Paper Doll’s Tax-Smart Organizing Tips: 2021

Photo by Khaosai Wongnatthak at Vecteezy

I know this will be hard to believe, but “doing” your income taxes does not have to be painful. (Paying your taxes is another issue altogether.) The key to succeeding is, no surprise, getting organized — knowing what information you need, what specific forms to expect, and having it all ready when the questions are asked.

Today’s post will give you some guidance regarding what you need to organize to get your taxes completed. But first, you should be aware of some important news regarding preparing your 2020 tax return.

TAX NEWS YOU CAN USE TO KEEP ORGANIZED

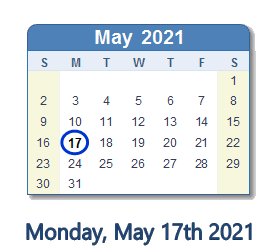

Tax Deadline Changed

Most years, Tax Day is April 15th, give or take a day for weekends or special holidays. (For example, in 2023, April 15th falls on a Saturday, so Tax Day would normally be April 17th, the following Monday. However, that’s Patriots’ Day in Massachusetts, Maine, and several other states, so Tax Day will be April 18, 2023, nationally.) In 2020, due to the pandemic, the IRS moved the federal Tax Day forward to July 15, 2020, and most states delayed their tax filings, too.

Last week, after leaving people guessing for several months, the IRS announced that Tax Day 2021 has been delayed one month to Monday, May 17, 2021.

Note: this extension only refers to individual tax returns; federal estimated quarterly payments and other federal tax deadlines haven’t changed. Thirteen states have already changed their tax deadlines to May 17, 2021, with more considering a change, so please consult your own state’s revenue department websites for up-to-date information in your state.

I encourage you to pretend that the IRS did not delay the date, and use this as an opportunity to set up small blocks of time, even 20 minutes each evening over the course of a week or so, to gather your resources. If you work on your taxes in small chunks of time, bit by bit, it won’t seem so overwhelming. Again, once you have all the information, it’s just about being able to answer the questions.

Unemployment Funds “Bonus”

Did you receive unemployment benefits during 2020? (You should have a 1099-G if you did!) Many Americans did, including self-employed individuals who had never been able to collect unemployment previously. Often, people are so relieved to receive these funds that they do not consider that unemployment payments are taxable and they do not opt to have taxes deducted, assuming (or hoping) that by April of the next year, their financial fortunes will have improved. This can be problematic even when there isn’t a global pandemic going on!

If you did not think about paying taxes on that compensation, there’s a little good news. Although it’s really rare for this kind of retroactive relief, as part of the American Rescue Plan of 2021, the first $10,200 of unemployment benefits earned in 2020 will not be taxable for people with incomes of less than $150,000.

Last week, most of the online tax preparation companies updated their software to adjust for this. If you started doing your taxes weeks or days ago but didn’t finish, when you log in you may be surprised to see that your amount owed is lower or your refund is higher. Whoohoo!

Nick Youngson via CC BY-SA 3.0 Alpha Stock Images

Are you Old School? Do you do your taxes on paper? The IRS has released instructions and a worksheet for taking advantage of that $10,200 exclusion for unemployment compensation. (Cheatsheet: you’re going to focus on line 7 of your 1040!)

What if you already filed your taxes? You may be thinking that you’ll have to file an amendment to your tax return in order to get money refunded to you. Not so fast! Hold your horses!

The IRS has stated that individuals who have already filed their returns and who paid taxes on their unemployment benefits (either through them being taken out by their states or on their recently-filed returns) should NOT amend their returns. Rather, the IRS will be recalculating those returns and money will be refunded to individuals by direct deposit or check, depending on their circumstances.

Again, for those of you in the back, still high-fiving about this income not being taxable: the IRS will automatically process refunds to account for the first $10,200 in unemployment benefits! Don’t amend your taxes for this!

Stimulus Not Taxable

You may have received a federal stimulus check in 2020, $1200 for each individual under a certain income threshold plus $500 for each dependent child. Your stimulus payment is NOT taxable. Why? Because, due to the way the law was written, stimulus checks are not considered “income.” Rather, they are advance payments of a tax credit, and tax credits aren’t taxable income.

However, if you were eligible but did not receive your stimulus check, you will be able to report that fact on your return to apply it toward your taxes owed or refund due. You do this by claiming the Recovery Rebate Credit. Your accountant or tax software will know how to handle this, but keep your eye on line 30 of your 1040 form. (Do you like reading the nuts and bolts? Check out page 58 of the IRS tax instructions for the Recovery Rebate Credit worksheet.)

Earned Income Tax Credit (EITC) Option

Those of you who earned less in 2020 than in 2019 (and that includes a lot of people) have a delightful surprise awaiting you. When doing your 2020 taxes, you have the option of using either your 2020 or 2019 income to calculate your Earned Income Tax Credit.

Special Forms for Seniors

Are you a senior? As of last year, if you are over 65, instead of filing the standard 1040 form, you can file the 1040-SR. The main benefit is that this form, when printed, uses a larger font and provides easier readability.

New Kind of 1099 for Freelancers

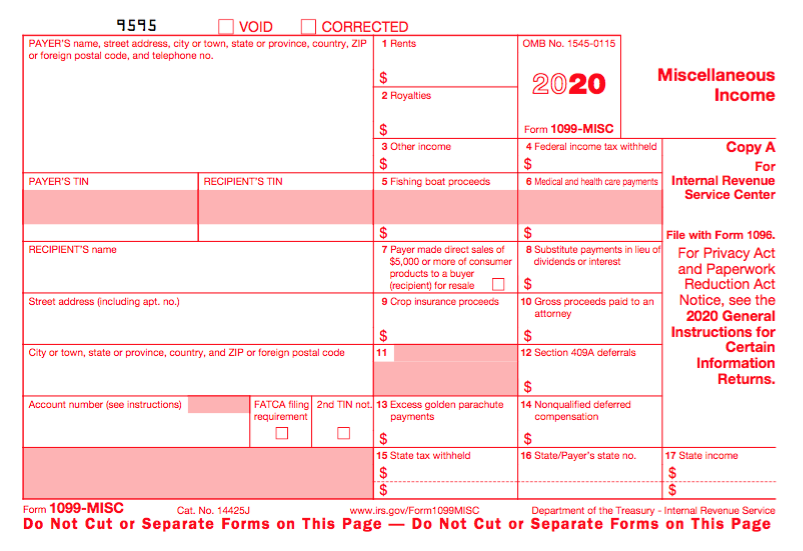

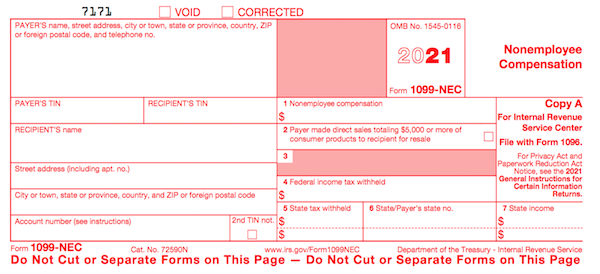

In the past, freelancers, independent contractors, and similar non-employees received the 1099-MISC — you know how organizers feel about a “miscellaneous” category! This year, there’s a new form, the 1099-NEC for non-employee compensation. (See below for more on this new form.)

Photo courtesy of Chris Potter/CCPix at www.ccPixs.com under CC 2.0

KNOW WHAT YOU SPENT

The best time to get ready for doing your taxes in 2021 was back in early 2020, but something tells me you were a little distracted by world events and trying to buy toilet paper. To file your taxes for this most wackadoodle of years, you’re going to have access a lot of information about your 2020 spending, like:

- receipts for tax-deductible purchases (check for paper receipts as well as email confirmations of purchases)

- statements for ongoing accounts

- an online financial dashboard (like Quicken, Mint, Personal Capital, or YNAB)

If you made a lot of Amazon purchases this year (and really, who didn’t?), especially if you are self-employeed and can expense office supplies and other work-related items, you can select “2020” from the drop-down section under Your Orders in your Amazon account; digital orders (such as for educational materials) have their own drop-down, three tabs to the right. To download your entire Amazon order history, go to the Amazon Request My Data page.

Gather all your tangible information in a folder labeled Tax Prep 2020, or use something like the Smead All-In-One Income Tax Organizer. Just having it all together will be the first step toward tabulating the correct amounts.

GATHER YE FORMS

Of course, most of the big-ticket items you’ll be entering into tax software (or, gulp, on paper forms) comes not from the little receipts and statements you get during the year, but from the official forms you receive.

It all starts with the supporting documents called information returns. These are sent to you by others – employers, banks, brokerage houses, schools, casinos, and others. The law requires these entities to send them to you by February 1, so you shouldn’t have to do much searching. They should have shown up in your mail. So that scary-but-official mail you threw on top of the microwave the week before Valentine’s Day? Move the oven mitts and get looking!

MONEY YOU RECEIVED

W-2 (Wage and Tax Statement)

Did you have an employer in 2020 (even for part of it)? Then you should have received a W-2. Your employer is supposed to send one copy to you and one to the IRS, reporting how much you were paid (in wages, salaries, and/or tips). If applicable, it should also indicate how much money was withheld from you and paid to federal and/or state governments for taxes and FICA (Social Security and Medicare).

Federal, state, and local taxes, FICA, unemployment insurance, and a few other withholdings are considered statutory payroll tax deductions. Statutes (that is, laws) require them. Duh!

Sometimes, a court might rule that an an employee’s wages may be garnished, but this has nothing to do with sprigs of parsley. People behind on child support payments or who owe money in lawsuits may have money removed from their earnings, before it ever gets to their paychecks, to ensure it goes directly to whomever is owed.

Your W-2 may also report voluntary payroll deductions. These are amounts withheld from your paycheck because you’ve granted permission. These may include your portion of health and life insurance premiums, contributions to your 401(k) or other retirement fund, employee stock purchasing plans, one-time or ongoing donations to the United Way, union dues, etc.

Photo by The New York Public Library on Unsplash

You probably got multiple copies of the same W-2. Employers submit copy A directly to the Social Security Administration (remember that FICA we talked about?) and keep copy D for their own records. Copies B and C are for you (the employee) – you send one to the IRS with your federal tax return and keep one for your own records. Then, copies 1 and 2 are provided to file with any applicable state or local tax authorities. (I’ve never figured out why W-2 copies 1 and 2 aren’t called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, FF, and G, skipping E entirely?)

I've never figured out why W-2 copies 1 and 2 aren't called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, and G, skipping E entirely? Share on XIn theory, a W-2 should be mailed to the address listed on your W-4. (Don’t be confused. The W-4, is the form that tells your boss how much to withhold based on your number of dependents you have an any necessary adjustments.) Many smaller companies don’t bother mailing the W-2 and just hand them to you, but given how many people are still working from home and how iffy the postal service has been (cough, cough), you might have to Zoom or send an email to Madge in HR. Some things to consider:

- Did you change employers last year? You should have received W-2s from each employer. (If you changed jobs at the same company, you’ll receive one W-2 from each employer, not one per position. If you changed companies within a larger corporation, though, you may get one for each.)

- Did you change addresses since you filled out your W-4? There’s only so much a former employer will do to track you down to give you your W-2. Keep the boss updated!

Don’t assume that if you don’t have your W-2, then nobody knows what you made. Remember, the IRS got Copy A. The IRS knows what you made, so be sure you do, too! (If your former company went out of business or is otherwise not returning your calls, possibly due to COVID weirdness, the IRS has a procedure to allow you to file your taxes in the absence of a W-2.)

Examine your W-2 it carefully. Do the numbers seem right? Compare them to the final pay stub you got for last year. Calendar years usually end mid-week (and sometimes, mid-pay period), so the numbers won’t correspond exactly, but they’ll be close enough for you to spot if something is seriously wrong. The sooner you call your employer’s attention to an error, the sooner you can prepare your return.

W-2G (Certain Gambling Winnings)

The W2G is the freewheeling cousin of the W-2. While a W-2 is for money you make while working, the W-2G is what you get while playing. If you win more than $600 in any gambling session at a casino – whoohoo! – the “house” should request your Tax ID (generally your Social Security number) and either prepare a W-2G on the spot or send it to you in January.

Casinos aren’t interested in keeping up with your losses, just your winnings, so they only tell the IRS about what they paid you. If you do go gambling and want to deduct losses, the IRS requires you to be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses.

(And yeah, all of 2020 did seem like a gamble. You’re right.)

1099s (Income)

A 1099 is a form that basically says, “Hey, we paid you some money for something, but you weren’t an employee.” You get a copy; the IRS gets a copy. Easy-peasy.

There’s not just one type of 1099; actually, there are a whole bunch of 1099s. Some of the more common are:

Got a bank account? This form reflects the interest income you receive from interest-bearing savings and checking accounts, money market bank accounts, certificates of deposit, and other accounts that pay interest. It also notes whether foreign or U.S. taxes were withheld and if there were any penalties assigned for early withdrawal from an interest-bearing account. Internet-only banks often require you to log into your account to get your 1099-INT, so don’t count on it coming by mail. If you received less than $10 in interest, your bank may not send a 1099-INT.

Do you own stock or other taxable investments? This form indicates the dividends or capital gains you received as an investor. Your broker, plan services company, mutual fund company or other type of investment company will send this form. Not all dividends are created equal; ask your tax professional if you have any that seem unusual or complicated. Whether you receive dividend checks or your dividends are held in a DRIP (a direct re-investment plan), if you did not earn at least $10 in dividends, you are unlikely to receive a 1099-DIV.

This form is subtitled “Certain Government Payments” and can cover everything from state unemployment compensation to tax refunds, credits, and offsets at the state and local level. It can also be used to report payment of taxable grants, agricultural payments, and other nifty things where a state or local government gives you money.

1099-NEC (NEW!!!)

As noted above, this is a new form designed to take some of the weight off the 1099-MISC (see below). If you’re self-employed (a freelancer, an independent contractor, etc.), you should get a 1099-NEC, starting this year. However, people are unfamiliar with this form and may still send you 1099-MISC until the 1099-NEC is more widely known.

Another problem is that even if someone paid you for doing work as an independent contractor, they may not know they should be sending you a 1099-NEC. So, if you are self-employed or irregularly employed, it’s essential to keep track of your own incoming revenue. Otherwise, if the person who paid you ever gets audited, it could trigger some messy situations for you, too.

Now that this form no longer covers all the different forms of income for freelances and independent contractors, it is truly more applicable to call it “miscellaneous.” It will generally be used to report payment of royalties, broker payments, certain rents, prizes and awards, fishing boat proceeds (yes, really!), crop insurance proceeds, and some payments to attorneys that wouldn’t be reported on a 1099-NEC, like if you received a settlement and were required to pay an attorney a portion of it. In general, once people get used to the 1099-NEC, you’ll only get this miscellaneous form to report truly miscellaneous payments.

SSA-1099 (Nobody knows why the numbers and letters are reversed on this one form! It must be done by the same people who label the copies of W2s and bra sizes!)

If you receive Social Security benefits, you should receive an SSA-1099 or an SSA-1042s, the latter being for non-citizens who live outside the United States but receive benefits. (For example, widows or widowers who are receiving spousal benefits.) The 1099-SSA tends to come on a long form, folded and sealed such that it makes its own envelope.

A 1099 doesn’t always indicate that you were literally paid money. For example, a 1099-C indicates that a party has forgiven a debt, like a mortgage or part of a credit card balance. You may owe tax on forgiven debts, and the 1099-C alerts the IRS that since you didn’t pay money owed, and got to keep it in your pocket, it’s as if you received money.

Your 1099s sometimes hide in plain sight. Occasionally, instead of sending a 1099 in a separate envelope, a bank or brokerage house may include a 1099 form in the same envelope – sometimes perforated, at the bottom of a quarterly or end-of-year financial statement, so be sure to check all that boring-looking official mail that arrives. Multiple forms may be sent as a “combined 1099,” scrolling across multiple pages, so check the reverse of other forms, in case you seem to be missing one.

MONEY YOU PAID

1098 (Mortgage Interest)

A 1098 is not a 1099 with low-self-esteem. The vanilla, no-frills 1098 reflects the interest you paid on your mortgage, which is generally deductible on your federal taxes. Renters don’t get 1098s; neither do homeowners who’ve paid off their mortgages.

There are also sub-types of 1098s for things other than interest on property loans:

- 1098-T indicates tuition you paid; you’ll get this from a college or training school.

- 1098-E shows you’ve paid interest on a student loan and will come from your lender.

- 1098-C indicates the donation value of a car, boat or airplane.

Photo by Diego F. Parra from Pexels

1095-A (Health Insurance Statement)

The 1095-A is also called the Health Insurance Marketplace Statement. We are all generally required to have health insurance. If you purchased yours through a state or federal exchange, this document helps you determine whether you are able to receive an additional premium tax credit or have to pay some back.

Related forms include the 1095-B (supplied by companies with fewer than 50 employees), detailing the the type of coverage you had, the period of coverage, and your number of dependents, so you can prove you had the Minimum Essential Coverage (MEC) required by law. A 1095-C is similar, but for employers with more than 50 employees.

FINAL THOUGHTS

While I spelled out the most common ones, there are other, less common, information returns. If you receive a mysterious form, or have questions about how to use a form, the IRS has a surprisingly easy Forms, Instructions and Publications Search. Also, I am a Certified Professional Organizer, not an accountant, so please address any concerns to your friendly neighborhood tax preparer.

Making sure you have all of the necessary forms in hand will make it much easier to prepare your tax return. Once you have filed your taxes, make a list of all the forms you received this year, and tuck that list into your tickler file for next January. Check off each form as it arrives, and you’ll have a better sense of when you’ll be ready to start working on your 2021 taxes in 2022.

Honestly, reading this post makes my head spin. Every time tax season rolls around, I think it needs a good professional organizer to come in and overhaul the whole thing. It seems way too complicated to me! I am thankful to have an accountant to help me, but even so, as you say, I need to be organized and stay on top of things. Thanks for sharing this!

LOL. I think these things, similar to health insurance paperwork, seem complicated, but they’re not. If you can play a board game like Monopoly, handling cash, dice, and top hat (or race car!) or pay your monthly bills and handle the statements, your online checkbook, and your register (yes, I still use a checkbook register!), this is the same thing.

And it’s just like the organizing you do every day — collect, sort, purge, contain. Once this is all done, it’s only the math that’s hard, and I don’t encourage ANYONE to do that on their own. 😉

I’m one of the odd ones that actually enjoys preparing all the papers and summaries to give to our accountant. In another life, I might have been an accountant. But frankly, I prefer to pay someone to handle our returns, especially because the tax laws constantly change. I love hearing about the changes in tax laws and especially those that might benefit us.

You detailed the information out really well- no surprise, my friend. And while you mentioned this was another LONG post, it seemed shorter than I expected. Maybe that goes back to my fascination with taxes.

Years ago, I switched from doing things manually to tracking everything with Quicken. It makes tax prep time SO much easier and faster. I keep a folder for each tax year. As forms come in, I drop them in there, so when it’s time to pull everything together for our accountant, I don’t have to go hunting down the “goods.”

You and I are a lot alike in this regard. I have one folder into which all the tax-related papers drop. I don’t use cash unless I’m traveling, so 99.9% of my financial transactions shows up in Mint, and I check the categorization weekly to make sure everything is accurate, and try to remember to do “splits” if I’ve purchased something where the receipt covers two categories. (Yes, at tax time, I have to fix anything the system automatically got wrong, because my pharmacy is in a grocery store, and those can be conflated.)

And I’m glad it didn’t seem too long; 3200 words! Thank you for reading and being so supportive!

I love the puzzle of doing my own taxes, so this post will be cozy bedtime reading for me to make sure I haven’t missed anything! On point with the form labeling: “I’ve never figured out why W-2 copies 1 and 2 aren’t called E and F. Did the same person who came up with this decide that bras should be sized as A, B, C, D, DD, DDD, F, and G, skipping E entirely?”

The first part (news) is the exciting stuff. The short second part is an aside on organizing — I should do a blog post just on that after tax time to help people get ready for next year. The third part, all those forms, is a long-standing post I’ve revisited every few years, but the new 1099-NEC is the big news, as we’ll be seeing that a lot more!

And seriously, why are there no size E bras?

Great stuff! I help my small business clients with bookkeeping, so I get how complicated it is. Lucky for us that most of the time, the IRS systems do not change, so when you get it once, you do not need to learn it again.

The last few years have been a whirlwind of changes, and people need to stay on top of their own situation to make sure no mistakes happen. I find that taking notes on the notices and placing the papers all in one area throughout the year helps for end-of-year preparations.

Thanks for sharing this information.

Thanks for reading, Sabrina! And you’re right, the last few years have seen LOTS of changes. I’m excited about how many people are being helped by the recent changes, but I bet it’ll be a while before people feel like they’ve absorbed it all.

This is great and timely information. I haven’t done my taxes yet, so I was happy to learn of the unemployment benefits bonus, but I learned that I could have already filed and I wouldn’t have had to refile. I also looked up my state’s decision on the filing deadline. Thanks for all the info.

I hope you get happy surprises when you finalize your taxes, Janet! And yes, it’s a relief, I’m sure, to many Americans who filed as soon as possible that they’ll be getting some of that money back! Thanks for reading!