier for a gift receipt. Then, keep your receipt for your records, as necessary, and provide the gift receipt along with the card to your recipient.

If you purchase gift cards online, route all your online receipts to one “Gift Receipts” folder on your hard drive. It will make it easier to verify purchase dates and forward the information to your recipients.

Let your recipient know that it’s the purchase (or fund reloading date) that starts the expiration clock–not the date on the card. After a card’s expiration, your giftee can call the toll-free number and request a new card. Retailers must do this for free or return the remaining balance.

6) Organize your own gift cards in an easily-accessible place.

For brick and mortar stores, convenience is key–you don’t want to hold up the lines. If you only have a few cards, dedicate a pocket of your wallet for gift cards, or keep them with your cash, as they act as faux money.

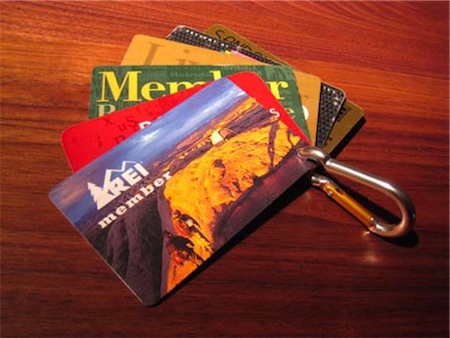

To organize multiple gift cards for power shopping, work with your personal style. If you’re a no-frills person, use a heavy-duty hole punch to punch a hole in a corner of each card, carefully avoiding the magnetic strip, bar code or information regarding the toll-free phone number or URL. Then run all of your cards on one inexpensive keyring or carabiner, just as we discussed doing for retailer loyalty cards.

If you prefer a more fashionable method for organizing gift cards, consider keeping a Card Cubby (as I reviewed here) in your bag.

Whatever your style, take time to review what cards you have before a shopping spree.

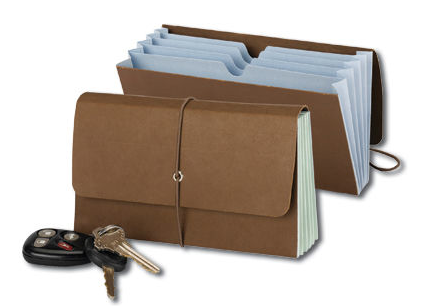

For gift cards you’re most likely to use at an online store, tidily keep cards together in a petite (6-1/2″ x 3-1/2″) Smead Tag Along Organizer

at your bill-paying station or computer so you can remember what cards you have when it’s time to make an online purchase.

7) Remember to use your cards.

Get in the habit of checking which restaurant cards you possess before making lunch dates or dinner plans. If you’re likely to forget you ever even received gift cards, make notations on your calendar or a recurring appointment alarm on your cell phone and/or computer to remind you to check which cards you own. Just re-familiarizing yourself with which cards you posses will help keep the cards at the top of your mind; having your cards with you, when and where you shop, will make you more likely to reap the rewards your cards have to offer.

Keep track of the last time you used your cards, too. Whenever you spend money or load more funds on a gift card, use a mini Post-It or even write the date on the back of the card with a Sharpie. This will help you keep track of when those 12-month inactivity fees will kick in.

8) Restart the clock. Because many cards are reloadable, consumers can extend the expiration period as well as the dormancy period. Thus, if you have balance on a card that’s likely to start earning a service fee for dormancy, add $1 to the balance, thereby restarting the inactivity/dormancy clock for another 12 months.

9) Re-gift, sell, or donate the cards you know you’ll never use to maximize the value.

10) Cash in your bounty!

The clock is ticking, so don’t procrastinate. We all have a tendency to save things for special occasions. Too often, the opportunity to enjoy something is put off so long that we miss out. So, use the good china, wear your best outfit, and cash in those gift cards before the chance is gone.

Make any day a special occasion. Instead of letting your gift cards languish, gather your friends or family together to dine out with you and use that restaurant card. Buy that nifty gadget or new book or attractive sweater, content that it makes no dent in your budget and yet lets you pamper yourself. You deserve it.

Research proves the best and most memorable gifts are clutter-free, those that allow recipients to enjoy experiences rather than things they’ll have to dust, dry clean or store in the attic. Thus, focus on gift cards for experiences: restaurants, theater tickets, cooking classes, spa treatments, etc.

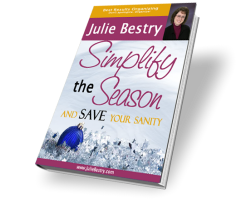

For more clutter-free gift ideas, particularly those in the easy-to-wrap gift card category, as well as advice on how to maneuver through the holiday season unscathed (financially, emotionally and in good health) please check out my ebook, Simplify the Season and Save Your Sanity.

The Gift Card Revolution (Part 2): Get the Best Deals, Avoid Fraud, and Set Bad Cards Free

Last week, we reviewed how new regulations regarding gift cards help gift-giving consumers and their recipients keep more of the value of their cards. Knowing the protections available is a great start, but there’s more you can do to improve your gift card experience. Today, we’ll weigh the relative value of gift card options, protect you from fraud, and review ways to unload unwanted gift cards for a financial (or charitable) benefit.

THE BEST AND THE WORST

Those new regulations cushion the impact of the worst offenders, putting a buffer between consumers and those annoying fees and expiration dates. But that doesn’t mean all cards of the same denomination have the same value. To borrow from George Orwell, some gift cards are more equal than others.

![]()

Bankrate.com studied and ranked 54 of the most popular gift cards on features ranging from existence and types of expiration dates and fees to the availability of online balance checking and free shipping.

In this study, Bankrate examined 46 retailer cards for mass retailers (from Target and Walmart to Macy’s and Nordstrom), restaurants (ranging from McDonald’s and Taco Bell to the more upscale Bonefish Grill and Maggiano’s), clothiers (like Old Navy and The Gap), and specialty merchants (like bookstores, spas, office suppliers and home improvement stores). Bankrate also reviewed eight network-branded (Visa, Discover, MasterCard and American Express) cards.

Bankrate found, as we discussed last week, that most Closed Loop (i.e., retailer) cards have few fees and don’t expire. Most Open Loop (network branded) cards, however, generally come with fees at the time of purchase as well as more fees after purchase, such as inactivity and administrative fees. The eight Open Loop cards Bankrate surveyed all charged purchase fees at the point of sale, and all but two had expiration dates.

So, while your recipient will have a wider array of purchase options if you give a Visa or American Express gift card, it’s going to increase your up-front costs and decrease the actual gift value for slow-pokier recipients. Thus, if you have any familiarity at all with your recipients’ tastes, Paper Doll advises selecting a retailer card instead of a network-branded card. If you’re truly worried that you can’t identify their preferences, opt for a card at a store that offers a wide array of goodies, like Target or Kohl’s, to maximize the bang for your buck.

It’s worth reviewing Bankrate’s list of cards before setting out on your next gift card shopping spree.

ScripSmart is an online service that helps members keep track of the expiration dates of their gifts cards, “nags” them to make use of the cards they’ve registered, and alerts them if their cards are in danger due to issuers’ impending insolvency.

ScripSmart also reviews and scores gift cards based on 30 specific features and policies. “Great” cards fall in the 80-100 range — sort of an honor roll of gift cards, while “Average” cards sit in the 60-79 range and “Buyer Beware” cards fall below 60.

ScripSmart recently posted a list of gift cards to avoid. (You weren’t really going to buy anyone a Rite-Aid gift card for the holidays, though, were you?)

Remember last week’s quiz regarding the most highly regarded organizing-related gift card? Coming in on top of ScripSmart’s list of best gift cards, with a score of 99%, is a favorite “Big Box” shrine to organization, The Container Store.

A WARNING ABOUT INSOLVENCY

Sure, web sites like ScripSmart are great for alerting consumers to perilous gift card purchases, but readers, please, use your common sense. As Circuit City, KB Toys and The Bombay Company gift card holders learned a few years ago, when a retailer goes belly-up, gift cards become entirely worthless. The CARD Act has no provisions to protect consumers from retailer insolvency, and companies don’t have to sequester funds to refund unusable gift cards. So, don’t buy gift cards from retailers whose looming bankruptcies make the nightly news.

A WARNING ABOUT FRAUD

Consumer watchdogs note that fraudsters often copy the numbers off pre-loaded gift cards and use them to make online purchases. Then, when consumers eventually purchase those cards and go to redeem them, they find the balances are reduced or at zero. Paper Doll cautions readers to purchase gift cards that are loaded with funds at the time of purchase.

CASH IN YOUR UNUSED GIFT CARDS

Yes, the point of giving someone a gift card is to solve the problem of what to give the person who has everything, wants nothing, or is too picky to enjoy whatever you might select. But as a recipient, you may not have everything, may want something, and may not be (all that) picky, but might still receive gift cards for stores or service providers that just don’t fit your personal style. Some cards, if you’ll pardon the this week’s inevitable theme, are turkeys!

So what can you do?

Well, you could re-gift a card. It’s much easier to re-gift a gift card than other unwanted gifts, as they’re less likely to collect dust and their box edges aren’t apt to get dented when shuffled around the house. But maybe nobody in your circle really wants a gift card to Yarn Emporium or Guns & Groceries. Maybe all your friends are organic-only vegetarians and you’d like to unload a gift card for Omaha Steaks. Then what?

You could sell gift cards using the same venues you’d use to get rid of other gifts that don’t fit your style: eBay, Craig’s List, or even offer it up to the highest bidder on your favorite social networking site (provided the gift-giver isn’t isn’t apt to get wise and un-friend you). You can also donate gift cards to charities or even individuals.

Paper Doll thinks a better alternative (other than charitable donations) is to find a gift card exchange site that will purchase your gift cards for a large percentage of the face value and act as a middle-man to broker your card to buyers. For most of these sites, sellers merely type in the retailer and dollar amount and an offer price pops up instantly. Some sites to consider:

PlasticJungle.com is a popular trading post, enabling consumers to buy, sell, trade and donate new and partially used gift cards. Plastic Jungle is best known as a resource for quickly selling unwanted gift cards at 65% to 92% of the verified card balance, depending on how sought-after a particular merchant’s card might be.

Plastic Jungle doesn’t purchase all gift cards — the face value must be at least $25, and the company deals in only a few hundred popular cards, including Best Buy, Land’s End, Macy’s and AMC Theaters. However, you can sell a card even if it doesn’t bear the full face value. So, if you have a $50 card with $35 left, once Plastic Jungle verifies the balance, you’ll get your hefty cut. Also, sellers are given the option to donate some or all of the sale proceeds to any non-profit.

Plastic Jungle resells gift cards at a 10-16% discount off the card’s face value, and you can set up a wish list to be notified when a particular gift card becomes available. All transactions are guaranteed.

GiftCardRescue gives you three options: sell your gift cards for cash and receive 60-85% of the face value, exchange unwanted cards for Amazon gift card credits 5% higher than the amount you’d receive in cash, or buy gift cards, discounted 10-30%. A $25 card I tested, one produced before the new regulations kicked in, with about 10 months remaining before expiration, could earn me $17.50 in cash or $18.37 in Amazon credit.

GiftCardRescue buys the cards of approximately 300 merchants. Select the merchant from a drop-down box, enter the value and expiration date (if there is one), and get an offer quote. To sell, register for an account, arrange to receive your check, and mail your gift card. It’s that simple. GiftCardRescue mails payment within two days of receipt of cards. Transactions are 100% guaranteed.

![]()

Cardpool purchases gift cards at up to 92% of the face value, sells them at discounts of up to 30% off, and promises payments for sold cards will be sent within 24 hours of receipt. Like Plastic Jungle, you can donate proceeds of your sale to charity; however, Cardpool offers only two non-profit options: Andre Sobel River of Life Foundation or City of Dreams. [Editor’s note: Cardpool no longer appears to have a relationship with any non-profits.]

Cardpool differs from its competitors in a few ways. First, Cardpool only purchases and sells cards without expiration dates or associated fees. This means you need not worry about comparing cards based on any feature except the products and services your recipient can purchase.

However, unlike many of the other sites, while Carpool guarantees purchases up to $1000, transactions are only guaranteed for 100 days. Paper Doll is concerned that given how often people forget about their gift cards for months on end (an experience next week’s post is designed to help ameliorate), a mere one hundred days is not enough time for some recipients to realize there’s a problem, notify you and achieve a resolution.

Swapagift.com has a slightly different approach for buying consumers’ unwanted cards. If:

- You have a card on Swapagift’s Preferred Merchant list,

- the balance on a gift card is between $25.00 and $300.00, and

- the card has no pending expiration,

then Swapagift will purchase the card immediately, for 60, 65 or 70% of the current value, depending on into which Preferred Merchant list category the card falls. You mail the card, and they mail the money. However, if you want cash faster, you can visit one of 600+ Swapagift certified partner locations, usually kiosks inside brick-and-mortar financial services storefronts, like Western Union and check-cashing venues, and they’ll pay you the same day.

Swapagift also sells cards at up to a 25% discount via partner site GiftCards.com.

Next week, we’ll review the top ten tips for decluttering the gift card experience. We’ll look at buying, pricing, giving, organizing and enjoying gift cards — so you can save money, you and your recipients can save time, and everyone can maximize the value of well chosen clutter-free gift cards. (Paper Doll isn’t kidding. There are some serious money-saving tips in next week’s post!)

Until then, Paper Doll encourages wise gifting and wishes you a healthy, happy, and safe Thanksgiving.

The Gift Card Revolution (Part 1): What The New Regulations Mean For You

The shopping season is upon is. While we’d like to delight in finding the perfect presents for friends and family, we are often stymied by obstacles. Busy schedules or inclement weather may keep us from getting out to the stores. Perhaps there are people on our lists for whom, no matter how hard we try, we’re just uncertain what item (or size) would be right. This is exactly why the gift card was invented.

Actually, it’s why the gift certificate was invented, but in 1994, Blockbuster (remember them?) started using plastic gift cards to replace gift certificates, which had begun being counterfeited in large numbers. Gift cards have become so popular over the last decade and a half that the National Retail Federation reports that 57% of Americans rank gift cards as their first choice for holiday presents.

A survey by Visa found that 85% of respondents would appreciated receiving a branded gift card, and 65% prefer gift cards to “non-essential” gifts like scarves or cologne. And as of this season, members of Facebook will be able to buy and send retailer gift cards via the social networking site.

ADVANTAGES

It’s been a long time since gift cards were seen as boring or generic gifts. It’s not just that recipients are eager to replace Aunt Gertrude’s tastes with their own. Gift-givers, recipients and retailers all benefit from gift cards due to:

Portability — Shipping costs are high and always increasing, but gift cards are small, light and can be mailed, along with a holiday card, at no extra cost.

Traveling over the river and through the woods to Grandmother’s house for Christmahanukwanzaakah? Once you, your spouse, the kids, Fluffy and Rover and everyone’s accoutrements make it into the car, along with refreshments and gadgets and “Mom, he’s touching me!!!!”, oversized or oddly shaped giftwrapped presents offer one headache too many. And air travel with gifts adds insult to injury. Not only must we now pay extra just to bring luggage on the plane, but security rules require gifts to be unwrapped, such that we must now cringe at the hands of strange TSA agents pawing the delicate gifts transported to loved ones. Gift cards, conversely, fit the SUV or the carry-on bag without muss, fuss or cringe-inducement.

Uniform size — Gift certificates varied widely in dimensions and materials. They were usually too large to tuck neatly in wallets and tended to get thrown in drawers and baskets until they were long-forgotten and eventually expired. (Yes, that happens with gift cards, too, but at least the size gives them a fighting chance.)

Visual appeal — Many gift cards bear attractive, whimsical or message-laden designs to counteract the generic size and shape.

Electronic system authorization — Unlike bus and train cards or the ubiquitous Vendacards Paper Doll used in college to make photocopies, gift cards don’t have stored values. Instead, gift cards are encrypted at purchase with dollar values stored in centralized data banks. This is good for retailers, because stores need not worry about counterfeiting, and good for consumers, because one phone call allows provides access to the current balance without having to keep up with receipts.

DISADVANTAGES

Unfortunately, for many years, most consumers remained unaware of the serious drawbacks of plastic gift cards, including the existence of administrative, inactivity and dormancy fees, expiration dates, and the comparative differences between Open and Closed Loop gift cards.

Open Loop cards are “network-branded” cards issued and backed by financial institutions like Visa or American Express and can be used practically anywhere those institutions’ credit cards are accepted. Closed Loop cards can only be redeemed at the issuing retailer; for example, Walmart, Bed, Bath and Beyond or iTunes. While Closed Loop cards tend not to have expiration dates or administrative fees, Open Loop cards expire and pile on fees. (After all, as with credit cards, the big guys make their money not from the purchases you make, but from fees — like those associated with you forgetting you’ve got the gift card in the first place.)

THE NEW RULES

Back in February, Paper Doll told you about the Credit Card Accountability, Responsibility and Disclosure Act, or CARD Act, designed to enact new consumer protections. What you may not know is that while the CARD act was primarily about credit cards, it also included some nifty provisions related to gift cards, which went into effect on August 22, 2010. These new regulations level the playing field — with all retailers, in all states, subject to the same federal guidelines.

The highlights in the consumer’s favor:

Longer Periods Before Expiration — One year limits are old news. Now, gift cards can’t expire for at least 5 years from date of issuance. That means five years from the date of purchase for gift certificate-style cards, or five years from the “date of last load of funds (in the case of a store gift card or general-use prepaid card)”, according to the Federal Reserve.

Gift Cards Expire — But Your Money Doesn’t! — This is the biggest news, and the aspect Paper Doll thinks the media has failed to report loudly enough. If the expiration date on your gift card passes, but there’s still a balance on the card, call the card company at the toll-free number and request a new card. Retailers are required to either do this free or return the remaining balance. (So, when you purchase a gift card and notice the expiration date is only 4 years and three months away, you might want to let your recipient know the date of purchase…that’s what starts the meter running.)

No Inactivity Fees…at least for the first year — Retailers aren’t allowed to apply inactivity fees until at least 12 months after the last use of the card — whether that use involves decreasing or increasing the value of the card. So, if you’d like to give Grandma a gift card for her favorite store, restaurant or spa chain, but she’s only up from Boca Raton in the summertime, don’t fret. Those inactivity fees won’t start for 12 months, rather than the previous one to six months that were often standard.

Monthly Fee Limits — Now, no more than one fee of any type can be applied to the card in any one month. So, for example, if you’ve not used a gift card in more than 12 months, while a retailer may charge an inactivity fee or an administrative fee, it can’t charge both.

Written Disclosures — Every gift card must include the following in writing: disclosure of fees, an expiration date and a toll-free telephone number or website where you can get more information about the card.

Stronger State Laws Still Reign — If you live in a state with even more stringent laws than those provided by these regulations, your state’s law will prevail. To find out more about the regulations that pertain to gift card purchases in your state, the National Conference of State Legislatures has put together this summary of state regulations, current as of September 2010.

There is one drawback associated with the new rules. Retailers may still charge a one-time fee when you purchase a gift card. However, this tends to only occur with Closed Loop “network branded” cards, which generally charge $3-7 per card; store cards rarely have fees associated with purchase.

Lastly, these new regulations only apply to actual gift cards, and not to reloadable cards for pre-paid phone service or rechargeable (credit card-like) debit cards, loyalty cards or rebate cards.

A HITCH IN THE GIDDYUP

Although the law passed in late 2009, retailers protested that in order to make the original deadline, upwards of 100 million otherwise serviceable gift cards would have had to have been destroyed, and gift card manufacturers might not have been able to produce replacements in adequate numbers in time for the holidays. Thus, via the ECO Gift Card Act, a codified “interim final rule” from the Federal Reserve, Congress exempted cards produced prior to April 10, 2010 from the new disclosure agreements until January 31, 2011.

So, you just know that lots of stores nationwide will still have pre-April 2010 cards hanging next to cash registers from Portland, Maine to Portland, Oregon and everywhere in between during the 2010 shopping season.

All is not lost, however.

Under this ramp-up period exemption, retailers can’t just party like it’s 1999…or 2009. Card issuers are required to use alternate methods to inform consumers and gift card recipients about card fees and terms of usage…they just don’t have to have the messages printed on the cards. They can alert us through general advertising, signage in the stores, language on their websites and even during “customer service calls”, though one wonders how intently an agitated homeowner, drowning in soap bubbles from an over-agitated washing machine, will be paying attention to gift card mumblings from a customer service telephone rep.

Learning how the new regulatory protections apply to you is a great first step, but there’s more to know.

Next week, we’ll explore services for identifying and buying the best gift cards while avoiding cards from companies potentially in financial distress. We’ll also discuss how you can protect yourself from gift card fraud and organize the gift cards you receive to minimize loss and maximize rewards. And we’ll check out some exciting new options for turning the gift cards you know you’ll never use into cash.

Until next week, here’s a mini-quiz. (No cheating by Googling…just offer up your best guess.)

Get Back To Where You Once Belonged: Breadcrumbs, Luggage Tags and Tattoos

Once upon a time, long before the invention of GPS (and even before The Beatles climbed out on a rooftop), people were worried about getting themselves (and their loved ones) back to where they belonged.

In the Time of Fairy Tales

Hansel and Gretel were cursed with a stepmother who was more Disney stereotype and less Carol Brady. The woodcutter’s kids overhear their stepmom’s evil plot to reduce the number of mouths to feed at the cottage by sending them deep into the woods, too far to ever return home. In a tale that would make any kid dubious of parental love, the co-dependent woodcutter follows his wife’s orders. (Sheesh. Doesn’t anyone ever call Child Protective Services in these fairy tales?)

After Hansel and Gretel’s successful effort finding their way home with a path marked by surreptitiously-dropped pebbles, the evil stepmother tries again, but first locks the kids in their rooms with just bread and water to sustain them and prevents them from gathering more stones. The next day, not-so-sharp Hansel takes a slice (a slice?! not even a loaf?!) of bread and the drops a trail of breadcrumbs, with plans to follow the crumbs back home.

Apparently a kid who doesn’t realize hungry birds are going to nibble a bread buffet probably doesn’t realize he’s better off seeking out a different domicile. So, not a perfect plan, but certainly one that had an impact on future day trippers.

Nineteenth Century English Country Homes

In At Home: A Short History of Private Life, Bill Bryson tells a tale of backstairs intrigue in large country houses:

Guests brought their own servants, too, so at weekends it was not unusual for the number of people within a country house to swell by as many as 150. Amid such a mass of bodies, confusion was inevitable. On one occasion in the 1890s, Lord Charles Beresford, a well-known rake, let himself into what he believed was his mistress’s bedroom and with a lusty cry of “Cock-a-doodle-doo!” leaped into the bed only to discover that it was occupied by the Bishop of Chester and his wife. To avoid such confusions, guests at Wentworth Woodhouse, a stately pile in Yorkshire, were given silver boxes containing personalized confetti, which they could sprinkle through the corridors to help find their way back to, or between, rooms.

Don’t you wonder at the efforts put forth by scullery maids and their cohorts, cleaning the floors but ensuring multiple trails of differently-colored confetti remained untouched?

WWII: Luggage Tags and Little Ones

Just prior to the outbreak of World War II — and during the war, especially during the London Blitz — British children were sent from cities to rural areas, ostensibly to safety, as part of evacuation programs like Operation Pied Piper. History books are replete with stories of British (and later, European) children, standing on train platforms, with luggage tags (bearing their names and essential data) pinned to their coats or hanging from strings around their necks.

Even the grinchiest hearts lurch at the thought of children, tagged like luggage, being sent away from their families “for the duration”, as the phrase went. But today, even the shortest field trip or crowded fairground can give moms or dads pause about how best to ensure their little ones will get back to where they belong.

Of course, parents work hard to teach their children how to locate and identify a policeman, and how to memorize their parents’ vital information to report to a grownup (but not a stranger). Over the years, parents have learned how to sew identifying information into kids’ jackets but refrain from personalizing clothing so as not to give any ne’er-do-wells an opening.

A whole industry has even grown up recently around technological gadget solutions like Amber Alert GPS, Brickhouse Child Locator, GPS Nanny, and Track My Kids.

However, there’s a simple but low-cost (sticky) paper solution, an upgrade of the luggage tag notion: customized adhesive labels.

Modern Day Return-To-Sender Solutions

Tottoos was inspired by a lost child in a football stadium. The founder explains:

We were heading to the concessions stand and spotted a little girl standing up against a trashcan, crying. We asked if she needed help. She told us she couldn’t find her mother. When we asked what her mother’s name was, she said, “Mommy.”

I stayed with her while my husband made his way through the sea of people in search of a security guard. I was thinking the whole time how worried the girl’s mother must have been and wished I could just call her to let her know where her child was, and that she was safe.

If your child is going to be in a crowd — on a field trip with school, at a fairground or amusement park, or anywhere that he or she could become separated from you or whomever is in charge — Tottoos are an inexpensive solution for minimizing anxiety.

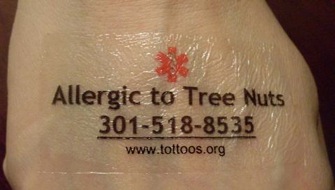

Tottoos are custom-made with FDA-approved adhesives and last 12 hours or longer when properly applied to clean, dry skin. The decals can feature personalized data, such as “If I am lost, please call [number of your choice]” or the name and emergency phone number of a preschool, elementary school, worship group or other organization overseeing an outing.

Thus, a child need not provide an excess of personal information to a stranger (even a Good Samaritan). Further, parents and organizations can ensure that there’s a breadcrumb trail back to home base, even if a child is unable (due to hysterics, confusion or inability to memorize numerical sequences) to provide essential information.

In addition to identifying emergency contacts, Tottoos also offers kits with customizable decals to display important medical information, like allergies or chronic illness alerts and instructions regarding what to do in case of emergency.

SafetyTat uses “medical-grade, hypoallergenic, latex-free adhesive” on all of their products. Paper Doll thinks SafetyTat earns bonus points for offering the same kind of solution as Tottoos, but with a charming artistic flair.

There are a variety of SafetyTats for different needs.

Quick Stick Write-On! SafetyTats employ a proprietary Tattek peel-and-stick approach. They come in brightly colored basic versions for boys and girls, and allow parents to quickly write a contact number and attach the decal to a child at a moment’s notice. A pack of 18 Quick Stick Write-On! Safety Tats are $19.99 and come with a waterproof tattoo marking pen.

Original SafetyTats are similar to the QuickStick variety, but the clarity and appearance may vary according to the child’s skin tone, and they require water to affix to the skin (like old-fashioned kiddie faux tattoos). Pre-created phrases for the line of 27 “tattoos” (with a wide variety of designs) include:

In case of emergency, contact…

If lost, please contact…

I have non-verbal autism…

ALERT: Nut Allergy

ALLERGIC to BEE STINGS

ALERT: Diabetic

and a variety of other stock phrases from which to choose, in packets of 30 for $19.95. (Other kit sizes are available.)

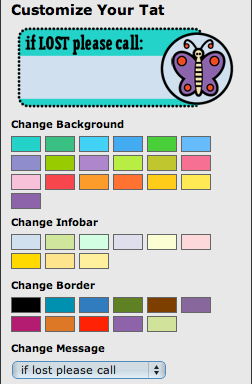

TatBuilder allows customers to easily create thousands of possible combinations of styles and features, including background and border colors, message text and icons or artwork. Just click to choose features and select text from a drop-down menu:

TatBuilder allows the designer two lines for contact information on each tattoo. A package of 24 tattoos is $19.95.

Random thoughts:

Paper Doll always suspected that Hansel and Gretel’s stepmother and the Soylent Green-loving witch were long-lost relatives, but this might be the result of a lifetime of watching television melodramas.

Also, Paper Mommy never let Paper Doll out of her sight until college, relegating what could have been carefree afternoon hours to playing room mother, looking at bones while touring natural history museums and discovering the essentials of making maple syrup at Tifft Nature Preserve. Not once did she ever misplace a kid.

Follow Me