A Taxing Conversation (Part 2): Organize Yourself To Avoid Tax Scams

When I was in high school, my cherished French teacher, Mr. Calandra, would sometimes ask a question that yielded a rush to respond from even the most sluggish students. It was a gimme; an obvious answer and we all jumped for it…and we were all wrong. Mr. Calandra would get a glint in his eye and a grin on this face. He’d make a motion with his hands as if he were a reeling in a bite on his fishing rod and shout out, “You got fished!” Little did we (or, he, I imagine) anticipate that his endearing way of saying “I caught you!” would serve as a warning for internet-related financial and tax scams…especially given that the internet had not yet been invented.

Each year, myriad citizens are taken in by scurrilous tax scams. These scams target the elderly, the poor and those who are inexperienced in the ways of the Internal Revenue Service. To protect yourself and those about whom you care, know the facts:

1) The IRS Will Not Email You

Con artists and scammers send emails purporting to be from the Internal Revenue Service, the Treasury Department or, less often, a state’s tax collecting body, to request personal information: Social Security numbers, birth dates, bank account numbers, credit card numbers, etc.

Scam emails will sometimes state that the taxpayer is late with payments or provision of information and may threaten fines or jail time if this personal information is not turned over immediately. Alternatively, scammers may appeal to our greedier natures and promise that we are due a long-withheld refund for which we must merely provide certain documentation in order to receive.

The purpose of scam emails may be two-fold. Primarily, scammers are phishing, or masquerading as a legitimate entity for the purpose of identity theft. Armed with your personal information, they can apply for credit, insurance or financial benefits in your name, purloining your identity and ruining your financial history.

Often, those who are naive in the ways of the internet mistakenly assume that because the emails do not request a return email reply (and may even warn against it) but instead, direct the taxpayer to a particular “official” link to fill in an online form, that the email is legitimate. For example, someone lacking experience in the darker side of the internet might see the link:

http://www.InternalRevenueService.gov/ThisTotallyIsn’tAScam

and be unaware that hotlinks can be coded to go somewhere other than where they appear to send you. (Go on, click the above link. It’s safe. Paper Doll promises you. We’ll all wait while you click.)

See my point?

The only difference is that scammers will link to their own sites, which they may have made look like official government sites, counting on each email recipient’s inability to notice that the URL in the address box changed to something malicious. If you provide information at the ensuing site, you then become complicit in your own defrauding.

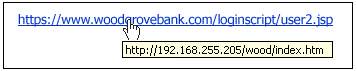

In addition to direct phishing, scammers may embed emails with viruses or may cause malware, malicious software, to engage when you click the links, enabling access to private data on your computer. Scammers count on you not knowing that by hovering your cursor over a link in an email or on a web site, you can actually see (either in a pop-over window or in the status bar at the bottom of your browser) the URL of the real link to which you are being sent.

Microsoft’s security center illustrates what the link might look like if hovered over:

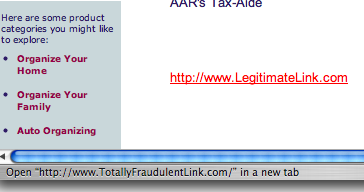

Similarly, if you hover your cursor over a link and look at the bottom of the screen, at your browser’s status bar, you can see if there’s a mismatch, as noted below:

To stay safe, install updated anti-virus software and avoid clicking suspicious links.

One recent scam that has been popular lately is an email warning recipients that they are in trouble because they failed to submit a W-2 by the well-publicized January 31st deadline. The email provides a link which the recipient can click and fill in the requested information — much like the traditional email phishing scams. However, this scam really takes advantage of the recipient not knowing how the United States tax system works, because employers provide W-2s to the IRS by January 31st each year, not employees.

For what it’s worth, the IRS only contacts taxpayers by mail, via the U.S. Postal Service. (If you are married and have filed jointly, both spouses will get identical letters, sent in two separate envelopes, to the same residence.) The IRS uses your full name and address and provides quite a bit of identifying information to show they have adequate knowledge about you. Scammers usually possess no information about you besides your email address and possibly first or last name, generally deduced from your email address.

Another clue to the fraudulent nature of many scam emails is spelling and grammar. The mail the IRS sends is spelled correctly and uses proper, traditional grammar. Conversely, scammers are usually not the sharpest knives in the drawer and their emails are often riddled with misspellings, grammar mistakes and sentences that are circular, incomplete and lacking proper punctuation.

So, as the IRS does not email you, no matter how scary (or intriguing) an emailed warning (or offer) from “the IRS” seems to be, don’t believe it.

Do not click on links in tax-related emails or provide personal information via links appearing in emails.

For more information regarding how you can protect yourself and your loved ones online, visit  OnGuardOnline.gov, co-sponsored by the IRS, the Federal Trade Commission, the Department of Homeland Security and other government agencies.

OnGuardOnline.gov, co-sponsored by the IRS, the Federal Trade Commission, the Department of Homeland Security and other government agencies.

It should go without saying that the IRS also does not text, tweet or Facebook-message about individual accounts.

2) The IRS Will Not Call To Harass You

Just as with the email examples, taxpayers have reported receiving harassing phone calls from persons who purport to be with the IRS. Usually, these are threatening calls, stating that the taxpayer is delinquent in paying taxes or submitting certain types of documentation. Again, these callers often threaten imprisonment or fines if their demands are not met immediately.

Less often, the callers claim to have state or federal refunds due, either from prior years’ returns or from the estate of some long-lost relative, now deceased. In both cases, whether threatening (to invoke fear) or promising (to inspire greed), these scammers are out to phish as much personal information from you as possible.

Turn the tables. Try to get as much information as you can regarding the caller’s name, phone number and the address to which they wish you to mail funds, without providing any personal information of your own. Then hang up and report the scam to the Federal Trade Commission.

If you believe you have been contacted by a scammer, or have been the victim of a scam, report your experience to the following agencies and organizations:

The web site of the National Association of Attorneys General provides a link and contact information for your state’s Attorney General.

The Anti-Phishing Working Group (APWG) is a consortium of internet service providers, financial institutions, security vendors and law enforcement agencies working to fight phishing.

3) Strangers Who Contact You By Mail, Email or Phone Can’t Reduce Your Tax Debt

Unlike official, government-approved non-profit agencies that can help consumers consolidate and/or reduce their credit card debt, there are no companies that can reduce your tax burden on your behalf. You (and your CPA, tax attorney or enrolled agent) must work directly with the Internal Revenue Service to engage in any negotiations regarding payment terms, fines and penalties.

The Better Business Bureau is contacted each year by thousands of complainants who paid fees for “tax reduction” services to companies that never contacted the IRS on their behalf. Don’t get added to that list.

4) Phishing Scammers Don’t Only Pretend To Be With the IRS

Some scam artists are more creative than others. Although they don’t know you, and don’t have any idea with whom you bank or what brokerage you use, scammers are willing to play the law of averages. Like spammers, they figure if they send enough scam emails, somebody will take the bait.

You’ve probably received bank scam emails before. An email claims to be from your bank, and may even carry your bank’s logo, color scheme and formatting. The email may claim that someone has attempted to access your online account and that access privileges have been locked out until you use their specific link to click and then log in with your user name and password. The only problem is that the link provided does not go to your bank or brokerage, but to their own phishy (and fishy) site.

Wells-Fargo account holders, for example, may immediately realize it’s a scam when contacted by a bank with whom they have no relationship, whether it’s Bank of America or First National Bank of Fiction, and yet they may be much more trusting when the email purports to be from their own Wells-Fargo. In such cases, quickly deleting the email and logging in via a bookmarked or hand-typed URL will soon prove the fraudulent nature of such emails.

At tax time, these phishing emails become more common, promising to provide quick and easy access to essential 1099s if the recipient will merely use the provided link to log in and “prove” or “validate” identity. Paper Doll readers are too smart to fall for this, but be sure to warn your less web-savvy and too-trusting friends.

5) There’s (Almost) No Free Lunch

Another popular tax-related fraud is the free tax preparation scam. While there are non-profit agencies available to help senior citizens, those with low incomes, military families and others in special circumstances with their tax preparation (and we’ll be discussing these programs at length next week), scams abound in this arena.

Some fraudulent tax preparers are just phishing for personal data. Others promise prospective clients unrealistically huge refunds in return for a percentage of the monies secured. They achieve this by claiming inflated or false expenses and deductions and fake or excessive tax credits. Although the preparers get the booty, the clients get the boot — when the IRS detects the fraud, the clients and not the (long-gone) preparers are on the hook for additional owed taxes, interest, fines and penalties.

Per the IRS (FS-2009-7), when selecting a tax preparer, heed the following advice:

- Be cautious of tax preparers who claim they can obtain larger refunds than other preparers.

- Avoid preparers who base their fee on a percentage of the refund.

- Use a reputable tax professional who signs the tax return and provides a copy.

- Consider whether the individual or firm will be around to answer questions about the preparation of the tax return months, or even years, after the return has been filed.

- Check the person’s credentials. Only attorneys, certified public accountants (CPAs) and enrolled agents can represent taxpayers before the IRS in all matters, including audits, collection and appeals. Other return preparers may only represent taxpayers for audits of returns they actually prepared.

- Find out if the preparer is affiliated with a professional organization that provides its members with continuing education and resources and holds them to a code of ethics.

- Ask friends and family whether they know anyone who has used the tax professional and whether they were satisfied with the service they received.

There are far worse ways to be fooled than to be Rick-Rolled. Be wary, online and off, to avoid common tax scams. Don’t let the bad guys say, “You got fished!”

Follow Me