Paper Doll

Reference Files Master Class (Part 3) — Medical Papers

For our final post of Get Organized & Be Productive (GO) Month, we’re continuing our refresh of classic posts and essential concepts in paper organizing. So far, we’ve looked at:

Paper Doll Shares 12 Kinds of Paper To Declutter Now

Reference Files Master Class (Part 1) — The Essentials of Paper Filing

Reference Files Master Class (Part 2) — Financial and Legal Papers

Today, we continue onward with the next element of the reference papers in your personal or family filing system.

- Financial

- Legal

- Medical

- Household

- Personal

MEDICAL FILES

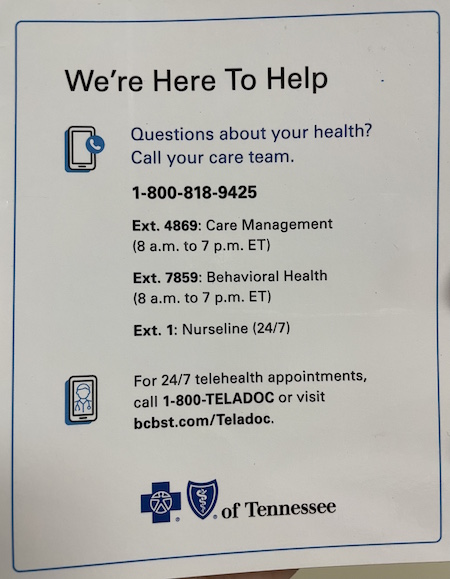

There’s a special name the information you maintain about your medical life: a personal health record (PHR). With the financial and legal documents we covered last week, I strongly recommended using to develop your file management skills; however, you’ll see that with medical information, I recommend a hybrid approach with paper and sometimes a digital one.

Your Role as Personal/Family Medical Historian

You may wonder why you might need to keep medical paperwork of any kind. After all, don’t the doctors all have your files? It’s not like the average person has a collection of all their own dental X-rays and test results laying around. But there are certain reasons you should keep at least some of your medical information, if not your actual records. For example:

- When you go to a new health care provider or visit the hospital, you will be asked for a detailed medical history. Will you really remember the years and types of all of your (or your family members’) illnesses, surgeries, and complications? Which physicians were seen and what their contact information was? Which medications caused allergic reactions? It’s your job to provide that information.

- If you change health insurance companies or apply for life insurance, you’ll have to provide a detailed medical history. If you are found to have given even the teeniest of wrong answers, your policy could be voided retroactively and you could be on the hook for hundreds of thousands of dollars of healthcare!

- First responders may need information in a hurry. This is why you need to keep updated copies of your medication lists (medication names, dosages, prescribing physicians) in multiple places, immediately accessible. (See Organize to Help First Responders: The Vial Of Life for details on this specific issue.)

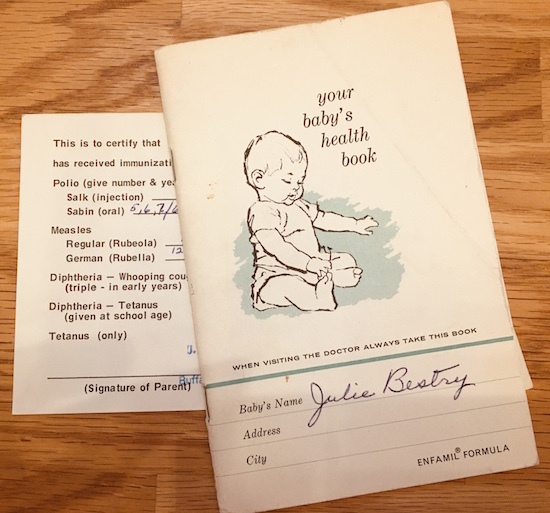

- Quick access to accurate information may determine a medical course of action. For example, if your college student calls to say they had a minor accident and the student health center wants to know how long ago they had a tetanus booster, don’t you want to give the right answer? (Better yet, arm your adult kids with copies of their records so they’ll know!)

Doctor With Stethascope Photo by Online Marketing impulsq on Unsplash

- If you’re in the ER or at Urgent Care and are asked a question about your medical history, you can’t rely on your primary care physician’s records. The doctor’s staff may be unreachable on weekends and holidays, or in the evenings, or on inclement weather days.

- Your physician or dentist may retire with little notice, giving you no chance to get copies of records. (I’ve had three doctors and a dentist retire in the last 5 years. Yes, I’m starting to take it personally!)

- If you can prove you’ve already been tested for certain things, you may be able to avoid unnecessary (and expensive) medical tests.

- If you have proof of immunizations, you can make sure you’re protected against all sorts of yuckies without having duplicate ouchies! (Yes, these are the correct medical terms.) Proof also ensures that your children can attend school or go to summer camp. (You do not want to spend the days prior to driving cross-country to your student’s new campus rushing to find a physician who will squeeze your 18-year-old in for shots.)

- Speaking of immunizations, if you ever work or vacation outside North America, you may need proof of health and immunization for travel; you don’t want to have to contact your doctor over and over and be beholden to their convenience and schedules. (For more, check the CDC’s Yellow Book on Traveler’s Health.)

Additionally, you may be responsible for making decisions or overseeing care for someone else. This might be your child or your spouse, where you can rely on your memory. But what if you’re involved in the care of an elderly and/or ailing relative? Wouldn’t you prefer they had this information organized and available to you?

And what if you’re the one who is ill and needing someone to advocate for your medical well-being? While it’s important for your healthcare proxy (the person with your medical Power of Attorney) to have access to the full picture, sometimes it’s just helpful for your loved ones to be able to provide educated input when you are feeling woozy or distressed.

Methods for Organizing Medical Information

To start, create a hanging folder for each person in the household. How many internal folders you’ll need for each person depends on how much information pertains to each individual.

One folder may suffice for younger, healthier individuals with limited records. However, my clients often use three — one for medical information, one for dental information (often including extensive orthodontia plans), and one for vision (to track vision changes and safely keep eyeglass or contact lens prescriptions until needed). If anyone in the family has a specific, ongoing medical condition (diabetes, arthritis, etc.) add extra interior folders as needed so you can track specialized medical information.

There are other auxiliary methods for maintaining medical records:

- 3-ring binders — If you or someone in your family has a complicated medical situation, a chronic illness, or is undergoing cancer treatment or dialysis, and is visiting many doctors and hospitals, often having to supply information repeatedly, a sectioned-three ring binder for mobile use may make it easier for you to take notes or have providers make copies of your information. Consider this an adjunct to your paper file system, with sections for appointment dates, notes, special instructions, and test results.

- Medical Organizer — If you are in college or newly graduated, your filing space in a dorm or small apartment may be limited. To get you started, you may want to use a something like the multi-pocked Smead All-in-One Healthcare and Wellness Organizer.

Reference Files Master Class (Part 2) — Financial and Legal Papers

As we move through Get Organized & Be Productive (GO) Month, the annual initiative sponsored by the National Association of Productivity & Organizing Professionals (NAPO), it’s the perfect time to revisit classic posts and essential concepts in paper organizing.

Two weeks ago, we looked at Paper Doll Shares 12 Kinds of Paper To Declutter Now, and while the items listed there aren’t the only papers you can purge, they’re a great start for lessening the clutter so you can see what you own, need, and must organize.

Last week, we began our modern refresh of the basics with Reference Files Master Class (Part 1) — The Essentials of Paper Filing. You can sort and purge papers without those filing resources, but having them allows you to create a system that can grow and expand as your needs change. Even somewhat orderly stacks and piles are better than disarray, but a good filing system assures you that everything won’t be sent into chaos when the kids and pets (or spouses behaving like kids and pets) chase one another through the house.

As I’ve been teaching my professional organizing clients for 22 years, all reference papers can fall into one of five categories. Today, we’ll be reviewing the first two:

- Financial

- Legal

- Medical

- Household

- Personal

FINANCIAL FILES

In almost any household, whether you’re a family of one or 10 (and I mean, geez, even the Brady Bunch, with Alice, only had nine!), financial paperwork makes up the bulk of almost any personal or family filing system.

It’s the nature of living in a Western, capitalist society in the 21st-century — everything centers around whatever represents having or owing little green pieces of paper. At least our Canadian readers have much more colorful currency.

Canadian Frontier Banknotes @2006 Bank of Canada

Your financial files keep track of money coming in (in Yoda-speak, quite literally, in-come), money going out for expenses, money we are investing and (hopefully) growing for future use, and everything related to money we give governments to run things. (If we don’t have the focus and energy to organize our financial paperwork, how would we ever deal with having to raise our own armies and fill our own potholes?!)

Let’s look at each of these categories, in turn.

Transitional Money

Most of your files will relate to money that’s coming to you or paid (or at least owed) by you. But all that money tends to funnel through a few central locations that serve as receiving and funding sources. Generally, these are bank (or credit union) accounts and brokerage accounts.

Bank/credit union statements reflect the monthly status of checking, savings, and trust accounts. These represent collections of funds that are in transition, basically at a weigh-station until you determine where the money is going. Accounts may accrue interest or have fees associated with them, and some (like certificates of deposit) act like investment accounts, but are still basically interest-bearing accounts. Take time each month to make sure these accounts reflect what you think they should.

Brokerage statements reflect investments. Separate these by investment type, like retirement, college savings, goal-related (vacation funds, Christmas Club accounts, etc.), first, and then sub-categorize (and alphabetize) by company. So, in the Retirement hanging folder, you might have interior folders for your 401(k), an old 403(b), IRAs with Fidelity and Vanguard, and so on. Each account should have its own folder.

Clearly label folders with the financial body (bank, brokerage, etc.) and account type; if you have more than one account of the same type at the same institution, put the last four digits of the account number on the file label.

Income

However many people in your household have a job (or jobs), income is likely reflected by pay stubs from employment. In ye olden days, they were truly stubs from checks received from employers. Nowadays, almost everyone gets paid electronically by direct deposit, but often receives printed pay “stubs” showing not merely what was earned, but any deductions from the paycheck. Common deductions include:

- FICA (payroll tax, which goes to Social Security and Medicare)

- Other income tax (federal/state/local)

- Insurance premiums for health, life, and disability coverage

- Retirement contributions (which may or may not be matched by employer contributions)

- Charitable contributions (also called payroll giving) like United Way

- Wage garnishments for child support or other

- Union dues

(If your income is derived from your own business, keep business files separated from personal files.)

While employment is the main category, it’s not the only type of income. You may also receive paperwork reflecting receipt of alimony or child support, Social Security income, disability payments, IRA disbursements, personal loans repaid to you, stock-dividends (outside of a dividend reimbursement plan) and lottery or gambling winnings.

This leaves aside illegal proceeds; Tony Soprano isn’t likely to give you a 1099 for the bribe he paid you. (Tony Soprano also didn’t give me a lot of options for clean language, even when I found a really applicable filing-related, if potty-mouthed, clip.)

Whether you regularly receive money or get a one-time lump sum, keep records for tax and other legal reasons (like divorce and child support proceedings, Medicaid evaluations, etc.)

Maintain an interior folder for each type of income you usually receive to make it easy to check your 1099s against when preparing your taxes. If you have multiple sources of income within one type (and get lots of paperwork for each), label a folder with the name of each high-volume payer.

Outgoing Money (Expenses)

In business, they’re called Accounts Payable. These are your regular (monthly, quarterly, annual, etc.) plus occasional (unexpected) lump-sum payments, reflected by bills or statements, like:

- Monthly/periodic personal/household bills — rent or mortgage, utilities, auto or health insurance, etc.

- Credit cards statements

- Loans — personal, auto, college, home equity, etc.

- Medical bills — these may be one-time or part of an ongoing payment plan

- Tuition —

- Miscellaneous invoices or payment records reflecting anything for or which you wish to keep careful records, like tutoring, music lessons, tuition, professional organizer, fitness trainer, etc.

If your bills are paid by automatic withdrawal, verify that the proper amount was removed from your bank account or charged to your credit card, and then file the papers away. (For now, we’re assuming paper files; we’ll cover scanning and digital filing in the future.)

You may not enjoy the paperwork, but ignoring money issues won’t make them go away. If you struggle with keeping track of finances, learning to manage them in paper form makes money feel tangible, builds financial management skills, and increases financial awareness.

Ignoring money issues won't make them go away. If you struggle with keeping track of finances, managing them in paper form makes money feel tangible and 'real,' builds financial management skills, and increases financial awareness. Click To TweetIf you receive paper bills but pay each individually online, write the confirmation number and date of payment on the statement. If you still pay by check, tear off the stub to mail back with your payment (assuming you’re not doing online bill-pay), note the check number and date of payment on the larger, non-stub portion of the statement.

Create an interior (manila) folder for each account you hold. It doesn’t matter if you use generic terms (cable, power, water) or company-specific (Spectrum, ConEdison, Springfield Water). The key is to create labels that reflect the way you think. Keep it simple — the more complicated the system, the more friction will prevent you from filing things away.

If you have multiple accounts for the same company — for example, one water bill for your city penthouse and one for your summer cottage (or more likely, one bill for each of several student loans), label folders to differentiate between the two. (So: “Water — Park Avenue” vs. “Water — Park Avenue”; “College Loan — 1st National” vs. “College Loan — Fred’s Bank.”)

For credit cards, if you have more than one card from any one issuing lender, put the last four digits of the card number on the label (AmEx – 4321, AmEx – 9876) to help you file or access papers quickly.

Label a hanging folder for each sub-category. If you have more than one hanging folder’s worth of interior folders, just label the first in the sequence. It will be obvious from the interior labels that you’re still in that same sub-category.

Taxes

Create at least one tax-prep folder, or have one for medical expense records, one for charitable donation records and a third for “other” tax issues. Each January, when you start receiving W-2s and 1099s, pop them in your Tax Prep [Year] file folders. Once your taxes are completed, create an interior folder for a copy of your filed return and all supporting documentation.

As an alternative to collecting active tax filing year documents in file folders, you may want to sequester them in a portable tax according file, whether pre-made like the Smead All-in-One Income Tax Organizer.

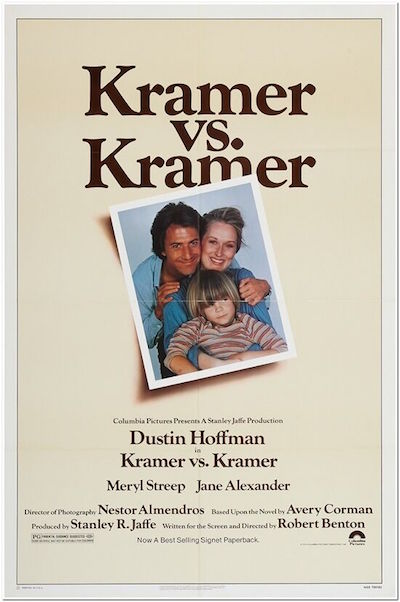

Reference Files Master Class (Part 1) — The Essentials of Paper Filing

COPING WITH PAPER OVERWHELM

After last week’s post, Paper Doll Shares 12 Kinds of Paper To Declutter Now, I had a number of readers mention to me that while knowing what to get rid of helps them deal with their paper piles, they were still sometimes at a loss as to what to do with the rest.

Some fear they should be scanning everything to keep it digital, but don’t even own scanners. Others feel frustrated because even when they’ve arranged to get (and pay) their bills digitally, they still have paper coming to them. Many people feel at odds with the 21st-century pressure to have digital records, and don’t particularly feel adept with handling papers digitally. (They forget to look at email until it’s too late, or they never get around to scanning, or information just doesn’t seem “real” to them if it’s not in tangible form).

Over the 16+ years that I’ve been blogging as Paper Doll, I’ve tried to get across that whether you use analog or digital techniques — whether for paying bills, or keeping track of your appointments and tasks, or filing or archiving your information — doesn’t matter. That is, the method doesn’t matter; the commitment to a system is what is most important.

But 16 years is a long time. Babies born during the launch of my first Paper Doll posts are old enough to drive! To give you a sense of how long ago that was, Desperate Housewives was still a top-10 TV show (and people were still watching broadcast television). The top song was Crank That (Soulja Boy) and we were all trying (and mostly failing) to do the dance.

I originally wrote about the elements of a reference filing system in the first month of Paper Doll posts, back in 2007. It’s time to revisit the topic, see how digital solutions do (and don’t) help with the paper overwhelm, and introduce new readers to the best ways to manage paper.

Over the next several weeks, we’ll be taking a fresh look at how eliminate the frustration of paper files.

The Ice Cream Rule

The key to making any system work is just that — a system. That means having a location where something belongs and behavioral rules to get them there. I often refer to this as the Ice Cream Rule. If you come home from the store with two bags, one holding a half gallon of cream and one with a package of toilet paper, which one will you put away first? And where would you put them?

Even people who insist that they’re terrible with systems laugh and admit that they automatically know to put the ice cream away first; they recognize that they’ll end up with a melted mess if they do not.

They also have no worries that they’ll put the ice cream where they won’t be able to find it again — in the cupboard or the pantry — because their system not only includes behavioral cues (ice cream before toilet paper), but a geographic location (that is, the freezer) where the ice cream belongs.

Yes, people may drop the bag with the toilet paper on the kitchen floor, or hang it on the linen closet door, or actually put away the toilet paper in the bathroom right after getting the ice cream in the freezer.

Admittedly, the behavioral part of putting away non-urgent items isn’t perfect. The squeaky wheel gets the oil, and when it comes to putting things away properly, ice cream’s urgency is squeakier than toilet paper. (That said, the retrieval of ice cream is likely to be less urgent.)

A HOME FOR YOUR REFERENCE FILING SYSTEM

The point, and I do have one, is that to create order with the paper in our lives, we must ensure that we know exactly where everything goes. How? Filing papers is easy once each item is assigned a place to live. All of your reference papers need to have a home.

Keep in mind, that home does not have to be a palace. You certainly can invest in filing cabinets. These range from bargain 2-drawer metal filing cabinets to office-style 4-drawer tower-style cabinets.

If you prefer lateral filing cabinets (where you stand to the side of the open drawer, rather than in front of it), there are a variety of styles and materials from which to choose.

Paper Doll Shares 12 Kinds of Paper To Declutter Now

After last week’s 24 Smart Ways to Get More Organized and Productive in 2024, we continue with GO Month, an entire month devoted to getting organized and being productive. I thought it might be time to hit a classic Paper Doll topic topic: decluttering papers!

Quite often, Paper Doll focuses on the papers and documents you need to acquire and keep. Always start with the essentials:

How to Replace and Organize 7 Essential Government Documents

How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Ask Paper Doll: Do I Really Need A Safe Deposit Box?

However, we must also look at what we no longer need, and what papers we’d be better off without.

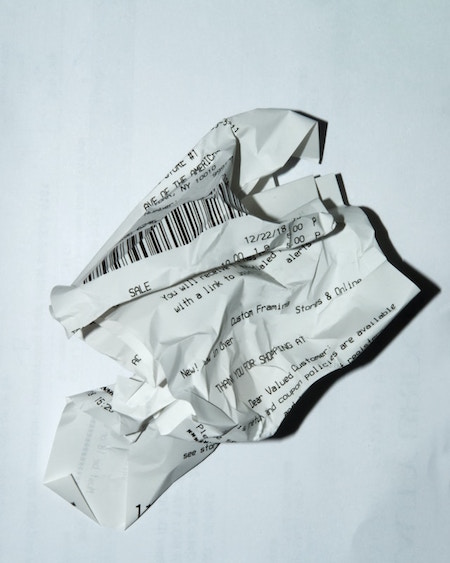

OLD RECEIPTS

Some people throw out all of their receipts. Their desks, bags, dresser-tops and bedside tables are clear of crumpled papers, but they have trouble reconstructing their financial history at tax time, they can’t figure out where their cash went, and can’t prove ownership or value of high-ticket items.

More often, people go to the opposite extremes and keep all of their receipts. When working with clients, I’ll often find zip-locked bags and drawers filled with random receipts. In addition to receipts strewn about, the collected and squirreled-away receipts tend to be older, anywhere from a year to five+ years in the past.

These clients have a vague sense that someone once told them to save receipts in case they needed to return something or create a budget based on tracked expenses. The problem? Neither of these well-intentioned reasons are based on a realistic view of their paper-cluttered lives.

Yes, you should hold onto receipts for purchases you might return, but most return policies that limit how long after the purchase something may be returned. In general, you’ll need the receipt to return something for a full refund for up to 30 days after purchase; after that, the best you can hope for at most retailers is store credit. (Stores vary, and Nerd Wallet has a great piece, Return Policy Guide: What to Know and Which Stores Stand Out, on the most generous return policies at stores like Costco, Kohl’s, and IKEA.)

Similarly, if you were going to track your expenses to create a budget, receipts from years ago won’t help now. Paper Doll gives you permission to start fresh with January (and last week’s receipts) and let go of the bulk of your random receipt clutter.

Woman with Receipts Photo by Karolina Grabowska at Pexels

Reasons to Keep Receipts

There are five main reasons to keep receipts, and none are “forever” reasons:

1) The item is returnable — only keep the receipt until the return period ends.

2) It’s a big-ticket item — keep a Big-Ticket Purchases folder for these kinds of receipts in your financial filing section.

Figure out your comfort level to determine whether “big-ticket” is $50 or $500 or $5 zillion; if the receipt is above a certain threshold, you may want to add a rider to your homeowners or renters insurance policy.

The IRS allows taxpayers to choose between deducting state taxes and sales tax; if you opt for sales tax, the default amount is often the wisest option; however, you’ve purchased a house, auto, boat, private plane, or personal rocket ship, you’ll definitely want proof of that big ticket deduction.

3) The receipt helps you prove ownership. This tends to go along with Big-Ticket items, as you’ll rarely be asked to prove that the soon-to-be-moldy asparagus in your fridge actually belongs to you.

4) The receipt is for something tax-deductible. Non-business purchases are more likely to be deductible if they’re related to healthcare, government fees or taxes, child/dependent care, or tax credits for things the government is trying to promote, like environmentally beneficial or energy efficient home improvements.

5) The purchase will be reimbursed by someone (employer, insurance company, etc.) at a later date.

Additionally, if you’re divorcing and seeking alimony and/or child support, you may need to collate receipts to prove the costs of life maintenance.

Here are some basic guidelines for the receipts you can discard, with a few caveats.

Crumpled Receipt Photo by Michael Walter on Unsplash

Cash Receipts

- Let go of cash receipts for consumable products (like food and beverages) whenever you want. If you’re not tracking expenses, you can toss them immediately. You can even refuse to accept receipts.

If you buy a Slushie at 7-Eleven or a burrito at the taco truck and pay with cash, you’re generally safe tossing receipt — unless you watch too many Law & Order reruns and are convinced you need to be able to prove your time-stamped whereabouts at all times.

- Keep cash receipts for things you might return, but only for the duration return period. After the return policy, buh-bye!

For example, if you buy clothes, a toy, or anything for your home, car, or family with cash, keep a plain #10 envelope to stash purchase receipts. Keep the envelope near where you handle your daily finances so that you know where to find receipts if you need to make a return.

Set a reminder, perhaps on the 5th of every month, to flip through the receipts. Once past the store’s return policy, shred the receipt.

The above assumes you’re not buying fancy-pants, expensive things with cash (and that you are not a member of a Sopranos-style crime family. If you are, please confer with your accountant.)

Debit and Credit Card Receipts

- Keep debit and credit card receipts until the return period has expired and you’ve eyeballed your statement or online account to verify that the final price is accurate.

As with cash receipts, pop credit card and debit card receipts in that #10 envelope. If you get paper statements for your bank and credit card accounts, reconcile the values monthly when your statements arrive. If you no longer get statements, reconcile receipts against your running online account weekly.

Deposit Slips and ATM Withdrawal Slips

If you think about it, a deposit slip is really a receipt, only instead of paying a store or service provider for what they’ve given you, you’re paying the future version of yourself who will spend that money later.

As for the five reasons to keep receipts, none particularly apply here. If you wanted to return the cash you withdrew, you could do that without the ATM slip, and taking or giving back your own money doesn’t involve tax deductions. Reimburse-ability doesn’t apply. The “big ticket” status isn’t applicable with withdrawals (as banks limit how much you can take out in one day); deposits are a little stickier, as there’s a paperwork rigamarole to go through if you ever deposit more than $9,999.99.

Of course, if you’re sort who worries about that pesky Law & Order issue regarding your whereabouts, you might also fear having to prove ownership of the money you’ve withdrawn.

In general, treat these as if they were debit or credit card receipts, and save them until your bank has accurately recorded the information. (But if you are making manual deposits of $10,000 or more, note the purpose, save the receipts, and tuck them in your tax prep folders just in case the amounts are questioned in an audit.)

A Few Other Notes About Receipts

Your pharmacy will print a summary of all prescription purchases. Once you’ve checked your receipts against your bank or credit card statements, you can shred pharmaceutical receipts; just ask your pharmacy to provide printout in early January for the preceding calendar year. (It’s to your benefit to only use one pharmacy so you don’t have to keep track of these things. If you must use a different pharmacy — if you’re on vacation or your regular pharmacy is out of your prescription medication — save those receipts.)

Collect all receipts for tax-deductible expenses (like charitable donations, or medical and pharmaceutical expenses in your Tax Prep hanging folder until you’ve completed your taxes for the prior year. (You won’t know until the end of any given year whether you accumulated a high enough percentage of your adjusted gross income to deduct itemized expenses.)

Keep receipts for anything for which you are due reimbursement until you get paid. This may include:

- Work and travel-related expenses where your company reimburses you. Label a folder “Reimbursable Expenses” and toss receipts in there. Set a reminder on your calendar for the week prior to when expense reports are due, to ensure you don’t put it off and delay recouping your costs.

- Healthcare expenses for which your health insurance company reimburses you. Usually, you pay a co-pay or co-insurance to a healthcare provider, but sometimes providers won’t file insurance claims. You may have to submit documents from the provider, plus your receipt, and forms directly to your insurance company to get reimbursed for medical expenses.

- Sometimes, you’ll need to submit receipts to your car or homeowners/renters policy insurance company for repairs done to your auto or home. You might need to submit receipts to someone else’s insurance company if the other party was at fault. Always keep the original and provide them with photocopies).

If you’re reimbursed for a high-dollar amount for anything unusual, keep the receipt and the proof of reimbursement in your tax prep folder. If audited, it will be easy to say, “Hey, I anticipated that you’d wonder about this! So, here’s the receipt where I chartered a helicopter to get my boss to the top of the mountain for a super-important meeting, and here’s the income you’re questioning, where I was reimbursed for what I paid out.”

Always have a system for collecting your receipts until you get home. Do not stuff receipts in your coat pocket, no matter how many people are behind you in line. Do not put receipts in the shopping bag, because it’s too easy for them to fall out in the car, or for the bag to be discarded with a receipt still inside. Make 2024 the year you resolve not to have any crumpled receipts in your pockets or your car!

[We’ll take a fresh look at digital receipts in a future post, but the rules regarding what you can let go of are the same for digital as paper.]

OLD HOUSEHOLD UTILITY BILLS

It’s common for me to find that clients have saved multiple years of old electric, gas, water, and sewer bills. They shrug. Someone, somewhere, told them they were supposed to save all records.

People’s parents (particularly fathers) rightly told them that it’s important to keep all records regarding auto maintenance. A full and detailed record helps boost the resale value of a car. (Secondarily, if there’s a recall, the car owner can get reimbursed for work previously done.)

The thing is, even if you keep meticulous records, a prospective home buyer isn’t going to offer you more for your house based on ancient utility bills. Knowing what it cost to heat your home in January or cool it in July back in 1992 is not useful information!

Little House Photo by Kostiantyn Li on Unsplash

Keep paper utility statements for the prior calendar year and the current one, just so that you can easily compare year-to-year (for example, to trace the likelihood of a leak vs. “Oh, yeah, July water bills are always high because we use the Slip & Slide). Shred the older ones.

(Note: if you take a tax deduction for a home office for your home-based business, keep utility bills as supporting documents for business tax returns.)

OLD INSURANCE POLICIES

People have a habit of keeping really old insurance policy paperwork.

I advise that if you don’t have any pending claims against your insurer and nobody has a lawsuit against you, it’s OK to shred old declaration pages and toss the generic boilerplate from old home and car policies. You may want to keep the front page of the policy listing the old policy number and contact information for the insurer.

With health insurance policies, if you’ve changed policies recently, I find it’s helpful to keep the paperwork related to coverage you had in the prior calendar year. While medical providers are supposed to process claims within 90 days, I’ve seen where physicians’ offices were so disorganized they were trying to recoup fees (either through insurance or directly from patients) more than a year later. Keeping the essential info about the policy can help if you get caught with “zombie” claims. But policies older than the prior calendar year, unless you’re still fighting about claims, can be shredded.

One insurance policy caveat: If you cash in a life insurance policy, either for the cash value or after someone has passed, make sure you log that you have done so. I’ve worked with clients where there’s been great excitement upon finding old life insurance policy paperwork, only to learn the original policy holder cashed in the policy up to 50 years earlier, but never destroyed or discarded the old paperwork. Bummer.

For clarity, if you cash in a policy, make a note somewhere accessible (like your inventory of assets and debts) so that your future fuzzy brain or your inheritors can make sense of what happened.

EXPIRED WARRANTIES

If the warranty or guarantee period has already expired, toss out the warranty/guarantee card. (If it was a bigger ticket item and you’d stapled the receipt to the warranty card, make sure the receipt gets saved.)

If you no longer even own the product associated with the warranty or guarantee, dunk it like a basketball! Swoosh! (But shred the receipt.)

MANUALS FOR THINGS YOU DON’T OWN (AND SOME YOU DO)

If you don’t own the thing anymore, you don’t need the manual!

If you own the thing, but know how to use it, you don’t need the manual! (I often joke that if you don’t know how to use your toaster or hair dryer, you have a bigger problem than clutter.)

For guidance, there are ways to pare down and organize your manuals, find digital alternatives, or even digitize your collection to help keep things streamlined:

Paper Doll’s Manual Override – Part 1: Declutter and Organize Owner’s Manuals

Paper Doll’s Manual Override – Part 2: Twelve Resources To Find An Owner’s Manual

Paper Doll’s Manual Override – Part 3: Create & Organize A Digital Owner’s Manual Library

OLD DRIVING DIRECTIONS MADE REDUNDANT BY GPS

As you go through your files and piles of old papers, you may find driving directions to anywhere from hotel venues to summer camps to doctor’s offices.

If you’re never going there again, toss the paper. If Siri or Google Maps can get you there, toss the paper. If there’s anything special about the directions (maybe for the last tenth of a mile) and you could get the information again easily, toss the paper. If that last bit of the trip requires special instructions, create a contact (for the venue, the camp, or the office) in your phone and put those final, special directions in the “Notes” field.

DUPLICATE DOCUMENTS

Have you ever accidentally printed a copy of something multiple times and kept the copies? If the item is a form or a template you have to share (physically) with others and can’t just forward a digital file, make a folder. But if you just have random duplicate or triplicate or seventeenplicate of something you printed for no discernible reason, recycle or shred, as applicable.

OLD BOARDING PASSES

Yes, most of us now use digital boarding passes, but if anything changes about your flight, the nice typey-typey airport people will give you a new set of paper boarding passes. When you get home, don’t toss them in a pile with other crumpled receipts. Old boarding passes are of no future use to you. Shred them!

FYI, those QR codes along the edges have all sorts of personally identifiable information about you. They may not be useful to you, but leaving them out on your desk for anyone to find makes it easier for someone to purloin that information.

OLD CONFERENCE PAPERS AND BINDERS

Not all conference material is created equal. Go through your old conference binders and folders, especially those from early in your career. Be ruthless about letting go of handouts and notes related topics that no longer interest you or fields of study in which you never worked, or never intend to work again.

Trust that any information you want can be found again, and found more easily than spelunking in piles of old binders in the back of a closet.

Similarly, get rid of flyers, programs, and any other conference materials that don’t contain essential information.

JUNK MAIL

Did you ask for it? Do you want or need it? No? It’s junk! Instead of letting it pile up, shred it and sent it on its way. To stop junk mail in its tracks:

- Opt out of credit card and insurance offers for 5 years by going to optoutprescreen.com or call 1-888-5-OPT-OUT (1-888-567-8688), operated by the major credit bureaus. You’ll have to supply personal information like your name and address. They’ll also ask for your Social Security number and date of birth; it’s optional, and they’ve always claimed it’s confidential, but this is the 21st-century, so who knows?

- If you prefer to opt out permanently, start the process at optoutprescreen.com or call 1-888-5-OPT-OUT, but to complete the request, they’ll make you sign and return a Permanent Opt-Out Election form.

For other kinds of marketing junk mail, register at the Direct Marketing Association’s (DMA) consumer site, DMAchoice.org and pay a $4 processing fee for ten years of protection from most (but not all) junk mail.

OUTDATED, LOW-QUALITY, OR IRRELEVANT INFORMATION

I once worked with a (very) organized author. I initially joked that I wasn’t sure how I could help, as her office seemed orderly and tidy. However, when we looked in her files, I saw the problem.

The client wrote novels with storylines that included medical information, so she’d saved a few decades of internet printouts regarding diagnoses and treatments of various conditions. In almost every folder, any clip from the web from more than two or three years earlier was completely outdated. While some fields may include timeless information, research related to the sciences is likely to be superseded by newer data and analysis each year.

Unless your actual job description requires analyzing what used to be advised or believed vs. what is now known to be true, toss the outdated information.

Similarly, let go of any clipped articles or printouts that reflect information you already know (or that has become common knowledge), that has been disproven, lacks credibility, or isn’t related to your work or interests.

Tips from 1999 on traveling to Europe won’t fly (pun intended) in a post-9/11 world, but even advice from pre-COVID may not be valid. Introductory-level parenting articles from when your kids were tiny might have been useful, but if you’re cruising toward grandparenthood, you’ll find guidance has changed. Just let the internet be your filing cabinet!

DAMAGED PAPERS

This should go without saying, but discard any papers that are damaged due to water, fire, or animal predation. Papers with tiny blobs of mold can damage your neurological and pulmonological health. If a piece of paper is readable but yucky, digitize it (but then disinfect your scanner).

FINAL RESOURCES

You’ll be delighted to lessen your paper clutter knowing that much of what you’ve saved (due to misinformation, fear, or just plain inertia) can go. However, anytime there’s anything personally identifiable in your papers, make sure you shred them.

Paper Doll’s Secrets: Shred Successfully & Save Money is a good resource for making it easy to destroy what you don’t need and prevent identify thieves and other sneaky folks from benefiting from your decluttering.

Finally, knowing what to get rid of is only part of the paper decluttering process. For a full-on look at strategies for knowing papers to keep, and for how long, check out my classic ebook, Do I Have To Keep this Piece of Paper.

24 Smart Ways to Get More Organized and Productive in 2024

Happy New Year! Happy GO Month!

January is Get Organized & Be Productive (GO) Month, an annual initiative sponsored by the National Association of Productivity & Organizing Professionals (NAPO). We professional organizers and productivity experts celebrate how NAPO members work to improve the lives of our clients and audiences by helping create environments that support productivity, health, and well-being. What better way to start the year than creating systems and skills, spaces and attitudes — all to foster a better way of living?!

To start GO Month, today’s I’m echoing Gretchen Rubin’s 24 for ’24 theme that I mentioned recently, and offering you 24 ways to move yourself toward a more organized and productive life in 2024. There are 23 weekdays in January this year, so if you’re feeling aspirational and want to conquer all of these, you can even take the weekends off as the last item is a thinking task rather than a doing task.

I broke these organizing and productivity achievements down by category, but there’s no particular order in which you need to approach them, and certainly you don’t need to accomplish every one on the list, in January or even all year. Jump in and get started — some only take a few minutes.

PUT LAST YEAR AWAY

1) Make many happy returns!

Did you know that shoppers will return $173 billion in merchandise by the end of January? Chances are good that you (or someone for whom you oversee such things) got gifts that need to be returned.

Don’t put it off. The longer you wait, the more clutter will build up in your space, and the more likely you will be to suffer clutter-blindness until the return period has expired. Most stores have extended return policies during the holidays, but they can range upward from 30, depending on whether you have a gift receipt.

The Krazy Coupon Lady blog reviews the 2024 return deadlines for major retailers. She notes that you’ll get your refunds faster by returning items to the brick & mortar stores rather than shipping them back. You’ll also save money, because some online retailers charge a restocking fee.

2) Purge your holiday cards.

While tangible greeting are getting fewer and farther between, you probably still got a stack. Reread them one last time, and then LET THEM GO.

Did Hallmark or American Greetings do the heavy lifting, and the senders just signed their names? Toss them into the recycling bin. Paper Doll‘s grants you permission to only save cards with messages that are personal or resonant.

If they don’t make you cry, laugh, or go, “Ohhhhh,” don’t let them turn into the clutter you and your professional organizer will have to toss out years from now when you’re trying to downsize to a smaller home! It’s a holiday message, not a historical document; you don’t transcribe your holiday phone conversations and keep them forever, right?

The same goes for photos of other people’s families. You don’t have to be the curator of the museum of other people’s family history; let them do that.

3) Update your contacts.

Before you toss those cards, check the return addresses on the envelopes and update the information in your own contacts app, spreadsheet, or address book.

Next, delete the entries for people you’ll never contact again — that ex (who belongs in the past), that boss who used to call you about work stuff on weekends (ditto), people who are no longer in your life, and those who are no longer on this mortal coil.

If you don’t recognize the name of someone in your contacts, Google them or check LinkedIn (is it your mom’s doctor? your mechanic?) and if you still don’t know who it is, you’re obviously not going to be calling or texting them. Worst case scenario, if they text you, you can type back, “New phone, who dis?”

BOX UP YOUR INBOXES

4) Delete (most of) your old voicemails.

How often do you return a call only to hear, “The voicemail box is full and is not accepting messages. Please try again later.” When someone calls you and requests you call them back but their voicemail is full, it’s frustrating because it makes more labor for you.

Do you assume that it’s a cell phone and text them? (I believe texting strangers without permission is a breach of etiquette.) Plan to call back later? Assume that they’ll see the missed call and get back to you, starting another round of phone tag? ARGH!

Dial in to your voicemail and start deleting. Save phone numbers for anyone you’ll need to contact and log anything you may need to follow up on. But unless you’re saving a voicemail for legal purposes or because you can see yourself sitting in an airport, listening to a loved one’s message over and over (cue sappy rom-com music), delete old voicemails.

If you’ve got a landline, clear that voicemail. If you’ve still got an answering machine, how’s the weather in 1997? Yeah, delete old messages.

Smith.ai has a great blog post on how to download important voicemails (from a wide variety of phone platforms) to an audio file. Stop cluttering your voicemail inbox!

5) Clear Your Email Inboxes

Start by sorting your inbox by sender and deleting anything that’s advertising or old newsletters. If you haven’t acted on it by now, free yourself from inbox clutter! Delete! Then conquer email threads, like about picking meeting times (especially if those meetings were in the past).

Take a few minutes at the end of each day to delete a chunk of old emails. To try a bolder approach, check out a classic Paper Doll post from 2009, A Different Kind of Bankruptcy, on how to declare email bankruptcy.

6) Purge all of your other tangible and digital inboxes.

Evernote has a default inbox; if you don’t designate into which folder a saved note should go, your note goes somewhere like Paper Doll‘s Default Folder. Lots of your note-taking and other project apps have default storage that serves as holding pens. Read through what you’ve collected — sort by date and focus on the recent items first — and either file in the right folders or hit delete!

Walk around your house or office and find all the places you tend to plop paper down. Get it in one pile. (Set aside anything you’ll absolutely need in the next few days to safeguard it.) Take 10 minutes a day to purge, sort, and file away those random pieces of paper so that you always know where they are.

HIT THE PAPER TRAIL

7) Embrace being a VIP about your VIPs.

You need your Very Important Papers for all sorts of Very Important Reasons. If the last few years have proven anything, it’s that life is unpredictable, so we need to find ways to make things as predictable and dependable as possible.

Yes, putting together essential paperwork isn’t fun. It’s boring. But you want it to be boring. The more boring your vital documents are, the more it means there will be no surprises for your loved ones in troubling times (like during and after an illness, after a death, while recovering possessions after a natural disaster) or even when you’re just trying to accomplish something like getting on an airplane.

Start with these posts, then make a list of any document you already have (and where it is), and another list of what you need to create, and plan meetings with your family and a trusted advisor to set things in motion.

How to Replace and Organize 7 Essential Government Documents

How to Create, Organize, and Safeguard 5 Essential Legal and Estate Documents

The Professor and Mary Ann: 8 Other Essential Documents You Need To Create

Paper Doll’s Ultimate Guide to Getting a Document Notarized

Paper Doll’s Ultimate Guide to Legally Changing Your Name

A New VIP: A Form You Didn’t Know You Needed

8) Create your tax prep folder now so you’ll be ready for April 15th.

Do you toss non-urgent mail on top of the microwave? Might those important 1099s and 1098s and 1095-A and W-2s get lost? Don’t lose deductions, pay more taxes, or get in trouble with the IRS!

By the end of January, you’ll start getting tax documents in the mail. Pop them in a folder in your financial files or in a dedicated holder like the Smead All-in-One Income Tax Organizer.

Follow Me