Paper Doll Bids a Wistful Farewell to Savings Bonds

It’s the end of an era. Last week, the Bureau of Public Debt announced that effective January 1, 2012, financial institutions will no longer sell paper savings bond certificates. This move is in alignment with the U.S. Department of Treasury’s initiative towards all-electronic transactions, as announced in April 2010.

It’s estimated that eliminating “over-the-counter” paper certificate sales will save $70 million over the course of the next five years. Indeed, as of December 31, 2010, the government had already stopped selling paper savings bond certificates through payroll deduction plans, so this was the logical next step. The combined elimination of payroll deduction sales and individual OTC sales is predicted to save $120 million over the next five years.

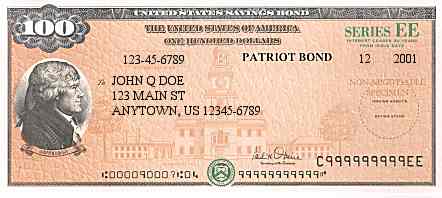

Of course, savings bonds themselves aren’t being eliminated — just the certificates. You’ll still be able to purchase bonds though the TreasuryDirect website. You just won’t be able to roll them up, tie them with ribbon and present them as gifts to your loved ones. You won’t be able to hoard them in your bedside drawer or roll around on a pile of certificates (not that Paper Doll would want to hear about it if you did.) You can still invest, but there’s no more pomp or circumstance about it.

U.S. Public Debt Commissioner Van Zeck recently stated, “Savings bonds are very much a part of this country’s history and culture, and will remain a part of America’s future – but in electronic form…It’s time for us to take a 1935 model and make it a 21st century investment tool….Investors will no longer have to worry about misplacing, losing or storing paper savings bonds.”

While that’s true, investors may now have to worry about misplacing password-protected account cards or slips of paper onto which they’ve written their bond numbers, or about web fraud. But it might be argued that, collectively, we’ll be losing something else, as well.

KEEPING THE NATION’S BOOKS

The elimination of paper certificates saves the government space (for storing savings bond certificate stock and other tangible resources), expenses for tangibles (ink for printing, certificate paper stock, postage, and envelopes), and fees paid to banks and credit unions for processing bond applications. Financial efficiency is a good thing.

It’s uncertain, though, what kind of impact the change will have on sales of savings bonds. It’s been reported that sales rates for savings bonds have decreased 53% since 2001, and digital sales accounted for only 11% of the $1.2 billion in savings bonds purchased from October 2010 through June 2011.

Maybe most consumers didn’t know they could purchase bonds electronically, but with 89% of purchases in that period being paper certificates, one has to wonder whether going digital might dramatically decrease the number of people buying savings bonds overall. It depends on whether they’re buying them for inflation-hedging investments or more ineffable qualities.

THE SENTIMENTAL VIEW

Great-Grandma and Great-Grandpa, who probably still revel in the ritual of going to their bank branches to purchase saving bonds for the newest acorn on the family tree, will have a few options. If they’re web-savvy, they can use TreasuryDirect; if not, perhaps their kids or friends will help them pursue the online process. Or, more likely, they’ll get a crisp $50 or $100 from Ye Olde Bank and skip buying savings bonds altogether.

And it’s not just the older generation. While I-series bonds currently have a nifty 4.6% return, EE-series bonds, at 1.1%, don’t exactly yield exciting returns on investment. Then again, people don’t buy them, at least as gifts, solely for the ROI. People also give savings bonds because of the old-fashioned visual and tactile appeal.

As a professional organizer, I’m happy about the increased efficiency and reduced costs. And yet, as Paper Doll, I’m a little melancholy at the shuttering of yet another lovely, old-fashioned tie to the past. Sure, I’d long since gotten used to the idea of “book entry” (i.e., digital) stock ownership in lieu of having actual stock certificates. Somehow, keeping tangible stock certificates around made me feel a bit like Scrooge McDuck, hoarding my gold! But savings bonds?

Savings bonds have always brought to mind a semi-antiquated but memorable way to deliver a gift spanning time, from past to present to future. I received savings bonds upon my birth and bat mitzvah, and have blogged previously about how my college crowd has made it a tradition to collectively give savings bonds when anyone in our group gives birth or adopts. When I purchased my first car, the bulk of my down payment came from bonds issued in 1967, and before cashing them in, I took time to read the old typefaces on the certificates and the sprawling handwriting styles on the accompanying cards’ sweet, optimistic messages.

OTHER CLOUDS ON THE HORIZON

For investors, the situation is somewhat dependent upon how smoothly the transition works. The old Legacy Treasury Direct system whereby investors could purchase and redeem Treasury bills and other securities by telephone or mail is also being phased out in favor of an all-digital plan, but has been fraught with glitches and marked by complaints from older investors.

In addition, two other practical issues are in play. First, the TreasuryDirect web site, although improved, is still not as fluid or intuitive an interface as, say, Google. It can be clunky. Also, there’s growing consumer concern about hacking and web fraud. Even if the interface is improved and TreasuryDirect’s web security rivals that at Fort Knox, perception becomes reality. Because savings bonds are not essential, poor PR could keep resistance high and purchase rates low.

WHAT IT MEANS FOR YOU: YOUR OLD CERTIFICATES

If you already have paper savings bond certificates, you can still redeem them at banks and credit unions, as always. If you have a savings bond which hasn’t yet matured, but was lost, stolen, eaten by the family pet or otherwise destroyed, you’re OK. It can be reissued in paper certificate or electronic form. (Paper Doll wonders why paper certificates are allowed for replacing old certificates when everything else is going digital.)

WHAT IT MEANS FOR YOU: GIFT-GIVING

Effective January 1, 2012, if you want to buy a savings bond for yourself or as a gift, you’ll first have to sign up for a TreasuryDirect account:

1) Provide your name, email address, bank or credit union routing and account numbers, and your taxpayer ID (Social Security or Employer Identification number).

2) Create a username and password and choose your security questions. (Safeguard the information you choose!)

3) Once your account request is processed (which can take up to 14 days, so plan ahead), you’ll receive an access card which will enable you to manage your account.

Next, to actually buy a gift bond, you’ll need to know a recipient’s full name, Social Security number, and, if applicable, TreasuryDirect account number. When the gift bond is processed, the recipient will receive an email, announcing the receipt of the gift in his or her TreasuryDirect account. You can also print a savings bond gift certificate, which makes the whole transaction a little less mundane than buying a Bobblehead on eBay via Paypal.

If you give a bond to a minor, the bond is placed in an online gift box until he or she reaches 18 years of age. At that point, the newly-minted adult can open his or her own TreasuryDirect account. Parents who wish to maintain a little extra control (or secrecy) can open their own TreasuryDirect accounts through which they can create custodial accounts in which the gifted bond may be safely kept.

Gee. Fun. Wow.

Sigh.

WHAT IT MEANS FOR YOU: A BIG CHANGE FOR THE INVESTOR CROWD

Along with the elimination of paper certificates, there’s a new change that primarily impacts serious investors. Currently, you’re limited to $5,000 in paper savings bond purchases, per year, for each bond series (EE and I bonds), plus another $5000, of each, per year, via the Treasury Direct website.

As of 2012, however, the limit will just be $5000 in purchases from TreasuryDirect. So, hey, Big Spender, if you were counting on buying $10K of each series of savings bonds per year, you’ll have to scale back and invest elsewhere.

There’s one exception. Currently, you can request to receive up to $5000 of your federal income tax refund in I-series savings bonds, and that won’t change with the new rules. Thus, while $10,000 of saving bond investment purchases via paper certificates have been cut out, you can recoup half that lost opportunity via your refund. It’s believed that for 2012, at least, those tax refunds via I-series bonds may be available as paper certificates.

WHAT’S NEXT FOR YOU?

Buying savings bonds electronically isn’t new. The government has been selling Series EE and I savings bonds electronically, 24/7/365, through TreasuryDirect since 2002. Opening and maintaining a TreasuryDirect account is free. Once you create your account, you can:

—Purchase, manage, and redeem Series EE and I electronic savings bonds for yourself.

–Purchase electronic savings bonds as a gift for someone else.

—Convert the Series EE and I paper savings bonds certificates you already own to electronic format via the SmartExchange feature.

—Enroll in a payroll savings plan at work so you can purchase electronic savings bonds, the cost for which gets deducted just like taxes, insurance, 401(K) contributions, United Way donations and other similar payroll deductions.

—Invest in other U.S. Treasury securities (like T-bills, notes, bonds, and Treasury Inflation-Protected Securities (TIPS).

GOT BONDS?

As of July 1, 2011, there were 45 million matured, unredeemed savings bonds worth approximately $16.2 billion, just sitting there. Are any of them yours? Be sure to check the savings bonds you own via TreasuryDirect’s Savings Bond Calculator (to see the current value) or Treasury Hunt (to see if you’ve got money waiting for you).

SOME PARTING ADVICE

The last time I wrote about savings bonds was in January 2008, in the post Lost and Found: Savings Bonds (and saving yourself a headache later on). While some of that advice may become moot, much of it will remain useful until all of the 672 million outstanding paper savings bonds (both matured and not-yet-matured) — worth $181 billion — are cashed in. Thus, please avail yourself of the advice in that post if you want to know how to:

- Record and safeguard your savings bond certificates and associated information outside of the TreasuryDirect savings bond management system

- Locate and/or replace missing savings bond certificates

- Redeem savings bonds

Of course, you could opt to exchange your paper savings bond certificates for digital versions using SmartExchange. Then, at least, you won’t have to worry about which bonds are held digitally and which are still held via paper.

Readers, what do you think? Will you miss savings bond certificates? Will you embrace the digital system completely? Do you have any savings bond stories? Please share your thoughts in the comments section below.

Follow Me