Archive for ‘General’ Category

Paper Doll’s Strategies for Paying Bills On Time–Part 2

Bills paid after their due dates have severe repercussions, ranging from late fees to increased interest rates to severe dinging of FICO scores. Last week, we began reviewing some strategies for making sure those bills got paid on time in order to avoid the unfortunate circumstances that befall the late payers.

1) Pay Bills the Day They Arrive

2) Tickle Yourself With an Organized System

3) Don’t Worry, But Be Alarmed

4) Set Up Automatic Payments

Today, we delve into further strategies for making sure bills get paid on time so that your finances can stay in the black. (Does anyone else think it’s funny that while being “in the pink” implies health, finances “in the red” are bleak? Wouldn’t it make more sense for good financial health to be “in the green”? No? Just me, eh?)

5) Use Online Bill-Pay

Using an online, non-automated, bill-paying system allows you to reap the rewards of going digital while maintaining the control that automated payment systems lack. There are no stamps, envelopes, trips to the post office or worries that your check will get lost in the mail. A few keystrokes are speedier than writing out checks.

You can arrange for a bill to be paid any time between receipt of the bill and the due date; actually, if you have a sense of the amount that needs to be paid, you can even arrange to schedule payment before the official bill has arrived. And you can set payments to be made while you’re traveling or otherwise occupied, without fear that a bill might fall through the cracks.

This satisfies the needs of those who normally would have blanched at the idea of strategy #1, paying bills the day they arrive. By scheduling the exact payment due date in accordance with your cash flow, you can maintain hold on your funds for as long as is convenient. This is especially advantageous for those who have interest-bearing checking accounts — earn interest on your funds for as long as possible, but ensure that no due dates are bypassed.

Non-automated bill payment systems can also make great use of two other strategies we’ve covered. First, strategy #2 (having an organized system) means that even when you’re scheduling online payments, if you manually (but digitally) review your financial obligations and schedule payments on a regular basis, you’ll monitor fluctuations in your charges, notice errors and perhaps shop for more competitive rates.

Online bill-pay also works well in tandem with strategy #3. Most vendors, and just about all banks, allow you to set email and/or text alerts to warn you of impending due dates or low-balance thresholds so that you can make quick adjustments.

There are three ways to use online bill-pay for maximum convenience and benefits:

A) Pay each bill from an individual vendor’s website — This option involves going to the web site of each individual vendor to set up an online payment program, providing personal information to validate yourself as the account holder.

Gather all of your files for your monthly or quarterly bills to make sure you don’t forget anything you regularly pay. These might include bills for:

Mortgage or Rent

Landline and/or Cell Phone

Utilities (Electric, Gas, Water, Internet)

Debts (Credit Cards, Loans)

Insurance

Whenever a bill is due, you will log into the account for that creditor (using your username and password), click on the bill payment option, and specify the amount you wish to pay. With many vendors, the sole option will be to pay the amount due. With credit card companies, the options will include paying the total amount due, the minimum amount due or some other specified amount between those two. Some vendors (and all credit card companies) will maintain records of your bank routing number and account number; others may require you to provide it anew with each payment.

Once you set the payment date and amount, you’ll be asked to review and confirm the transaction. Upon transaction approval, you’ll be provided with a confirmation number (or a combination of letters and numbers). Most systems provide a method for quickly printing the confirmation; obviously, this increases rather than decreases your use of paper. I encourage you to (carefully) scribble the confirmation number, date and amount of payment on your statement and file it away. If you get paperless statements, save the confirmation page as a PDF.

This method gives you maximum control, but is time-consuming and a bit awkward. You must maintain login information for each vendor and must log in to each site, one after the next, to complete your transactions.

B) Pay all bills from your bank or credit union’s centralized online bill-paying center.

Your online bank or credit union account may already be set up to allow you to pay bills online. If not, you’ll need to create an account, with a user name, password and a series of security questions.

Next, with all of the same bills used in the prior example, create a payee for any vendor whom you may want to pay on a regular basis. Your bank or credit union will probably have many of your payees (and their addresses) already in the system; for those they don’t have, you’ll need to provide information including each payee’s payment address and telephone number and your individual account number with each vendor. Once set up, the payees will stay in the system until or unless you delete or revise them.

Logging in to pay a bill (or many bills, all on one screen) should take no more than a minute or two. Enter the payment amount and select the date on which the bill should be paid and the account from which the funds should be withdrawn (if you have more than one account at that financial institution). Again, I suggest you write the confirmation number on your statement, along with the date and, if you’re not paying a bill in full, the amount paid.

Assuming your bank or credit union offers a robust online banking system with free bill-payment services, using this as your primary method is quick and convenient. However, while some payees can receive electronic checks, others may require checks, and will therefore need payments scheduled at least four days prior to their due dates for ample delivery time.

C) Combine Vendor and Bank Bill-Payment Systems

Paper Doll encourages clients to use their bank bill-pay systems as their primary payment method. However, it’s still a good idea to set up those online accounts with individual vendors as a back-up for special circumstances, such as when:

–A busy life or emergency situations overwhelm you such that even combining strategies 2, 3 and 5B fail, and a payment due date is looming. Even if 99% of the time, you’ll pay via your online bank account, if unexpected travel or personal emergencies flummox you, you can generally log into a vendor account and have a payment scheduled today be credited for today.

–Your bank is experiencing online difficulties. This is extremely rare, but denial-of-service attacks on financial institutions sometimes make logging in impossible for minutes to hours. Being able to switch gears and quickly make a payment at a vendor site on an ad hoc basis is a nifty (belt) alternative to your normal (suspenders) method.

6) Bill Everything to One Rewards-Earning Credit Card

Yikes. Yes, I’ve known people for whom this system is workable. They set up everything from utility bills to gym memberships to insurance premiums to be billed to one credit card upon which they earn points for every dollar spent. Points can be turned into cash, miles, or any of a variety of perks, and the user only has to pay one bill each month.

This option can work well for high wealth individuals who can easily pay off balances — every single month! If you only have one bill to pay, it’s probably a lot easier to notice it when it comes in the mail, and paying it as soon as it arrives (whether via traditional or online means) is relatively convenient.

If you select this option, you must have enough of a cushion so that if you run into a revenue problem, it doesn’t turn into a cash flow problem. You’d need to have at least two months’ worth of funds in your checking account to cover payment of this credit card (and at least eight months’ worth in your emergency fund) before considering this option.

Also, it’s essential to have a back-up plan in case you are unable physically (as opposed to financially) pay this bill. If you are unexpectedly caught out of the country, without access to the internet or phone, you would need to have a system in place whereby your spouse, assistant or trusted friend could pay your huge, honking credit card bill (and/or transfer funds between accounts to accommodate this, if necessary). Otherwise, you’re likely to have not only a hefty late payment fee but a huge boost in interest payments, a possible increase in your interest rate, and a serious a ding to your FICO score.

In theory, there’s not a huge difference between having all of your bills paid by credit card and then paying the lump sum and a dozen separate monthly bills that add up to the same amount. In actuality, however, I’m concerned about the psychological shift this process entails. As with automatic bill payment, I fear you’re less likely to pay attention — to feel the pain — of the money you spend if you don’t actually, manually, make a payment on a regular basis.

7) Outsource Bill-Paying to a Specialist

We all have things at which we excel…and things at which we don’t. Paper Doll doesn’t blink at an organizing project, is a speed demon when it comes to typing, and can decipher a muddled check register from fifty paces. I cannot, however, do any formal dance step that would have been out of place in Desperately Seeking Susan.

You, dear readers, have your own things at which you excel. But even after employing some combination or even all of the first six strategies, any of a variety of life circumstances (ranging from juggling the care of both elderly relatives and lively kids, to running a business, to dealing with ADHD), may leave you waiving a white flag.

If trading tasks with your spouse or significant other meant the bills would all be paid on time, even if it meant giving up titular control over the household finances, you’d probably consider it. But what if your partner is treading water at least as furiously as you are? Or what if you’re a singleton? There’s still someone to whom you can turn.

You might think outsourcing bill payment is a luxury, but many people find that hiring a professional relieves them of the anxiety, dread and annoyance related to financial tasks. They believe the amount they pay for assistance is vastly outweighed by the money they save, ensuring their financial pictures stay rosy.

Certainly many individuals and businesses make use of bookkeepers to keep their finances straight and ensure that bills are paid on time. Similarly, one of the many specialty practices of members of the National Association of Professional Organizers (NAPO) is financial organizing. A professional organizer specializing in financial organizing may help prune and organize financial records, assist with setting up online payment systems, or actually pay bills and monitor the accuracy of financial transactions — all depending on a client’s needs and desires.

One should also note that the American Association of Daily Money Managers (AADMM) is a national organization of professionals who provide personal financial and/or bookkeeping services to senior citizens, the disabled, busy professionals and others who find keeping up with bills and other financial tasks to be onerous or inconvenient. (Not surprisingly, many financial organizers are members of both NAPO and AADMM.)

Just as you might make use of the services of a fitness trainer, life coach, or academic tutor, a financial organizer can help you accomplish your essential financial tasks so that you can focus on what means the most to you. A financial organizer is also a superior solution for overwhelmed members of the sandwich generation who are trying to oversee their own finances, as well as those of their senior citizen parents or grandparents.

Whatever bill-paying strategies you employ, know that you can control your financial destiny.

Paper Doll’s Strategies for Paying Bills On Time–Part 1

“There’s always something to be thankful for. If you can’t pay your bills, you can be thankful you’re not one of your creditors.”

~ Anonymous

One of the biggest paper management complaints I get is that clients find it hard to pay their bills on time. It’s not the financial aspect, per se, but a problem of fitting bill-paying into an already overstuffed schedule.

Over the next two posts, we’ll consider multiple solutions to the problem of paying bills on time, and I invite you to review the pros and cons of each to see which fit your individual style. The thing is, no one system is perfect for everyone. Indeed, I think that no one system is perfect for anyone. Rather, Paper Doll believes you’ll find that mixing-and-matching these strategies will help you create a workable system for your own personal lifestyle.

On to the strategies…

1) Pay Bills the Day They Arrive

This simple strategy requires the least amount of advanced planning, and if adhered to, is the least likely to lead to procrastination or late fees. Like clockwork, bring in the mail every day, open the envelopes, toss extraneous junk and “shiny” advertising material and pay your bills immediately. Done!

Paying bills the day they arrive saves time (on a daily basis) because it’s easy to complete quickly, eliminates anxiety regarding whether you may forget to pay, and helps you stick to your budget. If you pay for all of the things for which you have already obligated yourself, you’re less likely to spend on wants before needs.

Yes, this is the easiest system, but it’s also the least-often used.

Certainly, some people skip this option because they lack the funds to pay each bill on the day it arrives. Most of us live on budgets, and if our two biggest bills (for example, mortgage and insurance) arrived on the same day, it might wipe out (or even exceed) our checking account balances, leaving nothing to live on. So, there may be a practical reason for not paying bills as they arrive.

For others, however, who definitely have enough money in the bank, there tend to be psychological or philosophical obstacles to using this strategy. They may think, for example:

“I’m not going to pay this bill until right before it’s due. They don’t deserve my money one minute earlier than necessary.”

This attitude is particularly striking when someone wishes to avoid paying a credit card bill, failing to consider that payment was actually due weeks before, but they opted to use credit to “time shift” the payment. They’ve already written an IOU…the bill is the reminder that the IOU has come due.

If this is your philosophy, consider writing checks the day they arrive, but tucking them into a tickler or calendar page for the day you will mail them. Or use your online bill-paying system as soon as the bill arrives, but schedule payment delivery for the last possible date. Bank of America lets you select the date you want the payee to receive the money and guarantees the transaction. Other banks schedule by when a check or electronic payment is sent; if the payee requires a tangible check, it can lead to delays, so know how your online system works.

“If I pay this bill the day it arrives, what if an emergency pops up and I don’t have the money because I’ve already paid this bill?”

This is a reasonable fear, especially if someone is operating on so thin a margin that paying the electric bill might mean not being able to pay for necessities or emergencies. In this situation, the organizational issue of paying bills on time is not the main concern, but rather the focus needs to be on personal financial management and building an emergency fund.

“I don’t like paying my bills in dribs and drabs. I want to pay them all at once.”

This behavioral preference is similar to not wanting to hang up clothes (or toss them in the wash) as soon as you undress, not wanting to file each piece of paper as you finish with it, or not wanting to wash each dish (or put it in the dishwasher) when done eating.

Sure, there’s something to be said for flow, doing a large project at once and pushing through it to give yourself the satisfaction of completion of a major task. However, the more we let our clothes pile up on the exercise machine, the more we let our filing pile up in the office, and the more we let the dishes pile up in the sink, the more of a behemoth the task seems, and the more likely we are to procrastinate altogether. The downside of procrastinating on those tasks are wrinkled clothes, messy offices and dried-on kitchen yuckiness. The downside of procrastinating on bill-paying? Late fees, increased interest rates and lowered FICO scores.

2) Tickle Yourself With an Organized System

If you don’t do something immediately, you have to do it later. (That’s just a law of the space-time continuum. We still can’t travel backwards in time.) To make sure you do it later, you’ve got to have a system in place to help accomplish it, and that system involves both physical and behavioral elements. Physically, a bill-paying center includes the following elements:

Letter opener

Calculator

Pencil and scrap paper

Envelopes

Stamps

Return address labels

Non-washable gel-ink pens (to deter identity theft and fraud)

Computer or mobile device (though I advise against paying bills while mobile)

Printer (optional)

Next, your system needs to include the following behavioral elements:

–Show up for mail call. Open the mail the day it arrives, toss out the glossy advertising inserts, and if you pay online, toss the envelopes, too. Even if you’re not going to pay right away, process the bill immediately to keep it from ending up on top of the microwave or hidden under an ad from the Franklin Mint.

–Scan each statement to review the charges, note any unexplained fees, and check for new policies and/or errors. (The sooner you catch a billing error, the easier it is to fix.)

–Circle or highlight the payment due date. Then use the elements of the systems we’ll review today and next week to make sure the bill actually gets paid by the due date.

–Glance at the calendar to make sure there are no weekends or federal holidays on or around the payment due date that might present delivery obstacles.

–If the due date is consistently inconvenient because of your cash flow pattern, ask the vendor to change the date to a more convenient one.

–Put your bills in one place, at your bill-paying center, and arrange them in chronological order by due date. Alternatively, use a tickler file and put the bills in slots at least 7 days in advance of when they’re due.

3) Don’t Worry, But Be Alarmed

Alarms and alerts are the perfect way to ensure tasks get out of your head and conquered in the material world. For example, most banks’ online bill-paying systems will allow you to set up email or text alerts to let you know when a bill has become available to pay, as well as at various increments (7 days prior, 3 days prior or on the day) before the bill is due.

Similarly, you can set alarms or alerts on your computer (through your task list or calendar) or cell phone (via regular alarms or smart phone apps) to create a fixed schedule to pay either each individual bill that is due or to get you on a regular bill-paying schedule…for example, every Tuesday evening at 8 p.m. or Thursday morning at 10 a.m.

The only problem with alarms and alerts is that if you tend to internally rebel against authority (even something as simple as a “Don’t Walk” sign), then repeated alarms might seem like pestering, against which you might rebel by refusing to acknowledge them…even if you set the alarms yourself. If that’s the case, I encourage you to read the chapter on the Defier Procrastinator in Dr. Linda Sapadin’s book It’s About Time for a greater understanding of how you can conquer this procrastination style.

I also urge you to consider making the alarms fun. Instead of creating an alert that says “Pay the electric bill”, make it say “If the electric bill doesn’t get paid, all the yummy ice cream will melt!”

4) Set Up Automatic Payments

If you prefer to “set it and forget it”, consider one of two ways to accomplish setting up automatic payments.

A) Go to the web site of the vendor (utility, credit card company, insurance agency, etc.) and set up a recurring automatic payment. In addition to vendor account information, you’ll have to provide your bank routing number and account number. Some creditors (like your mortgage company), may require you to sign a document in order to complete the process.

or

B) Go to your bank’s online bill-paying center and within your account, create a payee for any vendor whom you want to pay on a regular basis. Provide payee data and the day of the month your prefer ongoing payments to be made. For fixed amount bills, set the dollar amount. For fluctuating bills, it’s a little more complicated because, on its own, your bank has no way of knowing how much to pay a vendor whose charges change from month to month. Your bank likely has a paperless bill option that allows the vendor to send paperless statements, which trigger your bank to alert you and enable you to authorize payments.

Automatic payments have many distinct advantages. You don’t have to pay for postage, you can skip writing checks, handling envelopes and going to the post office, and you can largely forget about paying bills.

Automatic bill payment is not for everyone. If you have a strong need for control (or have ever been called a micro-manager), you might feel more comfortable using an online bill-paying system (strategy #5) to manually schedule payments. If you’re too hands-off and lack funds in a particular month such that you won’t be able to pay until after a bill is due, unless you manually cancel the auto-payment, you might overdraft your account. Thus, a system you put in place to allow you to “set it and forget it” will lead you into trouble if you actually forget it completely.

Also, just because payments are automatic, doesn’t mean that your financial management can also go on auto-pilot. It’s still essential for you to monitor your statements — whether via monthly paper statements, or, preferably, via weekly viewing of your account online — to make sure there are no computer or human errors.

Further, automatic payments tend to make people less aware of their spending patterns. If you have to sit down to write out a check to the phone or insurance company on a regular basis, you might be more inspired to check competitive rates more often, but if you never see your bills, you might become complacent about what vendors are charging.

Remember to cancel automatic payments if you no longer want or need a service, or if you relocate. Gyms and certain telecommunication companies are famous for not ceasing billing when they are obligated to do so, and only your diligence can ensure that billing — and the automatic debiting of funds from your account — will cease.

Finally, maintain a list of which bills are debited through automatic payments and which are paid manually (by check, phone or ad hoc online payment). Make sure you enter automatic payments in your check register so that you (and your spouse or significant other) can verify payment. If you neither keep a register nor reconcile your account, consider keeping a payment chart in your tickler file and checking off a monthly column as individual payments are verified.

Next week, we’ll review other on-time bill-paying strategies and see how you can:

5) Use Online Bill-Pay — to reap the rewards of going digital while maintaining the control that automated payments lack

6) Bill Everything to One Rewards-Earning Credit Card (But please, don’t even think of attempting this until you read next week’s post!)

7) Outsource Bill-Paying to a Specialist

Next Monday, May 30th, is Memorial Day, a federal holiday in the United States. The banks will be closed and the U.S. Postal Service will not be running. So, if you have any bills due early next week, be sure to arrange to pay them (by check, phone or online) so that you’ll be credited for an on-time payment.

Social Security Goes Paperless & Gets Lean, Green & A Little Mean

It seems the Social Security Administration has given up its love affair with the post office and has found an electric new paramour. Two major changes are taking place with regard to how the SSA is reducing its costs…and its paper usage.

THE CHECK IS NOT IN THE MAIL

Prior to this month, anyone registering for first-time Social Security or Supplemental Security Income benefits had the choice between paper checks or electronic payments. Effective May 1, 2011, however, anyone who signs up has to choose among options for receiving funds electronically. There are three electronic payment alternatives:

1) Direct Deposit — This method, similar to the way most Americans now receive their wages, has some distinct advantages.

Speed — Payments appear in recipients’ bank accounts soon after midnight on the date of payment.

Convenience — There’s no need to go to the bank to deposit checks, delaying earning of interest or risking the lost or misplacement of a check.

Security — Social Security check fraud is minimized because ne’er-do-wells can’t gain access to recipients’ funds by mailbox-diving.

While direct deposit is not perfect, it’s generally a simple and secure way to receive benefit payments. When registering for new benefits via direct deposit into a bank or credit union account, be ready to supply your:

Financial institution’s routing transit number — That’s the first set of numbers, on the the bottom left of any check, bound on either side by the following symbol |: and looking something like |: 054000030 |:

Account number

Account type (checking or savings)

2) Direct Express is a MasterCard-branded debit card. Instead of mailing a check, the Social Security Administration deposits federal benefit payments directly into a recipient’s card account. The card, which looks like any other ATM or debit card, can generally be used to withdraw money at ATM machines or at the teller stations at banks or credit unions, to make purchases at retail locations, to get cash back with purchases (such as at grocery or drug stores) or to pay standard bills.

The advantages of Direct Express cards are similar to those of direct deposit:

Security — There’s no risk of lost or stolen checks, as the money is merely loaded into the Direct Express account, and thus, onto the card. The account itself is protected by the use of a 4-digit PIN (personal identification number). The funds in the account are protected by federal consumer regulation laws and are FDIC-ensured, just like funds held in a generic bank account.

If a user loses the Direct Express card and reports it promptly, the card (and the associated value) will be replaced for free. Additional replacements in the same calendar year cost $4, and an overnight delivery of a replacement card costs $13.50.

Ease of Use — Benefits (whether Social Security retirement benefits or Supplemental Security Income) are automatically posted to the Direct Express card account on a specified payment day each month. You don’t need to keep an eye on the mailbox.

Convenience — Since there’s no need to deposit or cash a check, you can skip the bank and avoid usurious check-cashing services. Direct Express cards can be used to make purchases anywhere debit MasterCards are accepted.

The Social Security Administration notes that signing up for the card is free, and that there are no monthly charges for using the Direct Express card. Other bank-like services provided for free include:

- Access to a toll-free customer service number or website 24/7/365

- Optional phone, email or text message notification of deposits

- Optional phone, email or text message low balance alerts when an account balance falls below a pre-specified level

However, Direct Express card network users are accorded only one free ATM cash withdrawal per deposit per month. After that, there’s a $0.90 surcharge for each additional ATM withdrawal. Other charges include:

$0.75 to have a paper statement mailed

$1.50 to have funds transferred from the Direct Express account to a bank or credit union account

$3.00 plus 3% currency conversion fee for each withdrawal via a non-U.S. ATM

3% currency conversion fee for each purchase/transaction outside of the United States

While the Direct Express program is safer and more convenient than paper checks, I would strongly encourage readers to opt for direct deposit. With direct deposit, the money is there in one’s bank or credit union account. There’s far less chance of theft or loss; if you lose a bank debit card, you can still write a check, but if you lose your Direct Express card, you’ll have to wait for a replacement to arrive, leaving you without access to your money for some number of days.

Direct Express is for those who don’t have traditional accounts at financial institutions. While I counsel against operating without a bank or credit union account, I understand that increasing bank maintenance fees are making it harder for everyone, and particularly those with low balances, to afford accounts. However, there are a variety of internet-only banks that provide ATM access, free checking accounts and low (sometimes $1) minimums. To find an account that suits your needs, check out the Checking & Savings tab at Bankrate.com and search via the “Find a Checking Account” menu.

3) Electronic Transfer Account (ETA) is a low-cost, federally-insured account through traditional financial institutions. The U.S. Department of the Treasury designed the electronic transfer account for recipients of federal benefits (including Social Security and Supplemental Security Income, veterans’ benefits, civil service or military wages or retirement benefits, and Railroad Retirement Board payments) who either do not have, or may not qualify for, a checking or savings account at a traditional bank or credit union. To find an ETA provider in your state, click on the ETA provider map.

Some of the features of an ETA include:

–A cap on fees at $3/month

–FDIC-insured funds

–No minimum balance (except in states where credit unions are legally required to enforce minimums)

–At least four withdrawals may be made per month

–A monthly printed statement at no charge

While ETA account-holders can make transfers and withdrawals, they cannot write checks.

For more information, call 888-382-3311 or review the ETA fact sheet.

NOT JUST FOR NEWBIES

Even if you currently get paper checks from the Social Security Administration, all of this information applies to you, too. Anyone still receiving payment by check will have to switch to an electronic payment method by March 1, 2013.

Why wait until the last minute? Visit the Go Direct website to get started.

THE BIG PICTURE

The change from paper checks to digital payments will save the Social Security Administration approximately $120 million in greenbacks, not to mention administrative labor. In addition, from the (environmentally) green perspective, the move is estimated to save 12 million pounds of paper over the next five years.

TAKING (AWAY) YOUR STATEMENT

While the elimination of paper checks is economically, environmentally and individually a positive one, another change isn’t quite as spiffy.

The Social Security Administration began mailing annual personalized statements to 125 million workers aged 25 or older in 1999, at an annual cost of approximately $70 million, according to SSA Commissioner Michael Astrue. (Statements had been available upon request and/or sent automatically to some groups of workers, as early as 1988.) In 2010, more than 158 million Americans received such statements, which have become an indispensable resource for gathering essential information about future retirement income and enabling personal financial planning.

In the past, I’ve blogged about the importance of maintaining and checking your Social Security benefits statements. Unfortunately, it looks like my advice will now be moot.

As of last month, the government has suspended mailing those paper statements. Normally, you’d receive your statement three months prior to your birthday, but as of April, the economy has forced the government to go digital. So, if you’re a July baby, you can stop checking your mailbox — there’s no statement on its way.

For now, at least, to get a baseline benefits estimate, users must go online at the Social Security Administration’s Benefits Estimator or call 800-772-1213. At the Benefits Estimator screen, enter your full name, mother’s maiden name, Social Security number, birth date and place of birth. It should go without saying that you should only use this estimator on a secure computer with a secure firewall enabled. Don’t even consider using a public computer, or using your own laptop on a public WiFi network.

Unfortunately, at least in the short term, we will all be missing some vital information, as the individual paper statements provided far more detailed information than the online Social Security Estimator tool can do. For example, our paper statements have always shown an individual’s lifetime earnings history and estimates of disability and survivor benefits, which the online estimator does not.

There are other problems. Younger workers, or any workers who haven’t earned the 40 work credits necessary to qualify for any sort of benefits payout, can’t access the online Benefits Estimator. While local Social Security Administration offices can provide printouts of the required information to workers who visit in person, this is neither a convenient nor long-term solution.

It is widely rumored that more robust online account information will be made available in the near future, hopefully by the end of this calendar year, and when more is known, I’ll be sure to report on it. Until then, the government is saving money, to the tune of approximately $30 million between April and September (which marks the end of the fiscal year). If, as planned, mailed statements are only resumed for workers 60 and older, the government can save additional $60 million in 2012 and annually thereafter.

Paper Doll wonders, however, what impact these missing statements might have on personal, rather than national, economies. Previously, paper statements acted as annual (and nagging) reminders to get to work on planning for the day when we wouldn’t go to work. Without a snapshot of where we stand, and a pesky tug on the sleeve to remind us to be concerned, how many of us might put off peering into the abyss of our financial futures?

Readers, please share your thoughts on these cost-saving, environmentally-friendly, but decidedly revamped Social Security Administration methods.

NAPO Expo 2011 Recap (Part 4): The Professor’s Coconut Radio

Recapping the NAPO conference and expo sometimes feels like the theme song from Gilligan’s Island. We’ve covered the millionaire (and his wife) and the movie star — our profession’s rock stars. The “I Feel Pretty” product reviews were certainly the Ginger and Maryanne of our industry. Then we talked about the good Goliaths, the big kahunas, the Gilligan & the Skipper of paper organizing (Smead and Pendaflex, or Pendaflex and Smead — let’s not take the metaphor too literally). Last week, I covered all the essential and nifty hanging things the castaways brought in their luggage and used to adorn the walls of their huts (though why they brought luggage on a three-hour tour has always remained a mystery).

While it would take the better part of a year to cover ALL of the vendors at the conference, there were three ingenious products that reminded me of the nifty inventions that dreamy Roy Hinkley  (what, you didn’t know that was the Professor’s real name?) came up with on the island.

(what, you didn’t know that was the Professor’s real name?) came up with on the island.

Today, I present you with the winners of the Paper Doll “Coconut Radio” Award for inventive organizing products, each of which, like the Professor’s creations, excels with regard to one or more of the following characteristics — they’re super-cool, technological or green (because, let’s face it, the Professor was all about natural products and re-purposing).

I rarely get giddy with excitement over organizing products, especially organizing products unrelated to managing paper. So, followers of my Facebook and Twitter posts suspected I was awfully intrigued by this next product. I couldn’t stop talking about my eagerness to see it in action after hearing about it from my colleague, Monica Ricci, who first reviewed Pliio at the 2011 International Home and Housewares Show in March.

Pliio is an organizing tool (or as the Pliio folks say, a clothing management system) that files your clothes. No, seriously. It helps you FILE your CLOTHES! How cool is that?

Pardon Paper Doll for gushing, but even with all my organizing skills in realms outside of the paper world, I’ve always envied the people whose drawers looked like the assistant manager at The Gap had just come through and tidied up. I’ve gazed longingly at the Flip-&-Fold style of laundry gadgets that let you fold each article of clothing to the same size. But until I saw Pliio, I didn’t realize what was missing…what I truly wanted was a magical tool for organizing clothes as if they were paper files!

Pliio is the brainchild of professional organizer Clare Kumar and industrial and graphic designer Yuriko Zakimi. Mechanically, the product is simple. A Pliio folding filer is a pad about the size of a small placemat, which is placed in the center of the article of clothing you wish to fold. You manually fold in the sides/sleeves to conform to the edges of the pad, and then fold the Pliio from one end to the other, essentially rolling the item like a soft taco until it is neatly arrayed in a package about the size of a woman’s wallet or a small clutch purse.

Then, fold your next article of clothing, and the next, lining up each vertical piece (with the Pliio remaining inside) next to the prior one, anywhere from a drawer (like a filing cabinet) to a shelf (like open filing at the doctor’s office) to a canvas sweater box (like a desk-top file box). I can definitely see it becoming a favorite for travelers seeking ways to consolidate space in luggage (as airline baggage fees continue to rise). But the best part of Pliio is that because you’re “filing” your clothing vertically, you can see each individual article of clothing, so nothing gets hidden or buried.

I initially imagined this would only be useful for filing t-shirts and polos, which would have been inventive enough, but Clare won me over at conference by showing how versatile the Pliio was for folding blouses and even dresses while keeping them wrinkle-free. (And don’t get my started on the too-cute-for-words mini-Pliio for folding baby clothes!)

To see the Pliio in action, take a peek at this video put together by my NAPO conference roomie, professional organizer and blogger Deb Lee:

As Clare says in the video, the system is designed to take you from piles of clothes to files of clothes. And what Paper Doll worth her salt wouldn’t love that?

The only downside? Pliio is not yet available in stores. Patience, Gilligan.

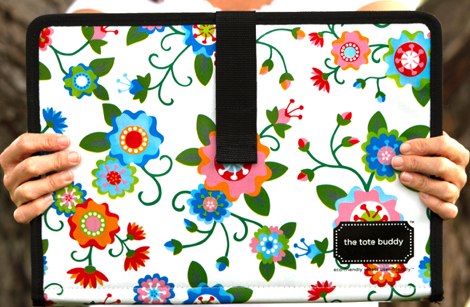

My first introduction to the The Tote Buddy name came at the start of this year’s conference, when we learned that our cantaloupe-colored conference tote bags were provided by The Tote Buddy. I mistakenly assumed the company made only environmentally-friendly grocery totes. Been there, done that, I thought, and relegated visiting the booth to the outskirts of my schedule.

Shame on Paper Doll!

Surely by now you’ve noticed that two decades of “paper or plastic?” have stepped aside, making way for “Will you need a bag or did you bring your own?” Even the least green among us are doing our part for the environment, carrying reusable tote bags to the grocery store and on errands in order to decrease the use of environmentally-unfriendly plastic bags and deforesting paper bags.

But it’s easy to forget to bring that bland black or grey tote into the store. Totes are generally branded with a store’s logo and are often not all that cute. And if you’re getting more than one bag’s worth of stuff, it’s unwieldy to carry a pile of totes at once.

The solution? The Tote Buddy, billed as the World’s First Reusable Bag Organizer, is a stylishly attractive tool for storing and carrying your totes, making it more likely that you’ll feel fashionable when carrying the totes…making it more likely you’ll enjoy using them…making it more likely you’ll actually remember to use them. Win! Win! Win!

The Tote Buddy people explain even better in their 6- (yes, six) second video how to get from having a mess of forgettable, unattractive bags to having a memorable, fashionable way to carry them:

The Tote Buddy is a portfolio-style case. Undo the Velcro fastener, unfold The Tote Buddy, and place your folded totes inside, with the handles facing out. Re-fasten the Velcro strap and use the totes’ own handles to carry the whole kit & caboodle. Using re-usable tote bags is good for the planet, and using a pretty carrying case is good for your mood.

The Tote Buddy measures 15 1/2″ W by 11 1/2″ H (when viewed with the spine facing downward), is made of 100% recyclable non-woven polypropylene with an adjustable Velcro closure, and comes in two styles, a lighthearted floral and a sleek black:

Each Tote Buddy holds up to ten totes and sells for $14.97. The Tote Buddy also sells spacious and attractive totes in floral and cantaloupe (OK, they call it orange, but PaperMommy can tell you how much I hate that color) for $7 and $3, respectively. Such selections ensure that your Tote Buddy handles are fashion-forward, as well.

I bet even the Skipper would get one for his Little Buddy.

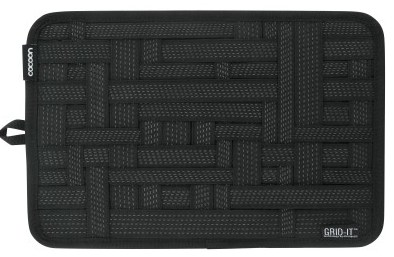

Newcomer Grid-It!, from Cocoon Innovations, was the geeky (in a good way) belle of the ball at this year’s NAPO expo. It even won the NAPO Organizers’ Choice Award for Best Technology Product! This is all the more intriguing because the Grid-It! isn’t made of metal or plastic, requires no batteries or chargers to power it, and doesn’t have any moving parts!

Grid-It! is actually an organizing system for providing practically endless configurations to hold all of your digital devices, accessories and personal items in place. (How many configurations? Try the game to see for yourself.)

The design of Grid-It! is simple, yet brilliant. There’s a flat mat or pad-like base covered in rubberized woven elastic bands for firmly holding items in place…or, in the words of Cocoon Innovations, it’s an “object retention system for gadget organization.” Because of the vertical and horizontal placement of the elastic bands, you have a versatile array of possible configurations which can change easily, depending on what you’re trying carry with you. (The back can even double as a mouse pad!)

Whether you’re high tech or low tech, have iPads or doo-dads, there seems to be a useful Grid-It! solution. Instead of a purse, backpack, messenger bag or briefcase with a sea of gadgets and essentials swimming at the bottom, Grid-It! lets you configure your own pegboard-style layout for your Blackberry or iPhone, iPod, hand-held game, wireless mouse, ear buds, USB cords, memory cards, chargers for your cameras and phones, flash drives and more.

If you’re low-tech (or just need to carry some low-tech items along with the others), attach sunglasses, lipstick, business cards, chewing gum (unchewed and still wrapped, please), hand sanitizer, batteries, etc. And Grid-It! can be used just as well for office or school supplies, tools (a boon for professional organizers or computer repair specialists)

and even cosmetics.

and even cosmetics.The Grid-It! isn’t just for everyday use carting around the essentials (and luxuries) of modern life. Imagine how much easier it would be to unload your airline carry-on for hand inspection when everything is attached to one rubberized pad.

There are multiple varieties of Grid-It!, from a tiny 7″ W by 5″ H grid for $9.99 to progressively longer and/or wider versions, up to the 15″ W by 11″ H luggage accessory style for $29.99.

They also make one with three metal-reinforced holes for storing in a three-ring binder and a sun visor Grid-It! for keeping your car organized.

The standard Grid-It! is black, although some sizes and styles come in alternate colors, including ![]() High Rise Gray, Royal Blue, Racing Red and Blush Pink.

High Rise Gray, Royal Blue, Racing Red and Blush Pink.

The only negative thing I can say about Grid-It! is that I didn’t get one. The guys had them on display at their booth the night before the conference officially started, and by the time I meandered over to them on Thursday morning, they’d been picked clean of all their sample giveaways. (They did, however, offer a plethora of Juicy Fruit gum and Tic-Tacs, two items they’d been using so show the Grid-It!’s versatility.)

The Grid-It! certainly will help you keep essentials close at hand better than Gilligan’s tree sap pancake syrup boat glue!

Ah, the Professor. So, he could build a nuclear reactor out of sand and palm fronds but couldn’t fix a three-foot hole in the side of a boat? Can you imagine all he could have accomplished, if only he’d ever been to a NAPO conference and expo?

NAPO Expo 2011 Recap (Part 3): Sharing Some Hang-Ups, or Cool Vertical Storage

Hanging around this year’s NAPO expo, I noticed a decided theme: hanging around!

HANGING CHADS

Who voted for annoying plastic hanging folder tabs? Heat, direct sunlight and age discolor them and make the tabs brittle. The “paper” cuts they yield are on par with those from a file folder. (Ouch!) They’re awkward to put in place, and every time you want to change the label, you must remove the old one and find the set of spare perforated labels.

Recently, there’s been a move towards built-in hanging-file tabs. Pendaflex came up with Ready-Tab Reinforced Hanging File Folders with pre-attached

reinforced polylaminate clear tabs. The tabs are build-in to the folders and pre-set in three or five tabbing positions for letter-sized hanging folders and six positions in legal sized. The tabs merely fold up into view and snap into place, so there’s no searching for lost plastic tabs, nor any struggling to position tabs into place. It’s an elegant solution that eliminates those annoying hard plastic tabs everyone hates. However, if you’ve got sausage fingers like Paper Doll‘s, you’ll still struggle to label and insert the tiny perforated papers into the little sleeves.

Pendaflex’s ReadyTab Reinforced Hanging Folders come in boxes of 25 olive green, blue, yellow, orange, red, bright green and violet and assorted colors (all of the previous except olive and violet) and in boxes of 20 in pink in support of the Breast Cancer Research Foundation.

Meanwhile, Smead created FasTab Hanging Folders with 1/3 cut oversized, reinforced labeling  surfaces that look like jumbo manila folder tabs–they’re 20% larger than standard non-hanging folder label tabs. You can’t lose the tab because it’s all part of the folder, there’s no plastic involved, and there’s no struggling with those flimsy inserts.

surfaces that look like jumbo manila folder tabs–they’re 20% larger than standard non-hanging folder label tabs. You can’t lose the tab because it’s all part of the folder, there’s no plastic involved, and there’s no struggling with those flimsy inserts.

However, there’s a limit to how many times the tab can be relabeled without losing aesthetic appeal, particularly if you tend to hand-write labels, whether with a pencil, pen or Sharpie. Plus, if you prefer using a label maker and affixing label tape, one imagines the structural integrity of the tab will have an only slightly longer life than that of a typical internal folder, unless you plan to layer label upon label as categories change.

FasTab Hanging Folders come in boxes of 20 moss, red, yellow, green, or blue and in boxes of 18 assorted colors. For those who prefer uniformity, they also come in boxes of 20 right-tab-only folders, in moss.

Both of the Big Guys’ solutions seek to reinvent the hanging folder, but a newcomer to this year’s expo reinvented the filing tab, itself.

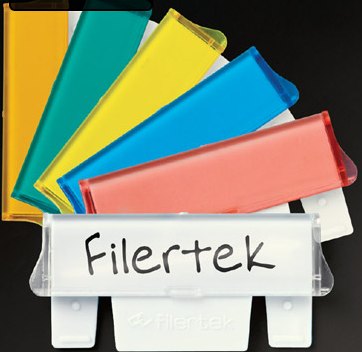

Filertek Dry Erase Hanging File Tab, from Australia’s The Pencil Grip, Inc., is a new plastic hanging file tab with its own patented built-in writing surface. It obviates any need to keep track of those little perforated labels onto which it can be so hard to write.

With Filertek, you write directly on the tab with a dry erase pen, flip down the little visor-like cover (available in clear or assorted colors) and click it closed. Then, attach to hanging folders as normal. To reuse, simply flip the cover up, wipe the tab clean and create a new label. Lather, rinse, repeat.

Paper Doll likes the fact that the tabs aren’t made of that sharp, awkward stuff used for traditional plastic tabs. However, it is still plastic, so for those of you trying to answer the paper vs. plastic question for yourself, I can only suggest that these tabs will remain both aesthetically and functionally pleasing for longer than the traditional tabs. Of course, those icky tabs are free with the purchase of traditional hanging folders, while Filertek involves an additional purchase.

Filertek comes in packages of five color tabs, as well as packages of one dozen tabs and 50 tabs (white or assorted colors), each with a special odor-free, black Filertek dry erase pen.

HANGING ON FOR DEAR LIFE

The Get It Together Life In a Box was created by Hallie Hawkins, an attorney, and Shay Prosser, a financial planner. In the past, vendors have displayed numerous boxed hanging file systems at the NAPO conference. The main difference with this system is the expertise of the two women who have created a company centered around providing independent legal and financial education.

Their workshops and mentoring programs focus on subjects like credit report review and cash flow analysis, retirement and estate planning, understanding benefits, avoiding identity theft, and legal planning. From this, they developed a tangible system for handling the essential documents of life: birth and death certificates, wills, emergency information, insurance policies, car titles and property deeds…and all of the other VIP (Very Important Papers) we talk about here on a regular basis.

Life in a Box includes:

- Life in a Box Guide — This is a guide to the legal and financial reasoning behind the Life in a Box system, particularly useful for those attempting to organize their personal documents and information for the first time, perhaps without the assistance of a professional organizer.

- How to Get It Together — Today!, a 50+ page book of advice on financial and legal issues ranging from handling cash flow to estate planning.

- 30 labeled hanging file folders for maintaining financial and legal records — This system is pre-labeled with the specific document types one might forget. Thus, instead of an umbrella folder for legal documents, the system specifies will, Power of Attorney, Health Care Directive, etc. so that users can identify which specific legal or financial documents may be missing.

- A sturdy box for safely storing the paperwork

Pricing depends largely on the box type or system level selected, with price points ranging from $50 to $175. The basic Life in a Box uses a sturdy plastic file box with a flip-top lid, while the Executive version comes in a brown leatherette box with a velvety interior. For more security, the Life in a Box SuperSecure is housed in a black Vaultz cabinet with a combination lock, while the Fireproof SuperSecure includes a light grey Sentry-brand file box, fireproof up to 1550 Fahrenheit.

There’s also an Out of the Box version of Life in the Box for those who want all of the information and pre-defined folder labels but intend to store the information in their own pre-existing filing cabinet or storage system.

The physical system for the Life in a Box is not new, of course. It’s a container, file folders and labels — just like those we’ve reviewed previously. However, the added elements, including the financial and legal information provided by experts in their fields, are a novel twist.

HANGING OUT IN STYLE

Gear Pockets and Simply Stashed, under the Christy Designs umbrella, don’t make products for organizing paper, but last year, after I shared my delight about them with my newsletter readers, I realized they were too good to keep secret. And let’s face it, if you’re organized, you’ll save those little green pieces of paper.

When I first heard about Simply Stashed, it was described to me as being “like an over-the-door shoe organizer, but prettier and kinda cool”. To be honest, there’s a lot I could (and will) say about this aesthetically-appealing tool for vertical storage, but that description really hits the high points.

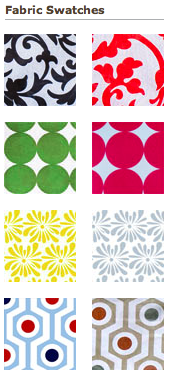

Each Simply Stashed is fully lined with eco-friendly fabrics for easy cleaning and double-stitched with transparent pockets in a variety of sizes, depending on the model chosen, with a charming selection of colors and patterns, including florals, dots, petals and geometric shapes:

The Original Stash is 19″ wide by 52″ long, running almost the full-length of a door to maximize vertical storage space without using up limited depth of space. All twenty pockets are identically sized and placed in five rows of four clear pockets. It’s suitable for storing everything from children’s clothes to accessories (belts, hosiery, etc.) to outerwear items (hats, gloves, scarves, etc.). The Variety Stash, pictured above (right), measures similarly, but has 14 differently sized pockets, to enable you to store items of mixed sizes, like school supplies, crafts, and more.

One of my clients installed the Original Stash inside a hall closet and used it to store a cornucopia of modern electronic supplies: chargers for cell phones, cameras, and video cameras, extra chargers and supplies for e-readers, tablet computers, handheld video games and more, plus battery packs for various devices. With each pocket labeled, there’s never any question as to whose device is where.

There’s also a Mini-Stash, 19″ wide by 36″ long, suitable for smaller spaces (like dorm rooms, small offices, and bathrooms) that can store jewelry, hair and other beauty accessories, or baby supplies tidily. There are five rows of three pockets, each, with the center column pockets slightly wider than the outer, flanking, pockets.

The Original and Variety run $29.95; the Mini is $26.95.

Gear Pockets, the sturdier “brother” line, is suited for garage, mud room and utility room storage of sports paraphernalia, gardening tools and “tough guy” stuff. Made of heavy duty 600 Denier polyester, with gussetted, industrial strength mesh, the 26″ wide by 48″ long Gear Pockets have rust-free stainless steel grommets positioned at 16″ and 24″ (to align with studs) and come with mounting hardware. Gear Pockets come in three styles — the Organizer and Sportsman styles, below,

To receive a 10% discount on Simply Stashed or Gear Pockets, use the coupon code BESTRESULTS at checkout. (In the interest of full disclosure, as a member of the affiliate program, I’ll get brownie points if you make a purchase using that code. But hey, you get 10% off just for being a Paper Doll reader!)

Next week, we’ll finish our look back at the 2011 NAPO expo with intriguing, creative products that are just what you never knew you wanted!

Follow Me